UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ______

Commission file number. 001-38013

iFresh Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 82-066764 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

2-39 54th Avenue

Long Island City, NY

(Address of principal executive offices)

(718) 628 6200

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Common Stock, Par Value $0.0001 Per Share | NASDAQ Capital Market | |

| (Title of Class) | (Name of exchange on which registered) |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Check whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the 4,216,125 voting and non-voting common equity stock held by non-affiliates of the Registrant was approximately $9.4 million as of September 28, 2018, the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sale price of the Registrant’s common stock on such date of $2.230 per share.

There were a total of 18,351,497 shares of the registrant’s Common Stock, par value $0.0001 per share, outstanding as of June 27, 2019.

DOCUMENTS INCORPORATED BY REFERENCE: None.

Table of Contents

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements and information relating to iFresh, Inc., that are based on the beliefs of our management as well as assumptions made by and information currently available to us. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions, including among many others: a general economic downturn; a downturn in the securities markets; Securities and Exchange Commission regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Should any of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this report as anticipated, estimated or expected. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. Important factors that may cause actual results to differ from those projected include the risk factors specified above. Notwithstanding the above, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered as an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including statements regarding new and existing products and opportunities; statements regarding market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; any of the factors mentioned in the “Risk Factors” section of this Form 10-K; and any statements or assumptions underlying any of the foregoing. Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to:

| ● | “we,” “us,” “iFresh,” “the Company” “IFMK” or “our Company” are references to iFresh Inc. and its subsidiaries; |

| ● | “U.S. dollar,” “$” and “US$” are a reference to the legal currency of the United States; |

| ● | “SEC” is a reference to the United States Securities and Exchange Commission; |

| ● | “Securities Act” is a reference to Securities Act of 1933, as amended; and |

| ● | “Exchange Act” is a reference to the Securities Exchange Act of 1934, as amended; |

ii

We were formerly a special purpose company incorporated under the laws of the Cayman Islands on September 23, 2014 under the name E-Compass Acquisition Corp. (“E-Compass”) in order to serve as a vehicle for the acquisition of an operating business in the e-commerce and consumer retail industry. On February 10, 2017, pursuant to the terms of a merger agreement, dated as of July 25, 2016 (the “Merger Agreement”), through a series of transactions, we merged with our wholly owned subsidiary to reincorporate into Delaware and then acquired NYM Holding, Inc. (“NYM”), and as a result, NYM became our direct wholly-owned subsidiary (the “Transactions”). As a result of the Transactions, as of immediately after the Transactions, the former stockholders of NYM owned approximately 83.9% of our outstanding common stock and the former stockholders of E-Compass owned the remaining 16.1%.

The Merger Agreement is described more fully in the sections entitled “The Business Combination Proposal” and “The Acquisition Agreement” beginning at pages 38 and 60, respectively, of the final prospectus contained in the Registration Statement on Form S-4 and definitive proxy statement (the “Proxy Statement/Prospectus”) filed with the Securities and Exchange Commission (the “Commission”) on December 16, 2016 by iFresh and E-Compass, and such description is incorporated herein by reference.

Upon the closing of the Transactions, E-Compass’s common stock, rights and units ceased trading and our common stock began trading on the NASDAQ Capital Market under the symbol “IFMK”.

Recent Development

On May 20, 2019 (the “Effective Date”), the Company, NYM, certain subsidiaries of NYM, Mr. Long Deng and KeyBank National Association entered into a forbearance agreement (the “Forbearance Agreement”) with respect to that certain Credit Agreement, dated as of December 23, 2016, as amended, pursuant to which KeyBank National Association, “Keybank” the or “Lender”, made available to NYM, the “Borrower”, a revolving credit facility, a term loan facility, and other credit accommodations. Pursuant to that certain Guaranty Agreement, dated as of December 26, 2016, as amended by several joinder agreements, the Company, certain subsidiaries of NYM and Mr. Long Deng (collectively, the “Guarantors”, and together with the Borrower, the “Loan Parties”) have agreed to guarantee the payment and performance of the obligations of the Borrower under the Credit Agreement (“Obligations”). The Lender has agreed to delay the exercise of its rights and remedies under the Loan Agreement based on the existence of certain events of default (the “Specified Events of Default”) until the earlier to occur of: (a) 5:00 p.m. Eastern Time on the 90th day from Effective Date; and (b) a Forbearance Event of Default.

On June 1 and June 5, 2019, respectively, the Company, and two holders (the “Holders”) of the Company’s warrants (the “Existing Warrants”) issued pursuant to that certain Securities Purchase Agreement dated October 19, 2018, entered into certain Exchange Agreements (the “Agreements”), whereby the Company agreed to issue to the Holders an aggregate of 1,170,000 shares (“Exchange Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) and warrant to purchase an aggregate of 1,170,000 shares of Common Stock (the “Exchange Warrants”) as the negotiated purchase price for the Existing Warrants based on the Black Scholes Value as a result of a certain transaction which was deemed as a Fundamental Transaction (as defined in the Existing Warrants) pursuant to Section 3(e) of the Existing Warrants.

1

On June 7, 2019, we entered into a share exchange agreement (the “Exchange Agreement”) with Xiaotai and the equity holders of Xiaotai (the “Xiaotai Sellers”), pursuant to which, among other things and subject to the terms and conditions contained therein, we will acquire all of the outstanding issued shares and other equity interests in Xiaotai from the Xiaotai Sellers (the “Acquisition”). Pursuant to the Exchange Agreement, in exchange for all of the outstanding shares of Xiaotai, we will issue 254,813,383 shares of common stock (the “Exchange Shares”) to the Xiaotai Sellers. The Exchange Shares will be allocated among the Xiaotai Sellers pro-rata based on each such seller’s ownership of Xiaotai prior to the closing.

On June 7, 2019, we and NYM Holding, Inc., entered into a share purchase agreement (the “Purchase Agreement”) with Go Fresh 365 Inc. (“Go Fresh”), solely owned by Mr. Long Deng, IFMK’s Chief Executive Officer. The Purchase Agreement provides for the sale of 100% of the equity interest in NYM to Go Fresh for cash consideration of $9.1 million (the “Spin-off”). The transactions contemplated by the Purchase Agreement are a condition to the closing of the Acquisition and would take place contemporaneously with the closing of the Acquisition. We refer to the Acquisition and Spin-off as (the “Restructure”).

Upon completion of the Acquisition and the simultaneous Spin-Off, we will own 100% of Xiaotai, and will be a financial services group operating in both smart financing as well as microfinance sectors in China. It is anticipated immediately upon completion of the Restructure, our existing shareholders will retain an ownership interest of approximately 6% and the Xiaotai Sellers will own approximately 94% of the Company assuming issuance of additional 254,813,383 shares by IFMK prior to closing of the Acquisition.

The Company will hold a special meeting in 2019 to seek stockholders’ approval of several items, including:

(1) to adopt the Exchange Agreement and to approve the Acquisition of Xiaotai contemplated by such agreement;

(2) to adopt the Purchase Agreement and to approve the Spin-off of Company’s existing assets contemplated by such agreement;

(3) to approve and adopt an amendment to our Certificate of Incorporation (“Charter Amendment”)to affect a reverse stock split of the Company’s issued and outstanding common stock, par value $0.0001 (“Common Stock”) by a ratio of not less than one-for-two and not more than one-for-ten, and then a forward stock split of our then issued and outstanding common stock by a ratio of not less than one-for-two and not more than one-for-ten immediately following the reverse split (the “Reverse Split”) prior to a time to be determined, with the exact ratios to be set at a whole number within this range, as determined by the Board in its sole discretion;

(4) to approve and adopt an amendment to the Company’s Certificate of Incorporation to increase the number of shares of common stock that the Company has authority to issue from 100,000,000 to 1,000,000,000 and the number of shares of Preferred Stock that the Company has authority to issue from 1,000,000 to 10,000,000; and consequently, to increase the total number of shares of all classes of capital stock that the Company has authority to issue from 101,000,000 to 1,010,000,000; and

(5) approval of the Charter Amendment to change the Company’s corporate name to “Terran Financial Services Group.”

