UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23297

Infinity Long/Short Equity Fund, LLC.

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 299-2270

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to The Members is attached herewith.

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Semi-Annual Report

For the Six Months Ended September 30, 2021

(Unaudited)

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

For the Six Months Ended September 30, 2021

Semi-Annual Report

Table of Contents

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by the Fund’s private placement memorandum. Please read it carefully before investing.

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Schedule of Investments

September 30, 2021 (Unaudited)

| Redemptions | Redemption | Investment | Original | |||||||||||||

| Investment Funds (91.70%) | Permitted | Notice Period | Strategy | Cost | Fair Value | Acquisition Date | ||||||||||

| Coatue Qualified Partners, L.P. a,b,c | Quarterly | 45 Days | Fundamental (TMT Focus) | $ | 1,815,196 | 3,744,183 | 10/1/2016 | |||||||||

| MW Eureka (US) Fund Class A2 a,b | Monthly | 30 Days | Fundamental & Quantitative | 972,993 | 1,396,572 | 10/1/2016 | ||||||||||

| Point72 Capital, L.P. Class A-na,b,c,d | Quarterly | 45 Days | Fundamental & Quantitative | 1,383,887 | 1,662,871 | 6/1/2020 | ||||||||||

| Swiftcurrent Partners, L.P.a,b,c | Semi-Annually | 90 Days | Fundamental | 2,623,123 | 2,619,894 | 10/1/2017 | ||||||||||

| Two Sigma Spectrum Cayman Fund, Ltd. Class A1a,b,e | Quarterly | 55 Days | Quantitative | 2,572,355 | 3,079,720 | 1/1/2018 | ||||||||||

| Total Investment Funds (cost $9,367,554) (91.70%) | 12,503,240 | |||||||||||||||

| Total Investment (cost $9,367,554) (91.70%) | $ | 12,503,240 | ||||||||||||||

| Other assets in excess of liabilities (8.30%) | 1,131,838 | |||||||||||||||

| Members’ Equity - 100.00% | $ | 13,635,078 | ||||||||||||||

TMT - Technology, media and telecom

a Non-income producing.

b Investment Funds are issued in private placement transactions and as such are restricted as to resale.

c Early redemption penalties may apply.

d The investment fund can institute a gate provision on redemptions at the fund level of 25% of the fair value of the investment in the investment fund.

e The investment fund can institute a gate provision on redemptions at the fund level of 10% of the fair value of the investment in the investment fund.

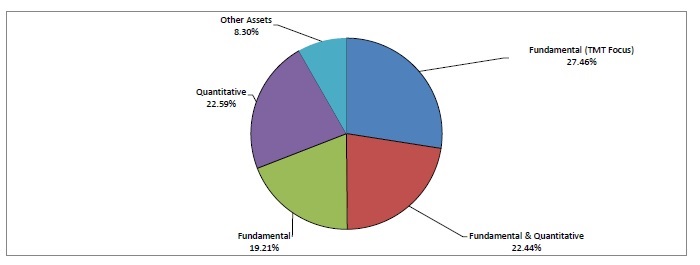

INVESTMENT STRATEGIES OF INVESTMENT FUND HOLDINGS AS A PERCENTAGE OF TOTAL MEMBERS’ EQUITY

Percentages as a percentage of total members’ equity are as follows:

The accompanying notes are an integral part of these Financial Statements.

| 1 |

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Statement of Assets, Liabilities and Members’ Equity

September 30, 2021 (Unaudited)

| Assets | ||||

| Investments, at fair value (cost $9,367,554) | $ | 12,503,240 | ||

| Cash | 355,194 | |||

| Receivable for investments sold | 5,337,428 | |||

| Prepaid assets | 22,292 | |||

| Due from Adviser | 4,377 | |||

| Total Assets | 18,222,531 | |||

| Liabilities | ||||

| Payable for shares repurchased | 4,543,544 | |||

| Accounting and administration fees payable | 15,182 | |||

| Professional fees payable | 26,247 | |||

| Custody fees payable | 950 | |||

| Other fees payable | 1,230 | |||

| Registration fees payable | 300 | |||

| Total Liabilities | 4,587,453 | |||

| Members’ Equity | $ | 13,635,078 | ||

| Members’ Equity consists of: | ||||

| Members’ Equity paid-in capital | $ | 9,972,745 | ||

| Total distributable earnings | 3,662,333 | |||

| Total Members’ Equity | $ | 13,635,078 | ||

| Number of Shares Outstanding | 10,990 | |||

| Members’ Equity per Share | $ | 1,240.62 | ||

The accompanying notes are an integral part of these Financial Statements.

