As filed with the Securities and Exchange Commission on January 10,

2020

Registration

No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

ENDRA LIFE SCIENCES INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

26-0579295

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

ENDRA

Life Sciences Inc.

3600

Green Court, Suite 350

Ann

Arbor, MI 48105

(734)

335-0468

(Address, including zip code, and telephone number, including area

code, of registrant’s principal executive

offices)

Francois

Michelon

Chief

Executive Officer

ENDRA

Life Sciences Inc.

3600

Green Court, Suite 350

Ann

Arbor, MI 48105

(734)

335-0468

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copy

to:

Mark R.

Busch

K&L

Gates LLP

214

North Tryon Street, 47th Floor

Charlotte,

North Carolina 28202

(704)

331-7440

From time to time after the effective date of this registration

statement.

(Approximate date of commencement of proposed sale to the

public)

If the

only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box.

☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

If this

Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e)

under the Securities Act, check the following box.

☐

If this

Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant

to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act (check one):

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☒

|

Smaller

reporting company ☒

|

|

|

Emerging

growth company ☒

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to

Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

Title

of Each Class of Securities to be Registered

|

Amount to be

Registered (1)(2)

|

Proposed Maximum

Offering Price Per Share (3)

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee

|

|

Common stock, par

value $0.0001 per share

|

25,644,002

|

$1.85

|

$47,313,183.69

|

$6,141.25

|

(1)

In accordance with

Rule 416 under the Securities Act of 1933, as amended (the

“Securities Act”), this registration statement shall be

deemed to cover an indeterminate number of additional shares to be

offered or issued from stock splits, stock dividends or similar

transactions with respect to the shares being

registered.

(2)

Includes (i)

904,526 shares of common stock, par value $0.0001 per share

(“Common Stock”), issued in a private placement that

closed on December 11, 2019 (the “First Private

Placement”); (ii) 7,191,873 shares of Common Stock that are

issuable upon conversion of the Company’s Series A

Convertible Preferred Stock, par value $0.0001 per share (the

“Series A Preferred Stock”), issued in the First

Private Placement; (iii) 8,096,399 shares of Common Stock that are

issuable upon exercise of the warrants that were issued with the

Series A Preferred Stock, including warrants issued to the

placement agent in the First Private Placement; (iv) an estimated

8,660,410 shares of Common Stock that may be issuable in respect of

accrued but unpaid dividends on shares of Series A Preferred Stock;

(v) 232,461 shares of

Common Stock that are issuable upon conversion of the

Company’s Series B Convertible Preferred Stock, par value

$0.0001 per share (the “Series B Preferred Stock”),

issued in a private placement that closed on December 23, 2019 (the

“Second Private Placement”); (vi) 278,948 shares of Common Stock that are

issuable upon exercise of the warrants that were issued with the

Series B Preferred Stock, including warrants issued to the

placement agent in the Second Private Placement; and (vii) an

estimated 279,385 shares

of Common Stock that may be issuable in respect of accrued but

unpaid dividends on shares of Series B Preferred

Stock.

(3)

Estimated solely

for the purpose of calculating the registration fee pursuant to

Rule 457(c) under the Securities Act. Based on the average of the

high and low reported trading prices of Common Stock as reported on

the Nasdaq Capital Market on January 8, 2020.

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of

1933, as amended, or until the Registration Statement shall become

effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

i

The information in this prospectus is not complete and may be

changed. The selling stockholders may not sell these securities

until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer

to sell these securities and the selling stockholders are not

soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

Subject to completion, dated January 10, 2020

ENDRA Life Sciences Inc.

Prospectus

25,644,002 Shares of Common Stock for sale by the Selling

Stockholders

This

prospectus relates to the resale or other disposition from time to

time of up to 25,644,002 shares of our common stock, par value

$0.0001 per share (“Common Stock”), in connection with

a private placement that closed on December 11, 2019 (the

“First Private Placement”) and a private placement that

closed on December 23, 2019 (the “Second Private

Placement”), by the persons described in this prospectus,

whom we call the “Selling Stockholders,” identified in

the section of this prospectus entitled “Selling

Stockholders.” Of these shares, (i) 904,526 shares were

issued in the First Private Placement; (ii) 7,191,873 shares are

issuable upon conversion of the Company’s Series A

Convertible Preferred Stock, par value $0.0001 per share (the

“Series A Preferred Stock”), issued in the First

Private Placement; (iii) 8,096,399 shares are issuable upon

exercise of the warrants that were issued with the Series A

Preferred Stock, including warrants issued to Lake Street Capital

Markets, LLC (“Lake Street”) and its designees in

connection with Lake Street’s services as placement agent in

the First Private Placement (collectively, the “Series A

Warrants”); (iv) an estimated 8,660,410 shares may be

issuable in respect of accrued and unpaid dividends on shares of

Series A Preferred Stock; (v) 232,461 shares are issuable upon

conversion of the Company’s Series B Convertible Preferred

Stock, par value $0.0001 per share (the “Series B Preferred

Stock”), issued in the Second Private Placement; (vi) 278,948

shares are issuable upon exercise of the warrants that were issued

with the Series B Preferred Stock, including warrants issued to

Lake Street and its designees in connection with Lake

Street’s services as placement agent in the Second Private

Placement (collectively, the “Series B Warrants”); and

(vii) an estimated 279,385 shares may be issuable in respect of

accrued and unpaid dividends on shares of Series B Preferred Stock

(all such shares of Common Stock described in (i) through (vii)

above, the “Securities”).

We are

registering the Securities as required by the terms of the

registration rights agreement among the investors in the First

Private Placement, the investors in the Second Private Placement,

Lake Street and us. Such registration does not mean that the

Selling Stockholders will actually offer or sell any of the

Securities offered by this prospectus.

The

Securities may be sold by the Selling Stockholders from time to

time in the open market, through privately negotiated transactions

or a combination of these methods, at market prices prevailing at

the time of sale or at negotiated prices. The distribution of the

Securities by the Selling Stockholders is not subject to any

underwriting agreement. We will not receive any proceeds from the

sale of the Securities by the Selling Stockholders, although we

will receive the exercise price of any exercised Series A Warrants

and Series B Warrants paid to us by the Selling Stockholders, which

will be used for working capital and general corporate purposes. We

will bear all expenses of registration incurred in connection with

this offering, but all selling and other expenses incurred by the

Selling Stockholders will be borne by them.

Our

Common Stock is traded on the Nasdaq Capital Market under the

symbol “NDRA.” On January 8, 2020, the last reported

sale price for our Common Stock was $1.81 per share. The warrants

issued in our May 2017 initial public offering are listed on the

Nasdaq Capital Market under the symbol “NDRAW;”

however, the Series A Warrants and Series B Warrants issued in the

First Private Placement and Second Private Placement, respectively,

are not so listed.

We are

an “Emerging Growth Company” as defined in the

Jumpstart Our Business Startups Act of 2012 and, as such, have

elected to comply with certain reduced public company reporting

requirements for this prospectus and future filings. See

“Prospectus Summary − Implications of Being an Emerging

Growth Company.”

