Exhibit 99.1

ANNUAL INFORMATION FORM

For the fiscal year ended October 31, 2023

DECEMBER 13, 2023

ANNUAL INFORMATION FORM

All information is as of October 31, 2023, and all dollar amounts are expressed in Canadian dollars, unless otherwise stated.

Unless otherwise stated, year references refer to the fiscal year ending in the referenced year.

TABLE OF CONTENTS

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS |

4 |

|

NON-GAAP AND OTHER FINANCIAL MEASURES |

5 |

|

Other Financial Measures |

5 |

|

CORPORATE STRUCTURE |

5 |

|

Incorporation |

5 |

|

GENERAL DEVELOPMENT OF THE BUSINESS |

6 |

|

Three Year History |

6 |

|

DESCRIPTION OF THE BUSINESS |

8 |

|

General Summary |

8 |

|

Digital Banking |

8 |

|

Lending |

8 |

|

Funding |

9 |

|

Capital |

9 |

|

Credit Quality |

10 |

|

DRT Cyber Inc. |

10 |

|

Specialized Skills and Knowledge / Competitive Conditions |

10 |

|

New Services |

11 |

|

Supervision and Regulation |

11 |

|

Employees and Principal Properties |

12 |

|

Risk Factors |

12 |

|

DIVIDENDS |

12 |

|

Common Shares |

12 |

|

Preferred Shares |

12 |

|

Series 1 Preferred Shares |

12 |

|

Series 3 Preferred Shares |

13 |

|

Dividend Summary |

13 |

|

CAPITAL STRUCTURE |

13 |

|

Common Shares |

13 |

|

Preferred Shares |

14 |

|

Series 1 Preferred Shares |

15 |

|

Series 2 Preferred Shares |

16 |

|

Series 3 Preferred Shares |

16 |

|

Series 4 Preferred Shares |

16 |

|

Constraints |

17 |

|

MARKET FOR SECURITIES |

17 |

|

Trading Price and Volume |

17 |

|

DIRECTORS AND OFFICERS |

19 |

|

Directors |

19 |

|

Executive Officers |

20 |

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

21 |

|

TRANSFER AGENT AND REGISTRAR |

21 |

|

EXPERTS |

21 |

|

AUDIT COMMITTEE |

21 |

|

Audit Committee Mandate |

21 |

|

Composition of the Audit Committee |

21 |

|

Relevant Education and Experience |

21 |

|

Pre-Approval Policies and Procedures |

22 |

|

Auditor Fees |

22 |

|

ADDITIONAL INFORMATION |

23 |

|

APPENDIX A: AUDIT COMMITTEE MANDATE |

24 |

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form, and the documents incorporated by reference in this Annual Information Form, contain forward-looking information within the meaning of the applicable securities legislation that are based on expectations, estimates and projections as at the date of this Annual Information Form or the dates of the documents incorporated by reference in this Annual Information Form, as applicable. This forward-looking information includes, but is not limited to, statements and information concerning: future growth and potential achievements of VersaBank; statements relating to the business, future activities of, and developments related to VersaBank after the date of this Annual Information Form; the payment of dividends on common shares and preferred shares; and other events or conditions that may occur in the future.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, are accompanied by phrases such as “expects”, “is expected”, “anticipates”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes”, “aims”, “endeavours”, “projects”, “continue”, “predicts”, “potential”, “intends”, or the negative of these terms or variations of such words and phrases or stating that certain actions, events or results “may”, “could”, “would”, “might”, “will”, or “should” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on the beliefs of VersaBank’s management, as well as on assumptions, which such management believes to be reasonable based on information currently available at the time such statements were made. However, there can be no assurance that the forward-looking information will prove to be accurate. Such assumptions and factors include, among other things, the strength of the economies in Canada and the United States in general and the strength of local economies within Canada and the United States in which VersaBank conducts operations; foreign exchange currency rates, the impact of the COVID-19 pandemic (the “Pandemic”); the effects of changes in monetary and fiscal policy, including changes in interest rate policies of the Bank of Canada and other central banks; changing global commodity prices; the effects of competition in the markets in which VersaBank operates; capital market fluctuations; the timely development and introduction of new products in receptive markets; the impact of inflationary trends; changes in laws and regulations pertaining to financial services; changes in tax laws; technological changes; unexpected judicial or regulatory proceedings; unexpected change in consumer spending and saving habits; the impact of wars and conflicts; and VersaBank’s anticipation of and success in managing the risks resulting from the foregoing. The foregoing list of important factors is not exhaustive. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

By its nature, forward-looking information is based on assumptions and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of VersaBank to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Forward-looking information is subject to a variety of risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by forward-looking information, including, without limitation: general business, economic, competitive, political, regulatory and social uncertainties; risks related to factors beyond the control of VersaBank; risks related to the business of VersaBank; risks related to political developments and policy shifts; risks related to amendments to laws; risks related to the Pandemic; or risks related to the market value of VersaBank securities. Additional risks and uncertainties regarding VersaBank are described in its Management’s Discussion and Analysis for the year ended October 31, 2023 (the “2023 MD&A”), which is available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Some of the important risks and uncertainties that could affect forward-looking information are described further in this Annual Information Form, the 2023 MD&A, and in other documents incorporated by reference in this Annual Information Form. Although VersaBank has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results that are not anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. This forward-looking information is made as of the date of this Annual Information Form, and other than as required by applicable securities laws, VersaBank assumes no obligation to update or revise such forward-looking information to reflect new events or circumstances.

NON-GAAP AND OTHER FINANCIAL MEASURES

Non-GAAP and other financial measures are not standardized financial measures under financial reporting framework used to prepare the financial statements of VersaBank to which these measures relate. These measures may not be comparable to similar financial measures disclosed by other issuers. VersaBank uses these financial measures to assess its performance and as such believes these financial measures are useful in providing readers with a better understanding of how management assesses VersaBank’s performance.

For additional disclosure regarding these financial measures and financial ratios and, where applicable, a reconciliation to the most directly comparable measure calculated in accordance with IFRS please refer to the “Non-GAAP and Other Financial Measures” section in the 2023 MD&A which information is incorporated by reference herein. The 2023 MD&A, is available on SEDAR+ at www.sedarplus.ca.

OTHER FINANCIAL MEASURES

Net Interest Margin are calculated as net interest income divided by average total assets. Net interest margin does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

CORPORATE STRUCTURE

INCORPORATION

VersaBank (or the “Bank”) is a Schedule I bank governed by the Bank Act (Canada) (the “Bank Act”). VersaBank was originally incorporated as a trust company, Pacific & Western Trust Corporation (“PW Trust”), under The Business Corporations Act (Saskatchewan) in 1979. In 2002, PW Trust was granted a Schedule I bank license and continued under the Bank Act as Pacific & Western Bank of Canada (“PW Bank”). PW Bank completed an initial public offering in 2013 and changed its name to “VersaBank” in 2016. With the approval of the Minister of Finance (Canada) (the “Minister”), VersaBank merged with its parent holding company, PWC Capital Inc., pursuant to letters patent of amalgamation under the Bank Act, in 2017 (the “Amalgamation”). VersaBank is a reporting issuer with securities regulators in Canada and the United States of America (the “U.S.”). VersaBank’s common shares trade on the Toronto Stock Exchange (“TSX”) and the Nasdaq under the symbol VBNK, and its series 1 preferred shares trade on the TSX under the symbol VBNK.PR.A.

VersaBank’s head and registered office is Suite 2002–140 Fullarton Street, London, Ontario N6A 5P2.

