UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended

OR

For the transition period from ________ to ________

Commission

file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.0001 per share | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchanged on Which Registered | ||

| The

|

As

of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market

value of the Common Stock held by non-affiliates of the registrant was approximately $

The number of shares outstanding of the registrant’s Common Stock, par value of $0.0001 per share, as of March 21, 2022 was .

DOCUMENTS INCORPORATED BY REFERENCE

Motus GI Holdings, Inc.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2021

| i |

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

| ● | our limited operating history; | |

| ● | our history of operating losses in each year since inception and expectation that we will continue to incur operating losses for the foreseeable future; | |

| ● | our current and future capital requirements to support our development and commercialization efforts for the Pure-Vu System and our ability to satisfy our capital needs; | |

| ● | our ability to remain compliant with the requirements of The Nasdaq Capital Market for continued listing; | |

| ● | our dependence on the Pure-Vu System, our sole product; | |

| ● | our ability to commercialize the Pure-Vu System; | |

| ● | our ability to obtain approval from regulatory agents in different jurisdictions for the Pure-Vu System; | |

| ● | our Pure-Vu System and the procedure to cleanse the colon in preparation for colonoscopy are not currently separately reimbursable through private or governmental third-party payors; | |

| ● | our ability to obtain approval or certification from regulatory or other competent entities in different jurisdictions for the Pure-Vu System; | |

| ● | our dependence on third-parties to manufacture the Pure-Vu System; | |

| ● | our ability to maintain or protect the validity of our patents and other intellectual property; | |

| ● | our ability to retain key executives and medical and science personnel; | |

| ● | our ability to internally develop new inventions and intellectual property; | |

| ● | interpretations of current laws and the passages of future laws; | |

| ● | acceptance of our business model by investors; | |

| ● | the accuracy of our estimates regarding expenses and capital requirements | |

| ● | our ability to adequately support growth; and | |

| ● | our ability to project in the short term the hospital medical device environment considering the global pandemic and strains on hospital systems |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Part I—Item 1A—Risk Factors” for additional risks which could adversely impact our business and financial performance.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and we believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

| 1 |

| ITEM 1. | BUSINESS |

Overview

We have developed the Pure-Vu System, a medical device that has been cleared by the U.S. Food and Drug Administration (the “FDA”) to help facilitate the cleansing of a poorly prepared gastrointestinal tract during colonoscopy and to help facilitate upper gastrointestinal (“GI”) endoscopy procedures. The Pure-Vu System is also CE marked in the European Economic Area (EEA) for use in colonoscopy. The Pure-Vu System integrates with standard and slim colonoscopes, as well as gastroscopes, to improve visualization during colonoscopy and upper GI procedures while preserving established procedural workflow and techniques. Through irrigation and evacuation of debris, the Pure-Vu System is designed to provide better-quality exams. Challenges exist for inpatient colonoscopy and endoscopy, particularly for patients who are elderly, with comorbidities, or active bleeds, where the ability to visualize, diagnose and treat is often compromised due to debris, including fecal matter, blood, or blood clots. We believe this is especially true in high acuity patients, like GI bleeding where the existence of blood and blood clots can impair a physician’s view and removing them can be critical in allowing a physician the ability to identify and treat the source of bleeding on a timely basis. We believe use of the Pure-Vu System may lead to

positive outcomes and lower costs for  hospitals by safely and quickly improving visualization of the colon and upper GI tract, potentially enabling effective diagnosis

and treatment without delay. In multiple clinical studies to date, involving the treatment of challenging inpatient and outpatient

cases, the Pure-Vu System has consistently helped achieve adequate bowel cleanliness rates greater than 95% following a reduced prep

regimen. We also believe that the technology may be useful in the future as a tool to help reduce user dependency on conventional

pre-procedural bowel prep regimens. Based on our review and analysis of 2019 market data and 2021 projections for the U.S. and

Europe, as obtained from iData Research Inc., we believe that during 2021 approximately 1.5 million inpatient colonoscopy

procedures were performed in the U.S. and approximately 4.8 million worldwide. Upper GI bleeds occurred in the U.S. at a rate of

approximately 400,000 cases per year in 2019, according to iData Research Inc. The Pure-Vu System has been assigned an ICD-10 code

in the US. The system does not currently have unique codes with any private or governmental third-party payors in any other country

or for any other use; however, we intend to pursue reimbursement activities in the future, particularly in the outpatient

colonoscopy market. We recently received 510(k) clearance from the FDA for our Pure-Vu EVS System and expect to commence

commercialization by the end of Q1 2022. We do not expect to generate significant revenue from product sales until the COVID-19

pandemic has fully subsided and we further expand our commercialization efforts, which is subject to significant

uncertainty.

hospitals by safely and quickly improving visualization of the colon and upper GI tract, potentially enabling effective diagnosis

and treatment without delay. In multiple clinical studies to date, involving the treatment of challenging inpatient and outpatient

cases, the Pure-Vu System has consistently helped achieve adequate bowel cleanliness rates greater than 95% following a reduced prep

regimen. We also believe that the technology may be useful in the future as a tool to help reduce user dependency on conventional

pre-procedural bowel prep regimens. Based on our review and analysis of 2019 market data and 2021 projections for the U.S. and

Europe, as obtained from iData Research Inc., we believe that during 2021 approximately 1.5 million inpatient colonoscopy

procedures were performed in the U.S. and approximately 4.8 million worldwide. Upper GI bleeds occurred in the U.S. at a rate of

approximately 400,000 cases per year in 2019, according to iData Research Inc. The Pure-Vu System has been assigned an ICD-10 code

in the US. The system does not currently have unique codes with any private or governmental third-party payors in any other country

or for any other use; however, we intend to pursue reimbursement activities in the future, particularly in the outpatient

colonoscopy market. We recently received 510(k) clearance from the FDA for our Pure-Vu EVS System and expect to commence

commercialization by the end of Q1 2022. We do not expect to generate significant revenue from product sales until the COVID-19

pandemic has fully subsided and we further expand our commercialization efforts, which is subject to significant

uncertainty.

| 2 |

Market Overview

Colonoscopies are one of the most frequently performed medical procedures with over 20 million colonoscopies performed in the United States each year and more than 54 million worldwide, per 2019 iData Research Inc. Based on our review and analysis of this market data as well as 2021 projections for the U.S. and Europe, as obtained from iData Research Inc., we estimate that during 2022 approximately 1.5 million inpatient colonoscopy procedures in a hospital setting will be performed in the U.S. Hospital based colonoscopies are typically performed to help diagnose and treat lower gastrointestinal (GI) bleeding, irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), anemia or infection. A majority of total colonoscopies in the U.S. and worldwide are performed as outpatient procedures at an ambulatory endoscopy center and/or hospital outpatient departments, with the bulk of procedures performed to detect and prevent colorectal cancer (CRC). According to the CDC (2018), approximately 31% of eligible patients are still not current with their CRC screening in the U.S. Over the past few decades, CRC has been demonstrated to be one of the most preventable cancers if detected early through the use of colonoscopy screening.

