UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark one)

OR

For

the fiscal year ended

OR

OR

for the transition period from ____________ to ____________

Commission

file number

(Exact name of the Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

c/o Qingdao Tiandihui Foodstuffs Co. Ltd.,

Tel: +86-532-8615-7918

(Address of principal executive offices)

c/o Qingdao Tiandihui Foodstuffs Co. Ltd.,

People’s

Republic of

Tel: +

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

On April 29, 2022, the issuer had

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ Large Accelerated filer | ☐ Accelerated filer | ☒ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s

assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Table of Contents

i

CERTAIN INFORMATION

In this Annual Report on Form 20-F (the “Annual Report”), unless otherwise indicated, numerical figures included in this Annual Report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

For the sake of clarity, this Annual Report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English.

Except where the context otherwise requires and for purposes of this Annual Report only:

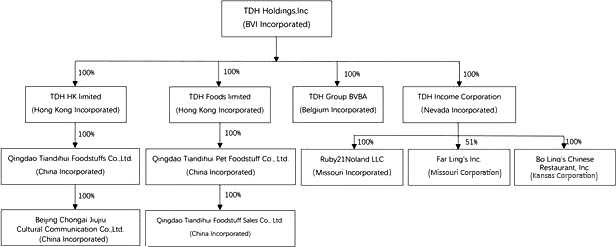

| ● | Depending on the context, the terms “we,” “us,” “our company,” and “our” refer to TDH Holdings, Inc., a British Virgin Islands company; |

| ● | TDH HK Limited, a Hong Kong company wholly-owned by TDH HOLDINGS, INC.; |

| ● | TDH Foods Limited, a Hong Kong company wholly-owned by TDH HOLDINGS, INC.; |

| ● | TDH Group BVA, a Belgium company wholly-owned by TDH Holdings, Inc; |

| ● | TDH Income Corporation, a Nevada corporation; |

| ● | Ruby21Noland LLC, a Missouri corporation; |

| ● | Far Ling’s Inc., a Missouri corporation; |

| ● | Bo Ling’s Chinese Restaurant, Inc., a Kansas corporation; |

| ● | Qingdao Tiandihui Foodstuffs Co., Ltd., a Chinese limited liability company; |

| ● | Qingdao Tiandihui Pet Foodstuffs Co., Ltd., a Chinese limited liability company; |

| ● | Qingdao Tiandihui Foodstuffs Sales Co., Ltd., a Chinese limited liability company; |

| ● | Beijing Chongai Jiujiu Cultural Communication Co., Ltd., a Chinese limited liability company; |

| ● | “shares” and “common shares” refer to our shares, $0.001 par value per share; |

| ● | “China” and “PRC” refer to the People’s Republic of China, excluding, for the purposes of this Annual Report only, Macau, Taiwan and Hong Kong; and |

| ● | all references to “RMB,” and “Renminbi” are to the legal currency of China, all references to “USD,” and “U.S. Dollars” are to the legal currency of the United States., all references to “Yen” and “¥” is to the legal currency of Japan, and all references to “Euro” and “€” are to the legal currency of Belgium. |

ii

FORWARD-LOOKING STATEMENTS

This Report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based on the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” “Information on the Company” and elsewhere in this Annual Report.

This Annual Report should be read in conjunction with our audited financial statements and the accompanying notes thereto, which are included in Item 18 of this Annual Report.

Summary of Risk Factors

Investing in our Common Shares involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our Common Shares. Below please find a summary of the principal risks we face, organized under the relevant headings. These risks are discussed more fully in the section titled “Risk Factors”

Risks related to our business. See “Risk Factors – Risks Related to Our Business”

Risk and uncertainties related to our business include, but are not limited to, the following:

| ● | Legal claims by vendors could impair our ability to continue as a going concern. |

| ● | Various pending lawsuits, legal claims, proceedings and arbitrations could impair our ability to continue as a going concern. |

| ● | Labor arbitration claims by former employees could impair our ability to continue as a going concern. |

| ● | The report of our independent registered public accounting firm on our financial statements includes an explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern. |

| ● | We have incurred recurring losses and anticipate continuing to incur losses in the future. |

| ● | The turnaround of our business depends on our ability to accurately predict consumer trends and demand and successfully introduce new products and product line extensions and improve existing products. |

| ● | We may not be able to successfully implement our turning loss into profits strategy on a timely basis or at all. |

| ● | Any damage to our reputation or our brand may materially adversely affect our business, financial condition and results of operations. |

| ● | Our business is dependent on trends that may change or not continue, and our historical growth may not be indicative of our future results. |

| ● | There may be decreased spending on pets globally in a challenging economic climate. |

| ● | Our business depends, in part, on the sufficiency and effectiveness of our marketing and trade promotion programs. |

| ● | We depend on our key personnel, and our business and growth prospects may be severely disrupted if we lose their services. |

iii

| ● | If we are unable to maintain or increase prices, we may fail to generate a positive margin. |

| ● | If our products are alleged to cause injury or illness or fail to comply with PRC or other applicable governmental regulations, we may need to recall our products and may experience product liability claims. |

| ● | We rely upon a limited number of contract manufacturers to provide a significant portion of our supply of products. |

| ● | We operate in a highly competitive industry and may lose market share or experience margin erosion if we are unable to compete effectively. |

| ● | Relocating some of our production facilities may adversely affect our results of operations. |

| ● | Our online activities are dependent on our ability to access the Internet and operate online in a fast, secure and reliable manner. |

| ● | We may be subject to intellectual property infringement claims or other allegations, which could result in substantial damages and diversion of management’s efforts and attention. |

| ● | Our success depends on our ability to attract and retain key employees and the succession of senior management. |

Risks related to our restaurant segment business. See “Risk Factors – Risks Related to the Restaurant Segment”

Risk and uncertainties related to our restaurant segment business include, but are not limited to, the following:

| ● | Social distancing measures and changes in consumer behavior as a result of COVID-19 have affected and may materially and adversely affect us. |

| ● | Our restaurant base is geographically concentrated in Kansas, and we could be negatively affected by conditions specific to these states. |

| ● | Failure to preserve the value and relevance of our brand could have an adverse impact on our financial results. |

| ● | If we do not anticipate and address evolving consumer preferences and effectively execute our pricing, promotional and marketing plans, our business could suffer. |

| ● | We face intense competition in our markets, which could hurt our business. |

Risks related to our the Covid-19 pandemic. See “Risk Factors – Risks Related to the Current Pandemic”

Risk and uncertainties related to the current pandemic business include, but are not limited to, the following:

| ● | The continued uncertainties associated with the global spread of the COVID-19 (coronavirus) may further adversely impact the Company’s business operations. |

