December 1, 2022

VIA CONFIDENTIAL SUBMISSION TO THE STAFF

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

Division of Corporation Finance

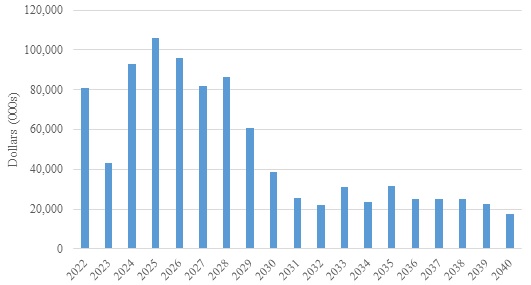

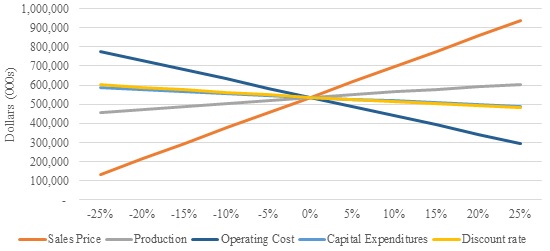

Office of Real Estate & Construction

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Re: | Ramaco Resources, Inc. |

| Form 10-K for the Fiscal Year Ended December 31, 2021 | |

| Filed April 1, 2022 | |

| Form 10-Q for the Quarterly Period Ended June 30, 2022 | |

| Filed August 9, 2022 | |

| File No. 001-38003 |

Ladies and Gentlemen:

This letter sets forth the responses of Ramaco Resources, Inc. (the “Company”) to the comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in your letter, dated October 31, 2022, with respect to the Company’s Form 10-K for the Fiscal Year Ended December 31, 2021, Filed April 1, 2022 (the “10-K”) and Form 10-Q for the Quarterly Period Ended June 30, 2022, Filed August 9, 2022 (the “10-Q”), File No. 001-38003.

In addition, we have attached as Exhibit A hereto a form of Amendment No. 1 to the 10-K (the “Form Amendment”) that the Company will file subsequent to the Staff confirming there are no additional comments thereto (the “10-K/A”). The changes to the Form Amendment are shown in bold and underline. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed thereto in the 10-K. For your convenience, each of the Staff’s comments is reprinted in bold below, followed by the Company’s responses thereto.

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

U.S. Securities & Exchange Commission

December 1, 2022

Page 2

Form 10-K for the Fiscal Year Ended December 31, 2021

General, page 4

| 1. | A review of your other filings indicates that in 2011 you acquired an interest in the Brook Property which has significant coal tonnage. You are currently conducting an exploration program on this property. Your filings indicate this coal deposit contains an excess of a billion coal tons, of which you control 162 M tons. Please explain why this disclosure is missing from your Form 10-K report and the basis for determining which of your properties are material. |

Response:

The Company respectfully acknowledges the Staff’s comment and advises the Staff that the Brook Property is not reflected in the 10-K because the Company did not own the Brook Property as of December 31, 2021. The Company acquired the Brook Property as part of the Ramaco Coal transaction, which closed in April 2022.

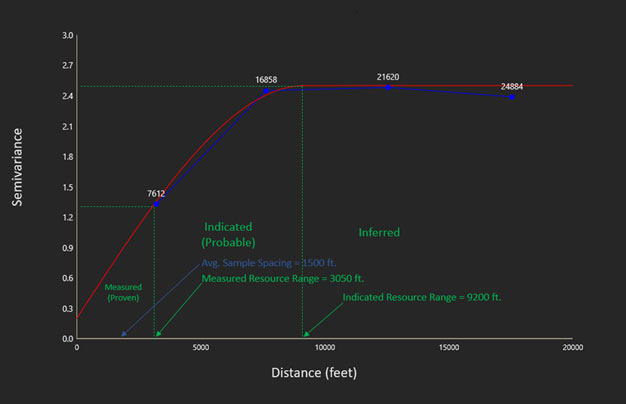

| 2. | We note your statement of 769 million resource tons. This is the sum of only your measured and indicated resources. Please review your entire filing and revise to report your resources as the sum of your total resources when referring to a general resource tonnage or clarify in each instance that this resource quantity is only the measured and indicated tonnage |

Response:

The Company respectfully acknowledges the Staff’s comment and has revised the disclosure in the Form Amendment as reflected on pages A-3 and A-4 of Exhibit A attached hereto.

Summary Overview of Mining Operations, page 49

| 3. | Please revise your filing to report each individual property’s production as required by Item 1303(B)(2)(i) of regulation S-K. |

Response:

The Company respectfully acknowledges the Staff’s comment and has revised the disclosure in the Form Amendment as reflected on page A-19 of Exhibit A attached hereto.

| 2 |

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

U.S. Securities & Exchange Commission

December 1, 2022

Page 3

Table 2 Summary Mineral Reserves, page 55

| 4. | We note your Big Creek probable reserves does not correspond to your technical report. Please review and modify your reserves as necessary. |

Response:

The Company respectfully acknowledges the Staff’s comment and has revised the disclosure in the Form Amendment as reflected on page A-23 of Exhibit A attached hereto.

Item 9A. Controls and Procedures, page 94

| 5. | Please provide management's assessment of the effectiveness of your internal control over financial reporting. Refer to Item 308(a)(3) of Regulation S-K. |

Response:

The Company respectfully acknowledges the Staff’s comment and has revised the disclosure in the Form Amendment as reflected on page A-25 of Exhibit A attached hereto.

| 6. | We note the language in the Exhibit 31.1 certifications that you filed did not conform exactly to the language set forth in Item 601(b)(31)(i) of Regulation S-K. Specifically, we note the exclusion of internal control over financial reporting language within the introductory sentence of paragraph 4. Please amend your Form 10-K to revise your certifications to conform exactly to the language set forth in Item 601(b)(31)(i) of Regulation S-K. Please also refer to Regulation S-K C&DI 246.13. |

Response:

The Company respectfully acknowledges the Staff’s comment and has revised Exhibits 31.1 and 31.2 of the Form Amendment as reflected in Exhibit B attached hereto (showing changes in bold and underline).

| 3 |

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

U.S. Securities & Exchange Commission

December 1, 2022

Page 4

Exhibits 96.1 and 96.2

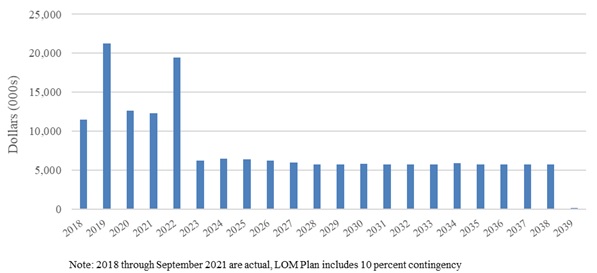

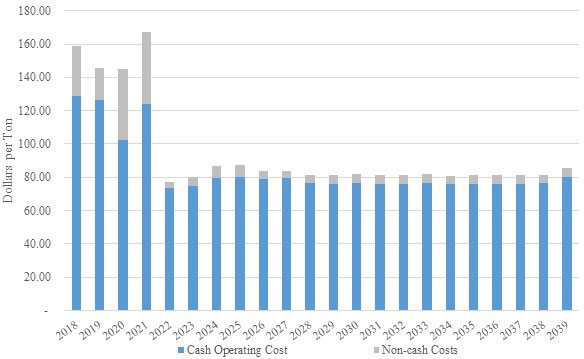

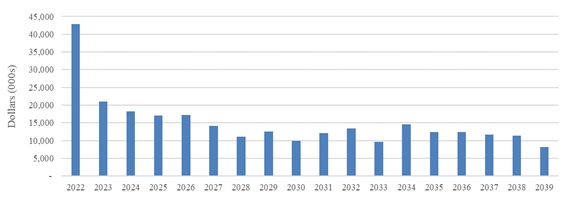

Capital and Operating Costs, page ES-18

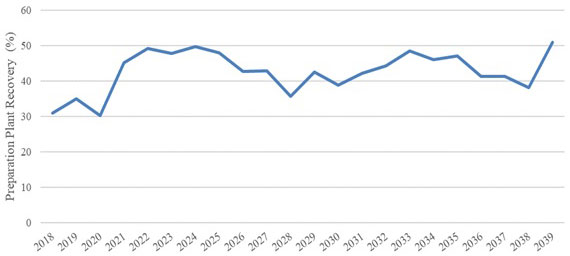

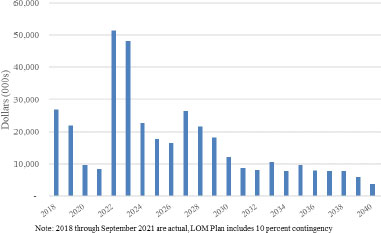

| 7. | We note your illustrations/charts related to your Life of Mine (LOM) annual capital and operating cost estimates. Please modify your filing and provide more detail related to major line items/cost centers and provide numeric values on an annual basis with totals for your LOM annual capital and operating cost estimates as required by Item 601 (b)(96)(iii)(b)(18) of Regulation S-K. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summaries as reflected on pages C-100 through C-104 of Exhibit C attached hereto and pages D-105 through D-108 of Exhibit D attached hereto.

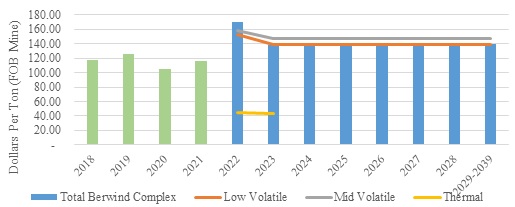

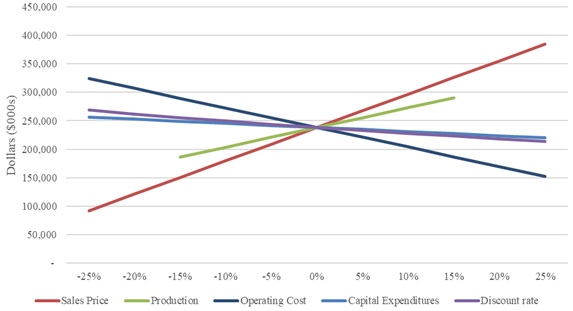

Exhibits 96.1 and 96.2

Economic Analysis, page ES-19

| 8. | Please modify your filing and provide annual numerical values for your LOM on an after-tax basis annual cash flow, including your annual production, salable product quantities, revenues, major cost centers, taxes & royalties, capital, and final reclamation and closure costs for your life of mine, demonstrating your deposit is economically viable. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summaries as reflected on pages C-105 through C-109 of Exhibit C attached hereto and D-109 through D-113 of Exhibit D attached hereto.

Exhibit 96.1 Berwind Complex

Development and Operations, page 5, page EX-5

| 9. | We note your historical production for 2021 conflicts with your production reported on page 70. Please review and revise as necessary. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summary as reflected on pages C-5 and C-70 of Exhibit C attached hereto.

| 4 |

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

U.S. Securities & Exchange Commission

December 1, 2022

Page 5

Exhibit 96.2 Elk Creek Complex

Development and Operations, page 5, page EY-5

| 10. | We believe your historical production for 2021 appears to be a typographic error and should be 1.981 M tons. Please review and correct as necessary. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summary as reflected on page D-5 of Exhibit D attached hereto.

