UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1681

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

| (a) |

Horizon Kinetics ETFs

Horizon Kinetics Inflation Beneficiaries ETF (INFL)

Horizon Kinetics Blockchain Development ETF (BCDF)

ANNUAL REPORT

December 31, 2022

Horizon Kinetics ETFs

Table of Contents

Shareholder Letters (Unaudited) |

2 |

Shareholder Expense Example (Unaudited) |

9 |

Performance Overviews (Unaudited) |

10 |

Schedules of Investments |

12 |

Statements of Assets and Liabilities |

15 |

Statements of Operations |

16 |

Statements of Changes in Net Assets |

17 |

Financial Highlights |

19 |

Notes to Financial Statements |

21 |

Report of Independent Registered Public Accounting Firm |

30 |

Board Consideration and Approval of Continuation of Advisory Agreement (Unaudited) |

31 |

Board Consideration and Approval of Advisory Agreement (Unaudited) |

33 |

Supplemental Information (Unaudited) |

35 |

Board of Trustees and Officers (Unaudited) |

36 |

Privacy Policy (Unaudited) |

38 |

1

Horizon Kinetics Inflation Beneficiaries ETF

Shareholder Letter

December 31, 2022 (Unaudited)

INFL (“Fund”) Investment Commentary

We believe that the only means to achieve compounded investment returns above market benchmarks without correspondingly higher risk is to formulate a unique process and adhere to it through multiple market cycles. This stands in contrast to the conventional approach, which constantly shifts investments based on the perceived preferences of the market. The latter approach requires not only the prescience to consistently interpret the market’s next predilection, but also the ability to time the shifts such that they are neither too early nor too late. Difficult as it is to do this successfully, most investors invest in this manner. Perhaps they have the hubris to believe that they have a unique ability to tactically shift investments. However, the more likely reason is that most investors are unwilling to accept underperformance over discrete periods of time. Adherence to a disciplined investment approach over an extended period of time all but guarantees periods of underperformance when other strategies are in vogue.

We are pleased with the results we have achieved in the nearly two years1 since the fund launched, when inflation was largely dismissed as a vestige of the past. We believe that we have correctly identified drivers of rising structural inflation that are unlikely to abate for many years, if not decades. Despite the recent success, our positioning remains distinctly non-consensus compared to the broader market. We take comfort in the fact that we remain in the minority with our investment positioning, but also recognize the vicissitudes in short-term variables which can impact our results.

One of the primary components of our non-consensus investment positioning is our emphasis upon hard assets. Hard assets are simply tangible, finite resources which have largely inelastic demand and limited supply growth potential. Examples include energy, precious metals, base metals, agricultural commodities, and land. Companies engaged in these industries are typically capital intensive and highly exposed to the market cycles, and therefore, they trade at low cash flow2 multiples. Furthermore, many of these industries experience extreme “capital cycles”; whereby, capital chases high returns when the market conditions are accommodative, ultimately increasing supply such that forward returns are dismal, following which, capital flees the industry. These violent cycles can substantially impair capital, particularly in highly indebted companies with poor unit economics.

We have experienced a reasonably robust cycle of higher returns in many hard asset markets, but we believe that a much longer, steeper cycle is only just beginning. This view is largely based on the fact that i.) the preceding capital “down cycle,” where capital has been withdrawn from these industries, has been particularly protracted, and ii.) capital has yet to return to these industries despite higher returns over the past year. That being said, now is not the time to be greedy, and staying power is amongst the highest priorities when investing in cyclical industries and hard asset companies.

The current setup for this investment style reminds us of the 1888 poem “Casey at the Bat” by Ernest Thayer. In the poem the fictional “Mudville” baseball team is losing by two runs in the last inning of the game, with their star player “Casey” up fifth in the lineup. The crowd is of the belief that victory is assured if only Casey can get to bat; however, this would require two of the lowly players preceding him to get on base. Alas, after the 1st and 2nd batters fail to advance, the 3rd and 4th batters safely reach base – only for Casey to strike out.

The poem is illustrative of the hard asset capital cycle, where the investments appear to be in a dire position, but against the odds salvation arrives— yet, ultimately fails to deliver. Investment funds flows only enter hard assets once Casey has arrived at bat, which equates to high prices and low prospective returns. The only way for an investment to be successful at this point is for Casey to hit a home run —anything less will be punished by the market. The worst-case scenario is for Casey to strike out, which results in steep investor loses and capital fleeing the industry again.

We don’t think that we are anywhere near a “Casey moment” yet, which would be where capital is abundant, valuations are high, and prospective returns are low, but we still recognize the need not to strike out in these investments. The best way that we can seek to protect against such a scenario is to recognize the volatility in these sub-industries and to invest in efficient, capital light business models that are less susceptible to striking out. Tempting as it may be to try to hit a home run and embrace companies with the highest leverage to higher hard asset prices (i.e., indebted mining and energy extraction companies), these businesses are far more prone to the impairment of capital. On the other hand, the capital light businesses are consistently hitting singles and doubles, slowly compounding value. This summarizes our strategy and positioning: though returns may be variable, we believe that this is a necessary part of seeking asymmetric opportunities to compound our capital base, even though we are frequently at odds with the consensus.

|

1 |

The Fund was launched on January 11, 2021 |

|

2 |

Cash Flow is the increase or decrease in the amount of money a business, institution, or individual has. |

2

Horizon Kinetics Inflation Beneficiaries ETF

Shareholder Letter

December 31, 2022 (Unaudited)

Inflation Backdrop

The Fund is invested in such a manner that the returns are not predicated on ever rising inflation – in other words we believe that reasonable returns can be achieved under status quo conditions or even lower price environments. However, market sentiment around companies exposed to these markets is highly sensitive to inflation expectations over the short to intermediate term. To be sure, inflation expectations (1-year break-evens) have fallen considerably compared to a year earlier. Rather than opine on this development, we believe that it is important to recognize that this is irrelevant to our positioning and the Fund’s return profile, because:

|

● |

The structural inflation drivers that the Fund is primarily exposed to are large components of overall inflation measures (i.e., CPI, PCE3), but can also de-couple from broader benchmarks under certain conditions. We believe that this is occurring as cyclical inflation drivers are moderating for a variety of reasons; yet, structural inflation drivers remain in low supply, and are capacity constrained. |

|

● |

Consensus investment positioning, which dictates inflation break-evens, appears to reflect the belief that a severe recession is imminent, and will be sufficiently severe to curtail aggregate demand despite tailwinds related to the reopening of the Chinese economy. Economic data appears to contradict this thesis, but the implied expectations (Eurodollar futures) of easing monetary policy later this year would likely catalyze a second, more severe wave of (structural) inflation. |