GENERAL DEVELOPMENT OF THE BUSINESS

THREE YEAR HISTORY

The following summary highlights select financial metrics and developments for the Bank’s three most recent fiscal year periods:

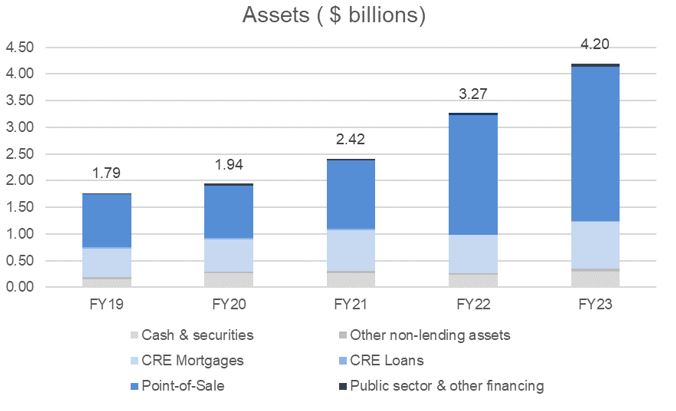

In 2021, the Bank generated annual interest income of $89.5 million, net interest income (“NII”) of $60.2 million, and net interest margin (“NIM”) of 2.76% on an average lending asset balance of $1.88 billion. As part of the Bank’s continuing expansion of its cybersecurity services, it acquired, through DRT Cyber Inc. (“DRTC”), 2021945 Ontario Inc., operating as Digital Boundary Group (“DBG”), an information technology security assurance service firm. The accretive contribution from this acquisition was reflected in the Bank’s non-interest income of $5.2 million, which in conjunction with the increase in the Bank’s lending activities resulted in the Bank generating record net income of $22.4 million. During the year and following the year end, VersaBank declared quarterly common share dividends of $0.025 per share. Total assets at the end of fiscal 2021 were $2.42 billion.

In 2021, the Bank completed a number of share and other regulatory capital transactions. On October 7, 2021, the Bank returned to treasury and cancelled 7,477 common shares with a value of $39,000 or $5.24 per common share. The cancelled shares represent predecessor share classes that had not been deposited and exchanged for VersaBank common shares in connection with the Amalgamation.

On September 21, 2021, the Bank completed a treasury offering of 5,500,000 common shares at a price of USD $10.00 per share, or CAD $12.80 per share for gross proceeds of USD $55.0 million. On September 29, 2021, the underwriters of the aforementioned offering exercised their full over-allotment option to purchase an additional 825,000 shares (15% of the 5,500,000 common shares issued via the base offering referenced above) at a price of USD $10.00 per share, or CAD $12.68 per share for gross proceeds of USD $8.3 million (collectively, the “Common Share Offering”). Total net cash proceeds from the Common Share Offering were CAD $73.2 million. However, the Bank’s share capital increased by CAD $75.1 million as a function of the Common Share Offering and tax effected issue costs in the amount of CAD $5.4 million. The Bank’s issue costs are subject to current and future tax deductions and as such the Bank has recognized a deferred tax asset corresponding to same.

On April 30, 2021, the Bank redeemed all of its 1,681,320 outstanding, Non-Cumulative Series 3 preferred shares, non-viability contingent capital (“NVCC”) using cash on hand. The amount paid on redemption for each share was $10.00, and in aggregate $16.8 million. The initial capitalized transaction costs in the amount of $1.1 million were applied against retained earnings.

Also, on April 30, 2021, the Bank completed a private placement of NVCC-compliant fixed-to-floating rate subordinated notes (“Notes”) in the principal amount of USD $75.0 million, equivalent to CAD $92.1 million as at April 30, 2021.

1 This is a non-GAAP measure. See definition in “Non-GAAP and Other Financial Measures”.

On April 7, 2021, the Bank announced that it had received an investment-grade credit rating of “A” for the Bank overall and “A-” for the issue of the Notes up to U.S. $100 million from Egan-Jones Ratings Company, a U.S. Nationally Recognized Statistical Rating Organization (“NRSRO”) and U.S. National Association of Insurance Commissioners (“NAIC”) recognized Credit Rating Provider.

In 2022, the Bank generated annual interest income of $126.8 million, NII of $76.7 million, and NIM of 2.70% on an average lending asset balance of $2.55 billion. The increase in the Bank’s lending activities resulted in the Bank generating net income of $22.7 million. During the year and following the year end, VersaBank declared quarterly common share dividends of $0.025 per share. Total assets at the end of fiscal 2022 were $3.27 billion.

On February 7, 2022, the Bank granted options to employees under its Long-Term Incentive Plan (“LTIP”). As of October 31, 2023, there were 874,393 options outstanding under the LTIP.

On March 31, 2022, VersaBank entered into an agreement with its first Point-of-Sale Finance partner in the U.S. VersaBank’s Point-of-Sale Financing business operates via its Receivable Purchase Program, which purchases loan and lease receivables from finance companies across a wide variety of sectors, including commercial equipment, consumer healthcare, vehicles, and home improvement. The U.S. Point-of-Sale business represents a significant additional opportunity to grow the Bank’s loan portfolio over the long-term. VersaBank established its U.S. subsidiary, VersaFinance US Corp. to facilitate operations of the U.S. Receivable Purchase Program.

On June 14, 2022, the Bank announced its intention to acquire Office of the Comptroller of the Currency (“OCC”) registered, Stearns Bank Holdingford N.A., through its subsidiary, VersaHoldings US Corp. for an estimated purchase price of USD $13.5 million, subject to adjustment. The acquisition is expected to add approximately USD $60 million in total assets to VersaBank and will provide access to U.S. deposits to fuel the growth of its Receivable Purchase Program business. On December 7, 2022, the Bank submitted its application to the Federal Reserve Board and the Office of the Comptroller of the Currency to acquire Stearns Bank Holdingford N.A. The Bank continues to advance the process seeking approval of the proposed acquisition of OCC-chartered U.S. bank, Stearns Bank Holdingford N.A., and expects a decision from U.S. regulators during the first calendar quarter of 2024. If favourable, the Bank will proceed toward completion of the acquisition as soon as possible, subject to Canadian regulatory (OSFI) approval.

On August 5, 2022, the Bank received approval from the TSX to proceed with a Normal Course Issuer Bid (“NCIB”) for its common shares on both the TSX and Nasdaq exchanges. Pursuant to the NCIB, VersaBank may purchase for cancellation up to 1,700,000 of its common shares representing approximately 9.54% of its public float. VersaBank’s directors and management believe that the market price of VersaBank’s common shares does not reflect the value of the business and the future prospects of same, and further, reflects a material discount to book value and as such the purchase of common shares for cancellation at such time is a prudent corporate measure and represents an attractive investment for the Bank.

In 2023, the Bank generated annual interest income of $229.3 million, NII of $100.1 million, and NIM of 2.68% on an average lending asset balance of $3.42 billion. The increase in the Bank’s lending activities resulted in the Bank generating net income of $42.2 million. During the year and following the year end, VersaBank declared quarterly common share dividends of $0.025 per share. Total assets at the end of fiscal 2023 were $4.20 billion.

On August 16, 2023, the NCIB expired. At the time of expiry, the Bank had repurchased 1,516,658 shares under the NCIB.

2 A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time by the credit rating agency.

On September 15, 2023, 40,000 options, which were granted to the Bank’s President & Chief Executive Officer on October 31, 2013, under a legacy plan, were exercised for $7.00 per share.

DESCRIPTION OF THE BUSINESS

GENERAL SUMMARY

VersaBank is a Canadian Schedule I (federally regulated) chartered bank with a difference. VersaBank became the world’s first fully digital financial institution when it adopted its highly efficient business-to-business model in 1993 using its proprietary state-of-the-art financial technology to profitably address underserved segments of the Canadian banking market in the pursuit of superior net interest margins while mitigating risk. VersaBank obtains its deposits and provides the majority of its loans and leases electronically, with innovative deposit and lending solutions for financial intermediaries that allow them to excel in their core businesses. In addition, leveraging its internally developed IT security software and capabilities, VersaBank established wholly-owned, subsidiary, DRTC, to pursue significant large-market opportunities in cybersecurity and develop innovative solutions to address the rapidly growing volume of cyber threats challenging financial institutions, multi-national corporations, and government entities on a daily basis.

The Bank has two reportable operating segments, those being Digital Banking and DRTC. The two operating segments are strategic business operations providing distinct products and services to different markets and are separately managed due to the distinct nature of each business. The following summarizes the operations of each of the reportable segments:

Digital Banking: The Bank employs a branchless business-to-business (partner-based) model using its proprietary financial technology to address underserved segments in the Canadian and U.S. banking markets. VersaBank obtains its deposits and provides the majority of its loans and leases electronically via innovative deposit and lending solutions for financial intermediaries.

DRTC (cybersecurity services and banking and financial technology development): Leveraging its internally developed IT security software and capabilities, VersaBank established a wholly owned subsidiary, DRTC, to pursue significant large-market opportunities in cybersecurity and to develop innovative solutions to address the rapidly growing volume of cyber threats challenging financial institutions, multi-national corporations, and government entities.

Digital Banking

Lending

Point-of-Sale Financing (previously referred to as eCommerce)

VersaBank provides financing to its network of origination partners, who offer point-of-sale loans and leases to consumers and commercial clients in various markets throughout Canada and the U.S. through its Receivable Purchase Program. This business continues to indicate strong potential for growth and enhanced profitability, and further, has been structured such that the risk profile remains within the Bank’s risk appetite as a function primarily of the cash reserves retained from the Bank’s origination partners. Accordingly, VersaBank continues to allocate considerable resources to the development of innovative enhancements to maintain its competitive advantage and increase the rate of growth of this portfolio. Point-of-Sale Financing assets, at October 31, 2023, were $2.9 billion.

Commercial Lending

Commercial loans are originated through a well-established network of mortgage brokers and syndication partners and through direct contact with VersaBank’s clients. These loans are well-secured by real estate assets primarily located in Ontario and, to a lesser extent, other Canadian provinces. VersaBank is continuing to approach this business with caution and is winding down the non-core portion of this portfolio. Commercial loans, at October 31, 2023, were $953 million.

Funding

VersaBank has established three core low-cost diversified funding (deposit) channels that provide it with a significant cost of funds advantage: personal deposits, commercial deposits, and cash reserves retained from VersaBank’s Point-of-Sale Financing origination partners that are classified as other liabilities. Personal deposits, consisting predominately of guaranteed investment certificates, are sourced primarily through a well-established and diversified deposit broker network that the Bank continues to grow and expand across Canada. Commercial deposits are sourced primarily through a customized banking solution made available to insolvency professionals in Canada. VersaBank developed innovative software that integrates banking services through a proprietary application programming interface (“API”) with market-leading software platforms used to administer insolvency and restructuring proceedings.

Capital

As at October 31, 2023, VersaBank’s common equity tier 1 ratio was 11.33% versus 12.00% as at October 31, 2022, which reflects the Bank’s significant growth in assets in fiscal 2023 as described previously. VersaBank, like most small-scale Canadian banks, uses the Standardized Approach to calculate its risk-weighted assets. VersaBank’s lending operations focus on transactions with lower-than-average risk (as demonstrated by its long history of low provision for credit losses). VersaBank believes that the Standardized Approach does not accurately reflect the intrinsic risk in its lending portfolio and, consequently, VersaBank’s leverage ratio is one of the most conservative in the industry, being more than twice the average leverage ratio of the major Canadian Schedule I banks, which use the Advanced Internal Ratings Based Approach to calculate their risk-weighted assets.

On August 5, 2022, the Bank received approval from the TSX to proceed with an NCIB for its common shares on both the TSX and Nasdaq exchanges. Pursuant to the NCIB, VersaBank was able to purchase for cancellation up to 1,700,000 of its common shares representing approximately 9.54% of its public float at the time of approval. VersaBank’s directors and management believed that the market price of VersaBank’s common shares did not reflect the value of the business and the future prospects of same, and further, reflected a material discount to book value and as such the purchase of common shares for cancellation at such time was a prudent corporate measure and represents an attractive investment for the Bank. The Bank was eligible to make purchases commencing on August 17, 2022 and the NCIB was terminated on August 16, 2023. The purchases were made by VersaBank through the facilities of the TSX and alternate trading systems and in accordance with the rules of the TSX or such alternate trading systems, as applicable, the prices that VersaBank paid for the Common Shares was at the market price of such shares at the time of acquisition. VersaBank made no purchases of Common Shares other than open market purchases. All shares purchased under the NCIB were cancelled. For the year ended October 31, 2023, the Bank purchased and cancelled 1,321,358 (2022 - 195,300) Common Shares for $13.3 million (2022 - $1.9 million), reducing the Bank’s Common Share value by $11.4 million (2022 - $1.7 million) and retained earnings by $1.9 million (2022 - $238,000).

Credit Quality

VersaBank’s business strategy involves taking lower credit risk but achieving higher NIM by providing innovative, technology-based solutions and superior service in niche markets that are not well-served by the larger financial institutions. VersaBank consistently leads the Canadian lending industry with very low credit losses.

DRT Cyber Inc.

The Bank, through its wholly owned subsidiary, DRTC, offers leading in-depth cybersecurity protocols, banking and financial technology development, software and supporting systems for the purpose of mitigating exposure to the myriad of cybersecurity risks that businesses, governments, and other organizations face in the normal course of their operations. Early in its planning phase, the Bank recognized an opportunity to leverage its excess capacity and scale its operations to address large-market opportunities in the cybersecurity space, and further develop innovative solutions to address the rapidly growing volume of cyber threats challenging, not only financial institutions, but also multi-national corporations and government entities on a daily basis. DRTC is headquartered in Washington D.C. and services clients globally. DRTC’s VersaVault® product is the world’s first digital bank vault built for clients holding digital assets, providing impenetrable world class security, privacy of secured keys and client-centric access flexibility. On November 30, 2020, DRTC acquired DBG. With offices in London, Ontario, and Dallas, Texas, DBG provides corporate and government clients with a suite of IT security assurance services, that range from external network, web and mobile app penetration testing through to physical social engineering engagements along with supervisory control and data acquisition (“SCADA”) system assessments, as well as various aspects of training. As a division of DRTC, DBG has and will continue to strengthen our Business Development Partner Network and propel the growth and expansion of DRTC’s existing business.

SPECIALIZED SKILLS AND KNOWLEDGE / COMPETITIVE CONDITIONS

The Canadian financial services industry is highly developed and competitive. While many of Canada’s financial institutions carry on full-service banking businesses, VersaBank is highly specialized and has a relatively narrow but focused product offering. Further, the Bank believes that its products are ideally suited to the niche markets that it has chosen to operate in and, accordingly, its products are in high demand.

VersaBank competes with a variety of Canadian financial institutions, both large and small, in the various markets in which it participates. VersaBank utilizes custom and in-house designed software that provides a significant advantage in speed of delivery, versatility, and efficiency. VersaBank’s highly skilled team of software experts and lending professionals consistently provide innovative financing and deposit solutions via a digital platform with the capability to quickly and efficiently respond to changes in the marketplace. VersaBank also has in place a well-developed credit adjudication function that has resulted in it consistently achieving industry leading credit performance.

NEW SERVICES

VersaBank did not start offering any new services in 2023.

SUPERVISION AND REGULATION

VersaBank’s activities are governed by the Bank Act. In accordance with the Bank Act, banks may engage in and carry on the business of banking and such business generally as it pertains to the business of banking. The Office of the Superintendent of Financial Institutions (Canada) (“OSFI” or the “Superintendent”) is responsible for the administration of the Bank Act. The Superintendent issues guidelines regarding disclosure of a bank's financial information. The Superintendent is required to make an annual examination of each bank and to monitor each bank’s financial condition.

The Bank is also subject to regulation under the Financial Consumer Agency of Canada Act (the “FCAC Act”). The Financial Consumer Agency of Canada (the “Agency”), among other things, enforces consumer-related provisions of the federal statutes that govern financial institutions. The Commissioner of the Agency must report to the Minister on all matters connected with the administration of the FCAC Act and consumer provisions of other federal statutes. The Bank is also subject to provincial and territorial laws of general application.

The Bank is a member institution of the Canada Deposit Insurance Corporation (“CDIC”). Subject to limits, CDIC insures certain deposits held at its member institutions.

Banks, in Canada, have broad powers to invest in the securities of other corporations and entities, but the Bank Act imposes limits upon substantial investments. Under the Bank Act, a bank has a substantial investment in a body corporate when (i) the voting shares beneficially owned by the bank and by entities controlled by the bank carry voting rights in excess of 10% of all of the voting rights in the body corporate or (ii) the total of the shares of the body corporate that are beneficially owned by the bank and entities controlled by the bank represent more than 25% of the total shareholders’ equity of the body corporate. A Canadian chartered bank is permitted to have a substantial investment in entities whose activities are consistent with those of certain prescribed permitted substantial investments. In general, a bank will be permitted to acquire and hold a substantial investment in an entity that carries on a financial service activity which the bank could have carried on itself, whether that entity is regulated or not. Further, a bank may invest in entities that carry on commercial activities that are related to the promotion, sale, delivery or distribution of a financial product or service, or that relate to certain information services. A bank may also invest in entities that invest in real property, act as mutual funds or mutual fund distributors or that service financial institutions, and a bank may have downstream holding companies to hold these investments. In certain cases, the approval of the Superintendent is required prior to making the investment. Banks may, by way of temporary investment, acquire control of, or acquire or increase a substantial investment in, an entity for a two-year period. This time period may be extended upon application to the Superintendent. In prescribed circumstances, Banks may also invest in reliance upon the Specialized Financing Entity rules set out in the Bank Act and in the Specialized Financing (Banks) Regulations. Other than for authorized types of insurance, banks may offer insurance products only through duly authorized subsidiaries and not through their branch systems. Banks are prohibited from engaging in direct automobile leasing.

The Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the “Act”) is applicable to the Bank’s business in Canada. The Act implements specific measures designed to detect and deter money laundering and the financing of terrorist activities. Further, the Act sets out obligations related to deterring and detecting money laundering and terrorist financing from a global perspective, in order to minimize the possibility that the Bank could become a party to these activities. The Bank has enterprise-wide anti-money laundering and anti-terrorist financing policies and procedures which assist in reducing the risk of facilitating money laundering and terrorist financing activities.

EMPLOYEES AND PRINCIPAL PROPERTIES

At October 31, 2023, VersaBank had 119 full-time equivalent employees. VersaBank is a digital, branchless bank with a business-to-business model. Its head office is in London, Ontario, and it has two digital technology facilities, one located at the London International Airport and the other located on the University of Saskatchewan’s campus in Innovation Place.

RISK FACTORS

The risks faced by VersaBank are described under the headings “Enterprise Risk Management” and “Factors that May Affect Future Results” in VersaBank’s 2023 MD&A, which is incorporated herein by reference. Additional risks are described in VersaBank’s Management Proxy Circular dated April 19, 2023, which is incorporated herein by reference. Both documents are available on SEDAR+ at www.sedarplus.ca.

DIVIDENDS

COMMON SHARES

Holders of Common Shares of VersaBank (“Common Shares”) are entitled to receive, as and when declared by the Board, dividends. VersaBank’s Board of Directors (the “Board”) declared the initial quarterly cash dividend on Common Shares at its meeting on November 28, 2017.

During fiscal 2021, 2022 and 2023, VersaBank maintained its quarterly dividend at $0.025 per share. Prior to this the Bank increased its quarterly dividend paid on Common Shares in each year since the Bank declared and paid its first quarterly dividends in fiscal 2018. VersaBank expects to continue paying quarterly cash dividends at a rate of $0.025 per share on the last day of January, April, July, and October in each year; however, the declaration of a dividend, and the amount thereof, is at the discretion of the Board. Although it is management’s intention that dividends be paid on Common Shares, holders of Common Shares should not assume that dividends will be paid in the future.

PREFERRED SHARES

Series 1 Preferred Shares

For the five-year period commencing on November 1, 2019, holders of Series 1 Preferred Shares of VersaBank (“Series 1 Preferred Shares”) are entitled to receive, as and when declared by the Board, fixed non-cumulative preferential cash dividends at the rate of $0.6772 per share per annum, or $0.1693 per share per quarter. Such dividends are paid quarterly on the last day of January, April, July, and October in each year.

The Series 1 Preferred Shares were listed and posted for trading on the TSX on October 30, 2014. The initial dividend payment on the Series 1 Preferred Shares was made by VersaBank on January 31, 2015, in the amount of $0.176 per share. Thereafter, until the five-year rate reset on October 31, 2019, VersaBank paid quarterly cash dividends to holders of Series 1 Preferred Shares at a rate of $0.175 per share.

Additional information regarding the Series 1 Preferred Shares is described within the Short Form Prospectus dated October 22, 2014 (the “Series 1 Prospectus”), which is incorporated herein by reference. The Series 1 Prospectus is available on SEDAR+ at www.sedarplus.ca.

Series 3 Preferred Shares

The Series 3 Preferred Shares were redeemed on April 30, 2021.

Holders of Series 3 Preferred Shares of VersaBank (“Series 3 Preferred Shares”) were entitled to receive, as and when declared by the Board, fixed non-cumulative preferential cash dividends at the rate of $0.70 per share per annum, or $0.175 per share per quarter. Such dividends were paid quarterly on the last day of January, April, July, and October in each year.

The Series 3 Preferred Shares were listed and posted for trading on the TSX on February 19, 2015. The initial dividend payment on the Series 3 Preferred Shares was made by VersaBank on July 31, 2015, in the amount of $0.2992 per Series 3 Preferred Share. Thereafter, VersaBank has paid quarterly cash dividends to holders of Series 3 Preferred Shares at a rate of $0.175 per share.

Additional information regarding the Series 3 Preferred Shares is described within the Short Form Prospectus dated February 19, 2015 (the “Series 3 Prospectus”), which is incorporated herein by reference. The Series 3 Prospectus is available on SEDAR+ at www.sedarplus.ca.

DIVIDEND SUMMARY

The following dividends were declared for each of the three most recently completed financial years:

|

Share Class |

F2023 |

F2022 |

F2021 |

|

Common Shares |

$2,610,374 |

$2,739,656 |

$2,270,296 |

|

Series 1 Preferred Shares |

$989,701 |

$989,701 |

$989,701 |

|

Series 3 Preferred Shares |

$0 |

$0 |

$588,462 |

CAPITAL STRUCTURE

VersaBank is authorized to issue an unlimited number of Common Shares and an unlimited number of non-voting preferred shares of VersaBank, issuable in series ("Preferred Shares"). Below is a summary of VersaBank’s share capital. This summary is qualified in its entirety by VersaBank’s by-laws and the actual terms and conditions of such shares.

COMMON SHARES

VersaBank commenced trading on the TSX on August 27, 2013, under the ticker symbol PWB. On May 17, 2016, the Bank’s common shares began trading on the TSX under the ticker symbol VB. VersaBank completed an initial public offering in the U.S. and commenced trading on the Nasdaq on September 24, 2021, under the symbol VBNK. There were 25,964,424 Common Shares outstanding as at October 31, 2023. On January 25, 2022, the Bank’s common shares began trading on the TSX under the ticker symbol VBNK, replacing the previous ticker symbol VB. On August 17, 2022, VersaBank commenced an NCIB to purchase up to 1.7 million common shares for cancellation for an aggregate amount not to exceed $17.8 million during the period of August 17, 2022, through August 16, 2023. The NCIB expired on August 16, 2023.

3 Amounts rounded to nearest dollar.

Holders of Common Shares are entitled to vote at all meetings of shareholders, except for meetings at which only holders of another specified class or series of shares of VersaBank are entitled to vote separately as a class or series.

Holders of Common Shares are entitled to receive dividends as and when declared by the Board, subject to the preference of the Preferred Shares.

In the event of the dissolution, liquidation or winding-up of VersaBank, subject to the prior rights of the holders of Preferred Shares, and after payment of all outstanding debts, the holders of Common Shares will be entitled to receive the remaining property and assets of VersaBank.

PREFERRED SHARES

Preferred Shares may be issued, at any time or from time to time, in one or more series with such rights, privileges, restrictions and conditions as the Board may determine, subject to the Bank Act, VersaBank’s by-laws and any required regulatory approval.

Except with respect to amendments to the rights, privileges, restrictions, or conditions of the Preferred Shares, as required by law or as specified in the rights, privileges, restrictions and conditions attached from time to time to any series of Preferred Shares, the holders of the Preferred Shares as a class shall not be entitled as such to receive notice of, to attend or to vote at any meeting of the shareholders of VersaBank.

Each series of Preferred Shares ranks on a parity basis with every other series of Preferred Shares with respect to dividends and return of capital. The Preferred Shares are entitled to a preference over the Common Shares, and any other shares ranking junior to the Preferred Shares, with respect to priority in payment of dividends and in the distribution of assets in the event of the liquidation, dissolution or winding-up of VersaBank.

Preferred Shares of any series may also be given such other preferences not inconsistent with the rights, privileges, restrictions, and conditions attached to the Preferred Shares as a class over the Common Shares and any other shares ranking junior to the Preferred Shares as may be determined by the Board in the case of such series of Preferred Shares.

VersaBank’s Board has authorized the issuance of an unlimited number of Series 1 Preferred Shares, an unlimited number of non-cumulative floating rate Series 2 Preferred Shares (“Series 2 Preferred Shares”), an unlimited number of Series 3 Preferred Shares, and an unlimited number of non-cumulative floating rate Series 4 Preferred Shares (“Series 4 Preferred Shares”).

The following is a summary of the rights, privileges, restrictions, and conditions of, or attaching to, each of the four series of Preferred Shares.

Series 1 Preferred Shares

There were 1,461,460 Series 1 Preferred Shares outstanding as at October 31, 2023.

During the initial five-year period ending October 31, 2019, holders of Series 1 Preferred Shares were entitled to receive preferential, non-cumulative, cash dividends, as and when declared by the Board, payable quarterly on the last day of January, April, July, and October in each year, at 7.00% per annum. Thereafter, the dividend rate resets every five years at a level of 543 basis points over the then 5-year Government of Canada bond yield. On November 1, 2019, in accordance with the Series 1 Prospectus, the dividend rate reset to 6.772% per annum.

The Series 1 Preferred Shares were not redeemable prior to October 31, 2019. On October 31, 2019, VersaBank did not, in accordance with its option, redeem any of the outstanding Series 1 Preferred Shares for cash. VersaBank may, at its option, redeem for cash all, or any part, of the then outstanding Series 1 Preferred Shares on October 31 every five years after October 31, 2019, at a price equal to $10.00 per share together with all declared and unpaid dividends to the date fixed for redemption. All such redemptions are subject to the provisions of applicable securities law, the rules of the TSX and the Bank Act, and to the prior consent of the Superintendent.

Holders of Series 1 Preferred Shares will have/had the right to elect to convert, subject to certain conditions, any or all of their Series 1 Preferred Shares into an equal number of Series 2 Preferred Shares on October 31, 2019, and on October 31 every five years thereafter (each such date being a “Series 1 Conversion Date”). Holders of Series 1 Preferred Shares are not entitled to convert their shares into Series 2 Preferred Shares if VersaBank determines that there would remain outstanding, on a Series 1 Conversion Date, less than 200,000 Series 2 Preferred Shares. In addition, if VersaBank determines that there would remain outstanding, on a Series 1 Conversion Date, less than 200,000 Series 1 Preferred Shares, then all, but not part, of the remaining outstanding Series 1 Preferred Shares will automatically be converted into an equal number of Series 2 Preferred Shares on the applicable Series 1 Conversion Date. As of October 31, 2020, none of the Series 1 Preferred Shares had been converted to Series 2 Preferred Shares.

Upon the occurrence of a Trigger Event, as set out in the OSFI Guideline for Capital Adequacy Requirements (“CAR”), Chapter 2 – Definition of Capital (the “CAR Guideline”), effective November 1, 2018, as such term may be amended or superseded by OSFI from time to time, each Series 1 Preferred Share will be automatically converted, without the consent of the holders, into newly issued, fully-paid Common Shares, the number of which is determined by the conversion formula outlined in the Series 1 Preferred Shares terms and conditions (a “Series 1 Contingent Conversion”).

Subject to the provisions of applicable securities law, the rules of the TSX and the Bank Act, as applicable, and to the prior consent of the Superintendent, VersaBank may purchase for cancellation at any time all, or from time to time any part, of the Series 1 Preferred Shares then outstanding by private contract or in the open market or by tender at the lowest price or prices at which in the opinion of the Board such shares are obtainable.

In the event of the liquidation, dissolution or winding-up of VersaBank, provided that a Series 1 Contingent Conversion has not occurred, the holders of the Series 1 Preferred Shares will be entitled to receive $10.00 per Series 1 Preferred Share held by them, plus any dividends declared and unpaid to the date of distribution, before any amounts are paid or assets are distributed to holders of Common Shares, or any other shares ranking junior to the Series 1 Preferred Shares. After payment of those amounts, the holders of Series 1 Preferred Shares will not be entitled to share in any further distribution of the property or assets of VersaBank. If a Series 1 Contingent Conversion has occurred, all Series 1 Preferred Shares will have been converted into Common Shares which will rank on parity with all other Common Shares.

Holders of Series 1 Preferred Shares will not be entitled to receive notice of or to attend or to vote at any meeting of shareholders of VersaBank unless and until the first time at which the Board has not declared the dividend in full on the Series 1 Preferred Shares in any quarter. In that event, the holders of the Series 1 Preferred Shares will be entitled to receive notice of and to attend only a meeting of shareholders at which directors are to be elected and will have one vote for each Series 1 Preferred Share held. Such voting rights will cease on payment in full by VersaBank of the first dividend on the Series 1 Preferred Shares to which the holders are entitled subsequent to the time the voting rights first arose until such time as VersaBank may again fail to declare the dividend in full on the Series 1 Preferred Shares in any quarter, in which event the voting rights will become effective again and so on from time to time. In connection with any action taken by VersaBank which requires the approval of the holders of Series 1 Preferred Shares voting as a series or as part of the class, each such share will entitle the holder thereof to one vote.

Series 2 Preferred Shares

The Series 2 Preferred Shares are part of VersaBank’s authorized share capital, but no shares in this series have been issued as at October 31, 2023. If issued, holders of Series 2 Preferred Shares will be entitled to receive quarterly floating dividends, as and when declared by the Board, equal to the 90-day Government of Canada Treasury Bill rate plus 543 basis points. Additional information regarding the Series 2 Preferred Shares, including voting rights, provisions for exchange, conversion, exercise, redemption and retraction, dividend rights, and rights upon dissolution or winding-up is described within the Series 1 Prospectus.

Series 3 Preferred Shares

The Series 3 Preferred Shares were redeemed on April 30, 2021. There were nil Series 3 Preferred Shares outstanding as at October 31, 2023.

During the initial six-year period ending April 30, 2021, holders of Series 3 Preferred Shares were entitled to receive preferential, non-cumulative, cash dividends, as and when declared by the Board, payable quarterly on the last day of January, April, July, and October in each year, at 7.00% per annum. Thereafter, the dividend rate will reset every five years at a level of 569 basis points over the then 5-year Government of Canada bond yield.

The Series 3 Preferred Shares were redeemed by VersaBank, at its option, for cash on April 30, 2021, at a price equal to $10.00 per share together with all declared and unpaid dividends to the date fixed for redemption. The redemption was subject to the provisions of applicable securities law, the rules of the TSX and the Bank Act, and to the prior consent of the Superintendent.

Series 4 Preferred Shares

The Series 4 Preferred Shares are part of VersaBank’s authorized share capital, but no shares in this series have been issued as at October 31, 2023. If issued, holders of Series 4 Preferred Shares will be entitled to receive quarterly floating dividends, as and when declared by the Board, equal to the 90-day Government of Canada Treasury Bill rate plus 569 basis points. Additional information regarding the Series 4 Preferred Shares, including voting rights, provisions for exchange, conversion, exercise, redemption and retraction, dividend rights, and rights upon dissolution or winding-up is described within the Series 3 Prospectus.

CONSTRAINTS

The Bank Act contains restrictions on the issue, transfer, acquisition, and beneficial ownership of all shares of a chartered bank. For example, if a bank has equity of $12 billion or more, no person shall be a major shareholder of the bank, which includes a shareholder which owns, directly or indirectly, more than 20% of its outstanding voting shares of any class or more than 30% of its outstanding non-voting shares of any class. VersaBank does not meet this equity threshold and thus this restriction does not currently apply to VersaBank.