|

|

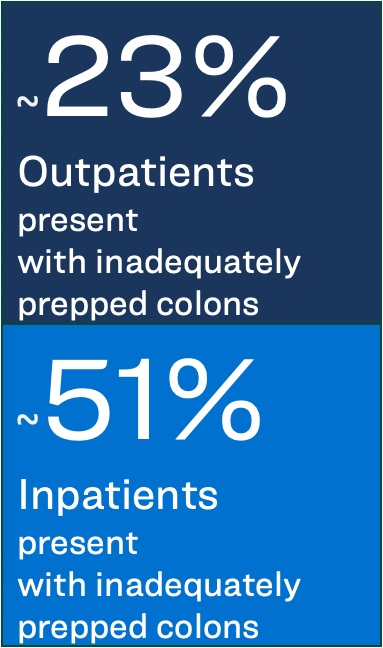

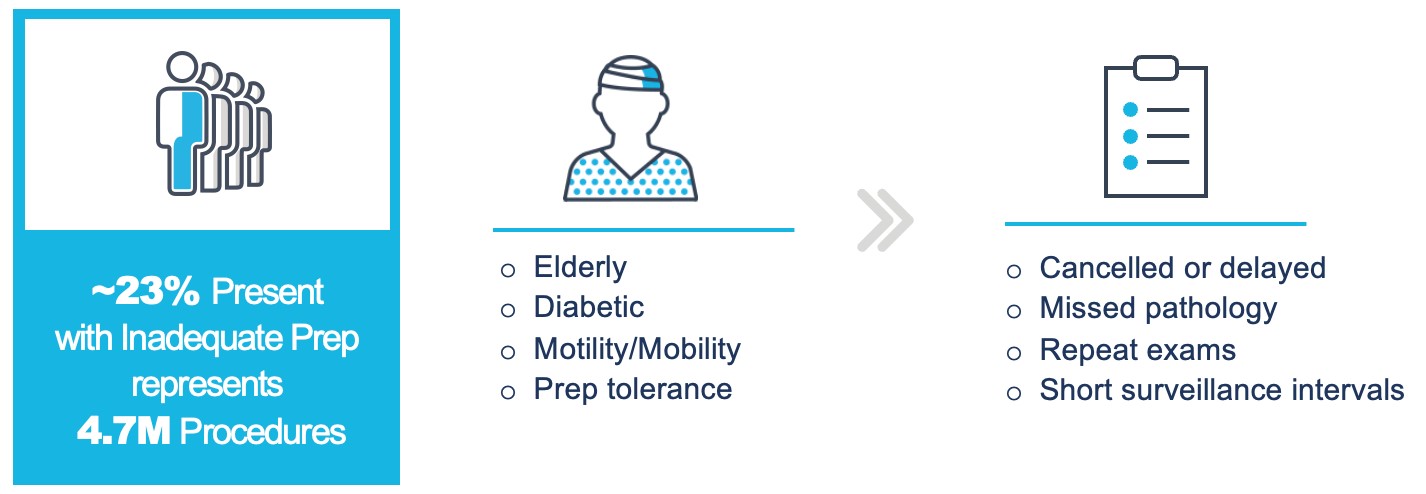

Despite the pervasiveness and effectiveness of colonoscopy, a key ongoing clinical challenge of the procedure is that patients are required to undergo a potent pre-procedure bowel preparation regimen to try to ensure that the colon is fully cleansed to enable clear visualization of the tissue. Successful bowel preparation is one of the most important factors in delivering a thorough, high quality exam and is well documented to have a direct impact on the adenoma detection rate (ADR), the rate of detecting pre-cancer anomalies in the colon tissue, which in turn predicts a decrease in CRC risk. An inadequately prepared colon can impact the diagnostic accuracy of the procedure and can lead to procedures having to be repeated earlier than the medical guidelines advise or can lead to failed procedures especially in the inpatient setting. Rescheduling the procedure is inconvenient to the patient (and many patients fail to come for their follow-up), creates inefficiencies in the provider’s workflow, and increases the length of hospital stay, each of which results in increased healthcare costs. The preparation regimen typically requires patients to be on a liquid diet for over 24 hours, drink up to four liters of a purgative, spend up to 12 hours prior to the exam periodically going to the bathroom to empty their bowels, and disrupting their daily activities, which could include missing work or other activities. The regimens can be highly disruptive and uncomfortable for many patients. In fact, approximately 57% of patients cite not wanting to take the bowel preparation as the number one deterrent for the procedure, as noted by Harewood et al., American Journal of Gastroenterology (2002). Further, it is estimated by HRA Healthcare Research & Analytics (2015) that approximately 23% of outpatients present with inadequately prepped colons, resulting in a number of colonoscopies that yield poor diagnostic accuracy or failed colonoscopies that must be repeated. For inpatients, this figure jumps to approximately 51% according to a recently published study by the Cleveland Clinic. It has also been reported that patients requiring frequent colonoscopies, such as CRC survivors and other surveillance patients, account for approximately 21% of the outpatient colonoscopies performed annually in the U.S., per Lieberman D.A. et.al., American Society for Gastrointestinal Endoscopy (2005).

Inpatient Opportunity: improving efficiencies and shortening time to complete a successful colonoscopy

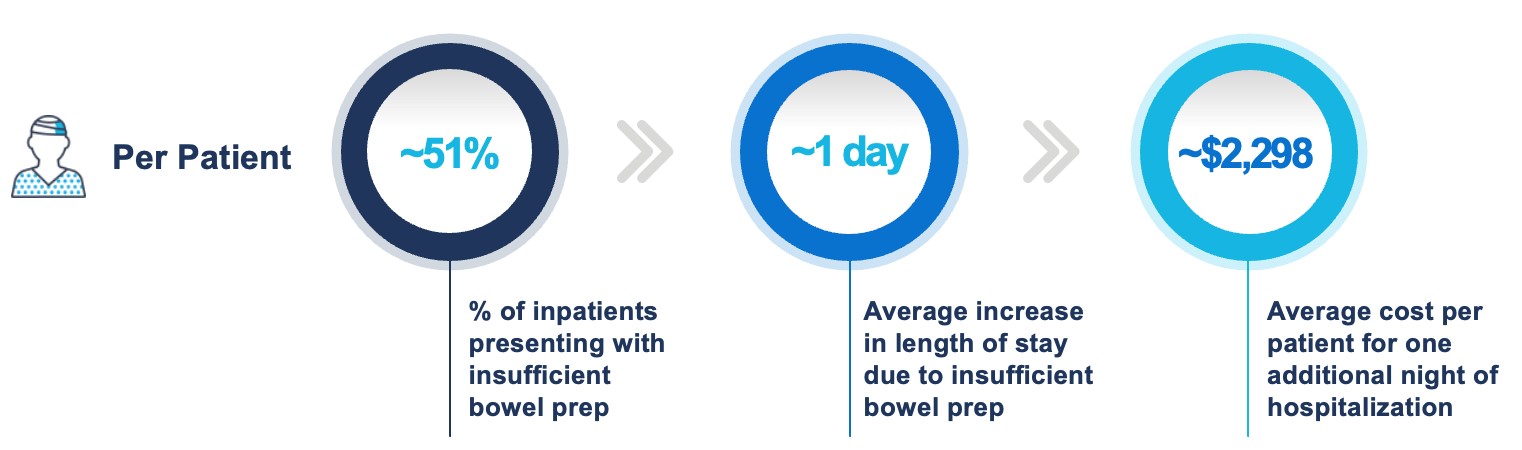

Inpatient colonoscopy is usually performed to diagnose the source of various gastrointestinal conditions such as lower GI bleeding or bowel pain. For an inpatient hospital stay, the Centers for Medicare and Medicaid Services, or CMS, uses a prospective payment system, or PPS, based upon the MS-DRG payment groupings, to pay for hospital services with the goal of encouraging providers to minimize their costs. The DRG assignment is influenced by a combination of factors such as a patient’s sex, diagnosis at the time of discharge and procedures performed. Based on patient specific information, all hospital expenses for their care during an inpatient stay are packaged and assigned to one of over 700 MS-DRGs (“Medicare Severity – Diagnostics Related Groups”). According to Decision Driver Analytics, a reimbursement consulting agency, when a colonoscopy is performed as the primary procedure (no other procedures or complicating diagnosis), MSDRGs 395, 394 or 393 would apply which pay between $3,861 (without complications or major comorbidities) and $9,421 (with major complications and comorbidities), which are average figures subject to adjustment. The National Inpatient Sample (“NIS”) and other literature sources note that the cost for a standard hospital bed averages $2,298 and the cost for an intensive care unit (“ICU”) bed averages $6,546 per day in the U.S, so reducing the length of stay can save the hospital significant expense.

