UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6511

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

(a)

Roundhill ETFs

Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD)

Roundhill Sports Betting & iGaming ETF (BETZ)

ANNUAL REPORT

December 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (“SEC”), paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Funds’ reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future Fund reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

This report is submitted for the general information of shareholders of the Funds. It is not authorized for distribution unless preceded or accompanied by a current prospectus for the Funds.

Roundhill ETFs

Table of Contents

Shareholder Letter (Unaudited) |

2 |

Roundhill BITKRAFT Esports & Digital Entertainment ETF |

2 |

Roundhill Sports Betting & iGaming ETF |

4 |

Performance Overview (Unaudited) |

6 |

Schedule of Investments |

8 |

Roundhill BITKRAFT Esports & Digital Entertainment ETF |

8 |

Roundhill Sports Betting & iGaming ETF |

10 |

Statements of Assets and Liabilities |

12 |

Statements of Operations |

13 |

Statements of Changes in Net Assets |

14 |

Roundhill BITKRAFT Esports & Digital Entertainment ETF |

14 |

Roundhill Sports Betting & iGaming ETF |

15 |

Financial Highlights |

16 |

Roundhill BITKRAFT Esports & Digital Entertainment ETF |

16 |

Roundhill Sports Betting & iGaming ETF |

17 |

Notes to Financial Statements |

18 |

Report of Independent Registered Public Accounting Firm |

27 |

Shareholder Expense Example (Unaudited) |

28 |

Trustees and Officers of the Trust (Unaudited) |

29 |

Supplemental Information (Unaudited) |

31 |

Privacy Policy (Unaudited) |

32 |

1

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Shareholder Letter

December 31, 2020 (Unaudited)

Dear Shareholders,

The Roundhill BITKRAFT Esports & Digital Entertainment ETF (“NERD” or the “Fund”) seeks to track the total return performance, before fees and expenses, of its underlying index, the Roundhill BITKRAFT Esports Index (the “Index”). 2020 represented the first full year of performance for NERD, as the Fund was launched on June 3, 2019. From January 1, 2020 through December 31, 2020, the Fund’s fiscal year, performance was as follows:

|

● |

NERD (NAV) +89.88% |

|

● |

NERD (Market Price) +89.62% |

|

● |

NERD Index +91.55% |

Roundhill has chosen the Solactive GBS Developed Markets Large & Mid Cap USD as its broad-based performance benchmark. For calendar year 2020, this benchmark returned +16.29%. NERD’s outperformance over the Solactive benchmark was driven by its targeted exposure to the esports and video game industry, which experienced significant growth over the year due to the stay-at-home environment spurred by the pandemic. NERD also benefited from its exposure to emerging markets including China, which saw its local constituents appreciate significantly amid a falling dollar and positive full year GDP growth at the country level.

The largest single security contributors to performance over the fiscal period were:

|

● |

Sea Ltd +14.18% |

|

● |

Bilibili +9.39% |

|

● |

Nexon GT +6.32% |

The largest single security detractors from performance over the period:

|

● |

Gungho -0.44% |

|

● |

AfreecaTV -0.42% |

|

● |

Mail.ru Group -0.41% |

Despite the challenging macro environment brought on by the COVID-19 pandemic, NERD performed strongly compared with broad-based benchmarks. After a relatively quiet year in 2019, this year saw significant broad-based gaming growth caused by a confluence of factors, mostly stemming from the stay-at-home orders prevalent throughout most markets in 2020. Publishers and developers experienced banner years as hours played increased not only for seasoned gamers, but millions of new consumers became gamers for the first time as well. This was buoyed by the launch of the ninth-generation of consoles in November – the Xbox Series X from Microsoft and the PlayStation 5 from Sony. The ecosystem surrounding gaming benefited greatly as well. Peripheral makers saw record sales as demand for webcams, keyboards, mice, and PC components for the enthusiast community was exceedingly high. Within esports, tournaments for top titles like DotA 2, League of Legends, CS:GO, and Rocket League shifted online. We expect competition to continue online for most if not all of 2021, with a return to relative normalcy sometime in 2022.

In our previous shareholder letter, we believed that 2021 would be a transition year for gaming, primarily due to the new consoles, but we believe that it is now clear that 2020 marked that transition. While comparables will certainly be difficult in 2021, as of the end of last year, demand was still outpacing supply for much of the industry. For example, graphics cards and consoles were being marked up significantly versus their stated MSRP on ecommerce sites like eBay. Companies like Microsoft and NVIDIA have stated they were constrained by a global shortage in the semiconductor supply chain due to COVID-19. This demand tailwind should carry over into the first half of 2021, in our view, with increasing amounts of supply generating higher revenues for manufacturers. While 2020 itself is unlikely to ever be repeated, it marks a long-lasting shift in digital media consumption.

2

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Shareholder Letter

December 31, 2020 (Unaudited) (Continued)

On a NAV basis before fees, NERD experienced a tracking difference of -1.67%. Approximately -0.40% of this difference was due to the Fund’s expense ratio. The remainder was due to the volatility of individual names in the portfolio - tracking difference between the basket and the Index was amplified due to small misweights intra-quarter which occur with most indexed products. Furthermore, we incur transaction costs each quarter when we rebalance the portfolio or add/remove securities from the portfolio.

In December 2020, Roundhill implemented a securities lending program for the Fund through its custodian U.S. Bank N.A. While it is still too early to gauge the impact of lending the less-liquid names in the portfolio, we believe it will be additive to performance, and help reduce tracking between the Index and the portfolio. Our collateral is reinvested in the First American Government Obligations Fund - Class X.

Sincerely,

Will Hershey, Co-Founder & CEO

Tim Maloney, Co-Founder & CIO

Roundhill Investments

Investing involves risk, including possible loss of principal. Esports gaming companies face intense competition, both domestically and internationally, may have limited product lines, markets, financial resources, or personnel, may have products that face rapid obsolescence, and are heavily dependent on the protection of patent and intellectual property rights. Such factors may adversely affect the profitability and value of video gaming companies. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks.

Past performance is no guarantee of future results. Current and future portfolio holdings are subject to change and risk.

3

Roundhill Sports Betting & iGaming ETF

Shareholder Letter

December 31, 2020 (Unaudited)

Dear Shareholders,

The Roundhill Sports Betting & iGaming ETF (“BETZ” or the “Fund”) seeks to track the total return performance, before fees and expenses, of its underlying index, the Roundhill Sports Betting & iGaming Index (the “Index”). BETZ was launched on June 3, 2020 and began trading on the NYSE. From June 3, 2020 through December 31, 2020, performance was as follows:

|

● |

BETZ (NAV) +68.28% |

|

● |

BETZ (Market Price) +68.15% |

|

● |

BETZ Index +67.35% |

Roundhill has chosen the “Solactive GBS Developed Markets Large & Mid Cap USD” as its broad-based performance benchmark. From June 3, 2020 through December 31, 2020, this benchmark returned +22.19%. BETZ’s outperformance over the Solactive benchmark was driven by its targeted exposure to sports betting and iGaming, which experienced significant growth over the year due to the stay-at-home environment spurred by the pandemic. While sports were largely not available during the first half of the year, BETZ benefited from its second half launch when sports also returned to broadcasting and streaming. Sports betting legalization progressed meaningfully throughout the United States over the period as well. The Fund also benefited from its exposure to ex-US markets, which benefited also due to a falling dollar.

