UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

OR

For

the fiscal year ended

OR

OR

Commission

File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

State

of

(Address of principal executive offices)

Chief Executive Officer

Telephone

number: +

Facsimile number: +972-077-9709031

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| American Depositary Shares each representing 5 | ||||

| (1) | Evidenced by American Depositary Receipts. Not for trading, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

ordinary shares as of December 31, 2022.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging Growth Company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes

☐

TABLE OF CONTENTS

| i |

| ii |

INTRODUCTION

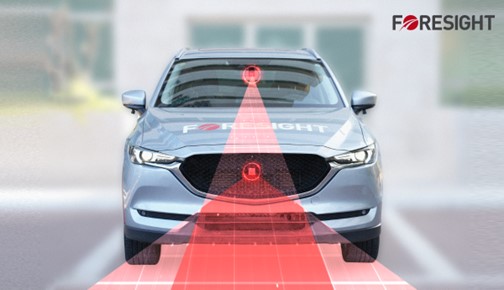

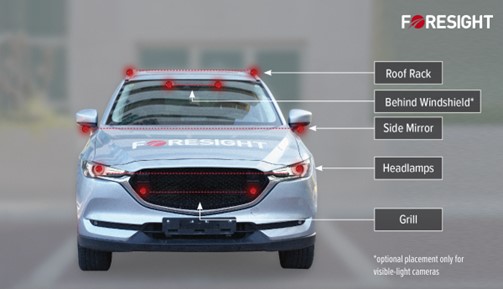

We are a technology company engaged in development of smart multi-spectral 3D vision software solutions and cellular-based applications. Through our wholly owned subsidiaries, Foresight Automotive Ltd., or Foresight Automotive, Foresight Changzhou Automotive Ltd., or Foresight Changzhou and Eye-Net Mobile Ltd., or Eye-Net Mobile, we develop both “in-line-of-sight” vision solutions and “beyond-line-of-sight” accident-prevention solutions.

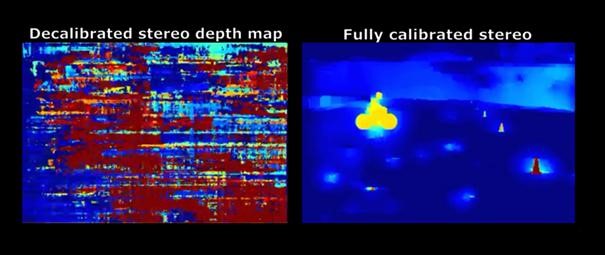

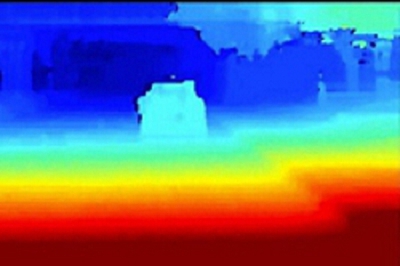

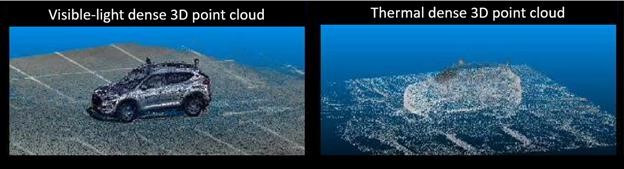

Our 3D vision solutions include modules of automatic calibration and dense three-dimensional (3D) point cloud that can be applied to diverse markets such as automotive, defense, autonomous vehicles, agriculture and heavy industrial equipment. Eye-Net Mobile’s cellular-based solution suite provides real-time pre-collision alerts to enhance road safety and situational awareness for all road users in the urban mobility environment by incorporating cutting-edge artificial intelligence (AI) technology and advanced analytics.

We were incorporated in the State of Israel in September 1977 under the name Golan Melechet Machshevet (1997) Ltd. In April 1987, we became a public company in Israel, and our shares were listed for trade on the Tel Aviv Stock Exchange Ltd., or TASE. On May 16, 2010, we changed our name to Asia Development (A.D.B.M.) Ltd., and on January 12, 2016, we changed our name to Foresight Autonomous Holdings Ltd. Our Ordinary Shares are currently traded on the TASE, and American Depositary Shares, or ADSs, each representing five of our Ordinary Shares, currently trade on the Nasdaq Capital Market, both under the symbol “FRSX”. The Bank of New York Mellon acts as depositary of the ADSs.

| iii |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this annual report on Form 20-F may be deemed to be “forward-looking statements”. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “predict,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| ● | the ability to correctly identify and enter new markets; | |

| ● | the overall global economic environment; | |

| ● | the impact of competition and new technologies; | |

| ● | general market, political and economic conditions in the countries in which we operate; | |

| ● | projected capital expenditures and liquidity; | |

| ● | our ability to regain and effectively comply with the minimum bid requirements of Nasdaq; | |

| ● | changes in our strategy; | |

| ● | the impact of the coronavirus, or COVID-19, pandemic, and resulting government actions on us; and | |

| ● | those factors referred to in “Item 3. Key Information – D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in this annual report on Form 20-F generally. |

Readers are urged to carefully review and consider the various disclosures made throughout this annual report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this annual report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the section of this annual report on Form 20-F entitled “Item 4. Information on the Company” contains information obtained from independent industry sources and other sources that we have not independently verified.

| iv |

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Foresight” refer to Foresight Autonomous Holdings Ltd. and its wholly owned subsidiaries, Foresight Automotive Ltd, an Israeli corporation, Eye-Net Mobile Ltd, an Israeli corporation, and Foresight Automotive’s wholly owned subsidiary, Foresight Changzhou Automotive Ltd, a Chinese corporation. References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. References to “Ordinary Shares” are to our Ordinary Shares, no par value. We report our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

Unless the context otherwise indicates or requires, “Foresight Autonomous Holdings,” “Foresight®,” the Foresight Autonomous Holdings logo and all product names and trade names used by us in this annual report on Form 20-F, including QuadSight® and Eye-Net™ are our proprietary trademarks and service marks. These trademarks and service marks are important to our business. Although we have omitted the “®” and “TM” trademark designations for such marks in this annual report on Form 20-F, all rights to such trademarks and service marks are nevertheless reserved.

