UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended:

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to __________________

Commission file number:

(Exact Name of Registrant as Specified in Its Charter) |

| ||

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of Principal Executive Offices) |

| (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

|

| The | ||

Warrants, each to purchase one share of Common Stock |

| NDRAW |

| The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant, as of June 30, 2021, was approximately $

As of March 28, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2021. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

ENDRA LIFE SCIENCES INC.

TABLE OF CONTENTS

| 1 |

| Table of Contents |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate,” “strategy”, “future”, “likely” or other comparable terms and references to future periods. All statements other than statements of historical facts included in this Annual Report regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding expectations for revenues, cash flows and financial performance, the anticipated results of our development efforts and the timing for receipt of required regulatory approvals and product launches.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| · | our limited commercial experience, limited cash and history of losses; |

|

|

|

| · | our ability to obtain adequate financing to fund our business operations in the future; |

|

|

|

| · | our ability to achieve profitability; |

|

|

|

| · | our ability to develop a commercially feasible application based on our Thermo-Acoustic Enhanced Ultrasound (“TAEUS”) technology; |

|

|

|

| · | market acceptance of our technology; |

|

|

|

| · | uncertainties associated with COVID-19 or coronavirus, including its possible effects on our operations; |

|

|

|

| · | results of our human studies, which may be negative or inconclusive; |

|

|

|

| · | our ability to find and maintain development partners; |

|

|

|

| · | our reliance on third parties, collaborations, strategic alliances and licensing arrangements to complete our business strategy; |

|

|

|

| · | the amount and nature of competition in our industry; |

|

|

|

| · | our ability to protect our intellectual property; |

|

|

|

| · | potential changes in the healthcare industry or third-party reimbursement practices; |

|

|

|

| · | delays and changes in regulatory requirements, policy and guidelines, including potential delays in submitting required regulatory applications or other submissions with respect to U.S. Food and Drug Administration (“FDA”) or other regulatory agency approval; |

|

|

|

| · | our ability to maintain CE mark certification, and secure required FDA and other governmental approvals, for our TAEUS applications; |

|

|

|

| · | our ability to comply with regulation by various federal, state, local and foreign governmental agencies and to maintain necessary regulatory clearances or approvals; |

| 2 |

| Table of Contents |

| · | our ability to regain and maintain compliance with Nasdaq listing standards; |

|

|

|

| · | our dependence on our senior management team; and |

|

|

|

| · | the other risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of this Annual Report. |

Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

RISK FACTOR SUMMARY

Below is a bulleted summary of our principal risk factors, however this list does not fully represent all of our known risk factors. We encourage you to carefully review the full risk factors contained in this Annual Report in their entirety for additional information regarding the material factors that make an investment in our securities speculative or risky. These risks and uncertainties include, but are not limited to, the following:

Risks Related to our Business

| · | We have a history of operating losses, we may never achieve or maintain profitability, and we will need to raise significant additional capital if we are going to continue as a going concern. |

|

|

|

| · | Our efforts may never result in the successful development of commercial applications based on our TAEUS technology, on which our success is substantially dependent. |

|

|

|

| · | Our TAEUS platform applications may not achieve adequate market acceptance by the physicians, patients, third-party payors and others in the medical community. |

|

|

|

| · | The outbreak of COVID-19 could adversely impact our business, including our pre-sales activities, clinical trials and ability to obtain regulatory approvals. |

|

|

|

| · | We may not remain commercially viable if there is an inadequate level of reimbursement by governmental programs and other third-party payors for our planned products or associated procedures. |

|

|

|

| · | We have limited resources and depend on third parties to design and manufacture, and seek regulatory approval of, our TAEUS applications. |

|

|

|

| · | We will need to develop marketing and distribution capabilities both internally and through our relationships with third parties in order to sell any of our TAEUS products receiving regulatory approval. |

|

|

|

| · | Competition in the medical imaging market is intense and we may be unable to successfully compete. |

|

|

|

| · | We intend to market our TAEUS applications, if approved, globally, in which case we will be subject to the risks of doing business outside of the United States. |

|

|

|

| · | We depend on our senior management team and the loss of one or more key employees or an inability to attract and retain highly skilled employees could harm our business. |

|

|

|

| · | Misdiagnosis, warranty and other claims, as well as product field actions and regulatory proceedings, initiated against us could increase our costs, delay or reduce our sales and damage our reputation. |

| 3 |

| Table of Contents |

Risks Related to Intellectual Property and Other Legal Matters

| · | If we are unable to protect our intellectual property, which entails significant expense and resources, then our financial condition, results of operations and the value of our technology and products could be adversely affected. |

|

|

|

| · | Policing unauthorized use of our proprietary rights can be difficult, expensive and time-consuming, and we might be unable to determine the extent of this unauthorized use. |

|

|

|

| · | Intellectual property rights may not provide adequate protection, which may permit third parties to compete against us more effectively. |

Risks Related to Government Regulation

| · | If we fail to obtain and maintain necessary regulatory clearances or approvals for our TAEUS applications, or if clearances or approvals for future applications and indications are delayed or not issued, our commercial operations will be harmed. |

|

|

|

| · | Healthcare reform measures could hinder or prevent our planned products' commercial success. |

|

|

|

| · | If we fail to comply with healthcare regulations, we could face substantial penalties and our business, operations and financial condition could be adversely affected. |

Risks Related to Owning Our Securities, Our Financial Results and Our Need for Financing

| · | Our quarterly and annual results may fluctuate significantly, may not fully reflect the underlying performance of our business and may result in volatility in the price of our securities. |

|

|

|

| · | Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future for reasons unrelated to our operating performance or prospects, and as a result, investors in our common stock could incur substantial losses. |

|

|

|

| · | We may be subject to securities litigation, which is expensive and could divert management attention. |

|

|

|

| · | If we are unable to implement and maintain effective internal control over financial reporting, including by remediating current material weaknesses in our internal control over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our securities may decrease. |

|

|

|

| · | Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud. |

|

|

|

| · | Future sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plan, could result in dilution of the percentage ownership of our stockholders and could cause the price of our securities to fall. |

|

|

|

| · | Our charter documents and Delaware law may inhibit a takeover that stockholders consider favorable. |

| 4 |

| Table of Contents |

PART I

As used in this Annual Report, unless the context otherwise requires, the terms “ENDRA,” “we,” “us,” “our,” and the “Company” refer to ENDRA Life Sciences Inc., a Delaware corporation.

Item 1. Business

Overview

We were incorporated as a Delaware corporation in 2007. We are leveraging experience with pre-clinical enhanced ultrasound devices to develop technology for increasing the capabilities of clinical diagnostic ultrasound in order to broaden patient access to the safe diagnosis and treatment of a number of significant medical conditions in circumstances where expensive X-ray computed tomography (“CT”) and magnetic resonance imaging (“MRI”) technology, or other diagnostic technologies such as surgical biopsy, are unavailable or impractical.