The largest single security contributors to performance over the fiscal period were:

|

● |

William Hill +6.73% |

|

● |

PointsBet +6.11% |

|

● |

Penn National +5.44% |

The largest single security detractors from performance over the period:

|

● |

Bet-At-Home.com -1.20% |

|

● |

Wynn Resorts -0.71% |

|

● |

Score Media -0.65% |

Sports betting and iGaming saw record growth across a number of states, including New Jersey which set a national U.S. record for sports betting handle in a year at $6 billion ($5.5 billion from online wagers).1 Online casino gaming in the state increased 102% year over year. Legal sports betting commenced in Illinois, Michigan, Montana, Colorado, Washington D.C., and Tennessee, with approvals still pending in a number of other states as well.2 For iGaming, positive performance was driven by consumers globally gambling online, with casinos and other betting institutions closed due to local orders.

On a NAV basis before fees, BETZ experienced positive tracking difference of +0.93%. Approximately -0.43% of this difference was due to the Fund’s expense ratio. On a gross basis, tracking difference was +1.36%. This was largely due to the volatility of individual names in the portfolio - tracking difference between the basket and the Index was amplified due to small misweights intra-quarter which occur with most indexed products. While we do incur quarterly transaction costs each quarter during portfolio rebalances, tracking was still positive for the seven months the Fund was live in 2020. Note we normally expect Fund NAV performance to trail index performance by approximately the expense ratio, less any additional transaction costs or weight differences.

|

1 |

Source: Darren Rovell, Action Network. “New Jersey Smashes Nevada’s All-Time Record for Yearly Sports Betting Handle. |

|

2 |

Source: Ryan Rodenberg, ESPN.com. “United States of Sports Betting”. 11/3/2020. |

4

Roundhill Sports Betting & iGaming ETF

Shareholder Letter

December 31, 2020 (Unaudited) (Continued)

In December 2020, Roundhill implemented a securities lending program for the Fund through its custodian U.S. Bank N.A. While it is still too early to gauge the impact of lending the less-liquid names in the portfolio, we believe it will be meaningfully additive to performance, and help manage tracking between the Index and the portfolio. Our collateral is reinvested in the First American Government Obligations Fund – Class X.

Sincerely,

Will Hershey, Co-Founder & CEO

Tim Maloney, Co-Founder & CIO

Roundhill Investments

Investing involves risk, including possible loss of principal. The iGaming and sports betting industry is characterized by an increasingly high degree of competition among a large number of participants including from participants performing illegal activities or unregulated companies. Expansion of iGaming and sports betting in other jurisdictions (both regulated and unregulated) could increase competition with traditional betting companies, which could have an adverse impact on their financial condition, operations and cash flows. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks.

Past performance is no guarantee of future results. Current and future portfolio holdings are subject to change and risk.

5

Roundhill ETFs

Performance Overview

December 31, 2020 (Unaudited)

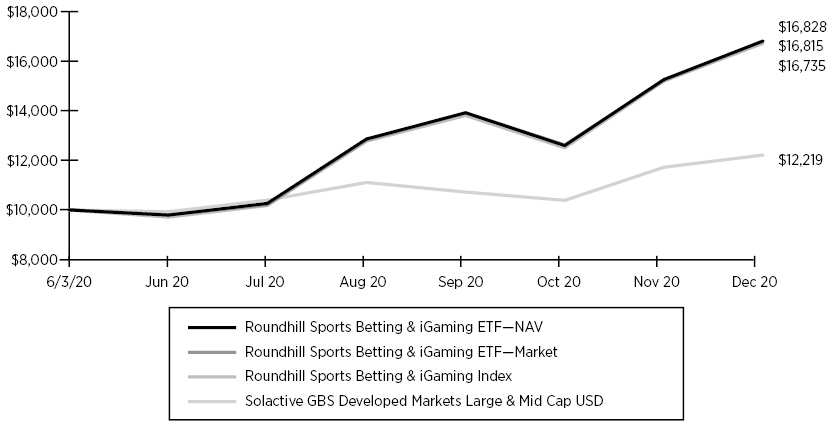

Hypothetical Growth of $10,000 Investment

(Since Commencement through 12/31/2020)

6

Roundhill ETFs

Performance Overview

December 31, 2020 (Unaudited) (Continued)

ANNUALIZED TOTAL RETURN FOR THE |

||

Total Returns |

1 Year |

Since |

Roundhill BITKRAFT Esports & Digital Entertainment ETF—NAV |

89.88% |

57.73% |

Roundhill BITKRAFT Esports & Digital Entertainment ETF—Market |

89.62% |

57.89% |

Roundhill BITKRAFT Esports Index |

91.55% |

59.23% |

Solactive GBS Developed Markets Large & Mid Cap USD |

16.29% |

21.34% |

|

1 |

The Fund commenced operations on June 3, 2019. |

CUMULATIVE TOTAL RETURN FOR THE |

|

Total Returns |

Since Commencement2 |

Roundhill Sports Betting & iGaming ETF—NAV |

68.28% |

Roundhill Sports Betting & iGaming ETF—Market |

68.15% |

Roundhill Sports Betting & iGaming Index |

67.35% |

Solactive GBS Developed Markets Large & Mid Cap USD |

22.19% |

|

2 |

The Fund commenced operations on June 3, 2020. |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00pm Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced.

The Roundhill BITKRAFT Esports & Digital Entertainment ETF is designed to offer retail and institutional investors exposure to esports & digital entertainment by providing investment results that closely correspond, before fees and expenses, to the performance of the Roundhill BITKRAFT Esports Index. The Roundhill BITKRAFT Esports Index is the first rules-based index designed to track the performance of the growing market of electronic sports, or “esports”. The Index consists of a modified equal-weighted portfolio of globally-listed companies who are actively involved in the competitive video gaming industry. This classification includes, but is not limited to: video game publishers, streaming network operators, video game tournament and league operators/owners, competitive team owners, and hardware companies. An index is unmanaged and is not available for direct investment.

The Roundhill Sports Betting & iGaming ETF is designed to offer retail and institutional investors exposure to sports betting and gaming industries by providing investment results that closely correspond, before fees and expenses, to the performance of the Roundhill Sports Betting & iGaming Index. The Roundhill Sports Betting & iGaming Index is the first rules-based index designed to track the performance of the growing market of online sports betting and gaming, or “iGaming”. The Index consists of a tiered weight portfolio of globally-listed companies who are actively involved in the sports betting & iGaming industry. This classification includes, but is not limited to: companies that operate in-person and/or online/internet sports books; companies that operate online/internet gambling platforms; and companies that provide infrastructure or technology to such companies. An index is unmanaged and is not available for direct investment.

The Solactive GBS Developed Markets Large & Mid Cap USD is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Developed Markets. It is calculated as a Total Return index in USD and weighted by free-float market capitalization.

