UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38003

RAMACO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Delaware |

| 38-4018838 |

(State or other jurisdiction |

| (I.R.S. Employer |

|

| |

250 West Main Street, Suite 1800 |

| 40507 |

(Address of principal executive offices) |

| (Zip Code) |

(859) 244-7455

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered on which registered |

Common Stock, $0.01 par value | | METC | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued is audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was $21.5 million.

As of February 15, 2021, the registrant had 42,637,302 shares of common stock outstanding.

Documents Incorporated by Reference:

Certain information required to be furnished pursuant to Part III of this Form 10-K is set forth in, and is hereby incorporated by reference herein from, the definitive proxy statement for our 2021 Annual General Meeting of Stockholders, to be filed by Ramaco Resources with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days after December 31, 2020 (the “2021 Proxy Statement”).

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this report, regarding our strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this annual report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” included in this report.

Forward-looking statements may include statements about:

| ● | risks related to the impact of the COVID-19 global pandemic, such as the scope and duration of the outbreak, the health and safety of our employees, government actions and restrictive measures implemented in response, delays and cancellations of customer sales, supply chain disruptions and other impacts to the business, or our ability to execute our business continuity plans; |

| ● | anticipated production levels, costs, sales volumes and revenue; |

| ● | timing and ability to complete major capital projects; |

| ● | economic conditions in the metallurgical coal and steel industries generally, including any near-term or long-term downturn in these industries as a result of the COVID-19 pandemic and related actions; |

| ● | expected costs to develop planned and future mining operations, including the costs to construct necessary processing and transport facilities; |

| ● | estimated quantities or quality of our metallurgical coal reserves; |

| ● | our ability to obtain additional financing on favorable terms, if required, to complete the acquisition of additional metallurgical coal reserves as currently contemplated or to fund the operations and growth of our business; |

| ● | maintenance, operating or other expenses or changes in the timing thereof; |

| ● | financial condition and liquidity of our customers; |

| ● | competition in coal markets; |

| ● | the price of metallurgical coal and/or thermal coal; |

| ● | compliance with stringent domestic and foreign laws and regulations, including environmental, climate change and health and safety regulations, and permitting requirements, as well as changes in the regulatory environment, including as a result of the change in the presidential administration and composition of the U.S. Congress, the adoption of new or revised laws, regulations and permitting requirements; |

| ● | potential legal proceedings and regulatory inquiries against us; |

| ● | the impact of weather and natural disasters on demand, production and transportation; |

| ● | purchases by major customers and our ability to renew sales contracts; |

| ● | credit and performance risks associated with customers, suppliers, contract miners, co-shippers and trading, banks and other financial counterparties; |

| ● | geologic, equipment, permitting, site access and operational risks and new technologies related to mining; |

| ● | transportation availability, performance and costs; |

| ● | availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; |

| ● | timely review and approval of permits, permit renewals, extensions and amendments by regulatory authorities; |

| ● | our ability to comply with certain debt covenants; |

| ● | our expectations relating to dividend payments and our ability to make such payments; and |

| ● | other risks identified in this Annual Report that are not historical. |

3

We caution you that these forward-looking statements are subject to a number of risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control, incident to the development, production, gathering and sale of coal. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this Annual Report are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved or occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

All forward-looking statements, expressed or implied, included in this report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this report.

Ramaco Resources, Inc. is a Delaware corporation formed in October 2016. Our common stock is listed on the NASDAQ Global Select Market under the symbol “METC”. Our principal corporate offices are located in Lexington, Kentucky. As used herein, “Ramaco Resources,” “we,” “our,” and similar terms include Ramaco Resources, Inc. and its subsidiaries, unless the context indicates otherwise.

General

We are an operator and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. We are a pure play metallurgical coal company with 262 million tons of high-quality metallurgical coal reserves. We believe our advantaged reserve geology provides us with higher productivities and industry leading lower cash costs. Our development portfolio primarily includes four properties: Elk Creek, Berwind, RAM Mine and Knox Creek.

We believe each of these properties possesses geologic and logistical advantages that make our coal among the lowest delivered-cost U.S. metallurgical coal to a majority of our domestic target customer base, North American blast furnace steel mills and coke plants, as well as international metallurgical coal consumers.

We operate three deep mines and a surface mine at our Elk Creek mining complex. Development of this complex commenced in 2016 and included construction of a preparation plant and rail load-out facilities. The Elk Creek property consists of approximately 20,166 acres of controlled mineral rights and contains 25 seams that we have targeted for production.

Development of our Berwind mining complex began in late 2017. In 2020, we suspended development at the Berwind mining complex due to lower pricing and demand largely caused by the novel coronavirus disease 2019 (“COVID-19”) outbreak. This complex remains a key part of our anticipated future growth. We expect to achieve commercial production at the Berwind mining complex approximately six months after we resume the slope project as described under “Our Projects – Berwind” below. The Berwind property consists of approximately 31,200 acres of controlled mineral rights.

4

Our Knox Creek facility includes a preparation plant and 62,100 acres of controlled mineral rights that we expect to develop in the future. The Knox Creek preparation plant processes coal from our Berwind mine as well as coal we may purchase from third parties.

Our RAM Mine property is located in southwestern Pennsylvania, consists of approximately 1,570 acres of controlled mineral rights, and is scheduled for initial production after a mining permit is issued. We expect this permit to be issued in 2021.

As of December 31, 2020, our estimated aggregate annual production capacity is approximately 2.3 million clean tons of coal. We plan to complete development of our existing properties and increase production from our existing development portfolio to more than 4-4.5 million clean tons of metallurgical coal annually, subject to market conditions, permitting and additional capital deployment. We may also acquire additional reserves or infrastructure that contribute to our focus on advantaged geology and lower costs.

Metallurgical Coal Industry

Metallurgical coal is also known as “coking coal,” and is a key component of the blast furnace steelmaking process. North American metallurgical mines are primarily located in the Appalachian area of the eastern United States, and supply all of the requirements of the steel industry. Imported metallurgical coal has historically been un-economic due to transportation costs. Supply in excess of what can be consumed in North America is exported to the seaborne market to buyers in Europe, South America, Africa, India and Asia.

Metallurgical coal is transported by truck, rail and barge to coke batteries. Metallurgical coal contracts in North America frequently are calendar year contracts where both prices and volumes are fixed in the third or fourth quarter for the following calendar year.

The United States is the second largest global supplier to the seaborne metallurgical coal market behind Australia. U.S. producers, with their variable production volumes, generally serve as a swing supplier to the international metallurgical coal market. U.S. metallurgical coal exports compete with Australian metallurgical coals that are generally produced at lower cost, but are geographically disadvantaged to supply Western Europe. Conversely, Australian production has a much shorter logistical route to East Asian customers. Any supply shortfall out of Australia, or increase in global demand beyond Australia’s capacity, has historically been serviced by U.S. coal producers.