2

Overview and History

iFresh, through its wholly owned subsidiary, NYM, is a fast growing Asian/Chinese grocery supermarket chain in the North Eastern U.S. providing food and other merchandise hard to find in mainstream grocery stores. Since NYM was formed in 1995, it has targeted the Chinese and other Asian populations (collectively, the “Asian Americans”) in the U.S. with a deep cultural understanding of its consumers’ unique consumption habits. iFresh currently has ten 10 retail supermarkets across New York, Massachusetts and Florida, with over 6,224,500 sales transactions in the fiscal year ended March 31, 2019. NYM also has two stores under construction which are expected to open in the fourth quarter in 2018. In addition to retail supermarkets, iFresh operates two in-house wholesale businesses, Strong America Inc. (“Strong America”) and New York Mart Group (“NYMG”), that offer more than 6,000 wholesale products and service to iFresh retail supermarkets and over 1,000 external customers including wholesale stores, retail supermarkets and restaurants. iFresh has a stable supply of food from farms in New Jersey and Florida, ensuring reliable supplies of popular vegetables, fruits and seafood. iFresh’s wholesale businesses and long term relationships with various farms insulate iFresh from supply interruptions, allowing it remain competitive even during difficult markets.

Based on management’s understanding of the Asian American market, iFresh aims to satisfy the increasing demands of Asian Americans, whose purchasing power has been growing rapidly, for fresh and unique produce, seafood and other groceries that are not found in mainstream supermarkets, such as produce like Shanghai baby bok choy, snap bean, winter gourd, baby Chinese kale, longyan and lychee; a variety of live seafood such as shrimp, clams, lobster, geoduck, and Alaska king crab; and Chinese specialty groceries like soy sauce, sesame oil, oyster sauce, bean paste, Sriracha, tofu, noodles and dried mushrooms. With an in-house logistics team and strong relationships with farms, iFresh is capable of offering high quality specialty perishables at competitive prices. Specialty produce, live seafood and other perishables constituted 65.2% of iFresh’s total retail sales during the fiscal year ended March 31, 2019.

iFresh’s business began as Strong America, a wholesale business founded in 1995 in Long Island City, New York. Strong America imported food and groceries from China and other East Asian countries and sold them to various types of retailers in the New York area. Witnessing the rapid growth of Chinese immigrants and the potential of this niche market, iFresh opened its first retail supermarket in Chinatown in downtown Manhattan in August 2001. From 2001 to 2014, iFresh expanded steadily, hired a bilingual team that grew into midlevel managers, and reshaped itself into a retail supermarket chain featuring exotic Asian food and other items. Since 2001, iFresh opened five stores in Brooklyn, Flushing, Elmhurst and Manhattan’s Chinatown, where the Asian and Chinese population is highly concentrated. In 2009, iFresh acquired Ming’s supermarket in Boston, Massachusetts. Observing that the Chinese and Asian population was growing quickly in Florida, iFresh opened its first store in Sunrise, Florida in 2012. In 2013, it acquired Zen Supermarket in Quincy, Massachusetts to better cater to the growing demand in the Greater Boston Area.

3

On July 13, 2017, the Company acquired assets from Mia Supermarket in Orlando FL, a 20,370 square-foot grocery store located at 2415 E. Colonial Drive, from Michael Farmers Supermarket, LLC. The new store, which is called iFresh East Colonial, will be the first iFresh store in Orlando and the second in Florida. iFresh acquired the supermarket for $1,050,000 in cash. The purchase included property and equipment, and inventory of the old store. The Company did not assume any liabilities. The store started to operate in August 2017.

Also on July 13, 2017, the Company acquired all of the shares of iFresh Glen Cove Inc. (“Glen Cove”) from Long Deng, the Company’s Chairman and Chief Executive Officer, for 50,000 shares of the Company’s common stock. The transaction was approved by the Company’s Board of Directors and the price was agreed to be based upon a review of the assets and financial statements of Glen Cove. Glen Cove is setting up a 22,859 square-foot brand new grocery store in Garden City, New York located at 192 Glen Cove Road, within the Roosevelt Field Mall business district. This will be the Company’s first store in Long Island and the sixth in New York. The store opened in January, 2019.

On October 2, 2017, the Company acquired all of the shares of New York Mart CT, Inc. (“NYM CT”) from Long Deng, the Company’s Chairman and Chief Executive Officer, for $3,500,000. The store is currently under renovation and the Company expects the Connecticut store to open in 2020

Also on October 2, 2017, the Company acquired all of the shares of New York Mart N. Miami Inc. (“NYM N. Miami”) from Long Deng, the Company’s Chairman and Chief Executive Officer, and Yang Yu Gao for $3,500,000 and 45,000 shares of the Company’s common stock. The store is currently under construction. The Company expects the store to open in the third quarter of 2019.

iFresh currently operates ten (10) retail super markets and two (2) wholesale facilities. iFresh plans to strategically expand along the I-95 corridor and eventually operate super markets in all states on the east coast.

iFresh believes that the following characteristics of its business shapes its leadership and success in its industry:

| ● | iFresh provides unique products to meet the demands of the Asian-American Market; |

| ● | iFresh has established a merchandising system backed by an in-house wholesale business and by long-standing relationships with farms; |

| ● | iFresh maintains an in-house cooling system with unique hibernation technology that has developed over 20 years to preserve perishables, especially produce and seafood; |

| ● | iFresh capitalizes on economies of scale, allowing strong negotiating power with upstream vendors, downstream customers and sizable competitors; and |

| ● | iFresh has a proven and replicable track record of management, operation, acquisition and organic growth. |

iFresh’s net sales were $125.4 million and $136.7 million for the years ended March 31, 2019 and 2018, respectively. iFresh’s net loss was $12 million for the year end March 31, 2019, a decrease of $11.2 million, or 1416 %, from $0.8 million of net loss for the year end March 31, 2018. Adjusted EBITDA was $(7.8) million for the year end March 31, 2019, a decrease of $9.8 million, or 496%, from $2 million for the year end March 31, 2018. For additional information on Adjusted EBITDA, See the section entitled “iFresh’s Management’s Discussion and Analysis of Financial Condition and Results of Operations — Adjusted EBITDA,” beginning on page 34.

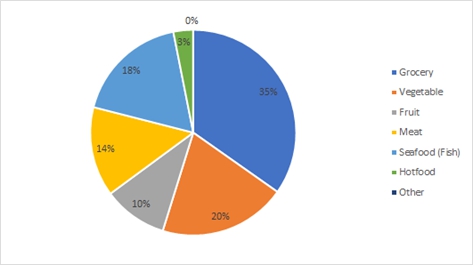

In terms of sales by category, perishables, including vegetables, seafood, meat, fruit and hot food (collectively, the “Perishables”), constituted approximately 65.2% of iFresh’s total annual retail sales during the fiscal year ended March 31, 2019. Within this category, vegetables and seafood constituted 37.9% of overall annual retail sales.

4

The table and graph below depicts sales of iFresh by category of iFresh for the fiscal year ended March 31, 2019:

Figure 1 Sales by Category

Industry and Market Analysis

Grocery Shopping Habits of Target Market

Buy Fresh — Asian Americans, of which Chinese Americans constitute a significant percentage, typically purchase fresh, perishable food, according to Nielsen’s Asian-American Consumer 2015 Report1. Unique cooking styles of Asian Americans, such as steaming, wokking and shared hot-pot cooking, require fresh ingredients not commonly found in the U.S. Asian Americans purchase Perishables that are all over-index compared with that of general U.S. population. For example, Asian Americans purchase fresh seafood 50% more frequently than the general market and spend 147% more on the category than non-Asian Americans in the total U.S. population. Asian Americans purchase fresh vegetables 26% more frequently than non-Asian American consumers and spend 62%more than the total U.S. population. Additionally, Asian Americans purchase fresh fruit 11% more frequently than non-Asian Americans and spend 27% more than the total U.S. population. Consistent with the foregoing, iFresh’s fresh seafood, fresh vegetables and fresh fruit in the aggregate contributed 48.0% to iFresh’s total sales as of March 31, 2019.