7

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Schedule of Investments

December 31, 2020

Shares |

Value |

|||||||

COMMON STOCKS — 99.9% |

||||||||

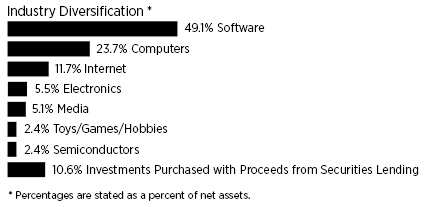

Computers — 23.7% |

||||||||

Asetek A/S (a)(b) |

57,211 | $ | 727,002 | |||||

Asustek Computer, Inc. (a) |

197,357 | 1,759,482 | ||||||

Corsair Gaming, Inc. (b)(f) |

103,208 | 3,738,194 | ||||||

Endor AG (a)(b) |

2,564 | 379,601 | ||||||

Guillemot Corp. (a)(b) |

71,951 | 753,589 | ||||||

Keywords Studios PLC (a)(b) |

48,759 | 1,906,211 | ||||||

Logitech International SA (a) |

19,010 | 1,847,773 | ||||||

Razer, Inc. (a)(b)(c) |

9,134,000 | 2,803,629 | ||||||

Thermaltake Technology Co., Ltd. (a) |

786,319 | 1,715,473 | ||||||

Tobii AB (a)(b) |

270,143 | 1,861,796 | ||||||

| 17,492,750 | ||||||||

Electronics — 5.5% |

||||||||

Micro-Star International Co., Ltd. (a) |

375,423 | 1,770,359 | ||||||

Turtle Beach Corp. (b) |

104,710 | 2,256,500 | ||||||

| 4,026,859 | ||||||||

Internet — 11.7% |

||||||||

AfreecaTV Co., Ltd. (a) |

50,137 | 2,792,312 | ||||||

NCSoft Corp. (a) |

2,262 | 1,938,619 | ||||||

Tencent Holdings Ltd. (a) |

53,400 | 3,884,212 | ||||||

| 8,615,143 | ||||||||

Media — 5.1% |

||||||||

Modern Times Group MTG AB - Class B (a)(b) |

211,205 | 3,772,735 | ||||||

Semiconductors — 2.4% |

||||||||

NVIDIA Corp. |

3,344 | 1,746,237 | ||||||

Software — 49.1% (e) |

||||||||

Activision Blizzard, Inc. |

44,198 | 4,103,784 | ||||||

Bilibili, Inc. - ADR (a)(b) |

31,445 | 2,695,465 | ||||||

Capcom Co., Ltd. (a) |

26,700 | 1,732,675 | ||||||

Com2uS Corp. (a) |

12,758 | 1,870,892 | ||||||

DouYu International Holdings Ltd. - ADR (a)(b) |

326,853 | 3,614,994 | ||||||

Electronic Arts, Inc. |

18,672 | 2,681,299 | ||||||

Enthusiast Gaming Holdings, Inc. (a)(b) |

202,338 | 719,459 | ||||||

HUYA, Inc. - ADR (a)(b)(f) |

189,386 | 3,774,463 | ||||||

Konami Holdings Corp. (a) |

31,100 | 1,747,106 | ||||||

NetEase, Inc. - ADR (a) |

28,091 | 2,690,275 | ||||||

Sea Ltd. - ADR (a)(b) |

13,291 | 2,645,574 | ||||||

Skillz, Inc. (b)(f) |

127,283 | 2,545,660 | ||||||

Take-Two Interactive Software, Inc. (b) |

13,092 | 2,720,387 | ||||||

Ubisoft Entertainment SA (a)(b) |

27,578 | 2,660,316 | ||||||

| 36,202,349 | ||||||||

Toys/Games/Hobbies — 2.4% |

||||||||

Nintendo Co., Ltd. (a) |

2,800 | 1,785,307 | ||||||

TOTAL COMMON STOCKS (Cost $60,226,069) |

73,641,380 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 10.6% |

||||||||

First American Government Obligations Fund - Class X, 0.04% (d) |

7,819,921 | 7,819,921 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost - $7,819,921) |

7,819,921 | |||||||

TOTAL INVESTMENTS — 110.5% (Cost $68,045,990) |

81,461,301 | |||||||

Other assets and liabilities, net — (10.5)% |

(7,744,063 | ) | ||||||

NET ASSETS — 100.0% |

$ | 73,717,238 | ||||||

ADR American Depositary Receipt

PLC Public Limited Company

|

(a) |

Foreign issued security, or represents a foreign issued security. |

|

(b) |

Non-income producing security. |

|

(c) |

Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

|

(d) |

The rate shown is the annualized seven-day yield at period end. |

|

(e) |

To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

|

(f) |

All or a portion of this security is on loan as of December 31, 2020. The market value of securities out on loan is $7,623,703. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

8

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Schedule of Investments

December 31, 2020 (Continued)

COUNTRY |

Percentage |

United States |

26.9% |

China |

22.6% |

South Korea |

9.0% |

Sweden |

7.6% |

Singapore |

7.4% |

Japan |

7.1% |

Taiwan |

7.1% |

France |

4.6% |

Ireland |

2.6% |

Switzerland |

2.5% |

Denmark |

1.0% |

Canada |

1.0% |

Germany |

0.5% |

Total Country |

99.9% |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

10.6% |

TOTAL INVESTMENTS |

110.5% |

Other assets and liabilities, net |

-10.5% |

NET ASSETS |

100.0% |

The accompanying notes are an integral part of the financial statements.

