As filed with the Securities and Exchange Commission on April 19, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| ENDRA Life Sciences Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

| 3845 |

| 26-0579295 |

| (State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

3600 Green Court, Suite 350,

Ann Arbor, MI 48105-1570

(734) 335-0468

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_____________________

Francois Michelon

Chief Executive Officer

ENDRA Life Sciences Inc.

3600 Green Court, Suite 350,

Ann Arbor, MI 48105-1570

(734) 335-0468

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________

Copies to:

| Mark R. Busch, Esq. Coleman Wombwell, Esq. K&L Gates LLP 300 South Tryon Suite 1000 Charlotte, NC 28202 Telephone: (704) 331-7400 |

| Robert Charron, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas, 11th Floor New York, New York 10165 Telephone: (212) 370-1300 |

_____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion, dated April 19, 2024 |

[●] Shares of Common Stock

Pre-Funded Warrants to purchase up to [●] Shares of Common Stock

Series A Warrants to purchase up to [●] Shares of Common Stock

Series B Warrants to purchase up to [●] Shares of Common Stock and

[●] Shares of Common Stock underlying the Pre-Funded Warrants, Series A Warrants and Series B Warrants

This is a firm commitment public offering of [●] shares of common stock, par value $0.0001 per share (“common stock”), together with Series A warrants to purchase [●] shares of common stock (the “Series A Warrants”) and Series B warrants to purchase [●] shares of common stock (the “Series B Warrants” and, together with the Series A Warrants, the “common warrants”). The common stock and common warrants will be sold in a fixed combination, with each share of common stock accompanied by a Series A Warrant to purchase one share of common stock and a Series B Warrant to purchase one share of common stock. The shares of common stock and common warrants are immediately separable and will be issued separately in this offering but must be purchased together in this offering. The Series A Warrants will have an exercise price of $ per share and will be exercisable beginning on the effective date of shareholder approval of the issuance of shares upon exercise of the common warrants (the “Warrant Shareholder Approval”). The effective date of Warrant Shareholder Approval is the “Initial Exercise Date” for the common warrants. The Series A Warrants will expire on five-year anniversary of the Initial Exercise Date. The Series B Warrants will have an exercise price of $ per share and will be exercisable beginning on the Initial Exercise Date. The Series B Warrants will expire on the twelve-month anniversary of the Initial Exercise Date.

Our common stock trades on the Nasdaq Capital Market under the symbol “NDRA.” The assumed public offering price for each share of common stock and the accompanying common warrants for purposes of this preliminary prospectus is $0.2334 (equal to the last sale price of our common stock as reported by The Nasdaq Capital Market on April 18, 2024). The actual public offering price per each set of a share of common stock and accompanying common warrants in this offering will be determined between us and the underwriter at the time of pricing and may reflect a discount to the current market price for our common stock. Therefore, the recent market price used throughout this preliminary prospectus as a basis for an assumed public offering price per share of common stock and accompanying common warrants may not be indicative of the final offering price.

We are also offering pre-funded warrants to purchase up to an aggregate of [●] shares of common stock (the “pre-funded warrants”), in lieu of shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99 %) of our outstanding shares of common stock following the consummation of this offering. A holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates and certain related parties, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant is exercisable for one share of our common stock. Each pre-funded warrant is being issued together with the same common warrants described above being issued with each share of common stock. For each pre-funded warrant that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one basis. The combined public offering price of each pre-funded warrant, together with the accompanying common warrants, will be equal to the price being sold to the public in this offering, minus $0.0001. The pre-funded warrants are immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. The pre-funded warrants and the common warrants are immediately separable and will be issued separately but will be purchased together in this offering. In this prospectus, we refer to the common warrants and pre-funded warrants together as the “warrants”. This prospectus also relates to the offering of common stock issuable upon exercise of such warrants. We collectively refer to the shares of common stock and warrants offered hereby and the shares of common stock underlying the warrants as the “securities.” There is no established public trading market for the warrants, and we do not expect a market to develop. We do not intend to apply for listing of the warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the warrants will be limited.

| i |

|

|

| Per share and common warrants |

|

| Per pre-funded warrant and common warrants |

|

| Total |

| |||

| Public offering price |

| $ |

|

| $ |

|

| $ |

| |||

| Underwriting discounts and commissions(1) |

| $ |

|

| $ |

|

| $ |

| |||

| Proceeds, before expenses, to us(2) |

| $ |

|

| $ |

|

| $ |

| |||

____________

| (1) | We have agreed to give the underwriter a discount equal to seven percent (7.0%) of the gross proceeds of this offering. This does not include the reimbursement of certain expenses of the underwriter we have agreed to pay. We have also agreed to issue the underwriter a warrant to purchase a number of shares of common stock equal to five percent (5.0%) of the common stock in this offering (including the common stock issuable upon the exercise of the pre-funded warrants). See “Underwriting” for additional disclosure regarding the underwriting discounts and commissions and estimated offering expenses. |

|

|

|

| (2) | The amount of the offering proceeds to us presented in this table does not give effect to any exercise of the warrants being issued in this offering. |

Investing in our securities involves a high degree of risk. See “Risk Factors” on page [●] of this prospectus and elsewhere in any supplements for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares to purchasers on or about , 2024.

Sole Managing Underwriter

Craig-Hallum

The date of this prospectus is , 2024.

| ii |

|

| Page | |

|

| iv | |

|

| 1 | |

|

| 7 | |

|

| 11 | |

|

| 12 | |

|

| 13 | |

|

| 20 | |

|

| 22 | |

|

| 22 | |

|

| 22 | |

|

| 23 |

You should rely only on the information contained in this prospectus. Neither we nor the underwriter has authorized anyone to provide you with different information and, if provided, such information or representations must not be relied upon as having been authorized by us or the underwriter. This prospectus shall not constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation.

You should read this prospectus together with the additional information described below under the heading “Where You Can Find More Information.” We may also provide a prospectus supplement or post-effective amendment to the Registration Statement to add information to, or update or change information contained in, this prospectus. This prospectus does not contain all of the information included in the Registration Statement. For a more complete understanding of the offering of the securities, you should refer to the Registration Statement, including its exhibits.