Our business and an investment in the Securities involve a high

degree of risk. Before making any investment in the Securities, you

should read and carefully consider risks described in the

“Risk Factors” section beginning on page 9 of this

prospectus.

You

should rely only on the information contained in this prospectus or

any prospectus supplement or amendment hereto. We have not

authorized anyone to provide you with different information. This

prospectus may only be used where it is legal to sell the

Securities. The information in this prospectus is only accurate on

the date of this prospectus, regardless of the time of any sale of

Securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of the Securities

or determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

This

prospectus is dated January , 2020.

ii

You should rely only on the information contained in this

prospectus. We have not authorized any other person to provide you

with information that is different from that contained in this

prospectus. If anyone provides you with different or inconsistent

information, you should not rely on it. We take no responsibility

for, and can provide no assurance as to the reliability of, any

other information that others may give you. The Selling

Stockholders are offering to sell and seeking offers to buy the

Securities only in jurisdictions where offers and sales are

permitted. You should assume that the information contained in this

prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or of any

sale of our Securities. Our business, financial condition, results

of operations and prospects may have changed since that date. We

are not making an offer of any Securities in any jurisdiction where

the offer is not permitted.

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

1

|

|

THE OFFERING

|

7

|

|

RISK FACTORS

|

8

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

9

|

|

USE OF PROCEEDS

|

10

|

|

DETERMINATION OF OFFERING PRICE

|

10

|

|

SELLING STOCKHOLDERS

|

11

|

|

PLAN OF DISTRIBUTION

|

28

|

|

DESCRIPTION OF CAPITAL STOCK

|

30

|

|

LEGAL MATTERS

|

33

|

|

EXPERTS

|

33

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

34

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

35

|

iii

This

prospectus is part of a registration statement on Form S-3 that we

filed with the Securities and Exchange Commission (the

“SEC”) utilizing a “shelf” registration

process. Under this process, the Selling Stockholders may from time

to time, in one or more offerings, sell the shares of Common Stock

described in this prospectus.

In addition, a prospectus supplement may also add, update or change

the information contained or incorporated in this prospectus. Any

prospectus supplement will supersede this prospectus to the extent

it contains information that is different from, or that conflicts

with, the information contained or incorporated in this prospectus.

The registration statement we filed with the SEC includes exhibits

that provide more detail of the matters discussed in this

prospectus. You should read and consider all information contained

in this prospectus and the related registration statement and

exhibits filed with the SEC and any accompanying prospectus

supplement in making your investment decision. You should also read

and consider the information contained in the documents identified

under the headings “Where You Can Find More

Information” and “Incorporation of Certain Information

by Reference” in this prospectus.

Persons

who come into possession of this prospectus in jurisdictions

outside the United States are required to inform themselves about

and to observe any restrictions as to this offering and the

distribution of this prospectus applicable to that

jurisdiction.

Unless

otherwise stated or the context requires otherwise, references to

“ENDRA”, the “Company,” “we,”

“us” or “our” are to ENDRA Life Sciences

Inc.

iv

|

|

|

|

|

|

PROSPECTUS SUMMARY

The following summary highlights selected information contained

elsewhere in or incorporated by reference in this prospectus. This

summary is not complete and does not contain all of the information

that should be considered before investing in our Securities.

Potential investors should read the entire prospectus carefully,

including the more detailed information regarding our business

provided in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2018 (the “Form 10-K”) incorporated

herein by reference, the risks of purchasing our Securities

discussed under the “Risk Factors” section of the Form

10-K, and our financial statements and the accompanying notes to

the financial statements incorporated herein by

reference.

Our Company

We are

leveraging experience with pre-clinical enhanced ultrasound devices

to develop technology for increasing the capabilities of clinical

diagnostic ultrasound, to broaden patient access to the safe

diagnosis and treatment of a number of significant medical

conditions in circumstances where expensive X-ray computed

tomography (“CT”) and magnetic resonance imaging

(“MRI”) technology is unavailable or

impractical.

In

2010, we began marketing and selling our Nexus 128 system, which

combined light-based thermoacoustics and ultrasound to address the

imaging needs of researchers studying disease models in

pre-clinical applications. Building on this expertise in

thermoacoustics, we have developed a next-generation technology

platform — Thermo Acoustic Enhanced Ultrasound, or TAEUS

— which is intended to enhance the capability of clinical

ultrasound technology and support the diagnosis and treatment of a

number of significant medical conditions that currently require the

use of expensive CT or MRI imaging or where imaging is not

practical using existing technology.

We

ceased production of our Nexus 128 system as of January 1, 2019 and

stopped providing service support and parts for all existing Nexus

128 systems as of July 1, 2019 in order to focus our resources on

the development of our TAEUS technology.

Image below: An illustration of a typical cart-based ultrasound

system (left) with ENDRA’s first-generation technology

(right).

|

|

|

|

|

|

1

|

|

|

|

|

|

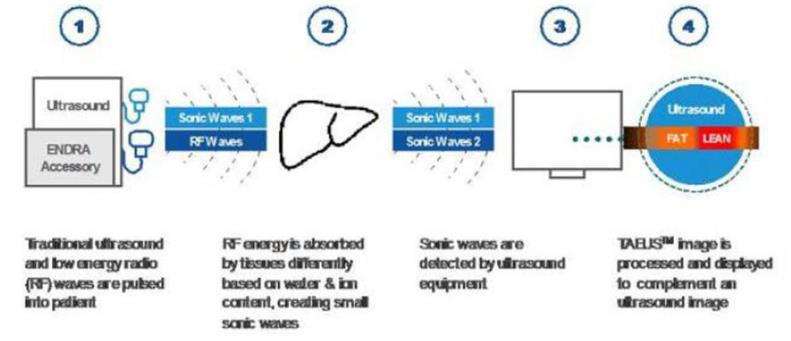

Unlike the

near-infrared light pulses used in our legacy Nexus 128 system, our

TAEUS technology uses radio frequency, or RF, pulses to stimulate

tissues, using a small fraction (less than 1%) of the energy that

would be transmitted into the body during an MRI scan. The use of

RF energy allows our TAEUS technology to penetrate deep into

tissue, enabling the imaging of human anatomy at depths equivalent

to those of conventional ultrasound. The RF pulses are absorbed by

tissue and converted into ultrasound signals, which are detected by

an external ultrasound receiver and a digital acquisition system

that is part of the TAEUS system. The detected ultrasound is

processed into images using our proprietary algorithms and

displayed to complement conventional gray-scale ultrasound images.

The TAEUS imaging process is illustrated below:

We believe that our

TAEUS technology has the potential to add a number of new

capabilities to conventional ultrasound and thereby enhance the

utility of both existing and new ultrasound systems and extend the

use of ultrasound technology to circumstances that either require

the use of expensive CT or MRI imaging systems or where imaging is

not practical using existing technology.

