Exhibit 99.1

FOR THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF GTY TECHNOLOGY HOLDINGS INC. THIS PROXY IS SOLICITED

ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints William D. Green and Harry L. You (the “Proxies”),

and each of them independently, with full power of substitution, as proxies to vote all of the ordinary shares of GTY Technology

Holdings Inc., a Cayman Islands exempted company (the “Company”), that the undersigned is entitled to vote (the “Shares”)

at the Extraordinary General Meeting of Shareholders of the Company to be held on _______________, 2019 at _________ a.m. Local

Time at the offices of Winston & Strawn LLP, 200 Park Avenue, New York, New York 10166, and at any adjournments and/or postponements

thereof. The undersigned acknowledges receipt of the enclosed proxy statement and revokes all prior proxies for said meeting. THE

SHARES REPRESENTED BY THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER(S).

IF NO SPECIFIC DIRECTION IS GIVEN AS TO THE PROPOSALS ON THE REVERSE SIDE, THIS PROXY WILL BE VOTED “FOR” PROPOSALS

1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13 AND 14. PLEASE MARK, SIGN, DATE, AND RETURN THE PROXY CARD PROMPTLY. (Continued and to

be marked, dated and signed on the reverse side) P R O X Y C A R D Important Notice Regarding the Availability of Proxy Materials

for the 2019 Extraordinary General Meeting of Shareholders to be held on ___________, 2019. This notice of Extraordinary General

Meeting, the accompanying Proxy Statement is available at: https://www.cstproxy.com/gtytechnologyholdings/sm2019