An inpatient colonoscopy is generally more problematic than an outpatient procedure due primarily to poorer quality bowel prep, which can lead to lower rates of successful completion of the procedure and a higher frequency of repeat procedures. Inpatients are difficult to prep as exemplified by inadequate bowel prep rates. Published studies have found that the inpatient population experiences rates of insufficiently prepped colons at the time of colonoscopy as high as 55%. This has been shown to lead directly to significantly longer hospital stays and other additional costs due to the need for repeated preps, repeated colonoscopies, and additional diagnostic procedures. This is exemplified in a recently published study by the Cleveland Clinic that showed an inadequate preparation rate of 51% in the study population of 8,819 inpatients. The study noted that the 51% of the study population that were inadequately prepped stayed one day extra in the hospital compared to patients with adequate preparation. Another study, from Northwestern University Hospital System, showed an average hospital stay extension of two days and cost increase of as much as $8,000 per patient as a result of challenges associated with bowel preparation. We believe the Pure-Vu System may improve outcomes and lower costs for hospitals by potentially reducing the time to a successful colonoscopy, minimizing delayed and incomplete procedures, and improving the quality of an exam.

| 3 |

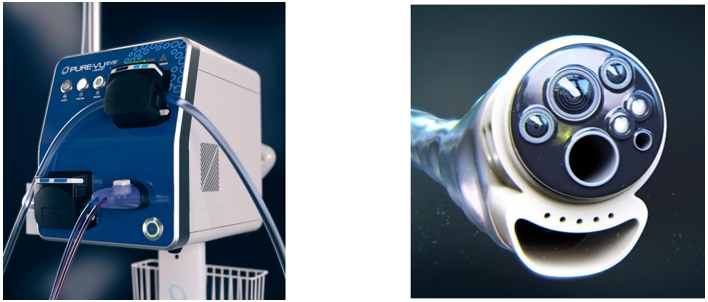

Our Pure-Vu Solution

Our system consists of a workstation controller and a single-use, disposable sleeve that fits over most standard and slim colonoscopes. Together with the colonoscope, the Pure-Vu System performs rapid, effective, and efficient intra-procedural cleaning without compromising procedural workflow and techniques. The over-sleeve has an umbilical section that connects the disposable over-sleeve to the workstation. The over-sleeve is treated with a hydrophilic lubricious coating that reduces friction and allows for smooth advancement through the colon. The workstation, through a series of peristaltic pumps activated by foot pedals, delivers an irrigation medium of air and water that creates a pulsed vortex inside the colon to break up fecal matter while simultaneously evacuating the colon content into waste receptacles already used in a standard colonoscopy procedure. The proprietary smart sense suction (evacuation) system in the device has sensors built in that can detect the formation of a blockage and automatically clear it allowing the physician to remove significant debris from the patient. The Pure-Vu System has been clinically demonstrated to be capable of cleaning poorly prepared colons in minutes. We are building an extensive intellectual property portfolio designed to protect key aspects of the system, including the pulsed vortex irrigation and auto-purge functions.

In June 2019, the 510(k) premarket notification for the second-generation (“Gen 2”) of the Pure-Vu System was reviewed and cleared by the FDA. We received the initial CE Certificate of Conformity, allowing us to affix the CE Mark to the Gen 2 Pure-Vu System in March 2020. We received a supplement to the initial CE Certificate of Conformity for all the latest upgrades in January 2021.

On February 14, 2022 we announced the 510(k) clearance by the FDA of our Pure-Vu EVS System. The new Pure-Vu EVS is designed to offer usability advancements over the currently marketed device, including enhanced physician navigation and control, on-demand bedside loading, expanded cleansing capacity, and a smaller workstation footprint. All upgrades are tied to the market development work the Company has done over the last year. The commercial launch of the Pure-Vu EVS in the first quarter of 2022 is anticipated to accelerate speed of adoption in the U.S. and global markets over time. In addition, the advancements made by the Pure-Vu EVS are expected to support future innovation and indication expansion of the Pure-Vu platform.

We have also implemented an improved manufacturing cost structure that we believe better positions the Company to broaden commercial utilization, increase margins, and establish distribution relationships in more cost sensitive global markets over time.

| 4 |

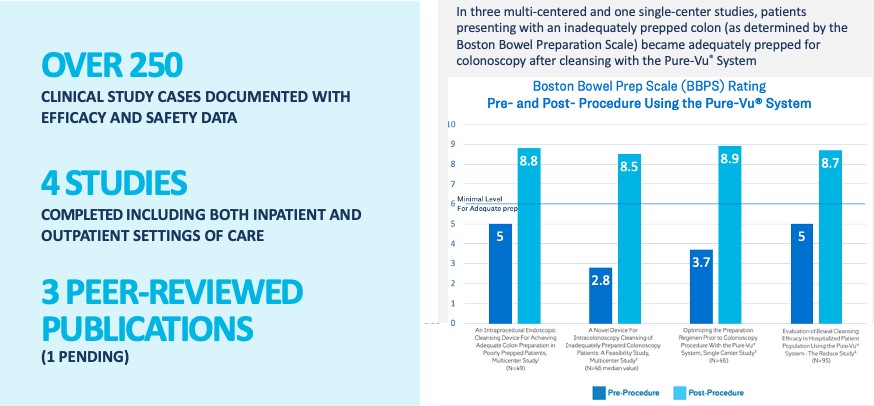

Pre-Clinical and Clinical Data & Safety

The Pure-Vu System has been studied in multiple clinical studies in patients receiving a reduced prep regime as well as a study focused on the inpatient population. The Pure-Vu System was used in two multi-center clinical studies in the EU and Israel, and also a single center study in the US. The first study involved 49 patients and was completed in the second quarter of 2016. The second study was completed in June 2017 and involved 46 patients. Patients in these studies had a restricted diet for 18-24 hours and received a split dose of 20mg of over-the-counter Dulcolax® (bisocodyl). Patients did not take any liquid purgative traditionally prescribed for bowel preparation. The clinical data showing performance of the Pure-Vu System in these studies using the BBPS, is shown below. The clinical results from the 2016 study were presented at the United European Gastroenterology Week (“UEGW”) in October 2016 and the second study was published in the peer review journal Endoscopy in 2018. The clinical results from the 2017 study were presented at the UEGW in October 2017, showing similar results, as shown below. This study has recently been published in Endoscopy, one of the top peer reviewed journals in the EU.

The third clinical study in the outpatient setting was presented at the American College of Gastroenterology (“ACG”) Annual Meeting in October 2018. This study was performed in the United States and showed that the Pure-Vu System demonstrated safe and effective colonic cleaning in the per protocol analysis of 46 patients receiving a reduced prep regimen. The study was initially designed to compare two different minimal bowel preparation regimens. Initially patients were randomized to receive one of two minimal bowel preparations: three doses of 17 gr. MiraLAX each mixed in 8.5 oz. of clear liquids or two doses of 7.5 oz. magnesium citrate (MgC) each taken with 19.5 oz. of clear liquid. A study amendment early on replaced the MiraLAX arm, due to obvious inferior Boston Bowel Preparation Scale (“BBPS”), a validated assessment instrument, scoring from the outset. The replacement arm consisted of two doses of 5 oz. MgC taken with 16 oz. of clear liquid. All patients were allowed to eat a low residue diet on the day prior and were asked to avoid seeds and nuts for five days prior to their procedure. Study objectives evaluated for each study arm included: (1) improvement of colon cleansing from presentation baseline to completion of the procedure (as assessed by the BBPS) through the use of the Pure-Vu System, (2) time required to reach the cecum, (3) total procedure time, and (4) safety. No significant differences were found between the three groups with regard to demographics or indication for colonoscopy. No serious adverse events related to the device were reported. The use of the Pure-Vu System enabled successful intraprocedural cleansing of the colon and ensured successful completion of all colonoscopies performed (100% success rate). Although there were only 46 patients in the study, there was a highly significant difference in the study population (p value <0.0001) between the baseline preparation and that seen post cleansing with the Pure-Vu System. The use of the Pure-Vu System added some time to the procedure, but the total procedure time was approximately 25 minutes in this study.

REDUCE Study

The Reduce study (“Reliable Endoscopic Diagnosis Utilizing Cleansing Enhancement”), was first presented at Digestive Disease Week (DDW) conference in May of 2019 and a full manuscript, titled “A multi-center, prospective, inpatient feasibility study to evaluate the use of an intra-colonoscopy cleansing device to optimize colon preparation in hospitalized patients: the REDUCE study”, was published in the peer review journal BMC Gastroenterology in Q2 of 2021. The REDUCE study was a multi-center inpatient prospective trial designed to evaluate Pure-Vu System’s ability to consistently and reliably improve bowel preparation to facilitate a successful colonoscopy in a timely manner in patients who were indicated for a diagnostic colonoscopy. The study enrolled 95 hospitalized patients on schedule regardless of their level of pre-procedural bowel preparation. The primary endpoint for the study was improvement of bowel preparation from baseline to post procedure as assessed by the Boston Bowel Preparation Scale (“BBPS”), which assesses the cleanliness of the each of the three segments of the colon on a 0 to 3 scale and requires a minimum score of 2 or better per segment to be considered adequately prepped.

For inpatients that received the Pure-Vu System, adequate bowel preparation improved from a baseline of 38% to 96% in segments evaluated. The analysis from the REDUCE study showed statistically significant improvement in every segment of the colon after Pure-Vu System use. The per segment BBPS improved from an average baseline of 1.74, 1.74 and 1.5 to 2.89, 2.91 and 2.86 respectively with a statistically significant p value of .001 for all three segments of the colon. The primary indication for patients enrolled in the study (68%) was a GI bleed. Acute GI bleeds can lead to hemodynamic instability and is a critical population to treat in an urgent fashion. Physicians were able to achieve a successful clinical outcome in 97% of patients in the study.

