UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

+86-

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | |

|

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☒ |

| International Financial Reporting Standards as issued |

| Other ☐ |

|

| by the International Accounting Standards Board ☐ |

|

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐ Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

|

| Page | ||

5 | ||||

5 | ||||

5 | ||||

5 | ||||

46 | ||||

66 | ||||

66 | ||||

79 | ||||

87 | ||||

88 | ||||

90 | ||||

90 | ||||

101 | ||||

102 | ||||

103 | ||||

103 | ||||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 103 | |||

103 | ||||

104 | ||||

104 | ||||

104 | ||||

104 | ||||

104 | ||||

105 | ||||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 105 | |||

105 | ||||

105 | ||||

106 | ||||

106 | ||||

106 | ||||

106 | ||||

107 |

2

Conventions Used in this Annual Report

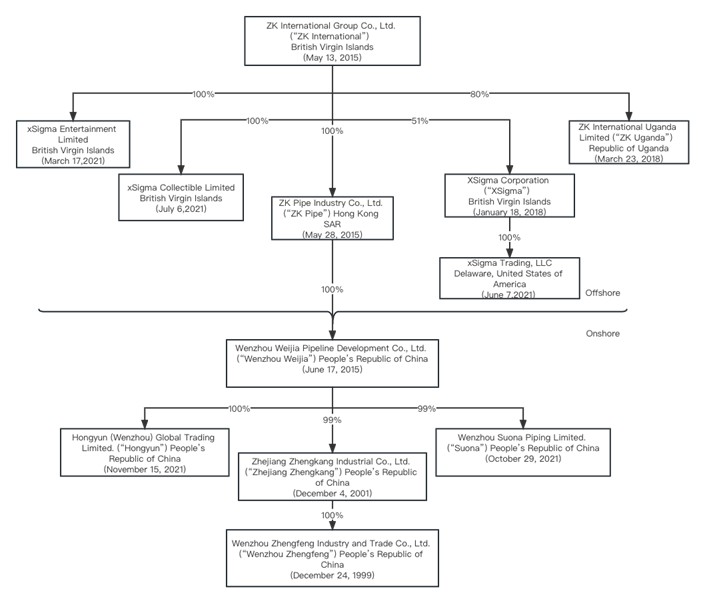

Except where the context otherwise requires and for purposes of this annual report on Form 20-F only, “we,” “us,” “our company,” “Company,” “our” and “ZK” refer to:

· | Wenzhou Weijia Pipeline Development Co., Ltd. (also referred to as 温州维佳管道发展有限公司 in China), a PRC company (“Wenzhou Weijia” when individually referenced), which is a wholly-owned subsidiary of ZK Pipe; |

· | Wenzhou Zhengfeng Industry and Trade Co., Ltd. (also referred to as 温州正丰工贸有限公司 in China), a PRC company (“Wenzhou Zhengfeng” when individually referenced), which is a wholly-owned subsidiary of Zhejiang Zhengkang; and |

· | xSigma Corporation, a British Virgin Islands company limited by ordinary shares (“xSigma Corporation” when individually referenced), 51% of its equity interest is held by ZK International; |

· | xSigma Collectibles Limited, a British Virgin Islands company limited by ordinary shares (“xSigma Collectibles” when individually referenced), a wholly-owned subsidiary of ZK International; |

· | xSigma Entertainment Limited, a British Virgin Islands company limited by ordinary shares (“xSigma Entertainment” when individually referenced), a wholly-owned subsidiary of ZK International; |

· | xSigma Trading, LLC, a Delaware limited liability company (“xSigma Trading, LLC” when individually referenced), a wholly-owned subsidiary of xSigma Corporation; |

· | ZK International Group Co., Ltd., a British Virgin Islands company limited by ordinary shares (“ZK International” when individually referenced); |

· | ZK International Uganda Limited, a company incorporated under the laws of the Republic of Uganda (“ZK Uganda” when individually referenced), 80% of its equity interest is held by ZK International; |

· | ZK Pipe Industry Co., Ltd., a Hong Kong limited company (“ZK Pipe” when individually referenced), which is a wholly-owned subsidiary of ZK International; |

· | Zhejiang Zhengkang Industrial Co., Ltd. (also referred to as 浙江正康实业股份有限公司 in China), a PRC company (“Zhejiang Zhengkang” when individually referenced), 99% of its equity interest is held by Wenzhou Weijia; |

| ● | Hongyun (Wenzhou) Global Trading Limited. (also referred to as 宏蕴(温州)国际贸易有限公司 in China), a PRC company (“Hongyun” when individually referenced), 100% of its equity interest is held by Wenzhou Weijia; |

| ● | Wenzhou Suona Piping Limited. (also referred to as 温州索纳管业有限公司 in China), a PRC company (“Suona” when individually referenced), 99% of its equity interest is held by Wenzhou Weijia; |

Investors are cautioned that you own interest in ZK International, the holding company established in the British Virgin Islands that does not have conduct material operations. ZK International conducts business through its subsidiaries, primarily based in China.

This annual report contains translations of certain RMB amounts into U.S. dollar amounts at a specified rate solely for the convenience of the reader. All reference to “U.S. dollars”, “USD”, “US$” or “$” are to United States dollars. The exchange rates in effect as of September 30, 2022, 2021, and 2020 were US $1.00 for RMB 7.1135, RMB 6.4434, and RMB 6.7896, respectively. The average exchange rates for the years ended September 30, 2022, 2021, and 2020 were US $1.00 for RMB 6.5532, RMB 6.5072, and RMB 7.0056, respectively. We use period-end exchange rates for assets and liabilities and average exchange rates for revenue and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

3

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed in this report may constitute forward-looking statements for purposes of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” and similar expressions are intended to identify such forward-looking statements. Our actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including, without limitation, those discussed under “Item 3—Key Information—Risk Factors,” “Item 4—Information on the Company,” “Item 5—Operating and Financial Review and Prospects,” and elsewhere in this report, as well as factors which may be identified from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) or in the documents where such forward-looking statements appear. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

The forward-looking statements contained in this report reflect our views and assumptions only as of the date this report is signed. Except as required by law, we assume no responsibility for updating any forward-looking statements.

4

PART I

ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable for annual reports on Form 20-F.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable for annual reports on Form 20-F.

ITEM 3. | KEY INFORMATION |

Implications of the Holding Foreign Companies Accountable Act (“HFCAA”)

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. An identified issuer will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. In June 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed.

Neither ZK International nor any of its subsidiaries has been identified and we do not expect ZK International or any of its subsidiaries to be identified by the Commission under the HFCAA and the AHFCAA. Our auditor, ZH CPA, LLC, is headquartered in Denver, Colorado, and is subject to inspection by the PCAOB on a regular basis. However, recent developments with respect to audits of China-based companies create uncertainty about the ability of ZH CPA, LLC to fully cooperate with the PCAOB’s request for audit workpapers without the approval of the Chinese authorities. We cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCAA, the AHFCAA, and ultimately result in a determination by a securities exchange to delist the Company’s securities. If we cannot engage a new auditor within a reasonable time under reasonable terms, our ordinary shares may be delisted, and the price of our ordinary shares may significantly decrease or become worthless. See “Item 3.D Risk Factors — Risks Related to Our Ordinary Shares — Our ordinary shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment” on page 41.

5

Corporate Structure and the Risks Relating to Being a China-based Company

ZK International is a British Virgin Islands incorporated holding company without any material operations. ZK International conducts business through its subsidiaries, primarily based in China. ZK International does not conduct business through variable interest entity structure. Our corporate structure involves unique risks to investors. For more details of risks related to our corporate structure, see “Item 3.D Risk Factors — Risks Related to Our Corporate Structure —ZK International is a holding company and will rely on dividends paid by our subsidiaries for our cash needs. Any limitation on the ability of our subsidiaries to make dividend payments to us, or any tax implications of making dividend payments to us, could limit our ability to pay our expenses or pay dividends to holders of our ordinary shares.” on page 39 and “PRC regulation of loans to and direct investment in PRC entities by offshore holding companies to PRC entities may delay or prevent us from making loans or additional capital contributions to our PRC operating subsidiaries.” starting on page 40.

The PRC subsidiaries, Wenzhou Weijia, Wenzhou Zhengfeng, and Zhenjiang Zhengkang, are subject to various legal and operational risks associated with being based in China and having a majority of operations in China. The PRC government has significant authority to exert influence on the ability of a China-based company to conduct its business, accept foreign investments or be listed on a U.S. or other foreign exchange. The PRC government has initiated a series of regulatory actions and statements recently to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this annual report, we and our PRC subsidiary have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice, or sanction. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on the ability of the PRC subsidiaries to conduct business, accept foreign investments, and list on an U.S. or other foreign exchange. These risks may result in a material change in the operations of the PRC subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless. See “Risk Factors — Risks Related to Doing Business in China — The Chinese government may intervene or influence the operations of the PRC subsidiaries at any time. Such risks may result in a material change in the operations of the PRC subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless.” on page 31, “— The Chinese government exerts substantial influence over the manner in which the PRC subsidiaries must conduct business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if our holding company or subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which may cause the value of our ordinary shares to significantly decline or be worthless.” on page 32, and “ — The approval of the China Securities Regulatory Commission may be required in connection with future offerings, and, if required, we cannot predict whether we will be able to obtain such approval.” on page 33.

Summary of Risk Factors

Investing in our Company involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Company. Below please find a summary of the risks and challenges we face organized under relevant headings. These risks are discussed more fully in the section titled “Item 3.D. Risk Factors” in this Annual Report.

Risks Related to Doing Business in China

Risks related to the Chinese government’s exertion of substantial influence over the manner in which we must conduct our business activities. If our holding company or subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which may cause the value of our ordinary shares to significantly decline or be worthless.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, and government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

6

On June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took effect on September 1, 2021. On August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal Information Protection Law of the People’s Republic of China”, or “PRC Personal Information Protection Law”, which became effective on November 1, 2021. On December 28, 2021, the CAC jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which became effective on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. We believe that neither we nor our subsidiaries are currently required to obtain permission from any of the PRC authorities to operate and issue our ordinary shares to foreign investors, or required to obtain permission or approval from the CSRC, Cyberspace Administration of China (“CAC”) or any other governmental agency. On November 14, 2021, the CAC published the Security Administration Draft, which provides that data processing operators engaging in data processing activities that affect or may affect national security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. According to the Security Administration Draft, data processing operators who possess personal data of at least one million users or collect data that affects or may affect national security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. The deadline for public comments on the Security Administration Draft was December 13, 2021. As of the date of this annual report, we and our PRC subsidiary have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice, or sanction. Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. If we do not receive or maintain the approval, or inadvertently conclude that such approval is not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations and the value of our ordinary shares, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which the PRC subsidiaries must conduct business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if our holding company or subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which may cause the value of our ordinary shares to significantly decline or be worthless” on page 32.

Risks related to the Chinese government’s intervene or influence on the operations of the PRC subsidiaries.

The Chinese government may intervene or influence the operations of the PRC subsidiaries at any time. Such risks may result in a material change in the operations of the PRC subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — The Chinese government may intervene or influence the operations of the PRC subsidiaries at any time. Such risks may result in a material change in the operations of the PRC subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless” on page 31.

Risks related to the approval of the China Securities Regulatory Commission may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such approval.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, adopted the M&A Rules, which became effective on September 8, 2006 and was amended on June 22, 2009. On July 6, 2021, the State Council and General Office of the CPC Central Committee issued Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. On December 24, 2021, the CSRC, together with other relevant government authorities in China issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments), and the Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (“Draft Overseas Listing Regulations”). There remain uncertainties as to whether the Draft Overseas Listing Regulations are appliable to us and our continued listing on Nasdaq. If it is determined that CSRC approval is required for our continued listing, we may face sanctions by the CSRC or other PRC regulatory agencies for failure to seek CSRC approval for this offering. These sanctions may include fines and penalties on our operations in the PRC, limitations on our operating privileges in the PRC, suspension of business operations in the PRC, delays in or restrictions on the repatriation of the proceeds from this offering into the PRC, restrictions on or prohibition of the payments or remittance of dividends by our PRC subsidiary, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — The approval of the China Securities Regulatory Commission may be required in connection with future offerings, and, if required, we cannot predict whether we will be able to obtain such approval” on page 33.

7

Risks related to the Opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council may subject us to additional compliance requirement in the future.

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued Opinions emphasizing the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. Since these Opinions were recently issued, official guidance and interpretation of the Opinions remain unclear in several respects at this time. Therefore, we cannot assure you that we will remain fully compliant with all new regulatory requirements of the Opinions or any future implementation rules on a timely basis, or at all. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — The Opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council may subject us to additional compliance requirement in the future” on page 33.

Risks related to becoming subject to recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, could harm our business operations, reputation and result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably.

Recently, U.S. public companies with substantially their operations in China, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our company and our business. If we become the subject of any unfavorable allegations, it may be a major distraction to our management. If such allegations are not proven to be groundless, our company and business operations will be severely hampered and your investment in our stock could be rendered worthless. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations and our reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably” on page 34.

Risks related to adverse change in political and economic policies of the PRC government

Substantially all of our operations are located in China. Accordingly, our business, prospects, financial condition and results of operations may be influenced to a significant degree by political, economic and social conditions in China generally and by continued economic growth in China as a whole. See “Item 3.D. Risk Factors—Risks Related to Doing Business in China—Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position” on page 34.

Risks related to the imposition of trade barriers and taxes that may reduce our ability to do business internationally, and the resulting loss of revenue could harm our profitability.

We may experience barriers to conducting business and trade in our targeted emerging markets in the form of delayed customs clearances, customs duties and tariffs, and there can be no assurance that this will not reduce the level of sales that we achieve in such markets, which would reduce our revenues and profits. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — Imposition of trade barriers and taxes may reduce our ability to do business internationally, and the resulting loss of revenue could harm our profitability” on page 35.

Risks related to our operations and assets in the PRC since shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers.

Most of our executive officers and directors are non-residents of the U.S., and substantially all the assets of such persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — Since the operations of the PRC subsidiaries and substantially all of our assets are located in the PRC, shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers” on page 35.

8

Risks related to our uncertainty with respect to the PRC legal system which could adversely affect us.

We conduct all our business through subsidiaries in China and our PRC subsidiaries are generally subject to laws and regulations applicable to foreign investments, and wholly foreign-owned enterprises. Uncertainties regarding the enforcement of laws and the fact that rules and regulations in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our PRC Subsidiaries’ operations at any time, or may exert more oversight and control over offerings conducted overseas and/or foreign investment in issuers with substantial operations in China could result in a material change in our operations or financial performance and/or could result in a material reduction in the value of our ordinary shares or hinder our ability to raise necessary capital. See “Item 3.D. Risk Factors — Risks Related to Doing Business in China — Uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice could adversely affect us” on page 36.

Risks related to the Chinese governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our security-holders. See “Item 3.D. Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may affect the value of your investment” on page 37.

Risks related to PRC subsidiaries’ ability to increase their registered capital or distribute profits to us

PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, which could adversely affect our business and prospects. See “Item 3.D. Risk Factors-Risks Related to Doing Business in China - PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us or otherwise expose us or our PRC resident beneficial owners to liability and penalties under PRC law” on page 38.

Risks Related to Our Corporate Structure

Risks related to our status as a holding company which makes us reliant on dividends paid by our subsidiaries for our cash needs.

We are a BVI holding company and conduct substantially all of our business through our subsidiaries in China. We may rely on dividends to be paid by our PRC subsidiaries to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict our PRC subsidiaries’ ability to pay dividends or make other distributions to us. See “Item 3.D. Risk Factors — Risks Related to Our Corporate Structure — ZK International is a holding company and will rely on dividends paid by our subsidiaries for our cash needs. Any limitation on the ability of our subsidiaries to make dividend payments to us, or any tax implications of making dividend payments to us, could limit our ability to pay our expenses or pay dividends to holders of our ordinary shares” on page 39 and “— PRC regulation of loans to and direct investment in PRC entities by offshore holding companies to PRC entities may delay or prevent us from making loans or additional capital contributions to our PRC operating subsidiaries” on page 40.

Risks Related to Our Business and Industry

Risks Related to the coronavirus (COVID-19) pandemic.

Zhejiang Province, where we conduct a substantial part of our business, was materially impacted by the spread of a novel strain of coronavirus (COVID-19). The extent to which the COVID-19 outbreak continues to impact our financial condition and results of operations for cannot be reasonably estimated at this time and will depend on future developments that currently cannot be predicted. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Our business could be materially harmed by the ongoing coronavirus (COVID-19) pandemic” on page 18.

9

Risks relating to operating in a highly competitive industry.

We face competition from both regional and importing manufacturers for pipe and fitting products because the market is fragmented, has low barriers to entry, and is driven for many of our products on the basis of price. Competitors may be able to grow and consolidate, as to take advantage of economies of scale, which could put pressure on our margins and adversely affect our financial condition or ability to expand our business. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Our industry is very competitive in China” on page 19.

Risks related to any decline in the availability or increase in the cost of raw materials.

Our pipe and fitting manufacturing operations depend heavily on the availability of various raw materials and energy resources. Any decline in the availability of raw material or fluctuation in the prices for raw materials or energy resources could materially increase our costs and therefore lower our earnings. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Any decline in the availability or increase in the cost of raw materials could materially affect our earnings” on page 20.

Risks related to outstanding bank loans.

If we are unable to make our payments when due or to refinance such amounts, our property could be foreclosed and our business could be negatively affected. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Outstanding bank loans may reduce our available funds” on page 20.

Risks related to our potential for weak liquidity.

If we continue to experience an increase in accounts receivable without substantial collection of them, this weak liquidity could have a material adverse effect on our financial health and performance. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Weak liquidity may have material adverse effect on our results of operations” on page 20.

Risks related to any supply chain disruption.

Supply chain fragmentation and local protectionism within China may complicate supply chain disruption risks. Limitations inherent within the supply chain, including competitive, governmental, legal, natural disasters, and other events could cause significant disruptions to our supply chain, manufacturing capability and distribution system. These disruptions could adversely impact our ability to produce and deliver products. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — Any disruption in the supply chain of raw materials and our products could adversely impact our ability to produce and deliver products” on page 21.

10

Risks related to our failure to protect our intellectual property rights, which could harm our business and competitive position.

Because of ambiguities in the PRC laws and enforcement difficulties, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other western countries. Furthermore, policing unauthorized use of proprietary technology is difficult and expensive, and we may need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope, and validity of our proprietary rights or those of others. Such litigation and an adverse determination in any such litigation, if any, could result in substantial costs and diversion of resources and management attention, which could materially and adversely harm our business and competitive position. See “Item 3.D. Risk Factors — Risks Related to Our Business and Industry — If we fail to protect our intellectual property rights, it could harm our business and competitive position” on page 23.

Risks Related to Investment in CG Malta Holding Limited

Risks related to becoming an investment company under U.S. federal securities law, which may require us to fundamentally restructure our business or potentially to cease operations.

If we are deemed to be an “investment company” under the Investment Company Act and cannot otherwise qualify for an exception or exemption from such definition, we would be required to register under the Investment Company Act as an investment company, fundamentally restructure our business or cease operations. If we were to register as an investment company after obtaining an order permitting us to do so, we would not be able to operate our business as we currently intend to conduct it. If we were to decide to not register under the Investment Company Act or if we were unable to register under the Investment Company Act, we would have to fundamentally restructure our business or cease operations. If we were found in violation of the Investment Company Act, we could become subject to monetary penalties or injunctive relief, or both. The abrupt change in our structure or operations due to these impacts of registering as an investment company or violating the Investment Company Act could materially and negatively affect our operations. See “Item 3.D. Risk Factors — Risks Related to Investment in CG Malta Holding Limited — We are subject to the risk of becoming an investment company under U.S. federal securities law, which may require us to fundamentally restructure our business or potentially to cease operations” on page 25.

11

Risks related to the potential for our designation as a “Passive Foreign Investment Company” in the future.

A non-U.S. corporation will be treated as a “Passive Foreign Investment Company” (“PFIC”) for U.S. Federal Income Tax purpose if at least 75% its gross income is “passive income” or on average at least 50% of the value of its assets is attributable to assets that produce passive income. It is likely that xSigma Entertainment’s investment in CG Malta Holding Limited would be deemed passive. If xSigma Entertainment completes the full investment in CG Malta Holding Limited, there is a risk that the Company will become an investment company, a PFIC or both. The consequence of any of those scenarios, or even the perception that such scenarios could occur, could result in a material change in our operations, a significant drop in the market price of our ordinary shares, possible civil litigation and regulatory enforcement. See “Item 3.D. Risk Factors — Risks Related to Investment in CG Malta Holding Limited — We could be deemed as a ‘Passive Foreign Investment Company’ in the future” on page 25.

Risks related to the online gaming and interactive entertainment industry because it is a new and evolving industry.

The industry may be affected by, among other things, developments in gaming platforms, legal and regulatory. Thus, CG Malta Holding Limited may become subject to additional compliance and subject to related costs, which may adversely affect the return on our investment in CG Malta Holding Limited. See “Item 3.D. Risk Factors — Risks Related to Investment in CG Malta Holding Limited — The online gaming and interactive entertainment industry is a new and evolving industrys, presenting significant uncertainty and business risks for CG Malta Holding Limited” on page 26.

Risks Related to the Stablecoin Exchange Platform

Risks related to our dependency on the volume of transactions conducted on the stablecoin exchange platform.

xSigma Corporation plans to generate commission revenue from the stablecoin in connection with the exchange by users through the stablecoin exchange platform. Due to the coin’s low trading volume and unstable market price, the exchange does not recognize revenue for the token until monetization of the token. As such, if xSigma Corporation does not manage to grow the transaction volume, our business, operating results and financial conditions would be adversely affected. See “Item 3.D. Risk Factors — Risks Related to the Stablecoin Exchange Platform — Our total revenue will be dependent on volume of transactions conducted on the stablecoin exchange platform. If xSigma Corporation does not manage to grow such volume, our business, operating results, and financial condition would be adversely affected” on page 26.

Risks related to Cryptocurrency, including stablecoin, because it is not legal tender, is not backed by the U.S. government or most other governments, and customer balances are not covered by FDIC or SIPC protections.

Although they are considered fiat-backed stablecoins. They are not legal tender, are not backed by the U.S. government or most other governments and customer balances are not covered by FDIC or SIPC protections. Federal, state and foreign governments may restrict the use and exchange of cryptocurrency, including the stablecoins, and regulation in the U.S. and in other countries is still developing. xSigma Corporation’s ability to operate the stablecoin exchange platform may be limited by these restrictions which may reduce liquidity of cryptocurrencies in the market and damage their public perception, and their utility as a payment system, which could decrease the price of cryptocurrencies generally or individually. It is possible that the adoption of cryptocurrencies may slow, take longer to develop or never be broadly adopted, which would negatively impact xSigma Corporation’s business, financial condition and results of operations. See “Item 3.D. Risk Factors — Risks Related to the Stablecoin Exchange Platform — Cryptocurrency, including stablecoin, is not legal tender, is not backed by the U.S. government or most other governments, and customer balances are not covered by FDIC or SIPC protections. The value of a cryptocurrency may be derived in large part from the continued willingness of market participants to exchange legal tender for cryptocurrency, or a particular cryptocurrency for another, which, if such willingness diminishes or disappears, may result in permanent and total loss of value for that particular cryptocurrency” on page 27.

12

Risks related to the regulation of the cryptocurrency industry which is incipient, fragmented and complex is likely to substantially change and xSigma Corporation’s interpretations of any cryptocurrency regulation may be challenged or its failure to comply with regulations may negatively impact its operations.

xSigma Corporation’s stablecoin exchange platform currently provides customers with the ability to exchange a limited number of DAI, USDC and USDT. Both domestic and foreign regulators and governments are increasingly focused on the regulation of cryptocurrencies however, there is currently no uniform applicable legal or regulatory regime governing cryptocurrencies in the United States. Thus, there is a substantial risk of inconsistent regulatory guidance among federal and state agencies and state governments which, along with potential accounting and tax issues or other requirements relating to cryptocurrencies, could impede xSigma Corporation’s growth and operations. See “Item 3.D. Risk Factors — Risks Related to the Stablecoin Exchange Platform — Regulation of the cryptocurrency industry is incipient, fragmented and complex and will likely change substantially. xSigma Corporation’s interpretations of any cryptocurrency regulation may be subject to challenge by the relevant regulators and xSigma Corporation’s failure to comply with such regulation may negatively impact its ability to allow customers to buy, hold and sell cryptocurrencies with it in the future and may materially adversely affect its business, financial condition and results of operations” on page 28.

Risks related to Cryptocurrency’s status as a “security” in any jurisdiction which is subject to a high degree of uncertainty and xSigma Corporation inability to properly characterize cryptocurrency may subject it to federal or state regulatory scrutiny, investigations, fines and other penalties.

The SEC has taken the position that certain cryptocurrencies fall within the definition of a “security” under the U.S. federal securities laws but that the application of the securities laws to cryptocurrencies may not be warranted in every instance. More so, platforms that bring together purchasers and sellers to trade cryptocurrencies are generally subject to registration as national securities exchanges, or must qualify for an exemption. In the event that the SEC, a foreign regulatory authority, or court were to determine that a stablecoin currently offered, sold or exchanged on the xSigma Corporation’s platform is a “security” under applicable laws, xSigma Corporation could be subject to legal or regulatory action. Such an action may adversely affect xSigma Corporation’s business, financial condition and results of operations. See “Item 3.D. Risk Factors — Risks Related to the Stablecoin Exchange Platform — A particular cryptocurrency’s status as a ‘security’ in any jurisdiction is subject to a high degree of uncertainty and if xSigma Corporation is unable to properly characterize a cryptocurrency it may be subject to federal or state regulatory scrutiny, investigations, fines and other penalties, which may adversely affect xSigma Corporation’s business, financial condition and results of operations” on page 29.

Risks Related to The Equity, Contract For Differences (CFD) and Crypto Trading Platform

Risks related to xSigma Corporation’s implementation of know-your-customer procedures to prevent offers and sales of CFD and Crypto assets in the United States or to U.S. persons, in the face of risks related to outdated, inaccurate, false or misleading information and the use of virtual private network to visit xSigma’s trading platform.

Although xSigma Trading or its licensed partners will take measures to screen accounts, block IP of users from U.S. sanctioned countries, and conduct KYC procedures at account opening and on an annual basis thereafter, xSigma Corporation cannot fully confirm the accuracy, currency and completeness of such information beyond reasonable effort. Furthermore, xSigma Corporation may not be able to prevent users from using virtual private network or other high technology measures to circumvent the blacklist IP address to visit the websites. If xSigma Corporation fails to comply with relevant laws and regulations, xSigma Corporation will be subject to legal or regulatory sanctions, fines or penalties, financial loss, or damage to reputation. See “Item 3.D. Risk Factors — Risks Related to The Equity, Contract For Differences (CFD) and Crypto Trading Platform — Although xSigma Corporation have the know-your-customer, or KYC procedures to prevent offers and sales of CFD and Crypto assets in the United States or to U.S. persons, xSigma Corporation faces the risks related to the KYC procedures when the clients provide outdated, inaccurate, false or misleading information or use virtual private network to visit xSigma Trading, the equity, CFD and Crypto trading platform” on page 30.

13

Risks Related to the Non-fungible Token (NFT) Marketplace

Risks related to the failure to safeguard and manage xSigma Collectibles’ customers’ fiat money and crypto assets could adversely impact our business, operating results, and financial condition.

Any failure by xSigma Collectibles or its service providers to manage customers’ crypto assets and funds appropriately and in compliance with applicable regulatory requirements could result in reputational harm, significant financial losses, lead customers to discontinue or reduce their use of our products, and result in significant penalties and fines, which could adversely impact our business, operating results, and financial condition. See “Item 3.D. Risk Factors — Risks Related to the Non-fungible Token (NFT) Marketplace — The failure to safeguard and manage xSigma Collectibles’ customers’ fiat money and crypto assets could adversely impact our business, operating results, and financial condition” on page 31.

Risks Related to Our Ordinary Shares

Risks that trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completely our auditor and that as a result an exchange may determine to delist our securities.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020 and states that if the SEC determines a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit such securities from being traded on a national securities exchange or in the over the counter trading market in the United States. In June 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed.

Neither ZK International nor any of its subsidiaries has been identified and we do not expect ZK International or any of its subsidiaries to be identified by the Commission under the HFCAA and the AHFCAA. Our current auditor, ZH CPA, LLC,is a U.S.-based accounting firm that is registered with the PCAOB and can be inspected by the PCAOB. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCAA, the AHFCAA, and ultimately result in a determination by a securities exchange to delist the Company’s securities. If we cannot engage a new auditor within a reasonable time under reasonable terms, our ordinary shares may be delisted, and the price of our ordinary shares may significantly decrease or become worthless. See “Item 3.D. Risk Factors — Risks Related to Our Ordinary Shares — Our ordinary shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment” on page 40.

Risks related to our ability to follow certain home country corporate governance practices instead of otherwise applicable Nasdaq Capital Market requirements as a foreign private issuer, which may result in less protection than afforded to investors under rules applicable to domestic U.S. issuers.

As a foreign private issuer, we are permitted to and did follow certain home country corporate governance practices instead of those otherwise required under the applicable rules of the Nasdaq Capital Market for domestic U.S. issuers, provided we disclose the requirements we are not following and describe the home country practices we are following. Following our home country governance

14

practices as opposed to the requirements that would otherwise apply to a U.S. company listed on the Nasdaq Capital Market may provide less protection to you than what is accorded to investors under the applicable rules of the Nasdaq Capital Market applicable to domestic U.S. issuers. See “Item 3.D. Risk Factors — Risks Related to Our Ordinary Shares — As a foreign private issuer, we are permitted to, and did follow certain home country corporate governance practices instead of otherwise applicable Nasdaq Capital Market requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers” on page 42.

Risks related to shareholder inability to commence derivative actions, thereby depriving shareholders of the ability to protect their interests.

British Virgin Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States. Moreover, there is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will generally recognize and enforce the non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. This means that even if shareholders were to sue us successfully, they may not be able to recover anything to make up for the losses suffered. See “Item 3.D. Risk Factors — Risks Related to Our Ordinary Shares — British Virgin Islands companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests” on page 44.

Risks related to the market price of the Company’s ordinary shares may continue to be volatile.

The trading price of our ordinary shares has been volatile and could continue to be subject to wide fluctuations in response to various factors, some of which are beyond our control. Such a decline in the market price of our ordinary shares could adversely affect our ability to issue additional shares or other of our securities and our ability to obtain additional financing in the future. See “Item 3.D. Risk Factors — Risks Related to Our Ordinary Shares — The market price of the Company’s ordinary shares may continue to be volatile” on page 45.

PRC Permissions and Approvals

The PRC Subsidiaries are not operating in an industry that prohibits or limits foreign investment. In addition, other than those requisite for a domestic company in China to engage in the businesses similar to ours, the PRC Subsidiaries are not required to obtain any permissions or approvals from Chinese authorities, including the China Securities Regulatory Commission (CSRC), Cyberspace Administration of China (CAC) or any other governmental agency that is required to operate the business of the PRC subsidiaries and to offer our securities to foreign investors. However, if we do not receive or maintain the permissions and approvals, or we inadvertently conclude that such permissions and approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain permission and approval in the future, we may be subject to investigations by competent regulators, fines or penalties, ordered to suspend our relevant operations and rectify any non-compliance, prohibited from engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. See “Risk Factors – Risks Related to Doing Business in China – The Chinese government exerts substantial influence over the manner in which the PRC Subsidiaries must conduct business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if our holding company or subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which may cause the value of our ordinary shares to significantly decline or be worthless” on page 32.

15

Our PRC subsidiaries have received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied. The following table provides details on the licenses and permissions held by our PRC subsidiaries.

Company | License/Permission/Approval | Issuing Authority | Validity |

Wenzhou Weijia | Business License | Wenzhou Municipal Administration for Market Regulation | Until June 16, 2035 |

Wenzhou Zhengfeng | Business License | Wenzhou Municipal Administration for Market Regulation | Long-term |

Zhenjiang Zhengkang | Business License | Wenzhou Municipal Administration for Market Regulation | Long-term |

Zhenjiang Zhengkang | the registration receipts of stationary pollution source discharge | Ministry of Ecology and Environment of the People’s Republic of China | Until March 14, 2025 |

Hongyun | Business License | Wenzhou Municipal Administration for Market Regulation | Long-term |

Suona | Business License | Wenzhou Municipal Administration for Market Regulation | Long-term |

Cash and Asset Transfers within the Corporate Structure

ZK International is a holding company and conduct substantially all of our business through our PRC subsidiaries. ZK International may relies on dividends to be paid by its subsidiaries to fund its cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to the shareholders, to service any debt ZK International may incur and to pay the operating expenses. If the subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Within our direct holding structure, the cross-border transfers of funds within our corporate entities are in compliance with the laws of the British Virgin Islands, the Republic of Uganda, Delaware, Hong Kong and the PRC. ZK International may transfer funds to its subsidiaries through capital contribution or loans without restrictions on the amount of the funds, subject to compliance with the relevant laws and regulations, and subject to satisfaction of applicable government registration, approval and filing requirements.

ZK International’s BVI subsidiaries, xSigma Entertainment Limited, xSigma Collectible Limited and xSigma Corporation, may, according to the BVI Business Companies Act 2004 (as amended) but subject in each case to their respective memorandum and articles of association, make dividends and distribution to ZK International to the extent that immediately after the distribution, such company’s assets do not exceed its liabilities and that such company is able to pay its debts as they fall due.

ZK International’s Hong Kong subsidiary, ZK Pipe Industry Co., Ltd. may, according to the Companies Ordinance of Hong Kong, make a distribution out of profits available for distribution to ZK International.

ZK International’s subsidiary established in the Repuiblic of Uganda, ZK International Uganda Limited, may, according to the Companies Act of 2012, as amended, make a distribution out of profits to ZK International.

According to the Limited Liability Company Act of Delaware, ZK’s indirect subsidiary established in Delaware, xSigma Trading LLC, may make a distribution to its parent company, xSigma Corporation to the extend, after giving effect to the distribution, all liabilities of xSigma Trading LLC, other than liabilities to xSigma Corporation on account of xSigma Corporation’s membership interests in xSigma Trading LLC, if any, do not exceed the fair value of the assets of xSigma Trading LLC.

The PRC has currency and capital transfer regulations that require us to comply with certain requirements for the movement of capital. The Company is able to transfer cash (US Dollars), through its Hong Kong subsidiary, ZK Pipe Industry Co., Ltd., to its PRC subsidiaries through an investment (by increasing the Company’s registered capital in a PRC subsidiary).

Increasing the registered capital in a PRC subsidiary requires the filing of the local commerce department, while a shareholder loan requires a filing with the State Administration of Foreign Exchange or its local bureau. Aside from the declaration to the State Administration of Foreign Exchange, there is no restriction or limitations on such cash transfer or earnings distribution.

16

With respect to the payment of dividends by a PRC subsidairy, we note the following:

| 1. | PRC regulations currently permit the payment of dividends only out of accumulated profits, as determined in accordance with accounting standards and PRC regulations (an in-depth description of the PRC regulations is set forth below); |

| 2. | The PRC subsidiaries are required to set aside, at a minimum, 10% of their net income after taxes, based on PRC accounting standards, each year as statutory surplus reserves until the cumulative amount of such reserves reaches 50% of their registered capital; |

| 3. | Such reserves may not be distributed as cash dividends; |

| 4. | The PRC subsidiaries may also allocate a portion of their after-tax profits to fund their staff welfare and bonus funds; except in the event of a liquidation, these funds may also not be distributed to shareholders; the Company does not participate in a Common Welfare Fund; and |

| 5. | The incurrence of debt, specifically the instruments governing such debt, may restrict a subsidiary’s ability to pay stockholder dividends or make other cash distributions. |

The Company’s subsidiaries within China can transfer funds to each other when necessary through the way of current lending. The transfer of funds among companies are subject to the Provisions on Private Lending Cases, which was implemented on August 20, 2020 to regulate the financing activities between natural persons, legal persons and unincorporated organizations. The Provisions on Private Lending Cases does not prohibit using cash generated from one subsidiary to fund another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC subsidiaries’ ability to transfer cash between subsidiaries.

If our PRC subsidiaries are unable to pay shareholder dividends and/or make other cash payments to the other companies within our corporate structure when needed, our ability to conduct operations, make investments, engage in acquisitions, or undertake other activities requiring working capital may be materially and adversely affected. However, the operations and business of the PRC subsidiaries, including investment and/or acquisitions by our subsidiaries within China, will not be affected as long as the capital is not transferred in or out of the PRC.

During the fiscal year ended September 30, 2022, 2021 and 2020 and until the date of this annual report, there has been no transfers, dividends, or distributions between ZK International, its subsidiaries, or to investors, except that during the fiscal year ended September 30, 2022, ZK International transferred a total of $4,139,100 to Zhejiang Zhengkang Industrial Co. for business operation purposes.

ZK International’s subsidiaries have not distributed any earnings to ZK International. ZK International has not distributed any earnings to its shareholders. ZK International and its subsidiaries do not have any plan to distribute earnings or settle amounts owed in the foreseeable future. For the foreseeable future, ZK International and the subsidiaries intend to use the earnings for business operations. As a result, we do not expect to pay any cash dividends in the foreseeable future. Also, as of the date of this annual report, no cash generated from one subsidiary is used to fund another subsidiary’s operations and we do not anticipate any difficulties or limitations on our ability to transfer cash between subsidiaries. We have not installed any cash management policies that dictate the amount of such funding.

A. Selected Financial Data

The following table presents the selected consolidated financial information for our company. The selected consolidated statements of comprehensive income data for the fiscal years ended September 30, 2022, 2021, 2020, 2019, and 2018 and the selected consolidated balance sheets data as of September 30, 2022, 2021, 2020, 2019, and 2018 have been derived from our audited consolidated financial statements, which are included in this annual report beginning on page F-1. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” below. Our audited consolidated financial statements are prepared and presented in accordance with US GAAP.

(All amounts in thousands of U.S. dollars, except Shares outstanding)

17

Statement of operations data:

For the Fiscal Year ended September 30, | |||||||||||||||

| 2022 |

| 2021 |

| 2020 |

| 2019 |

| 2018 | ||||||

Revenue | $ | 102,391,636 | $ | 99,407,217 | $ | 86,846,791 | $ | 63,883,520 | $ | 54,884,381 | |||||

Cost of Revenue | $ | (94,796,037) | $ | (92,936,029) | $ | (82,903,989) | $ | (48,239,478) | $ | (36,593,792) | |||||

Gross Profit | $ | 7,595,599 | $ | 6,471,188 | $ | 3,942,802 | $ | 15,644,042 | $ | 18,290,589 | |||||

General and administrative expenses | $ | 5,421,575 | $ | 5,772,710 | $ | 2,482,972 | $ | 2,897,995 | $ | 4,071,116 | |||||

Asset impairment costs | 2,771,019 | — | — | — | — | ||||||||||

Research and development expenses | $ | 987,186 | $ | 1,234,161 | $ | 1,123,555 | $ | 1,452,061 | $ | 1,652,633 | |||||

Selling and marketing costs | $ | 2,380,429 | $ | 3,117,906 | $ | 2,215,651 | $ | 2,647,429 | $ | 2,949,204 | |||||

income (loss) from operations | $ | (3,964,610) | $ | (3,653,589) | $ | (1,879,376) | $ | 8,646,557 | $ | 9,617,636 | |||||

Interest expense | $ | (3,451,665) | $ | (1,196,648) | $ | (1,000,554) | $ | (1,151,045) | $ | (1,239,170) | |||||

Interest income | $ | 109,290 | $ | 13,733 | $ | 7,192 | $ | 24,437 | $ | 10,702 | |||||

Gain on disposal of subsidiary | $ | — | — |

| 536,612 |

| — |

| — | ||||||

Income (loss) on investment | $ | — | 50,649 |

| (256,937) |

| — |

| — | ||||||

Other income (expense), net | $ | (88,125) | $ | 431,438 | $ | 327,845 | $ | 921,973 | $ | 112,099 | |||||

Income (loss) before income taxes | $ | (7,395,110) | $ | (4,354,417) | $ | (2,265,218) | $ | 8,441,922 | $ | 8,501,267 | |||||

Income taxes | $ | 1,340,844 | $ | 552,146 | $ | 1,428,202 | $ | (248,228) | $ | (1,398,210) | |||||

Net income (loss) | $ | (6,054,266) | $ | (3,802,271) | $ | (837,016) | $ | 8,193,694 | $ | 5,933,688 | |||||

Foreign currency translation adjustment | $ | (5,504,385) | $ | 2,423,439 | $ | 2,319,048 | $ | (1,694,278) | $ | 272,237 | |||||

Comprehensive income (loss) | $ | (11,558,651) | $ | (1,378,832) | $ | 1,482,032 | $ | 6,499,416 | $ | 6,205,925 | |||||

Balance sheet data:

As of September 30, | |||||||||||||||

| 2022 |

| 2021 |

| 2020 |

| 2019 |

| 2018 | ||||||

Current assets | $ | 66,769,931 | $ | 78,703,663 | $ | 64,782,494 | $ | 58,853,036 | $ | 64,347,173 | |||||

Total assets | $ | 128,923,580 | $ | 133,662,301 | $ | 86,450,504 | $ | 78,402,367 | $ | 76,398,563 | |||||

Current liabilities | $ | 43,848,943 | $ | 44,510,115 | $ | 40,877,485 | $ | 34,584,662 | $ | 39,130,971 | |||||

Total liabilities | $ | 43,859,199 | $ | 44,537,949 | $ | 41,146,775 | $ | 34,584,662 | $ | 39,130,971 | |||||

Total shareholders' equity | $ | 85,064,381 | $ | 89,124,352 | $ | 45,303,729 | $ | 43,817,705 | $ | 37,267,592 | |||||

Shares outstanding |

| 30,392,940 |

| 28,918,177 |

| 16,558,037 |

| 16,558,037 |

| 16,528,037 | |||||

B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

D. Risk Factors

Risks Related to Our Business and Industry

Our business could be materially harmed by the ongoing coronavirus (COVID-19) pandemic.

Since the end of 2019, there has been an ongoing spread of a novel strain of coronavirus (COVID-19) in China, which has spread rapidly to many parts of the world. In March 2020, the World Health Organization (“WHO”) declared the COVID-19 as a pandemic. Governments in affected countries are imposing travel bans, quarantines and other emergency public health measures, which have caused material disruption to businesses globally resulting in an economic slowdown. These measures, though temporary in nature, may continue and increase depending on developments in the COVID-19’s outbreak.

18

Zhejiang Province, where we conduct a substantial part of our business, was materially impacted by the COVID-19. We followed the recommendations of local health authorities to minimize exposure risk for our employees, including the temporary closure of our offices and suspension of marketing activities, and having employees work remotely. Our on-site work was not resumed until mid-March 2020 upon approval from the local government. Due to the extended lock-down and self-quarantine policies in China, we experienced significant business disruption during the lock-down period from February to mid-March. The production of the Company’s suppliers and logistics services were suspended since early February and did not resume until February 25, 2020 and was picking up slowly after China reopened businesses nationwide. During the fiscal year 2022, the Company experienced delays in the purchase of raw material from supplies and delivery of products to domestic customers in China on a timely basis as a consequence of travel restrictions. Although the situation has eased since mid-May 2022, the number of orders placed by the customers was affected, as the business of those customers was negatively impacted. Meanwhile, the prices of the raw materials have also rised siginicantly since October 2021, especially the nikel which is an important component of stainless steel. Our management believes that the above negative impacts of the COVID-19 pandemic had a negative impact on our overall business operations and financial results for the fiscal year 2022; however, our management anticipates that the negative impacts of the COVID-19 pandemic will be eased during the fiscal year 2023 as China government has terminated the previous restriction policies and aims to reopen the economy.

The extent to which the COVID-19 outbreak impacts our financial condition and results of operations for the full year of 2023 cannot be reasonably estimated at this time and will depend on future developments that currently cannot be predicted, including new information which may emerge concerning the severity of the COVID-19 outbreak and the actions to contain the COVID-19 outbreak or treat its impact, the government steps to combat the virus, the disruption to the general business activities of the PRC and the impact on the economic growth and business of our manufacturers and distributors for the foreseeable future, among others.

We may incur liability for unpaid taxes, including interest and penalties.