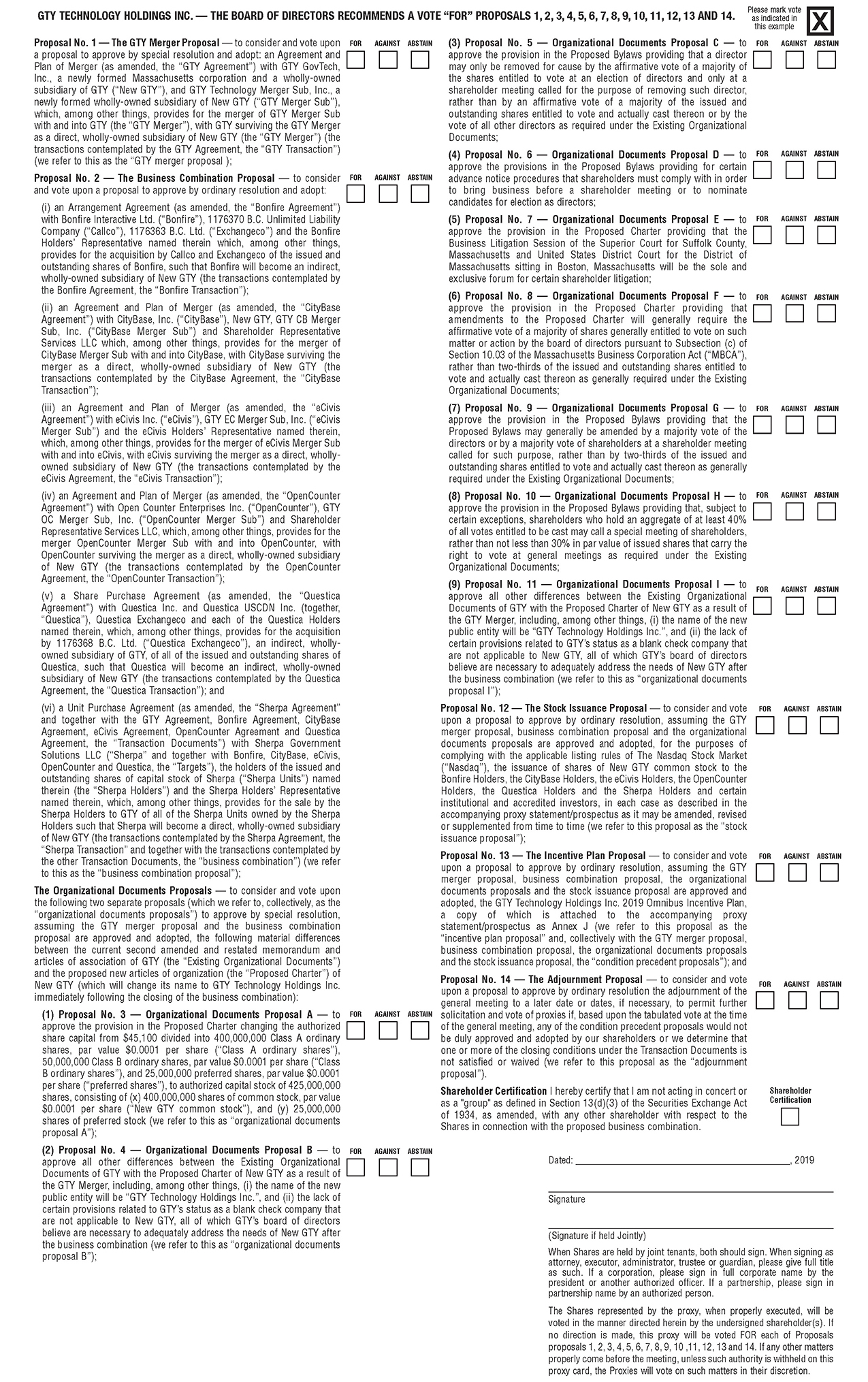

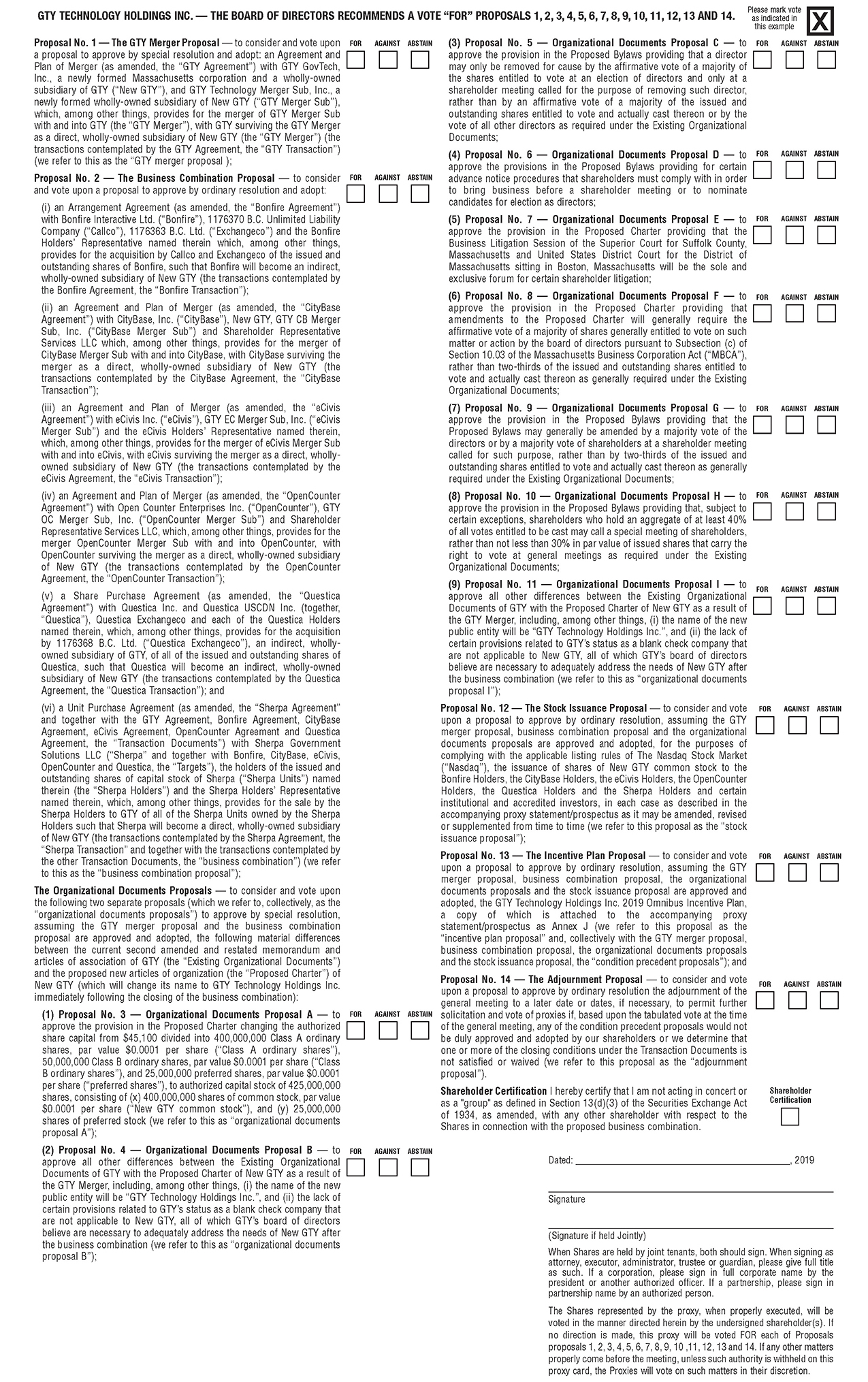

Please mark vote as indicated in this example GTY TECHNOLOGY HOLDINGS INC. — THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13 AND 14. X FOR AGAINST ABSTAIN FOR AGAINST

ABSTAIN FOR AGAINST ABSTAIN Shareholder Certification Proposal No. 1 — The GTY Merger Proposal — to consider and vote

upon a proposal to approve by special resolution and adopt: an Agreement and Plan of Merger (as amended, the “GTY Agreement”)

with GTY GovTech, Inc., a newly formed Massachusetts corporation and a wholly-owned subsidiary of GTY (“New GTY”),

and GTY Technology Merger Sub, Inc., a newly formed wholly-owned subsidiary of New GTY (“GTY Merger Sub”), which, among

other things, provides for the merger of GTY Merger Sub with and into GTY (the “GTY Merger”), with GTY surviving the

GTY Merger as a direct, wholly-owned subsidiary of New GTY (the “GTY Merger”) (the transactions contemplated by the

GTY Agreement, the “GTY Transaction”) (we refer to this as the “GTY merger proposal ); Proposal No. 2 —

The Business Combination Proposal — to consider and vote upon a proposal to approve by ordinary resolution and adopt: (i)

an Arrangement Agreement (as amended, the “Bonfire Agreement”) with Bonfire Interactive Ltd. (“Bonfire”),

1176370 B.C. Unlimited Liability Company (“Callco”), 1176363 B.C. Ltd. (“Exchangeco”) and the Bonfire Holders’

Representative named therein which, among other things, provides for the acquisition by Callco and Exchangeco of the issued and