Our TAEUS platform

is not intended to replace CT or MRI systems, both of which are

versatile imaging technologies with capabilities and uses beyond

the focus of our business. However, they are also expensive, with a

CT system costing approximately $1 million and an MRI system

costing up to $3 million. In addition, and in contrast to

ultrasound systems, due to their limited number and the fact that

they are usually fixed-in-place at major medical facilities, CT or

MRI systems are frequently inaccessible to patients.

To demonstrate the

capabilities of our TAEUS platform, we have conducted various

internal ex-vivo laboratory experiments and limited internal

in-vivo large animal studies. In our ex-vivo and in-vivo testing,

we have demonstrated that the TAEUS platform has the following

capabilities and potential clinical applications:

● Tissue Composition:

Our TAEUS technology enables ultrasound to distinguish fat from

lean tissue. This capability would enable the use of TAEUS-enhanced

ultrasound for the early identification, staging and monitoring of

NAFLD, a precursor to nonalcoholic steatohepatitis

(“NASH”), liver fibrosis, cirrhosis and liver

cancer.

● Temperature

Monitoring: Our TAEUS technology enables traditional ultrasound to

visualize changes in tissue temperature, in real time. This

capability would enable the use of TAEUS-enhanced ultrasound to

guide thermoablative therapy, which uses heat or cold to remove

tissue, such as in the treatment of cardiac atrial fibrillation, or

removal of cancerous liver and kidney lesions, with greater

accuracy.

● Vascular Imaging:

Our TAEUS technology enables ultrasound to view blood vessels from

any angle, using only a saline solution contrasting agent, unlike

Doppler ultrasound, which requires precise viewing angles. This

capability would enable the use of TAEUS-enhanced ultrasound to

easily identify arterial plaque or malformed vessels.

● Tissue Perfusion:

Our TAEUS technology enables ultrasound to image blood flow at the

capillary level in a region, organ or tissue. This capability could

be used to assist physicians in characterizing microvasculature

fluid flows symptomatic of damaged tissue, such as internal

bleeding from trauma, or diseased tissue, such as certain

cancers.

|

|

|

|

|

|

2

|

|

|

|

|

|

To

further test the capability of our TAEUS platform to distinguish

tissue composition in conjunction with an NAFLD application, we

engaged the Centre for Imaging Technology Commercialization

(“CIMTEC”), a contract research organization, to

initiate human studies. In October

2018, we received an Investigational Testing Authorization from

Health Canada to commence the first human studies with our TAEUS

clinical system targeting NAFLD, guiding our algorithm development,

and comparing our technology to MRI. The feasibility study, the

first of several planned human studies, is being conducted in

collaboration with Robarts Research Institute in London, Canada. We

reported our completion of this study on September 26, 2019. The

data collected from the study, including additional usability

inputs, was included in our TAEUS liver device technical file

submission for device CE Mark, which we submitted in December

2019.

Ultrasound

systems are more broadly available to patients than either CT or

MRI systems. There are an estimated one million ultrasound systems

globally in use today generating over 400 million annual diagnostic

ultrasound procedures. Sales of ultrasound diagnostic equipment

were approximately $4.4 billion globally in 2017 and an estimated

30,000 to 50,000 new and replacement ultrasound systems are sold

into the market annually. Ultrasound systems are relatively

inexpensive compared to CT and MRI systems, with smaller portable

ultrasound systems costing as little as $10,000 and new cart-based

ultrasound systems costing between $75,000 and $200,000. These

numbers cover all types of diagnostic ultrasound procedures,

including systems intended for cardiology, prenatal and abdominal

use. However, we do not intend to address low-cost, portable

ultrasound systems and systems focused on applications, such as

prenatal care, where we believe our TAEUS technology will not

substantially impact patient care. Accordingly, we define our

addressable market for one or more of our TAEUS applications at

approximately 365,000 cart-based ultrasound systems currently in

use throughout the world.

Many

ultrasound systems are designed to be moved by an operator from

room to room, or closer to patients. CT and MRI systems are

stationary systems, requiring the patient to travel to a medical

center; there are only about 32,000 CT systems and 16,000 MRI

systems located in the United States. Ultrasound technology does

not present the same safety concerns as CT and MRI technology,

since ultrasound does not emit ionizing radiation and ultrasound

contrast agents are considered to be generally safe. The

ultrasound’s imaging capabilities, however, are more limited

compared to CT and MRI technologies, which are able to measure

tissue temperature during thermal ablation surgery or quantify fat

to diagnose early stage liver disease.

After

approval, our TAEUS technology can be added as an accessory to

existing ultrasound systems, helping to improve clinical

decision-making on the front lines of patient care, without

requiring new clinical workflows or large capital investments. We

are also developing TAEUS for incorporation into new ultrasound

systems, primarily through our collaboration with GE Healthcare,

described more fully below.

Because

of the large number of traditional ultrasound systems currently in

global use, we are first developing our TAEUS technology for sale

as an aftermarket accessory that works with existing ultrasound

systems. Because our TAEUS technology is designed to enhance the

utility of, not replace, conventional ultrasound, we believe

healthcare providers will be able to increase the utilization of,

and generate new revenue from, their existing ultrasound systems

once we obtain required regulatory approval for specific

applications. Based on our design work and our understanding of the

ultrasound accessory market, we intend to price our initial NAFLD

TAEUS application at a price point approximating $50,000, which may

enable purchasers to recoup their investment by performing a

relatively small number of additional ultrasound procedures. We

further believe that clinicians will be attracted to our technology

because it will enable them to perform more procedures with

existing ultrasound equipment, thereby retaining more imaging

patients in their clinics rather than referring patients out to a

regional medical center for a CT or MRI scan.

Each of

our TAEUS platform applications will require regulatory approvals

before we are able to sell or license the application. Based on

certain factors, such as the installed base of ultrasound systems,

availability of other imaging technologies, such as CT and MRI,

economic strength and applicable regulatory requirements, we intend

to seek initial approval of our applications for sale in the

European Union, followed by the United States and

China.

The

first TAEUS application we intend to commercialize is our NAFLD

TAEUS application. Our initial target market for this application

is the European Union. We believe that our NAFLD TAEUS application

will qualify for sale in the European Union as a Class IIa medical

device. As a result, we will be required to obtain a CE mark for

our NAFLD TAEUS application before we can sell the application in

the European Union. To this end, we have contracted with medical

device contract engineering firms to perform the commercial product

engineering for our NAFLD TAEUS application. Existing regulations

would not require us to conduct a clinical trial to obtain a CE

mark for this application. Nonetheless, for commercial reasons and

to support our CE mark application we have contracted CIMTEC to

conduct human studies to demonstrate our NAFLD TAEUS

application’s ability to distinguish fat from lean tissue. In

December 2019, we submitted a technical file for a CE mark for our TAEUS liver

device.

|

|

|

|

|

|

3

|

|

|

|

|

|

While

we are seeking a CE mark for our NAFLD TAEUS application, we are

also preparing to expand our sales, marketing and customer support

capabilities, so that we can commence initial sales of the

application in the European Union once we have received this

regulatory approval. Following receipt of such CE mark and

placement of initial systems with researchers and universities, we

plan to conduct one or more clinical studies to further demonstrate

this product’s capabilities.

