As filed with the Securities and Exchange Commission on September 28, 2017

Registration No. 333-216694

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IMPERIAL GARDEN & RESORT, INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| 7999 (amusement and recreation | ||

| British Virgin Islands | services) | Not Applicable |

| State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| Incorporation or organization | Classification Code Number) | Identification No.) |

106 Zhouzi Street, 4th Floor, 4E

Neihu District, Taipei, Taiwan (Republic of China) 11493

Telephone: 886-2-2658-2927

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Maples Corporate Services (BVI) Limited

Kingston Chambers, PO Box 173

Road Town, Tortola, British Virgin Islands

Tel: 1-284-852-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jay Kaplowitz, Esq. | |

| Cheryll Calaguio, Esq. | |

| Huan Lou, Esq. | Joan Wu, Esq. |

| Sichenzia Ross Ference Kesner LLP | Hunter Taubman Fischer & Li LLC |

| 1185 Avenue of the Americas, 37th Floor | 1450 Broadway, 26th Floor |

| New York, NY 10036 | New York, NY 10018 |

| (212) 930-9700 – telephone | (212) 530-2208 – telephone |

| (212) 930-9725 – facsimile | (212) 202-6380 – facsimile |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company x

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. x

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of each class of | Amount | Proposed maximum | Proposed maximum | Amount of | ||||||||||||

| securities to be registered | to be registered | offering price per unit | aggregate offering price (2) | registration fee (3) | ||||||||||||

| Ordinary shares, par value US $0.01 per share(1) | 10,000,000 | $ | 5 | $ | 50,000,000 | $ | 5,795 | |||||||||

| Ordinary shares owned by selling stockholders(1) | 6,387,430 | 5 | 31,937,150 | 3,701.52 | ||||||||||||

| Selling Agent’s warrants(4) | — | — | — | — | ||||||||||||

| Ordinary shares, underlying Selling Agent’s warrants(5) | $ | 3,750,000 | $ | 434.63 | ||||||||||||

| Total | $ | 85,687,150 | $ | 9,931.15 | ||||||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, the securities being registered hereunder include such indeterminate number of additional ordinary shares as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (2) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

| (3) | We have paid an aggregate of $10,220.89 of the registration fee, which is more than the estimated registration fee due to the Securities and Exchange Commission. Such discrepancy was caused by the reduced amount of Selling Agent’s warrants. |

| (4) | In accordance with Rule 457(g) under the Securities Act, because the ordinary shares underlying the Selling Agent’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. | |

| (5) | The warrants issued to the Selling Agent are exercisable at a per share exercise price equal to 125% of the public offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Selling Agent’s warrants is $3,750,000 (which equals to 125% of $3,000,000 that is the result of 6% of the maximum amount offered by us). |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the United States Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated , 2017

PRELIMINARY PROSPECTUS

Minimum Offering: 3,000,000 Shares of Ordinary Shares

Maximum Offering: 10,000,000 Shares of Ordinary Shares

Selling Shareholders: 6,387,430 Shares of Ordinary Shares

IMPERIAL GARDEN & RESORT, INC.

This is an initial public offering of the ordinary shares of Imperial Garden & Resort, Inc. We are offering a minimum amount of 3,000,000 and a maximum amount of 10,000,000 ordinary shares, par value $0.01, and the selling shareholders named in this prospectus are offering an aggregate of 6,387,430 ordinary shares. Prior to this offering, there has been no public market for our ordinary shares. We expect the initial public offering price will be $5 per share. We will not receive any proceeds from the ordinary shares sold by the selling shareholders.

We have reserved the symbol “MNSI” for purposes of listing the ordinary shares on the Nasdaq Stock Market and applied to list the ordinary shares on that exchange. If the application is approved, trading of the ordinary shares on the Nasdaq Stock Market is expected to begin within five days after the date of the initial issuance of the ordinary shares pursuant to this prospectus. However, the Nasdaq Stock Market is still reviewing our application and there is no assurance that our ordinary shares will be listed on such exchange in a timely manner or at all.

Investing in our ordinary shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 13 to read about factors you should consider before buying the ordinary shares.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 8 of this prospectus for more information.

Offering from Imperial Garden & Resort, Inc.

Number

of by Us | Initial Public Offering Price per Share | Total Initial Public Offering Price | Underwriting Discounts and Commissions | Proceeds to Our Company Before Expenses | ||||||||||||||||

| Minimum | 3,000,000 | $ | 5 | $ | 15,000,000 | $ | 1,050,000 | $ | 13,950,000 | |||||||||||

| Maximum | 10,000,000 | $ | 5 | $ | 50,000,000 | $ | 3,500,000 | $ | 46,500,000 | |||||||||||

Offering from the Selling Shareholders

Number

of by the Selling Shareholders | Initial Public Offering Price per Share | Total Initial Public Offering Price | Underwriting Discounts and Commissions | Proceeds to the Selling Shareholders Before Expenses | ||||||||||||||

| 6,387,430 | $ | 5 | $ | 31,937,150 | $ | 0 | $ | 31,937,150 | ||||||||||

The Selling Agent is selling the ordinary shares in this offering on a best efforts basis. The Selling Agent is not required to sell any specific number or dollar amount of ordinary shares but will use its best efforts to sell the ordinary shares offered. One of the conditions to our obligation to sell any securities through the Selling Agent is that, upon the closing of the offering, the ordinary shares would qualify for listing on the NASDAQ market. The Selling Agent is not engaged to selling any ordinary shares offered by the selling shareholders.

We do not intend to close this offering unless we sell at least a minimum number of the ordinary shares, at the price per share set forth above, to result in sufficient proceeds to list the ordinary shares on NASDAQ. The offering shall terminate on the earlier of (i) any time after the minimum offering amount of the ordinary shares is raised, or (ii) one hundred and twenty (120) days from the effective date of this prospectus, or the expiration date. If we can successfully raise the minimum offering amount within the offering period, the proceeds from the offering will be released to us after deducting certain escrow fees. The proceeds from the sale of the ordinary shares in this offering will be payable to “[ ]” and will be deposited in a separate (limited to funds received on behalf of us) non-interest bearing trust bank account until the minimum offering amount is raised. We expect that delivery of the ordinary shares will be made to investors through the book-entry facilities of the Depository Trust Company. We are selling the ordinary shares offered hereby on an “all or none” basis up to the minimum offering amount. Therefore if we do not raise the aggregate offering amount of $15,000,000 within one hundred and twenty (120) days at a minimum price of $5 per share, we will not conduct a closing of this offering and will promptly refund investors with all amounts previously deposited by them in escrow, without interest or deduction.

Neither the United States Securities and Exchange Commission nor any state securities commission or any other regulatory body has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Selling Agent expects to deliver the ordinary shares against payments in U.S. dollars to purchasers on or about____________, 2017.

