00016800622024False--12-31Q2http://fasb.org/us-gaap/2024#AccountingStandardsUpdate201613Member351367364202xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureacmr:classiso4217:CNYacmr:installmentacmr:loanacmr:voteacmr:subsidiaryacmr:legalProceedingacmr:segmentutr:sqft00016800622024-01-012024-06-300001680062us-gaap:CommonClassAMember2024-08-020001680062us-gaap:CommonClassBMember2024-08-0200016800622024-06-3000016800622023-12-310001680062us-gaap:NonrelatedPartyMember2024-06-300001680062us-gaap:NonrelatedPartyMember2023-12-310001680062us-gaap:RelatedPartyMember2024-06-300001680062us-gaap:RelatedPartyMember2023-12-310001680062us-gaap:CommonClassAMember2024-06-300001680062us-gaap:CommonClassAMember2023-12-310001680062us-gaap:CommonClassBMember2024-06-300001680062us-gaap:CommonClassBMember2023-12-3100016800622024-04-012024-06-3000016800622023-04-012023-06-3000016800622023-01-012023-06-300001680062us-gaap:RelatedPartyMember2024-04-012024-06-300001680062us-gaap:RelatedPartyMember2024-01-012024-06-300001680062us-gaap:RelatedPartyMember2023-04-012023-06-300001680062us-gaap:RelatedPartyMember2023-01-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001680062us-gaap:AdditionalPaidInCapitalMember2022-12-310001680062us-gaap:RetainedEarningsMember2022-12-310001680062us-gaap:RetainedEarningsAppropriatedMember2022-12-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001680062us-gaap:NoncontrollingInterestMember2022-12-3100016800622022-12-3100016800622022-01-012022-12-310001680062srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310001680062srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001680062us-gaap:RetainedEarningsMember2023-01-012023-06-300001680062us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-06-300001680062us-gaap:RetainedEarningsMember2023-06-300001680062us-gaap:RetainedEarningsAppropriatedMember2023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001680062us-gaap:NoncontrollingInterestMember2023-06-3000016800622023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001680062us-gaap:AdditionalPaidInCapitalMember2023-12-310001680062us-gaap:RetainedEarningsMember2023-12-310001680062us-gaap:RetainedEarningsAppropriatedMember2023-12-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001680062us-gaap:NoncontrollingInterestMember2023-12-310001680062us-gaap:RetainedEarningsMember2024-01-012024-06-300001680062us-gaap:NoncontrollingInterestMember2024-01-012024-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001680062us-gaap:CommonClassAMember2024-01-012024-06-300001680062us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-06-300001680062us-gaap:AdditionalPaidInCapitalMember2024-06-300001680062us-gaap:RetainedEarningsMember2024-06-300001680062us-gaap:RetainedEarningsAppropriatedMember2024-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001680062us-gaap:NoncontrollingInterestMember2024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001680062us-gaap:AdditionalPaidInCapitalMember2023-03-310001680062us-gaap:RetainedEarningsMember2023-03-310001680062us-gaap:RetainedEarningsAppropriatedMember2023-03-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001680062us-gaap:NoncontrollingInterestMember2023-03-3100016800622023-03-310001680062us-gaap:RetainedEarningsMember2023-04-012023-06-300001680062us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001680062us-gaap:CommonClassAMember2023-04-012023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001680062us-gaap:AdditionalPaidInCapitalMember2024-03-310001680062us-gaap:RetainedEarningsMember2024-03-310001680062us-gaap:RetainedEarningsAppropriatedMember2024-03-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001680062us-gaap:NoncontrollingInterestMember2024-03-3100016800622024-03-310001680062us-gaap:RetainedEarningsMember2024-04-012024-06-300001680062us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-04-012024-06-300001680062us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001680062acmr:ACMResearchShanghaiIncMember2024-06-300001680062acmr:ACMResearchShanghaiIncMember2023-12-310001680062acmr:ACMResearchWuxiIncMember2024-06-300001680062acmr:ACMResearchWuxiIncMember2023-12-310001680062acmr:CleanChipTechnologiesLimitedMember2024-06-300001680062acmr:CleanChipTechnologiesLimitedMember2023-12-310001680062acmr:ACMResearchKoreaCOLTDMember2024-06-300001680062acmr:ACMResearchKoreaCOLTDMember2023-12-310001680062acmr:ShengweiResearchShanghaiIncMember2024-06-300001680062acmr:ShengweiResearchShanghaiIncMember2023-12-310001680062acmr:ACMResearchCAIncMember2024-06-300001680062acmr:ACMResearchCAIncMember2023-12-310001680062acmr:ACMResearchCaymanIncMember2024-06-300001680062acmr:ACMResearchCaymanIncMember2023-12-310001680062acmr:ACMResearchSingaporePTELTDMember2024-06-300001680062acmr:ACMResearchSingaporePTELTDMember2023-12-310001680062acmr:ACMResearchBeijingIncMember2024-06-300001680062acmr:ACMResearchBeijingIncMember2023-12-310001680062acmr:HangukACMCOLTDMember2024-06-300001680062acmr:HangukACMCOLTDMember2023-12-310001680062acmr:YushengMicroSemiconductorShanghaiCoLtdMember2024-06-300001680062acmr:YushengMicroSemiconductorShanghaiCoLtdMember2023-12-310001680062acmr:ACMWooliMicroelectronicsShanghaiCoLtdMember2024-06-300001680062acmr:ACMWooliMicroelectronicsShanghaiCoLtdMember2023-12-310001680062country:US2024-06-300001680062country:US2023-12-310001680062country:CN2024-06-300001680062country:CN2023-12-310001680062country:HK2024-06-300001680062country:HK2023-12-310001680062country:KR2024-06-300001680062country:KR2023-12-310001680062country:SG2024-06-300001680062country:SG2023-12-310001680062acmr:ACMShanghaiMember2024-04-012024-06-300001680062acmr:ACMShanghaiMember2023-04-012023-06-300001680062acmr:ACMShanghaiMember2024-01-012024-06-300001680062acmr:ACMShanghaiMember2023-01-012023-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2024-01-012024-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2024-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2023-12-310001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2024-01-012024-06-300001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2024-06-300001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2023-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2024-01-012024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2023-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2024-01-012024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2023-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2024-01-012024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2023-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOnDecember252025Member2024-01-012024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOnDecember252025Member2024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOnDecember252025Member2023-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2024-01-012024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2024-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2023-12-310001680062acmr:ChinaIndustrialBankDepositMaturingJanuary32026Member2024-01-012024-06-300001680062acmr:ChinaIndustrialBankDepositMaturingJanuary32026Member2024-06-300001680062acmr:ChinaIndustrialBankDepositMaturingJanuary32026Member2023-12-310001680062acmr:ChinaEverbrightBankDepositMaturingDecember52024Member2024-01-012024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingDecember52024Member2024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingDecember52024Member2023-12-310001680062acmr:ChinaEverbrightBankDepositMaturingMay222024Member2024-01-012024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingMay222024Member2024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingMay222024Member2023-12-310001680062acmr:ChinaEverbrightBankDepositMaturingApril52024Member2024-01-012024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingApril52024Member2024-06-300001680062acmr:ChinaEverbrightBankDepositMaturingApril52024Member2023-12-310001680062acmr:ChinaMerchantBankLujiazuiBranchDepositMaturingMay272024Member2024-01-012024-06-300001680062acmr:ChinaMerchantBankLujiazuiBranchDepositMaturingMay272024Member2024-06-300001680062acmr:ChinaMerchantBankLujiazuiBranchDepositMaturingMay272024Member2023-12-310001680062acmr:BankOfNingboDepositMaturingSeptember112024Member2024-01-012024-06-300001680062acmr:BankOfNingboDepositMaturingSeptember112024Member2024-06-300001680062acmr:BankOfNingboDepositMaturingSeptember112024Member2023-12-310001680062us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001680062us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001680062us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001680062us-gaap:FairValueMeasurementsRecurringMember2024-06-300001680062us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680062us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680062us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680062us-gaap:FairValueMeasurementsRecurringMember2023-12-310001680062us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001680062us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001680062us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001680062us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001680062acmr:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001680062acmr:ThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001680062acmr:ThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001680062acmr:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001680062acmr:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001680062acmr:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2024-04-012024-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2023-04-012023-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2024-01-012024-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2023-01-012023-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2024-04-012024-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2023-04-012023-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2024-01-012024-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2023-01-012023-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2024-04-012024-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2023-04-012023-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2024-01-012024-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2023-01-012023-06-