Simultaneously

with the process of obtaining a CE mark for our NAFLD TAEUS

application, we intend to prepare for submission to the U.S. Food

and Drug Administration, or the FDA, an application under the Food,

Drug and Cosmetic Act, or the FD&C Act, to sell our NAFLD TAEUS

application in the U.S. We anticipate that the application, as well

as those for our other TAEUS applications, will be submitted for

approval under Section 510(k) of the FD&C Act. We expect that

our initial FDA clearance will allow us to sell the NAFLD TAEUS

application in the U.S. with general imaging claims. However, we

will need to obtain additional FDA clearances to be able to make

diagnostic claims for fatty tissue content determination.

Accordingly, to support our commercialization efforts we expect

that, following receipt of our initial FDA clearance, we will

submit one or more additional applications to the FDA, each of

which will need to include additional clinical trial data, so that

following receipt of the necessary clearances we may make those

diagnostic claims.

Collaboration with GE Healthcare

In

April 2016, we entered into a Collaborative Research Agreement with

General Electric Company, acting through its GE Healthcare business

unit and the GE Global Research Center, or GE Healthcare. Under the

terms of the agreement, GE Healthcare has agreed to assist us in

our efforts to commercialize our TAEUS technology for use in a

fatty liver application by, among other things, providing equipment

and technical advice, and facilitating introductions to GE

Healthcare clinical ultrasound customers. In return for this

assistance, we have agreed to afford GE Healthcare certain rights

of first offer with respect to manufacturing and licensing rights

for the target application. More specifically, we have agreed that,

prior to commercially releasing our NAFLD TAEUS application, we

will offer to negotiate an exclusive ultrasound manufacturer

relationship with GE Healthcare for a period of at least one year

of commercial sales. The commercial sales would involve, within our

sole discretion, either our Company commercially selling GE

Healthcare ultrasound systems as the exclusive ultrasound system

with our TAEUS fatty liver application embedded, or GE Healthcare

being the exclusive ultrasound manufacturer to sell ultrasound

systems with our TAEUS fatty liver application embedded. The

agreement is subject to termination by either party upon not less

than 60 days’ notice.

On

January 30, 2018, we and GE Healthcare entered into an amendment to

our agreement, extending its term by 21 months to January 22, 2020.

We are in discussions with GE Healthcare regarding further

extending this term.

Recent Developments

Private Placement of Series A Preferred Stock, Common Stock and

Warrants

On December 11, 2019, we closed the First Private Placement, in

which we sold 6,338.49 shares of its Series A Preferred Stock and

0.9 million shares of Common Stock, along with Series A Warrants

exercisable for an aggregate of 8.2 million shares of Common Stock,

to accredited investors (the “Series A Investors”) for

approximately $7.9 million of gross proceeds. The First Private

Placement was made pursuant to a Securities Purchase Agreement (the

“Series A Purchase Agreement”), dated as of December 5,

2019. The closing consisted of (i) the issuance of 5,809.09 shares

of Series A Preferred Stock, approximately 0.8 million shares of

Common Stock and Series A Warrants exercisable for an aggregate of

approximately 7.5 million shares of Common Stock to Series A

Investors party to the Series A Purchase Agreement as of December

5, 2019 and (ii) the issuance of 529.40 shares of Series A

Preferred Stock, approximately 0.1 million shares of Common Stock

and Series A Warrants exercisable for an aggregate of approximately

0.7 million shares of Common Stock to Investors who joined as

parties to the Series A Purchase Agreement as of December 10, 2019.

Pursuant to the Series A Purchase Agreement, each Investor elected

whether to receive shares of Series A Preferred Stock or shares of

Common Stock in the First Private Placement. We used a portion of

the net proceeds from the First Private Placement to repay certain

outstanding convertible notes due April 2020 and plan to use

remaining net proceeds for working capital and general corporate

purposes.

In connection with the closing of the First Private Placement, we

filed a Certificate of Designations of Series A Convertible

Preferred Stock (the “Series A Certificate of

Designations”) with the Secretary of State of the State of

Delaware setting forth the rights and preferences of the Series A

Preferred Stock. Each share of Series A Preferred Stock has a

$1,000 issue price (the “Series A Issue Price”).

Dividends accrue on the Series A Issue Price at a rate of 6.0% per

annum and are payable to holders of Series A Preferred Stock as,

when and if declared by our Board of Directors. Shares of Series A

Preferred Stock, including accrued but unpaid dividends, are

convertible into Common Stock at a conversion price of $0.87 per

share of Common Stock. The conversion price is subject to

proportional adjustment for certain transactions relating to our

capital stock, including stock splits, stock dividends and similar

transactions. Holders of Series A Preferred Stock are entitled to a

liquidation preference in the event of any liquidation, dissolution

or winding up of the Company based on their shares’ aggregate

Series A Issue Price and accrued and unpaid dividends. Holders may

convert their shares of Series A Preferred Stock into Common Stock

at any time and we have the right to cause each holder to convert

their shares of Series A Preferred Stock in the event that (i) the

average of the daily volume-weighted average price of Common Stock

over any 10 consecutive trading days is greater than $1.74 (as

adjusted for stock splits, stock dividends and similar

transactions) and (ii) there is then an effective registration

statement registering under the Securities Act of 1933, as amended

(the “Securities Act”), the resale of the shares of

Common Stock issuable upon such conversion of Series A Preferred

Stock (together, the “Series A Forced Conversion

Conditions”). Holders of shares of Series A Preferred Stock

vote with the holders of Common Stock and are entitled to a number

of votes equal to the number of shares of Common Stock into which

such holder’s shares of Series A Preferred Stock are then

convertible.

|

|

|

|

|

|

4

|

|

|

|

|

|

Each Series A Warrant entitles the holder to purchase a share of

Common Stock for an exercise price per share equal to $0.87. The

Series A Warrants are exercisable commencing immediately upon

issuance and expire on the date five years after the date of the

closing of the First Private Placement (the “Series A Closing

Date”), unless earlier terminated pursuant to the terms of

the Series A Warrant. If, during the term of the Series A Warrants,

the Series A Forced Conversion Conditions are met, we may deliver

notice thereof to the holders of the Series A Warrants and, after a

30-day period following such notice, any unexercised Series A

Warrants will be forfeited. The Series A Warrants provide for

cashless exercise in the event there is no effective registration

statement registering under the Securities Act the resale of the

shares of Common Stock issuable upon exercise of such Series A

Warrants.

The Series A Purchase

Agreement includes customary representations, warranties and

covenants. In connection with the First Private Placement, we paid

to Lake Street, the placement agent, a commission of 8.0% of the

gross proceeds from the First Private Placement, agreed to

reimburse up to $35,000 of Lake Street’s expenses and issued

to Lake Street a warrant exercisable for 327,606 shares of Common

Stock (the “Series A Placement Agent Warrant”). The

terms of the Series A Placement Agent Warrant are the same as those

of the Series A Warrants.