Summary Risk Factors

The risk factors described below are a summary of the principal risk factors associated with an investment in us. These are not the only risks we face. You should carefully consider these risk factors, together with the risk factors set forth in Item 3D. of this Report and the other reports and documents filed by us with the SEC.

| Risks Related to Our Financial Condition and Capital Requirements | ||

| ● | We are a development-stage company and have a limited operating history, have incurred losses since the date of our inception and anticipate that we will continue to incur significant losses until we are able to commercialize our products. | |

| ● | We have not generated any significant revenue from the sale of our current products and may never be profitable. | |

| Risks Related to Our Business and Industry | ||

| ● | Defects in products could give rise to product returns or product liability, warranty or other claims that could result in material expenses, diversion of management time and attention and damage to our reputation. | |

| ● | Our future success depends in part on our ability to retain our executive officers and to attract, retain and motivate other qualified personnel. | |

| ● | Under applicable employment laws, we may not be able to enforce covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees. | |

| ● | We depend entirely on the success of our current products in development, and we may not be able to successfully introduce these products and commercialize them. | |

| ● | We depend entirely on the success of our current products in development, and we may not be able to successfully introduce these products and commercialize them. | |

| ● | We face business disruption and related risks resulting from the recent outbreak of the novel Coronavirus 2019, or the COVID-19 pandemic, which could have a material adverse effect on our business and results of our operations. | |

| v |

| Risks Related to Our Intellectual Property | ||

| ● | If we are unable to obtain and maintain effective intellectual property rights and proprietary rights for our products, we may not be able to effectively compete in our markets. | |

| ● | Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms. | |

| ● | Patent policy and rule changes could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of any issued patents. | |

| Risks Related to the Ownership of the ADSs or our Ordinary Shares | ||

| ● | If we are unable to comply with Nasdaq listing requirements, our ADSs could be delisted from Nasdaq, and as a result, we and our shareholders could incur material adverse consequences, including negative impact on our liquidity, our shareholders’ ability to sell shares and our ability to raise capital. | |

| ● | Our principal shareholders, officers and directors beneficially own over 11.97% of our outstanding Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval. | |

| ● | Holders of ADSs must act through the depositary to exercise their rights as our shareholders. | |

| ● | The Jumpstart Our Business Startups Act allows us to postpone the date by which we must comply with some of the laws and regulations intended to protect investors and reduce the amount of information we provide in our reports filed with the Securities and Exchange Commission, which could undermine investor confidence in our company and adversely affect the market price of the ADSs or our Ordinary Shares. | |

| ● | If we are unable to comply with Nasdaq minimum bid requirement, our ADSs could be delisted from Nasdaq, and as a result we and our shareholders could incur material adverse consequences, including a negative impact on our liquidity, our shareholders’ ability to sell securities and our ability to raise capital. | |

| Risks Related Israeli Law and Our Incorporation, Location and Operations in Israel | ||

| ● | We are exposed to fluctuations in currency exchange rates. | |

| ● | Provisions of Israeli law and our articles of association may delay, prevent or otherwise impede a merger with, or acquisition of, our company, which could prevent a change of control, even when the terms of such transaction are favorable to us and our shareholders. | |

| ● | Our headquarters, research and development and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel. | |

| 1 |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data.

[Removed and reserved]

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. If any of these risks actually occurs, our business and financial condition could suffer and the price of the ADSs could decline.

Risks Related to Our Financial Condition and Capital Requirements

We are a development-stage company and have a limited operating history on which to assess the prospects for our business, have incurred significant losses since the date of our inception, and anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products.

Our significant shareholder, Magna B.S.P. Ltd., or Magna, was incorporated in Israel in 2001. Starting in 2011, Magna began to develop technology devoted to vehicle safety. Magna operated its vehicle safety segment of operations as a separate division for accounting purposes. On October 11, 2015, we entered into a merger agreement, or the Merger, with Magna and Foresight Automotive, whereby we acquired 100% of the share capital of Foresight Automotive from Magna. Since the date of the Merger, we have been operating as a development-stage company and have a limited operating history on which to assess the prospects for our business, have incurred significant losses, and anticipate that we will continue to incur significant losses for the foreseeable future.

Since the date of the Merger, and as of December 31, 2022, we have incurred net losses of approximately $101.5 million.

We have devoted substantially all of our financial resources to develop our products. We have financed our operations primarily through the issuance of equity securities. The amount of our future net losses will depend, in part, on completing the development of our products, the rate of our future expenditures and our ability to obtain funding through the issuance of our securities, strategic collaborations or grants. We expect to continue to incur significant losses until we are able to successfully commercialize our products. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the development of our products; | |

| ● | establish a sales, marketing, distribution and technical support infrastructure to commercialize our products; |

| 2 |

| ● | seek to identify, assess, acquire, license, and/or develop other products and subsequent generations of our current products; | |

| ● | seek to maintain, protect, and expand our intellectual property portfolio; | |

| ● | seek to attract and retain skilled personnel; and | |

| ● | create additional infrastructure to support our operations as a public company and our product development and planned future commercialization efforts. |

We have not generated any significant revenue from the sale of our current products and may never be profitable.