The chart below shows the outcome of the primary endpoint using the BBPS both pre and post use of the Pure-Vu System in a side-by-side fashion. It can be seen from the data that the high cleansing level achieved with the Pure-Vu System is consistent across the various studies:

| 5 |

Cost Effectiveness Analysis and Independent Studies

In Q2 of 2021, we announced the publication of a sponsored Pure-Vu System® Cost Effectiveness Analysis in the Journal of Cost Effectiveness and Resource Allocation, which is titled, “Colonoscopy in poorly prepped colons. A cost effectiveness analysis comparing standard of care to a new cleansing technology.” This study suggests that, assuming a national average compliance rate for colonoscopy in the U.S. at 60%, as reported by the American Cancer Society in 2017, the use of Pure Vu has the potential to provide the US healthcare system lifetime savings of $833-$922 per patient depending on the insurer when compared to the standard of care. Sponsorship of analysis and development of the manuscript was provided by us.

On October 26, 2021, we announced the presentation of results from an independent single-center study of the Pure-Vu System as an adjunct to colon cleansing in patients with inadequate bowel preparation (IBP) in a poster presentation at the 2021 American College of Gastroenterology (ACG) Annual Scientific Meeting.

In the independent study, the Pure-Vu System was used in 40 patients (14 inpatient procedures (35%) and 26 outpatient procedures (65%)) with IBP to complete the colonoscopy. The indication for colonoscopy was either diagnostic or colorectal cancer (CRC) screening/surveillance. Pure-Vu was used as an adjunct to IBP to allow completion of procedure in 37 patients. In patients with IBP, the mean BBPS score improved from 3.1 (range: 0-6) to 8.5 (range 5-9) after intra-procedural cleansing. Three patients had active lower gastrointestinal bleeding (LGIB), and the Pure-Vu System was used without bowel preparation to promptly detect the etiology and possibly treat. When used in emergency colonoscopy without bowel preparation, procedures could be completed in all three patients detecting and treating diverticular and post-polypectomy bleeding in one patient each and diagnosing severe right sided ischemic colitis in another. The study authors concluded the utility of the Pure-Vu System without prior bowel preparation in LGIB needs further study. Use of Pure-Vu System did not interfere with the performance of endoscopic interventions including biopsy, cold/hot snare polypectomy, or EMR. Besides minor mucosal trauma in two cases, no major complications were observed with the Pure-Vu System.

Current Clinical Studies

Our current clinical research efforts are focused on critical patient populations such as acute lower GI bleeds, where time to a successful colonoscopy can be clinically impactful. We are working with a major hospital system on a study that is focused on rapid examination of significant lower GI bleed patients. In this study the patients will not ingest any purgative based preparation and only receive two tap water enemas prior to the procedure. We are planning to incorporate the new Pure-Vu EVS platform into this clinical study. We are also evaluating additional studies focused on critical populations in both the inpatient and outpatient markets. As an example, studying the ability of the Pure-Vu System to impact outpatients that have a history of poor preparation that cannot get a quality exam and have to come back on a shortened surveillance interval may be of interest. Our strategy currently includes designing a large, multi-center trial that may provide clinical data to pursue reimbursement applications.

On June 16, 2021, we announced the enrollment of the first patients in the European Union (EU) study of the Pure-Vu System, which is evaluating the clinical outcomes in patients with a history of poor bowel preparation using a low volume preparation with limited diet restrictions and the Pure-Vu System. On September 8, 2021, we announced the enrollment of patients at GastroZentrum Lippe, a private endoscopy clinic in Germany, the second site for this EU study of the Pure-Vu System. We believe Germany is currently the largest colonoscopy market in Europe, with approximately 1.7 million procedures expected to have been completed in 2021, according to iData Research.

The EU study has now completed full enrollment of patients who have had a history of poor bowel preparation and were scheduled for either screening, diagnostic, or surveillance colonoscopy across two sites, including the Radboud University Medical Center (Netherlands) and GastroZentrum Lippe (Germany). The patients underwent a low volume bowel preparation, with just 2x150ml picoprep. The patients were also allowed to eat a low fiber diet for two days prior to the colonoscopy as opposed to the typical clear liquid diet the day before a colonoscopy. The patients then received intra-procedural bowel cleansing with the Pure-Vu System. The primary endpoint for the study is improvement of the bowel preparation from baseline to post procedure as assessed by the Boston Bowel Preparation Scale (BBPS), which assesses the cleanliness of each of the three segments of the colon on a zero to three scale and requires a minimum score of two or better per segment to be considered adequately prepped. The study will also look at key clinical endpoints related to the quality of the examination including detection of critical pathology in the colon. This study is expected to be completed by the end of Q2 2022.

Intellectual Property

Our IP position comprises a portfolio covering highly innovative technologies rooted in systems and methods for cleaning body cavities with or without the use of an endoscope. Currently we have fourteen granted or allowed patents in the U.S., seventeen patents in Asia (Japan, China and Hong Kong), and nine patents in the EU, with patent protection until at least 2039. In addition, we have 23 pending patent applications in various regions of the world with a focus on the U.S., EU and Japan. We have registered trademarks for Motus GI and for the Pure-Vu System in the U.S., EU and other international jurisdictions. We also have a pending trademark application in the U.S. to MICRO-PREP.

Our portfolio of patents and patent applications focuses on cleaning body cavities in a safe and efficient manner, insertion, movement and steering of an endoscopic device within the body cavity in a predetermined direction; coordinated positioning of an endoscope with a suction device and cleaning systems with automatic self-purging features. Coverage includes critical aspects of our system that we believe are key to cleaning the colon or other body cavities effectively and efficiently. These aspects include cleansing jet methodologies, sensing and control of evacuation to avoid clogging, designs for easy attachment to endoscopes and cleaning segments under water.

Our commercial success depends in part on our ability to obtain and maintain patent and other proprietary protection for Pure-Vu and to operate without infringing the proprietary right of others and to prevent others from infringing our proprietary rights. We strive to protect our intellectual property through a combination of patents and trademarks, as well as through confidentiality provisions in our contracts. With respect to the Pure-Vu System, we endeavor to obtain and maintain patent protection in the United States and internationally on identified and potentially patentable aspects of the system. We cannot be sure that the patents will be granted with respect to any patent applications we may own or license in the future, nor can we be sure that our existing patents or any patents we may own or license in the future will be useful in protecting our technology.

| 6 |

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. For example, significant aspects of our proprietary technology platform are based on unpatented trade secrets and know-how. Trade secrets and know-how can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors and commercial partners. These agreements are designed to protect our proprietary information and, in the case of the invention assignment agreements, to grant us ownership of technologies that are developed through a relationship with a third party. We also seek to preserve the integrity and confidentiality of our data and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

We also plan to continue to seek trademark protection in the United States and outside of the United States where available and when appropriate. We intend to use these registered marks in connection with our research and development as well as our product candidates.

Competition

We do not believe that there are currently any direct competitors in the market, nor any known competing medical device under development, using similar technology to our technology. Currently the major colonoscope manufacturers (i.e., Olympus Corp, Pentax Medical, Fujifilm Medical) as well as some smaller equipment manufacturers (i.e., Medivators, Erbe) sell a lesser powered irrigation pump that can pump fluid through the auxiliary water jet or working channel of a colonoscope. Potentially competitive is an intra-procedural device under development by Medjet Ltd. MedJet’s device goes through the working channel of a scope, is used mostly for spot cleaning a small amount of debris and does not have the capability to fully clean the colon of large amounts of fecal matter. The MedJet product also requires the physician to remove it from the working channel during the procedure if they need to remove significant debris, polyps or take a biopsy, impacting the workflow of the procedure. There is also a device under development by a company named OTTek Ltd. The device is called the FIOT (Flow in Over Tube). The tube is noted as being able to create a channel between the endoscope and the inside of the over tube to facilitate the removal of debris. The competitive products mentioned are not currently separately reimbursed by private or government payors. There are over ten different preparation regimens used prior to colonoscopy today. Some are prescription medications and others are over-the-counter. Typically, the over-the-counter regimens are not indicated for colonoscopy prep but for issues of motility, such as constipation, but are still widely prescribed by physicians for colonoscopy prep. Depending on the insurance a patient has, the prescription prep may be covered in part but many of them require the patient to pay out-of-pocket.