Export metallurgical coal pricing is determined utilizing a series of indices from a number of independent sources and is adjusted for coal quality. Contracted volumes have terms that vary in duration from spot to one year, rarely exceeding one year. In some cases, indices are used at the point that the coal changes hands. In other cases, an average over time may be utilized. When the term “benchmark” is still utilized, it too is determined based on index values, typically for the preceding three months.

Metallurgical coals are generally classified as high, medium or low volatile. Volatiles are products, other than water, that are released as gas or vapor when coal is converted to coke. Carbon is what remains when the volatiles are released.

Our Strategy

Our business strategy is to increase stockholder value through sustained earnings growth and cash flow generation by:

Developing and Operating Our Metallurgical Coal Properties. We have a 262 million ton reserve base of high-quality metallurgical coal with attractive quality characteristics across high-volatility and low-volatility segments. This geologically advantaged reserve base allows for flexible capital spending in challenging market conditions.

We plan to complete development of our existing properties and increase production from our existing development portfolio to more than 4-4.5 million clean tons of metallurgical coal, subject to market conditions,

5

permitting and additional capital deployment. We may also acquire additional reserves or infrastructure that contribute to our focus on advantaged geology and lower costs.

Being a Low-Cost U.S. Producer of Metallurgical Coal. Our reserve base presents advantaged geologic characteristics such as relatively thick coal seams at the deep mines, a low effective mining ratio at the surface mines, and desirable metallurgical coal quality. These characteristics contribute to a production profile that has a cash cost of production that is significantly below most U.S. metallurgical coal producers.

Maintaining a conservative capital structure and prudently managing the business for the long term. We are committed to maintaining a conservative capital structure with a reasonable amount of debt that will afford us the financial flexibility to execute our business strategies on an ongoing basis.

Enhancing Coal Purchase Opportunities. Depending on market conditions, we purchase coal from other independent producers. Purchased coal is complementary from a blending standpoint with our produced coals or it may also be sold as an independent product.

Demonstrating Excellence in Safety and Environmental Stewardship. We are committed to complying with both regulatory and our own high standards for environmental and employee health and safety requirements. We believe that business excellence is achieved through the pursuit of safer and more productive work practices.

6

Our Projects

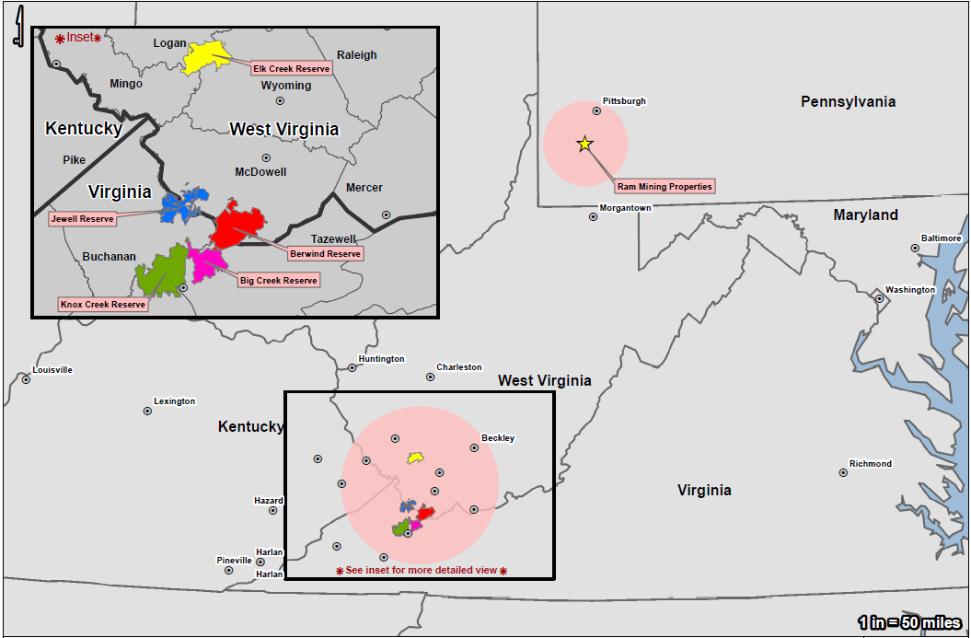

Our properties are primarily located in southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. The following map shows the location of our mining complexes and projects:

Elk Creek Mining Complex

Our Elk Creek mining complex in southern West Virginia began production in late December 2016. The Elk Creek property consists of approximately 20,166 acres of controlled mineral and contains 25 seams that we believe are economically mineable. Nearly all our seams contain high-quality, high volatile metallurgical coal accessible at or above drainage. Additionally, almost all of this coal is high-fluidity, which is an important factor for high volatile metallurgical coal.

We control the majority of the coal and related mining rights within the existing permitted areas and our current mine plans, as well as the surface for our surface facilities, through leases and subleases from Ramaco Coal, LLC, a related party, and McDonald Land Company. We estimate that the Elk Creek mining complex contains reserves capable of yielding approximately 113 million tons of clean saleable metallurgical coal.

We currently market most of the coal produced from the Elk Creek mining complex as a blended high volatile A/B product. When segregated, a portion of our coal can be sold as a high volatile A product for a premium. Our market for Elk Creek production is principally North American coke and steel producers. We also market our coal to European, South American, Asian and African customers, and occasionally to coal traders and brokers for use in filling orders for their blended products. Additionally, we seek to market a portion of our coal in the specialty coal markets that value low ash content.

7

We process our Elk Creek coal production through a 700 raw ton-per-hour preparation plant. The plant has a large-diameter (48”) heavy-media cyclone, dual-stage spiral concentrators, froth flotation, horizontal vibratory and screen bowl centrifuges. Our rail load-out facilities at Elk Creek are capable of loading 4,000 tons per hour and a full 150-car unit train in under four hours. The load-out facility is served by the CSX railroad. We also have the ability to develop on controlled property a rail-loading facility on the Norfolk Southern railroad, which would facilitate dual rail service. We have not yet committed the capital for development of a Norfolk Southern rail facility.

The existing impoundment at Elk Creek has been converted principally into a combined refuse facility. The combined capacity is expected to provide approximately 20 years of disposal life for our operations. We completed construction of a full complement of plate presses during 2020 to allow for dewatering material currently being pumped to our impoundment. This equipment allows us to process all waste material for placement in the combined refuse facility.

On November 5, 2018, one of our three raw coal storage silos that fed our Elk Creek plant experienced a partial structural failure. A temporary conveying system completed in late-November 2018 restored approximately 80% of our plant capacity. We completed a permanent belt workaround and restored the preparation plant to its full processing capacity in mid-2019. Our insurance carrier, Federal Insurance Company, disputed our claim for coverage based on certain exclusions to the applicable policy and, therefore, on August 21, 2019 we filed suit against Federal Insurance Company and Chubb INA Holdings, Inc. in Logan County Circuit Court in West Virginia seeking a declaratory judgment that the partial silo collapse was an insurable event and to require coverage under our policy. Defendants removed the case to the United States District Court for the Southern District of West Virginia, and upon removal, we substituted ACE American Insurance Company as a defendant in place of Chubb INA Holdings, Inc. Currently, the case is scheduled for trial beginning June 29, 2021, in Charleston, West Virginia.