9

Roundhill Sports Betting & iGaming ETF

Schedule of Investments

December 31, 2020

Shares |

Value |

|||||||

COMMON STOCKS — 100.0% |

||||||||

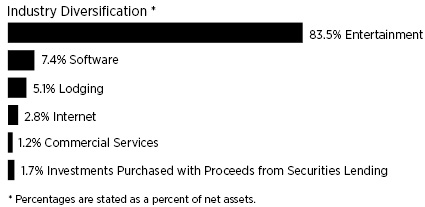

Commercial Services — 1.2% |

||||||||

QIWI PLC - ADR (a)(f) |

239,710 | $ | 2,469,013 | |||||

Entertainment — 83.5% (e) |

||||||||

888 Holdings PLC (a) |

1,083,197 | 4,227,305 | ||||||

Aspire Global PLC (a)(b)(c) |

132,843 | 644,598 | ||||||

bet-at-home.com AG (a) |

25,208 | 982,362 | ||||||

Betmakers Technology Group Ltd. (a)(b) |

6,555,847 | 3,389,420 | ||||||

Betsson AB (a)(b) |

721,293 | 6,472,934 | ||||||

Caesars Entertainment, Inc. (b) |

71,124 | 5,282,379 | ||||||

Churchill Downs, Inc. |

33,712 | 6,566,760 | ||||||

DraftKings, Inc. - Class A (b) |

198,393 | 9,237,178 | ||||||

Enlabs AB (a)(b) |

343,512 | 1,585,269 | ||||||

Entain PLC (a)(b) |

638,588 | 9,894,465 | ||||||

Evolution Gaming Group AB (a)(c) |

97,157 | 9,875,908 | ||||||

Flutter Entertainment PLC (a)(b) |

51,255 | 10,586,460 | ||||||

Gamesys Group PLC (a) |

233,339 | 3,636,154 | ||||||

Gaming Realms PLC (a)(b) |

1,895,393 | 564,814 | ||||||

GAN Ltd. (a)(b)(f) |

357,156 | 7,243,124 | ||||||

Golden Nugget Online Gaming, Inc. (b) |

277,478 | 5,466,317 | ||||||

International Game Technology PLC (b) |

361,337 | 6,121,049 | ||||||

Kambi Group PLC (a)(b) |

151,962 | 7,179,409 | ||||||

Kindred Group PLC - SDR (a)(b) |

1,006,879 | 9,876,856 | ||||||

LeoVegas AB (a)(c) |

980,544 | 4,166,914 | ||||||

OPAP SA (a) |

407,811 | 5,463,826 | ||||||

Penn National Gaming, Inc. (b) |

124,055 | 10,714,630 | ||||||

PointsBet Holdings Ltd. (a) |

1,143,845 | 10,477,067 | ||||||

Rush Street Interactive, Inc. (b) |

294,847 | 6,383,438 | ||||||

Scientific Games Corp. (b) |

165,197 | 6,854,024 | ||||||

Tabcorp Holdings Ltd. (a)(b) |

2,450,130 | 7,373,532 | ||||||

Tokyotokeiba Co., Ltd. (a) |

72,700 | 3,295,423 | ||||||

William Hill PLC (a)(b) |

2,478,746 | 9,151,803 | ||||||

| 172,713,418 | ||||||||

Internet — 2.8% |

||||||||

Catena Media PLC (a)(b) |

936,964 | 3,194,500 | ||||||

Gaming Innovation Group, Inc. (a)(b) |

314,221 | 440,397 | ||||||

Score Media and Gaming, Inc. (a)(b) |

1,841,657 | 2,168,356 | ||||||

| 5,803,253 | ||||||||

Lodging — 5.1% |

||||||||

Boyd Gaming Corp. (b) |

111,609 | 4,790,258 | ||||||

MGM Resorts International |

184,071 | 5,800,077 | ||||||

| 10,590,335 | ||||||||

Software — 7.4% |

||||||||

Better Collective A/S (a)(b) |

134,199 | 2,475,620 | ||||||

Playtech PLC (a)(b) |

1,231,968 | 6,758,007 | ||||||

Scout Gaming Group AB (a)(b) |

49,731 | 290,663 | ||||||

Skillz, Inc. (b)(f) |

287,264 | 5,745,280 | ||||||

| 15,269,570 | ||||||||

TOTAL COMMON STOCKS (Cost $155,339,444) |

206,845,589 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 1.7% |

||||||||

First American Government Obligations Fund - Class X, 0.04% (d) |

3,536,889 | 3,536,889 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost - $3,536,889) |

3,536,889 | |||||||

TOTAL INVESTMENTS — 101.7% (Cost $158,876,333) |

210,382,478 | |||||||

Other assets and liabilities, net — (1.7)% |

(3,491,181 | ) | ||||||

NET ASSETS — 100.0% |

$ | 206,891,297 | ||||||

ADR American Depositary Receipt

PLC Public Limited Company

SDR Special Drawing Rights

|

(a) |

Foreign issued security, or represents a foreign issued security. |

|

(b) |

Non-income producing security. |

|

(c) |

Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

|

(d) |

The rate shown is the annualized seven-day yield at period end. |

|

(e) |

To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

|

(f) |

All or a portion of this security is on loan as of December 31, 2020. The market value of securities out on loan is $3,491,596. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

10

Roundhill Sports Betting & iGaming ETF

Schedule of Investments

December 31, 2020 (Continued)

COUNTRY |

Percentage |

United States |

35.3% |

Sweden |

10.8% |

Australia |

10.3% |

Malta |

10.3% |

Britain |

10.0% |

Isle of Man |

8.1% |

Ireland |

5.1% |

Greece |

2.6% |

Gibraltar |

2.0% |

Japan |

1.6% |

Denmark |

1.2% |

Cyprus |

1.2% |

Canada |

1.0% |

Germany |

0.5% |

Total Country |

100.0% |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING |

1.7% |

TOTAL INVESTMENTS |

101.7% |

Other assets and liabilities, net |

-1.7% |

NET ASSETS |

100.0% |

The accompanying notes are an integral part of the financial statements.

11

Roundhill ETFs

Statements of Assets and Liabilities

December 31, 2020

Roundhill |

Roundhill |

|||||||

Assets |

||||||||

Investments, at value (cost $68,045,990 and $158,876,333)(1) |

$ | 81,461,301 | $ | 210,382,478 | ||||

Investment securities sold |

285,581 | 353,048 | ||||||

Dividend and interest receivable |

47,146 | 35,405 | ||||||

Securities lending receivable |

18,919 | 8,018 | ||||||

Total Assets |

81,812,947 | 210,778,949 | ||||||

Liabilities |

||||||||

Payable for collateral on securities loaned (Note 7) |

7,819,921 | 3,536,889 | ||||||

Due to custodian |

119,545 | 165,104 | ||||||

Foreign currency payable to custodian, at value (cost $— and $1,499) |

— | 1,499 | ||||||

Investment securities purchased |

128,264 | 68,553 | ||||||

Payable to Adviser |

27,979 | 115,607 | ||||||

Total liabilities |

8,095,709 | 3,887,652 | ||||||

Net Assets |

$ | 73,717,238 | $ | 206,891,297 | ||||

Net Assets Consists of: |

||||||||

Paid-in capital |

$ | 61,357,188 | $ | 158,706,512 | ||||

Total distributable earnings |

12,360,050 | 48,184,785 | ||||||

Net Assets |

$ | 73,717,238 | $ | 206,891,297 | ||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

2,450,000 | 8,000,000 | ||||||

Net Asset Value, redemption price and offering price per share |

$ | 30.09 | $ | 25.86 | ||||

(1) Includes loaned securities with a value of: |

$ | 7,623,703 | $ | 3,491,596 | ||||

The accompanying notes are an integral part of the financial statements.

12

Roundhill ETFs

Statements of Operations

For the Year or Period Ended December 31, 2020

Roundhill |

Roundhill |

|||||||

Investment Income |

||||||||

Dividend income (net of withholding taxes and issuance fees of $40,790 and $59,065, respectively) |

$ | 166,026 | $ | 1,126,668 | ||||

Securities lending income, net |

18,919 | 8,018 | ||||||

Interest income |

105 | 98 | ||||||

Total investment income |

185,050 | 1,134,784 | ||||||

Expenses |

||||||||

Advisory fees |

149,241 | 510,342 | ||||||

Tax expense |

185 | 185 | ||||||

Total expenses before reimbursement by Adviser |

149,426 | 510,527 | ||||||

Expense reimbursement by Adviser |

(16,856 | ) | — | |||||

Net expenses |

132,570 | 510,527 | ||||||

Net investment income |

52,480 | 624,257 | ||||||

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Translation |

||||||||

Net realized gain (loss) from: |

||||||||

Investments |

7,326,996 | 5,716,629 | ||||||

Foreign currency transactions |

(72,816 | ) | (76,424 | ) | ||||

Net realized gain on investments and foreign currency |

7,254,180 | 5,640,205 | ||||||

Net change in unrealized appreciation/depreciation on: |

||||||||

Investments |

12,970,148 | 51,506,145 | ||||||

Foreign currency translation |

(467 | ) | (361 | ) | ||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

12,969,681 | 51,505,784 | ||||||

Net realized and unrealized gain on investments and foreign currency transactions |

20,223,861 | 57,145,989 | ||||||

Net increase in net assets from operations |

$ | 20,276,341 | $ | 57,770,246 | ||||

|

(1) |

The Fund commenced operations on June 3, 2020. |

The accompanying notes are an integral part of the financial statements.