| 2 |

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Statement of Operations

For the Six Months Ended September 30, 2021 (Unaudited)

| Income | ||||

| Miscellaneous Income | $ | 2 | ||

| Expenses | ||||

| Investment management fee | 113,968 | |||

| Professional fees | 54,799 | |||

| Accounting and administration fees | 41,684 | |||

| Managers’ fees | 14,000 | |||

| Chief Compliance Officer fees | 7,755 | |||

| Custody fees | 5,785 | |||

| Other expenses | 5,697 | |||

| Federal Tax Expense | 3,218 | |||

| Insurance fees | 3,181 | |||

| Registration fees | 150 | |||

| Total Operating Expenses | 250,237 | |||

| Expense Waivers | (118,345 | ) | ||

| Net Expenses | 131,892 | |||

| Net Investment Loss | (131,890 | ) | ||

| Realized and Unrealized Gain on Investments | ||||

| Net realized gain from investments | 1,365,046 | |||

| Net change in unrealized appreciation/depreciation on investments | (400,070 | ) | ||

| Net Realized and Unrealized Gain on Investments | 964,976 | |||

| Net Increase in Members’ Equity from Operations | $ | 833,086 | ||

The accompanying notes are an integral part of these Financial Statements.

| 3 |

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Statements of Changes in Members’ Equity

| For the | ||||||||

| Six Months Ended | ||||||||

| September 30, 2021 | Year Ended | |||||||

| (Unaudited) | March 31, 2021 | |||||||

| Operations | ||||||||

| Net investment loss | $ | (131,890 | ) | $ | (265,708 | ) | ||

| Net realized gain on investments | 1,365,046 | 417,077 | ||||||

| Net change in unrealized appreciation/depreciation on investments | (400,070 | ) | 2,617,274 | |||||

| Net change in Members’ equity from operations | 833,086 | 2,768,643 | ||||||

| Distributions to Members | ||||||||

| Distributions | - | (151,687 | ) | |||||

| Net change in Members’ equity from distributions to Members | - | (151,687 | ) | |||||

| Capital Share Transactions | ||||||||

| Reinvested distributions | - | 151,687 | ||||||

| Shares repurchased | (5,081,508 | ) | (2,126,531 | ) | ||||

| Net change in Members’ equity from capital transactions | (5,081,508 | ) | (1,974,844 | ) | ||||

| Total Increase (Decrease) | (4,248,422 | ) | 642,112 | |||||

| Members’ Equity | ||||||||

| Beginning of period | 17,883,500 | 17,241,388 | ||||||

| End of period | $ | 13,635,078 | $ | 17,883,500 | ||||

The accompanying notes are an integral part of these Financial Statements.

| 4 |

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Statement of Cash Flows

For the Six Months Ended September 30, 2021 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net Increase in Members’ Equity from Operations | $ | 833,086 | ||

| Adjustments to reconcile Net Increase in Members’ Equity from | ||||

| Operations to net cash provided by operating activities: | ||||

| Net realized gain from investments | (1,365,046 | ) | ||

| Net change in unrealized appreciation/depreciation on investments | 400,070 | |||

| Proceeds from Investment Funds sold | 1,000,000 | |||

| Changes in operating assets and liabilities: | ||||

| Increase in other assets | (22,292 | ) | ||

| Decrease in accounting and administration fees payable | (5,023 | ) | ||

| Decrease in professional fees payable | (8,913 | ) | ||

| Decrease in custody fees payable | (1,698 | ) | ||

| Increase in registration fees payable | 150 | |||

| Decrease in other fees payable | (2,425 | ) | ||

| Net Cash Provided by Operating Activities | 823,532 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Payments for shares repurchased | (544,088 | ) | ||

| Net Cash Used in Financing Activities | (544,088 | ) | ||

| Net change in cash | 279,445 | |||

| Cash at beginning of period | 75,749 | |||

| Cash at end of period | $ | 355,194 | ||

The accompanying notes are an integral part of these Financial Statements.

| 5 |

Infinity Long/Short Equity Fund, LLC

(a Delaware Limited Liability Company)

Financial Highlights

| Per

share operating performance. For a capital share outstanding throughout each period. |

For

the Six Months Ended September 30, 2021 (Unaudited) |

Year

Ended March 31, 2021 |

Year

Ended March 31, 2020 |

Year

Ended March 31, 2019 |

Year

Ended March 31, 2018* |

Period

from October 1, 2016 (Commencement of Operations) to March 31, 2017 |

||||||||||||||||||

| Members’ Equity, Beginning of Period | $ | 1,184.62 | $ | 1,020.71 | $ | 1,093.88 | $ | 1,098.86 | $ | 1,022.61 | $ | 1,000.00 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment loss (1) | (9.17 | ) | (17.00 | ) | (16.53 | ) | (17.02 | ) | (13.97 | ) | (5.31 | ) | ||||||||||||

| Net realized and unrealized gain (loss) on investments | 65.17 | 190.98 | (41.30 | ) | 23.27 | 91.18 | 27.92 | |||||||||||||||||

| Total from investment operations: | 56.00 | 173.98 | (57.83 | ) | 6.25 | 77.21 | 22.61 | |||||||||||||||||

| Distributions to Members | ||||||||||||||||||||||||

| From net investment income | - | (10.07 | ) | - | (0.74 | ) | (0.96 | ) | - | |||||||||||||||

| From net realized gains | - | - | (15.34 | ) | (10.49 | ) | - | - | ||||||||||||||||

| Net change in Members’ equity due to distributions to Members | - | (10.07 | ) | (15.34 | ) | (11.23 | ) | (0.96 | ) | - | ||||||||||||||

| Members’ Equity, End of Period | $ | 1,240.62 | $ | 1,184.62 | $ | 1,020.71 | $ | 1,093.88 | $ | 1,098.86 | $ | 1,022.61 | ||||||||||||

| Total Return (2) | 4.73 | % (3) | 17.02 | % | (5.41 | )% | 0.61 | % | 7.55 | % | 2.26% (3) | |||||||||||||

| Members’ Equity, end of period (in thousands) | $ | 13,635 | $ | 17,884 | $ | 17,241 | $ | 18,866 | $ | 19,796 | $ | 7,144 | ||||||||||||

| Net investment loss to average Members’ equity | (1.50 | )% (4) | (1.50 | )% | (1.50 | )% | (1.56 | )% | (1.29 | )% | (1.06 | )% (4) | ||||||||||||

| Ratio of gross expenses to average Members’ equity (5) | 2.85 | % (4) | 2.75 | % | 2.75 | % | 2.81 | % | 2.68 | % | 2.26 | % (4) | ||||||||||||

| Ratio of expense waiver to average Members’ equity | (1.35 | )% (4) | (1.25 | )% | (1.25 | )% | (1.25 | )% | (1.39 | )% | (1.20 | )% (4) | ||||||||||||

| Ratio of net expenses to average Members’ equity | 1.50 | % (4) | 1.50 | % | 1.50 | % | 1.56 | % (6) | 1.29 | % | 1.06 | % (4) | ||||||||||||

| Portfolio Turnover | 0.00 | % (3) | 10.68 | % | 30.09 | % | 4.20 | % | 24.27 | % | 0.18 | % (3) | ||||||||||||

| * | As of October 4, 2017 the Fund registered as an investment company under the Investment Company Act of 1940, as amended. |

| (1) | Based on average shares outstanding for the year. |

| (2) | Total Return based on Members’ equity is the combination of changes in Members’ equity and reinvested dividend income in Members’ equity, if any. Total Return does not reflect the impact of any applicable sales charges. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Represents the ratio of expenses to average Members’ equity absent fee waivers and/or expense reimbursement by the Adviser. |

| (6) | The Fund’s operating expenses include an excise tax, which is excluded from the Expense Limitation calculation. If the excise tax was excluded from operating expenses, the net expense ratio would be 1.50%. |

The accompanying notes are an integral part of these Financial Statements.

| 6 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited)

| 1. | ORGANIZATION |

Infinity Long/Short Equity Fund, LLC (the “Fund”) is a Delaware limited liability company organized under a Limited Liability Company Agreement dated June 22, 2016 and commenced operations on October 1, 2016. On October 4, 2017, the Fund registered with the Securities and Exchange Commission (the “SEC”), as a non-diversified, closed-end management investment company, under the Investment Company Act of 1940, as amended (the “1940 Act”). Infinity Capital Advisors, LLC serves as the investment adviser (the “Adviser”) of the Fund. The Adviser is an investment adviser registered with the SEC under the Investment Advisers Act of 1940, as amended.

The investment objective of the Fund is to seek long-term capital growth. The Fund is a “fund of funds” that invests primarily in general or limited partnerships, funds, corporations, trusts or other investment vehicles (collectively, “Investment Funds”) based primarily in the United States that invest or trade, both long and short, in a wide range of securities, and, to a lesser extent, other property and currency interests. Certain of the Investment Funds in which the Fund may invest are commonly referred to as hedge funds. The Fund may also make investments outside of Investment Funds to hedge exposures deemed too risky or to invest in strategies not employed by the Fund’s Investment Funds. Such investments could also be used to hedge a position in an Investment Fund that is locked-up or difficult to sell. Direct investments could include U.S. and foreign equity securities, debt securities, exchange-traded funds and derivatives related to such instruments, including futures and options thereon.

The Board of Managers of the Fund (the “Board”) has overall responsibility for the management and supervision of the business operations of the Fund.

| 2. | PLAN OF LIQUIDATION |

On August 17, 2021, the Board approved a Plan of Liquidation (the “Plan”) for the Fund and determined to close and liquidate the Fund, as soon as practicable. This decision was made after careful consideration of the Fund’s current and future prospects. The Plan provides for the liquidation of the Fund and the pro rata distribution of assets of the Fund to its investors (“Members”) on the effective date of the liquidation. The Liquidation of the Fund will be effective on or about November 30, 2021 (the “Effective Date”). Accordingly, effective August 19, 2021, the Fund discontinued accepting orders for the purchase of units of beneficial interest (“Shares”) of the Fund and ceased making tender offers for the repurchase of Shares. The Plan provides for the Fund to make distributions, approximately quarterly, to Members of its available cash resulting from the liquidation of the Fund’s portfolio securities. The Plan also provides that proportionate interests of Members in the assets of the Fund will be fixed on the basis of its shareholdings at the close of business on the Effective Date.

As soon as possible after all of the Fund’s investments in portfolio securities are converted to cash, the Fund shall make to each Member of record on the Effective Date: (1) a final liquidating distribution equal to the Member’s proportionate net assets of the Fund, and (2) information concerning the sources of the liquidating distribution. All outstanding Shares will be cancelled following the liquidating distribution. Prior to that time, the net proceeds from the liquidation of portfolio securities will be invested in cash equivalent securities or held in cash and shall be distributed to Members, as described above. During this time, the Fund may hold more cash or cash equivalents than normal, which may prevent the Fund from meeting its stated investment objective. The Fund’s ability to convert its portfolio securities to cash is subject to the redemption restrictions of the underlying investment funds in which the Fund invests. As a result, the Fund’s final liquidating distribution to Members may not occur for several quarters.

| 3. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates. The Fund is an investment company and follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946.

| 7 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

| 3. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

a. Valuation of Investments

The Board has established a Valuation Committee to oversee the valuation of the Fund’s investments on behalf of the Fund. The Board has approved valuation procedures for the Fund (the “Valuation Procedures”). The Valuation Procedures provide that the Fund will value its investments in direct investments and Investment Funds at fair value.

The valuations of investments in Investment Funds are supported by information received from the Investment Funds such as monthly net asset values, investor reports, and audited financial statements, when available.

In accordance with the Valuation Procedures, fair value as of each month-end or other applicable accounting periods, as applicable, ordinarily will be the value determined as of such date by each Investment Fund in accordance with the Investment Fund’s valuation policies and reported at the time of the Fund’s valuation. As a general matter, the fair value of the Fund’s interest in an Investment Fund will represent the amount that the Fund could reasonably expect to receive from the Investment Fund if the Fund’s interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. Generally, the fair value of an Investment Fund is its net asset value. In the event that the Investment Fund does not report a month-end net asset value to the Fund on a timely basis, the Fund will determine the fair value of such Investment Fund based on the most recent final or estimated value reported by the Investment Fund, as well as any other relevant information available at the time the Fund values its portfolio. Using the nomenclature of the hedge fund industry, any values reported as “estimated” or “final” are expected to reasonably reflect fair market values of securities when available or fair value as of the Fund’s valuation date. A substantial amount of time may elapse between the occurrence of an event necessitating the pricing of the Fund’s assets and the receipt of valuation information from the underlying manager of an Investment Fund.

If it is probable that the Fund will sell an investment at an amount different from the net asset valuation or in other situations where the month-end valuation of the Investment Fund is not available, or when the Fund believes alternative valuation techniques are more appropriate, the Adviser and the Valuation Committee may consider other factors, including subscription and redemption rights, expected discounted cash flows, transactions in the secondary market, bids received from potential buyers, and overall market conditions in determining fair value.

The Fund classifies its assets and liabilities into three levels based on the lowest level of input that is significant to the fair value measurement. Estimated values may differ from the values that would have been used if a ready market existed or if the investments were liquidated at the valuation date.

The three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

| • | Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities |

| • | Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, ability to redeem in the near term (generally within the next calendar quarter for Investment Funds), etc.) |

| • | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) or investments that cannot be fully redeemed at the net asset value in the “near term” (these are investments that generally have one or more of the following characteristics: gated redemptions, suspended redemptions, or have lock-up periods greater than 90 days). |

Investments in affiliated and private investment funds valued at the net asset value as practical expedient are not required under U.S. GAAP to be classified in the fair value hierarchy. Investment Funds with a fair value of $12,503,240 are excluded from the fair value hierarchy as of September 30, 2021.

| 8 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

| 3. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

a. Valuation of Investments (continued)

The Adviser generally categorizes the investment strategies of the Investment Funds into investment strategy categories. The investment objective of the long/short hedge funds is to outperform the equity markets with half to two-thirds of the indices’ volatility. The investment strategy of the fundamental bottom-up long/short equities managers is to perform balance sheet analysis, along with many other layers of company and industry specific analysis to uncover intrinsic values that do not match where the market is currently priced. These managers will buy stocks that are below their intrinsic value and they will short stocks they feel are above their intrinsic value. The sector specific Investment Fund managers rely on their deep expertise within their sector of focus and work to provide alpha through the active management of their sectors through deep fundamental analysis. The quantitative approach uses internally developed and tested algorithms and models that use market data to trade in the equity space.

