An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

SUBJECT TO COMPLETION, DATED DECEMBER 29, 2017 .

PSI INTERNATIONAL, INC.

Up to 2,000,000 Shares of Common Stock

$15.00 per Share

Minimum Purchase: 100 Shares ($1,500.00)

This is an initial public offering of up to 2,000,000 shares of common stock of PSI International, Inc., or the “Company.” In this offering circular, we refer to the shares offered by us as the “Shares.” Our executive offices are located at 11200 Waples Mill Road Suite 200, Fairfax, Virginia 22030 and our telephone number is (703) 621-5823. Our website is www.psiint.com, the contents of which are not incorporated in this offering circular.

Generally, no sale may be made to you in this offering to the extent that the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Prior to this offering, there has been no public market for our common stock. We have submitted an application with The NASDAQ Stock Market LLC (“NASDAQ”) to list our common stock on The NASDAQ Capital Market under the symbol “PSIT.” In order to list, the NASDAQ Capital Market requires that, among other criteria, at least 1,000,000 publicly-held shares of our common stock be outstanding, the shares be held in the aggregate by at least 300 round lot holders, the market value of the publicly-held shares of our common stock be at least $15.0 million, and the bid price per share of our common stock be $4.00 or more. We will not satisfy these requirements until we have a sufficient amount of subscriptions in this Offering. We do not intend to close this offering unless we satisfy the listing conditions to trade our common stock on the NASDAQ Capital Market and receive a listing approval letter from NASDAQ. In the event our NASDAQ listing application is denied, investors will have their subscription funds promptly refunded without interest thereon or deduction therefrom.

This offering is being conducted on a “best-efforts” basis by our officers, directors and employees and through www.StartEngine.com, a website owned and operated by an unaffiliated third party that provides a crowdfunding platform and technology support to issuers engaging in Regulation A+ Offerings. Our officers, directors and employees will not receive any commission or any other remuneration for any sales. We will pay StartEngine a cash fee and warrants to purchase commons stock for shares sold through StartEngine.com. In offering the Shares on our behalf, our officers, directors and employees will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended, or the Exchange Act . There is currently no underwriter or sales agents for the Shares; however, the Company reserves the right to retain the services of one or more FINRA registered broker-dealers to serve as the underwriter of the Shares in consideration for customary fees and commissions not exceeding those imposed by FINRA. In the event we engage an underwriter, we will file an amendment to this Offering Circular to disclose the name of the underwriter and the terms of underwriting compensation. See “Plan of Distribution.”

The offering price has been fixed at $15.00 per Share throughout the offering period. The minimum subscription shall be for 100 Shares ($1,500), although the Company might accept subscription for lesser amounts in its sole discretion. The offering price of the Shares has been arbitrarily determined by the Company and bears no relationship to conventional criteria, such as book value or earnings per share, and shall be fixed throughout the term of this offering. There can be no assurance that the offering price bears any relation to the current fair market value of the common stock.

The offering will commence within two calendar days after this offering circular has been qualified by the U.S. Securities and Exchange Commission, or the “Commission” or the “SEC.” There is no minimum number of Shares that we must sell in order to conduct a closing in this offering and we intend to have multiple closings until the termination of the offering period. This offering will terminate upon the earlier of (i) such time as all of the Shares have been sold pursuant to the offering statement; (ii) our board of directors determines to terminate the offering; or (iii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days.

After the Offering Statement has been qualified by the SEC, we will accept tenders of funds to purchase the Shares. We may close on investments on a “rolling” basis (so not all investors will receive their shares on the same date). The funds tendered by potential investors will be held in a separate bank account maintained by Prime Trust, LLC, (the “Escrow Agent”) as agent or trustee for the persons who have the beneficial interests therein in accordance with Rule 15c2-4 of the Exchange Act (the “Escrow Account”). Upon each closing, the proceeds collected for such closing will be disbursed to the Company and the Shares for each closing will be issued to investors. If the offering does not close or the Escrow Agent does not receive written instructions from the Company prior to the termination date of the offering, the Escrow Agent will terminate the Escrow Account and the proceeds for the offering held in the Escrow Account will be promptly returned to investors, without interest thereon or deduction therefrom. You will not have the right to withdraw your funds during the offering other than if our NASDAQ application is denied. See “Plan of Distribution.”

This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES OF OUR COMMON STOCK ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 9 OF THIS OFFERING CIRCULAR.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

| Price

to public | Underwriter discounts and commissions (1) | Proceeds

to the issuer (2) | Proceeds

to other persons | |||||||||||||

| Per Share | $ | 15.00 | $ | 0.00 | $ | 15.00 | $ | 0.00 | ||||||||

| Total Minimum Amount (3) | $ | N/A | $ | N/A | $ | N/A | $ | N/A | ||||||||

Total Maximum Amount | $ | 30,000,000.00 | $ | 0.00 | $ | 30,000,000.00 | $ | 0.00 | ||||||||

| (1) |

There is currently no underwriter or sales agents for the Shares; however, the Company reserves the right to retain the services of one or more FINRA registered broker-dealers to serve as the underwriter of the Shares in consideration for customary fees and commissions not exceeding those imposed by FINRA. In the event we engage an underwriter, we will file an amendment to this Offering Circular to disclose the name of the underwriter and the terms of underwriting compensation. On November 14, 2017, we entered into a Posting Agreement with StartEngine Crowdfunding, Inc., which has agreed to host our offering on their online platform, StartEngine.com, in consideration for a $50.00 cash fee per investor and five year warrants to purchase our common stock. See “Plan of Distribution.” | |

| (2) | Before deducting expenses, estimated to be approximately to be $1,070,000, including legal fees, accounting fees, and fees and expenses of VStock Transfer, LLC for acting as the Company’s stock transfer agent in connection with this offering, FundAmerica, LLC, for certain administrative services, Prime Trust, LLC, for certain escrow services, and StartEngine Crowdfunding, Inc., for certain online posting services. For more information about the expenses of this offering, please see the section entitled, “Plan of Distribution.” | |

| (3) | There is no minimum number of Shares that must be sold in this offering other than each investor must invest at least $1,500 (100 Shares) which may be waived by the Company. |

The date of this offering circular is ___________, 2017

Table of Contents

Unless otherwise specified, the information in this offering circular is set forth as of December 29, 2017 , and we anticipate that changes in our affairs will occur after such date. We have not authorized any person to give any information or to make any representations, other than as contained in this offering circular, in connection with the offer contained in this offering circular. If any person gives you any information or makes representations in connection with this offer, do not rely on it as information we have authorized. This offering circular is not an offer to sell our common stock in any state or other jurisdiction to any person to whom it is unlawful to make such offer.

| 2 |

The following summary highlights selected information from this offering circular and may not contain all of the information that is important to you. To understand our business and this offering fully, you should read this entire offering circular carefully, including the financial statements and the related notes in this offering circular. When we refer in this offering circular to the “Company,” “we,” “us,” and “our,” we mean PSI International, Inc., a Virginia corporation. This offering circular contains forward-looking statements and information relating to the Company. See “Cautionary Note Regarding Forward Looking Statements” on page 33.