13

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Statements of Changes in Net Assets

|

Year |

Period |

||||||

From Operations |

||||||||

Net investment income |

$ | 52,480 | $ | 38,749 | ||||

Net realized gain on investments and foreign currency transactions |

7,254,180 | 145,940 | ||||||

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation |

12,969,681 | 445,190 | ||||||

Net increase in net assets resulting from operations |

20,276,341 | 629,879 | ||||||

From Distributions |

||||||||

Distributable earnings |

(775,814 | ) | (32,724 | ) | ||||

Return of capital |

— | (756 | ) | |||||

Total distributions |

(775,814 | ) | (33,480 | ) | ||||

From Capital Share Transactions |

||||||||

Proceeds from shares sold |

66,790,205 | 13,330,515 | ||||||

Cost of shares redeemed |

(23,404,637 | ) | (3,121,587 | ) | ||||

Transaction fees (Note 4) |

21,385 | 4,431 | ||||||

Net increase in net assets resulting from capital share transactions |

43,406,953 | 10,213,359 | ||||||

Total Increase in Net Assets |

62,907,480 | 10,809,758 | ||||||

Net Assets |

||||||||

Beginning of period |

10,809,758 | — | ||||||

End of period |

$ | 73,717,238 | $ | 10,809,758 | ||||

Changes in Shares Outstanding |

||||||||

Shares outstanding, beginning of period |

675,000 | — | ||||||

Shares sold |

2,725,000 | 875,000 | ||||||

Shares redeemed |

(950,000 | ) | (200,000 | ) | ||||

Shares outstanding, end of period |

2,450,000 | 675,000 | ||||||

|

(1) |

The Fund commenced operations on June 3, 2019. |

The accompanying notes are an integral part of the financial statements.

14

Roundhill Sports Betting & iGaming ETF

Statement of Changes in Net Assets

|

Period |

|||

From Operations |

||||

Net investment income |

$ | 624,257 | ||

Net realized gain on investments and foreign currency transactions |

5,640,205 | |||

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation |

51,505,784 | |||

Net increase in net assets resulting from operations |

57,770,246 | |||

From Distributions |

||||

Distributable earnings |

(550,629 | ) | ||

Return of capital |

(8,305 | ) | ||

Total distributions |

(558,934 | ) | ||

From Capital Share Transactions |

||||

Proceeds from shares sold |

183,892,167 | |||

Cost of shares redeemed |

(34,212,905 | ) | ||

Transaction fees (Note 4) |

723 | |||

Net increase in net assets resulting from capital share transactions |

149,679,985 | |||

Total Increase in Net Assets |

206,891,297 | |||

Net Assets |

||||

Beginning of period |

— | |||

End of period |

$ | 206,891,297 | ||

Changes in Shares Outstanding |

||||

Shares outstanding, beginning of period |

— | |||

Shares sold |

9,850,000 | |||

Shares redeemed |

(1,850,000 | ) | ||

Shares outstanding, end of period |

8,000,000 | |||

|

(1) |

The Fund commenced operations on June 3, 2020. |

The accompanying notes are an integral part of the financial statements.

15

Roundhill BITKRAFT Esports & Digital Entertainment ETF

Financial Highlights

For a Share Outstanding Throughout each Period

|

Year |

Period |

||||||

Net Asset Value, Beginning of Period |

$ | 16.01 | $ | 14.86 | ||||

Income from investment operations: |

||||||||

Net investment income(2) |

0.04 | 0.08 | ||||||

Net realized and unrealized gain on investments |

14.34 | 1.11 | ||||||

Total from investment operations |

14.38 | 1.19 | ||||||

Less distributions paid: |

||||||||

From net investment income |

(0.10 | ) | (0.05 | ) | ||||

From net realized gains |

(0.22 | ) | — | |||||

From return of capital |

— | 0.00 | (7) | |||||

Total distributions paid |

(0.32 | ) | (0.05 | ) | ||||

Capital share transactions: |

||||||||

Transaction fees (see Note 4) |

0.02 | 0.01 | ||||||

Net Asset Value, End of Period |

$ | 30.09 | $ | 16.01 | ||||

Total return, at NAV(3) |

89.88 | %(9) | 8.11 | %(4)(9) | ||||

Total return, at Market(3) |

89.62 | %(9) | 8.42 | %(4)(9) | ||||

Supplemental Data and Ratios: |

||||||||

Net assets, end of period (000’s) |

$ | 73,717 | $ | 10,810 | ||||

Ratio of expenses to average net assets: |

||||||||

Before waivers of expenses(8) |

0.50 | % | 0.50 | %(5) | ||||

After waivers of expenses(8) |

0.44 | % | 0.25 | %(5) | ||||

Ratio of net investment income to average net assets: |

||||||||

Before waivers of expenses(8) |

0.12 | % | 0.65 | %(5) | ||||

After waivers of expenses(8) |

0.18 | % | 0.90 | %(5) | ||||

Portfolio turnover rate(6) |

93 | % | 34 | %(4) | ||||

|

(1) |

The Fund commenced investment operations on June 3, 2019. |

|

(2) |

Per share net investment income was calculated using average shares outstanding. |

|

(3) |

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Amount is less than $0.005. |

|

(8) |

Pursuant to a fee waiver agreement between the Adviser and the Trust, on behalf of the Fund, the Adviser contractually agreed effective June 3, 2019 (commencement of operations) through June 30, 2020, to reduce the Fund’s unitary management fee to 0.25%. |

|

(9) |

The returns reflect the actual performance for the period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period. |

The accompanying notes are an integral part of the financial statements.

16

Roundhill Sports Betting & iGaming ETF

Financial Highlights

For a Share Outstanding Throughout the Period

|

Period |

|||

Net Asset Value, Beginning of Period |

$ | 15.41 | ||

Income from investment operations: |

||||

Net investment income(2) |

0.11 | |||

Net realized and unrealized gain on investments |

10.41 | |||

Total from investment operations |

10.52 | |||

Less distributions paid: |

||||

From net investment income |

(0.07 | ) | ||

From return of capital |

(0.00 | )(7) | ||

Total distributions paid |

(0.07 | ) | ||

Capital share transactions: |

||||

Transaction fees (see Note 4) |

0.00 | (7) | ||

Net Asset Value, End of Period |

$ | 25.86 | ||

Total return, at NAV(3) |

68.28 | %(4) | ||

Total return, at Market(3) |

68.15 | %(4) | ||

Supplemental Data and Ratios: |

||||

Net assets, end of period (000’s) |

$ | 206,891 | ||

Ratio of expenses to average net assets |

0.75 | %(5) | ||

Ratio of net investment income to average net assets |

0.92 | %(5) | ||

Portfolio turnover rate(6) |

43 | %(4) | ||

|

(1) |

The Fund commenced investment operations on June 3, 2020. |

|

(2) |

Per share net investment income was calculated using average shares outstanding. |

|

(3) |

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

|

(4) |

Not annualized for periods less than one year. |

|

(5) |

Annualized for periods less than one year. |

|

(6) |

Excludes in-kind transactions associated with creations and redemptions of the Fund. |

|

(7) |

Amount is less than $0.005. |

The accompanying notes are an integral part of the financial statements.

17

Roundhill ETFs

Notes to Financial Statements

December 31, 2020

|

1. |

ORGANIZATION |

Roundhill BITKRAFT Esports & Digital Entertainment ETF (“NERD”) and Roundhill Sports Betting & iGaming ETF (“BETZ”) (each a “Fund” and collectively, the “Funds”) are non-diversified series of Listed Funds Trust (the “Trust”), formerly Active Weighting Funds ETF Trust. The Trust was organized as a Delaware statutory trust on August 26, 2016, under a Declaration of Trust amended on December 21, 2018, and is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

NERD is a passively-managed exchange-traded fund (“ETF”). NERD’s objective is to track the total return performance, before fees and expenses, of the Roundhill BITKRAFT Esports Index (the “NERD Index”). The NERD Index tracks the performance of the common stock (or corresponding American Depositary Receipts (“ADRs”) or Global Depositary Receipts (“GDRs”)) of exchange-listed companies across the globe (including in emerging markets) that earn revenue from electronic sports, or esports related business activities, including: video game publishing, video game development, video game streaming platforms, organizing video game tournaments and/or events, operating and/or owning video game leagues, owning competitive video game teams, and gaming hardware and technology companies, or whose principal business activity is classified as that of another digital entertainment business activity, such as broadcasting, interactive home entertainment, interactive media & services, technology hardware storage or technology hardware, storage and peripherals.

BETZ is a passively-managed ETF. BETZ’s objective is to track the total return performance, before fees and expenses, of the Roundhill Sports Betting & iGaming Index (the “BETZ Index”). The BETZ Index tracks the performance of the common stock (or corresponding ADRs or GDRs) of exchange-listed companies that earn revenue from online gaming (“iGaming”). iGaming is broadly defined as the wagering of money or some other value on the outcome of an event or a game, using the internet. The BETZ Index includes: companies that operate in-person and/or online/internet sports books; companies that operate online/internet gambling platforms; and companies that provide infrastructure or technology to such companies.

Costs incurred by BETZ in connection with the organization, registration and the initial public offering of shares were paid by Roundhill Financial Inc. (“Roundhill” or the “Adviser”), the Fund’s Investment Adviser.

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. Each Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and follows the significant accounting policies described below.

Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Share Transactions

The net asset value (“NAV”) per share of each Fund will be equal to a Fund’s total assets minus a Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the New York Stock Exchange (“NYSE”) is open for trading.

Fair Value Measurement

In calculating the NAV, each Fund’s exchange-traded equity securities will be valued at fair value, which will generally be determined using the last reported official closing or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

18

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

Securities listed on the NASDAQ Stock Market, Inc. are generally valued at the NASDAQ official closing price. Foreign securities will be priced in their local currencies as of the close of their primary exchange or market or as of the time each Fund calculates its NAV on the valuation date, whichever is earlier.

If market quotations are not readily available, or if it is determined that a quotation of a security does not represent fair value, then the security is valued at fair value as determined in good faith by the Adviser using procedures adopted by the Board of Trustees of the Trust (the “Board”). The circumstances in which a security may be fair valued include, among others: the occurrence of events that are significant to a particular issuer, such as mergers, restructurings or defaults; the occurrence of events that are significant to an entire market, such as natural disasters in a particular region or government actions; trading restrictions on securities; thinly traded securities; and market events such as trading halts and early market closings. Due to the inherent uncertainty of valuations, fair values may differ significantly from the values that would have been used had an active market existed. Fair valuation could result in a different NAV than a NAV determined by using market quotations. Such valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Money market funds are valued at NAV. If NAV is not readily available, the securities will be valued at fair value.

FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and requires disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurements. Under ASC 820, various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the following hierarchy:

|

● |

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

|

● |

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

|

● |

Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Foreign securities, currencies and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar using the applicable currency exchange rates as of the close of the NYSE, generally 4:00 p.m. Eastern Time.

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

19

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

The Funds report net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

All other securities and investments for which market values are not readily available, including restricted securities, and those securities for which it is inappropriate to determine prices in accordance with the aforementioned procedures, are valued at fair value as determined in good faith under procedures adopted by the Board, although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The hierarchy classification of inputs used to value the Funds’ investments at December 31, 2020 are as follows:

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

NERD |

||||||||||||||||

Investments - Assets: |

||||||||||||||||

Common Stocks* |

$ | 73,641,380 | $ | — | $ | — | $ | 73,641,380 | ||||||||

Investments Purchased With Proceeds From Securities Lending |

7,819,921 | — | — | 7,819,921 | ||||||||||||

Total Investments - Assets |

$ | 81,461,301 | $ | — | $ | — | $ | 81,461,301 | ||||||||

BETZ |

||||||||||||||||

Investments - Assets: |

||||||||||||||||

Common Stocks* |

$ | 206,845,589 | $ | — | $ | — | $ | 206,845,589 | ||||||||

Investments Purchased With Proceeds From Securities Lending |

3,536,889 | — | — | 3,536,889 | ||||||||||||

Total Investments - Assets |

$ | 210,382,478 | $ | — | $ | — | $ | 210,382,478 | ||||||||

|

* |

See the Schedule of Investments for industry classifications. |

Security Transactions

Investment transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses from the sale or disposition of securities are calculated based on the specific identification basis.

Investment Income

Dividend income is recognized on the ex-dividend date. Interest income is accrued daily. Withholding taxes on foreign dividends has been provided for in accordance with Funds’ understanding of the applicable tax rules and regulations. An amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity, unless the Adviser determines in good faith that such method does not represent fair value.

Tax Information, Dividends and Distributions to Shareholders and Uncertain Tax Positions

The Funds are treated as separate entities for Federal income tax purposes. Each Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To qualify and remain eligible for the special tax treatment accorded to RICs, each Fund must meet certain annual

20

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

income and quarterly asset diversification requirements and must distribute annually at least 90% of the sum of (i) its investment company taxable income (which includes dividends, interest and net short-term capital gains) and (ii) certain net tax-exempt income, if any. If so qualified, each Fund will not be subject to Federal income tax.

Distributions to shareholders are recorded on the ex-dividend date. The Funds generally pay out dividends from net investment income, if any, annually, and distribute their net capital gains, if any, to shareholders at least annually. The Funds may also pay a special distribution at the end of the calendar year to comply with Federal tax requirements. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed earnings and profit for tax purposes are reported as a tax return of capital.