These are more short-term oriented factors but are nonetheless not relevant to our positioning. We invest with a long-term mindset and are far more focused on secular factors influencing the companies in our portfolio. In short, we believe that the prior thirty years of declining interest rates, declining or low inflation and rising profit margins has ceded to a new environment of higher interest rates, higher (volatile) inflation and pressure on profit margins. This view can be summarized through the following points:

|

● |

Globalization is inherently disinflationary (i.e., a slower rise in prices) due to various trade and supply chain efficiencies. After years of increasing globalization, the marginal benefit of these factors is declining. At the same time, there are also various current global onshoring initiatives to increase the resilience of businesses/governments, perhaps at the expense of efficiency. This will add to cost pressures over time. |

|

● |

A secondary benefit that globalization bestowed upon the developed world was abundant and inexpensive labor and raw materials. As many of the non-OECD nations have grown GDP per capita and exhausted the lowest cost resources, they are now competing with the OECD world for labor and materials. Higher labor and materials costs are likely to be amongst the most enduring cost pressures in the years ahead. |

|

● |

One of the economic “miracles” of the past era was the productivity gains achieved by the mature western economies. This coincided with the wide scale adoption and implementation of the internet (i.e., 1999-2010), a period during which productivity gains added over 320 basis points4 per year to nominal GDP growth. Absent a similar technological break-through, productivity gains will be muted – particularly as “inefficient” government spending grows as a portion of GDP. |

These rapidly reversing disinflationary forces must also be considered within the context that they facilitated consistent federal government deficits, resulting in 2.4x growth in the debt to GDP ratio in the United States without inflation. What the result of such policies would be without these mitigating circumstances bears consideration – as does the likelihood of politicians to reducing spending.

In summary, recession fears and cyclical components of inflation are masking the forest through the trees regarding long-term price levels.

|

3 |

CPI: The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. PCE: The Personal Consumption Expenditures Price Index (PCE) is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. |

|

4 |

Basis points are a common unit of measure for percentages in finance. One basis point is equal to 1/100th of 1%. |

3

Horizon Kinetics Inflation Beneficiaries ETF

Shareholder Letter

December 31, 2022 (Unaudited)

Performance Review

The Fund generated a positive return for the year, despite steep declines in global equity benchmarks. The positive performance was primarily driven by strong returns in energy, agriculture, and diversified metals companies. The gains were partially offset by declines in financial exchanges, real estate management companies and health care research companies. Precious metal companies modestly detracted from returns, but markedly outperformed broader equity benchmarks.

The vast majority of the positions in the Fund are in capital-light companies, specifically royalties in energy, precious metals, and diversified metals industries, as well as brokerages, asset managers and exchanges, insurance, real estate, land, financial services, and health care. It is rare that all price levels rise in unison, but we believe that it is important to have exposure to a broad universe of price drivers in the Fund. While we believe that each business has unique assets and attributes, which are distinct from the macro/sector drivers, we will address the latter below.

Energy, food, and industrial metals are critical to the functioning of the global economy but are taken for granted and are dismissed by many investors. This dynamic has resulted in structural supply shortages; however, capital expenditures have not yet responded. While the spot prices of these commodities are driven by current supply/demand balances relative to inventory levels, the longer-term prices are likely to be overwhelmed by the supply insufficiency. We continue to express our exposure to these markets, primarily through capital businesses given the cyclicality of these markets in the shorter-term.

Exchanges are a critical infrastructure to the global financial system, which generally incur zero principal risk, and act solely as a marketplace. These businesses thrive during periods of heightened trading volume, which often coincides with market volatility. The prior year had no shortage of volatility and trading volumes, but the companies traded lower with broader markets. We expect these returns to de-couple over time.

Real estate is the ultimate interest rate sensitive asset; hence, the historic rise in short-term interest rates materially (negatively) impacted real estate prices. We primarily own asset managers and land companies, which are less sensitive to rates, but declined, nonetheless. Similar to exchanges, we believe that this relationship will not endure.

Health care has been amongst the highest and most consistent drivers of inflation for decades, but there are few capital light businesses in the sector. We have focused our investments in contract research organizations “CROs” which can scale with rising prices in the sector and add efficiency to various pharmaceutical, biotech and government customers. These companies proved to be more exposed to a rising cost structure than we originally expected, but we are monitoring the margins into the coming year.

Precious metals serve a “barbell” function in the portfolio, with the potential to benefit both from high growth/high inflation and store of value during market displacements. The prior year proved to be in the middle ground of these scenarios (with inflation expectations falling), which when combined with a very strong U.S. Dollar, acted as a headwind to the metals and the sector. Suffice it to say, we don’t expect these conditions to persist indefinitely.

Data as of: 12/31/2022

1 Month |

YTD |

1 Year |

3 Year |

5 Year |

Since Inception |

|

Net Asset Value |

-4.38% |

2.57% |

2.57% |

— |

— |

13.93% |

Market Value |

-4.44% |

2.66% |

2.66% |

— |

— |

13.97% |

PERFORMANCE RISK DISCLOSURES

Inception Date: 1/11/2021. Expense Ratio: 0.85%.

Returns are average annualized total returns, except those for periods of less than one year, which are cumulative.

4

Horizon Kinetics Inflation Beneficiaries ETF

Shareholder Letter

December 31, 2022 (Unaudited)

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to most recent month end please call 646-495-7333.

Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Short term performance, in particular is not a good indication of future performance and an investment should not be made based solely on returns.

IMPORTANT RISK DISCLOSURES

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory prospectus and summary prospectus by contacting 646-495-7333. Read it carefully before investing.

The Horizon Kinetics Inflation Beneficiaries ETF (Symbol: INFL) is an exchange traded fund managed by Horizon Kinetics Asset Management LLC (“HKAM”).

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The Fund’s investments in securities linked to real assets involve significant risks, including financial, operating, and competitive risks. Investments in securities linked to real assets expose the Fund to potentially adverse macroeconomic conditions, such as a rise in interest rates or a downturn in the economy in which the asset is located.

The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security.

The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The Fund may invest in the securities of smaller and mid-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The fund is actively managed and may be affected by the investment adviser’s security selections.

Diversification does not assure a profit or protect against a loss in a declining market.

HKAM does not provide tax or legal advice, all investors are encouraged to consult their tax and legal advisors regarding an investment in the Fund. You may obtain additional information about HKAM at our website at www.horizonkinetics.com.

No part of this material may be copied, photocopied, or duplicated in any form, by any means, or redistributed without the express written consent of HKAM.

The Horizon Kinetics Inflation Beneficiaries ETF (INFL) is distributed by Foreside Fund Services, LLC (“Foreside”). Foreside is not affiliated with INFL or Horizon Kinetics LLC or its subsidiaries.

5

Horizon Kinetics Blockchain Development ETF

Shareholder Letter

December 31, 2022 (Unaudited)

Dear Fellow Shareholders,

Technology changes. People don’t.

Over the past year, we’ve seen some high-profile examples of dubious behavior exhibited by some tied to the crypto industry. It should be noted that poor decision-making by industry participants is an indictment of the bad actor – not the underlying asset. Unfortunately, across asset classes, over the years we have seen countless examples of the misuse of client assets by brokers.

