As filed with the Securities and Exchange Commission on September 15, 2022

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FREIGHT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

(Translation of Registrant’s name into English)

| British Virgin Islands | N/A | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

2001 Timberloch Place, Suite 500

The Woodlands, TX 77380

Telephone: (773) 905-5076

(Address and telephone number of Registrant’s principal executive offices)

Mr. Javier Selgas, Chief Executive Officer

2001 Timberloch Place, Suite 500

The Woodlands, TX 77380

Telephone: (773) 905-5076

(Name, address, and telephone number of agent for service)

Copies to:

Benjamin Tan, Esq.

Sichenzia Ross Ference, LLP

1185 Avenue of the Americas, 31st Floor,

New York, NY 10036

+1-212-930-9700 – telephone

+1-212-930-9725 - facsimile

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement as determined by the registrant.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 15, 2022

FREIGHT TECHNOLOGIES, INC.

$15,000,000

Ordinary Shares

Share Purchase Contracts

Share Purchase Units

Warrants

Debt Securities

Rights

Units

We may offer, from time to time, in one or more offerings, ordinary shares, share purchase contracts, share purchase units, warrants, debt securities, rights or units, which we collectively refer to as the “securities”. The aggregate initial offering price of the securities that we may offer and sell under this prospectus will not exceed $15,000,000. We may offer and sell any combination of the securities described in this prospectus in different series, at times, in amounts, at prices and on terms to be determined at, or prior to, the time of each offering. This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements to this prospectus. The prospectus supplements will also describe the specific manner in which these securities will be offered and may also supplement, update or amend information contained in this prospectus. This prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement. You should read this prospectus and any applicable prospectus supplement before you invest.

The securities covered by this prospectus may be offered through one or more underwriters, dealers and agents or directly to purchasers. The names of any underwriters, dealers or agents, if any, will be included in a supplement to this prospectus. For general information about the distribution of securities offered, please see “Plan of Distribution”.

Our ordinary shares issued pursuant to a registration statement on Form F-1 (No. 333-217326) are traded on the Nasdaq Capital Market under the symbol “FRGT”. On September 14, 2022, the closing price of our ordinary shares as reported by the Nasdaq Capital Market was $1.00 per ordinary share. As of September 14, 2022, the aggregate market value of our outstanding ordinary shares held by non-affiliates using the closing price on the Nasdaq Capital Market of $1.00 was approximately $7,987,553 based on 9,357,919 outstanding ordinary shares, of which approximately 7,987,553 ordinary shares were held by non-affiliates. We have not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over the counter trading market in the U.S.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two years.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

| 2 |

On December 16, 2021, PCAOB announced the PCAOB HFCA Act determinations (the “PCAOB determinations”) relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong.

Our previous auditor, Centurion ZD CPA & Co., the independent registered public accounting firm that issued the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess Centurion ZD CPA & Co.’s compliance with applicable professional standards. Centurion ZD CPA & Co. is headquartered in Hong Kong with no branches or offices in the United States. As such, Centurion ZD CPA & Co., was identified as a firm subject to the PCAOB’s determinations.

On June 13, 2022, we dismissed Centurion ZD CPA & Co. and appointed UHY LLP as our new independent public accounting firm. UHY LLP, which is headquartered in Michigan, has been inspected by the PCAOB on a regular basis, with the last inspection completed in 2019, and it is not subject to the determinations announced by the PCAOB on December 16, 2021. If trading in our Ordinary Shares is prohibited under the HFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Ordinary Shares. If our Ordinary Shares are unable to be listed on another securities exchange by then, such a delisting would substantially impair your ability to sell or purchase our Ordinary Shares when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the price of our Ordinary Shares.

See “Risk Factors — Risks Related to our Ordinary Shares - Our shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. If the bill passed by the U.S. Senate on June 22, 2021 is passed by the U.S. House of Representatives and signed into law, this would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable from three years to two. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our securities. Such risks include but not limited to that trading in our securities may be prohibited under the HFCA Act and as a result an exchange may determine to delist our securities.

We cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. It remains unclear what the SEC’s implementation process related to the March 2021 interim final amendments will entail or what further actions the SEC, the PCAOB or Nasdaq will take to address these issues and what impact those actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, the March 2021 interim final amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our Ordinary Shares could be adversely affected, trading in our securities may be prohibited and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time.

See “Risk Factors — NASDAQ may apply additional and more stringent criteria for our continued listing.”

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute, and there will not be, an offering of securities to the public in the British Virgin Islands.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement. The information contained or incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

Investing in our securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the ‘‘Risk Factors’’ section of this prospectus and in the applicable prospectus supplement before you make your investment decision.

Neither the Securities and Exchange Commission, the Government of the British Virgin Islands (and any of its regulatory authorities), nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _______________, 2022

| 3 |

| 4 |

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | “Amended Memorandum and Articles” refers to the amended and restated memorandum and articles of association in force on the date of this Registration Statement. | |

| ● | “BVI Act” refers to the BVI Business Companies Act (As Revised). | |

| ● | “we,” “us,” “our Company,” “our,” or “FRGT” refers to Freight Technologies, Inc., (formerly known as Hudson Capital, Inc. or “HUSN”), its subsidiaries, and, in the context of describing our operations and consolidated financial information, our consolidated affiliated entities in China, including but not limited to, prior to the Merger, Hongkong Internet Financial Services Limited, Hongkong Shengqi Technology Limited, Beijing Yingxin Yijia Network Technology Co., Ltd, Sheng Ying Xin (Beijing) Management Consulting Co., Ltd, Kashgar Sheng Yingxin Enterprise Consulting Co., Ltd., Fu Hui (Shenzhen) Commercial Factoring Co., Ltd., Ltd., CIFS (Xiamen) Financial Leasing Co., Ltd., Fuhui (Xiamen) Commercial Factoring Co., Ltd., Zhizhen Investment & Research (Beijing) Information Consulting Co., Ltd., Hangzhou Yuchuang Investment Partnership and our U.S. subsidiaries, Hudson Capital USA Inc., Hudson Capital Merger Sub I Inc. and Hudson Capital Merger Sub II Inc and after the Merger, Freight App, Inc. and Freight App de México S.A De C.V. | |