In 2010, we began marketing and selling our Nexus 128 system, which combined light-based thermoacoustics and ultrasound to address the imaging needs of researchers studying disease models in pre-clinical applications. Building on this expertise in thermoacoustics, we have developed a next-generation technology platform — Thermo Acoustic Enhanced Ultrasound, or TAEUSⓇ — which is intended to enhance the capability of clinical ultrasound technology and support the diagnosis and treatment of a number of significant medical conditions that currently require the use of expensive CT or MRI imaging or where imaging is not practical using existing technology. We ceased production, service support and parts for our Nexus 128 system in 2019 in order to focus our resources exclusively on the development of our TAEUS technology.

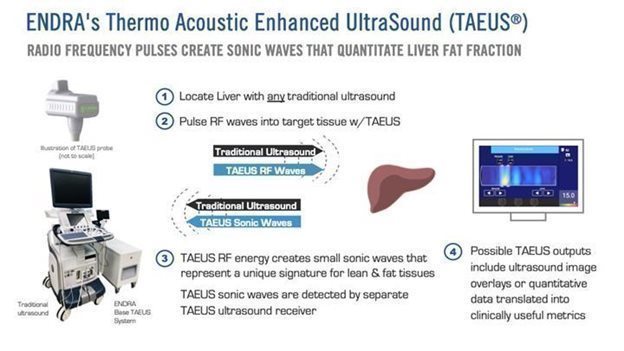

Our TAEUS technology uses radio frequency (“RF”) pulses to stimulate tissues, using a small fraction (less than 1%) of the amount of energy that would be transmitted into the body during an MRI scan. The use of RF energy allows our TAEUS technology to penetrate deep into tissue, enabling the imaging of human anatomy at depths equivalent to those of conventional ultrasound. The RF pulses are absorbed by tissue and converted into ultrasound signals, which are detected by an external ultrasound receiver and a digital acquisition system that is part of the TAEUS system. The detected ultrasound is processed into images and other forms of data using our proprietary algorithms and displayed to complement conventional gray-scale ultrasound images.

As described below, our first TAEUS platform application focuses on quantifying fat in the liver and stage progression of nonalcoholic fatty liver disease (“NAFLD”) which, untreated, can progress to Nonalcoholic Steatohepatitis (“NASH”), fibrosis, cirrhosis and liver cancer. In April 2016, we entered into a Collaborative Research Agreement with General Electric Company, acting through its GE Healthcare business unit and the GE Global Research Center (collectively, “GE Healthcare”), under which GE Healthcare has agreed to assist us in our efforts to commercialize this application. In November 2017, we contracted with the Centre for Imaging Technology Commercialization (“CIMTEC”) to initiate human studies, through Canada-based Robarts Research Institute, with our TAEUS device targeting NAFLD. In October 2018, we received an Investigational Testing Authorization (“ITA”) from Health Canada to commence the first human studies in healthy volunteers with our TAEUS clinical system targeting NAFLD, guiding our algorithm development, and comparing our technology to MRI. The feasibility study was conducted in collaboration with the widely respected Robarts Research Institute in London, Ontario, Canada. We reported the completion and top-level findings of this study in September 2019. The data collected from the study, including additional usability inputs, was included in our TAEUS liver device technical file submission for device CE mark, which we received for our NAFLD TAEUS application in March 2020. ENDRA now has eight clinical research partnerships with research hospitals in North America, Europe and Asia for the conduct of clinical studies comparing our TAEUS clinical system to MRI-PDFF in the measurement of liver fat. In June 2020, we completed a 510(k) Premarket Notification submission to the FDA for the NAFLD TAEUS application. Following meetings with the FDA in connection with its review of our application, we determined that the 510(k) pathway was not the optimal option due to the novel nature of our NAFLD TAEUS application and, in February 2022, announced that we would pursue the de novo pathway for FDA approval of our NAFLD TAEUS application.

Each of our TAEUS platform applications will require regulatory approvals before we are able to sell or license the application. Based on certain factors, such as the installed base of ultrasound systems, availability of other imaging technologies, such as CT and MRI, economic strength and applicable regulatory requirements, we intend to seek initial approval of our applications for sale in the European Union, followed by the United States and China.

Diagnostic Imaging Technologies

Diagnostic imaging technologies such as CT, MRI and ultrasound allow physicians to look inside a person’s body to guide treatment or gather information about medical conditions such as broken bones, cancers, signs of heart disease or internal bleeding. The type of imaging technology a physician uses depends on a patient’s symptoms and the part of the body being examined. CT technology is well suited for viewing bone injuries, diagnosing lung and chest problems, and detecting cancers. MRI technology excels at examining soft tissue in ligament and tendon injuries, spinal cord injuries, and brain tumors. CT scans can take as little as 5 minutes, while an MRI scan can take up to 30 minutes.

| 5 |

| Table of Contents |

Unfortunately, while CT and MRI systems are versatile and create high quality images, they are also expensive and not always accessible to patients. A CT system costs approximately $1 million and an MRI system can cost up to $3 million. CT and MRI systems are large and can weigh several tons, typically requiring significant modifications to existing healthcare facilities to safely site the CT and MRI equipment. Because of their size and weight, CT and MRI systems are usually fixed-in-place at major medical facilities. As a result, they are less accessible to primary care and rural clinics, economically developing markets, and patient bedsides. As of 2018, there were only approximately 63,000 CT systems and 50,000 MRI systems in the world, approximately 50% of which were located in the U.S. and Japan.

While CT and MRI systems create high quality images, their use is not always practical. For example, the diagnosis and treatment of the estimated 1.8 billion people suffering from NAFLD requires ongoing surveillance of the patients’ livers to assess the progression of the disease and the efficacy of treatment. However, the use of CT and MRI systems to perform that surveillance is impractical for a number of reasons, including the high cost of the scan, the limited availability of CT and MRI systems and the required use of contrast agents, including those containing radioactive substances that can cause allergic reactions and reduced kidney functions. Patient exposure to the ionizing radiation generated by a CT system must be limited for safety reasons. Similarly, because of the strong magnetic field created by an MRI machine, patients with metal joint replacements or cardiac pacemakers cannot be imaged with an MRI system.

Because of CT and MRI’s limited availability and practical limitations, a patient who would otherwise be a candidate for CT or MRI scanning must often rely on less effective or less practical methods. For example, MRI scans are not typically used to measure tissue temperature during thermoablative (temperature-based) surgery. Instead, physicians use printed manufacturer guidelines to time the thermal surgery or insert surgical temperature probes in an attempt to guide treatment. As a result, the treatment is often imprecise or comes with additional risks, such as infection.

Ultrasound Technology

An ultrasound machine transmits sound waves, which bounce off tissues, organs and blood in the body. The ultrasound machine captures these echoes and uses them to create an image. Ultrasound technology excels at imaging the structure of internal organs, muscles and bone surfaces. Due to its utility, cost-effectiveness and safety profile, ultrasound imaging is frequently used in a physician’s examination room or at a patient’s bedside as a first-line diagnostic tool, which has resulted in an overall increase in the number of ultrasound scans performed.