Past instances of client asset misuse and fraud have led to bankruptcies for the perpetrators, and adjustments in industry regulations to provide additional customer protections. Fraudulent activities committed by commodity trading companies in 2011 and 2012 did not indicate some indelible flaw in wheat or soybeans. The underlying products and assets that these firms transacted in were not the cause of unlawful behavior. They did not “fail” industry participants.

In the wake of recent developments, it seems likely that additional cryptocurrency regulation will be proposed. But it is extremely difficult to enforce restrictions at the base protocol layer. How does any authority effectively impose its will upon a global decentralized system of math, algorithms, rules, and intangible assets? Many misinterpret what these regulatory intentions mean for digital assets.

Participants need to ensure they are getting a fair price, that their assets are secure, and that they are not being manipulated. Within all the prospects of disintermediation and decentralization, we will still need regulated parties to filter through the pseudo-information presented from those trying to game the system. Every transaction provides information content for subsequent valuations. Inauthentic transactions, like spoofing and wash-sales, can easily distort markets. The full benefits of blockchain-based assets cannot be realized without transactional authenticity at the marketplace level.

For nearly every asset class, there are controls related to transactions that realize the practical limitations of human nature. Regulatory authorities do not have the resources to perform these duties directly, so they “deputize” institutions as Self-Regulatory Organizations (“SRO”) to police trading and industry participants. We know many of these SROs as financial exchanges.

There are SROs that offer crypto futures, but there are currently no crypto spot exchanges that operate with the designation of SRO. In fact, it is difficult to call the companies facilitating transactions in the spot market “exchanges”, as they really only match buyers and sellers without much authority over rule-setting or enforcement. We view them more from a brokerage perspective. Many of these companies hold inventory for market making purposes or for their own benefit, which is something that obscures the neutrality required for Self-Regulatory Organizations. An exchange that takes market risk may not be entirely objective.

This landscape is quickly changing. The Chicago Board Options Exchange now offers Cboe Digital, with a substantial set of rules and procedures for spot market digital asset trading and clearing. It may take some time for review by regulatory authorities, but we believe it is likely that Cboe Digital’s Spot Market will eventually be recognized as a much-needed SRO that provides clarity and transparency to crypto spot trading. If this plays out, it is likely that other exchanges with solid regulatory standing will follow. This is an enormous step in the recognition of cryptocurrencies as a legitimate asset class. It is also an enormous development for the portfolio.

True exchanges like Cboe have robust business models: high margins, scalability, and low capex1 requirements needed to achieve growth. They operate as financial technology companies but lack the excessive tech valuations. We view these companies as solid businesses in their current form, with incredible optionality related to the incorporation of blockchain-based digital assets.

We’ve focused much of the portfolio commentary and decision-making on the prospects of the cryptocurrency market. Though blockchain applications are not restricted to cryptocurrencies, we believe that select cryptocurrencies are currently the most promising use case of the technology. Bitcoin, and a few others with similar implementations, stand out from the perspective of decentralization, scarcity, security, and transparency. The application of the technology to tokenize other assets in a decentralized format with provable issuance, transfers, and balances across participants remains a vision of our management team.

|

1 |

CAPEX: Capital expenditures (capex) refer to funds that are used by a company for the purchase, improvement, or maintenance of long-term assets to improve the efficiency or capacity of the company. |

6

Horizon Kinetics Blockchain Development ETF

Shareholder Letter

December 31, 2022 (Unaudited)

Blockchain does not inherently make a digital asset valuable. There are a variety of iterations that apply different protocols, but the tech can be used to provide substantial improvements to incumbent systems. The digital asset itself still needs to exhibit the same supply and demand attractiveness that drives interest in any investment. This is why, with over 20,000 cryptocurrencies available, we are only interested in a handful from an investment perspective.

A strength of the portfolio lies in the wide net cast by an exchange-heavy approach. For exchanges, it may not matter which digital assets end up the winners and losers of the coming age. As long as a sound platform can apply a consistent ruleset among similar blockchain-based assets, these exchanges can benefit from additional volume across the ecosystem. While we optimistically await additional applications of the technology, we are happy to hold companies that aim to enhance the networks of digital assets we currently find valuable.

BCDF was curated with a forward-looking approach to the blockchain developments within these businesses. While most exchanges are involved with the development of digital asset solutions, it remains a relatively small portion of their revenues given the infancy of the asset class. We believe this will change in the near future, as this optionality is realized, and the asset class is legitimized.

Portfolio Update:

The Fund’s negative performance was driven by a significant collapse in the cryptocurrency markets, as highly leveraged companies across the industry collapsed under sustained price pressure. Cryptocurrency as an asset class is still nascent, and many companies with more established exposure remain unproven from an operating perspective. The Fund has largely avoided these companies, preferring to own firms with sound business models even if their blockchain solutions remain in early development.

Major performance drivers remain tied to transactional volume and adoption of cryptocurrencies as an asset class. Financial exchanges and select investment managers exemplify sound businesses that can exploit the optionality tied to any expansion of these metrics. Rising cryptocurrency prices and a renaissance in the bitcoin mining space may give rise to additional opportunities for allocations. We remain optimistic that major vectors of bitcoin economics – the network hash rate and equipment pricing– will eventually normalize, providing an opportunistic environment for those companies with appropriate capitalization and patience.

Data as of: 12/31/2022

1 Month |

YTD |

1 Year |

3 Year |

5 Year |

Since Inception |

|

Net Asset Value |

-4.22% |

-21.50% |

— |

— |

— |

— |

Market Value |

-4.30% |

-21.31% |

— |

— |

— |

— |

PERFORMANCE RISK DISCLOSURES

Inception Date: 8/1/2022. Expense Ratio: 0.85%.

Returns are average annualized total returns, except those for periods of less than one year, which are cumulative.

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to most recent month end please call 646-495-7333.

Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Short term performance, in particular is not a good indication of future performance and an investment should not be made based solely on returns.

7

Horizon Kinetics Blockchain Development ETF

Shareholder Letter

December 31, 2022 (Unaudited)

IMPORTANT RISK DISCLOSURES

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory prospectus and summary prospectus by contacting 646-495-7333. Read it carefully before investing.

The Horizon Kinetics Blockchain Development ETF (Symbol: BCDF) is an exchange traded fund managed by Horizon Kinetics Asset Management LLC (“HKAM”).

Associated Risk of Investing in Blockchain Development Companies. The Fund will invest in Blockchain Development Companies. At times, Blockchain Development Companies may be out of favor and underperform other industries or groups of industries or the market as a whole. In such event, the value of the Shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The Fund’s investments in securities linked to real assets involve significant risks, including financial, operating, and competitive risks. Investments in securities linked to real assets expose the Fund to potentially adverse macroeconomic conditions, such as a rise in interest rates or a downturn in the economy in which the asset is located.

The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security.