| ● | “China” or “PRC” refers to the People’s Republic of China, and solely for the purpose of this annual report, excluding Taiwan, Hong Kong and Macau; | |

| ● | “Fr8App” refers to Freight App, Inc., our primary operating subsidiary. | |

| ● | “Merger” refers to the consummation of that certain merger agreement, dated December 13, 2021, and as amended on December 29, 2021 (the “Merger Agreement”) by and among Hudson Capital, Inc,. Hudson Capital Merger Sub I, Inc., a Delaware corporation and wholly-owned subsidiary of Hudson Capital (“Merger Sub”), Freight App, Inc., a Delaware corporation (“Fr8App”) and ATW Master Fund II, L.P., as the representative of the stockholders of Fr8App (the “Stockholders’ Representative”) whereby Merger Sub I merged with and into Fr8App, with Fr8App surviving the Merger and continuing as a direct wholly-owned subsidiary of the Company. The Merger closed on February 14, 2022 and the separate corporate existence of Merger Sub I and its Certificate of Incorporation and by-laws then in effect ceased, and the organizational documents of Fr8App after the Merger is in the form as agreed by the Company and Fr8App. | |

| ● | “shares” or “Ordinary Shares” refers to our ordinary shares, par value $0.011 per share and prior to the reverse split, par value $0.005. | |

| ● | “U.S.” means the United States of America; | |

| ● | “U.S. GAAP” refers to generally accepted accounting principles in the United States; | |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; | |

| ● | “$,” “dollars,” “US$” or “U.S. dollars” refers to the legal currency of the United States; and | |

| ● | all discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding. |

| 5 |

Unless otherwise indicated, information contained in this prospectus concerning our industry, our market share and the markets that we serve is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts) and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets that we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any such information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by third-parties and by us.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, such as statements related to future events, business strategy, future performance, future operations, backlog, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek,” “anticipate,” “plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,” “predict,” “potential,” “targeting,” “intend,” “could,” “might,” “should,” “believe” and similar expressions or their negative. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on management’s belief, based on currently available information, as to the outcome and timing of future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed in such forward-looking statements. When evaluating forward-looking statements, you should consider the risk factors and other cautionary statements described in “Risk Factors.” We believe the expectations reflected in the forward-looking statements contained in this prospectus are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking statements should not be unduly relied upon.

Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to:

| ● | the effect of economic and political conditions in the industries and markets in which our businesses operate in the United States, Mexico and Canada and any changes therein, including financial market conditions, fluctuations in commodity prices, interest rates and foreign currency exchange rates, inflation, levels of end market demand in construction, the impact of weather conditions, concerns over border issues, pandemic health issues (including the coronavirus disease (“COVID-19”) and its effects, among other things, on production and on global supply, demand, and distribution disruptions as the outbreak continues and results in an increasingly prolonged period of travel, commercial and/or other similar restrictions and limitations), natural disasters and the financial condition of our customers and suppliers; | |

| ● | challenges in the development, production, delivery, support, performance and realization of the anticipated benefits of advanced technologies and new products and services, the ongoing availability and dependability of cloud-based systems; | |

| ● | rates of adoption of new technology, from products that could be potential competitors to Our products to those that might affect the primary target market of carriers and commercial truck freight in general; | |

| ● | rates of adoption of self-driving units commercial trucks or other transportation methods that are competitive with trucking and truck freight; | |

| ● | future levels of indebtedness, capital spending and research and development spending; | |

| ● | future availability of capital and credit and factors that may affect such availability, including credit market conditions and our capital structure and credit ratings; | |

| ● | delays and disruption in the delivery of materials and services from suppliers; continuity and/or development of new inventory, merchandising and distribution strategies; | |

| ● | cost reduction efforts and restructuring costs and savings and other consequences thereof; | |

| ● | new business and investment opportunities; |

| 6 |

| ● | risks resulting from a less diversified business model and balance of operations across product lines, regions and industries due to the separation; | |

| ● | the outcome of legal proceedings, investigations and other contingencies; | |

| ● | the effect of changes in political conditions in the U.S. and other countries, in which our businesses operate, including the effect of changes in U.S. trade policies, on general market conditions, global trade policies and currency exchange rates in the near term and beyond; | |

| ● | the effect of changes in tax, environmental, regulatory (including among other things import/export) and other laws and regulations in Mexico, U.S. and Canada and any other countries in which our businesses may operate; | |

| ● | our ability to retain and hire key personnel; | |

| ● | the scope, nature, impact or timing of acquisition and divestiture activity, including among other things integration of acquired businesses into existing businesses and realization of synergies and opportunities for growth and innovation and incurrence of related costs. |

These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. Our future results will depend upon various other risks and uncertainties, including those described in “Risk Factors.” All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date hereof. We undertake no obligation to update or revise any forward-looking statements after the date on which any such statement is made, whether as a result of new information, future events or otherwise.

Cautionary Statement Regarding Holding Foreign Companies Accountable Act

Holding Foreign Companies Accountable Act (the “HFCA Act”)

The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over the counter trading market in the U.S.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two years.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

On December 16, 2021, PCAOB announced the PCAOB HFCA Act determinations (the “PCAOB determinations”) relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong.

Our previous auditor, Centurion ZD CPA & Co., the independent registered public accounting firm that issued the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess Centurion ZD CPA & Co.’s compliance with applicable professional standards. Centurion ZD CPA & Co. is headquartered in Hong Kong with no branches or offices in the United States. As such, Centurion ZD CPA & Co., was identified as a firm subject to the PCAOB’s determinations.

| 7 |

On June 13, 2022, we dismissed Centurion ZD CPA & Co. and appointed UHY LLP as our new independent public accounting firm. UHY LLP, which is headquartered in Michigan, has been inspected by the PCAOB on a regular basis, with the last inspection completed in 2019, and it is not subject to the determinations announced by the PCAOB on December 16, 2021. If trading in our Ordinary Shares is prohibited under the HFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Ordinary Shares. If our Ordinary Shares are unable to be listed on another securities exchange by then, such a delisting would substantially impair your ability to sell or purchase our Ordinary Shares when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the price of our Ordinary Shares.