Exhibit 96.2 Elk Creek Complex

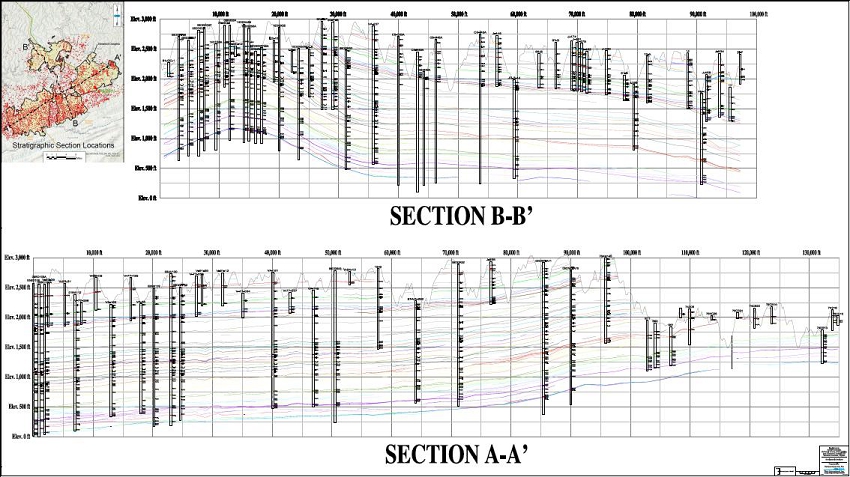

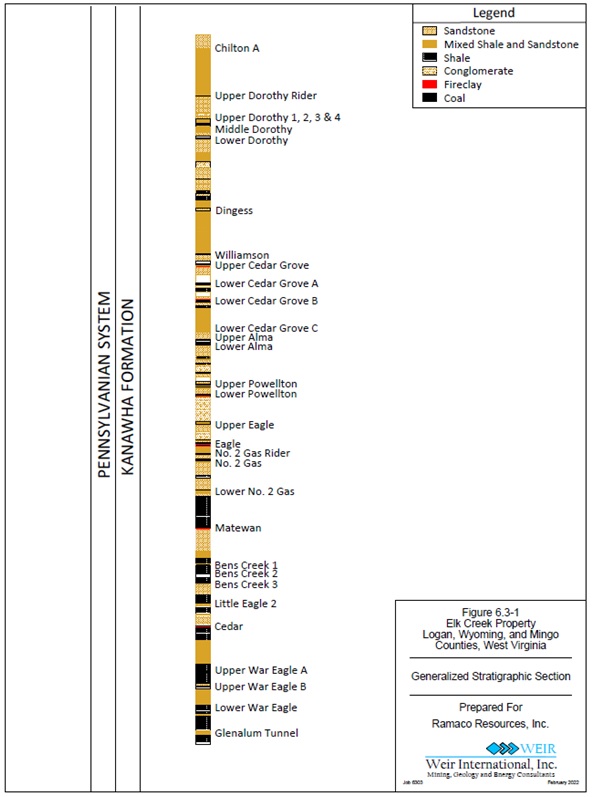

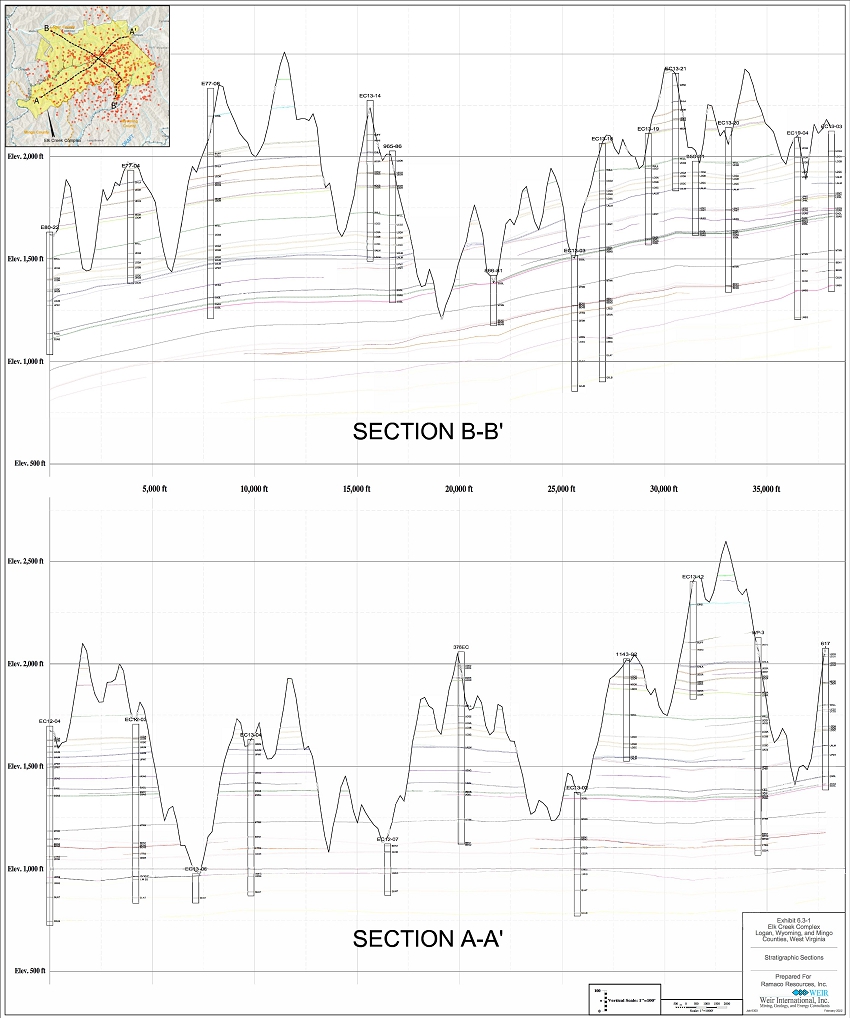

Stratigraphic Column and Cross Section, page 29, page EY-29

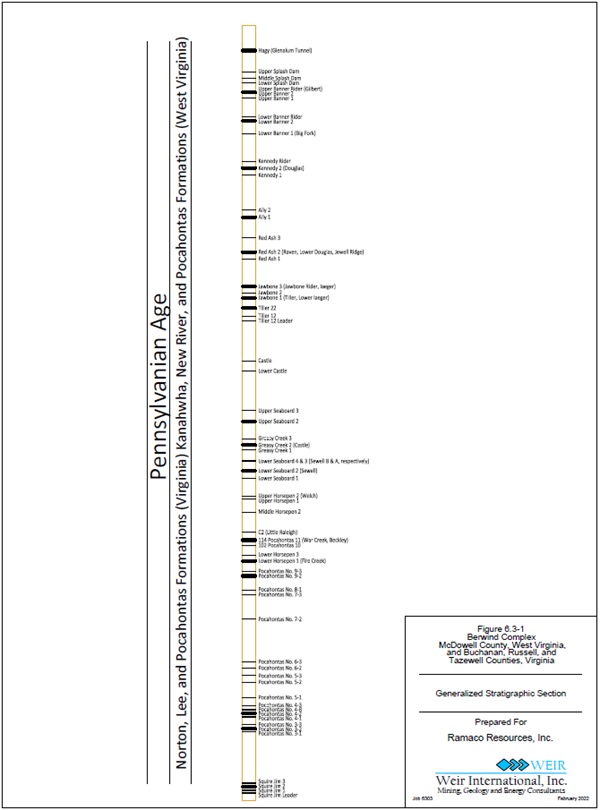

| 11. | We have reviewed Section 6.3 and note the Exhibit 6.3-1 found in Appendix A has been omitted. Please modify your filing and insert this exhibit. |

Response:

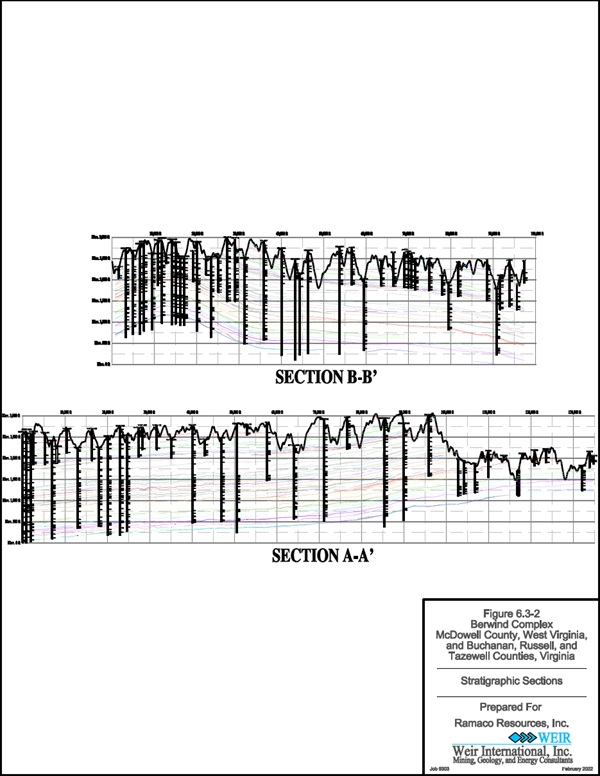

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summaries to include Exhibit 6.3-2 in Appendix A as reflected on page C-118 of Exhibit C attached hereto and Exhibit 6.3-1 in Appendix A as reflected on page D-122 of Exhibit D attached hereto.

Exhibit 96.2 Elk Creek Complex

Estimates of Mineral Resources, page 48, page EY-48

| 12. | We have reviewed your resource tabulation and found you have omitted the Moorefork mine from the resource totals. Please review and modify your filing to correct your total resource disclosure. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summary as reflected on page D-47 and D-48 of Exhibit D attached hereto.

Exhibit 96.2 Elk Creek Complex

Table 13.2.1-2 Elk Creek Complex, Page 67, page EY-67

| 13. | We have reviewed your ROM tabulation on this page and found a discrepancy with the totals presented. Please review and modify your filing to correct your ROM production totals. |

Response:

The Company respectfully acknowledges the Staff’s comment and has amended the technical report summary as reflected on page D-67 of Exhibit D hereto.

| 5 |

Isabel Rivera

Pam Howell

Paul Cline

Shannon Menjivar

U.S. Securities & Exchange Commission

December 1, 2022

Page 6

Form 10-Q for the Quarterly Period Ended June 30, 2022

Note 12 - Ramaco Coal Acquisition, page 17

| 14. | The acquisition of Ramaco Coal was accounted for as a purchase of assets. Tell us why this transaction did not constitute the acquisition of a business. Your response should clearly explain why Ramaco Coal did not represent a business in accordance with the guidance outlined in ASC 805-10-55-4 through 55-6 and 805-10-55-8 through 805-10-55-9. |

Response:

The Company respectfully acknowledges the Staff’s comment and advises the Staff that the Company conducted an assessment as to whether the acquisition of Ramaco Coal constitutes a purchase of assets or the acquisition of a business pursuant to ASC 805. ASC 805-10-55-5A provides a practical screen test for determining whether an acquisition is a purchase of assets or an acquisition of a business: “If substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets, the asset is not considered a business. Gross assets acquired should exclude cash and cash equivalents, deferred tax assets, and goodwill resulting from the effects of deferred tax liabilities. However, the gross assets acquired should include any consideration transferred (plus the fair value of any noncontrolling interest and previously held interest, if any) in excess of the fair value of net identifiable assets acquired.”

While ASC 805 does not define what constitutes “substantially all,” this term is typically interpreted in other areas of U.S. GAAP to mean at least 90%. In the acquisition of Ramaco Coal, the gross assets acquired consist of mineral rights, buildings, and machinery and equipment. The Company determined that the mineral rights constitute a single identifiable asset in accordance with requirements ASC 805-10-55-5B and ASC 805-10-55-5C. The Company subsequently determined that the fair value of the mineral rights comprised over 90%, or “substantially all,” of the combined fair value of the gross assets acquired. Therefore, the Company concluded that the acquisition of Ramaco Coal did not constitute an acquisition of a business pursuant to ASC 805.

| 6 |

| Sincerely, | |

| /s/ Randall W. Atkins | |

| Name: Randall W. Atkins | |

| Title: Chairman and Chief Executive Officer |

| cc: | Matthew Pacey, P.C., Kirkland & Ellis LLP |

| Anthony Sanderson, Kirkland & Ellis LLP |

EXHIBIT A

Form Amendment

A - 1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38003

RAMACO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 38-4018838 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) | |

| 250 West

Main Street, Suite 1800 Lexington, Kentucky |

40507 | |

| (Address of principal executive offices) | (Zip Code) |

(859) 244-7455

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered on which registered | ||

| Common Stock, $0.01 par value | METC | NASDAQ Global Select Market | ||

| 9.00% Senior Notes due 2026 | METCL | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued is audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was $68.8 million.

As of March 29, 2022, the registrant had 44,273,388 shares of common stock outstanding.

Documents Incorporated by Reference:

Certain information required to be furnished pursuant to Part III of this Annual Report on Form 10-K is set forth in, and is hereby incorporated by reference herein from, the definitive proxy statement for our 2022 Annual General Meeting of Stockholders, to be filed by Ramaco Resources with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days after December 31, 2021.

Explanatory Note

Ramaco Resources, Inc. (“we,” “us,” or “our”) is filing this Amendment No. 1 on Form 10-K/A (the “Amendment”) in order to amend and restate certain items of its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, originally filed April 1, 2022 (the “Original 10-K”), to provide amended disclosures pursuant to correspondence with the staff (the “Staff”) of the Securities and Exchange Commission (“SEC”) in connection with the Staff’s review of the Original Filing. The following items are hereby amended and restated in their entirety: Part I. Item 1, Part I. Item 2., Part II. Item 9A and Part IV. Item 15.

We are also including currently dated certifications by our principal executive officer and principal financial officer as Exhibits 31.1 and 31.2 under Section 302 of the Sarbanes-Oxley Act of 2002, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, we are including currently dated technical report summaries as Exhibits 96.1 and 96.2.

Other than as expressly set forth above and except with respect to certain conforming changes made to our exhibit index, this Amendment does not, and does not purport to, update or restate the information in the Original 10-K or reflect any events that have occurred after the Original 10-K. Moreover, the information in this Amendment does not update or otherwise affect the financial statements filed as part of the Original 10-K. This Amendment should be read in conjunction with the Original 10-K and our other filings with the SEC.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| ITEM 1. | Business | 3 |

| ITEM 2. | Properties | 17 |

| PART II | ||

| ITEM 9A. | Controls and Procedures | 25 |

| PART IV | ||

| ITEM 15. | Exhibits and Financial Statement Schedules | 26 |

| SIGNATURES | 32 |

| A - 2 |

Ramaco Resources, Inc. is a Delaware corporation formed in October 2016. Our common stock is listed on the NASDAQ Global Select Market under the symbol “METC”. Our 9.00% Senior Notes due 2026 (the “Senior Notes”) are listed on the NASDAQ Global Select Market under the symbol “METCL”. Our principal corporate offices are located in Lexington, Kentucky. As used herein, “Ramaco Resources,” “we,” “our,” and similar terms include Ramaco Resources, Inc. and its subsidiaries, unless the context indicates otherwise.