Pursuant to the Series A Purchase Agreement, the Company, the

Investors and Lake Street entered into a registration rights

agreement (the “Registration Rights Agreement”)

pursuant to which we agreed to file a registration statement (the

“Registration Statement”) within 30 days of the Series

A Closing Date covering the resale of the shares of Common Stock

issuable upon conversion of the Series A Preferred Stock, the

shares of Common Stock issued at the closing of the First Private

Placement, and the shares of Common Stock issuable upon exercise of

the Series A Warrants and the Placement Agent Warrant

(collectively, the “Series A Registrable Securities”).

Pursuant to the Registration Rights Agreement, we have agreed to

use our commercially reasonable efforts to cause the Registration

Statement to become effective as soon as practicable after filing

and to remain effective until the earlier of the date that (i) all

of the Series A Registrable Securities have been sold or (ii) the

Series A Registrable Securities may be sold without restriction by

each holder pursuant to Rule 144 under the Securities

Act.

Private Placement of Series B Preferred Stock and

Warrants

On December 23, 2019, we closed the Second Private Placement, in

which we sold 351.711 shares of Series B Preferred Stock, along

with Series B Warrants exercisable for an aggregate of 426,316

shares of Common Stock, to accredited investors (the “Series

B Investors”) for approximately $405,000 of gross proceeds.

The Second Private Placement was made pursuant to a Securities

Purchase Agreement (the “Series B Purchase Agreement”),

dated as of December 19, 2019. We plan to use the net proceeds from

the Second Private Placement for working capital and general

corporate purposes.

In connection with the closing of the Second Private Placement, we

filed a Certificate of Designations of Series B Convertible

Preferred Stock (the “Series B Certificate of

Designations”) with the Secretary of State of the State of

Delaware setting forth the rights and preferences of the Series B

Preferred Stock. The Series B Preferred Stock has substantially the

same rights and preferences as Series A Preferred Stock, except for

a different conversion price and trading price of Common Stock at

which the Series B Preferred Stock becomes subject to automatic

conversion. Each share of Series B Preferred Stock has a $1,000

issue price (the “Series B Issue Price”). Dividends

accrue on the Series B Issue Price at a rate of 6.0% per annum and

are payable to holders of Series B Preferred Stock as, when and if

declared by our Board of Directors. Shares of Series B Preferred

Stock, including accrued but unpaid dividends, are convertible into

Common Stock at a conversion price of $0.99 per share of Common

Stock. The conversion price is subject to proportional adjustment

for certain transactions relating to our capital stock, including

stock splits, stock dividends and similar transactions. Holders of

Series B Preferred Stock are entitled to a liquidation preference

in the event of any liquidation, dissolution or winding up of the

Company based on their shares’ aggregate Series B Issue Price

and accrued and unpaid dividends. Such liquidation preference of

Series B Preferred Stock holders is on a pari passu basis with holders of Series A Preferred Stock.

Holders may convert their shares of Series B Preferred Stock into

Common Stock at any time and we have the right to cause each holder

to convert their shares of Series B Preferred Stock in the event

that (i) the average of the daily volume-weighted average price of

Common Stock over any 10 consecutive trading days is greater than

$1.98 (as adjusted for stock splits, stock dividends and similar

transactions) and (ii) there is then an effective registration

statement registering under the Securities Act the resale of the

shares of Common Stock issuable upon such conversion of Series B

Preferred Stock (together, the “Series B Forced Conversion

Conditions”). Holders of shares of Series B Preferred Stock

vote with the holders of Common Stock, and with any other shares of

preferred stock that vote with the Common Stock, and are entitled

to a number of votes equal to the number of shares of Common Stock

into which such holder’s shares of Series B Preferred Stock

are then convertible.

Each Series B Warrant entitles the holder to purchase shares of

Common Stock for an exercise price per share equal to $0.99. The

Series B Warrants are exercisable commencing immediately upon

issuance and expire on the date five years after the date of the

closing of the Second Private Placement (the “Series B

Closing Date”), unless earlier terminated pursuant to the

terms of the Series B Warrant. If, during the term of the Series B

Warrants, the Series B Forced Conversion Conditions are met, we may

deliver notice thereof to the holders of the Series B Warrants and,

after a 30-day period following such notice, any unexercised Series

B Warrants will be forfeited. The Series B Warrants provide for

cashless exercise in the event there is no effective registration

statement registering under the Securities Act the resale of the

shares of Common Stock issuable upon exercise of such Series B

Warrants.

The Series B Purchase Agreement includes customary representations,

warranties and covenants. In connection with the closing of the

Second Private Placement, we paid to Lake Street, the placement

agent, a commission of approximately 8.0% of the gross proceeds

from the Second Private Placement and issued to Lake Street a

warrant exercisable for 14,211 shares of Common Stock (the

“Series B Placement Agent Warrant”). The terms of the

Series B Placement Agent Warrant are the same as those of the

Series B Warrants.

|

|

|

|

|

|

5

|

|

|

|

|

|

Pursuant to the Series B Purchase Agreement, the Series B Investors

became parties to the Registration Rights Agreement, pursuant to

which we agreed to file the Registration Statement within 30 days

of the Series A Closing Date covering the resale of the shares of

Common Stock issuable upon conversion of the Series B Preferred

Stock, the shares of Common Stock issuable upon exercise of the

Series B Warrants and the Series B Placement Agent Warrant and the

Series A Registrable Securities. The Registration Rights Agreement

is summarized above in this “Recent Developments”

section.

Risks Related to Our Business

An

investment in our Securities involves a high degree of risk. You

should carefully consider the risks summarized below. These risks

are discussed more fully in the “Risk Factors” section

of our Form 10-K incorporated herein by reference. These risks

include, but are not limited to, the following:

● We have a history

of operating losses, and we may never achieve or maintain

profitability.

● Our efforts may

never result in the successful development of commercial

applications based on our TAEUS technology.

● If we fail to

obtain and maintain necessary regulatory clearances or approvals

for our TAEUS applications, or if clearances or approvals for

future applications and indications are delayed or not issued, our

commercial operations will be harmed.

● Our limited

commercial experience makes it difficult to evaluate our current

business, predict our future results or forecast our financial

performance and growth.

● We are depending on

third parties to design, manufacture and seek regulatory approval

of our TAEUS applications. If any third party fails to successfully

design, manufacture and gain regulatory approval of our TAEUS

applications, our business will be materially harmed.

● Competition in the

medical imaging market is intense and we may be unable to

successfully compete.

● If we are unable to

secure additional financing on favorable terms, or at all, to meet

our future capital needs, we will be unable to complete fully our

current business plan.

● We intend to market

our TAEUS applications, if approved, globally, in which case we

will be subject to the risks of doing business outside of the

United States.

● If we are unable to

protect our intellectual property, then our financial condition,

results of operations and the value of our technology and products

could be adversely affected.