A large portion of our controlled reserves are permitted through existing, issued permits. We currently have three mining permits that have not been activated and we are actively pursuing multiple new permits.

On January 3, 2020, we entered into a mineral lease with the McDonald Land Company for coal reserves which, in many cases, are located immediately adjacent to our Elk Creek complex. This leased property became available after the former base lease with another party was terminated. The prior lessee, who controlled the property since 1978, did not produce commercial amounts of coal from the property during their possession of the lease. While it is unusual to have a metallurgical reserve in this part of Central Appalachia remain idle for such an extended period of time, the configuration and location of the tracts lend themselves to be mined and processed far more efficiently from our Elk Creek property. The McDonald reserves are expected to have the same geologic advantages and low costs that are being experienced in our Elk Creek mines. Our 2020 reserve study of the McDonald tracts showed over 21 million proven and probable reserves in approximately 20 different coal seams to our Elk Creek reserve base. We project to mine approximately 10 million tons of these reserves in our current 10 year mine plan.

Berwind Mining Complex

Our Berwind mining complex is located on the border of West Virginia and Virginia and is well-positioned to fill the anticipated market for low volatile coals. The Berwind property consists of approximately 31,200 acres of controlled mineral and contains a large area of Squire Jim seam coal deposits. The Squire Jim seam of coal is the lowest known coal seam on the geologic column in this region, and due to depth of cover has never been significantly explored. We have outcrop access to this seam at the top of an anticline. Should we choose to develop this seam in the future, we expect to experience above average seam height.

Development of our Berwind mining complex began in late 2017 in the thinner Pocahontas No. 3 seam with plans to slope up into the thicker Pocahontas No. 4 seam, subject to market conditions. In 2020, we suspended development at the Berwind mining complex due to lower pricing and demand largely caused by the economic effects of COVID-19. This complex remains a key part of our anticipated future growth. We expect to achieve commercial production at the Berwind mining complex approximately six months after we resume the slope project. We estimate that the mine life for the Berwind mining complex is more than 20 years.

8

In February 2021, the resumption of the slope development project at Berwind was approved by our Board of Directors in anticipation of better market conditions. We view Berwind as the second flagship complex for Ramaco. The slope project will allow us to transition our mining efforts at Berwind to the thicker Pocahontas No. 4 seam. We have already expended more than $50 million in growth capital during the past four years in development at the Berwind mining complex. We anticipate spending another $10-12 million in growth capital over the next 12 months with approximately one-third of that outlay occurring in early 2022. At full production at Berwind, we expect to produce approximately 750,000 tons per year of high quality low-volatile coal with total cash costs per ton in the low- to mid-$70’s for company produced coal. We expect to have initial production by late 2021, and to ramp up to full production levels by the second quarter of 2022.

We are currently mining a small amount of coal from the Triad mine at Berwind. The mine is anticipated to produce less than 250,000 tons in 2021, and should function as a bridge until the main Berwind Pocahontas #4 reserve is fully activated.

We have the necessary permits for the Berwind mine for our current and budgeted operations. A permit for our Squire Jim seam room-and-pillar underground mine was issued during 2020. At this point, we do not anticipate activating this mining permit.

Knox Creek

The Knox Creek property consists of approximately 62,100 acres of controlled mineral, a 650 tons per hour preparation plant and coal-loading facility along with a refuse impoundment. Rail service is provided by Norfolk Southern.

The Tiller Mine slope face-up and shafts were idled before our acquisition of the property. We have spent limited amounts of capital to review the feasibility of a high volatile A metallurgical deep mine in the Jawbone seam of coal. This seam is located slightly above the Tiller Seam and would be accessed via a short slope. Jawbone coal could flow through the same portal and slope as the idle Tiller mine.

From time to time, we process coal purchased from other independent producers at the Knox Creek preparation plant and load-out facilities. We also process and load coal trucked from our Berwind mine at this facility.

In the fourth quarter of 2019, we acquired multiple permits from various affiliates of Omega Highwall Mining, LLC. Consideration for the transaction included assumption of approximately $0.6 million of ARO liability, curing minor lease defaults, and paying advance royalties under two assumed lease instruments. The total out-of-pocket consideration was less than $0.1 million, most of which is recoupable against future royalty payments. These permits are in close proximity to our Knox Creek preparation plant and loadout infrastructure, and provide immediate access to two separate mining areas in Southwestern Virginia. One is a deep mine permit in the Jawbone Seam, which contains approximately 2.65 million tons of geologically advantaged metallurgical coal. The second is a metallurgical surface mine in the Tiller and Red Ash seams that is spade ready for production. It contains approximately 800,000 tons of coal that can be mined via the surface and highwall mining methods. The surface mining is expected to have very low mining ratios. The combination of close proximity to Knox Creek and advantaged geology make these two mines likely to become active in the next few years. The fully permitted surface mine is one of the areas, subject to market conditions, that could positively impact near-term production and profitability. It is possible that the surface mine will be operated utilizing third party contractors we would manage.

In February 2021, a new mine development project known as the Big Creek mine and located near our Knox Creek preparation plant was approved by our Board of Directors. We anticipate to begin production at the Big Creek mine within approximately four to six months of breaking ground. We have obtained all required permits to begin development of the Big Creek mine. We anticipate full production of around 150,000-200,000 tons a year of primarily high quality, mid-volatile coal by the fourth quarter of 2021, with cash costs per ton in the upper $50’s for company produced coal. We expect growth capital spending in the development of the Big Creek mine to be roughly $5-7 million over the next two quarters. We expect this mine to be able to produce at these levels for more than three years.

9

RAM Mine

Our RAM Mine property is located in southwestern Pennsylvania, consists of approximately 1,570 acres of controlled mineral and is scheduled for initial production after a mining permit is issued. Production of high volatile coal from the Pittsburgh seam is planned from a single continuous-miner room-and-pillar underground operation. The Pittsburgh seam, in close proximity to Pittsburgh area coke plants, has historically been a key feedstock for these coke plants. Operation of our RAM Mine coal reserve may require access to a newly constructed preparation plant and loading facility, third party processing, or direct shipment of raw coal product. Upon commencement of mining, we anticipate that the mine will produce at an annualized rate of between 300 and 500 thousand tons with an estimated 10-year mining life.

We expect that coal from the RAM Mine coal reserve will be transported to our customers by highway trucks, rail cars or by barge on river systems. In addition to close proximity to river barge facilities, our RAM Mine operations are also near Norfolk Southern rail access.

The RAM Mine coal reserve is not yet permitted, although we have applied for a permit and it is in the final phase of the permit application process. We expect this permit to be issued in 2021.

Customers and Contracts

Coal prices differ substantially by region and are impacted by many factors including the overall economy, demand for steel, demand for electricity, location, market, quality and type of coal, mine operation costs and the cost of customer alternatives. The major factors influencing our business are the global economy and demand for steel.

We market the bulk of our production to North American integrated steel mills and coke plants, in addition to international customers primarily in Europe, South America, Asia and Africa. Additionally, we market limited amounts of our production to various premium-priced specialty markets, such as foundry cokemakers, manufacturers of activated carbon products, and specialty metals producers.

We sold 1.75 million tons of coal during 2020. Of this, 71% was sold to North American markets and 29% was sold into export markets, excluding Canada. Principally, our export market sales were made to Europe. During 2020, sales to three customers accounted for approximately 70% of total revenue. The total balance due from these three customers at December 31, 2020 was approximately 46% of total accounts receivable. During 2019, sales to three customers accounted for approximately 53% of total revenue. The total balance due from these two customers at December 31, 2019 was approximately 58% of total accounts receivable. No other customer accounted for more than 10% of our revenue during this period. If a major customer decided to stop purchasing coal or significantly reduced its purchases from us, revenue could decline and our operating results and financial condition could be adversely affected.

Trade Names, Trademarks and Patents

We do not have any registered trademarks or trade names for our products, services or subsidiaries, and we do not believe that any trademark or trade name is material to our business. The names of the seams in which we have coal reserves, and attributes thereof, are widely recognized in the metallurgical coal market.

Competition

Our principal domestic competitors include Blackhawk Mining, LLC, Coronado Global Resources, Inc., Corsa Coal Corp, Arch Resources, Inc., Alpha Metallurgical Resources, Inc., Energy, Inc. and Warrior Met Coal, Inc. We also compete in international markets directly with domestic companies and with companies that produce coal from one or more foreign countries, such as Australia, Canada, Colombia and South Africa. Many of these coal producers are larger than we are and have greater financial resources and larger reserve bases than we do.

10

Suppliers

Supplies used in our business include petroleum-based fuels, explosives, tires, conveyance structure, ventilation supplies, lubricants and other raw materials as well as spare parts and other consumables used in the mining process. We use third-party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction. We believe adequate substitute suppliers and contractors are available and we are not dependent on any one supplier or contractor. We continually seek to develop relationships with suppliers and contractors that focus on reducing our costs while improving quality and service.

Environmental, Health and Safety and Other Regulatory Matters

Our operations are subject to federal, state, and local laws and regulations, such as those relating to matters such as permitting and licensing, employee health and safety, reclamation and restoration of mining properties, water discharges, air emissions, plant and wildlife protection, the storage, treatment and disposal of wastes, remediation of contaminants, surface subsidence from underground mining and the effects of mining on surface water and groundwater conditions.

Compliance with these laws and regulations may be costly and time-consuming and may delay commencement, continuation or expansion of exploration or production at our facilities. They may also depress demand for our products by imposing more stringent requirements and limits on our customers’ operations. Moreover, these laws are constantly evolving and are becoming increasingly complex and stringent over time. These laws and regulations, particularly new legislative or administrative proposals, or judicial interpretations of existing laws and regulations related to the protection of the environment could result in substantially increased capital, operating and compliance costs.

Due in part to these extensive and comprehensive regulatory requirements and ever-changing interpretations of these requirements, violations of these laws can occur from time to time in our industry and also in our operations. Expenditures relating to environmental compliance are a major cost consideration for our operations and safety and compliance is a significant factor in mine design, both to meet regulatory requirements and to minimize long-term environmental liabilities.

The following is a summary of the various federal and state environmental and similar regulations that have a material impact on our business:

Surface Mining Control and Reclamation Act. The Surface Mining Control and Reclamation Act of 1977 (“SMCRA”) establishes operational, reclamation and closure standards for our mining operations and requires that comprehensive environmental protection and reclamation standards be met during the course of and following completion of mining activities. SMCRA also stipulates compliance with many other major environmental statutes, including the CAA, the CWA, the ESA, RCRA and CERCLA. Permits for all mining operations must be obtained from the United States Office of Surface Mining Reclamation and Enforcement (“OSMRE”) or, where state regulatory agencies have adopted federally approved state programs under SMCRA, the appropriate state regulatory authority. Our operations are located in states which have achieved primary jurisdiction for enforcement of SMCRA through approved state programs.

SMCRA imposes a complex set of requirements covering all facets of coal mining. SMCRA regulations govern, among other things, coal prospecting, mine plan development, topsoil or growth medium removal and replacement, disposal of excess spoil and coal refuse, protection of the hydrologic balance, and suitable post mining land uses.

From time to time, OSMRE will also update its mining regulations under SMCRA. For example, OSMRE has previously sought to impose stricter stream protection requirements by requiring more extension pre-mining and baseline data for coal mining operations. The rule was disapproved by Congress pursuant to the Congressional Review Act (“CRA”). However, whether Congress will enact future legislation to require a new Stream Protection Rule remains uncertain. The existing rules, or other new SMCRA regulations, could result in additional material costs, obligations and restrictions upon our operations.

11

Abandoned Mine Lands Fund. SMCRA also imposes a reclamation fee on all current mining operations, the proceeds of which are deposited in the Abandoned Mine Reclamation Fund (“AML Fund”), which is used to restore unreclaimed and abandoned mine lands mined before 1977. The current per ton fee is $0.28 per ton for surface-mined coal and $0.12 per ton for underground-mined coal. These fees are currently scheduled to be in effect until September 30, 2021. Estimates of our total reclamation and mine-closing liabilities are based upon permit requirements and our experience related to similar activities. If these accruals are insufficient or our liability in a particular year is greater than currently anticipated, our future operating results could be adversely affected.

Mining Permits and Approvals. Numerous governmental permits and approvals are required for mining operations. We are required to prepare and present to federal, state, and local authorities data detailing the effect or impact that any proposed exploration project for production of coal may have upon the environment, the public and our employees. The permitting rules, and the interpretations of these rules, are complex, change frequently, and may be subject to discretionary interpretations by regulators. The requirements imposed by these permits and associated regulations can be costly and time-consuming and may delay commencement or continuation of exploration, production or expansion at our operations. The governing laws, rules, and regulations authorize substantial fines and penalties, including revocation or suspension of mining permits under some circumstances. Monetary sanctions and, in certain circumstances, even criminal sanctions may be imposed for failure to comply with these laws.

Applications for permits and permit renewals at our mining operations are also subject to public comment and potential legal challenges from third parties seeking to prevent a permit from being issued, or to overturn the applicable agency’s grant of the permit. Should our permitting efforts become subject to such challenges, the permits may not be issued in a timely fashion, may involve requirements which restrict our ability to conduct our mining operations or to do so profitably, or may not be issued at all. Any delays, denials, or revocation of these or other similar permits we need to operate could reduce our production and materially adversely impact our cash flow and results of our operations.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators must also submit a reclamation plan for restoring the mined property to its prior condition, productive use or other permitted condition. The conditions of certain permits also require that we obtain surface owner consent if the surface estate has been split from the mineral estate. This requires us to negotiate with third parties for surface access that overlies coal we acquired or intend to acquire. These negotiations can be costly and time-consuming, lasting years in some instances, which can create additional delays in the permitting process. If we cannot successfully negotiate for land access, we could be denied a permit to mine coal we already own.

Finally, we typically submit necessary mining permit applications several months, or even years, before we anticipate mining a new area. However, we cannot control the pace at which the government issues permits needed for new or ongoing operations. For example, the process of obtaining CWA permits can be particularly time-consuming and subject to delays and denials. The EPA also has the authority to veto permits issued by the Corps under the CWA’s Section 404 program that prohibits the discharge of dredged or fill material into regulated waters without a permit. Even after we obtain the permits that we need to operate, many of the permits must be periodically renewed, or may require modification. There is some risk that not all existing permits will be approved for renewal, or that existing permits will be approved for renewal only upon terms that restrict or limit our operations in ways that may be material.

Financial Assurance. Federal and state laws require a mine operator to secure the performance of its reclamation and lease obligations under SMCRA through the use of surety bonds or other approved forms of financial security for payment of certain long-term obligations, including mine closure or reclamation costs. The changes in the market for coal used to generate electricity in recent years have led to bankruptcies involving prominent coal producers. Several of these companies relied on self-bonding to guarantee their responsibilities under the SMCRA permits including for reclamation. In response to these bankruptcies, OSMRE issued a Policy Advisory in August 2016 to state agencies that was intended to discourage authorized states from approving self-bonding arrangements. Although the Policy Advisory was rescinded in October 2017, certain states, including Virginia, had previously announced that they would no longer accept self-bonding to secure reclamation obligations under the state mining laws. Additionally, in March 2018, the Government Accounting Office recommended that Congress consider amending SMCRA to eliminate the availability of self-bonding to guarantee responsibilities under SMCRA permits. Individually and collectively, these and future revised various financial assurance requirements may increase the amount of financial assurance needed and

12

limit the types of acceptable instruments, straining the capacity of the surety markets to meet demand. This may delay the timing for and increase the costs of obtaining the required financial assurance.

We use surety bonds, trusts and letters of credit to provide financial assurance for certain transactions and business activities. Federal and state laws require us to obtain surety bonds to secure payment of certain long-term obligations including mine closure or reclamation costs and other miscellaneous obligations. The bonds are renewable on a yearly basis. Surety bond rates have increased in recent years and the market terms of such bonds have generally become less favorable. Sureties typically require coal producers to post collateral, often having a value equal to 40% or more of the face amount of the bond. As a result, we may be required to provide collateral, letters of credit or other assurances of payment in order to obtain the necessary types and amounts of financial assurance. Under our surety bonding program, we are not currently required to post any letters of credit or other collateral to secure the surety bonds; obtaining letters of credit in lieu of surety bonds could result in a significant cost increase. Moreover, the need to obtain letters of credit may also reduce amounts that we can borrow under any senior secured credit facility for other purposes. If, in the future, we are unable to secure surety bonds for these obligations and are forced to secure letters of credit indefinitely or obtain some other form of financial assurance at too high of a cost, our profitability may be negatively affected.

We intend to maintain a credit profile that precludes the need to post collateral for our surety bonds. Nonetheless, our surety has the right to demand additional collateral at its discretion.

Some international customers require new suppliers to post performance guarantees during the initial stages of qualifying to become a long-term supplier. To date we have not had to provide a performance guarantee, but it is possible that such a guarantee could be required in the future.

Mine Safety and Health. The Mine Act and the MINER Act, and regulations issued under these federal statutes, impose stringent health and safety standards on mining operations. The regulations that have been adopted under the Mine Act and the MINER Act are comprehensive and affect numerous aspects of mining operations, including training of mine personnel, mining procedures, roof control, ventilation, blasting, use and maintenance of mining equipment, dust and noise control, communications, emergency response procedures, and other matters. MSHA regularly inspects mines to ensure compliance with regulations promulgated under the Mine Act and MINER Act.

Pennsylvania, West Virginia, and Virginia all have similar programs for mine safety and health regulation and enforcement. The various requirements mandated by federal and state statutes, rules, and regulations place restrictions on our methods of operation and result in fees and civil penalties for violations of such requirements or criminal liability for the knowing violation of such standards, significantly impacting operating costs and productivity.

The regulations enacted under the Mine Act and MINER Act as well as under similar state acts are routinely expanded or made more stringent, raising compliance costs and increasing potential liability. For example, MSHA published a request for information in August 2019 related to its consideration of a lower exposure limit for silica in respirable dust. Our compliance with current or future mine health and safety regulations could increase our mining costs. At this time, it is not possible to predict the full effect that new or proposed statutes, regulations and policies will have on our operating costs, but any expansion of existing regulations, or making such regulations more stringent may have a negative impact on the profitability of our operations. If we were to be found in violation of mine safety and health regulations, we could face penalties or restrictions that may materially and adversely impact our operations, financial results and liquidity.

In addition, government inspectors have the authority to issue orders to shut down our operations based on safety considerations under certain circumstances, such as imminent dangers, accidents, failures to abate violations, and unwarrantable failures to comply with mandatory safety standards. If an incident were to occur at one of our operations, it could be shut down for an extended period of time, and our reputation with prospective customers could be materially damaged. Moreover, if one of our operations is issued a notice of pattern of violations, then MSHA can issue an order withdrawing the miners from the area affected by any enforcement action during each subsequent significant and substantial (“S&S”) citation until the S&S citation or order is abated.

13

Workers’ Compensation and Black Lung. We are insured for workers’ compensation benefits for work related injuries that occur within our United States operations. We retain first-dollar coverage for all of our subsidiaries and are insured for the statutory limits. Workers’ compensation liabilities, including those related to claims incurred but not reported, are recorded principally using annual valuations based on discounted future expected payments using historical data of the operating subsidiary or combined insurance industry data when historical data is limited. State workers’ compensation acts typically provide for an exception to an employer’s immunity from civil lawsuits for workplace injuries in the case of intentional torts. However, West Virginia’s workers’ compensation act provides a much broader exception to workers’ compensation immunity. The exception allows an injured employee to recover against his or her employer where he or she can show damages caused by an unsafe working condition of which the employer was aware that was a violation of a statute, regulation, rule or consensus industry standard. These types of lawsuits are not uncommon and could have a significant impact on our operating costs.

In addition, we obtained from a third-party insurer a workers’ compensation insurance policy, which includes coverage for medical and disability benefits for black lung disease under the Federal Coal Mine Health and Safety Act of 1969 and the Mine Act, as amended. Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must pay federal black lung benefits to claimants who are current and former employees and also make payments to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to January 1, 1970.

The Patient Protection and Affordable Care Act of 2010 includes significant changes to the federal black lung program including an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim and the establishment of a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program. In addition to possibly incurring liability under federal statutes, we may also be liable under state laws for black lung claims.