General

We are an operator and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. We are a pure play metallurgical coal company with 39 million reserve tons and 769 million measured and indicated resource tons of high-quality metallurgical coal. We believe our advantaged reserve geology provides us with higher productivities and industry leading lower cash costs.

Our development portfolio primarily includes four properties: Elk Creek, Berwind, Knox Creek and RAM Mine. Each of these properties possesses geologic and logistical advantages that make our coal among the lowest delivered-cost U.S. metallurgical coal to our domestic target customer base, North American blast furnace steel mills and coke plants, as well as international metallurgical coal consumers.

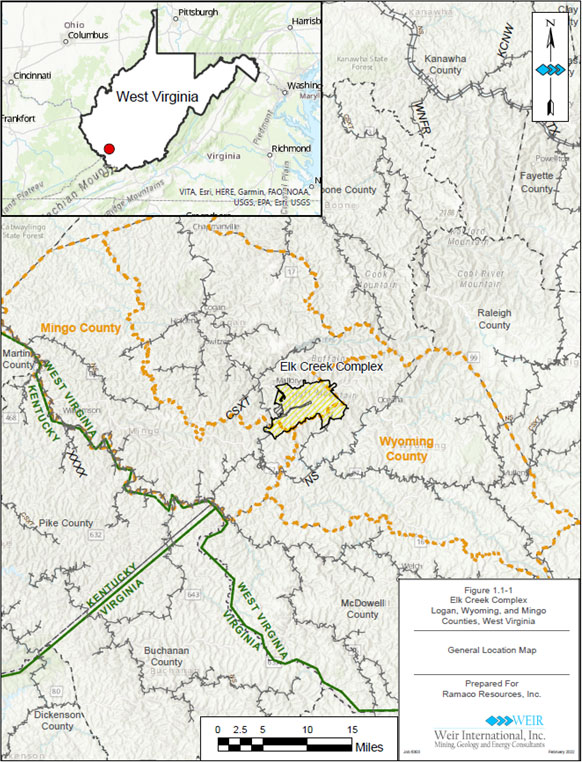

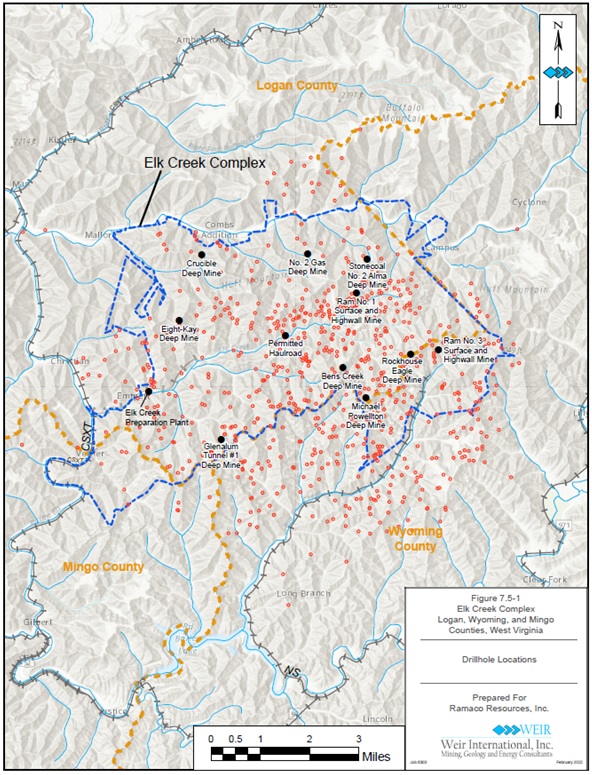

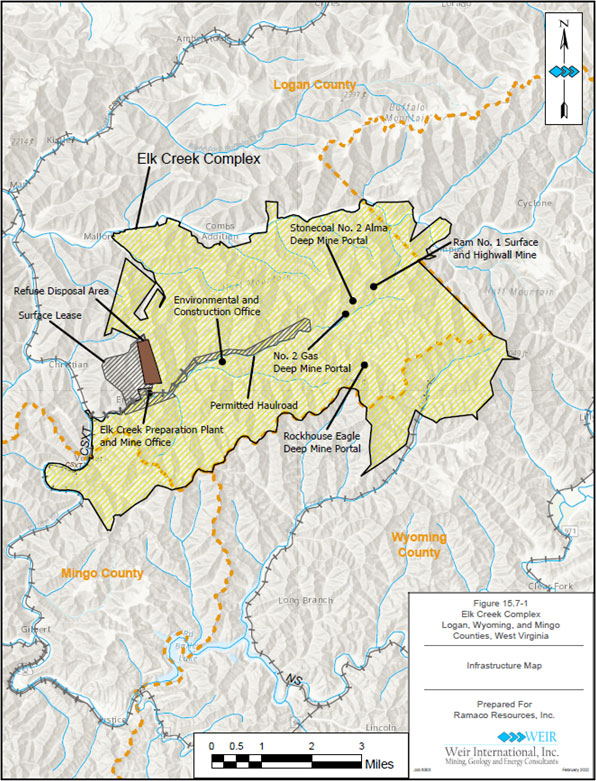

Our operations include three deep mines and a surface mine at our Elk Creek mining complex (the “Elk Creek Complex”). Development of this complex commenced in 2016 and included construction of a preparation plant and rail load-out facilities. The Elk Creek property consists of approximately 20,200 acres of controlled mineral rights and contains approximately 16 seams that we have targeted for production.

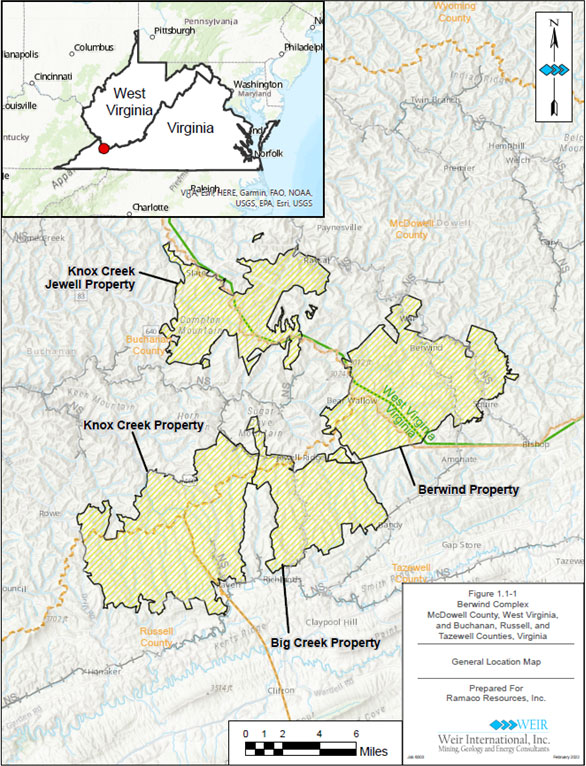

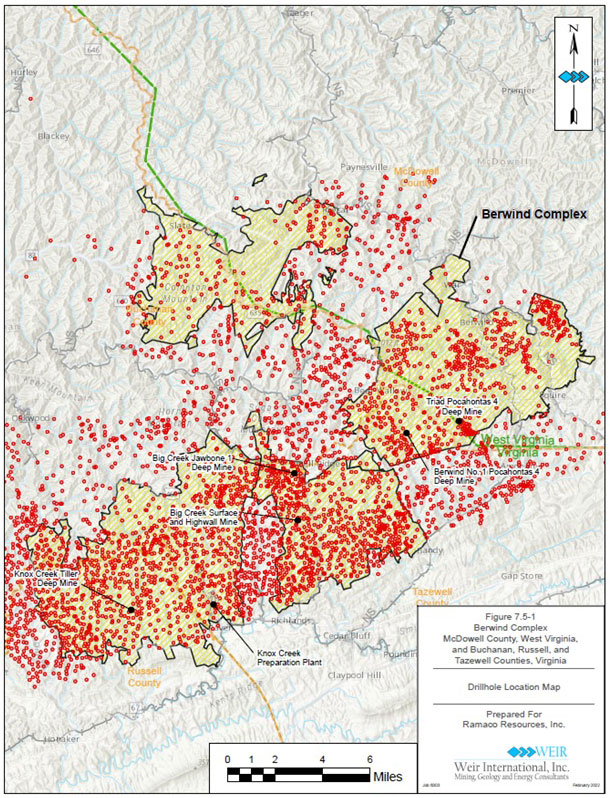

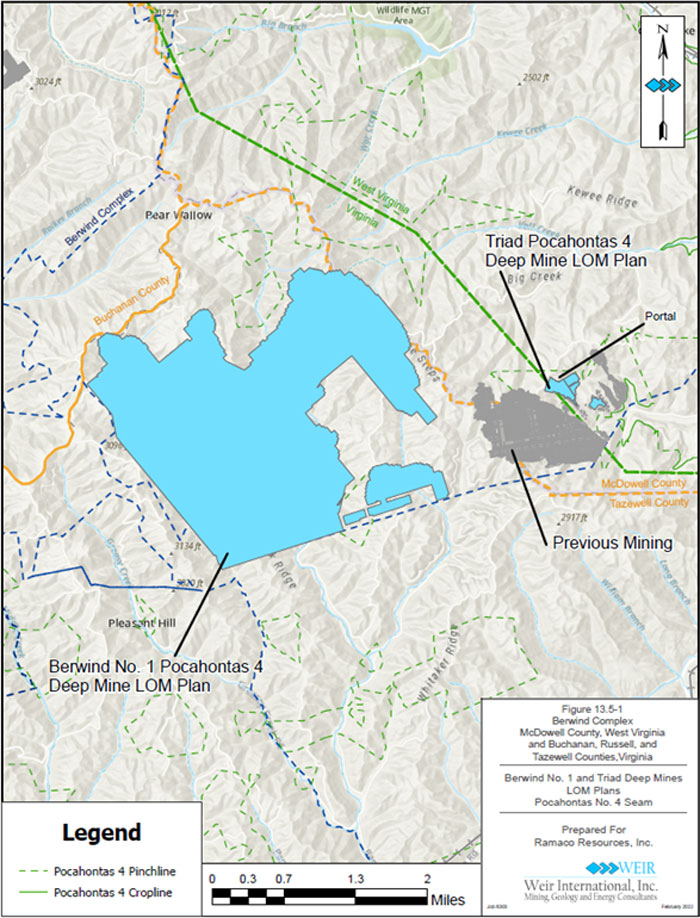

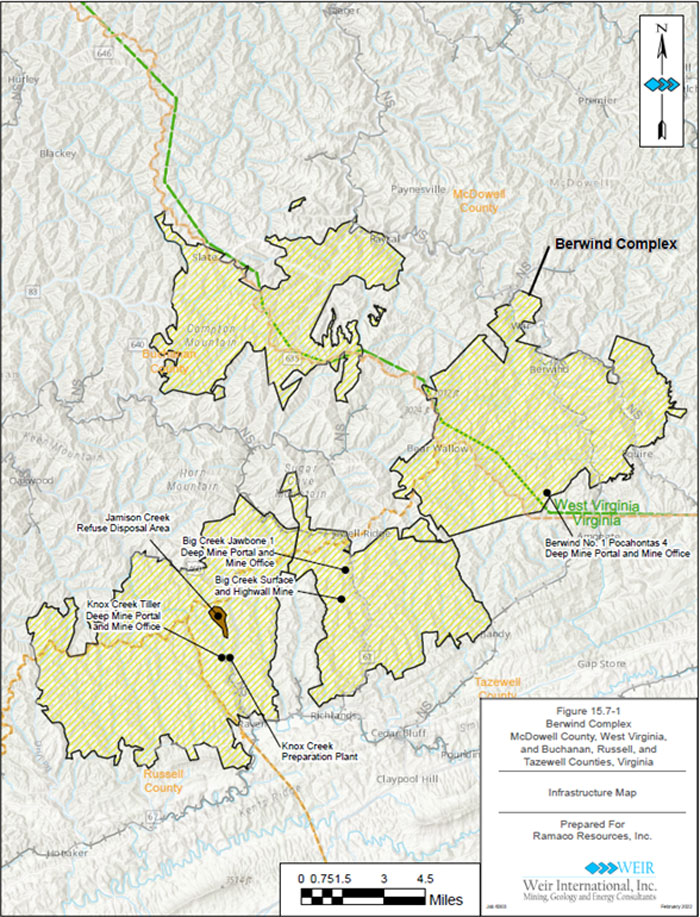

Development of our Berwind mining complex (the “Berwind Complex”) began in late-2017. In 2020, we suspended development at the Berwind Complex due to lower pricing and demand largely caused by the COVID-19 outbreak. In early-2021, as pricing and demand improved, Berwind development was restarted. We successfully reached the thicker Pocahontas No. 4 seam in late-2021. The Berwind property consists of approximately 41,300 acres of controlled mineral rights.