The Fund does not invest directly in cryptocurrencies or initial coin offerings and as a result, its performance does not seek to, and should not be expected to, correspond to the performance of any particular cryptocurrency. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The Fund may invest in the securities of smaller and mid-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The fund is actively managed and may be affected by the investment adviser’s security selections.

Diversification does not assure a profit or protect against a loss in a declining market.

HKAM does not provide tax or legal advice, all investors are encouraged to consult their tax and legal advisors regarding an investment in the Fund. You may obtain additional information about HKAM at our website at www.horizonkinetics.com.

No part of this material may be copied, photocopied, or duplicated in any form, by any means, or redistributed without the express written consent of HKAM.

The Horizon Kinetics Blockchain Development ETF (BCDF) is distributed by Foreside Fund Services, LLC (“Foreside”). Foreside is not affiliated with BCDF or Horizon Kinetics LLC or its subsidiaries.

8

Horizon Kinetics ETFs

Shareholder Expense Example

(Unaudited)

As a shareholder of a Fund you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (July 1, 2022 to December 31, 2022).

ACTUAL EXPENSES

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning |

Ending |

Annualized |

Expenses |

|

Horizon Kinetics Inflation Beneficiaries ETF |

||||

Actual |

$ 1,000.00 |

$ 1,111.80 |

0.85% |

$ 4.52(1) |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

$ 1,020.92 |

0.85% |

$ 4.33(2) |

|

(1) |

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value during the period, multiplied by 184/365 (to reflect the six-month period). |

Hypothetical |

Beginning |

Ending |

Annualized |

Expenses |

|

Horizon Kinetics Blockchain Development ETF |

|||||

Actual |

N/A |

$ 1,000.00 |

$ 785.00 |

0.85% |

$ 3.18(3) |

Hypothetical (5% return before expenses) |

$ 1,000.00 |

N/A |

$ 1,020.92 |

0.85% |

$ 4.33(2) |

|

(^) |

Fund commenced operations on August 1, 2022. |

|

(2) |

Hypothetical expenses are calculated using the Fund’s annualized expense ratio multiplied by the average account value during the period, multiplied by the number of days in the most recent six-month period, 184 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

|

(3) |

Actual expenses are calculated using the Fund’s annualized expense ratio multiplied by the average account value during the period, multiplied by the number of days since inception, 153 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

9

Horizon Kinetics Inflation Beneficiaries ETF

Performance Overview

December 31, 2022 (Unaudited)

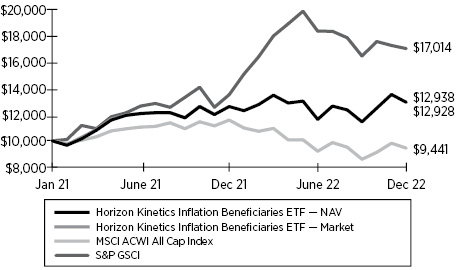

Hypothetical Growth of $10,000 Investment

(Since Commencement through 12/31/2022)

ANNUALIZED TOTAL RETURN |

||

Total Returns |

1 Year |

Since |

Horizon Kinetics Inflation Beneficiaries ETF — NAV |

2.57% |

13.93% |

Horizon Kinetics Inflation Beneficiaries ETF — Market |

2.66% |

13.97% |

MSCI ACWI All Cap Index |

(18.44)% |

(2.88)% |

S&P GSCI |

25.99% |

30.97% |

|

1 |

The Fund commenced operations on January 11, 2021. |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (800) 617-0004. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (“NAV”), and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00 p.m. Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distribution. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The MSCI ACWI All Cap Index covers more than 14,000 securities and includes large, mid, small, and micro-cap size segments. The S&P GSCI is the commodity equivalent of stock indexes, such as the S&P 500 and Dow Jones.

This chart illustrates the performance of a hypothetical $10,000 investment made on January 11, 2021 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends. It is not possible to invest directly in an index.

The accompanying notes are an integral part of the financial statements.

10

Horizon Kinetics Blockhain Development ETF

Performance Overview

December 31, 2022 (Unaudited)

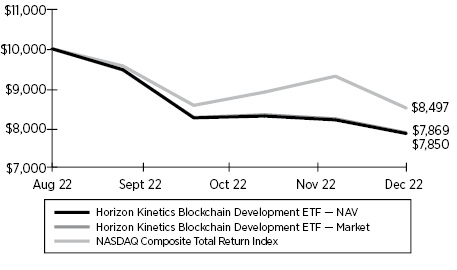

Hypothetical Growth of $10,000 Investment

(Since Commencement through 12/31/2022)

CUMULATIVE TOTAL RETURN |

|

Total Returns |

Since |

Horizon Kinetics Blockchain Development ETF—NAV |

(21.50)% |

Horizon Kinetics Blockchain Development ETF—Market |

(21.31)% |

NASDAQ Composite Total Return Index |

(15.03)% |

|

1 |

The Fund commenced operations on August 1, 2022. |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (800) 617-0004. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (“NAV”), and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00 p.m. Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distribution. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The NASDAQ Composite Total Return Index covers more than 3,700 equity securities including common stocks, ordinary shares, American depository receipts (ADRs), units of real estate investment trusts (REITs), publicly traded partnerships, and tracking stocks.

This chart illustrates the performance of a hypothetical $10,000 investment made on August 1, 2022 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends. It is not possible to invest directly in an index.

The accompanying notes are an integral part of the financial statements.