Our Company

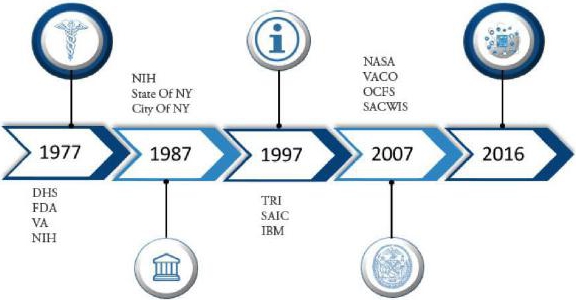

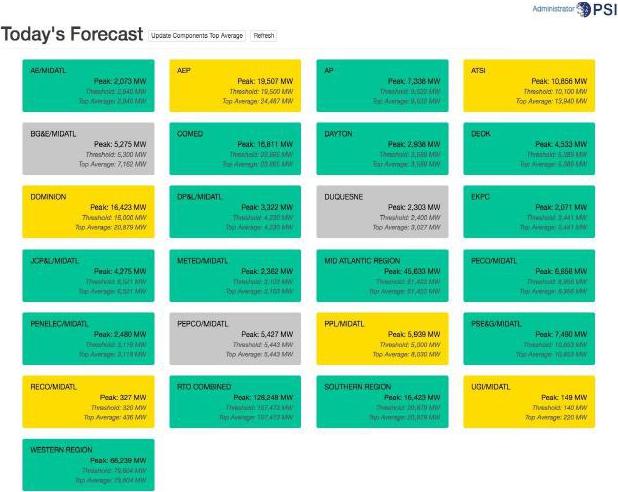

PSI International, Inc. (“PSI International,” “PSI,” the “Company,” “or “we,” “us,” “our” or similar terms) founded its business in 1977 as a provider of information technology (“IT”) and communications technology solutions and services to federal, state, and city government agencies. We provide enterprising solutions and services to the U.S. defense, intelligence, health care, and civilian government agencies, as well as major corporations in the private sector. We allow customers in any industry to improve their business performance, improve customer service, detect fraud, and reduce resource consumption by using their data to create new insights and to automate business processes. The demand for our services, in large measure, is created by the increasingly complex network, systems, and information environments in which government agencies and businesses operate, and by the need to stay current with emerging technology while increasing productivity and, ultimately, performance.

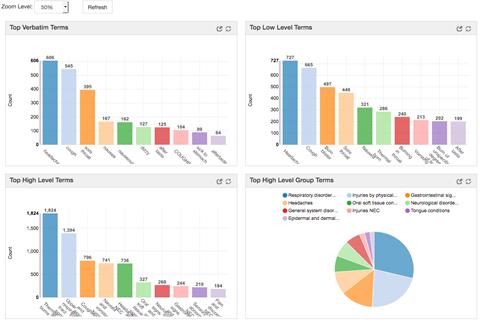

We provide IT and communications technology solutions to deliver cost-effective solutions and services across four niche service areas: (1) Information Technology; (2) Health Science; (3) Human Services and (4) Renewable Energy Management. We leverage technology and innovation in such fields to allow customers in any industry to improve business performance, improve customer service, detect fraud, and reduce resource consumption by using their data to create new insights and to automate business processes. Our goal is to become a significant provider of such services to major corporations in the private sector and continue to grow our public sector client base by keeping our current clientele and developing new public sector clientele across existing and new product categories.

| 3 |

Our Mission

Our business mission is “to integrate technologies and subject matter expertise to enhance our client’s ability to securely capture, store, retrieve, distribute, and use information. As a corporation and as individuals, we will constantly improve our abilities and methods of providing services.”

Our Technology

For over 40 years, we have been offering our data management, analytical and real-time tracking system, cyber securities and technical architecture to provide integration services and solutions to the United States’ Department of Defense, or “DOD,” Department of Homeland Security, or DHS, National Aeronautics and Space Administration, or “NASA,” and Food and Drug Administration, or the “FDA,” and other state agencies such as NYPD, MTA, WMATA.

| 4 |

We offer a comprehensive portfolio of contract vehicles to provide a wide range of options for our customers. We utilize Indefinite Delivery/ Indefinite Quantity (ID/IQ) contracts, Government-Wide Acquisition Contracts (GWACs), our GSA IT Schedule 70 contract, and various State- and City-wide Back-drop contracts within New York to deliver innovation-driven services and solutions to federal, state and local governmental agencies. Our business strategy is to apply big data analytics, database administration and applied research to assist our U.S. Government customers to solve their information-related challenges.

Executive Offices; General History

As of June 30, 2017 and December 31, 2016, we had 111 and 99 full-time employees, respectively, and 256 and 262 independent contractors, respectively, working at locations throughout the eastern United States. Our website is www.psiint.com, the contents of which are not incorporated in this offering circular. We are headquartered at 11200 Waples Mill Road, Suite 200, Fairfax, Virginia 22030.

We were originally incorporated as Planning Systems International, Inc. in Massachusetts on February 3, 1977. In March 1984, we changed our name to PSI International, Inc. and in September 2004, we changed our state of domicile to Virginia. Pursuant to that certain Stock Purchase Agreement, dated October 30, 2015, between PSI Investment, LLC, a Virginia limited liability company of which Richard Kyeongsoo Seol, our President and Chairman, has voting and dispositive control (“PSI Investment”), and the then shareholders of the Company, PSI Investment acquired 100% of the outstanding shares of the Company’s common stock from former shareholders.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. These reduced reporting requirements include:

| 5 |

| ● | An exemption from compliance with the auditor attestation requirement on the effectiveness of our internal controls over financial reporting; | |

| ● | Reduced disclosure about our executive compensation arrangements; and | |

| ● | An exemption from the requirements to obtain a non-binding advisory vote on executive compensation or shareholder approval of any golden parachute arrangements. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available benefits of the JOBS Act. We have taken advantage of some of the reduced reporting requirements in this offering circular. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies until we are required or choose to do so, whichever is earlier.