We have not yet commercialized any of our products and have not generated any significant revenue since the date of the Merger. Our ability to generate revenue and achieve profitability depends on our ability to successfully complete the development of, and to commercialize, our products. Our ability to generate future revenue from product sales depends heavily on our success in many areas, including but not limited to:

| ● | completing development of our products; | |

| ● | establishing and maintaining supply and manufacturing relationships with third parties that can provide adequate (in amount and quality) products to support market demand for our products; | |

| ● | launching and commercializing products, either directly or with a collaborator or distributor; | |

| ● | addressing any competing technological and market developments; | |

| ● | identifying, assessing, acquiring and/or developing new products; | |

| ● | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter; | |

| ● | maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trade secrets and know-how; and | |

| ● | attracting, hiring and retaining qualified personnel. |

We expect that we will need to raise substantial additional capital before we can expect to become profitable from sales of our products. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We expect that we will require substantial additional capital to commercialize our products. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future capital requirements will depend on many factors, including but not limited to:

| ● | the scope, rate of progress, results and cost of product development, and other related activities; | |

| ● | the cost of establishing commercial supplies of our products; | |

| ● | the cost and timing of establishing sales, marketing, and distribution capabilities; and | |

| ● | the terms and timing of any collaborative, licensing, and other arrangements that we may establish. |

| 3 |

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of the ADSs and Ordinary Shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of our products or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

We maintain our cash at financial institutions, some in balances that exceed federally insured limits.

A small portion of our cash is held in accounts at U.S. banking institutions that we believe are of high quality. Cash held in non-interest-bearing and interest-bearing operating accounts may exceed the Federal Deposit Insurance Corporation, or FDIC, insurance limits. If such banking institutions were to fail, we could lose all or a portion of those amounts held in excess of such insurance limitations. The FDIC took control of one such banking institution, Silicon Valley Bank, or SVB, on March 10, 2023, in which we held funds in certain accounts and as a result, we stood to lose approximately $0.6 million. The FDIC also took control of Signature Bank on March 12, 2023, though we do not hold any accounts at this bank.

On March 13, 2023, the U.S. Federal Reserve announced that account holders would not bear the loss of SVB’s collapse and since that time, we have been able to make payments and move all of the funds held in SVB to other banks in the United States Thus, we do not view the risk as material to our financial condition. However, as the FDIC continues to address the situation with SVB, Signature Bank and other similarly situated banking institutions, the risk of loss in excess of insurance limitations has generally increased. Any material loss that we may experience in the future could have an adverse effect on our ability to pay our operational expenses or make other payments and may require us to move our accounts to other banks, which could cause a temporary delay in making payments to our vendors and employees and cause other operational inconveniences.

Risks Related to Our Business and Industry

Defects in products could give rise to product returns or product liability, warranty or other claims that could result in material expenses, diversion of management time and attention, and damage to our reputation.

Even if we are successful in introducing our products to the market, our products may contain undetected defects or errors that, despite testing, are not discovered until after a product has been used. This could result in delayed market acceptance of those products, claims from distributors, end-users or others, increased end-user service and support costs and warranty claims, damage to our reputation and business, or significant costs to correct the defect or error. We may from time to time become subject to warranty or product liability claims that could lead to significant expenses as we need to compensate affected end-users for costs incurred related to product quality issues.

Any claim brought against us, regardless of its merit, could result in material expense, diversion of management time and attention, and damage to our reputation, and could cause us to fail to retain or attract customers. Currently, we do not maintain product liability insurance, which will be necessary prior to the commercialization of our products. It is likely that any product liability insurance that we will have in the future will be subject to significant deductibles and there is no guarantee that such insurance will be available or adequate to protect against all such claims, or we may elect to self-insure with respect to certain matters. Costs or payments made in connection with warranty and product liability claims and product recalls or other claims could materially affect our financial condition and results of operations.

Furthermore, the automotive industry in general is subject to litigation claims due to the nature of personal injuries that result from traffic accidents. The emerging technologies of advanced driver assistance systems, or ADAS, and autonomous driving have not yet been litigated or legislated to a point whereby their legal implications are well documented. As a potential provider of such products, we may become liable for losses that exceed the current industry and regulatory norms. In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of such products if the defect or the alleged defect relates to motor vehicle safety. Depending on the terms under which we supply our products, an auto manufacturer or other ADAS developers to whom we sell our software may hold us responsible for some or all of the entire repair or replacement costs of these products.

| 4 |

Our future success depends in part on our ability to retain our executive officers and to attract, retain and motivate other qualified personnel.

We are highly dependent on the services of Mr. Haim Siboni. The loss of his services without proper replacement may adversely impact the achievement of our objectives. Mr. Siboni may leave our employment at any time subject to contractual notice periods, as applicable. Also, our performance is largely dependent on the talents and efforts of highly skilled individuals, particularly our software engineers and computer vision professionals. Recruiting and retaining qualified employees, consultants, and advisors for our business, including scientific and technical personnel, will also be critical to our success. There is currently a shortage of skilled personnel in our industry, which is likely to continue. As a result, competition for skilled personnel is intense and the turnover rate can be high. We may not be able to attract and retain personnel on acceptable terms given the competition in the industry in which we operate. Moreover, certain of our competitors or other technology businesses may seek to hire our employees. The inability to recruit and retain qualified personnel, or the loss of the services of our executive officers, without proper replacement, may impede the progress of our development and commercialization objectives.

Under applicable employment laws, we may not be able to enforce covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We generally enter into non-competition agreements with our employees. These agreements prohibit our employees from competing directly with us or working for our competitors or clients for a limited period after they cease working for us. We may be unable to enforce these agreements under the laws of the jurisdictions in which our employees work and it may be difficult for us to restrict our competitors from benefiting from the expertise that our former employees or consultants developed while working for us. For example, Israeli courts have required employers seeking to enforce non-compete undertakings of a former employee to demonstrate that the competitive activities of the former employee will harm one of a limited number of material interests of the employer that have been recognized by the courts, such as the secrecy of a company’s confidential commercial information or the protection of its intellectual property. If we cannot demonstrate that such interests will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or consultants and our ability to remain competitive may be diminished.

We depend entirely on the success of our current products in development, and we may not be able to successfully introduce these products and commercialize them.

We have invested almost all of our efforts and financial resources in the research and development of our products in development. As a result, our business is entirely dependent on our ability to complete the development of, and to successfully commercialize, our product candidates. The process of development and commercialization is long, complex, costly and uncertain of outcome.

We may not be able to introduce products acceptable to customers and we may not be able to improve the technology used in our current solutions in response to changing technology and end-user needs.

The markets in which we operate are subject to rapid and substantial innovation, regulation and technological change, mainly driven by technological advances and end-user requirements and preferences, as well as the emergence of new standards and practices. Even if we are able to complete the development of our products in development, our ability to compete in the ADAS, semi-autonomous and autonomous vehicle markets will depend, in large part, on our future success in enhancing our existing products and developing new solutions that will address the varied needs of prospective end-users, and respond to technological advances and industry standards and practices on a cost-effective and timely basis to otherwise gain market acceptance.

Even if we successfully introduce our existing products in development, it is likely that new solutions and technologies that we develop will eventually supplant our existing solutions or that our competitors will create solutions that will replace our solutions. As a result, any of our products may be rendered obsolete or uneconomical by our or others’ technological advances.

| 5 |

We may not be able to successfully manage our planned growth and expansion.

We expect to continue to make investments in our products in development. We expect that our annual operating expenses will continue to increase as we invest in business development, marketing, research and development, manufacturing and production infrastructure, and develop customer service and support resources for future customers. Failure to expand operational and financial systems timely or efficiently may result in operating inefficiencies, which could increase costs and expenses to a greater extent than we anticipate and may also prevent us from successfully executing our business plan. We may not be able to offset the costs of operation expansion by leveraging the economies of scale from our growth in negotiations with our suppliers and contract manufacturers. Additionally, if we increase our operating expenses in anticipation of the growth of our business and this growth falls short of our expectations, our financial results will be negatively impacted.

If our business grows, we will have to manage additional product design projects, materials procurement processes, and sales efforts and marketing for an increasing number of products, as well as expand the number and scope of our relationships with suppliers, distributors and end customers. If we fail to manage these additional responsibilities and relationships successfully, we may incur significant costs, which may negatively impact our operating results. Additionally, in our efforts to be first to market with new products with innovative functionality and features, we may devote significant research and development resources to products and product features for which a market does not develop quickly, or at all. If we are not able to predict market trends accurately, we may not benefit from such research and development activities, and our results of operations may suffer.

As our future development and commercialization plans and strategies develop, we expect to need additional managerial, operational, sales, marketing, financial and legal personnel. Our management may need to divert a disproportionate amount of its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, failure to deliver and timely deliver our products to customers, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional new products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenue could be reduced, and we may not be able to implement our business strategy.

Our operating results and financial condition may fluctuate.

Even if we are successful in introducing our products to the market, the operating results and financial condition of our company may fluctuate from quarter to quarter and year to year and are likely to continue to vary due to several factors, many of which will not be within our control. If our operating results do not meet the guidance that we provide to the marketplace or the expectations of securities analysts or investors, the market price of the ADS will likely decline. Fluctuations in our operating results and financial condition may be due to several factors, including those listed below and those identified throughout this “Risk Factors” section:

| ● | the degree of market acceptance of our products and services; | |

| ● | the mix of products and services that we sell during any period; | |

| ● | long sale cycles; | |

| ● | changes in the amount that we spend to develop, acquire or license new products, technologies or businesses; | |

| ● | changes in the amounts that we spend to promote our products and services; | |

| ● | changes in the cost of satisfying our warranty obligations and servicing our installed base of solutions; |

| 6 |

| ● | delays between our expenditures to develop and market new or enhanced solutions and consumables and the generation of sales from those products; | |

| ● | development of new competitive products and services by others; | |

| ● | difficulty in predicting sales patterns and reorder rates that may result from a multi-tier distribution strategy associated with new product categories; | |

| ● | litigation or threats of litigation, including intellectual property claims by third parties; | |

| ● | changes in accounting rules and tax laws; | |

| ● | changes in regulations and standards; | |

| ● | the geographic distribution of our sales; | |

| ● | our responses to price competition; | |

| ● | general economic and industry conditions that affect end-user demand and end-user levels of product design and manufacturing; | |

| ● | changes in interest rates that affect returns on our cash balances and short-term investments; | |

| ● | changes in dollar-shekel exchange rates that affect the value of our net assets, future revenues and expenditures from and/or relating to our activities carried out in those currencies; and | |

| ● | the level of research and development activities by our company. |

Due to all of the foregoing factors, and the other risks discussed herein, you should not rely on quarter-to-quarter comparisons of our operating results as an indicator of our future performance.

The markets in which we participate are competitive. Even if we are successful in completing the development of our products in development, our failure to compete successfully could cause any future revenues and the demand for our products not to materialize or to decline over time.

We aim to sell our products to automotive manufacturers, heavy and agricultural equipment manufacturers that incorporate ADAS, semi-autonomous and autonomous technologies in their automobiles and/or equipment and other companies that market or develop component parts of these systems. Many of our competitors have extensive track records and relationships within the automotive industry.