300001680062country:CN2024-04-012024-06-300001680062country:CN2023-04-012023-06-300001680062country:CN2024-01-012024-06-300001680062country:CN2023-01-012023-06-300001680062acmr:OherRegionsMember2024-04-012024-06-300001680062acmr:OherRegionsMember2023-04-012023-06-300001680062acmr:OherRegionsMember2024-01-012024-06-300001680062acmr:OherRegionsMember2023-01-012023-06-300001680062acmr:FirstToolsMember2024-01-012024-06-300001680062acmr:FirstToolsCustomerOwnershipMember2024-06-300001680062acmr:FirstToolsCustomerOwnershipMember2023-12-310001680062acmr:BuildingsAndPlantsMember2024-06-300001680062acmr:BuildingsAndPlantsMember2023-12-310001680062us-gaap:EquipmentMember2024-06-300001680062us-gaap:EquipmentMember2023-12-310001680062us-gaap:OfficeEquipmentMember2024-06-300001680062us-gaap:OfficeEquipmentMember2023-12-310001680062us-gaap:TransportationEquipmentMember2024-06-300001680062us-gaap:TransportationEquipmentMember2023-12-310001680062us-gaap:LeaseholdImprovementsMember2024-06-300001680062us-gaap:LeaseholdImprovementsMember2023-12-310001680062acmr:ACMLingangMemberacmr:BuildingsAndPlantsMember2024-06-300001680062acmr:ACMShanghaiMemberacmr:BuildingsAndPlantsMember2024-06-300001680062acmr:LineOfCreditUpToRMB150000FromChinaEverbrightBankMember2024-06-300001680062acmr:LineOfCreditUpToRMB150000FromChinaEverbrightBankMember2023-12-310001680062acmr:LineOfCreditDueOnAugust292024WithAnAnnualInterestRateOf3.00Member2023-01-012023-12-310001680062acmr:LineOfCreditDueOnAugust292024WithAnAnnualInterestRateOf3.00Member2024-01-012024-06-300001680062acmr:LineOfCreditDueOnAugust292024WithAnAnnualInterestRateOf3.00Member2024-06-300001680062acmr:LineOfCreditDueOnAugust292024WithAnAnnualInterestRateOf3.00Member2023-12-310001680062acmr:LineOfCreditUpToRMB40000FromBankOfChinaMember2024-06-300001680062acmr:LineOfCreditUpToRMB40000FromBankOfChinaMember2023-12-310001680062acmr:LineOfCreditDueOnSeptember72024WithAnAnnualInterestRateOf2.87.Member2024-01-012024-06-300001680062acmr:LineOfCreditDueOnSeptember72024WithAnAnnualInterestRateOf2.87.Member2023-01-012023-12-310001680062acmr:LineOfCreditDueOnSeptember72024WithAnAnnualInterestRateOf2.87.Member2024-06-300001680062acmr:LineOfCreditDueOnSeptember72024WithAnAnnualInterestRateOf2.87.Member2023-12-310001680062acmr:LineOfCreditUpToRMB200000FromChinaMerchantsBankMember2023-12-310001680062acmr:LineOfCreditUpToRMB200000FromChinaMerchantsBankMember2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust72024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust72024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust72024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust72024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust82024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust82024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust82024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust82024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust92024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust92024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust92024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust92024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust142024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust142024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust142024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust142024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust172024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust172024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust172024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust172024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust202024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust202024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust202024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust202024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust212024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust212024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust212024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust212024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust222024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust222024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust222024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust222024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust242024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust242024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust242024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust242024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust272024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust272024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust272024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust272024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust292024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust292024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust292024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust292024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust302024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust302024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust302024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnAugust302024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember32024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember32024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember32024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember32024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember52024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember52024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember52024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember52024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember62024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember62024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember62024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember62024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember102024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember102024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember102024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember102024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember122024WithAnAnnualInterestRateOf300Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember122024WithAnAnnualInterestRateOf300Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember122024WithAnAnnualInterestRateOf300Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnSeptember122024WithAnAnnualInterestRateOf300Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary272025WithAnAnnualInterestRateOf2.60Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary272025WithAnAnnualInterestRateOf2.60Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary272025WithAnAnnualInterestRateOf2.60Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary272025WithAnAnnualInterestRateOf2.60Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary282025WithAnAnnualInterestRateOf2.60Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary282025WithAnAnnualInterestRateOf2.60Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary282025WithAnAnnualInterestRateOf2.60Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnFebruary282025WithAnAnnualInterestRateOf2.60Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch12025WithAnAnnualInterestRateOf2.60Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch12025WithAnAnnualInterestRateOf2.60Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch12025WithAnAnnualInterestRateOf2.60Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch12025WithAnAnnualInterestRateOf2.60Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch52025WithAnAnnualInterestRateOf2.60Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch52025WithAnAnnualInterestRateOf2.60Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch52025WithAnAnnualInterestRateOf2.60Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch52025WithAnAnnualInterestRateOf2.60Member2023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch82025WithAnAnnualInterestRateOf2.60Member2023-01-012023-12-310001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch82025WithAnAnnualInterestRateOf2.60Member2024-01-012024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch82025WithAnAnnualInterestRateOf2.60Member2024-06-300001680062acmr:LineOfCreditChinaMerchantsBankDueOnMarch82025WithAnAnnualInterestRateOf2.60Member2023-12-310001680062acmr:LineOfCreditUpToRMB120000FromBankOfChinaMember2023-12-310001680062acmr:LineOfCreditUpToRMB120000FromBankOfChinaMember2024-06-300001680062acmr:LineOfCreditBankOfChinaDueOnMarch202025WithAnAnnualInterestRateOf2.75Member2023-01-012023-12-310001680062acmr:LineOfCreditBankOfChinaDueOnMarch202025WithAnAnnualInterestRateOf2.75Member2024-01-012024-06-300001680062acmr:LineOfCreditBankOfChinaDueOnMarch202025WithAnAnnualInterestRateOf2.75Member2024-06-300001680062acmr:LineOfCreditBankOfChinaDueOnMarch202025WithAnAnnualInterestRateOf2.75Member2023-12-310001680062acmr:LineOfCreditUpToKRW500000FromIndustrialBankOfKoreaMember2023-12-310001680062acmr:LineOfCreditUpToKRW500000FromIndustrialBankOfKoreaMember2024-06-300001680062acmr:LineOfCreditDueOnJuly122024WithAnAnnualInterestRateOf6.03Member2023-01-012023-12-310001680062acmr:LineOfCreditDueOnJuly122024WithAnAnnualInterestRateOf6.03Member2024-01-012024-06-300001680062acmr:LineOfCreditDueOnJuly122024WithAnAnnualInterestRateOf6.03Member2024-06-300001680062acmr:LineOfCreditDueOnJuly122024WithAnAnnualInterestRateOf6.03Member2023-12-310001680062acmr:LineOfCreditUpToKRW2000000FromIndustrialBankOfKoreaMember2024-06-300001680062acmr:LineOfCreditUpToKRW2000000FromIndustrialBankOfKoreaMember2023-12-310001680062acmr:LineOfCreditDueOnDecember152024WithAnAnnualInterestRateOf4.29Member2023-01-012023-12-310001680062acmr:LineOfCreditDueOnDecember152024WithAnAnnualInterestRateOf4.29Member2024-01-012024-06-300001680062acmr:LineOfCreditDueOnDecember152024WithAnAnnualInterestRateOf4.29Member2024-06-300001680062acmr:LineOfCreditDueOnDecember152024WithAnAnnualInterestRateOf4.29Member2023-12-310001680062acmr:ChinaMerchantsBankMember