See “Risk Factors — Risks Related to our Ordinary Shares - Our shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. If the bill passed by the U.S. Senate on June 22, 2021 is passed by the U.S. House of Representatives and signed into law, this would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable from three years to two. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our securities. Such risks include but not limited to that trading in our securities may be prohibited under the HFCA Act and as a result an exchange may determine to delist our securities.

We cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. It remains unclear what the SEC’s implementation process related to the March 2021 interim final amendments will entail or what further actions the SEC, the PCAOB or Nasdaq will take to address these issues and what impact those actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, the March 2021 interim final amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our Ordinary Shares could be adversely affected, trading in our securities may be prohibited and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time.

See “Risk Factors — NASDAQ may apply additional and more stringent criteria for our continued listing.”

| 8 |

Cautionary Statement About Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

We are a British Virgin Islands company and substantially all of our assets are located outside of the U.S. A substantial majority of our current operations are conducted in Mexico. In addition, some of our directors and officers reside outside the U.S. As a result, it may be difficult for you to effect service of process within the U.S. or elsewhere upon these persons. It may also be difficult for you to enforce in Mexico or British Virgin Islands courts judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, some of whom are not residents in the U.S. and the substantial majority of whose assets are located outside of the U.S. It may be difficult or impossible for you to bring an action against us in the British Virgin Islands if you believe your rights under the U.S. securities laws have been infringed. In addition, there is uncertainty as to whether the courts of the British Virgin Islands or Mexico would recognize or enforce judgments of U.S. courts against us or such persons predicated upon the civil liability provisions of the securities laws of the U.S. or any state and it is uncertain whether such British Virgin Islands or Mexico courts would hear original actions brought in the British Virgin Islands or Mexico against us or such persons predicated upon the securities laws of the U.S. or any state.

Our corporate affairs will be governed by our Amended Memorandum and Articles, the BVI Act and the common law of the British Virgin Islands. The rights of shareholders to take legal action against our directors, actions by minority shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are to a large extent governed by the common law of the British Virgin Islands. The common law of the BVI is derived in part from comparatively limited judicial precedent in the BVI as well as that from English common law, which has persuasive, but not binding, authority on a court in the BVI. The rights of our shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are not as clearly established as they would be under statutes or judicial precedents in some jurisdictions in the United States. In particular, the British Virgin Islands have a less developed body of securities laws as compared to the United States, and some states (such as Delaware) have more fully developed and judicially interpreted bodies of corporate law. There is no statutory recognition in the BVI of judgments obtained in the U.S., although the courts of the BVI will in certain circumstances recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. As a result of all of the above, public members may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling members than they would as members of a U.S. public company.

Certain corporate governance practices in the British Virgin Islands, which is our home country, differ significantly from the NASDAQ Capital Market corporate governance listing standards. To the extent we choose to follow home country practice with respect to corporate governance matters, our shareholders may be afforded less protection than they otherwise would under NASDAQ Capital Market corporate governance listing standards applicable to U.S. domestic issuers. For a discussion of significant differences between the provisions the BVI Act and the laws applicable to companies incorporated in the United States and their shareholders, see “DESCRIPTION OF ORDINARY SHARES - Material Differences in British Virgin Islands Law and our Memorandum and Articles of Association and Delaware Law”.

| 9 |

This prospectus is a part of a registration statement that we have filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to an aggregate offering price of $15,000,000.

Each time we sell securities, we will provide a supplement to this prospectus that contains specific information about the securities being offered and the specific terms of that offering. The supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement.

We may offer and sell securities to, or through, underwriting syndicates or dealers, through agents or directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering.

In connection with any offering of securities (unless otherwise specified in a prospectus supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution.”

Please carefully read both this prospectus and any prospectus supplement together with the documents incorporated herein by reference under “Incorporation by Reference” and the additional information described below under “Where You Can Get More Information.”

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences. You should read the tax discussion contained in the applicable prospectus supplement and consult your tax advisor with respect to your own particular circumstances.

You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized anyone to provide you with different information. The distribution or possession of this prospectus in or from certain jurisdictions may be restricted by law. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is accurate only as of the date of this prospectus and any information incorporated by reference is accurate as of the date of the applicable document incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

We have relied on statistics provided by a variety of publicly-available sources. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus. We have sought to provide current information in this prospectus and believe that the statistics provided in this prospectus remain up-to-date and reliable, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus.

| 10 |

Overview

We were originally established as “China Internet Nationwide Financial Services Inc.”, a holding company incorporated under the laws of British Virgin Islands on September 28, 2015. Our corporate name was changed to “Hudson Capital Inc.” on April 23, 2020 and we began to trade under our new symbol, “HUSN” on May 8, 2020. Our securities were also transferred to the Nasdaq Capital Market at the opening of business on July 16, 2020.

We were previously involved in providing financial advisory services in the People’s Republic of China. Since February 14, 2022, when we consummated the Merger and March 30, 2022, when we sold our wholly-owned Hong Kong subsidiary, Hongkong Internet Financial Services Limited (“HKIFS”), which held and operated our financial advisory business, in its entirety to a private investor, we are no longer in the financial advisory business and no longer have any presence or holdings outside of North America.

Instead, we are now, through our wholly-owned subsidiary, Freight App, Inc. (formerly known as “Freight Hub, Inc.” and hereinafter referred to as “Fr8App”) and Fr8App’s wholly-owned Mexico subsidiary, Freight App de México, S.A De C.V. (“Freight App Mexico”) involved in the freight management business. On May 26, 2022, we changed our name and ticker symbol from Hudson Capital, Inc. and HUSN, respectively, to Freight Technologies, Inc., and FRGT, respectively.

Our Products

Fr8App’s technology product offerings includes (i) a computerized platform (the “Platform”) that holds an online portal (the “Portal”) and a mobile App solution (the “App”) to provide third-party logistics (“3PL”) services to companies actively involved in the freight transportation market, (ii) a Transport Management Solution (“TMS “) for customers to manage their own fleet, and (iii) freight brokerage support and customer service based on the Platform.

The freight transportation supply chain begins with parties having transportation needs (“Shippers”) and addressed by those offering freight transportation services (“Carriers”). Shippers seeking suitable means of transportation for their supplies represent demand and Carriers with freight transportation capability represent supply. The digital freight matching technology on Fr8App’s Platform streamlines and simplifies cross-border shipping logistics by facilitating the matching of demand with supply. Shippers that use Fr8App’s Platform can connect with a wide network of reliable Carriers who can fulfill their logistics needs across North America. Use of Fr8App’s Platform brings the additional benefit of providing transparency on all shipment characteristics to allow for the identification of available and qualified freight capacity.

Fr8App believes it is the first digital commercial freight-matching broker to offer 3PL while targeting the domestic Mexican and the cross-border Mexico-U.S.-Canada markets (“Target Markets”). Fr8App serves cross-border traffic across the Mexico-U.S. border, the U.S.-Canada border, and domestic shipments within each of these three countries, with a primary focus on full truck-load freight. Its cutting-edge cloud-based Platform was designed to connect in real-time parties with commercial transportation needs.

Our principal executive office is located at 2001 Timberloch Place, Suite 500 The Woodlands, TX 77380 and our phone number is (773) 905-5076. We maintain a corporate website at https://www.fr8.app/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

Our Corporate Structure

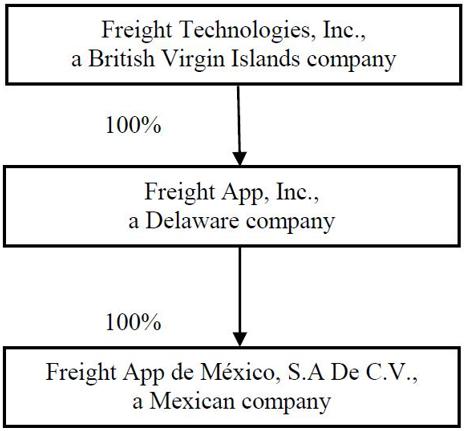

We are a British Virgin Islands business company that wholly owns our Delaware subsidiary, our wholly-owned subsidiary, Freight App, Inc. (formerly known as “Freight Hub, Inc.” and hereinafter referred to as “Fr8App”) and Fr8App’s wholly-owned Mexico subsidiary, Freight App de México, S.A De C.V. (“Freight App Mexico”).

| 11 |

The following diagram illustrates our corporate structure as of the date of this prospectus. For more detail on our corporate history please refer to “Our Corporate History and Structure” appearing on page 11 of this prospectus.

RISK FACTORS

Investing in our securities involves risks. Before investing in any securities offered pursuant to this prospectus, you should carefully consider the risk factors and uncertainties set forth under the heading “Item 3.D. Risk Factors” in our Annual Report, as amended, on Form 20-F for the year ended December 31, 2021, which is incorporated in this prospectus by reference, as updated by our subsequent filings under the Exchange Act and, if applicable, in any accompanying prospectus supplement subsequently filed relating to a specific offering or sale.

Our capitalization and indebtedness will be set forth in a prospectus supplement or in a report on Form 6-K subsequently furnished to the SEC and specifically incorporated herein by reference.

Unless we otherwise indicate in a prospectus supplement, we currently intend to use the net proceeds from the sale of our securities for general working capital.

More detailed information regarding the use of proceeds from the sale of securities, including any determinable milestones at the applicable time, will be described in any applicable prospectus supplement. We may also, from time to time, issue securities otherwise than pursuant to a prospectus supplement to this prospectus.

Our dividend policy is set forth under the heading “Item 8.A. Consolidated Statements and Other Financial Information” in our Annual Report, as amended, on Form 20-F for the year ended December 31, 2021, which is incorporated in this prospectus by reference, as updated by our subsequent filings under the Exchange Act.

| 12 |

We may offer and issue from time to time ordinary shares, share purchase contracts, share purchase units, warrants, debt securities, rights or units, or any combination thereof, up to an aggregate initial offering price of up to $15,000,000 in one or more transactions under this shelf prospectus. The price of securities offered will depend on a number of factors that may be relevant at the time of offer. See “Plan of Distribution.”

The ordinary shares were first listed on the Nasdaq Global Market under the symbol “CIFS” on August 8, 2017. Our corporate name was changed to “Hudson Capital Inc.” on April 23, 2020 and we began to trade under our new symbol, “HUSN” on May 8, 2020. Our ordinary shares were transferred to the Nasdaq Capital Market at the opening of business on July 16, 2020. On May 26, 2022, we changed our name from Hudson Capital, Inc. to Freight Technologies, Inc. and began trading under our new stock symbol, “FRGT”, on May 27, 2022.

The following tables sets forth, for the periods indicated, the high and low trading prices of the ordinary shares as reported on the Nasdaq Capital Market prior to the filing of this prospectus.

The following table sets forth the annual high and low last trade prices of our ordinary shares as reported by The NASDAQ Stock Market during the fiscal years 2021, 2020 and 2019 . The prices are inter-dealer prices, without retail markup, markdown or commission.

| Period | High | Low | ||||||

| Fiscal Year ended December 31, 2019 | $ | 4.96 | $ | 0.81 | ||||

| Fiscal Year ended December 31, 2020 | $ | 3.72 | $ | 0.352 | ||||

| Fiscal Year ended December 31, 2021 | $ | 10.6608 | $ | 4.9119 | ||||

The following table sets forth the high and low last trade prices of our ordinary shares as reported by The NASDAQ Stock Market for each fiscal quarter of 2019, 2020 and 2021 . The prices are inter-dealer prices, without retail markup, markdown or commission.

| Period | High | Low | ||||||

| Fiscal Year 2019, quarter ended | ||||||||

| March 31, 2019 | $ | 4.96 | $ | 0.853 | ||||

| June 30, 2019 | $ | 3.87 | $ | 1.28 | ||||

| September 30, 2019 | $ | 2.20 | $ | 1.44 | ||||

| December 31, 2019 | $ | 1.60 | $ | 0.81 | ||||

| Fiscal Year 2020, quarter ended | ||||||||

| March 31, 2020 | $ | 1.20 | $ | 0.384 | ||||

| June 30, 2020 | $ | 1.18 | $ | 0.39 | ||||

| September 30, 2020 | $ | 0.839 | $ | 0.352 | ||||

| December 31, 2020 | $ | 3.72 | $ | 0.415 | ||||

| Fiscal Year 2021, quarter ended | ||||||||

| March 31, 2021 | $ | 10.6608 | $ | 6.4317 | ||||

| June 30, 2021 | $ | 8.5683 | $ | 4.9119 | ||||

| September 30, 2021 | $ | 8.4581 | $ | 5.1322 | ||||

| December 31, 2021 | $ | 7.3789 | $ | 5.3084 | ||||

| 13 |

The following table sets forth the monthly high and low last trade prices of our ordinary shares as reported by The NASDAQ Stock Market for each month in 2022 preceding this date of prospectus. The prices are inter-dealer prices, without retail markup, markdown or commission, and do not necessarily reflect actual transactions.

| Period | High | Low | ||||||

| Month Ended: | ||||||||

| August 31, 2022 | $ | 2.1700 | $ | 1.5400 | ||||

| July 31, 2022 | $ | 2.4800 | $ | 1.3600 | ||||

| June 30, 2022 | $ | 1.6800 | $ | 1.3300 | ||||

| May 31, 2022 | $ | 2.0800 | $ | 1.5200 | ||||

| April 30, 2022 | $ | 2.6300 | $ | 1.9300 | ||||

| March 31, 2022 | $ | 2.6700 | $ | 1.7000 | ||||

| February 28, 2022* | $ | 6.5529 | * | $ | 2.2050 | * | ||

| January 31, 2022 | $ | 5.9692 | $ | 4.1850 | ||||

*The Company effected a 2.2:1 reverse split of its ordinary shares on February 14, 2022.

DESCRIPTION OF SHARE CAPITAL AND GOVERNING DOCUMENTS

Freight Technologies, Inc. is a BVI business company incorporated on September 28, 2015 and our affairs are governed by the provisions of our memorandum and articles of association, as amended and restated from time to time, the BVI Act, and the applicable laws of the British Virgin Islands, or the BVI (including applicable common law).

As provided in our Amended Memorandum and Articles, subject to the BVI Act, we have full capacity to carry on or undertake any business or activity, do any act or enter into any transaction, and, for such purposes, full rights, powers and privileges. Our registered office is c/o Maples Corporate Services Limited, P.O. Box 173, Road Town, Tortola, British Virgin Islands.

As of the date of this prospectus, the Company is authorized to issue an unlimited number of shares divided into (a) an unlimited number of shares divided into an unlimited number of ordinary shares with a par value of US$0.011 each, (b) a maximum of 30,525,000 series A preferred shares (together, the “Series A Preferred Shares”) designated as follows: (i) a maximum of 25,000 series seed preferred shares with a par value of US$0.0001 each (the “Series Seed Preferred Shares”), (ii) a maximum of 10,000,000 series A1-A preferred shares with a par value of US$0.0001 each (the “Series A1-A Preferred Shares”), (iii) a maximum of 3,000,000 series A2 preferred shares with a par value of US$0.0001 each (the “Series A2 Preferred Shares”); and (iv) a maximum of 17,500,000 series A4 preferred shares with a par value of US$0.0001 each (the “Series A4 Preferred Shares”), (c) a maximum of 21,000,000 series B preferred shares with a par value of US$0.0001 each (the “Series B Preferred Shares”) and (d) an unlimited number of blank check preferred shares with no par value (the “Blank Check Preferred Shares”). As of the date of this prospectus, 7,689,462 Ordinary Shares, 5,316 Series Seed Preferred Shares, 4,451,929 series A1-A Preferred Shares, 1,264,366 Series A2 Preferred Shares, 1,378,456 .81 Series A4 Preferred Shares and 17,318,280 Series By Preferred Shares were issued, fully paid and outstanding. No Blank Check Preferred Shares have been issued. All of our issued and outstanding shares have been validly issued, fully paid and non-assessable. Our Ordinary Shares are not redeemable and are not subject to any preemptive right.

Ordinary Shares

In the last three years, we have issued an aggregate of 3,113,060 Ordinary Shares in several private placements and public offerings for aggregate net proceeds of approximately $6,779,190, which amount includes the issuance of Ordinary Shares upon the conversion of options, warrants and performance rights.

Pre-Funded Warrants and Options

In addition to Ordinary Shares, in the last three years, we have issued pre-funded warrants to purchase an aggregate of 650,000 Ordinary Shares to advisors, consultants and investors, with exercise prices ranging from $0.001 per share, of which 499,751 warrants have been exercised, and no options have been granted.

| 14 |

Preferred Shares

In the three years prior to December 31, 2021, we issued an aggregate of zero Preferred Shares. At the closing of the Merger on February 14, 2022, we issued $3.5 million, in Preferred Series B Shares which are convertible into 1,060,606 Ordinary Shares in addition to 1,939,394 in Series A Warrants with an exercise price of $3.300, 395,652 in Series B Warrants with an exercise price of $2.640, 2,573,470 in Series C Warrants with an exercise price of $1.650, and 3,541,941 in Series D Warrants with an exercise price of $2.475. Series A, B, C and D warrants all had termination dates of February 14, 2029. On February 14, 2022, we also issued Series Seed Preferred Shares, Series A1-A Preferred Shares, Series A2 Preferred Shares, Series A4 Preferred Shares and Series B Preferred Shares, which were convertible into 7,020 Ordinary Shares, 4,473,547 Ordinary Shares, 1,264,360 Ordinary Shares, 2,195,930 Ordinary Shares, and 8,450,457 Ordinary Shares, respectively. On July 11, 2022, the Company amended all Series A, B, C and D Warrants to permit a cashless exercise at fixed exchange ratios into Ordinary Shares of 0.779, 0.816, 0.888 and 0.826, respectively, for an aggregate amount upon exchange of all Warrants of 7,044,524 Ordinary Shares. On July 11, 2022, we agreed to issue 1,928,571 Series A4 Preferred Shares for an aggregate amount of $2.7 million. On July 11, 2022, we also adjusted the conversion prices all Series A Preferred Shares and Series B Preferred Shares that contain features requiring adjustment of conversion prices in cases where offerings for equity are made at a lower price that that particular share’s conversion price. The additional Ordinary shares to be registered arising from the adjustment of conversion prices as a result of the July 11, 2022 financing was 37,347,648 shares.

The following are summaries of material provisions of our Amended Memorandum and Articles and the BVI Act insofar as they relate to the material terms of our Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares.

Ordinary Shares

General. The Amended Memorandum and Articles authorize the issuance of an unlimited number of Ordinary Shares with a par value of US$0.11 each. Holders of Ordinary Shares will have the same rights. All of our outstanding Ordinary Shares are fully paid and non-assessable. To the extent they are issued, certificates representing the Ordinary Shares are issued in registered form.

Dividends. Subject to the rights of the Series A Preferred Shares, the holders of our Ordinary Shares are entitled to dividends out of funds legally available when and as declared by our board of directors subject to the BVI Act. Our Amended Memorandum and Articles provide that dividends may be declared and paid at such time, and in such an amount, as the directors determine subject to their being satisfied that the Company will meet the statutory solvency test immediately after the dividend.

Voting Rights. In respect of all matters subject to a members’ vote, each Ordinary Share is entitled to one vote for each Ordinary Share registered in his or her name on our register of members. Holders of Ordinary Shares shall at all times vote together on all resolutions submitted to a vote of the members. Voting at any meeting of members is by show of hands unless a poll is demanded. A poll may be demanded by the chairman of such meeting or any one member.

Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the assets of the Company available for distribution to its shareholders shall be distributed to the holders of Series A4 Preferred Shares, the holders of Series A2 Preferred Shares, the holders of Series A1 Preferred Shares, the holders of the Series Seed Preferred Shares and the holders of Ordinary Shares, pro rata based on the number of shares held by each shareholder, treating for this purpose all such securities as if they had been converted to Ordinary Shares pursuant to the terms of the Amended Memorandum and Articles immediately prior to such liquidation, dissolution or winding up of the Company.

Series A Preferred Shares

General. The Amended Memorandum and Articles authorise the issuance of a maximum of 30,525,000 Series A Preferred Shares designated as follows: (i) a maximum of 25,000 Series Seed Preferred Shares with a par value of US$0.0001 each, (ii) a maximum of 10,000,000 Series A1-A Preferred Shares with a par value of US$0.0001 each, (iii) a maximum of 3,000,000 Series A2 preferred shares with a par value of US$0.0001 each; and (iv) a maximum of 17,500,000 Series A4 preferred shares with a par value of US$0.0001 each. All of our outstanding Series A Preferred Shares are fully paid and non-assessable. To the extent they are issued, certificates representing the Series A Preferred Shares are issued in registered form.

| 15 |

Dividends. The holders of our Series A Preferred Shares are entitled to receive, simultaneously with the holders of Ordinary Shares, a dividend on each outstanding Series A Preferred Share in an amount as calculated in accordance with the Amended Memorandum and Articles.

Voting Rights. The holders of Series A Preferred Shares shall not be entitled to vote on any resolution of shareholders, except in relation to a variation of the rights of the Series A Preferred Shares.

Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the assets of the Company available for distribution to its shareholders shall be distributed to the holders of Series A4 Preferred Shares, the holders of Series A2 Preferred Shares, the holders of Series A1 Preferred Shares, the holders of the Series Seed Preferred Shares and the holders of Ordinary Shares, pro rata based on the number of shares held by each shareholder, treating for this purpose all such securities as if they had been converted to Ordinary Shares pursuant to the terms of the Amended Memorandum and Articles immediately prior to such liquidation, dissolution or winding up of the Company.

Conversion Rights. The Series A Preferred Shares are convertible, at the option of the holder thereof, at any time and from time to time, into such number of fully paid and non-assessable Ordinary Shares at the applicable Conversion Price as detailed in the Amended Memorandum and Articles and subject to adjustment in the event (i) of a division or combination of shares, (ii) that the Company makes or issues or fixes a record date for the determination of holders of Ordinary Shares entitled to receive a dividends or other distribution payable on the Ordinary Shares in additional Ordinary Shares, (iii) that the Company makes or issues or fixes a record date for the determination of holders of Ordinary Shares entitled to receive a dividends or other distribution payable in shares of the Company (other than a distribution of Ordinary Shares in respect of the outstanding Ordinary Shares), and (iv) of any reorganization, recapitalization, reclassification, consolidation or merger involving the Company in which the Ordinary Shares (but not the Series A Preferred Shares) is converted into or exchanged for securities, cash or other property.

Protective Provisions. At any time when Series A Preferred Shares are outstanding, the Company shall not do any of the following without the written consent or affirmative approval of the holders of at least a majority of the Series A Preferred Shares voting together as a single class, which must include ATW Master Fund II, L.P.: (a) amend, alter or repeal any provision of the Amended Memorandum and Articles in any manner that is adverse to, derogates from, or negatively affects the rights of any class of Series A1-A Preferred Shares or the Series A2 Preferred Shares, (b) create, or the authorise the creation of, or issue or oblige itself to issue shares of, any additional class or series of shares that ranks senior to the Series A1 Preferred Shares or the Series A1-A Preferred Shares with respect to the distribution of assets on the liquidation, dissolution or winding up of the Company, the payment of dividends and rights of redemption, or increase the authorised number of any such class of Series A Preferred Shares or increase the authorised number of any additional class or series of shares of the Company, (c) reclassify, alter or amend any existing security of the Company that is pari passu with the Series A2 Preferred Shares or the Series A1-A Preferred Shares if such reclassification, alteration or amendment would render such other security senior to any such class of Series A Preferred Shares; (d) reclassify, alter or amend any existing security of the Company that is junior to the Series A Preferred Shares if such reclassification, alteration or amendment would render such other security senior to or pari passu with any such class of Series A Preferred Shares, (e) purchase or redeem (or permit any subsidiary to purchase or redeem) or pay or declare any dividend or distribution on any shares of the Company other than (i) redemptions of or dividends or distributions on the Series A2 Preferred Shares and Series A1-A Preferred Shares as expressly authorised in the Amended Memorandum and Articles, (ii) dividends or other distributions payable on the Ordinary Shares solely in the form of additional shares of Ordinary Shares by way of bonus share issue or otherwise and (iii) any repurchase, redemption, surrender or other acquisition of shares from former employees, officers, directors, consultants or other persons who performed services for the Company or any subsidiary in connection with the cessation of such employment or service at the lower of the original purchase price or the then-current fair market value thereof, or (f) create, or hold shares or capital stock in, any subsidiary that is not wholly owned (either directly or through one or more other subsidiaries) by the Company, or permit any subsidiary to create or authorize the creation of, or issue or obligate itself to issue, any shares of any class or series of shares or capital stock, or sell, transfer, or otherwise dispose of any shares or capital stock of any direct or indirect subsidiary of the Company, or permit any direct or indirect subsidiary to sell, lease, transfer, exclusively license or otherwise dispose (in a single transaction or series of related transactions) of all or substantially all of the assets of such subsidiary.

| 16 |

Any rights, powers, preferences and other terms of the Series A Preferred Shares in the Amended Memorandum and Articles, may be waived on behalf of all holders of Series A Preferred Shares by the written consent or affirmative vote of the holders of a majority of the then outstanding Series A Preferred Shares.

Series B Preferred Shares

General. The Amended Memorandum and Articles authorise the issuance of a maximum of 21,000,000 Series B Preferred Shares with a par value of US$0.0001 each. All of our outstanding Series B Preferred Shares are fully paid and non-assessable. To the extent they are issued, certificates representing the Series B Preferred Shares are issued in registered form.

Dividends. The holders of Series B Preferred Shares shall be entitled to receive dividends on Series B Preferred Shares equal (on an as-if-converted-to-Ordinary Shares basis) to and in the same form as dividends actually paid on Ordinary Shares when, as and if such dividends are paid on Ordinary Shares. No other dividends or other distributions shall be paid on Series B Preferred Shares.

Voting Rights. The holders of Series B Preferred Shares shall not be entitled to vote on any resolution of shareholders, except in relation to a variation of the rights of the Series B Preferred Shares.

Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of Series B Preferred Shares shall be entitled to receive out of the assets, whether capital or surplus, of the Company the same amount that a shareholder of Ordinary Shares would receive if the Series B Preferred Shares were fully converted (disregarding for such purposes any conversion limitations hereunder) to Ordinary Shares which amounts shall be paid pari passu with all shareholders of Ordinary Shares.

Conversion Rights. The Series B Preferred Shares are convertible, at the option of the holder thereof, at any time and from time to time and after the Series B Original Issue Date, into such number of fully paid and non-assessable Ordinary Shares at the applicable Conversion Price as detailed in the Amended Memorandum and Articles and subject to adjustment if the Company (i) pays a share dividend or issues bonus shares or otherwise makes a distribution or distributions payable in Ordinary Shares on Ordinary Shares or any other Ordinary Share Equivalents (which, for avoidance of doubt, shall not include any Ordinary Shares issued by the Company upon conversion of, or payment of a dividend on, the Series B Preferred Shares), (ii) subdivides outstanding Ordinary Shares into a larger number of shares, (iii) combines (including by way of reverse share split or combination) outstanding Ordinary Shares into a smaller number of shares, or (iv) issues, in the event of a reclassification of the Ordinary Shares, any shares of the Company.

Protective Provisions. As long as any Series B Preferred Shares are outstanding, the Company shall not do any of the following without the written consent or affirmative approval of the holders of a majority of the then outstanding Series B Preferred Shares: (a) alter or change adversely the powers, preferences or rights given to the Series B Preferred Shares or alter or amend the Amended Memorandum and Articles, in any manner that adversely affects the rights of the holders of the Series B Preferred Shares, (b) increase the number of authorised Series B Preferred Shares; or (c) enter into any agreement with respect to any of the foregoing.

Any rights, powers, preferences and other terms of the Series B Preferred Shares in the Amended Memorandum and Articles, may be waived on behalf of all holders of Series B Preferred Shares by the written consent or affirmative vote of the holders of a majority of the then outstanding Series B Preferred Shares.

| 17 |

Blank Check Preferred Shares

Our Amended Memorandum and Articles provide that Blank Check Preferred Shares may be issued from time to time in one or more series. Our board of directors are authorized to fix the voting rights, if any, designations, powers, preferences, the relative, participating, optional or other special rights and any qualifications, limitations and restrictions thereof, applicable to the shares of each series. Our board of directors are able to, without shareholder approval, issue Blank Check Preferred Shares with voting and other rights that could adversely affect the voting power and other rights of the holders of the ordinary shares and could have anti-takeover effects. The ability of our board of directors to issue Blank Check Preferred Shares without shareholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. We have no Blank Check Preferred Shares issued and outstanding at the date hereof. Although we do not currently intend to issue any Blank Check Preferred Shares, we cannot assure you that we will not do so in the future. No Blank Check Preferred Shares are being issued or registered in this offering.

General

Objects and Purposes, Register, and Shareholders. Subject to the BVI Act and BVI law, our objects and purposes are unlimited. Our register of members will be maintained by our transfer agent, Transhare Corporation. Under the BVI Act, a BVI company may treat the registered holder of a share as the only person entitled to (a) exercise any voting rights attaching to the share, (b) receive notices, (c) receive a distribution in respect of the share and (d) exercise other rights and powers attaching to the share. Consequently, as a matter of BVI law, where a shareholder’s shares are registered in the name of a nominee (such as Cede & Co), the nominee is entitled to receive notices, receive distributions and exercise rights in respect of any such shares registered in its name. The beneficial owners of the shares registered in a nominee’s name will therefore be reliant on their contractual arrangements with the nominee in order to receive notices and dividends and ensure the nominee exercises voting and other rights in respect of the shares in accordance with their directions.

Directors’ Powers. Under the BVI Act, subject to any modifications or limitations in a company’s memorandum and articles of association, a company’s business and affairs are managed by, or under the direction or supervision of, its directors; and directors generally have all powers necessary to manage a company. A director must disclose any interest he has on any proposal, arrangement or contract not entered into in the ordinary course of business and on usual terms and conditions. An interested director may (subject to the memorandum and articles) vote on a transaction in which he has an interest. In accordance with, and subject to, our Amended Memorandum and Articles, the directors may by resolution of directors exercise all the powers of the Company to incur indebtedness, liabilities or obligations and to secure indebtedness, liabilities or obligations whether of the Company or of any third party.

Appointment and Removal of Directors. In accordance with our Amended Memorandum and Articles, any director may be appointed by resolution of shareholders or resolution of directors. A director shall be removed from office (a) with or without cause, by resolution of shareholders passed at a meeting called for the purpose of removing the director or by written resolution passed by at least 75% of the votes of the shares of the company entitled to vote or (b) with cause, by resolution of directors passed at a meeting of directors called for the purpose of removing the director.

Shareholder Meetings. In accordance with, and subject to, our Amended Memorandum and Articles, (a) any director of the Company may convene meetings of the shareholders at such times as the director considers necessary or desirable (and the director convening a meeting of shareholders may fix as the record date for determining those shareholders that are entitled to vote at the meeting the date notice is given of the meeting, or such other date as may be specified in the notice, being a date not earlier than the date of the notice); and (b) upon the written request of shareholders entitled to exercise 30% or more of the voting rights in respect of the matter for which the meeting is requested, the directors shall convene a meeting of shareholders. Under BVI law, the memorandum and articles of association may be amended to decrease but not increase the required percentage to call a meeting above 30%. In accordance with, and subject to, our Amended Memorandum and Articles, (a) the director convening a meeting shall give not less than 7 days’ notice of a meeting of shareholders to those shareholders whose names on the date the notice is given appear as shareholders in the register of members of the Company and are entitled to vote at the meeting; and the other directors; (b) a meeting of shareholders held in contravention of the requirement to give notice is valid if shareholders holding at least 90% of the total voting rights on all the matters to be considered at the meeting have waived notice of the meeting and, for this purpose, the presence of a shareholder at the meeting shall constitute waiver in relation to all of the ordinary shares that that shareholder holds; (c) a quorum required for a meeting of members consists of not less than 50% of the votes of the Share entitled to vote present in person or by proxy at the meeting or, if a corporation or other non-natural person, by its duly authorized representative; and (d) if within two hours from the time appointed for the meeting a quorum is not present, the meeting, if convened upon the request of the shareholders, shall be dissolved; in any other case it shall stand adjourned to the next business day in the jurisdiction in which the meeting was to have been held at the same time and place or to such other time and place as the directors may determine, and if at the adjourned meeting there are present within one hour from the time appointed for the meeting in person or by proxy not less than one third of the votes of the ordinary shares entitled to vote on the matters to be considered by the meeting, those present shall constitute a quorum but otherwise the meeting shall be dissolved.

| 18 |

Disclosure of the Securities and Exchange Commission’s Position on Indemnification for Securities Act Liabilities. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, the registrant has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Transfer of Shares. Under the BVI Act shares that are listed on a recognized exchange may be transferred without the need for a written instrument of transfer if the transfer is carried out in accordance with the laws, rules, procedures and other requirements applicable to shares listed on the recognized exchange and subject to the Company’s memorandum and articles of association.

Calls on Shares and Forfeiture of Shares. Our board of directors may from time to time make calls upon members for any amounts unpaid on their shares in a notice served to such members at least 14 clear days prior to the specified time of payment. The shares that have been called upon and remain unpaid are subject to forfeiture.

Redemption of Shares. Subject to the written consent or affirmative approval of the holders of Series A Preferred Shares where applicable, the BVI Act and our Amended Memorandum and Articles permit us to purchase our own shares with the prior written consent of the relevant members, on such terms and in such manner as may be determined by our board of directors and by a resolution of directors and in accordance with the BVI Act.

Issuance of Additional Shares. Subject to the written consent or affirmative approval of the holders of Series A Preferred Shares, our Amended Memorandum and Articles authorize our board of directors to issue additional shares from time to time as our board of directors shall determine. Our Amended Memorandum and Articles do not provide for pre-emptive rights.

However, under British Virgin Islands law, our directors may only exercise the rights and powers granted to them under our Amended Memorandum and Articles for a proper purpose and for what they believe in good faith to be in the best interests of our Company.

Anti-Takeover Provisions. Some provisions of our Amended Memorandum and Articles may discourage, delay or prevent a change of control of our company or management that members may consider favorable, including provisions that:

| ● | authorize our board of directors to issue preference shares in one or more series and to designate the price, rights, preferences, privileges and restrictions of such preference shares without any further vote or action by our members; and | |

| ● | limit the ability of members to requisition and convene general meetings of members. |

However, under British Virgin Islands law, our directors may only exercise the rights and powers granted to them under our Amended Memorandum and Articles for a proper purpose and for what they believe in good faith to be in the best interests of our Company.

Summary of Certain Significant Provisions of BVI Law

The BVI Act differs from laws applicable to US corporations and their shareholders. Set forth below is a summary of certain significant provisions of the BVI Act applicable to us (save to the extent that such provisions have been, to the extent permitted under the BVI Act, negated or modified in our Amended Memorandum and Articles in accordance with the BVI Act).

Mergers, Consolidations and Similar Arrangements. The BVI Act provides for mergers as that expression is understood under US corporate law. Common law mergers are also permitted outside of the scope of the BVI Act. Under the BVI Act two or more BVI companies or a BVI company and non-BVI company, each a “constituent company”, may merge or consolidate. The BVI Act provides for slightly different procedures depending on the nature of the parties to the merger.

| 19 |

A merger involves the merging of two or more companies into one of the constituent companies (to the merger) with one constituent company continuing in existence to become the surviving company post-merger. A consolidation involves two or more companies consolidating into a new company.

A merger is effective on the date that the articles of merger (as described below) are registered by the Registrar of Corporate Affairs in the BVI, or on such later date, not exceeding 30 days from the date of registration as is stated in the articles of merger.

As soon as a merger becomes effective:

| a) | the surviving company (so far as is consistent with its memorandum and articles, as amended by the articles of merger) has all rights, privileges, immunities, powers, objects and purposes of each of the constituent companies; | |