We prepare our financial statements in accordance with Generally Accepted Accounting Principles in the United States of America (U.S. GAAP). See “Risk Factors—We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the offering less attractive to investors.”

| 6 |

The Offering

| Issuer | PSI International, Inc., a Virginia corporation | |

| Securities being offered | 2,000,000 shares of common stock, no par value per share, or the Shares | |

| Offering price | $15.00 per Share | |

| Term of this offering | This offering will terminate upon the earlier of (i) such time as all of the Shares have been sold pursuant to the offering statement; (ii) our board of directors determines to terminate the offering; or (iii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days. | |

| Common stock outstanding immediately before this offering | 12,000,000 shares, 12,000,000 shares on a fully-diluted basis. | |

| Common stock outstanding immediately after this offering | 14,000,000 shares of common stock, assuming all of the 2,000,000 Shares offered by the Company are sold in this offering and excluding 500,000 shares of our common stock reserved for issuance under our 2017 Equity Incentive Plan, including shares issuable upon the exercise of outstanding stock options. | |

| Proposed Listing | Prior to this offering, there has been no public market for our common stock. We have submitted an application with The NASDAQ Stock Market LLC (“NASDAQ”) to list our common stock on The NASDAQ Capital Market under the symbol “PSIT.”

In order to list, the NASDAQ Capital Market requires that, among other criteria, at least 1,000,000 publicly-held shares of our common stock be outstanding, the shares be held in the aggregate by at least 300 round lot holders, the market value of the publicly-held shares of our common stock be at least $15.0 million, and the bid price per share of our common stock be $4.00 or more. We will not satisfy these requirements until we have a sufficient amount of subscriptions in this Offering. We do not intend to close this offering unless we satisfy the listing conditions to trade our common stock on the NASDAQ Capital Market and receive a listing approval letter from NASDAQ. In the event our NASDAQ listing application is denied, investors will have their subscription funds promptly refunded without interest thereon or deduction therefrom.

Our common stock will not commence trading on NASDAQ until all of the following conditions are met: (i) we meet the initial listing requirements of NASDAQ; (ii) the offering is terminated; and (iii) we have filed a post-qualification amendment to the Offering Statement and a registration statement on Form 8-A (“Form 8-A”) under the Exchange Act, and such post-qualification amendment is qualified by the SEC and the Form 8-A has become effective. Pursuant to applicable rules under Regulation A, the Form 8-A will not become effective until the SEC qualifies the post-qualification amendment. We intend to file the post-qualification amendment and request its qualification immediately prior to the termination of the offering in order that the Form 8-A may become effective as soon as practicable. Even if we meet the minimum requirements for listing on NASDAQ, we may wait before terminating the offering and commencing the trading of our common stock on NASDAQ in order to raise additional proceeds. As a result, you may experience a delay between the closing of your purchase of shares of our common stock and the commencement of exchange trading of our common stock . See “Plan of Distribution ; NASDAQ Listing Application .” | |

| Use of Proceeds | We intend to use the net proceeds that we receive in this offering, along with readily available cash, to increase the capitalization and financial flexibility of the Company, to develop an energy management system, to acquire solar projects, to reinforce the Research and Development Center including technology, market analysis, and risk solution, and to improve training classes and proposal management. | |

| Please see “Use of Proceeds” on page 59 of this offering circular. | ||

| Risk Factors | See “Risk Factors” starting on page 9 of this offering circular and other information appearing elsewhere in this office circular for a discussion of factors you should carefully consider before deciding whether to invest in our common stock. | |

| Proposed NASDAQ Symbol | PSIT |

| 7 |

Investing in our common stock involves a high degree of risk. Investors should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this offering circular, including our audited financial statements and related notes appearing at the end of this offering circular, before making an investment decision. The risks described below are not the only ones facing us. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. In such case, the trading price of our common stock could decline, and you may lose all or part of your original investment. This offering circular also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below.

Risks Related to Our Business

We are dependent on state and local government contracts for the majority of our revenue, primarily New York State, and a reduction or delay in spending by state and local governmental agencies, especially New York State, or a change in their mission priorities could adversely affect our business and operating results.

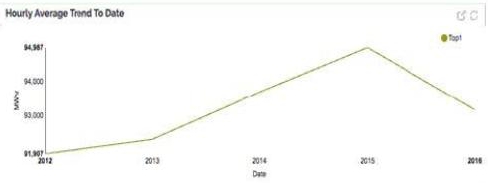

For the fiscal year ended December 31, 2016, our contracts with state and local governmental agencies represented approximately 86.7% of our revenue compared to 11.4% and 1.9% from our contracts with federal agencies and commercial customers, respectively. More specifically, approximately 63.1% or $33,090,203 of our 2016 revenue was generated under our contracts with New York State’s governmental agencies, of which approximately 57.4% or $30,107,250 was under our New York State’s Hourly-Based Information Technology Services contract (“HBITS”) pursuant to which we provide a wide range of information technology and telecommunications consulting resources to various agencies of New York State. For the six months ended June 30, 2017, our contracts with state and local government agencies represented 85.59% of our revenue, compared to 7.62% and 6.79% from our contracts with federal agencies and commercial agencies, respectively. Approximately 67.37% or $16,191,501 of our revenue for the six months ended June 30, 2017 was generated with contracts under New York State’s HBITS.

Therefore, our success is materially dependent on our contracts with state and local governmental agencies, specifically New York State. Companies engaged in government contracting are subject to certain unique business risks not shared by those serving the general commercial sector. Among these risks are:

| ● | a competitive procurement process with no firm schedule or guarantee of contracts being awarded; | |

| ● | competitive pricing pressure that may require cost reductions in order to realize revenue under contracts; | |

| ● | award of work to competitors due primarily to policy reasons; | |

| ● | dependence on congressional and state appropriations and administrative allotment of funds; | |

| ● | policies and regulations that can be readily changed by governing bodies; | |

| ● | competing political priorities and changes in the political climate regarding funding and operations of the services; | |

| ● | shifts in buying practices and policy changes regarding the use of contractors; | |

| ● | changes in and delays or cancellations of government programs or requirements; | |

| ● | government contracts that are usually awarded for relatively short periods of time and are subject to renewal options in favor of the government; and | |

| ● | many contracts with government agencies require annual funding and may be terminated in the agency’s sole discretion. |

A reduction or shift in spending priorities by New York’s and other state and local governmental agencies could limit or eliminate the continued funding of the Company under existing government contracts or awards of new contracts or new task orders under existing contracts. Any such reductions or shifts in spending, if significant, could have a material adverse effect on our business.

| 8 |

We depend on contracts with state and local governmental agencies, especially New York State, for approximately 85.6% all of our total revenue for six months ended June 30, 2017. If our relationships with such agencies are harmed, our future revenue and operating profits could materially decline.