Table 1 Asian-American Consumption of Perishables2

| Asian-American Fresh Category Consumption (Index vs. Total Population of 100) | $ Volume Index | Purchasing Frequency Index | ||||||

| Fresh Fruits | 127 | 111 | ||||||

| Fresh Meats | 106 | 103 | ||||||

| Prepared Foods | 143 | 115 | ||||||

| Takeout | 121 | 102 | ||||||

| Fresh Vegetables | 162 | 126 | ||||||

| Fresh Poultry | 108 | 103 | ||||||

| Fresh Seafood | 247 | 150 | ||||||

| 1 | Culturally Connected and Forging the Future: The Asian-American Consumer 2015 Report. The Nielsen Company. |

| 2 | Id. at 10. |

5

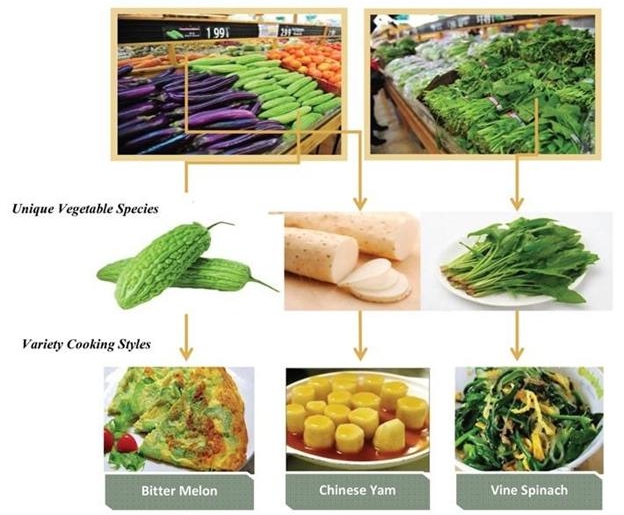

Unique Species and Cuisines — Asian cuisines incorporate many perishables that are hard to find in traditional U.S. supermarkets. Many cuisines require vegetables not commonly planted in the U.S. or meat not widely used by mass market consumers. The following two examples help illustrate the unique foods used in Asian cuisines:

Example 1: Unique vegetable species

Vegetables make up the bulk of daily consumption by Asian Americans. Asian American consumers usually buy a variety of vegetables in large quantities and use unique vegetable species such as bitter melons, Chinese yams, vine spinaches, Chinese cabbages and winter melon. Asian Americans therefore value supermarkets that provide fresh vegetable offerings at affordable prices.

6

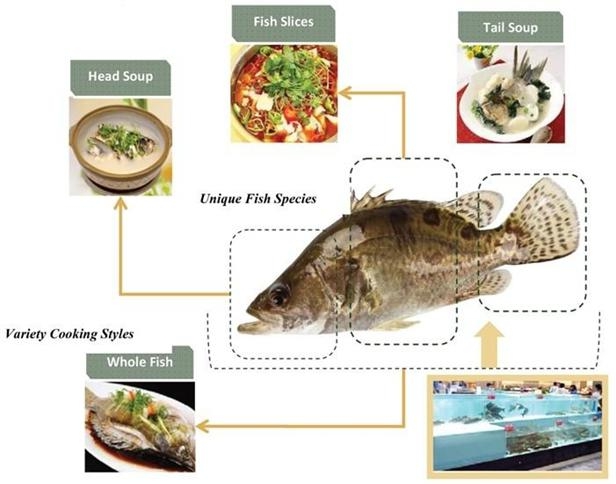

Example 2: Unique fish species and cooking styles

Asian American consumers consume fish not commonly sold in mainstream supermarkets. Unlike many mainstream supermarkets, iFresh offers consumers live fish in fish tanks and has fish experts readily available to provide fish cleaning services free of charge.

In addition, Asian American consumers use many more parts of the fish than do non-Asian American consumers. For example, fish head soup and fish tail soup are two popular dishes that require only the fish head or fish tail as ingredients. Asian Americans also buy live fish and ask fish experts to cut them in thin slices as an ingredient of boiled fish in hot sauce or fish hot pot. iFresh organizes the seafood section according to the needs of its customers, which iFresh believes not only attracts customers, but effectively boosts sales of seafood.

In addition to vegetables and fish, Asian Americans look for the following additional specialty products:

Fruits — Mainstream supermarkets rarely have pitaya, longyan, lychee and star fruit available. Such unavailability motivates Asian Americans to shop at Chinese and Asian grocery stores on a regular basis to purchase such specialty fruits.

Meat — Mainstream supermarkets generally offer meats in cuts such as cubes, steaks, slices and ribs. However, such supermarkets rarely offer super-thinly sliced hot-pot meat, organ meat or chicken feet. Chinese and Asian cuisines use various kinds of meat for different purposes. Asian specialty supermarkets such as iFresh understand such Asian cuisines and dietary needs, and fill the market gap in offering hot-pot meat, organ meat, chicken feet and other rare cuts of meat on a regular basis.

Snacks, Seasonings and Other — Asian specialty supermarkets offer various snacks, seasonings, cooking utensils and other items not generally found in mainstream U.S. supermarkets. Chinese and Asian seasonings and spices include peanut oil, cooking wine, vinegars, dark soy sauce, black bean sauce, pepper oil and chilly oil. Some seasoning or spice can include sub-types, each of which has its own target customers. For example, people from the northern and southern parts of China usually shop for different type of vinegars.

7

Consequently, we believe that the uniqueness in the shopping habits of iFresh’s target customers evidences the importance of Asian American specialty supermarkets such as iFresh. iFresh’s understanding of Asian American culture and eating habits fill a market gap and distinguishes Asian supermarkets from mainstream competitors.

Current Industry Landscape

Highly Fragmented and unsophisticated competitors — We consider the markets we participate in to be highly fragmented. There is no recognized industry leader nationwide. Most market participants are small players with a single store run by family members catering to the local market11, meaning that the bulk of competitors are unsophisticated. Because of this, iFresh believes that most of its competitors are unable to take advantage of economies of scale, modern management, in-house wholesales facilities and logistics which distinguishes iFresh from its competitive peers. The reality of low market concentration and unsophisticated competitors gives iFresh the opportunity to consolidate the market and cement its dominant market position.

8

Unsatisfied Customers — As previously mentioned, there are an increasing number of younger Chinese that choose to reside out of traditional Chinese communities for better working, educational and environmental opportunities. However, large-scale comprehensive Chinese groceries tend to exist only in Chinatowns. The weekly shopping for this group of Asian Americans involves either long distance travel or a compromise at local small grocery stores with limited selections and high prices. iFresh will try to meet their demand as well as reshape the market by increasing the number of stores and via its online-shopping initiatives.

Limited Vendors — Many of the products that stock iFresh’s shelves can rarely be sourced from the typical U.S. vendors. Most vendors of U.S. Chinese and Asian supermarkets are individually owned and small in size. Securing a sufficient and stable supply of core perishables, therefore, is a recognized challenge in this niche market. Observing the challenge and through years of effort, iFresh has established long-standing relationships with several large farms. We believe that the relationships with these farms is symbiotic — on one hand, cooperative farms provide iFresh with priority when supplying core produce popular with Asian American customers; on the other hand, iFresh communicates the latest market trends and customer preference to cooperating farms, ensuring the farms’ produce selection and activities closely target the market demand.

Fast Growing Market — The growing population and increasing purchasing power cultivate a promising market prospect in good momentum. According to The US Census Bureau — American Community Survey 2011 – 2015, the Chinese population had a growth rate of 17.43% from 2011 to 2015, far beyond the 3.07% growth rate of US population and even the 8.77% Hispanic population growth rate. New York, New Jersey, Pennsylvania, Florida and Maryland alone have a total Chinese population of 1,139136, making up more than 27.56% of total Chinese American population nationwide.

In sum, we see a great opportunity for market consolidation and significant potential for improvement in this market. We believe iFresh has all the right ingredients to address the current market imperfections and we are ready to catch the wave to make iFresh a national leader in the niche market.

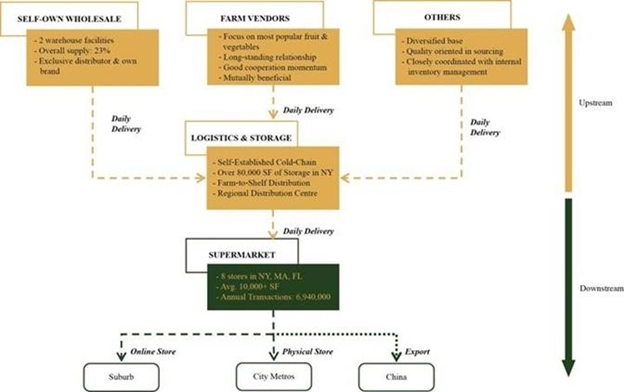

iFresh’s Business Model

iFresh’s business model features a vertically integrated structure covering upstream supply and downstream retail supermarkets. iFresh has its own wholesale businesses, Strong America and New York Mart Group (“NYMG”), which supply one thirdof the items sold in its retail supermarkets with nine self-owned brands, including Family Elephant, Feiyan and Green Acre, and an exclusive distributorship for seven famous foreign brands such as Shuang Deng, You Joy, Bai Lu and Gu Yue Long Shan . For many years, iFresh has worked with farms that mainly grow Chinese specialty vegetables and fruits and supply the most popular yet hard-to-source vegetables and fruits directly to iFresh supermarkets and maintains long-term and stable relationships with them. iFresh centralizes purchases through one of its wholesale facilities by making quarterly purchase plans and placing weekly order with farms. The long-term relationships with farms and the central purchase management system secure its supply of the most popular vegetables and fruits, even though iFresh doesn’t have any long-term contractual relationships with its farm suppliers. Working with its vendors, iFresh can respond to market trends to avoid supply interruption in high seasons. iFresh has a diversified vendor base and has established sustainable relationships during its 20-year history in this niche market sector.

9

iFresh’s two wholesale businesses, Strong America and NYMG, collectively provide more than 6,000 wholesale products and services to iFresh’s retail supermarkets and over 1,000 external customers throughout the United States. Such external customers include, but are not limited to, wholesale stores, retail supermarkets and restaurants. The two wholesale arms have distinct focuses: Strong America mainly provides grocery products and services to iFresh retail store and external supermarkets, and it will also focus on supplying fresh perishable items to retail supermarkets. Strong America owns nine exclusive distributorship rights and iFresh’s ten self-owned brands. Strong America acquired its self-owned brands from third parties and integrated them into its wholesale catalog. The ten self-owned brands cover rice, noodles, seasonings (including Chinese spices), frozen vegetables, frozen seafood, and frozen dumplings, which are all popular daily staples for Chinese and other Asian consumers in the United States. Strong America imports over 2,000 items from all over Asia, with products from mainland China, Thailand and Taiwan making up 95% of its total imports. NYMG serves as an important connection to farms in New Jersey and Florida, which ensures reliable supplies of popular vegetables, fruits and seafood to iFresh’s retail stores. The two in-house wholesale arms of iFresh not only secure the supply of products for iFresh’s retail business, but also offer significant synergies in iFresh’s operations.

Produce and groceries are delivered to iFresh supermarkets in New York, Massachusetts and Florida on a daily basis from iFresh’s wholesale facilities, farm partners and external vendors as directed by iFresh’s in-house logistics system. iFresh has an 80,000 square foot warehouse in Long Island City, New York, which serves as its regional distribution center for imported and frozen products. For live seafood or produce, the in-house logistics team uses hibernation technology and the cold-chain network to best ensure freshness from farm to shelf.

With ten retail supermarkets in New York, Massachusetts and Florida, mainly in Chinatowns or city centers, and average store sizes over 10,000 square feet, iFresh has over 6.2 million annual sales transactions. At the same time, iFresh continues to reach out to the growing Asian American population living in suburban areas through its online shopping and delivery initiative. iFresh also has successfully exported live lobsters to China, which bears the potential to ignite the demand of a large market.

10

The graph below depicts iFresh’s business model and its vertically integrated structure:

Figure 2 Business Model of iFresh

iFresh’s Competitive Strengths

Well Recognized Brand in Niche Market

iFresh capitalizes on its established brand and reputation in the following respects:

i. Benefit from cost efficiency and economies of scale:

Unlike many of its direct competitors which are family-owned single stores, iFresh has 10 retail supermarkets. With larger supplies and strong sales, iFresh is often approached by third party vendors and capable of getting competitive prices for a wide range of items. This corporate structure coupled with its wholesale facilities further enables iFresh to best deploy its experienced staff to coordinate stock and to make the most use of its infrastructure and distribution network.

ii. Strong negotiation power with vendors and competitors

iFresh is often approached by third party vendors and capable of getting competitive price due to its chain store structure and sustainably strong sales performance. iFresh’s two in-house wholesale facilities are influential in Chinese and Asian goods importing and wholesale industries. At least five of iFresh’s largest direct competitors are also its clients for imported goods, frozen seafood and other frozen products. Additionally, iFresh’s long-standing relationship with farms in New Jersey and Florida reduce its reliance on external vendors. We believe the iFresh brand, scale, in-house wholesale facilities and long-standing relationship with farm partners shaped its negotiation power with vendors and competitors.

11

iii. Developed Infrastructure

Unlike many of its competitors, iFresh has its own wholesale channel, Strong America, which has been in the business of importing and exporting Chinese and Asian specialty food and groceries for over 20 years. Apart from channel advantages, Strong America specializes in identifying products that are popular among Asian American consumers but rarely found in mainstream stores. Without multi-layer intermediates, iFresh retail supermarkets set such products at competitive prices, not only securing the supply of popular products, but boosting its operation profitability as well. Furthermore, for most commonly needed ingredients like rice, noodles, frozen Chinese and Asian convenience foods, imported snacks and Chinese and Asian seasonings and spices, Strong America established nine self-owned brands and obtained the exclusive distributorship for 8 famous Chinese brands, as listed in Table 3 and Table 2 below, respectively. In addition, iFresh has built and maintained relationships with retailers of various sizes. In other words, iFresh’s advantages in market familiarity, established infrastructure, scale, sourcing management capability and well-recognized brand reputation shape a high barrier protecting it from immediate impact of new entrants.

Track Record in Operation and Expansion

i. Record of acquisitions in different locations

Since 2009, iFresh successfully acquired four stores, one in New York, one in Florida, and two in Massachusetts. In July and October 2017, iFresh acquired iFresh Glen Cove Inc. (“Glen Cove”), New York Mart CT, Inc. (“NYM CT”) and New York Mart N. Miami Inc. (“NYM N. Miami”) from Long Deng, the Company’s Chairman and Chief Executive Officer. iFresh targeted stores in desirable locations, especially under-performers that iFresh could acquire at an advantageous cost. iFresh then utilized its well-developed in-house distribution networks, corporate infrastructure and long-term relationship with farm partners and third-party vendors to boost performance. All three acquired stores realized enhanced and stabilized profit the first year after acquisition.

ii. Adoption of scalable small-box format

iFresh brands itself as a player in the specialty store sector and adopts the small-box format generally adopted in this sector. We believe the small-box format fits into iFresh’s business model and enables it to boost profitability from structural synergy and efficiency.

Compared with iFresh’s mainstream competitors whose average store size normally ranges from 40,000 — 60,000 square feet, the average store size of iFresh is approximately 19,000 square feet with average selling space of approximately 14,000 square feet. iFresh’s adoption of small-box model is rooted on its understanding that customers shop with iFresh mainly for unique produce, seafood and groceries that are difficult to find elsewhere. The small-box format forces iFresh to focus on products that cover the target customer’s unique needs. In addition, the small-box format ensures flexibility, makes it easier for iFresh to discontinue individual products and react quickly to market changes.

Strong Vendor Management

i. Capability to source globally

iFresh has global sourcing capability mainly through Strong America and NYMG. In the aggregate, Strong America and NYMG import over 2,000 items from all over Asia. The top three importing countries are China, Thailand and Taiwan, making up 95% of total imports. iFresh’s wholesale businesses together supply 19.6% of total goods, in which 6% are imported goods, sold in iFresh retail supermarkets at attractive prices.

12

Strong America is also the exclusive distributor of seven famous overseas brands, covering cooking wine, yellow wine, rice noodles, seasonings and spices and snacks. They are all famous daily food staple brands in China and are familiar to iFresh’s target customers. We believe that the exclusive distributorship strengthens iFresh brand and its negotiation power among current competitors, new market entrants and consumers. The table below lists the details of iFresh’s exclusive distributorship:

Table 2 Exclusive Distributorship

| Company | Name | Trademark | Products | Exclusive Region | ||||

| Strong America | ShuangDeng(1) |  |

Cooking Wine | East America, Central and South America | ||||

| Strong America | Gu Yue Long Shan(2) |

|

Yellow Wine | North America | ||||

| Strong America | Bai Lu(1) |  |

Rice Noodles | East America, Central and South America | ||||

| Strong America | You Joy(5) |  |

Seasonings and spices | East Coast of the U.S., Midwestern U.S. and Central and South America | ||||

| Strong America | Hao Ren Jia(6) |  |

Seasonings and spices | U.S. East Coast | ||||

| Strong America | Da Hong Pao(6) |  |

Seasonings and spices | U.S. East Coast | ||||

| Strong America | Bei Da Huang(7) |  |

Beans | U.S. East Coast |

| (1) | Strong America has an exclusive distribution agreement with Fujian International Trade Development Company, Ltd., which granted Strong America exclusive distribution rights for the products registered under the brands of “Shuang Deng” and “Bai Lu” for East America, Central America and South America for a period of five years from October 1, 2015 to September 30, 2020. The agreement can be renewed six months before expiration with the consent of both parties. |

13

| (2) | Strong America entered an exclusive distribution agreement with Zhejiang Gu Yue Long Shan Wine Co., Ltd. since January 1, 2015, which granted Strong America exclusive distribution rights for the products registered under the brand of “Gu Yue Long Shan” for North America. Under the consent of both parties, Strong America is currently the sole distributor of “Gu Yue Long Shan” within the North America Region. |

| (3) | Strong America has an exclusive distribution agreement with Sichuan Youjia Foodstuffs Co., Ltd., which granted Strong America exclusive distribution right for the products registered under the brand of “You Joy” for the East Coast of the U.S., Midwestern U.S. and Central and South America for a period of five years, from January 1, 2015 till December 31, 2019. The agreement can be renewed six months before expiration with consents of both parties. Strong America agreed to make annual purchase of over RMB 2,200,000 under this agreement. |

| (4) | Strong America has an exclusive distribution agreement with Sichuan Teway Food Group Co., Ltd., which granted Strong America exclusive distribution rights for the products registered under the brands of “Hao Ren Jia” and “Da Hong Pao” for the region of East Coast of America for a period of three years from July 1, 2014 to July 31, 2019. The agreement can be renewed six months before expiration with consents of both parties. |

| (5) | Strong America has extended the exclusive distribution agreement with Beidahuang (Dalian) Ouya International Trade Co., Ltd. (CHINA), which granted Strong America exclusive distribution rights for the products registered under the brands of “Bei Da Huang” for the East Coast of America for one year from August 1, 2017 to August 1, 2018. |

ii. Self-owned brands for target customers at competitive prices

Since 2011, Strong America, one of iFresh’s wholesale facilities, established ten brands, covering items such as rice, noodles, Chinese spices and seasonings, frozen vegetables, frozen seafood, and frozen dumplings. They are all popular sellers because they are staples for iFresh’s target customers. iFresh believes that these self-owned brands enable it to enjoy competitive sourcing price, protect it from source and sale interruption, and enhance its negotiating power with existing competitors and new entrants. Also, iFresh Inc. registered its own name as the brand of the supermarket chain stores. The table below provides details regarding iFresh’s self-owned brands.

14

Table 3 Self-owned brands

| Company | Name | Trademark | Products | Registration Number |

Date Registered | |||||

| Strong America | Family elephant |  |

Rice and rice products | 4839414 | 10/27/2015 | |||||

| Strong America | Feiyan |  |

Chinese noodles, Chinese rice noodles, noodles vermicelli | 3945424 | 4/12/2011 | |||||

| Strong America | Green Acre |  |

Dried beans, dried fruit and vegetables, frozen vegetables | 4933029 | 4/5/2016 | |||||

| Strong America | Golden Smell |  |

Processed vegetables and fruits; Noodles, seasoning, edible oil and flavoring combined in unitary packages; Beauty beverages, namely, fruit juices and energy drinks | 5035326 | 12/31/2015 | |||||

| Strong America | Redolent |  |

Rice porridge, namely, congee | N/A | Pending | |||||

| Strong America |

ShuangDeng/ Double Lantern Brand |

|

Cooking wine | N/A | Pending | |||||

| Strong America | Seastar |  |

Frozen seafood and frozen seafood products | N/A | Pending | |||||

| iFresh Inc. | I FRESH |  |

Supermarkets | N/A | Pending | |||||

| iFresh Inc. | I FRESH |  |

Supermarkets | N/A | Pending |

Proprietary and in-house Cold Chain System

Since Mr. Long Deng established Strong America in 1995, iFresh has strived to build a proprietary cold-chain logistics system which evolved with the expansion of iFresh. Based on years of experience, iFresh’s logistics team is now capable of delivering frozen goods to more than 20 states in the Eastern U.S. using its unique packing and temperature control technology.

Live Seafood — All live seafood is collected daily from wharfs or markets at midnight, and immediately distributed via in-house logistics to all retail supermarkets. For different species, iFresh maintains different water temperatures and oxygen density in its tanks and containers. Hibernation technology is widely used in the in-house cold-chain system for long distance distribution to best ensure freshness and quality. The hibernation technology even enables iFresh to deliver live lobsters to China with an over 95% survival rate.

15

Fruit& Vegetables — iFresh adopts different storage technologies based on characteristics of different fruits and vegetables, the knowledge only obtained from years of experience. All vegetables and fruits are delivered and sold on a daily basis, to lower worn rate, lower human cost and keep up the high quality.

Growth Strategy

Stores Site Selection — For new stores, iFresh has an established procedure to select new stores sites. First, iFresh contacts local real estate brokers and appraisers for demographic reports for a group of locations it is interested in. After reading the reports carefully, it narrows down the alternatives for further study. Next, it interviews with a diverse selection of influential local groups, including but not limited to, local Chinese associations, Chinese schools and local WeChat12 groups, to better understand local preference in food and grocery shopping. After further narrowing down the alternative sites, the iFresh team visits the target sites and conducts a field survey on the distribution, density and purchasing preferences of the local Chinese community. The team then runs systematic comparisons through acquiring cost and return analysis and investment feasibility evaluation on target alternatives, and reaches a conclusion on where to open the new store.

| 12 | WeChat is a popular social media among Chinese speaking communities. |

16

Figure 3 Procedure of Store Site Selection

Future Growth Prospects

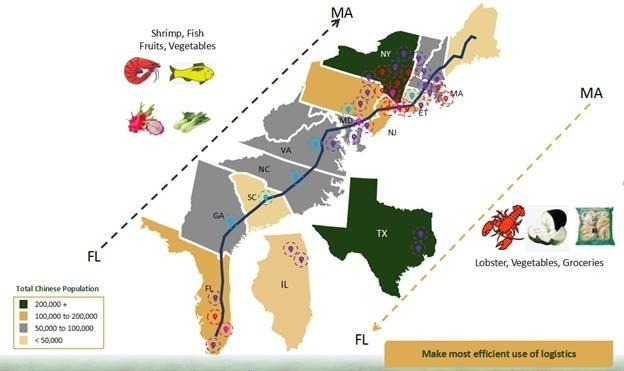

iFresh plans to continue its vertically-integrated model and cultivate future growth by opening new stores, acquisition and developing online business. Geographically, iFresh plans to first expand along I-95 corridor based on its established logistics system and industry leadership, and then gradually go nationwide. For new stores, iFresh has already been approached by or has approached some targets for the purpose of possible acquisitions. Although it has no definitive agreements in place, iFresh has a detailed expansion plan in place. The current logistics network will also be coordinated to cover the new stores in the most efficient and economical way. In addition, iFresh stores in new locations will serve as distribution centers for its online shopping and delivery services to capture the growing Chinese population in large suburban areas.

17

Figure 4 Future Expansion Plan

iFresh will continue targeting stores averaging over 10,000 square feet. Based on its experience, iFresh expects that the average investment per store will be $2.0 million to $3.0 million and that the conversion period will be about 2 years, which means it will take about 2 years on average for newly acquired stores to enter into normal sales scale and profitability. In the aggregate, iFresh will need approximately $10 million of capital in addition to its cash flow in place for the year ended March 31, 2020 to fully execute the physical acquisitions, online platform development and new-store openings in the future.

Stores and Operation

iFresh offers well-assorted, high-quality and globally-sourced food products in its stores, with a special focus on perishable categories and hard-to-find products important to its target customers.

Store Layout

We believe that iFresh’s cultural advantage is unique in comparison with its mainstream peers. iFresh’s ability to identify, source, merchandise and market differentiated Asian and Chinese products that sharply meet the need of its target customers are critical to its success. Its centralized merchandising team rigorously rotates, updates and re-evaluates its existing merchandise offerings and regularly tests new products in retailing stores to excite its customers and to better understand customer preference. iFresh maintains a consistent flow of new products in its stores and keeps its product assortment fresh and relevant.

iFresh plans to use consistent decoration across all stores to emphasis iFresh’s brand and evoke a feeling of trustworthiness and consistent high-quality. It puts special focus on seafood and produce because their price and quality are key determining factors of Chinese or Asian customers’ shopping experience. Perishables in aggregate make up approximately 60% of store selling space on average. To optimize usage of available space, iFresh places popular items such as bok choy, lychee, longyan in most noticeable areas, and prices them competitively to attract customer traffic. The idea is to adopt a standardized product display with flexible arrangements customized to the shopping habits of local consumers.

18

iFresh has a significant focus on perishable product categories which include vegetables, seafood, fruit, meat and prepared foods. In fiscal year ended March 31, 2019, the perishable categories contributed approximately 65.2% to iFresh’s total net sales, similar to 64.5% for the year ended March 31, 2018, in alignment with the space occupancy of perishables. The top three sales generators are vegetables, seafood and meat as shown in Table 4 below. iFresh’s focus on perishables came from its years of research and analysis of target customer’s shopping preferences. This also echoed well with conclusions given in Nielsen report that Asian and Chinese Americans prefer to buy fresh and shop for seafood and vegetables most often.

With respect to non-perishables, iFresh has over 6,600 grocery products on shelf ranging from cooking utensils, canned foods, Chinese and Asian seasonings and spices, to domestic and imported snacks. With a small-box format, iFresh is highly selective in its grocery offerings and is flexible enough to remove unprofitable or poor-selling items quickly. 95% of iFresh’s imported groceries are sourced from China, Thailand and Taiwan to meet the diverse demand of not only Chinese Americans but targeted customers originated from east and south-east Asia. In fiscal year ended March 31, 2019, the non-perishable grocery category contributed approximately 34.8% to iFresh’s total Net Sales and realized a markup of 36.0% on average for the year ended March 31, 2019.

The table below depicts the components of net sales and gross margin in detail as of March 31, 2019:

Table 4 Contribution of Categories

| Category | Net Sales % | Markup % | ||||||

| Vegetables | 20.0 | % | 38.3 | % | ||||

| Seafood | 17.9 | % | 21.0 | % | ||||

| Meat | 14.1 | % | 40.0 | % | ||||

| Fruit | 10.1 | % | 32.2 | % | ||||

| Hot Food | 3.1 | % | 61.1 | % | ||||

| Perishable Total/Average | 65.2 | % | 32.7 | % | ||||

| Grocery | 34.8 | % | 36.0 | % | ||||

Management and sale of Perishables

Vegetables — All iFresh stores receive deliveries of vegetables every day and are required to sell out all vegetables on daily basis. iFresh discounts its vegetables after 7:00 p.m., which significantly lowers the storage cost and worn-and-torn rate and improves profitability. In addition, to lower the worn-out rate of green-leaf vegetables due to customer rummage, iFresh usually packs and sells such vegetables in bags. iFresh also displays and sells different kinds of vegetables according to their characteristics. For example, Chinese yams need to be displayed on wood shreds to keep them fresh, while winter melons are typically sold in pieces due to their large size.

Seafood — As an established procedure, in-house merchants of iFresh collect live seafood from wharfs and markets at midnight on a daily basis. The purchases are immediately distributed to all retailing stores via iFresh’s in-house cold chain systems in which hibernation technology keeps seafood alive and ensures their freshness and high-quality. iFresh discounts remaining stock after 7pm, to make space for new deliveries, reduce storage costs and maintain its standard for freshness and quality.

Meat— Since iFresh can sell more body parts of an animal than a mainstream grocery store, the sales it generates from a whole pig, chicken or cattle are much higher than that of mainstream groceries, which leads to higher margin in meat and meat products sales.

Fruit— Almost all of the iFresh’s unique fruit species are seasonal offerings and the quality and price are decisive to customer traffic during high season. Financially, the unique fruit species are sold at higher unit prices and generally offer higher profit margins. iFresh benefits from its long-standing relationship with farm vendors to stay competitive in high seasons and enjoy better sourcing price and higher profit margin from fruit sales.

19

Hot Food — Hot food options vary among iFresh’s different store locations. iFresh provides prepared Chinese cuisines which require specific cooking utensils and are thus not easily made at home by customers, such as Char Siu, qingtuan, roasted duck, roasted goose, as well as an assortment of dim sums. In addition, iFresh adjusts its hot food offerings periodically based on the responses from customers. As a commitment to freshness and quality, all prepared food in iFresh are made and sold on a daily basis. Leftovers are sold at a discount after 7:00 p.m.

Pricing Strategy

In general, iFresh’s pricing strategy is to provide premium products at reasonable prices. iFresh believes pricing should be based on the quality of products and the shopping experience rather than promotional pricing to drive sales. Its goal is to deliver a sense of value to and foster a relationship of trust with its target and loyal customers.

iFresh adopts different pricing strategies for different food categories. For best sellers such as seafood and core produce such as swimming shrimp and bok choy, iFresh prices competitively and aims to attract consumer traffic. For groceries and dry foods which are usually imported and have a long shelf life, iFresh prices at a premium (average markup of 36.0%). Due to changes in market conditions and seasonal supply, iFresh’s pricing for seafood and produce are more volatile when compared with other categories. Despite the effects of seasonality, iFresh is able to maintain competitive pricing even in high seasons thanks to its long-standing relationship with its farm partners.

Marketing and advertising

iFresh believes its unique offerings, competitive price of popular produce, and word-of–mouth are major drivers of store sales. Apart from word-of-mouth, iFresh advertises using in-store tastings, in-store weekly promotion signage, cooking demonstrations and product sampling. iFresh also promotes its stores on its official website, uses an electronic newsletter, and/or inserts sales flyers in local Chinese newspapers or magazines on a monthly or weekly basis. iFresh’s online business is marketed mainly on its official website and on WeChat, the most widely-used mobile social app among Chinese immigrant. As of the fiscal years ended March 31, 2019 and 2018, iFresh recognized $410,671 and $143,824 for marketing and advertising expenses, respectively. Overall, iFresh utilized a mixed marketing and advertising methods to enhance iFresh brand and sales, to regularly communicate with its target customers and to strengthen its ability to market new and differentiated products.

Store Staffing and Operations

iFresh adopts a systematic approach to support operations and the sustainable development of stores. The comprehensive support includes, but is not limited to, employee training and scheduling, store design, layout, product sourcing and inventory management systems, especially focusing on perishables. The support enables iFresh to lower worn-and-tear rate, to enhance operating margins and profit and to help build iFresh’s image of a Chinese supermarket chain committed to freshness and high-quality.

Each iFresh retail supermarket is operated with high autonomy. A store manager oversees the general operation and an assistant manager is also appointed to assist the supervision. To ensure expertise in management and high quality of offerings, department managers are also appointed by category at each store. The department managers in each store generally include a vegetable manager, a fruit manager, a seafood manager, a meat manager, a grocery manager and a hot food manager. Since a department manager shoulders the detailed management for the specific category he or she is in charge of, he or she is commonly experienced in this category or has been with iFresh for years and exhibited superior performance. As a group, the store manager and store department managers help to ensure the quality of iFresh’s offerings.

Competition

Food retail is a large and highly competitive industry, but we believe that the market participants in the Chinese supermarket industry, a niche market are highly fragmented and immature. Currently, iFresh faces competition from smaller or dispersed competitors focusing on the niche market of Chinese and other Asian consumers. However, with the rapid growth of the Chinese and other Asian population and their consumption power, other competitors may also begin operating in this niche market in the future. Those competitors include: (i) national conventional supermarkets, (ii) regional supermarkets, (iii) national superstores, (iv) alternative food retailers, (v) local foods stores, (vi) small specialty stores, and (vii) farmers’ markets.

20

The national and regional supermarket chains are experienced in operating multiple store locations, expansion management and have greater marketing or financial resources than iFresh does. Even though currently they offer only a limited selection of Chinese and Asian specialty foods, they may be able to devote greater resources to sourcing, promoting and selling their products if they choose to do so. The local food stores and markets are small in size with a deep understanding of local preferences. Their lack of scale results in high risk and limited growth potential.

Trademarks and Other Intellectual Property

iFresh owns four Trademarks: (i) Family Elephant; (ii) Green Acre; (iii) Golden Smell; and (iv) Redolent. iFresh’s trademarks cover rice and rice products and seasonings and spices, as well as assortment of noodles, frozen vegetables, frozen dumplings and frozen seafood. Trademarks are generally renewed for a 10-year period. We consider iFresh’s trademarks to be valuable assets that diversify customer’s value alternatives, a useful strategy to enhance profit margins and an important way to establish and protect iFresh brand in a competitive environment.

iFresh plans to acquire more brands or even develop NYM-branded products in the near future. iFresh will evaluate the acquisition opportunities on a case by case basis, considering the timing, impact to current products and the product quality.

The Fresh Market, Inc., the owner of the federally registered THE FRESH MARKET trademark, has informed the Company that The Fresh Market considers the Company’s use of the words “iFresh Market” on some of its storefronts as well as the domain name “www.ifreshmarket.com” to infringe on The Fresh Market’s trademark. The Company is considering its response to The Fresh Market’s communication.

Insurance

iFresh uses insurance to provide coverage for potential liability for worker’s compensation, automobile and general liability, product liability, director and officers’ liability, employee health care benefits and other casualty and property risks. Changes in legal trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, insolvency or insurance carriers, and changes in discount rates could all affect ultimate settlements of claims. iFresh evaluates its insurance requirements on an ongoing basis to ensure it maintains adequate levels of coverage.

Properties

iFresh’s headquarters has been located in Long Island City since 1999. The head office is leased at current market rate from a real estate company in which our Director and Chief Executive Officer, Long Deng, has a significant equity interest. The headquarter and the attached warehouse spaces are located in a desirable area in New York City’s up and coming Hunters Point neighborhood. We believe that the space can be easily rented to or sold to any third party if not used by us. All of our retail supermarkets lease operating space from various third parties with which we maintain long-term leases averaging approximately 11.9 years. Five of the ten current leases have remaining periods of at least 10 years; and the rest five current leases come with a renewal option ranging from 10 to 20 years. New York Mart Group rents 20,000 square feet of storage from third parties, while Strong America rents 60,000 square feet of storage from a real estate company in which Long Deng, our Director and Chief Executive Officer, has a significant equity and control.

21

The list below details the information related to iFresh’s leases:

Table 5 iFresh’s leases

| Store Name | Location | Gross Sq. Ft. |

Lease Start |

Lease End | Remaining Years |

Renewal Options | ||||||

| New York Mart 8 Ave, Inc. | 6023 8th Ave, Brooklyn, NY 11120 |

15,000 | 11/1/2011 | 10/31/2036 | 18.3 | N/A | ||||||

| New York Mart Roosevelt Inc. | 142-41 Roosevelt Ave, Flushing, NY 11354 |

18,000 | 6/8/2010 | 6/7/2040 | 21.9 | 10 years | ||||||

| New York Mart East Broadway Inc. | 75 East Broadway, New York, NY 10002 |

7,500 | 12/28/2001 | 10/31/2024 | 6.3 | 5 years | ||||||

| New York Mart Mott St. Inc. | 128 Mott Street, New York, NY 10013 |

12,000 | 11/1/2010 | 10/31/2025 | 7.3 | 10 years | ||||||

| New York Mart Ave U 2nd Inc. | 17-21 Ave U, Brooklyn, NY 11229 |

14,000 | 5/31/2011 | 8/31/2028 | 10.1 | N/A | ||||||

| Ming’s Supermarket Inc. | 1102 Washington Street, Boston, MA 02118 |

23,356 | 1/1/2007 | 12/1/2026 | 8.4 | 10 years | ||||||

| Zen Mkt Quincy, Inc. | 733 Hancock St. Quincy, MA 02170 |

10,000 | 3/1/2003 | 6/30/2023 | 5.7 | 10 years | ||||||

| New York Mart Sunrise Inc. | 10101 Sunset Strop Sunrise, FL 33322 |

15,033 | 12/1/2010 | 11/30/2030 | 12.4 | 20 years | ||||||

| iFresh E. Colonial, Inc. | 2415 E Colonial Drive, Orlando, FL 32803 |

20,370 | 7/5/2017 | 1/1/2024 | 5.5 | N/A | ||||||

| Strong America Limited | 2-39 54th Ave, Long Island City, NY 11101 |

59,000 | 5/1/2016 | 4/30/2026 | 7.8 | N/A | ||||||

| Strong America Limited | 2-39 54th Ave, Long Island City, NY 11101 |

10,886 | 3/1/2017 | 9/30/2027 | 9.4 | Auto renewal each year (unless 60 day notice) | ||||||

| New York Mart Group Inc. | 55-01 2nd Street, Long Island City, NY 11101 |

20,000 | 3/1/2011 | 2/28/2021 | 2.6 | N/A | ||||||

| New York Mart Group Inc. | 2-39 54th Ave, Long Island City, NY 11101 |

14,048 | 3/1/2017 | 9/30/2027 | 9.4 | 5 years |

Employees

As of March 31, 2019, we had approximately 376 employees, 233 of whom are full-time employees and the remaining 143 of whom work part-time. We have 58 employees who have worked with us for 10 years or more. Our employees are not unionized nor, to our knowledge, are there any plans for them to unionize. We have never experienced a strike or significant work stoppage. iFresh regards its employee relations to be good.

Seasonality

As with other participants in the food retail industry, iFresh’s sales are affected by seasonality. First, weekly sales fluctuate throughout the year, with weekends generating more sales over weekdays. Weekends enable customers living further from iFresh’s stores to shop in iFresh’s stores.

iFresh also has higher sales in its third fiscal quarter when customers make holiday purchases. In contrast to conventional supermarkets, iFresh’s are not only affected by U.S. holidays, but by traditional Chinese holidays as well, such as the Spring Festival (in January or February), the Dragon Boat Festival (in June), and the Mid-Autumn Festival (in September or October). Each of the Chinese festivals features a specific traditional food which will be very popular just prior to or at the holiday season. Therefore, iFresh observes not only a general sales increase but also a sharp sales increase for that traditional Chinese food related to the festival.

22

iFresh’s target customers also believe that food in season is the best. Therefore, popular species of vegetables, fruit and seafood change with season. For example, iFresh target customers will look for longyan and lychee in summer but not in winter even if they are on shelf; similarly, customers look for Chinese dates and sugar cane in winter but never in summer. The seasonality in both customer demand and supply has a direct impact on iFresh’s merchandising, pricing, sales and profitability.

Regulation

iFresh operates in multiple states and is subject to federal, state and local laws and regulations in states it operates. Particularly, the jurisdictions in which it operates regulate the licensing of supermarkets, the sale of alcoholic beverages and the sale of lotteries. iFresh must comply with provisions regulating health and sanitation standards, food labeling, licensing for alcoholic beverages and lottery sales. The manufacturing, processing, formulating, packaging, labeling and advertising of product are subject to regulation by various federal agencies including the Food and Drug Administration, the Federal Trade Commission, the United States Department of Agriculture, the Consumer Product Safety Commission and the Environmental Protection Agency. iFresh stores are subject to regular but unscheduled inspections. iFresh stores are also subject to laws governing its relationship with employees including minimum wage requirement, overtime, working conditions, immigration, disabled access and work permit requirements. Certain of iFresh’s parking lots and warehouses and its prepared food sections either have temporary certificates of occupancy or are awaiting certificates of occupancy. In addition, a number of federal, state and local laws impose requirements or restrictions on business owners with respect to access by disabled persons. iFresh believes that it is in material compliance with laws and regulations in each jurisdiction. iFresh’s compliance with these regulations may require additional capital expenditures and could materially adversely affect its ability to conduct business as planned.