Many of our current and potential competitors have longer operating histories and more extensive name recognition than we have and may also have greater financial, marketing, manufacturing, distribution and other resources than we have. Current and future competitors may be able to respond more quickly to new or emerging technologies and changes in customer demands and to devote greater resources to the development, promotion and sale of their products than we can. Our current and potential competitors may develop and market new technologies that render our existing or future products obsolete, unmarketable or less competitive (whether from a price perspective or otherwise). We cannot assure you that we will be able to maintain a competitive position or to compete successfully against current and future sources of competition.

If our relationships with suppliers for our products and services were to terminate or our manufacturing arrangements were to be disrupted, our business could be interrupted.

Our products depend on certain third-party technology and we purchase component parts that are used in our products from third-party suppliers, some of whom may compete with us. While there are several potential suppliers of most of these component parts that we use, we currently choose to use only one or a limited number of suppliers for several of these components. Our reliance on a single or limited number of vendors involves several risks, including:

| 7 |

| ● | potential shortages of some key components; | |

| ● | product performance shortfalls, if traceable to particular product components, since the supplier of the faulty component cannot readily be replaced; | |

| ● | discontinuation of a product on which we rely; | |

| ● | potential insolvency of these vendors; and | |

| ● | reduced control over delivery schedules, manufacturing capabilities, quality and costs. |

In addition, we require any new supplier to become “qualified” pursuant to our internal procedures. The qualification process involves evaluations of varying durations, which may cause production delays if we were required to qualify a new supplier unexpectedly. We generally assemble our solutions and parts based on our internal forecasts and the availability of assemblies, components and finished goods that are supplied to us by third parties, which are subject to various lead times. If certain suppliers were to decide to discontinue production of an assembly, component that we use, the unanticipated change in the availability of supplies, or unanticipated supply limitations, could cause delays in, or loss of, sales, increased production or related costs and consequently reduced margins, and damage to our reputation. If we were unable to find a suitable supplier for a particular component, we could be required to modify our existing products or the end-parts that we offer to accommodate substitute components or compounds.

Discontinuation of operations at our manufacturing sites could prevent us from timely filling customer orders and could lead to unforeseen costs for us.

We plan to assemble and test the solutions that we sell at subcontractors’ facilities in various locations that are specifically dedicated to separate categories of systems and consumables. Because of our reliance on all of these production facilities, a disruption at any of those facilities could materially damage our ability to supply our products to the marketplace in a timely manner. Depending on the cause of the disruption, we could also incur significant costs to remedy the disruption and resume product shipments. Such disruptions may be caused by, among other factors, pandemics, earthquakes, fire, flood and other natural disasters. Accordingly, any such disruption could result in a material adverse effect on our revenue, results of operations and earnings, and could also potentially damage our reputation.

Our planned international operations will expose us to additional market and operational risks, and failure to manage these risks may adversely affect our business and operating results.

We expect to derive a substantial percentage of our sales from international markets. Accordingly, we will face significant operational risks from doing business internationally, including:

| ● | fluctuations in foreign currency exchange rates; | |

| ● | potentially longer sales and payment cycles; | |

| ● | potentially greater difficulties in collecting accounts receivable; | |

| ● | potentially adverse tax consequences; | |

| ● | reduced protection of intellectual property rights in certain countries, particularly in Asia and South America; | |

| ● | difficulties in staffing and managing foreign operations; | |

| ● | laws and business practices favoring local competition; | |

| ● | costs and difficulties of customizing products for foreign countries; | |

| ● | compliance with a wide variety of complex foreign laws, treaties and regulations; |

| 8 |

| ● | an outbreak of a contagious disease, such as coronavirus, which may cause us, third party vendors and manufacturers and/or customers to temporarily suspend our or their respective operations in the affected city or country; | |

| ● | export license constraints or restrictions due to the unique technology of our products, some of which are dual use (defense and industry); | |

| ● | tariffs, trade barriers and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets; and | |

| ● | being subject to the laws, regulations and the court systems of many jurisdictions. |

Our failure to manage the market and operational risks associated with our international operations effectively could limit the future growth of our business and adversely affect our operating results.

We may face business disruption and related risks resulting from the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

We have been impacted by the COVID-19 pandemic, and we cannot predict the future impacts the COVID-19 pandemic, including the emergence of new strains such as the Omicron or Delta variant, may have on its business, results of operations and financial condition. While COVID-19 is still spreading and the final implications of the pandemic are difficult to estimate at this stage, it is clear that it has affected the lives of a large portion of the global population. At this time, the pandemic has caused states of emergency to be declared in various countries, including China, where we have significant operations. If travel restrictions or quarantines are reimposed in China or globally, various institutions and companies may be closed, which would impact our operations. Numerous government regulations and public advisories, as well as shifting social behaviors, temporarily and from time to time limited or closed non-essential transportation, government functions, business activities and person-to-person interactions, and the duration of such trends is difficult to predict. While certain COVID-19 mitigation actions have since been relaxed, no assurance can be made that such actions, or other measures, will not be reimposed in the future. In addition, the U.S. government has restricted travel to the United States from foreign nationals who have not been vaccinated against COVID-19. Although to date these restrictions have not materially impacted our operations other than the ability to travel which resulted within some delays in our trials, demonstrations and installations, the effect on our business, from the spread of COVID-19 and the COVID-19 mitigation actions implemented by the governments of the State of Israel, the United States and other countries, may worsen over time.

Authorities around the world have and may continue implementing similar restrictions on business and individuals in their jurisdictions. To date, we have taken action to enable our employees to work remotely from home a portion of the time but there can be no assurance that these measures will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state, local authorities and any other relevant jurisdiction, or that we determine are in the best interests of our employees.

Significant disruptions of our information technology systems or breaches of our data security could adversely affect our business.

