As filed with the Securities and Exchange Commission on November 10, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FRANKLY INC.

(Exact Name of Registrant as Specified in its Charter)

British Columbia (State or other jurisdiction of incorporation or organization) |

7370 (Primary Standard Industrial Classification Code Number) |

98-1230527 (I.R.S. Employer Identification Number) |

333 Bryant Street, Suite 240

San Francisco, CA 94107

(415) 861-9797

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Steve Chung

Chief Executive Officer

333 Bryant Street, Suite 240

San Francisco, CA 94107

(415) 861-9797

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard I. Anslow, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 (212) 370-1300 (Phone) (212) 370-7889 (Fax) |

John D. Hogoboom Lowenstein Sandler LLP 1251 Ave of the Americas New York, New York 10020 (212) 262-6700 (Phone) (212) 262-7402 (Fax) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee |

||||||

| Common shares, no par value per share(3) | $ | 10,000,000 | $ | 1,159 | ||||

(1) Estimated solely for the purpose of calculating the registration fee under Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”).

(2) Includes additional common shares which may be issued upon exercise of a 45-day option granted to the underwriter to cover over-allotments, if any.

(3) Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional common shares as may be issued after the date hereof as a result of share splits, share dividends or similar transactions.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement related to these securities filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell or a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. |

Subject to completion, dated November 10, 2016

Shares

Frankly Inc.

Common Shares

This is the initial public offering of our common shares in the United States. We are offering common shares. Prior to this offering, there has been no public market for our common shares in the United States. Our common shares are listed on the TSX Venture Exchange Inc. (“TSX-V”) under the symbol “TLK”. On November 7, 2016, the last reported sale price of our common shares on the TSX-V was CDN$0.40 per share. We have applied to have our common shares listed on the Nasdaq Capital Market under the symbol “FKLY”. We expect that the public offering price will be between $ and $ per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 8 of this prospectus for a discussion of the risks that you should consider in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discount(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ |

(1) See “Underwriting” on page 84 of this prospectus for a description of the compensation payable to the underwriters.

We have granted the underwriters a 45-day option to buy up to an additional common shares to cover over-allotments, if any.

The underwriters expect to deliver the common shares to the purchasers on or about , 2016.

Sole Book-Running Manager

Roth Capital Partners

Co-Manager

Noble Financial Capital Markets

The date of this prospectus is , 2016

TABLE OF CONTENTS

| i |

In this prospectus, currency amounts are stated in U.S. dollars (“$”), unless specified otherwise. All references to CDN$ are to the Canadian dollars.

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the U.S.: We have not, and the underwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the U.S.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

| ii |

This summary highlights certain information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” sections of this prospectus before making an investment decision. References in this prospectus to “we,” “us,” “our” and “Company” refer to Frankly Inc. and its subsidiaries.

Overview

Our mission is to help TV broadcasters and media companies transform their traditional business from just delivering content over-the-air via broadcast television to distributing content in multi-platform, digital formats on new platforms such as mobile, tablets, desktop and other connected devices. Our core product is a white-labeled software platform that enables media companies to publish their official content onto multiscreen devices, increase social interaction on those multiscreen experiences, and enable digital advertising. The platform consists of a content management system (“CMS”) platform, native mobile and over-the-top (“OTT”) applications, responsive web framework, digital video solutions and digital advertising solutions. We generate revenues by charging monthly recurring software licensing fees, variable usage fees for our platform and sharing digital advertising revenue with our customers.

Our platform is currently being used by approximately 200 U.S. local news stations, mostly affiliated with large broadcasting networks such as NBC, CBS, FOX and ABC, covering nearly 58 million monthly users. We have also consistently ranked as one of the top 14 to 18 Internet destinations in the U.S. in the news and information category according to comScore’s Media Metrix report. We plan to enhance our platform in the future by expanding our offerings to other media verticals and international markets, together with investments into channel partnerships, sales and marketing, enhanced data analytics and innovative advertising products.

Our Products and Services

We have had two distinct phases of product evolution in our history. In our first phase from February 2013 until August 2015, we were developers of mobile applications and a next generation server platform. During this phase, we launched, developed and marketed a consumer focused Frankly Chat mobile application, as well as launched a white-labeled, business-to-business mobile communication platform via a software development kit (“SDK”) that was used by retailers such as Victoria’s Secret, professional sport teams such as the Sacramento Kings, non-profits such as the United Nations Foundation and publishers such as the Bleacher Report. The mobile app and SDK business are no longer a material part of our business but the technology became the foundation for our current platform. Through the acquisition of Frankly Media in August 2015, we leveraged our existing mobile and platform expertise to become a software-as-a-service (“SaaS”) provider of content management for broadcasters and media companies. Today, we provide a white-labeled, integrated software platform to broadcasters and media companies which use our technology to get their content onto multiscreen devices, increase social interaction on those multiscreen experiences, and enable digital advertising.

Our platform consists of the following offerings and features:

CMS platform connected white-labeled application frameworks. Our white-labeled application frameworks for mobile applications, connected TV applications and desktop and mobile websites connect back into our CMS platform. They simplify the distribution of content across multiple platforms. Our mobile application framework is a white-labeled Android or iOS mobile application framework that enables our customers to easily publish their official mobile apps to their audience. Our native connected TV framework is a white-labeled Apple TV, Roku and FireTV application framework that enables our customers to easily publish their official connected TV apps to their audience. We also provide a responsive web framework which is a white-labeled desktop and mobile web, collectively, a responsive web, framework that enables our customers to easily publish their official Internet homepages.

| 1 |

Robust Video-on-demand (“VoD”) and live video solution. Our VoD and live video solution ingests live video content into our on-premise server that encodes, transcodes and enables digital VoD clipping and live video publishing in an integrated format that eliminates the need for customers to deal with multiple vendors.

Digital advertising solutions. Our digital advertising solutions include both programmatic (automated) and direct agency sales efforts to place digital advertising onto our customer’s digital properties in return for revenue share of the advertising dollars. We also provide local ad sales products and consulting and support services in exchange for monthly fees, and charge our customers for the use of our ad serving platform to serve ads for local and national advertising campaigns. The array of advertising products and services we offer provides our customers with turnkey access to the latest advertising solutions and simplifies the complicated task of monetizing their online properties.

Data-as-a-service. Our newest Data-as-a-service product leverages a Data Management Platform (“DMP”) offering our customers access to targeted audience data and user segments in order to increase targeting and higher advertising rates to advertisers on their digital properties. We plan to continue to develop this product to enable our customers to have actionable data to drive increased audience engagement and enhanced user experience.

As of October 31, 2016, we had approximately 200 TV stations as customers and were approaching 58 million unique visitors to our customers’ sites each month across one or all of our products and services discussed above.

Recent Developments

The August 2016 Refinancing

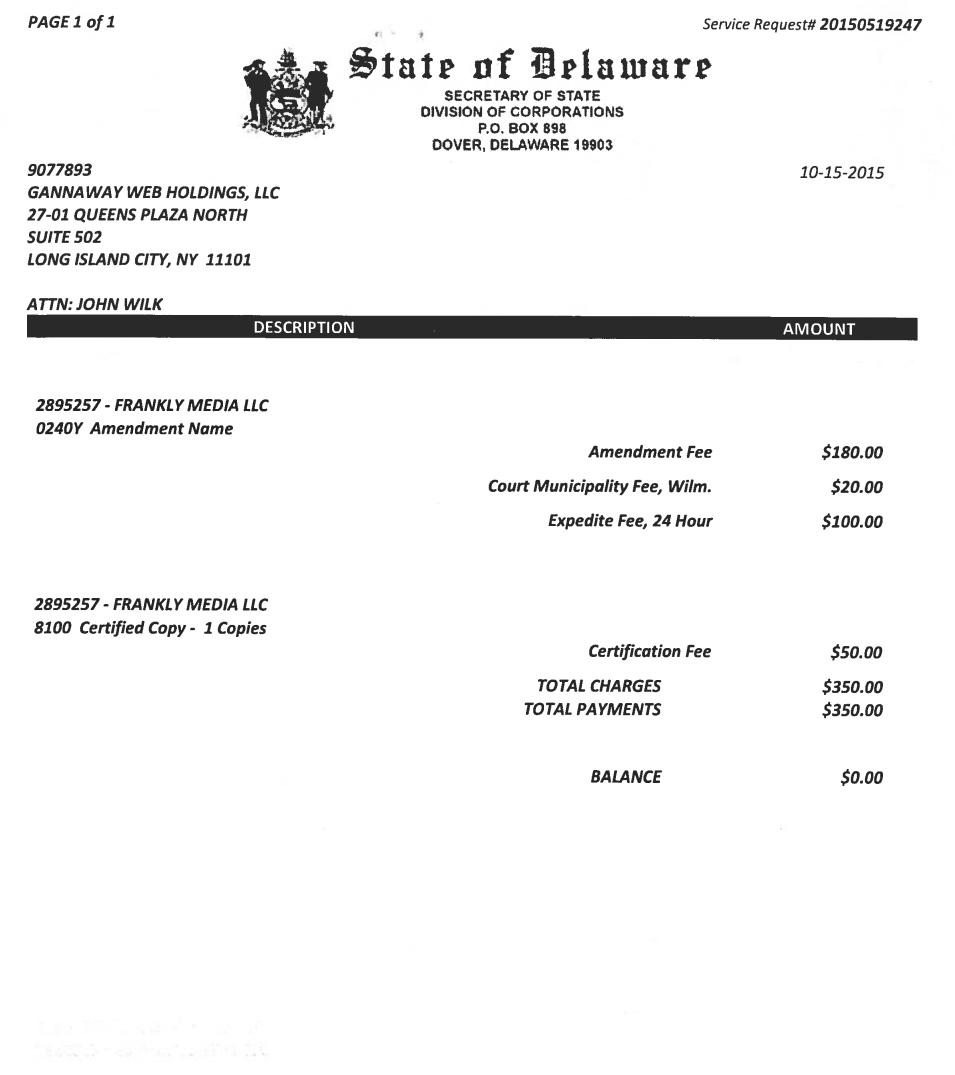

On August 31, 2016, we entered into a $14.5 million credit facility (the “Credit Facility”) under a credit agreement (the “Credit Agreement”) with Raycom Media, Inc. (“Raycom”). The proceeds of the Credit Facility were used to pay in full the $11 million promissory note (the “GEI Promissory Note”) issued to Gannaway Entertainment Inc. (“GEI”) and $3 million of the $4 million promissory note issued to Raycom (the “Original Raycom Note” and together with the GEI Promissory Note, the “Worldnow Promissory Notes”), each issued in connection with the acquisition of Gannaway Web Holdings, LLC, now Frankly Media. In addition, we issued to Raycom 14,809,720 warrants (the “Warrants”) to purchase one common share per warrant at a price per share of CDN$0.50 ($0.39 based on the exchange rate at August 18, 2016) and repaid in full our $2.0 million outstanding revolving credit facility with Bridge Bank (the “Bridge Bank Loan”). Subject to Raycom’s discretion, we also have an additional $1.5 million available for borrowing under the Credit Facility. We also entered into a share purchase agreement (the “Raycom SPA”) pursuant to which we converted $1 million of the Original Raycom Note into 2,553,400 common shares. We refer to these transactions as the “August 2016 Refinancing”.

Securities Purchase Agreement

Under the Raycom SPA, we agreed to enlarge our Board to seven (7) directors, subject to shareholder approval, within 90 days of August 31, 2016. In addition, so long as Raycom holds not less than 20% of our issued and outstanding common shares calculated on a fully diluted basis, it has (i) the designation rights to two (2) directors as management’s nominees for election to our Board, one who is our current Board member, Joseph G. Fiveash, III and one who must be an independent director as defined in Rule 5605(a)(2) of the Nasdaq Rules, and (ii) approval rights to one of the independent directors named as management’s nominees for election to our Board outside of the two Raycom designated directors. Pursuant to the SPA, Raycom has designated Joseph Fiveash as its director designee. We expect to have the second Raycom board designee and the seventh board member appointed prior to this offering subject to shareholder approval.

Credit Agreement

We will pay interest on each loan outstanding at any time at a rate per annum of 10%. Interest will accrue and be calculated, but not compounded, daily on the principal amount of each loan on the basis of the actual number of days each loan is outstanding and will be compounded and payable monthly in arrears on each interest payment date. To the maximum extent permitted by applicable law, we will pay interest on all overdue amounts, including any overdue interest payments, from the date each of those amounts is due until the date each of those amounts is

| 2 |

paid in full. That interest will be calculated daily, compounded monthly and payable on demand of Raycom at a rate per annum of 12%. We have the option to repay all or a portion of loans outstanding under the Credit Facility without premium, penalty or bonus upon prior notice to Raycom and repayment of all interest, fees and other amounts accrued and unpaid under the Credit Facility.

We must also make the following mandatory repayments:

(a) $2 million prior to August 31, 2019;

(b) commencing on November 30, 2019 and on the last day of the month of each three month period thereafter, an amount of $687,500 per three month period;

(c) proceeds (less actual costs paid and income taxes) on any asset sales or issuances of debt or equity;

(d) upon a successful listing of our common shares on Nasdaq with a capital raise of between $8 million to $11 million, mandatory repayment in the amount of $2 million, which will be applied toward the repayment obligation required by (a) above if completed by March 31, 2017;

(e) upon a successful listing of our common shares on Nasdaq with a capital raise of more than $12 million, a mandatory repayment in the amount of $3 million which will be applied toward the $2 million repayment obligation required by (a) above if completed by March 31, 2017 and any amounts raised in excess of $2 million will be applied pro rata to repayment obligations required by (b) above commencing November 30, 2019; and

(f) commencing on the financial year ending December 31, 2017, and each financial year ending thereafter, 100% of the current year excess cash flow amount in excess of $2 million must be paid to Raycom as a mandatory repayment amount no later than May 1 of the following year until a total leverage ratio of not more than 3:1 has been met for such fiscal year, at which point 50% of the current year excess cash amount in excess of $2 million will be paid to Raycom as mandatory repayment amounts. Such excess cash flow payments will be applied pro rata to reduce other mandatory payments due thereunder.

In addition, we must maintain certain leverage ratios and interest coverage ratios beginning the fiscal quarter ending December 31, 2017. The leverage ratios range from 4:1 to 2.5:1 and 2:1 to 3.5:1 for the interest coverage ratio. We are also subject to certain covenants regarding, among others, indebtedness, fundamental corporate changes and dispositions and acquisitions. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—The Credit Agreement”.

Upon an event of default, Raycom may by written notice terminate the facility immediately and declare all obligations under the Credit Agreement and the related loan documents, whether matured or not, to be immediately due and payable. Raycom may also as and by way of collateral security, deposit and retain in an interest bearing account, amounts received by Raycom from us under the Credit Agreement and the related loan documents and realize upon the Security Interest Agreements, Guaranty Agreements and Pledge Agreement as described below. If we fail to perform any of our obligations under the Credit Agreement and the related loan documents, Raycom may upon 10 days’ notice, perform such covenant or agreement if capable. Any amount paid by Raycom under such covenant or agreement will be repaid by us on demand and will bear interest at 12% per annum.

Guaranty Agreements, Security Interest Agreements and Pledge Agreement

In connection with the Credit Agreement, our subsidiaries Frankly Co. and Frankly Media LLC have entered into guaranty agreements (the “Guaranty Agreements”) whereby Frankly Co. and Frankly Media LLC have guaranteed our obligations under the Credit Agreement. In addition, each of Frankly Inc., Frankly Co. and Frankly Media LLC have entered into security interest agreements (the “Security Interest Agreements”) and pledge agreements (the “Pledge Agreements”) pursuant to which Raycom has first priority security interests in substantially all of our assets.

| 3 |

Upon an event of default, we will be required to deposit all interests, income, dividends, distributions and other amounts payable in cash in respect of the pledged interests into a collateral account over which Raycom has the sole control and may apply such amounts in its sole discretion to the secured obligations under the Credit Agreement. Upon the cure or waiver of a default, Raycom will repay to us all cash interest, income, dividends, distributions and other amounts that remain in such collateral account. In addition, upon an event of default, Raycom has the right to (i) transfer in its name or the name of any of its agents or nominees the pledged interests, (ii) to exercise all voting, consensual and other rights and power and any and all rights of conversion, exchange, subscription and other rights, privileges or options pertaining to the pledged interests whether or not transferred into the name of Raycom, and (iii) to sell, resell, assign and deliver all or any of the pledged interests. We have also agreed to use our best efforts to cause a registration under the Securities Act and applicable state securities laws of the pledged interests upon the written request from Raycom.

Raycom may transfer or assign, syndicate, grant a participation interest in or grant a security interest in, all or any part of its rights, remedies and obligations under the Credit Agreement and the related loan documents, without notice or our consent.

Summary Risks Associated with Our Business

An investment in our common shares involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

● We have a limited operating history which may make it difficult for investors to evaluate our prospects for success.

● Since our inception, we have experienced losses and have an accumulated deficit of $46.0 million as of June 30, 2016 and we may incur additional losses in the future.

● Our independent registered public accounting firm has expressed in its report on our audited consolidated financial statements a substantial doubt about our ability to continue as a going concern.

● Our revenue and operating results may fluctuate, which may make our results difficult to predict and could cause our results to fall short of expectations.

● If we are unable in the future to generate new customers for our mobile technology products, our financial performance may be materially and adversely affected.

● A significant portion of our projected revenue is generated from the sale of national and local online advertising inventory, which is dependent on available advertising inventory and market demand and prices for such inventory. A decline in available supply of advertising inventory, general demand for advertising inventory and general economic conditions may materially and adversely affect our advertising revenue which may negatively affect our overall financial condition and results of operations.

● A significant percentage of our revenue is generated from two large customers. If we are unable to maintain our relationship with these customers, our business and operations may be materially and adversely affected.

● We determined that a portion of our goodwill and amortizable intangible assets were impaired as of December 31, 2015 and we recorded an impairment charge of approximately $12.2 million to earnings for the year ended December 31, 2015.

● Our degree of leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting operational goals.

| 4 |

● Our debt agreements and those of our subsidiaries contain restrictions that limit our flexibility in operating our business.

● If we are unable to protect our intellectual property, the value of our brand and other intangible assets may be diminished, and our business may be adversely affected.

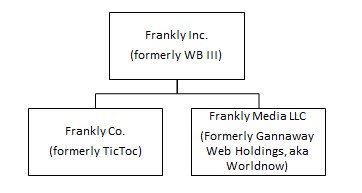

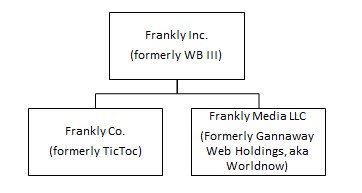

● We are a holding company and our only asset is the direct ownership of Frankly Co. and Frankly Media LLC.

● We have no operating history as a publicly traded company in the U.S.

Corporate Information

We were originally formed under the Business Corporations Act (Ontario) (the “OBCA”) in June 2013 under the name WB III Acquisition Corp. (“WB III”) and completed our initial public offering in Canada in October 2013. In December 2014, we completed a reverse triangular merger with Frankly Co. and a wholly-owned subsidiary WB III Subco Inc. and changed our name to Frankly Inc. (the “Qualifying Transaction”). In August 2015, we acquired Frankly Media LLC. Our main offices are located in San Francisco, California and New York, New York. On July 11, 2016, we continued the Company as a British Columbia corporation under the Business Corporations Act (British Columbia) (the “BCBCA”).

Frankly Co. (formerly TicToc Planet Inc.) commenced its material business operations in February 2013, and we subsequently acquired Frankly Co. in December 2014 in connection with the Qualifying Transaction. We then acquired Frankly Media LLC in August 2015. We have had two distinct phases of product evolution in our history. From February 2013 until August 2015, we developed mobile applications and a next generation server platform. Through the acquisition of Frankly Media in August 2015, we leveraged our existing mobile and platform expertise to become a SaaS provider of content management for broadcasters and media companies.

Our corporate headquarters is located at 333 Bryant Street, Suite 240, San Francisco, CA 94107. Our telephone number is (415) 861-9797. Our Internet website is http://www.franklyinc.com. We have not incorporated by reference into this prospectus any of the information on, or accessible through, our website, and you should not consider our website to be a part of this document. Our website address is included in this document for reference only.

The following chart illustrates our organizational structure:

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| 5 |

● being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectu

● not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”);

● reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

● exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1 billion or more in annual gross revenues; (ii) the end of fiscal year 2021; (iii) our issuance, in a three year period, of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

| 6 |

The Offering

| Common shares offered by us | shares | |

| Common shares to be outstanding after this offering | shares ( shares if the underwriters’ over-allotment option is exercised in full) | |

| Over-allotment option | We will grant the underwriters a 45-day option to acquire up to an additional common shares, solely for the purpose of covering over-allotments, if any. | |

Use of proceeds

|

We estimate that we will receive net proceeds of approximately $ million from the sale of the common shares offered in this offering, or approximately $ million if the underwriters exercise their over-allotment option in full, based on an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and after deducting the estimated underwriting discount and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering as follows:

● $ to increase sales and marketing investments (including channel partnerships) to increase market share and expand into other verticals; ● $ for product development on existing and new products including CMS, mobile and TV apps, and video workflow; ● $ for development of new business lines in big data and digital advertising; ● $2 million to repay a portion of the Credit Facility; and ● the balance for working capital and general corporate purposes.

See the section entitled “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| Risk factors | See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | |

| Proposed Nasdaq symbol | FKLY |

The number of common shares to be outstanding after this offering is based on 32,983,887 common shares outstanding as of October 31, 2016 and excludes as of such date the following:

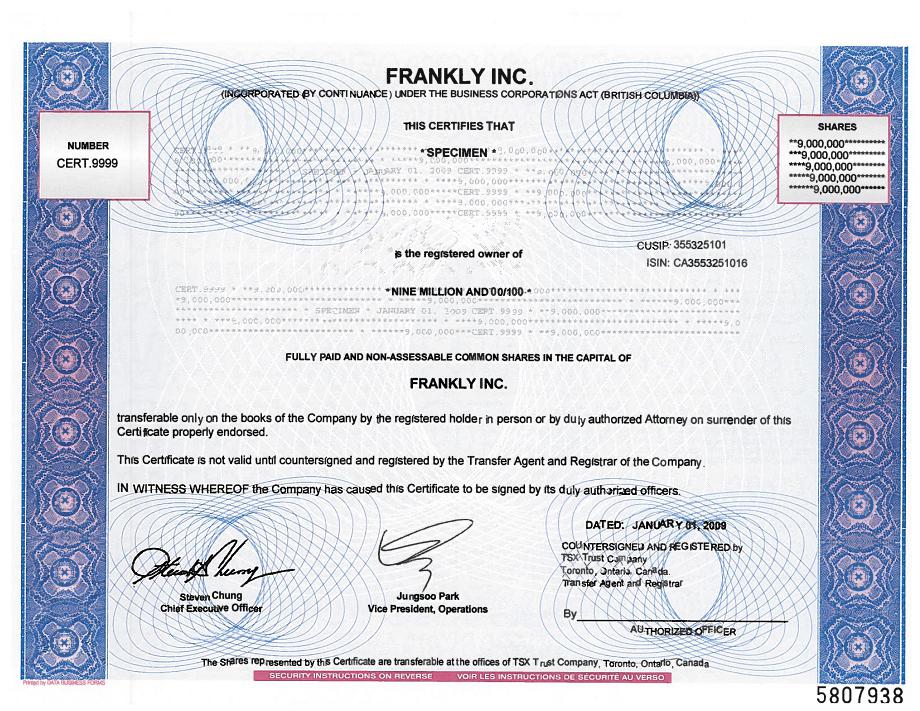

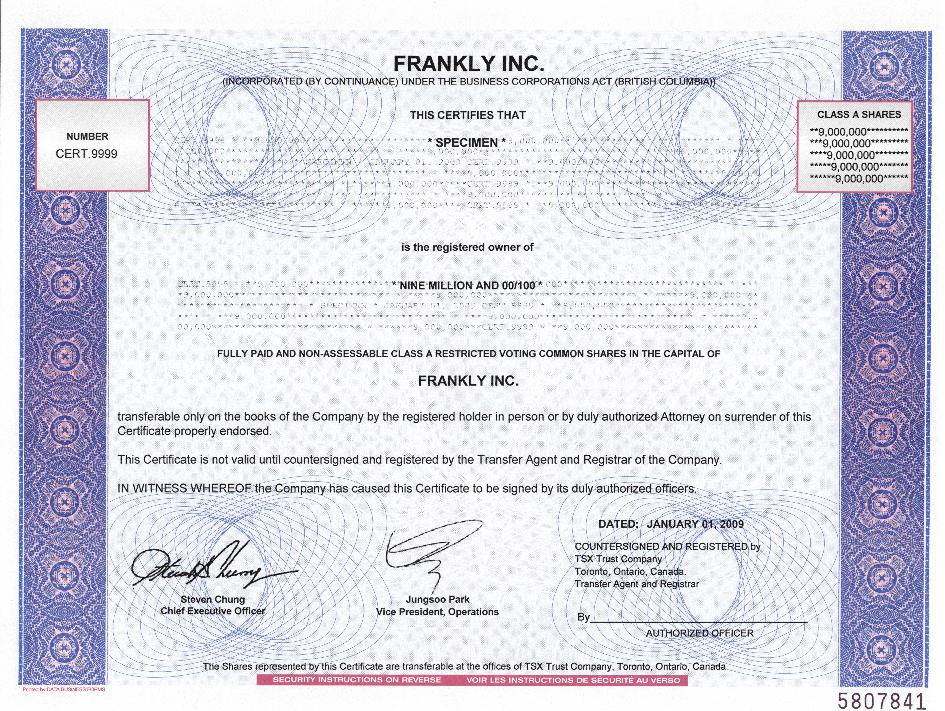

| (i) | 1,752,934 outstanding Class A Restricted Voting Shares (the “Restricted Shares”); |

| (ii) | 4,272,874 common shares issuable upon the exercise of outstanding stock options having a weighted average exercise price of $1.14 per share granted under our Amended and Restated Equity Incentive Plan (the “Equity Plan”); |

| (iii) | 1,232,805 common shares issuable pursuant to restricted stock units (“RSUs”) issued and outstanding under our Equity Plan; |

| (iv) | 14,809,720 common shares issuable upon exercise of outstanding warrants having an exercise price of $0.39 per share; and |

| (v) | 119,336 additional common shares reserved for future issuance under our Equity Plan as of October 31, 2016. |

Except as otherwise indicated herein, all information in this prospectus assumes no exercise of the underwriters’ over-allotment option.

| 7 |

Any investment in our common shares involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common shares. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

We have a limited operating history which may make it difficult for investors to evaluate our prospects for success.

Frankly Co. was incorporated under the laws of the State of Delaware on September 10, 2012. Frankly Inc. was incorporated on June 7, 2013 and completed a reverse triangular merger with Frankly Co. and a wholly-owned subsidiary, WB III Subco Inc., in December 2014. In addition, we completed the acquisition of Gannaway Web Holdings, LLC, now Frankly Media LLC, on August 25, 2015. Although Frankly Media LLC has been operating since 1998, we have a limited operating history as a consolidated company. This lack of consolidated operating history may make it difficult for investors to evaluate our prospects for success. There is no assurance that we will be successful and the likelihood of success must be considered in light of our relatively early stage of consolidated operations.

Since our inception, we have experienced losses and have an accumulated deficit of approximately $46.0 million as of June 30, 2016 and we may incur additional losses in the future.

We have in the past incurred, and we may in the future incur, losses and experience negative cash flow, either or both of which may be significant. We recorded net losses from inception through the year ended December 31, 2015. We recorded a net loss of $3.1 million and $24.7 million for the six months ended June 30, 2016 and the year ended December 31, 2015, respectively. As of June 30, 2016 and December 31, 2015, our consolidated accumulated deficit was approximately $46.0 million and $42.9 million, respectively. We cannot assure you that we can achieve profitability on a quarterly or annual basis in the future. Failure to become profitable may materially and adversely affect the market price of our common shares.

Our independent registered public accounting firm has expressed in its report on our audited consolidated financial statements a substantial doubt about our ability to continue as a going concern.

We have not yet generated sufficient revenues from our operations to fund our activities, and we are therefore dependent upon external sources for the financing of our operations. As a result, our independent registered public accounting firm has expressed in its report on the consolidated financial statements included as part of this prospectus a substantial doubt regarding our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result if we are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our common shares might lose their entire investment.

Our revenue and operating results may fluctuate, which may make our results difficult to predict and could cause our results to fall short of expectations.

As a result of the rapidly changing nature of the markets in which we compete, our quarterly and annual revenue and operating results may fluctuate from period to period. These fluctuations may be caused by a number of factors, many of which are beyond our control. For example, changes in industry or third-party specifications may alter our development timelines and consequently our ability to deliver and monetize new or updated products and services. Additionally, impending changes to technology standards may cause customers to delay investing in new or additional products and services such as the ones we offer. Other factors that may cause fluctuations in our revenue and operation results include but are not limited to:

| 8 |

| ● | any failure to maintain strong customer relationships; | |

| ● | any failure of significant customers to renew their agreements with us; | |

| ● | our ability to attract and retain current and new customers; | |

| ● | variations in the demand for our services and products and the use cycles of our services and products by our customers; | |

| ● | changes in our pricing policies or those of our competitors; | |

| ● | service outages, other technical difficulties or security breaches; | |

| ● | limitations relating to the capacity of our networks, systems and processes; | |

| ● | maintaining appropriate staffing levels and capabilities relative to projected growth; | |

| ● | the timing of costs related to the development or acquisition of technologies, services or businesses to support our existing users and potential growth opportunities; and | |

| ● | general economic, industry and market conditions and those conditions specific to internet usage and advertising businesses. |

For these reasons and because the market for our services and products is relatively new and rapidly changing, it is difficult to predict our future financial results.

If we are unable to retain and acquire new CMS platform customers, our financial performance may be materially and adversely affected.

Our financial performance and operations are dependent on retaining our current CMS platform customers and acquiring new CMS platform customers. We currently serve a large number of customers with our CMS platform and a typical customer contract runs for multiple years. However, we compete with the other technology providers in the market and increasing competition may affect our ability to retain current and acquire new customers. Any number of factors could potentially negatively affect our customer retention or acquisition. For example, a current customer may request products or services that we currently do not provide and may be unwilling to wait until we can develop or source such additional features. Other factors that affect our ability to retain or acquire new CMS platform customers include:

| ● | customers increasingly use competing products or services; |

| ● | we fail to introduce new and improved products or if we introduce new products or services that are not favorably received; |

| ● | we are unable to continue to develop new products and services that work with a variety of mobile operating systems and networks and/or that have a high level of market acceptance; |

| ● | there are changes in customer preference; |

| ● | there is consolidation or vertical integration of our customers; |

| ● | there are changes in customer sentiment about the quality or usefulness of our products and services; |

| ● | there are adverse changes in our products that are mandated by legislation, regulatory authorities, or litigation, including settlements or consent decrees; |

| ● | technical or other problems prevent us from delivering our products in a rapid and reliable manner; |

| ● | we fail to provide adequate customer service to our customers; or |

| ● | we, our software developers, or other companies in our industry are the subject of adverse media reports or other negative publicity. |

If we are unable to retain and acquire new customers, our financial performance may be materially and adversely affected.

| 9 |

If we are unable in the future to generate new customers for our mobile technology products, our financial performance may be materially and adversely affected.

As consumer preferences migrate to accessing news and information content through mobile devices, we expect that an increasing amount of our revenue will be derived from our native mobile technology software applications. Our ability to grow our revenues is dependent, in part, on our ability to increase the number of customers that license our mobile software applications. If we are unable to provide compelling native mobile technology and platforms to our customers or if customer adoption of native mobile technology and platforms is slow to develop, we may be unable to retain our current customers or acquire new customers.

A significant portion of our projected revenue is generated from the sale of national and local online advertising inventory, which is dependent on available advertising inventory and market demand and prices for such inventory. A decline in available supply of advertising inventory, general demand for advertising inventory and general economic conditions may materially and adversely affect our advertising revenue.

A significant portion of our projected revenue is generated from the sale of national and local online advertising inventory, the majority of which we sell on an automated basis through real-time bidding. We also sell a small portion of our inventory to premium direct advertising customers to whom we provide guaranteed advertisement inventory. Our advertising revenue is dependent on the amount of advertising inventory that is available to us to sell and market demand and prices for such inventory.

The amount of advertising inventory available for us to sell is affected by many variables including but not limited to:

| ● | the negotiated amount of inventory we receive from our current CMS customers; |

| ● | the amount of additional inventory our current CMS customers permit us to sell on their behalf; |

| ● | our ability to acquire inventory to sell on behalf of parties that are not customers of our CMS; |

| ● | the amount of end-user traffic to our customers’ online properties; and |

| ● | the specific type of advertising to be sold, such as display, video or mobile advertising. |

While we endeavor to maximize the amount of inventory we are able to sell, some of the foregoing variables, and by extension the amount of inventory we may sell, are affected by market forces and other contingencies that we do not control.

The other principal component of gross advertising revenue is the price at which advertising inventory may be sold. To a large extent, the prices we are able to achieve for our advertising inventory are a product of the market supply and demand, which may vary based on several factors including ad size, ad type, geographic region and time of year. At a macro level, advertising spending is also sensitive to overall economic conditions, and our advertising revenues will be adversely affected if advertisers respond to weak and uncertain economic conditions by reducing their budgets or changing their spending patterns. There are limitations on the amount that we can compensate for fluctuations in the prevailing market prices for advertising inventory. Any reduction in spending by existing or potential advertisers and a decline in available advertising inventory or demand for such inventory would negatively affect our advertising revenue and could affect our ability to grow our advertising customer base.

Some of our customer agreements require us to guarantee certain advertising revenues. If market rates fall below our guaranteed customer agreement rates, we will experience a loss on those advertising inventory units subject to the guarantee.

We have entered into agreements with certain of our existing customers, and in the future we may enter into additional customer agreements, that require us to guarantee minimum amounts of revenue per advertising unit sold, for national advertising inventory that we sell on behalf of these customers. In the event that market rates for national advertising inventory fall below the rates we have guaranteed, we will experience a loss on those advertising inventory units subject to the guarantee. If the amount of advertising inventory subject to guarantees and sold at a loss is large enough and/or the margin by which the market rates fall short of the guaranteed rates is great enough, we could experience a material reduction in our advertising revenues, which would materially and adversely affect our overall revenues.

| 10 |

If we are unable to respond to the rapid technological changes in our industry or develop new products and services in a cost effective manner, we may be unable to compete successfully in the competitive market in which we operate and our financial results could be adversely affected.

Business on the internet is characterized by rapid technological change. Accordingly, we continue to upgrade and improve the features of our products and services. Given the high level of competition in our market and the ever changing technology needs of our customers, our ability to successfully compete depends on our successful development of new products and services. If we are unable, for technological, legal, financial or other reasons, to adapt in a timely manner to changing market conditions in our industry or address or satisfy our customers’ requirements or preferences in their technology needs, our business, results of operations and financial condition would be materially and adversely affected. Sudden changes in user requirements and preferences, frequent new product and service introductions embodying new technologies, and the emergence of new industry and regulatory standards and practices such as data privacy and security standards could render our products, services and our proprietary technology and systems obsolete. The rapid evolution of these products and services will require that we continually improve the performance, features and reliability of our products and services. However, the complexity of developing new technology in a rapidly changing marketplace may increase our development costs. If we are unable to develop new products and services in a cost-effective manner, we may be unable to compete successfully in the market in which we operate.

We may introduce significant changes to our existing products or develop and introduce new and unproven products. If any of our new products or services, including upgrades to our current products or services, do not meet our customers’ expectations or fail to generate revenue, we could lose our customers or fail to generate any revenue from such products or services and our business may be harmed.

We may introduce significant changes to our existing products or develop and introduce new and unproven products or services, including using technologies with which we have little or no prior development or operating experience. If new or enhanced products fail to attract or retain customers or to generate sufficient revenue, operating margin, or other value to justify certain investments, our business may be adversely affected. If we are not successful with new approaches to monetization, we may not be able to maintain or grow our revenue as anticipated or recover any associated development costs.

In addition, updating our technology may require significant additional capital expenditures. If any of our upgrades to our current services do not meet our customer’s expectations, we could lose customers and our business may be harmed. If new services require us to grow rapidly, this could place a significant strain on our managerial, operational, technical and financial resources. In order to manage our growth, we could be required to implement new or upgraded operating and financial systems, procedures and controls. Our failure to expand our operations in an efficient manner could cause our expenses to grow, our revenue to decline or grow more slowly than expected.

A significant percentage of our revenue is generated from two large customers. If we are unable to maintain our relationship with these customers, our business and operations may be materially and adversely affected.

Approximately 36% and 32% of our revenue for the year ended December 31, 2015 and six months ended June 30, 2016 was generated from our three largest and two largest customers, respectively. If we are unable to maintain our relationship with these customers, or if any of these customers reduce their purchase commitments, our business and operations may be materially and adversely affected.

The loss of one or more of our key personnel, or our failure to attract and retain other highly qualified personnel in the future, could harm our business.

We currently depend on the continued services and performance of our key personnel, including Steve Chung, our Chief Executive Officer, Louis Schwartz, our Chief Financial Officer and Chief Operating Officer, Harrison Shih, our Chief Product Officer, and Omar Karim, Head of Engineering. The loss of key personnel, including members of management as well as key engineering, product development, marketing, and sales personnel, could disrupt our operations and have an adverse effect on our business. As we continue to grow, we cannot guarantee that we will continue to attract the personnel we need to maintain our competitive position. In particular, we intend to hire a significant number of personnel in the coming years, and we expect to face significant competition from other companies in hiring such personnel, particularly in the San Francisco Bay Area and New York City markets. As we grow, the incentives to attract, retain, and motivate employees provided by our equity awards or by future arrangements, such as through cash bonuses, may not be as effective as in the past. If we do not succeed in attracting, hiring, and integrating excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively.

| 11 |

We determined that a portion of our goodwill and amortizable intangible assets were impaired as of December 31, 2015 and we recorded an impairment charge of approximately $12.2 million to earnings for the year ended December 31, 2015.

Under U.S. generally accepted accounting principles (“U.S. GAAP”), we review our goodwill for impairment at least annually on December 31 and when events or changes in circumstances indicate that the carrying value may not be recoverable. We review our amortizable intangible assets for impairment when events or changes in circumstances indicate that the carrying value may not be recoverable. Factors that may be considered a change in circumstances indicating that the carrying value of our goodwill or amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization, reduced future cash flow estimates, and slower growth rates in our industry. We determined that a portion of our goodwill and amortizable intangible assets were impaired as of December 31, 2015 and we recorded an impairment charge of approximately $12.2 million to earnings for the year ended December 31, 2015. Future assessments may yield different results, and from time to time, we may be required to record a significant charge to earnings in our consolidated financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined, resulting in a negative impact on our results of operations.

We may expand our business through acquisitions of, or investments in, other companies or new technologies, or joint ventures or other strategic alliances with other companies, which may divert our management’s attention or prove not to be successful or result in equity dilution.

In December 2014, we completed a qualifying transaction through a reverse triangular merger with TicToc and WB III Subco Inc. In August 2015, we acquired Frankly Media. We may decide to pursue other acquisitions of, investments in, or joint ventures involving other technologies and businesses in the future. Such transactions could divert our management’s time and focus from operating our business.

Integrating an acquired company, business or technology is risky and may result in unforeseen operating difficulties and expenditures, including, among other things, with respect to:

| ● | incorporating new technologies into our existing business infrastructure; |

| ● | consolidating corporate and administrative functions; |

| ● | coordinating our sales and marketing functions to incorporate the new business or technology; |

| ● | maintaining morale, retaining and integrating key employees to support the new business or technology and managing our expansion in capacity; and |

| ● | maintaining standards, controls, procedures and policies (including effective internal control over financial reporting and disclosure controls and procedures). |

In addition, a significant portion of the purchase price of companies we may acquire may be allocated to acquired goodwill and other intangible assets, which must be assessed for impairment at least annually. In the future, if our acquisitions do not yield expected returns, we may be required to take charges to our earnings based on this impairment assessment process, which could harm our operating results.

Future acquisitions could result in potentially dilutive issuances of our equity securities, including our common shares, or the incurrence of debt, contingent liabilities, amortization expenses or acquired in-process research and development expenses, any of which could harm our business, financial condition and results of operations. Future acquisitions may also require us to obtain additional financing, which may not be available on favorable terms or at all.

Finally, our skill at investing our funds in illiquid securities issued by other companies is untested. Although we will review the results and prospects of any such investments carefully, it is possible that such investments could result in a total loss. Additionally, we may have little or no control over the companies in which we may invest, and we may be forced to rely on the management of the companies in which we invest to make reasonable and sound business decisions. If the companies in which we invest are not successfully able to manage the risks facing them, such companies could suffer, and we may lose all or part of our investment in such companies.

| 12 |

If we fail to manage our growth effectively, our business, financial condition and results of operations may suffer.

We have grown rapidly since our incorporation and we plan to continue to grow at a rapid pace. This growth has put significant demands on our processes, systems and personnel. We have made and we expect to make further investments in additional personnel, systems and internal control processes to help manage our growth. In addition, we have sought to, and may continue to seek to, grow through strategic acquisitions. Our growth strategy may place significant demands on our management and our operational and financial infrastructure. Our ability to manage our growth effectively and to integrate new technologies and acquisitions into our existing business will require us to continue to expand our operational, financial and management information systems and to continue to retain, attract, train, motivate and manage key employees. Growth could strain our ability to:

| ● | develop and improve our operational, financial and management controls; | |

| ● | enhance our reporting systems and procedures; | |

| ● | recruit, train and retain highly skilled personnel; | |

| ● | maintain our quality standards; and | |

| ● | maintain our user satisfaction. |

Managing our growth will require significant expenditures and allocation of valuable management resources. If we fail to achieve the necessary level of efficiency in our organization as it grows or if we are unable to successfully manage and support our rapid growth and the challenges and difficulties associated with managing a larger, more complex business, this could cause a material adverse effect on our business, financial position and results of operations, and the market value of our shares could decline.

Our degree of leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting operational goals.

As of June 30, 2016, our total indebtedness was approximately $17.3 million. In August 2016, we paid down in full the Bridge Bank Loan and we entered into the $14.5 million Credit Facility. The Credit Facility was used to pay down the $11 million GEI Promissory Note and $3 million of the $4 million Original Raycom Note. Subject to Raycom’s discretion, we also have an additional $1.5 million available for borrowing under the Credit Facility.

Our degree of leverage could have important consequences for the holders of our common shares, including:

| ● | increasing our vulnerability to general economic and industry conditions; | |

| ● | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; | |

| ● | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; | |

| ● | limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and | |

| ● | limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged. |

We may incur substantial additional indebtedness in the future, subject to the restrictions contained in the Credit Facility. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify.

| 13 |

Our debt agreements and those of our subsidiaries contain restrictions that limit our flexibility in operating our business.

Amounts outstanding under the Credit Facility are secured by first priority security interests in substantially all of our assets and are guaranteed by our subsidiaries.

The terms of the Credit Agreement and Credit Facility contain various covenants that limit our ability to engage in specified types of transactions. The covenants limit our and our restricted subsidiaries’ ability to, among other things:

| ● | incur additional indebtedness or issue certain preferred shares; | |

| ● | pay dividends on, repurchase or make distributions in respect of our capital stock or make other restricted payments; | |

| ● | make certain investments; | |

| ● | sell or transfer assets; | |

| ● | create liens; | |

| amalgamate, consolidate or merge with any other person; | ||

| ● | sell or otherwise dispose of all or substantially all of our assets; and | |

| ● | enter into certain transactions with our affiliates. |

We are also required under the Credit Agreement and Credit Facility to satisfy and maintain specified financial ratios and other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control and we may not meet those ratios and tests. A breach of any of these covenants could result in a default under the Credit Agreement and Credit Facility. Upon the occurrence of an event of default under the Credit Agreement, Raycom could elect to declare all amounts outstanding under the Credit Agreement and Credit Facility to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, Raycom could proceed against the collateral granted to them to secure the indebtedness.

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or refinance our debt obligations, depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance our indebtedness, including the notes. We may not be able to effect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, those alternative actions may not allow us to meet our scheduled debt service obligations.

We cannot be certain that additional financing will be available on reasonable terms when required, or at all.

From time to time, we may need additional financing. Our ability to obtain additional financing, if and when required, will depend on investor demand, our operating performance, the condition of the capital markets, and other factors. To the extent we draw on our credit facilities, if any, to fund certain obligations, we may need to raise additional funds and we cannot assure investors that additional financing will be available to us on favorable terms when required, or at all. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences, or privileges senior to the rights of the common shares issued in this offering, and existing shareholders may experience dilution.

| 14 |

If we are unable to protect our intellectual property, the value of our brand and other intangible assets may be diminished, and our business may be adversely affected.

We rely and expect to continue to rely on a combination of confidentiality and license agreements with our employees, consultants, and third parties with whom we have relationships. In the future we may acquire patents or patent portfolios, which could require significant cash expenditures. However, third parties may knowingly or unknowingly infringe our proprietary rights, third parties may challenge proprietary rights held by us, and pending and future trademark and patent applications may not be approved. In addition, effective intellectual property protection may not be available in every country in which we operate or intend to operate our business. In any or all of these cases, we may be required to expend significant time and expense in order to prevent infringement or to enforce our rights. Although we have taken measures to protect our proprietary rights, there can be no assurance that others will not offer products or concepts that are substantially similar to ours and compete with our business. In addition, we occasionally include open source software in our products. As a result of the use of open source in our products, we may license or be required to license innovations that turn out to be material to our business and may also be exposed to increased litigation risk. If the protection of our proprietary rights is inadequate to prevent unauthorized use or appropriation by third parties, the value of our brand and other intangible assets may be diminished and competitors may be able to more effectively mimic our service and methods of operations. Any of these events could have an adverse effect on our business and financial results.

We are a holding company and our only asset is the direct ownership of Frankly Co. and Frankly Media.

We are a holding company and have no material non-financial assets other than direct ownership of Frankly Co. and Frankly Media. We have no independent means of generating revenue. To the extent that we will need funds beyond our own financial resources to pay liabilities or to fund operations, and Frankly Co. and/or Frankly Media are/is restricted from making distributions to us under applicable laws or regulations or agreements, or not have sufficient earnings to make these distributions, we may have to borrow or otherwise raise funds sufficient to meet these obligations and operate our business and, thus, our liquidity and financial condition could be materially adversely affected.

We may be party to litigation, which can be expensive and time consuming, and, if resolved adversely, could have a significant impact on our business, financial condition, or results of operations.

Our business, financial condition, or results of operations could be adversely affected as a result of an unfavorable resolution of future disputes and litigation. Companies in the internet, technology, and media industries own large numbers of patents, copyrights, trademarks, and trade secrets, and frequently enter into litigation based on allegations of infringement, misappropriation, or other violations of intellectual property or other rights. In addition, various “non-practicing entities” that own patents and other intellectual property rights often attempt to aggressively assert their rights in order to extract value from technology companies. Furthermore, from time to time we may introduce new products, including in areas where we currently do not compete, which could increase our exposure to patent and other intellectual property claims from competitors and non-practicing entities.

Defending patent and other intellectual property litigation is costly and can impose a significant burden on management and employees, and there can be no assurances that favorable final outcomes will be obtained in all cases. In addition, plaintiffs may seek, and we may become subject to, preliminary or provisional rulings in the course of any such litigation, including potential preliminary injunctions requiring us to cease some or all of our operations. We may decide to settle such lawsuits and disputes on terms that are unfavorable to us. Similarly, if any litigation to which we are a party is resolved adversely, we may be subject to an unfavorable judgment that may not be reversed upon appeal. The terms of such a settlement or judgment may require us to cease some or all of our operations or pay substantial amounts to the other party. In addition, we may have to seek a license to continue practices found to be in violation of a third party’s rights, which may not be available on reasonable terms, or at all, and may significantly increase our operating costs and expenses. As a result, we may also be required to develop alternative non-infringing technology or practices or discontinue the practices. The development of alternative non-infringing technology or practices could require significant effort and expense or may not be feasible.

| 15 |

Our software is highly technical, and if it contains undetected errors, our business could be adversely affected.

Our products incorporate software that is highly technical and complex. Our software may now or in the future contain, undetected errors, bugs, or vulnerabilities. Some errors in our software codes may only be discovered after the codes have been released. Any errors, bugs, or vulnerabilities discovered in our codes after release could result in damage to our reputation, loss of users, loss of revenue, or liability for damages.

We rely on third parties to provide the technologies necessary to deliver products and services to our customers, and any change in the licensing terms, costs, availability, or acceptance of these technologies could adversely affect our business.

We rely on third parties to provide the technologies that we use to deliver our products and services to our customers. There can be no assurance that these providers will continue to license their technologies or otherwise make them available to us on reasonable terms, or at all. Providers may change the fees they charge users or otherwise change their business models in a manner that impedes the acceptance of their technologies. In order for our services to be successful, there must be a large base of users of the technologies necessary to deliver our products and services. We have limited or no control over the availability or acceptance of these technologies, and any change in the licensing terms, costs, availability or user acceptance of these technologies could adversely affect our business.

Failure to license necessary third party software for use in our products and services, or failure to successfully integrate third party software, could cause delays or reductions in our sales, or errors or failures of our service.

We license third party software that we incorporate into our products and services. In the future, we might need to license other software to enhance our products and meet evolving customer requirements. These licenses may not continue to be available on commercially reasonable terms or at all. Some of this technology could be difficult to replace once integrated. The loss of, or inability to obtain, these licenses could result in delays or reductions of our applications until we identify, license and integrate or develop equivalent software, and new licenses could require us to pay higher royalties. If we are unable to successfully license and integrate third party technology, we could experience a reduction in functionality and/or errors or failures of our products, which may reduce demand for our products and services.

Third-party licenses may expose us to increased risks, including risks associated with the integration of new technology, the impact of new technology integration on our existing technology, open source software disclosure risks, the diversion of resources from the development of our own proprietary technology, and our inability to generate revenue from new technology sufficient to offset associated acquisition and maintenance costs.

Computer malware, viruses, hacking and phishing attacks, and spamming could harm our business and results of operations.

Computer malware, viruses, and computer hacking and phishing attacks have become more prevalent in our industry and may occur on our systems in the future. Our main customers are local media companies and given the ability of American news outlets to reach a large user base, our technology and content platform could be the targets of hostile attempts to breach the security and integrity of the platform. A coordinated attack on our infrastructure is a risk to the stability of the platform. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain the performance, reliability, security, and availability of our products and technical infrastructure to the satisfaction of our customers may harm our reputation and our ability to retain existing customers and attract new customers.

System failures or capacity constraints could harm our business and financial performance.

The provision of our services and products depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our service. Such interruptions could harm our business, financial condition and results of operations, and our reputation could be damaged if people believe our systems are unreliable. Our systems are vulnerable to damage or interruption from extreme weather events, terrorist attacks, floods, fires, power loss, telecommunications failures, security breaches, computer malware, computer hacking attacks, computer viruses, computer denial of service attacks or other attempts to, or events that, harm our systems. Our data centers may also be subject to break-ins, sabotage and intentional acts of vandalism and to potential disruptions if the operators of the facilities have financial difficulties. If we were forced to rely on our system back-ups to restore the systems, we could experience significant delays in restoring the functionality of our platform and could experience loss of data, which could materially harm our business and our operating results. Although we maintain insurance to cover a variety of risks, the scope and amount of our insurance coverage may not be sufficient to cover our losses resulting from system failures or other disruptions to our online operations. Any system failure or disruption and any resulting losses that are not recoverable under our insurance policies may materially harm our business, financial condition and results of operations. To date, we have never experienced any material losses as a result of system failures or online disruptions.

| 16 |

Our business depends on continued and unimpeded access to the Internet by us, our customers and their end users. Internet access providers or distributors may be able to block, degrade or charge for access to our content, which could lead to additional expenses to us and our customers and the loss of end users and advertisers.

Products and services such as ours depend on our ability and the ability of our customers’ users to access the Internet. Currently, this access is provided by companies that have, or in the future may have, significant market power in the broadband and internet access marketplace, including incumbent telephone companies, cable companies, mobile communications companies and government-owned service providers. Some of these providers may take, or have stated that they may take, measures that could degrade, disrupt, or increase the cost of user access to products or services such as ours by restricting or prohibiting the use of their infrastructure to support or facilitate product or service offerings such as ours, or by charging increased fees to businesses such as ours to provide content or to have users access that content. Such interference could result in a loss of existing viewers, subscribers and advertisers, and increased costs, and could impair our ability to attract new viewers, subscribers and advertisers, thereby harming our revenues and growth.

We may not maintain acceptable website performance for our platform, which may negatively impact our relationships with our customers and harm our business, financial condition and results of operations.

A key element to our continued growth is the ability of our customers’ audience to access the platform and other offerings within acceptable load times. We refer to this as website performance. We may in the future experience platform disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints due to an overwhelming number of users accessing our technology simultaneously, and denial of service or fraud or security attacks.

In some instances, we may not be able to identify the cause or causes of these website performance problems within an acceptable period of time. It may become increasingly difficult to maintain and improve website performance, especially during peak usage times, as our solutions become more complex and our user traffic increases. If our platform is unavailable when consumers attempt to access them or do not load as quickly as they expect, our customers seek alternative services or services from our competitors. To the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business and operating results may be harmed.

We may incur liability as a result of information retrieved from or transmitted over the internet or through our customer websites and claims related to our products.