Ultrasound systems are more broadly available to patients than either CT or MRI systems. There are an estimated one million ultrasound systems globally in use today. Ultrasound systems are relatively inexpensive compared to CT and MRI systems, with smaller portable ultrasound systems costing as little as $10,000 and new cart-based ultrasound systems costing between $75,000 and $200,000. Ultrasound systems are also more mobile than CT and MRI systems and many are designed to be moved by an operator from room to room, or closer to patients. Ultrasound technology does not present the same safety concerns as CT and MRI technology, since ultrasound does not emit ionizing radiation and ultrasound contrast agents are generally considered to be safe.

However, ultrasound’s imaging capabilities are more limited compared to CT and MRI technology. For example, ultrasound systems cannot measure tissue temperature during thermal ablation surgery or quantify fat to diagnose early-stage liver disease -- instances where CT and MRI systems are used.

Ultrasound Market

Sales of ultrasound diagnostic equipment were approximately $4.4 billion globally in 2017 and are expected to grow at approximately 4.4% annually. There are an estimated one million installed systems generating over 400 million annual diagnostic ultrasound procedures globally. Additionally, an estimated 30,000 to 50,000 new and replacement systems are sold into the market each year. These numbers include both portable and cart-based ultrasound systems, and cover all types of diagnostic ultrasound procedures, including systems intended for cardiology, prenatal and abdominal use. We do not currently intend to address ultrasound systems focused on applications in prenatal care, where we believe our TAEUS technology will not substantially impact patient care. Accordingly, we define our addressable market for one or more of our TAEUS applications at approximately 365,000 cart-based ultrasound systems currently in use throughout the world.

| 6 |

| Table of Contents |

We believe that demand for ultrasound systems is driven primarily by the following factors:

| · | Population growth and age demographics that increase the demand for diagnostic screening for cancer, cardiology, and prenatal applications. |

|

|

|

| · | Economic development broadening investment in healthcare in underserved markets such as China and Latin America, where ultrasound technology has significant appeal due to its price point and flexibility at point-of-care. |

|

|

|

| · | Expanding ultrasound applications and improving image quality that drive demand for new ultrasound technologies, such as software enhancements, bi-axial probes, and dedicated single application systems. |

|

|

|

| · | Positive insurance reimbursement rate trends for ultrasound diagnostics due to the technology’s safety and cost-effectiveness. |

Unmet Need

We believe that the limited availability of high-utility and cost-effective imaging technology represents a significant unmet medical need. We believe that expanding the capability of ultrasound technology to perform more of the imaging tasks presently available only on expensive CT and MRI systems will satisfy this unmet need.

Our Solutions

Our TAEUS technology uses a pulsed energy source – specifically, radio-frequency (“RF”) – to generate ultrasonic waves in tissue. These waves are then detected with ultrasound equipment and used to create high-contrast images and other forms of data using our proprietary algorithms. Unlike conventional ultrasound, which creates images based on the scattering properties of tissue, thermoacoustic imaging provides tissue absorption maps of the pulsed energy, similar to those generated by CT scans. Ultrasound is only utilized to transmit the absorption signal to the imaging system outside of the body.

Our TAEUS Technology Platform for Clinical Applications

To increase the utility of our thermoacoustic technology, in 2013 we began to develop our TAEUS technology platform. Unlike the near-infrared light pulses used in our earlier photoacoustic systems, our TAEUS technology uses RF pulses to stimulate tissues, using a small fraction of the energy transmitted into the body during an MRI scan. Using RF energy enables our TAEUS technology to penetrate deep into tissue, enabling the imaging of human anatomy at depths equivalent to those of conventional ultrasound. The RF pulses are absorbed by tissue and converted into ultrasound signals, which are detected by an external ultrasound receiver and a digital acquisition system that is part of the TAEUS system. Our RF-based thermoacoustics imaging is not adversely affected by blood-filled organs, enabling our TAEUS technology to be used in clinical liver applications, among others. The detected ultrasound can then be processed into ultrasound overlays or quantitative data that may be translated into clinically useful metrics using our proprietary algorithms and displayed to complement conventional gray-scale ultrasound images. The TAEUS imaging concept is illustrated below:

| 7 |

| Table of Contents |

After required regulatory approvals, our TAEUS technology can be added as an accessory to existing ultrasound systems, helping to improve clinical decision-making on the front lines of patient care, without requiring substantially new clinical workflows or large capital investments. We are also developing TAEUS for incorporation into new ultrasound systems manufactured by companies such as GE Healthcare, described more fully below.

We believe that our TAEUS technology has the potential to add a number of new capabilities to conventional ultrasound and thereby enhance the utility of both existing and new ultrasound systems and extend the use of ultrasound technology to circumstances that either currently require the use of expensive CT or MRI imaging systems, where imaging is not practical using existing technology, or where other assessment tools such as surgical biopsy are required. To demonstrate the capabilities of our TAEUS platform, we have conducted various internal ex-vivo laboratory experiments and limited internal in-vivo large animal studies. In our ex-vivo and in-vivo testing, we have demonstrated that the TAEUS platform has the following capabilities and potential clinical applications:

| · | Tissue Composition: Our TAEUS technology enables ultrasound to distinguish fat from lean tissue. This capability would enable the use of TAEUS-enhanced ultrasound for the early identification, staging and monitoring of NAFLD, a precursor to NASH, liver fibrosis, cirrhosis and liver cancer. |

|

|

|

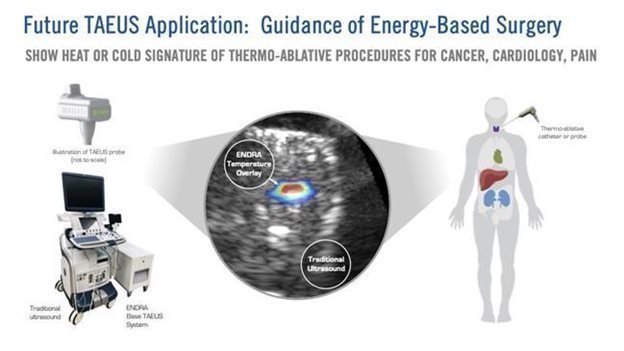

| · | Temperature Monitoring: Our TAEUS technology enables traditional ultrasound to visualize changes in tissue temperature, in real time. This capability would enable the use of TAEUS-enhanced ultrasound to guide thermoablative therapy, which uses heat or cold to remove tissue, such as in the treatment of cardiac atrial fibrillation, or removal of cancerous liver and kidney lesions, with greater accuracy. |

|

|

|

| · | Vascular Imaging: Our TAEUS technology enables ultrasound to view blood vessels from any angle, using only a saline solution contrasting agent, unlike Doppler ultrasound, which requires precise viewing angles. This capability would enable the use of TAEUS-enhanced ultrasound to easily identify arterial plaque or malformed vessels. |

|

|

|

| ● | Tissue Perfusion: Our TAEUS technology enables ultrasound to image blood flow at the capillary level in a region, organ or tissue. This capability could be used to assist physicians in characterizing microvasculature fluid flows symptomatic of damaged tissue, such as internal bleeding from trauma, or diseased tissue, such as certain cancers. |

Because of the large number of traditional ultrasound systems currently in global use, we are first developing our TAEUS technology for sale as an aftermarket accessory that works with existing ultrasound systems. Because our TAEUS technology is designed to enhance the utility of, not replace, conventional ultrasound, we believe healthcare providers will be able to increase the utilization of, and generate new revenue from, their existing ultrasound systems once we obtain required regulatory approval for specific applications. We further believe that clinicians will be attracted to our technology because it will enable them to perform more procedures with existing ultrasound equipment, thereby retaining more imaging patients in their clinics rather than referring patients out to a regional medical center for a CT or MRI scan.

ENDRA’s first clinical product is designed to interface with a conventional ultrasound scanner, utilizing the scanner’s B-mode imaging to guide the selected region for assessment of liver fat content. The following sub-systems will comprise ENDRA’s first generation product.

Radio Frequency (RF) Source and Computer:

The RF source consists of a low power waveform generator and an amplifier. Together, these components provide the characteristic pulses required to excite thermoacoustic signals in tissue. The computer provides processing capability to both utilize the conventional ultrasound data for navigation to the measurement site of interest, and the calculations required to convert digitized thermoacoustic signals to measurements of fat in liver tissue. The entire sub-system will reside in a single enclosure, on wheels, and sit adjacent to the ultrasound imaging system.

Specialized Transducer:

A single channel ‘receive only’ ultrasound transducer is specifically designed and optimized for thermoacoustic imaging. The transducer sub-system will detect thermoacoustic signals excited by the RF source within the liver. The transducer assembly includes electronics for signal amplification, digitization, and signal processing. The specialized transducer will attach to the conventional ultrasound probe used for liver imaging.

| 8 |

| Table of Contents |

RF Applicator:

The RF applicator transmits pulses of energy, provided by the RF source, into tissue. The applicator is positioned in proximity to the target region for measurement.

A second generation product is expected to provide two dimensional imaging with a transducer composed of multiple receive elements. The RF source and applicator would be similar to those in the first generation product but the multi-element transducer would allow for multiple applications including: reading tissue composition, temperature, vascular flow, tissue perfusion, and other potential applications. Ultimately, we expect our technology will be incorporated into conventional ultrasound systems and our business model will transition from producing stand-alone systems to licensing our technology, IP and specialized components to ultrasound OEMs. Existing ultrasound equipment already includes power supplies, computation, high speed electronics, and ultrasound transducers, which may be leveraged by our thermoacoustic imaging applications. The RF source and applicator are the principal hardware components that will be added to OEM ultrasound systems for the OEM fully integrated form of our product.

We are following a model that mirrors the approach used by companies in the past to introduce new ultrasound imaging capabilities to existing conventional ultrasound scanners. Color Doppler, elastography, 3-D imaging, and high channel count systems were all introduced by new companies (not already involved in conventional ultrasound imaging). Historically, ultrasound imaging has grown through the introduction of unique technology and capabilities that expanded the applications and use of clinical ultrasound in a form that often added separate hardware to existing ultrasound systems. Ultimately, as these new technologies gained acceptance in the marketplace they were incorporated into OEM-designed and built systems that were sold by the leading ultrasound imaging vendors.

TAEUS System for the Early Assessment and Monitoring of Nonalcoholic Fatty Liver Disease, or NAFLD

Our first TAEUS platform application focuses on quantifying fat in the liver and stage progression of NAFLD which, untreated, can progress to NASH, fibrosis, cirrhosis and liver cancer. In 2015, over 1.8 billion people were affected by NAFLD/NASH. The World Gastroenterology Organisation considers NAFLD/NASH a global pandemic affecting rich and poor countries alike. Obesity, hepatitis, and diabetes are leading contributors to the development of NAFLD.

Left untreated, an estimated 30% of NAFLD cases progress to NASH, a condition in which liver fat causes inflammation and decreased liver function, possibly resulting in fatigue, weight loss, muscle pain and abdominal pain. Excess liver fat remains a root cause of and key clinical concern for both of NASH and NAFLD.

Approximately 25% of NASH cases progress to liver fibrosis, in which liver inflammation causes scar tissue which eventually prevents the liver from functioning properly. The scar tissue blocks the flow of blood through the liver and slows the processing of nutrients, hormones, drugs, and naturally produced toxins. It also slows the production of proteins and other substances made by the liver. Once a patient develops cirrhosis of the liver, the only life-saving therapy is a liver transplant. Additionally, cirrhosis patients may develop liver cancer. In 2018, the World Health Organization estimated that liver cancer kills 782,000 people annually. Because of the increased incidence of obesity, hepatitis and diabetes throughout the world, NAFLD has become the most common chronic liver disease and an important cause of cirrhosis and liver cancer worldwide.

Despite the increased incidence of NAFLD and its role in the development of NASH, cirrhosis and liver cancer, we believe that no low-cost, accurate and safe method exists for measuring fat in the liver. Current liver enzyme blood tests are indicative, but cannot reliably confirm early stage NAFLD or NASH, and liver enzyme levels are normal in a large percentage of patients with NAFLD. Existing ultrasound technology can only measure fat qualitatively in the liver at moderate to severe levels, typically greater than 30% liver fat, and ultrasound has low accuracy when used on obese patients. While early stage NAFLD and NASH can be confirmed by an MRI scan, an MRI scan is expensive, and MRI systems are not widely available or practical for many patients. A surgical biopsy can be used to confirm NAFLD and NASH, but is also expensive, involves a painful procedure and exposes patients to the risk of infection and bleeding. Furthermore, MRIs and surgical biopsies are impractical for repeated screening and monitoring of liver disease. We believe these limitations negatively impact the diagnosis and treatment of patients with NAFLD.

Billions of dollars are spent annually on the diagnosis and treatment of NAFLD and related liver diseases. In the United States alone, the median Medicare inpatient charge per NAFLD patient is estimated to be $36,000 and the total annual direct medical costs for NAFLD are estimated to be $103 billion. Patients diagnosed with NAFLD and related liver diseases are typically treated with therapies such as statins, insulin sensitizers and other compounds and are encouraged to adopt lifestyle changes to improve their overall health. Identification and staging of NAFLD is central to determining the course of treatment.

| 9 |

| Table of Contents |

In addition, patients receiving treatment for NAFLD-spectrum liver diseases must continue to be monitored to assess disease progression and the efficacy of treatment. Because of the high cost and limited global availability, CT and MRI technology is not typically used for this function.

We believe our TAEUS technology will enable primary care physicians, radiologists and hepatologists to diagnose NAFLD earlier and monitor patients with NAFLD-spectrum liver diseases more accurately and cost-effectively than is possible with existing technology.

