UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2019

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File No. 000-55673

ANVIA HOLDINGS CORPORATION

(Exact name of small business issuer as specified in its charter)

| DELAWARE | 81-3416105 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

100 Challenger Road, Suite 830, Ridgefield Park, NJ 07660

(Address of principal executive offices)

(323) 713-3244

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company,” and emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | ANVV | OTC Markets Group |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The number of shares of Common Stock, $0.0001 par value, of the registrant outstanding at March 31, 2019 was 42,257,878.

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Form 10-Q”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties.

Forward-looking statements may include the words “may,” “could,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “desire,” “goal,” “should,” “objective,” “seek,” “plan,” “strive” or “anticipate,” as well as variations of such words or similar expressions, or the negatives of these words. These forward-looking statements present our estimates and assumptions only as of the date of this Form 10-Q. Except for our ongoing obligation to disclose material information as required by the federal securities laws, we do not intend, and undertake no obligation, to update any forward-looking statement. We caution readers not to place undue reliance on any such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes will likely vary materially from those indicated.

| 3 |

ANVIA HOLDINGS CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| March 31, 2019 | December 31,2018 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and bank balances | $ | 188,603 | $ | 248,253 | ||||

| Trade receivable | 376,184 | 547,846 | ||||||

| Other receivables and deposits | 363,514 | 1,399,023 | ||||||

| Amount owing by directors | - | |||||||

| Total Current Assets | 928,301 | 2,195,122 | ||||||

| Non-current assets: | ||||||||

| Plant and equipment, net | 440,831 | 485,050 | ||||||

| Intangible assets | 6,929 | 7,526 | ||||||

| Other investments | 912,294 | 160,354 | ||||||

| Goodwill | 2,937,263 | 3,199,274 | ||||||

| Total non-current asset | 4,297,317 | 3,852,204 | ||||||

| TOTAL ASSETS | $ | 5,225,618 | $ | 6,047,326 | ||||

| LIABILITIES | ||||||||

| Current Liabilities: | ||||||||

| Trade payable | $ | 49,766 | $ | 325,971 | ||||

| Other payables and accrued liabilities | 2,262,788 | 3,310,262 | ||||||

| Embedded conversion option liability | 9,232,412 | 2,412,285 | ||||||

| Convertible notes payable, net of debt discount | 1,575,858 | 221,222 | ||||||

| Amount owing to directors | 503,940 | 785,797 | ||||||

| Income tax payable | 589,242 | 5,448 | ||||||

| Total Current Liabilities | 14,214,006 | 7,060,985 | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Stockholders’ Equity | ||||||||

| Series A Preferred stock, $0.0001 par value, 100,000,000 shares authorized; 42,257,877 and 41,004,994 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 4,226 | 4,101 | ||||||

| Discount on common stock | (500 | ) | (500 | ) | ||||

| Additional paid in capital | 2,633,127 | 1,956,402 | ||||||

| Stock subscriptions received in advance | (262,768 | ) | ||||||

| Accumulated losses | (11,246,233 | ) | (2,848,437 | ) | ||||

| Other comprehensive expense | (118,560 | ) | (127,020 | ) | ||||

| Total equity attributable to owners of the Company | (8,990,708 | ) | (1,015,454 | ) | ||||

| Non-controlling interests | 2,320 | 1,795 | ||||||

| Total stockholders’ equity | (8,988,388 | ) | (1,013,659 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS EQUITY | $ | 5,225,618 | $ | 6,047,326 | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

| 4 |

ANVIA HOLDINGS CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| For the Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Revenue | $ | 1,678,069 | $ | 17,839 | ||||

| Cost of Revenue | (49,876 | ) | (4,369 | ) | ||||

| Gross Profit | 1,628,193 | 13,470 | ||||||

| Operating Expenses / Income: | ||||||||

| General and administrative | (2,464,282 | ) | (47,478 | ) | ||||

| Other income | 1,321 | 65 | ||||||

| Total Operating Expenses | (2,940,793 | ) | - | |||||

| Loss from Operations | (3,775,561 | ) | (33,943 | ) | ||||

| Finance costs | (4,621,821 | ) | - | |||||

| Loss before Tax | (8,397,382 | ) | (33,943 | ) | ||||

| Income Tax expense | - | - | ||||||

| Net Loss | $ | (8,397,382 | ) | $ | (33,943 | ) | ||

| Net profit attributable to non-controlling interests | (412 | ) | - | |||||

| Net loss attributable to the Company | $ | (8,397,794 | ) | $ | (33,943 | ) | ||

| Other comprehensive expense: | ||||||||

| Foreign currency translation gain (loss) | 8,571 | - | ||||||

| Comprehensive loss | $ | (8,389,223 | ) | $ | (33,943 | ) | ||

| Other comprehensive income attributable to non-controlling interests | (112 | ) | ||||||

| Total Comprehensive loss attributable to the Company | (8,389,335 | ) | (33,943 | ) | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

| 5 |

ANVIA HOLDINGS CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net loss | $ | (8,397,382 | ) | $ | (34,008 | ) | ||

| Adjustment to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Amortization of computer software | 597 | 1,500 | ||||||

| Depreciation of property and equipment | 92,442 | - | ||||||

| Goodwill adjustments | 262,010 | - | ||||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | 1,207,171 | 76,128 | ||||||

| Accounts payable | (730,967 | ) | (11,850 | ) | ||||

| Net Cash (Used in)/Provided by Operating Activities | (7,566,129 | ) | 31,770 | |||||

| Cash Flows from Investing Activities | ||||||||

| Acquisition of other investments | (751,941 | ) | - | |||||

| Acquisition of plant and equipment | (48,223 | ) | - | |||||

| Net cash paid for earnest deposit for acquisitions | - | (52,853 | ) | |||||

| Net Cash Used In Financing Activities | (800,164 | ) | (52,853 | ) | ||||

| Cash Flows from Financing Activities | ||||||||

| Cash proceeds from issuance of share capital | 414,083 | - | ||||||

| Cash proceeds from issuance of: | ||||||||

| - Embedded conversion option liability | 6,820,126 | - | ||||||

| - Convertible notes payable, net of debt discount | 1,354,636 | - | ||||||

| Cash proceeds advanced from related party | (281,857 | ) | 21,359 | |||||

| Repayment to Directors | - | |||||||

| Net Cash Provided by Financing Activities | 8,306,988 | 21,359 | ||||||

| Effect of exchange rate changes on cash | (345 | ) | (11 | ) | ||||

| Net Increase in Cash and Cash Equivalents | (59,650 | ) | 265 | |||||

| Cash and Cash Equivalents, Beginning of the Period | 248,253 | 468 | ||||||

| Cash and Cash Equivalents, End of the Period | $ | 188,603 | $ | 733 | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

| 6 |

ANVIA HOLDINGS CORPORATION AND SUBSIDIARY

Notes to Condensed Consolidated Financial Statements

March 31, 2019

(Unaudited)

NOTE 1 – ORGANIZATION AND BUSINESS BACKGROUND

Anvia Holdings Corporation (formerly Dove Street Acquisition Corporation) was incorporated on July 22, 2016 under the laws of the state of Delaware. The Company is engaged in the development and commercialization of web-based technology, the “Anvia Loyalty” and “Anvia Learning” mobile applications, and other intellectual property (collectively the “Anvia Technology”), as evidenced by the introduction of the Anvia Technology into the stream of commerce, and the Company’s commercial relationships with third parties.

On January 10, 2017, the Company effected a change of control by cancelling an aggregate of 19,500,000 shares of common stock of existing shareholders, issuing 5,000,000 shares of common stock to its sole officer and director; electing new officer and director and accepting the resignations of its then existing officers and directors. In connection with the change of control, the sole shareholder of the Company and its board of directors unanimously approved the change of the Company’s name from Dove Street Acquisition Corporation to Anvia Holdings Corporation.

The principal office address is located at 100 Challenger Road, Suite 830, Ridgefield Park, NJ 07660.

| 7 |

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

These accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

Going concern

The Company’s consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has generated minimal revenue and has sustained operating losses since inception to date and allow it to continue as a going concern. The continuation of the Company as a going concern is dependent upon the ability of the Company to obtain necessary financing to continue operations, and the attainment of profitable operations. The Company incurred a net loss of $8,397,382 for the period ended March 31, 2019, incurred a net current liability or working capital deficit is 13,285,705 and an accumulated loss of $11,246,233 as of March 31, 2019. These factors, among others, raise a substantial doubt regarding the Company’s ability to continue as a going concern. If the Company is unable to obtain adequate capital, it could be forced to cease operations. The accompanying consolidated financial statements do not include any adjustments to reflect the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the valuation of accounts receivable, accounts payable, accrued liabilities, payable to related party, valuation of beneficial conversion features in convertible debt, valuation of derivatives, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash and cash equivalents

Cash and cash equivalents represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Plant and equipment

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis to write off the cost over the following expected useful lives of the assets concerned. The principal annual rates used are as follows:

| Categories | Principal Annual Rates | |

| Computer and software | 20% | |

| Furniture and fittings | 20% | |

| Renovation | 20% | |

| Motor vehicles | 20% |

Fully depreciated plant and equipment are retained in the financial statements until they are no longer in use.

| 8 |

Intangible assets

Intangible assets are stated at cost less accumulated amortization. Intangible assets represented the registration costs of trademarks, which are amortized on a straight-line basis over a useful life of five years.

The Company follows ASC Topic 350 in accounting for intangible assets, which requires impairment losses to be recorded when indicators of impairment are present and the undiscounted cash flows estimated to be generated by the assets are less than the assets’ carrying amounts. There was no impairment losses recorded on intangible assets for the year ended March 31, 2019.

Deferred income

Deferred income refers to fees received in advance for services which have not yet been performed. Deferred income is classified on the consolidated balance sheet as current liability.

Revenue recognition

The Company provides vocational training, consulting services for assets and education for construction tradesman that need qualifications for roofing, plumbing, home renovation, electrical and carpentry. The Company’s training packages vary in price according to the different types of vocational training and education programs purchased by the customers. The Company recognizes revenue upon the completion of the vocational training courses and education programs offered to its customers. The Company recognizes as revenue any deposits previously received, as they are non-refundable upon commencement of the vocational training courses.

The Company’s revenue recognition policy is based on the revenue recognition criteria established in accordance with Accounting Standards Codification (ASC) 605. The criteria and how the Company satisfies each element are as follows: (1) persuasive evidence of an arrangement – the Company and the customer enters into a signed contract; (2) delivery has occurred – as noted above, upon the commencement of the training course, the deposit is non-refundable per the terms of the signed contract and upon completion of the course, the Company has provided all services to be delivered to the customer under the contract; (3) the price is fixed and determinable – the signed contract indicates a fixed dollar amount for the training for the courses enrolled by the customer; (4) collectability is reasonable assured – the Company receives as payment a deposit and the balance of the training upon the completion of the training course.

Comprehensive income

ASC Topic 220, “Comprehensive Income” establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying statements of stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation and cumulative net change in the fair value of available-for-sale investments held at the balance sheet date. This comprehensive income is not included in the computation of income tax expense or benefit.

Income tax expense

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclosed in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

| 9 |

The Company conducts major businesses in Malaysia and is subject to tax in their own jurisdictions. As a result of its business activities, the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

Foreign currencies translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The functional currency of the Company is the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the Company maintains its books and record in a local currency, Malaysian Ringgit (“MYR” or “RM”) and Australian Dollars (“AUD”), which is functional currency as being the primary currency of the economic environment in which the entity operates.

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income.

Translation of amounts from the local currency of the Company into US$1 has been made at the following exchange rates for the respective years:

| 31 March, 2019 | 31 December, 2018 | |||||||

| Year-end US$1 : MYR exchange rate | 4.0800 | 4.1300 | ||||||

| Yearly average US$1 : MYR exchange rate | 4.0899 | 4.0307 | ||||||

| Year-end AUD : US$1 exchange rate | 0.7104 | 0.7046 | ||||||

| Yearly average AUD : US$1 exchange rate | 0.7122 | 0.7482 | ||||||

| Year-end US$1 : Philippine Pesos exchange rate | 52.6944 | 52.5000 | ||||||

| Yearly average US$1 : Philippine Pesos exchange rate | 52.3827 | N/A | ||||||

Related parties

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

Fair value of financial instruments

The carrying value of the Company’s financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables, amount due to related parties and other payables approximate at their fair values because of the short-term nature of these financial instruments.

| 10 |

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

Level 1: Observable inputs such as quoted prices in active markets;

Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions

As of December 31, 2018, and 2017, the Company did not have any nonfinancial assets and liabilities that are recognized or disclosed at fair value in the financial statements, at least annually, on a recurring basis, nor did the Company have any assets or liabilities measured at fair value on a non-recurring basis.

Earnings (Loss) per share

The Company computes net earnings (loss) per share in accordance with ASC 260, “Earnings per Share”. ASC 260 requires presentation of both basic and diluted net earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing earnings (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible note and preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive.

Recent accounting pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

Recent accounting pronouncements (continued)

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”). ASU 2014-09 supersedes the revenue recognition requirements in “Revenue Recognition (Topic 605)”, and requires entities to recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services. ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early adoption is not permitted. In August 2015, the FASB issued an Accounting Standards Update to defer by one year the effective dates of its new revenue recognition standard until annual reporting periods beginning after December 15, 2017 (2018 for calendar-year public entities) and interim periods therein. This adoption will not have a material impact on our financial statements.

In June 2014, the FASB issued ASU 2014-15, “Presentation of Financial Statements-Going concern (Subtopic 205-40) which provides guidance to an organization’s management, with principles and definitions that are intended to reduce diversity in the timing and content of disclosures that are commonly provided by organizations today in the financial statement footnotes. This guidance in ASU 2014-15 is effective for annual periods ending after December 15, 2016, and interim periods within annual periods beginning after December 15, 2016. Early application is permitted for annual or interim reporting periods for which the financial statements have not previously been issued. This adoption will not have a material impact on our financial statements.

In February 2015, the FASB issued ASU 2015-02 “Consolidation (Topic 810): Amendments to the Consolidation Analysis.” ASU 2015-02 changes the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. It is effective for annual reporting periods, and interim periods within those years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period. This adoption will not have a material impact on our financial statements.

| 11 |

In July 2015, the FASB issued ASU 2015-11, Inventory, which requires an entity to measure inventory within the scope at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. The effective date for the standard is for fiscal years beginning after December 15, 2016. Early adoption is permitted. We will recognize our inventories at cost or net realizable value, whichever lower.

In February 2016, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842). Under the new guidance, lessees will be required recognize the following for all leases (with the exception of short-term leases) at the commencement date: 1) A lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted basis; and 2) A right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term. The new lease guidance simplified the accounting for sale and leaseback transactions primarily because lessees must recognize lease assets and lease liabilities. Lessees will no longer be provided with a source of off-balance sheet financing. The amendments in this ASU are effective for fiscal years beginning after December 15, 2019, including interim periods within those years. The Company is evaluating this ASU and has not determined the effect of this standard on its ongoing financial reporting.

In January 2017, the FASB issued Accounting Standards Update No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business (ASU 2017-01), which revises the definition of a business and provides new guidance in evaluating when a set of transferred assets and activities is a business. We will adopt the new standard effective January 1, 2018, on a prospective basis and do not expect the standard to have a material impact on our consolidated financial statements.

3. CASH AND CASH EQUIVALENTS

Cash and cash equivalents represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

The Group had cash balances of $188,603 and $248,253 as of March 31, 2019 and December 31, 2018, respectively.

4. ACCOUNTS RECEIVABLE

The Group recorded a trade receivable of $376,184 and $547,846 as of March 31, 2019 and December 31, 2018, respectively.

Whilst, other receivables are recorded at $363,514 and 1,399,023 as of March 31, 2019 and December 31, 2018, respectively

5. PLANT AND EQUIPMENT, NET

During quarter under review, the Group acquired plant and equipment for an amount of $48,223 and recorded a depreciation of $92,442.

6. INTANGIBLE ASSETS, NET

During quarter under review, the Group amortized its intangible assets by an amount of $597.

7. OTHER INVESTMENTS

During quarter under review, the Group acquired other investments for an amount of $751,941.

| 12 |

8. TRADE PAYABLES, OTHER PAYABLES AND ACCRUED LIABILITIES

As at 31 March 2019, the Group recorded a trade payable of $49,766 (2018: $325,971) and other payables of $2,262,788 (2018: $ 3310,262) respectively.

9. CONVERTIBLE NOTES PAYABLES, NET OF DEBT DISCOUNT

On June 5, 2018, the Company entered into an Equity Financing Agreement and Registration Rights Agreement with GHS Investments, LLC (the “GHS”) pursuant to which GHS has agreed to purchase up to $10,000,000 in shares of Company common stock. The obligations of GHS to purchase the shares of Company common stock are subject to the conditions set forth in the Equity Financing Agreement, including, without limitation, the condition that a registration statement on Form S-1 registering the shares of Company common stock to be sold to GHS be filed with the Securities and Exchange Commission and become effective. The Registration Rights Agreement provides that the Company shall use commercially reasonable efforts to file the registration statement within 30 days after the date of the Registration Rights Agreement and have the registration statement become effective within 90 days after it is filed. The purchase price of the shares of Company common stock will be equal to 80% of the market price (as determined in the Equity Financing Agreement) calculated at the time of purchase. In connection with the Equity Financing Agreement, the Company executed a convertible promissory note in the principal amount of $40,000 (the “GHS Note”) as payment of the commitment fee for the Equity Financing Agreement. The GHS Note bears interest at the rate of 8% and must be repaid on or before March 5, 2019. For the three months ended March 31, 2019, the Company has accrued and recorded an interest expense of $ 955.99 on the GHS Note. The commitment fee in the principal amount of $ 40,000 is paid from the company according the date in the agreement.

On June 21, 2018, the Company executed a $333,000 Convertible Promissory Note (the “Note”) with Labrys Fund, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on December 21, 2018 (the “Maturity Date”). This note in paid on time from the Company. The total consideration received against the Note was $303,000, with the Note bearing $30,000 Original Issue Discount (the “OID”) and $3,000 for legal expenses. Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remained payable regardless of time and manner of payment by the Company. The Maturity Date was December 21, 2018 the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, have been due and paid on December 18, 2019.

For both the three months and twelve months ended December 31, 2018, the Company has recognized interest expense of 30,000 related to the amortization of the OID, interest expense of $ 17,915.18 on the Note and $321,073 related to the amortization of the beneficial conversion feature discount as it related to this Note.

On November 15, 2018, the Company executed a $250,000 Convertible Promissory Note (the “Note”) with EMA Fund, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on May 15, 2019 (the “Maturity Date”). The total consideration received against the Note was $222,500, with the Note bearing $25,000 Original Issue Discount (the “OID”) and $2,500 for legal expenses. Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remains payable regardless of time and manner of payment by the Company. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before May 15, 2019 without any prepayment penalties. This note is paid on May 10, 2019. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 565,321 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 13 |

In connection with the issuance of the Note, the Company recorded a debt discount related to the OID in the amount of $25,000 which will be amortized to interest expense over the term of the loan. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $444,873 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $1 at issuance date, a risk-free interest rate of 2.12%, expected volatility of the Company’s stock of 264.64%. For the three months March 31, 2019, the Company has recognized interest expense of $ 12,500.00 related to the amortization of the OID, interest expense of $ 7,397.26 on the Note and $ 112,500.00 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at November 15, 2018, December 31, 2018 and March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ (869,564.14), which was included in other expenses.

Additionally, in connection with the Note, the Company also issued 31,250 shares of common stock of the Company to the holder as a commitment fee for this note on November 15, 2018. The commitment shares fair value was calculated as $31,250 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at December 31, 2018.

On November 29, 2018, the Company executed a $660,000 Convertible Promissory Note (the “Note”) with LABRYS Fund, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on May 29, 2019 (the “Maturity Date”). The total consideration received against the Note was $600,000, with the Note bearing $60,000 Original Issue Discount (the “OID”) and $6,000 for legal expenses. Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remains payable regardless of time and manner of payment by the Company. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before May 29, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 1,483,523 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 14 |

In connection with the issuance of the Note, the Company recorded a debt discount related to the OID in the amount of $60,000 which will be amortized to interest expense over the term of the loan. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $1,094,778 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $1.03 at issuance date, a risk-free interest rate of 2.12%, expected volatility of the Company’s stock of 266.57%. For the three months ended March 31, 2019, the Company has recognized interest expense of $ 30,000.00 related to the amortization of the OID, interest expense of $ 19,528.77 on the Note and $ 300,000.00 related to the amortization of the beneficial conversion feature discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at November 29, 2018, December 31, 2018 and March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months and twelve months ended March 31, 2019 of $ (2,292,808.61), which was included in other expenses.

Additionally, in connection with the Note, the Company also issued 1,000,000 shares of common stock of the Company to the holder as a security deposit, provided however, the shares must be returned to the Company’s treasury if the Note is fully repaid and satisfied prior to the Maturity Date. The refundable shares fair value was calculated as $1,030,000.00 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at December 31, 2018.

The Company also issued 120,000 shares of common stock of the Company to the holder as a commitment fee for this note. The commitment shares fair value was calculated as $123,600 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at December 31, 2018.

On January 15, 2019, the Company executed a $110,000 Convertible Promissory Note (the “Note”) with TFK Investments, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on July 15, 2019 (the “Maturity Date”). The total consideration received against the Note was $97,500, with the Note bearing $12,500 Original Issue Discount (the “OID”). Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remains payable regardless of time and manner of payment by the Company. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before July 15, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 243,810 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 15 |

In connection with the issuance of the Note, the Company recorded a debt discount related to the OID in the amount of $12,500 which will be amortized to interest expense over the term of the loan. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $ 290,552.26 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $0.94 at issuance date, a risk-free interest rate of 2.5%, expected annualized volatility of the Company’s stock of 317.01%. For the three months March 31, 2019, the Company has recognized interest expense of $ 5,069.44 related to the amortization of the OID, interest expense of $ 2,640.00 on the Note and $ 39,541.67 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note are bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ (395,971.59), which was included in other expenses.

Additionally, in connection with the Note, the Company also issued 20,000 shares of common stock of the Company to the holder as a commitment fee for this note on January 15, 2019. The commitment shares fair value was calculated as $18,800 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31, 2018.

In connection with the Note, the Company also issued 100,000 shares of common stock of the Company to the holder as a security deposit, provided however, the shares must be returned to the Company’s treasury if the Note is fully repaid and satisfied prior to the Maturity Date. The refundable shares fair value was calculated as $94,000.00 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31,2019.

On February 19, 2019, the Company executed a $103,000 Convertible Promissory Note (the “Note”) with Power UP, an unrelated-party (the “Lender”), bearing an interest rate of 8%, unsecured, and due on August 19, 2019 (the “Maturity Date”). The total consideration received against the Note was $103,000 and no OID. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before August 19, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

| 16 |

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 65% of the lowest trade price for the last 25 days prior to the issuance of the Note or 65% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 207,598 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

In connection with the issuance of the Note, the Company has not recorded any debt discount related to the OID as it is not applicable for this note. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $ 135,523.18 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $0.65 at issuance date, a risk-free interest rate of 2.51%, expected annualized volatility of the Company’s stock of 322.20%. For the three months March 31, 2019, the Company has recognized interest expense of $ 903.01 on the Note and $ 22,888.89 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ (456,365.01), which was included in other expenses.

On March 15, 2019, the Company executed a $150,000 Convertible Promissory Note (the “Note”) with FirstFire, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on September 15, 2019 (the “Maturity Date”). The total consideration received against the Note was $121,440, with the Note bearing $15,000 Original Issue Discount (the “OID”) and $13,560 legal & finance cost. Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remains payable regardless of time and manner of payment by the Company. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before September 15, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 325,956 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 17 |

In connection with the issuance of the Note, the Company recorded a debt discount related to the OID in the amount of $15,000 which will be amortized to interest expense over the term of the loan. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $ 1,262,174.6 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $3.48 at issuance date, a risk-free interest rate of 2.49%, expected annualized volatility of the Company’s stock of 352.45%. For the three months March 31, 2019, the Company has recognized interest expense of $ 1,000.00 related to the amortization of the OID, interest expense of $ 591.78 on the Note and $ 9,000 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ 315,857.68, which was included in other income.

Additionally, in connection with the Note, the Company also issued 19,480 shares of common stock of the Company to the holder as a commitment fee for this note on March 15, 2019. The commitment shares fair value was calculated as $52,401.2 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31, 2019.

In connection with the Note, the Company also issued 97,402 shares of common stock of the Company to the holder as a security deposit, provided however, the shares must be returned to the Company’s treasury if the Note is fully repaid and satisfied prior to the Maturity Date. The refundable shares fair value was calculated as $262,011.38 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31,2019.

On March 15, 2019, the Company executed a $110,000 Convertible Promissory Note (the “Note”) with Crown Bridge, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on September 15, 2019 (the “Maturity Date”). The total consideration received against the Note was $96,500, with the Note bearing $11,000 Original Issue Discount (the “OID”) and $2,500 legal cost. Any interest payable is in addition to the OID, and that OID (or prorated OID, if applicable) remains payable regardless of time and manner of payment by the Company. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before September 15, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 239,035 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 18 |

In connection with the issuance of the Note, the Company recorded a debt discount related to the OID in the amount of $11,000 which will be amortized to interest expense over the term of the loan. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $ 925,594.71 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $3.48 at issuance date, a risk-free interest rate of 2.49%, expected annualized volatility of the Company’s stock of 352.45%. For the three months March 31, 2019, the Company has recognized interest expense of $ 733.33 related to the amortization of the OID, interest expense of $ 433.97 on the Note and $ 6,600 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ 231,628.96, which was included in other income.

Additionally, in connection with the Note, the Company also issued 20,000 shares of common stock of the Company to the holder as a commitment fee for this note on March 15, 2019. The commitment shares fair value was calculated as $53,800 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31, 2019.

In connection with the Note, the Company also issued 100,000 shares of common stock of the Company to the holder as a security deposit, provided however, the shares must be returned to the Company’s treasury if the Note is fully repaid and satisfied prior to the Maturity Date. The refundable shares fair value was calculated as $269,000 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31,2019.

On March 15, 2019, the Company executed a $250,000 Convertible Promissory Note (the “Note”) with Auctus Fund, an unrelated-party (the “Lender”), bearing an interest rate of 12%, unsecured, and due on September 15, 2019 (the “Maturity Date”). The total consideration received against the Note was $222,250.00, with $27,750 legal & finance cost. The Maturity Date is the date upon which the principal sum of this promissory note, as well as any unpaid interest and other fees, shall be due and payable. The Note may be prepaid at any time before September 15, 2019 without any prepayment penalties. Any amount of principal or interest on this Note which is not paid when due, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%) per annum or (ii) the maximum amount allowed by law from the due date thereof until the same is paid (the “Default Interest”). Interest shall commence accruing on the date that the Note is fully paid and shall be computed on the basis of a 365-day year and the actual number of days elapsed.

The Lender has the right in its sole and absolute discretion, from time to time, and at any time on or following the 180th calendar day after the date Note and ending on the later of (i) the Maturity Date and (ii) the date of payment of the Default Interest, each in respect of the remaining principal amount of this Note to convert all or part of the outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares of Common Stock of the Company as per the Conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. The Conversion Price is the lesser of 60% of the lowest trade price for the last 25 days prior to the issuance of the Note or 60% of the lowest market price over the 25 days prior to conversion. Total debt outstanding at March 31, 2019 pursuant to the convertible note payable resulted in potential conversion of debt into 543,260 common shares of common stock. The Note contains certain representations, warranties, covenants and events of default, and increases in the conversion discount and amount of the principal and interest rates under the Note in the event of such defaults.

| 19 |

In connection with the issuance of the Note, the Company has not recorded a debt discount related to the OID as it is not applicable. In accordance with ASC 815, the conversion feature meets the definition of a derivative and therefore requires bifurcation and is accounted for as a derivative liability. The Company recognized a debt discount related to the bifurcated embedded conversion option derivative liability in the amount of $ $ 2,103,624.35 using the Black-Scholes pricing model, which will be amortized to interest expense over the term of the Note, using effective interest method. The key valuation assumptions used consist, in part, of the price of the Company’s common stock of $3.48 at issuance date, a risk-free interest rate of 2.49%, expected annualized volatility of the Company’s stock of 352.45%. For the three months March 31, 2019, the Company has recognized interest expense of $ 986.30 on the Note and $ 16,666.67 related to the amortization of the embedded conversion option liabilities discount as it related to this Note.

Under the provisions of ASC 815-40, convertible instruments issued by the Company qualify for derivative treatment due to the variable conversion formula. The embedded conversion features of the Note is bifurcated and recorded as a liability which is revalued at fair value each reporting date. If the fair value of the embedded conversion feature exceeds the face value of the related debt, net of other discounts, the excess is recorded as a change in fair value on the issuance date. Embedded conversion features are valued at their fair value, rather than by the intrinsic value method. The Company calculated the estimated fair values of the liabilities for embedded conversion feature at March 31, 2019 with the Black-Scholes option pricing model using the closing price of the Company’s common stock at each respective date and the ranges for volatility, expected term and risk-free interest indicated above. As a result, the Company recorded a change in the fair value of the liabilities for embedded conversion option derivative instruments for the three months ended March 31, 2019 of $ 526,429.46, which was included in other income.

Additionally, in connection with the Note, the Company also issued 32,467 shares of common stock of the Company to the holder as a commitment fee for this note on March 15, 2019. The commitment shares fair value was calculated as $87,336.23 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31, 2019.

In connection with the Note, the Company also issued 162,337 shares of common stock of the Company to the holder as a security deposit, provided however, the shares must be returned to the Company’s treasury if the Note is fully repaid and satisfied prior to the Maturity Date. The refundable shares fair value was calculated as $436,686.53 being the fair value of common stock on the date of issuance (Note 9) and recorded as restricted stock receivable in the accompanying consolidated financial statements at March 31,2019.

| 20 |

10. AMOUNT OWING TO DIRECTORS

The amount owing to directors is unsecured, interest-free with no fixed repayment term.

11. INCOME TAX

No income tax is provided due to the statement of profit or loss and other comprehensive income recorded a net loss during the quarter under review.

12. FOREIGN CURRENCY EXCHANGE RATE

The Company cannot guarantee that the current exchange rate will remain stable, therefore there is a possibility that the Company could post the same amount of income for two comparable periods and because of the fluctuating exchange rate post higher or lower income depending on exchange rate converted into US$ at the end of the financial year. The exchange rate could fluctuate depending on changes in political and economic environments without notice.

13. PRIOR PERIOD ADJUSTMENTS

During the course of consolidation of current quarter financial position of the Group, management noted the following errors which may trigger prior year adjustments:

| - | No provision of dividend payable was made on Xamerg Pty Ltd (Eagle Academy) as at 31 December, 2018. | |

| - | Consolidated Sage Interactive MSC Sdn. Bhd. as at 31 December, 2018 which the Company had previously disposed-off by Sage Interactive Sdn. Bhd. |

Consequently, the management immediate notified those charged with governance the above errors. The Group is currently assessing the financial impact that may arise from the above errors and amendments to the relevant financial results will be made in due course.

14. SUBSEQUENT EVENTS

Management has evaluated subsequent events through May 20, 2019, the date the financial statements were available to be issued noting the following transactions that would impact the accounting for events or transactions in the current period or require additional disclosures.

On May 2, 2019 (The “Company” or “Anvia Holdings”) announced that it has executed a definitive agreement to acquire all of the issued and outstanding shares of XSEED Pty Ltd, an Australian Registered Training Organization.Under the agreement Anvia Holdings through its fully owned subsidiary Anvia (Australia) Pty Ltd shall acquire 100% of XSEED Pty Ltd outstanding shares for about USD 352,000 (AUD 500,000).