Implications of Being an Emerging Growth Company

We are

an “emerging growth company,” as defined in the

Jumpstart Our Business Startups Act of 2012 (the “JOBS

Act”) and, for as long as we continue to be an

“emerging growth company,” we may choose to take

advantage of exemptions from various reporting requirements

applicable to other public companies but not to “emerging

growth companies,” including, but not limited to, not being

required to comply with the auditor attestation requirements of

Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure

obligations regarding executive compensation in our periodic

reports and proxy statements, and exemptions from the requirements

of holding a nonbinding advisory vote on executive compensation and

stockholder approval of any golden parachute payments not

previously approved. We could be an “emerging growth

company” until December 31, 2022, or until the earliest of

(i) the last day of the first fiscal year in which our annual gross

revenues exceed $1.07 billion, (ii) the date that we become a

“large accelerated filer” as defined in Rule 12b-2

under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), which would occur if the market value

of our common stock that is held by non-affiliates exceeds $700

million as of the last business day of our most recently completed

second fiscal quarter, or (iii) the date on which we have issued

more than $1 billion in non-convertible debt during the preceding

three-year period. We are choosing to “opt out” of the

extended transition periods available under the JOBS Act for

complying with new or revised accounting standards, but intend to

take advantage of the other exemptions discussed

above.

We are

also currently considered a “smaller reporting

company,” which generally means that we have a public float

of less than $250 million. If we are still considered a

“smaller reporting company” at such time as we cease to

be an “emerging growth company,” we will be subject to

increased disclosure requirements. However, the disclosure

requirements will still be less than they would be if we were not

considered either an “emerging growth company” or a

“smaller reporting company.” Specifically, similar to

“emerging growth companies,” “smaller reporting

companies” are able to provide simplified executive

compensation disclosures in their filings; are exempt from the

provisions of Section 404(b) of the Sarbanes-Oxley Act requiring

that independent registered public accounting firms provide an

attestation report on the effectiveness of internal control over

financial reporting; and have certain other decreased disclosure

obligations in their SEC filings, including, among other things,

being required to provide only two years of audited financial

statements in annual reports.

Corporate Information

We were

incorporated in Delaware in July 2007 and have a wholly-owned

subsidiary, ENDRA Life Sciences Canada Inc. Our corporate

headquarters is located at 3600 Green Court, Suite 350, Ann Arbor,

Michigan 48105-1570. Our website can be accessed at

www.endrainc.com. The telephone number of our principal executive

office is (734) 335-0468. The information contained on, or that may

be obtained from, our website is not, and shall not be deemed to

be, a part of this prospectus.

|

|

|

|

|

|

6

THE OFFERING

|

Common

Stock currently outstanding

|

|

8,420,401

(1)

|

|

Common

Stock offered by the Company

|

|

None.

|

|

Common

Stock offered by the Selling Stockholders

|

|

Up to

25,644,002 shares of Common Stock, which include:

● 904,526 shares

issued in the First Private Placement;

● 7,191,873 shares

that are issuable upon conversion of the Series A Preferred

Stock;

● 8,096,399 shares

that are issuable upon exercise of the Series A

Warrants;

● an estimated

8,660,410 shares that may be issuable in respect of accrued and

unpaid dividends on shares of Series A Preferred

Stock;

● 232,461 shares that

are issuable upon conversion of the Series B Preferred

Stock;

● 278,948 shares that

are issuable upon exercise of the Series B Warrants;

and

● an estimated

279,385 shares that may be issuable in respect of accrued and

unpaid dividends on shares of Series B Preferred

Stock.

|

|

Use of

proceeds

|

|

We will

not receive any of the proceeds from the sales of the Securities by

the Selling Stockholders, although we will receive proceeds from

the exercise price of any Series A Warrants and Series B Warrants

exercised on a cash basis. We intend to use those proceeds, if any,

for working capital and general corporate purposes.

|

|

Nasdaq

symbol for Common Stock

|

|

NDRA.

|

|

Risk

factors

|

|

You

should carefully consider the information set forth in this

prospectus and, in particular, the specific factors set forth in

the “Risk Factors” section in the Form 10-K

incorporated herein by reference before deciding whether or not to

invest in the Securities.

|

(1) As

of December 31, 2019. This number excludes the shares of Common

Stock issuable upon the conversion of the Series A Preferred Stock

and Series B Preferred Stock, shares of Common Stock issuable upon

exercise of the Series A Warrants and Series B Warrants, and shares

of Common Stock that may be issuable in respect of accrued and

unpaid dividends on shares of Series A Preferred Stock and Series B

Preferred Stock covered hereby as well as:

●

1,932,000 shares of

Common Stock issuable upon the exercise of outstanding warrants

issued in our initial public offering listed on the Nasdaq Capital

Market under the symbol “NDRAW,” at an exercise price

of $6.25 per share;

●

2,606,566 shares of

Common Stock issuable upon the exercise of outstanding unregistered

warrants, at a weighted average exercise price of $2.83 per

share;

●

3,413,723 shares of

Common Stock issuable upon the exercise of outstanding stock

options issued pursuant to our 2016 Omnibus Incentive Plan (the

“Incentive Plan”) at a weighted average exercise price

of $1.80 per share;

●

1,109,532 shares of

Common Stock reserved for future issuance under our Incentive Plan;

and

●

371,517 shares of

Common Stock issuable upon the conversion our 10.0% Senior Secured

Convertible Notes due April 26, 2020, including an estimated 6,426

shares that may be issued in respect of accrued and unpaid interest

upon conversion of such notes.

See

“Description of Capital Stock” below.

7

RISK FACTORS

An

investment in the Securities involves a high degree of risk. You

should carefully consider all of the information set forth in this

prospectus and the documents incorporated by reference herein and,

in particular, the risks set forth under the section captioned

“Risk Factors” contained in our Form 10-K, before

deciding to invest in the Securities. The risks and uncertainties

we have described this prospectus and in any document incorporated

herein are not the only ones we face, but are considered to be the

most material. If

additional risks and uncertainties that are not presently known to

us or that we currently deem immaterial later materialize, then our

business, prospects, results of operations and financial condition

could be materially adversely affected. In that event, the trading

price of our securities could decline, and you may lose all or part

of your investment in our securities.

8

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference contain

“forward-looking statements” within the meaning of

Section 27A of the Securities Act and Section 21E of the Exchange

Act, that are intended to be covered by the “safe

harbor” created by those sections. Forward-looking

statements, which are based on certain assumptions and describe our

future plans, strategies and expectations, can generally be

identified by the use of forward-looking terms such as

“believe,” “expect,” “may,”

“will,” “should,” “would,”

“could,” “seek,” “intend,”

“plan,” “goal,” “project,”

“estimate,” “anticipate,”

“strategy”, “future”, “likely”

or other comparable terms and references to future periods. All

statements other than statements of historical facts included in

this prospectus and the documents incorporated by reference

regarding our strategies, prospects, financial condition,

operations, costs, plans and objectives are forward-looking

statements. Examples of forward-looking statements include, among

others, statements we make regarding expectations for revenues,

cash flows and financial performance, the anticipated results of

our development efforts and the timing for receipt of required

regulatory approvals and product launches.

Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following:

●

our limited

commercial experience, limited cash and history of

losses;

●

our ability to

obtain adequate financing to fund our business operations in the

future;

●

our ability to

achieve profitability;

●

our ability to

develop a commercially feasible application based on our TAEUS

technology;

●

market acceptance

of our technology;

●

results of our

human studies, which may be negative or inconclusive;

●

our ability to find

and maintain development partners;

●

our reliance on

collaborations and strategic alliances and licensing

arrangements;

●

the amount and

nature of competition in our industry;

●

our ability to

protect our intellectual property;

●

potential changes

in the healthcare industry or third-party reimbursement

practices;

●

delays and changes

in regulatory requirements, policy and guidelines including

potential delays in submitting required regulatory applications for

CE mark certification or FDA approval;

●

our ability to

obtain CE mark certification and secure required FDA and other

governmental approvals for our TAEUS applications;

●

our ability to

maintain compliance with Nasdaq listing standards;

●

our ability to

comply with regulation by various federal, state, local and foreign

governmental agencies and to maintain necessary regulatory

clearances or approvals; and

●

the other risks and

uncertainties described in the Risk Factors section of our Form

10-K and in the Management’s Discussion and Analysis of

Financial Condition and Results of Operations section in our

Quarterly Report on Form 10-Q for the quarterly period ended

September 30, 2019.

Any

forward-looking statement made by us in this prospectus is based

only on information currently available to us and speaks only as of

the date on which it is made. We undertake no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise. We anticipate

that subsequent events and developments will cause our views to

change. You should read this prospectus and the documents

referenced in this prospectus and filed as exhibits to the

registration statement, of which this prospectus is a part,

completely and with the understanding that our actual future

results may be materially different from what we expect. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, merger, dispositions, joint ventures or

investments we may undertake. We qualify all of our forward-looking

statements by these cautionary statements.

9

USE OF PROCEEDS

We will

not receive any proceeds from the sale of Common Stock by the

Selling Stockholders. To the extent we receive proceeds from the

exercise of Series A Warrants and Series B Warrants held by the

Selling Stockholders, we will use those proceeds for working

capital and other general corporate purposes.

We have

agreed to bear the expenses (other than selling commissions or any

legal expenses incurred by any Selling Stockholder) in connection

with the registration of the shares of our Common Stock being

offered for resale hereunder by the Selling

Stockholders.

See

“Plan of Distribution” elsewhere in this prospectus for

more information.

DETERMINATION OF OFFERING PRICE

The

Selling Stockholders will determine at what price they may sell the

offered Common Stock, and such sales may be made at prevailing

market prices or at privately negotiated prices. See “Plan of

Distribution” below for more information.

10

SELLING STOCKHOLDERS

This

prospectus covers the resale from time to time by the Selling

Stockholders identified in the table below of up to 25,644,002

shares of Common Stock, which include:

●

904,526 shares

issued in the First Private Placement;

●

7,191,873 shares

that are issuable upon conversion of the Series A Preferred

Stock;

●

8,096,399 shares

that are issuable upon exercise of the Series A

Warrants;

●

an estimated

8,660,410 shares that may be issuable in respect of accrued and

unpaid dividends on shares of Series A Preferred

Stock;

●

232,461 shares that

are issuable upon conversion of the Series B Preferred

Stock;

●

278,948 shares that

are issuable upon exercise of the Series B Warrants;

and

●

an estimated

279,385 shares that may be issuable in respect of accrued and

unpaid dividends on shares of Series A Preferred Stock

The

Selling Stockholders identified in the table below may from time to

time offer and sell under this prospectus any or all of the shares

of Common Stock covered hereby described under the column

“Shares of Common Stock Registered Hereby” in such

table below.

Certain

Selling Stockholders may be deemed to be “underwriters”

as defined in the Securities Act. Any profits realized by such

Selling Stockholders may be deemed to be underwriting discounts and

commissions under the Securities Act.

The

table below has been prepared based upon the information furnished

to us by the Selling Stockholders and/or our transfer agent as of

the date of this prospectus. The Selling Stockholders identified

below may have converted, sold, transferred or otherwise disposed

of some or all of their Series A Preferred Stock, Series A

Warrants, Series B Preferred Stock, Series B Warrants or underlying

Common Stock since the date on which the information in the

following table is presented in transactions exempt from or not

subject to the registration requirements of the Securities Act.

Information concerning the Selling Stockholders may change from

time to time and, if necessary, we will amend or supplement this

prospectus accordingly. We cannot give an estimate as to the number

of shares of Common Stock that will actually be held by the Selling

Stockholders upon termination of this offering because the Selling

Stockholders may offer some or all of their Common Stock, as

applicable, under the offering contemplated by this prospectus or

may acquire additional shares of Common Stock. The aggregate total

number of shares of Common Stock that may be sold hereunder will

not exceed the number of shares of Common Stock offered hereby.

Please read the section entitled “Plan of Distribution”

in this prospectus.

The

following table sets forth the name of each Selling Stockholder,

the number of shares of our Common Stock beneficially owned by such

Selling Stockholder before this offering, the number of shares of

Common Stock to be offered for such Selling Stockholder’s

account and (if one percent or more) the percentage of Common Stock

to be beneficially owned by such Selling Stockholder after

completion of the offering. The number of shares of Common Stock

owned are those beneficially owned, as determined under the rules

of the SEC, and such information is not necessarily indicative of

beneficial ownership for any other purpose. Under such rules, the

Selling Stockholders’ beneficial ownership includes any

shares of our Common Stock as to which a person has sole or shared

voting power or dispositive power and any shares of Common Stock

which the person has the right to acquire within 60 days after

December 31, 2019 (as used in this section, the

“Determination Date”), through the conversion or

exercise of any option, warrant or right or other security

(including upon the conversion of the Series A Preferred Stock and

Series B Preferred Stock and exercise of the Series A Warrants and

Series B Warrants), or pursuant to the automatic termination of a

power of attorney or revocation of a trust, discretionary account

or similar arrangement, and such shares are deemed to be

beneficially owned and outstanding for computing the share

ownership and percentage of the person holding such options,

warrants or other rights, but are not deemed outstanding for

computing the percentage of any other person. Except where we had

knowledge of such ownership, the number presented in this column

may not include shares held in street name or through other

entities over which the Selling Stockholders have voting and

dispositive power.

Unless

otherwise set forth below, based upon information furnished to us

by the Selling Stockholders, (a) the persons and entities named in

the table have sole voting and sole dispositive power with respect

to the shares set forth opposite the Selling Stockholder’s

name, subject to community property laws, where applicable, (b) no

Selling Stockholder had any position, office or other material

relationship within the past three years with us or with any of our

predecessors or affiliates, and (c) no Selling Stockholder is a

broker-dealer or an affiliate of a broker-dealer. The number of

shares of Common Stock shown as beneficially owned before the

offering is based on information furnished to us or otherwise based

on information available to us at the timing of the filing of the

registration statement of which this prospectus forms a

part.