Further, no person shall have a significant interest in any class of shares of a bank unless the person first receives the approval of the Minister. Ownership, directly or indirectly, of more than 10% of any class of shares of a bank constitutes a significant interest. As of October 31, 2023, 340268 Ontario Limited owned approximately 32.78% of the Common Shares of the Bank. Approval from the Minister for 340268 Ontario Limited to have a significant interest in the common shares of VersaBank was obtained in conjunction with the closing of the Amalgamation.

VersaBank monitors the above constraints on shareholdings through various means including completion of Declaration of Ownership Forms for shareholder certificate transfer requests. If any person contravenes the above constraints on shareholdings, neither such person, nor any entity controlled by the particular person, may exercise any voting rights until the shares to which the constraint relates are disposed of. Additionally, the terms and conditions of the Series 1 Preferred Shares, the Series 2 Preferred Shares, the Series 3 Preferred Shares, and the Series 4 Preferred Shares include specific mechanics by which VersaBank is permitted to facilitate a sale of shares on behalf of such persons that are prohibited from taking delivery of shares issued upon a conversion.

The Bank Act prohibits the registration of a transfer or issue of any shares of VersaBank to, and the exercise, in person or by proxy, of any voting rights attached to any share of VersaBank that is beneficially owned by, His Majesty in right of Canada or of a province or any agent or agency of His Majesty in either of those rights, or to the government of a foreign country or any political subdivision, agent or agency of any of them.

Under the Bank Act, VersaBank is prohibited from redeeming or purchasing any of its shares or its subordinated debt, unless the consent of the Superintendent has been obtained. In addition, the Bank Act prohibits VersaBank from purchasing or redeeming any shares or paying any dividends if there are reasonable grounds for believing that VersaBank is, or the payment would cause VersaBank to be, in contravention of the Bank Act requirement to maintain, in relation to VersaBank's operations, adequate capital and appropriate forms of liquidity and to comply with any regulations or directions of the Superintendent in relation thereto.

MARKET FOR SECURITIES

TRADING PRICE AND VOLUME

The following VersaBank securities are listed and posted for trading on the TSX with the respective trading symbols indicated:

| Common Shares | - | VBNK | |

| Series 1 Preferred Shares | - | VBNK.PR.A | |

The following chart provides a summary of trading on the TSX in CAD:

|

COMMON SHARES |

SERIES 1 PREFERRED SHARES |

|||||

|

Month |

High |

Low |

Trading Volume |

High |

Low |

Trading Volume |

|

Oct 2023 |

$10.74 |

$9.96 |

51,638 |

$9.65 |

$9.35 |

21,802 |

|

Sep 2023 |

$11.55 |

$10.31 |

76,568 |

$9.45 |

$9.30 |

9,961 |

|

Aug 2023 |

$11.61 |

$10.59 |

83,504 |

$9.60 |

$9.41 |

4,731 |

|

Jul 2023 |

$11.66 |

$9.80 |

126,406 |

$9.6 |

$9.41 |

18,564 |

|

Jun 2023 |

$10.56 |

$9.35 |

74,263 |

$9.70 |

$9.40 |

24,320 |

|

May 2023 |

$9.95 |

$8.60 |

150,002 |

$9.76 |

$9.53 |

11,092 |

|

Apr 2023 |

$10.38 |

$9.72 |

74,764 |

$9.75 |

$9.65 |

13,830 |

|

Mar 2023 |

$10.50 |

$9.52 |

163,095 |

$9.90 |

$9.35 |

33,495 |

|

Feb 2023 |

$10.62 |

$9.90 |

53,316 |

$9.82 |

$9.75 |

6,360 |

|

Jan 2023 |

$10.60 |

$9.84 |

76,434 |

$10.10 |

$9.70 |

14,617 |

|

Dec 2022 |

$10.43 |

$8.90 |

85,453 |

$9.85 |

$9.42 |

7,950 |

|

Nov 2022 |

$9.98 |

$8.91 |

189,322 |

$9.78 |

$9.25 |

10,000 |

VersaBank’s common shares are listed and posted for trading on the Nasdaq under the trading symbol VBNK.

The following chart provides a summary of trading on the Nasdaq in USD:

|

COMMON SHARES |

|||

|

Month |

High |

Low |

Trading Volume |

|

Oct 2023 |

$7.93 |

$7.24 |

169,540 |

|

Sep 2023 |

$8.64 |

$7.69 |

88,974 |

|

Aug 2023 |

$9.02 |

$7.98 |

149,493 |

|

Jul 2023 |

$8.96 |

$7.30 |

200,386 |

|

Jun 2023 |

$8.01 |

$6.95 |

638,291 |

|

May 2023 |

$7.37 |

$7.02 |

175,161 |

|

Apr 2023 |

$7.74 |

$7.32 |

189,834 |

|

Mar 2023 |

$7.64 |

$7.00 |

709,977 |

|

Feb 2023 |

$7.90 |

$7.41 |

1,626,219 |

|

Jan 2023 |

$7.98 |

$7.45 |

198,989 |

|

Dec 2022 |

$7.68 |

$6.62 |

1,133,912 |

|

Nov 2022 |

$7.38 |

$6.59 |

308,303 |

DIRECTORS AND OFFICERS

DIRECTORS

The names, municipalities of residence, positions held with VersaBank, and principal occupations of its directors, as of December 13, 2023, are as follows:

|

Name

|

Office Held and Time as Director |

Principal Occupation |

|

The Honourable Thomas A. Hockin, P.C. Rancho Mirage, California, USA |

Chair Director since August 21, 2014 |

Retired, former Executive Director of the International Monetary Fund |

|

David R. Taylor Ilderton, Ontario |

President and Chief Executive Officer Director since January 18, 1993 |

President and Chief Executive Officer of VersaBank |

|

Gabrielle Bochynek(3) Stratford, Ontario |

Director since April 24, 2019 |

Principal, Human Resources & Labour Relations, The Osborne Group |

|

Robbert-Jan Brabander (2)(4) Richmond Hill, Ontario |

Director since November 4, 2009 |

Managing Director of Bells & Whistles Communications, Inc. and former Chief Financial Officer & Treasurer of General Motors of Canada Limited |

|

David A. Bratton (3) London, Ontario |

Director since September 23, 1993 |

Retired, former President of Bratton Consulting Inc. |

|

Peter M. Irwin (1)(2) Toronto, Ontario |

Director since January 1, 2021 |

Retired, former Managing Director at CIBC World Markets Inc. |

|

Richard H. L. Jankura(1)(2) London, Ontario |

Director since May 6, 2022 |

Retired, former Chief Financial Officer of Jones Healthcare Group |

|

Arthur R. Linton (4) Kitchener, Ontario |

Director since April 22, 2020 |

Independent Corporate Director and Lawyer |

|

Susan T. McGovern (3)(4) Aurora, Ontario |

Vice-Chair Director since May 6, 2011 |

Executive Advisor in the Ontario Ministry of Finance |

|

Paul G. Oliver (1) Markham, Ontario |

Director since June 2, 2005 |

Retired, former senior partner of PricewaterhouseCoopers LLP |

|

(1) |

Member of the Audit Committee |

|

(2) |

Member of the Risk Oversight Committee |

|

(3) |

Member of the Conduct Review, Governance & HR Committee |

|

(4) |

Member of the Innovation and Technology Committee |

Directors are elected annually and hold office until the next annual meeting of shareholders.

EXECUTIVE OFFICERS

The names, municipalities of residence, positions held with VersaBank, and principal occupations of its executive officers, as of December 13, 2023, are as follows:

|

Name

|

Office Held |

Principal Occupation |

|

David R. Taylor Ilderton, Ontario |

President and Chief Executive Officer |

President and Chief Executive Officer of VersaBank |

|

Tammie Ashton |

Chief Risk Officer |

Chief Risk Officer of VersaBank |

|

John Asma |

Chief Financial Officer |

Chief Financial Officer of VersaBank |

|

Shawn Clarke Ilderton, Ontario |

Chief Operating Officer |

Chief Operating Officer of VersaBank |

|

Garry Clement |

Chief Anti-Money Laundering Officer |

Chief Anti-Money Laundering Officer of VersaBank |

|

Michael R. Dixon London, Ontario |

SVP, Point-of-Sale Financing |

SVP, Point-of-Sale Financing of VersaBank |

|

Brent T. Hodge |

SVP, General Counsel, Corporate Secretary, and Chief Compliance Officer |

SVP, General Counsel, Corporate Secretary, and Chief Compliance Officer of VersaBank |

|

Joanne Johnston |

Chief Internal Auditor |

Chief Internal Auditor of VersaBank |

|

Nick Kristo London, Ontario |

Chief Credit Officer |

Chief Credit Officer of VersaBank |

|

Wooi Koay |

Chief Information Officer |

Chief Information Officer of VersaBank |

|

Tel Matrundola |

Executive Vice President |

Executive Vice President of VersaBank |

|

Rick Smyth Port Stanley, Ontario |

SVP, Commercial Lending |

SVP, Commercial Lending of VersaBank |

|

Jonathan Taylor Salt Spring Island, British Columbia |

Chief Human Resources Officer |

Chief Human Resources Officer of VersaBank |

At December 13, 2023, there were 25,964,424 issued and outstanding Common Shares. The directors and executive officers of VersaBank as a group beneficially own, directly or indirectly, or have control or direction over 1,682,310 Common Shares, representing approximately 6.48% of the total number of Common Shares outstanding.

At December 13, 2023, there were 1,461,460 issued and outstanding Series 1 Preferred Shares of VersaBank. The directors and executive officers of VersaBank as a group beneficially own, directly or indirectly, or have control or direction over 7,435 Series 1 Preferred Shares of VersaBank, representing approximately 0.51% of the total number of Series 1 Preferred Shares outstanding.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

To the knowledge of VersaBank, there are no material interests, direct or indirect, of any director or executive officer of VersaBank, any shareholder that beneficially owns, or controls or directs (directly or indirectly), more than 10% of any class or series of VersaBank’s outstanding voting securities, or any associate or affiliate of any of the foregoing persons, in any transaction within the last three financial years ended October 31, 2023.

TRANSFER AGENT AND REGISTRAR

VersaBank’s current registrar and transfer agent is Odyssey Trust Company (“Odyssey”), 1230 – 300 5th Avenue SW, Calgary, AB T2P 3C4. Odyssey replaced Computershare Investor Services Inc., the Bank’s previous transfer agent, effective July 31, 2023.

EXPERTS

Ernst & Young LLP are the current auditors of VersaBank. Ernst & Young LLP replaced KPMG LLP, the Bank’s previous auditors on December 14, 2022. Ernst & Young LLP have confirmed with respect to VersaBank that they are independent within the meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable legislation or regulations and also that they are independent accountants with respect to VersaBank under all relevant U.S. professional and regulatory standards.

AUDIT COMMITTEE

AUDIT COMMITTEE MANDATE

The Mandate of the Audit Committee is attached to this Annual Information Form as Appendix A.

COMPOSITION OF THE AUDIT COMMITTEE

The members of the Audit Committee are:

|

(1) |

Paul G. Oliver (Chair) |

|

(2) |

Peter M. Irwin |

|

(3) |

Richard H. L. Jankura |

Each member of the Audit Committee is both independent and financially literate, as such terms are defined in Canadian securities legislation.

RELEVANT EDUCATION AND EXPERIENCE

Mr. Oliver is a retired senior partner of PricewaterhouseCoopers LLP in the Financial Services Industry Practice. His practice focused on assurance, financial reporting, and business advisory services, covering a broad range of organizations, with a focus in the regulated financial services industry. Mr. Oliver was admitted to the Institute of Chartered Accountants in England and Wales in 1968. He was elected a Fellow of the Institute of Chartered Accountants of Ontario in 2003, after having been admitted to membership in 1971. Mr. Oliver is also a Certified Director of the Institute of Corporate Directors.

Mr. Irwin is a retired Canadian financial services executive with over 30 years of industry experience in a variety of roles, including investment banking, capital markets, corporate development, merchant banking, and private equity. A Managing Director at CIBC World Markets Inc. prior to his retirement in January 2017, he has worked with a wide range of corporate and government issuers and investors in the Canadian and international financial markets in many different areas. Mr. Irwin earned an Honours B.A. in Business Administration from the Ivey School of Business, Western University, in 1980.

Mr. Jankura is a retired senior finance and accounting executive who has over 30 years of knowledge and expertise within a diverse range of industries. He is a Chartered Professional Accountant and prior to his retirement served as the Chief Financial Officer of Jones Healthcare Group and Discovery Air Inc., where he was responsible for building the finance, treasury, and reporting infrastructure for the organization. Mr. Jankura has also held several senior roles in the banking and venture capital industries, which included responsibility for risk management oversight. He has served as a member of a number of for-profit and not-for-profit boards, including that of a federally regulated trust company. Mr. Jankura earned an Honours Bachelor of Business Administration from Wilfred Laurier University.

PRE-APPROVAL POLICIES AND PROCEDURES

The Board has approved an Audit Services Policy which provides that the Audit Committee shall pre-approve non-audit services and audit and non-audit related fees to be provided by the external auditor on a case-by-case basis.

AUDITOR FEES

Audit Fees

Audit fees paid to Ernst & Young LLP during the year ended October 31, 2023, for VersaBank were $750,000. Audit fees paid to KPMG LLP during the year ended October 31, 2022, were $934,000. Audit fees were for professional services rendered by Ernst & Young LLP and KPMG LLP for the audit of VersaBank’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

Audit-related fees paid to Ernst & Young LLP during the year ended October 31, 2023, for VersaBank were $15,000. Audit-related fees paid to KPMG LLP during the year ended October 31, 2022, for VersaBank were $20,000. Audit-related fees were for assurance and services reasonably related to the performance of the audit of the consolidated financial statements.

Tax-Related Fees

Fees paid to Ernst & Young LLP for tax related services during the year ended October 31, 2023, for VersaBank were $154,000. Fees paid to KPMG LLP for tax related services during the year ended October 31, 2022, for VersaBank were $170,660. Tax fees were for tax compliance, tax advice and tax-planning professional services.

Ernst & Young LLP and KPMG LLP fees are exclusive of any information technology infrastructure costs and administrative support charges and applicable taxes. No other fees were paid to Ernst & Young LLP during the years ended October 31, 2023 or KPMG LLP during the years ended October 31, 2023.

ADDITIONAL INFORMATION

Additional information regarding VersaBank may be found on SEDAR+ at www.sedarplus.ca, EDGAR at www.sec.gov/edgar, or at www.versabank.com.

Information, including directors’ and officers’ remuneration and indebtedness, principal holders of VersaBank’s securities, and securities authorized for issuance under equity compensation plans will be contained in the Management Proxy Circular for the Annual Meeting of Shareholders being held on or about April 17, 2024. Additional financial information is provided in VersaBank’s consolidated financial statements and MD&A for the year ended October 31, 2023.

APPENDIX A: AUDIT COMMITTEE MANDATE

Purpose

The Audit Committee is responsible for assisting the Bank’s Board of Directors (the “Board”) in its oversight of (i) the integrity of the Bank’s financial statements, public documents, and other financial filings; (ii) the qualifications, performance and independence of the external auditors; (iii) the performance of the Bank’s Chief Financial Officer and internal audit function; and (iv) internal controls that are appropriately designed and operate effectively.

Organization of the Audit Committee

The Audit Committee shall be comprised of not less than three directors, one of whom shall serve as the Chair of the Committee. Each member of the Audit Committee must be independent, financially literate, and unaffiliated directors .

Meetings of the Audit Committee

In order for the Committee to transact business, a majority of the members of the Committee must be present. The Committee shall meet at least once each quarter and shall schedule a sufficient number of meetings (whether in person or by teleconference) to carry out its mandate.

There shall be an in-camera session at each quarterly Committee meeting with only independent directors present.

Committee members are expected to devote the appropriate amount of time necessary to review meeting materials such that they are able to engage in informed discussion and make informed decisions.

Reporting to the Board

The Committee shall present a verbal summary report of matters discussed at each of its meetings at the next following meeting of the Board of Directors with respect to its activities with such recommendations as are deemed desirable in the circumstances. In addition, the Committee may call a meeting of the Board of Directors to consider any matter that is of concern to the Committee.