The date of this prospectus is _____, 2017

| ii |

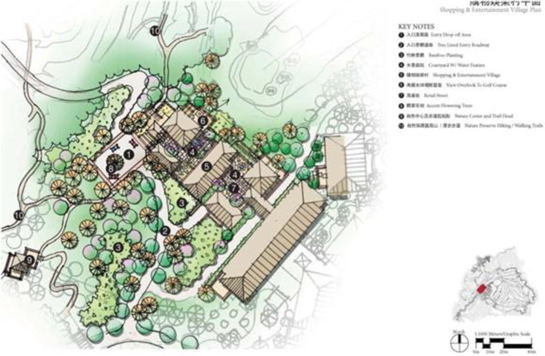

Bird’s Eye View of The Royal Country Club Resort & Spa when Phase II is completed

Phase II: The Royal Country Club Resort & Spa, Shopping & Entertainment Village and Clubhouse

| iii |

TABLE OF CONTENTS

This prospectus contains estimates and information concerning our industry, including market positions, market sizes, and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a number of assumptions and limitations and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risks due to a variety of factors, including those described in the “Risk Factors” section. These and other factors could cause results to differ materially from those expressed in these publications and reports.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares.

Until__________, 2017 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as Selling Agents and with respect to their unsold allotments or subscriptions.

| iv |

PROSPECTUS CONVENTIONS

Except where the context otherwise requires and for purposes of this prospectus only:

| • | “ordinary shares” refer to our ordinary shares, par value US$0.01 per share; |

| • | “APR” or “annual percentage rate” refers to the annual rate that is charged to borrowers, including a fixed interest rate and a transaction fee rate, expressed as a single percentage number that represents the actual yearly cost of borrowing over the life of a loan; |

| • | the terms “we,” “us,” “our,” “the Company,” “our Company” or “Imperial Garden” refers to Imperial Garden & Resort, Inc., a British Virgin Islands corporation, and all of the Subsidiaries as defined herein unless the context specifies; |

| • | the “Board” or “Board of Directors” refers to the board of directors of the Company; |

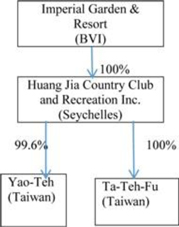

| • | “Subsidiary” or “Subsidiaries,” refer to “HUANG JIA Country CLUB and Recreation Inc.,” “Yao-Teh International Recreation Co., Ltd.” and “Ta-Teh-Fu Co., Ltd.”; |

| • | “China”, “mainland China” and “P.R.C.” refer to the People’s Republic of China, excluding Taiwan, Hong Kong or Macau for purposes of this prospectus; |

| • | “BVI” refers to British Virgin Islands; |

| • | “R.O.C.” or “Taiwan” refers to Taiwan, the Republic of China; |

| • | all references to “NTD” and “New Taiwan Dollars” are to the legal currency of R.O.C.; and |

| • | all references to “U.S. dollars”, “dollars”, and “$” are to the legal currency of the United States. |

This prospectus specifies certain NTD amounts and in parenthesis the approximate U.S. dollar amounts at the exchange rate on the date of this prospectus. The conversion rates regarding NTD and U.S. dollars are subject to change and, therefore, we can provide no assurance that U.S. dollar amounts specified in this prospectus will not change.

For clarification, this prospectus follows English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chairman of the Board of Directors is “Fun-Ming Lo,” even though, in Chinese, his name would be presented as “Lo Fun-Ming.”

We have relied on statistics provided by a variety of publicly-available sources regarding Taiwan’s and China’s expectations of growth, Taiwan’s and China’s interest in the travel and tourism industry, which we have not, directly or indirectly, sponsored or participated in the publication of any of such materials.

| 1 |

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the ordinary shares discussed under “Risk Factors,” before deciding whether to buy the ordinary shares. This prospectus contains information from a report commissioned by us dated June, 2015, as updated from time to time, by the Cuningham Group (“Cuningham”), an independent architectural design firm.

Our Mission

We seek to provide premium services to customers in the hospitality and entertainment businesses. Building on our current golf operation, we intend to expand our services to include leisure vacations, business travel, retail and dining segments. Our goal is to operate one of the largest resorts in Taiwan.

Our Business

We were incorporated in the British Virgin Islands on September 23, 2016. We are a development stage company, and we currently manage and operate a golf course known as the Royal Country Club, located in Taiwan on a parcel of land of which Yao-Teh International Recreation Co., Ltd., (“Yao-Teh”) and Ta-Teh-Fu Co., Ltd. (“Ta-Teh-Fu”), two of our Subsidiaries, are the current record owners. Occupying approximately 197.7 acres of land, the Royal Country Club features a renovated18-hole golf course designed by Robert T. Jones, a world-class golf architect, a snack bar providing indigenous Hakka food, various amenities, such as locker and shower rooms, and a retail store that offers golf equipment and accessories. A majority of our current income is derived from the management and operations of the Royal Country Club.

We aim to construct, develop and operate the “Royal Country Club Spa & Resort,” a premier resort, which we intend to complete in two phases, Phase I and Phase II. Phase I will include construction of a premium hotel that will feature a full service hot spring spa and outdoor swimming pools, as well as a courtyard garden and a river view that will house water falls, restaurants and bars. Further, we envision, although we do not guarantee, that during Phase I, we will also complete the construction and development of a natural hot spring spa, which will be connected to the main hotel area by a bridge. We intend, although cannot guarantee, to finish Phase I by the end of 2018 and expect to be fully operational in the third quarter of 2020. We have applied for the necessary licenses to start the planned construction. However, we anticipate that it may take up to eighteen (18) months from February 2016 to obtain such licenses. According to our current business plan, we anticipate to spend approximately $50 million to complete Phase I and approximately $150 million for the completion of Phase II.

During Phase II, we anticipate constructing and developing a second hotel, three upscale restaurants, pools and water slides, a Japanese garden, a multi-purpose center for weddings and conferences and a shopping and entertainment village and other venues or facilities for recreational purposes. The garden will be designed and arranged to recreate a scene reflecting Japan in the 17th century. We believe that this Japanese garden will be the largest garden in the world, occupying approximately 281.7 acres of land.

On September 11, 2015, the Company and InterContinental Hotels Group (Shanghai) Ltd. (“IHG”) entered into a binding letter of intent, pursuant to which during the pre-commencement period, IHG has agreed to provide technical services to us, including a review of the hotel building plan for Phase I and Phase II in accordance with IHG’s Holiday Inn Standards. We have paid the first installment of the pre-commencement management fee and IHG has been providing assistance and guidance on our hotel plans. After the completion of land reclassification, we anticipate entering into a formal management contract with IHG, under which IHG will provide hotel management services in exchange for a set of fees, including incentive management fees, business planning application cost, revenue & channel management for hire service fee, licensing fee and system fund contributions.

| 2 |

We expect that upon the completion of the two phases described above, we will begin to generate higher revenues.