A significant invasion, interruption, destruction or breakdown of our information technology systems and/or infrastructure by persons with authorized or unauthorized access could negatively impact our business and operations. We could also experience business interruption, information theft and/or reputational damage from cyber-attacks, which may compromise our systems and lead to data leakage either internally or at our third-party providers. Our systems have been, and are expected to continue to be, the target of malware and other cyber-attacks. Although we have invested in measures to reduce these risks, we cannot assure you that these measures will be successful in preventing compromise and/or disruption of our information technology systems and related data.

| 9 |

Our products will be subject to automotive regulations due to the global quality requirements, which could prevent us from marketing our products to vehicle manufacturers.

The automotive regulations are dynamic and changing and effected by the final customer quality requirements as well. Even if we are successful in completing the development of our products, our failure to comply with the different types of regulations and requirements could delay the transfer to production schedule and eventually time to market.

In order to market our products to vehicle manufacturers we will be required to accomplish different type of regulations requirements such as ISO 26262 Functional Safety Regulations (ASIL) and Auto Spice or other common quality management methodologies. In order to meet the quality requirements, we will have to cooperate with vehicle manufacturers, to receive their customers’ quality requirements that meet the requisite regulation of such customers and implement tools, processes and methodologies. Such processes and tools will require resources and funds and will consume significant time effort until fully fulfilled. We are already investing time and efforts in order to study the global quality and regulations requirements, but we cannot assure, at this time, that we will be able to meet the regulations requirements on time.

Our products are cost sensitive and subject to customers’ aggressive target costs. Our products are sub solutions of modules as part of full semi-autonomous or autonomous systems with low cost product expectations and we may therefore be forced to lower or costs or have lower margins.

The automotive industry is one that continuously strives for cost reduction goals and optimizing the vehicle cost to meet the end customers’ expectations. For example, the target cost of ADAS, semi-autonomous and autonomous systems are being continuously reduced and while our products are cost sensitive to various costs factors, we may fail to meet these reduced market targets costs. We are working to build a robust supply chain network to support our cost reduction efforts and optimize our hardware and software costs, but may not be successful in doing so. If we are unable to reduce our costs in line with industry target cost, our results of operations may be adversely impacted.

Our business and operations would suffer in the event of computer system failures, cyber-attacks or a deficiency in our cybersecurity.

Despite the implementation of security measures intended to secure our data against impermissible access and to preserve the integrity and confidentiality of our data, our internal computer systems, and those of third parties on which we rely, we are vulnerable to damage from computer viruses, malware, natural disasters, terrorism, war, telecommunication and electrical failures, cyber-attacks or cyber-intrusions over the Internet, attachments to emails, persons inside our organization, or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyber-attacks or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. If such an event were to occur and cause interruptions in our operations, it could result in a material disruption of our business. To the extent that any disruption or security breach was to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur material legal claims, damage to our reputation, regulatory investigations and redresses, and penalties and liabilities.

While we do not currently, we may conduct a substantial amount of business in China. The legal system in China has inherent uncertainties that could have a material adverse effect on our business, financial condition and results of operations.

We have begun to conduct proof of concept, or POC, projects in China and have established a subsidiary in China for these purposes. As a result, we may engage in a substantial amount of business in China in the future. The Chinese legal system is based on written statutes and their legal interpretation by the Standing Committee of the National People’s Congress. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, the Chinese government has been developing a comprehensive system of commercial laws dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, there is a general lack of internal guidelines or authoritative interpretive guidance and because of the limited number of published cases and their non-binding nature, interpretation and enforcement of these laws and regulations involve uncertainties. Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention. Since Chinese administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems.

Risks Related to Our Intellectual Property

If we are unable to obtain and maintain effective intellectual property rights for our products, we may not be able to compete effectively in our markets.

Historically, we have relied on trade secret protection and confidentiality agreements to protect the intellectual property related to our technologies and products. Since December 2015, we have also sought patent protection for certain of our products. Our success depends in large part on our ability to obtain and maintain patent and other intellectual property protection in the United States and in other countries with respect to our proprietary technology and new products.

We have sought to protect our proprietary position by filing patent applications in Israel, the United States and in other countries, with respect to our novel technologies and products, which are important to our business. Patent prosecution is expensive and time consuming, and we may not be able to file and prosecute all necessary or desirable patent applications at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection.

| 10 |

Foresight Automotive has a growing portfolio of three granted U.S. patents and four pending U.S. non-provisional applications, two granted patents with the Israeli Patent Office, one granted patent and five full applications in China, one of which has been allowed, six applications in Europe, four applications in Japan, and one PCT application. Eye-Net Mobile has a growing portfolio of one granted U.S. patent, three U.S. provisional patent applications, one full application with the Israeli Patent Office and one application in Europe. We cannot offer any assurances about which, if any, patent applications will issue, the breadth of any such patent or whether any issued patents will be found invalid and unenforceable or will be threatened by third parties. Any successful opposition to these patents or any other patents owned by or licensed to us after patent issuance could deprive us of rights to prevent others from exploiting our technology and may affect the successful commercialization of our products.

Further, there is no assurance that all potentially relevant prior art relating to our patent applications has been found, which can invalidate a patent or prevent a patent from issuing from a pending patent application. Even if patents do successfully issue, and even if such patents cover our products, third parties may challenge their validity, enforceability, or scope, which may result in such patents being narrowed, found unenforceable or invalidated. Furthermore, even if they are unchallenged, our patent applications and any future patents may not adequately protect our intellectual property, provide exclusivity for our new products, or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business.

If we cannot obtain and maintain effective patent rights for our products, we may not be able to compete effectively, and our business and results of operations would be harmed.