A significant number of pharmaceutical compounds targeting liver disease are in development by companies such as Pfizer, Viking Theraputics, Inventiva, Madrigal Pharmaceuticals, Inc. and Galmed Pharmaceuticals. The pharmaceutical industry’s increased presence in the liver disease space represents a synergistic opportunity for ENDRA, as early detection of NAFLD could enable prescription of drug treatment at the most advantageous time for patients. The companies can also benefit from simpler, non-invasive measurements of biomarkers, such as liver fat, in the clinical stage. To this end, in March 2021 ENDRA announced a collaboration agreement with Hepion Pharmaceuticals to incorporate TAEUS as an add-on technology to support Hepion’s patient screening and biomarker measurements during its Phase 2b study of its lead drug candidate.

In April 2016, we entered into a Collaborative Research Agreement with General Electric Company, acting through its GE Healthcare business unit and the GE Global Research Center (collectively, “GE Healthcare”). Under the terms of the agreement, GE Healthcare has agreed to assist us in our efforts to commercialize our TAEUS technology for use in a fatty liver application by, among other things, providing equipment and technical advice, and facilitating introductions to GE Healthcare clinical ultrasound customers. In return for this assistance, we have agreed to afford GE Healthcare certain rights of first offer with respect to manufacturing and licensing rights for the target application. More specifically, we have agreed that, prior to commercially releasing our NAFLD TAEUS application, we will offer to negotiate an exclusive ultrasound manufacturer relationship with GE Healthcare for a period of at least one year of commercial sales. The commercial sales would involve, within our sole discretion, either our commercially selling GE Healthcare ultrasound systems as the exclusive ultrasound system with our TAEUS fatty liver application embedded, or GE Healthcare being the exclusive ultrasound manufacturer to sell ultrasound systems with our TAEUS fatty liver application embedded. The agreement with GE Healthcare does not prevent us from selling our TAEUS fatty liver application technology to distributors or directly to non-manufacturer purchasers. Additionally, the agreement provides that (1) prior to offering to license any of our TAEUS fatty liver application intellectual property to a third party, we will first offer to negotiate to license our TAEUS fatty liver application intellectual property to GE Healthcare and (2) prior to selling any equity interests to a healthcare device manufacturer, we must first offer to negotiate in good faith to sell such equity interests to GE Healthcare. The agreement is subject to termination by either party upon not less than 60 days’ notice. On December 16, 2020, we and GE Healthcare entered into an amendment to our agreement, extending its term to December 16, 2022.

In 2018, we received authorization to commence the first human studies in healthy volunteers with our TAEUS clinical system targeting NAFLD, guiding our algorithm development, and comparing our technology to MRI. The feasibility study was conducted in collaboration with the widely respected Robarts Research Institute in London, Canada. We reported the completion of this 50-subject study and top-level findings in September 2019. The data collected from the study, including additional usability inputs, was included in our TAEUS liver device technical file submission for device CE mark. Additionally, in 2019 we entered into clinical evaluation agreements with Rocky Vista University College of Osteopathic Medicine (RVUCOM) and the University of Pittsburgh Medical Center (UPMC) and in 2020 with the Medical College of Wisconsin (MCW), Universitätsmedizin der Johannes Gutenberg-Universität Mainz and Centre Hospitalier Universitaire d'Angers, France (CHU Angers).

We received CE mark approval for our TAEUS FLIP (Fatty Liver Imaging Probe) system in March 2020, indicating that the TAEUS FLIP system complies with all applicable European Directives and Regulations in the European Union (“EU”) and other CE mark geographies, including the 27 EU member states. In support of our commercialization efforts in the EU, we have contracted 4 sales representatives in France, the United Kingdom, and Germany and expect to expand marketing efforts into Scandinavia and other European markets. We actively attend various trade shows and clinical conferences across the UK and EU to drive our marketing presence amongst medical professionals that constitute our target market. We have also entered into agreements with clinical evaluation sites in Switzerland, Germany, UK and France to collect clinical evidence with aim to underscore clinical utility of the TAEUS device for assessing NAFLD.

We are pursuing FDA approval of our TAEUS FLIP system to enable sales in the United States. We submitted a 510(k) Premarket Notification application to the FDA in June 2020. Following meetings with the FDA in connection with its review of our application, we determined that the 510(k) pathway was not the optimal option due to the novel nature of our TAEUS system and, in February 2022, announced that we would pursue the de novo pathway for FDA approval of our NAFLD TAEUS application.

| 10 |

| Table of Contents |

Other Potential Clinical Applications for our TAEUS Technology

Temperature Monitoring of Thermoablative Surgery

We also intend to develop a TAEUS platform application to guide thermal ablation surgery, such as in the treatment of cardiac atrial fibrillation, chronic pain and lesions of the liver, thyroid, kidneys and other soft tissues. We plan to target clinical users of thermoablative technology, including interventional radiologists, cardiologists, gynecologists and surgical oncologists.

Thermoablation involves the use of heat or cold to remove malfunctioning or diseased tissue in surgical oncology, cardiology, neurology, gynecology, and urology applications. Thermoablative technologies include RF, microwave, laser and cryogenic ablation. The worldwide market for RF surgical ablation procedures alone was estimated in 2015 to be $3.7 billion per annum, generating over 5 million annual RF ablation procedures and growing at approximately 18% annually. We believe that the growth of this market is driven primarily by the aging global population requiring more cardiac and cancer procedures, as well as the relative ease-of-use and low cost of thermoablative technologies when compared to open surgery.

However, RF and other thermoablative surgery technologies pose risks, including under-treatment of diseased tissue and unintended thermal damage to areas outside the treatment area. For example, it has been reported that patients receiving RF ablation of liver tumors have experienced thermal injury to the diaphragm, gallbladder, bile ducts and gastrointestinal tract, some of which have resulted in patient deaths.

Clinicians must rely on printed manufacturer guidelines to plan procedures using thermal ablation technologies or, when available, monitor tissue temperature changes in real-time with MRI imaging or surgical temperature probes. We believe these existing methods either lack real-time precision or are impractical due to cost, poor availability and other factors.

We believe that the ability to visualize changes in tissue temperature in real time could potentially enhance the effectiveness and safety of thermoablation therapies and that our TAEUS technology platform combined with traditional ultrasound has the potential to guide thermoablation surgery more cost-effectively and more accurately than existing methods.

Image below: Depiction of ex-vivo TAEUS tissue temperature analysis overlaid on traditional ultrasound image.

Vascular Imaging

We believe that our TAEUS technology can be used to image blood vessels and distinguish them from the surrounding tissue. In addition to our NAFLD and thermoablation applications, we intend to develop a cardiovascular application based on our TAEUS technology that, with the use of a standard saline contrast agent, can enable existing ultrasound systems to perform a number of cardiovascular diagnostic functions, such as identifying arterial plaque or blocked or malformed vessels, as well as safely guiding biopsies away from vital vasculature.

| 11 |

| Table of Contents |

Conventional ultrasound imaging systems use Doppler imaging in a variety of vascular applications. Doppler ultrasound, which images the velocity of blood, is effective in larger vessels and regions where blood velocity is high. However, Doppler ultrasound is not sufficiently sensitive for use in very small vessels or in vascular imaging applications where blood velocities are very low. For these applications, contrast enhanced CT and MRI angiography is used which requires the patient to be injected with a contrast agent, iodinated compounds and gadolinium, respectively. Contrast-enhanced CT and MRI scans both require referral for examination after initial screening with ultrasound and carry risks associated with their respective contrast agents. We believe that our TAEUS platform has the potential to offer the advantages of CT and MR contrast enhanced imaging at the point of care using only a safe electrolyte solution as the contrast agent.

Tissue Perfusion or “Leakiness”

We believe that our TAEUS technology can be used to image tissue perfusion, or the absorption of fluids into an organ or tissue. We intend to develop an application for our TAEUS platform that would enable ultrasound detection of microvasculature fluid flows symptomatic of tissue compromised by trauma or disease.

When a person’s body is affected by disease or trauma, blood and other fluids may leak from damaged tissues in subtle ways. Traditional ultrasound cannot effectively image these disruptions in microvascular permeability, but we believe ultrasound combined with our TAEUS technology can.

We believe that, using our TAEUS technology, physicians will be able to quickly and clearly see tissue compromised by disease, such as cancer or trauma, especially with the use of a standard saline contrast agent, when CT or MRI is not readily available.

Intellectual Property

We rely on a combination of patent, copyright, trademark and trade secret laws and other agreements with employees and third parties to establish and protect our proprietary intellectual property rights. We require our officers, employees and consultants to enter into standard agreements containing provisions requiring confidentiality of proprietary information and assignment to us of all inventions made during the course of their employment or consulting relationship. We also enter into nondisclosure agreements with our commercial counterparties and limit access to, and distribution of, our proprietary information.

We are committed to developing and protecting our intellectual property and, where appropriate, filing patent applications to protect our technology. Our issued and pending patents claims are directed at the following areas related to our technology:

| · | Methods to induce and enhance thermoacoustic signal generation; |

|

|

|

| · | System configurations, devices and novel hardware for transmission of RF pulses into tissue and detection of acoustic signals; |

|

|

|

| · | Methods for integrating our devices with existing conventional ultrasound systems; and |

|

|

|

| · | Methods and algorithms for signal processing, image formation and analysis. |

As of the date of this Annual Report, we maintain a patent portfolio consisting of twenty-three (23) patents issued in the United States and sixteen (16) issued patents in foreign jurisdictions, fourteen (14) patent applications pending in the United States and thirty-four (34) patent applications pending in foreign jurisdictions relating to our technology. These patents and patent applications mostly cover certain innovations relating to fat imaging, fat quantitation, and temperature monitoring in the liver and other tissues.

Each of our utility patents generally has a term of 20 years from its respective priority (earliest filing) date. Design patents have a term of 14 years from a respective filing date. Among our issued utility patents in the U.S., the first patent is set to expire in 2033 and the last patent is set to expire in 2041.

Sales and Marketing

During 2019 we hired our Chief Commercial Officer and began planning to build a sales and marketing team dedicated to our TAEUS clinical applications. In parallel to securing all necessary government marketing approvals, we have begun to hire a small internal sales and marketing team to engage and support channel partners and clinical customers. As we previously did with our Nexus 128 system, we intend to partner with several geographically-focused independent clinical ultrasound equipment distributors to market and sell our TAEUS applications. We believe that these distributors have existing customer relationships, a strong knowledge of diagnostic imaging technology and the capabilities to support the installation, customer training and post-sale service of capital equipment and software.

| 12 |

| Table of Contents |

We also intend to work with original equipment manufacturers, or OEMs, of ultrasound and thermal ablation equipment to sell our TAEUS applications alongside their own new systems and into their existing installed base systems. We believe that these OEMs will find our applications attractive as the applications would enable them to generate additional revenue from their installed systems – as they currently do with aftermarket accessory portfolios. We believe our relationship with GE Healthcare will facilitate this strategy.

Based on our design work and our understanding of the ultrasound accessory market, we intend to price our initial NAFLD TAEUS application at a price point approximating $35,000 to $55,000, which should enable purchasers to recoup their investment in less than one year by performing a relatively small number of additional ultrasound procedures.

Some of our future TAEUS offerings are expected to be implemented via a hardware platform that can run multiple individual software applications that we plan to offer TAEUS users for a one-time licensing fee, enabling users to perform more procedures with their existing ultrasound equipment and retaining more patients in their clinics rather than referring them out to a regional imaging medical center for a CT or MRI scan.

We also intend to offer a license for our TAEUS technology to OEMs, such as GE Healthcare, for incorporation in their new ultrasound systems.

Engineering, Design and Manufacturing

Development of TAEUS Device

We contracted with StarFish Product Engineering, Inc. (“StarFish”), a medical device contract manufacturing company, to develop ENDRA’s prototype TAEUS device into a clinical product that met CE regulatory requirements required for commercial launch. We leveraged StarFish’s expertise in the preparation and submission of our CE Technical File documentation, submitted in December 2019, which enabled us to secure the European Union CE Mark for the TAEUS liver application in March 2020. We also leveraged StarFish’s expertise in preparation of documentation for the 510(k) submission made to the FDA in June 2020.

We believe that our contract manufacturers will either supply necessary components internally or obtain them from third-party sources. At this time, we do not know whether any components are or will be single sourced.

Regulatory Approval Pathway and Human Study

Each of our TAEUS platform applications will require regulatory approvals before we are able to sell or license the application. Based on certain factors, such as the installed base of ultrasound systems, availability of other imaging technologies, such as CT and MRI, economic strength and applicable regulatory requirements, we sought initial approval of our applications for sale in the European Union, followed by the United States and plan to seek additional approval in China.

The first TAEUS application we intend to commercialize is our NAFLD TAEUS application. Our initial target market for this application is the European Union. For commercial reasons and to support our application for CE marking, we contracted with CIMTEC, a medical imaging research group, to conduct human studies through Canada-based Robarts Research Institute to demonstrate our NAFLD TAEUS application’s ability to distinguish fat from lean tissue. In September 2019, we announced the completion and reported top-level findings of Robarts Research Institute’s initial healthy subject study and data collection of 50 subjects, which was included in our TAEUS liver device technical file submission for device CE mark. We received CE mark approval for our NAFLD TAEUS application in March 2020. We are now in the process of notifying the competent authorities that we have received the CE mark and registering the product in each of the initial target markets.

In 2021, Regulation (EU)2017/745 on medical devices (the “Medical Device Regulation” or “MDR”) came into effect. The MDR imposes significant additional obligations on medical device-related companies. Changes imposed by the MDR include more restrictive requirements for clinical evidence and pre-market assessment of safety and performance, revised classifications to indicate risk levels, stricter requirements for third party testing by government accredited groups for some types of medical devices, and tightened and streamlined quality management system assessment procedures. These new rules could impose additional requirements on our business, such as a requirement to conduct clinical trials to maintain our existing and obtain additional CE mark applications for existing and new products. Also, the MDR provides for additional post-market surveillance obligations, and further requirements for the traceability of products, transparency, refined responsibilities for economic operators (including manufacturer, distributors and importers) as well as a tightened and more comprehensive quality management system.

| 13 |

| Table of Contents |

In June 2020, we submitted to the FDA our application under the Food, Drug and Cosmetic Act (the “FD&C Act”) to sell our NAFLD TAEUS application in the U.S. The application was submitted for clearance under Section 510(k) of the FD&C Act. Following meetings with the FDA in connection with its review of our application, we determined that the 510(k) pathway was not the optimal option due to the novel nature of our TAEUS system and, in February 2022, announced that we would pursue the de novo pathway for FDA approval of our NAFLD TAEUS application. We are currently in the process of preparing a submission for the classification of our NAFLD TAEUS application as a Class II device under a de novo review, which process is described below under “FDA Approval or Clearance of Medical Devices’. This de novo submission will include as support clinical data gathered from a new human study comparing liver fat measurements by our TAEUS device to measurements by MRI-PDFF. We expect that the FDA’s grant of our initial de novo request will allow us to sell the NAFLD TAEUS application in the U.S. with general imaging claims. However, we will need to obtain additional FDA clearances to be able to make diagnostic claims for fatty tissue content determination. Accordingly, to support our commercialization efforts we expect that, following receipt of the FDA’s grant of our initial de novo request, we would submit one or more additional applications to the FDA, each of which would need to include additional clinical trial data, so that following receipt of the necessary clearances we may make those diagnostic claims. We believe these additional applications will be eligible for submission under Section 510(k) following the reclassification that would be established by the FDA’s grant of the anticipated de novo request for our NAFLD TAEUS device.

Regulation

European Union

The primary regulatory environment in Europe is the European Union, which consists of 27 member states encompassing most of the major countries in Europe. In the European Union, applications incorporating our TAEUS technology are regulated as Class IIa medical devices by the European Medicines Agency (the “EMA”) and the European Union Commission. As described above, our NAFLD TAEUS application has received, and we expect our future applications will need to receive, a CE mark from an appropriate Competent Authority or government-accredited group (a “Notified Body”), as the case may be, as a result of successful review of one or more submissions prepared by our contract engineering and manufacturer(s), so that such applications can be marketed and distributed within the European Economic Area. Each of our applications will be required to be regularly recertified for CE marking, which recertification may require an annual audit. The audit procedure, which will include on-site visits at our facility, and the contract manufacturer’s(s’) facility(ies), will require us to provide the contract manufacturer(s) with information and documentation concerning our quality management system and all applicable documents, policies, procedures, manuals, and other information.

In the European Union, the manufacturer of medical devices is subject to current Good Manufacturing Practice, or cGMP, as set forth in the relevant laws and guidelines of the European Union and its member states. Compliance with cGMP is generally assessed by a Notified Body accredited by a Competent Authority. For a Class IIa device, typically, quality system evaluation is performed by the Notified Body, which also provides the certifications necessary to fix a CE mark to the products. The Notified Body may conduct inspections of relevant facilities, and review manufacturing procedures, operating systems and personnel qualifications. In addition to obtaining approval for each application, in many cases each device manufacturing facility must be audited on a periodic basis by the Notified Body. Further inspections may occur over the life of the application.

FDA Regulation

Each of our products must be approved or cleared by the FDA before it is marketed in the United States. Before and after approval or clearance in the United States, our applications are subject to extensive regulation by the FDA under the FD&C Act and/or the Public Health Service Act, as well as by other regulatory bodies. The FDA regulations govern, among other things, the development, testing, manufacturing, labeling, safety, storage, record-keeping, market clearance or approval, advertising and promotion, import and export, marketing and sales, and distribution of medical devices and pharmaceutical products.

FDA Approval or Clearance of Medical Devices

In the United States, medical devices are subject to varying degrees of regulatory control and are classified in one of three classes depending on the extent of controls the FDA determines are necessary to reasonably ensure their safety and efficacy:

| · | Class I: general controls, such as labeling and adherence to quality system regulations; |

|

|

|

| · | Class II: special controls, clearance of a premarket notification, or 510(k) submission, specific controls such as performance standards, patient registries and post-market surveillance and additional controls such as labeling and adherence to quality system regulations; and |

|

|

|

| · | Class III: special controls and approval of a premarket approval, or PMA, application. |

| 14 |

| Table of Contents |

We expect all of our products to be classified as Class II medical devices and thus require FDA authorization prior to marketing by means of a 510(k) clearance or de novo request, rather than a PMA application.

To request marketing authorization by means of a 510(k) clearance, we must submit a notification demonstrating that the proposed device is substantially equivalent to another legally marketed medical device, has the same intended use, and is as safe and effective as a legally marketed device and does not raise different questions of safety and effectiveness than a legally marketed device. 510(k) submissions generally include, among other things, a description of the device and its manufacturing, device labeling, medical devices to which the device is substantially equivalent, safety and biocompatibility information and the results of performance testing. In some cases, a 510(k) submission must include data from human clinical studies. Marketing may commence only when the FDA issues an order finding substantial equivalence. Historically, the typical 510(k) review time has been approximately nine to twelve months from the date of the initial 510(k) submission. However, the COVID-19 pandemic has resulted in the FDA reallocating a number of its reviewers to address emergency use authorizations for COVID-19-related products, which may result in longer 510(k) review times for other devices.

In many instances, the 510(k) pathway for product marketing requires only non-clinical testing as proof of substantial equivalence to a lawfully marketed predicate device for a given indication. However, in some instances the FDA may require clinical studies to demonstrate substantial equivalence to the predicate device. Whether clinical data is provided or not, the FDA may decide to reject the substantial equivalence argument we present. If that happens, the device is automatically designated as a Class III device, unless the sponsor requests a risk-based classification determination for the device in accordance with the “de novo” process, which may determine that the new device is of low to moderate risk and that it can be appropriately be regulated as a Class I or II device. In the de novo process, the FDA must determine that general and special controls are sufficient to provide reasonable assurance of the safety and effectiveness of a device which has no predicate. Upon receipt of a de novo request, the FDA will conduct an acceptance review to assess the completeness of the application and whether its meets the minimum threshold of acceptability. If the de novo request is accepted for substantive review, the FDA will conduct a classification review of legally marketed device types and analyze whether an existing legally marketed device of the same type exists, which information is used to confirm the subject device is eligible for de novo classification. During the course of review, the FDA may address any issues through interactive review or send a formal request for additional information in order for the review to proceed. If a de novo request is granted, the device may be legally marketed, and a new classification is established. If the device is classified as Class II, the device may serve as a predicate for future 510(k) submissions. If the device is not approved through de novo review, then it must go through the standard PMA process for Class III devices, which generally requires extensive pre-clinical and clinical trial data and involves an inspection of the manufacturer’s facilities for compliance with quality system requirements as well as a review period during which an FDA advisory committee is convened to review the application and make a recommendation to the FDA regarding its approval.

