UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report:

For the transition period from _____________ to _____________.

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s Name into English)

(Jurisdiction of Incorporation or Organization)

(Address of Principal Executive Offices)

Tel:

(Name, Telephone, and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | ☒ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

i

INTRODUCTION

Except where the context otherwise indicates and for the purpose of this annual report only:

| ● | “Antalpha” refers to Antalpha Holdings Limited, a limited liability company organized under the laws of the British Virgin Islands, and/or its subsidiaries, Antalpha Technologies Limited, Antalpha Technologies Holdings Limited and Antalpha Platform Technologies Limited; |

| ● | “China” or “PRC” refers to the People’s Republic of China and only when this annual report refers to specific laws and regulations adopted by the PRC, excludes Hong Kong, Macau and Taiwan; |

| ● | “IFRS” refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board; |

| ● | “Metalpha,” “we,” “us,” “our company” or “our” refers to Metalpha Technology Holding Limited and its subsidiaries; |

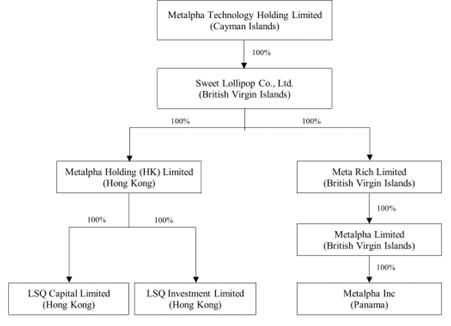

| ● | “Meta Rich” refers to Meta Rich Limited, a limited liability company organized under the laws of the British Virgin Islands and a wholly owned subsidiary of Sweet Lollipop; |

| ● | “Metalpha HK” refers to Metalpha Holding (HK) Limited (formerly known as Longyun International Holdings Limited), a limited liability company organized under the laws of Hong Kong and a wholly owned subsidiary of Sweet Lollipop; |

| ● | “PCAOB” refers to the Public Company Accounting Oversight Board; |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “SEC” refers to the U.S. Securities and Exchange Commission; |

| ● | “SFC” refers to Securities and Futures Commission of Hong Kong; |

| ● | “shares,” “Shares,” or “Ordinary Shares” refers to the ordinary shares, par value US$0.0001 per share, of Metalpha Technology Holding Limited; |

| ● | “Sweet Lollipop” refers to Sweet Lollipop Co., Ltd., a limited liability company organized under the laws of the British Virgin Islands and a wholly-owned subsidiary of Metalpha Technology Holding Limited; and |

| ● | “U.S. dollars,” “US$,” “$,” or “dollars” refers to the legal currency of the United States. |

Our reporting currency is U.S. dollars. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, the conversions between U.S. dollars and Hong Kong dollars were made at the rate of HK$7.8499 to US$1.00, the exchange rate on March 31, 2023 set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve Board. We make no representation that any Hong Kong dollars or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate, or at all. Any discrepancies in any table between totals and sums of amounts listed therein are due to rounding.

ii

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. These statements involve known and unknown risks, uncertainties, and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” that may cause our actual results, performance, or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue,” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy, and financial needs. These forward-looking statements include statements relating to:

| ● | future financial and operating results, including revenue, income, expenditures, cash balances, and other financial items; |

| ● | our ability to execute our growth, expansion, and acquisition strategies, including our ability to meet our goals; |

| ● | anticipated trends, growth rates, and challenges in our business, the crypto economy, the price and market capitalization of crypto assets and in the markets in which we operate; |

| ● | market acceptance of our products and services; |

| ● | current and future economic and political conditions; |

| ● | our ability to compete in an industry with low barriers to entry; |

| ● | our capital requirements and our ability to raise any additional financing which we may require; |

| ● | our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business both in the United States and internationally given the highly evolving and uncertain regulatory landscape; |

| ● | our ability to protect our intellectual property rights and secure the right to use other intellectual property that we deem to be essential or desirable to the conduct of our business; |

| ● | our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; |

| ● | our ability to retain the services of key personnel; |

| ● | overall industry and market performance; and |

| ● | other assumptions described in this annual report underlying or relating to any forward-looking statements. |

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Other sections of this annual report include additional factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should read thoroughly this annual report and the documents that we refer to with the understanding that our actual future results may be materially different from, or worse than, what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we refer to in this annual report and exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

iii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

Corporate Structure

Metalpha Technology Holding Limited is a Cayman Islands holding company. It does not engage in operations itself but rather conducts its operations through its subsidiaries incorporated in the British Virgin Islands, Panama and Hong Kong.

The following diagram illustrates our corporate structure as of the date of this annual report, including our significant subsidiaries.

A. [Reserved]

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

1

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully below in this section.

Risks Relating to Our Business and Industry

Risks and uncertainties related to our business and industries include, but are not limited to, the following:

| ● | We have a limited operating history and are subject to the risks encountered by early-stage companies; |

| ● | We may need additional capital to fund our future operations and, if it is not available when needed, we may need to reduce our planned expansion and marketing efforts, which may reduce our income; |

| ● | Our auditor has indicated that there is a substantial doubt about our ability to continue as a going concern. |

| ● | Our wealth management business is subject to customer concentration risk; |

| ● | We rely on certain related party for products subscription and any shortage or interruption in subscription could slow our growth and reduce our profitability; |

| ● | Our business operations significantly depend on several key partners in the crypto industry for trading and asset custody. If these key partners experience operational disruptions due to mismanagement or regulatory sanctions resulting from non-compliance, their services may be interrupted or we may lose our assets which materially and adversely affect our business operations, financial condition and future growth; |

| ● | It may be or become illegal to acquire, own, hold, sell or use cryptocurrencies, participate in the blockchain, or transfer or utilize similar cryptocurrency assets in international markets where we operate due to adverse changes in the regulatory and policy environment in different jurisdictions; and |

| ● | The loss or destruction of private keys required to access any digital assets held by us may be irreversible. If we are unable to access our private keys or if we experience a hack or other data loss relating to our ability to access any digital assets, it could cause regulatory scrutiny, reputational harm, and other losses. |

Risks Related to Doing Business in Jurisdictions Where We Operate

Risks and uncertainties related doing business in jurisdictions we operate include, but are not limited to, the following:

| ● | A downturn in the Hong Kong, China or global economy, and economic and political policies of China could materially and adversely affect our business and financial condition; |

| ● | The Hong Kong legal system embodies uncertainties which could limit the legal protections available to us; |

| ● | Hong Kong laws and regulations related to the cryptocurrency business is still under development and subject to significant changes, and any potential changes in the legal and regulatory landscape may adversely affect our business financial condition and future expansion; |

| ● | Hong Kong regulatory requirement of prior approval for transfer of shares in excess of certain threshold may restrict future takeovers and other transactions; and |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against us or our management named in this annual report based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China. |

2

Risks Relating to Our Ordinary Shares and the Trading Market

Risks and uncertainties related to our Ordinary Shares and the trading market include, but are not limited to, the following:

| ● | If we become directly subject to the scrutiny, criticism, and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation; |

| ● | Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.; |

| ● | The market price of our Ordinary Shares may be volatile or may decline regardless of our operating performance; |

| ● | If we cannot continue to satisfy listing requirements and other rules of Nasdaq Capital Market, although we exempt from certain corporate governance standards applicable to U.S. issuers as a Foreign Private Issuer, our securities may be delisted, which could negatively impact the price of our securities and your ability to sell them; and |

| ● | We have a substantial number of warrants outstanding. The exercise of our outstanding warrants can have a dilutive effect on our Ordinary Shares. |

Risks Relating to Our Business and Industry

We have a limited operating history and are subject to the risks encountered by early-stage companies.

The PRC operating entities had been in business since October 2014 until all business operations in mainland China were ceased and sold to third parties in March 2023. We have been a provider of wealth management services since December 2021.

As a fairly new operation, our business strategies and model are constantly being tested by the market. As such, our business may be subject to significant fluctuations in operating results.

Accordingly, you should consider our prospects in light of the costs, uncertainties, delays, and difficulties frequently encountered by companies with a limited operating history. In particular, you should consider that there is a significant risk that:

| ● | Our ability to introduce and manage the development of new wealth management business; |

| ● | We may require additional capital to develop and expand our operations, which may not be available to us when we require such additional capital; |

| ● | Our wealth management business is subject to customer concentration risk; |

| ● | Our marketing and growth strategy may not be successful; and |

| ● | Our business may be subject to significant fluctuations in operating results. |

Our future growth will depend substantially on our ability to address these and the other risks described in this annual report. If the operating entities do not successfully address these risks, their, and consequentially, our business would be significantly harmed.

3

We may need additional capital to fund our future operations and, if it is not available when needed, we may need to reduce our planned expansion and marketing efforts, which may reduce our income.

We believe that our existing working capital and cash available from operations will enable us to meet our working capital requirements for at least the next 12 months. However, if cash from our future operations is insufficient, or if cash is used for acquisitions or other currently unanticipated purposes, we may need additional capital. In addition, if we fail to generate sufficient net income from our business, it may continue to expend significant amounts of capital. As a result, we could be required to raise additional capital. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in dilution of the shares held by existing shareholders. If additional funds are raised through the issuance of debt or equity securities, such securities may provide the holders certain rights, preferences, and privileges senior to those of shareholders holding our Ordinary Shares, and the terms of any such debt securities could impose restrictions on the operating entities’ operations. We cannot assure you that additional capital, if required, will be available on acceptable terms, or at all. If we are unable to obtain sufficient amounts of additional capital, we may be required to reduce our scope of planned product development and marketing efforts, which could harm our business, financial condition and operating results.

Our auditor has indicated that there is a substantial doubt about our ability to continue as a going concern.

To date, we had net loss for the year, accumulated deficits and cash used in operating activities. For the fiscal year ended March 31, 2023, we recorded loss for the year of $20.2 million and net cash used in operating activities of $1.1 million. As of March 31, 2023, we had an aggregate accumulated deficit of $40.2 million. We anticipate that we will continue to report losses as well as negative operating cash flow. As a result of these net losses and other factors, our independent auditor issued an audit opinion with respect to our financial statements for the three years ended March 31, 2023 that indicated that there is a substantial doubt about our ability to continue as a going concern. Our financial statements have been prepared assuming we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These audited consolidated financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should we be unable to continue as a going concern.

There can be no assurance that we will ever be able to achieve or sustain profitability or positive cash flow. Our ability to continue as a going concern is dependent upon improving operational efficiency and cost reductions, generating sufficient cash flow from operations and obtaining additional capital and financing. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business.

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth and execute our business strategy.

If our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and its financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon our consultant team, consisting of 11 consultants. The loss of the services of our consultant team for any reason could significantly adversely impact our business and results of operations. Competition for senior management and senior technology personnel is intense and the pool of qualified candidates is very limited. We cannot assure you that the services of our senior executives, consultant team and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement if any of them were to leave.

We rely on certain related party for products subscription and any shortage or interruption in subscription could slow our growth and reduce our profitability.

Antalpha is a substantial shareholder of the Company and hence it is a related party of the Company. Antalpha is one of our key customers who subscribe to our issued cryptocurrency derivative products. For the fiscal year ended March 31, 2023, the aggregate notional amount of products we issued was approximately $382 million, among which Antalpha subscribed to products with a notional amount of approximately $326 million, accounting for approximately 85.6% of the total amount for the same fiscal year.

4

In addition, Antalpha provides significant support to our operations through its subsidiaries. These subsidiaries deliver technical management services and customer referral services, contributing significantly to our business growth and operational efficiency.

If our relationship with Antalpha deteriorates for any reason, Antalpha may slow down or even stop subscriptions to our products and/or terminate the services provided to us through its subsidiaries. As a result, our business, results of operations, financial condition and prospects could be materially and adversely affected.

Our wealth management business is subject to customer concentration risk.