In December 2021, we acquired what are referred to as the “Amonate Assets” from subsidiaries of Coronado Global Resources Inc. (“Coronado”) as described under “Our Projects – Berwind” below. The Amonate Assets include a processing plant located in our Berwind Complex, saving us transportation costs to our Knox Creek plant 26 miles away. We expect to incur approximately $10 million of capital expenditures in 2022 to bring the newly acquired plant at the Berwind Complex online.

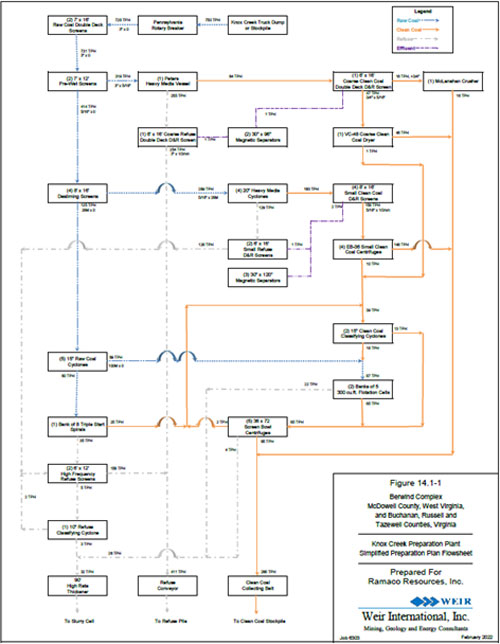

Our Knox Creek facility includes a preparation plant and 62,100 acres of controlled mineral rights that we expect to develop in the future. The Knox Creek preparation plant processes coal from our Berwind Complex (until the newly acquired plant at the Berwind Complex is placed into operation) as well as coal we may purchase from third parties.

Our RAM Mine property is located in southwestern Pennsylvania, consists of approximately 1,567 acres of controlled mineral rights, and is scheduled for initial production after a mining permit is issued and market conditions warrant development.

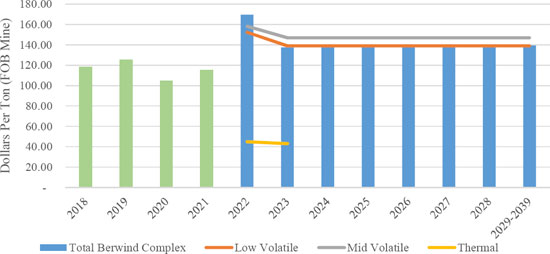

As of December 31, 2021, our estimated aggregate annual production capacity is approximately 2.4 million clean tons of coal. We plan to complete development of our existing properties and increase production from our existing development portfolio to approximately 5 million clean tons of metallurgical coal annually, subject to market conditions, permitting and additional capital deployment. We may also acquire additional reserves or infrastructure that contribute to our focus on advantaged geology and lower costs.

Metallurgical Coal Industry

Metallurgical coal is also known as “met coal “ or “coking coal,” and is a key component of the blast furnace steelmaking process. United States metallurgical coal mines are primarily located in the Appalachian area of the eastern U.S. Imported metallurgical coal has historically been uneconomic due to transportation costs and availability of domestic supply. Metallurgical coal is transported to domestic customers by truck, rail, barge and vessel. Metallurgical coal contracts in North America are typically 12-month, calendar year contracts where both prices and volumes are fixed. These contracts are normally negotiated and settled during the third and fourth quarters of the preceding calendar year.

| A - 3 |

U.S. metallurgical coal supply in excess of what can be consumed in North America is exported to the seaborne market and sold to buyers in Europe, South America, Africa, India and Asia. The U.S. is the second largest global supplier to the seaborne metallurgical coal market behind Australia. U.S. metallurgical coal exports are primarily sold to buyers in the Atlantic Basin market (customers in Europe, Brazil and Africa), and serve as swing supply to buyers in the Pacific Basin (customers in India, South Korea, Japan and China). U.S. metallurgical coal exports compete with Australian metallurgical coals that are generally produced at a lower cost, but are geographically disadvantaged to the Atlantic Basin. Conversely, Australian production has a much shorter logistical route to Pacific Basin customers. Any supply shortfall out of Australia, or increase in global demand beyond Australia’s capacity, has historically been serviced by U.S. and Canadian metallurgical coal producers.

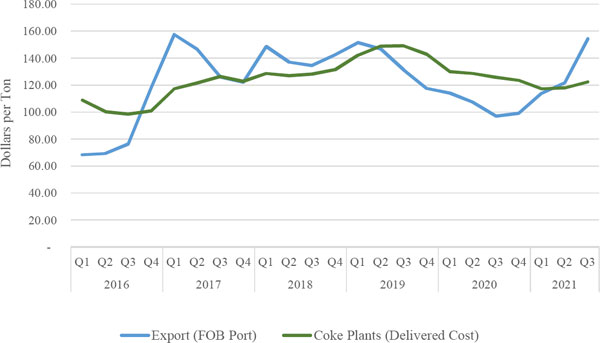

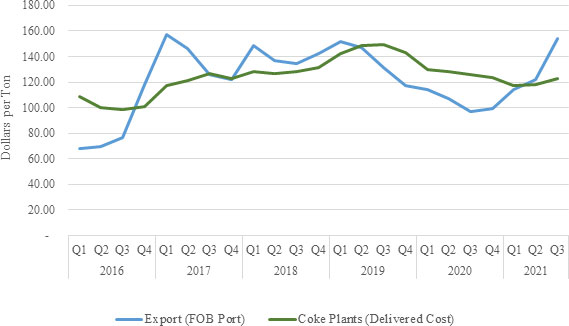

Export metallurgical coal pricing is determined utilizing a series of indices from a number of independent sources and is adjusted for coal quality. Contracted export volumes have terms that vary in duration from spot cargoes to one year, rarely exceeding one year. In some cases, indices are used to calculate pricing at the point that the coal changes hands. In other cases, an average value of indices over time may be utilized. While the term “benchmark” is still utilized, it too is determined based on index values, typically for the preceding three months.

Metallurgical coals are generally classified as high, medium or low-volatile (“vol”). Volatiles are products, other than water, that are released as gas or vapor when coal is converted to coke. Carbon is the primary element which remains when the volatiles are released.

Our Strategy

Our business strategy is to increase stockholder value through sustained earnings growth, cash flow generation and dividends by:

Developing and Operating Our Metallurgical Coal Properties. We have 39 million and 769 million measured and indicated tons of high-quality metallurgical coal reserves and resources, respectively, with attractive quality characteristics across high-volatility and low-volatility segments. This geologically advantaged resource and reserve base allows for flexible capital spending in challenging market conditions.

We plan to complete development of our existing properties and increase production from our existing development portfolio to approximately 5 million clean tons of metallurgical coal, subject to market conditions, permitting and additional capital deployment. We may also acquire additional reserves or infrastructure that contribute to our focus on advantaged geology and lower costs.

Being a Low-Cost U.S. Producer of Metallurgical Coal. Our reserve base presents advantaged geologic characteristics such as relatively thick coal seams at the deep mines, a low effective mining ratio at the surface mines, and desirable metallurgical coal quality. These characteristics contribute to a production profile that has a cash cost of production that is significantly below most U.S. metallurgical coal producers.

Maintaining a conservative capital structure and prudently managing the business for the long term. We are committed to maintaining a conservative capital structure with a reasonable amount of debt that will afford us the financial flexibility to execute our business strategies on an ongoing basis.

Enhancing Coal Purchase Opportunities. Depending on market conditions, we purchase coal from other independent producers. Purchased coal is complementary from a blending standpoint with our produced coals or it may also be sold as an independent product.

Demonstrating Excellence in Safety and Environmental Stewardship. We are committed to complying with both regulatory and our own high standards for environmental and employee health and safety requirements. We believe that business excellence is achieved through the pursuit of safer and more productive work practices.

| A - 4 |

Our Projects

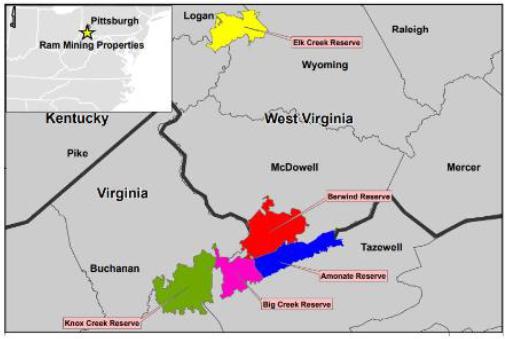

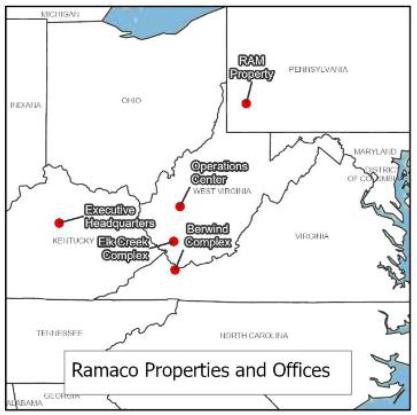

Our properties are primarily located in southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. The following map shows the location of our mining complexes and projects:

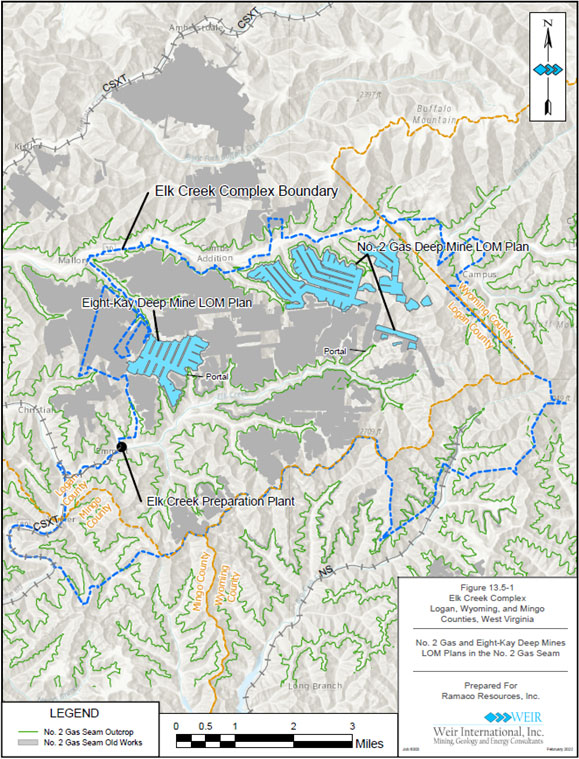

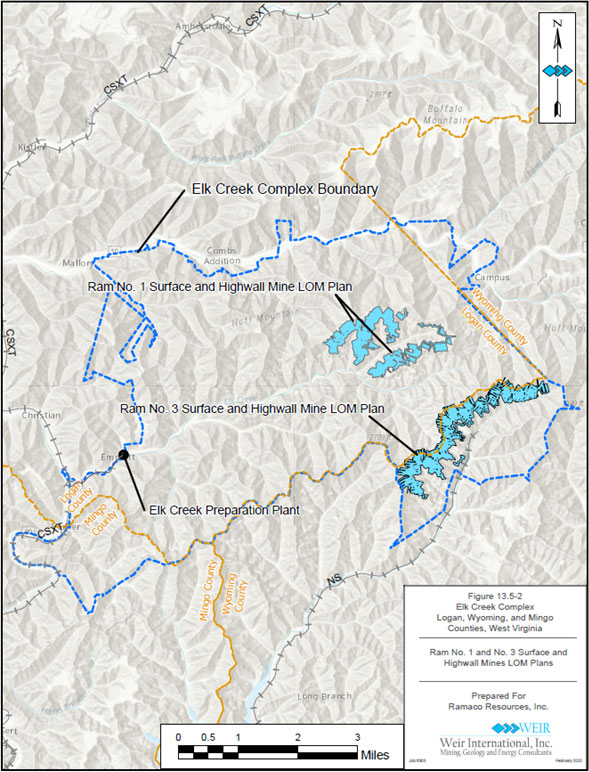

Elk Creek Mining Complex

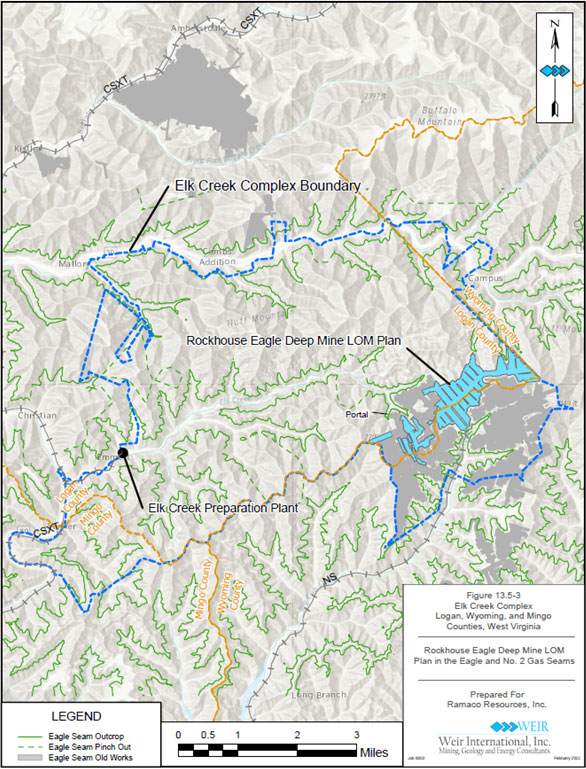

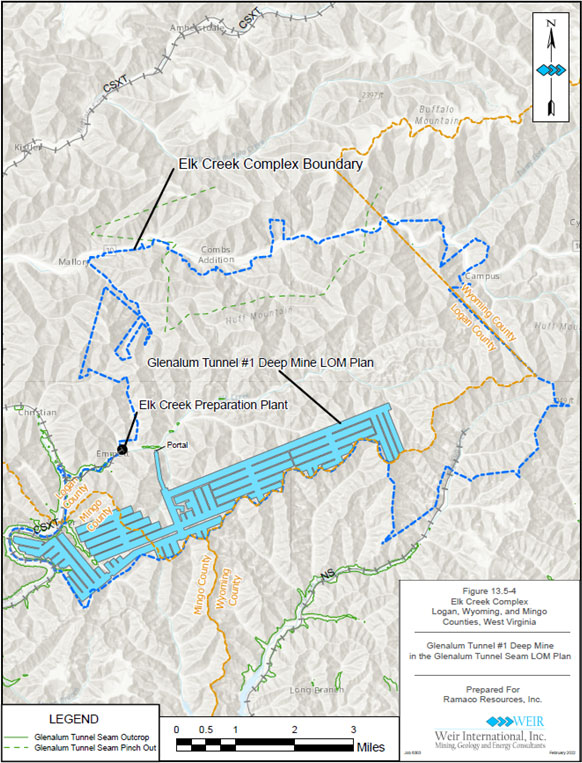

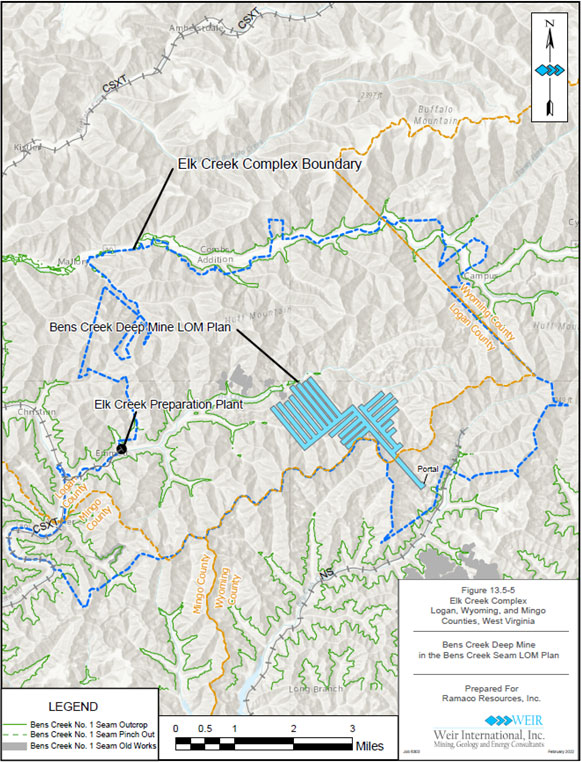

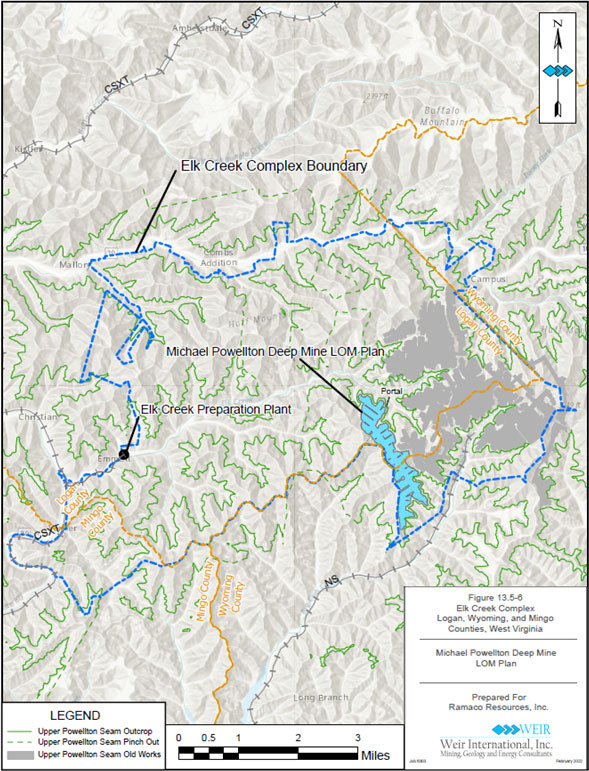

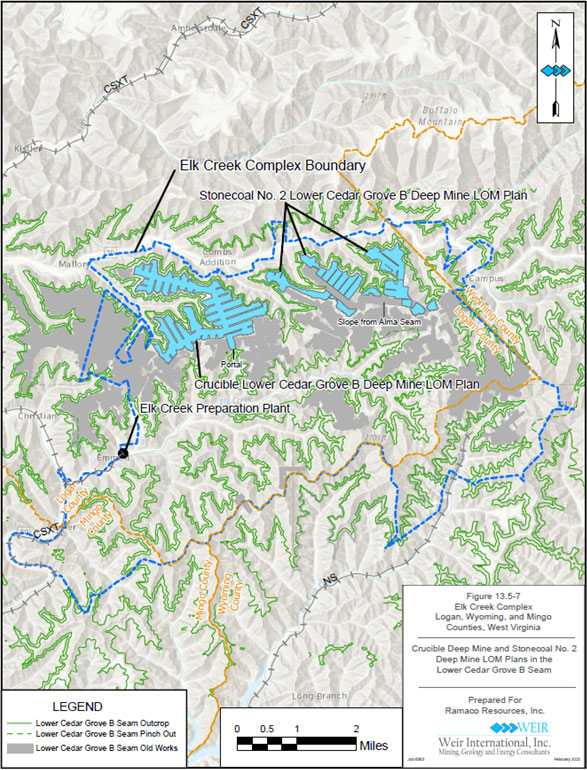

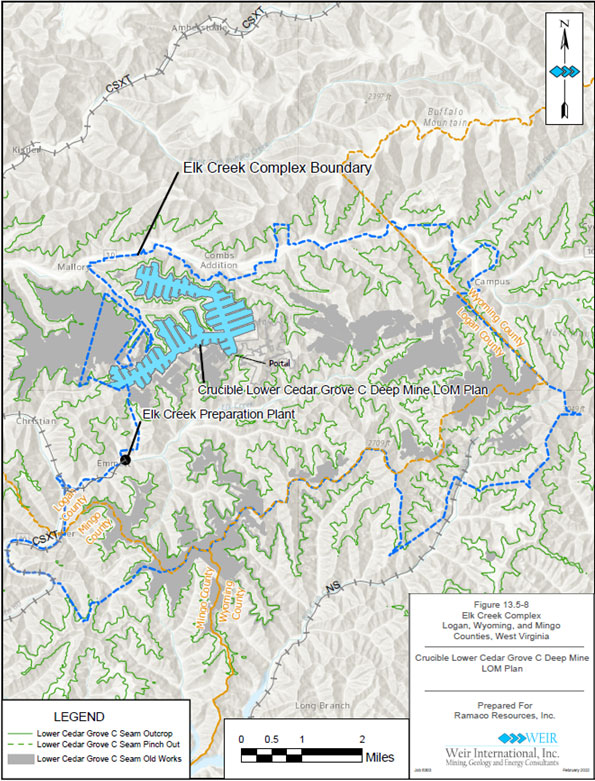

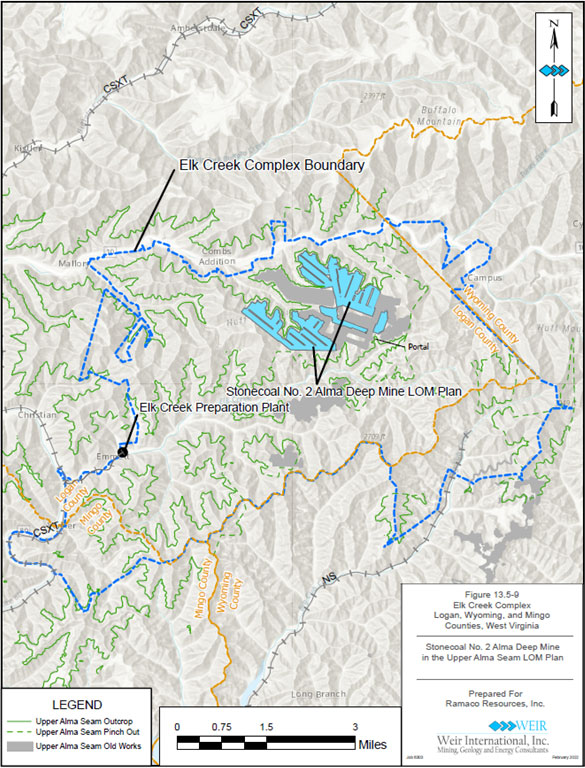

Our Elk Creek Complex in southern West Virginia began production in late December 2016. The Elk Creek property consists of approximately 20,200 acres of controlled mineral and contains 16 seams that we believe are economically mineable. Nearly all our seams contain high-quality, high-volatile metallurgical coal accessible at or above drainage. Additionally, almost all of this coal is high-fluidity, which is an important factor for high-volatile metallurgical coal.

We control the majority of the coal and related mining rights within the existing permitted areas and our current mine plans, as well as the surface for our surface facilities, through leases and subleases from Ramaco Coal, LLC, a related party, and McDonald Land Company. We estimate that the Elk Creek Complex contains reserves capable of yielding approximately 29 million tons of clean saleable metallurgical coal and 223 million tons of high-quality metallurgical coal resources. We expect many of the coal resources will be converted to reserves when further drilling and exploration is completed on the property.

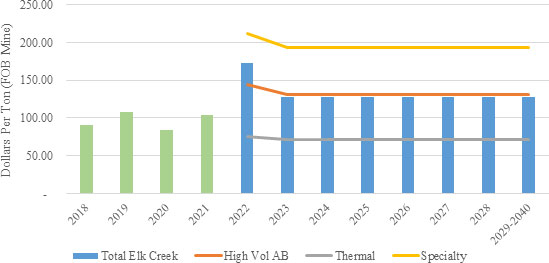

We currently market most of the coal produced from the Elk Creek Complex as a blended high-volatile A/B product. When segregated, a portion of our coal can be sold as a high-volatile A product for a premium. Our market for Elk Creek production is principally North American coke and steel producers. We also market our coal to European, South American, Asian and African customers, and occasionally to coal traders and brokers for use in filling orders for their blended products. Additionally, we seek to market a portion of our coal in the specialty coal markets that value low ash content.

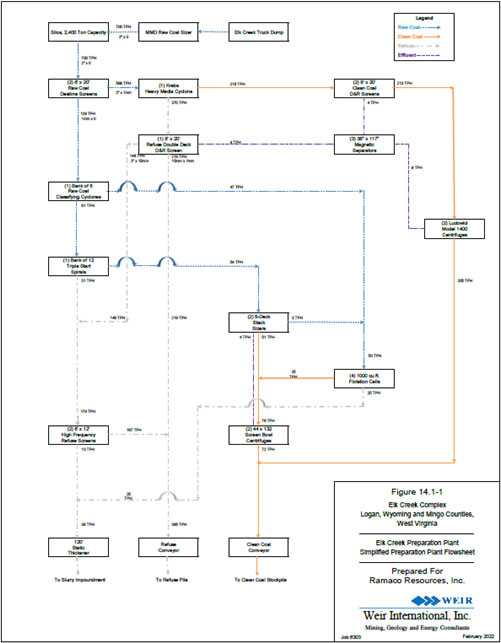

We process our Elk Creek coal production through a 700 raw ton-per-hour preparation plant. The plant has a large-diameter (48”) heavy-media cyclone, dual-stage spiral concentrators, froth flotation, horizontal vibratory and screen bowl centrifuges. Our rail load-out facilities at Elk Creek are capable of loading 4,000 tons per hour and a full 150-car unit train in under four hours. The load-out facility is served by the CSX railroad. We also have the ability to develop on controlled property a rail-loading facility on the Norfolk Southern railroad, which would facilitate dual rail service. We have not yet committed the capital for development of a Norfolk Southern rail facility.

The combined refuse capacity at the active disposal areas is expected to provide approximately 12 years of disposal life for our operations. We completed construction of a full complement of plate presses during 2020 to allow for dewatering material which then was being pumped as slurry to our impoundment. This equipment allows us to process all waste material for placement in areas designed for combined refuse disposal and maximize the life for disposal of fine waste rock in the pool of the impoundment.