outstanding shares of Bonfire, such that Bonfire will become an indirect, wholly-owned subsidiary of New GTY (the transactions

contemplated by the Bonfire Agreement, the “Bonfire Transaction”); (ii) an Agreement and Plan of Merger (as amended,

the “CityBase Agreement”) with CityBase, Inc. (“CityBase”), New GTY, GTY CB Merger Sub, Inc. (“CityBase

Merger Sub”) and Shareholder Representative Services LLC which, among other things, provides for the merger of CityBase Merger

Sub with and into CityBase, with CityBase surviving the merger as a direct, wholly-owned subsidiary of New GTY (the transactions

contemplated by the CityBase Agreement, the “CityBase Transaction”); (iii) an Agreement and Plan of Merger (as amended,

the “eCivis Agreement”) with eCivis Inc. (“eCivis”), GTY EC Merger Sub, Inc. (“eCivis Merger Sub”)

and the eCivis Holders’ Representative named therein, which, among other things, provides for the merger of eCivis Merger

Sub with and into eCivis, with eCivis surviving the merger as a direct, whollyowned subsidiary of New GTY (the transactions contemplated

by the eCivis Agreement, the “eCivis Transaction”); (iv) an Agreement and Plan of Merger (as amended, the “OpenCounter

Agreement”) with Open Counter Enterprises Inc. (“OpenCounter”), GTY OC Merger Sub, Inc. (“OpenCounter Merger

Sub”) and Shareholder Representative Services LLC, which, among other things, provides for the merger OpenCounter Merger