The medical device and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. We have indirect competitors in a number of sectors, many of which have substantially greater name recognition, commercial infrastructures and financial, technical and personnel resources than Motus GI. Currently, the colonoscopy market is dominated by Olympus Corp, who controls a majority of the market, with Pentax Medical and FujiFilm Medical taking most of the rest of the U.S. colonoscope market. Boston Scientific, Medtronic GI Solutions, Conmed Corporation, Steris, Ambu A/S, and other smaller players sell ancillary devices and accessories into the marketplace as well. These established competitors may invest heavily to quickly discover and develop novel devices that could make our Pure-Vu System obsolete or uneconomical. These include but are not limited to capsule endoscopy, virtual colonoscopy using CT scans, etc. These technologies may require the same level of prep as conventional colonoscopies and if a polyp or abnormality is detected, the patient may still need to undergo a colonoscopy. Other screening tests for colon cancer specifically include fecal occult blood tests and DNA stool tests such as the Cologuard test from Exact Sciences. However, Cologuard is not a replacement for diagnostic colonoscopies or surveillance colonoscopies in high-risk individuals and has a lower specificity than standard colonoscopies. While none of these testing alternatives may ever fully replace the colonoscopy, over time, they may take market share away from conventional colonoscopies for specific purposes and may lower the potential market opportunity for us.

| 7 |

Any new product that competes with an approved product may need to demonstrate compelling advantages in efficacy, cost, convenience, tolerability and safety to be commercially successful. Other competitive factors, including new competitive entrants, could force us to lower prices or could result in reduced sales. In addition, new products developed by others could emerge as competitors to the Pure-Vu System. If we are not able to compete effectively against our current and future competitors, our business will not grow and our financial condition and operations will suffer.

Research and Development

We have research and development capabilities in electrical and mechanical engineering with laboratories in our facility in Israel for development and prototyping, and electronics design and testing. We also use consultants and third party design houses to complement our internal capabilities.

We have received, and may receive in the future, grants from the Government of the State of Israel through the Israeli National Authority for Technological Innovation (the “IIA”) (formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry (the “OCS”)), for the financing of a portion of our research and development expenditures pursuant to the Israeli Law for the Encouragement of Research, Development and Technological Innovation in Industry 5744-1984 (the “Research Law”), and the regulations previously promulgated thereunder, as well as the IIA’s rules and benefit tracks which apply to companies receiving IIA funding (collectively, including the Research Law, the “IIA Regulations”).

As of December 31, 2021, we had received grants from the IIA in the aggregate amount of $1.3 million and had a contingent obligation to the IIA up to an aggregate amount of approximately $1.4 million (assuming no increase, per the IIA Regulations, as described below). As of December 31, 2021, we paid a minimal amount to the IIA. We may apply for additional IIA grants in the future. However, as the funds available for IIA grants out of the annual budget of the State of Israel are subject to the pre-approval of the IIA and have been reduced in the past and may be further reduced in the future, we cannot predict whether we will be entitled to – or approved for – any future grants, or the amounts of any such grants (if approved).

In exchange for these grants, we are required to pay royalties to the IIA of 4% (which may be increased under certain circumstances) from our revenues generated (in any fashion) from know-how developed using IIA grants(and any derivatives of such IIA funded know-how), up to an aggregate of 100% (which may be increased under certain circumstances) of the U.S. dollar-linked value of the grant, plus interest at the rate of 12-month LIBOR.

The IIA Regulations also require that products developed with IIA grants be manufactured in Israel at a rate (scope) which will not be less than the rate of manufacturing and added value in Israel that were set forth in the relevant grant applications submitted to the IIA. Furthermore, the IIA Regulations require that the know-how resulting from research and development according to an IIA-approved plan, not being the product developed within the framework of such approved plan, and any right deriving therefrom may not be transferred outside of Israel (including by way of certain licenses), unless prior approval is received from the IIA. We received a general approval for such transfer. The transfer outside of Israel of manufacturing which is connected with the IIA-funded knowhow at a greater scope than the scope set forth in the general approval will result in a higher royalty repayment rate and may further result in increased royalties (up to three times the aggregate amount of the IIA grants plus interest thereon). In addition, the transfer outside of Israel of IIA-funded knowhow may trigger additional payments to the IIA (up to six times the aggregate amount of the IIA grants plus interest thereon). Even following the full repayment of any IIA grants, we must nevertheless continue to comply with the requirements of the IIA Regulations. The foregoing restrictions and requirements for payment may impair our ability to transfer or sell our technology assets outside of Israel or to outsource or transfer development or manufacturing activities with respect to any IIA-funded know-how outside of Israel.

Furthermore, companies that receive IIA funding are generally required to ensure that all rights in the IIA-backed product are retained by them. This means that, generally, all know-how which is derived from the research and development conducted pursuant to an IIA approved plan, and every right derived from it, must be owned by the recipient of the IIA funding from the date such know-how is generated. Companies that receive IIA funding are further subject to reporting requirements and other technical requirements, which are intended to allow the IIA to ensure that the IIA Regulations are being complied with.

If we fail to comply with any of the conditions and restrictions imposed by the IIA Regulations, or by the specific terms under which we received the grants, we may be required to refund any grants previously received together with interest and penalties, and, in certain circumstances, may be subject to criminal charges.

For additional information, see “Part I—Item 1A—Risk Factors—Risks Related to Our Operations in Israel.”