11

|

Name of Selling

Security Holder

|

Shares of Common

Stock Beneficially Owned Prior to this Offering

|

Shares of Common

Stock Registered Hereby

|

Shares of Common

Stock Beneficially Owned upon Completion of this Offering

(1)

|

Percentage of

Common Stock Beneficially Owned upon Completion of this Offering

(2)

|

|

Anthony

DiGiandomenico (3)

|

391,058

|

201,006

|

190,049

|

2.3%

|

|

Dennis T. Whalen

& Linda P. Whalen JTWROS (4)

|

40,202

|

64,407

|

-

|

*

|

|

Xavier Aguirre

(5)

|

20,102

|

32,205

|

-

|

*

|

|

Carlo Alberici

(6)

|

147,450

|

236,229

|

-

|

*

|

|

James R. Aldridge

(7)

|

50,252

|

80,509

|

-

|

*

|

|

Howard Altshuler

(8)

|

51,202

|

64,407

|

11,000

|

*

|

|

Patrick M.

Barberich & Monica Barberich JTWROS (9)

|

30,152

|

48,306

|

-

|

*

|

|

Anthony J. Berni

(10)

|

40,202

|

64,407

|

-

|

*

|

|

Chase Lankford Bice

(11)

|

30,152

|

48,306

|

-

|

*

|

|

Mark W. Boyer

(12)

|

194,396

|

311,441

|

-

|

*

|

|

Jeffrey Ronald

Boyle (13)

|

37,558

|

60,171

|

-

|

*

|

|

John M. Brady

(14)

|

77,098

|

123,518

|

-

|

*

|

|

Michael J. Burwell

(15)

|

194,396

|

311,441

|

-

|

*

|

|

Matthew W. Cambi

(16)

|

77,098

|

123,518

|

-

|

*

|

|

Donald Cameron

(17)

|

50,252

|

80,509

|

-

|

*

|

|

Timothy L.

Carpenter & Julie L. Carpenter JTWROS (18)

|

30,152

|

48,306

|

-

|

*

|

|

Peter A. Casey

(19)

|

20,102

|

32,205

|

-

|

*

|

|

Catalytic

Opportunity LLC Series A (20)

|

2,010,052

|

3,220,301

|

-

|

*

|

|

Catalytic

Opportunity LLC Series A-1 (21)

|

2,512,564

|

4,025,375

|

-

|

*

|

|

Vaidyanthan

Chandrashekhar (22)

|

46,948

|

75,215

|

-

|

*

|

|

Rich Chirico

(23)

|

50,252

|

80,509

|

-

|

*

|

|

Ronald J. Ciasulli

(24)

|

56,336

|

90,256

|

-

|

*

|

|

Mario Dell'Aera

(25)

|

244,646

|

391,947

|

-

|

*

|

|

Mark R. Demich

(26)

|

97,198

|

155,721

|

-

|

*

|

|

Paul G. Elie

(27)

|

97,198

|

155,721

|

-

|

*

|

|

Michael Fahey

(28)

|

46,948

|

75,215

|

-

|

*

|

|

Charles Joseph Finn

(29)

|

147,450

|

236,229

|

-

|

*

|

|

Gregory G. Galdi

(30)

|

288,288

|

461,866

|

-

|

*

|

|

Philip Garland

& Cynthia Garland JTWROS (31)

|

77,098

|

123,518

|

-

|

*

|

|

Scott J. Gehsman

(32)

|

46,948

|

75,215

|

-

|

*

|

|

TTEE Patrick John

Gregory Revocable Trust DTD 6-26-1990 (33)

|

67,048

|

107,417

|

-

|

*

|

|

Scott Guasta

(34)

|

100,504

|

161,017

|

-

|

*

|

|

Michael Harsh &

Sandra E. Hansen Harsh JTWROS (35)

|

56,044

|

35,425

|

33,932

|

*

|

|

Kevin A. Healy

(36)

|

40,202

|

64,407

|

-

|

*

|

|

Kevin J. Herzberg

(37)

|

50,252

|

80,509

|

-

|

*

|

|

Dennis D. Howarter

& Pamela J. Howarter JTWROS (38)

|

194,396

|

311,441

|

-

|

*

|

|

Donald L. Hulet

(39)

|

67,708

|

108,475

|

-

|

*

|

|

Frank Ingriselli

(40)

|

46,948

|

75,215

|

-

|

*

|

|

Joseph M. Janinski

(41)

|

40,202

|

64,407

|

-

|

*

|

|

Anthony D. Johnston

(42)

|

30,152

|

48,306

|

-

|

*

|

|

Robert

Kastenschmidt (43)

|

97,198

|

155,721

|

-

|

*

|

|

Robert Richard

Keehan (44)

|

97,198

|

155,721

|

-

|

*

|

|

Frederick M. Kelso

(45)

|

77,098

|

123,518

|

-

|

*

|

|

Benjamin King

(46)

|

50,252

|

50,252

|

-

|

*

|

|

John Klinge

(47)

|

46,948

|

75,215

|

-

|

*

|

|

James M. Koch

(48)

|

70,352

|

112,711

|

-

|

*

|

|

James P. Kolar

(49)

|

97,198

|

155,721

|

-

|

*

|

|

John C. Koppin

(50)

|

46,948

|

75,215

|

-

|

*

|

|

Kurtis Krentz

(51)

|

144,144

|

230,933

|

-

|

*

|

|

Jeffrey E. Kuhlin

(52)

|

50,252

|

80,509

|

-

|

*

|

|

Dennis Lam

(53)

|

30,152

|

48,306

|

-

|

*

|

|

James C. Leslie

(54)

|

40,202

|

64,407

|

-

|

*

|

|

Paul E. Linthorst

(55)

|

30,152

|

48,306

|

-

|

*

|

|

Jose M. Martinez

(56)

|

46,948

|

75,215

|

-

|

*

|

|

William E. Marx

(57)

|

50,252

|

80,509

|

-

|

*

|

|

Thorne Joseph Brown

Matteson (58)

|

50,252

|

80,509

|

-

|

*

|

|

Joseph Michalczyk

(59)

|

77,758

|

124,576

|

-

|

*

|

|

Francois Michelon

(60)

|

450,811

|

16,104

|

440,759

|

5.2%

|

|

Jeffery L. Miller

& Khristen N. Zar JTWROS (61)

|

97,198

|

155,721

|

-

|

*

|

|

Russell Moore

(62)

|

30,152

|

48,306

|

-

|

*

|

|

Jorge Morazzani

(63)

|

46,948

|

75,215

|

-

|

*

|

|

Edmond Allen

Morrison (64)

|

46,948

|

75,215

|

-

|

*

|

|

Chester P. Mowrey,

Jr. (65)

|

46,948

|

75,215

|

-

|

*

|

|

James Eric Nicely

& Karen B. Nicely JTWROS (66)