11

Horizon Kinetics Inflation Beneficiaries ETF

Schedule of Investments

December 31, 2022

|

Shares |

Value |

||||||

COMMON STOCKS — 95.5% |

||||||||

Aerospace & Defense — 2.4% |

||||||||

CACI International, Inc. - Class A (a) |

102,010 | $ | 30,663,186 | |||||

Agriculture Operations — 10.2% |

||||||||

Archer-Daniels-Midland Co. |

750,859 | 69,717,258 | ||||||

Bunge, Ltd. (b) |

412,962 | 41,201,219 | ||||||

Wilmar International, Ltd. (b) |

6,189,500 | 19,244,121 | ||||||

| 130,162,598 | ||||||||

Fertilizer — 2.4% |

||||||||

Nutrien, Ltd. |

425,903 | 31,103,696 | ||||||

Global Exchanges — 11.3% |

||||||||

ASX, Ltd. (b) |

785,785 | 36,246,504 | ||||||

Deutsche Boerse AG (b) |

273,780 | 47,159,620 | ||||||

Japan Exchange Group, Inc. (b) |

517,829 | 7,446,895 | ||||||

Singapore Exchange, Ltd. (b) |

4,353,518 | 29,051,585 | ||||||

TMX Group, Ltd. (b) |

241,462 | 24,150,655 | ||||||

| 144,055,259 | ||||||||

Insurance Brokers — 3.2% |

||||||||

Marsh & McLennan Cos., Inc. |

246,464 | 40,784,863 | ||||||

Investment Management & Advisory Services — 1.8% |

||||||||

Cohen & Steers, Inc. |

225,063 | 14,530,067 | ||||||

Sprott, Inc. (b)(d) |

240,900 | 8,029,197 | ||||||

| 22,559,264 | ||||||||

Medical Labs & Testing Services — 2.6% |

||||||||

Charles River Laboratories International, Inc. (a) |

154,467 | 33,658,359 | ||||||

Medical, Biomedical & Genetics — 1.2% |

||||||||

Royalty Pharma PLC - Class A (b) |

398,484 | 15,748,088 | ||||||

Metal, Diversified — 5.0% |

||||||||

Altius Minerals Corp. (b) |

608,233 | 9,970,002 | ||||||

Glencore PLC (b) |

8,124,146 | 53,983,764 | ||||||

| 63,953,766 | ||||||||

Metal, Iron — 3.4% |

||||||||

Deterra Royalties, Ltd. (b) |

7,586,186 | 23,562,140 | ||||||

Labrador Iron Ore Royalty Corp. (b)(d) |

385,752 | 9,560,170 | ||||||

Mesabi Trust |

575,335 | 10,367,537 | ||||||

| 43,489,847 | ||||||||

Oil Company, Exploration & Production — 24.6% |

||||||||

Permian Basin Royalty Trust |

1,046,586 | 26,373,967 | ||||||

PrairieSky Royalty, Ltd. (b) |

4,244,959 | 67,984,509 | ||||||

Sabine Royalty Trust |

7,631 | 652,069 | ||||||

Sitio Royalties Corp. (d) |

2,097,283 | 60,506,610 | ||||||

Texas Pacific Land Corp. |

34,304 | 80,416,466 | ||||||

Topaz Energy Corp. (b) |

629,091 | 9,810,468 | ||||||

Viper Energy Partners LP |

2,112,084 | 67,143,150 | ||||||

| 312,887,239 | ||||||||

Pipelines — 2.8% |

||||||||

Cheniere Energy, Inc. |

236,288 | 35,433,749 | ||||||

Precious Metals — 11.1% |

||||||||

Franco-Nevada Corp. (b) |

372,864 | 50,888,479 | ||||||

Osisko Gold Royalties, Ltd. (b) |

2,139,084 | 25,818,744 | ||||||

Sandstorm Gold, Ltd. (b) |

2,674,218 | 14,066,386 | ||||||

Wheaton Precious Metals Corp. (b) |

1,295,624 | 50,632,986 | ||||||

| 141,406,595 | ||||||||

Private Equity — 2.3% |

||||||||

Brookfield Asset Management, Ltd. (a)(b) |

189,308 | 5,427,460 | ||||||

Brookfield Corp. (b) |

757,211 | 23,821,858 | ||||||

| 29,249,318 | ||||||||

Real Estate Management & Services — 2.3% |

||||||||

CBRE Group, Inc. - Class A (a) |

384,625 | 29,600,740 | ||||||

Real Estate Operators & Developers — 1.2% |

||||||||

The St. Joe Co. |

382,165 | 14,770,677 | ||||||

Securities & Commodities Exchanges — 5.0% |

||||||||

CME Group, Inc. |

102,257 | 17,195,537 | ||||||

Intercontinental Exchange, Inc. |

448,994 | 46,062,295 | ||||||

| 63,257,832 | ||||||||

Timber — 2.6% |

||||||||

West Fraser Timber Co., Ltd. (b) |

462,961 | 33,467,451 | ||||||

TOTAL COMMON STOCKS (Cost $1,214,062,543) |

1,216,252,527 | |||||||

The accompanying notes are an integral part of the financial statements.

12

Horizon Kinetics Inflation Beneficiaries ETF

Schedule of Investments

December 31, 2022 (Continued)

|

Shares |

Value |

||||||

PARTNERSHIPS — 0.6% |

||||||||

Oil Company, Exploration & Production — 0.6% |

||||||||

Dorchester Minerals LP |

273,063 | $ | 8,172,775 | |||||

TOTAL PARTNERSHIPS (Cost $2,607,593) |

8,172,775 | |||||||

REAL ESTATE INVESTMENT TRUSTS (REITS) — 2.1% |

||||||||

Timber — 2.1% |

||||||||

Weyerhaeuser Co. |

876,955 | 27,185,605 | ||||||

TOTAL REITS (Cost $33,241,927) |

27,185,605 | |||||||

SHORT TERM INVESTMENTS — 1.7% |

||||||||

Deposit Accounts — 1.7% |

||||||||

U.S. Bank Money Market Deposit Account, 2.15% (c) |

21,552,819 | 21,552,819 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $21,552,819) |

21,552,819 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 3.6% |

||||||||

U.S. Bank Money Market Deposit Account, 2.15% (c) |

45,283,854 | 45,283,854 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

45,283,854 | |||||||

TOTAL INVESTMENTS (Cost $1,316,748,736) — 103.5% |

1,318,447,580 | |||||||

Other assets and liabilities, net — (3.5)% |

(44,224,530 | ) | ||||||

NET ASSETS — 100.0% |

$ | 1,274,223,050 | ||||||

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

All or a portion of this security is on loan as of December 31, 2022. The market value of securities out on loan is $42,305,823. |

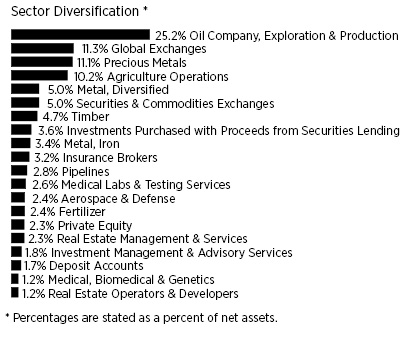

Percentages are stated as a percent of net assets.

COUNTRY |

Percentage of |

|||

United States |

50.8 | % | ||

Canada |

26.2 | % | ||

Australia |

4.6 | % | ||

Jersey |

4.2 | % | ||

Germany |

3.7 | % | ||

Singapore |

3.7 | % | ||

Bermuda |

3.2 | % | ||

United Kingdom |

1.2 | % | ||

Japan |

0.6 | % | ||

Total Country |

98.2 | % | ||

SHORT-TERM INVESTMENTS |

1.7 | % | ||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

3.6 | % | ||

TOTAL INVESTMENTS |

103.5 | % | ||

Other assets and liabilities, net |

-3.5 | % | ||

NET ASSETS |

100 | % | ||

The accompanying notes are an integral part of the financial statements.

