0001680873DEF 14AFALSE00016808732023-01-012023-12-310001680873hffg:ZhangMember2023-01-012023-12-31iso4217:USDxbrli:pure0001680873hffg:ZhangMember2022-01-012022-12-3100016808732022-01-012022-12-310001680873hffg:ZhangMember2021-01-012021-12-310001680873hffg:NiMember2021-01-012021-12-3100016808732021-01-012021-12-310001680873hffg:ZhangMember2020-01-012020-12-310001680873hffg:NiMember2020-01-012020-12-3100016808732020-01-012020-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberhffg:ZhangMemberecd:PeoMember2021-01-012021-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberhffg:NiMemberecd:PeoMember2021-01-012021-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberhffg:ZhangMemberecd:PeoMember2020-01-012020-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberhffg:NiMemberecd:PeoMember2020-01-012020-12-310001680873ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001680873ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001680873ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhffg:ZhangMemberecd:PeoMember2021-01-012021-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhffg:NiMemberecd:PeoMember2021-01-012021-12-310001680873ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhffg:ZhangMemberecd:PeoMember2020-01-012020-12-310001680873ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhffg:NiMemberecd:PeoMember2020-01-012020-12-310001680873ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001680873ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001680873ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001680873ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberhffg:ZhangMemberecd:PeoMember2021-01-012021-12-310001680873hffg:NiMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001680873ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberhffg:ZhangMemberecd:PeoMember2020-01-012020-12-310001680873hffg:NiMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310001680873ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001680873ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001680873hffg:ZhangMemberecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001680873hffg:NiMemberecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001680873hffg:ZhangMemberecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001680873hffg:NiMemberecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001680873ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001680873ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310001680873ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001680873ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310001680873ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001680873ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhffg:ZhangMemberecd:PeoMember2021-01-012021-12-310001680873hffg:NiMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310001680873ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310001680873ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhffg:ZhangMemberecd:PeoMember2020-01-012020-12-310001680873hffg:NiMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310001680873ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-01-012020-12-31000168087322023-01-012023-12-31000168087332023-01-012023-12-31000168087312023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material under §240.14a-12 |

HF FOODS GROUP INC

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | No fee required. |

| | |

| ☐ | Fee paid previously with preliminary materials |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

April 24, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of HF Foods Group Inc. (the “Company”), on June 3, 2024, at 12:00 PM., Eastern Time. NOTICE IS HEREBY GIVEN that the Board of Directors has determined to convene and conduct the Annual Meeting in a virtual meeting format only at www.virtualshareholdermeeting.com/hffg2024. We are pleased to utilize the virtual meeting format to provide ready access and cost savings for our stockholders and the Company. The virtual meeting format allows attendance from any location in the world. Please see the further instructions in this Proxy Statement. Stockholders will NOT be able to attend the annual meeting in-person.

The Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the meeting.

It is important that your shares be represented at the meeting, regardless of the number of shares you hold and whether or not you plan to attend the meeting. Accordingly, please exercise your right to vote by signing, dating and returning your proxy card in the enclosed envelope or voting by internet as described in the Proxy Statement. Your shares will be voted in accordance with the instructions you have given in your proxy.

Our Board of Directors and management look forward to seeing you at the meeting. Thank you for your continued support.

Sincerely yours,

/s/ Russell T. Libby

Russell T. Libby

Chairman of the Board

/s/ Xiao Mou Zhang

Xiao Mou Zhang

Chief Executive Officer

HF Foods Group Inc.

6325 South Rainbow Boulevard Suite 420, Las Vegas, Nevada, 89118

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON June 3, 2024

To Our Stockholders:

The Annual Meeting of Stockholders of HF Foods Group Inc., a Delaware corporation (the “Company”), will be held virtually on June 3, 2024, at 12:00 PM, Eastern Time, for the following purposes:

1. To elect five members of the Board of Directors to serve until the 2025 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified, or until their respective deaths, resignations or removals;

2. To ratify the selection of BDO USA, P.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2024;

3. To consider a non-binding advisory vote on compensation of our named executive officers;

4. To approve an amendment to the HF Foods Group Inc. 2018 Omnibus Equity Incentive Plan; and

5. To transact such other business as may properly come before the meeting or any continuation, adjournment or postponement thereof.

The Annual Meeting of Stockholders will be held virtually at www.virtualshareholdermeeting.com/hffg2024. You will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/hffg2024. Please see the further instructions in this Proxy Statement. Stockholders will NOT be able to attend the Annual Meeting in-person.

All stockholders are invited to electronically attend the Annual Meeting. Holders of record of the Company’s common stock at the close of business on April 11, 2024, are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

/s/ Russell T. Libby

Russell T. Libby

Chairman of the Board

/s/ Xiao Mou Zhang

Xiao Mou Zhang

Chief Executive Officer

Las Vegas, NV

April 24, 2024

| | |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING. |

TABLE OF CONTENTS

LETTER FROM OUR CHAIRMAN

Dear Stockholders,

It is my pleasure to welcome you to the 2024 Annual Meeting of Stockholders of HF Foods Group Inc. (“HF Foods” or the “Company”). On behalf of the Board of Directors and the management team, I am pleased to present the Proxy Statement for this year's meeting, outlining important information regarding the matters to be voted upon by our stockholders.

Strategic Transformational Plan

In a year in which deflation and inflation impacted important product categories, HF Foods focused on the Company’s core operations and initiated the Company’s transformation plan that we expect to help us drive long-term growth and profitability. We successfully implemented centralized purchasing in our Seafood business and saw the benefits in the form of higher margins. We have examined our cost structure and our facilities footprint, and have identified multiple opportunities for savings. Our continued focus on centralized purchasing and improving overall operational efficiency will see us drive additional savings.

In 2023 we also embarked on a strategic upgrade of our core systems. A new human resources and financial system was implemented, and in 2024 we expect to implement a new supply chain and warehouse management system. While system changes are always somewhat disruptive, we expect the benefits to be gained to greatly outweigh those disruptions. We believe these system changes, once fully implemented, should eliminate the material weaknesses identified in our Annual Report on Form 10-K.

As the only scaled, nationwide operator dedicated to serving the growing Asian foodservice market, HF Foods is well positioned to capitalize on these improvements in the near and long term, thanks to our deep customer loyalty and the incredible work of our entire team to execute our transformation initiative. To further our advantage, we continue to add and upgrade our talent levels across the organization. We have already seen improvement in key internal profitability metrics as a result of the Company’s optimization efforts and look forward to building on our progress in 2024 and beyond.

Financial Performance in Fiscal Year 20231

Given the external and internal challenges we faced in 2023, the Company was able to deliver net revenue of $1,148.5 million, gross profit of $204.0 million, gross profit margin of 17.8%, and adjusted EBITDA of $44.6 million. These results reflect the dedication and hard work of our employees and the strength of our business model, which allow us to continue to provide our customers with high-level service while also implementing our transformational plan.

It is a privilege to serve as your Chair and I greatly value your support of HF Foods. On behalf of our Board of Directors and all our HF Foods colleagues, thank you for your continued trust and investment in HF Foods.

Sincerely yours,

/s/ Russell T. Libby

Russell T. Libby

Chairman of the Board

_______________________

1 This paragraph contains non-GAAP financial measures. See page 49 in the accompanying proxy statement for a reconciliation of these non-GAAP measures to the corresponding GAAP results and an explanation of the adjustments that we have made in order to calculate these adjusted measures.

HF Foods Group Inc.

6325 South Rainbow Boulevard Suite 420

Las Vegas, NV 89118

PROXY STATEMENT

2024 Annual Meeting of Stockholders

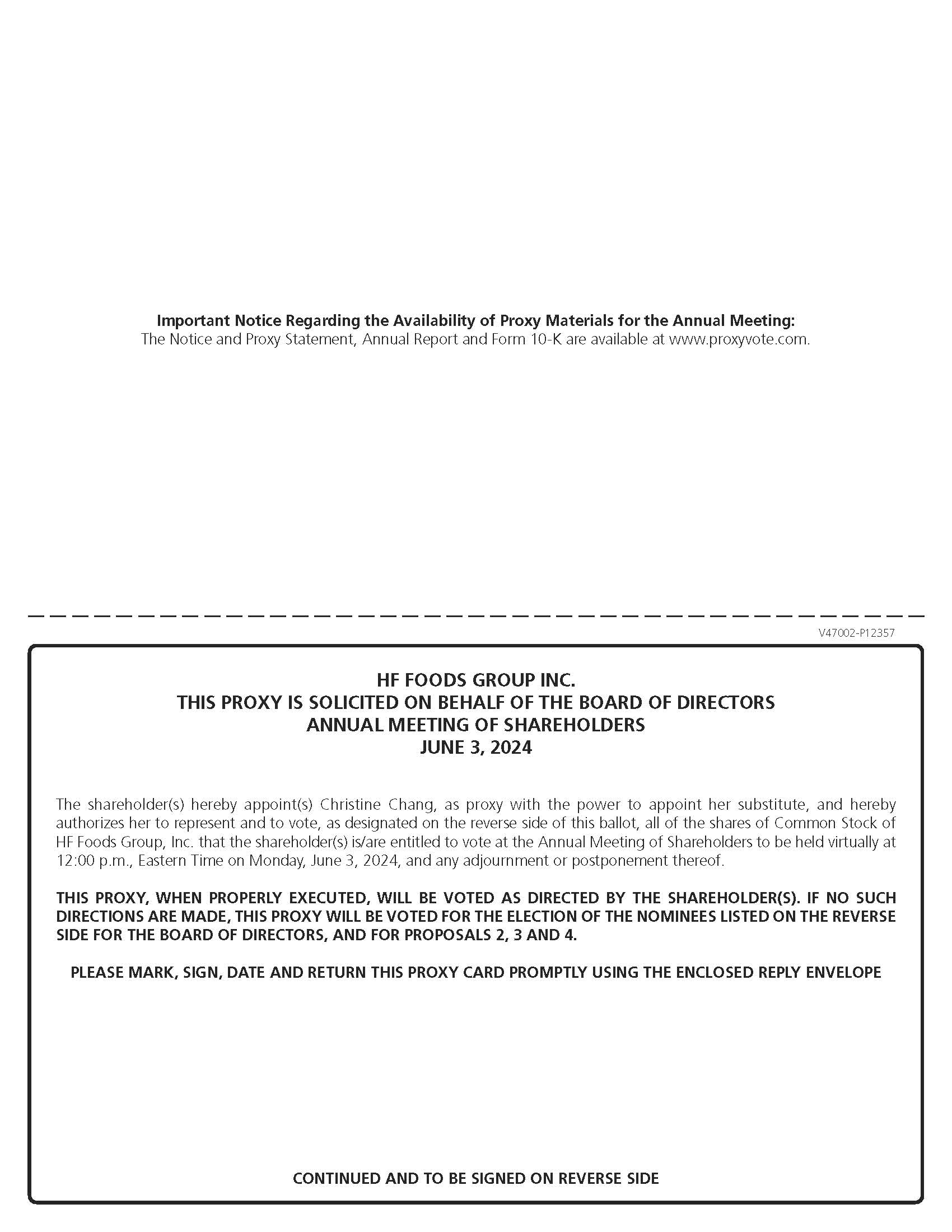

The enclosed proxy is solicited by the Board of Directors of HF Foods Group Inc. (the “Company”, “we” or “us”) for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on June 3, 2024, at 12:00 PM, Eastern Time, and at any continuation, adjournment or postponement thereof.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Who Can Attend and Vote

Only holders of our common stock of record at the close of business on April 11, 2024, the record date, are entitled to notice of and to vote at the Annual Meeting, and at any continuation(s), postponement(s) or adjournment(s) thereof. As of the record date, 52,155,968 shares of our common stock, par value $.0001 per share (“common stock”), were issued and outstanding. Holders of our common stock are entitled to one vote per share for each proposal presented at the Annual Meeting. The common stock does not have cumulative voting rights.

How do I Participate in the Annual Meeting

To participate in the virtual Annual Meeting, go to www.virtualshareholdermeeting.com/hffg2024.

If you are a stockholder of record as of April 11, 2024, the record date for the Annual Meeting, you should click on “I have a login,” enter the control number found on your proxy card or Notice of Internet Availability of Proxy Materials you previously received.

Voting Your Shares

If you are a registered holder, meaning that you hold our stock directly (not through a bank, broker or other nominee), you may vote during the virtual Annual Meeting by (a) visiting www.voteproxy.com and following the on-screen instructions (have your proxy card or Notice of Internet Availability of Proxy Materials available when you access the webpage), or (b) calling toll-free 1-800-PROXIES (1-800-776-9437) in the U.S. or 1-718-921-8500 from foreign countries from any touch-tone phone and following the instructions (have your proxy card or Notice of Internet Availability of Proxy Materials available when you call). You may also vote by completing and returning the proxy card in the enclosed envelope.

If your shares are held in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet voting will also be offered to stockholders owning shares through most banks and brokers.

Applicable stock exchange rules restrict when brokers who are record holders of shares may exercise discretionary authority to vote those shares in the absence of instructions from beneficial owners. Brokers are not permitted to vote on non-discretionary items such as director elections, executive compensation, and other significant matters absent instructions from the beneficial owner. As a result, if you are a street name stockholder, and you do not give voting instructions, the holder of record will not be permitted to vote your shares with respect to Proposal No. 1—Election of Directors, Proposal No. 3—Advisory Vote on Executive Compensation, or Proposal No. 4—Approval of an Amendment to the HF Foods Group Inc. 2018 Omnibus Equity Incentive Plan, and your shares will be considered “broker non-votes” with respect to these proposals. Although any broker non-votes would be counted as present at the Annual Meeting for purposes of determining a quorum, they will be treated as not entitled to vote with respect to each of Proposal Nos. 1, 3 and 4. If you are a street name stockholder, and you do not give voting instructions, the record holder will be entitled to vote your shares with respect to Proposal No. 2—Ratification of the Appointment of BDO USA, P.C. as our Independent Registered Public Accounting Firm for the year ending December 31, 2024 in its discretion.

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting to permit further solicitations of proxies.

The internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the internet should understand that there may be costs associated with electronic access. These charges include usage charges from internet access providers. The stockholder will bear the cost of these charges.

Procedural Matters

If you are a registered stockholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

•By Internet. You may submit a proxy electronically by visiting www.voteproxy.com and following the on-screen instructions (have your proxy card or Notice of Internet Availability of Proxy Materials available when you access the webpage).

•By Mail. You may submit a proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope in accordance with the enclosed instructions. We encourage you to sign and return the proxy or voter instruction card even if you plan to attend the Annual Meeting so that your shares will be voted even if you are unable to attend.

•By Phone. You may call toll-free 1-800-PROXIES (1-800-776-9437) in the U.S. or 1-718-921-8500 from foreign countries from any touch-tone phone and follow the instructions (have your proxy card or Notice of Internet Availability of Proxy Materials available when you call).

If your shares are held in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet voting will also be offered to stockholders owning shares through most banks and brokers.

Quorum

The presence at the Annual Meeting in person, virtually or by proxy of holders of a majority of our common stock outstanding and entitled to vote at the Annual Meeting will constitute a quorum. Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present.

Required Vote, Abstentions and Broker Non-Votes

Only stockholders of record at the close of business on April 11, 2024 have the right to vote at the Annual Meeting. The proposals at the Annual Meeting will require the following votes:

•Directors will be elected by an affirmative vote of a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on this matter. For each director nominee, you may vote “FOR,” “AGAINST” or “ABSTAIN”. Abstentions will have the same effect as a vote against the applicable director nominee in Proposal No. 1, and broker non-votes will have no effect on Proposal No. 1.

•Ratification of the selection of BDO USA, P.C. as our independent registered public accounting firm will require the affirmative vote of a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on this matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to ratify the selection of BDO USA, P.C. as our independent registered public accounting firm. Abstentions will have the same effect as a vote against Proposal No. 2. We do not expect any broker non-votes in connection with respect to Proposal No. 2.

•Approval, on an advisory basis, of our executive compensation will require the affirmative vote of a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on this matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to approve, on an advisory basis, our executive compensation. Abstentions will have the same effect as a vote against Proposal No. 3 and broker non-votes will have no effect on Proposal No. 3.

•Approval of the Amendment to the HF Foods Group Inc. 2018 Omnibus Equity Incentive Plan will require the affirmative vote of a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on this matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to approve the Amendment to the HF Foods Group Inc. 2018 Omnibus Equity Incentive Plan. Abstentions will have the same effect as a vote against Proposal No. 4 and broker non-votes will have no effect on Proposal No. 4.

An “ABSTAIN” vote represents a stockholder’s affirmative choice to decline to vote on a proposal. Given the requirement in our bylaws that a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on a proposal vote in favor of such proposal, an abstention on any proposal will have the same effect as a vote against that proposal.

Generally, “broker non-votes” occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of our independent registered public accounting firm, without instructions from the beneficial owner of those shares. As a result, we do not expect any broker non-votes in connection with the ratification of our independent registered public accounting firm. However, a broker is not entitled to vote shares held for a beneficial owner on proposals such as director elections, executive compensation, and other significant matters absent instructions from the beneficial owner. Accordingly, while broker non-votes are counted for purposes of determining whether a quorum is present at the Annual Meeting, broker non-votes will not be treated as shares entitled to vote on any such non-routine proposal and therefor will have no effect on the outcome of such proposal.

Default Voting

A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not indicate any contrary voting instructions, your shares will be voted in accordance with the Board’s recommendations, which are as follows:

•FOR the election of the five persons named in this proxy statement as the board’s nominees for election as directors;

•FOR the ratification of the selection of BDO USA, P.C. as our independent registered public accounting firm for the year ending December 31, 2024;

•FOR the approval, on an advisory basis, of our executive compensation;

•FOR the approval of an amendment to the HF Foods Group Inc. 2018 Omnibus Equity Incentive Plan; and

•FOR approval of authority to transact such other business as may properly come before the Annual Meeting.

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy, and it is the intention of the persons named on the proxy to vote the shares represented thereby on those matters in accordance with their best judgment. The board knows of no matters, other than those previously stated herein, to be presented for consideration at the Annual Meeting.

How to Revoke Your Proxy

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing with the Secretary of the Company an instrument of revocation or a duly executed proxy bearing a later date, or by electing to vote by telephone or internet. The mere presence at the Annual Meeting of the person appointing a proxy does not, however, revoke the appointment. If your shares are held in “street name” through a bank, broker or other nominee, any changes need to be made through them. Your last vote will be the vote that is counted.

Expenses of Solicitation

We will bear all costs incurred in the solicitation of proxies, including the preparation, printing and mailing of the Notice of Annual Meeting of Stockholders, proxy statement and the related materials. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone, e-mail, facsimile or other means, without additional compensation.

Stockholder List

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our headquarters located at 6325 South Rainbow Boulevard Suite 420, Las Vegas, Nevada, 89118 beginning May 24, 2024, ten days prior to the Annual Meeting of Stockholders, during normal business hours for examination by any stockholder registered on our stock ledger as of the record date for any purpose germane to the Annual Meeting.

Householding/Delivery of Documents to Stockholders

The Securities and Exchange Commission (“SEC”) rules permit registrants to adopt a procedure called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one set of proxy materials, unless one or more of these stockholders notifies the registrant that they wish to continue receiving individual sets. This procedure reduces printing costs and postage fees incurred by the registrant.

We have not adopted this householding procedure with respect to our record holders; however, a number of brokerage firms have instituted householding which may impact certain beneficial owners of our common stock. If your family has multiple accounts by which you hold common stock, you may have received a householding notification from your broker. Please contact your broker directly if you have any questions, require additional copies of the proxy materials, or wish to revoke your decision to household, and thereby receive multiple sets. Those options are available to you at any time.

Beginning on or around April 24, 2024, we will mail to our stockholders our Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2023, which includes our audited consolidated financial statements, together with these proxy materials.

PRINCIPAL STOCKHOLDERS

Common Stock

The following table sets forth, as of April 11, 2024, information with respect to the securities holdings of all persons that we, pursuant to filings with the SEC and our stock transfer records, have reason to believe may be deemed the beneficial owner of more than 5% of our common stock. The following table also sets forth, as of such date, the beneficial ownership of our common stock by all of our current officers and directors, both individually and as a group.

The beneficial owners and amount of securities beneficially owned have been determined in accordance with Rule 13d-3 under the Exchange Act and, in accordance therewith, include all shares of our common stock that may be acquired by such beneficial owners within 60 days of April 11, 2024 upon the exercise or conversion of any options, warrants or other convertible securities. This table has been prepared based on 52,155,968 shares of common stock outstanding as of April 11, 2024.

| | | | | | | | |

Name and Address of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership | Percent of Class |

Xiao Mou Zhang (2) | 3,121,485 | 6% |

Xi Lin (3) | 191,839 | * |

Carlos Rodriguez (4) | 134,094 | * |

Christine Chang (5) | 113,274 | * |

| Hong Wang | 36,957 | * |

| Russell T. Libby | 59,983 | * |

| Valerie Chase | 27,286 | * |

| Prudence Kuai | 15,544 | * |

| | |

All directors and executives officers as a group (7 individuals) (6) | 3,566,368 | 7% |

| Five Percent Holders: | | |

Zhou Min Ni (7)(8)(9) | 3,555,673 | 7% |

Irrevocable Trust for Raymond Ni (8) | 5,591,553 | 11% |

*Less than one percent.

(1)Unless otherwise indicated, the address of each person listed below is c/o HF Foods Group Inc., 6325 South Rainbow Boulevard Suite 420, Las Vegas, Nevada, 89118.

(2)Includes (i) 3,055,731 shares of Class A Common Stock, of which 340,648 shares of Class A Common Stock were granted as compensation under the 2018 Omnibus Equity Incentive Plan (the “2018 Plan”) and 130,000 shares of Class A Common Stock are held indirectly by Mr. Zhang’s spouse, and (ii) 65,754 shares underlying performance restricted stock units that are scheduled to vest within 60 days of April 11, 2024.

(3)Includes (i) 158,961 shares of Class A Common Stock granted as compensation under the 2018 Plan and (ii) 32,878 shares underlying performance restricted stock units that are scheduled to vest within 60 days of April 11, 2024.

(4)Includes (i) 104,870 shares of Class A Common Stock granted as compensation under the 2018 Plan and (ii) 29,224 shares underlying performance restricted stock units that are scheduled to vest within 60 days of April 11, 2024. Mr. Rodriguez departed the Company effective April 8, 2024.

(5)Includes (i) 92,577 shares of Class A Common Stock granted as compensation under the 2018 Plan and (ii) 20,697 shares underlying performance restricted stock units that are scheduled to vest within 60 days of April 11, 2024.

(6)Does not include the ownership of Mr. Rodriguez, who served as the Company’s Chief Financial Officer during Fiscal Year 2023 and who departed from the Company effective April 8, 2024.

(7)The information regarding the 3,555,673 shares beneficially owned by Zhou Min Ni is based on a Schedule 13D/A filed with the SEC by Zhou Min Ni on December 22, 2023 (the “Zhou Min Ni Schedule 13D”). The business address for Zhou Min Ni is 6001 West Market Street, Greensboro, NC 27409.

(8)The information regarding the shares beneficially owned by the Irrevocable Trust for Raymond Ni (the “Raymond Ni Trust”) is based on a Schedule 13D/A filed with the SEC by the Raymond Ni Trust on May 12, 2023 (the “Raymond Ni Trust Schedule 13D)”. Raymond Ni is Zhou Min Ni’s son. As disclosed in the Raymond Ni Trust Schedule 13D, Fai Lam is the trustee for the Raymond Ni Trust and the Raymond Ni Trust has voting and dispositive power over the shares held by the Raymond Ni Trust. In the Zhou Min Ni Form 4 filed on July 12, 2021 (the “Zhou Min Ni Form 4”), Zhou Min Ni disclaimed beneficial ownership over the shares held by the Raymond Ni Trust. The address for the Raymond Ni Trust is 6001 West Market Street, Greensboro, NC 27409.

(9)According to the Zhou Min Ni Form 4, trusts established by Zhou Min Ni for the benefit of his daughters, Amanda Ni, Ivy Ni and Tina Ni hold 798,793 shares, 798,793 shares and 683,793 shares respectively and 2,281,379 shares in the aggregate. In the Zhou Min Ni Form 4, Zhou Min Ni disclaimed beneficial ownership over the shares owned by the trusts established by him for the benefit of Amanda, Ivy and Tina Ni.

PROPOSAL 1: ELECTION OF DIRECTORS

Our bylaws provide that the Board of Directors shall consist of one or more members. The exact number of directors shall be fixed by and may be changed from time to time by resolution of the Board of Directors. The Board of Directors adopted a resolution on December 13, 2021, to provide that there shall be a total of five (5) directors, who shall hold office until each such director’s successor is elected and qualified, or until such director’s earlier resignation or removal.

The Nominating and Governance Committee (“Nominating Committee”) of the Board of Directors has unanimously recommended Russell T. Libby, Xiao Mou Zhang, Valerie Chase, Dr. Hong Wang and Prudence Kuai as nominees to our Board of Directors. If elected at the Annual Meeting, each of the nominees would serve until the 2025 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified, or until such director’s earlier death, resignation or removal.

The nominees have consented to being nominated and have expressed their intention to serve if elected. We have no reason to believe that the nominees will be unable to serve if elected to office and, to our knowledge, the nominees intend to serve the entire term for which election is sought. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board of Directors may elect to reduce its size. Only the nominees or substitute nominees designated by the Board of Directors will be eligible to stand for election as directors at the Annual Meeting. There are no arrangements or understandings between any director, or nominee for directorship, pursuant to which such director or nominee was selected as a director or nominee.

Nominees for Board of Directors

We believe that our Board of Directors should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe that experience, qualifications, or skills in the following areas are most important: procurement and distribution of food and related products, particularly those used by Chinese restaurants; delivery and logistics; customer service; restaurant industry management; technology and automation; accounting and finance; strategic planning; human resources and development practices; and board practices of other corporations. We believe that our current board members possess the professional and personal qualifications necessary for board service, and have highlighted particularly noteworthy attributes for each board member below. No director or nominee for director of the Company is also a director of a company having a class of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

The principal occupation, business experience for at least the past five years, and the age as of April 24, 2024, of each director nominee is included below.

The Company’s directors and nominees are as follows:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Russell T. Libby | | 58 | | Independent Director and Chairman of the Board |

| Xiao Mou Zhang | | 51 | | Director, Chief Executive Officer |

| Valerie Chase | | 41 | | Independent Director |

| | | | |

| Prudence Kuai | | 68 | | Independent Director |

| Hong Wang | | 65 | | Independent Director |

Russell T. Libby has served as a director since July 1, 2020, and was elected Chairman of the Board on February 22, 2021. Mr. Libby held numerous positions of increasing responsibility within the leadership of Sysco Corp. from 2007 through 2019, most recently Executive Vice President - Administration and Corporate Secretary. Prior to his career with Sysco, he served as President, COFRA North America, and Vice President - Legal, for Good Energies, Inc., investment advisors to private equity and venture capital funds owned by COFRA Holding A.G., a Swiss international conglomerate. Mr. Libby began his career in 1991 as a corporate associate with Arnall Golden Gregory, LLP, a full-service law firm in Atlanta. In 1995, he joined Liuski International, Inc., a computer distribution and manufacturing company, as General Counsel, Vice President - Human Resources and Secretary. In 1988, he received his Bachelor of Arts degree in International Relations from the University of Virginia in Charlottesville and, in 1991, he earned a J.D. degree from Emory University School of Law in Atlanta. Mr. Libby currently serves as a director on the board of Legacy Food Group, a holding company comprised of regional independent food distributors. Since October 2022, Mr. Libby has also served on the board of the Batten School of Leadership and Public Policy at the University of Virginia. We believe Mr. Libby’s qualifications to sit on our Board of Directors include his knowledge of food distribution management and operations, mergers and acquisitions, business environment, and financial markets.

Xiao Mou Zhang (aka Peter Zhang) has served as Co-Chief Executive Officer and director since November 4, 2019, following the merger between the Company and B&R Global Holdings Inc. ("B&R Global"), and was promoted to sole Chief Executive Officer on February 23, 2021. From 2014 until the merger, he served as Chairman of the Board and a Director of B&R Global that was co-founded by Mr. Zhang and his partners, to consolidate the shareholdings of various operating entities across the Pacific and Mountain States regions. Mr. Zhang has well over 20 years of experience in the food distribution industry with extensive experience in sales, marketing, financing, acquisitions, inventory, logistics and distribution. Under Mr. Zhang’s leadership, B&R Global established a large supplier network and maintained long-term relationships with many major suppliers stemming from business relationships that were built up over the years. We believe Mr. Zhang’s qualifications to sit on our Board of Directors include his extensive knowledge of the food distribution industry, particularly serving Chinese/Asian restaurants, and his over 20 years of management and leadership experience at B&R Global.

Valerie Chase has served as a director since December 15, 2021. Ms. Chase’s experience includes 19 years in the finance and accounting industry. She has broad experience across the finance function including technical accounting and SEC reporting, internal controls implementation and compliance, acquisitions and divestitures, cybersecurity and system implementations. From 2018 to 2021, Ms. Chase served as the Vice President, Chief Accounting Officer and Controller of Magnolia Oil & Gas Corporation, a Houston based publicly traded oil & gas exploration and production company (“Magnolia Oil & Gas”). As one of the first employees of Magnolia Oil & Gas, she was instrumental in setting up several governance processes and establishing effective internal controls. From 2010 to 2018, Ms. Chase served in roles of increasing responsibility with Apache Corporation, a Houston-based, publicly traded oil & gas exploration and production company, culminating in her role as the head of accounting policy and financial controls. Ms. Chase’s previously spent four years with Ernst & Young LLP, from 2005 to 2009. Ms. Chase holds a Bachelor of Economics degree and a Master of Accounting degree from the University of Michigan in Ann Arbor and is a Certified Public Accountant in the State of Texas. Ms. Chase currently serves as Treasurer for the board of directors of LifeHouse of Houston, a non-profit organization that serves pregnant women and their babies, based in Houston Texas. We believe Ms. Chase’s qualifications to sit on our Board of Directors include her experience in finance, accounting and corporate governance, as well as her expertise in accounting procedures, policies and financial controls.

Prudence Kuai joined as a director in January 2023. Ms. Kuai has most recently served as Chief Information Officer for Akumin/Alliance Imaging Company, a position which she held from July 2018 to February 2022. Prior to this, Ms. Kuai served as Chief Information Officer for Florida Blue from July 2012 to May 2015. Ms. Kuai also sits on the board of a not-for-profit charity Gabriel’s House, which is a homeless shelter for women and children based in Oxnard, California. Ms. Kuai is a 25-year veteran of the healthcare industry and a thought leader in applying technological advancements in operational process automation, eCommerce, utilization of artificial intelligence and data analytics. Ms. Kuai received a Master’s degree in Mathematics from the University of Texas, Arlington, and a Bachelor’s degree in Mathematics from National Taiwan University. We believe Ms. Kuai’s qualifications to sit on our Board of Directors include her experience in technology, management systems, cybersecurity, mergers and acquisitions, and knowledge of Chinese culture.

Hong Wang has served as a director since December 2019. Dr. Wang was previously a member of the Board of Directors of the Company from August 22, 2018, through November 1, 2019. Dr. Wang has served as a Professor of Management Information Systems at North Carolina A&T State University since 2005 and a Visiting Professor at Yunnan University of Finance and Economics in China since June 2012, Dalian Maritime University in China since June 2012, and Henan Polytechnic University in China since June 2015. Dr. Wang has over 30 years of university teaching experience and has taught Management Sciences, Operations Research, Optimization, Business Environment, Management Concepts, Strategic Management, and Engineering Economy, in addition to various Information Systems courses at both graduate and undergraduate levels. Dr. Wang is active in professional and community services. He has served in multiple cities in the U.S. for several terms as President of local Chinese Associations, on various boards, as a principal of Chinese schools, as session chair of academic conferences, and as a journal referee. He also helped several Chinese universities to establish international programs in collaboration with U.S. universities. Dr. Wang received his Ph.D. in Management Information Systems/Decision Sciences from Ohio State University. We believe Dr. Wang’s qualifications to sit on our Board of Directors include his knowledge of Chinese culture, management, operations, optimization, business environment, and economic engineering, and his prior effective service as a member of our Board.

Required Vote

Approval of the election of each director nominee requires the affirmative vote of a majority of the shares of common stock present in person, virtually or by proxy at the Annual Meeting and entitled to vote on this proposal. This means that each nominee who receives “For” votes representing a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting and entitled to vote on this proposal will be elected. Accordingly, “Abstain” votes will have the same effect as a vote against the applicable director nominee. Broker non-votes are not treated as entitled to vote on this proposal, and accordingly will have no effect on the outcome of the vote on the proposal.

| | |

| The Board of Directors unanimously recommends a vote FOR each of the director nominees. |

Non-Director Executive Officers

The following sets forth information regarding our non-director executive officers as of April 24, 2024:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Xi Lin | | 35 | | President and Chief Operating Officer; Interim Chief Financial Officer |

| | | | |

| Christine Chang | | 41 | | General Counsel and Chief Compliance Officer |

| | | | |

| | | | |

Xi Lin (aka Felix Lin) was appointed to serve as President effective February 12, 2024, and has served as Chief Operating Officer since May 1, 2022. Mr. Lin also previously served as an independent director of the Company from November 2019 to April 2022. Mr. Lin worked in a number of positions at Blue Bird Corporation from 2010 until his resignation on April 1, 2022. Prior to his resignation, he was Vice President, with responsibility for compliance, human resources, government relations, corporate training, strategic relationships, and supply chain M&A. He also held various other leadership positions within Blue Bird Corporation in the Manufacturing Operations and Supply Chain Departments from 2015 to 2016, the Finance and Accounting Department in 2011 and from 2013 to 2015, and the International Business Development and M&A Departments in 2012. Mr. Lin received his B.A. in Accounting and Finance from the Eugene Stetson School of Business and Economics at Mercer University in Georgia, a Master’s degree in Accountancy from the J. Whitney Bunting College of Business at Georgia College and State University in Georgia, and a Master’s degree in Business Administration from the University of North Carolina at Chapel Hill.

Christine Chang has served as General Counsel and Chief Compliance Officer since September 8, 2021. Ms. Chang previously served as Vice President - Legal Affairs, Labor Relations and Litigation for Boyd Gaming Corp. From 2014 through August 2020, she served in various capacities as Corporate Counsel, Litigation, Senior Corporate Counsel, Litigation, and Vice President and Chief Counsel, Litigation, for Caesars Entertainment, Inc. Ms. Chang also served as an associate at the law firm of Dentons LLP, from 2008 to 2013. Ms. Chang holds a Bachelor of Arts in Rhetoric from the University of California Berkeley and a Juris Doctorate from Columbia University.

There are no arrangements or understandings between any executive officer pursuant to which such officer was selected as an executive officer.

CORPORATE GOVERNANCE

Director Independence

As required under the Nasdaq Capital Market listing rules (“Listing Rules”), a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. An “independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which, in the opinion of our Board of Directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors considered certain relationships between our directors and us when determining each director’s status as an “independent director” under Rule 5605(a)(2) of the Listing Rules. Based upon such definition and SEC regulations, we have determined that Russell T. Libby, Valerie Chase, Dr. Hong Wang and Prudence Kuai are “independent” under the Listing Rules.

Board Leadership Structure and Role in Risk Oversight

Russell T. Libby is the Chairman of our Board of Directors. Our corporate governance guidelines provide that the Board of Directors is responsible for reviewing the process for assessing the major risks facing us and the options for their mitigation. This responsibility is largely satisfied by the Audit Committee of our Board of Directors (the “Audit Committee”), which is responsible for reviewing and discussing with management and our independent registered public accounting firm our major risk exposures and the policies management has implemented to monitor such exposures, including our financial risk exposures and risk management policies. We believe that the leadership structure of our Board provides appropriate risk oversight of our activities.

Hedging and Pledging Policy

The Company’s insider trading policy prohibits the purchase or sale of puts, calls, options, or other derivative securities based on the Company’s securities. Directors and executive officers may not margin or make any offer to margin any of the Company’s securities as collateral to purchase the Company’s securities or the securities of any other issuer. Directors and executive officers may, however, use the Company’s securities they beneficially own as collateral for a bona fide loan.

Committees of the Board of Directors

Audit Committee

Our Audit Committee is currently comprised of Valerie Chase (Chair), Russell T. Libby, Dr. Hong Wang and Prudence Kuai, all of whom meet the independence standards for purposes of serving on an audit committee under the Listing Rules and the Exchange Act. Our Audit Committee (i) assists the Board of Directors in its oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, and corporate policies and controls, (ii) has the sole authority to retain and terminate our independent registered public accounting firm, approve all auditing services and related fees and the terms thereof, and pre-approve any non-audit services to be rendered by our independent registered public accounting firm, and (iii) is responsible for confirming the independence and objectivity of our independent registered public accounting firm. Our independent registered public accounting firm has unrestricted access to our Audit Committee. Our Board of Directors has determined that Valerie Chase qualifies as an “audit committee financial expert,” as such term is defined in Item 407 of Regulation S-K.

Our Audit Committee operates under a written charter that is reviewed annually. The charter is available at https://hffoodsgroup.com. The Audit Committee held ten (10) meetings during the year ended December 31, 2023.

Compensation Committee

The Compensation Committee of our Board of Directors (the “Compensation Committee”) is comprised of Dr. Hong Wang (Chair), Valerie Chase, Russell T. Libby and Prudence Kuai, all of whom currently meet the independence standards under the Listing Rules and the Exchange Act. The Compensation Committee’s duties include overseeing our overall compensation philosophy, policies and programs. This includes reviewing and analyzing the design and function of our various compensation components, establishing salaries, incentives and other forms of compensation for officers and non-employee directors, and administering our equity incentive plan. In fulfilling its responsibilities, the Compensation Committee has the authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee.

Our Compensation Committee operates under a written charter that is reviewed annually. The charter is available at https://hffoodsgroup.com/committee-composition/. The Compensation Committee held eight (8) meetings during the year ended December 31, 2023.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has ever been an officer or employee of the Company. Aside from Xi Lin, none of the Company’s executive officers serves, or has served, since inception, as a member of the Board of Directors, Compensation Committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of the Company’s directors or on the Company’s Compensation Committee.

Nominating and Governance Committee

Our Nominating Committee is comprised of Russell T. Libby (Chair), Dr. Hong Wang, Valerie Chase and Prudence Kuai, all of whom currently meet the independence standards under the Listing Rules and the Exchange Act. The Nominating Committee's duties include overseeing director candidates recommended for nomination by our stockholders during such times as they are seeking proposed nominees to stand for election at the next annual meeting of stockholders (or, if applicable, a special meeting of stockholders), and seeking director candidates when vacancies emerge. Our stockholders that wish to nominate a director for election to the Board of Directors should follow the procedures set forth below under the caption “Stockholder Recommendations for Nominations to the Board of Directors”. Our Nominating Committee operates under a written charter that is reviewed annually. The charter is available at https://hffoodsgroup.com/committee-composition/. The Nominating Committee held four (4) meetings during the year ended December 31, 2023.

Special Transactions Review Committee

Our Special Transactions Review Committee (“Special Transactions Committee”) is comprised of Valerie Chase (Chair), Russell T. Libby, Dr. Hong Wang and Prudence Kuai, all of whom currently meet the independence standards under the Listing Rules and the Exchange Act. The Special Transactions Committee’s duties include evaluating transactions in which other directors, members of management or significant stockholders may be interested parties.

Our Special Transactions Committee operates under a written charter that is reviewed annually. The charter is available at https://hffoodsgroup.com/committee-composition/. The Special Transactions Committee held five (5) meetings during the year ended December 31, 2023.

Considerations in Evaluating Director Nominees

In selecting nominees for director, without regard to the source of the recommendation, our Nominating Committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our Nominating Committee may consider, among other things, the current size and composition of our Board of Directors, the needs of our Board of Directors, and the respective committees of our Board of Directors. Some of the qualifications that may be considered include, without limitation, issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, leadership skills, potential conflicts of interest, and other commitments. Director candidates must have sufficient time available, in the judgment of our Nominating Committee, to perform all Board of Director and committee responsibilities. In addition, our Nominating Committee considers all applicable statutory and regulatory requirements and the requirements of any exchange upon which our common stock is listed or to which it may apply in the foreseeable future.

Although our Board of Directors does not maintain a specific policy with respect to board diversity, we believe that our Board of Directors should be a diverse body, and our Nominating Committee considers a broad range of backgrounds and experiences in reviewing candidates for nomination to the Board of Directors. In making determinations regarding nominations of directors, our Nominating Committee may take into account the benefits of diverse viewpoints and other related factors as it oversees the annual Board of Director and committee evaluations. After completing its review and evaluation of director candidates, our Nominating Committee recommends to our full Board of Directors the director nominees for selection.

Board Diversity Matrix

Recently adopted Nasdaq Rule 5605(f) requires each listed company that has five or fewer board members to have, or explain why it does not have, at least one diverse director on the board. Inasmuch as our current Board of Directors includes a number of diverse directors within the meaning of the Nasdaq Rule, the composition of our Board of Directors is in compliance with the Nasdaq diversity requirement.

The table below highlights certain features of the composition of our Board of Directors as of each of April 11, 2024, and April 6, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total number of directors | | 5 |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 2 | | 3 | | — | | — |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | — | | — | | — | | — |

| Alaskan Native or Native American | | — | | — | | — | | — |

| Asian | | 1 | | 2 | | — | | — |

| Hispanic or Latinx | | — | | — | | — | | — |

| Native Hawaiian or Pacific Islander | | — | | — | | — | | — |

| White | | 1 | | 1 | | — | | — |

| Two or more races or ethnicities | | — | | — | | — | | — |

| LGBTQ+ | | — |

| Did not disclose demographic background | | — |

Director Attendance

During 2023, the Board of Directors held eleven (11) meetings. Each of our directors attended 100% of all meetings of the Board of Directors and any committees on which such director was a member.

Although we do not have a specific director attendance policy, directors are encouraged to attend the annual meetings of stockholders.

Code of Conduct and Ethics

We have adopted a Code of Conduct and Business Ethics (the “Code”) that applies to our directors, officers and employees. The Code is designed to deter wrongdoing and promote: (i) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; (ii) full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in our other public communications; (iii) compliance with applicable governmental laws, rules, and regulations; (iv) the prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; and (v) accountability for adherence to the Code. We have adopted and maintain a Supplier Code of Conduct that sets forth standards of ethical business conduct and provides guidance applicable to our suppliers, vendors, and other third-party providers of goods and services. Copies of the Code and our Supplier Code of Conduct are available on our official website at https://hffoodsgroup.com. We intend to disclose any amendments or waivers of the Code on our website within four (4) business days.

CERTAIN RELATIONSHIPS AND TRANSACTIONS WITH RELATED PERSONS

Mr. Xiao Mou Zhang, our Chief Executive Officer and certain of his immediate family hold ownership interests in various companies (the “Related Parties”) involved in (i) the distribution of food and related products to restaurants and other retailers and (ii) the supply of fresh food, frozen food, and packaging supplies to distributors.

As disclosed in “Principal Stockholders,” the Company believes that Mr. Zhou Min Ni, the Company’s former Co-Chief Executive Officer, together with various trusts for the benefit of Mr. Ni's four children, are collectively the beneficial owners of approximately 22% of the Company’s outstanding shares of common stock, and he and certain of his immediate family members have ownership interests in Related Parties involved in (i) the distribution of food and related products to restaurants and other retailers and (ii) the supply of fresh food, frozen food, and packaging supplies to distributors.

The Company purchases products from and sells products to some of these Related Parties which at times also involve making advance payments to, or receiving advance payments from, these Related Parties. Prices paid for these goods are based on the prices published by the particular Related Party. The Company also leased to a Related Party, a warehouse and distribution facility near Savannah, Georgia, which promotes a relationship that helps the Company source a reliable supply of fresh and frozen seafood. The Company also leases from a Related Party its warehouse and distribution facility in Atlanta, Georgia, which enables the Company’s operations in that market. The Company has also made loans to certain Related Parties.

The Company makes regular purchases from and sales to various related parties. Related Party affiliations were attributed to transactions conducted between the Company and those business entities partially or wholly owned by Company officers. Management believes that the prices paid to these Related Parties as well as the level of service, reliability, delivery terms, and historical performance of these Related Parties are substantially equivalent to, or more advantageous than, prices and terms the Company would receive in arm’s length transactions from third parties that have no relationship with the Company and are capable of providing the same level of service. The Related Party affiliations, including the bona fides and fairness of certain transactions with related parties, are among the issues that were scrutinized as part of an internal investigation that has now concluded.

The Related Party transactions as of December 31, 2023, and for the year ended December 31, 2023, are identified as follows:

Related Party Sales, Purchases, and Lease Agreements

Purchases

Below is a summary of purchases of goods and services from Related Parties recorded for the year ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Ended December 31, |

| (In thousands) | | Nature | | | | | | 2023 | | | | |

| | | | | | | | | | | | | |

| (a) | Conexus Food Solutions (formerly known as Best Food Services, LLC) | | Trade | | | | | | $ | 8,581 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (b) | Enson Seafood GA, Inc. (formerly known as “GA-GW Seafood, Inc.”) | | Trade | | | | | | 37 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (b) | Ocean Pacific Seafood Group, Inc. | | Trade | | | | | | 381 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (c) | Asahi Food, Inc. | | Trade | | | | | | 71 | | | | | |

| (b) | Rainfield Ranches, LP | | Trade | | | | | | 134 | | | | | |

| | | | | | | | | | | | | |

| Total | | | | | | | | $ | 9,409 | | | | | |

_______________

(a)An equity interest is held by three Irrevocable Trusts for the benefit of Mr. Zhang's children.

(b)Mr. Zhou Min Ni owns an equity interest in this entity.

(c)The Company, through its subsidiary Mountain Food, LLC, owns an equity interest in this entity.

Sales

Below is a summary of sales to Related Parties recorded for the year ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | |

| | | | | Year Ended December 31, |

| (In thousands) | | | | | | 2023 | | | | |

| (a) | ABC Food Trading, LLC | | | | | | $ | 2,078 | | | | | |

| (b) | Asahi Food, Inc. | | | | | | 791 | | | | | |

| (a) | Conexus Food Solutions (formerly known as Best Food Services, LLC) | | | | | | 928 | | | | | |

| (c) | Eagle Food Service, LLC | | | | | | 1,942 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| (e) | First Choice Seafood, Inc. | | | | | | 31 | | | | | |

| (e) | Fortune One Foods, Inc. | | | | | | 42 | | | | | |

| | | | | | | | | | | |

| (d) | N&F Logistics, Inc. | | | | | | 6 | | | | | |

| (c) | Union Food LLC | | | | | | 27 | | | | | |

| | | | | | | | | | | |

| Total | | | | | | $ | 5,845 | | | | | |

_______________

(a)An equity interest is held by three Irrevocable Trusts for the benefit of Mr. Zhang's children.

(b)The Company, through its subsidiary Mountain Food, LLC, owns an equity interest in this entity.

(c)Tina Ni, one of Mr. Zhou Min Ni’s family members, owns an equity interest in this entity indirectly through its parent company.

(d)Mr. Zhou Min Ni owns an equity interest in this entity.

(e)Mr. Zhou Min Ni owns an equity interest in this entity indirectly through its parent company.

Lease Agreements

The Company leases various facilities to Related Parties.

In 2020, the Company renewed a warehouse lease from Yoan Chang Trading Inc. under an operating lease agreement which expired on December 31, 2020. In February 2021, the Company executed a new five-year operating lease agreement with Yoan Chang Trading Inc., effective January 1, 2021, and expiring on December 31, 2025. Rent expense was $0.3 million for the year ended December 31, 2023.

Beginning 2014, the Company leased a warehouse to Asahi Food, Inc. under a commercial lease agreement which was rescinded March 1, 2020. A new commercial lease agreement for a period of one year was entered into, expiring February 28, 2021, with a total of four renewal periods with each term being one year. Rental income was $0.1 million for the year ended December 31, 2023.

Related Party Balances

Accounts Receivable - Related Parties, Net

Below is a summary of accounts receivable with Related Parties recorded as of December 31, 2023:

| | | | | | | | | | | | | |

| (In thousands) | | December 31, 2023 | | |

| (a) | ABC Food Trading, LLC | | $ | 94 | | | |

| (b) | Asahi Food, Inc. | | 69 | | | |

| (a) | Conexus Food Solutions (formerly known as Best Food Services, LLC) | | 84 | | | |

| | | | | |

| (c) | Enson Seafood GA, Inc. (formerly known as GA-GW Seafood, Inc.) | | 59 | | | |

| | | | | |

| (d) | Union Food LLC | | 2 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total | | $ | 308 | | | |

_______________

(a)An equity interest is held by three Irrevocable Trusts for the benefit of Mr. Zhang's children.

(b)The Company, through its subsidiary Mountain Food, LLC, owns an equity interest in this entity.

(c)Mr. Zhou Min Ni owns an equity interest in this entity.

(d)Mr. Zhou Min Ni owns an equity interest in this entity indirectly through its parent company.

The Company has reserved for 100% of the accounts receivable for Union Food LLC as of December 31, 2023. The Company has reserved for 100% of the accounts receivable for Enson Seafood GA, Inc. as of December 31, 2023. All other accounts receivable from these related parties are current and considered fully collectible.

Accounts Payable - Related Parties

All the accounts payable to Related Parties are payable upon demand without interest. Below is a summary of accounts payable with related parties recorded as of December 31, 2023:

| | | | | | | | | | | | | |

| (In thousands) | | December 31, 2023 | | |

| (a) | Conexus Food Solutions (formerly known as Best Food Services, LLC) | | $ | 379 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Others | | 18 | | | |

| Total | | $ | 397 | | | |

_______________

(a)An equity interest is held by three Irrevocable Trusts for the benefit of Mr. Zhang's children.

Employment Matters

Joanne Ni, the wife of our former Co-CEO and current significant stockholder Mr. Zhou Min Ni, was employed by the Company from 2019 to May 2023, in the role of General Manager of the Company’s Greensboro, North Carolina distribution center. In 2023, Mrs. Ni earned total cash and non-cash compensation of $406,596.82. Additionally, Jamie Lam, Mr. Zhou Min Ni’s sister-in-law, has been employed by the Company since 2019, currently in the role of General Manager of the Company’s Ocala, Florida, Greensboro, North Carolina, and Atlanta, Georgia distribution centers. In 2023, Ms. Lam earned total cash and non-cash compensation of $697,424.09. Billy Zhang, the brother of our CEO Mr. Peter Zhang, is the manager of Min Food, Inc., a subsidiary of the Company, and has held this role since December 15, 2015. In 2023, Mr. Billy Zhang earned total cash and non-cash compensation of $176,608.54.

Procedures with Respect to Review and Approval of Related Party Transactions

During 2023, the Special Transactions Committee of our Board of Directors was responsible for assisting our Board of Directors in the oversight, monitoring, and advance written approval of transactions between the Company (including any of its subsidiaries) and Related Parties (as defined in Item 404 of Regulation S-K) or any entities in which a Related Party has a direct or indirect material interest. Under the Special Transactions Committee Charter, and consistent with NASDAQ rules, the Special Transactions Committee has adopted written transaction policies and procedures relating to approval or ratification of transactions with Related Parties. Our management, internal auditors, and legal counsel are obligated to report at the earliest practicable time the proposal or negotiation of, and all material information related to, every such transaction directly to the Special Transactions Committee for its review. In accordance with these policies and procedures, the Special Transactions Committee determines whether a related person has a material interest in a transaction. Following such determination, the Special Transaction Committee has the sole discretion to approve the execution and delivery by the Company, or any subsidiary of the Company, of any agreement or instrument which comprises, memorializes or is ancillary to any such Related Party transaction.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion & Analysis (“CD&A”) sets forth the Company’s executive compensation philosophy, practices and decisions for the fiscal year 2023 for its named executive officers (“NEOs”) listed below and included in the Summary Compensation Table.

| | | | | | | | |

| | |

Name | | Position Held with the Company During 2023 |

Xiao Mou Zhang | | Chief Executive Officer |

Xi Lin | | Chief Operating Officer 1 |

Carlos Rodriguez | | Chief Financial Officer 2 |

Christine Chang | | General Counsel and Chief Compliance Officer |

| | |

| | |

1 On February 9, 2024, the Company appointed Mr. Lin as President and Chief Operating Officer of the Company. Mr. Lin has also served as the Company’s Interim Chief Financial Officer since February 12, 2024. On April 22, 2024, the Company entered into an offer letter with Cindy Yao to serve as the Company’s Chief Financial Officer effective May 1, 2024.

2 Mr. Rodriguez served in this role until taking a leave of absence for personal reasons effective February 12, 2024; Mr. Rodriguez subsequently departed the Company on April 8, 2024.

In addition to the CD&A, the compensation and benefits provided to our NEOs in 2023 are set forth below in the Summary Compensation Table and other tables that follow this CD&A, as well as in the footnotes and narrative material that accompany those tables.

Executive Summary

The Company’s compensation program is designed to attract, retain, and motivate talented executives who contribute to the company's long-term success and stockholder value. Key highlights of our compensation program for fiscal year 2023 include:

•Alignment with Performance: Compensation is tied to performance, with a significant portion of executive pay being variable and performance based.

•Pay-for-Performance: The Company emphasizes a pay-for-performance philosophy, where compensation is directly linked to the achievement of strategic objectives and financial performance metrics.

•Competitive Compensation: In 2023, the Compensation Committee retained the services of an independent compensation consultant to ensure that compensation levels are competitive in attracting and retaining top talent.

Accomplishments and Challenges for 2023 and First Quarter of 2024

In fiscal year 2023, the Company accomplished the launch of its comprehensive operational transformation plan. The transformation plan is an effort to drive growth and cost savings, and includes the establishment of a fleet maintenance program, development of a national category purchase program, and the initiation of a network and facility study to optimize the Company’s distribution network. The Company benefited from higher margins in the Seafood category, primarily attributable to the successful implementation of a centralized seafood purchasing program that allows the Company to fully harness collective purchasing power.

In fiscal year 2023, net revenue was $1,148.5 million in 2023, compared to $1,170.5 million in 2022, a decrease of $22.0 million, or 1.9%. This decrease was primarily attributable to key challenges during the year, including deflationary pricing in imported frozen seafood, Asian specialty, poultry, and, to a lesser extent, exiting the Company’s chicken processing businesses. In 2022, the Company benefited from significant inflation experienced in poultry pricing, which declined in 2023. Gross profit was $204.0 million in 2023 compared to $205.5 million in 2022, a decrease of $1.5 million, or 0.7%. The decrease was primarily attributable to lower revenue. Gross profit margin of 17.8% for 2023 increased from 17.6% in the prior year.

Executive Compensation Philosophy

The Company is committed to maintaining a compensation program that aligns with corporate values, promotes stockholder interests, and drives long-term sustainable growth. The Company’s compensation philosophy is guided by the following key principles:

•Performance Alignment: We believe in linking executive compensation directly to the Company's performance and strategic objectives. Compensation is tied to both short-term and long-term performance metrics, ensuring that executives are incentivized to achieve results that drive stockholder value creation and support the Company’s strategic goals.

•Pay-for-Performance: Our compensation program emphasizes a pay-for-performance philosophy, where executive pay is directly tied to individual and Company performance. We believe that executives should be rewarded based on their contributions to the Company's success, with a significant portion of compensation being variable and performance based.

•Competitive Compensation: We strive to offer competitive compensation packages to attract and retain top executive talent within our industry. In late 2023, compensation levels were benchmarked against industry peers and relevant market data to ensure that our executives are fairly compensated relative to their peers and industry standards.

•Stockholder Alignment: We are committed to aligning executive compensation practices with the interests of our stockholders. We believe that executive pay should be transparent, reasonable, and aligned with stockholder value creation, promoting accountability and responsible governance.

•Governance and Oversight: The Compensation Committee of the Board of Directors oversees the development, implementation, and evaluation of our executive compensation program. The committee is composed of independent directors with relevant expertise and experience in compensation matters and operates in accordance with best corporate governance practices. The Compensation Committee has retained Pay Governance LLC (“Pay Governance”) to provide advice on best practices, review and assess compensation programs, and to assist in analyzing executive compensation. Pay Governance is an independent compensation consultant that provides executive compensation program design as well as research and competitive market intelligence on executive pay. Prior to engaging Pay Governance, the Compensation Committee considered the independence of Pay Governance and concluded that the work of Pay Governance did not raise any conflicts of interests.

•Transparency and Disclosure: We are committed to transparency and disclosure regarding our executive compensation practices. We believe that stockholders have the right to understand how executive pay is determined and how it aligns with Company performance and stockholder interests.

The compensation program for the Company’s NEOs consists of the following components:

•Base Salary: Provides a fixed annual salary to NEOs, reflecting their experience, skills, and responsibilities within the organization, and ensuring a competitive level of compensation relative to industry benchmarks.

•Annual Incentive Compensation: Performance-based bonuses tied to the achievement of annual financial targets, operational objectives, and individual performance goals, encouraging executives to deliver results that drive business success.

•Long-Term Incentive Plan: Equity-based awards designed to align NEO interests with long-term stockholder value creation and incentivize sustained performance and growth.

•Benefits: Comprehensive benefits packages provided to NEOs on the same basis as other employees, including health insurance, retirement plans, and other employee benefits, aimed at supporting the well-being and financial security of executives, employees and their families.

Pay Mix

The Company’s compensation mix is designed to align with the Company’s strategic objectives and performance goals, ensuring that executive pay reinforces the Company’s strategic priorities. The CEO and each of the other NEOs each receive compensation in each of these forms.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |