Filed pursuant to General Instruction II.L of Form F-10

File No. 333-283077

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED NOVEMBER 22, 2024

New Issue

US$75,000,009

5,660,378 Common Shares

This prospectus supplement (the “Prospectus Supplement”), together with the accompanying short form base shelf prospectus dated November 22, 2024 (the “Shelf Prospectus”), qualifies the distribution (the “Offering”) of common shares (the “Common Shares”) of VersaBank (the “Bank”, “us”, “we” or “our”) at a price of US$13.25 per Common Share (the “Offering Price”). The Offering consists of 5,660,378 Common Shares being issued and sold by the Bank (the “Offered Shares”). The Bank will use the net proceeds of the Offering as described in this Prospectus Supplement. See “Use of Proceeds”.

Our Common Shares are listed and posted for trading on The Nasdaq Global Select Market (“Nasdaq”) and the Toronto Stock Exchange (the “TSX”) under the symbol “VBNK”. On December 16, 2024, the last trading day before the filing of this Prospectus Supplement, the closing price of the Common Shares on the Nasdaq and TSX was US$14.82 and C$21.34, respectively.

| Price: US$13.25 per Offered Share |

| Price to the Public(1) | Underwriters’ Fee(2) | Net Proceeds to the Bank(3) | ||||||||

| Per Offered Share | US$13.25 | US$0.7685 | US$12.4815 | |||||||

| Total Offering(4) | US$75,000,009 | US$4,350,001 | US$70,650,008 | |||||||

| (1) | The Offering Price was determined by negotiation between the Bank and the Underwriters (as defined herein), with reference to the then-current market price for the Common Shares. |

| (2) | Pursuant to the terms of the Underwriting Agreement (as defined below) and in consideration of the services rendered by the Underwriters in connection with the Offering, the Underwriters will receive an aggregate fee (the “Underwriters’ Fee”) of US$4,350,001 representing 5.80% of the gross proceeds of the Offering. The Underwriters will also be reimbursed for certain expenses incurred in connection with this Offering. For additional information regarding underwriter compensation, see “Underwriting”. |

| (3) | After deducting the Underwriters’ Fee payable by the Bank, but before deducting the other expenses in respect of the Offering estimated to be approximately US$1,427,500. |

| (4) | The Bank has granted to the Underwriters an option (the “Over-Allotment Option”), exercisable, in whole or in part, from time to time not later than 30 days from the date of this Prospectus Supplement, to purchase from the Bank up to 849,056 additional Common Shares (the “Additional Shares”) to be issued by the Bank, representing in the aggregate 15% of the total number of Offered Shares, at the Offering Price, less the Underwriters’ Fee. The Underwriters may exercise the Over-Allotment Option solely for the purpose of covering over-allotments, if any. If the Over-Allotment Option is exercised in full, the total “Price to the Public”, “Underwriters’ Fee” and “Net Proceeds to the Bank” will be US$86,250,001, US$5,002,501 and US$81,247,500, respectively. See “Underwriting”. |

All dollar amounts in this Prospectus Supplement are in United States dollars, unless otherwise indicated. See “Currency Presentation and Exchange Rate Information”.

Investing in the Common Shares involves significant risk. Prospective investors should consider the risks outlined in this Prospectus Supplement, in the accompanying Shelf Prospectus and in the documents incorporated by reference herein and therein. See “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”.

Securities legislation in certain of the provinces of Canada provides purchasers with the right to withdraw or rescind from an agreement to purchase securities. See “Statutory Rights of Withdrawal and Rescission”.

Sole Bookrunning Manager

Raymond James

Co-Managers

| Keefe, Bruyette & Woods | Roth Canada, Inc. | |

| A Stifel Company |

December 16, 2024

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR ANY STATE SECURITIES COMMISSION OR ANY U.S. REGULATORY AUTHORITY, NOR HAVE THESE AUTHORITIES PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Offering is being made in the United States by a foreign issuer that is permitted, under a multijurisdictional disclosure system adopted in the United States and Canada, to prepare this Prospectus Supplement and the accompanying Shelf Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. The financial statements included or incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and may be subject to foreign auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Offered Shares may have tax consequences both in Canada and the United States. Such consequences for investors who are resident in, or citizens of, Canada or the United States may not be described fully herein. See “Certain Canadian Federal Income Tax Considerations” and “Material U.S. Federal Income Tax Considerations”.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Bank is a Canadian Schedule I chartered bank subject to the provisions of the Bank Act (Canada) (the “Bank Act”), that most of its directors and officers reside principally in Canada, that some or all of the Underwriters or experts named in the Registration Statement (as defined herein) may be residents of a foreign country, and that all or a substantial portion of the assets of the Bank and said persons may be located outside the United States. See “Enforcement of Civil Liabilities”.

The Offering is being made concurrently in the United States under the terms of the Bank’s registration statement on Form F-10 (the “Registration Statement”) filed with the SEC and in each of the provinces and territories of Canada, other than Quebec, under the terms of this Prospectus Supplement.

All dollar amounts in this Prospectus Supplement are in United States dollars, unless otherwise indicated. See “Currency Presentation and Exchange Rate Information”.

The Offered Shares are being offered in the United States by Raymond James & Associates, Inc., Keefe, Bruyette & Woods, Inc. and Roth Capital Partners, LLC (collectively, the “U.S. Underwriters”) and in each of the provinces and territories of Canada, other than Quebec, by Roth Canada, Inc. (the “Canadian Underwriter”, and together with the U.S. Underwriters, the “Underwriters”) pursuant to an underwriting agreement dated December 16, 2024, by and among the Bank and the Underwriters (the “Underwriting Agreement”). Subject to applicable law, the Underwriters may offer Offered Shares outside of the United States and Canada. See “Underwriting”.

The Bank will use the net proceeds from the Offering of the Offered Shares as described in this Prospectus Supplement. See “Use of Proceeds”.

The Underwriters, as principals, conditionally offer the Offered Shares qualified under this Prospectus Supplement and the Shelf Prospectus, subject to prior sale, when, as and if delivered by the Bank to the Underwriters and accepted by them subject to the conditions contained in the Underwriting Agreement, as described under “Underwriting”.

Certain legal matters relating to Canadian law with respect to the Offering will be passed upon for the Bank by Stikeman Elliott LLP. Certain legal matters relating to United States law with respect to the Offering will be passed upon for the Bank by Davis Polk & Wardwell LLP and for the Underwriters by Holland & Knight LLP. See “Legal Matters”.

Subject to applicable laws, the Underwriters may, in connection with this Offering, over-allot or effect transactions that stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail on the open market. Such transactions, if commenced, may be discontinued at any time. After the Underwriters have made reasonable efforts to sell the Offered Shares at the Offering Price, the Underwriters may offer the Offered Shares to the public at prices lower than the Offering Price. Any such reduction will not affect the proceeds of the Offering to be received by the Bank. See “Underwriting”.

The Bank has applied to list the Offered Shares and the Additional Shares distributed under this Prospectus Supplement on the Nasdaq and the TSX. Listing will be subject to the Bank fulfilling all of the listing requirements of the Nasdaq and of the TSX.

Subscriptions will be received subject to rejection or allotment, in whole or in part, and the right is reserved to close the subscription books at any time without notice. Closing of the Offering is expected to take place on or about December 18, 2024 (the “Closing Date”), or such earlier or later date as the Bank and the Underwriters may agree, but in any event no later than December 23, 2024.

It is expected that the Bank will arrange for the instant deposit of the Offered Shares under the book-based system of registration, to be registered to The Depository Trust Company (“DTC”) or its nominee and deposited with DTC on the Closing Date, or as may otherwise be agreed to among the Bank and the Underwriters. In the case of certain Canadian purchasers, the Bank may alternatively arrange for the electronic deposit of the Offered Shares distributed under the Offering under the book-based system of registration, to be registered in the name of CDS Clearing and Depository Services Inc. (“CDS”) or its nominee and deposited with CDS on the Closing Date. No certificates evidencing the Offered Shares will be issued to purchasers of the Offered Shares. Purchasers of the Offered Shares will receive only a customer confirmation from the Underwriter or other registered dealer from or through whom a beneficial interest in the Offered Shares is purchased. See “Underwriting”.

The Bank’s principal and registered office is located at Suite 2002, 140 Fullarton Street, London, Ontario N6A 5P2.

Prospectus Supplement

Page

Shelf Prospectus

Page

About This Prospectus Supplement

This document is composed of two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and adds to and supplements information contained in the accompanying Shelf Prospectus and the documents incorporated by reference therein. The second part is the Shelf Prospectus, which gives more general information, some of which may not apply to the Offering. This Prospectus Supplement is deemed to be incorporated by reference into the Shelf Prospectus solely for the purpose of this Offering.

Neither the Bank nor any of the Underwriters has authorized any person to provide readers with information or to make representations different from those contained in this Prospectus Supplement and the accompanying Shelf Prospectus (or incorporated by reference herein or therein). Neither the Bank nor the Underwriters take responsibility for, or can provide any assurance as to the reliability of, any other information that others may give readers of this Prospectus Supplement and the accompanying Shelf Prospectus. If the description of the Offered Shares or any other information varies between this Prospectus Supplement and the accompanying Shelf Prospectus (including the documents incorporated by reference herein and therein), the information in this Prospectus Supplement supersedes the information in the accompanying Shelf Prospectus. The Offered Shares are not being offered in any jurisdiction where the offer or sale is not permitted.

Readers should not assume that the information contained or incorporated by reference in this Prospectus Supplement and the accompanying Shelf Prospectus is accurate as of any date other than the date of this Prospectus Supplement and the accompanying Shelf Prospectus or the respective dates of the documents incorporated by reference herein or therein, unless otherwise noted herein or as required by law. The business, financial condition, results of operations and prospects of the Bank may have changed since those dates.

This Prospectus Supplement shall not be used by anyone for any purpose other than in connection with the Offering. We do not undertake to update the information contained or incorporated by reference herein or in the Shelf Prospectus, except as required by applicable securities laws. Information contained on, or otherwise accessed through, our website shall not be deemed to be a part of this Prospectus Supplement, the accompanying Shelf Prospectus or any document incorporated by reference herein or therein, and such information is not incorporated by reference herein or therein. Prospective investors should not rely on such information when deciding whether or not to invest in the Offered Shares.

S-i

Documents Incorporated by Reference

This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Shelf Prospectus solely for the purposes of this Offering. Other documents are also incorporated, or are deemed to be incorporated by reference, into the Shelf Prospectus and reference should be made to the Shelf Prospectus for full particulars thereof.

The following documents, filed with the various securities commissions or similar authorities in Canada, are incorporated by reference into, and form an integral part of, this Prospectus Supplement and the accompanying Shelf Prospectus:

| · | the Bank’s Annual Information Form dated December 8, 2024 for the year ended October 31, 2024 (the “Annual Information Form”); |

| · | the Bank’s comparative audited consolidated financial statements as at and for the years ended October 31, 2024 and 2023, together with the report of the independent registered public accounting firm thereon, dated December 8, 2024 (the “Annual Financial Statements”); |

| · | the Bank’s Management’s Discussion and Analysis for the year ended October 31, 2024 (the “Annual MD&A”); and |

| · | the Bank’s Management Proxy Circular regarding the Bank’s annual and special meeting of shareholders held on April 17, 2024. |

Any statement contained in this Prospectus Supplement, in the accompanying Shelf Prospectus or in any document incorporated or deemed to be incorporated by reference herein or therein shall be deemed to be modified or superseded, for purposes of this Prospectus Supplement, to the extent that a statement contained herein or in the accompanying Shelf Prospectus or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or in the accompanying Shelf Prospectus modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to prevent a statement that is made from being false or misleading in the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus Supplement.

Any document of the type required by National Instrument 44-101 – Short Form Prospectus Distributions to be incorporated by reference into a short form prospectus, including any annual information forms, material change reports (except confidential material change reports), business acquisition reports, interim financial statements, annual financial statements (in each case, including exhibits containing updated earnings coverage information) and the report of an independent registered public accounting firm thereon, management’s discussion and analysis and information circulars of the Bank, filed by the Bank with securities commissions or similar authorities in Canada, after the date of this Prospectus Supplement and for the duration of the Offering, shall be deemed to be incorporated by reference into this Prospectus Supplement. In addition, all documents filed on Form 6-K or Form 40-F by the Bank with the SEC on or after the date of this Prospectus Supplement shall be deemed to be incorporated by reference into the Registration Statement of which this Prospectus Supplement forms a part, if and to the extent, in the case of any Report on Form 6-K, expressly provided in such document.

Furthermore, other than in respect of the marketing materials relating to the road shows described under “Marketing Materials” below, any “template version” of any “marketing materials” (each as such term is defined in National Instrument 41-101 – General Prospectus Requirements) filed in connection with the Offering after the date of this Prospectus Supplement but prior to the termination of the distribution of the Offered Shares pursuant to the Offering is deemed to be incorporated by reference in this Prospectus Supplement and in the accompanying Shelf Prospectus.

The documents incorporated or deemed to be incorporated by reference herein contain meaningful and material information relating to the Bank, and readers should review all information contained in this Prospectus Supplement, the accompanying Shelf Prospectus and the documents incorporated or deemed to be incorporated by reference herein and therein.

Copies of the documents incorporated by reference in this Prospectus Supplement and the accompanying Shelf Prospectus may be obtained on request without charge from the Corporate Secretary, VersaBank, Suite 2002, 140 Fullarton Street, London, Ontario N6A 5P2, telephone: (519) 675-4201, and are also available electronically on the System for Electronic Document Analysis and Retrieval+ (“SEDAR+”) at www.sedarplus.ca and on the Electronic Data Gathering, Analysis, and Retrieval System (“EDGAR”) at www.sec.gov.

S-ii

Before filing this Prospectus Supplement, the Bank and the Underwriters held road shows that potential investors in the United States and in certain of the provinces and territories of Canada were able to attend. The Bank and the Underwriters provided marketing materials to those potential investors in connection with those road shows.

In doing so, the Bank and the Underwriters are relying on a provision in applicable Canadian securities legislation that allows issuers in certain U.S. cross-border offerings to not have to file marketing materials relating to those road shows on SEDAR+ or include or incorporate by reference those marketing materials in this Prospectus Supplement in respect of the Offering. To rely on this exemption, the Bank and the Underwriters must give a contractual right to Canadian investors in the event the marketing materials contain a misrepresentation.

Accordingly, the Bank and the Underwriters signing the certificate contained in this Prospectus Supplement have agreed that in the event the marketing materials relating to the road shows described above contain a misrepresentation (as defined in securities legislation in each of the provinces and territories of Canada, other than Quebec), a purchaser resident in a province or territory of Canada, other than Quebec, who was provided with those marketing materials in connection with the road shows and who purchases Offered Shares under this Prospectus Supplement during the period of distribution shall have, without regard to whether the purchaser relied on the misrepresentation, rights against the Bank and each such Underwriter with respect to the misrepresentation which are equivalent to the rights under the securities legislation of the jurisdiction of Canada where the purchaser is resident, subject to the defenses, limitations and other terms of that legislation, as if the misrepresentation was contained in this Prospectus Supplement.

However, this contractual right does not apply (i) to the extent that the contents of the marketing materials relating to the road shows have been modified or superseded by a statement in this Prospectus Supplement, and (ii) to any “comparables” (as such term is defined in National Instrument 41-101 – General Prospectus Requirements) in the marketing materials provided in accordance with applicable securities legislation.

S-iii

Non-IFRS Measures and Industry Metrics

This Prospectus Supplement, the accompanying Shelf Prospectus and/or the documents incorporated by reference herein or therein make reference to certain non-IFRS measures and industry metrics, such as “Basel III Common Equity Tier 1”, “Tier 1 and Total Capital Adequacy Ratios”, “Leverage Ratio”, “Book Value per Common Share”, “Cost of Funds”, “Efficiency Ratio”, “Efficiency Ratio Digital Banking”, “Net Interest Margin on Loans”, “Net Interest Margin or Spread”, “Provision for (Recovery of) Credit Losses as a Percentage of Average Total Loans”, “Return on Average Common Equity”, “Return on Average Total Assets” and “Yield” (each as defined below and together, the “Non-IFRS Measures”). See our Annual MD&A for reconciliations to the nearest IFRS measures. Our management uses these non-IFRS measures and other measures for a number of purposes including in order to facilitate operating performance comparisons.

Basel III Common Equity Tier 1, Tier 1 and Total Capital Adequacy Ratios and Leverage Ratios

In December 2009, the Basel Committee on Banking Supervision (the “Basel Committee”) announced consultative proposals to strengthen global capital and liquidity regulations for banks with the goal of promoting a more resilient banking sector. In December 2010, the Basel Committee finalized the new global bank capital adequacy rules for minimum and appropriate forms of bank liquidity (commonly called “Basel III”). In February 2011, the Office of the Superintendent of Financial Institutions (“OSFI”) announced that the Basel III requirements would be adopted for Canadian banks effective January 1, 2013. Basel III Common Equity Tier 1, Tier 1 and Total Capital adequacy ratios and the Leverage ratio are determined in accordance with guidelines issued by OSFI.

Book Value per Common Share

Book value per common share is defined as Shareholders’ Equity less amounts relating to preferred shares recorded in equity, divided by the number of common shares outstanding. Book value per common share does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Cost of Funds

Cost of funds is calculated as interest expense (as presented in the Bank’s consolidated statements of income and comprehensive income) divided by average total assets. Cost of funds does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Efficiency Ratio

The efficiency ratio is calculated as non-interest expenses from consolidated operations as a percentage of total revenue (as presented in the Bank’s consolidated statements of income and comprehensive income). This ratio does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Efficiency Ratio Digital Banking

Efficiency ratio digital banking is calculated as non-interest expenses from the digital banking operations as a percentage of total revenue from the digital banking operations. This ratio does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Net Interest Margin on Loans

Net interest margin on loans is calculated as net interest income adjusted for the impact of cash, securities and other assets, divided by average gross loans. This metric does not have a standard meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Net Interest Margin or Spread

Net interest margin or spread is calculated as net interest income divided by average total assets. Net interest margin or spread does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

S-iv

Provision for (Recovery of) Credit Losses as a Percentage of Average Total Loans

This measure captures the provision for (recovery of) credit losses (as presented in the Bank’s consolidated statements of income and comprehensive income) as a percentage of the Bank’s average loans, net of allowance for credit losses. This percentage does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Return on Average Common Equity

Return on average common equity for the Bank is defined as annualized net income of the Bank less amounts relating to preferred share dividends, divided by average common shareholders’ equity which is average shareholders’ equity less amounts relating to preferred shares recorded in equity. Return on average common equity does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Return on Average Total Assets

Return on average total assets for the Bank is defined as annualized net income of the Bank less amounts relating to preferred share dividends, divided by average total assets. Return on average total assets does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

Yield

Yield is calculated as interest income (as presented in the Bank’s consolidated statements of income and comprehensive income) divided by average total assets. Yield does not have a standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other financial institutions.

S-v

Market and industry data presented throughout this Prospectus Supplement, the accompanying Shelf Prospectus and/or the documents incorporated by reference herein or therein was obtained from independent industry and third-party sources and industry reports, and from publications, websites and other publicly available information, as well as industry and other data prepared by us or on our behalf on the basis of our knowledge of the markets in which we operate, including information provided by suppliers, partners, customers and other industry participants.

We believe that the market and economic data presented throughout this Prospectus Supplement, the accompanying Shelf Prospectus and/or the documents incorporated by reference herein or therein is accurate and, with respect to data prepared by us or on our behalf, that our estimates and assumptions are currently appropriate and reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data presented throughout this Prospectus Supplement, the accompanying Shelf Prospectus and/or the documents incorporated by reference herein or therein are not guaranteed and none of us or any of the Underwriters makes any representation as to the accuracy of such data. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Although we believe it to be reliable, none of us or any of the Underwriters has independently verified any of the data from third-party sources referred to in this Prospectus Supplement, the accompanying Shelf Prospectus and/or the documents incorporated by reference herein or therein, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying market, economic and other assumptions relied upon by such sources. Market and economic data are subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey.

S-vi

Currency Presentation and Exchange Rate Information

All dollar amounts in this Prospectus Supplement are in United States dollars, unless otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “C$” are to Canadian dollars.

The following table sets forth, for the periods indicated, the high, low, average and end of period daily average exchange rates for one U.S. dollar, expressed in Canadian dollars, published by the Bank of Canada during the respective periods.

| Year Ended October 31, | ||||||||||||

| 2024 | 2023 | 2022 | ||||||||||

| Highest rate during the period | 1.3916 | 1.3871 | 1.3856 | |||||||||

| Lowest rate during the period | 1.3205 | 1.3128 | 1.2368 | |||||||||

| Average for the period | 1.3613 | 1.3487 | 1.2874 | |||||||||

| Period end | 1.3916 | 1.3871 | 1.3649 | |||||||||

On December 16, 2024, the Bank of Canada daily average exchange rate was US$1.00 = C$0.7023.

S-vii

The following summary highlights selected information contained elsewhere in this Prospectus Supplement and does not contain all of the information that you should consider in making your investment decision. Before investing in our Common Shares, you should carefully read the entire Prospectus Supplement and Shelf Prospectus, including the financial statements contained elsewhere in this Prospectus Supplement, the other information incorporated by reference and the information set forth under the heading “Risk Factors.”

Business of the Bank

Who We Are

VersaBank is a Canadian Schedule I chartered bank regulated by OSFI in Canada, and its wholly owned subsidiary, VersaBank USA National Association, is a federally chartered bank in the United States, regulated by the Office of the Comptroller of the Currency (“OCC”) in the United States. VersaBank became one of the world’s first fully digital financial institutions by adopting a highly efficient business-to-business digital banking model. We conduct deposit gathering and loan origination activities predominantly via technology-enabled electronic deposit and lending solutions for financial intermediaries, enabling them to excel in their core businesses. Additionally, through our wholly owned subsidiary, Washington, D.C.-based DRT Cyber, Inc. (“DRTC”), we leverage our internally developed IT security software and capabilities to offer innovative cybersecurity products and solutions designed to address the rapidly growing volume of cyber threats constantly challenging financial institutions, multinational corporations, and government entities.

Recent Expansion into the United States

We believe the United States presents an attractive growth market for the innovative products and services we offer through our digital banking model. Starting with our initial public offering (“IPO”) in the United States in 2021, we began executing on our strategy to expand into the United States. Within roughly one year of our U.S. IPO, we finalized our first relationship with a U.S.-based point-of-sale (“POS”) lender and entered into a definitive agreement for our first acquisition of a U.S.-based insured depository institution. On August 30, 2024, VersaBank, through its wholly owned U.S. subsidiary VersaHoldings US Corp., completed its acquisition of Stearns Bank Holdingford, N.A. (“Stearns Holdingford”), which was subsequently renamed VersaBank USA National Association, for cash consideration of approximately $14.1 million (C$19.0 million). As part of the transaction, VersaBank, on a consolidated basis, acquired $68.4 million in assets and assumed $54.3 million in deposits and other liabilities. The acquisition of an OCC-licensed U.S. national bank provides access to lower-cost funds to fuel the growth of our receivable purchase program (“RPP”) for the U.S. POS financing market, which we believe will generate attractive risk-adjusted returns.

Our History

We have been pursuing our strategy of becoming a model for digital banking for more than three decades. In 1993, our founder and CEO, David Taylor, led a group of investors that purchased Pacific & Western Trust to realize his vision of a fully digital financial institution. In 2002, Pacific & Western Trust was granted a Canadian Schedule I banking license, the first such license granted in the preceding 18 years. By 2010, we developed and launched our proprietary RPP business for the POS financing market in Canada, providing what we believe are more efficient financing solutions to consumers through our origination partners in a rapidly expanding market.

Continuing to seek opportunities to expand our low-cost deposit funding platform, we launched our insolvency professional deposit business in 2012. In 2013, we completed our IPO in Canada on the TSX. In 2016, we changed our name and rebranded as VersaBank to reflect our versatility as an innovative digital bank. Our growth continued with our IPO in the United States in 2021.

In August 2024, we closed our acquisition of Stearns Holdingford, subsequently renaming it VersaBank USA National Association. Concurrently, we launched our RPP funding solution for POS finance companies in the U.S. market. This acquisition provides access to lower-cost funds, fueling the growth of our U.S. POS RPP.

Following this offering, we intend to capitalize on lending growth opportunities in Canada, led by our RPP financing business, as economic conditions improve and expand our RPP financing business in the U.S. market. Our commitment to innovation and digital banking continues to drive our strategic initiatives and growth.

S-11

Our Business Model

Through our proprietary financial technology, we aim to profitably and prudently address underserved segments of the Canadian and U.S. financial services markets. We are focused on developing and providing innovative, technology-based deposit-taking and lending solutions that pursue attractive risk-adjusted returns. Our lending business particularly focuses on POS financing.

As of October 31, 2024, we have grown our POS RPP loan and lease portfolio in Canada to $2.4 billion by addressing unmet market needs. We believe there is significant potential for incremental growth if the Canadian economy and consumer sentiment continue to improve. Additionally, we are expanding our POS RPP in the United States, where the market is estimated to be as large as $1.4 trillion.

Our business model leverages cutting-edge technology to offer efficient and effective financial solutions, positioning us to capitalize on emerging opportunities in both the Canadian and U.S. markets. By focusing on what we view as underserved segments, we aim to deliver superior value to our clients and stakeholders, driving sustainable growth, profitability, and operating leverage.

| · | Digital Banking Products and Services: We have a proven track record of developing and providing innovative, technology-based lending products and services. In our deposit-taking business, we recognized that Canada’s insolvency professionals were being underserved by generic “big bank” offerings that did not integrate with their own systems, resulting in inefficiency and higher costs. In response, we developed and launched our proprietary software solution in 2012, designed to integrate with the industry’s most commonly used administrative software. Since then, we have grown our insolvency professional deposit business to $534 million. In our lending business, following the 2007/2008 financial crisis, Canada’s “big ticket” POS lenders sought access to inexpensive capital and fast, convenient, automated financing solutions to drive growth in their businesses. Using our proprietary software, we developed and launched our RPP for POS financing business in 2010, which provides bridge financing to our origination and servicing partners. This allows our origination and servicing partners to accumulate a portfolio of individual loans and leases before the Bank purchases the cash flow receivables derived from them. Our POS RPP loan and lease portfolio has shown strong performance since the program’s inception 14 years ago. Since inception, we have acquired approximately $5.0 billion of POS RPP loans and leases and have realized zero losses, which we believe underscores the quality of our origination and servicing partners, our prudent credit risk management policies and practices, and the strength of our POS lending solutions, which continue to meet the evolving needs of our clients. |

| · | Cybersecurity Products and Services: We believe we have developed first-class cybersecurity protocols, software, and supporting systems to mitigate our exposure to the myriad of cybersecurity risks we face in the normal course of business. We are leveraging our excess capacity and scaling our operations to pursue significant opportunities in the cybersecurity space. Our goal is to further develop innovative solutions to address the rapidly growing volume of cyber threats that constantly challenge, not only financial institutions like VersaBank, but also multinational corporations and government entities. |

Our commitment to innovation has increased our operating leverage. Since 2019, we have achieved 151% overall growth in total loans, from approximately $1.2 billion as of October 31, 2019, to $3.0 billion as of October 31, 2024. During the same period, our deposits have grown by 173%, from $1.1 billion as of October 31, 2019, to $3.0 billion as of October 31, 2024. Our balance sheet growth over this period, together with our prudent expense management, has enhanced our operations, resulting in an adjusted digital banking efficiency ratio, excluding $2.7 million pre-tax one-time costs, associated with the acquisition of Stearns Holdingford, incentive awards related to the specific performance-based milestones, and adjustments related to the write-down of fixed assets, of 44% for the year ended October 31, 2024.

S-12

We have demonstrated strong profitability and significant shareholder value creation over recent years. Our financial performance has remained strong, with a 0.86% return on average total assets for the year ended October 31, 2024. Additionally, our return on average tangible common equity (“ROATCE”) remains strong at 10.6% for the year ended October 31, 2024. This performance is highlighted by a solid earnings trajectory, with Earnings per Share (“EPS”), adjusted for $3.9 million or $0.15 per share one-time costs, associated with the acquisition of Stearns Holdingford, incentive awards related to the specific performance-based milestones, adjustments related to write down of fixed assets, and a deferred tax adjustment, increasing from $0.65 in 2019 to $1.23 in 2024, reflecting an overall growth of 91%. Our tangible book value per share (“TBVPS”) has also seen substantial growth, rising from $7.58 in 2019 to $10.36 in 2024, an overall increase of 37%.

S-13

Transformational Business Opportunity in the U.S.

On August 30, 2024, we completed our acquisition of Stearns Holdingford, marking a significant milestone in our strategic expansion into the U.S. market. This acquisition was valued at $14.1 million (C$19.0 million) in cash. As part of the transaction, on a consolidated basis, VersaBank acquired $68.4 million in assets and assumed $54.3 million in deposits and other liabilities. We believe this strategic transaction provides us with a robust platform to leverage our innovative financial solutions and expand our market presence.

High-Growth, Underserved Multi-Trillion-Dollar Market

We believe the U.S. POS financing market represents a high-growth, underserved opportunity, with an estimated market size of $1.4 trillion. In 2022, POS financing accounted for about 10% of the total unsecured lending balances in the U.S., growing faster than any other type of unsecured lending. We expect the anticipated growth to be driven by enhanced integration and better application experiences, with approximately 60% of U.S. consumers likely to use POS financing.

Innovative Funding Solution

Our POS RPP is designed to provide unique, and efficient digital funding solutions for POS finance companies. As of October 31, 2024, we have established two U.S.-based POS lending partnerships with approximately $43 million on balance sheet, with a robust pipeline of potential new partners following our recent expansion into the United States. In addition, we have the opportunity to syndicate originations through community-bank networks, generating up to 1.00% in annual fee income. As a result, we believe we are well-positioned for on-balance-sheet loan growth in fiscal year 2025.

Our Competitive Advantages in the U.S.

| · | Proven Track Record: Our RPP has a proven track record in Canada, which we are now leveraging to expand our market share in the larger U.S. POS lending market. |

| · | Funding Cost Efficiency: We have been able to fund our balance sheet with U.S. wholesale deposits, which we expect to save approximately 80 basis points when compared to wholesale deposits in Canada. In addition, implementing the U.S. RPP with the same technology and credit structure in Canada allows for higher efficiency, requiring fewer personnel to operate the business. |

| · | Higher Margins: Net interest margins for our U.S.-based RPP portfolio have been expected to be up to 100 basis points higher on average, as compared to our Canada-based RPP portfolio. |

| · | Credit Quality: High demand for our RPP products and services allows us to be selective in partnering with U.S. originators and servicers that we believe have good credit quality and who will adhere to our prudent origination and servicing standards. |

| · | Branchless Digital Bank: Since our inception, we have operated the Bank as a branchless direct-to-client model via telecommunication delivery. We have historically operated with lower overhead and expenses as compared to traditional banking models. |

We believe this transformational opportunity positions us to capitalize on the significant growth potential in the U.S. market, driving further our strategic initiatives and continuing to enhance shareholder value.

S-14

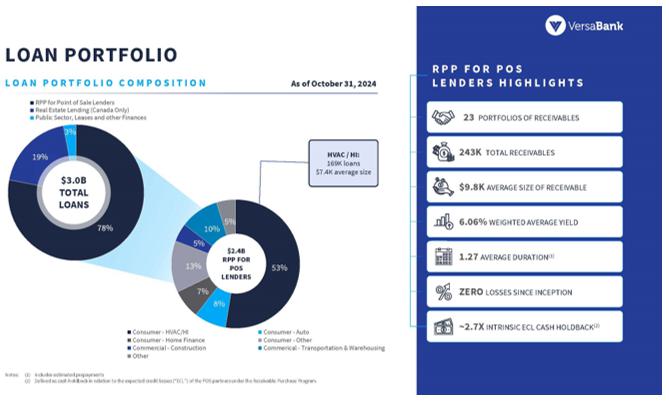

Lending Products and Services

| · | RPP Point-of-Sale Loans and Leases. Small loan and lease receivables are electronically purchased from our network of origination partners who make POS loans and leases in various markets throughout Canada and the United States. Our POS lending program is our main growth driver, with a portfolio that includes 23 partnerships and 243 thousand receivables. As of October 31, 2024, our RPP POS loans amounted to $2.4 billion, representing 78% of our total loans. The average receivable size is $9.8 thousand, with a weighted average yield of 6.06% and an average duration of approximately 1.27. Our RPP POS lending portfolio is diversified across various sectors, including home improvement/HVAC loans (53%), consumer - other loans (13%), commercial – transportation & warehousing loans (10%), consumer – auto loans (8%), consumer – home finance loans (7%), commercial – construction loans (5%), and other loans (5%). Our POS RPP loan and lease portfolio has shown strong performance since the program’s inception 14 years ago. Since inception, we have acquired approximately $5.0 billion of POS RPP loans and leases and have realized zero losses, which we believe underscores the quality of our origination and servicing partners, our prudent credit risk management policies and practices, and the strength of our POS lending solutions, which continue to meet the evolving needs of our clients. |

| · | Real Estate Lending (CRE) (Canada only). This high-quality vertical consists predominantly of business-to-business loans, with low credit risk exposure primarily related to insured, multi-family residential properties, offers significant competitive advantages. As of October 31, 2024, our real estate loans total $565 million, representing 19% of our total loans. Our diverse real estate lending focuses predominantly on traditional residential construction and term loans, primarily secured by real estate collateral in Ontario. We have seen substantial growth in multi-unit residential construction financing, which is insured by the Canada Mortgage and Housing Corporation (“CMHC”). We believe this segment has significant potential, with current commitments around $400 million and the possibility of growing to $1.0 billion over time. Our residential mortgage portfolio, 30% of which is insured by CMHC, focuses on residential projects as a safer strategy in an economy facing housing shortages. This strategic approach to commercial lending underscores our commitment to providing attractive risk-adjusted returns and supporting sustainable growth. VersaBank USA National Association does not expect to not undertake real estate lending. |

S-15

Source of Funding

VersaBank’s funding strategy is built on strong relationships and a diversified approach. Our primary sources of funding include insolvency professional deposits and wealth management sourced deposits, as well as lower-cost wholesale funding sources to support our U.S. product and service offerings. We have established proprietary, high-value services for over 100 insolvency firms in Canada, which manage bankruptcy assets using our proprietary technology. This segment has shown a 20% year-over-year growth rate, with current rates set at 2.96%. Additionally, we have a well-established network of over 120 wealth management firms across Canada, which contribute to our wealth management deposits. As of October 31, 2024, our total deposits amounted to $3.0 billion, with insolvency deposits making up 18% and wealth management deposits comprising 82%. This diversified funding base continues to support our lending practice growth, as we aim to continue meeting the needs of our clients effectively. With our recently closed acquisition in the United States, we now have access to lower cost wholesale funding that we expect to make us marginally more profitable as we expand.

Cybersecurity Products and Services

Through our wholly owned subsidiary, DRTC, we offer leading in-depth cybersecurity protocols, banking and financial technology development, software, and supporting systems to mitigate exposure to the myriad of cybersecurity risks that businesses, governments, and other organizations face in the normal course of their operations. Early in our planning phase, we recognized an opportunity to leverage our excess capacity and scale our operations to address large-market opportunities in the cybersecurity space, and further develop innovative solutions to address the rapidly growing volume of cyber threats challenging not only financial institutions but also multi-national corporations and government entities on a daily basis. DRTC is headquartered in Washington D.C. and services clients globally. We believe that DRTC’s VersaVault® System and Organization Controls 2 (“SOC2”) Type 1 compliant product is the world’s first digital bank vault built for clients holding digital assets, providing world-class security, privacy of secured keys, and client-centric access flexibility. However, VersaVault® has not yet been opened to third-party assets, and currently, it holds no assets. On November 30, 2020, DRTC acquired Digital Boundary Group (“DBG”). With offices in London, Ontario, and Dallas, Texas, DBG provides corporate and government clients with a suite of IT security assurance services, ranging from external network, web, and mobile app penetration testing to physical social engineering engagements along with supervisory control and data acquisition system assessments, as well as various aspects of training. DBG has obtained SOC2 Type 1 Certification which affirms that DBG’s services comply with the SOC Trust Services Criteria for Security, thereby providing customers, particularly those in regulated industries, with increased confidence in DBG’s ability to strengthen their security posture and mitigate cyber risk. As a division of DRTC, we believe that DBG will continue to strengthen our Business Development Partner Network and propel the growth and expansion of DRTC’s existing business.

S-16

Solid Capital Position

Like all Canadian Schedule I banks, we are supervised by the OSFI. OSFI has established capital requirements for Canadian banks that are closely aligned with the most recent Basel Committee recommendations. We set internal capital targets that are based on our assessment of the risks that we face. These internal capital targets are approximately 2% higher than OSFI’s minimum requirements. Additionally, we ensure that our capital position is aligned with the capital requirements set by the OCC. As of October 31, 2024, our Common Equity Tier 1 ratio was 11.2%, our Tier 1 Ratio was 11.2% and our Total Risk-based Capital Ratio was 14.5%. Each of these ratios exceeds our internal target ratios, providing us with strength and support for current lending growth.

Our Competitive Strengths

Performance & Growth

We have consistently demonstrated strong profitability, with a return on average total assets of 0.86% and a ROATCE of 10.6% for the year ended October 31, 2024. Our proven record of growth is highlighted by a CAGR of 21% in loans and 26% in deposits since our 2021 IPO in the United States. This growth has translated into significant shareholder value, with TBVPS increasing by 37% and adjusted earnings per share (EPS)1 growing by 91% since 2019. Our ability to maintain robust growth and profitability underscores our effective business strategy and operational excellence.

Credit Quality, Liquidity & Efficiency

Our diversified and conservative lending culture produces attractive risk-adjusted returns. We maintain a commercial lending portfolio with a weighted average loan-to-value ratio of 59% of the Non-Insured Commercial Real Estate Mortgage portfolio, which we believe provides a strong collateral base. Our POS lending portfolio includes significant built-in reserves through cash holdbacks, which account for 2.7x the intrinsic ECL cash holdback of POS loans as of October 31, 2024, providing an additional layer of security. Our credit risk mitigation model has resulted in a history of zero charge-offs since inception 14 years ago, reflecting our prudent risk management practices. Additionally, we have limited interest rate risk exposure on our investment portfolio, with zero unrealized losses and a liquidity ratio of 10.8%. We believe our efficiency ratio is top-tier compared to U.S. tech-oriented bank peers, highlighting our operational efficiency and cost management capabilities.

1 2024 EPS is adjusted for $3.9 million or $0.15 per share one-time costs, associated with the acquisition of Stearns Bank Holdingford, incentive awards related to the specific performance-based milestones, adjustments related to write down of fixed assets, and a deferred tax adjustment. Please see Appendix B for the reconciliation to the nearest IFRS measure.

S-17

Technology & Leadership

We leverage proprietary financial technology to offer innovative deposit and lending solutions to targeted markets with unmet needs. Our team of over 60 software experts, engineers, and technology managers has a track record of rapid, in-house development of innovative solutions. This technological prowess enables us to stay ahead of industry trends and meet the evolving needs of our clients. In addition, our management team, with a proven track record of executing on our business plan, strives to keep us at the forefront of the digital banking industry. Their extensive experience and strategic vision drive our continued success and growth.

VersaBank USA

Following our acquisition of Stearns Holdingford, we expanded our RPP into the larger U.S. POS lending market, which presents a multi-trillion-dollar opportunity. This strategic move allows us to leverage our proven RPP and structure implemented in Canada as we strive to capture a significant share of the U.S. market. We have access to the U.S. wholesale funding market and save approximately 80 basis points compared to Canada, enhancing our funding efficiency. For our business model, margins in the U.S. are expected to be up to 100 basis points wider than in Canada, further boosting our profitability and competitive edge. This expansion positions us to capitalize on the high-growth, underserved U.S. POS lending market, which we anticipate will drive future growth and shareholder value.

Our Strategy

Expand Growth and Gain Market Share in the U.S. POS Lending Market

We are strategically focused on expanding our presence in the high-growth, multi-trillion-dollar U.S. POS lending market. By leveraging our proven RPP and structure implemented in Canada, we aim to capture significant market share in the larger U.S. market. Our strategy includes forming partnerships with diverse industries and focusing on higher credit quality to promote sustainable growth. We plan to accelerate our growth by retaining more loans on our balance sheet, capitalizing on the wider margins available in the U.S. market, which are expected to be up to 100 basis points higher than in Canada. We believe this approach not only enhances our profitability, but also strengthens our competitive position in the U.S. market.

Capitalize on Canadian Lending Growth Opportunities

As economic conditions improve, we are well-positioned to capitalize on lending growth opportunities in Canada. We expect our robust POS loan pipeline will be driven by an improved economic backdrop and stronger consumer sentiment. We anticipate significant organic growth in POS lending as our current partners increase their adoption of new POS products. Additionally, we are targeting approximately $1 billion in CMHC insured mortgage commitments by the end of 2025. These CMHC-insured mortgages offer attractive spreads that are accretive to our net interest margin and carry zero risk-weighting, which we believe will further enhance our financial performance.

Head and Registered Office

The head and registered office of the Bank is Suite 2002, 140 Fullarton Street, London, Ontario N6A 5P2 and the Bank’s website is www.versabank.com. The information on the Bank’s website is not part of this Prospectus Supplement.

S-18

| Common Shares to be sold in this Offering | 5,660,378 Common Shares (6,509,434 Common Shares if the Underwriters exercise their Over-Allotment Option in full) |

| Common Shares to be outstanding after this Offering | 31,662,955 Common Shares (32,512,011 Common Shares if the Underwriters exercise their Over-Allotment Option in full) |

| Over-Allotment Option | The Underwriters have an option for a period of 30 days from the date of this Prospectus Supplement to purchase up to 849,056 additional Common Shares. |

| Use of Proceeds | The net proceeds will be used for general banking purposes and will qualify as Common Equity Tier 1 capital for the Bank. See “Use of Proceeds”. |

| Risk Factors | You should read the “Risk Factors” section of this Prospectus Supplement for a discussion of factors to consider carefully before deciding to invest in our Common Shares. |

| Nasdaq and TSX Trading Symbol | “VBNK”. |

The total number of common shares to be outstanding after this Offering is based on 26,002,577 Common Shares outstanding as of December 16, 2024 and excludes:

| · | 812,045 Common Shares issuable upon exercise of options outstanding under our equity compensation plan as of December 16, 2024; and |

| · | 1,258,293 additional Common Shares reserved for future issuance under our equity compensation plan as of December 16, 2024. |

Except as otherwise indicated, the information in this Prospectus Supplement reflects or assumes no exercise by the Underwriters of their Over-Allotment Option.

S-19

Summary Historical Financial and Other Data

The following tables present our summary consolidated financial and other data. We prepare our consolidated financial statements in accordance with IFRS as issued by the International Accounting Standards Board. The summary historical consolidated financial data as at and for the years ended October 31, 2024 and 2023 are derived from our Annual Financial Statements, which are incorporated herein by reference. Our historical results for any prior period are not necessarily indicative of results expected in any future period.

The financial data set forth below should be read in conjunction with, and is qualified by reference to our Annual MD&A, the Annual Financial Statements and the related notes thereto, incorporated herein by reference. See “Documents Incorporated by Reference”.

Summary Selected Statement of Income Data

| Year Ended October 31 | ||||||||

| 2024 | 2023 | |||||||

| (in thousands of C$) | ||||||||

| Interest income | $ | 285,419 | $ | 229,334 | ||||

| Interest expense | 182,764 | 129,283 | ||||||

| Non-interest income | 8,978 | 8,584 | ||||||

| Total Revenue | 111,633 | 108,635 | ||||||

| Provision for (recovery of) credit losses | (268 | ) | 609 | |||||

| Non-interest expenses | 57,108 | 50,381 | ||||||

| Income before income taxes | 54,793 | 57,645 | ||||||

| Income tax provision | 15,045 | 15,483 | ||||||

| Net Income | $ | 39,748 | $ | 42,162 | ||||

Summary Selected Balance Sheet Data

| As of October 31, | ||||||||

| 2024 | 2023 | |||||||

| (in thousands of C$) | ||||||||

| Assets | ||||||||

| Cash | $ | 225,254 | $ | 132,242 | ||||

| Securities | 299,300 | 167,940 | ||||||

| Loans, net of allowance for credit losses | 4,236,116 | 3,850,404 | ||||||

| Property and equipment | 23,885 | 6,536 | ||||||

| Goodwill | 12,301 | 5,754 | ||||||

| Intangible assets | 12,054 | 2,791 | ||||||

| Other assets | 29,574 | 35,943 | ||||||

| Total assets | $ | 4,838,484 | $ | 4,201,610 | ||||

| Liabilities & shareholders’ equity | ||||||||

| Deposits | $ | 4,144,673 | 3,533,366 | |||||

| Subordinated notes payable | 102,503 | 106,850 | ||||||

| Other liabilities | 192,105 | 184,236 | ||||||

| Total liabilities | 4,439,281 | 3,824,452 | ||||||

| Share capital | 215,610 | 228,471 | ||||||

| Contributed surplus | 2,485 | 2,513 | ||||||

| Retained earnings | 181,238 | 146,043 | ||||||

| Accumulated other comprehensive income | (130 | ) | 131 | |||||

| Total equity | 399,203 | 377,158 | ||||||

| Total liabilities & shareholders’ equity | $ | 4,838,484 | $ | 4,201,610 | ||||

S-20

Other Capital Management & Capital Resources Data

| As of October 31, | ||||||||

| 2024 | 2023 | |||||||

| (in thousands of C$) | ||||||||

| Capital Resources | ||||||||

| Common Equity Tier 1 capital | $ | 373,503 | $ | 350,812 | ||||

| Total Tier 1 capital | 373,503 | 364,459 | ||||||

| Total Tier 2 capital | 107,673 | 111,546 | ||||||

| Total regulatory capital | 481,176 | 476,005 | ||||||

| Total risk-weighted assets | 3,323,595 | 3,095,092 | ||||||

| Capital Ratios | ||||||||

| CET1 capital ratio | 11.24% | 11.33% | ||||||

| Tier 1 capital ratio | 11.24% | 11.78% | ||||||

| Total capital ratio | 14.48% | 15.38% | ||||||

| Leverage ratio | 7.38% | 8.30% | ||||||

S-21

An investment in the Offered Shares involves risks. Before purchasing the Offered Shares, prospective investors should carefully consider the information contained in, or incorporated by reference into, this Prospectus Supplement and the Shelf Prospectus, including, without limitation, the risk factors identified in our Annual MD&A incorporated by reference into this Prospectus Supplement and under “Risk Factors” in our Annual Information Form, which is also incorporated by reference herein. If any event arising from these risks occurs, our business, prospects, financial condition, results of operations or cash flows, or your investment in the Offered Shares, could be materially adversely affected.

Risks Relating to Our Business

The Bank recognizes that risk is present in all business activities and that the successful management of risk is a critical factor in maximizing shareholder value. As such, the Bank has developed and continues to enhance an Enterprise Risk Management (“ERM”) Program to identify, evaluate, treat, report on, and monitor the risks that impact the Bank. For further information concerning the ERM Program and the Bank’s risk appetite statement, as well as steps taken to mitigate risks, please see the information set forth under the heading “Enterprise Risk Management” in the Annual MD&A.

The Bank’s financial performance is influenced by its ability to execute strategic plans developed by management. If these strategic plans do not meet with success or there is a change in the Bank’s strategic plans, the Bank’s earnings could grow at a slower pace or decline.

The Bank has a number of strategies and priorities, which may include large scale strategic or regulatory initiatives that are at various stages of development or implementation. Examples include organic growth strategies, new acquisitions, integration of recently acquired businesses, including our recent acquisition of Stearns Holdingford in the United States, projects to meet new regulatory requirements, new platforms and new technology or enhancement to existing technology, and developing, managing and diversifying strategic loan origination and servicing partnerships. Risk can be elevated due to the size, scope, velocity, interdependency, and complexity of projects, the limited time frames to complete the projects, and competing priorities for limited specialized resources.

The Bank regularly explores opportunities to acquire companies, or businesses, directly or indirectly through the acquisition strategies of its subsidiaries. In respect of acquisitions, the Bank undertakes transaction assessments and due diligence before completing a merger or an acquisition and closely monitors integration activities and performance post-acquisition. However, the Bank’s ability to successfully complete an acquisition is often subject to regulatory and other approvals, and the Bank cannot be certain when or if, or on what terms and conditions, any required approvals will be granted.

In general, while significant management attention is placed on the governance, oversight, methodology, tools, and resources needed to manage the Bank’s priorities and strategies, the Bank’s ability to execute on them is dependent on a number of assumptions and factors. There is no assurance that the Bank will achieve its financial or strategic objectives, including anticipated cost savings or revenue synergies following acquisition and integration activities. In addition, from time to time, the Bank may invest in companies without taking a controlling position in those companies, which may subject the Bank to the operating and financial risks of those companies’ businesses, the risk that the relevant company may make business, financial or management decisions that the Bank does not agree with, and the risk that the Bank may have differing objectives than the companies in which the Bank has interests.

If any of the Bank’s acquisitions, strategic plans or priorities are not successfully executed, or do not achieve their financial or strategic objectives, there could be an impact on the Bank’s operations and financial performance and the Bank’s earnings could grow more slowly or decline.

Changes in laws and regulations, including how they are interpreted and enforced, could adversely affect the Bank’s earnings by allowing more competition in the marketplace and by increasing the costs of compliance. In addition, any failure to comply with laws and regulations could adversely affect the Bank’s reputation and earnings.

The financial services industry is highly regulated. The Bank’s operations, profitability and reputation could be adversely affected by the introduction of new laws and regulations, changes to interpretation or application of current laws and regulations, and issuance of judicial decisions. Adverse effects could also result from the fiscal, economic, and monetary policies of various central banks, regulatory agencies and governments in Canada and, following our recent geographic expansion, the United States, and changes in the interpretation or implementation of those policies. Such adverse effects may include incurring additional costs and resources to address initial and ongoing compliance; limiting the types or nature of products and services the Bank can provide and fees it can charge; unfavourably impacting the pricing and delivery of products and services the Bank provides; increasing the ability of new and existing competitors to compete on the basis of pricing, products and services; and increasing risks associated with potential non-compliance. In addition to the adverse impacts described above, the Bank’s failure to comply with applicable laws and regulations could result in sanctions and financial penalties that could adversely impact its earnings and its operations and damage its reputation.

S-22

The global anti-money laundering and economic sanctions landscape continues to experience regulatory change, with significant, complex new laws and regulations that have, or are anticipated to, come into force in the short and medium-term in many of the jurisdictions in which the Bank operates.

In addition, the global data and privacy landscape has and continues to experience regulatory change, with significant new, and amendments to, existing legislation anticipated in some of the jurisdictions in which the Bank does business.

Continued changes in the financial accounting and reporting standards that govern the preparation of the Bank’s financial statements can be significant and may materially impact how the Bank records its financial position and its results of operations. Where the Bank is required to retroactively apply a new or revised standard, it may be required to restate prior period financial results.

The Bank’s accounting policies and estimates are essential to understanding its results of operations and financial condition. Some of the Bank’s policies require subjective, complex judgments and estimates as they relate to matters that are inherently uncertain. Changes in these judgments or estimates and changes to accounting standards and policies could have a materially adverse impact on the Bank’s consolidated financial statements, and its reputation. The Bank has established procedures designed to ensure that accounting policies are applied consistently and that the processes for changing methodologies, determining estimates and adopting new accounting standards are controlled and occur in an appropriate and systematic manner. Significant accounting policies as well as current and future changes in accounting policies are described in Notes 2 and 3, and significant accounting judgments, estimates, and assumptions are described in Note 2 of the Annual Financial Statements.

The level of competition among financial institutions is high, and non-financial companies and government entities are increasingly offering services typically provided by banks. This could have an effect on the pricing of the Bank’s deposits and its lending products, and together with loss of market share, could adversely affect the Bank’s earnings.

The Bank operates in a highly competitive industry and its performance is impacted by the level of competition. Customer retention and acquisition, as well as the development, maintenance and diversification of our strategic loan origination and servicing partnerships, can be influenced by many factors, including the Bank’s reputation as well as the pricing, market differentiation, consolidation among loan originators and services, and overall customer experience of the Bank’s products and services.

Enhanced competition from incumbents and new entrants may impact the Bank’s pricing of products and services and may cause it to lose revenue and/or market share. Increased competition requires the Bank to make additional short- and long-term investments to remain competitive and continue delivering differentiated value to its customers and strategic loan origination and servicing partners, which may increase expenses. In addition, the Bank operates in environments where laws and regulations that apply to it may not universally apply to its current and emerging competitors, which could include non-traditional providers (such as fintech, big technology competitors) of financial products and services. Non-depository or non-financial institutions are often able to offer products and services that were traditionally banking products and compete with banks in offering digital financial solutions (primarily mobile or web-based services), without facing the same regulatory requirements or oversight. These competitors may also operate at much lower costs relative to revenue or balances than traditional banks. These third parties can seek to acquire customer relationships, react quickly to changes in consumer attitudes, and disintermediate customers from their primary financial institution, which can also increase fraud and privacy risks for customers and financial institutions in general. The nature of disruption is such that it can be difficult to anticipate and/or respond to adequately or quickly, representing inherent risks to certain Bank businesses, including payments. As such, this type of competition could also adversely impact the Bank’s earnings. To mitigate these effects and identify how the changing landscape can enhance the Bank’s value proposition, including delivering new revenue streams for the Bank and greater value for customers, stakeholders across each of the Bank’s business segments seek to understand and leverage emerging technologies and trends together with how they impact consumer behaviour patterns. This includes monitoring the competitive environment in which the Bank operates and reviewing or amending its customer acquisition, management, and retention strategies as appropriate and building optionality and flexibility in the operating environment and into the products and services offered to keep pace with evolving customer expectations. However, there is no assurance that these activities will mitigate these effects and risks. The Bank is committed to investing in differentiated and personalized experiences for its customers, putting a particular emphasis on mobile technologies, enabling customers to transact seamlessly across their preferred channels.

S-23

The Bank is also advancing artificial intelligence (“AI”) capabilities, to help further inform the Bank’s business decisions and risk management practices. While the Bank is seeking to drive adoption and use of AI in a responsible way, there is no assurance that AI will appropriately or sufficiently replicate certain outcomes or accurately predict future events or exposures.

The Bank is also looking at emerging trends, some accelerated by the disruption caused by the COVID-19 pandemic, that may disrupt traditional interfaces, interaction preferences, or customer expectations. The Bank considers various options to accelerate innovation, including making strategic investments in innovative companies, exploring partnership opportunities, and experimenting with new technologies and concepts internally, but there can be no assurance that these investments and activities will be successful. Legislative or regulatory action relating to such new technologies could emerge and continue to evolve, potentially increasing compliance costs and risks, all of which could adversely impact the Bank’s financial condition.

The Bank’s earnings are significantly affected by changes in general business and economic conditions in the regions in which it operates.

The Bank and its customers operate primarily in Canada, and the Bank recently expanded its operations into the United States. The Bank’s earnings are significantly affected by the general business and economic conditions within Canada. These conditions include financial market stability, interest rates, foreign exchange rates, changing global commodity prices, business investment, government spending and stimulation initiatives, consumer spending and the rate of inflation, which can affect the business and economic environments in each geographic region in which the Bank operates. Therefore, the amount of business that the Bank conducts in a specific geographic region may have an effect on the Bank’s overall revenues and earnings. Management regularly monitors the macroeconomic environment and incorporates potential material changes into business plans, strategies and stress tests.

The value of the Offered Shares may be affected by market value fluctuations resulting from factors which influence the Bank’s operations, including regulatory developments, competition and global market activity.

Financial markets’ expectations about inflation and central bank monetary policy have an impact on the level of interest rates, and fluctuations in interest rates that result from these changes could have an impact on the regions in which the Bank operates, and further, could have an impact on the Bank’s earnings.

Foreign exchange rate, interest rate and credit spread movements in Canada impact the Bank’s financial position and its future earnings. Changes in the value of the Canadian dollar relative to global foreign exchange rates may also affect the earnings of the Bank’s small business, commercial, and corporate clients. A change in the level of interest rates, negative interest rates or a prolonged low interest rate environment affects the interest spread between the Bank’s deposits and other liabilities and its loans and, as a result, impacts the Bank’s net interest income. A change in the level of credit spreads affects the relative valuation of assets and liabilities, and as a result, impacts the Bank’s earnings. The Bank manages its structural foreign exchange rate risk, interest rate risk and credit spread risk exposures in accordance with its ERM Program and risk management policies established by its risk committee.

The Bank’s liquidity could be impaired by an inability to access short-term funding, including brokered deposits, or an unforeseen outflow of cash.

The Bank raises its deposits primarily through a network of independent deposit brokers across Canada. While the Bank mitigates this risk by establishing and maintaining good working and mutually beneficial relationships with a diverse group of deposit brokers so as not to become overly reliant on any single deposit broker, the failure by the Bank to secure sufficient deposits from its broker network could negatively impact its financial condition and operating results.

S-24

When volatility or disruptions occur in the wholesale funding markets, the Bank’s ability to access short-term liquidity could be materially impaired. In addition, other factors outside of the Bank’s control, such as a general market disruption or an operational problem that affects third parties, could impair the Bank’s ability to access short-term funding or create an unforeseen outflow of cash due to, among other factors, draws on unfunded commitments or deposit attrition. The Bank’s inability to access short-term funding or capital markets could constrain the Bank’s ability to make new loans or meet existing lending commitments and could ultimately jeopardize the Bank’s overall liquidity and capitalization.

The Bank is highly dependent upon information technology and supporting infrastructure such as data and network access. Disruptions in information technology and infrastructure, whether attributed to internal or external factors, and including potential disruptions in services provided by various third parties, could adversely affect the ability of the Bank to conduct regular business and/or to deliver products and services to its clients.

Technology and cybersecurity risks for financial institutions like the Bank have increased in recent years. This is due, in part, to the proliferation, sophistication and constant evolution of new technologies and attack methodologies used by sociopolitical entities, organized criminals, malicious insiders, service providers, nation states, hackers and other internal or external parties. The increased risks are also a factor of the Bank’s size and scale of operations, geographic footprint, the complexity of its technology infrastructure, and the Bank’s use of internet and telecommunications technologies to conduct financial transactions, such as its continued development of mobile and internet banking platforms.

The Bank’s technologies, systems and networks, and those of the Bank’s customers (including their own devices) and third parties providing services to the Bank, continue to be subject to cyber-attacks, and may be subject to disruption of services, data security or other breaches (including loss or exposure of confidential information, including the personal information of customers or employees), identity theft and corporate espionage or other compromises. The Bank’s use of third-party service providers, which are subject to these potential compromises, increases the Bank’s risk of potential attack, breach or disruption as the Bank has less extensive, immediate or continuous oversight over their technology infrastructure or information security.