If we are unable to maintain effective proprietary rights for our products, we may not be able to compete effectively in our markets.

In addition to the protection afforded by any patents that may be granted, historically, we have relied on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable or that we elect not to patent, processes that are not easily known, knowable or easily ascertainable, and for which patent infringement is difficult to monitor and enforce and any other elements of our product candidate discovery and development processes that involve proprietary know-how, information or technology that is not covered by patents. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with our employees, consultants, scientific advisors, and contractors. We also seek to preserve the integrity and confidentiality of our data, trade secrets and intellectual property by maintaining physical security of our premises and physical and electronic security of our information technology systems. Agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets and intellectual property may otherwise become known or be independently discovered by competitors.

We cannot provide any assurances that our trade secrets and other confidential proprietary information will not be disclosed in violation of our confidentiality agreements or that competitors will not otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. Also, misappropriation or unauthorized and unavoidable disclosure of our trade secrets and intellectual property could impair our competitive position and may have a material adverse effect on our business. Additionally, if the steps taken to maintain our trade secrets and intellectual property are deemed inadequate, we may have insufficient recourse against third parties for misappropriating any trade secret.

Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms.

It is inherently difficult to conclusively assess our freedom to operate without infringing on third party rights. Our competitive position may be adversely affected if existing patents or patents resulting from patent applications issued to third parties or other third-party intellectual property rights are held to cover our products or elements thereof, or our manufacturing or uses relevant to our development plans. In such cases, we may not be in a position to develop or commercialize products or our product candidates unless we successfully pursue litigation to nullify or invalidate the third-party intellectual property right concerned or enter into a license agreement with the intellectual property right holder, if available on commercially reasonable terms. There may also be pending patent applications that if they result in issued patents, could be alleged to be infringed by our new products. If such an infringement claim should be brought and be successful, we may be required to pay substantial damages, be forced to abandon our new products or seek a license from any patent holders. No assurances can be given that a license will be available on commercially reasonable terms, if at all.

It is also possible that we have failed to identify relevant third-party patents or applications. For example, certain U.S. patent applications that will not be filed outside the United States remain confidential until patents issue. Patent applications in the United States and in most of the other countries are published approximately 18 months after the earliest filing for which priority is claimed, with such earliest filing date being commonly referred to as the priority date. Therefore, patent applications covering our new products or platform technology could have been filed by others without our knowledge. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our platform technologies, our new products or the use of our new products. Third party intellectual property right holders may also actively bring infringement claims against us. We cannot guarantee that we will be able to successfully settle or otherwise resolve such infringement claims. If we are unable to successfully settle future claims on terms acceptable to us, we may be required to engage in or continue costly, unpredictable and time-consuming litigation and may be prevented from or experience substantial delays in pursuing the development of and/or marketing our new products. If we fail in any such dispute, in addition to being forced to pay damages, we may be temporarily or permanently prohibited from commercializing our new products that are held to be infringing. We might, if possible, also be forced to redesign our new products so that we no longer infringe the third party’s intellectual property rights. Any of these events, even if we were ultimately to prevail, could require us to divert substantial financial and management resources that we would otherwise be able to devote to our business.

| 11 |

Patent policy and rule changes could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of any issued patents.

Changes in either the patent laws or interpretation of the patent laws in the United States and other countries may diminish the value of any patents that may issue from our patent applications or narrow the scope of our patent protection. The laws of foreign countries may not protect our rights to the same extent as the laws of the United States. Publications of discoveries in the scientific literature often lag behind the actual discoveries, and patent applications in the United States and other jurisdictions are typically not published until 18 months after filing, or in some cases not at all. We therefore cannot be certain that we were the first to file the invention claimed in our owned and licensed patent or pending applications, or that we or our licensor were the first to file for patent protection of such inventions. Assuming all other requirements for patentability are met, in the United States prior to 2013, the first to make the claimed invention without undue delay in filing, is entitled to the patent, while outside the United States, the first to file a patent application is entitled to the patent. After 2013, the Leahy-Smith America the United States has moved to a first to file system. Changes to the way patent applications will be prosecuted could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of any issued patents, all of which could have a material adverse effect on our business and financial condition.

We may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming, and unsuccessful.

Competitors may infringe our intellectual property. If we were to initiate legal proceedings against a third party to enforce a patent covering one of our new products, the defendant could counterclaim that the patent covering our product candidate is invalid and/or unenforceable. In patent litigation in the United States, defendant counterclaims alleging invalidity and/or unenforceability are commonplace. Grounds for a validity challenge could be an alleged failure to meet any of several statutory requirements, including lack of novelty, obviousness, or non-enablement. Grounds for an unenforceability assertion could be an allegation that someone connected with prosecution of the patent withheld relevant information from the United States Patent and Trademark Office, or USPTO, or made a misleading statement, during prosecution. The validity of U.S. patents may also be challenged in post-grant proceedings before the USPTO. The outcome following legal assertions of invalidity and unenforceability is unpredictable.

Derivation proceedings initiated by third parties or brought by us may be necessary to determine the priority of inventions and/or their scope with respect to our patent or patent applications or those of our licensors. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms. Our defense of litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. In addition, the uncertainties associated with litigation could have a material adverse effect on our ability to raise the funds necessary to continue our research programs, license necessary technology from third parties, or enter into development partnerships that would help us bring our new products to market.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of the ADSs or Ordinary Shares.

We may be subject to claims challenging the inventorship of our intellectual property.

We may be subject to claims that former employees, collaborators or other third parties have an interest in, or right to compensation, with respect to our current patent and patent applications, future patents or other intellectual property as an inventor or co-inventor. For example, we may have inventorship disputes arise from conflicting obligations of consultants or others who are involved in developing our products. Litigation may be necessary to defend against these and other claims challenging inventorship or claiming the right to compensation. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

| 12 |

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting, and defending patents on products, as well as monitoring their infringement in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries can be less extensive than those in the United States. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as federal and state laws in the United States.

Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and may also export otherwise infringing products to territories where we have patent protection, but enforcement is not as strong as that in the United States. These products may compete with our products. Future patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

Many companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets, and other intellectual property protection, which could make it difficult for us to stop the marketing of competing products in violation of our proprietary rights generally. Proceedings to enforce our patent rights in foreign jurisdictions, whether or not successful, could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our future patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to monitor and enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

Risks Related to the Ownership of the ADSs or Our Ordinary Shares

Our principal shareholders, officers and directors beneficially own over 11.97% of our outstanding Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval.

As of March 20, 2023, our principal shareholders, officers and directors beneficially own approximately 11.97% of our Ordinary Shares. This significant concentration of share ownership may adversely affect the trading price for our Ordinary Shares because investors often perceive disadvantages in owning shares in companies with controlling shareholders. As a result, these shareholders, if they acted together, could significantly influence or even unilaterally approve matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other business combination transactions. The interests of these shareholders may not always coincide with our interests or the interests of other shareholders.

Holders of ADSs must act through the depositary to exercise their rights as our shareholders.

Holders of the ADSs do not have the same rights of our shareholders and may only exercise the voting rights with respect to the underlying Ordinary Shares in accordance with the provisions of the deposit agreement for the ADSs. Under Israeli law, the minimum notice period required to convene a shareholders meeting is generally no less than 35 calendar days, but in some instances, 21 or 14 calendar days. When a shareholder meeting is convened, holders of the ADSs may not receive sufficient notice of a shareholders’ meeting to permit them to withdraw their Ordinary Shares to allow them to cast their vote with respect to any specific matter. In addition, the depositary and its agents may not be able to send voting instructions to holders of the ADSs or carry out their voting instructions in a timely manner. We will make all reasonable efforts to cause the depositary to extend voting rights to holders of the ADSs in a timely manner, but we cannot assure holders that they will receive the voting materials in time to ensure that they can instruct the depositary to vote their ADSs. Furthermore, the depositary and its agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for the effect of any such vote. As a result, holders of the ADSs may not be able to exercise their right to vote and they may lack recourse if their ADSs are not voted as they requested. In addition, in the capacity as a holder of ADSs, they will not be able to call a shareholders’ meeting unless they first withdraw their Ordinary Shares from the ADS program and convert them into the underlying Ordinary Shares held in the Israeli market in order to allow them to submit to us a request to call a meeting with respect to any specific matter, in accordance with the applicable provisions of the Israeli Companies Law 5759-1999, or the Companies Law, and our amended and restated articles of association.

| 13 |

The Jumpstart Our Business Startups Act, or the JOBS Act, allows us to postpone the date by which we must comply with some of the laws and regulations intended to protect investors and to reduce the amount of information we provide in our reports filed with the Securities and Exchange Commission, or the SEC, which could undermine investor confidence in our company and adversely affect the market price of the ADSs or our Ordinary Shares.

For so long as we remain an “emerging growth company” as defined in the JOBS Act, we intend to take advantage of certain exemptions from various requirements that are applicable to public companies that are not “emerging growth companies” including:

| ● | the provisions of the Sarbanes-Oxley Act requiring that our independent registered public accounting firm provide an attestation report on the effectiveness of our internal control over financial reporting; | |

| ● | Section 107 of the JOBS Act, which provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. This means that an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to delay such adoption of new or revised accounting standards. As a result of this adoption, our financial statements may not be comparable to companies that comply with the public company effective date; and | |

| ● | any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements. |

We intend to take advantage of these exemptions until we are no longer an “emerging growth company.” We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the date of our first sale of equity securities pursuant to an effective registration statement under the Securities Act, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Ordinary Shares that is held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

We cannot predict if investors will find the ADSs or our Ordinary Shares less attractive because we may rely on these exemptions. If some investors find the ADSs or our Ordinary Shares less attractive as a result, there may be a less active trading market for the ADSs or our Ordinary Shares, and our market prices may be more volatile and may decline.

If we are unable to comply with the Nasdaq minimum bid requirement, our ADSs could be delisted from Nasdaq, and as a result we and our shareholders could incur material adverse consequences, including a negative impact on our liquidity, our shareholders’ ability to sell shares and our ability to raise capital.

Our ADSs are currently listed on Nasdaq. Our listing on the Nasdaq Capital Market is conditioned upon our continued compliance with requirement to maintain a minimum bid price of $1.00 per share, pursuant to Nasdaq Listing Rule 5550(a)(2), or the Minimum Bid Requirement.

On May 23, 2022, we were advised that we no longer comply with the Minimum Bid Requirement. Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), we have been granted a 180-calendar day compliance period, or until November 21, 2022, to regain compliance with the Minimum Bid Requirement. To regain compliance, the closing bid price of our ADSs must meet or exceed $1.00 per share for at least 10 consecutive business days during the 180-calendar day compliance period. On November 22, 2022, we were informed that we have been granted an additional 180-day compliance period, or until May 22, 2023, to regain compliance with Nasdaq’s Minimum Bid Requirement.

If we are not in compliance by May 22, 2023, Nasdaq will provide notice that our ADSs will be subject to delisting.

We intend to monitor the closing bid price of our ADSs between now and May 22, 2023, and intend to consider available options to cure the deficiency and regain compliance with the Minimum Bid Requirement within the compliance period, including effective a reverse stock split. Our ADSs will continue to be listed and trade on Nasdaq during this period, unaffected by the receipt of the written notice from Nasdaq.