| 8 |

Manufacturing and Supply

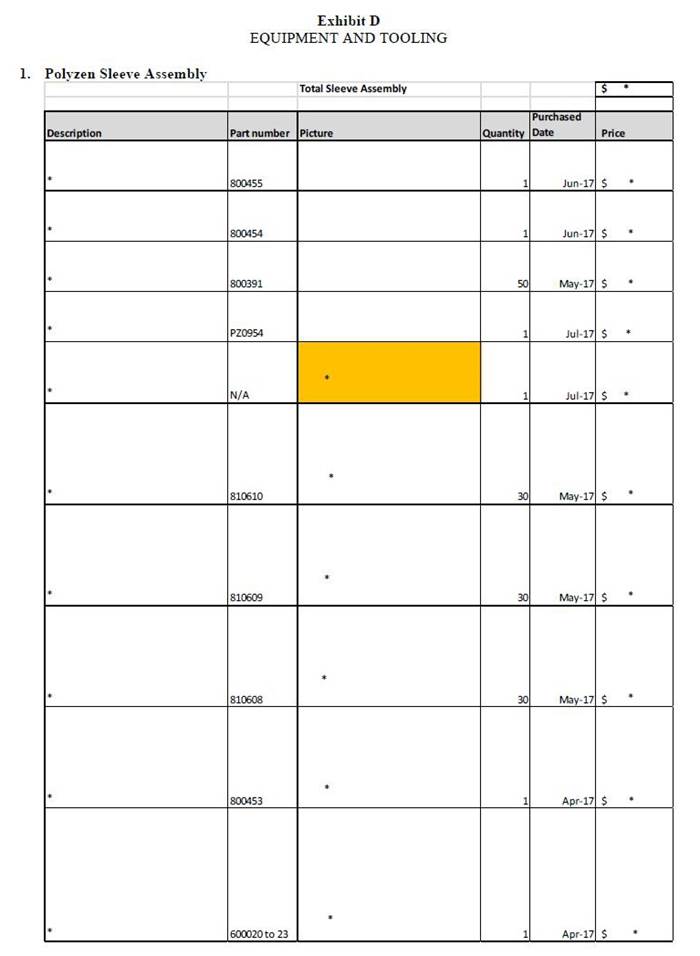

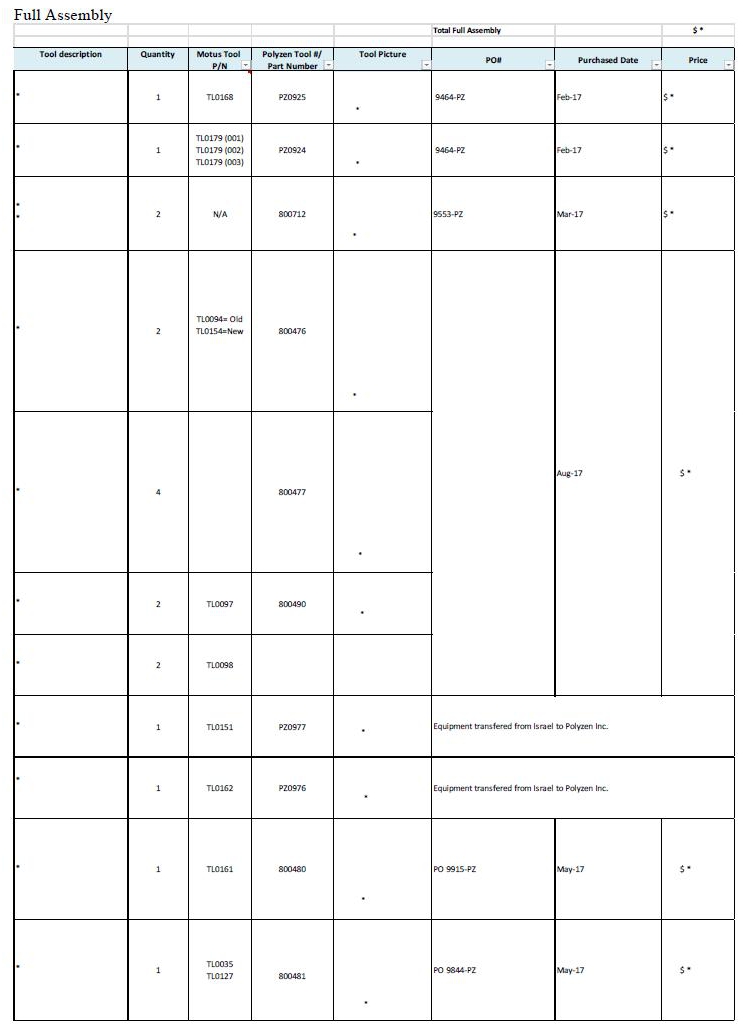

We have established relationships with research facilities, contract manufacturing organizations, or CMOs, and our collaborators to manufacture and supply our product for our initial U.S. market launch targeting early adopter hospitals and for our broader commercialization. Currently, the workstation and loading fixture component of our Pure-Vu System is manufactured by Sanmina Corporation at their facilities in Israel. We may enter into formal supply agreements for the manufacture of the workstation component and loading fixture of our Pure-Vu System with Sanmina Corporation as we continue to establish higher volume capabilities and our commercialization efforts grow. The disposable portion of our Gen 2 Pure-Vu System is manufactured by Polyzen, Inc., at their facilities in North Carolina, U.S., pursuant to a supply agreement we entered into with Polyzen, Inc. in September 2017. The disposable portion of the Pure-Vu EVS is manufactured by Sterling Industries in their Michigan, U.S. facility. We entered into a supply agreement with Sterling Industries in Q2 of 2021. Both Polyzen and Sterling Industries use Medacys in Shenzhen, China as key sub-supplier for the injection molded parts in the Pure Vu disposables. These manufacturing suppliers have extensive experience in medical devices and in dealing with regulatory bodies and other competent entities. These suppliers have ISO 13485 certified quality systems. We have an agreement in place with a third party logistics provider in the U.S. who is ISO 13485 certified and specializes in medical devices and equipment. They provide warehousing, shipping and back office support to meet our commercial needs.

For additional information, see “Part I—Item 1—Business—Research and Development” above, and “Part I—Item 1A—Risk Factors—Risks Related to Our Operations in Israel.”

U.S. Market Entry Strategy

Our initial launch strategy in the United States is focused on the acute care hospital market. Our focus is on building clinical champions amongst key Gastroenterologists, and other GI and nursing floor leadership and staff. Additionally, we articulate the clinical and economic value of the Pure-Vu System technology to key members of hospital administration. After a pre-defined product evaluation period, we seek to work within the Value Analysis Committee approval process, currently utilized within most U.S. hospitals and integrated delivery networks (IDNs). Following successful implementation at the flagship location within an IDN, we then seek to gain further expansion of the Pure-Vu System within sister hospital locations. We support our customers with robust training on the effective use of our Pure-Vu System technology through our training and in-servicing programs.

In addition to working with a third-party logistics provider specializing in medical devices to provide front and back office support to successfully fulfill customer orders, our commercial organization has implemented a robust customer relationship management tool to track account progress and help provide accurate forecasting for operations. We anticipate the sales cycle to be in the range of six to nine months. Timing of hospital capital budget availability may impact this anticipated cycle. Our primary focus is on gaining system placements in the acute care hospital market, driving utilization of our Pure-Vu System disposable sleeve, growing top line revenues and appropriately scaling the commercial organization.

Market Expansion Opportunities

While our time, effort and attention is primarily focused on driving adoption in the U.S. hospital market, we have identified several follow-on market expansion opportunities that are currently being evaluated, including the upper GI endoscopy and targeted outpatient markets, as described below.

Upper GI Endoscopy Market

On April 30, 2021, we announced that we received 510(k) clearance from the FDA for a version of the Pure-Vu System that is compatible with gastroscopes used during upper gastrointestinal (GI) endoscopy procedures to remove blood, blood clots and debris in order to provide a clear field-of-view for the endoscopist. The device is designed to integrate with therapeutic gastroscopes to enable safe and rapid cleansing during the procedure, while preserving established procedural workflow and techniques.

Upper GI bleeds occurred at a rate of approximately 400,000 cases per year in 2019 in the United States, according to iData Research Inc. The mortality rate of this condition can reach up to approximately 10%, as noted in Thad Wilkins, MD, et al., American Family Physician (2012). Removing adherent blood clots from the field of view is a significant need in allowing the physician the ability to find and treat the bleed. We believe the Pure-Vu System has the potential to be adapted and used during upper GI endoscopy procedures to remove clots and debris to provide a clear field of view for the endoscopist. This additional indication for the use of the Pure-Vu System would require a 510(k) clearance by the FDA.

The Company is currently conducting a controlled series of Upper GI initial pilot procedures in the US market, which is intended to inform the development of a Pure-Vu EVS version of the Upper GI solution for eventual submission to FDA for marketing approval in the US.

High Medical Need Outpatient Market

Our targeted Outpatient market focused on those patients at risk for inadequate prep presents a large potential commercial market opportunity for the Pure-Vu System. Based on our review and analysis of 2019 market data and 2021 projections for the U.S. and Europe, as obtained from iData Research Inc., and estimates from HRA Healthcare Research & Analytics - Market Research, May 2015, we believe there are ~4.7M targeted outpatient colonoscopies performed in the U.S. each year and ~11.7M worldwide. These colonoscopy patients can often times have an inadequate preparation, which may lead to repeat procedures earlier than the medical guidelines suggest. We believe use of the Pure-Vu System has the potential to reduce the need for such repeat procedures if used for patients at risk for inadequate prep in the outpatient colonoscopy market. We may seek to obtain reimbursement coverage for this market through exploration of programs with both private and public payers focused on new technology platforms.

| 9 |

Additionally, if we choose to explore either market, we may be able to leverage our existing hospital and physician relationships developed through our inpatient colonoscopy sales force to facilitate such expansion.

In March 2021, we presented a request for an ICD-10 code at a Center for Medicare and Medicaid Services (“CMS”) meeting, which is part of our broader strategy to obtain reimbursement for certain inpatient and outpatient procedures where the Pure-Vu System can help facilitate visualization of inadequately prepared colons in high medical need patients. On August 2, 2021, CMS granted the Pure-Vu System a permanent ICD-10 code which commenced on October 1, 2021. This activity is part of our broader strategy to continue to seek to obtain reimbursement in the future for certain outpatient procedures where we believe the Pure-Vu System can help facilitate visualization of inadequately prepared colons in high medical need patients.

Strategic Partnerships

We intend to explore potential strategic relationships to accelerate and scale our US commercialization effort, and to initiate sales in the EU, Japan, China and other markets in the future.

Employees

As of December 31, 2021, we had 30 full time employees. All of our employees are engaged in administration, finance, clinical, research and development, engineering, regulatory or sales and marketing functions. We believe our relations with our employees are good. We anticipate that the number of full time employees will grow as we scale our commercial capabilities. In addition, we utilize and will continue to utilize consultants, clinical research organizations and third parties to perform our pre-clinical studies, clinical studies, manufacturing and regulatory functions.

Under Israeli law, we and our employees in Israel are subject to Israeli protective labor provisions governing certain matters such as the length of the workday, minimum wages for employees, annual leave, sick pay, determination of severance pay and advance notice of termination of employment, as well as the procedures for hiring and dismissing employees and equal opportunity and anti-discrimination laws. While none of our employees in Israel is party to any collective bargaining agreements, expansion orders issued by the Israeli Ministry of Economy and Industry may make certain industry-wide collective bargaining agreements applicable to us. These agreements affect matters such as the length of the workday and week, recuperation pay, travel expenses and pension rights. We have never experienced labor-related work stoppages and believe that our good and positive relationships with our employees are a significant part of our operations.