Risks related to Doing Business in China. See “Risk Factors – Risks Related to Doing Business in China”

Risk and uncertainties related to doing business in China include, but are not limited to, the following:

| ● | Because of our corporate structure, we as well as the investors are subject to unique risks due to uncertainty of the interpretation and the application of the PRC laws and regulations. |

| ● | Uncertainties with respect to the PRC legal system could have a material adverse effect on us. |

| ● | The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our Common Shares. |

| ● | Draft rules for China-based companies seeking for securities offerings in foreign stock markets was released by the CSRC for public consultation. While such rules have not yet come into effect, the Chinese government may exert more oversight and control over overseas public offerings conducted by China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our Common Shares to investors and could cause the value of our Common Shares to significantly decline or become worthless. |

iv

| ● | CSRC and other Chinese government agencies may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers. Additional compliance procedures may be required in connection offerings, and, if required, we cannot predict whether we will be able to obtain such approval. As a result, we face uncertainty about future actions by the PRC government that could significantly affect our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. |

| ● | We may be liable for improper use or appropriation of personal information provided by our customers. |

| ● | We are dependent on the state of the PRC’s economy and a general economic downturn, a recession or a sudden disruption in business conditions in the PRC would have a material adverse effect on our business, financial condition and results of operations. |

| ● | Since our operations and assets are located in the PRC, shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers. |

| ● | We hold certain of our cash balances in RMB in uninsured bank accounts in China. |

| ● | We may be subject to PRC regulatory limitations on merger and acquisition (M&A) activities. |

| ● | Fluctuation of the Renminbi may indirectly affect our financial condition by affecting the volume of cross-border money flow. |

| ● | We may become a passive foreign investment company, which could result in adverse U.S. tax consequences to U.S. investors. |

| ● | Introduction of new laws or changes to existing laws by the PRC government may adversely affect our business. |

| ● | Governmental control of currency conversion may affect the value of your investment. |

| ● | PRC’s labor law restricts our ability to reduce our workforce in the PRC in the event of an economic downturn and may increase our production costs. |

| ● | Changes in PRC’s political and economic policies could harm our business. |

| ● | If relations between the United States and China worsen, our share price may decrease and we may have difficulty accessing U.S. capital markets. |

| ● | Because our operations are located in the PRC, information about our operations is not readily available from independent third-party sources. |

Risks related to Doing Business in China. See “Risk Factors – Risks Related to the Ownership of our Common Shares”

Risk and uncertainties related to ownership of our Commons Shares include, but are not limited to, the following:

| ● | We are a holding company incorporated in the British Virgin Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our subsidiaries established in the PRC. |

| ● | Recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our listing. |

| ● | The Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing. |

| ● | We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our shares less attractive to investors. |

| ● | If our financial condition deteriorates as a NASDAQ listed company, we may not meet continued listing standards on the NASDAQ Capital Market. |

| ● | We are a “foreign private issuer,” and our disclosure obligations differ from those of U.S. domestic reporting companies. As a result, we may not provide you the same information as U.S. domestic reporting companies or we may provide information at different times, which may make it more difficult for you to evaluate our performance and prospects. |

| ● | The market price of shares may be volatile, which could cause the value of your investment to decline. |

| ● | As the rights of shareholders under British Virgin Islands law differ from those under U.S. law, you may have fewer protections as a shareholder. |

v

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not required.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not required.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not required.

| C. | Reasons for the Offer and Use of Proceeds |

Not required.

| D. | Risk factors |

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report.

Risks Related to Our Business

Legal claims by vendors could impair our ability to continue as a going concern.

Since November 2019, the Company has been a subject of 57 lawsuits by its raw material supplies, printing and packaging supplies, transportation companies and other vendors. The claims raised in these lawsuits pertain to the Company’s non-payment of various invoices for supplier and vendor services rendered, with related interest and costs. As of the date of this report, in 44 cases, the creditors have reached civil conciliation letters with our company, and in 9 cases, the court has issued civil judgments. With respect to the remaining 4 cases, the plaintiffs withdrew the lawsuit because of lack of evidence. The mediation and judgment involved total claims of RMB13.86 million (USD$2.12 million). Such liabilities have been accrued and reflected in the consolidated financial statements for the year ended December 31, 2020. On March 13, 2021, a land use right and a factory building on the land owned by Qingdao Tiandihui Foodstuffs Co., Ltd. were auctioned by the court for $5,098,461 (RMB33.14 million). On March 16, 2022, the People’s Court of Huangdao District, Qingdao City, Shandong Province made a civil ruling and announced the acceptance of creditors’ application of bankruptcy liquidation of Qingdao Tiandihui Foodstuffs Co., Ltd., and it entered into bankruptcy proceedings. Accordingly, these legal claims are now subject to the bankruptcy proceedings.

1

Various pending lawsuits, legal claims, proceedings and arbitrations could impair our ability to continue as a going concern.

As of December 31, 2021, we had the following pending lawsuits, legal claims, proceedings and arbitrations:

| ● | On December 2, 2019, Qingdao Lingang Real Estate Co., Ltd. (“QLRE”), filed a civil lawsuit against Qingdao Tiandihui Foodstuffs Co., Ltd., Rongfeng Cui, and Yanjuan Wang. The Company entered into a loan agreement with QLRE in 2018 and borrowed RMB20 million (USD3.18 million) from QLRE in connection with purchase of a factory. The loan was guaranteed by Rongfeng Cui and his wife, Yanjuan Wang. The Company failed to make repayment to QLRE. On March 4, 2020, the Court ordered that: (i) the Company repay QLRE the principal amount of RMB20 million plus interest of RMB 550,000 accrued as of October 31, 2019. The court ordered that the payment be made within 10 business days after the effective date of the court ruling, and also ordered that the Company pay interest at the rate of 2% per month for the period from the date of November 1, 2019 to the date of full discharge of the debt, as well as the litigation fee of RMB77,000 (USD$11,933). If the debt is not repaid within the required timeframe, interest shall be doubled from the effective date of court order until the date of full discharge of the debt. As of December 31, 2021, we have not made the loan repayment to QLRE. On March 16, 2022, the People’s Court of Huangdao District, Qingdao City, Shandong Province made a civil ruling and announced the acceptance of creditors’ application of bankruptcy liquidation of Qingdao Tiandihui Foodstuffs Co., Ltd., and it entered into bankruptcy proceedings. Accordingly, these legal claims are now subject to the bankruptcy proceedings. |