State and local governmental agencies are our primary clients, with revenue from contracts and task orders, either as a prime or a subcontractor, with such agencies accounting for approximately 85.6% and 86.7% of our total revenue for the period ending June 30, 2017 and for the year ended December 31, 2016. New York State alone accounted for approximately 67.4% for the period ending June 30, 2017, and 57.4% of our total our revenue for the fiscal year ended December 31, 2016. For this reason, any issue that compromises our relationship with the state and local governmental agencies that we serve could cause our revenue to materially decline. Among the key factors in maintaining our relationship with state and local governmental agencies are our performance on contracts and task orders, the strength of our professional reputation, compliance with applicable laws and regulations, and the strength of our relationships with client personnel. In addition, the mishandling or the perception of mishandling of sensitive information, such as our failure to maintain the confidentiality of sensitive information associated with the work we perform for our clients, or even the existence of our business relationships with certain of our clients, including as a result of misconduct or other improper activities by our employees or subcontractors, or a failure to maintain adequate protection against security breaches, including those resulting from cyber-attacks, could harm our relationship with state and local governmental agencies that we serve. Our relationship with state and local governmental agencies that we serve could also be damaged as a result of an agency’s dissatisfaction with work performed by us, a subcontractor, or other third parties who provide services or products for a specific project for any reason, including due to perceived or actual deficiencies in the performance or quality of our work, and we may incur additional costs to address any such situation and the profitability of that work might be impaired. In addition, to the extent our performance under a contract does not meet an agency’s expectations, the client may seek to terminate the contract prior to its scheduled expiration date, provide a negative assessment of our performance to government-maintained contractor past-performance repositories, fail to award us additional business under existing contracts or otherwise, and direct future business to our competitors. Further, negative publicity concerning government contractors in general or us in particular may harm our reputation with government agencies. To the extent our reputation or relationships with state and local governmental agencies, especially New York State agencies, are impaired, our revenue and operating profits could materially decline resulting in the value of your investment in our common stock being adversely affected.

Our earnings and profitability may vary based on the mix of our contracts and may be adversely affected by our failure to accurately estimate or otherwise recover the expenses, time and resources for our contracts.

We enter into three general types of government agency contracts for our services: (i) cost-reimbursable, (ii) time-and-material and (iii) fixed-price contracts. For the six month period ended June 30, 2017 and fiscal year ending December 31, 2016, we derived approximately 3% and 2% of our revenue from cost-reimbursable contracts, approximately 89% and 93% from time-and-material contracts and approximately 8% and 5% from fixed-price contracts, respectively.

Each of these types of contracts, to varying degrees, involves the risk that we could underestimate our cost of fulfilling the particular contract, which may reduce the profit we earn or lead to a financial loss on the contract and adversely affect our operating results.

| ● | Under cost-reimbursable contracts, we are reimbursed for allowable costs up to a ceiling and paid a fee, which may be fixed or performance-based. If our actual costs exceed the contract ceiling or are not allowable under the terms of the contract or applicable regulations, we may not be able to recover those costs. In particular, there is increasing focus by government organizations on the extent to which government contractors, including us, are able to receive reimbursement for employee compensation and other types of costs. | |

| ● | Under time-and-material contracts, we are reimbursed for labor at negotiated fully burdened hourly billing rates and for certain allowable expenses. We assume financial risk on time-and-material contracts because of the fixed unit price nature of the negotiated labor prices and the level-of-effort (LOE) authorized in the budget. | |

| ● | Under fixed-price contracts, we perform specific tasks for a negotiated price. Compared to time-and-material and cost-reimbursable contracts, fixed-price contracts place the greatest performance risk on PSI and in return present circumstances that promote higher margins through the application of innovation to reduce performance costs while continuing to meet and deliver on customer contract expectations. Government agencies, where appropriate and to the maximum extent practicable, are increasing the use of fixed-price contracts. Because we assume the risk for cost overruns and contingent losses on fixed-price contracts, an increase in the percentage of fixed-price contracts in our contract mix would increase the Company’s risk of suffering losses. |

Additionally, our profits could be adversely affected if our costs under any of these contracts exceed the estimates used as a basis for contract negotiation. We have historically not experienced any losses on our contracts and therefore have not recorded any provision in our financial statements for losses on our contracts, as required under U.S. GAAP, but there can be no assurance that we will not incur losses in the future.

We may not be able to protect certain products in our intellectual property portfolio.

In connection with the performance of services, the federal, state and local governmental agencies have certain rights to inventions, data, software codes, and related material that we develop. Governmental agencies may generally disclose or license such information to third parties, including, in some instances, our competitors. In some of the subcontracts that we perform, the prime contractor may also have certain rights to the programs and products that we develop under the subcontract.

| 9 |

If our partners fail to perform their contractual obligations on a project, we could be exposed to legal liability, excess procurement costs, loss of reputation or reduced profits.

From time to time, we enter joint venture, teaming and subcontract agreements, and other contractual arrangements with partners to jointly bid on and execute certain projects. The success of these joint projects depends in part on the satisfactory performance of the contractual obligations by our partners. If any of our partners fail to satisfy their contractual obligations, we may be required to make additional investments and provide additional services to complete projects, increasing our cost on such projects. If we are unable to adequately address a partner’s performance issues, then our client could terminate the joint project, exposing us to legal liability, loss of reputation or reduced profits.

In order to succeed, we will have to keep up with a variety of rapidly changing technologies. Various factors could affect our ability to keep pace with these changes.

Our success will depend on our ability to keep pace with changing technologies that can occur rapidly in our core business. We may incur significant expenses updating our technologies, which could have a material adverse effect on our margins and results of operations. Even if we keep up with the latest developments and available technology, newer services or technologies could negatively affect our business.

| 10 |

Internal system or service failures could disrupt our business and impair our ability to effectively provide our services and products to our customers, which could damage our reputation and adversely affect our revenue, profitability and operating results.

Our information technology systems are subject to systems failures, including network, software or hardware failures, whether caused by us, third-party service providers, intruders or hackers, computer viruses, natural disasters, power shortages or terrorist attacks. Any such failures could cause loss of data and interruptions or delays in our business, cause us to incur remediation costs, subject us to claims and damage our reputation. Failure or disruption of our communications or utilities could cause us to interrupt or suspend our operations or otherwise adversely affect our business. Any system or service disruptions if not anticipated and appropriately mitigated could have a material adverse effect on our business including, among other things, an adverse effect on our ability to bill our customers for work performed on our contracts, collect the amounts that have been billed and produce accurate financial statements in a timely manner. Our property and business interruption insurance may be inadequate to compensate us for all losses that may occur as a result of any system or operational failure or disruption and, as a result, our results of operations could be materially and adversely affected. PSI is investing in systems that will allow it to achieve and remain in compliance with the regulations governing its business; however, there can be no assurance that such systems will be effective at achieving and maintaining compliance or that we will not incur additional costs in order to make such systems effective.

Our failure to maintain strong relationships with other contractors, or the failure of contractors with which we have entered into a sub- or prime contractor relationship to meet their obligations to us or our clients, could have a material adverse effect on our business and results of operations.