Israeli law generally requires the payment of severance pay by employers upon the retirement, death or dismissal of an employee. We fund our ongoing Israeli severance obligations by making monthly payments to the employees’ respective insurance policies. All of our current employees in Israel have agreed, as part of their employment agreements, that, upon termination of their employment, they will be entitled to receive only the amounts accrued in the insurance policies with respect to severance pay.

Furthermore, Israeli employees and employers are required to pay predetermined sums to the National Insurance Institute, which is similar to the U.S. Social Security Administration. These amounts also include payments for national health insurance.

Regulatory Matters

Government Regulation

Our business is subject to extensive federal, state, local and foreign laws and regulations, including those relating to the protection of the environment, health and safety. Some of the pertinent laws have not been definitively interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of subjective interpretations. In addition, these laws and their interpretations are subject to change, or new laws may be enacted.

Both federal and state governmental agencies continue to subject the healthcare industry to intense regulatory scrutiny, including heightened civil and criminal enforcement efforts. We believe that we have structured our business operations and relationships with our customers to comply with all applicable legal requirements. However, it is possible that governmental entities or other third parties could interpret these laws differently and assert otherwise. We discuss below the statutes and regulations that are most relevant to our business.

U.S. Food and Drug Administration regulation of medical devices.

The FDCA and FDA regulations establish a comprehensive system for the regulation of medical devices intended for human use. Our products include medical devices that are subject to these, as well as other federal, state, local and foreign, laws and regulations. The FDA is responsible for enforcing the laws and regulations governing medical devices in the United States.

| 10 |

The FDA classifies medical devices into one of three classes (Class I, Class II, or Class III) depending on their level of risk and the types of controls that are necessary to ensure device safety and effectiveness. The class assignment is a factor in determining the type of premarketing submission or application, if any, that will be required before marketing in the United States.

| ● | Class I devices present a low risk and are not life-sustaining or life-supporting. The majority of Class I devices are subject only to “general controls” (e.g., prohibition against adulteration and misbranding, registration and listing, good manufacturing practices, labeling, and adverse event reporting. General controls are baseline requirements that apply to all classes of medical devices.) | |

| ● | Class II devices present a moderate risk and are devices for which general controls alone are not sufficient to provide a reasonable assurance of safety and effectiveness. Devices in Class II are subject to both general controls and “special controls” (e.g., special labeling, compliance with performance standards, and post market surveillance. Unless exempted, Class II devices typically require FDA clearance before marketing, through the premarket notification (510(k)) process.) | |

| ● | Class III devices present the highest risk. These devices generally are life-sustaining, life-supporting, or for a use that is of substantial importance in preventing impairment of human health or present a potential unreasonable risk of illness or injury. Class III devices are devices for which general controls, by themselves, are insufficient and for which there is insufficient information to determine that application of special controls would provide a reasonable assurance of safety and effectiveness. Class III devices are subject to general controls and typically require FDA approval of a premarket approval (“PMA”) application before marketing. |

Unless it is exempt from premarket review requirements, a medical device must receive marketing authorization from the FDA prior to being commercially marketed, distributed or sold in the United States. The most common pathways for obtaining marketing authorization are 510(k) clearance and PMA.

510(k) pathway

The 510(k) review process compares a new device to a legally marketed device. Through the 510(k) process, the FDA determines whether a new medical device is “substantially equivalent” to a legally marketed device (i.e., predicate device) that is not subject to PMA requirements. “Substantial equivalence” means that the proposed device has the same intended use as the predicate device, and the same or similar technological characteristics, or if there are differences in technological characteristics, the differences do not raise different questions of safety and effectiveness as compared to the predicate, and the information submitted in the 510(k) demonstrates that the proposed device is as safe and effective as the predicate device.

To obtain 510(k) clearance, a company must submit a 510(k) application containing sufficient information and data to demonstrate that its proposed device is substantially equivalent to a legally marketed predicate device. These data generally include non-clinical performance testing (e.g., software validation, animal testing electrical safety testing), but may also include clinical data. Typically, it takes three to twelve months for the FDA to complete its review of a 510(k) submission; however, it can take significantly longer and clearance is never assured. During its review of a 510(k), the FDA may request additional information, including clinical data, which may significantly prolong the review process. After completing its review of a 510(k), the FDA may issue an order, in the form of a letter, that finds the device to be either (i) substantially equivalent and states that the device can be marketed in the United States, or (ii) not substantially equivalent and states that device cannot be marketed in the United States. Depending upon the reasons for the not substantially equivalent finding, the device may need to be approved through the PMA pathway (discussed below) prior to commercialization.

After a device receives 510(k) clearance, any modification that could significantly affect the safety or effectiveness of the device, or that would constitute a major change in its intended use, including significant modifications to any of our products or procedures, requires submission and clearance of a new 510(k) or approval of a PMA. The FDA relies on each manufacturer to make and document this determination initially, but the FDA can review any such decision and can disagree with a manufacturer’s determination. Modifications meeting certain conditions may be candidates for a streamlined FDA review known as Special 510(k) review, which the FDA intends to process within 30 days of receipt. If a device modification requires the submission of a 510(k), but the modification does not affect the intended use of the device or alter the fundamental technology of the device, then summary information that results from the design control process associated with the cleared device can serve as the basis for clearing the application. A Special 510(k) allows a manufacturer to declare conformance to design controls without providing new data. When a modification involves a change in material, the nature of the “new” material will determine whether a traditional or Special 510(k) is necessary. An Abbreviated 510(k) is another type of 510(k) that is intended to streamline the review of data through the reliance on one or more FDA-recognized consensus standards, special controls established by regulation, or FDA guidance documents. In most cases, an Abbreviated 510(k) includes one or more declarations of conformity to an FDA-recognized consensus standard. We may also make minor product enhancements that we believe do not require new 510(k) clearances. If the FDA disagrees with our determination regarding whether a new 510(k) clearance was required for these modifications, we may need to cease marketing and/or recall the modified device. The FDA may also subject us to other enforcement actions, including, but not limited to, issuing a warning letter or untitled letter to us, seizing our products, imposing civil penalties, or initiating criminal prosecution.

| 11 |

Premarket approval pathway

Unlike the comparative standard of the 510(k) pathway, the PMA approval process requires an independent demonstration of the safety and effectiveness of a device. PMA is the most stringent type of device marketing application required by the FDA. PMA approval is based on a determination by the FDA that the PMA contains sufficient valid scientific evidence to ensure that the device is safe and effective for its intended use(s). A PMA application generally includes extensive information about the device including the results of clinical testing conducted on the device and a detailed description of the manufacturing process.

After a PMA application is accepted for review, the FDA begins an in-depth review of the submitted information. FDA regulations provide 180 days to review the PMA and make a determination; however, in reality, the review time is normally longer (e.g., 1-3 years). During this review period, the FDA may request additional information or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the data supporting the application and provide recommendations to the FDA as to whether the data provide a reasonable assurance that the device is safe and effective for its intended use. In addition, the FDA generally will conduct a preapproval inspection of the manufacturing facility to ensure compliance with QSR, which imposes comprehensive development, testing, control, documentation and other quality assurance requirements for the design and manufacturing of a medical device.

Based on its review, the FDA may (i) issue an order approving the PMA, (ii) issue a letter stating the PMA is “approvable” (e.g., minor additional information is needed), (iii) issue a letter stating the PMA is “not approvable,” or (iv) issue an order denying PMA. A company may not market a device subject to PMA review until the FDA issues an order approving the PMA. As part of a PMA approval, the FDA may impose post-approval conditions intended to ensure the continued safety and effectiveness of the device including, among other things, restrictions on labeling, promotion, sale and distribution, and requiring the collection of additional clinical data. Failure to comply with the conditions of approval can result in materially adverse enforcement action, including withdrawal of the approval.

Most modifications to a PMA approved device, including changes to the design, labeling, or manufacturing process, require prior approval before being implemented. Prior approval is obtained through submission of a PMA supplement. The type of information required to support a PMA supplement and the FDA’s time for review of a PMA supplement vary depending on the nature of the modification.