Management evaluates the Funds’ tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Interest and penalties related to income taxes would be recorded as income tax expense. The Funds’ Federal income tax returns are subject to examination by the Internal Revenue Service (the “IRS”) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. As of December 31, 2020, the Funds’ fiscal period end, the Funds had no material uncertain tax positions and did not have a liability for any unrecognized tax benefits. As of December 31, 2020, the Funds’ fiscal period end, the Funds had no examination in progress and management is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months.

The Funds recognized no interest or penalties related to uncertain tax benefits in the fiscal period 2020. At December 31, 2020, the Funds’ fiscal period end, the tax periods from commencement of operations remained open to examination in the Funds’ major tax jurisdictions.

Indemnification

In the normal course of business, the Funds expect to enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these anticipated arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, the Adviser expects the risk of loss to be remote.

|

3. |

INVESTMENT ADVISORY AND OTHER AGREEMENTS |

Investment Advisory Agreement

The Trust has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser provides a continuous investment program for the Funds’ assets in accordance with its investment objectives, policies and limitations, and oversees the day-to-day operations of the Funds subject to the supervision of the Board, including the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act.

Pursuant to the Advisory Agreement between the Trust, on behalf of the Funds, and Roundhill, each Fund pays a unified management fee to the Adviser, which is calculated daily and paid monthly, at an annual rate of 0.50% of NERD’s average daily net assets and at an annual rate of 0.75% of BETZ’s average daily net assets. Roundhill has agreed to pay all expenses of the Funds except the fee paid to Roundhill under the Advisory Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses (if any). Roundhill, in turn, compensates Exchange Traded Concepts, LLC as the Sub-Adviser from the management fee it receives.

21

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

Exchange Traded Concepts, LLC (the “Sub-Adviser”), an Oklahoma limited liability company serves as the sub-adviser to the Funds. The Sub-Adviser is majority owned by Cottonwood ETF Holdings LLC. Pursuant to a Sub-Advisory Agreement between the Adviser and the Sub-Adviser (the “Sub-Advisory Agreement”), the Sub-Adviser is responsible for trading portfolio securities on behalf of the Funds, including selecting broker-dealers to execute purchase and sale transactions as instructed by the Adviser or in connection with any rebalancing or reconstitution of each Fund’s Index, subject to the supervision of the Adviser and the Board, including the independent Trustees. For its services, the Sub-Adviser is entitled to a sub-advisory fee paid by the Adviser, which is calculated daily and paid monthly, at an annual rate based on the average daily net assets of each Fund, and subject to a minimum annual fee as follows:

Minimum Annual Fee |

Asset-Based Fee |

$15,000 |

4 bps (0.04%) on the first $200 million 3.5 bps (0.035%) on the next $800 million 3 bps (0.03%) on the next $1 billion 2.5 bps (0.025%) on the balance over $2 billion |

BITKRAFT Esports Ventures Fund I, L.P. (“BITKRAFT”) is a minority owner of the Adviser and has (via an affiliate) licensed the name “BITKRAFT” to the Adviser for use with NERD. BITKRAFT is not involved in the management of NERD or the maintenance or calculation of the Index.

Fee Waiver Agreement

For NERD, the Adviser contractually agreed to waive 0.25% of its unified management fee until June 30, 2020. The Fee Waiver Agreement expired on June 30, 2020 and was not renewed. The Adviser waived $16,856 during the year ended December 31, 2020. Pursuant to the Fee Waiver Agreement, waived fees are not subject to recoupment by the Adviser.

Distribution Agreement and 12b-1 Plan

Foreside Fund Services, LLC (the “Distributor”) serves as each Fund’s distributor pursuant to a Distribution Services Agreement. The Distributor receives compensation for the statutory underwriting services it provides to the Funds. The Distributor enters into agreements with certain broker-dealers and others that will allow those parties to be “Authorized Participants” and to subscribe for and redeem shares of the Funds. The Distributor will not distribute shares in less than whole Creation Units and does not maintain a secondary market in shares.

The Board has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act (“Rule 12b-1 Plan”). In accordance with the Rule 12b-1 Plan, each Fund is authorized to pay an amount up to 0.25% of the Fund’s average daily net assets each year for certain distribution-related activities. As authorized by the Board, no Rule 12b-1 fees are currently paid by the Funds and there are no plans to impose these fees. However, in the event Rule 12b-1 fees are charged in the future, they will be paid out of each Fund’s assets. The Adviser and its affiliates may, out of their own resources, pay amounts to third parties for distribution or marketing services on behalf of the Funds.

Administrator, Custodian and Transfer Agent

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or “Administrator”) serves as administrator, transfer agent and fund accounting agent of the Funds pursuant to a Fund Servicing Agreement. U.S. Bank N.A. (the “Custodian”), an affiliate of Fund Services, serves as the Funds’ custodian pursuant to a Custody Agreement. Under the terms of these agreements, the Adviser pays each Fund’s administrative, custody and transfer agency fees.

A Trustee and all officers of the Trust are affiliated with the Administrator and Custodian.

|

4. |

CREATION AND REDEMPTION TRANSACTIONS |

Shares of the Funds are listed and traded on the NYSE Arca, Inc. (the “Exchange”). Each Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares called “Creation Units.” A Creation Unit generally consists of 25,000 shares. Creation Units are to be issued and redeemed principally in kind for a basket of securities and a balancing cash

22

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Market prices for the shares may be different from their NAV. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the NYSE is open for trading. The NAV of the shares of each Fund will be equal to a Fund’s total assets minus a Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent; however, for purposes of determining the price of Creation Units, the NAV will be calculated to five decimal places.

Creation Unit Transaction Fee

Authorized Participants will be required to pay to the Custodian a fixed transaction fee (the “Creation Unit Transaction Fee”) in connection with the issuance or redemption of Creation Units. The standard Creation Unit Transaction Fee will be the same regardless of the number of Creation Units purchased or redeemed by an investor on the applicable business day. The Creation Unit Transaction Fee charged by each Fund for each creation order is $500.

An additional variable fee of up to a maximum of 2% of the value of the Creation Units subject to the transaction may be imposed for (i) creations effected outside the Clearing Process and (ii) creations made in an all cash amount (to offset the Trust’s brokerage and other transaction costs associated with using cash to purchase or redeem the requisite Deposit Securities). Investors are responsible for the costs of transferring the securities constituting the Deposit Securities to the account of the Trust. Each Fund may determine to not charge a variable fee on certain orders when the Adviser has determined that doing so is in the best interests of Fund shareholders. Variable fees, if any, received by the Funds are displayed in the Capital Share Transactions section on the Statements of Changes in Net Assets.

Only “Authorized Participants” may purchase or redeem shares directly from the Funds. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. Securities received or delivered in connection with in-kind creates and redeems are valued as of the close of business on the effective date of the creation or redemption.

