UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2018

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ______________to ______________

GEX MANAGEMENT, INC.

(Exact name of registrant as specified in its charter)

| Texas | 333-213470 | 56-2428818 | ||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

12001 N. Central Expressway

Suite 825

Dallas, Texas 75243

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: 877-210-4396

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par value $0.001

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by a check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Securities Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports) (2) has been subject to such filing requirement for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-Accelerated Filer | [ ] | Smaller Reporting Company | [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ] No [X]

Aggregate market value of the voting stock held by non-affiliates of the registrant as of March 30, 2019: $ 697,361.

Indicate the number of Shares of outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date: As of April 1, 2019, the Registrant had 348,680,636 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

For purposes of this Annual Report, the terms “GEX,” “GEX Management,” “the Company,” “we,” “us,” and “our,” refer to GEX Management, Inc., a Texas Corporation, and its consolidated subsidiaries unless the context clearly indicates otherwise. Included in this Annual Report are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases, regarding, among other things, all statements other than statements of historical facts contained in this report, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. In addition, our past results of operations do not necessarily indicate our future results.

From time to time, we also provide forward-looking statements in other materials we release to the public, as well as oral forward-looking statements. Such statements relate to our current expectations, projections and assumptions about our business, the economy and future events or conditions. They do not relate strictly to historical or current facts.

Forward-looking statements are not guarantees and involve risks, uncertainties and assumptions that are difficult to predict. Actual results may differ materially from past results and from those indicated by such forward-looking statements if known or unknown risks or uncertainties materialize, or if underlying assumptions prove inaccurate. These risks and uncertainties include, among other things:

| ■ | our ability to execute our business plans or growth strategy; | |

| ■ | the nature of investment and acquisition opportunities we are pursuing, and the successful execution of such investments and acquisitions; | |

| ■ | our ability to successfully integrate acquired businesses and realize synergies; | |

| ■ | variations in our results of operations; | |

| ■ | our ability to accurately forecast the revenue under our contracts; | |

| ■ | competition for our services; | |

| ■ | our failure to maintain a high level of client retention or the unexpected reduction in scope or termination of key contracts with major clients; | |

| ■ | client dissatisfaction, our non-compliance with contractual provisions or regulatory requirements; | |

| ■ | our inability to manage our relationships with our clients; | |

| ■ | pending or threatened litigation; | |

| ■ | unfavorable outcomes in legal proceedings; | |

| ■ | our ability to generate sufficient cash to cover our interest and principal payments under our note payable, or to borrow or use credit; | |

| ■ | unexpected changes in tax laws, regulations or guidance and unexpected changes in our effective tax rate; and | |

| ■ | the market price of our common stock. |

Other sections of this report may include additional factors which could adversely affect our business and financial performance. New risk factors emerge from time to time and it is not possible for us to anticipate all the relevant risks to our business, and we cannot assess the impact of all such risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. Those factors include, among others, those matters disclosed in this Annual Report on Form 10-K.

| 3 |

Except as otherwise required by applicable laws and regulations, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this report, whether as a result of new information, future events, changed circumstances or any other reason after the date of this report. Neither the Private Securities Litigation Reform Act of 1995 nor Section 27A of the Securities Act of 1933 provides any protection to us for statements made in this report. You should not rely upon forward-looking statements as predictions of future events or performance. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

History and Development of Business

GEX Management, Inc. was originally formed in 2004 as Group Excellence Management, LLC. d/b/a MyEasyHQ. In March of 2016, it was converted from a limited liability company into a C corporation and changed its name to GEX Management, Inc. in April of 2016. GEX Management obtained its license to operate as a Professional Employer Organization (PEO), and established GEX Staffing, LLC, a wholly owned subsidiary of GEX Management, in March 2017 in order to begin distinguishing its staffing and PEO operations.

Carl Dorvil founded Group Excellence, LLC, a tutoring and mentoring company, from his dorm room at Southern Methodist University in 2004. Group Excellence provided tutoring and mentoring services to students with the goal of inspiring young persons to pursue high personal and academic achievement. The company quickly grew to more than six hundred employees. In 2011, Group Excellence was on Inc. 500’s annual list of the 500 fastest growing private companies in the United States.

In response to rapid growth, Mr. Dorvil developed GEX Management to facilitate the back-office functions of his company. GEX Management provided Group Excellence, LLC with human resources, IT, accounting/bookkeeping, social media, payroll, and conducted a majority of the overall operations of the company. Mr. Dorvil sold Group Excellence, LLC in 2011 but maintained ownership of GEX Management, which continued as a Professional Services Company providing back office support to the tutoring company, as well as third-party clients. In 2016 GEX Management revised its business model to provide staffing and back-office services to a wide variety of industries in order to expand the Company’s footprint, thereby building on the previous 12-year history of exceptional client service. On February 23, 2018, the US Secretary of Commerce, Wilbur Ross, mentioned at the “African American Leaders in the White House: Education, Business and Policy” that Dorvil was “the youngest African American CEO ever to take a company public in U.S. history.”

Over the last few years, GEX Management experienced tremendous growth in sales and customer pipeline - staffing business grew by over 1600%+ from 2016 to 2017 with the firm being named among the “fastest growing public companies in the North Texas region” by the Dallas Morning News, while also significantly expanding its client footprints across multiple staffing, business consulting and PEO opportunities.

Under the current management, GEX Management has set strategic goals in 2019 to expand further into areas of higher margin and growth business categories particularly in the space of IT and Management Consulting as well as identify synergistic opportunities in healthcare sector to deliver significant cost rationalization, benefits and integrated staffing solutions to clients and customers alike. In February 2019, GEX Management was invited to be a Preferred Supplier for one of the largest Managed Service Providers to Fortune 100 Companies in the Enterprise Technology Consulting and Staffing solutions space which has resulted in a significant business development opportunity that is expected to result in a strong revenue pipeline for 2019 and beyond. Additionally, GEX executed a strategic staffing agreement with a leading Ohio based Healthcare group to deliver staffing, HR management, payroll processing and benefit administration services to the client’s healthcare and clinical practice centers in the mid-west region. Management expects these and other potential organic and inorganic growth opportunities to help the firm achieve strong revenue growth while also help move towards profitability by targeting higher margin, lower cost business models and relying on less expensive debt instruments to help reduce the burden across the firm’s capital structure while maximizing efficient use of operating capital.

| 4 |

Business Operations

GEX Management is a progressive and growing provider of business management, PEO and staffing solutions for small to midsize businesses. By means of our value-driven co-employment model, we reduce employer stress and increase employee capacity by performing many of the skill-specific and time-intensive office functions that typically distract managers from growing their businesses. We likewise minimize employer-related risks and ensure that our clients are consistently in proper governmental compliance. Our service offerings include a robust PEO platform with online and mobile tools that allow our clients and their employees alike to manage their back-office information and conduct a variety of related functions 24-7. GEX Management also provides both long and short-term consulting and staffing solution services, including enterprise strategy and technology consulting, enterprise project management; grey, white and blue collar staffing solutions to middle market clients, and Human Capital Management (HCM) solution capabilities that include interview vetting, background checks, drug screening, employee onboarding, and more. The Company became licensed as a Professional Employer Organization (“PEO”) in 2017.

GEX Management is strategically purposed to provide tailored business service products and services to our clients. Our client-responsive approach is a key differentiator in the industry.

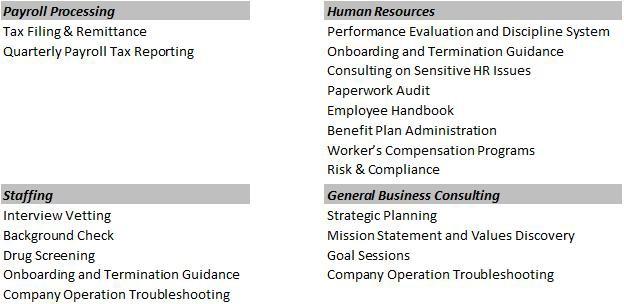

Specific services are described below:

|

|

|

| 5 |

Business Strategy

Our objective is to become a leading business management services company, and to continuously expand our client base. We seek to achieve this objective by continuing to implement our business strategy, which includes the primary elements enumerated below.

Marketing and Sales

Our comprehensive marketing efforts are fluid, adaptive, and results-driven. They comprise both traditional and non- traditional channels including print collateral, website, video, PowerPoint presentations, digital ads, social media posts and press releases. We likewise employ a small sales team. We strategically target small and mid-sized businesses that require the services we provide. Previously, a significant amount of corporate revenue has been derived through client referrals and management’s personal relationships. Our 2019 plan is to continue to leverage these important relationships while expanding our brand reach by means of integrated marketing campaigns, more timely, informative, and effectual messaging, and greater collaboration between marketing and sales in order to increase both client and sales growth.

Industry and Competitors

The PEO and Staffing industry is highly fragmented, resulting in robust competition. Competition affects our success in both the market segments we currently serve, as well as the new market segments we may enter in the future. We compete with several large business service companies, as well as PEOs and Administrative Service Organizations (“ASO”) that provide identical services to those GEX Management provides; some offer additional services. The financial and marketing resources of some of our competitors exceed those of GEX Management. Businesses primarily select a service provider based on price point/value, innovative/flexible product offerings, and quality of customer service.

Environmental Concerns

As a professional services company, federal, state or local laws that regulate the discharge of materials into the environment do not impact us.

| 6 |

Number of Employees

As of December 31, 2018 we had 6 employees.

As a Smaller Reporting Company we are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Corporate Office

As of December 31, 2018, GEX’s corporate offices were located at 12001 N. Central Expressway Suite 825, Dallas, Texas. GEX entered into a 38-month lease agreement on September 28, 2016.

Other Property

On December 29, 2017 GEX purchased 100% of the membership interest in AMAST Consulting, LLC (“AMAST”), which owned a multi-use office building in Lowell, Arkansas, which had an occupancy rate of 100% at the time of the acquisition. The terms of the Agreement to purchase AMAST include the fulfillment of the lease obligations of the current tenants, as well as the assumption of the debt that is collateralized by the building and associated property. The consolidated financials include the assets and debt of AMAST.

On September 28, 2018, the Company, consummated a real property purchase and sale transaction (“Setco Property Purchase Transaction”) with Setco International Forwarding Corporation, a Texas corporation (“Setco”), pursuant to which the Company purchased a 16.84 acre tract of land from Setco, located at 13000 S. Lyndon B. Johnson Freeway in Dallas, Texas, for an aggregate purchase price of $11,000,000.

GEX is not subject to any pending legal proceedings, nor is the Company aware of any material threatened claims against it.

ITEM 5. DEFAULTS UPON SENIOR SECURITIES

On June 4, 2018, the Company entered into a discounted Promissory Note Payable with a principal balance of $500,000, and bearing interest at a rate of 15% per annum. This note was personally guaranteed by Carl Dorvil, the Company’s former Chief Executive Officer and principal shareholder and secured, among other things, certain liens and security interests including the Setco property purchased on September 28, 2019. This note was due to be paid in full by August 1, 2018. The Company had been in negotiations to restructure this loan, as it was originally intended as a bridge loan with a term of 57 days. Pursuant to these negotiations, in August 2018, the maturity date on the note was extended to August 30, 2018. As of December 31, 2018, the Company failed to pay the Principal Amount and, therefore, continued to be in default under the Note.

In connection with the Merchant Cash Advances, the company has occasionally defaulted on making certain daily interest payments as a result of lack of immediate access to capital to fulfill short term payment obligations related to these debt like instruments. As a result of these defaults in timely payments, Confession of Judgements have been filed by some of these MCAs in the New York district courts and GEXM is currently in the process of negotiating settlement terms on monies owed to these parties.

As a result of the highly irregular and unregulated nature of the Merchant Cash Advance industry, current management has taken the decision to move away from these cash advance opportunities introduced by the prior finance teams and will, going forward, solely rely on more traditional and regulated sources of financing available within the investment and regulated capital markets. Additionally, current management has determined it to be necessary to cease active business discussions with MCAs and proceed with settlement discussions to reduce or eliminate the monies owed to the MCAs and related parties in a timely manner. The potential inability of the Company to satisfy these MCA obligations in a timely manner could result in a significant impact on the financial and operational health of the company which could also potentially result in the company pursuing Chapter 11 bankruptcy and /or similar legal avenues if it is not able to settle these outstanding MCA obligations in a timely manner. While the management team has already begun these settlement conversations and is hopeful of reaching a resolution in a timely manner, there can be no guarantee that such a settlement will be reached any time soon.

On account of the management decision to immediately cease business discussion with most MCA groups and because of the lack of regulatory oversight in the MCA industry’s record keeping practices which could result in wrong or misleading data for balance confirmation or audit purposes , the management has relied solely on bank statement records and prior management inputs in determining the balance outstanding with MCAs as presented in the financial statements and believe this to be accurate to best of their knowledge based on internally available information .

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 7 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is included in the OTCQB Market, under the symbol GXXM. The table below summarizes the high and low closing sales prices per share for our common stock for the periods indicated, as reported on OTCQB These amounts have been adjusted to reflect the 4 for 3 stock split of our common stock effected on December 12, 2017. The Company began trading on June 13, 2017 and therefore has no activity prior to the Quarter ended June 30, 2017.

| Quarter Ended | March 31, | June 30, | September 30, | December 31, | ||||||||||||

| Fiscal Year 2018 | ||||||||||||||||

| High | $ | 3.48 | $ | 1.86 | $ | 1.15 | $ | 0.212 | ||||||||

| Low | $ | 3.408 | $ | 1.50 | $ | 1.15 | $ | 0.212 | ||||||||

| Fiscal Year 2017 | ||||||||||||||||

| High | $ | — | $ | 8.60 | $ | 10.50 | $ | 8.25 | ||||||||

| Low | $ | — | $ | 1.40 | $ | 6.02 | $ | 3.41 | ||||||||

| Fiscal Year 2016 | ||||||||||||||||

| High | $ | — | $ | — | $ | — | $ | — | ||||||||

| Low | $ | — | $ | — | $ | — | $ | — | ||||||||

Shareholders

As of December 31, 2018, there were approximately 80 holders of record of our common stock. This number does not include shareholders for whom shares were held in “nominee” or “street name.”

Dividends

No Dividends were declared for the Fiscal year 2018.

Recent Sales of Unregistered Securities

On May 2, 2018, the Company purchased a 25% interest in Payroll Express, LLC (PE), a California limited liability company for $500,000 in cash. The Company recognized this investment under the equity method due to its ability to exercise significant influence over the operating and financial policies of PE. Additionally, the Company had the right, but not the obligation, to purchase an additional 26% interest under similar terms. On June 11, 2018, the Company paid $250,000 in cash to the owners of Payroll Express as a deposit towards purchasing additional shares in PE and is recorded in Other Assets on the Balance Sheet

On August 3, 2018, the Company entered into a Membership Interest Purchase Agreement with PE, pursuant to which the Company purchased an additional 26 % of the membership interests of PE for a purchase price of (a) $250,000, plus (b) warrants (the “Warrants”) to purchase 2,000,000 shares of the Company’s common stock. As a result of this transaction, the Company owned a total of 51% of the membership interests of PE. The Warrants were exercisable for a period of 24 months from the date of issuance. The Warrants provided for the purchase of shares of the Company’s Common Stock an exercise price of $1.06 per share. The Warrants were exercisable for cash, or on a cashless basis. The number of shares of Common Stock to be deliverable upon exercise of the Warrants were subject to adjustment for subdivision or consolidation of shares and other standard dilutive event.

On September 28, 2018, the Company, consummated a real property purchase and sale transaction (“Setco Property Purchase Transaction”) with Setco International Forwarding Corporation, a Texas corporation (“Setco”), pursuant to which the Company purchased a 16.84 acre tract of land from Setco, located at 13000 S. Lyndon B. Johnson Freeway in Dallas, Texas, for an aggregate purchase price of $11,000,000 , paid as follows:

| ● | $1,125,000, by the Company’s execution and delivery of a Real Estate Lien Note made to Setco (the “September 2018 Note”); | |

| ● | $4,875,000, by the Company’s issuance to Setco of 15,000,000 shares of the Company’s common stock (valued at $0.325 per share); and | |

| ● | $5,000,000, by the Company’s transfer to Setco of the Company’s 51% ownership interest in Payroll Express . |

ITEM 6. SELECTED FINANCIAL DATA

As a Smaller Reporting Company, we are not required to report selected financial data.

| 8 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Business

GEX Management is a business services company providing client employers and their employees with a broad portfolio of related products and services. We provide both long and short-term consulting and staffing solution services, including enterprise strategy and technology consulting, enterprise project management; grey, white and blue collar staffing solutions to middle market clients, and Human Capital Management (HCM) solution capabilities that include interview vetting, background checks, drug screening, employee onboarding, and more. Our PEO and Human Capital Management (HCM) platform, complete with online and mobile tools, allows our clients and their employees to digitally manage back office functions which as payroll processing, tax administration, employee onboarding and termination, compensation reporting, expense management, and benefits enrollment and administration.

Business Operations

GEX Management works continuously to expand its service offerings to its clients in order to assist them to achieve their respective business goals. Our unique and tailored approach, coupled with an ever-expanding array of services, has significantly differentiated the Company from competitors. GEX likewise distinguished itself in the market via accessible and exceptional client support ensuring that we will not only gain new clients but will retain those we currently have, resulting in long-term sustainability. Clients typically initiate service by means of a three-month agreement with the Company. The contract thereby automatically renews until terminated with a 30-day notice by either party.

Critical Accounting Policies

The Company’s financial statements were prepared in conformity with U.S. generally accepted accounting principles. As such, management is required to make certain estimates, judgments and assumptions that they believe are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expense during the periods presented.

Revenue Recognition

PEO Services

Professional Employment Organization (“PEO”) service revenues represent the fees charged to clients for administering payroll and payroll tax transactions for our clients’ Co-Employed Employees (“CEEs”), access to our HR and benefits administration services, consulting related to employment and benefit law compliance and general employment consulting related fees. PEO service revenues are recognized in the period the PEO services are performed as stipulated in the Client Service Agreement (“CSA”), where these fees are fixed or determinable, when the PEO client is invoiced and collectability is reasonably assured.

GEX is not considered the primary obligor with respect to CEE’s payroll and payroll tax payments and therefore, these payments are not reflected as either revenue or expense in our statements of operations.

| 9 |

PEO-related revenues also include revenues generated from insurance administration for our PEO clients. These insurance-related revenues include insurance-related billings, as well as administrative fees that GEX collects from PEO clients and withholds from CEEs for health benefit insurance plans provided by third-party insurance carriers. Insurance- related revenues are recognized over the period the insurance coverage is provided and where collectability is reasonably assured.

Staffing Services and Professional Services

Staffing services revenue is derived from supplying temporary staff to clients. Temporary staff generally consists of temporary workers working under a contract for a fixed period of time, or on a specific client project. The temporary staff includes both GEX employees and third-parties contracted by GEX.

Temporary staff are provided to clients through a Staffing Service Agreement (‘SSA’) involving a specified service that the temporary staff will provide to the client. When GEX is the principal or primary obligor for the temporary staff, GEX records the gross amount of the revenue and expense from the SSA.

GEX is generally the primary obligor when GEX is responsible for the fulfillment of services under the SSA, even if the temporary staff are not employees of GEX. This typically occurs when GEX contracts third-parties to fulfill all or part of the SSA with the client, but GEX remains the holder of the credit risk associated with the SSA, and GEX has total discretion in establishing the pricing under the SSA.

All other Professional Services revenues are recognized in the period the services are performed as stipulated in the client’s Outsourcing Agreement, when the client is invoiced, and collectability is reasonably assured. Revenue recognition for arrangements with multiple deliverables constituting a single unit of accounting is recognized generally over the greater of the term of the arrangement or the expected period of performance.

All staffing and consulting workers are completely vetted by the company to ensure their employment terms are in adherence to all applicable state. federal and immigration laws. Additionally, GEX Management carries professional liability and fidelity/crime insurance to protect against risks involving working at third party client locations that require the workers to handle sensitive client data and equipments.

Results of Operations for the Year Ended December 31, 2018 Compared to the Year Ended December 31, 2017

Revenues

| 10 |

Revenues for the year ended December 31, 2018 and 2017 were $8,762,332 and $8,407,088, respectively. Of that amount, related party revenues were $0 and $104,000 for the years ended December 31, 2018 and 2017 respectively. The increase in sales was primarily due to an increase in customer contracts relating to our staffing services and focusing our efforts on growing our business while laying the foundation for expansion in the future. Revenue for our PEO clients is recorded net of payroll expense, in accordance with current revenue recognition standards.

Management has identified several gaps in the proper implementation and execution of the revenue recognition policy by the previous finance team related to staffing and PEO services, including (1) inconsistencies in application of bill rates and margin rates as documented in customer contracts against actual customer invoices resulting in contract losses (2) lack of attention to detail in documenting invoices and mapping cost of sales accurately resulting in missed invoicing and gross sales losses (3) insufficient oversight by the principal finance executive in ensuring accurate book keeping and contract follow- ups are done by the finance team resulting in build-up of un-paid receivables and eventual write-offs of .invoices despite strong sales pipelines.

To satisfy these deficiencies in past financial controls, the current management has put in processes in place to strengthen internal controls such as, (1) adherence to established contract markups through enforcement of systematic and auto-invoicing processes to minimize manual errors and enforcing timely invoice submission to clients (2) frequent follow ups by the executive management team to ensure invoices and receivables are tracked and closed in a timely manner, and (3) timely alerts to customers to notify on upcoming billing cycles and payment dues

Cost of Services and Gross Profit

The Company’s gross profit was $549,519 or 6% Gross Margin in 2018 compared to $145,167 or 2% Gross Margin in 2017. The increase was primarily due to signing higher margin contracts in 2018 compared to 2017 and also significant cost rationalization efforts associated with customer contracts relating to our PEO and staffing services in 2018 compared to 2017.

Operating Expense

Total operating expense in the years ended December 31, 2018 and 2017 were $10,048,679 and $1,171,035 respectively. The increase reflects the increase in personnel and infrastructure costs, as well as fees and related expenses associated with growth of the Company.

Other Income and Expense

Other income and expense for the years ended December 31, 2018 and 2017 was primarily made up of non-cash gain on disposition assets, interest expenses and derivative gain/losses associated with derivative instruments. Interest expense, which related primarily to the interest on notes payable, was $247,963 and $14,039 for the years ended December 31, 2018 and 2017 respectively. Gain on disposition of asset, related to sale of equity interest in Payroll Express, was $2,130,000 and $0 for the years ended December 31, 2018 and 2017 respectively. Derivative gain, primarily related to warrants was $2,418,479 and $0 for the years ended December 31, 2018 and 2017 respectively.

Net Loss

Net loss for the years ended December 31, 2018 and 2017 was $5,105,047 and $867,035, respectively. The significant increase in losses for the year was attributable to the debt amortization expenses related to the MCA debt, interest expenses related to the convertible notes, higher G&A expenses related to stock based compensation and staffing expenses related to business development.

Liquidity and Capital Resources

The Company has identified several potential financing sources in order to raise the capital necessary to fund operations through December 30, 2019. Management believes that it has been historically difficult for minority and women owned businesses to get access to reasonably price capital at scale which creates an opportunity to invest into these companies and receive a greater than average return for our shareholders. However, the opportunity to make a significant return for our investors is so overwhelmingly compelling that management had in the past taken short term working capital loans against future receivables in order to timely fund the growth of the company. Going forward, management intends to move away from these expensive debt like obligations and rely on other traditional and non traditional debt instruments primarily in the form of convertible notes as well as explore various other alternatives including debt and equity financing vehicles, strategic partnerships, government programs that may be available to the Company, as well as trying to generate additional sales and increase margins. However, at this time the Company has no commitments to obtain any additional funds, and there can be no assurance such funds will be available on acceptable terms or at all. If the Company is unable to obtain additional funding, the Company’s financial condition and results of operations may be materially adversely affected and the Company may not be able to continue operations.

Additionally, even if the Company raises sufficient capital through additional equity or debt financing, strategic alternatives or otherwise, there can be no assurances that the revenue or capital infusion will be sufficient to enable it to develop its business to a level where it will be profitable or generate positive cash flow. If the Company incurs additional debt, a substantial portion of its operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, thus limiting funds available for business activities. The terms of any debt securities issued could also impose significant restrictions on the Company’s operations. Broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance, and may adversely impact our ability to raise additional funds. Similarly, if the Company’s common stock is delisted from the public exchange markets, it may limit its ability to raise additional funds.

| 11 |

A summary of our cash flows for the twelve months ended December 31, was as follows:

| 2018 | 2017 | |||||||

| Net cash used in operating activities | $ | (7,109,099 | ) | $ | (990,374 | ) | ||

| Net cash used in investing activities | (750,000 | ) | (40,113 | ) | ||||

| Net cash provided by financing activities | 7,488,785 | 1,133,188 | ||||||

| Net increase(decrease) in cash and cash equivalents | $ | (370,314 | ) | $ | 102,701 | |||

Net cash used in operating activities was $7,109,099for the twelve months ended December 31, 2018 as compared to $990,374 cash used in operating activities for the twelve months ended December 31, 2017. The increase in cash used in operating activities was in part due to higher operating expenses 2018 as the Company invested in customer contracts, business acquisition capital and hiring staffing personnel to support growth.

Net cash provided by financing activities of $17,488,785 for the twelve months ended December 31, 2018 came primarily from discounted notes payable agreement for the purchase and sale of the Company’s future receipts, convertible notes and other notes payable which was partially offset by payments on other debt.

Net cash used in investing activities of $750,000 for the twelve months ended December 31, 2018 was related to investment in 51% equity interest in Payroll Express.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

On March 25, 2019, the Board of Directors of GEX Management, Inc (the “Company”) approved the engagement of AJSH &Co LLP (“AJSH”) as the Company’s new independent registered public accounting firm for the year ending December 31, 2018. In connection with the selection of AJSH, the Audit Committee dismissed Heaton & Company, PLLC, dba Pinnacle Accountancy Group of Utah (“Heaton”) as the Company’s independent registered public accounting firm.

The Company’s financial statements as of December 31, 2017, included in this Form 10-K have been audited by Pinnacle Accountancy Group of Utah (a d/b/a of Heaton & Company, PLLC) independent registered public accountants, as set forth in their report. The financial statements have been included in reliance upon the authority of them as experts in accounting and auditing.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

During the years ended December 31, 2017 and 2016, and the subsequent interim period through September 30, 2018, there were no (1) disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with Heaton on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Heaton, would have caused Heaton to make reference to the subject matter of the disagreement in their reports, or (2) reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K). The audit reports of Heaton on the Company’s consolidated financial statements as of and for the years ended December 31, 2017 and 2016, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

The Company has provided Heaton with a copy of the disclosures it is making in this Current Report on Form 10-K prior to its filing with the Securities and Exchange Commission (“SEC”)

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

In accordance with Exchange Act Rules 13a-15 and 15a-15, we carried out an evaluation, under the supervision and with the participation of management, including our Interim Chief Executive Officer and Interim Chief Investment Officer, of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, our Interim Chief Executive Officer and Interim Chief Investment Officer concluded that our disclosure controls and procedures were effective as of December 31, 2018.

| 12 |

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act. Our internal control system was designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes, in accordance with generally accepted accounting principles in the United States of America. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. Because of inherent limitations, a system of internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate due to change in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

As part of its review into the company’s past operational and financial controls, current management has identified a pattern of inconsistent application of established practices by the prior finance executive team related to managing and executing contractual obligations and related book keeping practices. Lack of easily accessible expense records and failure to match certain contract terms to invoices have resulted in higher costs and missed profit opportunities despite the company recording strong sales during these periods. Additionally, lack of certain documentation related to terms and invoices have introduced challenges to performing accurate and timely audit and review of financial books of records by both current management and the newly introduced independent audit firm.

Despite these challenges, management has taking extraordinary steps to mitigate this risk by (1) reviewing the book of records for the entire 2018 fiscal year and ensuring journal entries are accurately documented for all past transactions and bank statement records are matched with book entries and corrected as needed to reflect accurate records (2) perform comprehensive review of invoices and receivables and write-off long standing receivables as bad expense if required based on detailed analysis (3) transition towards automatic bank feeds to the book of records and away from the past practice of manual book entries of bank deposits or withdrawals which are subject to human errors and prone to transactions risks. Management is confident that these changes would help mitigate the potential risks related to internal controls going forward.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting identified in connection with the evaluation we conducted of the effectiveness of our internal control over financial reporting as of December 31, 2018, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Inherent Limitations

Control systems, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control systems’ objectives are being met. Further, the design of any control systems must reflect the fact that there are resource constraints, and the benefits of all controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision making can be faulty and that breakdowns can occur because of simple errors or mistakes. Control systems can also be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures.

None.

| 13 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table lists the names and ages of the executive officers and directors a of the Company as of December 31, 2018. The directors will continue to serve until the next annual shareholders meeting, or until their successors are elected and qualified. All Directors have been elected to serve through the 2019 annual meeting. All officers serve at the discretion of the Chairman of the Board of Directors, and members of the Board of Directors.

| Name | Age | Position | Held Since | |||

| Srikumar Vanamali | 39 | Executive Director, Interim | October 2018 | |||

| 12001 N. Central Expy. Suite 825 | CEO, Interim CFO | |||||

| Dallas, Texas 75243 | ||||||

| Shaheed Bailey | 32 | Director, Interim | October 2018 | |||

| 12001 N. Central Expy. Suite 825 | CIO | |||||

| Dallas, TX 75243 |

*On October 15, 2018, , the prior Officers of the Company including Carl Dorvil (CEO), Chelsea Christopherson (COO) and Dario Saintus (Interim CFO) resigned as Officers of the Company and at the same time , Srikumar Vanamali and Shaheed Bailey were appointed as Officers and members to the Board of Directors of the Company.

Srikumar Vanamali:

Srikumar Vanamali, 37, is an experienced post-MBA executive with 15 years of top-tier, diverse experience in strategy and technology consulting, investment banking and professional business services. Mr. Vanamali has been leading the Company’s Corporate Strategy functions since June 2018. Prior to that, from January 2017 through May 2018, he worked as an investment banker at NMS Capital, a L.A.-based investment banking firm focusing on capital markets and M&A. Before joining NMS Capital, he was a Management Consultant for Sharp Decisions Inc, a business services company through which he provided consulting services to Toyota Financial Services from November 2014 through December 2016. Prior to this, he was a Consultant and Technology Lead at Infosys, a global consulting firm, from November 2003 through June 2012. Mr. Vanamali earned a Bachelor’s in Engineering, Computer Science from the University of Madras, in Chennai, Tamil Nadu, India, in 2003, and an MBA from UCLA Anderson School of Management, in Los Angeles, California, in 2014.

In October 2018, Mr. Vanamali became the Executive Director and Interim Chief Executive Officer and Director for GEX Management, Inc., and currently serves in these roles.

Shaheed Bailey:

Shaheed Bailey, 32, had been serving as Managing Partner and Chief Executive Officer of Veterans Capital Inc., a consulting firm that helps middle market companies raise equity/debt capital and locate strategic and value strategic acquisitions, and provides consulting for cost cutting, tax savings and growth strategies since October 2012. Prior to that, from June 2010 through September 2012, he served as a Sales Consultant/Partner for Sales Consultants of Morris County, a company that provided strategic consulting services. Before joining Sales Consultants of Morris County, he was a Private Banker with Wells Fargo Bank from July 2008 through April 2010. In October 2018, Mr. Bailey became the Interim Chief Investment Officer and Director for GEX Management, Inc., and currently serves in these roles.

On October 15, 2018, Carl Dorvil resigned as Chief Executive Officer of the Company. In connection with his resignation, Mr. Dorvil relinquished his role as “Principal Executive Officer” of the Company for SEC reporting purposes. Mr. Dorvil also resigned as the Company’s Chairman of the Board of Directors as of such date. Mr. Dorvil’s resignation was for personal reasons and was not the result of a disagreement with the Company on any matter relating to the Company’s operations, policies, or practices. In connection with Mr. Dorvil’s resignation, his Employment Agreement with the Company, dated June 26, 2017, was deemed to be terminated.

| 14 |

In connection with his resignation, on October 15, 2018, the Company entered into a Separation Letter and General Release Agreement with Mr. Dorvil (the “Dorvil Separation Agreement”), pursuant to which the Company agreed to pay Mr. Dorvil severance pay of three (3) months’ salary, in the aggregate amount of $37,500 (less standard withholding and applicable deductions), in consideration for his general release of the Company and certain related parties from any claims he may have against them. The severance payment is payable within 14 days from the date of Mr. Dorvil’s execution of the Dorvil Separation Agreement. The Company also agreed to reimburse Mr. Dorvil for all unreimbursed travel and business expenses to which Mr. Dorvil is entitled. The Dorvil Separation Agreement also contains standard provisions related to confidentiality and non-disparagement.

On October 15, 2018, Dario Saintus resigned as Interim Chief Financial Officer of the Company. In connection with his resignation, Mr. Saintus relinquished his role as “Principal Accounting Officer” of the Company for SEC reporting purposes. Mr. Saintus also resigned as member of the Company’s Board as of such date. Mr. Saintus’s resignation was for personal reasons and was not the result of a disagreement with the Company on any matter relating to the Company’s operations, policies, or practices. In connection with Mr. Saintus’s resignation, his Employment Agreement with the Company, dated May 4, 2018, was deemed to be terminated.

In connection with his resignation, on October 15, 2018, the Company entered into a Separation Letter and General Release Agreement with Mr. Saintus (the “Saintus Separation Agreement”), pursuant to which the Company agreed to pay Mr. Saintus severance pay of three (3) months’ salary, in the aggregate amount of $9,000 (less standard withholding and applicable deductions), in consideration for his general release of the Company and certain related parties from any claims he may have against them. The severance payment is payable within 14 days from the date of Mr. Saintus’s execution of the Saintus Separation Agreement. The Company also agreed to reimburse Mr. Saintus for all unreimbursed travel and business expenses to which Mr. Saintus is entitled. The Saintus Separation Agreement also contains standard provisions related to confidentiality and non-disparagement.

On October 15, 2018, Chelsea Christopherson resigned as President and Chief Operating Officer of the Company. Ms. Christopherson also resigned as member of the Company’s Board as of such date. Ms. Christopherson’s resignation was for personal reasons and was not the result of a disagreement with the Company on any matter relating to the Company’s operations, policies, or practices. In connection with Ms. Christopherson’s resignation, her Employment Agreement with the Company, dated June 26, 2017, was deemed to be terminated.

In connection with her resignation, on October 15, 2018, the Company entered into a Separation Letter and General Release Agreement with Ms. Christopherson (the “Christopherson Separation Agreement”), pursuant to which the Company agreed to pay Ms. Christopherson severance pay of three (3) months’ salary, in the aggregate amount of approximately $25,000 (less standard withholding and applicable deductions), in consideration for her general release of the Company and certain related parties from any claims she may have against them. The severance payment is payable within 14 days from the date of Ms. Christopherson’s execution of the Christopherson Separation Agreement. The Company also agreed to reimburse Ms. Christopherson for all unreimbursed travel and business expenses to which Ms. Christopherson is entitled. The Christopherson Separation Agreement also contains standard provisions related to confidentiality and non-disparagement.

On October 15, 2018, Srikumar Vanamali was appointed as a member of the Board, to fill one of the vacancies created by the resignations described above. In addition, upon effectiveness of the resignations described above, Mr. Vanamali was appointed as the Company’s Executive Director, Interim Chief Executive Officer, President, Interim Chief Financial Officer, Secretary and Treasurer, to serve in such offices at the pleasure of the Board, and until his successor has been appointed by the Board. In connection with his appointment as Interim Chief Executive Officer and Interim Chief Financial Officer of the Company, Mr. Vanamali was designated as the Company’s “Principal Executive Officer” and “Principal Financial and Accounting Officer,” respectively, for SEC reporting purposes,

In connection with his appointment as Executive Director and Interim Chief Executive Officer of the Company, the Company (a) agreed to pay Mr. Vanamali an annual base salary of $100,000, and (b) issued Mr. Vanamali 300,000 non-statutory stock options (the “Vanamali Stock Options”), exercisable at $1.00 per share, all of which stock options vested upon the date of grant.

| 15 |

On October 15, 2018, Shaheed Bailey was appointed as a member of the Board, to fill one of the vacancies created by the resignations described above. In addition, upon effectiveness of the resignations described above, Mr. Bailey was appointed as the Company’s Interim Chief Investment Officer, to serve in such offices at the pleasure of the Board, and until his successor has been appointed by the Board.

In connection with his appointment as Interim Chief Investment Officer of the Company, the Company agreed to issue Mr. Bailey 300,000 non-statutory stock options, exercisable at $1.00 per share, all of which stock options vested upon the date of grant.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

We believe that as of the date of this report they were all current in their 16(a) reports.

| 16 |

Board of Directors

Our Board of Directors currently consists of two members. Our directors serve one-year terms. Our Board of Directors has affirmatively determined that there are currently no independent directors serving on our board.

Committees of the Board of Directors

Audit Committee

We do not have a standing audit committee of the Board of Directors. Management has determined not to establish an audit committee at present because of our limited resources and limited operating activities do not warrant the formation of an audit committee or the expense of doing so. We do not have a financial expert serving on the Board of Directors or employed as an officer based on management’s belief that the cost of obtaining the services of a person who meets the criteria for a financial expert under Item 401(e) of Regulation S is beyond its limited financial resources and the financial skills of such an expert are simply not required or necessary for us to maintain effective internal controls and procedures for financial reporting in light of the limited scope and simplicity of accounting issues raised in its financial statements at this stage of its development.

Governance, Compensation and Nominating Committee

We do not have a standing governance, compensation and nominating committee of the Board of Directors. Management has determined not to establish governance, compensation and nominating committee at present because of our limited resources and limited operations do not warrant such a committee or the expense of doing so.

Code of Ethics

The Company has adopted the following code of ethics for officers, directors and employees:

| - | Show respect towards others in the workplace |

| - | Conduct all business activities in a fair and ethical manner |

| - | Work dutifully and responsibly for the Company’s shareholders and stakeholders |

The Company has provided its code of ethics on its website, of which a copy can be obtained by visiting http://www.gexmanagement.com or by calling the Company at 877.210.4396.

Limitation of Liability of Directors

Pursuant to the Texas Business Organizations Code, our Amended and Restated Articles of Incorporation exclude personal liability for our Directors for monetary damages based upon any violation of their fiduciary duties as Directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, or any transaction from which a Director receives an improper personal benefit. This exclusion of liability does not limit any right which a Director may have to be indemnified and does not affect any Director’s liability under federal or applicable state securities laws.

Legal Proceedings

During the past ten years, none of our present or former directors, executive officers or persons nominated to become directors or executive officers:

(1) A petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2) Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

| 17 |

(3) Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

(i) Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) Engaging in any type of business practice; or

(iii) Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4) Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

(5) Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

(6) Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

(7) Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

(i) Any Federal or State securities or commodities law or regulation; or

(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8) Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

| 18 |

Material Changes to the Procedures by which Security Holders May Recommend Nominees

There have been no material changes to the procedures by which security holders may recommend nominees to the registrants Board of Directors.

ITEM 11. EXECUTIVE COMPENSATION

Compensation of Executive Officers

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the named executive officers paid by us during the fiscal years ended December 31, 2018 in all capacities for the accounts of our executives, including the Interim Chief Executive Officer (“Interim CEO”) and Interim Chief Operating Officer (“Inteim COO”):

The following officers received the following compensation for the years ended December 31, 2018. These officers have employment contracts with the Company.

| Name and principal position | Year | Salary | Bonus | Stock Awards | Option Awards | Non-equity incentive plan compensation | Nonqualified deferred compensation | All other compensation | ||||||||||||||||

| Srikumar Vanamali, | 2018 | $ | 100,000 | None | None | 300,000 | None | None | None | |||||||||||||||

| Interim CEO/President | 2017 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||

| Shaheed Bailey, | 2018 | - | None | None | 300,000 | None | None | None | ||||||||||||||||

| Interim Chief Investment Officer | 2017 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||

| Option Awards | Stock Awards | |||||||||||||||

| Name and principal position | Number of Securities Underlying Unexercised options (#) exercisable | Number of Securities Underlying Unexercised options (#) Unexercisable | Equity incentive plan awards | Option exercise price | Option

expiration date | Number of share awards that have not vested | ||||||||||

| Srikumar Vanamali, Interim CEO/President | 300,000 | None | None | $ | 1 | N/A | None | |||||||||

| Shaheed Bailey, Interim CIO | 300,000 | None | None | $ | 1 | N/A | None | |||||||||

Employment Agreements

We have employment agreements in place with each of the above referenced officers of the Company.

| 19 |

Compensation of Directors

Directors do not receive any compensation for their services as directors. The Board of Directors has the authority to establish the compensation of directors. No amounts have been paid to, or accrued to, directors in such capacity.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

As of December 31, 2018, the following persons were known to have owned 5% or more of GEX Management’s Common Stock, as well as the Company’s officers and directors.

Name and Address of Beneficial Owner, Officer or Director | Amount Beneficially Owned | Percent of Class | ||||||

| Carl Dorvil | 6,438,788 | 20.79 | % | |||||

| SETCO Holding | 15,000,000 | 48.43 | % | |||||

| Directors and Officers as a Group1 | N/A | N/A | % | |||||

| Directors and Officers as a Group | ||||||||

| 12001 N. Central Expy., Suite 825 | ||||||||

| Dallas, Texas 75243 | ||||||||

1 The Current Board of Directors comprising of Srikumar Vanamali and Shaheed Bailey did not own GEX Common Stock as of December 31, 2018.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS AND DIRECTOR INDEPENDENCE

On March 1, 2015, the Company entered into a Loan Agreement with P413 Management, LLC (“P413”). P413 agreed to loan the Company up to $500,000 at a rate of 6%. On November 1, 2017, this line of credit was increased to $1,000,000. On September 1, 2018, P413 extended a $1,000,000 line of credit to GEX Staffing, Inc. under the same terms. GEX shareholder, Carl Dorvil, is a majority member interest owner in P413. These lines of credits have a balance of $1,168,933 and $352,100 at December 31, 2018 and 2017, respectively. The LOCs are due and payable on September 1, 2019.

The Company does not have any independent directors serving on the Board of Directors.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit Fees

The aggregate fees billed for professional services rendered by our auditors, for the audit of our annual financial statements and review of the financial statements included in our Form S-1, Form 10-K and Form 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the year ended December 31, 2018 and 2017 was $38,000 and $21,000.

Audit Related Fees

None.

Tax Fees

None.

All Other Fees

None.

| 20 |

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

Exhibits

XBRL

| 21 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on April 15, 2019.

| GEX Management, Inc. | ||

| By: | /s/ Srikumar Vanamali | |

| Srikumar Vanamali | ||

| Interim Chief Executive Officer | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned hereunto duly authorized.

| Name | Title | Date | |||

| By: | /s/ Srikumar Vanamali | Interim Chief Executive Officer and Chairman of the Board | April 15, 2019 | ||

| Srikumar Vanamali | |||||

| By: | /s/ Shaheed Bailey | Interim Chief Investment Officer, Director | April 15, 2019 | ||

| Shaheed Bailey | |||||

| 22 |

GEX MANAGEMENT, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| 23 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

GEX Management, Inc.

We were engaged to audit the accompanying consolidated balance sheet of GEX Management, Inc. (the “Company”) as of December 31, 2018, the related consolidated statements of operations, stockholders’ equity (deficit) and cash flow for the year then ended, and the related notes and schedules (collectively referred to as the “financial statements”). As described in the following paragraph, because the Company was unable to provide all required information to satisfy us, we were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the financial statements. We do not express an opinion on these financial statements.

The Company was unable to provide us all required information in time till the due date for its annual filing which left us unable to complete our audit procedures and form an opinion on its financial statements. Further, the financial statements of the Company as of December 31, 2017 were audited by other independent auditors. Those independent auditors expressed an unqualified opinion on the financial statements referred to in their report dated April 6, 2018.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

/s/ AJSH & Co LLP

AJSH & Co LLP

We have served as the Company’s Auditor since 2018.

New Delhi, India

April 12, 2019

| 24 |

Consolidated Balance Sheets

December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 39,782 | $ | 410,096 | ||||

| Accounts Receivable, net | - | 91,532 | ||||||

| Accounts Receivable - Related Party | - | 30,771 | ||||||

| Other Current Assets and Prepaid | 2,950,607 | 88,749 | ||||||

| Total Current Assets | $ | 2,990,388 | $ | 621,148 | ||||

| Property and Equipment, net | 13,400,408 | 2,463,377 | ||||||

| Other Assets | 1,409,699 | 4,471 | ||||||

| Total Assets | $ | 16,800,495 | $ | 3,088,996 | ||||

| Liabilities and Shareholders’ Equity (Deficit) | ||||||||

| Current Liabilities: | ||||||||

| Accounts Payable | $ | 71,020 | $ | 48,280 | ||||

| Accrued Expenses and Other | 2,070,037 | 20,514 | ||||||

| Accrued Interest Payable | 103,524 | 7,433 | ||||||

| Notes Payable - Current Portion | 6,026,039 | 56,649 | ||||||

| Total Current Liabilities | 8,270,620 | 132,876 | ||||||

| Long-term liabilities: | ||||||||

| Notes Payable | 1,091,360 | 1,254,271 | ||||||

| Lines of Credit - Related Party | 1,168,933 | 352,100 | ||||||

| Total Long-Term Liabilities | 2,260,293 | 1,606,371 | ||||||

| Total Liabilities | 10,530,913 | 1,739,247 | ||||||

| Commitments and contingencies (Note 10) | ||||||||

| Shareholders’ Equity (Deficit) | ||||||||

| Preferred Stock, $0.001 par value, 20,000,000 shares authorized, 0 shares issued and outstanding | — | — | ||||||

| Common Stock, $0.001 par value, 200,000,000 shares authorized, and 30,90,637 and 11,797,231 shares issued and outstanding | 30,990 | 11,797 | ||||||

| Additional Paid-In-Capital | 12,656,865 | 2,651,178 | ||||||

| Accumulated Deficit | (6,418,273 | ) | (1,313,226 | ) | ||||

| Total Shareholders’ Equity (Deficit) | 6,269,582 | 1,349,749 | ||||||

| Total Liabilities and Shareholders’ Equity (Deficit) | $ | 16,800,495 | $ | 3,088,996 | ||||

See accompanying notes to the consolidated financial statements.

| 25 |

Consolidated Statements of Operations Years Ended

December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Revenues | $ | 8,762,332 | $ | 8,303,088 | ||||

| Revenues - Related Party | 104,000 | |||||||

| Total Revenues | 8,762,332 | 8,407,088 | ||||||

| Cost of Revenues | 8,212,813 | 8,261,921 | ||||||

| Gross Profit | 549,519 | 145,167 | ||||||

| Operating Expenses: | ||||||||

| Depreciation and Amortization | 1,927,170 | 58,002 | ||||||

| Selling and Advertising | 15,464 | 139,938 | ||||||

| General and Administrative | 8,106,045 | 973,095 | ||||||

| Total Operating Expenses | 10,048,679 | 1,171,035 | ||||||

| Total Operating Loss | (9,499,160 | ) | (1,025,868 | ) | ||||

| Other Income (Expense) | ||||||||

| Gain on Extinguishment of Debt | — | 172,872 | ||||||

| Gain on Disposition of Asset/Equity Interest | 2,130,000 | — | ||||||

| Interest Income | — | — | ||||||

| Interest Expense | (247,963 | ) | (14,039 | ) | ||||

| Derivative Gain (Losses) | 2,418,479 | — | ||||||

| Other Income (Expense) | 93,598 | — | ||||||

| Net Other Income (Expense) | 4,394,114 | 158,833 | ||||||

| Net Loss Before Income Taxes | (5,105,047 | ) | (867,035 | ) | ||||

| Provision for Income Taxes | — | — | ||||||

| Net Loss | $ | (5,105,047 | ) | $ | (867,035 | ) | ||

| Income per common share: | ||||||||

| Net loss per common share – basic | $ | (00.16 | ) | $ | (0.08 | ) | ||

| Net loss per common share – diluted | $ | (0.16 | ) | $ | (0.08 | ) | ||

| Weighted Average Shares: | ||||||||

| Basic | 30,990,637 | 11,362,120 | ||||||

| Diluted | 30,990,637 | 11,362,120 | ||||||

See accompanying notes to the consolidated financial statements.

| 26 |

Consolidated Statement of Changes in Shareholders’ Equity (Deficit)

Years Ended December 31, 2018 and 2017

| Preferred | Common | Additional Paid-In- | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2016 | — | $ | — | 10,988,036 | $ | 10,988 | $ | 374,397 | $ | (446,191 | ) | $ | (60,806 | ) | ||||||||||||||

| Issuance of Common Shares for Cash | 366,684 | 367 | 826,721 | 827,088 | ||||||||||||||||||||||||

| Issuance of Common Shares for Services | 47,780 | 48 | 74,702 | 74,750 | ||||||||||||||||||||||||

| Issuance of Common Shares for Assets | 200,000 | 200 | 1,149,800 | 1,150,000 | ||||||||||||||||||||||||

| Issuance of Common Shares for Expenses | 1,067 | 1 | 7,879 | 7,880 | ||||||||||||||||||||||||

| Issuance of Common Shares for Debt and Interest | 153,664 | 153 | 172,719 | 172,872 | ||||||||||||||||||||||||

| Issuance of Common Shares for Accrued Liabilities | 40,000 | 40 | 44,960 | 45,000 | ||||||||||||||||||||||||

| Net Loss | (867,035 | ) | (867,035 | ) | ||||||||||||||||||||||||

| Balance at December 31, 2017 | — | $ | — | 11,797,231 | 11,797 | 2,651,178 | (1,313,226 | ) | $ | 1,349,749 | ||||||||||||||||||

| Issuance of Common Shares for Cash | 19,456 | 19 | 48,621 | 48,640 | ||||||||||||||||||||||||

| Issuance of Common Shares for Services | 3,941,611 | 3,942 | 4,844,225 | 4,848,167 | ||||||||||||||||||||||||

| Issuance of Common Shares for Assets | 15,000,000 | 15,000 | 4,860,000 | 4,875,000 | ||||||||||||||||||||||||

| Issuance of Common Shares for Expenses | — | — | — | — | ||||||||||||||||||||||||

| Issuance of Common Shares for Debt and Interest | 232,339 | 232 | 252,841 | 253,073 | ||||||||||||||||||||||||

| Issuance of Common Shares for Accrued Liabilities | — | — | — | — | ||||||||||||||||||||||||

| Net Loss | (5,105,047 | ) | (5,105,047 | ) | ||||||||||||||||||||||||

| Balance at December 31, 2018 | — | $ | — | 30,990,637 | $ | 30,990 | $ | 12,656,865 | $ | (6,418,273 | ) | $ | 6,269,582 | |||||||||||||||

See accompanying notes to the consolidated financial statements.

| 27 |

Consolidated Statements of Cash Flow

Years Ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Operating Activities: | ||||||||

| Net Loss | $ | (5,105,047 | ) | (867,035 | ) | |||

| Adjustments to reconcile net loss to net cash used by operating activities: | ||||||||

| Depreciation and Amortization | 1,927,170 | 58,002 | ||||||

| Stock Issued for Services | 4,848,167 | 74,750 | ||||||

| Stock Issued for Expenses | - | 7,880 | ||||||

| Write Off Balance of Contract Paid with Shares | 11,343 | |||||||

| Gain on Extinguishment of Debt | (172,872 | ) | ||||||

| Change in Assets and Liabilities: | ||||||||

| Accounts Receivable | 91,532 | 9,288 | ||||||

| Accounts Receivable - Related Party | 30,771 | (7,271 | ) | |||||

| Other Current Assets/Liabilities | (2,861,858 | ) | (118,373 | ) | ||||

| Other Assets/Liabilities | (8,208,189 | ) | (4,471 | ) | ||||

| Accounts Payable | 22,740 | 44,448 | ||||||

| Accrued Expenses and other payables | 2,049,523 | (40,101 | ) | |||||

| Accrued Interest Payable | 96,091 | 14,038 | ||||||

| Net Cash Used by Operating Activities | $ | (7,109,099 | ) | (990,374 | ) | |||

| Investing Activities: | ||||||||

| Purchase of Contracts | — | (37,500 | ) | |||||

| Investment in Equity Interest | (750,000 | ) | — | |||||

| Purchase of Fixed Assets | — | (2,613 | ) | |||||

| Net Cash Used in Investing Activities | $ | (750,000 | ) | $ | (40,113 | ) | ||

| Financing Activities: | ||||||||

| Proceeds from Common Stock/APIC | 48,640 | 827,088 | ||||||

| Proceeds from Line of Credit - Related Party, net | 816,833 | 306,100 | ||||||

| Payments/Proceeds on long-term debt | (653,922 | ) | ||||||

| Payments/Proceeds on short-term debt | 5,969,390 | |||||||

| Net Cash Provided by Financing Activities | $ | 7,488,785 | $ | 1,133,188 | ||||