After a device receives 510(k) clearance, including following classification as a Class I or II device upon an approved de novo request, any product modification that could significantly affect the safety or effectiveness of the product, or that would constitute a significant change in intended use, requires a new 510(k) clearance. If the FDA determines that the changed product does not qualify for 510(k) clearance, then a company must submit, and the FDA must approve, a PMA before marketing can begin.

| 15 |

| Table of Contents |

Clinical Trials of Medical Devices

One or more clinical trials are generally required to support a PMA application and more recently are becoming necessary to support a 510(k) submission. Clinical studies of unapproved or uncleared medical devices or devices being studied for uses for which they are not approved or cleared (investigational devices) must be conducted in compliance with FDA requirements. If an investigational device could pose a significant risk to patients, the sponsor company must submit an investigational device exemption application to the FDA prior to initiation of the clinical study. An investigational device exemption application must be supported by appropriate data, such as animal and laboratory test results, showing that it is safe to test the device on humans and that the testing protocol is scientifically sound. The investigational device exemption will automatically become effective 30 days after receipt by the FDA unless the FDA notifies the company that the investigation may not begin. Clinical studies of investigational devices may not begin until an institutional review board has approved the study.

During the study, the sponsor must comply with the FDA’s investigational device exemption requirements. These requirements include investigator selection, trial monitoring, adverse event reporting, and record keeping. The investigators must obtain patient informed consent, rigorously follow the investigational plan and study protocol, control the disposition of investigational devices, and comply with reporting and record keeping requirements. The sponsor, the FDA, or the institutional review board at each institution at which a clinical trial is being conducted may suspend a clinical trial at any time for various reasons, including a belief that the subjects are being exposed to an unacceptable risk. During the approval or clearance process, the FDA typically inspects the records relating to the conduct of one or more investigational sites participating in the study supporting the application.

Post-Approval Regulation of Medical Devices

After a device is cleared or approved for marketing, numerous and pervasive regulatory requirements continue to apply. These include:

| · | the FDA quality systems regulation, which governs, among other things, how manufacturers design, test, manufacture, exercise quality control over, and document manufacturing of their products; |

|

|

|

| · | labeling and claims regulations, which prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling; and |

|

|

|

| · | the Medical Device Reporting regulation, which requires reporting to the FDA of certain adverse experiences associated with use of the product. |

Good Manufacturing Practices Requirements

Manufacturers of medical devices are required to comply with the good manufacturing practices set forth in the quality system regulation promulgated under Section 520 of the FD&C Act. Current good manufacturing practices regulations require, among other things, quality control and quality assurance as well as the corresponding maintenance of records and documentation. The manufacturing facility for an approved product must be registered with the FDA and meet current good manufacturing practices requirements to the satisfaction of the FDA pursuant to a pre-PMA approval inspection before the facility can be used. Manufacturers, including third party contract manufacturers, are also subject to periodic inspections by the FDA and other authorities to assess compliance with applicable regulations. Failure to comply with statutory and regulatory requirements subjects a manufacturer to possible legal or regulatory action, including the seizure or recall of products, injunctions, consent decrees placing significant restrictions on or suspending manufacturing operations, and civil and criminal penalties. Adverse experiences with the product must be reported to the FDA and could result in the imposition of marketing restrictions through labeling changes or in product withdrawal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following the approval.

China Regulation

China’s regulatory approval framework includes nationwide approval based on a showing that the device for which approval is sought has been previously approved in the country of origin. Alternatively, we understand it is also possible to receive approval at the provincial level or to work exclusively with hospitals that do not require such nationwide or provincial approval. We intend to explore these potential paths to regulatory compliance in China.

Other Regulations

We will become subject to regulations and product registration requirements in many foreign countries in which we may sell our products, including in the areas of product standards, packaging requirements, labeling requirements, import and export restrictions and tariff regulations, duties and tax requirements. Additionally, third parties designing, manufacturing or conducting human studies of our devices will be subject to local regulations, such as those of Health Canada. The time required to obtain clearance required by foreign countries may be longer or shorter than that required for EMA or FDA clearance, and requirements for licensing a product in a foreign country may differ significantly from EMA and FDA requirements.

| 16 |

| Table of Contents |

Competition

While we believe that we are the only company developing RF-based thermoacoustic ultrasound products, we will face direct and indirect competition from a number of competitors, many of whom have greater financial, sales and marketing and other resources than we do.

Manufacturers of CT and MRI systems include multi-national corporations such as Royal Philips, Siemens AG and Fujifilm Corporation, many of whom also manufacture and sell ultrasound equipment. In the NAFLD diagnosis market we will compete with makers of surgical biopsy tools, such as Cook Medical and Sterylab S.r.l. In the thermal ablation market, we will compete with manufacturers of surgical temperature probes, such as Medtronic plc and St. Jude Medical, Inc.

Employees

As of December 31, 2021, we had 22 employees, all of whom are employed on a full-time basis. 13 full-time employees were engaged in research and development activities, 4 full-time employees were engaged in sales activities, 2 full-time employees were engaged in product assembly, and 3 full-time employees were engaged in administrative activities. Geographically we employ 15 people in the United States, 3 people in Canada, 2 people in France, 1 person in Germany and 1 person in the United Kingdom. None of our employees are covered by a collective bargaining agreement, and we believe our relationship with our employees is good.

We also employ technical advisors, on an as-needed basis, to supplement existing staff. We believe that these technical advisors provide us with necessary expertise in clinical ultrasound applications, ultrasound technology, and intellectual property.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and all other information contained in this Annual Report, including our financial statements and the related notes, before investing in our securities. The risks and uncertainties described below are not the only ones we face, but include the most significant factors currently known by us that make investing in our securities speculative or risky. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, also may become important factors that affect us. If any of the following risks materialize, our business, financial condition and results of operations could be materially harmed. In that case, the trading price of our securities could decline, and you may lose some or all of your investment.

Risks Related to Our Business

We have a history of operating losses, we may never achieve or maintain profitability, and we will need to raise significant additional capital if we are going to continue as a going concern.

We have limited commercial experience upon which investors may evaluate our prospects. We have only generated limited revenues to date and have a history of losses from operations. As of December 31, 2021, we had an accumulated deficit of $68,690,810. Our independent registered public accounting firm, in its report on our financial statements for the year ended December 31, 2021, has raised substantial doubt about our ability to continue as a going concern.

We will require additional capital in the near term to continue as a going concern to proceed with the commercialization of our planned TAEUS applications and to meet our growth and profitability targets. We have expended and expect to continue to expend significant resources on hiring of personnel, payroll and benefits, continued scientific and potential product research and development, potential product testing and pre-clinical and clinical investigations, expenses associated with the development of relationships with strategic partners, intellectual property development and prosecution, marketing and promotion, capital expenditures, working capital, and general and administrative expenses. We also expect to incur costs and expenses related to consulting, laboratory development, and the hiring of scientists and other operational personnel.

We may not be able to secure financing on favorable terms, or at all, to meet our future capital needs and our failure to obtain financing when needed could force us to delay, reduce or eliminate our product development programs and commercialization efforts.

We will need to raise additional capital in order to finance the full commercialization of our NAFLD TAEUS application and to complete the development of any other TAEUS application through public or private equity offerings, debt financings, corporate collaboration and licensing arrangements or other financing alternatives.

| 17 |

| Table of Contents |