Clinical trials

Clinical trials of medical devices in the United States are governed by the FDA’s Investigational Device Exemption (“IDE”) regulation. This regulation places significant responsibility on the sponsor of the clinical study including, but not limited to, choosing qualified investigators, monitoring the trial, submitting required reports, maintaining required records, and assuring investigators obtain informed consent, comply with the study protocol, control the disposition of the investigational device, submit required reports, etc.

Clinical trials of significant risk devices (e.g., implants, devices used in supporting or sustaining human life, devices of substantial importance in diagnosing, curing, mitigating or treating disease or otherwise preventing impairment of human health) require FDA and Institutional Review Board (“IRB”) approval prior to starting the trial. FDA approval is obtained through submission of an IDE application. Clinical trials of non-significant risk (“NSR”), devices (i.e., devices that do not meet the regulatory definition of a significant risk device) only require IRB approval before starting. The clinical trial sponsor is responsible for making the initial determination of whether a clinical study is significant risk or NSR; however, a reviewing IRB and/or FDA may review this decision and disagree with the determination.

| 12 |

An IDE application must be supported by appropriate data, such as performance data, animal and laboratory testing results, showing that it is safe to evaluate the device in humans and that the clinical study protocol is scientifically sound. There is no assurance that submission of an IDE will result in the ability to commence clinical trials. Additionally, after a trial begins, the FDA may place it on hold or terminate it if, among other reasons, it concludes that the clinical subjects are exposed to an unacceptable health risk.

As noted above, the FDA may require a company to collect clinical data on a device in the post-market setting.

The collection of such data may be required as a condition of PMA approval. The FDA also has the authority to order, via a letter, a post-market surveillance study for certain devices at any time after they have been cleared or approved.

Similar requirements may be applicable in other countries and jurisdictions, including in the European Economic Area or EEA (which includes the 27 EU Member States as well as Iceland, Liechtenstein and Norway) and in the United Kingdom.

Pervasive and continuing FDA regulation

After a device is placed on the market, regardless of its classification or premarket pathway, numerous additional FDA requirements generally apply. These include, but are not limited to:

| ● | Establishment registration and device listing requirements; | |

| ● | Quality System Regulation (“QSR”), which governs the methods used in, and the facilities and controls used for, the design, manufacture, packaging, labeling, storage, installation, and servicing of finished devices; | |

| ● | Labeling requirements, which mandate the inclusion of certain content in device labels and labeling, and generally require the label and package of medical devices to include a unique device identifier (“UDI”), and which also prohibit the promotion of products for uncleared or unapproved, i.e., “off-label,” uses; | |

| ● | Medical Device Reporting (“MDR”) regulation, which requires that manufacturers and importers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; and | |

| ● | Reports of Corrections and Removals regulation, which requires that manufacturers and importers report to the FDA recalls (i.e., corrections or removals) if undertaken to reduce a risk to health posed by the device or to remedy a violation of the FDCA that may present a risk to health; manufacturers and importers must keep records of recalls that they determine to be not reportable. |

The FDA enforces these requirements by inspection and market surveillance. Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, which may include, but is not limited to, the following sanctions:

| ● | Untitled letters or warning letters; | |

| ● | Fines, injunctions and civil penalties; | |

| ● | Recall or seizure of our products; | |

| ● | Operating restrictions, partial suspension or total shutdown of production; | |

| ● | Refusing our request for 510(k) clearance or premarket approval of new products; | |

| ● | Withdrawing 510(k) clearance or premarket approvals that are already granted; and | |

| ● | Criminal prosecution. |

| 13 |

We are subject to either announced or unannounced device inspections by the FDA, as well as other regulatory agencies overseeing the implementation of and compliance with applicable state public health regulations. These inspections may include our suppliers’ facilities.

International

International sales of medical devices are subject to foreign government regulations, which vary substantially from country to country. In order to market our products in other countries, we must obtain regulatory approvals or certifications and comply with extensive safety and quality regulations in those countries. The time required to obtain approval or certification to market our products in a foreign country may be longer or shorter than that required for FDA clearance or approval, and the requirements may differ. Medical device manufacturers intending to market medical devices in the European Economic Area (the “EEA”), are required to affix the CE Mark to their medical devices, often after the intervention of a Notified Body and the issuing of a CE Certificate of Conformity. Many other countries, such as Australia, India, New Zealand, Pakistan and Sri Lanka, accept CE Certificates of Conformity or FDA clearance or approval, although others, such as Brazil, Canada and Japan require separate regulatory filings.

The EU Medical Devices Regulation (Regulation 2017/745 of the European Parliament and of the Council of April 5, 2017 on medical devices), or “EU MDR”, sets out the basic regulatory framework currently applicable to medical devices in the EEA. The EU MDR became applicable on May 26, 2021, repealing the prior Council Directive 93/42/EEC, or the “EU MDD”, which had been regulating medical devices in the EEA for the past over 20 years. This represented a major change in the regulatory landscape of medical devices in the EEA. The EU MDR sets out certain transitional provisions that allow for medical devices covered by the repealed EU MDD (called “legacy devices”) to still be marketed in the EEA for a certain period of time.

In the EEA, medical devices are currently required to comply with the General Safety and Performance Requirements (or “GSPR”) in Annex I of the EU MDR (for legacy devices, this corresponds to the Essential Requirements of Annex I of the EU MDD). Compliance with GSPR is a prerequisite for us to be able to affix the CE Mark to our medical devices, without which they cannot be commercialized in the EEA. To demonstrate compliance with the GSPR and obtain the right to affix the CE Mark, we must undergo a conformity assessment procedure, which varies according to the type of medical device and its classification. In the EEA medical devices are classified into four different risk classes: Class I (which is further divided into (i) devices that are placed on the market in sterile condition, (ii) have a measuring function, (iii) are reusable surgical instruments, and (iv) all others), IIa, IIb and III.

Apart from low risk medical devices (Class I if they have no measuring function, are not sterile, and are not reusable surgical instruments), where the manufacturer can issue an EU Declaration of Conformity based on a self-assessment of the conformity of the devices with the GSPR, a conformity assessment procedure requires the intervention of a Notified Body, which is an organization accredited by the competent authority of an EEA Member State to conduct conformity assessments. The Notified Body would typically audit and examine the products’ technical documentation and the quality management system for the manufacture, design and final inspection of our medical devices before issuing a CE Certificate of Conformity. After receiving the CE Certificate of Conformity from the Notified Body upon successful completion of the conformity assessment, we can draw up an EU Declaration of Conformity which allows us to affix the CE Mark to our products.

Under the EU MDR, confirmation of conformity with relevant GSPR under the normal conditions of intended use of the device, and the evaluation of the undesirable side-effects and of the acceptability of the benefit-risk-ratio, shall be based on clinical data providing sufficient clinical evidence, including where applicable post-market data. Manufacturers are required to specify and justify the level of clinical evidence necessary to demonstrate conformity with the relevant GSPR. This level of clinical evidence must be appropriate in view of the characteristics of the device and its intended purpose.

Besides its involvement in the initial conformity assessment procedure, the Notified Body is required to carry out an annual audit (surveillance audit) and is also required to randomly perform unannounced audits at least once every five years. The quality management system and technical documentation of manufacturers will be required to be recertified periodically, as CE Certificates of Conformity issued by a Notified Body remain valid only for the period indicated in them, in no case exceeding five years.

The conduct of clinical studies in the EEA is governed by detailed regulatory obligations. These include the requirement of prior authorization by the Competent Authorities of the country in which the study takes place and the requirement to obtain a positive opinion from the relevant competent Ethics Committee. The conduct of clinical studies (called “clinical investigations” under the EU MDR) is now mandatory for implantable devices and Class III medical devices (with certain exemptions).

The EU MDR also provides various requirements relating to post-market surveillance and vigilance, including the obligation for manufacturers to implement a post-market surveillance system, in a manner that is proportionate to the risk class and appropriate for the type of device. Once a device is on the EEA market, manufacturers must comply with certain vigilance requirements, such as the reporting serious incidents and field safety corrective actions (even those occurring outside the EEA) to the relevant competent authorities.

Further, the advertising and promotion of our products in the EEA is subject to the EU MDR, to the national laws of individual EEA Member States, Directive 2006/114/EC concerning misleading and comparative advertising, and Directive 2005/29/EC on unfair commercial practices, as well as other EEA Member State laws and industry codes governing the advertising and promotion of medical devices. These laws may limit or restrict the advertising and promotion of our products to the general public and may impose limitations on our promotional activities with healthcare professionals.