2024-06-300001680062acmr:ChinaMerchantsBankMember2023-12-310001680062acmr:BankOfChinaMember2024-06-300001680062acmr:BankOfChinaMember2023-12-310001680062acmr:BankOfShanghaiMember2024-06-300001680062acmr:BankOfShanghaiMember2023-12-310001680062acmr:CiticBankMember2024-06-300001680062acmr:CiticBankMember2023-12-310001680062acmr:EverbrightBankMember2024-06-300001680062acmr:EverbrightBankMember2023-12-310001680062acmr:ChinaMerchantsBankMember2024-01-012024-06-300001680062acmr:BankOfChinaMember2024-01-012024-06-300001680062acmr:BankOfChinaMemberacmr:LoanTwoMember2024-01-012024-06-300001680062acmr:BankOfShanghaiMember2024-01-012024-06-300001680062acmr:CiticBankMemberacmr:LoneOneMember2024-01-012024-06-300001680062acmr:CiticBankMemberacmr:LoanTwoMember2024-01-012024-06-300001680062acmr:EverbrightBankMember2024-01-012024-06-300001680062acmr:SubsidiesCommencedIn2020AndPriorMember2024-06-300001680062acmr:SubsidiesCommencedIn2020AndPriorMember2023-12-310001680062acmr:SubsidiesToSWLingangRDDevelopmentIn2021Member2024-06-300001680062acmr:SubsidiesToSWLingangRDDevelopmentIn2021Member2023-12-310001680062acmr:OtherMember2024-06-300001680062acmr:OtherMember2023-12-310001680062acmr:CompanyCMemberus-gaap:CommonClassAMember2024-01-120001680062acmr:CompanyDMemberus-gaap:CommonClassAMember2024-01-190001680062acmr:CompanyEMemberus-gaap:CommonClassAMember2024-01-190001680062acmr:CompanyEMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:NinebellCompanyLimitedMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:WooilFluconCompanyLimitedMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:CompanyDMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:WaferworksCompanyLimitedMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:ShengyiMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:CompanyAMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:CompanyBMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:CompanyCMemberus-gaap:CommonClassAMember2024-06-300001680062acmr:NinebellCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:NinebellCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:WooilFluconCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:WooilFluconCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberacmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMemberacmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMemberacmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:CompanyDMemberacmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:CompanyDMemberacmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:InvestmentExcludingOtherMember2024-06-300001680062acmr:InvestmentExcludingOtherMember2023-12-310001680062acmr:WaferworksCompanyLimitedMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:WaferworksCompanyLimitedMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:CompanyAMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:CompanyAMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:CompanyBMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:CompanyBMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:CompanyCMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:CompanyCMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:CompanyEMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:CompanyEMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:OtherMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:OtherMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:SubtotalMeasurementAlternativeMemberus-gaap:OtherLongTermInvestmentsMember2024-06-300001680062acmr:SubtotalMeasurementAlternativeMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001680062us-gaap:OtherLongTermInvestmentsMember2024-06-300001680062us-gaap:OtherLongTermInvestmentsMember2023-12-310001680062acmr:NuodeAssetManagementCompanyLimitedMember2022-09-190001680062acmr:NuodeAssetManagementCompanyLimitedMember2022-09-270001680062acmr:NuodeAssetManagementCompanyLimitedMember2022-12-310001680062acmr:NuodeAssetManagementCompanyLimitedMember2024-06-300001680062acmr:HuahongSemiconductorLimitedMember2023-07-310001680062acmr:ZhongiuxinLimitedCompanyMember2023-09-300001680062acmr:ShanghaiSyncrystallineSiliconMaterialsCo.LtdMember2024-02-290001680062acmr:ShanghaiSyncrystallineSiliconMaterialsCo.LtdMember2024-06-300001680062acmr:SemiconductorManufacturingInternationalCorporationMember2023-04-012023-06-300001680062acmr:SemiconductorManufacturingInternationalCorporationMember2023-01-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:NinebellCoLtdMember2024-06-300001680062us-gaap:RelatedPartyMemberacmr:NinebellCoLtdMember2023-12-310001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2024-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-12-310001680062acmr:NinebellCoLtdMember2024-04-012024-06-300001680062acmr:NinebellCoLtdMember2023-04-012023-06-300001680062acmr:NinebellCoLtdMember2024-01-012024-06-300001680062acmr:NinebellCoLtdMember2023-01-012023-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2024-04-012024-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2023-04-012023-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2024-01-012024-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2023-01-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2024-04-012024-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-04-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2024-01-012024-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-01-012023-06-300001680062us-gaap:CommonClassBMember2024-01-012024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-012023-06-300001680062us-gaap:EmployeeStockOptionMember2023-12-310001680062us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001680062us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001680062us-gaap:EmployeeStockOptionMember2024-06-300001680062us-gaap:EmployeeStockOptionMember2024-04-012024-06-300001680062acmr:ServicePeriodBasedApproachMemberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-06-300001680062acmr:ServicePeriodBasedApproachMemberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-06-300001680062acmr:ServicePeriodBasedApproachMemberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-06-300001680062acmr:ServicePeriodBasedApproachMemberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2024-01-012024-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-12-310001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-01-012023-12-310001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2024-01-012024-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2024-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2024-04-012024-06-300001680062acmr:A2019StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-12-310001680062acmr:A2019StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001680062acmr:A2019StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-01-012024-06-300001680062acmr:A2019StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-06-300001680062acmr:A2019StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-04-012024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-12-310001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-01-012024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-06-300001680062acmr:A2023SubsidiaryStockOptionPlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ACMResearchShanghaiIncMember2024-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ACMResearchShanghaiIncMember2024-01-012024-06-300001680062acmr:A2023StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-04-012024-06-300001680062acmr:A2023StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-01-012024-06-300001680062acmr:A2023StockOptionIncentivePlanMemberacmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2024-06-300001680062us-gaap:CostOfSalesMember2024-04-012024-06-300001680062us-gaap:CostOfSalesMember2023-04-012023-06-300001680062us-gaap:CostOfSalesMember2024-01-012024-06-300001680062us-gaap:CostOfSalesMember2023-01-012023-06-300001680062us-gaap:SellingAndMarketingExpenseMember2024-04-012024-06-300001680062us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001680062us-gaap:SellingAndMarketingExpenseMember2024-01-012024-06-300001680062us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2024-04-012024-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001680062us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001680062us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-04-012023-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-01-012023-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ACMResearchShanghaiIncMember2024-04-012024-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ACMResearchShanghaiIncMember2023-04-012023-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ACMResearchShanghaiIncMember2023-01-012023-06-300001680062srt:MinimumMemberus-gaap:ForeignCountryMember2024-01-012024-06-300001680062srt:MaximumMemberus-gaap:ForeignCountryMember2024-01-012024-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:ForeignCountryMembersrt:MinimumMember2024-01-012024-06-300001680062acmr:ACMResearchWuxiIncMemberus-gaap:ForeignCountryMember2024-01-012024-06-300001680062acmr:ACMResearchBeijingIncMemberus-gaap:ForeignCountryMember2024-01-012024-06-300001680062acmr:ShengweiResearchShanghaiIncMemberus-gaap:ForeignCountryMember2024-01-012024-06-300001680062us-gaap:ForeignCountryMember2024-01-012024-06-300001680062acmr:ACMResearchShanghaiIncMember2024-01-012024-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:ForeignCountryMember2020-01-012022-12-310001680062us-gaap:SubsequentEventMember2024-07-300001680062acmr:DavidWangMember2024-01-012024-06-300001680062acmr:DavidWangMember2024-04-012024-06-300001680062acmr:DavidWangMember2024-06-300001680062acmr:TracyLiuMember2024-01-012024-06-300001680062acmr:TracyLiuMember2024-04-012024-06-300001680062acmr:TracyLiuMember2024-06-300001680062acmr:FupingChenMember2024-01-012024-06-300001680062acmr:FupingChenMember2024-04-012024-06-300001680062acmr:FupingChenMember2024-06-300001680062acmr:ShanghaiScienceAndTechnologyVentureCapitalCo.LtdMember2024-01-012024-06-300001680062acmr:ShanghaiScienceAndTechnologyVentureCapitalCo.LtdMember2024-04-012024-06-300001680062acmr:ShanghaiScienceAndTechnologyVentureCapitalCo.LtdMember2024-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _____________