A large portion of our controlled reserves are permitted through existing, issued permits. We currently have seven planned and permitted mines within the Elk Creek Complex and three permitted inactive mines. We are actively pursuing multiple new permits.

| A - 5 |

On January 3, 2020, we entered into a mineral lease with the McDonald Land Company for coal reserves which, in many cases, are located immediately adjacent to our Elk Creek Complex. This leased property became available after the former base lease with another party was terminated. The prior lessee, who controlled the property since 1978, did not produce commercial amounts of coal from the property during their possession of the lease. While it is unusual to have a metallurgical reserve in this part of Central Appalachia remain idle for such an extended period of time, the configuration and location of the tracts lend themselves to be mined and processed far more efficiently from our Elk Creek property. The McDonald reserves have the same geologic advantages and low costs that are being experienced in our Elk Creek mines.

During 2022, we plan to begin work on a throughput upgrade at our Elk Creek Preparation plant. We expect this upgrade will raise the nameplate processing capacity to 1,000 raw tons per hour and our approximate annual clean capacity from this complex to 2.5 million tons per year. We expect that this upgrade will be completed in 2023. In order to meet this increased capacity, we have also begun development work on additional high-quality, low-cost, high- volatile underground and surface mines at Elk Creek. These mines will begin production during 2022 and reach full levels of productivity during 2023 to align with the preparation plant upgrade.

Berwind Mining Complex

Our Berwind Complex is located on the border of West Virginia and Virginia and is well-positioned to fill the anticipated market for low-volatile coals. The Berwind property consists of approximately 41,300 acres of controlled mineral, excluding the Amonate acquisition.

Development of our Berwind Complex began in late-2017 in the thinner Pocahontas No. 3 seam with plans to slope up into the thicker Pocahontas No. 4 seam. In 2020, we suspended development at the Berwind Complex due to lower pricing and demand largely caused by the economic effects of COVID-19. In early-2021, as pricing and demand improved, Berwind development resumed. We successfully reached the Pocahontas No. 4 seam in late-2021 and expect to ramp up to full production levels during the second quarter of 2022.

We view Berwind as the second flagship complex for Ramaco. The slope project allows us to transition our mining efforts at Berwind to the thicker Pocahontas No. 4 seam. At full production at Berwind, we expect to produce approximately 750,000 tons per year of high quality low-volatile coal with total cash costs per ton in the low to mid-$70s for company produced coal, at midcycle pricing. When including the recently acquired Amonate reserves at our Berwind Complex, we ultimately anticipate over 1.5 million tons of annual production at Berwind. We estimate that the mine life for the Berwind Complex is almost 20 years.

We are currently mining a small amount of coal from the Triad mine at Berwind. The mine began production in 2021 and will continue in 2022 until exhaustion. It will function as a bridge until the main Berwind Pocahontas No. 4 reserve is fully activated.

We have the necessary permits for the Berwind Complex for our current and budgeted operations. A permit for our Squire Jim seam room-and-pillar underground mine was issued during 2020 and contains a large area of Squire Jim seam coal deposits. The Squire Jim seam of coal is the lowest known coal seam on the geologic column in this region, and due to depth of cover has never been significantly explored. At this point, we do not anticipate activating this mining permit.

In December 2021, we acquired the Amonate Assets from Coronado, pursuant to an asset purchase agreement. The acquisition, for a total cash consideration of $30 million, included a mine complex located in McDowell County, West Virginia and Tazewell County, Virginia adjacent and contiguous to the Company’s existing Berwind Complex. The acquisition primarily consists of high quality, low and mid-volatile metallurgical coal reserves and resources, much of which will be mined from the Company’s Berwind Complex. Also purchased were several additional permitted mines and a currently idled 1.3-million ton per annum capacity coal preparation plant.

We began mine development on the Amonate Assets and refurbishment of the existing but idled preparation facilities immediately. Initial production is expected by the second quarter of 2022, with total new incremental production for the entire year at approximately 200,000 tons. Given the proximity of the facility to our existing Berwind Complex, the Company expects to meaningfully utilize the facility as soon as the refurbishing efforts allow. We expect to incur approximately $10 million of capital expenditures in 2022 to bring the new plant at the Berwind Complex online. Ultimately, the combined Berwind Complex and Amonate Assets can produce over 1.5 million tons per year of primarily low-vol saleable coal. Once refurbished, the new Berwind preparation plant will be served by the Norfolk Southern railroad.

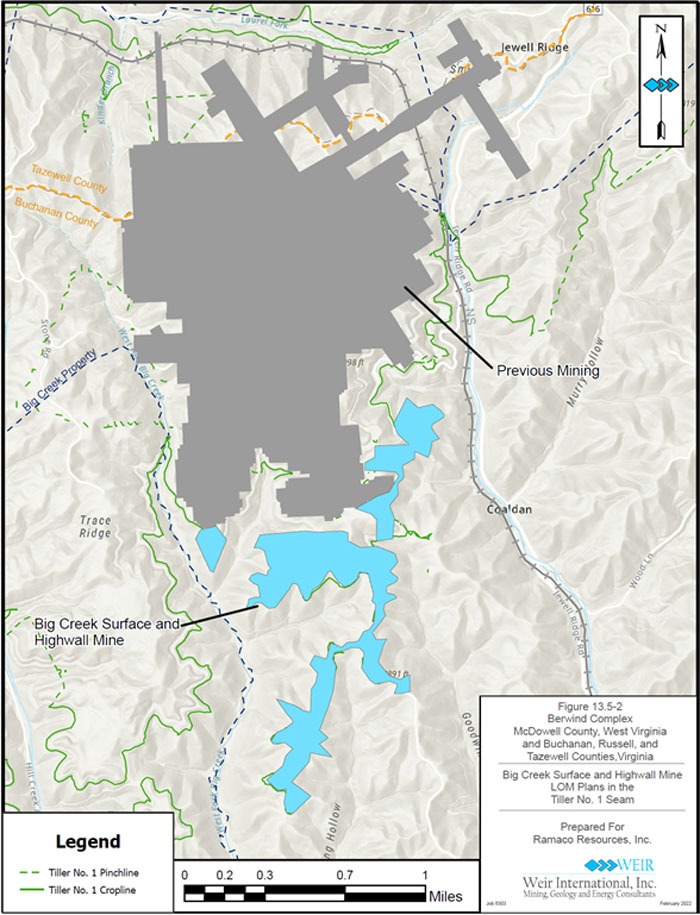

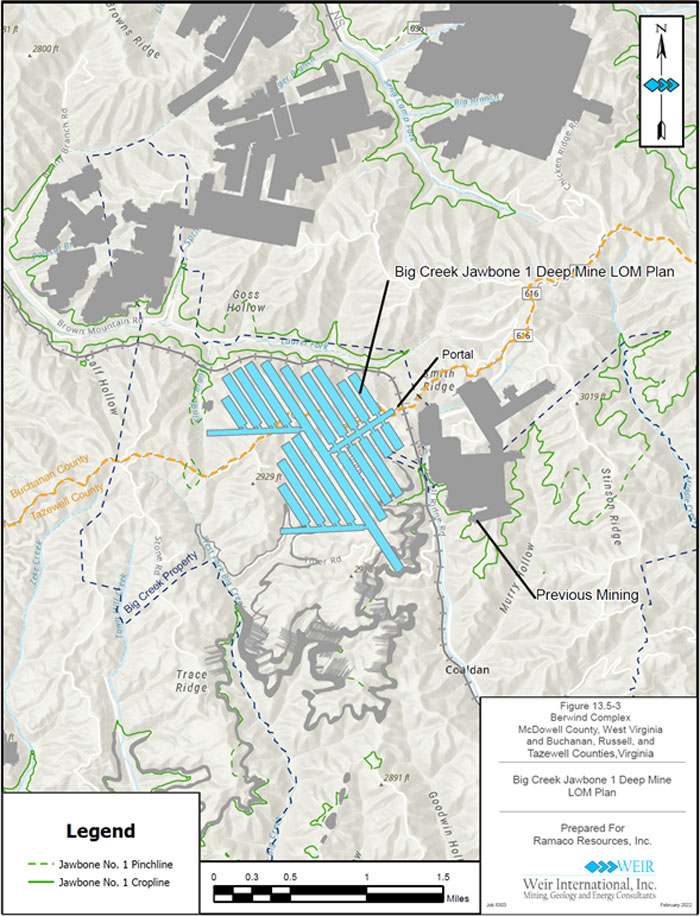

Knox Creek

The Knox Creek property consists of approximately 62,100 acres of controlled mineral, a 650 tons per hour preparation plant and a coal-loading facility along with a refuse impoundment. Rail service is provided by Norfolk Southern.

| A - 6 |

The Tiller Mine slope face-up and shafts were idled before our acquisition of the property. We have spent limited amounts of capital to review the feasibility of a high-vol A metallurgical deep mine in the Jawbone seam of coal. This seam is located slightly above the Tiller Seam and would be accessed via a short slope from within the existing Tiller seam mine. Jawbone coal could flow through the same portal and slope as the idle Tiller mine. Production is expected to resume once market conditions warrant such.

From time to time, we process coal purchased from other independent producers at the Knox Creek preparation plant and load-out facilities. We also process and load coal trucked from our Berwind Complex at this facility until the Berwind plant is brought online.

In the fourth quarter of 2019, we acquired multiple permits from various affiliates of Omega Highwall Mining, LLC. Consideration for the transaction included the assumption of approximately $0.6 million of asset retirement obligations (“ARO”) liability, curing minor lease defaults, and paying advance royalties under two assumed lease instruments. The total out-of-pocket consideration was less than $0.1 million, most of which is recoupable against future royalty payments. These permits are in close proximity to our Knox Creek preparation plant and loadout infrastructure, and provide immediate access to two separate mining areas in Southwestern Virginia. One is a deep mine permit in the Jawbone Seam, a geologically advantaged metallurgical coal reserve and resource. The second is a metallurgical surface mine in the Tiller seam that was spade ready for production at the time of acquisition and is mined via surface and highwall mining methods.

In August 2021, we began production at this new surface mine known as the Big Creek mine. We added a highwall miner in the fourth quarter of 2021. We anticipate full production of at least 300 thousand tons of primarily high quality, mid-vol saleable coal in 2022. We expect Big Creek to be able to produce at these levels for approximately three years.

RAM Mine

Our RAM Mine property is located in southwestern Pennsylvania, consists of approximately 1,570 acres of controlled mineral. Production of high-vol coal from the Pittsburgh seam is planned from a single continuous-miner room-and-pillar underground operation. The Pittsburgh seam, in close proximity to Pittsburgh area coke plants, has historically been a key feedstock for these coke plants. Operation of our RAM Mine coal reserve may require access to a newly constructed preparation plant and loading facility, third party processing, or direct shipment of raw coal product. Upon commencement of mining, we anticipate that the mine will produce at an annualized rate of between 300 and 500 thousand tons with an estimated 10-year mining life.

We expect that coal from the RAM Mine coal reserve will be transported to our customers by highway trucks, rail cars or by barge on river systems. In addition to close proximity to river barge facilities, our RAM Mine operations are also near Norfolk Southern rail access.

Our RAM Mine property initial production is subject to a final mining permit being issued and market conditions that warrant development.

Customers and Contracts

Coal prices differ substantially by region and are impacted by many factors including the overall economy, demand for steel, demand for electricity, location, market, quality and type of coal, mine operation costs and the cost of customer alternatives. The major factors influencing our business are the global economy and demand for steel.

We market the bulk of our production to North American integrated steel mills and coke plants, in addition to international customers primarily in Europe, South America, Asia and Africa. Additionally, we market limited amounts of our production to various premium-priced specialty markets, such as foundry cokemakers, manufacturers of activated carbon products, and specialty metals producers.

We sold 2.3 million tons of coal during 2021. Of this, 51% was sold to North American markets and 49% was sold into export markets, excluding Canada. Principally, our export market sales were made to Europe. During 2021, sales to three customers accounted for approximately 58% of total revenue. The total balance due from these three customers at December 31, 2021 was approximately 58% of total accounts receivable. During 2020, sales to three customers accounted for approximately 70% of total revenue. The total balance due from these three customers at December 31, 2020 was approximately 46% of total accounts receivable. No other customer accounted for more than 10% of our revenue during this period. If a major customer decided to stop purchasing coal or significantly reduced its purchases from us, revenue could decline and our operating results and financial condition could be adversely affected.

| A - 7 |

Trade Names, Trademarks and Patents

We do not have any registered trademarks or trade names for our products, services or subsidiaries, and we do not believe that any trademark or trade name is material to our business. The names of the seams in which we have coal reserves, and attributes thereof, are widely recognized in the metallurgical coal market.

Competition

Our principal domestic competitors include Alpha Metallurgical Resources, Inc., Blackhawk Mining, LLC, Coronado, Arch Resources, Inc., Peabody Energy Corporation and Warrior Met Coal, Inc. We also compete in international markets directly with domestic companies and with companies that produce coal from one or more foreign countries, such as Australia, Canada, and Colombia. Many of these coal producers are larger than we are and have greater financial resources and larger reserve bases than we do.

Suppliers

Supplies used in our business include petroleum-based fuels, explosives, tires, conveyance structure, ventilation supplies, lubricants and other raw materials as well as spare parts and other consumables used in the mining process. We use third-party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction. We believe adequate substitute suppliers and contractors are available, and we are not dependent on any one supplier or contractor. We continually seek to develop relationships with suppliers and contractors that focus on reducing our costs while improving quality and service.

Environmental, Health and Safety and Other Regulatory Matters

Our operations are subject to numerous federal, state, and local environmental, health and safety laws and regulations, such as those relating to permitting and licensing matters, employee health and safety, reclamation and restoration of mining properties, water discharges, air emissions, plant and wildlife protection, the storage, treatment and disposal of certain materials (including solid and hazardous wastes), remediation of contaminants, surface subsidence from underground mining and the effects of mining on surface water and groundwater conditions.

Compliance with these laws and regulations may be costly and time-consuming, delay commencement, continuation or expansion of exploration or production at our facilities, and depress demand for our products by imposing more stringent requirements and limits on our customers’ operations. Moreover, these laws are constantly evolving and the trend has been for increasingly complex and stringent regulation over time. New legislative or administrative proposals, or judicial interpretations of existing laws and regulations related to the protection of the environment could result in substantially increased capital, operating and compliance costs.

Due in part to these extensive and comprehensive regulatory requirements and ever-changing interpretations of these requirements, violations of these laws can occur from time to time in our industry and also in our operations. Expenditures relating to environmental compliance are a major cost consideration for our operations and safety and compliance is a significant factor in mine design, both to meet regulatory requirements and to minimize long-term environmental liabilities.

The following is a summary of the various federal and state environmental and similar regulations that have a material impact on our business:

Surface Mining Control and Reclamation Act. The Surface Mining Control and Reclamation Act of 1977 (the “SMCRA”) establishes comprehensive operational, reclamation and closure standards for our mining operations and requires that such standards be met during the course of and following completion of mining activities. The SMCRA also stipulates compliance with many other major environmental statutes, including the Clean Air Act (the “CAA”), the Clean Water Act (the “CWA”), the Endangered Species Act (the “ESA”), the Resource Conservation and Recovery Act (the “RCRA”) and the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (the “CERCLA”). Permits for all mining operations must be obtained from the United States Office of Surface Mining Reclamation and Enforcement (the “OSMRE”) or, where state regulatory agencies have adopted federally approved state programs under SMCRA, the appropriate state regulatory authority. Our operations are located in West Virginia, Virginia, and Pennsylvania, which have achieved primary jurisdiction for enforcement of SMCRA through approved state programs.

The SMCRA imposes a complex set of requirements covering all facets of coal mining. SMCRA regulations govern, among other things, coal prospecting, mine plan development, topsoil or growth medium removal and replacement, disposal of excess spoil and coal refuse, protection of the hydrologic balance, and suitable post mining land uses.

| A - 8 |

From time to time, the OSMRE will also update its mining regulations under the SMCRA. For example, the OSMRE has previously sought to impose stricter stream protection requirements by requiring more extension pre-mining and baseline data for coal mining operations. The rule was disapproved by Congress pursuant to the Congressional Review Act. However, whether Congress will enact future legislation to require a new stream protection rule remains uncertain. The existing rules, or other new SMCRA regulations, could result in additional material costs, obligations and restrictions upon our operations.

Abandoned Mine Lands Fund. The SMCRA also imposes a reclamation fee on all current mining operations, the proceeds of which are deposited in the Abandoned Mine Reclamation Fund (the “AML Fund”), which is used to restore unreclaimed and abandoned mine lands mined before 1977. The adjusted fees proposed in the pending Interim Final Rule per ton for October 1, 2021 through September 30, 2034 are (i) 22.4 cents per ton for surface-mined anthracite, bituminous, and subbituminous coal if the value per ton is $2.24 per ton or more, (ii) 9.6 cents per ton for underground-mined anthracite, bituminous, and subbituminous coal if the value per ton is $0.96 per ton, and (iii) 6.4 cents per ton for surface- and underground-mined lignite coal if the value per ton is $3.20 per ton or more. . The Interim Final Rule took effect on January 14, 2022, but the OSMRE is accepting comments until February 14, 2022. Estimates of our total reclamation and mine-closing liabilities are based upon permit requirements and our experience related to similar activities. If these accruals are insufficient or our liability in a particular year is greater than currently anticipated, our future operating results could be adversely affected.

Mining Permits and Approvals. Numerous governmental permits and approvals are required for mining operations. We are required to prepare and present to federal, state, and local authorities data detailing the effect or impact that any proposed exploration project for production of coal may have upon the environment, the public and our employees. The permitting rules are complex and continuously updated, and may be subject to discretionary interpretations by regulators. Further, the laws, rules, and regulations that govern our mining operations authorize substantial fines and penalties, including revocation or suspension of mining permits under some circumstances. Monetary sanctions and, in certain circumstances, even criminal sanctions may be imposed for failure to comply with these laws. Compliance with required permits and associated regulations may have a material adverse impact on our operations, earnings, or financial condition.

Applications for permits and permit renewals associated with our mining operations are also subject to public comment and potential legal challenges from third parties seeking to prevent a permit from being issued, or to overturn the applicable agency’s grant of the permit. Should our permitting efforts become subject to such challenges, the permits may not be issued in a timely fashion, may impose requirements which restrict our ability to conduct our mining operations or to do so profitably, or may not be issued at all. Any delays, denials, or revocation of these or other similar permits we need to operate could reduce our production and materially adversely impact our cash flow and results of our operations.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators must also submit a reclamation plan for restoring the mined property to its prior condition, productive use or other permitted condition. The conditions of certain permits also require that we obtain surface owner consent if the surface estate has been split from the mineral estate. This requires us to negotiate with third parties for surface access that overlies coal we acquired or intend to acquire. These negotiations can be costly and time-consuming, lasting years in some instances, which can create additional delays in the permitting process. If we cannot successfully negotiate for land access, we could be denied a permit to mine coal we already own.

Finally, we typically submit necessary mining permit applications several months, or even years, before we anticipate mining a new area. However, we cannot control the pace at which the government issues permits needed for new or ongoing operations. For example, the process of obtaining CWA permits can be particularly time-consuming and subject to delays and denials. The Environmental Protection Agency (the “EPA”) also has the authority to veto permits issued by the U.S. Army Corps. of Engineers (the “Corps”) under the CWA’s Section 404 program that prohibits the discharge of dredged or fill material into regulated waters without a permit. Even after we obtain the permits that we need to operate, many of the permits must be periodically renewed, or may require modification. There is some risk that not all existing permits will be approved for renewal, or that existing permits will be approved for renewal only upon terms that restrict or limit our operations in ways that may be material.

Financial Assurance. Federal and state laws require a mine operator to secure the performance of its reclamation and lease obligations under the SMCRA through the use of surety bonds or other approved forms of financial security for payment of certain long-term obligations, including mine closure or reclamation costs. The changes in the market for coal used to generate electricity in recent years have led to bankruptcies involving prominent coal producers. Several of these companies relied on self-bonding to guarantee their responsibilities under the SMCRA permits including for reclamation. In response to these bankruptcies, the OSMRE issued a policy advisory in August 2016 to state agencies that was intended to discourage authorized states from approving self-bonding arrangements (the “Policy Advisory”). Although the Policy Advisory was rescinded in October 2017, certain states, including Virginia, had previously announced that they would no longer accept self-bonding to secure reclamation obligations under the state mining laws. Additionally, in March 2018, the Government Accounting Office recommended that Congress consider amending the SMCRA to eliminate the availability of self-bonding to guarantee responsibilities under SMCRA permits. Individually and collectively, these and future revised various financial assurance requirements may increase the amount of financial assurance needed and limit the types of acceptable instruments, straining the capacity of the surety markets to meet demand. This may delay the timing for and increase the costs of obtaining the required financial assurance.

| A - 9 |

We use surety bonds, trusts and letters of credit to provide financial assurance for certain transactions and business activities. Federal and state laws require us to obtain surety bonds to secure payment of certain long-term obligations including mine closure or reclamation costs and other miscellaneous obligations. The bonds are renewable on a yearly basis. Surety bond rates have increased in recent years and the market terms of such bonds have generally become less favorable. Sureties typically require coal producers to post collateral, often having a value equal to 40% or more of the face amount of the bond. As a result, we may be required to provide collateral, letters of credit or other assurances of payment in order to obtain the necessary types and amounts of financial assurance. Under our surety bonding program, we are not currently required to post any letters of credit or other collateral to secure the surety bonds; obtaining letters of credit in lieu of surety bonds could result in a significant cost increase. Moreover, the need to obtain letters of credit may also reduce amounts that we can borrow under any senior secured credit facility for other purposes. If, in the future, we are unable to secure surety bonds for these obligations and are forced to secure letters of credit indefinitely or obtain some other form of financial assurance at too high of a cost, our profitability may be negatively affected.

We intend to maintain a credit profile that precludes the need to post collateral for our surety bonds. Nonetheless, our surety has the right to demand additional collateral at its discretion.

Some international customers require new suppliers to post performance guarantees during the initial stages of qualifying to become a long-term supplier. To date we have not had to provide a performance guarantee, but it is possible that such a guarantee could be required in the future.

Mine Safety and Health. The Federal Mine Safety and Health Act of 1977, as amended (the “MINE Act”) and the Mine Improvement and New Emergency Response Act of 2006 (the “MINER Act”), and regulations issued under these federal statutes, impose stringent health and safety standards on mining operations. The regulations that have been adopted under the Mine Act and the MINER Act are comprehensive and affect numerous aspects of mining operations, including training of mine personnel, mining procedures, roof control, ventilation, blasting, use and maintenance of mining equipment, dust and noise control, communications, emergency response procedures, and other matters. The Mine Safety and Health Administration (the “MSHA”) regularly inspects mines to ensure compliance with regulations promulgated under the Mine Act and MINER Act.

Pennsylvania, West Virginia, and Virginia all have similar programs for mine safety and health regulation and enforcement. The various requirements mandated by federal and state statutes, rules, and regulations place restrictions on our methods of operation and result in fees and civil penalties for violations of such requirements or criminal liability for the knowing violation of such standards, significantly impacting operating costs and productivity.

The regulations enacted under the Mine Act and MINER Act as well as under similar state acts are routinely expanded or made more stringent, raising compliance costs and increasing potential liability. For example, MSHA published a request for information in August 2019 related to its consideration of a lower exposure limit for silica in respirable dust. Our compliance with current or future mine health and safety regulations could increase our mining costs. At this time, it is not possible to predict the full effect that new or proposed statutes, regulations and policies will have on our operating costs, but any expansion of existing regulations, or making such regulations more stringent may have a negative impact on the profitability of our operations. If we were to be found in violation of mine safety and health regulations, we could face penalties or restrictions that may materially and adversely impact our operations, financial results and liquidity.

In addition, government inspectors have the authority to issue orders to shut down our operations based on safety considerations under certain circumstances, such as imminent dangers, accidents, failures to abate violations, and unwarrantable failures to comply with mandatory safety standards. If an incident were to occur at one of our operations, it could be shut down for an extended period of time, and our reputation with prospective customers could be materially damaged. Moreover, if one of our operations is issued a notice of pattern of violations, then MSHA can issue an order withdrawing the miners from the area affected by any enforcement action during each subsequent significant and substantial (“S&S”) citation until the S&S citation or order is abated.

| A - 10 |

Workers’ Compensation and Occupational Disease. We are insured for workers’ compensation benefits for work related injuries that occur within our United States operations. We retain insurance coverage for all of our subsidiaries and are insured for the statutory limits. Workers’ compensation liabilities, including those related to claims incurred but not reported, are recorded principally using annual valuations based on discounted future expected payments using historical data of the operating subsidiary or combined insurance industry data when historical data is limited. State workers’ compensation acts typically provide for an exception to an employer’s immunity from civil lawsuits for workplace injuries in the case of intentional torts. However, West Virginia’s workers’ compensation act provides a much broader exception to workers’ compensation immunity. The exception allows an injured employee to recover against his or her employer where he or she can show damages caused by an unsafe working condition of which the employer was aware that was a violation of a statute, regulation, rule or consensus industry standard. These types of lawsuits are not uncommon and could have a significant impact on our operating costs.

In addition, we obtained from a third-party insurer a workers’ compensation insurance policy, which includes coverage for medical and disability benefits for occupational disease under the Federal Coal Mine Health and Safety Act of 1969 and the Mine Act. Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must pay federal black lung benefits to claimants who are current and former employees and also make payments to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to January 1, 1970.

The Patient Protection and Affordable Care Act of 2010 includes significant changes to the federal black lung program including an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim and the establishment of a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program. In addition to possibly incurring liability under federal statutes, we may also be liable under state laws for black lung claims.

Clean Air Act. The CAA and comparable state laws that regulate air emissions affect coal mining operations both directly and indirectly. Direct impacts on coal mining and processing operations include CAA permitting requirements and emission control requirements relating to air pollutants, including particulate matter such as fugitive dust. The CAA indirectly impacts coal mining operations by extensively regulating the emissions of particulate matter, sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal-fired power plants. In addition to the greenhouse gas (“GHG”) issues discussed below, the air emissions programs that may materially and adversely affect our operations, financial results, liquidity, and demand for our coal, directly or indirectly, include, but are not limited to, the following:

| · | Cross-State Air Pollution Rule. In July 2011, the EPA finalized the Cross-State Air Pollution Rule (the “CSAPR”), a cap-and-trade program that requires 28 states in the Midwest and eastern seaboard of the U.S. to reduce power plant emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. In May 2017, the EPA further limited summertime (May-September) nitrogen oxide emissions from power plants in 22 states in the eastern United States in the CSAPR Update Rule. For states to meet these requirements, a number of coal-fired electric generating units will likely need to be retired, rather than retrofitted with the necessary emission control technologies, reducing demand for thermal coal. Moreover, in September 2019, the United States Court of Appeals for the District of Columbia Circuit (“D.C. Circuit”) remanded the CSAPR Update Rule to the EPA on the grounds that it failed to timely require upwind states to control or eliminate their contribution to ozone and/or fine particulate matter in downwind states, as required under the CAA. In October 2020, the EPA proposed a Revised CSAPR Update Rule in response to the D.C. Circuit’s ruling, which was finalized in April 2021. The final rule resolves 21 states’ outstanding interstate pollution transport obligations and would require additional emissions reductions of nitrogen oxides from power plants in 12 states. Imposition of stricter deadlines for controlling downwind contribution could accelerate unit retirements or the need to implement emission control strategies. Any reduction in the amount of coal consumed by electric power generators as a result of these limitations could decrease demand for thermal coal. However, the practical impact of CSAPR may be limited because utilities in the U.S. have continued to take steps to comply with the Clean Air Interstate Rule, which requires similar power plant emissions reductions, and because utilities are also required to comply with the Mercury and Air Toxics Standards (the “MATS”) regulations, finalized in 2020, which require overlapping power plant emissions reductions. |

| A - 11 |

| · | Acid Rain. Title IV of the CAA requires reductions of sulfur dioxide emissions by electric utilities and applies to all coal-fired power plants generating greater than 25 megawatts of power. Affected power plants have sought to reduce sulfur dioxide emissions by switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing or trading sulfur dioxide emission allowances. These reductions could impact our customers in the electric generation industry. These requirements are not supplanted by CSAPR. | |

| · | NAAQS for Criterion Pollutants. The CAA requires the EPA to set standards, referred to as National Ambient Air Quality Standards (“NAAQS”), for six common air pollutants: carbon monoxide, nitrogen dioxide, lead, ozone, particulate matter and sulfur dioxide. Areas that are not in compliance (referred to as “non-attainment areas”) with these standards must take steps to reduce emissions levels. The EPA has adopted NAAQS for carbon monoxide, nitrogen dioxide, sulfur dioxide, particulate matter and ground-level ozone. The CAA further requires the EPA to periodically review and revise the NAAQS, resulting in the adoption of increasingly more stringent standards over time. States with non-attainment areas must adopt a state implementation plan that demonstrates compliance with the existing or new air quality standards. These plans could require significant additional emissions control expenditures at coal-fired power plants. New rules and standards may also impose additional emissions control requirements on our customers in the electric generation, steelmaking, and coke industries. Because coal mining operations emit particulate matter and sulfur dioxide, our mining operations could be affected when the new standards are implemented by the states. | |

| · | Mercury and Hazardous Air Pollutants. The EPA has established emission standards for mercury and other metal, fine particulates, and acid gases from coal- and oil-fired power plants through the MATS rule. In May 2020, the EPA published a final rule reversing its prior determination that it is appropriate and necessary to regulate these pollutants. However, this rule will not alter or eliminate the emissions standards established by the MATS rule. Like CSAPR, MATS and other similar future regulations could accelerate the retirement of a significant number of coal-fired power plants. Such retirements would likely adversely impact our business. |

Global Climate Chnge. Climate change continues to attract considerable public and scientific attention. There is widespread concern about the contributions of human activity to such changes, especially through the emission of GHGs. Numerous reports from scientific and governmental bodies such as the United Nations Intergovernmental Panel on Climate Change have expressed heightened concerns about the impacts of human activity, especially fossil fuel combustion, on the global climate. There are three primary sources of GHGs associated with the coal industry. First, the end use of our coal by our customers in electricity generation, coke plants, and steelmaking is a source of GHGs. Second, combustion of fuel by equipment used in coal production and to transport our coal to our customers is a source of GHGs. Third, coal mining itself can release methane, which is considered to be a more potent GHG than carbon dioxide, directly into the atmosphere. These emissions from coal consumption, transportation and production are subject to pending and proposed regulation as part of initiatives to address global climate change.

As a result, numerous proposals have been made and are likely to continue to be made at the international, national, regional, state and local levels of government to monitor and limit emissions of GHGs. Collectively, these initiatives could result in higher electric costs to our customers or lower the demand for coal used in electric generation, which could in turn adversely impact our business.

At present, we are principally focused on metallurgical coal production, which is not used in connection with the production of power generation. However, we may seek to sell greater amounts of our coal into the power-generation market in the future. The market for our coal may be adversely impacted if comprehensive legislation or regulations focusing on GHG emission reductions are adopted, or if our customers are unable to obtain financing for their operations.

At the international level, in April 2016, the United States agreed to voluntarily limit or reduce future emissions as part of the Paris Agreement reached at the 21st Conference of the Parties of the United Nations Framework Convention on Climate Change. In November 2019, the United States submitted formal notification to the United Nations that it intended to withdraw from the agreement and withdrew from the agreement in November 2020. However, on January 20, 2021, President Biden issued written notification to the United Nations of the United States’ intention to rejoin the Paris Agreement, which became effective on February 19, 2021. In addition, shortly after taking office in January 2021, President Biden issued a series of executive orders designed to address climate change. In November 2021, the 26th Conference of the Parties to the United Nations Framework on Climate Change concluded with the finalization of the Glasgow Climate Pact, which stated long-term global goals (including those in the Paris Agreement) to limit the increase in the global average temperature and emphasized reductions in GHG emissions. 46 countries signed onto a Global Coal to Clean Energy Transition Statement, committing to transition away from unabated coal power generation by about 2030 for “major economies” and a global transition by roughly 2040. International commitments, reentry into the Paris Agreement and President Biden’s executive orders may result in the development of additional regulations or changes to existing regulations.

| A - 12 |

At the federal level, although no comprehensive climate change legislation has been implemented to date, such legislation has periodically been introduced in the U.S. Congress and may be proposed or adopted in the future. The likelihood of such legislation has increased due to the change in the administration. Furthermore, the EPA has determined that emissions of GHGs present an endangerment to public health and the environment, because emissions of GHGs are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA, over time, has attempted to restrict emissions of GHGs under existing provisions of the CAA. For example, in August 2015, the EPA finalized the Clean Power Plan (the “CPP”) to cut carbon emissions from existing power plants. The CPP did not formally go into effect because the Supreme Court stayed its implementation in February 2016 and in July 2019, the EPA adopted a rule that repealed and replaced the CPP. The new rule, titled the Affordable Clean Energy Rule (the “ACE Rule”), required states to set appropriate GHG emission standards for power plants within their jurisdiction based upon the application of “candidate” heat rate improvement measures. The D.C. Circuit repealed the ACE Rule in 2021, and there is ongoing litigation challenging the repeal of both the CPP and the ACE Rule. The EPA’s authority to regulate GHG emissions from existing power plants under the CAA and the reversal of the ACE Rule are currently being challenged at the Supreme Court. The outcome of this litigation, any future rules or future GHG emission standards may encourage a shift away from coal-fired power generation, adversely impacting the market for our product.

At the state level, several states, including Pennsylvania and Virginia, have already adopted measures requiring GHG emissions to be reduced within state boundaries, including cap-and-trade programs and the imposition of renewable energy portfolio standards. Various states and regions have also adopted GHG initiatives and certain governmental bodies, have imposed, or are considering the imposition of, fees or taxes based on the emission of GHGs by certain facilities. A number of states have also enacted legislative mandates requiring electricity suppliers to use renewable energy sources to generate a certain percentage of power.

The uncertainty over the outcome of litigation challenging the repeal of both the ACE Rule and the CPP and the extent of future regulation of GHG emissions may inhibit utilities from investing in the building of new coal-fired plants to replace older plants or investing in the upgrading of existing coal-fired plants. Any reduction in the amount of coal consumed by electric power generators as a result of actual or potential regulation of GHG emissions could decrease demand for thermal coal, thereby reducing our revenue and adversely affecting our business and results of operations. We or prospective customers may also have to invest in carbon dioxide capture and storage technologies in order to burn coal and comply with future GHG emission standards.

Finally, there have been attempts to encourage the reduction of coalbed methane emissions because methane has a greater GHG effect than carbon dioxide and can give rise to safety concerns. For example, the EPA has established the Coalbed Methane Outreach Program in an effort to mitigate methane emissions from underground coal mines through voluntary initiatives and outreach in partnership with the coal industry. If new laws or regulations were introduced to reduce coalbed methane emissions, those rules could adversely affect our costs of operations by requiring installation of air pollution controls, higher taxes, or costs incurred to purchase credits that permit us to continue operations.

Clean Water Act. The CWA and corresponding state laws and regulations affect coal mining operations by restricting the discharge of pollutants, including dredged or fill materials, into waters of the United States. Likewise, permits are required under the CWA to construct impoundments, fills or other structure in areas that are designated as waters of the United States. For example, prior to placing fill material in waters of the United States, such as with the construction of a valley fill, coal mining companies are required to obtain a permit from the Corps under Section 404 of the CWA. The permit can be either a Nationwide Permit (“NWP”), normally NWP 21, 49 or 50 for coal mining activities, or a more complicated individual permit. NWPs are designed to allow for an expedited permitting process, while individual permits involve a longer and more detailed review process. The EPA has the authority to veto permits issued by the Corps under the CWA’s Section 404 program that prohibits the discharge of dredged or fill material into regulated waters without a permit. Additionally, recent court decisions, regulatory actions and proposed legislation have created uncertainty over CWA jurisdiction and permitting requirements, such as an April 2020 decision further defining the scope of the CWA, wherein the U.S. Supreme Court held that, in certain cases, discharges from a point source to groundwater could fall within the scope of the CWA and require a permit.

Prior to discharging any pollutants into waters of the United States, coal mining companies must obtain a National Pollutant Discharge Elimination System (“NPDES”) permit from the appropriate state or federal permitting authority. NPDES permits include effluent limitations for discharged pollutants and other terms and conditions, including required monitoring of discharges. Failure to comply with the CWA or NPDES permits can lead to the imposition of significant penalties, litigation, compliance costs and delays in coal production. Potential changes in state and federally recommended water quality standards may result in the issuance or modification of permits with new or more stringent effluent limits or terms and conditions. For instance, waters that states have designated as impaired (i.e., as not meeting present water quality standards) are subject to Total Maximum Daily Load (“TMDL”) regulations, which may lead to the adoption of more stringent discharge standards for our coal mines and could require more costly treatment. Likewise, the water quality of certain receiving streams requires an anti-degradation review before approving any discharge permits. TMDL regulations and anti-degradation policies may increase the cost, time and difficulty associated with obtaining and complying with NPDES permits. In addition, in certain circumstances private citizens may challenge alleged violations of NPDES permit limits in court. Recently, certain citizen groups have filed lawsuits alleging ongoing discharges of pollutants, including selenium and conductance, from valley fills located at certain mining sites in some of the regions where we operate. In West Virginia, several of these cases have been successful for the challengers. While it is difficult to predict the outcome of any potential or future suits, such litigation could result in increased compliance costs following the completion of mining at our operations.

| A - 13 |

Finally, in June 2015, the EPA and the Corps published a new definition of “waters of the United States” (“WOTUS”) that would have expanded areas requiring NPDES or Corps Section 404 permits. This definition never took effect as it was replaced by the Navigable Waters Protection Rule (the “NWPR”) in December 2019. A coalition of states and cities, environmental groups and agricultural groups challenged the NWPR, which was vacated by the U.S. District Court for the District of Arizona in August 2021. The EPA is undergoing a rulemaking process to redefine the definition of WOTUS; in the interim, the EPA is utilizing the pre-2015 WOTUS definition until further notice. To the extent a new rule or further litigation expands the scope of the CWA’s jurisdiction, the CWA permits we need may not be issued, may not be issued in a timely fashion, or may be issued with new requirements which restrict our ability to conduct mining operations or to do so profitably.

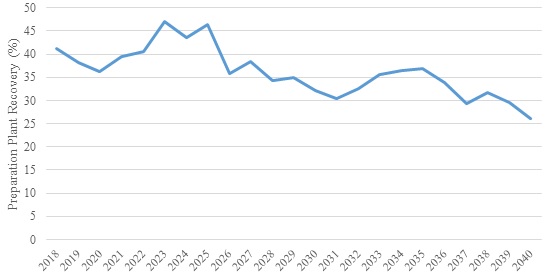

Resource Conservation and Recovery Act. The RCRA and corresponding state laws establish standards for the management of solid and hazardous wastes generated at our various facilities. Besides affecting current waste disposal practices, the RCRA also addresses the environmental effects of certain past hazardous waste treatment, storage and disposal practices. In addition, the RCRA requires certain of our facilities to evaluate and respond to any past release, or threatened release, of a hazardous substance that may pose a risk to human health or the environment.