Unless the context indicates otherwise, in this prospectus, the terms “ENDRA,” “we,” “us,” “our,” and the “Company” refer to ENDRA Life Sciences Inc., a Delaware corporation, and its subsidiaries.

| iii |

| Table of Contents |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate,” “strategy”, “future”, “likely” or other comparable terms and references to future periods. All statements other than statements of historical facts included in this prospectus regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding: estimates of the timing of future events and anticipated results of our development efforts, including the timing of submission for and receipt of required regulatory approvals and product launches; statements relating to future financial position and projected costs and revenue; expectations concerning our business strategy; and statements regarding our ability to find and maintain development partners.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

|

| · | our limited commercial experience, limited cash and history of losses; |

|

|

|

|

|

| · | our ability to obtain adequate financing to fund our business operations in the future; |

|

|

|

|

|

| · | our ability to achieve profitability; |

|

|

|

|

|

| · | delays and changes in regulatory requirements, policy and guidelines, including potential delays in submitting required regulatory applications or other submissions with respect to U.S. Food and Drug Administration (“FDA”) or other regulatory agency approval; |

|

|

|

|

|

| · | our ability to obtain and maintain required CE mark certifications and secure required FDA and other governmental approvals for our Thermo-Acoustic Enhanced Ultrasound (“TAEUS”) applications; |

|

|

|

|

|

| · | our ability to develop a commercially feasible application based on our TAEUS technology; |

|

|

|

|

|

| · | market acceptance of our technology; |

|

|

|

|

|

| · | the effect of macroeconomic conditions on our business; |

|

|

|

|

|

| · | results of our human studies, which may be negative or inconclusive; |

|

|

|

|

|

| · | our ability to find and maintain development partners; |

|

|

|

|

|

| · | our reliance on third parties, collaborations, strategic alliances and licensing arrangements to complete our business strategy; |

|

|

|

|

|

| · | the amount and nature of competition in our industry; |

|

|

|

|

|

| · | our ability to protect our intellectual property; |

|

|

|

|

|

| · | potential changes in the healthcare industry or third-party reimbursement practices; |

|

|

|

|

|

| · | our ability to comply with regulation by various federal, state, local and foreign governmental agencies and to maintain necessary regulatory clearances or approvals; |

|

|

|

|

|

| · | our ability to maintain compliance with Nasdaq listing standards; |

|

|

|

|

|

| · | our dependence on our senior management team; and |

|

|

|

|

|

| · | the other risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of our Annual Report on Form 10-K for the year ended December 31, 2023. |

Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

| iv |

| Table of Contents |

|

This summary contains basic information about us and our business but does not contain all of the information that is important to your investment decision. You should carefully read this summary together with the more detailed information contained elsewhere in this before making an investment decision. Investors should carefully consider the information set forth under the caption “Risk Factors” appearing elsewhere in this prospectus.

Overview

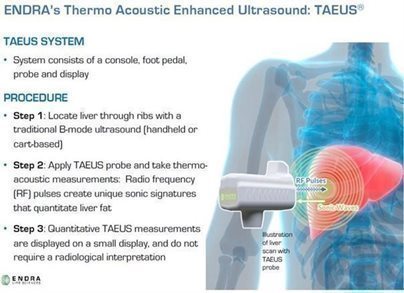

We were incorporated as a Delaware corporation in 2007. We are developing a next-generation enhanced ultrasound technology platform—Thermo Acoustic Enhanced Ultrasound, or TAEUS® — in order to broaden patient access to the safe diagnosis and treatment of a number of significant medical conditions in circumstances where expensive X-ray computed tomography (“CT”), magnetic resonance imaging (“MRI”) technology, or other diagnostic technologies such as surgical biopsy, are unavailable or impractical.

Our TAEUS technology uses radio frequency (“RF”) pulses to stimulate tissues, using a small fraction (less than 1%) of the amount of energy that would be transmitted into the body during an MRI scan. The use of RF energy allows our TAEUS technology to penetrate deep into tissue, enabling the imaging of human anatomy at depths equivalent to those of conventional ultrasound. The RF pulses are absorbed by tissue and converted into ultrasound signals, which are detected by an external ultrasound receiver and a digital acquisition system that is part of the TAEUS system. The detected ultrasound is processed into images and other forms of data using our proprietary software and algorithms and then displayed to complement conventional gray-scale ultrasound images. The TAEUS imaging concept is illustrated below:

We believe that our TAEUS technology has the potential to add a number of new capabilities to conventional ultrasound, and other types of capital medical equipment such as interventional thermo-ablation systems, and thereby enhance the utility of those systems. Additionally, we believe that our technology can extend the use of ultrasound technology to indications and clinical situations that currently require the use of expensive CT or MRI imaging systems, where imaging is not practical using existing technology, or where other assessment tools such as surgical biopsy are required.

Our TAEUS platform is not intended to replace CT or MRI systems, both of which are versatile imaging technologies with capabilities and uses beyond the focus of our business. These systems, while versatile, are relatively expensive—a CT system can cost approximately $1 million and an MRI system can cost up to approximately $3 million. In addition, and in contrast to ultrasound systems, due to their limited number and the fact that they are usually fixed-in-place at major medical facilities, CT or MRI systems are frequently inaccessible to many patients. For example, CT or MRI systems are generally less accessible to primary care practices, rural clinics, economically developing markets, and patient bedsides. |

| 1 |

| Table of Contents |

| Ultrasound systems are more broadly available to patients than either CT or MRI systems. There are an estimated 1.6 million diagnostic ultrasound systems globally in use today. The global diagnostic ultrasound device market is anticipated to expand at a CAGR of 4.07% from 2022 to 2030, according to Grand View Research. Ultrasound systems are relatively inexpensive compared to CT and MRI systems, as smaller portable ultrasound systems can cost as little as approximately $5,000 and the price of new cart-based ultrasound systems can range from approximately $75,000 to $200,000. These numbers include both portable and cart-based ultrasound systems, and cover all types of diagnostic ultrasound procedures, including systems intended for cardiology, prenatal and abdominal use. We do not currently intend to address cart-based ultrasound systems focused on applications in prenatal care, nor certain portable ultrasound applications such as emergency room medicine, where we believe our TAEUS technology may not substantially impact patient care. Accordingly, we estimate the addressable market for one or more of our current or future TAEUS applications to include approximately 700,000 ultrasound systems currently in use throughout the world, in addition to other types of capital equipment.