Resources and Authority

The Audit Committee has the authority to engage and compensate any outside advisor that is determined to be necessary to permit them to carry out these duties, provided such compensation does not exceed $10,000 in any fiscal year. Should the compensation of an outside advisor exceed $10,000 in any fiscal year the prior approval of the Board will be required.

Duties and Responsibilities of the Audit Committee

The members of the Audit Committee are charged with the following duties:

|

1. |

Financial Statements, Public Documents & Other Financial Filings |

|

a) |

Review such documents as needed to comply with regulatory requirements relevant to the Audit Committee, and report to the Board of Directors where approval of the documents by the Board is required. |

|

|

b) |

Review new accounting policies and amendments to existing accounting policies before recommending them to the Board of Directors for approval. |

|

|

c) |

Approve the interim quarterly financial statements and MD&A. |

|

|

d) |

Concur with the annual financial statements and the annual MD&A before recommending them to the Board of Directors for approval. |

|

|

e) |

Review the interim and annual earnings press releases before public disclosure. |

|

|

f) |

Review the Annual Information Form before recommending it to the Board of Directors for approval. |

|

|

g) |

Review the Monthly Reporting Package for the most recent quarter for which interim quarterly financial statements for the Bank are being issued. |

|

|

h) |

Review quarterly, management’s assessment of the appropriateness of the expected credit loss allowance. |

|

|

i) |

Review such investments and transactions that could adversely affect the well-being of the Bank as the auditor or auditors or any officer may bring to the attention of the Committee. |

|

2. |

Disclosure |

|

a) |

Concur with the Mandate of the Disclosure Committee before recommending it to the Board of Directors for approval. |

|

b) |

Review and approve the Corporate Disclosure Policy and all amendments thereto before recommending it to the Board of Directors for approval. |

|

c) |

Review the Disclosure Controls and Procedures. |

|

3. |

Internal Audit |

|

a) |

Review and concur in the appointment, replacement or dismissal of the Chief Internal Auditor. |

|

b) |

Concur with the Mandate of the Internal Audit Function before recommending it to the Board of Directors for approval. |

|

c) |

Annually approve a comprehensive risk-based audit plan as submitted by the Chief Internal Auditor. |

|

d) |

Ensure there are no unjustified restrictions or limitations on the Internal Audit function. |

|

e) |

Review all internal audit reports as submitted by the Chief Internal Auditor. |

|

f) |

Receive updates from the Chief Internal Auditor on the status of management’s implementation of the recommendations within the internal audit reports. |

|

g) |

Meet with the Chief Internal Auditor and with management to discuss the effectiveness of the internal control procedures established. |

|

h) |

Annually, review the Mandate of the Internal Audit Function and evaluate the effectiveness of the Chief Internal Auditor and contribute to his or her Annual Performance Appraisal. |

|

i) |

Meet with the Chief Internal Auditor in camera at the conclusion of each regularly scheduled meeting of the Committee. |

|

4. |

External Audit |

|

a) |

Concur with the external auditors to be nominated for the purpose of preparing or issuing an audit report or performing other audit, review or attest services before recommending them to the Board of Directors. |

|

b) |

Meet with the external auditor to review the Audit Planning Memorandum and annually approve the Audit Planning Memorandum. |

|

c) |

Concur with the compensation of the external auditor before recommending it to the Board of Directors for approval. |

|

d) |

Pre-approve services and expenditures to the external auditor, in accordance with the Audit Services Policy. |

|

e) |

Oversee the work of the external auditor engaged for the purpose of preparing or issuing an auditor’s report or performing other audit, review or attest services, including the resolution of disagreements between management and the external auditor regarding financial reporting. |

|

f) |

Meet with the external auditor or auditors to discuss the annual financial statements and the returns and transactions referred to in this Mandate. |

|

g) |

Annually review all amounts paid to the external auditor and other accounting firms in the previous year. |

|

h) |

Identify, evaluate by performing annual assessments and periodic comprehensive assessments and, where appropriate, recommend to the shareholder(s), replacement of the external auditor. |

|

i) |

Annually report to the Board on the effectiveness of the external auditor. |

|

j) |

Concur with hiring policies regarding partners, employees and former partners and employees of the present and former external auditor before recommending them to the Board of Directors for approval. |

|

k) |

Concur with the hiring of a partner, employee or former partner or employee of the present or former external auditor before recommending it to the Board of Directors for approval. |

|

l) |

Meet with the external auditor in-camera at the conclusion of each regularly scheduled meeting of the Committee. |

|

5. |

Capital Management |

|

a) |

Review, at least annually, the Bank’s policies and procedures with respect to capital management and receive management reports regarding adherence to same. |

|

b) |

Review and recommend to the Board for approval the annual ICAAP document of the Bank. |

|

c) |

Annually, prepare and submit to the Board of Directors an Annual Report which includes a statement from the Chief Internal Auditor that the Capital Management policy is being complied with. |

|

6. |

Complaints and Confidential Reporting |

|

a) |

Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters. |

|

b) |

Establish procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or audit matters. |

|

7. |

Anti-Money Laundering and Anti-Terrorist Financing |

|

a) |

Oversee the Bank’s Anti-Money Laundering and Anti-Terrorist Financing (“AML/ATF”) program and monitors its effectiveness on a regular basis. |

|

b) |

Be satisfied that the Chief Anti-Money Laundering Officer (“CAMLO”) has the necessary resources to carry out CAMLO responsibilities. |

|

c) |

Review and recommend to the Board for approval, the Bank’s AML/ATF Policy, and all changes to the Policy. |

|

d) |

At least annually, conduct a review of the AML/ATF Policy and associated procedures. |

|

e) |

Receive information from the Bank’s CAMLO on the inherent money laundering (“ML”) and terrorist-financing (“TF”) risks associated with the Bank’s activities at least once every three years. |

|

f) |

Receive information from the CAMLO on self-assessments of the ML and TF risk controls implemented by the Bank at least annually. |

|

g) |

Receive a report from the CAMLO at least annually on ML/TF risks Bank-wide. |

|

h) |

Receive an annual report from the CAMLO on compliance with the Bank’s AML/ATF policy. |

|

i) |

Receive a quarterly AML Risk Rating Report Summary from the CAMLO. |

|

j) |

Receive reports from the CAMLO as to transactions reported to FINTRAC or submitted to any law enforcement agency. |

|

k) |

Receive information from the CAMLO on significant changes to AML/ATF legislative requirements. |

|

l) |

The Committee shall have unfettered access to the CAMLO. |

|

m) |

Receive results of the Chief Internal Auditor’s independent effectiveness testing of the Bank’s AML/ATF program at least once every two years. |

|

n) |

Report to the Board of Directors on information and reports received from the CAMLO and the Chief Internal Auditor. |

|

o) |

Annually, review the mandate of the CAMLO and evaluate the effectiveness of the CAMLO and contribute to his or her Annual Performance Appraisal. |

|

p) |

Meet with the CAMLO in-camera at least bi-annually. |

|

8. |

Internal Controls |

|

a) |

Require management to implement and maintain appropriate internal control procedures. |

|

b) |

Review, evaluate and approve the internal control policies and procedures at least annually, and receive management reports regarding adherence to same to ensure internal controls are appropriately designed and operate effectively. |

|

9. |

Other Duties |

|

a) |

Annually, evaluate the effectiveness of the Chief Financial Officer and contribute to his or her Annual Performance Appraisal. |

|

b) |

Regarding matters falling under the Mandate of the Audit Committee, be aware of increased reputational risk to the Bank which can potentially impact the Bank’s image in the community or lower public confidence in it, resulting in the loss of business, legal action or increased regulatory oversight. |

|

c) |

Review regulatory reviews regarding matters falling under the Mandate of the Audit Committee and the status of management’s responses to any noted issues. |

|

d) |

On an annual basis review the policies relating to matters falling under the Mandate of the Audit Committee and report to the Board of Directors. |

|

e) |

Institute and oversee special investigations as needed. |

|

f) |

Perform other activities related to the Mandate as requested by the Board of Directors. |

|

g) |