| ● | On January 15, 2020, China Construction Bank (“CCB”), initiated a civil claim against Qingdao Tiandihui Foodstuffs Co., Ltd., Rongfeng Cui, and Yanjuan Wang. The plaintiff alleged that it executed a loan agreement with the Company in the amount of RMB19.93 million (USD3.08 million) for the purchase of manufacturing facility and the associated land use right located at Lingang Economic Development Zone, Huangdao District, Qingdao, Shandong Province, People’s Republic of China. Rongfeng Cui and his wife, Yanjuan Wang, co-signed for this loan as personal guarantors subject to joint and several liability in connection with the loan. The loan with CCB was guaranteed by Rongfeng Cui and Yanjuan Wang, and secured by a pledge by the aforementioned manufacturing facilities and associated land use right. On April 14, 2020, the Court has ordered among other things that the Company repay RMB19.93 million (USD3.25 million) of principal and accrued interest to CCB, and to sell the mortgaged property. On March 13, 2021, the land and factory buildings on the land owned by Qingdao Tiandihui Foodstuffs Co., Ltd. were auctioned by the court for $5,098,461 (RMB33.14 million), of which, $3,192,827 (RMB21.14 million) has been used to repay loan principal and accrued interest to CCB. The repayment was completed by April 2021. |

| ● | On November 11, 2019, Shanghai Pudong Development Bank Qingdao Branch(“SPDB”), filed a civil lawsuit against Qingdao Tiandihui Foodstuffs Co., Ltd., Qingdao Saike Environmental Technology Co., Ltd. (“Saike”), Qingdao Gaochuang Technology Finance Guarantee Co., Ltd. (“Gaochuang”), Rongfeng Cui, and Yanjuan Wang. In 2018, the Company entered into agreements with SPDB to borrow an aggregate of RMB4.85 million (USD0.75 million) from SPDB for working capital purpose. The Company failed to repay the debt upon maturity. The borrowing from SPDB was guaranteed by Rongfeng Cui and Yanjuan Wang, and secure by a pledge of land use right and real property of Saike and certaim real property owned by Rongfeng Cui and Yanjuan Wang. The Company failed to make repayment to SPDB on the maturity date. On October 24, 2020, the court has ordered the Company to repay SPDB the principal owed plus interest at the annual interest rate of 18.25%. The payment was required to be made within 10 business days after the effective date of the order. If the debt is not paid within the required timeframe, interest shall be doubled from the effective date of the court order until the date of full discharge of the debt. The Company is also required to pay litigation fees in the amount of RMB156,880 (USD 24,312). As of December 31, 2021, we have not made the repayment to SPDB. On March 16, 2022, the People’s Court of Huangdao District, Qingdao City, Shandong Province made a civil ruling and announced the acceptance of creditors’ application of bankruptcy liquidation of Qingdao Tiandihui Foodstuffs Co., Ltd., and it entered into bankruptcy proceedings. Accordingly, these legal claims are now subject to the bankruptcy proceedings. |

2

| ● | On December 10, 2019, Qingdao Gaochuang Technology Finance Guarantee Co., Ltd. (“Gaochuang”), initiated a civil claim against Qingdao Tiandihui Foodstuffs Co., Ltd., Qingdao Saike Environmental Technology Co., Ltd. (“Saike”), Rongfeng Cui, and Yanjuan Wang. In 2018, the Company entered into agreements with SPDB for bank acceptance draft and Gaochuang executed the guarantee of SPDB bank acceptance deposit on behalf of the Company in the amount of RMB1.2 million (USD0.19 million). The Company failed to repay the RMB 1.2 million ($0.19 million) deposit to Gaochuang upon the bank acceptance draft maturity date. The deposit made by Gaochuang was guaranteed by certain of the Company’s fixed assets and patents. On December 29, 2020, the court ordered the Company to repay the RMB 1.2 million ($0.19 million) deposit to Gaochuang and the interest at the annual interest rate of 4.15%. The payment was required to be made within 10 business days after the effective date of the court order. The court order also provides that if the debt is not paid within the required timeframe, interest shall be doubled from the effective date of court order until the date of full discharge of the debt. The court order also obligate the Company to bear litigation fees of RMB83,127(USD 12,882). As of December 31, 2021, we had not made the repayment to Gaochuang. On March 16, 2022, the People’s Court of Huangdao District, Qingdao City, Shandong Province made a civil ruling and announced the acceptance of creditors’ application of bankruptcy liquidation of Qingdao Tiandihui Foodstuffs Co., Ltd., and it entered into bankruptcy proceedings. Accordingly, these legal claims are now subject to the bankruptcy proceedings. |

| ● | On May 6, 2020, the Postal Savings Bank of China Limited Weihai Road Sub-branch of Qingdao North District (hereinafter referred to as Postal Savings) filed a civil lawsuit against Qingdao Tiandihui Foodstuffs Co., Ltd., Rongfeng Cui and Yanjuan Wang. The Company entered into two loan agreements with Postal Savings in 2018 and 2019, respectively, and borrowed RMB9.9 million ($1.53 million) in aggregate. The loans were guaranteed by Rongfeng Cui and Yanjuan Wang, and were secured by a pledge of real property owned by the Company and real property owned by Rongfeng Cui. The Company failed to pay its debt to Postal Savings when it was due. In June 2020, the court ordered the Company to repay to Postal Savings the principal and interest under the loan, and to reimburse Postal Savings for the litigation fees incurred by Postal Savings. If the court decide to auction the pledged real properties, Postal Savings shall have the priority right of the repayment from the auction proceeds. As of December 31, 2021, we had not made the repayment to Postal Savings. On March 16, 2022, the People’s Court of Huangdao District, Qingdao City, Shandong Province made a civil ruling and announced the acceptance of creditors’ application of bankruptcy liquidation of Qingdao Tiandihui Foodstuffs Co., Ltd., and it entered into bankruptcy proceedings. Accordingly, these legal claims are now subject to the bankruptcy proceedings. |

Labor arbitration claims by former employees could impair our ability to continue as a going concern.

The Company dismissed certain employees in 2019 and 2020 and only maintained 42 full-time employees during fiscal year 2021 and as of December 31, 2021. As a result of the employee layoffs, certain of the Company’s former employees commenced arbitration proceedings against the Company under applicable labor rules and standards, claiming, among others, lost wages, severance payments and/or social security obligations totaling RMB3.68 million (USD0.56 million). There were 98 labor arbitrations, of which 6 cases has been settled and the trial court has issued decisions on the remaining 92 cases. The Company accrued approximately $0.4 million contingent liabilities in other current liabilities on the consolidated balance sheet as of December 31, 2019 and recognized contingent losses of approximately $0.4 million for the year ended December 31, 2019. Upon the issuance of rulings in these cases, the Company further accrued approximately $0.1 million wage and/or severance payables in other current liabilities on the consolidated balance sheet as of December 31, 2020 and recognized losses of approximately $0.1 million for the year ended December 31, 2020. On March 13, 2021, the land and factory buildings above the land owned by Qingdao Tiandihui Foodstuffs Co., Ltd. were actioned by the court for $5,098,461 (RMB 33.14 million). In 2021, we have paid RMB3.73 million to substantially settle the labor arbitration cases with our former employees. We only had RMB 0.5 million ($0.08 million) remaining severance payables to them as of December 31, 2021, which we anticipate to fully settle by the end of 2022. Failure to successfully settle the claims could impair our ability to continue as a going concern. it entered into bankruptcy proceedings.