A creation unit will generally not be issued until the transfer of good title of the deposit securities to the Funds and the payment of any cash amounts have been completed. To the extent contemplated by the applicable participant agreement, Creation Units of the Funds will be issued to such authorized participant notwithstanding the fact that the Funds’ deposits have not been received in part or in whole, in reliance on the undertaking of the authorized participant to deliver the missing deposit securities as soon as possible. If the Funds or their agents do not receive all of the deposit securities, or the required cash amounts, by such time, then the order may be deemed rejected and the authorized participant shall be liable to the Funds for losses, if any.

|

5. |

FEDERAL INCOME TAX |

The tax character of distributions paid was as follows:

Ordinary |

Long-Term |

Return of |

||||||||||

Fiscal period ended December 31, 2020 |

||||||||||||

NERD |

$ | 548,036 | $ | 227,778 | $ | — | ||||||

BETZ |

550,629 | — | 8,305 | |||||||||

23

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

Ordinary |

Long-Term |

Return of |

||||||||||

Fiscal period ended December 31, 2019 |

||||||||||||

NERD |

$ | 32,724 | $ | — | $ | 756 | ||||||

BETZ |

— | — | — | |||||||||

|

(1) |

Ordinary income includes short-term capital gains. |

At December 31, 2020, the Funds’ fiscal period end, the components of distributable earnings (accumulated losses) and cost of investments on a tax basis, including the adjustments for financial reporting purposes as of the most recently completed Federal income tax reporting year, were as follows:

NERD |

BETZ |

|||||||

Federal Tax Cost of Investments |

$ | 69,005,557 | $ | 160,833,973 | ||||

Gross Tax Unrealized Appreciation |

$ | 14,349,814 | $ | 54,488,990 | ||||

Gross Tax Unrealized Depreciation |

(1,894,070 | ) | (4,940,485 | ) | ||||

Net Tax Unrealized Appreciation (Depreciation) |

12,455,744 | 49,548,505 | ||||||

Other Accumulated Gain (Loss) |

(95,694 | ) | (1,363,720 | ) | ||||

Total Distributable Earnings / (Accumulated Losses) |

$ | 12,360,050 | $ | 48,184,785 | ||||

The difference between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales and mark-to-market treatment of passive foreign investment companies.

Under current tax law, net capital losses realized after October 31 as well as certain specified ordinary losses incurred after October 31, may be deferred and treated as occurring on the first day of the following fiscal year. The Funds’ carryforward losses and post-October losses are determined only at the end of each fiscal year. At December 31, 2020, BETZ had short-term capital losses of $1,361,616 remaining which will be carried forward indefinitely to offset future realized capital gains. At December 31, 2020, NERD and BETZ deferred, on a tax basis, specified late year ordinary losses of $95,227 and $1,743, respectively.

U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent differences primarily relate to redemptions in-kind. For the fiscal period ended December 31, 2020, the following reclassifications were made for permanent tax differences on the Statements of Assets and Liabilities.

Total |

Paid-in Capital |

|||||||

NERD |

$ | (7,431,600 | ) | $ | 7,431,600 | |||

BETZ |

(9,034,832 | ) | 9,034,832 | |||||

24

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

|

6. |

INVESTMENT TRANSACTIONS |

During the fiscal year or period ended December 31, 2020, the Funds realized net capital gains and losses resulting from in-kind redemptions, in which shareholders exchanged Fund shares for securities held by the Funds rather than for cash. Because such gains are not taxable to the Funds, and are not distributed to shareholders, they have been reclassified from total distributable earnings (accumulated losses) to paid in-capital. The amount of realized gains and losses from in-kind redemptions included in realized gain/(loss) on investments in the Statements of Operations is as follows:

Realized Gains |

Realized Losses |

|||||||

NERD |

$ | 8,246,478 | $ | 40,225 | ||||

BETZ |

9,659,841 | 153,128 | ||||||

Purchases and sales of investments (excluding short-term investments), creations in-kind and redemptions in-kind for the fiscal year or period ended December 31, 2020 were as follows:

Purchases |

Sales |

Creations |

Redemptions |

|||||||||||||

NERD |

$ | 36,674,308 | $ | 28,069,535 | $ | 53,821,566 | $ | 19,876,733 | ||||||||

BETZ |

60,136,534 | 55,429,901 | 177,758,354 | 32,699,684 | ||||||||||||

|

7. |

SECURITIES LENDING |

The Funds may lend domestic and foreign securities in their portfolios to approved brokers, dealers and financial institutions (but not individuals) under terms of participation in a securities lending program effective November 19, 2020, which is administered by the Custodian. The securities lending agreement requires that loans are initially collateralized in an amount equal to at least 105% of the then current market value of any loaned securities that are foreign securities, or 102% of the then current market value of any other loaned securities. The custodian performs on a daily basis marking to market loaned securities and collateral. Each borrower is required, if necessary, to deliver additional collateral so that the total collateral held in the account for all loans of the Funds to the borrower will equal at least 100% of the market value of the loaned securities. The cash collateral is invested by the Custodian in accordance with approved investment guidelines. Those guidelines allow the cash collateral to be invested in readily marketable, high quality, short-term obligations issued or guaranteed by the United States Government; however, such investments are subject to risk of payment delays, declines in the value of collateral provided, default on the part of the issuer or counterparty, or otherwise may not generate sufficient interest to support the costs associated with securities lending. The Funds could also experience delays in recovering their securities and possible loss of income or value if the borrower fails to return the borrowed securities, although the Funds are indemnified from this risk by contract with the securities lending agent.

The collateral invested in the Funds, if any, is reflected in each Fund’s Schedule of Investments and is included in the Statements of Assets and Liabilities in the line item labeled “Investments, at value.” A liability of equal value to the cash collateral received and subsequently invested in the Funds is included on the Statements of Assets and Liabilities as “Collateral received for securities loaned.” During the fiscal period ended December 31, 2020, the Funds loaned securities and received cash collateral for the loans, which was invested in the First American Government Obligations Fund - Class X. The Funds receive compensation in the form of loan fees owed by borrowers and income earned on collateral investments. A portion of the interest received on the loan collateral is retained by the Funds and the remainder is rebated to the borrower of the securities. Pursuant to the securities lending agreement between the Trust, on behalf of the Funds, and the Custodian, each Fund pays a fee to the Custodian, which is calculated daily and paid monthly, at a rate of 20% of the Funds’ aggregate net income. The net amount of interest earned, after the interest rebate and the allocation to the Custodian, is included in the Statements of Operations as “Securities lending income, net.” The Funds continue to receive interest payments or dividends on the securities loaned during the borrowing period.

25

Roundhill ETFs

Notes to Financial Statements

December 31, 2020 (Continued)

As of December 31, 2020, the value of the securities on loan and payable for collateral due to broker were as follows:

Value of Securities on Loan and Collateral Received

Fund |

Values of |

Fund Collateral |

||||||

NERD |

$ | 7,623,703 | $ | 7,819,921 | ||||

BETZ |

3,491,596 | 3,536,889 | ||||||

|

* |

The cash collateral received was invested in the First American Government Obligations Fund - Class X, a money market fund subject to Rule 2a-7 under the 1940 Act with an overnight and continuous maturity, as shown on the Schedules of Investments. |

Due to the absence of a master netting agreement related to the Funds’ participation in securities lending, no additional offsetting disclosures have been made on behalf of the Funds for the total borrowings listed above.

|

8. |

PRINCIPAL RISKS |

As with all ETFs, shareholders of the Funds are subject to the risk that their investment could lose money. Each Fund is subject to the principal risks, any of which may adversely affect a Fund’s NAV, trading price, yield, total return and ability to meet its investment objective.