Commission file number: 001-38273

ACM Research, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Delaware | 94-3290283 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

42307 Osgood Road, Suite I Fremont, California | 94539 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (510) 445-3700

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on which Registered |

| Class A Common Stock, $0.0001 par value | | ACMR | | The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | | Accelerated filer | o |

| Non-accelerated filer | o | | Smaller reporting company | o |

| | | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Number of Shares Outstanding |

| Class A Common Stock, $0.0001 par value | | 57,449,013 shares outstanding as of August 2, 2024 |

| Class B Common Stock, $0.0001 par value | | 5,021,811 shares outstanding as of August 2, 2024 |

TABLE OF CONTENTS

ACM Research, Inc., or ACM Research, is a Delaware corporation founded in California in 1998 to supply capital equipment developed for the global semiconductor industry. Since 2005, ACM Research has conducted its business operations principally through its subsidiary ACM Research (Shanghai), Inc., or ACM Shanghai, a limited liability corporation formed by ACM Research in the People’s Republic of China, or mainland China, in 2005. Unless the context requires otherwise, references in this report to “our company,” “our,” “us,” “we” and similar terms refer to ACM Research, Inc. and its subsidiaries, including ACM Shanghai, collectively.

We conduct a substantial majority of our product development, manufacturing, support and services in mainland China through ACM Shanghai. We are not a mainland China operating company, and we do not conduct our operations in mainland China through the use of a variable interest entity or any other structure designed for the purpose of avoiding mainland China legal restrictions on direct foreign investments in mainland China-based companies. For a description of certain matters relating to our operations in mainland China, including our corporate structure, the movement of cash throughout our organization, certain audit and regulatory matters, and risks associated therewith, please see “Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report, the disclosure at the forefront of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and the Risk Factors included therein, as referenced or updated by the disclosure included in “Part II. Item 1A—Risk Factors” in this report.

For purposes of this report, certain amounts in Renminbi, or RMB, have been translated into U.S. dollars solely for the convenience of the reader. The translations have been made based on the conversion rates published by the State Administration of Foreign Exchange of the People’s Republic of China.

SAPS, TEBO, ULTRA C, ULTRA Fn, Ultra ECP, Ultra ECP map, and Ultra ECP ap are trademarks of ACM Research. For convenience, these trademarks appear in this report without ™ symbols, but that practice does not mean that ACM Research will not assert, to the fullest extent under applicable law, ACM Research’s rights to the trademarks. This report also contains other companies’ trademarks, registered marks and trade names, which are the property of those companies.

FORWARD-LOOKING STATEMENTS AND STATISTICAL DATA

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties and other factors, including those described or incorporated by reference in “Item 1A. Risk Factors” of Part II of this report, that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

The information included under the heading “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview,” of Part I of this report contains statistical data and estimates, including forecasts, that are based on information provided by Gartner, Inc., or Gartner, in “Forecast: Semiconductor Wafer Fab Equipment, Worldwide, 4Q23 Update” (December 2023), or the Gartner Report. The Gartner Report represents research opinions or viewpoints that are published, as part of a syndicated subscription service, by Gartner and are not representations of fact. The Gartner Report speaks as of its original publication date (and not as of the date of this report), and the opinions expressed in the Gartner Report are subject to change without notice. While we are not aware of any misstatements regarding any of the data presented from the Gartner Report, estimates, and in particular forecasts, involve numerous assumptions and are subject to risks and uncertainties, as well as change based on various factors, that could cause results to differ materially from those expressed in the data presented below.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Except as required by law, we assume no obligation to update these statements publicly or to update the reasons actual results could differ materially from those anticipated in these statements, even if new information becomes available in the future.

You should read this report, and the documents that we reference in this report and have filed as exhibits to this report, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

ACM RESEARCH, INC.