3

The report of our independent registered public accounting firm on our financial statements includes an explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern, and if our business is unable to continue it is likely investors will lose all of their investment.

As discussed in Note 2 to the consolidated financial statements to this Annual Report, the Company has suffered significant losses from operations and had negative cash flows from operating activities for the year ended December 31, 2021. The Company’s revenues generated are not currently sufficient and its business operations may be further affected by the ongoing COVID-19 pandemic. There can be no assurances that future revenue or capital infusion will be sufficient to enable the Company to develop its business to a level where it will be profitable or to generate positive cash flows. Our auditor, YCM CPA INC, has indicated in their report on the Company’s financial statements for the fiscal year ended December 31, 2021 that there is “substantial doubt about our ability to continue as a going concern”. A “going concern” opinion could impair our ability to finance our operations through the sale of equity, incurring debt, or other financing alternatives.

We anticipate incurring additional operating losses and may not be able to regain profitability in the foreseeable near future. Management’s plan to alleviate the substantial doubt about our ability to continue as a going concern include working to improve the Company’s liquidity and capital sources mainly through cash flow from its operations, renewal of bank borrowings and raise sufficient capital through equity or debt financing, strategic alliances or otherwise. If we are unable to achieve these goals, our business will be jeopardized and we may not be able to continue. If we ceased operations, it is likely that all of our investors will lose their investment.

In the absence of an infusion of substantial additional capital, our ability to continue to operate will be impaired, and we may not be able to continue as a going concern. Additionally, even if we raise sufficient capital through equity or debt financing, strategic alliances or otherwise, there can be no assurances that future revenue or capital infusion will be sufficient to enable us to develop our business to a level where it will be profitable or to generate positive cash flows.

We have incurred recurring losses and anticipate continuing to incur losses in the future.

Due to the sharp rise in market price of raw materials, the lack of operational efficiency of our production facilities and our inability to make bank loan repayment to financial institutions upon maturity, we temporarily suspended our production and normal business operations and we were involved in certain legal proceedings beginning in November 2019. The COVID-19 outbreak and spread further disrupted our business activities during the period from the beginning of 2020 up to May 2020 when we resumed our business operations. On October 31, 2021, we acquired 51% equity interests of Far Ling’s Inc. and 100% equity interests of Bo Ling’s Chinese Restaurant, Inc. This resulted in an increase of $0.6 million in food service revenue. However, our revenues generated are not currently sufficient and our business operations may be further affected by the ongoing COVID-19 pandemic. Our net losses were $874,668 in 2020 and $6,715,958 in 2021. Although we resumed our business operations in May 2020 and we are currently trying to implement our business strategies in order to manage the future growth of our business, we cannot assure our current efforts may achieve the anticipated results and we may continue to incur operating losses in the near term. We cannot guarantee that going forward we will operate profitably. In order to achieve profitability, among other factors, management must successfully execute our growth and operations in the markets on which we are focused. If we are unable to successfully take necessary steps, we may be unable to sustain or increase our profitability in the future.

4

The report of our independent registered public accounting firm expresses substantial doubt about the Company’s ability to continue as a going concern.

Our consolidated financial statements have been prepared assuming we will continue as a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, for the year ended December 31, 2021, we have incurred a net loss of approximately $6.72 million and cash used in operating activities amounted to approximately $3.45 million. As of December 31, 2021, our losses are significant and our revenues are insufficient, and while we have raised some capital through equity financing, there can be no assurances that future revenue or capital infusion will be sufficient to enable us to develop our business to a level where it will be profitable or to generate positive cash flows.

Management’s plan to alleviate the substantial doubt about the Company’s ability to continue as a going concern include attempting to improve its business profitability, its ability to generate sufficient cash flow from its operations to meet its operating needs on a timely basis, obtain additional working capital funds through debt and equity financings to eliminate inefficiencies in order to meet its anticipated cash requirements. However, there can be no assurance that these plans and arrangements will be sufficient to fund the Company’s ongoing capital expenditures, working capital, and other requirements. If we are unable to achieve these goals, our business would be jeopardized and the Company may not be able to continue. If we ceased operations, it is likely that all of our investors would lose their investment.

The Company is party to various legal proceedings by its vendors and lenders, which proceedings distract our management, are expensive to conduct and could result in significant damage award against the Company.

During the period from November 2019 to 2020, the Company has been named as a defendant in 57 lawsuits by its raw material supplies, printing and packaging supplies, transportation companies and other vendors. The claims raised in these lawsuits pertain to the Company’s non-payment of various invoices for supplier and vendor services rendered, with interest and costs. As of the date of this Annual Report, the creditors of 44 cases have reached civil conciliation letters with the Company, and the court has issued civil judgments in 9 cases, another 4 claimants withdrew their cases for various reasons including lack of evidence. The mediation and judgment costs are estimated approximately RMB13.86 million (USD$2.12 million). In addition, several lending institutions have instituted legal proceedings to recover loans made to the Company. Finally, there are several labor arbitration claims against the Company brought by its former employees following the layoffs, claiming, among others, lost wages, severance payments and/or social security obligations totaling RMB3.68 million (USD$0.56 million). On March 13, 2021, the land and factory buildings above the land owned by Qingdao Tiandihui Foodstuffs Co., Ltd. were auctioned by the court for $5,098,461 (RMB 33.14 million), among which, approximately $3.2 million has been used to repay the defaulted loan to China Construction Bank. In 2021, we have paid RMB3.73 million to substantially settle the labor arbitration cases with our former employees and we only have RMB 0.5 million ($0.08 million) remaining in severance payables to them as of December 31, 2021, which we anticipate to fully settle by the end of 2022. Failure to successfully settle the claims could impair our ability to continue as a going concern.

The turnaround of our business depends on our ability to accurately predict consumer trends and demand and successfully introduce new products and product line extensions and improve existing products.