Legal Proceedings

In the ordinary course of our business, we are subject to periodic lawsuits, investigations and claims, including, but not limited to, contractual disputes, premises claims and employment, environmental, health, safety and intellectual property matters. Although we cannot predict certainty the ultimate resolution of any lawsuits, investigations and claims asserted against it, we do not believe any currently pending legal proceedings to which it is a party will have a material adverse effect on its business, prospects, financial condition, cash flows or results of operations other than the following:

Leo J. Motsis, as Trustee of the 140-148 East Berkeley Realty Trust v. Ming’s Supermarket, Inc.

Ming’s Supermarket, Inc. (“Ming”), the subsidiary of the Company, is a tenant at a building located at 140-148 East Berkeley Street, Boston, MA (the “Property”), pursuant to a lease dated September 24, 1999 (the “Lease”). The Lease had a 10-year initial term, followed by an option for two additional 10-year terms. Ming has exercised that first option and the Lease has approximately 15 years remaining to run if the second option is also exercised. The Lease also gives Ming a right of first refusal on any sale of the building.

On February 22, 2015, a sprinkler pipe burst in the Property. This caused the Inspectional Services Department of the City of Boston (“ISD”) to inspect the Property. The ISD found a number of problems which have prevented further use of the Property. The ISD notified both landlord and tenant that the Property was only permitted for use as an elevator garage and that its use as a warehouse was never permitted and that a conditional use permit must be obtained from the City of Boston to make such use lawful. Moreover, the Property was found to have major structural issues requiring repair, as well as issues with the elevator and outside glass. The result of the ISD’s findings are that Ming was ordered not to use the Property for any purpose unless and until the structural and other repairs are completed and its use as a warehouse is permitted by the Boston Zoning Board.

While the Lease provides that the elevator (approximate cost $400,000) and glass repairs (approximate cost $30,000) are the responsibility of the tenant, the structural repairs (approximate cost $500,000) are the landlord’s responsibility under the Lease, unless the structural damage was caused by the tenant’s misuse of the Property. In this regard Ming has retained an expert who will testify the structural damage to the building was caused by long term water infiltration and is not the result of anything Ming did. Ming initially sought for the landlord to perform the structural repairs and agreed that upon completion of those repairs, Ming would repair the elevator and the broken glass. In addition, Ming asked the landlord to cooperate in permitting use of the Property as a warehouse.

23

The landlord refused to either perform structural repairs or to cooperate on the permitting. As a result, as of April 2015, Ming began withholding rent, since Ming was barred from using the Property by order of the ISD. The landlord then sued Ming for breach of the Lease and unpaid rent, and Ming counterclaimed for constructive eviction and for damages resulting from the landlord’s breach of its duty to perform structural repairs under the Lease.

The case was tried before a jury in August 2017. The jury awarded Ming judgment against the landlord in the amount of $795,000, plus continuing damages of $2,250 per month until the structural repairs are completed. The court found that the landlord’s actions violated the Massachusetts unfair and deceptive acts and practices statute and therefore doubled the amount of damages to $1,590,000 and further ruled that Ming should also recover costs and attorneys’ fees of approximately $250,000. The result is a judgment in favor of Ming and against the landlord that will total approximately $1.85 million. The judgment requires the landlord to repair the premises and obtain an occupancy permit. The landlord is responsible to Ming for damages in the amount of $2,250 per month until an occupancy permit is issued. The judgment also accrues interest at the rate of 12% per year until paid.

The landlord filed a Notice of Appeal, which will delay ultimate resolution of this matter for potentially one year or more. Ming has filed a lien against the landlord’s real estate as security for the judgment.

On May 31, 2018, the ISD issued an occupancy permit, triggering Ming’s requirement to resume regular rental payments.

The appeal hearing will be held on July 12, 2019. No guaranties or predictions can be made at this time as to ultimate final outcome of this case.

HDH, LLC v. New York Mart Group Inc.

A subsidiary of the Company, New York Mart Group, Inc., entered into a lease agreement with HDH, LLC for a warehouse located at 55-01 2nd Street, Long Island City, New York 11101 for the period March 15, 2011 through February 28, 2021. The landlord sued the tenant for breaching the lease by altering the premises without the landlord’s permission and without obtaining necessary governmental permits. The landlord also sued the tenant for failing to pay rent and additional fee. The trial court entered a judgement on September 28, 2018. The landlord claims it is entitled to $372,667 in damages and other related fees. New York Mart Group Inc. filed a notice of appeal, which might take 1 to 2 years. The Company is still negotiating a final agreement. Based on the Company’s best estimation on the negotiation, the Company has accrued $200,000 for the potential loss and expense associated with this case.

Voice Road Plaza, LLC v. New York Mart Group Inc

A subsidiary of the Company, New York Mart Group, Inc., entered into a lease with Voice Road Plaza, LLC for the Company’s new store Glen Cove located at Carle Place, NY 11514. The landlord sued the Company for failing to pay rent and additional fee. In April 2019, landlord was awarded money judgment of $207,975 and judgment of passion and warrant of eviction. The landlord has also requested legal order to withhold the Company’s bank account for $415,950 on May 3, 2019. On June 19, 2019, the Company signed Stipulation of Settlement with landlord to pay for the unpaid rent and execute warrant of eviction by July, 24, 2019. The Company has accrued around $210,000 expense associated with this case. The Company is planning to file a notice of appeal to sue the landlord not timely provide documents requested in order for the Company to obtain required license to operate.

Hartford Fire Insurance Company v. New York Mart Group Inc

On November 28, 2018, a lawsuit was filed against New York Mart Group, Inc. by Hartford Fire Insurance Company (“Hartford”), who seeks contractual indemnification from the Company and other defendants relating to certain supersedeas bonds issued by Hartford in connection with the unsuccessful appeal of state court litigation by iFresh’s codefendant. Hartford alleges that iFresh guaranteed performance of the bonds and therefore seeks to enforce the indemnification terms thereof against iFresh in addition to the other defendants. On June 14, 2019, Hartford filed a motion for summary judgment against iFresh, arguing that Hartford is entitled to judgment as a matter of law. The deadline for iFresh to respond to that motion has not yet occurred. In view of the uncertainties inherent in litigation, we are unable to form a judgment as to the likelihood of an unfavorable outcome. If the plaintiff was to prevail on the merit, it could obtained a judgment against iFresh in the amount of its alleged loss under the bonds for the amount of $424,772, in addition to attorney’s fee, costs and interest. The Company has accrued $500,000 for the potential loss and expense associated with this case.

Other litigations

Three of the subsidiaries of the Company has failed to pay the rents on time. The landlord has sued the Company to pay. The Company is going to engage attorney to represent the Company to file answer to summary of judgments made by opposing counsels. All unpaid rent has been fully accrued as of March 31, 2019.

24

An investment in our Common Stock is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this report, including the consolidated financial statements and notes thereto, before deciding to invest in our Common Stock. Any of the risk factors described below could significantly and adversely affect iFresh’s business, prospects, sales, revenues, gross profit, cash flows, financial condition, and results of operations.

Risks Related to the Company

We are currently in default under our Credit Facility with Key Bank, which limits our liquidity and could result in Key Bank accelerating amounts we owe to it under the facility.

On December 23, 2016, NYM, as borrower, entered into a $25 million senior secured Credit Agreement (the “Credit Agreement”) with Key Bank National Association (“Key Bank” or “Lender”). The Credit Agreement provides for (1) a revolving credit of $5,000,000 for making advance and issuance of letter of credit, (2) $15,000,000 of effective date term loan and (3) $5,000,000 of delayed draw term loan. The interest rate is equal to (1) the Lender’s “prime rate” plus 0.95%, or (b) the Adjusted LIBOR rate plus 1.95%. As reflected in the Company’s consolidated financial statements, the Company had operating losses in fiscal year 2019 and had negative working capital of $21.7 million and $18.4 million as of March 31, 2019 and 2018, respectively. The Company had negative equity of $1.0 million as of March 31, 2019. The Company did not meet the financial covenant required in the credit agreement with Keybank. As of March 31, 2019, the Company has outstanding loan facilities of approximately $21.3 million due to Keybank. Failure to maintain these loan facilities will have a significant impact on the Company’s operations.