The mockup of the natural hot spring spa that is planned to be built in Phase I

Upon completion of the first two phases discussed above, we plan to:

| 3 |

| · | Expand clientele for the Royal Country Club Spa & Resort by undergoing a marketing effort for our additional amenities. We intend to focus on marketing to people of different age groups and gender. |

| · | Provide more services and expand sources of income. We intend to increase sources of revenue from (1) hotel rooms, conference centers and wedding venues, (2) charging nature park admission fees, (3) charging admission fees for the floral garden, and (4) providing dining service at the restaurants and bars. |

| · | Form Strategic Partnerships. In addition to the collaboration with IHG, we anticipate developing strategic partnerships on a selective basis. For example, we have had discussions with several established entertainment companies that have extensive experience in our target markets and have indicated interest in jointly developing the resort. |

| · | Leverage Relationships. We are the first to develop and operate a golf resort featuring hot spring spas and natural habitation in Taiwan. We will continue creating unique or special features to attract customers and increase our market share in the hospitality industry. In order to do so, we intend to continue to leverage our development expertise, existing platform and business model and our access to international strategic partners with the end in view of developing a resort that is superior to others located in our geographical area. |

| · | Continue innovation. We intend to leverage our in-house expertise in conjunction with the knowledge and experience of our hotel management partners and consultants to develop innovations in resort entertainment activities and amenities. |

| 4 |

Japanese architecture and landscape designs intended to be used for Phase I and Phase II

Summary of Financial Operations

We had accumulated deficits of $74,087,309 and $71,036,558 as of December 31, 2016 and 2015, respectively. The net losses attributable to common stockholders of $3,291,429 and $3,763,596 for the years ended December 31, 2016 and 2015, respectively. As of December 31, 2016, we had $970,365 in current assets and $80,649,334 in current liabilities. Accordingly, as of December 31, 2016 our negative working capital position was $79,678,969.

As of the date of this prospectus, we have restructured a significant portion of our current and long-term liabilities through entering into agreements with various creditors which are described below. As a result of such restructuring and provided that we raise the minimum amount of $15,000,000 in this offering, our current assets, as adjusted, would be approximately $14,599,882 and our current liabilities would, as adjusted, be $13,604,434 as of December 31, 2016 which is anticipated to result in a positive working capital position of approximately $995,448.

| 5 |

As of December 31, 2016, we had line of credit in the amount of $1,803,086, long-term bank loans in the aggregate amount of $9,624,411 (inclusive of interest due but unpaid), and long-term notes payable amounting to $10,365,432 owed to Mr. Chen-Yu Lian. On July 25, 2017, Mr. Lian and Yao-Teh executed a settlement agreement (the “Settlement Agreement”) whereby Mr. Chen-Yu Lian agreed to cancel approximately $21,000,000of interest accrued on the notes payable (the interest portion of which was recorded as part of the accrued expenses and other current liabilities portion of our audited financial statements for the 2016 fiscal year). In addition, pursuant to the Settlement Agreement, the principal amount of the notes payable was reduced to NTD 150,000,000 (approximately $4.6 million) from the original amount of $10,365,432. Mr. Chen-Yu Lian further agreed not to demand the repayment of the principal portion in the near future.

In August 2017, the Taiwan Cooperative Bank agreed to restructure our outstanding loan with them concurrent with listing on the Nasdaq stock market. It is anticipated that the loan owed to Taiwan Cooperative Bank would be reduced from approximately $9.6 million to approximately $5.2 million, including the principal of NTD 89,313,950 (approximately $2.9 million) and interest of NTD 70,000,000 (approximately $2.3 million). The new loan will be reclassified as current on the balance sheet and the accrued interest would be fixed in the amount of 70,000,000NTD (equivalent to $2,305,893) without any additional interest to accrue on the principal or interest portion of the new loan.

The principal portion of the new loan will be repaid over five years, payable on a monthly basis, in an amount of approximately $49,400 per month (commencing from March 1, 2018). After the five-year period, Yao-Teh will pay back the interest portion of the loan over another five-year period on a monthly basis, in an amount of approximately $38,500 per month.

As of December 31, 2016, we had liabilities owed to related parties in the aggregate amount of $49,595,151, including $46,044,534 owed to a shareholder of the Company. On August 1, 2017, Mr. Fun-Ming Lo entered into a conversion agreement (the “Conversion Agreement”) with the Company and Yao-Teh, one of the Company’s subsidiaries, to convert the debt owed by the Company and Yao-Teh to Mr. Lo in the amount of $46,044,534 into ordinary shares of Company, at a conversion price of $4.5 per share, or an aggregate of 10,232,118 ordinary shares. As such, we eliminated all the debt owed to shareholders through issuance of additional equity of the Company.

Based on the cash flow statement for the year ended December 31, 2016, we estimate that we are using our funds at a rate of approximately $55,000 per month. We anticipate that at such burn rate, our current capital would likely to last half of a month without further funding. Mr. Fun-Ming Lo, the Chairman of the Board of Directors, has expressed his willingness to provide a line of credit to fund the operations of the Company in a maximum amount of $3,000,000 in order to reduce the shortage of working capital for a term commencing on the date of this Prospectus to December 31, 2017. On May 16, 2017, Mr. Fun-Ming Lo and us entered into a line of credit agreement (the “Line of Credit Agreement”), which documents the key terms of this loan arrangement and is attached herein as Exhibit 10.17. Pursuant to the Line of Credit Agreement, all loan amounts outstanding under such Agreement shall be paid with accrued but unpaid interest on or before January 1, 2020 (the “Maturity Date”) and the Board shall approve by resolutions each request of credit under such Agreement. The loans made under this Line of Credit Agreement shall be unsecured and bear an interest rate of 2.5% per annum of the outstanding balance from time to time, payable on or before the Maturity Date.

On June 9, 2017, Yao-Teh entered into a line of credit agreement (the “Mengxin Line of Credit Agreement”) with Mengxin Industrial Co., Ltd. (“Mengxin”), a Taiwanese company incorporated in 1996. Pursuant to the Mengxin Line of Credit Agreement, Mengxin agreed to provide Yao-Teh, upon its request, loans in an aggregate amount of up to NTD 1.2 billion (approximately $39.75 million). The terms of the Line of Credit shall be for a period of three years commencing on June 9, 2017. The loans shall bear interest at a rate of 4.5% per annum and shall be accrued on the outstanding balance of the loan from the occurrence date of each loan until the fifth year anniversary of each such loan. As of the date of this prospectus, Yao Teh obtained from Mengxin a loan of NTD 3.5 million (approximately $114,910) which will be used for the Company’s general working capital purposes.

Our independent auditor has issued a going concern opinion, which means there is substantial doubt that we can continue as an ongoing business for the next twelve (12) months. The financial statements included in the Registration Statement of which this prospectus is a part do not include any adjustments that might result from the uncertainty about our ability to continue in business.

Our Strategy

We plan to shift our business emphasis from the existing golf-centered model to a tourism-focused model. We believe that upon the completion of Phase I, as described above, we will be able to attract a broader range of visitors to our resort. As a part of our marketing strategy, we anticipate designing campaigns and marketing materials that target both domestic and international visitors. If we are successful in developing and operating the Royal Country Club Spa & Resort, we intend to apply the same management and operations model to other chain resorts that we may build and operate in the future.

Competition

In the hospitality and recreation industry, we are facing and expect to continue facing extensive competition from competitors of a similar scale in the same or similar industries and sectors. We have to keep innovating and upgrading our products and services to maintain our existing clientele and attract new customers to the Royal Country Club and the planned Royal Country Club Spa & Resort. For instances, currently the snack bar at the Royal Country Club provides delicious Hakka food to our golf customers. When the contemplated Royal Country Club Spa & Resort opens, the customers will be able to enjoy the view of the largest garden in Taiwan while playing golf therein. Although our current and future services and products provided at the Royal Country Club and to be provided at the planned Royal Country Club Spa & Resort are and will be special as compared to the services at traditional golf courses and hotels, we may not have effective measures to prevent others imitating our services and products. We will be likely to lose customers to other competing golf venues and hotels if those competitors offer similar or more services and products at lower prices.

Competitive Strengths

Our Competitive Strengths in the Golf Business

We believe the Royal Country Club is one of the leading golf venues in Taiwan. Our strengths in this sector include:

| · | Established scenic golf course and country club. We have completed significant renovation of our 18-hole golf course, which was designed by a world renowned golf architect. The golf course offers a challenging golf experience and provides what we believe to be a scenic setting. |

| · | Brand effect. We believe that the name of Royal Country Club will add value to the Royal Country Club Spa & Resort. |

| · | Special experience of indigenous culture, Hakka. Miaoli is the county where a lot of Hakka people reside. Currently, visitors of the Royal Country Club have an opportunity to participate in Hakka activities, such as participating in Hakka holiday ceremonies, visiting architecture of Hakka styles and tasting Hakka dishes. In the future, guests of our contemplated hotels will be able to visit Hakka places of interest in one trip to Miaoli while staying at our hotels. |

| · | Experienced management team and committed and motivated staff. Our senior management team has an average of approximately 20 years of experience in construction, real estate development and golf management industries and significant expertise in operating complex and themed golf courses. In addition, we have a team of skilled and committed employees. |

| 6 |

Our Competitive Strengths in the Resort Business

Upon completion of the two construction phases, the entire resort will feature premium hotels and high-quality country club amenities, hot spring spas, scenic hiking trails and Japanese gardens, in addition to the golf course. In that respect, we believe that our competitive strengths include:

| · | Upon completion of Phase II, we will be the only and the largest golf club in a garden in Taiwan. |

| · | We have rare underground hot spring in a resort. |

| · | We have engaged with IHG as strategic partner, a renowned international hospitality management company with experience in Asian markets. We believe IHG’s rich experience in resort and hotel management will provide superior services to our consumers. |

| · | We will build the only leisure resort with natural habitation in Miaoli. |

| · | We have convenient access to Zhongshan high-way, high speed rail and other public transportation. |

| · | Favorable Trends. We believe the recent vacation trends favor our core value, “quality first”. Nowadays visitors, particularly visitors from mainland China, are paying more attention to the free-styled vacation over the traditional group tour designed by tour agencies. Additionally, tourists from mainland China tend to stay in one place to know more about it. We believe that these trends will continue and that we are well positioned to take advantage of them. |

| · | First mover advantage. We will be among one of few resorts that operate a golf course, natural hot spring spas, nature parks, country clubhouses, and retail facilities in Taiwan. With our management team’s substantial experience, we believe we are well positioned to capitalize on our first-mover advantage and enhance our brand recognition. |

| 7 |

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (or the “Securities Act”), for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| · | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| · | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| · | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and, as long as we continue to qualify as an emerging growth company, we may elect to take advantage of this and other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We are also a “smaller reporting company,” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until our public float exceeds $75 million on the last day of our second fiscal quarter in the preceding fiscal year.

| 8 |

THE OFFERING

| Ordinary shares being offered by us | A minimum of 3,000,000 ordinary shares on a “best-efforts/ all or none” basis up to a maximum of 10,000,000 ordinary shares on a “best efforts” basis at an anticipated offering price of $5 per share. If we do not raise the aggregate minimum offering amount of $15,000,000, we will not conduct a closing of this offering and will return to investors all amounts previously deposited by them in escrow, without interest or deduction. Prior to the closing of this offering, all funds delivered as payment for the securities offering hereby shall be held in escrow by a third party, independent escrow agent. | |

| Ordinary shares being offered by the selling shareholders | 6,387,430 ordinary shares | |

| Ordinary shares outstanding prior to this offering | 40,904,208 | |

| Ordinary shares outstanding immediately after this offering | 43,904,208 ordinary shares at minimum and 50,904,208 ordinary shares at maximum. | |

| To better understand the ordinary shares, you should carefully read the “Description of Capital Stock” section of this prospectus. | ||

| Selling Agent Warrants | We shall grant to Network 1 Financial Securities, Inc. (the “Selling Agent”) ordinary share purchase warrants (the “Selling Agent Warrants”) covering a number of ordinary shares equal to six percent (6%) of the total number of ordinary shares being sold by the Selling Agent in this offering. | |

| Term of offering | The offering shall terminate on the earlier of (i) any time after the minimum offering amount is raised, or (ii) one hundred and twenty (120) days from the effective date of this prospectus, or the expiration date. The offering shall not be closed unless our ordinary shares are listed on the Nasdaq stock exchange. |

| 9 |

| Use of proceeds | We intend to use the proceeds from this offering for working capital and general corporate purposes, including the expansion of our business. To the extent that we are unable to raise the maximum proceeds in this offering, we may not be able to achieve all of our business objectives in a timely manner. See "Use of Proceeds" for more information. | |

| We will not receive any of the proceeds from the sale of the ordinary shares by any selling shareholders. | ||

| Risk factors | See “Risk Factors” and other information included in this prospectus for a discussion of the risks relating to investing in the ordinary shares. You should carefully consider these risks before deciding to invest in the ordinary shares. | |

| Lock-up | We and our directors, executive officers and our shareholders of over 5% of the outstanding equity securities issued by the Company have agreed not to sell, transfer or dispose of any ordinary shares or similar equity securities owned by them for a period of one hundred and eighty (180) days after the date of this prospectus, subject to certain exceptions. Immediately after the completion of this offering, approximately 34,516,780 of our ordinary shares then issued and outstanding will be subject to the lock-up agreements and other restrictions on transfer as described under “Shares Eligible for Future Sale” and “Plan of Distribution.” Ordinary shares offered by the selling shareholders are not subject to any lock-up restrictions. See “Shares Eligible for Future Sale” and “Plan of Distribution.” | |

| Listing | We have applied to have the ordinary shares listed on the NASDAQ under the symbol “MNSI.” NASDAQ is reviewing our application and we cannot provide any assurance that our application will be approved by NASDAQ. |

| 10 |

Summary of Financial Information

The following summary consolidated statements of operations for the years ended December 31, 2016 and December 31, 2015, and summary consolidated balance sheet as of December 31, 2016 and December 31, 2015 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our audited consolidated financial statements are prepared and presented in accordance with U.S. GAAP. Our historical results do not necessarily indicate results expected for any future periods. You should read this Summary of Financial Information section together with our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| For the Year Ended December 31, | ||||||||

| 2016 | 2015 | |||||||

| Income Statement Data: | ||||||||

| Net revenues | $ | 1,278,551 | $ | 1,213,410 | ||||

| Cost of revenues | 1,785,289 | 2,033,716 | ||||||

| Gross profit (loss) | (506,738 | ) | (820,306 | ) | ||||

| Selling, general and administrative expenses | 983,725 | 622,901 | ||||||

| Other income (expenses) | (1,813,020 | ) | (2,320,389 | ) | ||||

| Net loss | (3,303,483 | ) | (3,763,596 | ) | ||||

| Foreign currency exchange gain/(loss) | (708,209 | ) | 2,452,250 | |||||

| Comprehensive income (loss) | (3,999,638 | ) | (1,311,346 | ) | ||||

| As of December 31 | ||||||||

| 2016 | 2015 | |||||||

| Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 26,832 | $ | 97,586 | ||||

| Total current assets | 970,365 | 1,115,950 | ||||||

| Total assets | 62,902,479 | 63,043,585 | ||||||

| Total liabilities | 132,549,002 | 128,618,550 | ||||||

| Total deficit | (69,646,523 | ) | (65,574,965 | ) | ||||

| 11 |

Investing in the ordinary shares involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this prospectus before deciding to invest in the ordinary shares. We believe the risks and uncertainties described below represent all the material risks known to us that are related to our business and this offering. If any of the following risks actually occur, they may harm our business, financial condition and results of operations. In this event, the market price of the ordinary shares could decline and you could lose some or all of your investment.

Risks Relating to Our Early Stage Development and Our Operations in General

We are in the early stages of our planned expansion, and as such, we are subject to significant risks and uncertainties. The operating history of the golf course that we currently operate and manage may not serve as an adequate basis to judge our future operating results upon the completion of our contemplated Royal Country Club Spa & Resort.

While Yao-Teh has been operating our golf course since 1988, our planned expansion entails the construction, development and operations of two hotels and other recreational facilities. However, we have not had any direct experience in operating hotels, retail stores, gardens, conference centers, wedding venues, nature hot spring spas and other recreational facilities. As a result, you should consider our business and prospects in light of the risks, expenses and challenges attendant to the operations of a new business. These risks and challenges include:

| · | the uncertainties associated with our ability to continue our growth while trying to achieve and maintain our profitability; |

| · | our ability to establish our competitive position in the high end hotel segment of the lodging industry in Taiwan; |

| · | our ability to offer innovative products to attract recurring and new customers; |

| · | implementing our planned strategy and modifying it from time to time to respond effectively to competition and changes in customer preferences and needs; |

| · | increasing awareness of our brand in the resort business and continuing to develop customer loyalty; and |

| · | attracting, training, retaining and motivating skilled and devoted personnel. |

In addition, we have encountered and will continue to encounter risks and difficulties frequently experienced by early-stage companies, and those risks and difficulties may be heightened in a rapidly developing market such as Taiwan. Some of the risks relate to our ability to:

| · | complete our construction projects within their anticipated time schedules and budgets; |

| · | attract new and retain existing customers and obtain qualified employees; |

| · | operate, support, expand and develop our new and existing projects and facilities; |

| · | maintain effective control of our operating costs and expenses; |

| · | raise additional capital, as required; |

| · | develop and maintain internal personnel, systems and procedures to assure compliance with the extensive regulatory requirements applicable to the hospitality business as well as regulatory compliance as a public company; |

| · | respond to changes in our regulatory environment; and |

| · | respond to competitive market conditions. |

If we are unable to complete any of these tasks, we may be unable to complete all of the Royal Country Club Spa & Resort that are currently under development, operate our golf business in the manner we contemplate and generate revenues from such projects in the amounts and by the times we anticipate. If any of these events were to occur, it would cause a material adverse effect on our business and prospects, financial condition, results of operations and cash flows.

| 12 |

We have incurred losses in the past and may incur losses in the future.

We incurred net losses of $3,303,483 and $3,763,596 during the years ended December 31, 2016 and 2015, respectively. We had a total deficit of $69,646,523 and $65,574,965 as of December 31, 2016 and 2015, respectively. We expect our costs to increase as we start expanding our business and operations in the hospitality and entertainment industries. For instance, we estimate that the completion of the Royal Country Club Spa & Resort requires an investment of approximately $200 million, which will be raised in the form of equity and/or debt. Also the operations of the Royal Country Club may be impacted by the construction of the Royal Country Club Spa & Resort and therefore negatively influenced the revenue and profits of the golf operations. As a result, we may incur larger losses in the future. Based on the cash flow statement for the year ended December 31, 2016, we estimated that we are using our funds at a rate of approximately $55,000 per month. We anticipate that at such rate, our current capital would likely last half a month without further funding.

On May 16, 2017, Mr. Fun-Ming Lo, the Chairman of the Board of Directors, entered into the Line of Credit Agreement with us, pursuant to which Mr. Lo agreed to provide the Company with the necessary funds for its operations, when needed, in a maximum amount of $3,000,000 in order to reduce the shortage of working capital until December 31, 2017. In addition to the Line of Credit Agreement, on June 9, 2017, Yao-Teh entered into the Mengxin Line of Credit Agreement, pursuant to which Mengxin agreed to provide Yao-Teh, upon its request with loans in an aggregate amount of up to NTD 1.2 billion (approximately $39.75 million). The terms of the Line of Credit shall be for a period of three years commencing on June 9, 2017. As of the date of this prospectus, Yao Teh obtained from Mengxin a loan of NTD 3.5 million (approximately $114,910) which will be used for the Company’s general working capital purposes.

We have also restructured a significant portion of our current and long-term liabilities. On July 25, 2017, Mr. Chen-Yu Lian, one of our creditors, and Yao-Teh executed the Settlement Agreement whereby Mr. Chen-Yu Lian agreed to cancel approximately $21,000,000 of interest accrued on the notes payable (the interest portion of which was recorded as part of the accrued expenses and other current liabilities portion of our audited financial statements for the 2016 fiscal year). In addition, pursuant to the Settlement Agreement, the principal amount of the notes payable was reduced to NTD 150,000,000 (approximately $4.6 million) from the original amount of $10,365,432. The creditor further agreed not to demand the repayment of the principal portion in the near future.

In August 2017, the Taiwan Cooperative Bank agreed to restructure our outstanding loan with them concurrent with listing on the Nasdaq stock market. It is anticipated that the loan owed to Taiwan Cooperative Bank would be reduced from approximately $9.6 million to approximately $5.2 million, including the principal of NTD 89,313,950 (approximately $2.9 million) and interest of NTD 70,000,000 (approximately $2.3 million).

The principal portion of the new loan will be repaid over five years, payable on a monthly basis, in an amount of approximately $49,400 per month (commencing from March 1, 2018). After the five-year period, Yao-Teh will pay back the interest portion of the loan over another five-year period on a monthly basis, in an amount of approximately $38,500 per month.

If for any reason that we are not able to settle the loan owed to Taiwan Cooperative Bank, Taiwan Cooperative Bank may demand repayments of the loan.

As of December 31, 2016, we had a negative shareholders’ equity which could limit our financing ability in the credit market. A large number of banks and credit unions in Taiwan require positive shareholder equity before considering making commercial loans to companies. Due to the historical negative shareholder equity, it may be difficult for us to find willing creditors in Taiwan on commercially reasonable terms.

Failure to comply with privacy regulations and maintain the integrity of internal or customer data could result in faulty business decisions or harm to our reputation and subject us to additional costs, fines or lawsuits.

Certain information regarding our customers, including personally identifiable information and credit card numbers, is collected and maintained for a period of time for various business purposes, including maintaining records of customer preferences to enhance our customer service quality, the efficiency of billing and the effects of our marketing and promotional efforts. Additionally, we maintain personally identifiable information about our employees. The integrity and protection of our customer, employee and company data is critical to our business. Our customers expect that we adequately protect their personal information.

The regulations applicable to cyber security and privacy are increasingly demanding. Privacy regulation is an evolving area and may subject us to various compliance requirements. Compliance with applicable privacy regulations may increase our operating costs or adversely impact our ability to serve our customers and market our golf course and ancillary services to our customers. Theft, loss, misappropriation, fraudulent or unlawful use of customer, employee or company data, including cyberattacks, could harm our reputation, resulting in loss of customers, business disruption or increased costs, including remedial costs, lawsuits or fines. In addition, non-compliance with applicable privacy regulations by us (or in some circumstances, non-compliance by third parties engaged by us) could result in fines or restrictions on our use or transfer of data. Any of these matters could adversely affect our business, financial condition or results of operations.

The highly concentrated ownership and voting power of the Company may impact shareholders’ interests in the Company.

As of the date hereof, Mr. Lo owned approximately 76.27% of our ordinary shares and the voting power of the Company. It is anticipated that Mr. Lo will continue to own a majority of ordinary shares of the Company and correspondingly, will have the majority of the voting power of the Company. As such, you may not be able to influence the strategies, management or policies of the Company as you could at a company where the equity ownership is widely distributed.

Risks Relating to the Completion and Operation of the Royal Country Club Spa & Resort

We could encounter problems that substantially increase the costs to develop our Royal Country Club Spa & Resort and delay or prevent the opening of one or more of our contemplated facilities.

The current estimated budget for the Phase I and Phase II of the Royal Country Club Spa and Resort is based on preliminary projections, initial conceptual design and schedule estimates that we have prepared with the assistance of our independent architecture and design consultants. As of the date of this prospectus, the estimated cost to complete the construction and development of the Royal Country Club Spa and Resort is approximately US$200 million, consisting primarily of construction costs, design fees, professional service fees, consulting and management contract fees and the initial operating costs. However, completion of the resort, as envisioned, is subject to significant development and construction risks, which could have a material adverse impact on our timetables, cost budgets and our ability to complete the projects. These risks include the following:

| · | changes to plans and specifications; |

| · | engineering problems, including defective plans and specifications; |

| · | shortages of, and price increases in, energy, materials and skilled and unskilled labor, and inflation in key supply markets; |

| · | delays in obtaining or failure to obtain necessary permits, licenses and approvals; |

| 13 |

| · | changes in laws and regulations, or in the interpretation and enforcement of laws and regulations, applicable to leisure, residential, real estate development or construction projects and tourists’ permits for people from mainland China; |

| · | labor disputes or work stoppages; |

| · | disputes with and defaults by contractors and subcontractors; |

| · | environmental, health and safety issues, including site accidents; |

| · | weather interferences; |

| · | fires, typhoons and other natural disasters; |

| · | geological, construction, excavation, regulatory and equipment problems; and |

| · | other unanticipated circumstances or cost increases. |

The occurrence of any of these development and construction risks could increase the total costs, cause delays, prevent the construction or opening of any of our contemplated facilities or otherwise affect the design and features of the planned Royal Country Club Spa & Resort.

We may be required to incur significant additional indebtedness or other equity or equity-linked securities in order to complete construction and development of the Royal Country Club Spa & Resort. Our ability to obtain additional financing may be limited, which could delay or prevent the opening or completion of our Royal Country Club Spa & Resort.

We think that it is highly likely that we will require additional funding to complete the construction and development of the Royal Country Club Spa & Resort, as well as to fund initial operating activities and to service existing debt payments. We estimate that we would need approximately $150 million to complete the construction and start the initial operations of the entire Royal Country Club Spa & Resort as contemplated in addition to the funds raised in this offering assuming that we succeed in raising the maximum amount of capital through this offering. If delays and cost overruns are significant, the additional funding required could be substantial, which we will need to obtain either through equity issuances or debt financing. The raising of additional debt by us, if required, could result in the imposition of operating and financing covenants, or liens on our assets, that could significantly restrict our operations. In addition, the sale of additional equity securities could result in dilution to our shareholders’ interest in the Company.

Further, our ability to obtain required capital on acceptable terms, when required, is subject to a variety of uncertainties, including:

| · | limitations on our ability to incur additional debt, including as a result of prospective lenders’ evaluations of our creditworthiness and pursuant to restrictions imposed by our existing and anticipated credit facilities; |

| · | limitations on our ability to raise capital from the credit markets if the credit markets decline due to any large scale defaults originating from overleveraged Chinese companies in Taiwan and China; |

| · | investors’ and lenders’ perception of, and demand for, debt and equity securities of leisure and hospitality companies, as well as competing offerings of financing and investment opportunities in Taiwan by our competitors; |

| · | whether it is necessary to provide credit support or other assurances for our Subsidiaries, Yao-Teh and Ta-Teh-Fu; |

| · | conditions of the U.S., Taiwan, China, Hong Kong, and other capital markets in which we may seek to raise additional funds; |

| · | our future results of operations, financial condition and cash flows; |

| · | Taiwan and Chinese regulations on transferring funds between Taiwan and China; and |

| · | economic, political and other conditions in Taiwan, China and the great Asian region. |

| 14 |

As such, we cannot assure you that the necessary financing, if and when required by us, will be available in the future in the amounts or on terms acceptable to us, or at all. If we fail to raise additional funds in such amounts and at such times as we may need, we may be forced to reduce our expenditures and stay at a level that can be supported by our cash flow and delay the development of the Royal Country Club Spa & Resort. Without necessary capital, we may not be able to:

| · | develop and complete any new projects contemplated by our Board of Directors; |

| · | acquire necessary rights, assets or businesses; |

| · | expand our operations in Taiwan; |

| · | hire, train and retain employees for the resort to be constructed; |

| · | market our services and products; or |

| · | respond to competitive pressures or unanticipated funding requirements. |

Even if the Royal Country Club Spa & Resort is completed as planned, it may not be financially successful, which would limit our cash flow and would adversely affect our operations.

Even if all of the planned facilities contemplated within the Royal Country Club Spa & Resort are completed as planned, no assurance can be given that its operations will be financially successful or generate the cash flows that we require to sustain its operation. We may not attract the level of patronage that we anticipate. If we are unable to attract sufficient business, it would limit our cash flow and adversely affect our operations, our financial condition and our ability to service payments under any of our loan facilities.

Our future resort operating results are subject to conditions affecting the lodging industry in general and our return-driven development model is subject to certain risks.

Our operating results of the contemplated resort are subject to conditions typically affecting the lodging industry, which include:

| · | changes and volatility in general economic conditions; |

| · | our ability to maintain or increase sales to existing customers and attract new customers; |

| · | competition from other hotels and full-service resorts; |

| · | natural disasters or travelers’ fears of exposure to contagious diseases and social unrest; |

| · | seasonality of our business; |

| · | changes in travel patterns or in the desirability of particular locations, such as Miaoli; |

| · | increases in operating costs and expenses due to inflation and other factors; |

| · | local market conditions such as an oversupply of, or a reduction in demand for, hotel rooms; |

| · | the quality and performance of the future managers and other employees of our planned hotels; |

| · | the availability and cost of capital to allow us to fund construction and renovation of, and make other investments in, our hotels, entertainment facilities and ancillary equipment; and |

| · | the possibility that our leased properties may be subject to challenges as to their compliance with the relevant government regulations. |

In addition, our return-driven development model is subject to the following risks:

| · | we may not be able to control our costs effectively as anticipated; and |

| · | lack of resort operating history makes it difficult to evaluate our future prospects and results of operations of the planned resort. |

Changes in any of the conditions typically affecting the lodging industry in general, and the materialization of any risks applicable to our return-driven development model could adversely affect our occupancy rates, average daily rates and revenues generated per available room (“Rev PAR”), or otherwise adversely affect our results of operations and financial condition.

We expect to incur significant pre-opening expenses at the development stage and generate relatively low revenues at the ramp-up stage, which may have a significant negative impact on our financial performance.

We mainly utilize a build-and-operate model, under which the operation of our hotel goes through three stages: development, ramp-up and mature operations. During the development stage, hotels and the accommodations generally incur pre-opening expenses. During the ramp-up stage, when the occupancy rate is still relatively low, revenues generated by hotels may be insufficient to cover their operating costs, which are relatively fixed in nature. As a result, our contemplated hotels may not achieve profitability until they reach mature operations. This may have a significant negative impact on our financial performance during the development and ramp-up stages.

| 15 |

Our business is sensitive to global or regional economic crises. A severe or prolonged downturn in the global, Taiwanese, or Asian economy could cause a sharp reduction of expenditure on our planned resort and therefore materially and adversely affect our revenues and results of operations.

The recent 2015 economic recession in China has been challenging. Uncertainty in credit availability, rising unemployment and slow recovery from sluggish corporate operating and earning performance in certain major economies have continued in 2016. Capital market volatility remains at high levels, as a result of investors’ continued concerns about the systemic impact of potential long-term and wide-spread recession, geopolitical issues, the availability and cost of credit, and the housing and mortgage markets. The weak economic outlook has negatively affected business and consumer confidence and contributed to slow recoveries and low growth rates in most industries around the world.

Our contemplated resort is located in Miaoli where the local economy heavily depends upon tourism, including international visitors from China, South Korea, Japan, United States and other Southeastern Asian countries. Although there have been signs of recovery since the global financial debacle in 2007 originated in United States, there are still great uncertainties regarding economic conditions and the demand for luxurious hotels and golf courses in our targeted markets, such as Taiwan and China. Such uncertainties may adversely impact our results of operations of the planned resort. Continued turbulence in the international markets may also adversely affect our liquidity and financial condition, including our ability to access capital markets to meet our liquidity needs and fund the construction and development of our contemplated resort.

We have not entered into any construction contracts or negotiated with any construction companies regarding the construction of the Royal Country Club Spa & Resort, which may increase the risk of delay.

We have not entered into any construction contracts or negotiated with any construction companies regarding the construction of the Royal Country Club Spa & Resort, which may increase the risk of delay. We currently have not made any plans regarding hiring construction companies, such other engaging with a general contractor that will be responsible for finding subcontractors or directly with separate contractors that will build different parts of the Royal Country Club Spa & Resort. If we did not find competent and diligent construction companies for a reasonable price or found such companies after an extended period of time longer than we expected, it would increase the risks of delaying the construction and operation of the Royal Country Club Spa & Resort.

Our contractors may face difficulties in finding sufficient labor at acceptable cost, which could cause delays and increase construction costs of the Royal Country Club Spa & Resort.

The contractors we intend to retain to construct our Royal Country Club Spa & Resort may face difficulties in finding qualified construction laborers and managers, as many projects commence construction in Taiwan and as substantial construction activities continue in China. Immigration and labor regulations and political tension in Taiwan may cause our contractors to be unable to obtain sufficient laborers from China to make up any gaps in available labor in Taiwan and to reduce costs of construction, which could cause delays and increase construction costs of our projects.

We may encounter common risks associated with construction of hotel buildings and facilities of similar scales.

We expect to be exposed to general risks associated with construction of buildings and facilities for resorts, including but not limited to failure to obtain, or not obtaining in a timely manner, the necessary government licenses, permits and approvals, construction delays, budget overruns and construction contract disputes. In addition, we might experience increased holding costs as a result of delays. We have not yet entered into all of the definitive contracts necessary for the construction and development of the resort, such as construction contracts and recreational facility management contracts. We cannot assure you that we will be able to enter into definitive contracts with contractors and consulting companies with sufficient skills, financial strength and experience on commercially reasonable terms, or at all. We have not, and may not be able to, obtain guaranteed maximum price or fixed contract price terms on the construction contracts for the resort, which could cause us to bear greater risks of cost overruns and construction delays. If we are unable to enter into satisfactory construction contracts for the Royal Country Club Spa & Resort or are unable to closely control the construction costs and timetable for the projects, our business, financial condition and prospects may be materially and adversely affected.

| 16 |

Our insurance coverage may not be adequate to cover all losses that we may suffer from our planned Royal Country Club Spa & Resort. In addition, our insurance costs may increase and we may not be able to obtain the same insurance coverage in the future.

We plan to purchase insurance policies providing coverage for construction risks that we believe we may be subject to regarding the construction of the Royal Country Club Spa & Resort. The insurance policies that we expect to purchase will include the life insurance for the construction workers and executive officers, construction materials as well as buildings and fixtures under construction. However, this insurance coverage may exclude certain types of loss and damage, such as loss or damage resulting from acts of terrorism or liability for death or illness caused by contagious or infectious diseases. If loss or damage of those types were to occur, we could suffer significant uninsured losses. Further, the cost of coverage may in the future become so high that we may be unable to maintain the insurance policies we deem necessary for the construction and operations of our projects on commercially practicable terms, or at all, or we may need reduce our policy limits or agree to certain exclusions from our coverage. We cannot assure you that any such insurance policies we may obtain will be adequate to protect us from material losses.

Construction at our projects is subject to hazards that may cause personal injury or loss of life, thereby subjecting us to liabilities and possible losses, which may not be covered by our contemplated insurance policies.

The construction of large scale properties such as our Royal Country Club Spa & Resort can be dangerous. Construction workers at our projects are subject to hazards that may cause personal injury or loss of life, thereby subjecting the contractors and us to liabilities, possible losses, delays in completion of the projects and negative publicity. We believe that we and our contractors take safety precautions that are consistent with the industry practice, but these safety precautions may not be adequate to prevent serious personal injury or loss of life, damage to property or delays. If any accidents occur during the construction of our projects, we may be subject to delays, including delays imposed by regulators, liabilities and possible losses, which may not be covered by our insurance, and therefore our business, prospects and reputation may be materially and adversely affected.

We need the Development Permit, Construction License and Operation License to develop and operate the Royal Country Club Spa & Resort. If we do not obtain the appropriate licenses and permits, we would not be able to construct and use the facilities as contemplated and therefore would not be able to open and operate the resort as planned.

We are required to comply with real property and zoning law to ensure that we can build and operate the Royal Country Club Spa & Resort as intended. According to the letter issued from Chang Chen-Bin Architecture Firm dated October 3, 2016, we need to file our Development Plan of the Royal Country Club Spa & Resort, the Land and Water Reservation Plan and the Environmental Impact Report with the Miaoli County to obtain the development permit (the “Development Permit”) for our contemplated resort.

The Chang Chen-Bin Architecture firm has filed the Development Plan and estimates that it may take approximately eight months from filing for the required Development Permit to be issued. The risks involved in obtaining the Development Permit are that the review process by a committee from the Miaoli County may take longer than what the architecture firm has expected. If, for any reason, the Royal Country Club Spa & Resort operates without the proper licenses and permits, it would be subject to fines ranging from 3% to 30% of the contract price and be further required to obtain the necessary licenses and permits.

Upon obtaining the Development Permit, Chang Chen-Bin Architecture Firm will apply for the Construction License to allow us to begin building the resort while Yi-Cheng Huang, the Company’s consultant, simultaneously assists us in reclassifying our land as a special golf district for entertainment purposes. The land reclassification allows construction on our land and the Construction License allows us to begin construction. As explained below, our consultant estimates, although no guarantee can be given, that the land reclassification will be completed by the third quarter of 2017. Failure to obtain any of the Development Permit, land reclassification or the Construction License would prevent us from constructing any part of the resort as contemplated.

Once the resort is completed, Chang Chen-Bin Architecture Firm will, on behalf of the Company, apply for the Operation License which will allow us to operate the resort as currently contemplated.

We cannot assure you that we will be able to obtain the Development Permit, Construction License and Operation License or obtain such permits and licenses in a timely manner. If we did not successfully obtain any of the licenses or permits described herein in a timely manner, we would have to make abrupt changes to our business plan and development strategy which would negatively impact our business and operations.

| 17 |

The simultaneous planning, constructing and developing our Royal Country Club Spa & Resort and operating the golf course may strain our management time and resources, which could lead to delays, increased costs and other inefficiencies in the development of the resort or operation of the golf course.

The planning, designing and construction of Phase I and Phase II of the Royal Country Club Spa & Resort will proceed simultaneously with our operation of the golf course. This construction timetable enables us to maintain certain cash flow and revenue while the Royal Country Club Spa & Resort is being constructed, however, this would entail a significant amount of time and resources from members of our management, which may divert their attention from overseeing the day-to-day operations of the golf course.

We will need to recruit a substantial number of new employees before each of our projects can open and competition may limit our ability to attract qualified management and personnel.

We require extensive operational management and staff to open and operate the resort. Accordingly, we need to undertake a major recruiting program before the opening of the hotels and other comprising the Royal Country Club Spa & Resort. The pool of experienced hospitality and other skilled personnel in Taiwan is limited. Many of our new personnel will occupy sensitive positions requiring qualifications sufficient to meet high standards in the hospitality industry or will be required to possess other skills which entail substantial training and experience. Moreover, competition to recruit and retain qualified hospitality and other personnel is likely to intensify further as competition increases in the hospitality market in Taiwan. Other major resort hotels, such as a Renaissance hotel of the Marriott family in Taipei, are expected to open in Taiwan at or around the same time as our resort. We cannot assure you that we will be able to attract and retain a sufficient number of qualified individuals to operate our recreational and entertainment facilities or that costs to recruit and retain such personnel will not increase. Our inability to attract and retain qualified employees and senior management personnel could have a material adverse effect on our future business operations.

Our business depends substantially on the continuing efforts of our senior management and IHG’s expertise, and our business may be severely disrupted if we lose any of their services or if their other responsibilities cause them to be unable to devote sufficient time and attention to the Company.

We place substantial reliance on the project development and hospitality industry experience and knowledge of the Taiwan and Great Asia markets possessed by members of our senior management team, including Chairman Mr. Fun-Ming Lo, and IHG, which agrees to provide hotel management, technical support and operational services to our hotel to be completed first. The loss of the services of one or more of these members of our senior management team could hinder our ability to effectively manage our current business and implement our growth and development strategies as planned. Finding suitable replacements for Mr. Fun-Ming Lo or other members of our senior management could be difficult if not impossible, and competition for personnel of similar experience could be intense.

We plan to, with assistance from IHG, start recruiting hotel management and operation teams in the fourth quarter of 2017. We or IHG may fail to employ suitable or competent talents to operate and manage any of our contemplated hotels and recreational facilities. The unsuccessful or less than satisfactory operations of any of our planned business lines would exert adverse effect on the financial performance of our entire Company.

The lodging industry in Taiwan is highly competitive and growing rapidly in the past few years, and if we are unable to compete successfully, our financial condition and results of operations may be harmed.

The lodging industry in Taiwan is intensively competitive in 2015 as the supply for lodging exceeded the demand according to a news article published on Win Shang News, one of the real estate industry publications in China. In the past three years since 2013, more than one hundred brand new hotels have been constructed per year in Taiwan. Many of the existing hotels in our targeted markets may be more fully developed and have more revenue to finance ongoing operations than us. Upon opening of our hotels, we will compete primarily with other high end hotels as well as full-service resorts where the competition is mainly based on location, room rates, entertainment facilities, brand recognition, the quality of the accommodations and service levels. In addition, we may face competition from new entrants in the upscale hotel segment and the golf resort segment in Taiwan. Furthermore, we compete with all other hotels for guests primarily from Taiwan, China and Southeast Asian countries. Our typical business customers and leisure travelers may change their travel, spending and consumption patterns and choose hotels in different segments. New and existing competitors may offer more competitive rates, more comprehensive accommodation packages, greater convenience, services or amenities or superior facilities, which could result in a decrease in occupancy and average daily rates of our hotel rooms. Any of these factors may have an adverse effect on our competitive position, results of operations and financial condition.

| 18 |