Sub with and into OpenCounter, with OpenCounter surviving the merger as a direct, wholly-owned subsidiary of New GTY (the transactions

contemplated by the OpenCounter Agreement, the “OpenCounter Transaction”); (v) a Share Purchase Agreement (as amended,

the “Questica Agreement”) with Questica Inc. and Questica USCDN Inc. (together, “Questica”), Questica Exchangeco

and each of the Questica Holders named therein, which, among other things, provides for the acquisition by 1176368 B.C. Ltd. (“Questica

Exchangeco”), an indirect, whollyowned subsidiary of GTY, of all of the issued and outstanding shares of Questica, such that

Questica will become an indirect, wholly-owned subsidiary of New GTY (the transactions contemplated by the Questica Agreement,

the “Questica Transaction”); and (vi) a Unit Purchase Agreement (as amended, the “Sherpa Agreement” and

together with the GTY Agreement, Bonfire Agreement, CityBase Agreement, eCivis Agreement, OpenCounter Agreement and Questica Agreement,

the “Transaction Documents”) with Sherpa Government Solutions LLC (“Sherpa” and together with Bonfire,

CityBase, eCivis, OpenCounter and Questica, the “Targets”), the holders of the issued and outstanding shares of capital

stock of Sherpa (“Sherpa Units”) named therein (the “Sherpa Holders”) and the Sherpa Holders’ Representative

named therein, which, among other things, provides for the sale by the Sherpa Holders to GTY of all of the Sherpa Units owned by

the Sherpa Holders such that Sherpa will become a direct, wholly-owned subsidiary of New GTY (the transactions contemplated by

the Sherpa Agreement, the “Sherpa Transaction” and together with the transactions contemplated by the other Transaction

Documents, the “business combination”) (we refer to this as the “business combination proposal”); The Organizational

Documents Proposals — to consider and vote upon the following two separate proposals (which we refer to, collectively, as

the “organizational documents proposals”) to approve by special resolution, assuming the GTY merger proposal and the

business combination proposal are approved and adopted, the following material differences between the current second amended and

restated memorandum and articles of association of GTY (the “Existing Organizational Documents”) and the proposed new

articles of organization (the “Proposed Charter”) of New GTY (which will change its name to GTY Technology Holdings

Inc. immediately following the closing of the business combination): (1) Proposal No. 3 — Organizational Documents Proposal

A — to approve the provision in the Proposed Charter changing the authorized share capital from $45,100 divided into 400,000,000

Class A ordinary shares, par value $0.0001 per share (“Class A ordinary shares”), 50,000,000 Class B ordinary shares,

par value $0.0001 per share (“Class B ordinary shares”), and 25,000,000 preferred shares, par value $0.0001 per share

(“preferred shares”), to authorized capital stock of 425,000,000 shares, consisting of (x) 400,000,000 shares of common

stock, par value $0.0001 per share (“New GTY common stock”), and (y) 25,000,000 shares of preferred stock (we refer

to this as “organizational documents proposal A”); (2) Proposal No. 4 — Organizational Documents Proposal B —

to approve all other differences between the Existing Organizational Documents of GTY with the Proposed Charter of New GTY as a

result of the GTY Merger, including, among other things, (i) the name of the new public entity will be “GTY Technology Holdings

Inc.”, and (ii) the lack of certain provisions related to GTY’s status as a blank check company that are not applicable

to New GTY, all of which GTY’s board of directors believe are necessary to adequately address the needs of New GTY after

the business combination (we refer to this as “organizational documents proposal B”); (3) Proposal No. 5 — Organizational

Documents Proposal C — to approve the provision in the Proposed Bylaws providing that a director may only be removed for

cause by the affirmative vote of a majority of the shares entitled to vote at an election of directors and only at a shareholder

meeting called for the purpose of removing such director, rather than by an affirmative vote of a majority of the issued and outstanding

shares entitled to vote and actually cast thereon or by the vote of all other directors as required under the Existing Organizational

Documents; (4) Proposal No. 6 — Organizational Documents Proposal D — to approve the provisions in the Proposed Bylaws

providing for certain advance notice procedures that shareholders must comply with in order to bring business before a shareholder

meeting or to nominate candidates for election as directors; (5) Proposal No. 7 — Organizational Documents Proposal E —

to approve the provision in the Proposed Charter providing that the Business Litigation Session of the Superior Court for Suffolk