On May 14, 2019, the Company, through its wholly-owned subsidiary, Anvia (Australia) Pty Ltd., executed a definitive Share Sale Agreement (the “Agreement”) to acquire all of the issued and outstanding shares of Host Group of Companies Pty Ltd (Host Networks), an Australian data centre and hosting service based in Brisbane, Australia Under the Agreement the Company will acquire 100% of Host Networks from its four shareholders in exchange for $552,000 in cash and 665,066 shares of the Company’s common stock valued, for purposes of the Agreement, at $3.75 per share.

| 21 |

Item 2. Management’s Discussion and Analysis or Plan of Operation

The following discussion and analysis is based on, and should be read in conjunction with, the unaudited condensed consolidated financial statements and the notes thereto included elsewhere in this Form 10-Q. This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. The forward-looking statements in this Quarterly Report on Form 10-Q represent our views as of the date of this Quarterly Report on Form 10-Q. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Report on Form 10-Q.

We are a smaller reporting company as defined by Rule 12b-2 and incorporated in the State of Delaware on July 22, 2016. As of the periods from inception through the date of this quarterly report, we generated minimal revenues and incurred expenses and operating losses, as part of our development stage activities. We recorded a net loss of $8,397,382 for three months ended March 31, 2019, net cash flows used by operating activities was $(7,566,129), working capital deficit of $ 13,285,705 and an accumulated deficit of $11,246,233 at March 31, 2019.

We anticipate that we will need substantial working capital over the next 12 months to continue as a going concern and to expand our operations to distribute, sell and market products and solutions. Our independent auditors have expressed substantial doubt as to the ability of the Company to continue as a going concern. Unless we are able to generate sufficient cash flows from operations and/or obtain additional financing, there is a substantial doubt as to the ability of the Company to continue as a going concern. We intend to make an equity offering of our common stock for the acquisition and operation expenses. If we cannot raise the required cash, we will issue additional shares of our common stock in lieu of cash.

Our Current Business

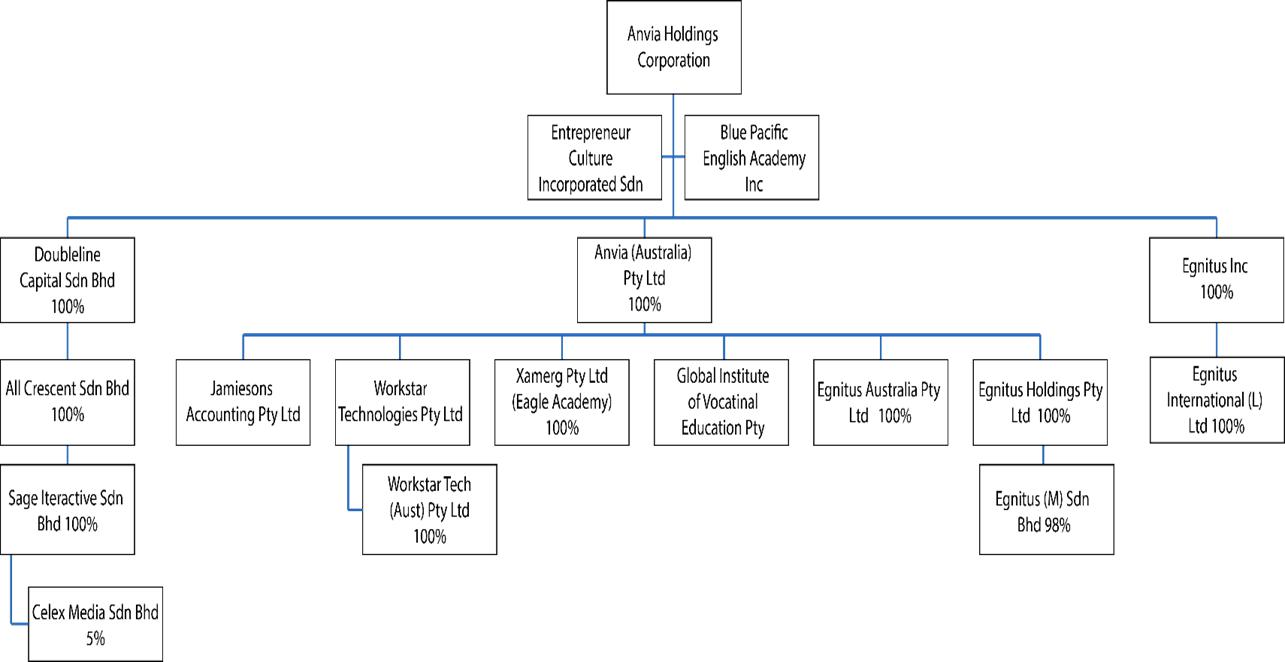

The Company has commenced operations since June 2017 and during the financial year 2018 it has completed 11 acquisitions in Australia, Malaysia, Philippines and the United States. The product development during 2017 and 2018 as well as the acquisitions by the Company have positioned the Company as a global technology company for self and business improvement. The Company now owns a number of proprietary software, mobile applications, learning and educational tools to help consumers and businesses improve and grow. The Company has a stated mission to make potential growth accessible and sustainable.