Due to the sharp rise in market price of raw materials, the lack of operational efficiency of our production facilities and our inability to make bank loan repayment upon maturity, we have suspended our production and normal business operations and we were involved in certain legal proceedings since November 2019. The COVID-19 outbreak and spread further disrupted our business activities from the beginning of 2020 up to May 2020 when we resumed our business operations. These factors led to significant decrease in our pet foods revenue by 40.46% or $0.33 million in 2021 as compared to 2020. On October 31, 2021, we acquired 51% equity interests of Far Ling’s Inc and 100% equity interests of Bo Ling’s Chinese Restaurant, Inc. This resulted in an increase of $0.6 million in food service revenue. However, our revenues generated are not currently sufficient and our business operations may be further affected by the ongoing COVID-19 pandemic. We suffered recurring net loss of approximately $6.72 million in 2021. We are currently facing the challenges to recover our production and normal business operations.

5

Our turnaround depends, in part, on our ability to successfully introduce new products and product line extensions and improve and reposition our existing products to meet the requirements of pet owners and the dietary needs of their pets. This, in turn, depends on our ability to predict and respond to evolving consumer trends, demands and preferences. The development and introduction of innovative new products and product line extensions involve considerable costs. In addition, it may be difficult to establish new supplier relationships and determine appropriate product selection when developing a new product or product line extension. Any new product or product line extension may not generate sufficient customer interest and sales to become a profitable product or to cover the costs of its development and promotion and may reduce our operating income. In addition, any such unsuccessful effort may adversely affect our brand. If we are not able to anticipate, identify or develop and market products that respond to changes in requirements and preferences of pet parents and their pets or if our new product introductions or repositioned products fail to gain consumer acceptance, we may not grow our business as anticipated, our sales may decline and our business, financial condition and results of operations may be materially adversely affected.

We may not be able to successfully implement our turning loss into profits strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our turning loss into profits strategy, including expanding distribution and improving placement of our products in the stores of our retail partners, attracting new consumers to our brands, introducing new products and product line extensions and expanding into new markets. Our ability to implement this strategy depends, among other things, on our ability to:

| ● | accurately anticipate customer needs, and innovate and develop new products or product enhancements that meet customer needs; |

| ● | price our products competitively and differentiate our product offerings from those of our competitors; |

| ● | enter into distribution and other strategic arrangements with retailers and other potential distributors of our products; |

| ● | continue to effectively compete in our distribution channels; |

| ● | increase our brand recognition by effectively implementing our marketing strategy and advertising initiatives; |

| ● | expand and maintain brand loyalty; |

| ● | maintain and, to the extent necessary, improve our high standards for product quality, safety and integrity; |

| ● | maintain sources for the required supply of quality raw ingredients to meet our growing demand; and |

| ● | identify and successfully enter and market our products in new geographic markets and market segments. |

These initiatives require significant capital expenditures and investment of valuable management and financial resources. There are no guarantees that we will be able to effectively manage any future growth in an efficient, cost-effective and timely manner, or at all. We may not be able to successfully implement our turning loss into profits strategy and may need to change our strategy. If we fail to implement our turning loss into profits strategy or if we invest resources in a turning loss into profits strategy that ultimately proves unsuccessful, our business, financial condition and results of operations may be materially adversely affected.

6

Any damage to our reputation or our brand may materially adversely affect our business, financial condition and results of operations.

Maintaining our strong reputation with consumers, our retail partners and our suppliers is critical to our success. Our brands may suffer if our marketing plans or product initiatives are not successful. The importance of our brands may increase if competitors offer more products with formulations similar to ours. Further, our brands may be negatively impacted due to real or perceived quality issues or if consumers perceive us as being untruthful in our marketing and advertising, even if such perceptions are not accurate. Product contamination, the failure to maintain high standards for product quality, safety and integrity, including raw materials and ingredients obtained from suppliers, or allegations of product quality issues, mislabeling or contamination, even if untrue or caused by our third-party contract manufacturers or raw material suppliers, may reduce demand for our products or cause production and delivery disruptions. We maintain guidelines and procedures to ensure the quality, safety and integrity of our products. However, we may be unable to detect or prevent product and/or ingredient quality issues, mislabeling or contamination, particularly in instances of fraud or attempts to cover up or obscure deviations from our guidelines and procedures. If any of our products become unfit for consumption, cause injury or are mislabeled, we may have to engage in a product recall and/or be subject to liability. Damage to our reputation or our brands or loss of consumer confidence in our products for any of these or other reasons could result in decreased demand for our products and our business, financial condition and results of operations may be materially adversely affected.

Our business is dependent on trends that may change or not continue, and our historical growth may not be indicative of our future results.

The growth of the global pet food industry and the market in China, in particular, depends primarily on the continuance of current trends in humanization of pets and premiumization of pet foods as well as on general economic conditions, the size of the pet population and average dog size. These trends may not continue or may change. In the event of a decline in the overall number or average size of pets, a change in the humanization, premiumization or health and wellness trends or during challenging economic times, we may be unable to persuade our customers and consumers to purchase our branded products instead of lower-priced products, and our business, financial condition and results of operations may be materially adversely affected.

There may be decreased spending on pets globally in a challenging economic climate.

Our business, financial condition and results of operations may be materially adversely affected by a challenging economic climate, including adverse changes in interest rates, volatile commodity markets and inflation, contraction in the availability of credit in the market and reductions in consumer spending. In addition, a slow-down in the general economy and/or PRC economy or a shift in consumer preferences for economic reasons or otherwise to less expensive products may result in reduced demand for our products which may affect our profitability. The keeping of pets and the purchase of pet-related products may constitute discretionary spending for some of our consumers and any material decline in the amount of consumer discretionary spending may reduce overall levels of pet ownership or spending on pets. As a result, a challenging economic climate may cause a decline in demand for our products which could be disproportionate as compared to competing pet food brands since our products command a price premium. In addition, we cannot predict how current or worsening economic conditions in the PRC and globally will affect our partners, suppliers and distributors. If economic conditions result in decreased spending on pets and have a negative impact on our retail partners, suppliers or distributors, our business, financial condition and results of operations may be materially adversely affected.

Our business depends, in part, on the sufficiency and effectiveness of our marketing and trade promotion programs.

Due to the competitive nature of our industry, we must effectively and efficiently promote and market our products through advertisements as well as trade promotions and incentives to sustain our competitive position in our market. Marketing investments may be costly. In addition, we may, from time to time, change our marketing strategies and spending, including the timing or nature of our trade promotions and incentives. We may also change our marketing strategies and spending in response to actions by our competitors and other pet food companies. The sufficiency and effectiveness of our marketing and trade promotions and incentives are important to our ability to retain and/or improve our market share and margins. If our marketing and trade promotions and incentives are not successful or if we fail to implement sufficient and effective marketing and trade promotions and incentives or adequately respond to changes in our competitors’ marketing strategies, our business, financial condition and results of operations may be adversely affected.

7

We depend on our key personnel, and our business and growth prospects may be severely disrupted if we lose their services.

Our future success depends heavily upon the continued service of our key executives. We rely on their business, industry, financial and capital markets knowledge and experience. If our CEO or CFO became unable or unwilling to continue in their present positions, we may not be able to replace them easily, our business may be significantly disrupted and our financial condition and results of operations may be materially adversely affected.

We do not maintain key man life insurance on any of our senior management or key personnel.

The loss of any one of them would have a material adverse effect on our business and operations. Competition for senior management and our other key personnel is intense and the pool of suitable candidates is limited. We may be unable to locate a suitable replacement for any senior management or key personnel that we lose. In addition, if any member of our senior management or key personnel joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our Company. In addition, we compete for qualified personnel with other companies, and we face competition in attracting skilled personnel and retaining the members of our senior management team. These personnel possess technical and business capabilities which are difficult to replace. There is intense competition for experienced senior management with technical and industry expertise in our industry, and we may not be able to retain our key personnel. Intense competition for these personnel could cause our compensation costs to increase, which could have a material adverse effect on our results of operations. Our future success and ability to grow our business will depend in part on the continued service of these individuals and our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals.

If we are unable to maintain or increase prices, we may fail to generate a positive margin.

We rely in part on price increases to offset cost increases and improve the profitability of our business. Our ability to maintain prices or effectively implement price increases may be affected by a number of factors, including raw material market price fluctuation, competition, effectiveness of our marketing programs, the continuing strength of our brands, market demand and general economic conditions, including inflationary pressures. In particular, in response to increased promotional activity by other pet food companies, we may have to increase our promotional spending, which may resulted in a lower average price per pound for our products and adversely impacted our gross margins. During challenging economic times, consumers may be less willing or able to pay a price premium for our branded products and may shift purchases to lower-priced or other value offerings, making it more difficult for us to maintain prices and/or effectively implement price increases. In addition, our retail partners and distributors may pressure us to rescind price increases that we have announced or already implemented, whether through a change in list price or increased promotional activity. If we are unable to maintain or increase prices for our products or must increase promotional activity, our margins may be adversely affected. Furthermore, price increases generally result in volume losses, as consumers purchase fewer units. If such losses are greater than expected or if we lose distribution due to a price increase, our business, financial condition and results of operations may be materially adversely affected.

If our products are alleged to cause injury or illness or fail to comply with PRC or other applicable governmental regulations, we may need to recall our products and may experience product liability claims.

Our products may be exposed to product recalls, including voluntary recalls or withdrawals, if they are alleged to pose a risk of injury or illness, or if they are alleged to have been mislabeled, misbranded or adulterated or to otherwise be in violation of governmental regulations. We may also voluntarily recall or withdraw products in order to protect our brand or reputation if we determine that they do not meet our standards, whether for palatability, appearance or otherwise. If there is any future product recall or withdrawal, it could result in substantial and unexpected expenditures, destruction of product inventory, damage to our reputation and lost sales due to the unavailability of the product for a period of time, and our business, financial condition and results of operations may be materially adversely affected. We also may be subject to claims if the consumption or use of our products is alleged to cause injury or illness. If there is a judgment against us or a settlement agreement related to a claim, our business, financial condition and results of operations may be materially adversely affected.

8

We are dependent on a limited number of retailer customers for a significant portion of our sales.

We sell our products to retail partners and distributors in specialty channels. Our ten largest retail partners, accounted for 54% of our net sales for the year ended December 31, 2018, 44% in 2019, 40% in 2020 and 38% in 2021. When we suspended of our production in November 2019 to deal with various vendor claims, legal proceedings and labor arbitrations as discussed above, and with additional challenges brought in by the global spread of COVID-19, our customer base has been reduced since 2020. If we were to continue to lose any of our key customers, if any of our retail partners continue to reduce the amount of their orders or if any of our key customers consolidate, reduce their store footprint and/or gain greater market power, or if we fail to attract a sufficient number of customers in a cost-effective manner, our business, financial condition and results of operations may be materially adversely affected. In addition, we may be similarly adversely impacted if any of our key customers experience any operational difficulties or generate less traffic.

We rely upon a limited number of contract manufacturers to provide a significant portion of our supply of products.

There is limited available manufacturing capacity that meets our quality standards. We have agreements with a network of contract manufacturers that require them to provide us with specific finished products. In 2021, our business operations were largely disrupted by the COVID-19 outbreak and spread as well pending claims, lawsuits, legal proceedings and labor arbitrations, which led to our reduced business activities and limited fulfillment of customer orders. As a result of significant decrease in our revenue, 4% of our cost of sales was derived from products purchased from contract manufacturers in 2021. The manufacture of our products may not be easily transferable to other sites in the event that any of our contract manufacturers experience breakdown, failure or substandard performance of equipment, disruption of supply or shortages of raw materials and other supplies, labor problems, power outages, adverse weather conditions and natural disasters or the need to comply with environmental and other directives of governmental agencies. From time to time, a contract manufacturer may experience financial difficulties or other business disruptions, which could disrupt our supply of finished goods or require that we incur additional expense by providing financial accommodations to the contract manufacturer or taking other steps to seek to minimize or avoid supply disruption, such as establishing a new contract manufacturing arrangement with another provider. The loss of any of these contract manufacturers or the failure for any reason of any of these contract manufacturers to fulfill their obligations under their agreements with us, including a failure to meet our quality controls and standards, may result in disruptions to our supply of finished goods. We may be unable to locate an additional or alternate contract manufacturing arrangement that meets our quality controls and standards in a timely manner or on commercially reasonable terms, if at all.

To the extent our retailer customers purchase products in excess of consumer consumption in any period, our sales in a subsequent period may be adversely affected as our customers seek to reduce their inventory levels.

From time to time, our retailer customers may purchase more product than they expect to sell to consumers during a particular time period. Our retailer customers may grow their inventory in anticipation of, or during, our promotional events, which typically provide for reduced prices during a specified time or other customer or consumer incentives. Our retailer customers may also grow inventory in anticipation of a price increase for our products, or otherwise over-order our products as a result of overestimating demand for our products. If a retailer customer increases its inventory during a particular reporting period as a result of a promotional event, anticipated price increase or otherwise, then sales during the subsequent reporting period may be adversely impacted as our customers seek to reduce their inventory to customary levels. This effect may be particularly pronounced when the promotional event, price increase or other event occurs near the end or beginning of a reporting period or when there are changes in the timing of a promotional event, price increase or similar event, as compared to the prior year. To the extent our retailer customers seek to reduce their usual or customary inventory levels or change their practices regarding purchases in excess of consumer consumption, our net sales and results of operations may be materially adversely affected in that period.

9

We operate in a highly competitive industry and may lose market share or experience margin erosion if we are unable to compete effectively.

We compete on the basis of product quality and palatability, brand awareness and loyalty, product variety and ingredients, interesting product names, product packaging and package design, reputation, price and promotional efforts. We compete with a significant number of companies of varying sizes, including divisions or subsidiaries of larger companies who may have greater financial resources and larger customer bases than we have. As a result, these competitors may be able to identify and adapt to changes in consumer preferences more quickly than us due to their resources and scale. They may also be more successful in marketing and selling their products, better able to increase prices to reflect cost pressures and better able to increase their promotional activity, which may impact us and the entire pet food industry. If these competitive pressures cause our products to lose market share or experience margin erosion, our business, financial conditions and results of operations may be materially adversely affected.

We may face issues with respect to raw materials and other supplies, including increased costs, disruptions of supply, shortages, contaminations, adulterations or mislabeling.

The Company’s key raw material ingredients include meat and fish. We and our contract manufacturers use various raw materials and other supplies in our business, including ingredients, packaging materials and fuel. The prices of our raw materials and other supplies are subject to fluctuations attributable to, among other things, changes in supply and demand of crops or other commodities, weather conditions, agricultural uncertainty or governmental incentives and controls. We generally do not have long-term supply contracts with our ingredient suppliers. The length of the contracts is fixed for a period of time, typically up to a year or for a season and/or a crop year. In addition, some of our raw materials are sourced from a limited number of suppliers. We may not be able to renew or enter into new contracts with our existing suppliers following the expiration of such contracts on commercially reasonable terms, or at all. If commodity prices increase, we may not be able to increase our prices to offset these increased costs. Moreover, our competitors may be better able than we are to implement productivity initiatives or effect price increases or to otherwise pass along cost increases to their customers. Some of the raw materials we use are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes and pestilences and may be impacted by climate change and other factors. Adverse weather conditions and natural disasters can reduce crop size and crop quality, which in turn could reduce supplies of raw materials, increase the prices of raw materials, increase costs of storing raw materials and interrupt or delay our production schedules if harvests are delayed. Our competitors may not be impacted by such weather conditions and natural disasters depending on the location of their suppliers and operations. If any of our raw materials or supplies are alleged or proven to include contaminants affecting the safety or quality of our products, we may need to find alternate materials or supplies, delay production of our products, discard or otherwise dispose of our products, or engage in a product recall, all of which may have a materially adverse effect on our business, financial condition and results of operations. We may be unable to detect or prevent the use of ingredients which do not meet our quality standards if our ingredient suppliers engage in fraud or attempt to cover up or obscure deviations from our guidelines and procedures. Any such conduct by any of our suppliers may result in a loss of consumer confidence in our brand and products and a reduction in our sales if consumers perceive us as being untruthful in our marketing and advertising and may materially adversely affect our brand, reputation, business, financial condition and results of operations. If our sources of raw materials and supplies are terminated or affected by adverse prices, weather conditions or quality concerns, we may not be able to identify alternate sources of raw materials or other supplies that meet our quality controls and standards to sustain our sales volumes or on commercially reasonable terms, or at all.

We may not be able to manage our manufacturing and supply chain effectively which may adversely affect our results of operations.

We must accurately forecast demand for our products in order to ensure we have adequate available manufacturing capacity. Our forecasts are based on multiple assumptions which may cause our estimates to be inaccurate and affect our ability to obtain adequate manufacturing capacity (whether our own manufacturing capacity or contract manufacturing capacity) in order to meet the demand for our products, which could prevent us from meeting increased customer or consumer demand and harm our brand and our business. However, if we overestimate our demand and overbuild our capacity, we may have significantly underutilized assets and may experience reduced margins. If we do not accurately align our manufacturing capabilities with demand, our business, financial condition and results of operations may be materially adversely affected. In addition, we must continuously monitor our inventory and product mix against forecasted demand. If we underestimate demand, we risk having inadequate supplies. We also face the risk of having too much inventory on hand that may reach its expiration date and become unsaleable, and we may be forced to rely on markdowns or promotional sales to dispose of excess or slow-moving inventory. If we are unable to manage our supply chain effectively, our operating costs could increase and our profit margins could decrease.

10

Our market size estimate may prove to be inaccurate.

Data for the PRC and global pet food retail sales is collected for most, but not all channels, and as a result, it is difficult to estimate the size of the market and predict the rate at which the market for our products will grow, if at all. While our market size estimate was made in good faith and is based on assumptions and estimates we believe to be reasonable, this estimate may not be accurate.

Relocating some of our production facilities may adversely affect our results of operations.

The Company’s Canning Facility and Pude Facility are located in the old city of Huangdao District, Qingdao. The Company has learned that the local governmental authorities proposed plans to redevelop certain portions of the old city to allow for more residential dwellings in the area. In March 2018, we terminated the lease of the Canning facility in light of the implementation of this plan. The relocation of Canning facility had adverse material effect on the Company’s operations by, among other things, causing a decrease in our production capacity from 18 tons per day to 4.6 tons per day since March 2018. If and to the extent we may be required to relocate the Pude Facility in the future, our results of operations may also be adversely affected.

We may face difficulties as we expand into countries in which we have no prior operating experience.

We intend to continue to expand our domestic and global footprint by entering into new markets. As we expand our business in China and into new countries we may encounter foreign economic, political, regulatory, personnel, technological, language barriers and other risks that increase our expenses or delay our ability to become profitable in such countries. These risks include:

| ● | fluctuations in currency exchange rates; |

| ● | the difficulty of enforcing agreements and collecting receivables through some foreign legal systems; |

| ● | customers in some foreign countries potentially having longer payment cycles; |

| ● | changes in local tax laws, tax rates in some countries that may exceed those of the United States or Canada and lower earnings due to withholding requirements or the imposition of tariffs, exchange controls or other restrictions; |

| ● | seasonal reductions in business activity; |

| ● | the credit risk of local customers and distributors; |

| ● | general economic and political conditions; |

| ● | unexpected changes in legal, regulatory or tax requirements; |

| ● | differences in language, culture and trends in foreign countries with respect to pets and pet care; |

11

| ● | the risk that certain governments may adopt regulations or take other actions that would have a direct or indirect adverse impact on our business and market opportunities, including nationalization of private enterprise; and |

| ● | non-compliance with applicable currency exchange control regulations, transfer pricing regulations or other similar regulations. |

In addition, our expansion into new countries may require significant resources and the efforts and attention of our management and other personnel, which will divert resources from our existing business operations. We may seek to grow our business through acquisitions of or investments in new or complementary businesses, facilities, technologies or products, or through strategic alliances, and the failure to manage acquisitions, investments or strategic alliances, or the failure to integrate them with our existing business, could have a material adverse effect on us. From time to time we may consider opportunities to acquire or make investments in new or complementary businesses, facilities, technologies or products, or enter into strategic alliances, that may enhance our capabilities, expand our manufacturing network, complement our current products or expand the breadth of our markets.