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Assets | (Unaudited) | | |

| Current assets: | | | |

| Cash and cash equivalents (note 2) | $ | 324,031 | | | $ | 182,090 | |

| Restricted cash | 881 | | | 1,083 | |

| Short-term time deposits (note 2) | 27,183 | | | 80,524 | |

| Short-term investments (note 15) | 19,597 | | | 21,312 | |

| Accounts receivable, net (note 4) | 293,499 | | | 283,186 | |

| Other receivables | 53,694 | | | 40,065 | |

| Inventories, net (note 5) | 602,927 | | | 545,395 | |

| Advances to related party (note 16) | 2,756 | | | 2,432 | |

| Prepaid expenses | 18,594 | | | 20,023 | |

| Total current assets | 1,343,162 | | | 1,176,110 | |

| Property, plant and equipment, net (note 6) | 228,731 | | | 201,848 | |

| Land use right, net (note 7) | 8,225 | | | 8,367 | |

| Operating lease right-of-use assets, net (note 11) | 6,252 | | | 7,026 | |

| Intangible assets, net | 2,836 | | | 2,538 | |

| Long-term time deposits (note 2) | 14,656 | | | 40,818 | |

| Deferred tax assets (note 19) | 20,898 | | | 20,271 | |

| Long-term investments (note 14) | 31,898 | | | 27,880 | |

| Other long-term assets (note 8) | 10,917 | | | 6,050 | |

| Total assets | $ | 1,667,575 | | | $ | 1,490,908 | |

| Liabilities and Equity | | | |

| Current liabilities: | | | |

| Short-term borrowings (note 9) | $ | 54,439 | | | $ | 31,335 | |

| Current portion of long-term borrowings (note 12) | 19,671 | | | 6,783 | |

| Related party accounts payable (note 16) | 18,012 | | | 11,407 | |

| Accounts payable | 142,418 | | | 141,814 | |

| Advances from customers (note 3) | 205,609 | | | 181,368 | |

| Deferred revenue (note 3) | 5,279 | | | 3,687 | |

| Income taxes payable (note 19) | 11,136 | | | 6,401 | |

| FIN-48 payable (note 19) | 12,093 | | | 12,149 | |

| Other payables and accrued expenses (note 10) | 114,940 | | | 102,951 | |

| Current portion of operating lease liabilities (note 11) | 2,573 | | | 2,764 | |

| Total current liabilities | 586,170 | | | 500,659 | |

| Long-term borrowings (note 12) | 70,833 | | | 53,952 | |

| Long-term operating lease liabilities (note 11) | 3,679 | | | 4,262 | |

| Other long-term liabilities (note 13) | 5,505 | | | 5,873 | |

| Total liabilities | 666,187 | | | 564,746 | |

| Commitments and contingencies (note 21) | | | |

| Equity: | | | |

| Stockholders’ equity: | | | |

| Class A Common stock (note 17) | 6 | | | 6 | |

| Class B Common stock (note 17) | 1 | | | 1 | |

| Additional paid-in capital | 659,462 | | | 629,845 | |

| Retained earnings | 198,470 | | | 156,827 | |

| Statutory surplus reserve (note 22) | 30,060 | | | 30,060 | |

| Accumulated other comprehensive loss | (54,830) | | | (49,349) | |

| Total ACM Research, Inc. stockholders’ equity | 833,169 | | | 767,390 | |

| Non-controlling interests | 168,219 | | | 158,772 | |

| Total equity | 1,001,388 | | | 926,162 | |

| Total liabilities and equity | $ | 1,667,575 | | | $ | 1,490,908 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(In thousands, except share and per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue (note 3) | $ | 202,480 | | | $ | 144,577 | | | $ | 354,671 | | | $ | 218,833 | |

Cost of revenue, including cost of revenue from related parties of $16.1 million and $31.3 million for the three and six months ended June 30, 2024, respectively and $11.3 and $29.7 million for the three and six months ended June 30, 2023, respectively (note 16) | 105,696 | | | 75,938 | | | 178,766 | | | 110,208 | |

| Gross profit | 96,784 | | | 68,639 | | | 175,905 | | | 108,625 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 17,135 | | | 11,439 | | | 31,308 | | | 20,776 | |

| Research and development | 25,968 | | | 20,064 | | | 49,886 | | | 34,093 | |

| General and administrative | 16,088 | | | 6,706 | | | 31,886 | | | 14,464 | |

| Total operating expenses | 59,191 | | | 38,209 | | | 113,080 | | | 69,333 | |

| Income from operations | 37,593 | | | 30,430 | | | 62,825 | | | 39,292 | |

| Interest income | 2,381 | | | 2,346 | | | 4,155 | | | 4,131 | |

| Interest expense | (932) | | | (649) | | | (1,715) | | | (1,344) | |

| Realized gain from sale of short-term investments (note 15) | — | | | 3,919 | | | 273 | | | 7,913 | |

Unrealized gain (loss) on short-term investments (note 15) | 1,031 | | | (2,455) | | | (1,564) | | | (3,109) | |

Other income, net | 1,357 | | | 3,724 | | | 4,437 | | | 2,306 | |

| Income (loss) from equity method investments (note 15) | (695) | | | 3,920 | | | (1,215) | | | 3,888 | |

| Income before income taxes | 40,735 | | | 41,235 | | | 67,196 | | | 53,077 | |

| Income tax expense (note 19) | (9,336) | | | (7,638) | | | (13,705) | | | (10,517) | |

| Net income | 31,399 | | | 33,597 | | | 53,491 | | | 42,560 | |

| Less: Net income attributable to non-controlling interests | 7,189 | | | 6,772 | | | 11,848 | | | 8,590 | |

| Net income attributable to ACM Research, Inc. | $ | 24,210 | | | $ | 26,825 | | | $ | 41,643 | | | $ | 33,970 | |

| | | | | | | |

Comprehensive income (loss): | | | | | | | |

| Net income | 31,399 | | | 33,597 | | | 53,491 | | | 42,560 | |

| Foreign currency translation adjustment, net of tax | 116 | | | (35,269) | | | (6,713) | | | (25,846) | |

Comprehensive income (loss) | 31,515 | | | (1,672) | | | 46,778 | | | 16,714 | |

| Less: Comprehensive income attributable to non-controlling interests | 7,210 | | | 652 | | | 10,616 | | | 4,114 | |

Comprehensive income (loss) attributable to ACM Research, Inc. | $ | 24,305 | | | $ | (2,324) | | | $ | 36,162 | | | $ | 12,600 | |

| | | | | | | |

| Net income attributable to ACM Research, Inc. per share of common stock (note 2): | | | | | | | |

| Basic | $ | 0.39 | | | $ | 0.45 | | | $ | 0.67 | | | $ | 0.57 | |

| Diluted | $ | 0.35 | | | $ | 0.41 | | | $ | 0.61 | | | $ | 0.52 | |

| | | | | | | |

| Weighted average shares of common stock outstanding used in computing per share amounts (note 2): | | | | | | | |

| Basic | 62,178,369 | | 59,898,149 | | 61,772,776 | | 59,817,903 |

| Diluted | 67,057,846 | | 64,929,638 | | 66,520,706 | | 64,968,900 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Changes in Equity