County, Massachusetts and United States District Court for the District of Massachusetts sitting in Boston, Massachusetts will

be the sole and exclusive forum for certain shareholder litigation; (6) Proposal No. 8 — Organizational Documents Proposal

F — to approve the provision in the Proposed Charter providing that amendments to the Proposed Charter will generally require

the affirmative vote of a majority of shares generally entitled to vote on such matter or action by the board of directors pursuant

to Subsection (c) of Section 10.03 of the Massachusetts Business Corporation Act (“MBCA”), rather than two-thirds of

the issued and outstanding shares entitled to vote and actually cast thereon as generally required under the Existing Organizational

Documents; (7) Proposal No. 9 — Organizational Documents Proposal G — to approve the provision in the Proposed Bylaws

providing that the Proposed Bylaws may generally be amended by a majority vote of the directors or by a majority vote of shareholders

at a shareholder meeting called for such purpose, rather than by two-thirds of the issued and outstanding shares entitled to vote

and actually cast thereon as generally required under the Existing Organizational Documents; (8) Proposal No. 10 — Organizational

Documents Proposal H — to approve the provision in the Proposed Bylaws providing that, subject to certain exceptions, shareholders

who hold an aggregate of at least 40% of all votes entitled to be cast may call a special meeting of shareholders, rather than

not less than 30% in par value of issued shares that carry the right to vote at general meetings as required under the Existing

Organizational Documents; (9) Proposal No. 11 — Organizational Documents Proposal I — to approve all other differences

between the Existing Organizational Documents of GTY with the Proposed Charter of New GTY as a result of the GTY Merger, including,

among other things, (i) the name of the new public entity will be “GTY Technology Holdings Inc.”, and (ii) the lack

of certain provisions related to GTY’s status as a blank check company that are not applicable to New GTY, all of which GTY’s

board of directors believe are necessary to adequately address the needs of New GTY after the business combination (we refer to

this as “organizational documents proposal I”); Proposal No. 12 — The Stock Issuance Proposal — to consider

and vote upon a proposal to approve by ordinary resolution, assuming the GTY merger proposal, business combination proposal and

the organizational documents proposals are approved and adopted, for the purposes of complying with the applicable listing rules

of The Nasdaq Stock Market (“Nasdaq”), the issuance of shares of New GTY common stock to the Bonfire Holders, the CityBase

Holders, the eCivis Holders, the OpenCounter Holders, the Questica Holders and the Sherpa Holders and certain institutional and

accredited investors, in each case as described in the accompanying proxy statement/prospectus as it may be amended, revised or

supplemented from time to time (we refer to this proposal as the “stock issuance proposal”); Proposal No. 13 —

The Incentive Plan Proposal — to consider and vote upon a proposal to approve by ordinary resolution, assuming the GTY merger

proposal, business combination proposal, the organizational documents proposals and the stock issuance proposal are approved and

adopted, the GTY Technology Holdings Inc. 2019 Omnibus Incentive Plan, a copy of which is attached to the accompanying proxy statement/prospectus

as Annex J (we refer to this proposal as the “incentive plan proposal” and, collectively with the GTY merger proposal,

business combination proposal, the organizational documents proposals and the stock issuance proposal, the “condition precedent

proposals”); and Proposal No. 14 — The Adjournment Proposal — to consider and vote upon a proposal to approve

by ordinary resolution the adjournment of the general meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the general meeting, any of the condition precedent proposals

would not be duly approved and adopted by our shareholders or we determine that one or more of the closing conditions under the

Transaction Documents is not satisfied or waived (we refer to this proposal as the “adjournment proposal”). Shareholder

Certification I hereby certify that I am not acting in concert or as a "group" as defined in Section 13(d)(3) of the

Securities Exchange Act of 1934, as amended, with any other shareholder with respect to the Shares in connection with the proposed

business combination. Dated: , 2019 Signature (Signature if held Jointly) When Shares are held by joint tenants, both should sign.

When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please

sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by

an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein

by the undersigned shareholder(s). If no direction is made, this proxy will be voted FOR each of Proposals proposals 1, 2, 3, 4,

5, 6, 7, 8, 9, 10 ,11, 12, 13 and 14. If any other matters properly come before the meeting, unless such authority is withheld

on this proxy card, the Proxies will vote on such matters in their discretion. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST

ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN

FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN