dxc-20210331DXC Technology Co00016885682021FYFALSEus-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccountingStandardsUpdate201613MemberP4YP4YP1YP1Yus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationus-gaap:DebtCurrentus-gaap:DebtCurrentus-gaap:LongTermDebtNoncurrentus-gaap:LongTermDebtNoncurrent0.33330.33330.333312P1Y00016885682020-04-012021-03-310001688568us-gaap:CommonStockMember2020-04-012021-03-310001688568dxc:SeniorNotesDue2025OneMember2020-04-012021-03-310001688568dxc:SeniorNotesDue2026Member2020-04-012021-03-31iso4217:USD00016885682020-09-30xbrli:shares00016885682021-05-2400016885682021-03-3100016885682020-03-31iso4217:USDxbrli:shares00016885682019-04-012020-03-3100016885682018-04-012019-03-3100016885682019-03-3100016885682018-03-310001688568us-gaap:CommonStockMember2018-03-310001688568us-gaap:AdditionalPaidInCapitalMember2018-03-310001688568us-gaap:RetainedEarningsMember2018-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-03-310001688568us-gaap:TreasuryStockMember2018-03-310001688568us-gaap:ParentMember2018-03-310001688568us-gaap:NoncontrollingInterestMember2018-03-3100016885682017-04-012018-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2018-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-03-310001688568us-gaap:RetainedEarningsMember2018-04-012019-03-310001688568us-gaap:ParentMember2018-04-012019-03-310001688568us-gaap:NoncontrollingInterestMember2018-04-012019-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-04-012019-03-310001688568us-gaap:AdditionalPaidInCapitalMember2018-04-012019-03-310001688568us-gaap:TreasuryStockMember2018-04-012019-03-310001688568us-gaap:CommonStockMember2018-04-012019-03-310001688568us-gaap:CommonStockMember2019-03-310001688568us-gaap:AdditionalPaidInCapitalMember2019-03-310001688568us-gaap:RetainedEarningsMember2019-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001688568us-gaap:TreasuryStockMember2019-03-310001688568us-gaap:ParentMember2019-03-310001688568us-gaap:NoncontrollingInterestMember2019-03-310001688568us-gaap:RetainedEarningsMember2019-04-012020-03-310001688568us-gaap:ParentMember2019-04-012020-03-310001688568us-gaap:NoncontrollingInterestMember2019-04-012020-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012020-03-310001688568us-gaap:AdditionalPaidInCapitalMember2019-04-012020-03-310001688568us-gaap:TreasuryStockMember2019-04-012020-03-310001688568us-gaap:CommonStockMember2019-04-012020-03-310001688568us-gaap:CommonStockMember2020-03-310001688568us-gaap:AdditionalPaidInCapitalMember2020-03-310001688568us-gaap:RetainedEarningsMember2020-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001688568us-gaap:TreasuryStockMember2020-03-310001688568us-gaap:ParentMember2020-03-310001688568us-gaap:NoncontrollingInterestMember2020-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2020-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2020-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-03-310001688568us-gaap:RetainedEarningsMember2020-04-012021-03-310001688568us-gaap:ParentMember2020-04-012021-03-310001688568us-gaap:NoncontrollingInterestMember2020-04-012021-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012021-03-310001688568us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-310001688568us-gaap:TreasuryStockMember2020-04-012021-03-310001688568us-gaap:CommonStockMember2020-04-012021-03-310001688568us-gaap:CommonStockMember2021-03-310001688568us-gaap:AdditionalPaidInCapitalMember2021-03-310001688568us-gaap:RetainedEarningsMember2021-03-310001688568us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001688568us-gaap:TreasuryStockMember2021-03-310001688568us-gaap:ParentMember2021-03-310001688568us-gaap:NoncontrollingInterestMember2021-03-31iso4217:EUR0001688568dxc:HealthcareSoftwareBusinessMemberus-gaap:SubsequentEventMember2021-04-010001688568dxc:HumanServicesBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-10-010001688568us-gaap:BuildingMember2020-04-012021-03-310001688568srt:MinimumMemberus-gaap:TechnologyEquipmentMember2020-04-012021-03-310001688568srt:MaximumMemberus-gaap:TechnologyEquipmentMember2020-04-012021-03-310001688568us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2020-04-012021-03-310001688568srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-04-012021-03-310001688568srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2020-04-012021-03-310001688568srt:MinimumMemberus-gaap:TechnologyEquipmentMember2019-03-312019-03-310001688568srt:MaximumMemberus-gaap:TechnologyEquipmentMember2019-03-312019-03-310001688568srt:MinimumMemberus-gaap:ComputerSoftwareIntangibleAssetMember2020-04-012021-03-310001688568srt:MaximumMemberus-gaap:ComputerSoftwareIntangibleAssetMember2020-04-012021-03-310001688568dxc:AXABankGermanyMember2021-01-012021-01-010001688568dxc:AXABankGermanyMember2021-01-010001688568dxc:LuxoftHoldingInc.Member2019-06-142019-06-14xbrli:pure0001688568dxc:LuxoftHoldingInc.Member2019-06-140001688568dxc:LuxoftHoldingInc.Memberus-gaap:CustomerRelatedIntangibleAssetsMember2019-06-142019-06-140001688568us-gaap:TradeNamesMemberdxc:LuxoftHoldingInc.Member2019-06-142019-06-140001688568dxc:LuxoftHoldingInc.Memberdxc:ComputerSoftwareIntangibleAssetDevelopedTechnologyMember2019-06-142019-06-140001688568dxc:LuxoftHoldingInc.Memberdxc:ComputerSoftwareIntangibleAssetThirdPartyPurchasedSoftwareMember2019-06-142019-06-140001688568dxc:LuxoftHoldingInc.Member2020-04-012021-03-310001688568dxc:MolinaMedicaidSolutionsMember2018-10-012018-10-010001688568dxc:MolinaMedicaidSolutionsMember2018-10-01dxc:acquisition0001688568us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-04-012020-03-310001688568us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-03-310001688568dxc:HumanServicesBusinessMemberdxc:MilanoPurchasersMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-10-012020-10-010001688568dxc:HumanServicesBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-10-012020-10-0100016885682020-10-012020-10-310001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-10-012020-10-31iso4217:GBP0001688568us-gaap:CommercialPaperMember2020-10-012020-10-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableEURDue2024Member2020-10-012020-10-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2020-10-012020-10-31iso4217:AUD0001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2020-10-012020-10-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableEURDue20222023Member2020-10-012020-10-310001688568dxc:SeriesOfInsignificantDisposalGroupsMember2020-04-012021-03-310001688568dxc:USPSSeparationITServicesAgreementMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMember2020-04-012021-03-310001688568dxc:USPSSeparationITServicesAgreementMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMember2019-04-012020-03-310001688568dxc:USPSSeparationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMember2018-05-312018-05-310001688568dxc:USPSSeparationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMember2018-05-310001688568dxc:USPSSeparationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMember2018-04-012019-03-310001688568dxc:HealthcareSoftwareBusinessMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2021-03-310001688568dxc:OtherBusinessesMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2021-03-310001688568us-gaap:DiscontinuedOperationsHeldforsaleMember2021-03-310001688568us-gaap:EmployeeStockOptionMember2020-04-012021-03-310001688568us-gaap:EmployeeStockOptionMember2019-04-012020-03-310001688568us-gaap:EmployeeStockOptionMember2018-04-012019-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2018-04-012019-03-310001688568us-gaap:PerformanceSharesMember2020-04-012021-03-310001688568us-gaap:PerformanceSharesMember2019-04-012020-03-310001688568us-gaap:PerformanceSharesMember2018-04-012019-03-310001688568us-gaap:BilledRevenuesMember2021-03-310001688568us-gaap:BilledRevenuesMember2020-03-310001688568us-gaap:UnbilledRevenuesMember2021-03-310001688568us-gaap:UnbilledRevenuesMember2020-03-310001688568dxc:OtherReceivablesMember2021-03-310001688568dxc:OtherReceivablesMember2020-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-03-310001688568dxc:PurchasersMember2020-06-300001688568dxc:PurchasersMember2020-09-300001688568dxc:PurchasersMember2021-03-31dxc:extension0001688568dxc:PurchasersMember2020-04-012021-03-310001688568dxc:PurchasersMember2019-03-310001688568dxc:PurchasersMember2019-04-012020-03-310001688568dxc:PurchasersMember2020-03-310001688568dxc:DEPurchasersMember2021-03-310001688568dxc:DEPurchasersMember2020-03-310001688568dxc:DEPurchasersMember2020-04-012021-03-310001688568dxc:DEPurchasersMember2019-03-310001688568dxc:DEPurchasersMember2019-04-012020-03-310001688568srt:MinimumMember2020-04-012021-03-310001688568srt:MaximumMember2020-04-012021-03-310001688568us-gaap:RealEstateMember2021-03-310001688568us-gaap:EquipmentMember2021-03-310001688568us-gaap:FairValueMeasurementsRecurringMember2021-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-310001688568us-gaap:FairValueMeasurementsRecurringMember2020-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-03-310001688568us-gaap:OtherDebtSecuritiesMember2021-03-310001688568us-gaap:OtherDebtSecuritiesMember2020-03-310001688568us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherIncomeMember2021-03-310001688568us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001688568us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001688568us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310001688568us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMember2020-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMember2020-04-012021-03-310001688568us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-03-310001688568us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2020-04-012021-03-310001688568us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2019-04-012020-03-310001688568us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2018-04-012019-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2020-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMember2020-03-310001688568us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2020-03-310001688568us-gaap:NondesignatedMember2021-03-310001688568us-gaap:NondesignatedMember2020-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberdxc:AccruedExpensesAndOtherCurrentLiabilitiesMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568us-gaap:DesignatedAsHedgingInstrumentMemberdxc:AccruedExpensesAndOtherCurrentLiabilitiesMemberus-gaap:ForeignExchangeForwardMember2020-03-310001688568dxc:AccruedExpensesAndOtherCurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-03-310001688568dxc:AccruedExpensesAndOtherCurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-03-31dxc:counterparty0001688568dxc:ForeignCurrencyDenominatedDebtMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001688568dxc:ForeignCurrencyDenominatedDebtMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-04-012021-03-310001688568dxc:ForeignCurrencyDenominatedDebtMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-03-310001688568us-gaap:LandBuildingsAndImprovementsMember2021-03-310001688568us-gaap:LandBuildingsAndImprovementsMember2020-03-310001688568us-gaap:ComputerEquipmentMember2021-03-310001688568us-gaap:ComputerEquipmentMember2020-03-310001688568us-gaap:FurnitureAndFixturesMember2021-03-310001688568us-gaap:FurnitureAndFixturesMember2020-03-310001688568us-gaap:ConstructionInProgressMember2021-03-310001688568us-gaap:ConstructionInProgressMember2020-03-310001688568us-gaap:ComputerSoftwareIntangibleAssetMember2021-03-310001688568us-gaap:CustomerRelatedIntangibleAssetsMember2021-03-310001688568us-gaap:OtherIntangibleAssetsMember2021-03-310001688568us-gaap:ComputerSoftwareIntangibleAssetMember2020-03-310001688568us-gaap:CustomerRelatedIntangibleAssetsMember2020-03-310001688568us-gaap:OtherIntangibleAssetsMember2020-03-310001688568us-gaap:OtherIntangibleAssetsMember2020-04-012021-03-310001688568us-gaap:OtherIntangibleAssetsMember2019-04-012020-03-310001688568us-gaap:OtherIntangibleAssetsMember2018-04-012019-03-310001688568dxc:OutsourcingContractCostsMember2020-04-012021-03-310001688568dxc:OutsourcingContractCostsMember2019-04-012020-03-310001688568dxc:OutsourcingContractCostsMember2018-04-012019-03-310001688568dxc:GBSSegmentMember2020-03-310001688568dxc:GISSegmentMember2020-03-310001688568dxc:GBSSegmentMember2020-04-012021-03-310001688568dxc:GISSegmentMember2020-04-012021-03-310001688568dxc:GBSSegmentMember2021-03-310001688568dxc:GISSegmentMember2021-03-310001688568dxc:GBSSegmentMember2019-03-310001688568dxc:GISSegmentMember2019-03-310001688568dxc:GBSSegmentMember2019-04-012020-03-310001688568dxc:GISSegmentMember2019-04-012020-03-310001688568dxc:HewlettPackardEnterpriseServicesMember2017-04-010001688568us-gaap:SegmentDiscontinuedOperationsMemberdxc:USPSSeparationMember2019-03-310001688568country:LU2020-04-012021-03-310001688568country:LU2019-04-012020-03-310001688568country:LU2018-04-012019-03-310001688568us-gaap:ForeignCountryMember2021-03-310001688568us-gaap:InternalRevenueServiceIRSMember2021-03-310001688568us-gaap:InternalRevenueServiceIRSMember2020-03-310001688568us-gaap:StateAndLocalJurisdictionMember2021-03-310001688568us-gaap:StateAndLocalJurisdictionMember2020-03-310001688568us-gaap:ForeignCountryMember2020-03-310001688568us-gaap:SettlementWithTaxingAuthorityMember2021-03-310001688568us-gaap:CommercialPaperMembersrt:MinimumMember2021-03-310001688568srt:MaximumMemberus-gaap:CommercialPaperMember2021-03-310001688568dxc:FinanceLeaseLiabilityCurrentMembersrt:MinimumMember2021-03-310001688568dxc:FinanceLeaseLiabilityCurrentMembersrt:MaximumMember2021-03-310001688568srt:MinimumMemberus-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2021-03-310001688568srt:MaximumMemberus-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2021-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2021-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2020-03-310001688568dxc:TermLoanPayableGBPDue2022Membersrt:MinimumMemberus-gaap:NotesPayableToBanksMember2021-03-310001688568srt:MaximumMemberdxc:TermLoanPayableGBPDue2022Memberus-gaap:NotesPayableToBanksMember2021-03-310001688568dxc:TermLoanPayableGBPDue2022Memberus-gaap:NotesPayableToBanksMember2021-03-310001688568dxc:TermLoanPayableGBPDue2022Memberus-gaap:NotesPayableToBanksMember2020-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableEURDue20222023Member2021-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableEURDue20222023Member2020-03-310001688568dxc:TermLoanPayableEURDue20232024Memberus-gaap:NotesPayableToBanksMember2021-03-310001688568dxc:TermLoanPayableEURDue20232024Memberus-gaap:NotesPayableToBanksMember2020-03-310001688568srt:MinimumMemberus-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2021-03-310001688568srt:MaximumMemberus-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2021-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2021-03-310001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2020-03-310001688568dxc:SeniorNotesDue2023OneMemberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2023OneMemberus-gaap:SeniorNotesMember2020-03-310001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SeniorNotesMember2020-03-310001688568us-gaap:SeniorNotesMemberdxc:SeniorNotesDue2025Member2021-03-310001688568us-gaap:SeniorNotesMemberdxc:SeniorNotesDue2025Member2020-03-310001688568dxc:SeniorNotesDue2026TwoMemberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2026TwoMemberus-gaap:SeniorNotesMember2020-03-310001688568us-gaap:SeniorNotesMemberdxc:SeniorNotesDue2025OneMember2021-03-310001688568us-gaap:SeniorNotesMemberdxc:SeniorNotesDue2025OneMember2020-03-310001688568dxc:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2020-03-310001688568dxc:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2020-03-310001688568dxc:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2020-03-310001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2021-03-310001688568srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-03-310001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-03-310001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-03-310001688568us-gaap:SecuredDebtMembersrt:MinimumMemberdxc:LeaseCreditFacilityVariousMember2021-03-310001688568srt:MaximumMemberus-gaap:SecuredDebtMemberdxc:LeaseCreditFacilityVariousMember2021-03-310001688568us-gaap:SecuredDebtMemberdxc:LeaseCreditFacilityVariousMember2021-03-310001688568us-gaap:SecuredDebtMemberdxc:LeaseCreditFacilityVariousMember2020-03-310001688568srt:MinimumMemberdxc:FinanceLeaseLiabilityNoncurrentMember2021-03-310001688568srt:MaximumMemberdxc:FinanceLeaseLiabilityNoncurrentMember2021-03-310001688568srt:MinimumMemberdxc:BorrowingsForAssetsAcquiredUnderLongTermFinancingMember2021-03-310001688568srt:MaximumMemberdxc:BorrowingsForAssetsAcquiredUnderLongTermFinancingMember2021-03-310001688568dxc:BorrowingsForAssetsAcquiredUnderLongTermFinancingMember2021-03-310001688568dxc:BorrowingsForAssetsAcquiredUnderLongTermFinancingMember2020-03-310001688568us-gaap:MandatorilyRedeemablePreferredStockMember2021-03-310001688568us-gaap:MandatorilyRedeemablePreferredStockMember2020-03-310001688568us-gaap:NotesPayableOtherPayablesMember2021-03-310001688568us-gaap:NotesPayableOtherPayablesMember2020-03-310001688568us-gaap:CommercialPaperMember2021-03-310001688568srt:MinimumMemberdxc:TermLoanPayableEURDue20232024Memberus-gaap:NotesPayableToBanksMemberdxc:EURIBORMember2020-04-012021-03-310001688568srt:MaximumMemberdxc:TermLoanPayableEURDue20232024Memberus-gaap:NotesPayableToBanksMemberdxc:EURIBORMember2020-04-012021-03-310001688568dxc:SeniorNotesDue2026TwoandSeniorNotes2024Memberus-gaap:SeniorNotesMember2020-06-300001688568dxc:SeniorNotesDue2024Memberus-gaap:SeniorNotesMember2020-06-300001688568dxc:SeniorNotesDue2026TwoMemberus-gaap:SeniorNotesMember2020-06-300001688568dxc:TermLoanPayableEURDue2023Memberus-gaap:NotesPayableToBanksMember2020-04-012020-06-300001688568dxc:TermLoanPayableGBPDue2022Memberus-gaap:NotesPayableToBanksMember2020-04-012020-06-300001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableAUDDue2022Member2020-04-012020-06-300001688568us-gaap:NotesPayableToBanksMemberdxc:TermLoanPayableUSDDue2025Member2020-04-012020-06-300001688568dxc:TermLoanPayableGBPDue2022Memberus-gaap:NotesPayableToBanksMember2020-07-012020-09-300001688568us-gaap:NotesPayableToBanksMember2020-10-012020-12-310001688568dxc:SeniorNotesDue2026OneMemberus-gaap:SeniorNotesMember2021-03-310001688568dxc:SeniorNotesDue2024Memberus-gaap:SeniorNotesMember2021-01-012021-03-310001688568dxc:SeniorNotesDue2023OneMemberus-gaap:SeniorNotesMember2021-03-160001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SeniorNotesMember2021-03-160001688568dxc:SeniorNotesDue2023OneMemberus-gaap:SeniorNotesMember2021-03-162021-03-160001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SeniorNotesMember2021-03-162021-03-160001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-04-012020-06-300001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-06-300001688568us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-04-012020-12-310001688568us-gaap:PensionPlansDefinedBenefitMember2020-04-012021-03-310001688568us-gaap:PensionPlansDefinedBenefitMember2019-04-012020-03-310001688568us-gaap:PensionPlansDefinedBenefitMember2018-04-012019-03-310001688568us-gaap:PensionPlansDefinedBenefitMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMember2019-03-310001688568us-gaap:PensionPlansDefinedBenefitMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2021-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:HedgeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:HedgeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMember2021-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMember2021-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalInternationalCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesGlobalMutualFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanEquitySecuritiesUSNorthAmericaCommingledFundsMember2020-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanFixedIncomeCommingledFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanAlternativeInvestmentsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:HedgeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:HedgeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMember2020-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310001688568dxc:DefinedBenefitPlanInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310001688568us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-04-012020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-04-012021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2020-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanCashAndOtherInvestmentsMember2021-03-310001688568us-gaap:PensionPlansDefinedBenefitMemberdxc:DefinedBenefitPlanCashAndOtherInvestmentsMember2020-03-3100016885682018-10-260001688568dxc:NonEmployeeDirectorsMember2020-04-012021-03-310001688568dxc:NonEmployeeDirectorsMember2021-03-310001688568dxc:NonEmployeeDirectorsMember2020-03-310001688568dxc:NonEmployeeDirectorsMember2019-04-012020-03-310001688568dxc:NonEmployeeDirectorsMember2018-04-012019-03-31dxc:vote00016885682017-04-0300016885682018-11-080001688568dxc:OpenMarketPurchasesMember2019-04-012020-03-310001688568dxc:AcceleratedShareRepurchaseAgreementMember2019-04-012020-03-310001688568dxc:OpenMarketPurchasesMember2018-04-012019-03-310001688568us-gaap:CommonStockMemberdxc:SharesRepurchasedFromEmployeesRelatedToStockOptionPlansMember2020-04-012021-03-310001688568us-gaap:CommonStockMemberdxc:SharesRepurchasedFromEmployeesRelatedToStockOptionPlansMember2019-04-012020-03-310001688568us-gaap:CommonStockMemberdxc:SharesRepurchasedFromEmployeesRelatedToStockOptionPlansMember2018-04-012019-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2018-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2018-04-012019-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-04-012019-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-04-012019-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-04-012019-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2019-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2019-04-012020-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-04-012020-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-04-012020-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-04-012020-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2020-04-012021-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-04-012021-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-04-012021-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-04-012021-03-310001688568us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001688568us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310001688568us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-03-310001688568us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2021-03-31dxc:anniversary0001688568us-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001688568us-gaap:PerformanceSharesMember2020-04-012021-03-310001688568dxc:AnniversaryOneMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001688568dxc:AnniversaryTwoMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001688568us-gaap:RestrictedStockUnitsRSUMemberdxc:AnniversaryThreeMember2020-04-012021-03-310001688568us-gaap:EmployeeStockMemberdxc:DXCSharePurchasePlanMember2020-04-012021-03-310001688568dxc:DXCEmployeeEquityPlanMember2021-03-310001688568dxc:DXCDirectorEquityPlanMember2021-03-310001688568dxc:DXCSharePurchasePlanMember2021-03-310001688568us-gaap:EmployeeStockOptionMember2020-04-012021-03-310001688568us-gaap:EmployeeStockOptionMember2018-03-310001688568us-gaap:EmployeeStockOptionMember2017-04-012018-03-310001688568us-gaap:EmployeeStockOptionMember2018-04-012019-03-310001688568us-gaap:EmployeeStockOptionMember2019-03-310001688568us-gaap:EmployeeStockOptionMember2019-04-012020-03-310001688568us-gaap:EmployeeStockOptionMember2020-03-310001688568us-gaap:EmployeeStockOptionMember2021-03-310001688568dxc:StockOptionPriceRange1Member2020-04-012021-03-310001688568dxc:StockOptionPriceRange1Member2021-03-310001688568dxc:StockOptionPriceRange2Member2020-04-012021-03-310001688568dxc:StockOptionPriceRange2Member2021-03-310001688568dxc:StockOptionPriceRange3Member2020-04-012021-03-310001688568dxc:StockOptionPriceRange3Member2021-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2018-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2018-04-012019-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2019-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310001688568us-gaap:RestrictedStockUnitsRSUMember2020-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2018-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2018-04-012019-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2019-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2020-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001688568dxc:NonemployeeDirectorIncentivesMemberus-gaap:RestrictedStockUnitsRSUMember2021-03-310001688568us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2020-04-012021-03-310001688568us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2020-04-012021-03-310001688568us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-04-012021-03-31dxc:segment0001688568dxc:GBSSegmentMemberus-gaap:OperatingSegmentsMember2020-04-012021-03-310001688568dxc:GISSegmentMemberus-gaap:OperatingSegmentsMember2020-04-012021-03-310001688568us-gaap:OperatingSegmentsMember2020-04-012021-03-310001688568us-gaap:MaterialReconcilingItemsMember2020-04-012021-03-310001688568dxc:GBSSegmentMemberus-gaap:OperatingSegmentsMember2019-04-012020-03-310001688568dxc:GISSegmentMemberus-gaap:OperatingSegmentsMember2019-04-012020-03-310001688568us-gaap:OperatingSegmentsMember2019-04-012020-03-310001688568us-gaap:MaterialReconcilingItemsMember2019-04-012020-03-310001688568dxc:GBSSegmentMemberus-gaap:OperatingSegmentsMember2018-04-012019-03-310001688568dxc:GISSegmentMemberus-gaap:OperatingSegmentsMember2018-04-012019-03-310001688568us-gaap:OperatingSegmentsMember2018-04-012019-03-310001688568us-gaap:MaterialReconcilingItemsMember2018-04-012019-03-310001688568country:US2021-03-310001688568country:US2020-03-310001688568country:GB2021-03-310001688568country:GB2020-03-310001688568country:AU2021-03-310001688568country:AU2020-03-310001688568dxc:OtherEuropeMember2021-03-310001688568dxc:OtherEuropeMember2020-03-310001688568dxc:OtherInternationalMember2021-03-310001688568dxc:OtherInternationalMember2020-03-310001688568country:US2020-04-012021-03-310001688568country:US2019-04-012020-03-310001688568country:US2018-04-012019-03-310001688568country:GB2020-04-012021-03-310001688568country:GB2019-04-012020-03-310001688568country:GB2018-04-012019-03-310001688568dxc:OtherEuropeMember2020-04-012021-03-310001688568dxc:OtherEuropeMember2019-04-012020-03-310001688568dxc:OtherEuropeMember2018-04-012019-03-310001688568country:AU2020-04-012021-03-310001688568country:AU2019-04-012020-03-310001688568country:AU2018-04-012019-03-310001688568dxc:OtherInternationalMember2020-04-012021-03-310001688568dxc:OtherInternationalMember2019-04-012020-03-310001688568dxc:OtherInternationalMember2018-04-012019-03-3100016885682021-04-012021-03-310001688568dxc:HumanServicesBusinessMember2020-04-012021-03-310001688568dxc:HealthcareSoftwareBusinessMember2020-04-012021-03-310001688568dxc:SalesCommissionMember2021-03-310001688568dxc:SalesCommissionMember2020-03-310001688568dxc:TransitionAndTransformationContractCostsMember2021-03-310001688568dxc:TransitionAndTransformationContractCostsMember2020-03-310001688568dxc:SalesCommissionMember2020-04-012021-03-310001688568dxc:SalesCommissionMember2019-04-012020-03-310001688568dxc:SalesCommissionMember2018-04-012019-03-310001688568dxc:TransitionAndTransformationContractCostsMember2020-04-012021-03-310001688568dxc:TransitionAndTransformationContractCostsMember2019-04-012020-03-310001688568dxc:TransitionAndTransformationContractCostsMember2018-04-012019-03-310001688568dxc:RestructuringPlanFiscal2019PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2019PlanMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2019PlanMember2021-03-310001688568dxc:RestructuringPlanFiscal2018PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2018PlanMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2018PlanMember2021-03-310001688568dxc:RestructuringPlanFiscal2017PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2017PlanMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2017PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2021PlanMember2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2021PlanMember2020-04-012021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2021PlanMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2021PlanMember2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2021PlanMember2020-04-012021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2021PlanMember2021-03-310001688568dxc:RestructuringPlanFiscal2021PlanMember2020-03-310001688568dxc:RestructuringPlanFiscal2021PlanMember2020-04-012021-03-310001688568dxc:RestructuringPlanFiscal2021PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2020PlanMember2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2020PlanMember2020-04-012021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2020PlanMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2020PlanMember2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2020PlanMember2020-04-012021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2020PlanMember2021-03-310001688568dxc:RestructuringPlanFiscal2020PlanMember2020-03-310001688568dxc:RestructuringPlanFiscal2020PlanMember2020-04-012021-03-310001688568dxc:RestructuringPlanFiscal2020PlanMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2019PlanMember2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2019PlanMember2020-04-012021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2019PlanMember2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2019PlanMember2020-04-012021-03-310001688568dxc:RestructuringPlanFiscal2019PlanMember2020-03-310001688568dxc:RestructuringPlanFiscal2019PlanMember2020-04-012021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2019Member2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2019Member2020-04-012021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2019Member2021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2019Member2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2019Member2020-04-012021-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2019Member2021-03-310001688568dxc:RestructuringPlansBeforeFiscal2019Member2020-03-310001688568dxc:RestructuringPlansBeforeFiscal2019Member2020-04-012021-03-310001688568dxc:RestructuringPlansBeforeFiscal2019Member2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:AcquiredLiabilitiesMember2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:AcquiredLiabilitiesMember2020-04-012021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:AcquiredLiabilitiesMember2021-03-310001688568us-gaap:FacilityClosingMemberdxc:AcquiredLiabilitiesMember2020-03-310001688568us-gaap:FacilityClosingMemberdxc:AcquiredLiabilitiesMember2020-04-012021-03-310001688568us-gaap:FacilityClosingMemberdxc:AcquiredLiabilitiesMember2021-03-310001688568dxc:AcquiredLiabilitiesMember2020-03-310001688568dxc:AcquiredLiabilitiesMember2020-04-012021-03-310001688568dxc:AcquiredLiabilitiesMember2021-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2020PlanMember2019-04-012020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568us-gaap:FacilityClosingMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2020PlanMember2019-04-012020-03-310001688568dxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2020PlanMember2019-03-310001688568dxc:RestructuringPlanFiscal2020PlanMember2019-04-012020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2019PlanMember2019-04-012020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568us-gaap:FacilityClosingMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2019PlanMember2019-04-012020-03-310001688568dxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2019PlanMember2019-03-310001688568dxc:RestructuringPlanFiscal2019PlanMember2019-04-012020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2018PlanMember2019-04-012020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlanFiscal2018PlanMember2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568us-gaap:FacilityClosingMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2018PlanMember2019-04-012020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlanFiscal2018PlanMember2020-03-310001688568dxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlanFiscal2018PlanMember2019-03-310001688568dxc:RestructuringPlanFiscal2018PlanMember2019-04-012020-03-310001688568dxc:RestructuringPlanFiscal2018PlanMember2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568us-gaap:EmployeeSeveranceMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-04-012020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:RestructuringPlansBeforeFiscal2018Member2020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568us-gaap:FacilityClosingMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-04-012020-03-310001688568us-gaap:FacilityClosingMemberdxc:RestructuringPlansBeforeFiscal2018Member2020-03-310001688568dxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:RestructuringPlansBeforeFiscal2018Member2019-03-310001688568dxc:RestructuringPlansBeforeFiscal2018Member2019-04-012020-03-310001688568dxc:RestructuringPlansBeforeFiscal2018Member2020-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:AcquiredLiabilitiesMember2019-03-310001688568us-gaap:EmployeeSeveranceMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:AcquiredLiabilitiesMember2019-03-310001688568us-gaap:EmployeeSeveranceMemberdxc:AcquiredLiabilitiesMember2019-04-012020-03-310001688568us-gaap:FacilityClosingMemberdxc:AcquiredLiabilitiesMember2019-03-310001688568us-gaap:FacilityClosingMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:AcquiredLiabilitiesMember2019-03-310001688568us-gaap:FacilityClosingMemberdxc:AcquiredLiabilitiesMember2019-04-012020-03-310001688568dxc:AcquiredLiabilitiesMember2019-03-310001688568srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberdxc:AcquiredLiabilitiesMember2019-03-310001688568dxc:AcquiredLiabilitiesMember2019-04-012020-03-310001688568dxc:SuretyBondsPerformanceGuaranteeMember2021-03-310001688568dxc:LettersOfCreditPerformanceGuaranteeMember2021-03-310001688568us-gaap:FinancialStandbyLetterOfCreditMember2021-03-31dxc:administrator0001688568dxc:StrauchFairLaborStandardsActCollectiveActionMember2014-03-292015-04-03dxc:individual0001688568dxc:StrauchFairLaborStandardsActCollectiveActionMember2020-04-012021-03-310001688568dxc:StrauchFairLaborStandardsActCollectiveActionMember2019-08-062019-08-060001688568dxc:StrauchFairLaborStandardsActCollectiveActionMember2019-09-012019-09-300001688568dxc:StrauchFairLaborStandardsActCollectiveActionMember2020-07-012020-07-31dxc:employee0001688568dxc:CivilComplaintAgainstEricPulierMemberus-gaap:SettledLitigationMember2015-05-122015-05-120001688568us-gaap:PendingLitigationMemberdxc:KemperCorporateServicesInc.v.ComputerSciencesCorporationMember2015-10-012015-10-310001688568us-gaap:SettledLitigationMemberdxc:KemperCorporateServicesInc.v.ComputerSciencesCorporationMember2017-10-012017-10-310001688568dxc:KemperCorporateServicesInc.v.ComputerSciencesCorporationMember2020-02-212020-02-210001688568dxc:KemperCorporateServicesInc.v.ComputerSciencesCorporationMember2020-02-222021-03-31dxc:plaintiff0001688568us-gaap:PendingLitigationMemberdxc:Forsythetal.v.HPInc.andHewlettPackardEnterpriseMember2018-10-012018-10-310001688568dxc:Forsythetal.v.HPInc.andHewlettPackardEnterpriseMemberus-gaap:SettledLitigationMemberdxc:EmployeesofFormerBusinessUnitsofHPEMember2018-10-012018-10-310001688568us-gaap:PendingLitigationMemberdxc:Forsythetal.v.HPInc.andHewlettPackardEnterpriseMember2019-06-012019-06-300001688568dxc:Forsythetal.v.HPInc.andHewlettPackardEnterpriseMemberus-gaap:SettledLitigationMember2019-12-012019-12-310001688568dxc:Forsythetal.v.HPInc.andHewlettPackardEnterpriseMemberus-gaap:SettledLitigationMemberdxc:EmployeesofFormerBusinessUnitsofHPEMember2019-12-012019-12-31dxc:officer0001688568dxc:InreDXCTechnologyCompanySecuritiesLitigationMember2018-12-27dxc:lawsuit0001688568dxc:InreDXCTechnologyCompanySecuritiesLitigationMember2019-03-012019-03-310001688568dxc:InreDXCTechnologyCompanySecuritiesLitigationMembersrt:OfficerMember2019-03-012019-03-31dxc:joint_venture00016885682017-02-020001688568dxc:PerspectarelatedDisputesSeparationandDistributionAgreementMember2019-10-012019-10-310001688568dxc:PerspectarelatedDisputesSeparationandDistributionAgreementMember2019-12-012019-12-310001688568dxc:PerspectarelatedDisputesSeparationandDistributionAgreementMember2021-01-012021-03-310001688568dxc:PerspectarelatedDisputesSeparationandDistributionAgreementMember2020-04-012021-03-310001688568dxc:PerspectarelatedDisputesITServicesAgreementMember2019-06-012019-06-300001688568dxc:PerspectarelatedDisputesITServicesAgreementMember2020-08-012020-08-310001688568dxc:PerspectarelatedDisputesITServicesAgreementMember2020-10-012020-10-310001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2021-04-010001688568dxc:SeniorNotesDue2023Memberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2021-04-010001688568dxc:SeniorNotesDue2023Memberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2021-04-012021-04-010001688568dxc:SeniorNotesDue2023TwoMemberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2021-04-012021-04-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| (Mark One) |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to __________________

Commission File No.: 1-4850

| | | | |

| | DXC TECHNOLOGY COMPANY |

| | (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | |

Nevada | | 61-1800317 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | |

1775 Tysons Boulevard | | |

Tysons, Virginia | | 22102 |

| (Address of principal executive offices) | | (zip code) |

| | | | | |

Registrant's telephone number, including area code: (703) 245-9675

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | DXC | The New York Stock Exchange |

2.750% Senior Notes Due 2025 | DXC 25 | The New York Stock Exchange |

1.750% Senior Notes Due 2026 | DXC 26 | The New York Stock Exchange |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | x | | | Accelerated Filer | o | |

| | | | | | |

| Non-accelerated Filer | o | | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant on September 30, 2020, the last business day of the registrant's most recently completed second fiscal quarter, based upon the closing price of a share of the registrant’s common stock on that date, was $4,531,553,903.

254,806,966 shares of common stock, par value $0.01 per share, were outstanding as of May 24, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement relating to its 2021 Annual Meeting of Stockholders (the "2021 Proxy Statement"), which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days after the registrant's fiscal year end of March 31, 2021, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

TABLE OF CONTENTS

| | | | | | | | | | | |

| Item | | | Page |

| | | |

| | | |

| 1. | | | |

| 1A. | | | |

| 1B. | | | |

| 2. | | | |

| 3. | | | |

| 4. | | | |

| | | |

| | | |

| | | |

| 5. | | | |

| 6. | | | |

| 7. | | | |

| 7A. | | | |

| 8. | | | |

| 9. | | | |

| 9A. | | | |

| 9B. | | | |

| | | |

| | | |

| | | |

| 10. | | | |

| 11. | | | |

| 12. | | | |

| 13. | | | |

| 14. | | | |

| | | |

| | PART IV | |

| | | |

| 15. | | | |

| 16. | | | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

All statements and assumptions contained in this Annual Report on Form 10-K and in the documents incorporated by reference that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Forward-looking statements often include words such as “anticipates,” “believes,” “estimates,” “expects,” “forecast,” “goal,” “intends,” “objective,” “plans,” “projects,” “strategy,” “target,” and “will” and words and terms of similar substance in discussions of future operating or financial performance. These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved.

Forward-looking statements include, among other things, statements with respect to our financial condition, results of operations, cash flows, business strategies, operating efficiencies or synergies, divestitures, competitive position, growth opportunities, share repurchases, dividend payments, plans and objectives of management and other matters. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be amplified by, the coronavirus disease 2019 (“COVID-19”) crisis and the impact of varying private and governmental responses that affect our customers, employees, vendors and the economies and communities where they operate.

Important factors that could cause actual results to differ materially from those described in forward-looking statements include, but are not limited to:

•the uncertainty of the magnitude, duration, geographic reach of the COVID-19 crisis, its impact on the global economy, and the impact of current and potential travel restrictions, stay-at-home orders, and economic restrictions implemented to address the crisis;

•the effects of macroeconomic and geopolitical trends and events;

•our inability to succeed in our strategic objectives;

•our inability to succeed in our strategic transactions;

•the risk of liability or damage to our reputation resulting from security incidents, including breaches, cyber-attacks insider threats, disclosure of sensitive data or failure to comply with data protection laws and regulations in a rapidly evolving regulatory environment; in each case, whether deliberate or accidental.

•our inability to develop and expand our service offerings to address emerging business demands and technological trends, including our inability to sell differentiated services up the Enterprise Technology Stack;

•the risks associated with our international operations;

•our credit rating and ability to manage working capital, refinance and raise additional capital for future needs;

•the competitive pressures faced by our business;

•our inability to accurately estimate the cost of services, and the completion timeline, of contracts;

•execution risks by us and our suppliers, customers, and partners;

•our inability to retain and hire key personnel and maintain relationships with key partners;

•our inability to comply with governmental regulations or the adoption of new laws or regulations;

•our inability to achieve the expected benefits of our restructuring plans;

•inadvertent infringement of third-party intellectual property rights or our inability to protect our own intellectual property assets;

•our inability to remediate any material weakness and maintain effective internal control over financial reporting;

•potential losses due to asset impairment charges;

•our inability to pay dividends or repurchase shares of our common stock;

•pending investigations, claims and disputes and any adverse impact on our profitability and liquidity;

•disruptions in the credit markets, including disruptions that reduce our customers' access to credit and increase the costs to our customers of obtaining credit;

•our failure to bid on projects effectively;

•financial difficulties of our customers and our inability to collect receivables;

•our inability to maintain and grow our customer relationships over time and to comply with customer contracts or government contracting regulations or requirements;

•changes in tax laws and any adverse impact on our effective tax rate;

•risks following the merger of Computer Sciences Corporation ("CSC") and Enterprise Services business of Hewlett Packard Enterprise Company's ("HPES") businesses, including anticipated tax treatment, unforeseen liabilities and future capital expenditures;

•risks following the spin-off of our former U.S. Public Sector business and its related mergers with Vencore Holding Corp. and KeyPoint Government Solutions to form Perspecta Inc. (the "USPS"); and

•the other factors described under Item 1A. “Risk Factors.”

No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements, which speak only as of the date they are made. Any forward-looking statement made by us in this Annual Report on Form 10-K speaks only as of the date on which this Annual Report on Form 10-K was first filed. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this report or to reflect the occurrence of unanticipated events, except as required by law.

Throughout this report, we refer to DXC Technology Company, together with its consolidated subsidiaries, as “we,” “us,” “our,” “DXC,” or the “Company.” In order to make this report easier to read, we also refer throughout to (i) our Consolidated Financial Statements as our “financial statements,” (ii) our Consolidated Statements of Operations as our “statements of operations,” (iii) our Consolidated Statement of Comprehensive (Loss) Income as the "statements of comprehensive income,"(iv) our Consolidated Balance Sheets as our “balance sheets” and (v) our Consolidated Statements of Cash Flows as our “statements of cash flows.” In addition, references throughout to numbered “Notes” refer to the numbered Notes to our Financial Statements that we include in the Financial Statements section of this report.

PART I

ITEM 1. BUSINESS

Overview

DXC, a Nevada corporation, is a global IT services market leader. Our more than 130,000 people in 70-plus countries help our global customers, over half of today’s fortune 500 companies, run mission-critical systems with the latest technology innovations across our Enterprise Technology Stack.

Our customers trust DXC to innovate and deliver transformative solutions for new levels of performance, profitability, competitiveness, and customer experience.

DXC was formed on April 1, 2017 by the merger of CSC and HPES (the "HPES Merger").

Transformation Journey

The DXC “Transformation Journey” strategy focuses on building stronger relationships with customers, its people, and unlocking value across the Enterprise Technology Stack.

Key transformation journey priorities include:

•Inspire and Take Care of our People – Ensuring the health and safety of our people is a top priority, especially in the current environment

Continuing to bring in new technology, account and delivery talent across the world, and making investments that recognize and reward our people

•Focus on Customers – Strengthening our customer relationships and ensuring we are proactively delivering for customers

•Optimize Cost – Optimizing value to better serve our customers by eliminating confusion and complexity

•Seize the Market – Seizing the market opportunity by cross-selling and expanding what we do with our customers across the Enterprise Technology Stack

•Unlock Value to Strengthen Balance Sheet – Unlocking value by pursuing strategic alternatives, rationalizing our portfolio, and strengthening our balance sheet through our commitment to running a long-term sustainable business

The Company will continue to focus on execution of its strategy in the next fiscal year, with a continued focus on our people, revenue stabilization, cost optimization and winning in the market. While the Company has already disclosed that it completed the sale of two businesses that comprised the Strategic Alternatives plan, the Company will continue its portfolio shaping efforts and divest assets that the Company does not believe are well integrated with its enterprise technology stack and its strategic direction so it can focus on its strategy.

Important Acquisitions and Divestitures

During fiscal 2021, DXC completed the sale of its U.S. State and Local Health and Human Services business ("HHS" or the "HHS Business") to Veritas Capital Fund Management, L.L.C. ("Veritas Capital") to form Gainwell Technologies. The sale was accomplished by the cash purchase of all equity interests and assets attributable to the HHS Business together with future services to be provided by the Company for a total enterprise value of $5.0 billion, subject to net working capital adjustments and assumed liabilities.

On July 17, 2020, DXC entered into a purchase agreement with Dedalus Holding S.p.A. ("Dedalus"), a company organized under the laws of Italy, pursuant to which Dedalus will acquire DXC’s healthcare provider software business (the "HPS" or the "HPS Business"). The sale was completed on April 1, 2021, for a purchase price of €462 million (approximately $543 million) (the "HPS Sale").

During fiscal 2020, DXC completed the acquisition of Luxoft Holding, Inc., a global scale digital service provider whose offerings encompass strategic consulting, custom software development, and digital solution engineering services. We also completed other acquisitions during fiscal 2020 to complement our offerings and to provide opportunities for future growth.

See Note 2 - "Acquisitions" and Note 3 - "Divestitures" for further information on acquisitions and divestitures.

Segments and Services

Our reportable segments are Global Business Services ("GBS") and Global Infrastructure Services ("GIS").

Global Business Services

GBS provides innovative technology solutions that help our customers address key business challenges and accelerate transformations tailored to each customer’s industry and specific objectives. GBS offerings include:

•Analytics and Engineering. Our portfolio of analytics services and extensive partner ecosystem help customers gain rapid insights, automate operations, and accelerate their transformation journeys. We provide software engineering and solutions that enable businesses to run and manage their mission-critical functions, transform their operations, and develop new ways of doing business.

•Applications. We use advanced technologies and methods to accelerate the creation, modernization, delivery and maintenance of high-quality, secure applications allowing customers to innovate faster while reducing risk, time to market, and total cost of ownership, across industries. Our vertical-specific IP includes solutions for insurance, banking and capital markets, and automotive among others.

•Business process services. Include integration and optimization of front and back office processes, and agile process automation. This helps companies to reduce cost and minimize business disruption, human error, and operational risk while improving customer experiences.

Global Infrastructure Services

GIS provides a portfolio of technology offerings that deliver predictable outcomes and measurable results while reducing business risk and operational costs for customers. GIS offerings include:

•Cloud and Security. We help customers to rapidly modernize by adapting legacy apps to cloud, migrate the right workloads, and securely manage their multi-cloud environments. Our security solutions help predict attacks, proactively respond to threats, ensure compliance and protect data, applications and infrastructure.

•IT Outsourcing ("ITO"). Our ITO services support infrastructure, applications, and workplace IT operations, including hardware, software, physical/virtual end-user devices, collaboration tools, and IT support services. We help customers securely optimize operations to ensure continuity of their systems and respond to new business and workplace demands while achieving cost takeout, all with limited resources, expertise, and budget.

•Modern Workplace. Services to fit our customer’s employee, business and IT needs from intelligent collaboration, modern device management, digital support services, Internet of Things ("IoT") and mobility services, providing a consumer-like, digital experience.

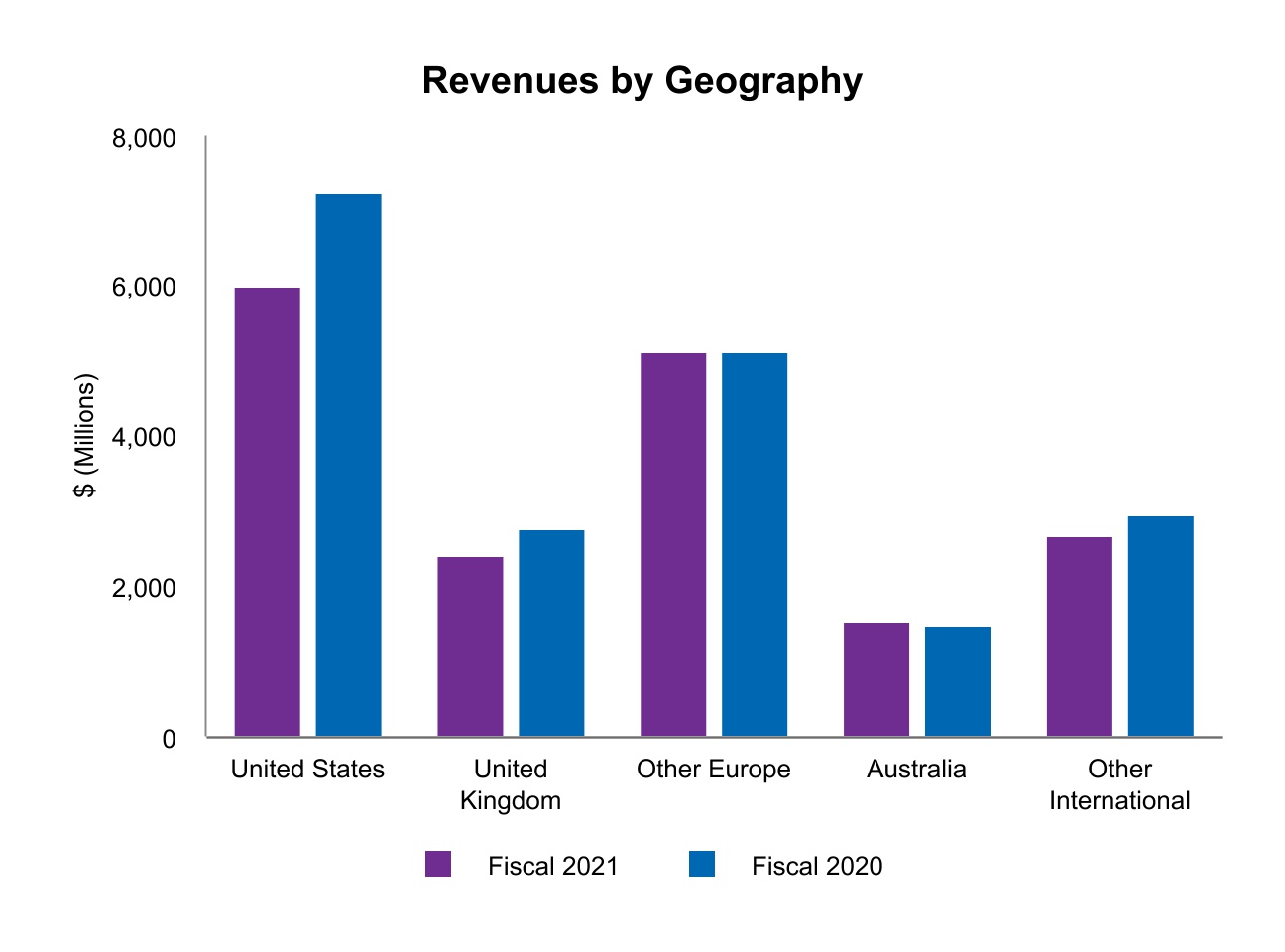

See Note 20 - "Segment and Geographic Information" for additional information related to our reportable segments, including the disclosure of segment revenues, segment profit, and financial information by geographic area.

Sales and Marketing

We market and sell our services to customers through our direct sales force, operating out of locations around the world. Our customers include commercial businesses of many sizes and in many industries and public sector enterprises. No individual customer exceeded 10% of our consolidated revenues for fiscal 2021, fiscal 2020, or fiscal 2019.

Seasonality