For the fiscal year ended March 31, 2023, the aggregate notional amount of the products we issued was approximately $382 million, among which our top three customers subscribed to products of an aggregate notional amount of approximately $360 million, representing approximately 94.2% of the total amount for the same fiscal year. Our largest customer, Antalpha, subscribed to products with a notional amount of approximately $326 million, accounting for approximately 85.6% of the total amount for the same fiscal year. There is no assurance that we will be able to maintain or expand our relationships with our top customers, or that they will continue to subscribe to our products in current subscription amounts or at all. If our top customers significantly reduce or even cease their subscriptions to our products, we may not be able to timely find alternative customers with comparable subscription amounts, or at all, and we may experience a significant decline in our income as a result. Moreover, the business and financial condition of our top customers may deteriorate, which may materially and adversely affect their subscriptions to our products. Any of the foregoing, if materializes, may materially and adversely affect our business, results of operations and financial condition.

The acceptance and widespread use of digital assets are subject to a variety of factors beyond our control. A decline in the acceptance and use of digital assets may adversely affect the investment in our securities.

Digital assets have only recently become accepted as a means of payment for goods and services by certain major retail and commercial outlets. There is currently limited use of digital assets, such as Bitcoin, in the retail and commercial markets, thus contributing to price volatility that could adversely affect an investment in our securities. In contrast, a significant portion of demand for digital assets is generated by speculators and investors seeking to profit from the short- or long-term holding of tokens. The relative lack of acceptance and use of digital assets in the retail and commercial markets, or a reduction of such use, limits the ability of end users to use digital assets to pay for goods and services. Such lack of acceptance or contraction in acceptance or use of digital assets may increase the price volatility or affect the value of digital assets we acquire or hold, which could materially and adversely affect our business operations, financial performance and prospects, as well as the investment in our securities.

Our business operations significantly depend on several key partners in the crypto industry for trading and asset custody. If these key partners experience operational disruptions due to fraud, security failures, mismanagement or regulatory sanctions resulting from non-compliance, their services may be interrupted or we may lose our assets which materially and adversely affect our business operations, financial condition and future growth.

Operational disruptions of crypto asset trading venues and asset custody providers due to fraud, business failures, hackers or malware, or regulatory sanctions may reduce confidence in the crypto assets market and result in our loss of assets which could have a material adverse effect on our business operations, financial condition and future growth.

In particular, Binance serves as our primary trading service provider with the majority of our hedging trades taking place on their platform. Simultaneously, Binance also acts as a crucial subscriber to our products. In June 2023, the SEC leveled legal charges against two of the largest exchanges, Binance and Coinbase, consecutively. Both lawsuits involve the listing and trading of tokens deemed by the SEC as unregistered securities, and the claim that the profit and pledge services offered by both exchanges also violate securities law. In the allegations against Binance, the SEC further extended the scope of the charges, asserting that the exchange engaged in settlement trading and mixed client funds between its domestic and overseas entities. If the legal proceedings between Binance and the SEC result unfavorably for Binance, rendering it incapable of providing trading services or leading to significant asset losses, it may have a severe adverse impact on our business.

5

We are subject to a highly evolving regulatory landscape and any adverse changes to, or our failure to comply with, any laws and regulations could adversely affect our business, reputation, prospects or operations.

Until recently, relatively little regulatory attention has been directed toward the crypto assets market by U.S. federal and state governments, non-U.S. governments and self-regulatory agencies. As crypto assets have grown in popularity and in market size, the U.S. regulatory regime - namely the Federal Reserve Board, U.S. Congress and certain U.S. agencies (e.g., the SEC, the U.S. Commodity Futures Trading Commission (the “CFTC”), the Financial Crimes Enforcement Network (the “FinCEN”) and the Federal Bureau of Investigation), and local and foreign governmental organizations, consumer agencies and public advocacy groups have been examining the operations of crypto networks, users and platforms, with a focus on how crypto assets can be used to launder the proceeds of illegal activities, fund criminal or terrorist enterprises, and the safety and soundness of platforms and other service providers that hold crypto assets for users. Many of these entities have called for heightened regulatory oversight, and have issued consumer advisories describing the risks posed by crypto assets to users and investors. For instance, in March 2022, Federal Reserve Chair Jerome Powell expressed the need for regulation to prevent “cryptocurrencies from serving as a vehicle for terrorist finance and just general criminal behavior.” On March 8, 2022, President Biden announced an executive order on cryptocurrencies which seeks to establish a unified federal regulatory regime for cryptocurrencies. The complexity and evolving nature of our business and the significant uncertainty surrounding the regulation of the crypto assets industry requires us to exercise our judgment as to whether certain laws, rules, and regulations apply to us, and it is possible that governmental bodies and regulators may disagree with our conclusions. To the extent we have not complied with such laws, rules and regulations, we could be subject to significant fines, revocation of licenses, limitations on our products and services, reputational harm, and other regulatory consequences, each of which may be significant and could adversely affect our business, operating results, and financial condition.

Additionally, the recent bankruptcy filings of FTX, the third largest digital asset exchange by volume at the time of its filing, and its affiliated hedge fund Alameda Research LLC, in addition to other bankruptcy filings of crypto companies throughout calendar year 2022, will likely attract heightened regulatory scrutiny from U.S. regulatory agencies such as the SEC and CFTC. Increasing regulation and regulatory scrutiny may result in additional costs for us and our management having to devote increased time and attention to regulatory matters, change aspects of our business or result in limits on the utility of Bitcoin. In addition, regulatory developments and/or our business activities may require us to comply with certain regulatory regimes. Increasingly strict legal and regulatory requirements and any regulatory investigations and enforcement may result in changes to our business, as well as increased costs, supervision and examination. Moreover, new laws, regulations, or interpretations may result in additional litigation, regulatory investigations, and enforcement or other actions. Adverse changes to, or our failure to comply with, any laws and regulations may have, an adverse effect on our reputation and brand and our business, operating results, and financial condition.