13

Horizon Kinetics Blockchain Development ETF

Schedule of Investments

December 31, 2022

| Shares | Value | |||||||

| COMMON STOCKS — 93.3% | ||||||||

| Aerospace & Defense — 6.5% | ||||||||

CACI International, Inc. - Class A (a) | 428 | $ | 128,653 | |||||

| Banks — 5.6% | ||||||||

Customers Bancorp, Inc. (a) | 2,496 | 70,737 | ||||||

| Signature Bank | 343 | 39,520 | ||||||

| 110,257 | ||||||||

| Capital Markets — 23.3% | ||||||||

Bakkt Holdings, Inc. (a) | 55,972 | 66,607 | ||||||

Galaxy Digital Holdings, Ltd. (a)(b) | 24,124 | 68,903 | ||||||

| MarketAxess Holdings, Inc. | 271 | 75,579 | ||||||

| Tradeweb Markets, Inc. - Class A | 1,003 | 65,125 | ||||||

Urbana Corp. - Class A (a)(b) | 30,306 | 86,783 | ||||||

| WisdomTree Investments, Inc. | 17,630 | 96,083 | ||||||

| 459,080 | ||||||||

| Global Exchanges — 31.2% | ||||||||

ASX, Ltd. (b) | 2,468 | 113,843 | ||||||

| Cboe Global Markets, Inc. | 315 | 39,523 | ||||||

Deutsche Boerse AG (b) | 748 | 128,846 | ||||||

Japan Exchange Group, Inc. (b) | 4,776 | 68,684 | ||||||

London Stock Exchange Group PLC (b) | 792 | 67,985 | ||||||

Singapore Exchange, Ltd. (b) | 14,328 | 95,612 | ||||||

TMX Group, Ltd. (b) | 1,016 | 101,619 | ||||||

| 616,112 | ||||||||

| IT Services — 7.3% | ||||||||

Applied Digital Corp. (a) | 11,576 | 21,300 | ||||||

Digital Garage, Inc. (b) | 3,512 | 121,773 | ||||||

| 143,073 | ||||||||

| Professional Services — 6.0% | ||||||||

| Science Applications International Corp. | 1,068 | 118,473 | ||||||

| Securities & Commodities Exchanges — 9.1% | ||||||||

| CME Group, Inc. | 448 | 75,336 | ||||||

| Intercontinental Exchange, Inc. | 1,024 | 105,052 | ||||||

| 180,388 | ||||||||

| Thrifts & Mortgage Finance — 4.3% | ||||||||

| New York Community Bancorp, Inc. | 9,860 | 84,796 | ||||||

TOTAL COMMON STOCKS (Cost $2,077,997) | 1,840,832 | |||||||

| SHORT TERM INVESTMENTS — 6.7% | ||||||||

| Deposit Accounts — 6.7% | ||||||||

U.S. Bank Money Market Deposit Account, 2.15% (c) | 132,240 | 132,240 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $132,240) | 132,240 | |||||||

TOTAL INVESTMENTS (Cost $2,210,237) — 100.0% | 1,973,072 | |||||||

Other assets and liabilities, net — (0.0)% (d) | (143 | ) | ||||||

| NET ASSETS — 100.0% | $ | 1,972,929 | ||||||

|

PLC |

Public Limited Company |

|

(a) |

Non-income producing security. |

|

(b) |

Foreign issued security, or represents a foreign issued security. |

|

(c) |

The rate shown is the seven-day yield at period end. |

|

(d) |

Amount is less than 0.05%. |

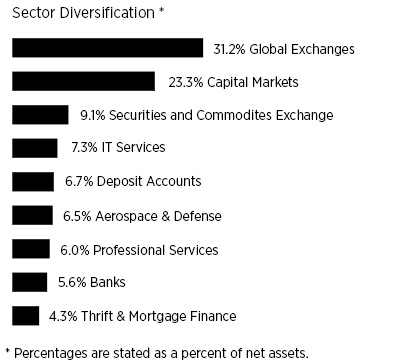

Percentages are stated as a percent of net assets.

COUNTRY |

Percentage of |

|||

United States |

50.0 | % | ||

Japan |

9.6 | % | ||

Canada |

9.5 | % | ||

Germany |

6.5 | % | ||

Australia |

5.8 | % | ||

Singapore |

4.9 | % | ||

Cayman Islands |

3.5 | % | ||

United Kingdom |

3.5 | % | ||

Total Country |

93.3 | % | ||

SHORT-TERM INVESTMENTS |

6.7 | % | ||

TOTAL INVESTMENTS |

100 | % | ||

Other assets and liabilities, net |

0.0 | % | ||

NET ASSETS |

100 | % | ||

The accompanying notes are an integral part of the financial statements.

14

Horizon Kinetics ETFs

Statements of Assets and Liabilities

December 31, 2022

Horizon Kinetics |

Horizon Kinetics |

|||||||

Assets |

||||||||

Investments, at value(1)(2) |

$ | 1,318,447,580 | $ | 1,973,072 | ||||

Cash |

90,608 | — | ||||||

Foreign currency, at value(3) |

118,978 | — | ||||||

Receivable for investment securities sold |

6,183,872 | — | ||||||

Dividends and interest receivable |

1,952,614 | 2,505 | ||||||

Securities lending income receivable |

14,276 | — | ||||||

Total assets |

1,326,807,928 | 1,975,577 | ||||||

Liabilities |

||||||||

Payable for collateral on securities loaned (Note 7) |

45,283,854 | — | ||||||

Payable for Fund shares redeemed |

6,309,910 | — | ||||||

Payable to Adviser |

937,737 | 1,450 | ||||||

Payable for investment securities purchased |

53,377 | 1,198 | ||||||

Total liabilities |

52,584,878 | 2,648 | ||||||

Net Assets |

$ | 1,274,223,050 | $ | 1,972,929 | ||||

Net Assets Consists of: |

||||||||

Paid-in capital |

$ | 1,280,159,802 | $ | 2,471,823 | ||||

Total distributable earnings (accumulated losses) |

(5,936,752 | ) | (498,894 | ) | ||||

Net Assets |

$ | 1,274,223,050 | $ | 1,972,929 | ||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

40,500,000 | 100,000 | ||||||

Net Asset Value, redemption price and offering price per share |

$ | 31.46 | $ | 19.73 | ||||

(1) Includes loaned securities with a value of: |

$ | 42,305,823 | $ | — | ||||

(2) Cost of investments |

1,316,748,736 | 2,210,237 | ||||||

(3) Cost of foreign currency |

118,812 | — | ||||||

The accompanying notes are an integral part of the financial statements.