Maintaining strong relationships with other government contractors, who may also be our competitors, is important to our business and our failure to do so could have a material adverse effect on our business, prospects, financial condition and operating results. To the extent that we fail to maintain good relations with our subcontractors or other prime contractors due to either perceived or actual performance failures or other conduct, they may refuse to hire us as a subcontractor in the future or to work with us as our subcontractor. In addition, other contractors may choose not to use us as a subcontractor or choose not to perform work for us as a subcontractor for any number of additional reasons, including because they choose to establish relationships with our competitors or because they choose to directly offer services that compete with our business.

| 11 |

Our revenue derived from contracts in which we acted as a subcontractor to other companies represented approximately 10.1% and 12.8% of our revenue for the six-month period ended June 30, 2017 and the fiscal year ended December 31, 2016, respectively. As a subcontractor, we often lack control over fulfillment of a contract, and poor performance on the contract could tarnish our reputation, even when we perform as required, and could cause other contractors to choose not to hire us as a subcontractor in the future. In addition, if the federal, state or local governments terminate or reduce other prime contractors’ programs or does not award them new contracts, subcontracting opportunities available to us could decrease, which would have a material adverse effect on our financial condition and results of operations.

Federal, state or local governmental spending and mission priorities could change in a manner that adversely affects our future revenue and limits our growth prospects.

Our business depends upon continued federal, state or local government expenditures on defense, intelligence and civil programs for which we provide support. These expenditures have not remained constant over time and have been reduced in certain periods. Our business, prospects, financial condition or operating results could be materially harmed among other causes by the following:

| ● | budgetary constraints affecting federal, state or local governmental spending generally, or specific agencies in particular, and changes in available funding; | |

| ● | a shift in expenditures away from agencies or programs that we support; | |

| ● | reduced federal, state or local government outsourcing of functions that we are currently contracted to provide, including as a result of increased insourcing; | |

| ● | changes in federal, state or local government programs that we support or related requirements; | |

| ● | federal, state or local government shutdowns (such as that which occurred during government fiscal year 2015) or weather-related closures and other potential delays in the appropriations process; | |

| ● | Government agencies awarding contracts on a technically acceptable/lowest cost basis in order to reduce expenditures; | |

| ● | delays in the payment of our invoices by government payment offices; and | |

| ● | changes in the political climate and general economic conditions, including a slowdown or unstable economic conditions and responses to conditions, such as emergency spending, that reduce funds available for other government priorities. |

| 12 |

These or other factors could cause federal, state and local governmental agencies to decrease the number of new contracts awarded generally and fail to award us new contracts, reduce their purchases under our existing contracts, exercise their right to terminate our contracts, or not exercise options to renew our contracts, any of which could cause a material decline in our revenue.

Federal, state and local governmental agencies may adopt new laws, rules and regulations that could have a material impact on our results of operations.

Our performance under our contracts with federal, state and local governmental agencies and our compliance with the terms of those contracts and applicable laws and regulations are subject to periodic audit, review and investigation by various agencies of the U.S. government. If such an audit, review or investigation uncovers a violation of a law or regulation, or improper or illegal activities relating to our contracts with such agencies, we may be subject to civil or criminal penalties or administrative sanctions, including the termination of contracts, forfeiture of profits, the triggering of price reduction clauses, suspension of payments, fines and suspension or debarment from contracting with governmental agencies. Such penalties and sanctions are not uncommon in the industry and there is inherent uncertainty as to the outcome of any particular audit, review or investigation. If we incur a material penalty or administrative sanction or otherwise suffer harm to our reputation, our profitability, cash position and future prospects could be materially and adversely affected. Further, if any of such governmental agencies were to initiate suspension or debarment proceedings against us or if we are indicted for or convicted of illegal activities relating to our government contracts following an audit, review or investigation, we may lose our ability to be awarded contracts in the future or receive renewals of existing contracts for a period of time which could materially and adversely affect our results of operations or financial condition. We could also suffer harm to our reputation if allegations of impropriety were made against us, which would impair our ability to win awards of contracts in the future or receive renewals of existing contracts.

| 13 |

We derive a majority of our revenue from contracts awarded through a competitive bidding process, and our revenue and profitability may be adversely affected if we are unable to compete effectively in the process or if there are delays caused by our competitors protesting major contract awards received by us.

We derive a majority of our revenue from federal, state and local government contracts awarded through competitive bidding processes. We do not expect this to change for the foreseeable future. Our failure to compete effectively in this procurement environment would have a material adverse effect on our revenue and profitability.

The competitive bidding process involves risk and significant costs to businesses operating in this environment, including:

| ● | the necessity to expend resources, make financial commitments (such as procuring leased premises) and bid on engagements in advance of the completion of their design, which may result in unforeseen difficulties in execution, cost overruns and, in the case of an unsuccessful competition, the loss of committed costs; | |

| ● | the substantial cost and managerial time and effort spent to prepare bids and proposals for contracts that may not be awarded to us; | |

| ● | the ability to accurately estimate the resources and costs that will be required to service any contract we are awarded; | |

| ● | the expense and delay that may arise if our competitors protest or challenge contract awards made to us pursuant to competitive bidding, and the risk that any such protest or challenge could result in the resubmission of bids on modified specifications, or in termination, reduction, or modification of the awarded contract; and | |

| ● | Any opportunity cost of bidding and winning other contracts we might otherwise pursue. |

In circumstances where contracts are held by other companies and are scheduled to expire, we still may not be provided the opportunity to bid on those contracts if the federal, state or local government determines to extend the existing contract for continuity of services. If we are unable to win particular contracts that are awarded through the competitive bidding process, we may not be able to operate in the market for services that are provided under those contracts for the duration of those contracts to the extent that there is no additional demand for such services. An inability to consistently win new contract awards over any extended period would have a material adverse effect on our business and results of operations.

| 14 |

It can take many months for the relevant federal, state and local government agency to resolve protests by one or more of our competitors of contract awards we receive. The resulting delay in the start-up and funding of the work under these contracts may cause our actual results to differ materially and adversely from those anticipated.

We may lose IT general service contracts, GSA IT Schedule 70, and our position as a prime contractor on one or more of our GWACs.

We believe that one of the key elements of our success is our position as the holder of contract vehicles of information technology, or “IT,” general service contracts, GSA IT Schedule 70, and as a prime contractor under four Government-Wide Acquisition Contract vehicles, or “GWACs,” as of June 30, 2017 and December 31, 2016. Accordingly, our ability to maintain our existing business and win new business depends on our ability to maintain our position as a IT general service contactor, GSA schedule contractor and a prime contractor on GWACs, the loss of any of which could have a material adverse effect on our ability to win new business and our operating results. In addition, if a governmental agency elects to use a contract vehicle that we do not hold, we will not be able to compete for work under that contract vehicle as a prime contractor.

We use estimates in recognizing revenue and if we make changes to estimates used in recognizing revenue, our profitability may be adversely affected.

Revenue from our fixed-price contracts is primarily recognized using the percentage-of-completion method with progress toward completion of a specific milestones and/or deliverables during the period of performance. Revenue from our cost-plus-fixed-fee contracts are based on negotiated fixed-fees over the life of the contract. Estimating costs at completion and fixed fees on our long-term contracts is complex and involves significant judgment. Adjustments to original estimates are often required as work progresses, experience is gained and additional information becomes known, even though the scope of the work required under the contract may not change. Any adjustment as a result of a change in estimate is recognized as events become known.

In the event updated estimates indicate that we will experience a loss on the contract, we recognize the estimated loss at the time it is determined. Additional information may subsequently indicate that the loss is more or less than initially recognized, which requires further adjustments in our financial statements. Changes in the underlying assumptions, circumstances or estimates could result in adjustments that could have a material adverse effect on our future results of operations.

We may not realize the full value of our backlog, which may result in lower than expected revenue.

We define backlog to include the following three components:

| ● | Funded Backlog. Funded backlog represents the revenue value of orders for services under existing contracts for which funding is appropriated or otherwise authorized less revenue previously recognized on these contracts. | |

| ● | Unfunded Backlog. Unfunded backlog represents the revenue value of orders for services under existing contracts for which funding has not been appropriated or otherwise authorized. | |

| ● | Priced Options. Priced contract options represent 100% of the revenue value of all future contract option periods under existing contracts that may be exercised at our clients’ option and for which funding has not been appropriated or otherwise authorized. |

| 15 |

We historically have not realized all of the revenue included in our total backlog, and we may not realize all of the revenue included in our total backlog in the future. There is a somewhat higher degree of risk in this regard with respect to unfunded backlog and priced options. In addition, there can be no assurance that our backlog will result in actual revenue in any particular period. This is because the actual receipt, timing and amount of revenue under contracts included in backlog are subject to various contingencies, including congressional appropriations, many of which are beyond our control. For example, the actual receipt of revenue from contracts included in backlog may never occur or may be delayed because a program schedule could change or the program could be canceled, or a contract could be reduced, modified or terminated early, including as a result of a lack of appropriated funds. In addition, even if our backlog results in revenue, the contracts may not be profitable.

Our success is highly dependent on our executive officers and management team, especially our President, Richard Seol, the loss of whom would have a material adverse effect on our business.

The success of our business is highly dependent on our executive officers and management team, especially our President, Richard K. Seol. The loss of Mr. Seol could have a material adverse effect on our business.

We may fail to attract, train and retain skilled and qualified employees with appropriate security clearances, which may impair our ability to generate revenue, effectively service our clients and execute our growth strategy.

Our business depends in large part upon our ability to attract and retain sufficient numbers of highly qualified individuals who may have advanced degrees in areas such as information technology as well as appropriate security clearances. We compete for such qualified personnel with other U.S. government contractors, the U.S. government and private industry, and such competition is intense. Personnel with the requisites skills, qualifications or security clearance may be in short supply or generally unavailable. In addition, our ability to recruit, hire and internally deploy former employees of the U.S. government is subject to complex laws and regulations, which may serve as an impediment to our ability to attract such former employees, and failure to comply with these laws and regulations may expose us and our employees to civil or criminal penalties. If we are unable to recruit and retain a sufficient number of qualified employees, our ability to maintain and grow our business and to effectively service our clients could be limited and our future revenue and results of operations could be materially and adversely affected. Furthermore, to the extent that we are unable to make necessary permanent hires to appropriately service our clients, we could be required to engage larger numbers of contracted personnel, which could reduce our profit margins.

If we are able to attract sufficient numbers of qualified new hires, training and retention costs may place significant demands on our resources. In addition, to the extent that we experience attrition in our employee ranks, we may realize only a limited or no return on such invested resources, and we would have to expend additional resources to hire and train replacement employees. The loss of services of key personnel could also impair our ability to perform required services under some of our contracts and to retain such contracts, as well as our ability to win new business.

| 16 |

We may fail to obtain and maintain necessary security clearances which may adversely affect our ability to perform on certain contracts.

Many U.S. government programs require contractors to have security clearances. Depending on the level of required clearance, security clearances can be difficult and time-consuming to obtain. If we or our employees and contractors are unable to obtain or retain necessary security clearances, we may not be able to win new business, and our existing clients could terminate their contracts with us or decide not to renew them. To the extent we are not able to obtain and maintain facility security clearances or engage employees with the required security clearances for a particular contract, we may not be able to bid on or win new contracts, or effectively rebid on expiring contracts, as well as lose existing contracts, which may adversely affect our operating results and inhibit the execution of our growth strategy.

We face intense competition from many competitors that, among other things, have greater resources than we do.

Our business operates in a highly competitive industry and we generally compete with a wide variety of federal, state and local government contractors, including large defense contractors, diversified service providers and small businesses. We also face competition from entrants into our markets including companies divested by large prime contractors in response to increasing scrutiny of Organizational Conflict of Interest, or OCI, issues. Some of these companies possess greater financial resources and larger technical staffs, and others that have smaller and more specialized staffs. These competitors could, among other things:

| ● | divert sales from us by winning very large-scale government contracts, a risk that is enhanced by the recent trend in government procurement practices to bundle services into larger contracts; | |

| ● | force us to charge lower prices in order to win or maintain contracts; | |

| ● | seek to hire our employees; or | |

| ● | adversely affect our relationships with current clients, including our ability to continue to win competitively awarded engagements where we are the incumbent. |

| 17 |

If we lose business to our competitors or are forced to lower our prices or suffer employee departures, our revenue and our operating profits could decline. In addition, we may face competition from our subcontractors who, from time to time, seek to obtain prime contractor status on contracts for which they currently serve as a subcontractor to us. If one or more of our current subcontractors are awarded prime contractor status on such contracts in the future, it could divert sales from us and could force us to charge lower prices, which could have a material adverse effect on our revenue and profitability.

Systems that we develop, integrate or maintain could experience security breaches which may damage our reputation with our clients and hinder future contract win rates.

Many of the systems we develop, integrate or maintain involve managing and protecting information involved in intelligence, national security and other sensitive or classified government functions. A security breach in one of these systems could cause serious harm to our business, damage our reputation and prevent us from being eligible for further work on sensitive or classified systems for federal, state and local government clients. We could incur losses from such a security breach that could exceed the policy limits under our professional liability insurance program. Damage to our reputation or limitations on our eligibility for additional work resulting from a security breach in one of the systems we develop, install or maintain could have a material adverse effect on our results of operations.

Our business may be adversely affected if we cannot collect our receivables.

We depend on the timely collection of our receivables to generate cash flow, provide working capital and continue our business operations. If the federal, state or local governmental agencies or any prime contractor for whom we are a subcontractor fails to pay or delays the payment of invoices for any reason, our business and financial condition may be materially and adversely affected. The federal, state or local governmental agencies may delay or fail to pay invoices for a number of reasons, including lack of appropriated funds, lack of an approved budget, or as a result of audit findings by government regulatory agencies. Some prime contractors for whom we are a subcontractor have significantly fewer financial resources than we do, which may increase the risk that we may not be paid in full or that payment may be delayed.

If we are not able to maintain and enhance our brand, our business and results of operations may be adversely affected.

We believe that the brand identities that we have developed have contributed significantly to the success of our business. We also believe that maintaining and enhancing our brand is important to expanding our customer base and attracting talented employees. In order to maintain and enhance our brand, we may be required to make further investments that may not be successful. Maintaining our brand will depend in part on our ability to remain a leader in data integration and management technology and our ability to continue to provide high-quality offerings. If we fail to promote and maintain our brands, or if we incur excessive costs in doing so, our business, financial condition, results of operations and cash flows may be harmed.

| 18 |

Our research and development efforts may not produce successful products or features that result in significant revenue, cost savings or other benefits in the near future, if at all.

Developing our products and related enhancements is expensive. Our investments in research and development may not result in significant design improvements, marketable products or features, or may result in products that are more expensive than anticipated. Additionally, we may not achieve the cost savings or the anticipated performance improvements we expect, and we may take longer to generate revenue, or generate less revenue, than we anticipate. Our future plans include significant investments in research and development and related product opportunities. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we may not receive significant revenue from these investments in the near future, if at all, or these investments may not yield the expected benefits, either of which could adversely affect our business and results of operations.

| 19 |

Failure to protect our proprietary technology and intellectual property rights could substantially harm our business and results of operations.

Our success depends to a significant degree on our ability to protect our proprietary technology, methodologies, know-how and our brand. We rely on a combination of contractual restrictions, and other intellectual property laws and confidentiality procedures to establish and protect our proprietary rights. However, the steps we take to protect our intellectual property may be inadequate. We will not be able to protect our intellectual property if we are unable to enforce our rights or if we do not detect unauthorized use of our intellectual property. If we fail to protect our intellectual property rights adequately, our competitors may gain access to our technology and our business may be harmed. In addition, defending our intellectual property rights might entail significant expense. We may be unable to prevent third parties from acquiring domain names or trademarks that are similar to, infringe upon, or diminish the value of our trademarks and other proprietary rights.

We enter into confidentiality and invention assignment agreements with our employees and consultants and enter into confidentiality agreements with other parties. No assurance can be given that these agreements will be effective in controlling access to and distribution of our proprietary information. Further, these agreements may not prevent our competitors from independently developing technologies that are substantially equivalent or superior to our products.

In order to protect our intellectual property rights, we may be required to spend significant resources to monitor and protect our intellectual property rights. Litigation may be necessary in the future to enforce our intellectual property rights and to protect our trade secrets. Litigation brought to protect and enforce our intellectual property rights could be costly, time-consuming, and distracting to management, and could result in the impairment or loss of portions of our intellectual property. Further, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims, and countersuits attacking the validity and enforceability of our intellectual property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could delay further sales or the implementation of our products, impair the functionality of our products, delay introductions of new products, result in our substituting inferior or more costly technologies into our products, or injure our reputation.

We could incur substantial costs as a result of any claim of infringement of another party’s intellectual property rights.

In recent years, there has been significant litigation involving patents and other intellectual property rights in the software industry. Companies providing software are increasingly bringing and becoming subject to suits alleging infringement of proprietary rights, particularly patent rights, we face a higher risk of being the subject of intellectual property infringement claims. We do not currently have a patent portfolio, which could prevent us from deterring patent infringement claims through our own patent portfolio, and our competitors and others may now and in the future have significantly larger and more mature patent portfolios than we have. The risk of patent litigation has been amplified by the increase in the number of a type of patent holder, which we refer to as a non-practicing entity, whose sole business is to assert such claims and against whom our own intellectual property portfolio may provide little deterrent value. We could incur substantial costs in prosecuting or defending any intellectual property litigation. If we sue to enforce our rights or are sued by a third party that claims that our solution infringes its rights, the litigation could be expensive and could divert our management resources. As of the date of this offering circular, we have not received any written notice of an infringement claim, invitation to license, or other intellectual property infringement action.

| 20 |

Any intellectual property litigation to which we might become a party, or for which we are required to provide indemnification, may require us to do one or more of the following:

| ● | Cease selling or using products that incorporate the intellectual property that we allegedly infringe; | |

| ● | Make substantial payments for legal fees, settlement payments or other costs or damages; | |

| ● | Obtain a license, which may not be available on reasonable terms or at all, to sell or use the relevant technology; or | |

| ● | Redesign the allegedly infringing products to avoid infringement, which could be costly, time-consuming or impossible. |

If we are required to make substantial payments or undertake any of the other actions noted above as a result of any intellectual property infringement claims against us or any obligation to indemnify our customers for such claims, such payments or actions could harm our business.

Our failure to protect personal information adequately could have an adverse effect on our business.

A wide variety of provincial, state, national, and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer, and other processing of personal data. These data protection and privacy-related laws and regulations are evolving and being tested in courts and may result in ever-increasing regulatory and public scrutiny as well as escalating levels of enforcement and sanctions. Any actual or perceived loss, improper retention or misuse of certain information or alleged violations of laws and regulations relating to privacy, data protection and data security, and any relevant claims, could result in enforcement action against us, including fines, imprisonment of company officials and public censure, claims for damages by customers and other affected individuals, damage to our reputation and loss of goodwill (both in relation to existing customers and prospective customers), any of which could have an adverse effect on our operations, financial performance, and business. Evolving and changing definitions of personal data and personal information, within the European Union, the United States, and elsewhere, especially relating to classification of IP addresses, machine identification, location data, and other information, may limit or inhibit our ability to operate or expand our business, including limiting strategic partnerships that may involve the sharing of data. Any perception of privacy or security concerns or an inability to comply with applicable laws, regulations, policies, industry standards, contractual obligations or other legal obligations, even if unfounded, may result in additional cost and liability to us, harm our reputation and inhibit adoption of our products by current and future customers, and adversely affect our business, financial condition, and operating results.

| 21 |

We have implemented and maintain security measures intended to protect personally identifiable information. However, our security measures remain vulnerable to various threats posed by hackers and criminals. If our security measures are overcome and any personally identifiable information that we collect or store becomes subject to unauthorized access, we may be required to comply with costly and burdensome breach notification obligations. We may also be subject to investigations, enforcement actions and private lawsuits. In addition, any data security incident is likely to generate negative publicity and have a negative effect on our business.

Our failure to raise additional capital or generate the significant capital necessary to expand our operations and invest in new products could reduce our ability to compete and could harm our business.

Depending on how many Shares are sold in this offering, we may need to raise additional funds to implement our business plans, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our shareholders may experience significant dilution of their ownership interests and the per share value of our ordinary shares could decline. Furthermore, if we engage in debt financing, the holders of debt would have priority over the holders of common stock and underlying ordinary shares, and we may be required to accept terms that restrict our ability to incur additional indebtedness. We may also be required to take other actions that would otherwise be in the interests of the debt holders and force us to maintain specified liquidity or other ratios, any of which could harm our business, results of operations, and financial condition. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things:

| ● | Develop or enhance our products and professional services; | |

| ● | Continue to expand our sales and marketing and research and development organizations; | |

| ● | Acquire complementary technologies, products or businesses; | |

| ● | Expand operations in the United States or internationally; | |

| ● | Hire, train, and retain employees; or | |

| ● | Respond to competitive pressures or unanticipated working capital requirements. |

Our failure to have sufficient capital to do any of these things could seriously harm our business, financial condition, and results of operations.

| 22 |

Catastrophic events, or man-made problems such as terrorism, may disrupt our business.

A significant natural disaster, such as an earthquake, fire, flood, or significant power outage could have an adverse impact on our business, results of operations, and financial condition. Many of our largest clients are headquartered in New York City, a region known for terrorist activity. In the event our or our channel provider’s abilities are hindered by any of the events discussed above, sales could be delayed, resulting in missed financial targets, such as revenue, for a particular quarter. In addition, acts of terrorism and other geo-political unrest could cause disruptions in our business or the business of our channel partners, customers or the economy as a whole. Any disruption in the business of our channel partners or customers that affects sales at the end of a fiscal quarter could have a significant adverse impact on our future quarterly results. All of the aforementioned risks may be further increased if the disaster recovery plans for us and our suppliers prove to be inadequate. To the extent that any of the above should result in delays or cancellations of customer orders, or the delay in the deployment of our products and services, our business, financial condition, and results of operations would be adversely affected.

Risk Related to Our Industry

We operate in highly competitive industries.

The markets for many of our services are highly competitive. There are numerous organizations that offer many of the same services offered by us. We compete with many companies that have greater resources than us and we cannot provide assurance that such competitors will not substantially increase the resources they devote to those businesses that compete directly with our services. Competitive factors considered by clients include reputation, performance, price, geographic location and availability of technically skilled personnel. In addition, we face competition from the use by our clients of in-house environmental, engineering and other staff.

| 23 |

Actual or perceived conflicts of interest may prevent us from being able to bid on or perform contracts.

Government agencies have conflict of interest policies that may prevent us from bidding on or performing certain contracts. When dealing with governmental agencies that have such policies, we must decide, at times with incomplete information, whether to participate in a particular business opportunity when doing so could preclude us from participating in a related procurement at a future date. We have, on occasion, declined to bid on certain projects because of actual or perceived conflicts of interest. We will continue to encounter such conflicts of interest in the future, which could cause us to be unable to secure key contracts with government customers.

Many of our U.S. government customers procure goods and services through ID/IQ, GWACs or our GSA IT Schedule 70 under which we must compete for post-award orders.

Budgetary pressures and reforms in the procurement process have caused many governmental agencies to purchase goods and services through ID/IQ contracts, our GSA IT Schedule 70 contract and other multiple award and/or GWAC contract vehicles. These contract vehicles increase competition and pricing pressures, requiring us to make sustained efforts following the initial contract award to obtain ongoing awards and realize revenue. There can be no assurance that we will increase revenue or otherwise sell successfully under these contract vehicles. Any failure by the Company to compete effectively in this procurement environment could harm our business, financial condition, operating results and cash flows and our ability to meet our financial obligations.

An economic downturn may have a material adverse effect on our business.

In an economic recession, or under other adverse macroeconomic conditions that may arise from natural or man-made events, customers and vendors may be less likely to meet contractual terms and payment or delivery obligations.

Our Government contracts may be terminated by the government at any time and may contain other provisions permitting the government to discontinue contract performance, and if lost contracts are not replaced, our operating results may differ materially and adversely from those anticipated.

| 24 |

The U.S. government may prefer minority-owned, small and small disadvantaged businesses; therefore, we may not win contracts we bid for.

As a result of the Small Business Administration, or SBA, set-aside program, the U.S. government may decide to restrict certain procurements only to bidders that qualify as minority-owned, small or small disadvantaged businesses. As a result, we would not be eligible to perform as a prime contractor on those programs and would be restricted to a maximum of 49% of the work as a subcontractor on those programs. An increase in the amount of procurements under the SBA set-aside program may impact our ability to bid on new procurements as a prime contractor or restrict our ability to re-compete on incumbent work that is placed in the set-aside program.

There may be a delay in the completion of the U.S. government’s budget process.

On an annual basis, the U.S. Congress must approve budgets that govern spending by each of the federal agencies we support. When the U.S. Congress is unable to agree on budget priorities, and thus is unable to pass the annual budget on a timely basis, the U.S. Congress typically enacts a continuing resolution. A continuing resolution allows government agencies to operate at spending levels approved in the previous budget cycle. When government agencies operate on the basis of a continuing resolution, they may delay funding we expect to receive on contracts we are already performing. Any such delays would likely result in new business initiatives being delayed or cancelled and a reduction in our backlog, and could have a material adverse effect on our revenue and operating results. State and local government agencies may have similar delays to those described at the federal level.

| 25 |

Risks Related to Our Common Stock and This Offering

Our financial results may vary significantly from period to period as a result of a number of factors many of which are outside our control, which could cause the market price of our common stock to decline.

Our financial results may vary significantly from period to period in the future as a result of many external factors that are outside of our control. Factors that may affect our financial results include those listed in this “Risk Factors” section and others such as:

| ● | any cause of reduction or delay in U.S. government funding (e.g., changes in presidential administrations that delay timing of procurements); | |

| ● | fluctuations in revenue earned on existing contracts; | |

| ● | commencement, completion or termination of contracts during a particular period; | |

| ● | a potential decline in our overall profit margins if our other direct costs and subcontract revenue grow at a faster rate than labor-related revenue; | |

| ● | strategic decisions by us or our competitors, such as changes to business strategy, strategic investments, acquisitions, divestitures, spin offs and joint ventures; | |

| ● | a change in our contract mix to less profitable contracts; | |

| ● | changes in policy or budgetary measures that adversely affect Government contracts in general; | |

| ● | variable purchasing patterns under Government GSA schedules, blanket purchase agreements, which are agreements that fulfill repetitive needs under GSA schedules, and ID/IQ contracts; | |

| ● | changes in demand for our services and solutions; | |

| ● | fluctuations in our staff utilization rates; | |

| ● | seasonality associated with the U.S. government’s fiscal year; | |

| ● | an inability to utilize existing or future tax benefits, including those related to our NOLs or stock-based compensation expense, for any reason, including a change in law; | |

| ● | alterations to contract requirements; and | |

| ● | adverse judgments or settlements in legal disputes. |

A decline in the price of our common stock due to any one or more of these factors could cause the value of your investment to decline.

| 26 |

There has been no public market for our common stock and an active market may not develop or be sustained, which could limit your ability to sell shares of our common stock.