|

PART I

|

|

Item 1

|

|

7

|

|

Item 1A

|

|

21

|

|

Item 1B

|

|

56

|

|

Item 2

|

|

57

|

|

Item 3

|

|

57

|

|

Item 4

|

|

57

|

| |

|

|

|

PART II

|

|

Item 5

|

|

58

|

|

Item 6

|

|

59

|

|

Item 7

|

|

60

|

|

Item 7A

|

|

89

|

|

Item 8

|

|

90

|

|

Item 9

|

|

140

|

|

Item 9A

|

|

140

|

|

Item 9B

|

|

142

|

|

Item 9C

|

|

142

|

| |

|

|

|

PART III

|

|

Item 10

|

|

143

|

|

Item 11

|

|

143

|

|

Item 12

|

|

143

|

|

Item 13

|

|

143

|

|

Item 14

|

|

143

|

| |

|

|

|

PART IV

|

|

Item 15

|

|

144

|

|

Item 16

|

|

147

|

|

|

|

148

|

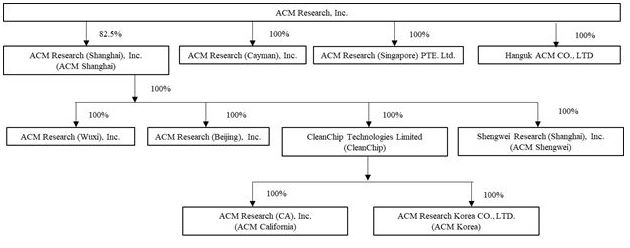

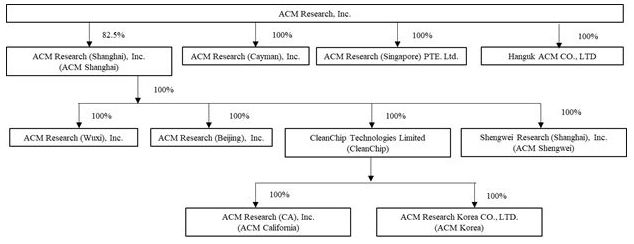

ACM Research, Inc., or ACM Research, is a Delaware corporation founded in California in 1998 to supply capital equipment developed for the global semiconductor industry. Since 2005, ACM

Research has conducted its business operations principally through its subsidiary ACM Research (Shanghai), Inc., or ACM Shanghai, a limited liability corporation formed by ACM Research in the People’s Republic of China, or the PRC, in 2005.

Unless the context requires otherwise, references in this report to “our company,” “our,” “us,” “we” and similar terms refer to ACM Research, Inc. and its subsidiaries, including ACM Shanghai, collectively.

Our principal corporate office is located in Fremont, California. We conduct a substantial majority of our product development, manufacturing, support and services in the PRC through ACM

Shanghai. We perform, through a subsidiary of ACM Shanghai, additional product development and subsystem production in South Korea, and we conduct, through ACM Research, sales and marketing activities focused on sales of ACM Shanghai products

in North America, Europe and certain regions in Asia outside mainland China.

ACM Research is not a PRC operating company, and we do not conduct our operations in the PRC through the use of a variable interest entity, or VIE, or any other structure designed for the

purpose of avoiding PRC legal restrictions on direct foreign investments in PRC-based companies. ACM Research has a direct ownership interest in ACM Shanghai as the result of its holding 82.5% of the outstanding shares of ACM Shanghai.

Stockholders of ACM Research may never directly own equity interests in ACM Shanghai. We do not believe that our corporate structure or any other matters relating to our business operations require that we obtain any permissions or approvals

from the China Securities Regulatory Commission, the Cyberspace Administration of China, or any other PRC central government authority in order to continue to list shares of Class A common stock of ACM Research on the Nasdaq Global Select

Market. This determination was based on the facts aforementioned and the PRC Company Law, PRC Securities Law, cybersecurity regulations and other relevant laws, regulations and regulatory requirements in the PRC currently in effect. However,

if this determination proves to be incorrect, then it could have a material adverse effect on ACM Research. See “Item IA. Risk Factors— Risks Related to International Aspects of Our Business—If any PRC

central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the authority’s permission or approval to continue the listing of ACM Research’s Class A common stock in the United States

or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such permission or approval, ACM Shanghai may be unable to obtain the required permission or approval or may only be able to obtain such

permission or approval on terms and conditions that impose material new restrictions and limitations on operation of ACM Shanghai, either of which could have a material adverse effect on our business, financial condition, results of

operations, reputation and prospects and on the trading price of ACM Research Class A common stock, which could decline in value or become worthless.”

The business of ACM Shanghai is subject to complex laws and regulations in the PRC that can change quickly with little or no advance notice. To date, beyond the COVID-19-related restrictions in

2022, we have not experienced such intervention or influence by PRC central government authorities or a change in those authorities’ rules and regulations that have had a material impact on ACM Shanghai or ACM Research.

In addition, in the ordinary course of business, ACM Shanghai is required to obtain certain operating permits and licenses necessary for it to operate in the PRC, including business licenses,

certifications relating to quality management standards, import and export-related qualifications from customs, as well as environmental and construction permits, licenses and approvals relating to construction projects. We believe ACM

Shanghai has all such required permits and licenses. However, from time to time the PRC government issues new regulations, which may require additional actions on the part of ACM Shanghai to comply. If ACM Shanghai does not, or is unable

to, obtain any such additional permits or licenses, ACM Shanghai may be subjected to restrictions and penalties imposed by the relevant PRC regulatory authorities, and it could have a material adverse effect on our business, financial

condition, results of operations, reputation and prospects and on the trading price of ACM Research Class A common stock, which could decline in value or become worthless.

The following chart depicts our corporate organization as of December 31, 2022:

Cash amounts held by ACM Shanghai at PRC banks in mainland China are subject to a series of risk control regulatory standards from PRC bank regulatory authorities. ACM Shanghai is required to

obtain approval from the State Administration of Foreign Exchange, or SAFE, to transfer funds into or out of the PRC. SAFE requires a valid agreement to approve the transfers, which are processed through a bank. Other than these PRC foreign

exchange restrictions, ACM Shanghai is not subject to any PRC restrictions and limitations on its ability to transfer funds to ACM Research or among our other subsidiaries. However, cash held by ACM Shanghai in mainland China does exceed

applicable insurance limits and is subject to risk of loss, although no such losses have been experienced to date.

ACM Research (CA), Inc., or ACM California, periodically procures goods and services on behalf of ACM Shanghai. For these transactions, ACM Shanghai makes cash payments to ACM California in

accordance with applicable transfer pricing arrangements. ACM California periodically borrows funds for working capital advances from its direct parent, CleanChip Technologies Limited, or CleanChip. ACM California renews or repays these

intercompany loans in accordance with their terms. For sales through CleanChip and ACM Research, a certain amount of sales proceeds is repatriated back to ACM Shanghai in accordance with applicable transfer pricing arrangements in the

ordinary course of business. Subsequent to June 30, 2020, with the exception of sales and services-related transfer-pricing payments in the ordinary course of business, no cash transfers, dividends or other payments or distributions have been

made between ACM Research and ACM Shanghai. We intend to retain any future earnings to finance the operations and expenses of our business, and we do not expect to distribute earnings or declare or pay any dividends in the foreseeable

future.

The U.S. Holding Foreign Companies Accountable Act, or the HFCA Act, requires that the Public Company Accounting Oversight Board, or the PCAOB, determine whether it is unable to inspect or

investigate completely registered public accounting firms located in a non-U.S. jurisdiction because of a position taken by one or more authorities in any non-U.S. jurisdiction. BDO China Shu Lun Pan Certified Public Accountants LLP, or BDO

China, had been our independent registered public accounting firm in recent years, including for the year ended December 31, 2021. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was

enacted on December 29, 2022 under the Consolidated Appropriations Act, 2023, as further described below. On December 16, 2021, the PCAOB reported its determination that it was unable to inspect or investigate completely registered public

accounting firms headquartered in the PRC and Hong Kong, including BDO China, because of positions taken by PRC authorities in those jurisdictions. On March 30, 2022, based on this determination, ACM Research was transferred to the SEC’s

“Conclusive list of issuers identified under the HFCA.” See “Item 1A. Risk Factors—Risks Related to International Aspects of Our Business—We could be adversely affected if we are unable to comply with recent and proposed legislation and

regulations regarding improved access to audit and other information and audit inspections of accounting firms operating in the PRC” of this report for more information. Under current regulations, if ACM Research were to be included on this

list for two consecutive years due to our independent auditor being located in a jurisdiction that does not allow for PCAOB inspections, the SEC would prohibit trading in our securities and this ultimately could cause our securities to be

delisted in the U.S., and their value may significantly decline or become worthless.

On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in the PRC and Hong Kong in

2022 and vacated its previous December 16, 2021 determination to the contrary. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in the PRC and

Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. PRC authorities will need to ensure that the PCAOB continues to have full access for inspections and investigations in 2023 and

beyond. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in the PRC and Hong Kong, among other jurisdictions. If the PRC authorities do not allow the PCAOB complete access for inspections and

investigations for two consecutive years, the SEC would prohibit trading in the securities of issuers engaging those audit firms, as required under the HFCA Act. Further, on December 29, 2022, the Consolidated Appropriations Act, 2023, was

signed into law by U.S. President Biden, which, among other things, amended the HFCA Act to reduce the number of consecutive non-inspection years that would trigger the trading prohibition under the HFCA Act from three years to two years

(originally such threshold under the HFCA Act was three consecutive years), and so that any foreign jurisdiction could be the reason why the PCAOB does not have complete access to inspect or investigate a company’s public accounting firm

(originally the HFCA Act only applied if the PCAOB’s ability to inspect or investigate was due to a position taken by an authority in the jurisdiction where the relevant public accounting firm was located).

In addition, on June 30, 2022, stockholders of ACM Research ratified the appointment of Armanino LLP as our independent auditor for the year ended December 31, 2022. Armanino LLP is neither

headquartered in the PRC or Hong Kong nor was it subject to the determinations announced by the PCAOB on December 16, 2021, which determinations were vacated by the PCAOB on December 15, 2022, and, subsequent to the filing of this report, we

do not believe ACM Research will appear on the “Conclusive list of issuers identified under the HFCAA” for a second time.

In addition to the matters discussed above, we are also subject to a number of legal and operational risks associated with our corporate structure, including as the result of a substantial

portion of our operations being conducted in the PRC. Consequences of any of those risks could result in a material adverse change in our operations or cause the value of ACM Research Class A common stock to significantly decline in value or

become worthless. Please carefully read the information included in “Item 1A. Risk Factors” of this report, in particular the risk factors addressing the following issues:

|

•

|

If any PRC central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the authority’s permission or approval to continue the listing of ACM

Research’s Class A common stock in the United States or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such permission or approval, or if we inadvertently conclude that such

permissions or approvals are not required, ACM Shanghai may be unable to obtain the required permission or approval or may only be able to obtain such permission or approval on terms and conditions that impose material new

restrictions and limitations on operation of ACM Shanghai, either of which could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects and on the trading price of ACM

Research Class A common stock, which could decline in value or become worthless.

|

| • |

PRC central government authorities may intervene in, or influence, ACM Shanghai’s PRC-based operations at any time, and those authorities’ rules and regulations in the PRC can change quickly with little or

no advance notice.

|

| • |

The PRC central government may determine to exert additional control over offerings conducted overseas or foreign investment in PRC-based issuers, which could result in a material change in operations of ACM

Shanghai and cause significant declines in the value of ACM Research Class A common stock, or make them worthless.

|

Recent statements and regulatory actions by PRC central government authorities with respect to the use of VIEs and to data security and anti-monopoly concerns have not affected our ability to

conduct our business operations in China. For further information, see “Item 1A. Risk Factors—Risks Related to International Aspects of Our Business” of this report for more information.

For purposes of this report, certain amounts in Renminbi, or RMB, have been translated into U.S. dollars solely for the convenience of the reader. The translations have been

made based on the conversion rates published by the State Administration of Foreign Exchange of the People’s Republic of China.

SAPS, TEBO, ULTRA C and ULTRA FURNACE are trademarks of ACM Research. For convenience, these trademarks appear in this report without ™ symbols, but that practice does not

mean that ACM Research will not assert, to the fullest extent under applicable law, ACM Research’s rights to the trademarks. This report also contains other companies’ trademarks, registered marks and trade names, which are the property of

those companies.

FORWARD-LOOKING STATEMENTS AND STATISTICAL DATA

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in

this report regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking

statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these

terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on our management’s belief and assumptions and on information currently

available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance, and involve known

and unknown risks, uncertainties and other factors, including those described or incorporated by reference in “Item 1A. Risk Factors” of Part I of this report, that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by these forward-looking statements.

The information included under the heading “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview,” of Part II of this report contains statistical

data and estimates, including forecasts, that are based on information provided by Gartner, Inc., or Gartner, in “Forecast: Semiconductor Wafer Fab Equipment, Worldwide, 4Q22 Update” (December 2022), or the Gartner Report. The Gartner Report

represents research opinions or viewpoints that are published, as part of a syndicated subscription service, by Gartner and are not representations of fact. The Gartner Report speaks as of its original publication date (and not as of the date

of this report), and the opinions expressed in the Gartner Report are subject to change without notice. While we are not aware of any misstatements regarding any of the data presented from the Gartner Report, estimates, and in particular

forecasts, involve numerous assumptions and are subject to risks and uncertainties, as well as change based on various factors, that could cause results to differ materially from those expressed in the data presented below.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Except as required by law, we assume no obligation to update these statements publicly or to

update the reasons actual results could differ materially from those anticipated in these statements, even if new information becomes available in the future.

You should read this report, and the documents that we reference in this report and have filed as exhibits to this report, completely and with the understanding that our actual future results may

be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I

Overview

We supply advanced, innovative capital equipment developed for the global semiconductor industry. Fabricators of advanced integrated circuits, or chips, can use our wet-cleaning and other

front-end processing tools in numerous steps to improve product yield, even at increasingly advanced process nodes. We have designed these tools for use in fabricating foundry, logic and memory chips, including dynamic random-access memory, or

DRAM, and 3D NAND-flash memory chips. We also develop, manufacture and sell a range of advanced packaging tools to wafer assembly and packaging customers.

Revenue from wet cleaning and other front-end processing tools totaled $308.5 million, or 79.3% of total revenue in 2022, $202.3 million, or 77.9% of total revenue in 2021, and $136.3 million, or

87.0% of total revenue in 2020. Selling prices for our wet-cleaning and other front-end processing tools range from $0.7 million to more than $5 million. Our customers for wet-cleaning and other front-end processing tools have included Shanghai

Huali Microelectronics Corporation, together with Huahong Semiconductor Ltd., collectively known as The Shanghai Huahong (Group) Company, Ltd., or The Huali Huahong Group, Semiconductor Manufacturing International Corporation, or SMIC, Shanghai

SK Hynix Inc., Yangtze Memory Technologies Co., Ltd., or YMTC, and ChangXin Memory Technologies.

Revenue from advanced packaging, other processing tools, services and spares totaled $80.3 million, or 20.7% of total revenue in 2022, $57.5 million, or 22.1% of total revenue in 2021, and $20.4

million, or 13.0% of total revenue in 2020. Selling prices for these tools range from $0.5 million to more than $4 million. Our customers for advanced packaging, and other processing tools have included Jiangyin Changdian Advanced Packaging

Co. Ltd., a leading PRC-based wafer bumping packaging house that is a subsidiary of JCET Group Co., Ltd.; Nantong Tongfu Microelectronics Co., Ltd., a PRC-based chip assembly and testing company that is a subsidiary of Nantong Fujitsu

Microelectronics Co., Ltd.; Nepes Co., Ltd., a semiconductor packaging company based in South Korea which acquired the operations of Deca Technologies’ Philippines manufacturing facility in 2020; and Wafer Works Corporation, a leading

PRC-based wafer supplier.

We estimate, based on third-party reports and on customer and other information, that our current product portfolio addresses approximately $16 billion of the 2022 global wafer fab equipment, or

WFE, market. By product line, we estimate an approximately $4.6 billion market opportunity is addressed by our wafer cleaning equipment, $4.3 billion by our Plasma-Enhanced Chemical Vapor Deposition, or PECVD, equipment, $3.2 billion by our

furnace equipment, $2.6 billion by our Track equipment, $800 million by our electro-chemical plating, or ECP, equipment, and more than $800 million by our stress-free polishing, advanced packaging, wafer processing, and other processing

equipment.

Based on Gartner’s estimates, the total available global market for these equipment segments increased by 7.6% from $20.1 billion in 2021, to $21.6 billion in 2022, and is expected to decrease by

19.6% to $17.4 billion in 2023. These equipment segments are a subset of the total worldwide semiconductor WFE market, which Gartner estimates increased by 8.9% from $92.4 billion in 2021 to $100.5 billion in 2022, and estimates will decrease

by 19.0% to $81.5 billion in 2023.

We have focused our selling efforts on establishing a referenceable base of leading foundry, logic and memory chip makers, whose use of our products can influence

decisions by other manufacturers. We believe this customer base has helped us penetrate the mature chip manufacturing markets and build credibility with additional industry leaders. We have used a “demo-to-sales” process to place evaluation

equipment, or “first tools,” with a number of selected customers.

To date, a substantial majority of our sales of single-wafer wet-cleaning equipment for front-end manufacturing have been to customers located in Asia, and we anticipate that a substantial

majority of our revenue from these products will continue to come from customers located in this region for the foreseeable future.

We have begun to add to our efforts to further address customers in North America, Western Europe and Southeast Asia by expanding our direct sales and services teams and increasing our global

marketing activities. Our U.S. operation includes sales, marketing and services personnel to expand and support major new customer initiatives for the products of ACM Shanghai to additional regions beyond mainland China. As of December 31,

2022, we have delivered one tool for evaluation to a U.S. lab of a global semiconductor capital equipment vendor, and two tools to the U.S. facility of a major U.S. semiconductor manufacturer. Both of these evaluations are supported by our

U.S. services team.

We are focused on building a strategic portfolio of intellectual property to support and protect our key innovations. Our tools have been developed using our key proprietary technologies:

|

●

|

Space Alternated Phase Shift, or SAPS, technology for flat and patterned (deep via or deep trench with stronger structure) wafer surfaces. SAPS technology employs

alternating phases of megasonic waves to deliver megasonic energy in a highly uniform manner on a microscopic level. We have shown SAPS technology to be more effective than conventional megasonic and jet spray technologies in

removing random defects across an entire wafer, with increasing relative effectiveness at more advanced production nodes.

|

| ● |

Timely Energized Bubble Oscillation, or TEBO, technology for patterned wafer surfaces at advanced process nodes. TEBO technology has been developed to provide

effective, damage-free cleaning for 2D and 3D patterned wafers with fine feature sizes. We have demonstrated the damage-free cleaning capabilities of TEBO technology on patterned wafers for feature nodes as small as 1xnm (16 to 19

nanometers, or nm), and we have shown TEBO technology can be applied in manufacturing processes for patterned chips with 3D architectures having aspect ratios as high as 60‑to‑1.

|

| ● |

Tahoe technology for cost and environmental savings. Tahoe technology delivers high cleaning performance using significantly less sulfuric acid and hydrogen peroxide

than is typically consumed by conventional high-temperature single-wafer cleaning tools.

|

| ● |

ECP technology for advanced metal plating. Our Ultra ECP ap, or Advanced Packaging, technology was developed for back-end assembly processes to deliver a more uniform

metal layer at the notch area of wafers prior to packaging. Our Ultra ECP map, or Multi-Anode Partial Plating, technology was developed for front-end wafer fabrication processes to deliver advanced electrochemical copper plating for

copper interconnect applications. Ultra ECP map offers improved gap-filling performance for ultra-thin seed layer applications, which is critical for advanced nodes at 28nm, 14nm and beyond.

|

In 2020, 2021 and 2022 we introduced and delivered a range of new tools intended to broaden our revenue opportunity with global semiconductor manufacturers. Product extensions include the Ultra

SFP ap tool for advanced packaging solutions, the Ultra C VI 18-chamber single wafer cleaning tool for advanced memory devices, and the Ultra ECP 3d platform for through-silicon-via, or tsv, application. New product lines include the Ultra fn

Furnace, our first dry processing tool, and a suite of semi-critical cleaning systems which include single wafer back side cleaning, scrubber, and auto bench cleaning tools.

We added two major new product categories in 2022 with the launch of the Ultra Pmax™ PECVD tool, which is equipped with a proprietary designed chamber, gas distribution unit and chuck, and is

intended to provide better film uniformity, reduced film stress, and improved particle performance, and the introduction of the Ultra Track tool, a 300mm process tool that delivers uniform air downflow, fast robot handling and customizable

software to address specific customer requirements, and has multiple features that enhance performance across defectivity, throughput, and cost of ownership.

We have been issued more than 448 patents in the United States, the People’s Republic of China, or PRC, Japan, Singapore, South Korea and Taiwan.

We conduct a substantial majority of our product development, manufacturing, support and services in the PRC, with additional product development and subsystem production in South Korea.

Substantially all of our integrated tools are built to order at our manufacturing facilities in the Pudong region of Shanghai, which now encompass a total of 236,000 square feet of floor space for production capacity, with leased buildings at

our Chuansha campus. In May 2020 ACM Shanghai, through its wholly owned subsidiary Shengwei Research (Shanghai), Inc., or ACM Shengwei, entered into an agreement for a land use right in the Lingang region of Shanghai. In 2020 ACM Shengwei began

a multi-year construction project for a new 1,000,000 square foot development and production center that will incorporate state-of-the-art manufacturing systems and automation technologies and will provide floor space to support significantly

increased production capacity and related research and development, or R&D, activities. We expect to complete construction of the first Lingang manufacturing building and commence initial production in the second half of 2023 timeframe.

Our experience has shown that chip manufacturers in the PRC and throughout Asia demand equipment that meets their specific technical requirements and generally prefer to build relationships with

local suppliers. We will continue to seek to leverage our local presence in the PRC and South Korea through our subsidiaries to address the growing market for semiconductor manufacturing equipment in the region by working closely with regional

chip manufacturers to understand their specific requirements, encourage them to adopt our technologies, and enable us to design innovative products and solutions to address their needs.

On November 18, 2021, ACM Shanghai successfully completed its initial public offering of shares of ACM Shanghai in the PRC, which we refer to as the STAR IPO, and its shares began trading on the

Shanghai Stock Exchange’s Sci-Tech innovAtion boaRd, known as the STAR Market, which we refer to as the STAR Listing, as described under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Technology and Product Offerings

Wet Cleaning Equipment for Front End Production Processes

Chip fabricators can use our single-wafer wet-cleaning tools in numerous steps to improve product yield in the front-end production process, during which individual devices are patterned in a chip

prior to being interconnected on a wafer. Our wet-cleaning equipment has been developed using our proprietary SAPS, TEBO and Tahoe technologies, which allow our tools to remove random defects from a wafer surface effectively, without damaging a

wafer or its features, even at increasingly advanced process nodes (the minimum line widths on a chip) of 22nm or less. We use a modular configuration that enables us to create a wet-cleaning tool meeting the specific requirements of a

customer, while using pre-existing designs for chamber, electrical, chemical delivery and other modules. Our modular approach supports a wide range of customer needs and facilitates the adaptation of our model tools for use with the optimal

chemicals selected to meet a customer’s requirements. Our tools are offered principally for use in manufacturing chips from 300 millimeter, or mm, silicon wafers, but we also offer solutions for 150mm and 200mm wafers and for nonstandard

substrates, including compound semiconductor, quartz, sapphire, glass and plastics.

SAPS Technology, Applications and Equipment

SAPS Technology

SAPS technology delivers megasonic energy uniformly to every point on an entire wafer by alternating phases of megasonic waves in the gap between a megasonic transducer and the wafer. Radicals for

removing random defects are generated in dilute solution, and the radical generation is promoted by megasonic energy. Unlike “stationary” megasonic transducers used in conventional megasonic cleaning methods, SAPS technology moves or tilts a

transducer while a wafer rotates, enabling megasonic energy to be delivered uniformly across all points on the wafer, even if the wafer is warped. The mechanical force of cavitations generated by megasonic energy enhances the mass transfer rate

of dislodged random defects and improves particle removal efficiency.

By delivering megasonic energy in a highly uniform manner on a microscopic level, SAPS technology can precisely control the intensity of megasonic energy and can effectively remove random defects

of all sizes across the entire wafer in less total cleaning time than conventional megasonic cleaning products, without loss of material or roughing of wafer surfaces. We have conducted trials demonstrating SAPS technology to be more effective

than conventional megasonic and jet spray cleaning technologies as defect sizes shrink from 300nm to 20nm and below. These trials show that SAPS technology has an even greater relative advantage over conventional jet spray technology for

cleaning defects between 50 and 65nm in size, and we expect the relative benefits of SAPS will continue to apply in cleaning even smaller defect sizes.

SAPS Applications

SAPS megasonic cleaning technology can be applied during the chip fabrication process to clean wafer surfaces and interconnects. It also can be used to clean, and lengthen the lifetime, of

recycled test wafers.

Wafer Surfaces. SAPS technology can enhance removal of random defects following planarization and deposition, which are among the most important, and most

repeated, steps in the fabrication process:

| ● |

Post CMP: Chemical mechanical planarization, or CMP, uses an abrasive chemical slurry following other fabrication processes, such as deposition and etching, in order to

achieve a smooth wafer surface in preparation for subsequent processing steps. SAPS technology can be applied following each CMP process to remove residual random defects deposited or formed during CMP.

|

| ● |

Post Hard Mask Deposition: As part of the photolithographical patterning process, a mask is applied with each deposition of a material layer to prevent etching of

material intended to be retained. Hard masks have been developed to etch high aspect-ratio features of advanced chips that traditional masks cannot tolerate. SAPS technology can be applied following each deposition step involving hard

masks that use nitride, oxide or carbon-based materials to achieve higher etch selectivity and resolution.

|

For these purposes, SAPS technology uses environmentally friendly dilute chemicals, reducing chemical consumption. Chemical types include dilute solutions of chemicals used in RCA cleaning, such

as dilute hydrofluoric acid and RCA SC-1 solutions, and, for higher quality wafer cleaning, functional de-ionized water produced by dissolving hydrogen, nitrogen or carbon dioxide in water containing a small amount of chemicals, such as

ammonia. Functional water removes random defects by generating radicals, and megasonic excitation can be used in conjunction with functional water to further increase the generation of radicals. Functional water has a lower cost and

environmental impact than RCA solutions, and using functional water is more efficient in eliminating random defects than using dilute chemicals or de-ionized water alone. We have shown that SAPS megasonic technology using functional water

exhibits high efficiency in removing random defects, especially particles smaller than 65nm, with minimal damage to structures.

Interconnects and Barrier Metals. Each successive advanced process node has led to finer feature sizes of interconnects such as contacts, which form

electrical pathways between a transistor and the first metal layer, and vias, which form electrical pathways between two metal layers. Advanced nodes have also resulted in higher aspect ratios for interconnect structures, with thinner,

redesigned metal barriers being used to prevent diffusion. SAPS technology can improve the removal of residues and other random defects from interconnects during the chip fabrication process:

| ● |

Post Contact/Via Etch: Wet etching processes are commonly used to create patterns of high-density contacts and vias. SAPS technology can be applied after each such

etching process to remove random defects that could otherwise lead to electrical shorts.

|

| ● |

Pre Barrier-Metal Deposition: Copper wiring requires metal diffusion barriers at the top of via holes to prevent electrical leakage. SAPS technology can be applied

prior to deposition of barrier metal to remove residual oxidized copper, which otherwise would adhere poorly to the barrier and impair performance.

|

For these applications, SAPS technology uses environmentally friendly dilute chemicals such as dilute hydrofluoric acid, RCA SC-1 solution, ozonated de-ionized water and functional de-ionized

water with dissolved hydrogen. These chemical solutions take the place of piranha solution, a high-temperature mixture of sulfuric acid and hydrogen peroxide used by conventional wet wafer cleaning processes. We have shown that SAPS technology

exhibits greater efficiency in removing random defects, and lower levels of material loss, than conventional processes, and our chemical solutions are less expensive and more environmentally conscious than piranha solution.

Recycled Test Wafers. In addition to using silicon wafers for chip production, chip manufacturers routinely process wafers through a limited portion of the

front-end fabrication steps in order to evaluate the health, performance and reliability of those steps. Manufacturers also use wafers for non-product purposes such as inline monitoring. Wafers used for purposes other than manufacturing revenue

products are known as test wafers, and it is typical for twenty to thirty percent of the wafers circulating in a fab to be test wafers. In light of the significant cost of wafers, manufacturers seek to re-use a test wafer for more than one

test. As test wafers are recycled, surface roughness and other defects progressively impair the ability of a wafer to complete tests accurately. SAPS technology can be applied to reduce random defect levels of a recycled wafer, enabling the

test wafer to be reclaimed for use in additional testing processes. For these purposes, SAPS technology includes improved fan filter units that balances intake and exhaust flows, precise temperature and concentration controls that ensure better

handling of concentrated acid processes, and two-chemical recycle capability that reduces chemical consumption.

SAPS Equipment

We offer two principal models of wet wafer cleaning equipment based on our SAPS technology, Ultra C SAPS II and Ultra C SAPS V. Each of these models is a single-wafer, serial-processing tool that

can be configured to customer specifications and, in conjunction with appropriate dilute chemicals, used to remove random defects from wafer surfaces or interconnects and barrier metals as part of the chip front-end fabrication process or for

recycling test wafers. By combining our megasonic and chemical cleaning technologies, we have designed these tools to remove random defects with greater efficacy and efficiency than conventional wafer cleaning processes, with enhanced process

flexibility and reduced quantities of chemicals. Each of our SAPS models was initially built to meet specific requirements of a key customer.

SAPS II (released in 2011). Highlights of our SAPS II equipment include:

|

|

● compact design, with footprint of 2.65m x 4.10m x 2.85m (WxDxH), requiring limited clean room floor space;

|

| |

|

● up to 8 chambers, providing throughput of up to 225 wafers per hour;

|

| |

|

● double-sided cleaning capability, with up to 5 cleaning chemicals for process flexibility;

|

| |

|

● 2-chemical recycling capability for reduced chemical consumption;

|

| |

|

● image wafer detection method for lowering wafer breakage rates; and

|

| |

|

● chemical delivery module for delivery of dilute hydrofluoric acid, RCA SC-1 solution, functional de-ionized water and carbon dioxide to each of

the chambers.

|

SAPS V (released in 2014). SAPS V includes SAPS II features with the following upgrades:

|

|

● compact design, with footprint of 2.55m x 5.1m x 2.85m (WxDxH), requiring limited clean room floor space;

|

| |

|

● up to 12 chambers, providing throughput of up to 375 wafers per hour;

|

| |

|

● chemical supply system integrated into mainframe;

|

| |

|

● inline mixing method replaces tank auto changing, reducing process time; and

|

| |

|

● improved drying technology using hot isopropyl alcohol and de-ionized water.

|

TEBO Technology, Applications and Equipment

TEBO Technology

We developed TEBO technology for application in wet wafer cleaning during the fabrication of 2D and 3D wafers with fine feature sizes. TEBO technology facilitates effective cleaning even with

patterned features too small or fragile to be addressed by conventional jet spray and megasonic cleaning technologies.

TEBO technology solves the problems created by transient cavitation in conventional megasonic cleaning processes. Cavitation is the formation of bubbles in a liquid, and transient cavitation is a

process in which a bubble in fluid implodes or collapses. In conventional megasonic cleaning processes, megasonic energy forms bubbles and then causes those bubbles to implode or collapse, blasting destructive high-pressure, high-temperature

micro jets toward the wafer surface. Our internal testing has confirmed that at any level of megasonic energy capable of removing random defects, the sonic energy and mechanical force generated by transient cavitation are sufficiently strong to

damage fragile patterned structures with features less than 70nm.

TEBO technology provides multi-parameter control of cavitation by using a sequence of rapid changes in pressure to force a bubble in liquid to oscillate at controlled sizes, shapes and

temperatures, rather than implode or collapse. As a result, cavitation remains stable during TEBO megasonic cleaning processes, and a chip fabricator can, using TEBO technology, apply the level of megasonic energy needed to remove random

defects without incurring the pattern damage created by transient cavitation in conventional megasonic cleaning.

We have demonstrated the damage-free or low-damage cleaning capabilities of TEBO technology on customers’ patterned wafers as small as 1xnm (16nm to 19nm), and we believe TEBO technology will be

applicable in even smaller fabrication process nodes. TEBO technology can be applied in manufacturing processes for conventional 2D chips with fine features and advanced chips with 3D structures, including Fin Field Effect Transistors or

FinFET, DRAM, 3D NAND and 3D cross point memory, and we expect it will be applicable to other 3D architectures developed in the future, such as carbon nanotubes and quantum devices. As a result of the thorough, controlled nature of TEBO

processes, cleaning time for TEBO-based solutions may take longer than conventional megasonic cleaning processes. Conventional processes have proven ineffective, however, for process nodes of 20nm or less, and we believe the increased yield

that can be achieved by using TEBO technology for nodes up to 70nm can more than offset the cost of the additional time in utilizing TEBO technology.

TEBO Applications

At process nodes of 28nm and less, chip makers face escalating challenges in eliminating nanometric particles and maintaining the condition of inside pattern surfaces. In order to maintain chip

quality and avoid yield loss, cleaning technologies must control random defects of diminishing killer defect sizes, without roughing or otherwise damaging surfaces of transistors, interconnects or other wafer features. TEBO technology can be

applied in numerous steps throughout the manufacturing process flow for effective, damage-free cleaning:

| ● |

Memory Chips: We estimate that TEBO technology can be applied in as many as 50 steps in the fabrication of a DRAM chip, consisting of up to 10 steps in cleaning ISO

structures, 20 steps in cleaning buried gates, and 20 steps in cleaning high aspect-ratio storage nodes and stacked films.

|

| ● |

Logic Chips: In the fabrication process for a logic chip with a FinFET structure, we estimate that TEBO technology can be used in 15 or more cleaning steps.

|

For purposes of solving inside pattern surface conditions for memory or logic chips, TEBO technology uses environmentally friendly dilute chemicals such as RCA SC-1 and hydrogen gas doped

functional water.

TEBO Equipment

We offer two models of wet wafer cleaning equipment based on our TEBO technology, Ultra C TEBO II and Ultra C TEBO V. Each of these models is a single-wafer, serial-processing tool that can be

configured to customer specifications and, in conjunction with appropriate dilute chemicals, used at numerous manufacturing processing steps for effective, damage-free cleaning of chips at process nodes of 28nm or less. TEBO equipment solves

the problem of pattern damage caused by transient cavitation in conventional jet spray and megasonic cleaning processes, providing better particle removal efficiency with limited material loss or roughing. TEBO equipment is being evaluated by a

select group of leading memory and logic chip customers.

Each model of TEBO equipment includes:

|

|

● an equipment front-end module, or EFEM, which moves wafers from chamber to chamber.

● one or more chamber modules, each equipped with a TEBO megasonic generator system.

● an electrical module to provide power for the tool; and

● a chemical delivery module.

|

| |

|

Ultra C TEBO II (released in 2016). Highlights of our Ultra C TEBO II equipment include:

|

| |

|

● compact design, with footprint of 2.25m x 2.25m x 2.85m (WxDxH);

● up to 8 chambers with an upgraded transport system and optimized robotic scheduler, providing throughput of up to 300 wafers per hour.

● EFEM module consisting of 4 load ports, transfer robot and 1 process robot; and

● focus on dilute chemicals contributes to environmental sustainability and lower cost of ownership.

|

| |

|

|

Ultra C TEBO V (released in 2016). Highlights of our Ultra C TEBO V equipment include:

|

| |

|

|

|

● footprint of 2.45m x 5.30m x 2.85m (WxDxH).

● up to 12 chamber modules, providing throughput of up to 300 wafers per hour.

● EFEM module consisting of 4 load ports, 1 transfer robot and 1 process robot: and

● chemical delivery module for delivery of isopropyl alcohol, dilute hydrofluoric acid, RCA SC-1 solution, functional de-ionized water and carbon

dioxide to each of the chambers.

|

Tahoe Overview

Our Ultra-C Tahoe wafer cleaning tool can deliver high cleaning performance using significantly less sulfuric acid and hydrogen peroxide than is typically consumed by conventional high-temperature

single-wafer cleaning tools. During normal single-wafer cleaning processes, only a fraction of the acid reacts with the wafer surface, while the majority is wasted as acid spins off the wafer and requires significant cost and effort to be

recycled. Tahoe employs a proprietary hybrid approach in which the sulfuric acid cleaning steps are processed in batch mode, and the final stage cleaning are processed with single-wafer cleaning technologies. In addition to providing cost

savings resulting from vastly reduced sulfuric acid consumption, Ultra-C Tahoe meets the needs of customers who face increased environmental regulations and demand new, more environmentally friendly tools. We delivered our first Ultra C Tahoe

tool to a strategic customer in 2019.

Advanced Packaging and other Back-End Processing Tools

We leverage our technology and expertise to provide a range of single-wafer tools for back-end wafer assembly and packaging factories. We develop, manufacture and sell a wide range of advanced

packaging tools, such as coaters, developers, photoresist strippers, scrubbers, wet etchers and copper-plating tools. We focus on providing custom-made, differentiated equipment that incorporates customer-requested features at a competitive

price.

For example, our Ultra C Coater is used in applying photoresist, a light-sensitive material used in photolithography to transfer a pattern from a mask onto a wafer. Coaters typically provide input

and output elevators, shuttle systems and other devices to handle and transport wafers during the coating process. Unlike most coaters, the Ultra C Coater is fully automated. Based on requests from customers, we developed and incorporated the

special function of chamber auto-clean module into the Ultra C Coater, which further differentiates it from other products in the market by reducing or eliminating the cleaning of shroud in the coater which increases the tool’s continuous

production time. The Ultra C Coater is designed to deliver improved throughput and more efficient tool utilization while eliminating particle generation.

Our other advanced packaging tools include: Ultra ECP ap, which delivers a uniform metal layer to finished wafers prior to packaging; Ultra C Developer, which applies liquid developer to selected

parts of photoresist to resolve an image; Ultra C PR Megasonic-Assisted Stripper, which removes photoresist; Ultra C Scrubber, which scrubs and cleans wafers; Ultra C Thin Wafer Scrubber, which addresses a sub-market of cleaning very thin

wafers for certain Asian assembly factories; and Ultra C Wet Etcher, which etches silicon wafers and copper and titanium interconnects.

Our Customers

Since 2009 we have delivered more than 380 wet cleaning and other front-end processing tools, more than 290 of which were repeat orders or acceptances upon contractual performance obligations

having been met and thereby generated revenue to us. The balance of the delivered tools is awaiting customer acceptance should contractual conditions be met. To date, substantially all of our sales of equipment for semiconductor-manufacturing

have been to customers located in Asia, and we anticipate that a substantial majority of our revenue from these products will continue to come from customers located in this region for the foreseeable future. We have begun to add to our efforts

to further address customers in North America, Western Europe and Southeast Asia, by expanding our direct sales teams and increasing our global marketing activities.

We generate most of our revenue from a limited number of customers as the result of our strategy of initially placing equipment with a small number of leading chip manufacturers that are driving

technology trends and key capability implementation. In 2022, 43.8% of our revenue was derived from three customers: The Huali Huahong Group, a leading PRC-based foundry, accounted for 18.2% of our revenue; SMIC, a leading PRC-based foundry,

accounted for 15.6% of our revenue, and YMTC, a leading PRC-based memory chip company, together with one of its subsidiaries, accounted for 10.0% of our revenue. In 2021, 48.9% of our revenue was derived from two customers: The Huali Huahong

Group accounted for 28.1% of our revenue; and YMTC, together with one of its subsidiaries, accounted for 20.8% of our revenue. In 2020, 75.8% of our revenue was derived from three customers: The Huali Huahong Group accounted for 36.9% of our

revenue; YMTC, together with one of its subsidiaries, accounted for 26.8% of our revenue; and SMIC accounted for 12.1% of our revenue.

For our back-end wafer assembly and packaging customers, we focus on providing custom-made, differentiated equipment that incorporates a customer’s requested features at a competitive cost of

ownership. Our customers for advanced packaging, wafer processing, and other back-end processing tools have included Jiangyin Changdian Advanced Packaging Co. Ltd., a leading PRC-based wafer bumping packaging house that is a subsidiary of JCET

Group Co., Ltd.; Nantong Tongfu Microelectronics Co., Ltd., a PRC-based chip assembly and testing company that is a subsidiary of Nantong Fujitsu Microelectronics Co., Ltd.; Nepes Co., Ltd., a semiconductor packaging company based in South

Korea which acquired the operations of Deca Technologies’ Philippines manufacturing facility in 2020; and Wafer Works Corporation, a leading PRC-based wafer supplier.

Sales and Marketing

We market and sell our products worldwide using a combination of our direct sales force and third-party representatives. We employ direct sales teams in Asia, Europe and North America, and have

located these teams near our customers, primarily in the PRC, South Korea, Taiwan and the United States. Each salesperson has specific local market expertise. We also employ field application engineers, who are typically co-located with our

direct sales teams, to provide technical pre- and post-sale support tours and other assistance to existing and potential customers throughout the customers’ fab planning and production line qualification and fab expansion phases. Our field

application engineers are organized by end markets as well as core competencies in hardware, control system, software and process development to support our customers.

To supplement our direct sales teams, we have contacts with several independent sales representatives in the PRC, South Korea and Taiwan. We select these independent representatives based on their

ability to provide effective field sales, marketing forecast and technical requirement updates for our products. In the case of representatives, our customers place purchase orders with us directly rather than with the representatives.

Our sales have historically been made using purchase orders with agreed technical specifications. Our sales terms and conditions are generally consistent with industry practice but may vary from

customer to customer. We seek to obtain a purchase order two to six months ahead of the customer’s desired delivery date. Consistent with industry practice, we allow customers to reschedule or cancel orders at a certain cost to them on

relatively short notice. Because of our relatively short delivery period and our practice of permitting rescheduling or cancellation, we believe that backlog is not a reliable indicator of our future revenue.

Our marketing team focuses on our product strategy and technology road maps, product marketing, new product introduction processes, demand assessment and competitive analysis, customer requirement

communication and public relations. Our marketing team also has the responsibility to conduct environmental scans, study industry trends and arrange our participation at major trade shows.

Manufacturing

We conduct a substantial majority of our product development, manufacturing, support and services in the PRC, with additional product development and subsystem production in South Korea.

Substantially all of our tools are built to order at our manufacturing facilities in the Pudong region of Shanghai, which now encompass a total of 236,000 square feet of floor space for production capacity.

In May 2020 ACM Shanghai, through its wholly owned subsidiary ACM Shengwei, entered into an agreement for a land use right in the Lingang region of Shanghai. In July 2020 ACM Shengwei began a

multi-year construction project for a new development and production center. The planned 1,000,000 square foot facility will incorporate state-of-the-art manufacturing systems and automation technologies and will provide the floor space to

support significantly more production capacity and related research and development activities when fully staffed and supplied. See “Item 2. Properties,” of Part I of this report.

Our experience has shown that chip manufacturers in the PRC and throughout Asia demand equipment meeting their specific technical requirements and prefer building relationships with local

suppliers. We will continue to seek to leverage our local presence to address the growing market for semiconductor manufacturing equipment in the region by working closely with regional chip manufacturers to understand their specific

requirements, encourage them to adopt our SAPS, TEBO, Tahoe, ECP, furnace and other technologies in our current portfolio, and enable us to design innovative products and solutions to address their needs.

Currently substantially all of our staff are able to work at both of our Shanghai facilities, and to date we have not experienced absenteeism of management or other key employees, other than

certain of our executive officers being delayed in traveling between the PRC, our California office, and other global locations, and a significant number of ACM Shanghai employees missing work in late 2022 and early 2023 for one or several

weeks due to COVID-19 related illness following relaxation of the PRC’s zero-COVID policies in December 2022. For additional information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations—COVID-19 Pandemic,” of Part II of this report.

We purchase some of the components and assemblies that we include in our products from single source suppliers. We believe that we could obtain and qualify alternative sources to supply these

components. Nevertheless, any prolonged inability to obtain these components could have an adverse effect on our operating results and could unfavorably impact our customer relationships. Please see “Item 1A. Risk Factors—Risks Related to Our

Business and Our Industry—We depend on a limited number of suppliers, including single source suppliers, for critical components and assemblies, and our business could be disrupted if they are unable to meet our needs.”

Research and Development

We believe that our success depends in part on our ability to develop and deliver breakthrough technologies and capabilities to meet our customers’ ever-more challenging technical requirements.

For this reason, we devote significant financial and personnel resources to research and development. Our research and development team is comprised of highly skilled engineers and technologists with extensive experience in megasonic

technology, cleaning processes and chemistry, mechanical design, and control system design.

For the foreseeable future we are focusing on enhancing our Ultra C SAPS, TEBO, Tahoe, ECP, furnace and other tools and integrating additional capabilities to meet and anticipate requirements

from our existing and potential customers. Our particular areas of focus include development of the following:

| ● |

new cleaning steps for Ultra C SAPS cleaners for application in logic chips and for DRAM, and 3D NAND technologies.

|

| ● |

new cleaning steps for Ultra C TEBO cleaners for FinFET in logic chips, gates in DRAM, and deep vias in 3D NAND technologies.

|

| ● |

new cleaning steps for Ultra Tahoe cleaners for application in logic chips and for DRAM and 3D NAND technologies.

|

| ● |

new dry technologies such as supercritical CO2 dry and advanced IPA dry for DRAM, and logic technologies.

|

| ● |

new hardware, including new system platforms, new and additional chamber structures and new chemical blending systems;

|

| ● |

new software to integrate new functionalities to improve tool performance; and

|

| ● |

support for the ongoing evaluations and commercialization efforts and product extensions for the newly introduced PECVD and Track product categories.

|

Longer term, we are working on new proprietary process capabilities based on our existing tool hardware platforms. We are also working to integrate our tools with third-party tools in adjacent

process areas in the chip manufacturing flow.

Our research and development expense totaled $62.2 million or 16.0% of revenue in 2022, $34.2 million or 13.2% of revenue in 2021 and $19.1 million or 12.2% of revenue in 2020. We intend to

continue to invest in research and development to support and enhance our existing cleaning products and to develop future product offerings to build and maintain our technology leadership position.

Intellectual Property

Our success and future revenue growth depend, in part, on our ability to protect our intellectual property. We control access to and use of our proprietary technologies, software and other

confidential information through the use of internal and external controls, including contractual protections with employees, consultants, advisors, customers, partners and suppliers. We rely primarily on patent, copyright, trademark and trade

secret laws, as well as confidentiality procedures, to protect our proprietary technologies and processes. All employees and consultants are required to execute confidentiality agreements in connection with their employment and consulting

relationships with us. We also require them to agree to disclose and assign to us all inventions conceived or made in connection with the employment or consulting relationship.

We have aggressively pursued intellectual property since our founding in 1998. We focus our patent filing efforts in the United States, and, when justified by cost and strategic importance, we

file corresponding foreign patent applications in strategic jurisdictions such as the European Union, the PRC, Japan, Singapore, South Korea, and Taiwan. Our patent strategy is designed to provide a balance between the need for coverage in our

strategic markets and the need to maintain costs at a reasonable level.

As of December 31, 2022, we had 41 issued patents, and 29 patents pending, in the United States. These patents carry expiration dates from 2027 through 2037. Many of the US patents and

applications have also been filed internationally, in one or more of the European Union, Japan, PRC, Singapore, South Korea, and Taiwan. Specifically, we own patents in wafer cleaning, electro-polishing and plating, wafer preparation, and other

semiconductor processing technologies. We have been issued more than 448 patents in the United States, the PRC, Japan, Korea, Singapore and Taiwan.

We manufacture advanced single-wafer cleaning systems equipped with our SAPS, TEBO and Tahoe technologies. Our wafer cleaning technologies are protected by US Patent Numbers 8580042, 8671961,

9070723, 9281177, 9492852, 9595457, 9633833, 10020208, 10910244, 11103898, 11037804, 11141762, 11462423, 11257667, and 11298727, as well as their corresponding international patents. We have 48 patents granted internationally protecting our

SAPS technologies. We also have filed 11 international patent applications for key TEBO technologies, and 4 for Tahoe, in accordance with the Patent Cooperation Treaty, in anticipation of filing in the U.S. national phase.

In addition to the above core technologies, we have technologies for SFP and ECP that are used in certain of our tools. SFP is an integral part of the electro polishing process. Our technology was

a breakthrough in electro-chemical-copper-planarization technology when it was first introduced, because it can polish, stress-free, copper layers used in copper low-K interconnects. Our innovations in SFP and ECP are reflected in US Patent

Numbers 6638863, 8518224, 10227705, and 11008669, and their corresponding international counterparts.

We also have technologies in other semiconductor processing areas, such as wafer preparation and some specific processing steps. The wafer preparation technology is covered by US Patent Numbers

8383429 and 9295167. The specific processing steps include US Patent Number 8598039 titled “Barrier layer removal method and apparatus,” and US Patent Number 10615073 titled “method for removing barrier layer for minimizing sidewall recess.”

To date we have not granted licenses to third parties under the patents described above. Not all of these patents have been implemented in products. We may enter into licensing or cross-licensing

arrangements with other companies in the future.

We cannot assure you that any patents will issue from any of our pending applications. Any rights granted under any of our existing or future patents may not provide meaningful protection or any

commercial advantage to us. With respect to our other proprietary rights, it may be possible for third parties to copy or otherwise obtain and use our proprietary technology or marks without authorization or to develop similar technology

independently.

The semiconductor equipment industry is characterized by vigorous protection and pursuit of intellectual property rights or positions, which have resulted in often protracted and expensive

litigation. We may in the future initiate claims or litigation against third parties to determine the validity and scope of proprietary rights of others. In addition, we may in the future initiate litigation to enforce our intellectual property

rights or the rights of our customers or to protect our trade secrets.

Our customers could become the target of litigation relating to the patent or other intellectual property rights of others. This could trigger technical support and indemnification obligations in

some of our customer agreements. These obligations could result in substantial expenses, including the payment by us of costs and damages related to claims of patent infringement. In addition to the time and expense required for us to provide

support or indemnification to our customers, any such litigation could disrupt the businesses of our customers, which in turn could hurt our relations with our customers and cause the sale of our products to decrease. We do not have any

insurance coverage for intellectual property infringement claims for which we may be obligated to provide indemnification.

Additional information about the risks relating to our intellectual property is provided under “Item 1A. Risk Factors—Risks Related to Our Intellectual Property and Data Security.”

Competition

The chip equipment industry is characterized by rapid change and is highly competitive throughout the world. We compete with semiconductor equipment companies located around the world, and we may

also face competition from new and emerging companies, including new competitors from the PRC. We consider our principal competitors to be those companies that provide wafer cleaning and electrical plating products to the market, including Lam

Research Corporation, NAURA Technology Group Co., Ltd., Mujin Electronics Co., Ltd., SCREEN SPE USA, LLC (a subsidiary of SCREEN Holdings Co., Ltd.), SEMES Co. Ltd., Tokyo Electron Ltd. and Kokusai Semiconductor Equipment Corporation. Key

competitors for our newly-introduced PECVD and Track products include Lam Research Corporation, Applied Materials, Inc., KINGSEMI Co., Ltd. and Suzho Jingtuo Semiconductor Technology Co., Ltd.

Compared to our company, our current and potential competitors may have:

| ● |

better established credibility and market reputations, longer operating histories, and broader product offerings;

|

| ● |

significantly greater financial, technical, marketing and other resources, which may allow them to pursue design, development, manufacturing, sales, marketing, distribution and service support of their

products;

|

| ● |

more extensive customer and partner relationships, which may position them to identify and respond more successfully to market developments and changes in customer demands; and

|

| ● |

multiple product offerings, which may enable them to offer bundled discounts for customers purchasing multiple products or other incentives that we cannot match or offer.

|

The principal competitive factors in our market include:

| ● |

performance of products, including particle removal efficiency, rate of damage to wafer structures, high temperature chemistry, throughput, tool uptime and reliability, safety, chemical waste treatment, and

environmental impact;

|

| ● |

gap filling capability, the deposited film thickness uniformity within wafer and wafer to wafer, particle generated on the wafer during the processes;

|

| ● |

service support capability and spare parts delivery time; innovation and development of functionality and features that are must-haves for advanced fabrication nodes;

|

| ● |

ability to anticipate customer requirements, especially for advanced process nodes of less than 45nm; ability to identify new process applications;

|

| ● |

brand recognition and reputation; and

|

| ● |

skill and capability of personnel, including design engineers, manufacturing engineers and technicians, application engineers, and service engineers.

|

In addition, semiconductor manufacturers must make a substantial investment to qualify and integrate new equipment into semiconductor production lines. Some manufacturers began fabricating chips

for the 5nm node in 2020 and the 3nm node in 2022. Once a semiconductor manufacturer has selected a particular supplier’s equipment and qualified it for production, the manufacturer generally maintains that selection for that specific

production application and technology node as long as the supplier’s products demonstrate performance to specification in the installed base. Accordingly, we may experience difficulty in selling to a given manufacturer if that manufacturer has

qualified a competitor’s equipment. If, however, that cleaning equipment constrains chip yield, we expect, based on our experience to date, that the manufacturer will evaluate implementing new equipment that cleans more effectively.

We intend to address the high-end fabrication market with advanced nodes, and we believe we compete favorably with respect to the factors described above. Most of our competitors offer

single-wafer cleaning products using jet spray technology, which has relatively poor particle removal efficiency for random defects less than 30nm in size and presents increased risk of damage to the fragile patterned architectures of wafers at

advanced process nodes. Certain of our competitors offer single-wafer cleaning products with megasonic cleaning capability, but we believe these products, which use conventional megasonic technology, are unable to maintain energy dose

uniformity on the entire wafer and often lack the ability to repeat the requisite uniform energy dose wafer to wafer in production, resulting in poor efficiency in removing random defects, longer processing time and greater loss of material. In

addition, these conventional megasonic products generate transient cavitation, which results in more incidents of damage to wafer structures with feature sizes of 70nm or less. We design our cleaning tools equipped with our proprietary SAPS,

TEBO and Tahoe technologies, which we believe offer better performance, much less chemical consumption, and lower cost of consumables, including at advanced process nodes of 22nm or less.

Human Capital

As of December 31, 2022, we had 1,209 full-time equivalent employees, of whom 110 were in administration, 253 were in manufacturing, 519 were in research and development, and 327 were in sales and marketing and customer services. Of these employees, 1,077 were located in mainland China and the Taiwan region, 119 were located in Korea and 13 were based in the United States. We have

never had a work stoppage, and none of our employees are represented by a labor organization or subject to any collective bargaining arrangements. We consider our employee relations to be good.

We compete in the highly competitive semiconductor equipment industry, with operations principally in the PRC. Attracting, developing, and retaining skilled and experienced employees in research

and development, manufacturing, sales and marketing, and other positions is crucial to our ability to compete effectively. Our ability to recruit and retain such employees depends on a number of factors, including our corporate culture and work

environment, informed by our values and behaviors, our corporate philosophy of talent development and career opportunities, and compensation and benefits.

Recruitment, Retention and Benefits

To attract and retain qualified employees and key talent, we offer total compensation packages that are competitive with comparable companies, particularly in the PRC and, specifically, Shanghai.

We provide training and development programs to our employees, and we have trained many of our key engineers and managers for more than a decade. Retention of these key employees is critical to

secure our future growth and technology development. To assist in employee retention and recruitment, we offer employee housing in the Lingang region of Shanghai in connection with the completion of ACM Shanghai’s housing facility in Lingang,

where we are in the process of building a new research and development and production center.

Health and Safety, Pandemic Response

When it comes to employee safety, we are committed to providing a safe work environment for our employees that meets or exceeds local environmental, health, and safety laws and regulations. As a

result of the COVID-19 pandemic, we have augmented certain of our normal business practices to ensure that we promote health and safety for our employees. We have established safety policies and protocols, and we regularly update our employees

with respect to any changes. A majority of our workforce provide services that cannot be performed remotely, and we have prioritized the health of those individuals that continue to work at our facilities. We have provided personal protective

equipment and cleaning supplies. We require masks to be worn in our facilities and have prohibited all non-essential domestic and international travel for all employees. We have also provided general information updates and support for our

employees to ensure that they have resources and information to protect their health and that of those around them, including their families and co-workers.

COVID-19 Pandemic

Following its initial outbreak in December 2019, COVID–19, or the coronavirus, spread across the PRC, the United States and globally. The COVID–19 outbreak has affected our business and operating

results since the first quarter of 2020. Since that time, travel between our offices in the United States and our facilities in the PRC has been and will likely continue to be restricted, which has and may continue to impact our ability to

effectively operate our company and to oversee our operations. The COVID–19 situation continues to evolve, and it is impossible for us to predict the effect and ultimate impact of the COVID–19 outbreak on our business operations and results. In

December 2022, the PRC government relaxed its zero-COVID policies, which resulted in large scale COVID-19 infections throughout China, including Shanghai. A significant number of ACM Shanghai employees were also infected, and in many cases

missed work for one or several weeks, which caused administrative and operational challenges in late 2022 and early 2023. We continue to monitor the impact of the COVID-19 pandemic on all aspects of our business, including our operations,

customers, suppliers and projects. While the ongoing regulatory measures instituted or recommended in response to COVID–19 are expected to be temporary, the duration of the business disruptions, and related financial impact, of the outbreak

cannot be estimated at this time.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—COVID‑19 Pandemic” of Part II of this report for additional discussion of our expectations and

estimates related to the COVID-19 Pandemic.

Environmental

Severe weather events, including earthquakes, fires, floods, heat waves, hurricanes and other environmental disasters, could pose a threat to our manufacturing and research and development

activities through physical damage to our operating facilities or equipment or disruption of power supply or telecommunications infrastructure. The frequency and intensity of severe weather events are reportedly increasing throughout the world

as part of broader climate changes. Global weather pattern changes may also pose long-term risks of physical impacts to our business. We maintain disaster recovery and business continuity plans that would be implemented to help us recover in

the event of severe weather events that interrupt our business. See “Item 1A. Risk Factors—General—Our production facilities could be damaged or disrupted by a natural disaster, war, terrorist attacks or other catastrophic events.”

Concerns about climate change have resulted in various laws and regulations that are intended to limit carbon emissions and address other environmental concerns. In recent years, the PRC, where

our production facilities are located, has undertaken comprehensive sustainability initiatives that are requiring companies to meet new environmental standards and deal with higher energy and other production costs. Environmental laws and

regulations may impose new or unexpected cost either directly through, for example, higher energy costs or indirectly through increased costs of compliance or of failing to comply with these laws and regulations. These laws and regulations