UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1681

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Reports to Stockholders.

| (a) |

Horizon Kinetics ETFs

Horizon Kinetics Inflation Beneficiaries ETF (INFL)

Horizon Kinetics Blockchain Development ETF (BCDF)

Horizon Kinetics Medical ETF (MEDX)

Horizon Kinetics SPAC Active ETF (SPAQ)

Horizon Kinetics Energy and Remediation ETF (NVIR)

SEMI-ANNUAL REPORT

June 30, 2023

(Unaudited)

Horizon Kinetics ETFs

Table of Contents

(Unaudited)

Shareholder Expense Example |

2 |

Schedules of Investments |

4 |

Statements of Assets and Liabilities |

13 |

Statements of Operations |

15 |

Statements of Changes in Net Assets |

17 |

Financial Highlights |

22 |

Notes to Financial Statements |

29 |

Supplemental Information |

40 |

Board Consideration and Approval of Advisory and Sub-Advisory Agreements |

42 |

Review of Liquidity Risk Management Program |

46 |

1

Horizon Kinetics ETFs

Shareholder Expense Example

(Unaudited)

As a shareholder of the Funds you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (January 1, 2023 to June 30, 2023).

ACTUAL EXPENSES

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning |

Ending |

Annualized |

Expenses |

|

Horizon Kinetics Inflation Beneficiaries ETF |

||||

Actual |

$ 1,000.00 |

$ 979.70 |

0.85% |

$ 4.17 |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

$ 1,020.58 |

0.85% |

$ 4.26 |

Horizon Kinetics Blockchain Development ETF |

|

|

|

|

Actual |

$ 1,000.00 |

$ 1,097.00 |

0.85% |

$ 4.42 |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

$ 1,020.58 |

0.85% |

$ 4.26 |

Horizon Kinetics Medical ETF |

|

|

|

|

Actual |

$ 1,000.00 |

$ 969.90 |

0.93% |

$ 4.54 |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

$ 1,020.18 |

0.93% |

$ 4.66 |

Horizon Kinetics SPAC Active ETF |

|

|

|

|

Actual |

$ 1,000.00 |

$ 1,034.30 |

0.86% |

$ 4.34 |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

$ 1,020.53 |

0.86% |

$ 4.31 |

|

(1) |

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the six-month period). |

2

Horizon Kinetics ETFs

Shareholder Expense Example

(Unaudited) (Continued)

Hypothetical |

Beginning |

Ending |

Annualized |

Expenses |

|

Horizon Kinetics Energy and Remediation ETF |

|||||

Actual |

N/A |

$ 1,000.00 |

$ 1,014.90 |

0.85% |

$ 3.05(1) |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

N/A |

$ 1,020.58 |

0.85% |

$ 3.29(2) |

|

^ |

Fund commenced operations on February 21, 2023. |

|

(1) |

Actual expenses are calculated using the Fund’s annualized expense ratio multiplied by the average account value during the period, multiplied by the number of days since inception, 130 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

|

(2) |

Hypothetical expenses are calculated using the Fund’s annualized expense ratio multiplied by the average account value during the period, multiplied by the number of days in the most recent six-month period, 181 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

3

Horizon Kinetics Inflation Beneficiaries ETF

Schedule of Investments

June 30, 2023 (Unaudited)

|

Shares |

Value |

||||||

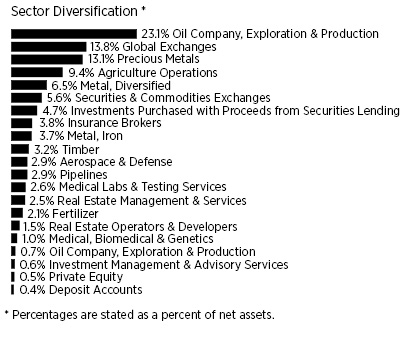

COMMON STOCKS — 98.8% |

||||||||

Aerospace & Defense — 2.9% |

||||||||

CACI International, Inc. - Class A (a) |

89,305 | $ | 30,438,716 | |||||

Agriculture Operations — 9.4% |

||||||||

Archer-Daniels-Midland Co. |

627,238 | 47,394,103 | ||||||

Bunge Ltd. (b) |

345,015 | 32,552,165 | ||||||

Clarkson PLC (b) |

92,250 | 3,471,528 | ||||||

Wilmar International Ltd. (b) |

4,945,217 | 13,885,414 | ||||||

| 97,303,210 | ||||||||

Fertilizer — 2.1% |

||||||||

Nutrien Ltd. |

369,807 | 21,837,103 | ||||||

Global Exchanges — 13.7% |

||||||||

ASX Ltd. (b) |

639,742 | 26,828,206 | ||||||

Aurubis AG (b) |

285,030 | 24,423,413 | ||||||

Deutsche Boerse AG (b) |

177,162 | 32,684,291 | ||||||

Japan Exchange Group, Inc. (b) |

432,656 | 7,507,533 | ||||||

Singapore Exchange Ltd. (b) |

3,937,403 | 27,959,096 | ||||||

TMX Group Ltd. (a)(b) |

1,008,395 | 22,716,989 | ||||||

| 142,119,528 | ||||||||

Insurance Brokers — 3.7% |

||||||||

Marsh & McLennan Cos., Inc. |

205,880 | 38,721,910 | ||||||

Investment Management & Advisory Services — 0.6% |

||||||||

Sprott, Inc. (b)(d) |

201,384 | 6,524,842 | ||||||

Medical Labs & Testing Services — 2.6% |

||||||||

Charles River Laboratories International, Inc. (a) |

129,102 | 27,143,696 | ||||||

Medical, Biomedical & Genetics — 1.0% |

||||||||

Royalty Pharma PLC - Class A (b) |

332,839 | 10,231,471 | ||||||

Metal, Diversified — 6.5% |

||||||||

Altius Minerals Corp. (a)(b) |

508,108 | 8,409,269 | ||||||

Cameco Corp. (b) |

660,074 | 20,680,119 | ||||||

Glencore PLC (b) |

6,785,296 | 38,344,509 | ||||||

| 67,433,897 | ||||||||

Metal, Iron — 3.7% |

||||||||

Deterra Royalties Ltd. (b) |

6,336,092 | 19,401,063 | ||||||

Labrador Iron Ore Royalty Corp. (a)(b)(d) |

322,206 | 7,567,854 | ||||||

Mesabi Trust |

550,552 | 11,236,766 | ||||||

| 38,205,683 | ||||||||

Oil Company, Exploration & Production — 23.1% |

||||||||

Permian Basin Royalty Trust |

1,100,830 | 27,443,692 | ||||||

PrairieSky Royalty, Ltd. (a)(b)(d) |

3,545,419 | 62,053,205 | ||||||

Sabine Royalty Trust |

26,628 | 1,755,850 | ||||||

San Juan Basin Royalty Trust (d) |

106,929 | 794,482 | ||||||

Sitio Royalties Corp. (d) |

1,629,860 | 42,816,422 | ||||||

Texas Pacific Land Corp. |

36,945 | 48,638,093 | ||||||

Topaz Energy Corp. (a)(b) |

525,495 | 8,192,679 | ||||||

Viper Energy Partners LP |

1,764,183 | 47,333,030 | ||||||

| 239,027,453 | ||||||||

Pipelines — 2.9% |

||||||||

Cheniere Energy, Inc. |

197,540 | 30,097,194 | ||||||

Precious Metals — 13.1% |

||||||||

Franco-Nevada Corp. (b) |

311,454 | 44,413,341 | ||||||

Metalla Royalty & Streaming Ltd. (a)(b) |

390,000 | 1,692,600 | ||||||

Osisko Gold Royalties Ltd. (b) |

1,786,644 | 27,460,718 | ||||||

Sandstorm Gold Ltd. (b) |

2,233,668 | 11,436,380 | ||||||

Wheaton Precious Metals Corp. (b) |

1,164,617 | 50,334,747 | ||||||

| 135,337,786 | ||||||||

Private Equity — 0.5% |

||||||||

Brookfield Asset Management Ltd. (b) |

158,303 | 5,165,427 | ||||||

Real Estate Management & Services — 2.5% |

||||||||

CBRE Group, Inc. - Class A (a) |

321,346 | 25,935,836 | ||||||

Real Estate Operators & Developers — 1.5% |

||||||||

The St. Joe Co. |

319,308 | 15,435,349 | ||||||

Securities & Commodities Exchanges — 5.6% |

||||||||

CME Group, Inc. |

85,436 | 15,830,436 | ||||||

Intercontinental Exchange, Inc. |

375,035 | 42,408,958 | ||||||

| 58,239,394 | ||||||||

The accompanying notes are an integral part of the financial statements.

4

Horizon Kinetics Inflation Beneficiaries ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

|

Shares |

Value |

||||||

Timber — 3.2% |

||||||||

West Fraser Timber Co. Ltd. (b) |

386,866 | $ | 33,262,739 | |||||

TOTAL COMMON STOCKS (Cost $1,067,216,208) |

1,022,461,234 | |||||||

PARTNERSHIPS — 0.7% |

||||||||

Oil Company, Exploration & Production — 0.7% |

||||||||

Dorchester Minerals LP |

241,755 | 7,242,980 | ||||||

TOTAL PARTNERSHIPS (Cost $2,002,583) |

7,242,980 | |||||||

SHORT TERM INVESTMENTS — 0.4% |

||||||||

Deposit Accounts — 0.4% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

4,101,288 | 4,101,288 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $4,101,288) |

4,101,288 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 4.7% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

48,266,085 | 48,266,085 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $48,266,085) |

48,266,085 | |||||||

TOTAL INVESTMENTS — 104.6% (Cost $1,121,586,164) |

1,082,071,587 | |||||||

Other assets and liabilities, net — (4.6)% |

(47,612,670 | ) | ||||||

NET ASSETS — 100.0% |

$ | 1,034,458,917 | ||||||

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

All or a portion of this security is on loan as of June 30, 2023. The market value of securities out on loan is $46,505,935. |

COUNTRY |

Percentage of |

|||

United States |

50.6 | % | ||

Canada |

26.1 | %* | ||

Germany |

5.5 | % | ||

Australia |

4.5 | % | ||

Singapore |

4.0 | % | ||

Jersey |

3.7 | % | ||

Bermuda |

3.1 | % | ||

United Kingdom |

1.3 | % | ||

Japan |

0.7 | % | ||

Total Country |

99.5 | % | ||

SHORT-TERM INVESTMENTS |

0.4 | % | ||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

4.7 | % | ||

TOTAL INVESTMENTS |

104.6 | % | ||

Other assets and liabilities, net |

(4.6 | )% | ||

NET ASSETS |

100.0 | % | ||

|

* |

To the extent the Fund invests more heavily in particular countries, its performance will be especially sensitive to developments that significantly affect those countries. |

The accompanying notes are an integral part of the financial statements.

5

Horizon Kinetics Blockchain Development ETF

Schedule of Investments

June 30, 2023 (Unaudited)

|

Shares |

Value |

||||||

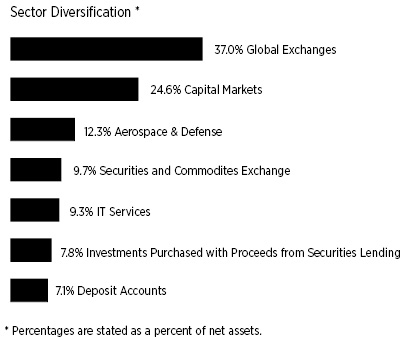

COMMON STOCKS — 92.9% |

||||||||

Aerospace & Defense — 12.3% |

||||||||

Science Applications International Corp. |

1,335 | $ | 150,161 | |||||

CACI International, Inc. - Class A (a) |

535 | 182,350 | ||||||

| 332,511 | ||||||||

Capital Markets — 24.6% |

||||||||

Bakkt Holdings, Inc.(a)(d) |

69,965 | 86,057 | ||||||

Galaxy Digital Holdings Ltd.(a)(b) |

28,655 | 124,083 | ||||||

MarketAxess Holdings, Inc. |

305 | 79,733 | ||||||

OTC Markets Group, Inc. |

725 | 41,760 | ||||||

Tradeweb Markets, Inc. - Class A |

1,253 | 85,806 | ||||||

Urbana Corp. - Class A (b) |

44,882 | 128,210 | ||||||

WisdomTree Investments, Inc. |

17,630 | 120,942 | ||||||

| 666,591 | ||||||||

Global Exchanges — 37.0% (e) |

||||||||

ASX, Ltd. (b) |

3,085 | 129,373 | ||||||

Cboe Global Markets, Inc. |

1,010 | 139,390 | ||||||

Deutsche Boerse AG (b) |

935 | 172,496 | ||||||

Japan Exchange Group, Inc. (b) |

6,770 | 117,474 | ||||||

London Stock Exchange Group PLC (b) |

1,265 | 134,546 | ||||||

Nasdaq, Inc. |

900 | 44,865 | ||||||

Singapore Exchange, Ltd. (b) |

17,910 | 127,177 | ||||||

TMX Group, Ltd. (b) |

6,035 | 135,956 | ||||||

| 1,001,277 | ||||||||

IT Services — 9.3% |

||||||||

Applied Digital Corp. (a)(d) |

14,470 | 135,295 | ||||||

Digital Garage, Inc. (b) |

4,390 | 116,481 | ||||||

| 251,776 | ||||||||

Securities & Commodities Exchanges — 9.7% |

||||||||

CME Group, Inc. |

630 | 116,733 | ||||||

Intercontinental Exchange, Inc. |

1,280 | 144,742 | ||||||

| 261,475 | ||||||||

TOTAL COMMON STOCKS (Cost $2,438,232) |

2,513,630 | |||||||

SHORT TERM INVESTMENTS — 7.1% |

||||||||

Deposit Accounts — 7.1% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

191,900 | 191,900 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $191,900) |

191,900 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 7.8% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

211,470 | 211,470 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $211,470) |

211,470 | |||||||

TOTAL INVESTMENTS (Cost $2,841,602) — 107.8% |

2,917,000 | |||||||

Other assets and liabilities, net — (7.8)% |

(211,333 | ) | ||||||

NET ASSETS — 100.0% |

$ | 2,705,667 | ||||||

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

All or a portion of this security is on loan as of June 30, 2023. The market value of securities out on loan is $218,649. |

|

(e) |

To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

The accompanying notes are an integral part of the financial statements.

6

Horizon Kinetics Blockchain Development ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

COUNTRY |

Percentage of |

|||

United States |

49.1 | % | ||

Canada |

14.3 | % | ||

Japan |

8.6 | % | ||

Germany |

6.4 | % | ||

United Kingdom |

5.0 | % | ||

Australia |

4.8 | % | ||

Singapore |

4.7 | % | ||

Total Country |

92.9 | % | ||

SHORT-TERM INVESTMENTS |

7.1 | % | ||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

7.8 | % | ||

TOTAL INVESTMENTS |

107.8 | % | ||

Other assets and liabilities, net |

(7.8 | )% | ||

NET ASSETS |

100.0 | % | ||

The accompanying notes are an integral part of the financial statements.

7

Horizon Kinetics Medical ETF

Schedule of Investments

June 30, 2023 (Unaudited)

|

Shares |

Value |

||||||

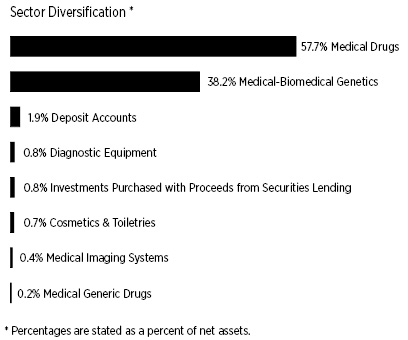

COMMON STOCKS — 98.0% |

||||||||

Cosmetics & Toiletries — 0.7% |

||||||||

Haleon PLC (b)(e) |

14,673 | $ | 122,960 | |||||

Diagnostic Equipment — 0.8% |

||||||||

Pacific Biosciences of California, Inc.(a) |

12,000 | 159,600 | ||||||

Medical Imaging Systems — 0.4% |

||||||||

GE HealthCare Technologies, Inc. |

1,000 | 81,240 | ||||||

Medical-Biomedical/Genetics — 38.2% (g) |

||||||||

2seventy bio, Inc.(a) |

18,000 | 182,160 | ||||||

Allogene Therapeutics, Inc.(a) |

20,000 | 99,400 | ||||||

Alnylam Pharmaceuticals, Inc.(a) |

3,000 | 569,820 | ||||||

Amgen, Inc. |

3,500 | 777,070 | ||||||

Beam Therapeutics, Inc.(a) |

10,000 | 319,300 | ||||||

Bicycle Therapeutics PLC (a)(b) |

15,000 | 382,800 | ||||||

Biogen, Inc.(a) |

3,250 | 925,762 | ||||||

Bluebird Bio, Inc.(a) |

38,000 | 125,020 | ||||||

CRISPR Therapeutics AG (a)(b) |

11,000 | 617,540 | ||||||

Editas Medicine, Inc.(a) |

33,000 | 271,590 | ||||||

Gilead Sciences, Inc. |

9,000 | 693,630 | ||||||

Immune Pharmaceuticals, Inc. (a)(d)(f) |

1 | — | ||||||

Intellia Therapeutics, Inc.(a) |

15,000 | 611,700 | ||||||

Ionis Pharmaceuticals, Inc.(a) |

13,000 | 533,390 | ||||||

Lantern Pharma, Inc.(a) |

30,000 | 169,200 | ||||||

Rain Oncology, Inc.(a)(e) |

25,000 | 30,000 | ||||||

Regeneron Pharmaceuticals, Inc.(a) |

750 | 538,905 | ||||||

Replimune Group, Inc.(a) |

15,000 | 348,300 | ||||||

Salarius Pharmaceuticals, Inc.(a) |

32,400 | 48,276 | ||||||

| 7,243,863 | ||||||||

Medical-Drugs — 57.7% (g) |

||||||||

AbbVie, Inc. |

8,000 | 1,077,840 | ||||||

Alkermes PLC (a)(b) |

24,000 | 751,200 | ||||||

AstraZeneca PLC (b) |

13,000 | 930,410 | ||||||

Bristol-Myers Squibb Co. |

18,500 | 1,183,075 | ||||||

Eli Lilly & Co. |

3,500 | 1,641,430 | ||||||

Galectin Therapeutics, Inc.(a) |

56,000 | 80,640 | ||||||

GSK PLC (b) |

11,738 | 418,342 | ||||||

Johnson & Johnson |

6,000 | 993,120 | ||||||

Merck & Co, Inc. |

7,000 | 807,730 | ||||||

Novartis AG (b) |

10,000 | 1,009,100 | ||||||

Organon & Co. |

8,400 | 174,804 | ||||||

Pfizer, Inc. |

27,000 | 990,360 | ||||||

Sanofi (b) |

13,000 | 700,700 | ||||||

Vanda Pharmaceuticals, Inc.(a) |

27,000 | 177,930 | ||||||

| 10,936,681 | ||||||||

Medical-Generic Drugs — 0.2% |

||||||||

Viatris, Inc. |

3,722 | 37,146 | ||||||

TOTAL COMMON STOCKS (Cost $12,089,420) |

18,581,490 | |||||||

SHORT TERM INVESTMENTS — 1.9% |

||||||||

Deposit Accounts — 1.9% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% |

363,228 | 363,228 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $363,228) |

363,228 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 0.8% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

153,721 | 153,721 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $153,721) |

153,721 | |||||||

TOTAL INVESTMENTS — 100.7% (Cost $12,606,369) |

19,098,439 | |||||||

Other assets and liabilities, net — (0.7)% |

(127,336 | ) | ||||||

NET ASSETS — 100.0% |

$ | 18,971,103 | ||||||

Percentages are stated as a percent of net assets.

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

Security has been deemed illiquid according to the Fund’s liquidity guidelines. The value of this security totals $0, which represents 0.00% of total net assets. |

|

(e) |

All or a portion of this security is on loan as of June 30, 2023. The market value of securities out on loan is $150,768. |

The accompanying notes are an integral part of the financial statements.

8

Horizon Kinetics Medical ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

|

(f) |

Value determined based on estimated fair value. The value of this security totals $0, which represents 0.00% of total net assets. Classified as Level 3 in the fair value hierarchy. Please refer to Note #2 of the Notes to Financial Statements. |

|

(g) |

To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

The accompanying notes are an integral part of the financial statements.

9

Horizon Kinetics SPAC Active ETF

Schedule of Investments

June 30, 2023 (Unaudited)

|

Shares |

Value |

||||||

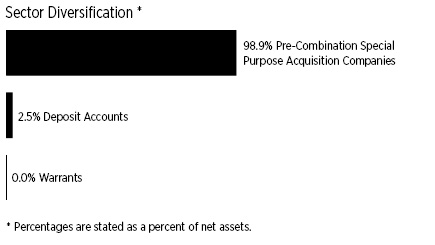

COMMON STOCKS — 98.9% |

||||||||

Pre-Combination Special Purpose Acquisition Companies — 98.9% (a) |

||||||||

Alchemy Invts Acquisitn Corp. - Class A |

50,000 | $ | 509,250 | |||||

Andretti Acquisition Corp.(b) |

40,015 | 425,760 | ||||||

Aura FAT Projects Acquisition Corp.(b) |

17,775 | 188,059 | ||||||

Bilander Acquisition Corp. |

39,258 | 398,469 | ||||||

Bukit Jalil Global Acquisition 1 Ltd. - Unit (b) |

50,000 | 509,000 | ||||||

Cartesian Growth Corp.II (b) |

66,614 | 710,771 | ||||||

Chenghe Acquisition Co. (b) |

56,381 | 603,277 | ||||||

Consilium Acquisition Corp I Ltd.(b) |

67,251 | 705,799 | ||||||

Conyers Park III Acquisition Corp. |

69,000 | 705,180 | ||||||

Elliott Opportunity II Corp. (b) |

39,244 | 406,568 | ||||||

Embrace Change Acquisition Corp. (b) |

34,624 | 366,322 | ||||||

Enphys Acquisition Corp. |

68,296 | 709,595 | ||||||

ESH Acquisition Corp. - Unit |

40,000 | 405,600 | ||||||

Everest Consolidator Acquisition Corp. |

41,949 | 446,757 | ||||||

Golden Star Acquisition Corp. - Unit (b) |

48,000 | 499,680 | ||||||

Gores Holdings IX, Inc. |

45,567 | 467,062 | ||||||

Infinite Acquisition Corp. (b) |

30,000 | 317,100 | ||||||

Inflection Point Acquisition Corp II - Unit (b) |

50,000 | 506,000 | ||||||

Investcorp Europe Acquisition Corp I (b) |

58,132 | 619,978 | ||||||

Kensington Capital Acquisition Corp V (b) |

76,426 | 807,058 | ||||||

KnightSwan Acquisition Corp. |

30,000 | 317,100 | ||||||

Live Oak Crestview Climate Acquisition Corp. |

68,117 | 698,199 | ||||||

Pearl Holdings Acquisition Corp. (b) |

45,278 | 478,136 | ||||||

Screaming Eagle Acquisition Corp. (b) |

58,159 | 600,782 | ||||||

SILVERspac, Inc. (b) |

52,015 | 540,436 | ||||||

SK Growth Opportunities Corp. (b) |

45,000 | 476,550 | ||||||

Spring Valley Acquisition Corp II (b) |

50,000 | 528,250 | ||||||

Waverley Capital Acquisition Corp 1 (b) |

20,821 | 215,914 | ||||||

TOTAL COMMON STOCKS (Cost $13,948,192) |

14,162,652 | |||||||

WARRANTS — 0.0% (c) |

||||||||

Alchemy Investments Acquisition Corp., Expiration: November 30, 2027, Exercise Price: $11.50 (b) |

25,000 | 4,625 | ||||||

TOTAL WARRANTS (Cost $3,632) |

4,625 | |||||||

SHORT TERM INVESTMENTS — 2.5% |

||||||||

Deposit Accounts — 2.5% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% |

359,483 | 359,483 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $359,483) |

359,483 | |||||||

TOTAL INVESTMENTS — 101.4% (Cost $14,311,307) |

14,526,760 | |||||||

Other assets and liabilities, net — (1.4)% |

(200,918 | ) | ||||||

NET ASSETS — 100.0% |

$ | 14,325,842 | ||||||

Percentages are stated as a percent of net assets.

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

Amount is less than 0.05%. |

COUNTRY |

Percentage of |

|||

United States |

24.0 | % | ||

Cayman Islands |

74.9 | %* | ||

Total Country |

98.9 | % | ||

SHORT-TERM INVESTMENTS |

2.5 | % | ||

TOTAL INVESTMENTS |

101.4 | % | ||

Other assets and liabilities, net |

(1.4 | )% | ||

NET ASSETS |

100.0 | % | ||

|

* |

To the extent the Fund invests more heavily in particular countries, its performance will be especially sensitive to developments that significantly affect those countries. |

The accompanying notes are an integral part of the financial statements.

10

Horizon Kinetics Energy and Remediation ETF

Schedule of Investments

June 30, 2023 (Unaudited)

|

Shares |

Value |

||||||

COMMON STOCKS — 93.8% |

||||||||

Chemical-Specialty — 2.0% |

||||||||

Ecolab, Inc. |

264 | $ | 49,286 | |||||

Diagnostic Equipment — 1.6% |

||||||||

Danaher Corp. |

164 | 39,360 | ||||||

Diagnostic Kits — 1.7% |

||||||||

IDEXX Laboratories, Inc. (a) |

84 | 42,187 | ||||||

Electronic Measure Instruments — 4.2% |

||||||||

Badger Meter, Inc. |

352 | 51,941 | ||||||

Itron, Inc. (a) |

736 | 53,066 | ||||||

| 105,007 | ||||||||

Engineering/R&D Services — 1.4% |

||||||||

Fluor Corp. (a) |

1,144 | 33,863 | ||||||

Machinery-Electrical — 1.8% |

||||||||

Franklin Electric Co, Inc. |

444 | 45,688 | ||||||

Machinery-Genral Industry — 1.6% |

||||||||

IDEX Corp. |

184 | 39,608 | ||||||

Machinery-Pumps — 5.3% |

||||||||

Flowserve Corp. |

1,196 | 44,431 | ||||||

Watts Water Technologies, Inc. |

236 | 43,360 | ||||||

Xylem, Inc./NY |

400 | 45,048 | ||||||

| 132,839 | ||||||||

Oil Company, Exploration & Production — 30.5%(f) |

||||||||

Chesapeake Energy Corp. |

1,140 | 95,395 | ||||||

ConocoPhillips |

880 | 91,177 | ||||||

Denbury, Inc. (a) |

1,120 | 96,611 | ||||||

Diamondback Energy, Inc. |

680 | 89,325 | ||||||

Oil Company, Exploration & Production — 30.5%(f) (continued) |

||||||||

EOG Resources, Inc. |

776 | 88,806 | ||||||

EQT Corp. |

2,964 | 121,909 | ||||||

Occidental Petroleum Corp. |

1,524 | 89,611 | ||||||

Pioneer Natural Resources Co. |

440 | 91,159 | ||||||

| 763,993 | ||||||||

Oil Company-Integrated — 3.2% |

||||||||

Suncor Energy, Inc. (b) |

2,772 | 81,275 | ||||||

Oil-Field Services — 17.9% |

||||||||

Calfrac Well Services, Ltd. (a)(b) |

9,548 | 27,708 | ||||||

CES Energy Solutions Corp. (b) |

19,764 | 39,132 | ||||||

Enerflex, Ltd. (b) |

6,660 | 45,421 | ||||||

Liberty Energy, Inc. |

2,772 | 37,062 | ||||||

Oil States International, Inc. (a) |

9,040 | 67,529 | ||||||

Schlumberger, Ltd. (b) |

1,692 | 83,111 | ||||||

Secure Energy Services, Inc. (b) |

6,964 | 33,366 | ||||||

STEP Energy Services, Ltd. (a)(b)(d) |

13,280 | 32,717 | ||||||

TETRA Technologies, Inc. (a) |

10,880 | 36,774 | ||||||

Trican Well Service, Ltd. (b) |

17,932 | 47,837 | ||||||

| 450,657 | ||||||||

Oil-U.S. Royalty Trusts — 10.9% |

||||||||

Permian Basin Royalty Trust (e) |

3,808 | 94,934 | ||||||

PrairieSky Royalty, Ltd. |

5,564 | 97,383 | ||||||

Sabine Royalty Trust |

173 | 11,408 | ||||||

San Juan Basin Royalty Trust (e) |

866 | 6,434 | ||||||

Texas Pacific Land Corp. |

48 | 63,192 | ||||||

| 273,351 | ||||||||

Pipelines — 7.6% |

||||||||

Cheniere Energy, Inc. |

628 | 95,682 | ||||||

The Williams Cos., Inc |

2,924 | 95,410 | ||||||

| 191,092 | ||||||||

Water Treatment Systems — 4.1% |

||||||||

Energy Recovery, Inc. (a) |

1,952 | 54,558 | ||||||

Pentair PLC |

756 | 48,838 | ||||||

| 103,396 | ||||||||

TOTAL COMMON STOCKS (Cost $2,326,752) |

2,351,602 | |||||||

SHORT TERM INVESTMENTS — 6.1% |

||||||||

Deposit Accounts — 6.1% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

153,883 | 153,883 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $153,883) |

153,883 | |||||||

The accompanying notes are an integral part of the financial statements.

11

Horizon Kinetics Energy and Remediation ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

|

Shares |

Value |

||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 0.7% |

||||||||

U.S. Bank Money Market Deposit Account, 5.35% (c) |

16,709 | $ | 16,709 | |||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $16,709) |

16,709 | |||||||

TOTAL INVESTMENTS — 100.6% (Cost $2,497,344) |

2,522,194 | |||||||

Other assets and liabilities, net — (0.6)% |

(14,438 | ) | ||||||

NET ASSETS — 100.0% |

$ | 2,507,756 | ||||||

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

|

(e) |

All or a portion of this security is on loan as of June 30, 2023. The market value of securities out on loan is $16,117. |

|

(f) |

To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

The accompanying notes are an integral part of the financial statements.

12

Horizon Kinetics ETFs

Statements of Assets and Liabilities

June 30, 2023 (Unaudited)

Horizon Kinetics |

Horizon Kinetics |

|||||||

Assets |

||||||||

Investments, at value(1)(2) |

$ | 1,082,071,587 | $ | 2,917,000 | ||||

Receivable for investment securities sold |

6,950,296 | — | ||||||

Dividends and interest receivable |

1,637,692 | 1,376 | ||||||

Securities lending income receivable |

12,107 | 643 | ||||||

Total assets |

1,090,671,682 | 2,919,019 | ||||||

Liabilities |

||||||||

Payable for collateral on securities loaned (Note 7) |

48,266,085 | 211,470 | ||||||

Payable to Custodian |

— | 12 | ||||||

Payable for Fund shares redeemed |

6,826,995 | — | ||||||

Payable to Adviser |

745,684 | 1,870 | ||||||

Payable for investment securities purchased |

374,001 | — | ||||||

Total liabilities |

56,212,765 | 213,352 | ||||||

Net Assets |

$ | 1,034,458,917 | $ | 2,705,667 | ||||

Net Assets Consists of: |

||||||||

Paid-in capital |

$ | 1,077,910,754 | $ | 2,985,298 | ||||

Total distributable earnings |

(43,451,837 | ) | (279,631 | ) | ||||

Net Assets |

$ | 1,034,458,917 | $ | 2,705,667 | ||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

33,825,000 | 125,000 | ||||||

Net Asset Value, redemption price and offering price per share |

$ | 30.58 | $ | 21.65 | ||||

(1) Includes loaned securities with a value of: |

$ | 46,505,935 | $ | 218,649 | ||||

(2) Cost of investments |

1,121,586,164 | 2,841,602 | ||||||

The accompanying notes are an integral part of the financial statements.

13

Horizon Kinetics ETFs

Statements of Assets and Liabilities

June 30, 2023 (Unaudited) (Continued)

Horizon Kinetics |

Horizon Kinetics |

Horizon Kinetics |

||||||||||

Assets |

||||||||||||

Investments, at value(1)(2) |

$ | 19,098,439 | $ | 14,526,760 | $ | 2,522,194 | ||||||

Dividends and interest receivable |

47,736 | 3,356 | 4,342 | |||||||||

Securities lending income receivable |

445 | — | 40 | |||||||||

Total assets |

19,146,620 | 14,530,116 | 2,526,576 | |||||||||

Liabilities |

||||||||||||

Payable for collateral on securities loaned (Note 7) |

153,721 | — | 16,709 | |||||||||

Payable to Adviser |

13,720 | 9,972 | 1,698 | |||||||||

Accrued expenses |

8,076 | 8,693 | — | |||||||||

Payable for investment securities purchased |

— | 185,609 | 413 | |||||||||

Total liabilities |

175,517 | 204,274 | 18,820 | |||||||||

Net Assets |

$ | 18,971,103 | $ | 14,325,842 | $ | 2,507,756 | ||||||

Net Assets Consists of: |

||||||||||||

Paid-in capital |

$ | 10,030,248 | $ | 14,248,842 | $ | 2,465,003 | ||||||

Total distributable earnings |

8,940,855 | 77,000 | 42,753 | |||||||||

Net Assets |

$ | 18,971,103 | $ | 14,325,842 | $ | 2,507,756 | ||||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

619,946 | 147,484 | 100,000 | |||||||||

Net Asset Value, redemption price and offering price per share |

$ | 30.60 | $ | 97.13 | $ | 25.08 | ||||||

(1) Includes loaned securities with a value of: |

$ | 150,768 | $ | — | $ | 16,117 | ||||||

(2) Cost of investments |

12,606,369 | 14,311,307 | 2,497,344 | |||||||||

The accompanying notes are an integral part of the financial statements.

14

Horizon Kinetics ETFs

Statements of Operations

For the Six Months Ended June 30, 2023 (Unaudited)

Horizon Kinetics |

Horizon Kinetics |

|||||||

Investment Income |

||||||||

Dividend income (net of withholding tax of $841,988 and $1,470, respectively) |

$ | 13,572,371 | $ | 22,932 | ||||

Interest income |

335,100 | 4,348 | ||||||

Securities lending income, net |

73,868 | 985 | ||||||

Total investment income |

13,981,339 | 28,265 | ||||||

Expenses |

||||||||

Investment advisory fees |

4,983,536 | 10,210 | ||||||

Total expenses |

4,983,536 | 10,210 | ||||||

Net investment income |

8,997,803 | 18,055 | ||||||

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency |

||||||||

Net realized gain (loss) on: |

||||||||

Investments |

3,098,121 | (111,313 | ) | |||||

Foreign currency transactions |

9,828 | (46 | ) | |||||

Net realized gain (loss) on investments and foreign currency transactions: |

3,107,949 | (111,359 | ) | |||||

Net change in unrealized appreciation/depreciation on: |

||||||||

Investments |

(41,213,421 | ) | 312,562 | |||||

Foreign currency translation |

1,481 | 5 | ||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

(41,211,940 | ) | 312,567 | |||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

(38,103,991 | ) | 201,208 | |||||

Net increase (decrease) in net assets from operations |

$ | (29,106,188 | ) | $ | 219,263 | |||

The accompanying notes are an integral part of the financial statements.

15

Horizon Kinetics ETFs

Statements of Operations

For the Period Ended June 30, 2023 (Unaudited) (Continued)

Horizon Kinetics |

Horizon Kinetics |

Horizon Kinetics |

||||||||||

Investment Income |

||||||||||||

Dividend income (net of withholding tax and issuance fees of $4,954, $0 and $974, respectively) |

$ | 218,466 | $ | — | $ | 22,100 | ||||||

Interest income |

21,299 | 29,082 | 2,421 | |||||||||

Securities lending income, net |

769 | — | 70 | |||||||||

Total investment income |

240,534 | 29,082 | 24,591 | |||||||||

Expenses |

||||||||||||

Investment advisory fees |

86,959 | 50,272 | 6,720 | |||||||||

Blue Sky Expense (2) |

18,250 | 23,659 | — | |||||||||

Legal Expense (2) |

13,812 | 5,868 | — | |||||||||

Other Expenses (2) |

12,474 | 7,509 | — | |||||||||

Total expenses |

131,495 | 87,308 | 6,720 | |||||||||

Less fees waived by the Adviser |

(42,468 | ) | (36,760 | ) | — | |||||||

Net Expenses |

89,027 | 50,548 | 6,720 | |||||||||

Net investment income (loss) |

151,507 | (21,466 | ) | 17,871 | ||||||||

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency |

||||||||||||

Net realized gain (loss) on: |

||||||||||||

Investments |

2,179,363 | (125,090 | ) | 25 | ||||||||

Foreign currency transactions |

— | — | 4 | |||||||||

Net realized gain (loss) on investments and foreign currency transactions: |

2,179,363 | (125,090 | ) | 29 | ||||||||

Net change in unrealized appreciation/depreciation on: |

||||||||||||

Investments |

(2,893,822 | ) | 529,567 | 24,850 | ||||||||

Foreign currency translation |

— | — | 4 | |||||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

(2,893,822 | ) | 529,567 | 24,854 | ||||||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

(714,459 | ) | 404,477 | 24,883 | ||||||||

Net increase (decrease) in net assets from operations |

$ | (562,952 | ) | $ | 383,011 | $ | 42,754 | |||||

|

(1) |

The Fund commenced operations on February 21, 2023. |

|

(2) |

Expenses are that of the Predecessor Funds (See Note #1 in the accompanying notes to these financial statements). |

The accompanying notes are an integral part of the financial statements.

16

Horizon Kinetics Inflation Beneficiaries ETF

Statements of Changes in Net Assets

Six Months |

Year |

|||||||

From Operations |

||||||||

Net investment income |

$ | 8,997,803 | $ | 21,211,514 | ||||

Net realized gain on investments and foreign currency transactions |

3,107,949 | 28,265,648 | ||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

(41,211,940 | ) | (48,077,330 | ) | ||||

Net increase (decrease) in net assets resulting from operations |

(29,106,188 | ) | 1,399,832 | |||||

From Distributions |

||||||||

Distributable earnings |

(8,408,897 | ) | (22,124,800 | ) | ||||

Total distributions |

(8,408,897 | ) | (22,124,800 | ) | ||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

26,617,590 | 640,032,713 | ||||||

Cost of shares redeemed |

(228,866,638 | ) | (213,596,625 | ) | ||||

Net increase (decrease) in net assets resulting from capital share transactions |

(202,249,048 | ) | 426,436,088 | |||||

Total Increase (Decrease) in Net Assets |

(239,764,133 | ) | 405,711,120 | |||||

Net Assets |

||||||||

Beginning of period |

1,274,223,050 | 868,511,930 | ||||||

End of period |

$ | 1,034,458,917 | $ | 1,274,223,050 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

40,500,000 | 27,825,000 | ||||||

Shares sold |

825,000 | 19,750,000 | ||||||

Shares redeemed |

(7,500,000 | ) | (7,075,000 | ) | ||||

Shares outstanding, end of period |

33,825,000 | 40,500,000 | ||||||

The accompanying notes are an integral part of the financial statements.

17

Horizon Kinetics Blockchain Development ETF

Statements of Changes in Net Assets

Six Months |

Period |

|||||||

From Operations |

||||||||

Net investment income |

$ | 18,055 | $ | 7,337 | ||||

Net realized loss on investments and foreign currency transactions |

(111,359 | ) | (261,629 | ) | ||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

312,567 | (237,168 | ) | |||||

Net increase (decrease) in net assets resulting from operations |

219,263 | (491,460 | ) | |||||

From Distributions |

||||||||

Distributable earnings |

— | (7,434 | ) | |||||

Total distributions |

— | (7,434 | ) | |||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

513,475 | 2,471,823 | ||||||

Cost of shares redeemed |

— | — | ||||||

Net increase in net assets resulting from capital share transactions |

513,475 | 2,471,823 | ||||||

Total Increase in Net Assets |

732,738 | 1,972,929 | ||||||

Net Assets |

||||||||

Beginning of period |

1,972,929 | — | ||||||

End of period |

$ | 2,705,667 | $ | 1,972,929 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

100,000 | — | ||||||

Shares sold |

25,000 | 100,000 | ||||||

Shares redeemed |

— | — | ||||||

Shares outstanding, end of period |

125,000 | 100,000 | ||||||

|

(1) |

The Fund commenced operations on August 1, 2022. |

The accompanying notes are an integral part of the financial statements.

18

Horizon Kinetics Medical ETF

Statements of Changes in Net Assets (1)

Six Months |

Year |

|||||||

From Operations |

||||||||

Net investment income |

$ | 151,507 | $ | 155,197 | ||||

Net realized gain on investments |

2,179,363 | 267,028 | ||||||

Net change in unrealized appreciation/depreciation on investments |

(2,893,822 | ) | 313,715 | |||||

Net increase (decrease) in net assets resulting from operations |

(562,952 | ) | 735,940 | |||||

From Distributions |

||||||||

Distributable earnings |

— | (316,610 | ) | |||||

Total distributions |

— | (316,610 | ) | |||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

1,561,025 | 3,533,428 | ||||||

Reinvestment of dividends |

— | 309,042 | ||||||

Cost of shares redeemed |

(1,306,495 | ) | (3,387,177 | ) | ||||

Redemption fees |

— | 15 | ||||||

Net increase in net assets resulting from capital share transactions |

254,530 | 455,308 | ||||||

Total Increase in Net Assets |

(308,422 | ) | 874,638 | |||||

Net Assets |

||||||||

Beginning of period |

19,279,525 | 18,404,887 | ||||||

End of period |

$ | 18,971,103 | $ | 19,279,525 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

611,165 | 1,273,051 | ||||||

Shares sold |

33,781 | 110,718 | ||||||

Shares reinvested |

— | 9,774 | ||||||

Shares redeemed |

(25,000 | ) | (782,378 | ) | ||||

Shares outstanding, end of period |

619,946 | 611,165 | ||||||

|

(1) |

For periods prior to the close of business on January 27, 2023, financial and other information shown herein for the Fund is that of the Kinetics Medical Fund. See Note #1. |

The accompanying notes are an integral part of the financial statements.

19

Horizon Kinetics SPAC Active ETF

Statements of Changes in Net Assets (1)

Six Months |

Year |

|||||||

From Operations |

||||||||

Net investment income (loss) |

$ | (21,466 | ) | $ | 73,142 | |||

Net realized gain (loss) on investments |

(125,090 | ) | 5,423 | |||||

Net change in unrealized appreciation/depreciation on investments |

529,567 | (401,371 | ) | |||||

Net increase (decrease) in net assets resulting from operations |

383,011 | (322,806 | ) | |||||

From Distributions |

||||||||

Distributable earnings |

— | (78,921 | ) | |||||

Total distributions |

— | (78,921 | ) | |||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

7,627,472 | 11,010,999 | ||||||

Reinvestment of dividends |

— | 73,690 | ||||||

Cost of shares redeemed |

(1,068,712 | ) | (11,579,783 | ) | ||||

Redemption fees |

— | 207 | ||||||

Net increase (decrease) in net assets resulting from capital share transactions |

6,558,760 | (494,887 | ) | |||||

Total Increase (Decrease) in Net Assets |

6,941,771 | (896,614 | ) | |||||

Net Assets |

||||||||

Beginning of period |

7,384,071 | 8,280,685 | ||||||

End of period |

$ | 14,325,842 | $ | 7,384,071 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

78,630 | 83,747 | ||||||

Shares sold |

80,000 | 117,291 | ||||||

Shares reinvested |

— | 783 | ||||||

Shares redeemed |

(11,146 | ) | (123,191 | ) | ||||

Shares outstanding, end of period |

147,484 | 78,630 | ||||||

|

(1) |

For periods prior to the close of business on January 27, 2023, financial and other information shown herein for the Fund is that of the Kinetics Alternative Income Fund. See Note #1. |

The accompanying notes are an integral part of the financial statements.

20

Horizon Kinetics Energy and Remediation ETF

Statement of Changes in Net Assets

Six Months |

||||

From Operations |

||||

Net investment income |

$ | 17,871 | ||

Net realized gain on investments and foreign currency transactions |

29 | |||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

24,854 | |||

Net increase in net assets resulting from operations |

42,754 | |||

From Capital Share Transactions |

||||

Proceeds from shares sold |

2,465,002 | |||

Net increase in net assets resulting from capital share transactions |

2,465,002 | |||

Total Increase in Net Assets |

2,507,756 | |||

Net Assets |

||||

Beginning of period |

— | |||

End of period |

$ | 2,507,756 | ||

Changes in Shares Outstanding |

||||

Shares outstanding, beginning of period |

— | |||

Shares sold |

100,000 | |||

Shares redeemed |

— | |||

Shares outstanding, end of period |

100,000 | |||

|

(1) |

The Fund commenced operations on February 21, 2023. |

The accompanying notes are an integral part of the financial statements.

21

Horizon Kinetics Inflation Beneficiaries ETF

Financial Highlights

For a Share Outstanding Throughout Each Period

Six Months |

Year |

Period |

||||||||||

Net Asset Value, Beginning of Period |

$ | 31.46 | $ | 31.21 | $ | 25.00 | ||||||

Income (Loss) from investment operations: |

||||||||||||

Net investment income (loss)(2) |

0.23 | 0.53 | 0.30 | |||||||||

Net realized and unrealized gain (loss) on investments |

(0.87 | ) | 0.24 | (8) | 6.19 | (8) | ||||||

Total from investment operations |

(0.64 | ) | 0.77 | 6.49 | ||||||||

Less distributions paid: |

||||||||||||

From net investment income |

(0.24 | ) | (0.52 | ) | (0.27 | ) | ||||||

From net realized gains |

— | — | (0.01 | ) | ||||||||

Total distributions paid |

(0.24 | ) | (0.52 | ) | (0.28 | ) | ||||||

Net Asset Value, End of Period |

$ | 30.58 | $ | 31.46 | $ | 31.21 | ||||||

Total return, at NAV(3)(5) |

(2.03 | )% | 2.57 | % | 26.05 | % | ||||||

Total return, at Market(4)(5) |

(2.13 | )% | 2.66 | % | 26.03 | % | ||||||

Supplemental Data and Ratios: |

||||||||||||

Net assets, end of period (000’s) |

$ | 1,034,459 | $ | 1,274,223 | $ | 868,512 | ||||||

Ratio of expenses to average net assets(6) |

0.85 | % | 0.85 | % | 0.85 | % | ||||||

Ratio of net investment income (loss) to average net assets(6) |

1.53 | % | 1.73 | % | 1.02 | % | ||||||

Portfolio turnover rate (5)(7) |

7 | % | 9 | % | 0 | % | ||||||

|

(1) |

The Fund commenced operations on January 11, 2021. |

|

(2) |

Per share net investment income (loss) was caclulated using average shares outstanding. |

|

(3) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, |

|

(4) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the New York Stock Exchange. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the New York Stock Exchange. |

|

(5) |

Not annualized for periods less than one year. |

|

(6) |

Annualized for periods less than one year. |

|

(7) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(8) |

Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share |

The accompanying notes are an integral part of the financial statements.

22

Horizon Kinetics Blockchain Development ETF

Financial Highlights

For a Share Outstanding Throughout Each Period

Six Months |

Period |

|||||||

Net Asset Value, Beginning of Period |

$ | 19.73 | $ | 25.23 | ||||

Income (Loss) from investment operations: |

||||||||

Net investment income (loss)(2) |

0.15 | 0.08 | ||||||

Net realized and unrealized gain (loss) on investments |

1.77 | (5.51 | ) | |||||

Total from investment operations |

1.92 | (5.43 | ) | |||||

Less distributions paid: |

||||||||

From net investment income |

— | (0.07 | ) | |||||

Total distributions paid |

— | (0.07 | ) | |||||

Net Asset Value, End of Period |

$ | 21.65 | $ | 19.73 | ||||

Total return, at NAV(3)(5) |

9.70 | % | (21.50 | )% | ||||

Total return, at Market(4)(5) |

9.72 | % | (21.31 | )% | ||||

Supplemental Data and Ratios: |

||||||||

Net assets, end of period (000’s) |

$ | 2,706 | $ | 1,973 | ||||

Ratio of expenses to average net assets(6) |

0.85 | % | 0.87 | %(8) | ||||

Ratio of net investment income (loss) to average net assets(6) |

1.50 | % | 0.90 | % | ||||

Portfolio turnover rate (5)(7) |

9 | % | 5 | % | ||||

|

(1) |

The Fund commenced operations on August 1, 2022. |

|

(2) |

Per share net investment income (loss) was caclulated using average shares outstanding. |

|

(3) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to the differences between the market price of the shares and the net asset value per share of the Fund. |

|

(4) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the New York Stock Exchange. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the New York Stock Exchange. |

|

(5) |

Not annualized for periods less than one year. |

|

(6) |

Annualized for periods less than one year. |

|

(7) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(8) |

Ratio of expenses to average net assets includes tax expense of 0.02% for the period ended December 31, 2022. |

The accompanying notes are an integral part of the financial statements.

23

Horizon Kinetics Medical ETF

Financial Highlights

For a Share Outstanding Throughout Each Period

Six Months |

Year |

Year |

Year |

Year |

Year |

|||||||||||||||||||

Net Asset Value, Beginning of Period |

$ | 31.55 | $ | 30.78 | $ | 28.13 | $ | 26.53 | $ | 23.47 | $ | 25.33 | ||||||||||||

Income (Loss) from investment operations: |

||||||||||||||||||||||||

Net investment income (loss)(1) |

0.24 | 0.27 | 0.25 | 0.29 | 0.33 | 0.27 | ||||||||||||||||||

Net realized and unrealized gain (loss) on investments |

(1.19 | ) | 1.02 | 2.73 | 2.11 | 3.43 | 0.12 | |||||||||||||||||

Total from investment operations |

(0.95 | ) | 1.29 | 2.98 | 2.40 | 3.76 | 0.39 | |||||||||||||||||

Capital share transactions: |

||||||||||||||||||||||||

Redemption Fees |

0.00 | 0.00 | (9) | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

Less distributions paid: |

||||||||||||||||||||||||

From net investment income |

— | (0.36 | ) | (0.26 | ) | (0.31 | ) | (0.35 | ) | (0.29 | ) | |||||||||||||

From net realized gains |

— | (0.16 | ) | (0.07 | ) | (0.49 | ) | (0.35 | ) | (1.96 | ) | |||||||||||||

Total distributions paid |

— | (0.52 | ) | (0.33 | ) | (0.80 | ) | (0.70 | ) | (2.25 | ) | |||||||||||||

Net Asset Value, End of Period |

$ | 30.60 | $ | 31.55 | $ | 30.78 | $ | 28.13 | $ | 26.53 | $ | 23.47 | ||||||||||||

Total return, at NAV(2)(4) |

(3.01 | )% | 4.21 | % | 10.59 | % | 9.04 | % | 16.04 | % | 1.67 | % | ||||||||||||

Total return, at Market(3)(4) |

(3.20 | )% | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

Supplemental Data and Ratios: |

||||||||||||||||||||||||

Net assets, end of period (000’s) |

$ | 18,971 | $ | 19,280 | $ | 16,188 | $ | 15,462 | $ | 15,442 | $ | 14,814 | ||||||||||||

Ratio of expenses to average net assets:(5) |

||||||||||||||||||||||||

Before expense reimbursement(7) |

1.38 | % | 2.21 | % | 2.18 | % | 2.26 | % | 2.34 | % | 2.23 | % | ||||||||||||

After expense reimbursement(7) |

0.93 | % | 1.39 | % | 1.39 | % | 1.39 | % | 1.39 | % | 1.39 | % | ||||||||||||

Ratio of net investment income (loss) to average net assets(5)(7) |

1.59 | % | 0.89 | % | 0.84 | % | 1.12 | % | 1.34 | % | 1.03 | % | ||||||||||||

Portfolio turnover rate (4)(6) |

1 | % | 3 | % | 1 | % | 7 | % | 6 | % | 0 | % | ||||||||||||

|

(1) |

Per share net investment income (loss) was caclulated using average shares outstanding. |

|

(2) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to the differences between the market price of the shares and the net asset value per share of the Fund. |

The accompanying notes are an integral part of the financial statements.

24

Horizon Kinetics Medical ETF

Financial Highlights

For a Share Outstanding Throughout Each Period (Continued)

|

(3) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the Nasdaq Stock Market. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the Nasdaq Stock Market. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These amounts would increase the net investment loss ratio or decrease the net investment income ratio, as applicable, had such reductions not occurred. See Note #3. |

|

(8) |

For periods prior to the close of business on January 27, 2023, financial and other information shown herein for the Fund is that of the Kinetics Medical Fund. See Note #1. |

|

(9) |

Amount calculated is less than $0.005. |

The accompanying notes are an integral part of the financial statements.

25

Horizon Kinetics SPAC Active ETF

Financial Highlights

For a Share Outstanding Throughout Each Period

Six Months |

Year |

Year |

Year |

Year |

Year |

|||||||||||||||||||

Net Asset Value, Beginning of Period |

$ | 93.91 | $ | 98.92 | $ | 100.24 | $ | 98.28 | $ | 97.46 | $ | 97.57 | ||||||||||||

Income (Loss) from investment operations: |

||||||||||||||||||||||||

Net investment income (loss)(1) |

(0.17 | ) | 0.89 | (0.15 | ) | 0.25 | 1.39 | 0.92 | ||||||||||||||||

Net realized and unrealized gain (loss) on investments |

3.39 | (4.92 | ) | (1.17 | ) | 1.91 | 1.01 | (0.03 | ) | |||||||||||||||

Total from investment operations |

3.22 | (4.03 | ) | (1.32 | ) | 2.16 | 2.40 | 0.89 | ||||||||||||||||

Capital share transactions: |

||||||||||||||||||||||||

Redemption Fees |

— | 0.00 | (9) | 0.00 | (9) | 0.02 | 0.00 | (9) | 0.01 | |||||||||||||||

Less distributions paid: |

||||||||||||||||||||||||

From net investment income |

— | (0.87 | ) | — | (0.22 | ) | (1.58 | ) | (1.01 | ) | ||||||||||||||

From net realized gains |

— | (0.11 | ) | — | — | — | — | |||||||||||||||||

Total distributions paid |

— | (0.98 | ) | — | (0.22 | ) | (1.58 | ) | (1.01 | ) | ||||||||||||||

Net Asset Value, End of Period |

$ | 97.13 | $ | 93.91 | $ | 98.92 | $ | 100.24 | $ | 98.28 | $ | 97.46 | ||||||||||||

Total return, at NAV(2)(4) |

3.43 | % | (4.07 | )% | (1.32 | )% | 2.23 | % | 2.47 | % | 0.92 | % | ||||||||||||

Total return, at Market(3)(4) |

3.45 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

Supplemental Data and Ratios: |

||||||||||||||||||||||||

Net assets, end of period (000’s) |

$ | 14,326 | $ | 7,384 | $ | 2,626 | $ | 2,642 | $ | 3,482 | $ | 4,265 | ||||||||||||

Ratio of expenses to average net assets:(5) |

||||||||||||||||||||||||

Before expense reimbursement(7) |

1.48 | % | 2.76 | % | 2.35 | % | 2.16 | % | 2.01 | % | 1.88 | % | ||||||||||||

After expense reimbursement(7) |

0.85 | % | 0.95 | % | 0.95 | % | 0.95 | % | 0.95 | % | 0.95 | % | ||||||||||||

Ratio of net investment income (loss) to average net assets(5)(7) |

(0.36 | )% | 0.93 | % | (0.15 | )% | 0.25 | % | 1.14 | % | 0.94 | % | ||||||||||||

Portfolio turnover rate (4)(6) |

86 | % | 0 | % | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||||||

|

(1) |

Per share net investment income (loss) was caclulated using average shares outstanding. |

|

(2) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to the differences between the market price of the shares and the net asset value per share of the Fund. |

The accompanying notes are an integral part of the financial statements.

26

Horizon Kinetics SPAC Active ETF

Financial Highlights

For a Share Outstanding Throughout Each Period (Continued)

|

(3) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the Nasdaq Stock Market. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the Nasdaq Stock Market. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These amounts would increase the net investment loss ratio or decrease the net investment income ratio, as applicable, had such reductions not occurred. See Note #3. |

|

(8) |

For periods prior to the close of business on January 27, 2023, financial and other information shown herein for the Fund is that of the Kinetics Alternative Income Fund. See Note #1. |

|

(9) |

Amount is less than $0.005. |

The accompanying notes are an integral part of the financial statements.

27

Horizon Kinetics Energy and Remediation ETF

Financial Highlights

For a Share Outstanding Throughout the Period

Period |

||||

Net Asset Value, Beginning of Period |

$ | 24.71 | ||

Income (Loss) from investment operations: |

||||

Net investment income (loss)(2) |

0.19 | |||

Net realized and unrealized gain (loss) |

0.18 | |||

Total from investment operations |

0.37 | |||

Net Asset Value, End of Period |

$ | 25.08 | ||

Total return, at NAV(3)(5) |

1.49 | % | ||

Total return, at Market(4)(5) |

1.77 | % | ||

Supplemental Data and Ratios: |

||||

Net assets, end of period (000’s) |

$ | 2,508 | ||

Ratio of expenses to average net assets(6) |

0.85 | % | ||

Ratio of net investment income (loss) to average net assets(6) |

2.26 | % | ||

Portfolio turnover rate (5)(7) |

0 | % | ||

|

(1) |

The Fund commenced operations on February 21, 2023. |

|

(2) |

Per share net investment income (loss) was caclulated using average shares outstanding. |

|

(3) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to the differences between the market price of the shares and the net asset value per share of the Fund. |

|

(4) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the New York Stock Exchange. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the New York Stock Exchange. |

|

(5) |

Not annualized for periods less than one year. |

|

(6) |

Annualized for periods less than one year. |

|

(7) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

The accompanying notes are an integral part of the financial statements.

28

Horizon Kinetics ETFs

Notes to Financial Statements

June 30, 2023 (Unaudited)

|

1. |

ORGANIZATION |

Horizon Kinetics Inflation Beneficiaries ETF (“INFL”), Horizon Kinetics Blockchain Development ETF (“BCDF”), Horizon Kinetics Medical ETF (“MEDX”), Horizon Kinetics SPAC Active ETF (“SPAQ”), and Horizon Kinetics Energy and Remediation ETF (“NVIR”) (each a “Fund” and collectively, the “Funds”) are non-diversified series of Listed Funds Trust (the “Trust”), formerly Active Weighting Funds ETF Trust. The Trust was organized as a Delaware statutory trust on August 26, 2016, under a Declaration of Trust amended on December 21, 2018 and is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

INFL is an actively managed exchange-traded fund (“ETF”) that seeks long-term capital growth in real (inflation-adjusted) terms. The Fund seeks to achieve its investment objective by investing primarily in the equity securities of domestic and foreign companies that are expected to benefit, either directly or indirectly, from rising prices (inflation).

BCDF is an actively managed ETF that seeks long-term growth of capital. The Fund seeks to achieve its investment objective by investing primarily in equity securities that to benefit, either directly or indirectly, from the use of blockchain technology in connection with the issuance, facilitation, custody, trading and administration of digital assets, including cryptocurrencies.

MEDX is an actively managed ETF that seeks long-term growth of capital. The Fund will invest primarily in patented first line pharmaceuticals and biologics as these products tend to have high profit margins and significant barriers to entry. The Fund employs a long-term perspective, seeking to capture returns of both intrinsic valuation realization and scientific discovery.

SPAQ is an actively managed ETF that seeks to generate realized capital gains in excess of short-term interest rates on a risk adjusted basis that pursues its investment objective primarily by investing, under normal circumstances, in special purpose acquisition companies (“SPACs”) that Ryan Heritage, LLP, the Fund’s investment sub-adviser (the “Sub-Adviser”), believes will generate net realized capital gains in excess of the income derived from bank certificates of deposit with similar maturities.

NVIR is an actively managed ETF that seeks long-term growth of capital. The Fund seeks to achieve its investment objective by investing primarily in the equity securities of domestic and foreign companies expected to benefit, either directly or indirectly, from the increasing focus on climate change and environmentally sensitive carbon-based energy production. The Fund employs a dual, reality-based mandate: (1) companies that produce carbon-based energy positioned to benefit from long-term global demand growth and developing structural supply insufficiency, and (2) remediation companies with existing and/or developing technologies that can alleviate the negative environmental impacts derived from the production and consumption of hydrocarbons.

MEDX and SPAQ are the successors in interest to the Kinetics Medical Fund and Kinetics Alternative Income Fund, respectively, each a series of Kinetics Mutual Funds, Inc., (the “Predecessor Funds”) pursuant to a tax-free reorganization that took place after the close of business on January 27, 2023. MEDX is the accounting and performance information successor of the Kinetics Medical Fund. SPAQ is the accounting information successor of the Kinetics Alternative Income Fund, but it has a different investment objective and strategy. Costs incurred by the Funds in connection with the reorganization were paid by the Horizon Kinetics Asset Management LLC (“Horizon Kinetics” or “Adviser”), the Funds’ Investment Adviser.

Costs incurred by the Funds in connection with the organization, registration and the initial public offering of shares were paid by the Adviser.

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. Each Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and follows the significant accounting policies described below.

29

Horizon Kinetics ETFs

Notes to Financial Statements

June 30, 2023 (Unaudited) (Continued)

Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Share Transactions

The net asset value (“NAV”) per share of each Fund will be equal to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the New York Stock Exchange (“NYSE”) is open for trading.

Fair Value Measurement

In calculating the NAV, each Fund’s exchange-traded equity securities will be valued at fair value, which will generally be determined using the last reported official closing or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Securities listed on the NASDAQ Stock Market, Inc. are generally valued at the NASDAQ official closing price.

If market quotations are not readily available, or if it is determined that a quotation of a security does not represent fair value, then the security is valued at fair value as determined in good faith by the Adviser using procedures adopted by the Board of Trustees of the Trust (the “Board”). The circumstances in which a security may be fair valued include, among others: the occurrence of events that are significant to a particular issuer, such as mergers, restructurings or defaults; the occurrence of events that are significant to an entire market, such as natural disasters in a particular region or government actions; trading restrictions on securities; thinly traded securities; and market events such as trading halts and early market closings. Due to the inherent uncertainty of valuations, fair values may differ significantly from the values that would have been used had an active market existed. Fair valuation could result in a different NAV than a NAV determined by using market quotations. Such valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Money market funds are valued at NAV. If NAV is not readily available the securities will be valued at fair value.

FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and requires disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurements. Under ASC 820, various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the following hierarchy:

|

● |

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

|

● |

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

|

● |