Clean Air Act. The CAA and comparable state laws that regulate air emissions affect coal mining operations both directly and indirectly. Direct impacts on coal mining and processing operations include CAA permitting requirements and emission control requirements relating to air pollutants, including particulate matter such as fugitive dust. The CAA indirectly affects coal mining operations by extensively regulating the emissions of particulate matter, sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal-fired power plants. In addition to the greenhouse gas (“GHG”) issues discussed below, the air emissions programs that may materially and adversely affect our operations, financial results, liquidity, and demand for our coal, directly or indirectly, include, but are not limited to, the following:

| ● | Cross-State Air Pollution Rule. In June 2011, the EPA finalized the Cross-State Air Pollution Rule (“CSAPR”), a cap-and-trade program that requires 28 states in the Midwest and eastern seaboard of the U.S. to reduce power plant emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. In May 2017, EPA further limited summertime (May-September) nitrogen oxide emissions from power plants in 22 states in the eastern United States in the CSAPR Update Rule. For states to meet these requirements, a number of coal-fired electric generating units will likely need to be retired, rather than retrofitted with the necessary emission control technologies, reducing demand for thermal coal. Moreover, in September 2019, the United States Court of Appeals for the District of Columbia Circuit (“D.C. Circuit”) remanded the CSAPR Update Rule to EPA on the grounds that it failed to timely require upwind states to control or eliminate their contribution to ozone and/or fine particulate matter in downwind states, as required under the federal Clean Air Act. In October 2020, EPA proposed a Revised CSAPR Update Rule in response to the D.C. Circuit’s ruling. The proposed rule addresses 21 states’ outstanding interstate pollution transport obligations and would require additional emissions reductions of nitrogen oxides from power plants in 12 states. Imposition of stricter deadlines for controlling downwind contribution could accelerate unit retirements or the need to implement emission control strategies. Any reduction in the amount of coal consumed by electric power generators as a result of these limitations could decrease demand for thermal coal. However, the practical impact of CSAPR may be limited because utilities in the U.S. have continued to take steps to comply with CAIR, which requires similar power plant |

14

| emissions reductions, and because utilities are preparing to comply with the Mercury and Air Toxics Standards (“MATS”) regulations, which require overlapping power plant emissions reductions. |

| ● | Acid Rain. Title IV of the CAA requires reductions of sulfur dioxide emissions by electric utilities and applies to all coal-fired power plants generating greater than 25 Megawatts of power. Affected power plants have sought to reduce sulfur dioxide emissions by switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing or trading sulfur dioxide emission allowances. These reductions could impact our customers in the electric generation industry. These requirements are not supplanted by CSAPR. |

| ● | NAAQS for Criterion Pollutants. The CAA requires the EPA to set standards, referred to as NAAQS, for six common air pollutants: carbon monoxide, nitrogen dioxide, lead, ozone, particulate matter and sulfur dioxide. Areas that are not in compliance (referred to as “non-attainment areas”) with these standards must take steps to reduce emissions levels. The EPA has adopted NAAQS for nitrogen oxide, sulfur dioxide, particulate matter and ozone. The CAA further requires EPA to periodically review and revise the NAAQS, resulting in the adoption of increasingly more stringent standards over time. States with areas non-attainment areas must adopt a state implementation plan (“SIP”) that demonstrates compliance with the existing or new air quality standards. These plans could require significant additional emissions control expenditures at coal-fired power plants. The final rules and new standards may also impose additional emissions control requirements on our customers in the electric generation, steelmaking, and coke industries. Because coal mining operations emit particulate matter and sulfur dioxide, our mining operations could be affected when the new standards are implemented by the states. |

| ● | Mercury and Hazardous Air Pollutants. The EPA has established emission standards for mercury and other metal, fine particulates, and acid gases from coal- and oil-fired power plants through the Mercury and Air Toxics Standards (“MATS”) rule. In May 2020, the EPA published a final rule reversing its prior determination that it is appropriate and necessary to regulate these pollutants. However, this rule will not alter or eliminate the emissions standards established by the MATS rule. Like CSAPR, MATS and other similar future regulations could accelerate the retirement of a significant number of coal-fired power plants. Such retirements would likely adversely impact our business. |

Global Climate Change. Climate change continues to attract considerable public and scientific attention. There is widespread concern about the contributions of human activity to such changes, especially through the emission of GHGs. There are three primary sources of GHGs associated with the coal industry. First, the end use of our coal by our customers in electricity generation, coke plants, and steelmaking is a source of GHGs. Second, combustion of fuel by equipment used in coal production and to transport our coal to our customers is a source of GHGs. Third, coal mining itself can release methane, which is considered to be a more potent GHG than CO2, directly into the atmosphere. These emissions from coal consumption, transportation and production are subject to pending and proposed regulation as part of initiatives to address global climate change.

As a result, numerous proposals have been made and are likely to continue to be made at the international, national, regional and state levels of government to monitor and limit emissions of GHGs. Collectively, these initiatives could result in higher electric costs to our customers or lower the demand for coal used in electric generation, which could in turn adversely impact our business.

At present, we are principally focused on metallurgical coal production, which is not used in connection with the production of power generation. However, we may seek to sell greater amounts of our coal into the power-generation market in the future. The market for our coal may be adversely impacted if comprehensive legislation or regulations focusing on GHG emission reductions are adopted, or if our customers are unable to obtain financing for their operations.

At the international level, President Obama announced in November 2014 that the United States would seek to cut net GHG emissions 26-28 percent below 2005 levels by 2025 in return for China’s commitment to seek to peak emissions around 2030, with concurrent increases in renewable energy. In April 2016, the United States further agreed to

15

voluntarily limit or reduce future emissions as part of the Paris Agreement reached at the United Nations Conference on Climate Change. In November 2019, the United States submitted formal notification to the United Nations that it intended to withdraw from the agreement and withdrew from the agreement in November 2020. However, on January 20, 2021, President Biden signed an “Acceptance on Behalf of the United States of America” that will allow the United States to rejoin the Paris Agreement. The newly signed acceptance, deposited with the United Nations on January 20, 2021, reverses the prior withdrawal. The United States will officially rejoin the Paris Agreement on February 19, 2021. In addition, shortly after taking office in January 2021, President Biden issued a series of executive orders designed to address climate change. Reentry into the Paris Agreement and President Biden’s executive orders may result in the development of additional regulations or changes to existing regulations.

At the federal level, although no comprehensive climate change legislation has been implemented to date, such legislation has periodically been introduced in the U.S. Congress and may be proposed or adopted in the future. The likelihood of such legislation has increased due to the change in the administration. Furthermore, the EPA has determined that emissions of GHGs present an endangerment to public health and the environment, because emissions of GHGs are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA has begun adopting and implementing regulations to restrict emissions of GHGs under existing provisions of the CAA. For example, in August 2015, EPA finalized the CPP to cut carbon emissions from existing power plants. The CPP creates individualized emission guidelines for states to follow, and requires each state to develop an implementation plan to meet the individual state’s specific targets for reducing GHG emissions. In July 2019, the EPA adopted a rule that replaced the CPP with a new rule titled the Affordable Clean Energy (“ACE”) Rule. Although the ACE rule moves away from the individualized emission guidelines of the CPP, it still requires states to set appropriate GHG emission standards for power plants within their jurisdiction based upon the application of “candidate” heat rate improvement measures. The implementation of the ACE rule is currently being challenged in the D.C. Circuit. These and future GHG emission standards may encourage a shift away from coal-fired power generation, adversely impacting the market for our product.

At the state level, several states, including Pennsylvania and Virginia, have already adopted measures requiring GHG emissions to be reduced within state boundaries, including cap-and-trade programs and the imposition of renewable energy portfolio standards. Various states and regions have also adopted GHG initiatives and certain governmental bodies, have imposed, or are considering the imposition of, fees or taxes based on the emission of GHGs by certain facilities. A number of states have also enacted legislative mandates requiring electricity suppliers to use renewable energy sources to generate a certain percentage of power.

The uncertainty over the outcome of litigation challenging the ACE rule and the extent of future regulation of GHG emissions may inhibit utilities from investing in the building of new coal-fired plants to replace older plants or investing in the upgrading of existing coal-fired plants. Any reduction in the amount of coal consumed by electric power generators as a result of actual or potential regulation of GHG emissions could decrease demand for thermal coal, thereby reducing our revenue and adversely affecting our business and results of operations. We or prospective customers may also have to invest in CO2 capture and storage technologies in order to burn coal and comply with future GHG emission standards.

Finally, there have been attempts to encourage the reduction of coalbed methane emissions because methane has a greater GHG effect than CO2 and can give rise to safety concerns. For example, EPA has established the Coalbed Methane Outreach Program (“CMOP”) in an effort to mitigate methane emissions from underground coal mines through voluntary initiatives and outreach. If new laws or regulations were introduced to reduce coalbed methane emissions, those rules could adversely affect our costs of operations by requiring installation of air pollution controls, higher taxes, or costs incurred to purchase credits that permit us to continue operations.

Clean Water Act. The CWA and corresponding state laws and regulations affect coal mining operations by restricting the discharge of pollutants, including dredged or fill materials, into waters of the United States. Likewise, permits are required under the CWA to construct impoundments, fills or other structure in areas that are designated as waters of the United States. The CWA provisions and associated state and federal regulations are complex and subject to amendments, legal challenges and changes in implementation. For example, prior to placing fill material in waters of the United States, such as with the construction of a valley fill, coal mining companies are required to obtain a permit from

16

the Corps under Section 404 of the CWA. The permit can be either a Nationwide Permit (“NWP”), normally NWP 21, 49 or 50 for coal mining activities, or a more complicated individual permit. NWPs are designed to allow for an expedited permitting process, while individual permits involve a longer and more detailed review process. The EPA has the authority to veto permits issued by the Corps under the CWA’s Section 404 program that prohibits the discharge of dredged or fill material into regulated waters without a permit. Recent court decisions, regulatory actions and proposed legislation have created uncertainty over CWA jurisdiction and permitting requirements.

Prior to discharging any pollutants into waters of the United States, coal mining companies must obtain a National Pollutant Discharge Elimination System (“NPDES”) permit from the appropriate state or federal permitting authority. NPDES permits include effluent limitations for discharged pollutants and other terms and conditions, including required monitoring of discharges. Failure to comply with the CWA or NPDES permits can lead to the imposition of significant penalties, litigation, compliance costs and delays in coal production. Changes and proposed changes in state and federally recommended water quality standards may result in the issuance or modification of permits with new or more stringent effluent limits or terms and conditions.

For instance, waters that states have designated as impaired (i.e., as not meeting present water quality standards) are subject to Total Maximum Daily Load (“TMDL”) regulations, which may lead to the adoption of more stringent discharge standards for our coal mines and could require more costly treatment. Likewise, the water quality of certain receiving streams requires an anti-degradation review before approving any discharge permits. TMDL regulations and anti-degradation policies may increase the cost, time and difficulty associated with obtaining and complying with NPDES permits.

In addition, in certain circumstances private citizens may challenge alleged violations of NPDES permit limits in court. Recently, certain citizen groups have filed lawsuits alleging ongoing discharges of pollutants, including selenium and conductance, from valley fills located at certain mining sites in some of the regions where we operate. In West Virginia, several of these cases have been successful for the challengers. While it is difficult to predict the outcome of any potential or future suits, such litigation could result in increased compliance costs following the completion of mining at our operations.

Finally, in June 2015, the EPA and the Corps published a new definition of “waters of the United States” (“WOTUS”) that would have expanded areas requiring NPDES or Corps Section 404 permits. In October 2019, EPA and the Army Corps of Engineers issued a final rule that repealed the 2015 WOTUS definition and reinstated the agencies’ narrower pre-2015 scope of federal CWA jurisdiction. In April 2020, EPA and the Army Corps of Engineers issued the final Navigable Waters Protection Rule amending the definition of “water of the United States” and replacing EPA’s October 2019 final rule. Judicial challenges to EPA’s October 2019 and April 2020 final rules are currently before multiple federal district courts. If the October 2019 final rules are vacated and the expanded scope of jurisdiction in the 2015 rule is ultimately implemented, the CWA permits we need may not be issued, may not be issued in a timely fashion, or may be issued with new requirements which restrict our ability to conduct mining operations or to do so profitably.

Resource Conservation and Recovery Act. RCRA and corresponding state laws establish standards for the management of solid and hazardous wastes generated at our various facilities. Besides affecting current waste disposal practices, RCRA also addresses the environmental effects of certain past hazardous waste treatment, storage and disposal practices. In addition, RCRA requires certain of our facilities to evaluate and respond to any past release, or threatened release, of a hazardous substance that may pose a risk to human health or the environment.

RCRA may affect coal mining operations by establishing requirements for the proper management, handling, transportation and disposal of solid and hazardous wastes. For example, EPA regulates coal ash as a solid waste under Subtitle D of RCRA through its coal combustion residuals (“CCR”) rule. This rule establishes limits for the location of new sites and requires closure of sites that fail to meet prescribed engineering standards, regular inspections of impoundments, and immediate remediation and closure of unlined ponds that are polluting ground water. As initially promulgated, the rule exempted closed coal ash impoundments located at inactive facilities and allowed for the continued operation of unlined or clay-lined ponds that were not polluting groundwater. However, in August 2020, EPA finalized amendments to its CCR rule that would require closure to be initiated at all unlined and clay-lined surface

17

impoundments by April 11, 2021. Additionally, in December 2016, Congress passed the Water Infrastructure Improvements for the Nation Act, which provides for the establishment of state and EPA permit programs for the control of coal combustion residuals and authorizes states to incorporate EPA’s final rule for coal combustion residuals or develop other criteria that are at least as protective as the final rule. These requirements, as well as any future changes in the management of coal combustion residuals, could increase our customers’ operating costs and potentially reduce their ability or need to purchase coal. In addition, contamination caused by the past disposal of coal combustion residuals, including coal ash, could lead to material liability for our customers under RCRA or other federal or state laws and potentially further reduce the demand for coal.

Currently, certain coal mine wastes, such as earth and rock covering a mineral deposit (commonly referred to as overburden) and coal cleaning wastes, are exempted from hazardous waste management under RCRA. Any change or reclassification of this exemption could significantly increase our coal mining costs.

Comprehensive Environmental Response, Compensation and Liability Act. CERCLA and similar state laws affect coal mining operations by, among other things, imposing cleanup requirements for threatened or actual releases of hazardous substances into the environment. Under CERCLA and similar state laws, joint and several liability may be imposed on hazardous substance generators, site owners, transporters, lessees and others regardless of fault or the legality of the original disposal activity. Although the EPA excludes most wastes generated by coal mining and processing operations from the primary hazardous waste laws, such wastes can, in certain circumstances, constitute hazardous substances for the purposes of CERCLA. In addition, the disposal, release or spilling of some products used by coal companies in operations, such as chemicals, could trigger the liability provisions of CERCLA or similar state laws. Thus, we may be subject to liability under CERCLA and similar state laws for coal mines that we currently own, lease or operate or that we or our predecessors have previously owned, leased or operated, and sites to which we or our predecessors sent hazardous substances. These liabilities could be significant and materially and adversely impact our financial results and liquidity.

Endangered Species and Bald and Golden Eagle Protection Acts. The ESA and similar state legislation protect species designated as threatened, endangered or other special status. The U.S. Fish and Wildlife Service (the “USFWS”) works closely with the OSMRE and state regulatory agencies to ensure that species subject to the ESA are protected from mining-related impacts. Several species indigenous to the areas in which we operate area protected under the ESA. Other species in the vicinity of our operations may have their listing status reviewed in the future and could also become protected under the ESA. In addition, the USFWS has identified bald eagle habitat in some of the counties where we operate. The Bald and Golden Eagle Protection Act prohibits taking certain actions that would harm bald or golden eagles without obtaining a permit from the USFWS. Compliance with the requirements of the ESA and the Bald and Golden Eagle Protection Act could have the effect of prohibiting or delaying us from obtaining mining permits. These requirements may also include restrictions on timber harvesting, road building and other mining or agricultural activities in areas containing the affected species or their habitats.

Use of Explosives. Our surface mining operations are subject to numerous regulations relating to blasting activities. Due to these regulations, we will incur costs to design and implement blast schedules and to conduct pre-blast surveys and blast monitoring. In addition, the storage of explosives is subject to various regulatory requirements. For example, the Department of Homeland Security requires facilities in possession of chemicals of interest (including ammonium nitrate at certain threshold levels) to complete a screening review. Our mines are low risk, Tier 4 facilities which are not subject to additional security plans. The adoption of future, more stringent standards related to the use of explosives could materially adversely impact our cost or ability to conduct our mining operations.

National Environmental Policy Act. NEPA requires federal agencies, including the Department of Interior, to evaluate major agency actions that have the potential to significantly impact the environment, such as issuing a permit or other approval. In the course of such evaluations, an agency will typically prepare an environmental assessment to determine the potential direct, indirect and cumulative impacts of a proposed project. Where the activities in question have significant impacts to the environment, the agency must prepare an environmental impact statement. Compliance with NEPA can be time-consuming and may result in the imposition of mitigation measures that could affect the amount of coal that we are able to produce from mines on federal lands, and may require public comment. Furthermore, whether agencies have complied with NEPA is subject to protest, appeal or litigation, which can delay or halt projects. The

18

NEPA review process, including potential disputes regarding the level of evaluation required for climate change impacts, may extend the time and/or increase the costs and difficulty of obtaining necessary governmental approvals, and may lead to litigation regarding the adequacy of the NEPA analysis, which could delay or potentially preclude the issuance of approvals or grant of leases.

In the past, the Council on Environmental Quality (“CEQ”) has issued guidance encouraging agencies to provide more detailed discussion of the direct, indirect, and cumulative impacts of a proposed action’s reasonably foreseeable GHG emissions and effects. Although this guidance has since been withdrawn, the adoption of a similar guidance in the future could create additional delays and costs in the NEPA review process or in our operations, or even an inability to obtain necessary federal approvals for our operations due to the increased risk of legal challenges from environmental groups seeking additional analysis of climate impacts.

Other Environmental Laws. We are required to comply with numerous other federal, state, and local environmental laws and regulations in addition to those previously discussed. These additional laws include but are not limited to the Safe Drinking Water Act, the Toxic Substances Control Act, and the Emergency Planning and Community Right-to-Know Act. Each of these laws can impact permitting or planned operations and can result in additional costs or operational delays.

Seasonality

Our primary business is not materially impacted by seasonal fluctuations. Demand for metallurgical coal is generally more heavily influenced by other factors such as the general economy, interest rates and commodity prices.

Human Capital Resources

We believe our employees are a competitive advantage. We seek to foster a culture that supports diversity and inclusion, and strive to provide a safe, healthy and rewarding work environment with opportunities for growth. We had 349 employees as of December 31, 2020, including our named executive officers. None of our employees are covered by collective bargaining agreements, and we have not experienced any strikes or work stoppages related to labor relation issues. We believe we have good relations with our employees. Our human capital resources objectives include, as applicable, identifying, recruiting, training, retaining, incentivizing and integrating our existing and additional employees. We also depend on experienced contractors and third-party consultants to conduct some of our day-to-day activities. We plan to continue to use the services of many of these contractors and consultants.

Safety Philosophy. We have a comprehensive health and safety program based on the core belief that all accidents and occupational illnesses are preventable. We believe that:

| ● | Business excellence is achieved through the pursuit of safer and more productive work practices. |

| ● | Any task that cannot be performed safely should not be performed. |

| ● | Working safely is a requirement of our employees. |

| ● | Controlling the work environment is important, but human behavior within the work environment is paramount. |

| ● | Safety starts with individual decision-making—all employees must assume a share of responsibility for acts within their control that pose a risk of injury to themselves or fellow workers. |

| ● | All levels of the organization must be proactive in implementing safety processes that promote a safe and healthy work environment. |

| ● | Consequently, we are committed to providing a safe work environment; providing our employees with proper training and equipment; and implementing safety and health rules, policies and programs that foster safety excellence. |

19

Our safety program includes a focus on the following:

| ● | Hiring the Right Workers. Our hiring program includes significant pre-employment screening and reference checks. |

| ● | Safety Incentives. We have a compensation system that encourages and rewards excellent safety performance. |

| ● | Communication. We conduct regular safety meetings with the frequent involvement of senior management to reinforce the “tone at the top.” |

| ● | Drug and Alcohol Testing. We require pre-employment drug screening as well as regular random drug testing that exceeds regulatory requirements. |

| ● | Continuous Improvement Programs. We track key safety performance metrics, including accident rates, violation types and frequencies. We have specific targets in these areas and we measure performance against these targets. Specific action plans are implemented for targeted improvement in areas where performance falls below our expectations. |

| ● | Training. Our training program includes comprehensive new employee orientation and training, annual refresher training and task training components. These training modules are designed to reinforce our high safety expectations. Work rules and procedures are a key element of this training. |