In addition, cryptocurrencies may be used by market participants for black market transactions, to conduct fraud, money laundering and terrorism-funding, tax evasion, economic sanction evasion or other illegal activities. As a result, governments may seek to regulate, restrict, control or ban the mining, using, holding and transferring of cryptocurrencies. We may not be able to eliminate all instances where other parties use cryptocurrencies in money laundering or other illegal or improper activities. We cannot assure you that we will successfully detect and prevent all money laundering or other illegal or improper activities which may adversely affect our reputation, business, financial condition and results of operations.

Any failure to obtain or renew any required approvals, licenses, permits or certifications could materially and adversely affect our business and results of operations.

As of the date of this annual report, the entirety of our cryptocurrency business is operated outside of mainland China and the United States. In accordance with the laws and regulations in the jurisdictions in which we operate, we may be required to maintain various approvals, licenses, permits and certifications in order to operate our cryptocurrency business. Complying with such laws and regulations may require substantial expense, and any non-compliance may expose us to liability. In the event of non-compliance, we may have to incur significant expenses and divert substantial management time to rectify the incidents. In the future, if we fail to obtain all the necessary approvals, licenses, permits and certifications, we may be subject to fines or the suspension of operations of any business that do not have all the requisite approvals, licenses, permits and certifications, which could materially and adversely affect our business and results of operations. We may also experience adverse publicity arising from non-compliance with government regulations, which would negatively impact our reputation.

6

We have adopted the development strategy to focus on the expansion of our business products of issuing cryptocurrency derivative products in international markets. As such, we are subject to regulations applicable to operators of cryptocurrency business and derivative products business in these jurisdictions. To our best knowledge, we do not believe we need to obtain relevant governmental approval and license required for issuing cryptocurrency derivative products to customers in these jurisdictions. However, we cannot assure you that we will be able to obtain, maintain or renew any required government approval, permit, licenses for our future operations on commercially reasonable terms and in a timely manner or at all. Failure to maintain or renew these government approvals, permit or licenses for our international operations may cause us to suspend or terminate our cryptocurrency derivative product operations in such jurisdictions, and may subject us to regulatory investigations or legal proceedings and fines in these jurisdictions, which could disrupt our international operations and materially and adversely affect our business, financial condition and results of operations.

More broadly, we cannot assure you that we will be able to fulfill all the conditions necessary to obtain the required government approvals in the jurisdictions where we operate, or that relevant government officials in these jurisdictions will always, if ever, exercise their discretion in our favor, or that we will be able to adapt to any new laws, regulations or policies. There may also be delays on the part of government authorities in reviewing our applications and granting approvals, whether due to the lack of administrative resources or the imposition of new rules, regulations, government policies or their implementation, interpretation and enforcement, or for no discernible reason at all. If we are unable to obtain, or experience material delays in obtaining, necessary government approvals, our operations may be substantially disrupted, which could materially and adversely affect our business, financial condition and results of operations.

We may face several risks due to disruptions in the crypto asset markets, including but not limited to the risk from depreciation in our stock price, loss of customer demand, financing risk, risk of increased losses or impairments in our investments or other assets, risks of legal proceedings and government investigations, and risks from price declines or price volatility of crypto assets.

In the first half of 2022, some of the well-known crypto asset market participants, including Celsius Network, Voyager Digital Ltd. and Three Arrows Capital, declared bankruptcy, resulting in a loss of confidence in participants of the digital asset ecosystem and negative publicity surrounding digital assets more broadly. In November 2022, FTX, the third largest digital asset exchange by volume at the time, halted customer withdrawals and shortly thereafter, FTX and its subsidiaries filed for bankruptcy.

In response to these events, the digital asset markets have experienced extreme price volatility and several other entities in the digital asset industry have been, and may continue to be, negatively affected, further undermining confidence in the digital assets markets. These events have also negatively impacted the liquidity of the digital assets markets as certain entities affiliated with FTX engaged in significant trading activity. If the liquidity of the digital assets markets continues to be negatively impacted by these events, digital asset prices may continue to experience significant volatility and confidence in the digital asset markets may be further undermined. These events are continuing to develop and it is not possible to predict at this time all of the risks that they may pose to us or on the digital asset industry as a whole.

We had no direct exposure to FTX or any of the above-mentioned cryptocurrency companies. We do not have material assets that may not be recovered or may otherwise be lost or misappropriated due to the bankruptcies. However, the failure or insolvency of large exchanges like FTX may cause decreases in the prices of cryptocurrencies and investor confidence in the ecosystem, which could adversely affect investments in our products. The high volatility and downturns in cryptocurrency prices generally do not directly impact our business, and heightened volatility in cryptocurrency prices can even increase our trading profits. However, high volatility and downturns in cryptocurrency prices may impact our customers’ confidence in the market, thereby adversely affecting our operations and financial condition. We will timely adjust our strategies to expand our business and optimize our operating efficiency in the current dynamic market conditions.

7

We cannot assure that the price of cryptocurrencies will remain high enough to sustain our operation or that the price of cryptocurrencies will not decline significantly in the future. Fluctuations in the price of cryptocurrencies have had and are expected to continue to have an immediate impact on the trading price of our Ordinary Shares even before our financial performance is affected, if at all. To the extent investors view our Ordinary Shares as linked to the value of our cryptocurrency derivative product services, the decline of cryptocurrency value may have a material adverse effect on the market value of our Ordinary Shares.

In addition, a perceived lack of stability in the digital asset exchange market and the closure or temporary shutdown of digital asset exchanges due to business failure, hackers or malware, government-mandated regulation, or fraud, may reduce confidence in digital asset networks and result in greater volatility in cryptocurrency values. These potential consequences of a digital asset exchange’s failure could adversely affect an investment in us or the loss of customer demand for our products and services with respect to our cryptocurrency business.

As of the date of this annual report, we are not subject to any legal proceedings or government investigations in the United States or in other jurisdictions. However, in the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been brought against that company. We may become involved in this type of litigation in the future. Litigation of this type may be expensive to defend and may divert our management’s attention and resources from the operation of our business.

Political or economic crises may result in large-scale sales of digital assets, which could cause a reduction in the value of some or all digital assets and adversely affect the investment in our securities.

As a relatively new alternative to fiat currencies that are backed by central governments, digital assets are subject to supply and demand forces based upon the desirability of an alternative and decentralized means of buying and selling goods and services. It is also unclear how such supply and demand will be impacted by geopolitical events. Nevertheless, political or economic crises may result in large-scale acquisitions or sales of digital assets either globally or locally. Large-scale sales of digital assets would cause a reduction in their value and could adversely affect the investment in our securities.

Changes in digital asset networks and blockchain vulnerabilities could adversely affect the investment in our securities.

Various technical issues and changes in the underlying digital asset networks or blockchains may adversely affect the value of digital assets and could adversely affect the investment in our securities, including:

| ● | changes to the protocols and software of digital asset networks, which are proposed by network contributors and could alter the properties and functionality of the networks; |

| ● | updates to the blockchain’s structure, such as block size or transaction limitations, which could impact transaction speed and overall network functionality, and in extreme cases, could lead to a “hard fork”, creating incompatible blockchain implementations; |

| ● | the lack of guaranteed financial incentives for contributors to maintain and develop the open-source digital asset networks, which could lead to failures in monitoring and upgrading the network; |

| ● | potential manipulation of the blockchain by persons gain control of more than 50% of the network’s processing power; |

| ● | significant reductions in the aggregate processing power or hashrate on any digital asset network, which could lead to delays in transaction confirmations; |

| ● | insufficient award of award of digital assets for solving blocks and transaction fees, which could impact the network’s functionality |

8

The recent disruption in the crypto asset markets may harm our reputation.

Due to the recent disruption in the crypto asset markets, our customer, suppliers and other business partners may deem our business to be risky and lose confidence in entering into business transactions with us. It may be difficult for us to reach the same business terms with such business partners like we did before. For example, our suppliers may require more deposits or advance payments from us.

In addition, additional regulations may subject us to investigation, administrative or regulatory proceedings, and civil or criminal litigations, all of which could harm our reputation and affect our business operation and the value of our Ordinary Shares. If we have difficulties to comply with such additional regulatory and registration requirements, we may have to cease certain or all of our operations. As of the date of this annual report, there is no material impact on our operations or financial conditions associated with any reputational harm that we may face in light of the recent disruption in the crypto asset markets. However, there is no guarantee that there will not be any material adverse effect on our business, financial condition and results of operations associated with the reputational harm that we may face in light of the recent disruption in the crypto asset markets.

Our offering of wealth management services may be subject to U.S. jurisdiction if it is not able to avoid offering or selling cryptocurrency derivative products to U.S. customers. Additionally, the offering of wealth management services may be deemed as securities offerings in other jurisdictions where it is offered.

To the extent that we are appropriately restricting U.S. persons from obtaining our cryptocurrency derivative products, such business should not be subject to U.S. securities laws. However, whether we are effective in avoiding U.S. jurisdiction by actually not offering or selling our cryptocurrency derivative products to U.S. customers would depend on, among others, the existence and effectiveness of measures adopted in practice against U.S. persons obtaining its services, such as screening mechanisms and/or contractual restrictions over transfers of the contracts to U.S. persons in the secondary market. If certain U.S. customers, or customers from other jurisdictions where our offering of cryptocurrency derivative products may be deemed as securities offerings, end up obtaining access to our cryptocurrency derivative products, and we have not registered the offering of such products, we may be deemed in breach of applicable securities laws. Such breach may result in sizable fines, reputational harms, restrictions of certain businesses, and materially adversely affect our business operation and financial conditions.

Because there has been limited precedent set for financial accounting for cryptocurrencies, the determinations that we have made for how to account for cryptocurrency-related transactions may be subject to change.

The accounting rules and regulations that we must comply with are complex and subject to interpretation by the International Accounting Standards Board, or the IASB, the SEC, and various bodies formed to promulgate and interpret appropriate accounting principles. A change in these principles or interpretations could have a significant effect on our reported financial results, and may even affect the reporting of transactions completed before the announcement or effectiveness of a change. Further, there has been limited precedents for the financial accounting of cryptocurrencies and related valuation and revenue recognition, and no official guidance has been provided by the IASB or the SEC. As such, there remains significant uncertainty on how companies can account for cryptocurrency transactions, cryptocurrencies, and related income. Uncertainties in or changes to in regulatory or financial accounting standards could result in the need to changing our accounting methods and restate our financial statements and impair our ability to provide timely and accurate financial information, which could adversely affect our financial statements, result in a loss of investor confidence, and more generally impact our business, operating results, and financial condition.

9

The loss or destruction of private keys required to access any digital assets held by us may be irreversible. If we are unable to access our private keys or if we experience a hack or other data loss relating to our ability to access any digital assets, it could cause regulatory scrutiny, reputational harm, and other losses.

Cryptocurrencies are generally controllable only by the possessor of the unique private key relating to the digital wallet in which the digital assets are held. While blockchain protocols typically require public addresses to be published when used in a transaction, private keys must be safeguarded and kept private in order to prevent a third party from accessing the digital assets held in such a wallet. We will publish the public key relating to digital wallets in use when we verify the receipt of transfers and disseminate such information into the network, but we will need to safeguard the private keys relating to such digital wallets. We safeguard and keep private the private keys relating to our digital assets by primarily utilizing enterprise multi-signature storage solution provided by an established third-party digital asset financial services platform.

To the extent that any of the private keys relating to our wallets containing digital assets held by us is lost, destroyed, or otherwise compromised or unavailable, and no backup of the private key is accessible, we will be unable to access digital assets held in the related wallet. Furthermore, as currently our digital wallet is maintained by a third-party digital asset financial services platform, we cannot provide assurance that our wallet will not be hacked or compromised, or that any information leakage and data security breach of such platform will not compromise the security of our digital wallet. Digital assets and blockchain technologies have been, and may in the future be, subject to security breaches, hacking, or other malicious activities. Any loss of private keys relating to, or hack or other compromise of, digital wallets used to store our digital assets could subject us to significant financial losses, and we may be unable to distribute mining rewards to customers of our mining pool services, or adequately compensate our customers for damages caused by such security breach. As such, any loss of private keys due to a hack, employee or service provider misconduct or error, or other compromise by third parties could hurt our brand and reputation, result in significant losses, and adversely impact our business, results of operations and/or financial condition.

We may not have adequate sources of recovery if the cryptocurrencies held by us are lost, stolen or destroyed, which could have a material adverse effect on our business, financial condition and results of operations.

Our portfolio of digital assets is held under the custodianship of various cryptocurrency service providers, including but not limited to Binance, Ceffu, Cobo and Antalpha. We believe that the security procedures that the cryptocurrency service providers utilize, such as issuing username, password, hardware tokens and manual review of the transactions inflow and outflow, are reasonably designed to safeguard the cryptocurrencies from theft, loss, destruction or other issues relating to hackers and technological attack. Nevertheless, the security procedures cannot guarantee the prevention of any loss due to a security breach, software defect or act of God that may be borne by us. If such cryptocurrencies are lost, stolen or destroyed under circumstances rendering a third party liable to us, we may not have the financial resources or insurance sufficient to satisfy any or all of our claims against the third party, or have the ability to retrieve, restore or replace the lost, stolen or destroyed cryptocurrencies due to governing network protocols and the strength of the cryptographic systems associated with such cryptocurrencies. To the extent that we are unable to recover on any of our claims against any such third party, such loss could have a material adverse effect on our business, financial condition and results of operations.

If such services are commercially available, we will consider adding regulated banks, rather than solely relying on crypto custodian, as the custodian for a material amount of our cryptocurrencies. Obtaining cryptocurrency custody services from a regulated bank may confer benefits such as improved security and reduced fraud. Nevertheless, until now, banks have generally declined to provide custody services for cryptocurrencies and other virtual assets, due to the absence of clarity on permissibility and on regulators’ views of these activities generally. On July 22, 2020, the U.S. Office of the Comptroller of the Currency released publicly an interpretive letter confirming the authority of a national bank to provide cryptocurrency custody services for customers, providing that a national bank engaging in such activities should develop and implement those activities consistent with sound risk management practices and align them with the bank’s overall business plans and strategies as set forth in the guidance. On January 27, 2023, the Board of Governors of the Federal Reserve System released publicly a policy statement to interpret section 9(13) of the Federal Reserve Act, clarifying that the state member banks are not prohibited under the policy from providing safekeeping services for crypto-assets in a custodial capacity, if such activities are conducted in a safe and sound manner and in compliance with consumer, anti-money-laundering, and anti-terrorist-financing laws. However, it will take time for banks to start offering cryptocurrencies custodian services, and before then, we may have to continue to rely on crypto custodians for our crypto custodian needs.

10

A particular digital asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if we are unable to properly characterize a digital asset, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, results of operations and/or financial condition.

The SEC and its staff have taken the position that certain digital assets fall within the definition of a “security” under the U.S. federal securities laws. The legal test for determining whether any given digital asset is a security is a highly complex, fact-driven analysis that evolves over time, and the outcome is difficult to predict. The SEC generally does not provide advance guidance or confirmation on the status of any particular digital asset as a security. Additionally, the SEC’s views in this area have evolved over time, and it is difficult to predict the direction or timing of any continuing evolution. Furthermore, it is also possible that a change in the governing administration or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff. Public statements by senior officials at the SEC indicate that the SEC does not intend to take the position that Bitcoin or Ethereum, in their current form, are securities. However, Bitcoin and Ethereum are the only digital assets as to which senior officials at the SEC have publicly expressed such a view. Such statements are not official policy statements by the SEC and reflect only the speakers’ views, which are not binding on the SEC or any other agency or court, and cannot be generalized to any other digital asset, such as Dogecoin. With respect to all other digital assets, there is currently no certainty under the applicable legal test that such assets are not securities, notwithstanding the conclusions we may draw based on our assessment regarding the likelihood that a particular digital asset could be deemed a “security” under applicable laws. Similarly, though the SEC’s Strategic Hub for Innovation and Financial Technology published a framework for analyzing whether any given digital asset is a security in April 2019, this framework is also not a rule, regulation or statement of the SEC and is not binding on the SEC.

Several foreign jurisdictions have taken a broad-based approach to classifying digital assets as “securities,” while other foreign jurisdictions have adopted a narrower approach. As a result, certain digital assets may be deemed to be a “security” under the laws of some jurisdictions but not others. Various foreign jurisdictions may, in the future, adopt additional laws, regulations, or directives that affect the characterization of digital assets as “securities.”

The classification of a digital asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer, sale, trading, and clearing of such assets. For example, a digital asset that is a security in the United States may generally only be offered or sold in the United States pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption from registration. Persons that effect transactions in digital assets that are securities in the United States may be subject to registration with the SEC as a “broker” or “dealer.” Platforms that bring together purchasers and sellers to trade digital assets that are securities in the United States are generally subject to registration as national securities exchanges, or must qualify for an exemption, such as by being operated by a registered broker-dealer as an alternative trading system (“ATS”), in compliance with rules for ATSs. Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency. Foreign jurisdictions may have similar licensing, registration, and qualification requirements.

We have adopted risk-based policies and procedures to analyze whether the digital assets that we hold and sell for our own account could be deemed to be a “security” under applicable laws. Our policies and procedures do not constitute a legal standard, but rather represent our management’s assessment, based on advice of our securities counsel, regarding the likelihood that a particular digital asset could be deemed a “security” under applicable laws. Regardless of our conclusions, we could be subject to legal or regulatory action in the event the SEC, a foreign regulatory authority, or a court were to determine that a digital asset currently held by us is a “security” under applicable laws. If the digital assets mined and held by us are deemed as securities, it could limit distributions, transfers, or other actions involving such digital assets in the global markets.

Because cryptocurrencies may be determined to be investment securities, we may inadvertently violate the Investment Company Act of 1940, as amended, and we may incur substantial losses and become subject to such act as a result.

We believe that we are not engaged in the business of investing, reinvesting, or trading in securities, and we do not hold ourselves out as being engaged in those activities. However, under the Investment Company Act of 1940, as amended (the “Investment Company Act”), a company may be deemed an investment company under section 3(a)(1)(C) thereof if the value of its investment securities is more than 40% of its total assets (exclusive of government securities and cash items) on an unconsolidated basis.

11

The cryptocurrency we own, acquire may be deemed an investment security by the SEC, although we do not believe any of the cryptocurrencies we own, acquire are securities.

Current and future legislation and the SEC rulemaking and other regulatory developments, including interpretations released by a regulatory authority, may impact the manner in which cryptocurrencies are treated for classification and clearing purposes. The SEC’s July 25, 2017 Report expressed its view that digital assets may be securities depending on the facts and circumstances. As of the date of this prospectus, we are not aware of any rules that have been proposed to regulate cryptocurrencies as securities. We cannot be certain as to how future regulatory developments will impact the treatment of cryptocurrency under the applicable U.S. federal or state laws. Such additional registrations may result in extraordinary, non-recurring expenses, thereby materially and adversely impacting an investment in us. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease certain of our operations. Any such action may adversely affect an investment in us.

Classification as an investment company under the Investment Company Act requires registration with the SEC. If an investment company fails to register, it would have to stop doing almost all business, and its contracts would become voidable. Registration is time consuming and restrictive and would require a restructuring of our operations, and we would be very constrained in the kind of business we could do as a registered investment company. Furthermore, we would become subject to substantial regulation concerning management, operations, transactions with affiliated persons and portfolio composition, and would need to file reports under the Investment Company Act regime. The cost of such compliance would result in substantial additional expenses, and the failure to complete the required registration would have a materially adverse impact to conduct our operations.

We do not maintain insurance for our digital assets, which may expose us and our shareholders to the risk of loss of our digital assets, and there will be limited rights of legal recourse available to us to recover our losses.

We do not maintain insurance for the digital assets held by us. Banking institutions will not accept our digital assets, and they are therefore not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Therefore, we may suffer loss with respect to our digital assets which is not covered by insurance, and we may not be able to recover any of our carried value in these digital assets if they are lost or stolen or suffer significant and sustained reduction in conversion spot price. If we are not otherwise able to recover damages from a malicious actor in connection with these losses, our business, results of operations and share price may be adversely affected.

We may not be able to adequately protect our intellectual property rights, and our competitors may be able to offer similar products and services, which would harm our competitive position.

Our success depends in part upon our intellectual property rights. The algorithms we use in providing the wealth management services are all self-developed. As of March 31, 2023, we held three domain names relating to our business, including our current and previous corporate websites. As of March 31, 2023, the affiliates of our shareholder, Antalpha, held 21 registered trademarks and 33 pending trademark applications and the relevant rights to the logo of Metalpha in various jurisdictions, including Hong Kong, China Taiwan, Bangladesh, Europe and the United States, among others. We have use and other relevant rights related to the “Metalpha” registered trademark and logo for our business operations. We rely primarily on trademark, copyright, service mark and trade secret laws, confidentiality procedures, license agreements and contractual provisions to establish and protect our proprietary rights over our products, procedures, algorithms and services. Other persons, including our competitors, could copy or otherwise obtain and use our technology without authorization, or develop similar intellectual property independently, and thus may be able to duplicate our products and services or design around any intellectual property rights we hold. We may also pursue the registration of our domain names, trademarks and service marks in various jurisdictions, including the United States. Although the protection afforded by copyright, trade secret and trademark law, written agreements and common law may provide some advantages, these statutory protections along with non-disclosure agreements with their employees may not be adequate to enable us to protect our intellectual property. Moreover, the intellectual property laws in certain jurisdictions are not considered as strong as comparable laws in the United States or the European Union. The enforcement of intellectual property rights in certain jurisdictions is difficult and, if we seek to commence litigation against any alleged infringer, there is no assurance that they will prevail. We cannot assure you that we will be able to protect our proprietary rights.

12

We face risks related to natural disasters, health epidemics, and other outbreaks, including the COVID-19 pandemic, which could significantly disrupt our operations.

Our business could be materially and adversely affected by natural disasters, health epidemics, or calamities. Fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks, or similar events may give rise to server interruptions, breakdowns, system failures, technology platform failures, or Internet failures, which could cause the loss or corruption of data or malfunctions of software or hardware as well as adversely affect our ability to provide products and services.

Our business could also be adversely affected by the effects of epidemics. In recent years, there have been breakouts of epidemics around the world, such as Ebola virus disease, H1N1 flu, avian flu and the COVID-19 pandemic. Our business operations could be disrupted if any of their employees gets or is suspected of getting infected, since it could require its employees to be quarantined and/or its offices to be closed and disinfected. In addition, our results of operations could be adversely affected to the extent that any of these epidemics harms the global economy in general.

Our management and compliance personnel have limited experience handling a listed cryptocurrency-related services company, and our compliance program has a recent history only.

Our management and compliance personnel have limited experience in handling regulatory and compliance matters relating to a listed cryptocurrency-related services company. Our key compliance documents and compliance programs, such as anti-money laundering and know-your-client procedures, also have a recent history only. We believe that we have measures designed to limit our counterparty risks. In order to further limit our exposure to counterparty risk, we adopted a two-pronged strategy. First, we carefully select our counterparties and only partner with industry-leading entities renowned for their robust operations, strong capabilities and impeccable reputation. Second, to mitigate the concentration risk, we strategically opt to work with multiple counterparties rather than relying on a single entity. Moreover, we also have a dedicated team of compliance experts and all of our significant business decisions are made following in-depth consultations with legal advisors and industry veterans. While we have been devoting a substantial amount of time and resources to various compliance initiatives and risk management measures, we cannot assure you the practical application and effectiveness of our compliance program and risk management measures, nor that there will not be a failure in detecting regulatory compliance issues or managing risk exposure, which may adversely affect our reputation, business, financial condition and results of operations.

Risks Related to Doing Business in Jurisdictions We Operate

A downturn in the Hong Kong, China or global economy, and economic and political policies of China could materially and adversely affect our business and financial condition.

A substantial part of our operations are located in Hong Kong. Accordingly, our business, prospects, financial condition and results of operations may be influenced to a significant degree by political, economic and social conditions in Hong Kong and China generally and by continued economic growth in Hong Kong and China as a whole. The Chinese economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us.

Economic conditions in Hong Kong and China are sensitive to global economic conditions. Any prolonged slowdown in the global or Chinese economy may affect potential clients’ confidence in financial market as a whole and have a negative impact on our business, results of operations and financial condition. Additionally, continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

13

The Hong Kong legal system embodies uncertainties which could limit the legal protections available to us.

Hong Kong is a Special Administrative Region of the PRC. Following British colonial rule from 1842 to 1997, China assumed sovereignty under the “one country, two systems” principle. The Hong Kong Special Administrative Region’s constitutional document, the Basic Law, ensures that the current political situation will remain in effect for 50 years. Hong Kong has enjoyed the freedom to function in a high degree of autonomy for its affairs, including currencies, immigration and custom, independent judiciary system and parliamentary system. On July 14, 2020, the United States signed an executive order to end the special status enjoyed by Hong Kong post-1997. As the autonomy currently enjoyed were compromised, it could potentially impact Hong Kong’s common law legal system and may in turn bring about uncertainty in, for example, the enforcement of our contractual rights. This could, in turn, materially and adversely affect our business and operation. Additionally, intellectual property rights and confidentiality protections in Hong Kong may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the Hong Kong legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the pre-emption of local regulations by national laws. These uncertainties could limit the legal protections available to us, including our ability to enforce our agreements with our clients.

Hong Kong laws and regulations related to the cryptocurrency business is still under development and subject to significant changes, and any potential changes in the legal and regulatory landscape may adversely affect our business financial condition and future expansion.

We are headquartered in Hong Kong, where we predominantly rely on the exemptions for trading cryptocurrency derivative products with seasoned professional investors to conduct our cryptocurrency business. Nevertheless, we cannot assure you that Hong Kong regulatory authorities will not tighten or even revoke these exemptions. If these exemptions are tightened or revoked, we may not be able to continue to expand our customer base, and our business model may be materially and adversely affected. We will closely monitor the potential changes in exemptions available to us and laws and regulations related to the cryptocurrency business in Hong Kong.

Hong Kong regulatory requirement of prior approval for any company or individual becoming a “substantial shareholder” may restrict future takeovers and other transactions.

Section 132 of Securities and Futures Ordinance (Cap. 157 of the laws of Hong Kong) (the “SFO”) requires prior approval from the HKSFC for any company or individual to become a substantial shareholder of an SFC-licensed company in Hong Kong. Under the SFO, a person will be a “substantial shareholder” of a licensed company if he, either alone or with associates, has an interest in or is entitled to control the exercise of the voting power of more than 10% of the total number of issued shares of the licensed company, or exercises control of 35% or more of the voting power of a company that controls more than 10% of the voting power of the licensed company. Further, all potential parties who will be new substantial shareholder(s) of the HKSFC-licensed subsidiaries are required to seek prior approval from the HKSFC. This regulatory requirement may discourage, delay or prevent a change in control of our Company, which could deprive our shareholders the opportunity to receive a premium for their shares as part of a future sale and may reduce the price of our shares upon the consummation of a future proposed business combination.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against us or our management named in this annual report based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China.

We are a company incorporated under the laws of the Cayman Islands. We conduct most of our cryptocurrency-based operations in Hong Kong through our subsidiaries, and almost all of our assets are located in Hong Kong. In addition, two of our directors reside in mainland China for a significant portion of the time. As a result, it may be difficult for you to effect service of process upon us or those persons inside mainland China. In addition, there is uncertainty as to whether the courts of the Cayman Islands or Hong Kong would recognize or enforce judgments of U.S. courts against us, or such persons predicated upon the civil liability provisions of the securities laws of the U.S. or any state. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence in Hong Kong. The inability for an overseas securities regulator to directly conduct investigation or evidence collection activities in Hong Kong may further increase difficulties faced by you in protecting your interests.

14

Risks Relating to Our Ordinary Shares and the Trading Market

If we become directly subject to the scrutiny, criticism, and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation.

U.S. public companies with the majority of their operations in China have faced extensive scrutiny, criticism and negative publicity from investors, financial commentators and regulatory agencies like the SEC. Much of the criticism has centered around financial and accounting irregularities, the absence of effective internal financial controls, inadequate or non-compliant corporate governance policies and in numerous cases, fraud allegations. Such negative publicity has led to sharp decreases in the stock value of many U.S. listed Chinese companies, with some becoming virtually worthless. These companies are often subject to shareholder lawsuits, SEC enforcement actions and both internal and external investigations into the allegations.

We have taken proactive steps to address these concerns. In March 2023, we divested all our operations in mainland China. However, due to our past operational history in mainland China, we may be perceived as a Chinese company, which may subject us to the negative effects of sector-wide scrutiny even though we no longer operate in mainland China. Although we have taken significant measures to distance ourselves from these risks, it remains unclear what the enduring impact of this widespread scrutiny, criticism and negative publicity will have on us, our business and our stock price. If we become the subject of any unfavorable allegations, regardless of whether they prove to be true or not, we would need to expend considerable resources investigating such allegations and defending ourselves. Such efforts would be costly and time-consuming and could potentially divert management attention away from our growth strategy. Furthermore, if such allegations turn out to be substantiated, our business operations would be materially and adversely affected, which could lead to a significant decline in the value of our stock.

The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC or Hong Kong.

We are regulated by the SEC and our reports and other filings with the SEC are subject to SEC review in accordance with the rules and regulations promulgated by the SEC under the Securities Act and the Exchange Act. Our SEC reports and other disclosure and public pronouncements are not subject to the review or scrutiny of any PRC or Hong Kong regulatory authority. For example, the disclosure in our SEC reports and other filings are not subject to the review by the China Securities Regulatory Commission or the HKSFC. Accordingly, you should review our SEC reports, filings, and our other public pronouncements with the understanding that no local regulator has done any review of us, our SEC reports, other filings, or any of our other public pronouncements.