15

Horizon Kinetics ETFs

Statements of Operations

For the Year or Period Ended December 31, 2022

Horizon Kinetics |

Horizon Kinetics |

|||||||

Investment Income |

||||||||

Dividend income (net of withholding tax of $1,404,320 and $303 respectively) |

$ | 31,284,941 | $ | 13,439 | ||||

Interest income |

298,378 | 961 | ||||||

Securities lending income, net |

61,730 | — | ||||||

Total investment income |

31,645,049 | 14,400 | ||||||

Expenses |

||||||||

Investment advisory fees |

10,433,292 | 6,878 | ||||||

Tax expense |

243 | 185 | ||||||

Total expenses |

10,433,535 | 7,063 | ||||||

Net investment income |

21,211,514 | 7,337 | ||||||

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency |

||||||||

Net realized gain (loss) on: |

||||||||

Investments |

28,276,336 | (261,676 | ) | |||||

Foreign currency transactions |

(10,688 | ) | 47 | |||||

Net realized gain (loss) on investments and foreign currency: |

28,265,648 | (261,629 | ) | |||||

Net change in unrealized appreciation/depreciation on: |

||||||||

Investments |

(48,072,709 | ) | (237,164 | ) | ||||

Foreign currency translation |

(4,621 | ) | (4 | ) | ||||

Net change in unrealized depreciation on investments and foreign currency translation |

(48,077,330 | ) | (237,168 | ) | ||||

Net realized and unrealized gain on investments and foreign currency loss |

(19,811,682 | ) | (498,797 | ) | ||||

Net increase (decrease) in net assets from operations |

$ | 1,399,832 | $ | (491,460 | ) | |||

|

(1) |

The Fund commenced operations on August 1, 2022. |

The accompanying notes are an integral part of the financial statements.

16

Horizon Kinetics Inflation Beneficiaries ETF

Statements of Changes in Net Assets

Year |

Period |

|||||||

From Operations |

||||||||

Net investment income |

$ | 21,211,514 | $ | 5,012,258 | ||||

Net realized gain on investments and foreign currency transactions |

28,265,648 | 10,814,131 | ||||||

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation |

(48,077,330 | ) | 49,772,557 | |||||

Net increase in net assets resulting from operations |

1,399,832 | 65,598,946 | ||||||

From Distributions |

||||||||

Distributable earnings |

(22,124,800 | ) | (6,395,043 | ) | ||||

Total distributions |

(22,124,800 | ) | (6,395,043 | ) | ||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

640,032,713 | 877,256,207 | ||||||

Cost of shares redeemed |

(213,596,625 | ) | (67,948,180 | ) | ||||

Net increase in net assets resulting from capital share transactions |

426,436,088 | 809,308,027 | ||||||

Total Increase in Net Assets |

405,711,120 | 868,511,930 | ||||||

Net Assets |

||||||||

Beginning of period |

868,511,930 | — | ||||||

End of period |

$ | 1,274,223,050 | $ | 868,511,930 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

27,825,000 | — | ||||||

Shares sold |

19,750,000 | 30,100,000 | ||||||

Shares redeemed |

(7,075,000 | ) | (2,275,000 | ) | ||||

Shares outstanding, end of period |

40,500,000 | 27,825,000 | ||||||

|

(1) |

The Fund commenced operations on January 11, 2021. |

The accompanying notes are an integral part of the financial statements.

17

Horizon Kinetics Blockchain Development ETF

Statement of Changes in Net Assets

Period |

||||

From Operations |

||||

Net investment income |

$ | 7,337 | ||

Net realized loss on investments and foreign currency transactions |

(261,629 | ) | ||

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation |

(237,168 | ) | ||

Net decrease in net assets resulting from operations |

(491,460 | ) | ||

From Distributions |

||||

Distributable earnings |

(7,434 | ) | ||

Total distributions |

(7,434 | ) | ||

From Capital Share Transactions |

||||

Proceeds from shares sold |

2,471,823 | |||

Cost of shares redeemed |

— | |||

Net increase in net assets resulting from capital share transactions |

2,471,823 | |||

Total Increase in Net Assets |

1,972,929 | |||

Net Assets |

||||

Beginning of period |

— | |||

End of period |

$ | 1,972,929 | ||

Changes in Shares Outstanding |

||||

Shares outstanding, beginning of period |

— | |||

Shares sold |

100,000 | |||

Shares redeemed |

— | |||

Shares outstanding, end of period |

100,000 | |||

|

(1) |

The Fund commenced operations on August 1, 2022. |

The accompanying notes are an integral part of the financial statements.

18

Horizon Kinetics Inflation Beneficiaries ETF

Financial Highlights

For a Share Outstanding Throughout each Period

Year |

Period |

|||||||

Net Asset Value, Beginning of Period |

$ | 31.21 | $ | 25.00 | ||||

Income (loss) from investment operations: |

||||||||

Net investment income(2) |

0.53 | 0.30 | ||||||

Net realized and unrealized gain (loss) on investments(7) |

0.24 | 6.19 | ||||||

Total from investment operations |

0.77 | 6.49 | ||||||

Less distributions paid: |

||||||||

From net investment income |

(0.52 | ) | (0.27 | ) | ||||

From net realized gains |

— | (0.01 | ) | |||||

Total distributions paid |

(0.52 | ) | (0.28 | ) | ||||

Net Asset Value, End of Period |

$ | 31.46 | $ | 31.21 | ||||

Total return, at NAV(3) |

2.57 | %(4) | 26.05 | %(4) | ||||

Total return, at Market(3) |

2.66 | %(4) | 26.03 | %(4) | ||||

Supplemental Data and Ratios: |

||||||||

Net assets, end of period (000’s) |

$ | 1,274,223 | $ | 868,512 | ||||

Ratio of expenses to average net assets |

0.85 | %(5) | 0.85 | %(5) | ||||

Ratio of net investment income to average net assets |

1.73 | %(5) | 1.02 | %(5) | ||||

Portfolio turnover rate(6) |

9.24 | %(4) | 0 | %(4)(8) | ||||

|

(1) |

The Fund commenced investment operations on January 11, 2021. |

|

(2) |

Per share net investment income was calculated using average shares outstanding. |

|

(3) |

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

|

(8) |

Amount is less than 0.5%. |

The accompanying notes are an integral part of the financial statements.

19

Horizon Kinetics Blockchain Development ETF

Financial Highlights

For a Share Outstanding Throughout each Period

Period |

||||

Net Asset Value, Beginning of Period |

$ | 25.23 | ||

Income (loss) from investment operations: |

||||

Net investment income(2)(7) |

0.08 | |||

Net realized and unrealized gain (loss) on investments |

(5.51 | ) | ||

Total from investment operations |

(5.43 | ) | ||

Less distributions paid: |

||||

From net investment income |

(0.07 | ) | ||

From net realized gains |

— | |||

Total distributions paid |

(0.07 | ) | ||

Net Asset Value, End of Period |

$ | 19.73 | ||

Total return, at NAV(3) |

(21.50 | )%(4) | ||

Total return, at Market(3) |

(21.31 | )%(4) | ||

Supplemental Data and Ratios: |

||||

Net assets, end of period (000’s) |

$ | 1,973 | ||

Ratio of expenses to average net assets |

0.87 | %(5)(8) | ||

Ratio of net investment income to average net assets |

0.90 | %(5) | ||

Portfolio turnover rate(6) |

5.12 | %(4) | ||

|

(1) |

The Fund commenced investment operations on August 1, 2022. |

|

(2) |

Per share net investment income was calculated using average shares outstanding. |

|

(3) |

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Amount is less than 0.05%. |

|

(8) |

Ratio of expenses to average net assets includes tax expense of 0.02% for the period ended December 31, 2022. |

The accompanying notes are an integral part of the financial statements.

20

Horizon Kinetics ETFs

Notes to Financial Statements

December 31, 2022

|

1. |

ORGANIZATION |

Horizon Kinetics Inflation Beneficiaries ETF (“INFL”) and Horizon Kinetics Blockchain Development ETF (“BCDF”) (each a “Fund” and collectively, the “Funds”) are non-diversified series of Listed Funds Trust (the “Trust”), formerly Active Weighting Funds ETF Trust. The Trust was organized as a Delaware statutory trust on August 26, 2016, under a Declaration of Trust amended on December 21, 2018 and is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

INFL is an actively-managed exchange-traded fund (“ETF”) that seeks long-term capital growth in real (inflation-adjusted) terms. The Fund seeks to achieve its investment objective by investing primarily in the equity securities of domestic and foreign companies that are expected to benefit, either directly or indirectly, from rising prices (inflation).

BCDF is an actively-managed ETF that seeks long-term growth of capital. The Fund seeks to achieve its investment objective by investing primarily in equity securities that to benefit, either directly or indirectly, from the use of blockchain technology in connection with the issuance, facilitation, custody, trading and administration of digital assets, including cryptocurrencies.

Costs incurred by the Fund in connection with the organization, registration and the initial public offering of shares were paid by Horizon Kinetics Asset Management LLC (“Horizon Kinetics” or “Adviser”), the Funds’ Investment Adviser.

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. Each Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and follows the significant accounting policies described below.

Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Share Transactions

The net asset value (“NAV”) per share of each Fund will be equal to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the New York Stock Exchange (“NYSE”) is open for trading.

Fair Value Measurement

In calculating the NAV, each Fund’s exchange-traded equity securities will be valued at fair value, which will generally be determined using the last reported official closing or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Securities listed on the NASDAQ Stock Market, Inc. are generally valued at the NASDAQ official closing price.

If market quotations are not readily available, or if it is determined that a quotation of a security does not represent fair value, then the security is valued at fair value as determined in good faith by the Adviser using procedures adopted by the Board of Trustees of the Trust (the “Board”). The circumstances in which a security may be fair valued include, among others: the occurrence of events that are significant to a particular issuer, such as mergers, restructurings or defaults; the occurrence of

21

Horizon Kinetics ETFs

Notes to Financial Statements

December 31, 2022 (Continued)

events that are significant to an entire market, such as natural disasters in a particular region or government actions; trading restrictions on securities; thinly traded securities; and market events such as trading halts and early market closings. Due to the inherent uncertainty of valuations, fair values may differ significantly from the values that would have been used had an active market existed. Fair valuation could result in a different NAV than a NAV determined by using market quotations. Such valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Money market funds are valued at NAV. If NAV is not readily available the securities will be valued at fair value.

FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and requires disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurements. Under ASC 820, various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the following hierarchy:

|

● |

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

|

● |

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

|

● |

Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing each Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Foreign securities, currencies and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar using the applicable currency exchange rates as of the close of the NYSE, generally 4:00 p.m. Eastern Time.

All other securities and investments for which market values are not readily available, including restricted securities, and those securities for which it is inappropriate to determine prices in accordance with the aforementioned procedures, are valued at fair value as determined in good faith under procedures adopted by the Board, although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

22

Horizon Kinetics ETFs

Notes to Financial Statements

December 31, 2022 (Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The hierarchy classification of inputs used to value the Funds’ investments at December 31, 2022, are as follows:

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

INFL |

||||||||||||||||

Investments - Assets: |

||||||||||||||||

Common Stocks* |

$ | 1,216,252,527 | $ | — | $ | — | $ | 1,216,252,527 | ||||||||

Partnerships* |

8,172,775 | — | — | 8,172,775 | ||||||||||||

Real Estate Investment Trusts* |

27,185,605 | — | — | 27,185,605 | ||||||||||||

Deposit Accounts |

21,552,819 | — | — | 21,552,819 | ||||||||||||

Investments Purchased with Proceeds From Securities Lending |

45,283,854 | — | — | 45,283,854 | ||||||||||||

Total Investments - Assets |

$ | 1,318,447,580 | $ | — | $ | — | $ | 1,318,447,580 | ||||||||

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

BCDF |

||||||||||||||||

Investments - Assets: |

||||||||||||||||

Common Stocks* |

$ | 1,840,832 | $ | — | $ | — | $ | 1,840,832 | ||||||||

Deposit Accounts |

132,240 | — | — | 132,240 | ||||||||||||

Total Investments - Assets |

$ | 1,973,072 | $ | — | $ | — | $ | 1,973,072 | ||||||||

|

* |

See Schedule of Investments for sector classifications. |

Security Transactions

Investment transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses from the sale or disposition of securities are calculated based on the specific identification basis.

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

The Funds report net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Investment Income

Dividend income is recognized on the ex-dividend date. Interest income is accrued daily. Withholding taxes on foreign dividends has been provided for in accordance with the Funds’ understanding of the applicable tax rules and regulations. An amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity, unless the Adviser determines in good faith that such method does not represent fair value.

Tax Information, Dividends and Distributions to Shareholders and Uncertain Tax Positions

The Funds are treated as a separate entity for Federal income tax purposes. Each Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To qualify and remain eligible for the special tax treatment accorded to RICs, each Fund must meet certain annual

23

Horizon Kinetics ETFs

Notes to Financial Statements

December 31, 2022 (Continued)

income and quarterly asset diversification requirements and must distribute annually at least 90% of the sum of (i) its investment company taxable income (which includes dividends, interest and net short-term capital gains) and (ii) certain net tax-exempt income, if any. If so qualified, each Fund will not be subject to Federal income tax.

Distributions to shareholders are recorded on the ex-dividend date. The Funds generally pays out dividends from net investment income, if any, at least quarterly, and distributes its net capital gains, if any, to shareholders at least annually. The Funds may also pay a special distribution at the end of the calendar year to comply with Federal tax requirements. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed earnings and profit for tax purposes are reported as a tax return of capital.

Management evaluates the Funds’ tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Interest and penalties related to income taxes would be recorded as income tax expense. The Funds’ Federal income tax returns are subject to examination by the Internal Revenue Service (the “IRS”) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. As of December 31, 2022, the Funds’ fiscal period end, the Funds had no examination in progress and management is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months.

INFL and BCDF recognized no interest or penalties related to uncertain tax benefits in the 2022 fiscal period. At December 31, 2022, the Funds’ fiscal period end, the tax periods from commencement of operations remained open to examination in the Funds’ major tax jurisdictions.

Indemnification

In the normal course of business, the Funds expect to enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these anticipated arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, the Adviser expects the risk of loss to be remote.

|

3. |

INVESTMENT ADVISORY AND OTHER AGREEMENTS |

Investment Advisory Agreement