For the Six Months Ended June 30, 2024 and 2023

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock Class A | | Common

Stock Class B | | | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-

in Capital | | Retained

Earnings | | Statutory

Surplus

Reserve | | Accumulated Other Comprehensive Income (Loss) | | Non-controlling

Interests | | Total

Equity |

| Balance at December 31, 2022 | 54,655,286 | | $ | 5 | | | 5,021,811 | | $ | 1 | | | $ | 604,089 | | | $ | 94,426 | | | $ | 16,881 | | | $ | (40,546) | | | $ | 137,315 | | | $ | 812,171 | |

| Cumulative effect of change in accounting principle under ASC 326, net of tax | - | | - | | | - | | - | | | - | | | (1,769) | | | - | | | - | | | — | | | (1,769) | |

| Net income | - | | - | | | - | | - | | | - | | | 33,970 | | | - | | | — | | | 8,590 | | | 42,560 | |

| Foreign currency translation adjustment | - | | - | | | - | | - | | | - | | | - | | | - | | | (21,370) | | | (4,476) | | | (25,846) | |

| Exercise of stock options | 296,204 | | - | | | - | | - | | | 691 | | | - | | | - | | | - | | | 3,834 | | | 4,525 | |

| Stock-based compensation | - | | - | | | - | | - | | | 4,085 | | | - | | | - | | | - | | | - | | | 4,085 | |

| ACM Shanghai dividend | - | | - | | | - | | - | | | - | | | - | | | - | | | - | | | (3,951) | | | (3,951) | |

| Balance at June 30, 2023 | 54,951,490 | | $ | 5 | | | 5,021,811 | | $ | 1 | | | $ | 608,865 | | | $ | 126,627 | | | $ | 16,881 | | | $ | (61,916) | | | $ | 141,312 | | | $ | 831,775 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock Class A | Common

Stock Class B | | | | | | |

| Shares | Amount | Shares | Amount | Additional Paid-

in Capital | Retained Earnings | Statutory Surplus

Reserve | Accumulated Other Comprehensive Loss | Non-controlling Interests | Total

Equity |

| Balance at December 31, 2023 | 56,036,172 | 6 | | 5,021,811 | 1 | | 629,845 | | 156,827 | | 30,060 | | (49,349) | | 158,772 | | 926,162 | |

| Net income | - | - | | - | | - | | - | | 41,643 | | - | | - | | 11,848 | | 53,491 | |

| Foreign currency translation adjustment | - | - | | - | | - | | - | | - | | - | | (5,481) | | (1,232) | | (6,713) | |

| Exercise of stock options | 1,366,081 | - | | - | | - | | 5,645 | | - | | - | | - | | 792 | | 6,437 | |

| Stock-based compensation | - | - | | - | - | | 23,972 | | - | | - | | - | | 4,939 | | 28,911 | |

| ACM Shanghai dividend | - | - | - | - | - | - | - | - | (6,900) | | (6,900) | |

| Balance at June 30, 2024 | 57,402,253 | $ | 6 | | 5,021,811 | $ | 1 | | $ | 659,462 | | $ | 198,470 | | $ | 30,060 | | $ | (54,830) | | $ | 168,219 | | $ | 1,001,388 | |

ACM RESEARCH, INC.

Condensed Consolidated Statements of Changes in Equity

For the Three Months Ended June 30, 2024 and 2023

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock Class A | | Common

Stock Class B | | Additional Paid-

in Capital | | Retained Earnings | | Statutory

Surplus

Reserve | | Accumulated

Other

Comprehensive

Income (loss) | | Non-controlling Interests | | Total

Equity |

| Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance at March 31, 2023 | 54,818,355 | | $ | 5 | | | 5,021,811 | | $ | 1 | | | $ | 606,398 | | | $ | 99,802 | | | $ | 16,881 | | | $ | (32,768) | | | $ | 140,778 | | | $ | 831,097 | |

| Net income | - | | - | | | - | | - | | | - | | | 26,825 | | | - | | | — | | | 6,772 | | | 33,597 | |

| Foreign currency translation adjustment | - | | - | | | - | | - | | | - | | | - | | | - | | | (29,148) | | | (6,121) | | | (35,269) | |

| Exercise of stock options | 133,135 | | - | | | - | | - | | | 450 | | | - | | | - | | | - | | | 3,834 | | | 4,284 | |

| Stock-based compensation | - | | - | | | - | | - | | | 2,017 | | | - | | | - | | | - | | | - | | | 2,017 | |

| ACM Shanghai dividend | - | | - | | | - | | - | | | - | | | - | | | - | | | - | | | (3,951) | | | (3,951) | |

| Balance at June 30, 2023 | 54,951,490 | | $ | 5 | | | 5,021,811 | | $ | 1 | | | $ | 608,865 | | | $ | 126,627 | | | $ | 16,881 | | | $ | (61,916) | | | $ | 141,312 | | | $ | 831,775 | |

| | | | | | | | | | | | | | | | | | | |

| Common

Stock Class A | | Common

Stock Class B | | Additional Paid-

in Capital | | Retained

earnings | | Statutory

Surplus

Reserve | | Accumulated

Other

Comprehensive

Loss | | Non-controlling

interests | | Total

Equity |

| Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance at March 31, 2024 | 56,986,777 | | $ | 6 | | | 5,021,811 | | $ | 1 | | | $ | 646,800 | | | $ | 174,260 | | | $ | 30,060 | | | $ | (54,925) | | | $ | 164,591 | | | $ | 960,793 | |

| Net income | - | | - | | | - | | - | | | - | | | 24,210 | | | - | | | — | | | 7,189 | | | 31,399 | |

| Foreign currency translation adjustment | - | | - | | | - | | - | | | - | | | - | | | - | | | 95 | | | 21 | | | 116 | |

| Exercise of stock options | 415,476 | | - | | | - | | - | | | 846 | | | - | | | - | | | - | | | 792 | | | 1,638 | |

| Stock-based compensation | - | | - | | | - | | - | | | 11,816 | | | - | | | - | | | - | | | 2,526 | | | 14,342 | |

| ACM Shanghai dividend | - | | - | | | - | | - | | | - | | | - | | | - | | | - | | | (6,900) | | | (6,900) | |

| Balance at June 30, 2024 | 57,402,253 | | $ | 6 | | | 5,021,811 | | $ | 1 | | | $ | 659,462 | | | $ | 198,470 | | | $ | 30,060 | | | $ | (54,830) | | | $ | 168,219 | | | $ | 1,001,388 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | | | | | |

| 2024 | | 2023 | | | | | | |

| Cash flows from operating activities: | | | | | | | | | |

| Net income | $ | 53,491 | | | $ | 42,560 | | | | | | | |

| Adjustments to reconcile net income from operations to net cash used in operating activities | | | | | | | | | |

| Non-cash operating lease cost | 2,004 | | | 1,740 | | | | | | | |

| Depreciation and amortization | 4,684 | | | 3,955 | | | | | | | |

| Loss on disposals of property, plant and equipment | (1) | | | (1) | | | | | | | |

| Realized gain on short-term investments | (273) | | | (7,913) | | | | | | | |

| Loss (income) from equity method investments | 1,215 | | | (3,888) | | | | | | | |

| Unrealized loss on short-term investments | 1,564 | | | 3,109 | | | | | | | |

| Inventory provision | 3,009 | | | 3,224 | | | | | | | |

| Provision for credit losses | 1,954 | | | 496 | | | | | | | |

| Deferred income taxes | (720) | | | (4,711) | | | | | | | |

| | | | | | | | | |

| Stock-based compensation | 28,911 | | | 4,085 | | | | | | | |

| | | | | | | | | |

| Dividends from unconsolidated affiliates | 600 | | | 5,095 | | | | | | | |

| Net changes in operating assets and liabilities: | | | | | | | | | |

| Accounts receivable | (14,842) | | | (28,630) | | | | | | | |

| Other receivables | (11,686) | | | (8,252) | | | | | | | |

| Inventories | (64,889) | | | (99,963) | | | | | | | |

| | | | | | | | | |

| Advances to related party (note 16) | (324) | | | 2,167 | | | | | | | |

| Prepaid expenses | 1,164 | | | (4,749) | | | | | | | |

| Related party accounts payable (note 16) | 6,605 | | | (2,589) | | | | | | | |

| Accounts payable | 2,400 | | | 9,963 | | | | | | | |

| Advances from customers | 26,333 | | | 46,611 | | | | | | | |

| Deferred revenue | 1,592 | | | 4,056 | | | | | | | |

| Income taxes payable | 4,755 | | | 8,629 | | | | | | | |

| FIN-48 payable | (56) | | | (240) | | | | | | | |

| Other payables and accrued expenses | 6,824 | | | 10,004 | | | | | | | |

| Operating lease liabilities | (2,004) | | | (1,740) | | | | | | | |

| Other long-term liabilities | (368) | | | (2,163) | | | | | | | |

| Net cash provided by (used in) operating activities | 51,942 | | | (19,145) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | |

| | | | | | | | | |

| Purchase of property and equipment | $ | (38,512) | | | (21,633) | | | | | | | |

| Purchase of intangible assets | (1,152) | | | (1,285) | | | | | | | |

| Purchase of short-term investments (note 15) | (1,403) | | | — | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Purchase of time deposits | (58,090) | | | (13,840) | | | | | | | |

| Proceeds from maturity of time deposits | 138,412 | | | 62,048 | | | | | | | |

| Proceeds from sale of short-term investments (note 15) | — | | | 17,709 | | | | | | | |

| Purchase of long-term investments (note 14) | (7,366) | | | (1,453) | | | | | | | |

| Net cash provided by investing activities | 31,889 | | | 41,546 | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | |

| Proceeds from short-term borrowings | 23,936 | | | — | | | | | | | |

| Repayments of short-term borrowings | (1,197) | | | — | | | | | | | |

| Proceeds from long-term borrowings | 32,277 | | | — | | | | | | | |

| Repayments of long-term borrowings | (3,202) | | | (1,111) | | | | | | | |

| Proceeds from exercise of stock options | 6,437 | | | 4,525 | | | | | | | |

| Net cash provided by financing activities | 58,251 | | | 3,414 | | | | | | | |

| | | | | | | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | $ | (343) | | | $ | (16,264) | | | | | | | |

| Net increase in cash, cash equivalents and restricted cash | 141,739 | | | $ | 9,551 | | | | | | | |

| Cash, cash equivalents and restricted cash at beginning of period | 183,173 | | | 248,451 | | | | | | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 324,912 | | | $ | 258,002 | | | | | | | |

| | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | | |

| Interest paid, net of capitalized interest | $ | 1,715 | | | $ | 1,344 | | | | | | | |

| Cash paid for income taxes | $ | 9,109 | | | $ | 7,243 | | | | | | | |

| | | | | | | | | |

| Reconciliation of cash, cash equivalents and restricted cash in consolidated statements of cash flows: | | | | | | | | | |

| Cash and cash equivalents | $ | 324,031 | | | $ | 257,420 | | | | | | | |

| Restricted cash | 881 | | | 582 | | | | | | | |

| | | | | | | | | |

| Cash, cash equivalents and restricted cash | $ | 324,912 | | | $ | 258,002 | | | | | | | |

| | | | | | | | | |

| Non-cash financing activities: | | | | | | | | | |

| Cashless exercise of stock options | $ | 262 | | | $ | 79 | | | | | | | |

| Non-cash investing activities: | | | | | | | | | |

| Proceeds from sale of short-term investments included in other receivables | $ | 3,167 | | | $ | — | | | | | | | |

| | | | | | | | | |

| Transfer from inventory to property, plant and equipment | $ | — | | | $ | 4,557 | | | | | | | |

| Transfer of prepayment for property to property, plant, and equipment | $ | 5,490 | | | $ | 177 | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share, percentage and per share data)

NOTE 1 – DESCRIPTION OF BUSINESS

ACM Research, Inc. (“ACM” or “ACM Research”) and its subsidiaries (collectively with ACM, the “Company”) develop, manufacture and sell capital equipment to the global semiconductor industry.

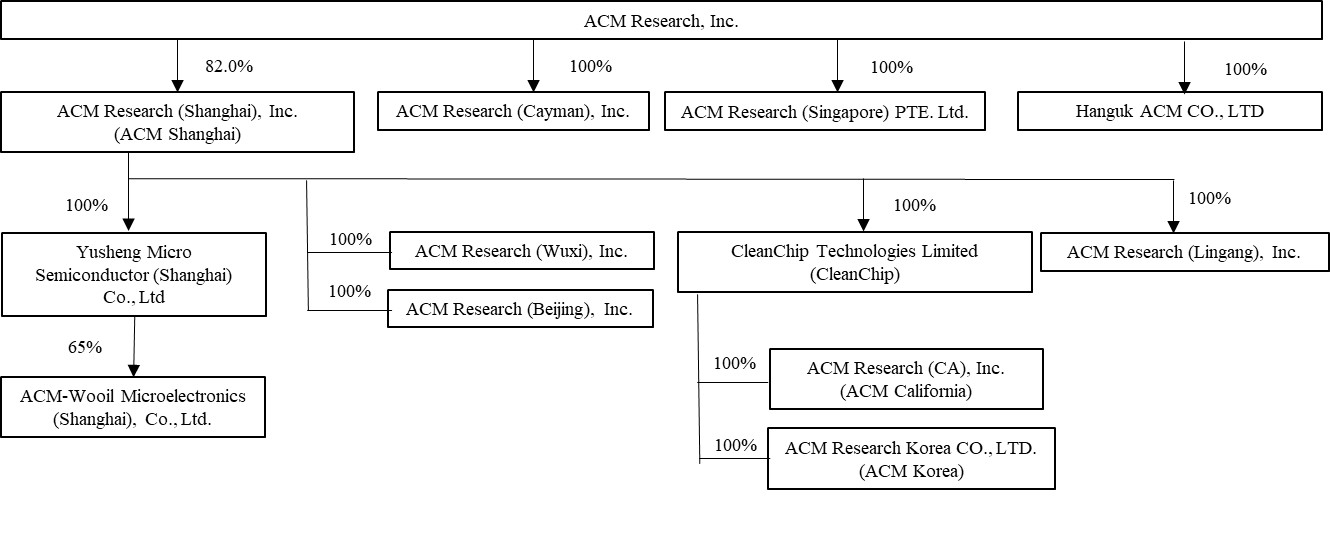

The Company has direct or indirect interests in the following subsidiaries:

| | | | | | | | | | | | | | |

| | | Effective interest held as at |

| Name of subsidiaries | Place and date of incorporation | Principal Activities | June 30,

2024 | December 31,

2023 |

| ACM Research (Shanghai), Inc. ("ACM Shanghai") | Mainland China, May 2005 | Principal operating subsidiary | 82.0 | % | 82.1 | % |

| ACM Research (Wuxi), Inc. ("ACM Wuxi") | Mainland China, July 2011 | Sales and services | 82.0 | % | 82.1 | % |

| CleanChip Technologies Limited ("CleanChip") | Hong Kong, June 2017 | Trading partner between ACM Shanghai and its customers | 82.0 | % | 82.1 | % |

| ACM Research Korea CO., LTD. | Korea, December 2017 | Sales, marketing, R&D, production | 82.0 | % | 82.1 | % |

| ACM Research ( Lingang), Inc. ("ACM Lingang") (1) | Mainland China, March 2019 | Management of production activities | 82.0 | % | 82.1 | % |

| ACM Research (CA), Inc. ("ACM California") | USA, April 2019 | Procurement for ACM Shanghai | 82.0 | % | 82.1 | % |

| ACM Research (Cayman), Inc. | Cayman Islands, April 2019 | Administrative function (inactive) | 100.0 | % | 100.0 | % |

| ACM Research (Singapore) PTE. Ltd. ("ACM Singapore") | Singapore, August 2021 | Sales, marketing, business development | 100.0 | % | 100.0 | % |

| ACM Research (Beijing), Inc. ("ACM Beijing") | Mainland China, February 2022 | Sales, marketing, business development | 82.0 | % | 82.1 | % |

| Hanguk ACM CO., LTD | Korea, March 2022 | Sales, services, business development | 100.0 | % | 100.0 | % |

| Yusheng Micro Semiconductor (Shanghai) Co., Ltd. | Mainland China, June 2023 | Business development | 82.0 | % | 82.1 | % |

| ACM-Wooil Microelectronics (Shanghai) Co., Ltd. | Mainland China, June 2023 | Component development and production | 59.3 | % | 59.4 | % |

(1) ACM Research (Lingang) Inc. is the English name referred to by its Chinese language name Shengwei Research (Shanghai), Inc., or ACM Shengwei in prior filings. ACM Research (Lingang), Inc. and Shengwei Research (Shanghai), Inc. refer to the same entity.

ACM RESEARCH, INC.

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share, percentage and per share data)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The Company’s condensed consolidated financial statements include the accounts of ACM and its subsidiaries. ACM’s subsidiaries are those entities in which ACM, directly or indirectly, controls a majority of the voting power. All significant intercompany transactions and balances have been eliminated upon consolidation.

The accompanying condensed consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and the rules and regulations of the Securities and Exchange Commission (the “SEC”) for reporting on Form 10-Q. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial statements. The accompanying condensed consolidated financial statements should be read in conjunction with the historical consolidated financial statements of the Company for the year ended December 31, 2023 included in ACM’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The accompanying condensed consolidated financial statements are unaudited. In the opinion of management, these unaudited condensed consolidated financial statements of the Company reflect all adjustments that are necessary for a fair presentation of the Company’s financial position and results of operations. Such adjustments are of a normal recurring nature, unless otherwise noted. The balance sheet as of June 30, 2024 and the results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of the results to be expected for any future period.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the balance sheet date and the reported revenues and expenses during the reported period in the condensed consolidated financial statements and accompanying notes. The Company’s significant accounting estimates and assumptions include, but are not limited to, those used for revenue recognition and deferred revenue, the valuation and recognition of fair value of certain short-term investments and long-term investments, stock-based compensation arrangements, realization of deferred tax assets, assessment for impairment of long-lived assets and long-term investments, allowance for credit losses, inventory valuation, useful lives of property, plant and equipment and useful lives of intangible assets.

Management evaluates these estimates and assumptions on a regular basis. Actual results could differ from those estimates and assumptions.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, bank deposits that are unrestricted as to withdrawal and use, and highly liquid investments with an original maturity date of three months or less at the date of purchase. At times, cash deposits may exceed government-insured limits.

ACM RESEARCH, INC.

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share, percentage and per share data)

The following table presents cash and cash equivalents, according to jurisdiction as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| United States | $ | 40,515 | | | $ | 43,614 | |

| Mainland China | 87,733 | | | 70,418 | |

| China Hong Kong | 194,979 | | | 64,057 | |

| Korea | 737 | | | 3,934 | |

| Singapore | 67 | | | 67 | |

| Total | $ | 324,031 | | | $ | 182,090 | |

The amounts in mainland China do not include short-term and long-term time deposits which totaled $41,839 and $121,342 at June 30, 2024 and December 31, 2023, respectively.

Cash held in the U.S. exceeds the Federal Deposit Insurance Corporation insurance limits and is subject to risk of loss. No losses have been experienced to date.

Cash amounts held in mainland China are subject to a series of risk control regulatory standards from mainland China bank regulatory authorities. ACM’s subsidiaries in mainland China are required to obtain approval from the State Administration of Foreign Exchange (“SAFE”) to transfer funds into or out of mainland China. SAFE requires a valid agreement to approve the transfers, which are processed through a bank. Other than these mainland China foreign exchange restrictions, ACM’s subsidiaries in mainland China are not subject to any restrictions and limitations on its ability to transfer funds to ACM or among our other subsidiaries. However, cash held in mainland China does exceed applicable insurance limits and is subject to risk of loss, although no such losses have been experienced to date.

ACM California periodically procures goods and services on behalf of ACM Shanghai and ACM Lingang. For these transactions, ACM Shanghai and ACM Lingang make cash payments to ACM California in accordance with applicable transfer pricing arrangements. For the three months ended June 30, 2024 and 2023, cash payments from ACM Shanghai and ACM Lingang to ACM California for the procurement of goods and services was $9,751 and $14,500, respectively. For the six months ended June 30, 2024 and 2023, cash payments from ACM Shanghai and ACM Lingang to ACM California for the procurement of goods and services was $14,399 and $25,431, respectively. ACM California periodically borrows funds for working capital advances from its direct parent, CleanChip. ACM California repays or renews these intercompany loans in accordance with their terms.

For sales through CleanChip and ACM Research, a certain amount of sales or advanced payments from customers is repatriated back to ACM Shanghai in accordance with applicable transfer pricing arrangements in the ordinary course of business. ACM Research provides services to certain customers located in the U.S., Europe and other regions outside of mainland China to support the evaluation of first tools and provide support for tools under warranty on behalf of ACM Shanghai. For these transactions, ACM Shanghai makes cash payments to ACM Research in accordance with applicable transfer pricing arrangements.

Amounts held in Korea exceed the Korea Deposit Insurance Corporation insurance limits and is subject to risk of loss. No losses have been experienced to date. There is no additional restriction for the transfer of cash from bank accounts in the U.S., Korea, Singapore and Hong Kong.

For the six months ended June 30, 2024 and 2023, with the exception of sales and services-related transfer-pricing payments in the ordinary course of business, no transfers, or distributions have been made between ACM Research and its subsidiaries, including ACM Shanghai, or to holders of ACM Research Class A common stock.

ACM RESEARCH, INC.

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share, percentage and per share data)

Time Deposits