We are conducting human clinical studies on our TAEUS Fatty Live Imaging Probe (“FLIP”) that enables ultrasound to distinguish fat from lean tissue. To demonstrate the other capabilities of our TAEUS platform, we have conducted various internal ex-vivo laboratory experiments and limited internal in-vivo large animal studies. Based on these experiments and studies, we have demonstrated that the TAEUS platform has the following capabilities and potential clinical applications:

| ||

|

| · | Tissue Composition: Our TAEUS technology enables ultrasound to distinguish fat from lean tissue. This capability would enable the use of TAEUS-enhanced ultrasound for the early identification, staging and monitoring of NAFLD, a precursor to NASH, liver fibrosis, cirrhosis and liver cancer. |

|

|

|

|

|

| · | Temperature Monitoring: Our TAEUS technology enables traditional ultrasound to visualize changes in tissue temperature, in real time. This capability would enable the use of TAEUS-enhanced ultrasound to guide thermoablative therapy, which uses heat or cold to affect tissue, such as in the treatment of cardiac atrial fibrillation, or removal of cancerous liver and kidney lesions, with greater accuracy, and perform cosmetology procedures such as lipolysis of abdominal fat. |

|

|

|

|

|

| · | Vascular Imaging: Our TAEUS technology has the potential to enable visualization of blood vessels from any angle, using only a saline solution contrasting agent, unlike Doppler ultrasound, which requires precise viewing angles. This capability would enable the use of TAEUS-enhanced ultrasound to assist in identifying arterial plaques or malformed vessels. |

|

|

|

|

|

| · | Tissue Perfusion: Our TAEUS technology has the potential to image blood flow at the capillary level in a region, organ or tissue. This capability could be used to assist physicians in characterizing abnormalities in tissue perfusion symptomatic of damaged tissue, such as internal bleeding from trauma, or diseased tissue, such as certain cancers. |

|

The first TAEUS application we intend to commercialize is our NAFLD TAEUS application addressing liver tissue composition. Our initial target market for this application is the European Union (“EU”) and United Kingdom. In September 2019, we announced the completion and reported top-level findings of an initial healthy subject study and data collection of 50 subjects, which was included in our TAEUS liver device technical file submission for device CE mark. We received CE mark approval for our TAEUS FLIP (Fatty Liver Imaging Probe) application in March 2020. We have registered the product in each of our primary target European markets (i.e., Germany, France, and the United Kingdom).

In June 2020, we submitted a 510(k) Application to the FDA for our TAEUS FLIP System. In February 2022, we announced that we would pursue FDA reclassification and clearance of our TAEUS FLIP System through the FDA’s “de novo” process. We subsequently voluntarily withdrew our 510(k) Application and submitted a de novo request for the TAEUS system to the FDA in the third quarter of 2023. In the fourth quarter of 2023, the FDA sent an Additional Information (“AI”) request related to our de novo application. Since we received the AI request, we have had several interactions with the FDA and have provided additional information. In order to fully respond to the FDA’s questions, we will need to compile additional clinical data, provide additional device test data, and respond to cybersecurity related questions in a new de novo submission. We have a scheduled in-person pre-submission meeting with the FDA in the second quarter of 2024. We currently anticipate completing the necessary clinical studies by the fourth quarter of 2024 and submitting the new de novo request to the FDA in the first half of 2025.

| ||

| 2 |

| Table of Contents |

| After required regulatory approvals, our TAEUS technology can be added as an accessory to existing, commercially available ultrasound systems, helping to improve clinical decision-making on the front lines of patient care, without requiring substantially new clinical workflows or large capital investments. We are also developing TAEUS for possible incorporation into new medical equipment manufactured by original equipment manufacturers (“OEMs”), such as GE Healthcare and others, to enhance the utility of those OEM systems, as described more fully in our Annual Report on Form 10-K. Based on our design work and our understanding of the medical capital equipment market, we intend to price our initial liver TAEUS system at a price point of approximately $65,000, which we believe could enable clinical purchasers to recoup their investment in less than one year by performing a relatively small number of additional procedures, initially paid out-of-pocket by patients until government and private insurance reimbursement is secured for the TAEUS liver procedures.

Recent Financial Results

Below is a summary of certain preliminary estimates regarding our financial results for the quarter ended March 31, 2024. This preliminary financial information is based upon our estimates and is subject to completion of our financial closing procedures. Moreover, this preliminary financial information has been prepared solely on the basis of information that is currently available to, and that is the responsibility of, management. Our independent registered public accounting firm has not audited or reviewed, and does not express an opinion with respect to, this information. This preliminary financial information is not a comprehensive statement of our financial results for the quarter ended March 31, 2024, and remains subject to, among other things, the completion of our financial closing procedures, final adjustments, completion of our internal review and review by our independent registered public accounting firm of our financial statements for the quarter ended March 31, 2024.

We expect [●] for the quarter ended March 31, 2024 and did not have any revenue for the quarter ended March 31, 2023.

We expect to record a net loss of approximately $[●] million for the quarter ended March 31, 2024, compared to a net loss of approximately $2.9 million for the quarter ended March 31, 2023.

As of March 31, 2024, we had total assets of approximately $[●] million and working capital of approximately $[●] million, including $[●] million of cash and cash equivalents.

Risk Factor Summary

Our business is subject to many significant risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and in the other documents we file with the SEC, each of which are incorporated by reference into this prospectus. You should read and carefully consider these risks, together with all of the other information in this prospectus, including the financial statements and the related notes included herein, before deciding whether to invest in our securities. If any of the risks discussed in this prospectus actually occur, our business, prospects, financial condition or operating results could be materially and adversely affected. In particular, our risks include, but are not limited to, the following: |

| 3 |

| Table of Contents |

|

| · | We have a history of operating losses and will need to raise significant additional capital to continue our business and operations. If we are unable to raise capital or secure financing on favorable terms, or at all, to meet our capital and operating needs, we will be forced to delay or reduce our product development program and commercialization efforts, which would have a material adverse effect on our business. |

|

|

|

|

|

| · | Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future for reasons unrelated to our operating performance or prospects, and as a result, investors in our common stock could incur substantial losses. |

|

|

|

|

|

| · | Our stock is subject to minimum requirements to remain listed on the Nasdaq Capital Market, including a minimum bid price requirement, and may be delisted if it does not maintain compliance with those requirements. |

|

|

|

|

|

| · | There is a limited market for our common stock. |

|

|

|

|

|

| · | If securities or industry analysts do not publish research reports about our business, or if they issue an adverse opinion about our business, the price of our securities and trading volume could decline. |

|

|

|

|

|

| · | We have not paid dividends in the past and have no plans to pay dividends. |

|

|

|

|

|

| · | Future sales and issuances of our common stock or rights to purchase common stock, including pursuant to our at-the-market offering program or equity incentive plan, could result in dilution of the percentage ownership of our stockholders and could cause the price of our securities to fall. |

|

|

|

|

|

| · | Our charter documents and Delaware law may inhibit a takeover that stockholders consider favorable. |

|

|

|

|

|

| · | As an investor, you may lose all of your investment. |

|

|

|

|

|

| · | Because the public offering price of our common stock offered herein or issuable upon the exercise of the warrants is substantially higher than the net tangible book value per share of our outstanding common stock following this offering, new investors will experience immediate and substantial dilution. |

|

|

|

|

|

| · | Our management will have broad discretion over the use of the net proceeds from this offering, which we may not use effectively or in a manner with which you agree. |

|

|

|

|

|

| · | There is no public market for the warrants. |

|

|

|

|

|

| · | A warrant does not entitle the holder to any rights as common stockholders until the holder exercises the warrant for shares of our common stock. |

|

|

|

|

|

| · | The warrants in this offering are speculative in nature. |

|

Corporate Information

We were incorporated in Delaware in July 2007. Our corporate headquarters is located at 3600 Green Court, Suite 350, Ann Arbor, Michigan 48105-1570. Our website can be accessed at www.endrainc.com. The telephone number of our principal executive office is (734) 335-0468. The information contained on, or that may be obtained from, our website is not, and shall not be deemed to be, a part of this prospectus. | ||

| 4 |

| Table of Contents |

| THE OFFERING | |

|

|

|

| Common stock offered by us | [●] shares. |

|

|

|

| Common warrants offered by us | Each share of common stock or pre-funded warrant is being offered together with (i) one Series A Warrant to purchase one share of common stock and (ii) one Series B Warrant to purchase one share of common stock. The Series A Warrants will have an exercise price of $ per share (100% of the public offering price of one share of common stock and accompanying common warrants). The Series B Warrants will have an exercise price of $ per share (100% of the public offering price of one share of common stock and accompanying common warrants).

The Series A Warrants and Series B Warrants will become exercisable beginning on the effective date of the Warrant Shareholder Approval. The Series A Warrants will expire on the five-year anniversary of the Initial Exercise Date and the Series B Warrants will expire on the twelve-month anniversary of the Initial Exercise Date.

The common warrants may be redeemed by the Company, in whole or in part, at a price of $0.0001 per warrant, by giving not less than 30 days’ prior notice to the holders of such common warrants at any time after the date on which (i) the daily volume weighted average trading price of the Company’s common stock has equaled or exceeded $[●] (150% of the exercise price) for 10 consecutive trading days and (ii) the average daily trading volume of the shares of the Company’s common stock for such 10-trading day period exceeds $150,000 of shares, as determined in accordance with the terms of the common warrants.

The shares of common stock or the pre-funded warrants, as applicable, sold in this offering and the accompanying common warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This offering also relates to the offering of the shares of common stock issuable upon exercise of the warrants. The exercise price and number of shares of common stock issuable upon exercise will be subject to certain further adjustments as described herein. See “Description of Securities”.

We are also registering the issuance of (i) the [●] shares of our common stock underlying the Series A Warrants and (ii) the [●] shares of our common stock underlying the Series B Warrants. |

|

|

|

| Pre-funded warrants offered by us | We are also offering pre-funded warrants to purchase up to [●] shares of common stock, which may be sold in lieu of the shares of common stock included in this offering. The purchase price of each pre-funded warrant and accompanying common warrants is equal to the price at which the share of common stock and accompanying warrants are being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant is $0.0001 per share. The pre-funded warrants are exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrants we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of common stock issuable upon exercise of the pre-funded warrants sold in this offering. |

|

|

|

| Underwriter warrants | In connection with our public offering, we have granted to the underwriter an option to purchase, for nominal consideration, warrants to purchase shares equal to 5.0% of the shares of common stock, and if applicable, pre-funded warrants sold in this offering (the “Underwriter Warrants”). The Underwriter Warrants have an exercise price of $[●] per share of common stock (120% of public offering price of one share of common stock and accompanying common warrants). The Underwriter Warrants will be exercisable immediately upon issuance and will expire three and one-half years from the commencement of sales in this offering. See “Description of Securities”. We are also registering the [●] shares of common stock issuable upon exercise of the Underwriter Warrants. |

|

|

|

| Common stock outstanding immediately prior to this offering | 11,035,659 shares. |

|

|

|

| Common stock outstanding immediately after giving effect to this offering | [●] shares (assuming no pre-funded warrants are issued in this offering and none of the warrants issued in this offering are exercised). |

|

|

|

| Use of proceeds | We estimate the net proceeds from this offering to us will be approximately $[●] million, assuming a public offering price of $0.2334 per share and accompanying warrants, which is the last reported sale price of our common stock on the Nasdaq Capital Market on April 18, 2024, and after deducting the estimated underwriting discounts and commissions and expected offering expenses payable by us.

We intend to use the net proceeds from this offering for working capital and general corporate purposes.

See the section titled “Use of Proceeds.” |

|

|

|

| Nasdaq Capital Market symbol | NDRA

There is no established trading market for the common warrants or pre-funded warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the common warrants or pre-funded warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the common warrants and pre-funded warrants will be limited. |

|

|

|

| Risk factors | See the section titled “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

| 5 |

| Table of Contents |

| The number of shares of our common stock to be outstanding after this offer is based on 11,035,659 shares of common stock outstanding as of April 18, 2024 and excludes the following: | ||

|

|

|

|

|

| · | 882,349 shares of common stock issuable upon the exercise of outstanding warrants at a weighted-average exercise price of $1.58 per share; |

|

|

|

|

|

| · | 2,010 shares of common stock issuable upon the conversion of outstanding shares of Series A Convertible Preferred Stock; |

|

|

|

|

|

| · | 624,240 shares of common stock issuable upon the exercise of outstanding stock options issued pursuant to our 2016 Omnibus Incentive Plan (the “Incentive Plan”) at a weighted average exercise price of $19.25 per share; and |

|

|

|

|

|

| · | 2,381,416 shares of common stock reserved for future issuance under the Incentive Plan. |

| 6 |

| Table of Contents |

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should read and consider carefully the following risk factors as well as the risk factors described under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference in this prospectus, together with the other information contained in or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes. Each of these risk factors, either alone or taken together, could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common stock. There may be additional risks that we do not presently know of or that we currently believe are immaterial, which could also impair our business and financial position. If any of the events described below were to occur, our financial condition, our ability to access capital resources, our results of operations and/or our future growth prospects could be materially and adversely affected, and the market price of our common stock could decline. As a result, you could lose some or all of any investment you may make in our securities.

Risks Related to this Offering and Our Securities

Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future for reasons unrelated to our operating performance or prospects, and as a result, investors in our common stock could incur substantial losses.

Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future. From January 1, 2023 through April 18, 2024, intra-day trading prices of shares of our common stock on the Nasdaq Capital Market fluctuated from a low of $0.221 to a high of $5.39, and may continue to fluctuate significantly in the future. The stock market in general and the market for healthcare companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, investors may experience losses on their investment in our common stock.

Additionally, securities of certain companies have experienced significant and extreme volatility in stock price due to a sudden increase in demand for stock resulting in aggregate short positions in the stock exceeding the number of shares available for purchase, forcing investors with short exposure to pay a premium to repurchase shares for delivery to share lenders. This is known as a “short squeeze.” These short squeezes have led to the price per share of those companies to trade at a significantly inflated rate that is disconnected from the underlying value of the company. Many investors who have purchased shares in those companies at an inflated rate face the risk of losing a significant portion of their original investment as the price per share declines steadily as interest in those stocks abates. While we have no reason to believe our shares would be the target of a short squeeze, there can be no assurance that they will not be in the future, and you may lose a significant portion or all of your investment if you purchase our shares at a rate that is significantly disconnected from our underlying value.

Our stock is subject to minimum requirements to remain listed on the Nasdaq Capital Market, including a minimum bid price requirement, and may be delisted if it does not maintain compliance with those requirements. A reverse stock split, if approved by our stockholders and effected by the Company, may not increase our stock price and have the desired effect of maintaining compliance with the rules of Nasdaq.

Nasdaq Marketplace Rule 5550(a)(2) requires a minimum bid price of $1.00 per share for primary equity securities listed on the Nasdaq Capital Market (the “Minimum Bid Price Requirement”). If the closing price of our common stock on the Nasdaq Capital Market remains below $1.00, we may receive a notification from the Listing Qualifications Department of Nasdaq notifying the Company of that it no longer meets the Minimum Bid Price Requirement and is subject to delisting if it is not able to regain compliance in a prescribed amount of time (which would be 180 days, pursuant to Nasdaq Marketplace Rule 5810).

| 7 |

| Table of Contents |

We may undertake a reverse stock split in order to increase the market price of our common stock so that we are able to regain compliance with the Minimum Bid Price Requirement. The common warrants offered hereby are subject to adjustment in connection with a reverse stock split in the event that the lowest daily volume weighted average price of our common stock on the Nasdaq Capital Market during the five trading days following the reverse stock split is lower than the exercise price of the warrants, in which case the exercise price of the warrants will be reduced and the number of shares underlying the warrants will be increased. However, the effect of the reverse stock split upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in like circumstances is varied. The price per share of our common stock after the reverse stock split may not reflect the exchange ratio implemented by the Board of Directors and the price per share following the effective time of the reverse stock split may not be maintained for any period of time following the reverse stock split. If the reverse stock split is consummated and the trading price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the reverse stock split. Even if the market price per post-reverse stock split share of our common stock remains in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum stockholders’ equity, the minimum number of shares that must be in the public float, the minimum market value of the public float and the minimum number of round lot holders.

We cannot assure you that we will regain compliance with the Minimum Bid Price Rule or, if we do regain compliance, that we will remain in compliance with all applicable requirements for continued listing on the Nasdaq Capital Market. If we fail to sustain compliance with all applicable requirements for continued listing on the Nasdaq Capital Market, our common stock may be subject to delisting by Nasdaq. This could inhibit the ability of stockholders of to trade their shares of common stock in the open market, thereby severely limiting the liquidity of such shares.

There is a limited market for our common stock.

Although our common stock is traded on the Nasdaq Capital Market, the volume of trading has historically been limited. Our average daily trading volume of our shares from January 1, 2023 to December 31, 2023 was approximately 66,369 shares. Thinly traded stock can be more volatile than stock trading in a more active public market. While we have made efforts to increase trading in our stock, we cannot predict the extent to which an active public market for our common stock will develop or be sustained. Therefore, a holder of our common stock who wishes to sell his or her shares may not be able to do so immediately or at an acceptable price.

If securities or industry analysts do not publish research reports about our business, or if they issue an adverse opinion about our business, the price of our securities and trading volume could decline.

The trading market for our securities is influenced by the research and reports that industry or securities analysts publish about us or our business. If any of the securities or industry analysts who cover us or may cover us in the future change their recommendation regarding our common stock adversely, or provide more favorable relative recommendations about our competitors, the price of our common stock would likely decline. If any securities or industry analyst who covers us or may cover us in the future were to cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the price or trading volume of our common stock to decline.

We have not paid dividends in the past and have no plans to pay dividends.

We plan to reinvest all of our earnings, to the extent we have earnings, in order to further develop our technology and potential products and to cover operating costs. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure you that we will, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our common stock as a dividend.

Future sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plan and our at-the-market equity offering program, could result in dilution of the percentage ownership of our stockholders and could cause the price of our securities to fall.

We expect that significant capital will be needed in the future to continue our planned operations. To the extent we raise capital by issuing common stock, convertible securities or other equity securities, our stockholders may experience substantial dilution, and new investors could gain rights superior to our existing stockholders.

| 8 |

| Table of Contents |

Our charter documents and Delaware law may inhibit a takeover that stockholders consider favorable.

Certain provisions of our Fourth Amended and Restated Certificate of Incorporation, as amended (our “Certificate of Incorporation”) and Amended and Restated Bylaws (our “Bylaws”) and applicable provisions of Delaware law may delay or discourage transactions involving an actual or potential change in control or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares, or transactions that our stockholders might otherwise deem to be in their best interests. The provisions in our Certificate of Incorporation and Bylaws:

|

| · | authorize our board of directors to issue preferred stock without stockholder approval and to designate the rights, preferences and privileges of each class; if issued, such preferred stock would increase the number of outstanding shares of our capital stock and could include terms that may deter an acquisition of us; |

|

|

|

|

|

| · | limit who may call stockholder meetings; |

|

|

|

|

|

| · | do not provide for cumulative voting rights; |

|

|

|

|

|

| · | provide that all vacancies in our board of directors may be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum; |

|

|

|

|

|

| · | provide that stockholders must comply with advance notice procedures with respect to stockholder proposals and the nomination of candidates for director; |

|

|

|

|

|

| · | provide that stockholders may only amend our Certificate of Incorporation upon a supermajority vote of stockholders; and |

|

|

|

|

|

| · | provide that the Court of Chancery of the State of Delaware will be the exclusive forum for certain legal claims. |

In addition, section 203 of the Delaware General Corporation Law limits our ability to engage in any business combination with a person who beneficially owns 15% or more of our outstanding voting stock unless certain conditions are satisfied. This restriction lasts for a period of three years following any such person’s share acquisition. These provisions may have the effect of entrenching our management team and may deprive stockholders of the opportunity to sell their shares to potential acquirers at a premium over prevailing prices. This potential inability to obtain a control premium could reduce the price of our common stock.

As an investor, you may lose all of your investment.

Investing in our securities involves a high degree of risk. As an investor, you may never recoup all, or even part, of your investment and you may never realize any return on your investment. You must be prepared to lose all of your investment.

Our management will have broad discretion over the use of the net proceeds from this offering, which we may not use effectively or in a manner with which you agree.

Our management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return for our company. In addition, pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

| 9 |

| Table of Contents |

The common warrants are not exercisable until shareholder approval and, in certain cases, may be redeemed by the Company prior to their expiration.

The Series A Warrants and Series B Warrants are not exercisable unless and until the Warrant Shareholder Approval is obtained from our stockholders.

While we intend to promptly seek Warrant Shareholder Approval, there is no guarantee that the Warrant Shareholder Approval will ever be obtained. If we are unable to obtain the Warrant Shareholder Approval, the common warrants may have no value.

Additionally, the Company may redeem such common warrants for a nominal price upon 30 days’ prior notice to holders of the common warrants in certain circumstances. In the event that the trading price of the common stock is then lower than the applicable exercise price, or if the trading price of the common stock decreases to below the applicable exercise price due to large amounts of investors exercising their common warrants at such time, or the market’s expectation that such exercises will occur, then the warrants may be “out-of-the-money” and you may choose not to exercise them prior to redemption by the Company.

There is no public market for the warrants.

There is no established public trading market for the warrants in this offering, and we do not expect a market to develop. In addition, the warrants are not listed, and we do not intend to apply for listing of the warrants, on any securities exchange or trading system. Without an active market, the liquidity of the warrants is limited, and investors may be unable to liquidate their investments in the warrants.

A warrant does not entitle the holder to any rights as common stockholders until the holder exercises the warrant for shares of our common stock.

Until you acquire shares of our common stock upon exercise of your warrants, the warrants will not provide you any rights as a common stockholder. Upon exercise of your warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs on or after the exercise date.

The common warrants in this offering are speculative in nature.

The common warrants in this offering do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price during a fixed period of time. Specifically, only following receipt of the Warrant Shareholder Approval, holders of the common warrants may exercise their right to acquire common stock and pay an exercise price of $ per share of common stock. The Series A Warrants will expire on the five-year anniversary of the date of Initial Exercise Date and the Series B Warrants will expire on the twelve-month anniversary of the Initial Exercise Date, and each series of common warrants may be subject to early redemption by the Company for a nominal price.

Moreover, following this offering, the market value of the common warrants, if any, is uncertain and there can be no assurance that the market value of the common warrants will equal or exceed their imputed offering price. There can also be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the common warrants and, consequently, whether it will ever be profitable for holders of the common warrants to exercise the common warrants.

| 10 |

| Table of Contents |

We estimate that the net proceeds to us from the issuance and the sale of the securities in this offering will be approximately $[●] million, based on the assumed public offering price of $0.2334 per share and accompanying common warrants, the last reported sale price of our common stock on the Nasdaq Capital Market on April 18, 2024, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will receive only nominal additional proceeds, if any, from the exercise of the pre-funded warrants.

We intend to use the net proceeds from this offering for working capital and general corporate purposes. We have not yet determined the amount of net proceeds to be used specifically for any particular purpose or the timing of these expenditures.

The expected use of net proceeds from this offering represents our intentions based upon our present plans and business conditions. We cannot predict with certainty all of the particular uses for the proceeds of this offering or the amounts that we will actually spend on the uses set forth above. Accordingly, our management will have significant flexibility in applying the net proceeds of this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business.

Pending our use of the net proceeds from this offering, we intend to maintain the net proceeds as cash deposits or cash management instruments, such as U.S. government securities or money market mutual funds.

| 11 |

| Table of Contents |

As of December 31, 2023, our historical net tangible book value was $5.7 million, or $0.51 per share of our common stock. Our historical net tangible book value per share represents total tangible assets less total liabilities divided by the number of shares of our common stock outstanding on December 31, 2023.

Our as adjusted net tangible book value represents our historical net tangible book value as adjusted to give effect to the sale of 21,422,451 shares of our common stock in this offering (assuming no issuance of pre-funded warrants) at an assumed public offering price of $0.2334 per share and accompanying warrants, which is based on the last reported sales price of our common stock on the Nasdaq Capital Market on April 18, 2024, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We determine dilution, or accretion, per share to investors participating in this offering by subtracting as adjusted net tangible book value per share after this offering from the assumed public offering price per share and accompanying common warrants paid by investors participating in this offering.

The following table illustrates this per share accretion:

| Assumed public offering price per share |

|

|

|

| $ | 0.2334 |

| |

| Historical net tangible book value per share as of December 31, 2023 |

| $ | 0.51 |

|

|

|

|

|

| Decrease in as adjusted net tangible book value per share attributable to new investors |

|

| (0.21 | ) |

|

|

|

|

| As adjusted net tangible book value per share |

|

|

|

|

|

| 0.31 |

|

| Accretion per share to new investors participating in this offering |

|

|

|

|

| $ | 0.07 |

|

Each $0.10 increase or decrease in the assumed public offering price of $0.2334 per share and accompanying warrants, which is based on the last reported sales price of our common stock on the Nasdaq Capital Market on April 18, 2024, would increase or decrease, as applicable, our as adjusted net tangible book value as of December 31, 2023 after this offering by $2.0 million, or $0.06 per share, and would increase or decrease accretion to investors in this offering by $0.04 per share, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase of 2.0 million shares in the number of shares we are offering would increase our as adjusted net tangible book value as of December 31, 2023 after this offering by $0.4 million, or $0.01 per share and would decrease accretion to investors in this offering by $0.01 per share assuming the assumed public offering price per share remains the same, and after deducting the underwriting discount and commissions and estimated offering expenses payable by us. Each decrease of 2.0 million shares in the number of shares we are offering would decrease our as adjusted net tangible book value as of December 31, 2023 after this offering by $0.4 million, or $0.01 per share and would increase accretion to investors in this offering by $0.01 per share assuming the assumed public offering price per share remains the same, and after deducting the underwriting discount and commissions and estimated offering expenses payable by us. The as adjusted information is illustrative only, and we will adjust this information based on the actual public offering price and other terms of this offering determined at pricing.

The foregoing tables and calculations (other than the historical net tangible book value calculation) are based on 11,035,659 shares of our common stock outstanding as of December 31, 2023, and excludes the shares issuable under our warrants and options outstanding as of December 31, 2023, as follows:

|

| · | 882,349 shares of common stock issuable upon the exercise of outstanding warrants at a weighted-average exercise price of $1.58 per share; |

|

|

|

|

|

| · | 2,010 shares of common stock issuable upon the conversion of outstanding shares of Series A Convertible Preferred Stock; |

|

|

|

|

|

| · | 624,240 shares of common stock issuable upon the exercise of outstanding stock options issued pursuant to the Incentive Plan at a weighted average exercise price of $19.25 per share; and |

|

|

|

|

|

| · | 2,381,416 shares of common stock reserved for future issuance under the Incentive Plan. |

Additionally, the foregoing tables and calculations (other than the historical net tangible book value calculation) assume no exercise of the common warrants and underwriters warrants sold in this offering.

| 12 |

| Table of Contents |

We are a Delaware company and our affairs are governed by our amended and restated certificate of incorporation and bylaws, the DGCL and the common law of the State of Delaware.

The following summary is not complete and is subject to, and is qualified in its entirety by reference to, the provisions of amended and restated certificate of incorporation and bylaws, copies of which are filed as exhibits to the Registration Statement of which this prospectus forms a part.

Securities Offered by Us in this Offering

We are offering [●] shares of common stock or pre-funded warrants to purchase up to an aggregate of [●] shares of common stock in lieu of shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock following the consummation of this offering, together with common warrants to purchase up to [●] shares of common stock. For each pre-funded warrant that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one basis. Each common warrant has an exercise price of $ per share. The shares of common stock and the common warrants are immediately separable and will be issued separately but must initially be purchased together in this offering.

Warrants to be Issued as Part of this Offering

Common warrants

The common warrants will be issued in the respective forms filed as an exhibit to the registration statement of which this prospectus is a part and the following summary is subject to and qualified in its entirety by the filed exhibits. You should review a copy of each form of common warrant for a complete description of the terms and conditions applicable to the common warrants.

The following is a brief summary of the common warrants and is still subject in all respect to the provisions contained in the form of common warrant.

Duration and Exercise Price

Each common warrant offered hereby has an initial exercise price per share equal to $ . The exercise price of the common warrants will be determined at the time of pricing based on negotiations with the underwriters. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

The common warrants will be issued separately from the common stock and pre-funded warrants included in this offering. Each share of our common stock or pre-funded warrant purchased in this offering will include a Series A Warrant and Series B Warrant, each to purchase one share of our common stock. The Series A Warrants and Series B Warrants will be issued in certificated form only.

Exercisability

The Series A Warrants and Series B Warrants are not exercisable until the effective date of the Warrant Shareholder Approval, if such approval is obtained. The Series A Warrants will expire on the five-year anniversary of the Initial Exercise Date and the Series B Warrants will expire on the twelve-month anniversary of the Initial Exercise Date.

Each common warrant will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full of the exercise price in immediately available funds for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below).

| 13 |

| Table of Contents |

Cashless Exercise

If at the time a holder exercises its common warrant, a registration statement registering the issuance of common stock underlying the common warrants under the Securities Act is not then effective or available, in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the number of shares of common stock determined according to a formula set forth in the common warrants.

Company Redemption Option

The Series A Warrants and Series B Warrants are redeemable by the Company in certain circumstances. Subject to certain exceptions, if, (i) the daily volume weighted average trading price of the Company’s common stock has equaled or exceeded $[●] (150% of the exercise price) for 10 consecutive trading days and (ii) the average daily trading volume of the shares of the Company’s common stock for such 10-trading day period exceeds $150,000 of shares, then we may, within one trading day of the end of such ten (10) Trading Days referred to above, upon notice (a “Redemption Notice”), call for redemption or cancellation of all or any portion of the warrants for which a notice of exercise has not yet been delivered for consideration equal to $0.0001 per warrant share. Any portion of a warrant subject to such Redemption Notice for which a notice of exercise shall not have been received by the Redemption Date (as hereinafter defined) will be canceled at 6:30 p.m. (New York City time) on the thirtieth calendar day after the date the Redemption Notice is sent by the Company (such date and time, the “Redemption Date”). Our right to call the warrants shall be exercised ratably among the holders based on each holders initial purchase of warrants.

Share Combination Event Adjustments.

Subject to the Warrant Shareholder Approval, if at any time on or after the date of issuance there occurs any share split, share dividend, share combination recapitalization or other similar transaction involving our common stock and the lowest daily volume weighted average price during the five consecutive trading days following the date of such event (the “Event Market Price”) is less than the exercise price then in effect, then the exercise price shall be reduced to the lowest daily volume weighted average price during such period and the number of warrant shares issuable shall be increased such that the aggregate exercise price payable thereunder, after taking into account the decrease in the exercise price, shall be equal to the aggregate exercise price on the date of issuance. If one or more share combination events occurs prior to the Warrant Shareholder Approval being obtained and a reduction of the exercise price would have been effected but for such shareholder approval not yet having being obtained, then the exercise price will automatically be reduced to the lowest Event Market Price with respect to any share combination event that occurred prior to the Warrant Shareholder Approval being obtained and the issuable shares will automatically be adjusted to equal the highest such number with respect to any share combination event that occurred prior to the Warrant Shareholder Approval being obtained.

Certain Adjustments

The exercise price and the number of shares issuable upon exercise of the common warrants is subject to appropriate adjustment in the event of stock splits, stock dividends, recapitalizations, reorganizations, schemes, arrangements or similar events affecting our common stock. The common warrant holders must pay the exercise price in cash or wire transfer of immediately available funds upon exercise of the common warrants, unless such holders are utilizing the cashless exercise provision of the common warrants, which is only available in certain circumstances such as if the underlying shares are not registered with the SEC pursuant to an effective registration statement. We intend to use commercially reasonable best efforts to have the registration statement of which this prospectus forms a part, effective when the common warrants are exercised.

Fundamental Transactions

In the event we consummate a merger or consolidation with or into another person or other reorganization event in which our common stock is converted or exchanged for securities, cash or other property, or we sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of our assets or we or another person acquire 50% or more of our outstanding shares of common stock, then following such event, the holders of the common warrants will be entitled to receive upon exercise of the common warrants the same kind and amount of securities, cash or property which the holders would have received had they exercised the common warrants immediately prior to such fundamental transaction. Any successor to us or surviving entity shall assume the obligations under the common warrants. Additionally, as more fully described in the Series A Warrant, in the event of certain fundamental transactions, the holders of the Series A Warrants will be entitled to receive consideration in an amount equal to the Black Scholes value of the Series A Warrants on the date of consummation of such transaction.

| 14 |

| Table of Contents |

Transferability

Subject to applicable laws, a common warrant may be transferred at the option of the holder upon surrender of the common warrant to us together with the appropriate instruments of transfer.

Exchange Listing

There is no established trading market for the common warrants. In addition, we do not intend to apply for the listing of the common warrants on any national securities exchange. Without an active trading market, the liquidity of the common warrants will be limited.

Right as a Stockholder

Except as otherwise provided in the common warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the common warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their common warrants.

Waivers and Adjustments

Subject to certain exceptions, any terms of the common warrants may be amended or waived with our written consent and the written consent of the holder.

Pre-funded warrants

The pre-funded warrants will be issued in a form filed as an exhibit to the registration statement of which this prospectus is a part and the following summary is subject to and qualified in its entirety by the filed exhibit. You should review a copy of the form of pre-funded warrant for a complete description of the terms and conditions applicable to the pre-funded warrants.

Duration and Exercise Price

The pre-funded warrants offered hereby will have an exercise price of $0.0001 per share. The pre-funded warrants will be immediately exercisable upon issuance and may be exercised at any time until the pre-funded warrants are exercised in full. The exercise prices and numbers of shares of common stock issuable upon exercise are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock. The pre-funded warrants will be issued in certificated form only.

Exercisability

The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise. A holder (together with its affiliates) may not exercise any portion of such holder’s pre-funded warrants to the extent that the holder would own more than 4.99% (or 9.99%, at the holder’s election) of our outstanding common stock immediately after exercise, except that upon notice from the holder to us, the holder may decrease or increase the limitation of ownership of outstanding stock after exercising the holder’s pre-funded warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants, provided that any increase in such limitation shall not be effective until 61 days following notice to us.

Fundamental Transactions

In the event we consummate a merger or consolidation with or into another person or other reorganization event in which our common stock is converted or exchanged for securities, cash or other property, or we sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of our assets or we or another person acquire 50% or more of our outstanding shares of common stock, then following such event, the holders of the pre-funded warrants will be entitled to receive upon exercise of the pre-funded warrants the same kind and amount of securities, cash or property which the holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental transaction. Any successor to us or surviving entity shall assume the obligations under the pre-funded warrants.

| 15 |

| Table of Contents |

Transferability

Subject to applicable laws and the restriction on transfer set forth in the pre-funded warrant, the pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded warrant to us together with the appropriate instruments of transfer.

Exchange Listing

There is no established trading market for the pre-funded warrants. In addition, we do not intend to apply for the listing of the pre-funded warrants on any national securities exchange. Without an active trading market, the liquidity of the pre-funded warrants will be limited.

Right as a Stockholder

Except as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the pre-funded warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their pre-funded warrants.

Waivers and Adjustments

Subject to certain exceptions, any terms of the pre-funded warrants may be amended or waived with our written consent and the written consent of the holder.

Underwriter Warrants