The Investment Funds compensate their respective Investment Fund managers through management fees currently ranging from 0.50% to 2.0% annually of average net asset value of the Fund’s investment and incentive allocations typically ranging between 10.0% and 25.0% of profits, subject to loss carryforward provisions, as defined in the respective Investment Funds’ agreements.

As of September 30, 2021, the Fund did not have any outstanding investment commitments to Investment Funds.

b. Investment Income

Interest income is recorded on an accrual basis. Investment transactions are accounted for on a trade date basis. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds.

c. Fund Expenses

The Fund will pay all of its expenses or reimburse the Adviser or its affiliates to the extent they have previously paid such expenses on behalf of the Fund. The expenses of the Fund include, but are not limited to, any fees and expenses in connection with the offering and issuance of Shares of the Fund; all fees and expenses directly related to portfolio transactions and positions for the Fund’s account, such as direct and indirect expenses associated with the Fund’s investments, and enforcing the Fund’s rights in respect of such investments; and all fees and expenses reasonably incurred in connection with the operation of the Fund, such as the investment management fee, legal fees, auditing fees, accounting, administration, and tax preparation fees, custodial fees, fees for data and software providers, costs of insurance, registration expenses, managers’ fees, and expenses of meetings of the Board.

d. Income Tax Information & Distributions to Members

The Fund’s policy is to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, that are applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its Members. Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze tax positions expected to be taken in the Fund’s tax returns, as defined by Internal Revenue Service (the “IRS”) statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. During the six months ended September 30, 2021, the Fund did not have a liability for any unrecognized tax benefits. At September 30, 2021, the tax years ended March 31, 2019, March 31, 2020, and March 31, 2021 remain open to examination by the IRS. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

| 9 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

| 3. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

d. Income Tax Information & Distributions to Members (continued)

The amount and timing of distributions are determined in accordance with federal income tax regulations. For financial reporting purposes, dividends and distributions to Shareholders are recorded on the ex-date.

The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain/(loss) items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to partnerships and passive foreign investment companies adjustments. These reclassifications have no effect on Members’ Equity or Members’ Equity per Share. For the tax year ended March 31, 2021, the following amounts were reclassified:

| Members’ Equity paid-in capital | $ | - | ||

| Total distributable earnings | - |

At March 31, 2021, the Fund had $345,736 of accumulated capital loss carryforward which consisted of $345,736 short-term and $0 long-term. To the extent that a fund may realize future net capital gains, those gains will be offset by any of its unused capital loss carryforward. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations.

At March 31, 2021, the federal tax cost of investment securities and unrealized appreciation (depreciation) as of the year-end were as follows:

| Gross unrealized appreciation | $ | 2,411,292 | ||

| Gross unrealized depreciation | (172,220 | ) | ||

| Net unrealized appreciation | $ | 2,239,072 | ||

| Cost of investments | $ | 14,636,620 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

As of March 31, 2021, the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | $ | 245,168 | ||

| Undistributed long-term capital gains | - | |||

| Tax accumulated earnings | 245,168 | |||

| Accumulated capital and other losses | (345,736 | ) | ||

| Unrealized appreciation | 2,239,072 | |||

| Other differences | 690,743 | |||

| Distributable net earnings | $ | 2,829,247 |

The tax character of distributions paid during the tax years ended March 31, 2021 and 2020 was as follows:

| Distributions paid from: | 2021 | 2020 | ||||||

| Ordinary income | $ | 151,687 | $ | 246,478 | ||||

| Net long-term capital gains | - | 11,558 | ||||||

| Total taxable distributions | 151,687 | 258,036 | ||||||

| Total distributions paid | $ | 151,687 | $ | 258,036 | ||||

| 10 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

e. Cash

Cash, if any, includes amounts held in interest bearing money market accounts. Such deposits, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

f. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in Members’ Equity from operations during the reporting period. Actual results could differ from those estimates.

| 4. | INVESTMENT MANAGEMENT AND OTHER AGREEMENTS |

The Fund pays the Adviser a management fee (“Investment Management Fee”) at an annual rate of 1.25%, payable monthly in arrears, based upon the Fund’s Members’ Equity as of month-end. The Investment Management Fee is paid to the Adviser before giving effect to any repurchase of Shares in the Fund effective as of that date, and will decrease the net profits or increase the net losses of the Fund that are credited to its Members. As of the Effective Date, the Plan provides that the Adviser will no longer charge an investment management fee to the Fund.

The Adviser has entered into an expense limitation and reimbursement agreement (the “Expense Limitation and Reimbursement Agreement”) with the Fund, whereby the Adviser has agreed to waive fees that it would otherwise have been paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction-related expenses, commitment or non-use fees related to the Fund’s line of credit, extraordinary expenses, and any Acquired Fund Fees and Expenses) do not exceed 1.50% of the net assets of the Fund on an annualized basis (the “Expense Limit”).

For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided they are able to effect such recoupment and remain in compliance with the Expense Limit. The Expense Limitation Agreement is in effect and will terminate on December 31, 2021. Each of the Fund and the Adviser may terminate the Expense Limitation Agreement upon thirty days’ written notice to the other party. For the six months ended September 30, 2021, the Adviser waived fees and reimbursed expenses of $118,345. At September 30, 2021, $244,204 is subject for recoupment through March 31, 2022, $234,057 is subject for recoupment through March 31, 2023, and $222,176 is subject for recoupment through March 31, 2024.

UMB Fund Services, Inc (“UMBFS”) acts as the Fund’s platform manager pursuant to a Platform Manager Agreement with the Fund. UMBFS does not receive a fee pursuant to the Platform Manager Agreement.

Foreside Fund Services, LLC acts as distributor to the Fund; UMBFS serves as the Fund’s fund accountant, transfer agent and administrator; UMB Bank, n.a., an affiliate of UMBFS, serves as the Fund’s custodian.

A manager and certain officers of the Fund are employees of UMBFS. The Fund does not compensate managers or officers affiliated with the Fund’s administrator. For the six months ended September 30, 2021, the Fund’s allocated fees incurred for managers are reported on the Statement of Operations.

Vigilant Compliance Services, LLC provides Chief Compliance Officer (“CCO”) services to the Fund. The Fund’s allocated fees incurred for CCO services for the six months ended September 30, 2021 were $7,755.

| 5. | RELATED PARTY TRANSACTIONS |

At September 30, 2021, Members who are affiliated with the Adviser owned approximately $845,196 (or approximately 6.2% of Members’ Equity) of the Fund.

| 11 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

| 6. | ADMINISTRATION AND CUSTODY AGREEMENT |

UMB Fund Services, Inc. serves as administrator (the “Administrator”) to the Fund and provides certain accounting, administrative, record keeping and investor related services. The Fund pays a monthly fee to the Administrator based upon average Members’ Equity, subject to certain minimums. UMB Bank, n.a. (the “Custodian”), an affiliate of the Administrator, serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with U.S. and non-U.S. sub-custodians, securities depositories and clearing agencies.

| 7. | INVESTMENT TRANSACTIONS |

For the six months ended September 30, 2021, the purchase and sale of investments, excluding short-term investments and U.S. government securities were $0 and $5,337,428, respectively

| 8. | CAPITAL SHARE TRANSACTIONS |

Shares are generally offered for purchase as of the first day of each calendar month at the Fund’s then-current Members’ Equity per Share (determined as of the close of the preceding month), except that Shares may be offered more or less frequently as determined by the Board in its sole discretion. Transactions in Shares were as follows:

| Shares outstanding, March 31, 2020 | 16,891.624 | |||

| Shares issued | - | |||

| Shares reinvested | 125.100 | |||

| Shares redeemed | (1,920.377 | ) | ||

| Shares outstanding, March 31, 2021 | 15,096.347 | |||

| Shares issued | - | |||

| Shares reinvested | - | |||

| Shares redeemed | (4,105.852 | ) | ||

| Shares outstanding, September 30, 2021 | 10,990.495 |

| 9. | REPURCHASE OF SHARES |

At the discretion of the Board and provided that it is in the best interests of the Fund and Members to do so, the Fund intends to provide a limited degree of liquidity to the Members by conducting repurchase offers generally quarterly with a Valuation Date (as defined below) on or about March 31, June 30, September 30 and December 31 of each year. In each repurchase offer, the Fund may offer to repurchase its Shares at their net asset value as determined as of approximately March 31, June 30, September 30 and December 31, of each year, as applicable. Each repurchase offer ordinarily will be limited to the repurchase of approximately 25% of the Shares outstanding, but if the value of Shares tendered for repurchase exceeds the value the Fund intended to repurchase, the Fund may determine to repurchase less than the full number of Shares tendered. In such event, Members will have their Shares repurchased on a pro rata basis, and tendering Members will not have all of their tendered Shares repurchased by the Fund. Members tendering Shares for repurchase will be asked to give written notice of their intent to do so by the date specified in the notice describing the terms of the applicable repurchase offer, which date will be approximately 95 days prior to the date of repurchase by the Fund.

| 10. | CREDIT FACILITY |

The Fund may enter into one or more credit agreements or other similar agreements negotiated on market terms (each, a “Borrowing Transaction”) with one or more banks or other financial institutions which may or may not be affiliated with the Adviser (each, a “Financial Institution”) as chosen by the Adviser and approved by the Board. The Fund may borrow under a credit facility for a number of reasons, including without limitation, to pay fees and expenses, to make annual income distributions and to satisfy certain repurchase offers in a timely manner to ensure liquidity for the investors. To facilitate such Borrowing Transactions, the Fund may pledge its assets to the Financial Institution. As of September 30, 2021, the fund did not have any borrowings.

| 11. | INDEMNIFICATION |

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, the Fund expects the risk of loss from such claims to be remote.

| 12 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

| 12. | RISK FACTORS |

The Fund is subject to substantial risks — including market risks, strategy risks and Investment Fund manager risks. Investment Funds generally will not be registered as investment companies under the 1940 Act and, therefore, the Fund will not be entitled to the various protections afforded by the 1940 Act with respect to its investments in Investment Funds. While the Adviser will attempt to moderate any risks of securities activities of the Investment Fund managers, there can be no assurance that the Fund’s investment activities will be successful or that the Members will not suffer losses. The Adviser will not have any control over the Investment Fund managers, thus there can be no assurances that an Investment Fund manager will manage its Investment Funds in a manner consistent with the Fund’s investment objective.

In early 2020, an outbreak of a novel strain of coronavirus (COVID-19) emerged globally. This coronavirus has resulted in closing international borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general public concern and uncertainty. The impact of this outbreak has negatively affected the worldwide economy, as well as the economies of individual countries, the financial health of individual companies and the market in general in significant and unforeseen ways. Although vaccines for COVID- 19 are becoming more widely available, it is unknown how long circumstances related to the pandemic will persist, whether they will reoccur in the future, whether efforts to support the economy and financial markets will be successful, and what additional implications may follow from the pandemic. The impact of these events and other epidemics or pandemics in the future could adversely affect Fund performance.

| 13. | SIGNIFICANT SHAREHOLDER |

As of September 30, 2021, the Fund has a Member that holds 89% of the outstanding Shares of the Fund. A significant redemption by this member could affect the Fund’s liquidity and the future viability of the Fund.

| 14. | SUBSEQUENT EVENTS |

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued. There were no subsequent events to report.

| 13 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX and a description of the Fund’s proxy voting policies are available: (i) without charge, upon request, by calling the Fund at 1-(877)-775-7751 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the SEC’s website at www.sec.gov.

Dividend Reinvestment Program

Each Member whose Shares are registered in its own name will automatically be a participant under the Fund’s dividend reinvestment program (the “DRIP”) and have all income dividends and/or capital gains distributions automatically reinvested in Shares unless such Member, at any time, specifically elects to receive income dividends and/or capital gains distributions in cash. Distributions are taxable whether they are received in cash or reinvested in Fund Shares. The Fund reserves the right to cap the aggregate amount of any income dividends and/or capital gain distributions that are made in cash (rather than being reinvested) at a total amount of not less than 20% of the total amount distributed to Members. In the event that Members submit elections in aggregate to receive more than the cap amount of such a distribution in cash, any such cap amount will be pro rated among those electing Members. For additional information about the DRIP, please contact UMB Fund Services at 1-(877)-775-7751.

Approval of Investment Management Agreement

At the meeting of the Board held on September 8, 2021, by a unanimous vote, the Board, including a majority of Managers who are not “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act (the “Independent Managers”), approved the Investment Management Agreement between the Adviser and the Fund (the “Agreement”). Pursuant to relief granted by the U.S. Securities and Exchange Commission (the “SEC”) in light of the COVID-19 pandemic (the “Order”) and a determination by the Board that reliance on the Order was appropriate due to circumstances related to the current or potential effects of COVID-19, the meeting was held by video-conference.

In advance of the September 8, 2021 meeting, the Independent Managers requested and received materials from the Adviser to assist them in considering the approval of the Agreement, including particularly in light of the pending liquidation of the Fund pursuant to a Plan of Liquidation approved by the Board on August 17, 2021. The Independent Managers reviewed reports from third parties and management about the below factors. The Board did not consider any single factor as controlling in determining whether or not to approve the Agreement. Nor are the items described herein all-encompassing of the matters considered by the Board.

The Board engaged in a detailed discussion of the materials with management of the Adviser. The Independent Managers then met separately with independent counsel to the Independent Managers for a full review of the materials. Following this session, the full Board reconvened and after further discussion determined that the information presented provided a sufficient basis upon which to approve the Agreement.

NATURE, EXTENT AND QUALITY OF SERVICES

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Adviser to the Fund under the Agreement, including in particular related to the pending liquidation of the Fund. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Adviser, including, among other things, providing office facilities, equipment, and personnel. The Board also reviewed and considered the qualifications of the key personnel of the Adviser who provide the investment advisory and/or administrative services to the Fund. The Board determined that the Adviser’s key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board also took into account the Adviser’s compliance policies and procedures, including the procedures used to determine the value of the Fund’s investments. The Board concluded that the overall quality of the advisory and administrative services provided to the Fund was satisfactory.

| 14 |

INFINITY LONG/SHORT EQUITY FUND, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

Approval of Investment Management Agreement (continued)

PERFORMANCE

The Board considered the investment performance of the Adviser with respect to the Fund. The Board considered the investment performance of the Fund since the Fund’s inception in October of 2016 and year-to-date as compared to the performance of the HFRX Equity Hedge Index (the “Index”), noting that the Fund had outperformed the Index for the 3-year and since inception periods ended June 30, 2021.

FEES AND EXPENSES RELATIVE TO COMPARABLE FUNDS MANAGED BY OTHER INVESTMENT MANAGERS

The Board reviewed the advisory fee rate paid by the Fund, which pursuant to the Fund’s pending liquidation would no longer be charged effective November 30, 2021. The Board compared the advisory fee for the Fund with various comparative data, including a report of other comparable funds and information with respect to other funds managed by the Adviser. The Board also noted that the Adviser had agreed to continue to contractually limit total annual operating expenses of the Fund to 1.50%, and that the Expense Limitation Agreement would terminate on December 31, 2021 pursuant to the Fund’s pending liquidation. The Board concluded that the advisory fees paid by the Fund were reasonable and satisfactory in light of the services provided to the Fund.

BREAKPOINTS AND ECONOMIES OF SCALE

The Board did not consider whether economies of scale might be achieved given that the Fund was no longer accepting new investments due to the pending liquidation of the Fund. The Board took into account that the Expense Limitation Agreement would continue until December 31, 2021 and the advisory fee would not be charged as of November 30, 2021.

PROFITABILITY OF ADVISER AND AFFILIATES

The Board considered and reviewed information concerning the costs incurred and profits realized by the Adviser from its relationship with the Fund. The Board also reviewed the Adviser’s financial condition. The Board noted that the financial condition of the Adviser appeared stable. The Board determined that the advisory fees and the compensation paid to the Adviser were reasonable and the financial condition of the Adviser was adequate.

ANCILLARY BENEFITS AND OTHER FACTORS

The Board also discussed other benefits received by the Adviser from its management of the Fund, including, without limitation, the ability to market its advisory services for similar products in the future. The Board noted that the Adviser did not have affiliations with the Fund’s transfer agent, administrator, custodian or private placement agent and therefore did not derive any benefits from the relationships these parties may have with the Fund. The Board concluded that the advisory fees were reasonable in light of the fall-out benefits.

GENERAL CONCLUSION

Based on its consideration of all factors that it deemed material, and assisted by the advice of its counsel, the Board concluded it would be in the best interest of the Fund and its Members to approve the continuance of the Agreement.

| 15 |

(b) The Registrant did not disseminate any information to shareholders specified by paragraph (c)(3) of Rule 30e-3 under the Act (17 CFR 270.30e-3).

ITEM 2. CODE OF ETHICS.

Not applicable to semi-annual reports.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to semi-annual reports.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to semi-annual reports.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to members filed under Item 1 of this form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the members may recommend nominees to the registrant's board of managers, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17CFR 229.407), or this Item.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable

ITEM 13. EXHIBITS.

(a)(1) Not applicable to semi-annual reports.

(a)(3) Not applicable.

(a)(4) Not applicable.

(b) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (registrant) | Infinity Long/Short Equity Fund, LLC | |

| By (Signature and Title)* | /s/ Jeff Vale | |

| Jeff Vale, President | ||

| (Principal Executive Officer) | ||

| Date | December 9, 2021 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Jeff Vale | |

| Jeff Vale, President | ||

| (Principal Executive Officer) |

| Date | December 9, 2021 |

| By (Signature and Title)* | /s/ Phillip Jarrell | |

| Phillip Jarrell, Treasurer | ||

| (Principal Financial Officer) | ||

| Date | December 9, 2021 | |

* Print the name and title of each signing officer under his or her signature.