Potential and completed acquisitions and investments and other strategic alliances involve numerous risks, including:

| ● | problems assimilating the purchased business, facilities, technologies or products; |

| ● | issues maintaining uniform standards, procedures, controls and policies; |

| ● | unanticipated costs associated with acquisitions, investments or strategic alliances; |

| ● | diversion of management’s attention from our existing business; |

| ● | adverse effects on existing business relationships with suppliers, contract manufacturers, retail partners and distribution customers; |

| ● | risks associated with entering new markets in which we have limited or no experience; |

| ● | potential loss of key employees of acquired businesses; and |

| ● | increased legal and accounting compliance costs. |

We do not know if we will be able to identify acquisitions or strategic relationships we deem suitable, whether we will be able to successfully complete any such transactions on favorable terms or at all or whether we will be able to successfully integrate any acquired business, facilities, technologies or products into our business or retain any key personnel, suppliers or customers. Our ability to successfully grow through strategic transactions depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, facilities, technologies and products and to obtain any necessary financing. These efforts could be expensive and time-consuming and may disrupt our ongoing business and prevent management from focusing on our operations. If we are unable to integrate any acquired businesses, facilities, technologies and products effectively, our business, results of operations and financial condition could be materially adversely affected.

Our online activities are dependent on our ability to access the Internet and operate online in a fast, secure and reliable manner.

We utilize online sale and multi-brand, multi-store brand sale strategies which use Tmall.com, JD.com and 1688 as our marketing platforms. Although we suspended our overseas e-commerce business since 2019, we are still preparing to expand our domestic e-commerce business in the near future. Our PRC marketing group has established a comprehensive network of various brand shops. Our online activities are dependent on our ability to operate online in a fast, secure and reliable manner which may be adversely affected as a result of PRC governmental regulations of e-commerce and other services, electronic devices, and competition and restrictive governmental actions. In addition, we may face risks relating to the governmental laws and regulations regarding consumer and data protection, privacy, network security, payments, and restrictions on pricing or discounts, as well as lower levels of consumer access, use of and spending on the Internet. Occurrence of any of the foregoing events (or a combination thereof) could have a material adverse effect on our ability to conduct online business, our financial condition and results of operations.

12

Failure to protect our intellectual property could harm our competitive position or require us to incur significant expenses to enforce our rights.

Our trademarks are valuable assets that support our brand and consumers’ perception of our products. We rely on trademark, copyright, trade secret, patent and other intellectual property laws, as well as nondisclosure and confidentiality agreements and other methods, to protect our trademarks, trade names, proprietary information, technologies and processes. Our non-disclosure agreements and confidentiality agreements may not effectively prevent disclosure of our proprietary information, technologies and processes and may not provide an adequate remedy in the event of unauthorized disclosure of such information, which could harm our competitive position. In addition, effective patent, copyright, trademark and trade secret protection may be unavailable or limited for some of our trademarks and patents in some foreign countries. We may need to engage in litigation or similar activities to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of proprietary rights of others. Any such litigation could require us to expend significant resources and divert the efforts and attention of our management and other personnel from our business operations. If we fail to protect our intellectual property, our business, financial condition and results of operations may be materially adversely affected.

We may be subject to intellectual property infringement claims or other allegations, which could result in substantial damages and diversion of management’s efforts and attention.

While we believe that our products do not infringe in any material respect upon proprietary rights of other parties and/or that meritorious defenses would exist with respect to any assertions to the contrary, we may from time to time be found to infringe on the proprietary rights of others. If patents later issue on these applications, we may be found liable for subsequent infringement. Any claims that our products or processes infringe these rights, regardless of their merit or resolution, could be costly and may divert the efforts and attention of our management and technical personnel. We may not prevail in such proceedings given the complex technical issues and inherent uncertainties in intellectual property litigation. If such proceedings result in an adverse outcome, we could, among other things, be required to:

| ● | pay substantial damages; |

| ● | cease the manufacture, use or sale of the infringing products; |

| ● | discontinue the use of the infringing processes; |

| ● | expend significant resources to develop non-infringing processes; and |

| ● | enter into licensing arrangements from the third party claiming infringement, which may not be available on commercially reasonable terms, or may not be available at all. |

If any of the foregoing occurs, our ability to compete could be affected or our business, financial condition and results of operations may be materially adversely affected.

13

Our success depends on our ability to attract and retain key employees and the succession of senior management.

Due to decreased business scale since late 2019 which was further affected by COVID-19, the Company dismissed certain employee and currently only maintains 42 full-time employees as of the date of this filing. However, in order to recover our business operations and achieve our turnaround goal, we may need effectively recruit, train and motivate a large number of new employees. Our continued growth and success require us to hire, retain and develop our leadership bench. If we are unable to attract and retain talented, highly qualified senior management and other key executives, as well as provide for the succession of senior management, our growth and results of operations may be adversely impacted.

Risks Related to the Restaurant Segment

The ongoing COVID-19 pandemic may continue to adversely affect, our operations, financial condition, liquidity and financial results.

In response to the Covid-19 outbreak, many state and local authorities had mandated the temporary closure of non-essential businesses and dine-in restaurant activity or limited indoor dining capacities. COVID-19 and the government measures taken to control it have caused a significant disruption to our business of Bo Lings. As of the filing date of this Annual Report on Form 20-F, we had Bo Lings operating at 100% indoor dining capacity. However, there can be no assurance that developments with respect to the COVD-19 pandemic and government measures taken to control it will not adversely affect our operations and financial results.

Our Bo Lings restaurant is located in Kansas. As a result of our concentration in this market, we may be disproportionately affected by any increased severity of the pandemic and heightened regulatory measures in Kansas compared to other chain restaurants with a broader national footprint.

A prolonged occurrence of COVID-19 may result in restaurant re-closures, prohibition on indoor dining, and further restrictions, including possible travel restrictions and additional restrictions on the restaurant industry. Our efforts to mitigate the effect of COVID-19 on our business or the economic downturn may be unsuccessful, and we may not be able to commence operations in a timeframe that is sufficient or otherwise take actions in response to developments with regard to the pandemic. The future sales levels of Bo Lings and our ability to implement our growth strategy remain highly uncertain, as the full impact and duration of the COVID-19 pandemic continues to evolve.

Social distancing measures and changes in consumer behavior as a result of COVID-19 have affected and may materially and adversely affect Bo Lings.