|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on which Registered

|

|

|

|

|

|

|

|

|

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company

|

|

|

|

|

Emerging growth company

|

|

|

Class

|

|

Number of Shares Outstanding

|

|

Class A Common Stock, $0.0001 par value

|

|

|

|

Class B Common Stock, $0.0001 par value

|

|

|

|

PART I

|

||

|

Item 1

|

7

|

|

|

Item 1A

|

21

|

|

|

Item 1B

|

56

|

|

|

Item 2

|

57

|

|

|

Item 3

|

57

|

|

|

Item 4

|

57

|

|

|

PART II

|

||

|

Item 5

|

58

|

|

|

Item 6

|

59

|

|

|

Item 7

|

60

|

|

|

Item 7A

|

89

|

|

|

Item 8

|

90

|

|

|

Item 9

|

140

|

|

|

Item 9A

|

140

|

|

|

Item 9B

|

142

|

|

|

Item 9C

|

142

|

|

|

PART III

|

||

|

Item 10

|

143

|

|

|

Item 11

|

143

|

|

|

Item 12

|

143

|

|

|

Item 13

|

143

|

|

|

Item 14

|

143

|

|

|

PART IV

|

||

|

Item 15

|

144

|

|

|

Item 16

|

147

|

|

|

148

|

||

|

•

|

If any PRC central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the authority’s permission or approval to continue the listing of ACM

Research’s Class A common stock in the United States or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such permission or approval, or if we inadvertently conclude that such

permissions or approvals are not required, ACM Shanghai may be unable to obtain the required permission or approval or may only be able to obtain such permission or approval on terms and conditions that impose material new

restrictions and limitations on operation of ACM Shanghai, either of which could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects and on the trading price of ACM

Research Class A common stock, which could decline in value or become worthless.

|

| • |

PRC central government authorities may intervene in, or influence, ACM Shanghai’s PRC-based operations at any time, and those authorities’ rules and regulations in the PRC can change quickly with little or

no advance notice.

|

| • |

The PRC central government may determine to exert additional control over offerings conducted overseas or foreign investment in PRC-based issuers, which could result in a material change in operations of ACM

Shanghai and cause significant declines in the value of ACM Research Class A common stock, or make them worthless.

|

| Item 1. |

Business

|

|

●

|

Space Alternated Phase Shift, or SAPS, technology for flat and patterned (deep via or deep trench with stronger structure) wafer surfaces. SAPS technology employs

alternating phases of megasonic waves to deliver megasonic energy in a highly uniform manner on a microscopic level. We have shown SAPS technology to be more effective than conventional megasonic and jet spray technologies in

removing random defects across an entire wafer, with increasing relative effectiveness at more advanced production nodes.

|

| ● |

Timely Energized Bubble Oscillation, or TEBO, technology for patterned wafer surfaces at advanced process nodes. TEBO technology has been developed to provide

effective, damage-free cleaning for 2D and 3D patterned wafers with fine feature sizes. We have demonstrated the damage-free cleaning capabilities of TEBO technology on patterned wafers for feature nodes as small as 1xnm (16 to 19

nanometers, or nm), and we have shown TEBO technology can be applied in manufacturing processes for patterned chips with 3D architectures having aspect ratios as high as 60‑to‑1.

|

| ● |

Tahoe technology for cost and environmental savings. Tahoe technology delivers high cleaning performance using significantly less sulfuric acid and hydrogen peroxide

than is typically consumed by conventional high-temperature single-wafer cleaning tools.

|

| ● |

ECP technology for advanced metal plating. Our Ultra ECP ap, or Advanced Packaging, technology was developed for back-end assembly processes to deliver a more uniform

metal layer at the notch area of wafers prior to packaging. Our Ultra ECP map, or Multi-Anode Partial Plating, technology was developed for front-end wafer fabrication processes to deliver advanced electrochemical copper plating for

copper interconnect applications. Ultra ECP map offers improved gap-filling performance for ultra-thin seed layer applications, which is critical for advanced nodes at 28nm, 14nm and beyond.

|

| ● |

Post CMP: Chemical mechanical planarization, or CMP, uses an abrasive chemical slurry following other fabrication processes, such as deposition and etching, in order to

achieve a smooth wafer surface in preparation for subsequent processing steps. SAPS technology can be applied following each CMP process to remove residual random defects deposited or formed during CMP.

|

| ● |

Post Hard Mask Deposition: As part of the photolithographical patterning process, a mask is applied with each deposition of a material layer to prevent etching of

material intended to be retained. Hard masks have been developed to etch high aspect-ratio features of advanced chips that traditional masks cannot tolerate. SAPS technology can be applied following each deposition step involving hard

masks that use nitride, oxide or carbon-based materials to achieve higher etch selectivity and resolution.

|

| ● |

Post Contact/Via Etch: Wet etching processes are commonly used to create patterns of high-density contacts and vias. SAPS technology can be applied after each such

etching process to remove random defects that could otherwise lead to electrical shorts.

|

| ● |

Pre Barrier-Metal Deposition: Copper wiring requires metal diffusion barriers at the top of via holes to prevent electrical leakage. SAPS technology can be applied

prior to deposition of barrier metal to remove residual oxidized copper, which otherwise would adhere poorly to the barrier and impair performance.

|

|

● compact design, with footprint of 2.65m x 4.10m x 2.85m (WxDxH), requiring limited clean room floor space;

|

|

● up to 8 chambers, providing throughput of up to 225 wafers per hour;

|

|

|

● double-sided cleaning capability, with up to 5 cleaning chemicals for process flexibility;

|

|

|

● 2-chemical recycling capability for reduced chemical consumption;

|

|

|

● image wafer detection method for lowering wafer breakage rates; and

|

|

|

● chemical delivery module for delivery of dilute hydrofluoric acid, RCA SC-1 solution, functional de-ionized water and carbon dioxide to each of

the chambers.

|

|

● compact design, with footprint of 2.55m x 5.1m x 2.85m (WxDxH), requiring limited clean room floor space;

|

|

● up to 12 chambers, providing throughput of up to 375 wafers per hour;

|

|

|

● chemical supply system integrated into mainframe;

|

|

|

● inline mixing method replaces tank auto changing, reducing process time; and

|

|

|

● improved drying technology using hot isopropyl alcohol and de-ionized water.

|

| ● |

Memory Chips: We estimate that TEBO technology can be applied in as many as 50 steps in the fabrication of a DRAM chip, consisting of up to 10 steps in cleaning ISO

structures, 20 steps in cleaning buried gates, and 20 steps in cleaning high aspect-ratio storage nodes and stacked films.

|

| ● |

Logic Chips: In the fabrication process for a logic chip with a FinFET structure, we estimate that TEBO technology can be used in 15 or more cleaning steps.

|

|

● an equipment front-end module, or EFEM, which moves wafers from chamber to chamber.

● one or more chamber modules, each equipped with a TEBO megasonic generator system.

● an electrical module to provide power for the tool; and

● a chemical delivery module.

|

|

Ultra C TEBO II (released in 2016). Highlights of our Ultra C TEBO II equipment include:

|

|

|

● compact design, with footprint of 2.25m x 2.25m x 2.85m (WxDxH);

● up to 8 chambers with an upgraded transport system and optimized robotic scheduler, providing throughput of up to 300 wafers per hour.

● EFEM module consisting of 4 load ports, transfer robot and 1 process robot; and

● focus on dilute chemicals contributes to environmental sustainability and lower cost of ownership.

|

|

Ultra C TEBO V (released in 2016). Highlights of our Ultra C TEBO V equipment include:

|

|

|

● footprint of 2.45m x 5.30m x 2.85m (WxDxH).

● up to 12 chamber modules, providing throughput of up to 300 wafers per hour.

● EFEM module consisting of 4 load ports, 1 transfer robot and 1 process robot: and

● chemical delivery module for delivery of isopropyl alcohol, dilute hydrofluoric acid, RCA SC-1 solution, functional de-ionized water and carbon

dioxide to each of the chambers.

|

| ● |

new cleaning steps for Ultra C SAPS cleaners for application in logic chips and for DRAM, and 3D NAND technologies.

|

| ● |

new cleaning steps for Ultra C TEBO cleaners for FinFET in logic chips, gates in DRAM, and deep vias in 3D NAND technologies.

|

| ● |

new cleaning steps for Ultra Tahoe cleaners for application in logic chips and for DRAM and 3D NAND technologies.

|

| ● |

new dry technologies such as supercritical CO2 dry and advanced IPA dry for DRAM, and logic technologies.

|

| ● |

new hardware, including new system platforms, new and additional chamber structures and new chemical blending systems;

|

| ● |

new software to integrate new functionalities to improve tool performance; and

|

| ● |

support for the ongoing evaluations and commercialization efforts and product extensions for the newly introduced PECVD and Track product categories.

|

| ● |

better established credibility and market reputations, longer operating histories, and broader product offerings;

|

| ● |

significantly greater financial, technical, marketing and other resources, which may allow them to pursue design, development, manufacturing, sales, marketing, distribution and service support of their

products;

|

| ● |

more extensive customer and partner relationships, which may position them to identify and respond more successfully to market developments and changes in customer demands; and

|

| ● |

multiple product offerings, which may enable them to offer bundled discounts for customers purchasing multiple products or other incentives that we cannot match or offer.

|

| ● |

performance of products, including particle removal efficiency, rate of damage to wafer structures, high temperature chemistry, throughput, tool uptime and reliability, safety, chemical waste treatment, and

environmental impact;

|

| ● |

gap filling capability, the deposited film thickness uniformity within wafer and wafer to wafer, particle generated on the wafer during the processes;

|

| ● |

service support capability and spare parts delivery time; innovation and development of functionality and features that are must-haves for advanced fabrication nodes;

|

| ● |

ability to anticipate customer requirements, especially for advanced process nodes of less than 45nm; ability to identify new process applications;

|

| ● |

brand recognition and reputation; and

|

| ● |

skill and capability of personnel, including design engineers, manufacturing engineers and technicians, application engineers, and service engineers.

|

| Item 1A. |

Risk Factors

|

|

•

|

if any PRC central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the authority’s permission or approval to

continue the listing of ACM Research’s Class A common stock in the United States or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such permission or approval, or if we

inadvertently conclude that permissions or approvals are not required, ACM Shanghai may be unable to obtain the required permission or approval or may only be able to obtain such permission or approval on terms and conditions

that impose material new restrictions and limitations on operation of ACM Shanghai, either of which could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects and

on the trading price of ACM Research Class A common stock, which could decline in value or become worthless;

|

| • |

PRC central government authorities may intervene in, or influence, ACM Shanghai’s PRC-based operations at any time, and those authorities’ rules and regulations in the PRC can change quickly with little or no

advance notice;

|

| • |

the PRC central government may determine to exert additional control over offerings conducted overseas or foreign investment in PRC-based issuers, which could result in a material change in operations of ACM

Shanghai and cause significant declines in the value of ACM Research Class A common stock, or make them worthless;

|

| • |

if we are unable to comply with recent and proposed legislation and regulations regarding improved access to audit and other information and audit inspections of accounting firms, including registered public

accounting firms, such as our prior audit firm, operating in the PRC, we could be adversely affected;

|

| • |

it may be difficult for overseas regulators to conduct investigations or collect evidence within the PRC;

|

| • |

certain of our assets are located outside of the United States and certain of our directors and officers reside outside of the United States, which may make it difficult for you to enforce your rights based on

the U.S. federal securities laws;

|

| • |

our potential future needs for additional capital that may not be available at all or on terms acceptable to us;

|

| • |

the cyclicality in the semiconductor industry that may lead to substantial variations in demand for our products;

|

| • |

our dependence on a small number of customers for a substantial portion of our revenue;

|

| • |

industry manufacturers of chips adopting our SAPS, TEBO, Tahoe, ECP, furnace and other technologies;

|

| • |

our SAPS, TEBO, Tahoe, ECP, furnace and other technologies not achieving widespread market acceptance;

|

| • |

our ability to continue to enhance our existing single-wafer wet cleaning tools and identifying and entering new product markets;

|

| • |

our ability to establish and maintain a reputation for credibility and product quality;

|

| • |

our ability to expand our customer base;

|

| • |

our long and unpredictable sales cycle, including our incurrence of significant expenses long before we can recognize revenue from new products, if at all;

|

| • |

difficulties in forecasting demand for our tools;

|

| • |

our reliance on third parties to manufacture significant portions of our tools and our ability to manage our relationships with these parties;

|

| • |

any shortage of components or subassemblies, which could result in delayed delivery of products to us or in increased costs to us;

|

| • |

our dependence on a limited number of suppliers, including single source suppliers, for critical components and subassemblies;

|

| • |

our dependence on our Chief Executive Officer and President and other senior management and key employees;

|

| • |

regulatory actions limiting our ability and the broader industry to import into the PRC items sourced from the U.S. or otherwise subject to control under the U.S. Export Administration Regulations (EAR),

thereby impacting our ability to sell our tools to customers in the PRC;

|

| • |

changes in government trade policies that could limit the demand for our tools and increase the cost of our tools;

|

| • |

changes in political and economic policies with respect to the PRC;

|

| • |

the PRC’s currency exchange control and government restrictions on investment repatriation may impact our ability to transfer funds outside of the PRC;

|

| • |

our ability to implement our strategy to expand our PRC operations;

|

| • |

our ability to achieve the results contemplated by our business strategy and our strategy for growth in the PRC and expectations related to the STAR Listing;

|

| • |

the effect of ACM Shanghai’s status as a publicly traded company that is controlled, but less than wholly owned, by ACM Research;

|

| • |

our ability to manage potentially inconsistent accounting and disclosure requirements of ACM Research and ACM Shanghai as a result of the STAR Listing;

|

| • |

our ability to protect our intellectual property, including in the PRC;

|

| • |

breaches of our cybersecurity systems;

|

| • |

impacts on our global supply chain due to the COVID-19 pandemic, and our ability to successfully manage the demand, supply, and operational challenges associated with the global semiconductor shortage;

|

| • |

the impact of the COVID-19 pandemic on our currently planned projects and investments in the PRC;

|

| • |

material weaknesses identified with respect to our internal controls over financial reporting;

|

| • |

the volatility in the market price of Class A common stock;

|

| • |

manipulative short sellers of our stock, which may drive down the market price of our Class A common stock and could result in litigation;

|

| • |

the difficulty to predict the effect of the STAR Listing and STAR IPO on the Class A common stock;

|

| • |

the dual class structure of Class A common stock, which has the effect of concentrating voting control with our executive officers and directors; and

|

| • |

the limited experience of our management team managing a public company.

|

|

•

|

Intellectual Property. Our commercial success depends in part on our ability to obtain and maintain patent and trade secret protection for our intellectual property,

including our SAPS, TEBO, Tahoe, ECP, furnace and other technologies and the design of our Ultra C equipment. See “—Risks Related to Our Intellectual Property and Data Security—Our success depends

on our ability to protect our intellectual property, including our SAPS, TEBO, Tahoe, ECP, furnace and other technologies.” in Item 1A, “Risk Factors” of Part I of this report. The significant majority of our intellectual

property has been developed in the PRC and is owned by ACM Shanghai. Implementation and enforcement of intellectual property-related laws in the PRC has historically been lacking due primarily to ambiguities in PRC intellectual

property law. See “—Risks Related to Our Intellectual Property and Data Security—We may not be able to protect our intellectual property rights throughout the world, including the PRC, which could

materially, negatively affect our business” in Item 1A, “Risk Factors” of Part I of this report. In the event PRC central government authorities were to significantly revise or revamp the current scope and structure of

intellectual property protection in the PRC, our ability to protect and enforce our intellectual property rights for our key proprietary technologies may be adversely impacted and competitors may be able to match our technologies

and tools in order to compete with us.

|

| • |

Title Defect in Leased Premises. We conduct research and development, and service support operations at ACM Shanghai’s headquarters located in the Zhangjiang Hi Tech Park in Shanghai, which ACM Shanghai

leases from Zhangjiang Group. Zhangjiang Group has not obtained a certificate of property title for the premises, although it has represented to ACM Shanghai that it has the right to rent the premises to ACM Shanghai. If any adjustment

in local regional overall planning of Shanghai, or any other reason, results in the demolition of such premises, the premises could not continue to be leased to ACM Shanghai and the day-to-day production and operation of ACM Shanghai

would be materially and adversely affected. See Item 2, “Properties” of Part I of this report.

|

| • |

COVID-19 Pandemic. We conduct substantially all of our product development, manufacturing, support and services in the PRC, and those activities have been directly impacted by COVID-19 and related

restrictions on transportation and public appearances, including implementation by PRC government authorities of “spot” and full-city quarantines in the city of Shanghai, where substantially all of our operations are located.

Furthermore, a number of our key customers have substantial operations based in operations areas of the PRC, including in the City of Shanghai, which required us to defer, in the first quarter of 2022, shipments of finished products to

those customers. A significant number of ACM Shanghai employees missed work in late 2022 and early 2023 for one or several weeks due to COVID-19 related illness following the relaxation of the PRC’s zero-COVID policies in December 2022.

For additional information see “—Risks Related to the COVID-19 Pandemic—Substantially all of our operations, as well as significant operations of a number of our key customers, are located in areas of

the PRC impacted by the COVID‑19 pandemic, and our operations have been, and may continue to be, adversely affected by the effects of PRC restrictions imposed as the result of COVID‑19” in Item 1A, “Risk Factors” of Part I of

this report.

|

| • |

Data Security. The Standing Committee of the National People’s Congress, or the Standing Committee, has promulgated the Cyber Security Law, which imposes requirements on entities who build and operate

the PRC’s internet architecture or provide services in the PRC over the internet, and the Data Security Law, which imposes data security and privacy obligations on entities and individuals carrying out data activities. The Data Security

Law also provides for a national security review procedure for data activities that may affect national security and imposes export restrictions on certain data an information. ACM Shanghai is not subject to the existing restrictions

imposed by the Cyber Security Law or the Data Security Law, in part because its business operations do not involve the collection, processing or use of data or information involving personal privacy or private information of customers.

In addition, ACM Shanghai is subject to oversight by the Cyberspace Administration of China, or the CAC, regarding data security. ACM Shanghai does not collect or maintain personal information except for routine personal information

necessary to process payroll payments and other benefits and emergency contact information, and as a result, ACM Shanghai is not currently subject to significant restrictions or limitations in addressing and managing data security

issues and complying with CAC regulations. To date, ACM Shanghai has not been involved in any investigations on cybersecurity review initiated by the CAC or any related PRC central government authority and has not received any inquiry,

notice, warning, or sanction in such respect. However, cybersecurity is increasingly a focus of the PRC central government. If the CAC or other PRC central government authorities should in the future require ACM Shanghai to comply with

these or additional, or more restrictive, PRC cybersecurity regulations, it could require ACM Shanghai to make changes to its operations, and any failure to satisfy or delay in meeting such requirements may subject ACM Shanghai to

restrictions and penalties imposed by the CAC or other PRC regulatory authorities, which may include regulatory actions, fines and penalties on our operations in the PRC, which could materially harm our business, financial condition,

results of operations, reputation and prospects.

|

| • |

Anti-Monopoly. A number of PRC laws and regulations have established procedures and requirements that could make merger and acquisition activities in China by foreign investors more time consuming and

complex. These laws and regulations, which include the Anti-Monopoly Law and the Rules of the Ministry of Commerce on Implementation of Security Review System of Mergers and Acquisitions of Domestic Enterprises by Foreign Investors,

impose requirements that in some instances that MOFCOM be notified in advance of, for example, any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. In addition, such Rules specify

that mergers and acquisitions by foreign investors that raise “national defense and security” concerns and mergers and acquisitions through which foreign investors may acquire de facto control over domestic enterprises that raise

“national security” concerns are subject to strict review by MOFCOM. In February 2021, the Anti-Monopoly Committee of the State Council published the Anti-Monopoly Guidelines for the Internet Platform Economy Sector, which stipulate

that any concentration of undertakings involving VIEs is subject to anti-monopoly review. Those Guidelines provide more stringent rules for Internet platform operators, including regulations on the use of data and algorithms, technology

and platform to commit abusive acts. The Measures for the Security Review for Foreign Investment, which was promulgated jointly by National Development and Reform Commission and MOFCOM effective January 18, 2021, and the Standing

Committee on Amending the Anti-Monopoly Law of the People’s Republic of China, which was promulgated by the Standing Committee effective August 1, 2022, delineated provisions concerning the security review procedures on foreign

investment, including the types of investments subject to review and the scopes and procedures of the review. ACM Shanghai does not have the concentration of business operators stipulated in the Anti-Monopoly Law, and our operations and

activities to date have not otherwise subjected us to restrictive provisions or limitations set forth in applicable PRC laws and regulations govern merger and acquisition activities. Among other things, ACM Shanghai’s business

operations do not constitute identified “national defense and security” concerns associated with the arms industry, any industry ancillary to the arms industry, or any other field related to national defense security. We cannot assure

you, however, that future changes in PRC laws and regulations governing mergers and acquisitions, including activities in the PRC by foreign investors, will not extend or otherwise modify existing requirements, which could materially

and adversely affect our PRC-based operations or our ability to expand by investments or acquisitions.

|

| • |

Permits. In the ordinary course of business, ACM Shanghai has obtained all of the permits and licenses it believes are necessary for it to operate in the PRC. ACM Shanghai may be adversely affected,

however, by the complexity, uncertainties and changes in PRC laws and regulations applicable to, or otherwise affecting, the semiconductor equipment industry and related businesses, and any lack of requisite approvals, licenses or

permits applicable to ACM Shanghai’s business may have a material adverse effect on its business and results of operations.

|

| • |

Trade Policies. Since 2018, general trade tensions between the United States and the PRC have escalated. See “—Regulatory Risks—Changes in government trade policies

could limit the demand for our tools and increase the cost of our tools” in Item 1A, “Risk Factors” of Part I of this report. The imposition of tariffs by the U.S. and PRC governments and the surrounding economic uncertainty

may negatively impact the semiconductor industry, including by reducing the demand of fabricators for capital equipment such as our tools. Further changes in trade policy, tariffs, additional taxes, restrictions on exports or other

trade barriers, or restrictions on supplies, equipment, and raw materials including rare earth minerals, may limit the ability of our customers to manufacture or sell semiconductors or to make the manufacture or sale of semiconductors

more expensive and less profitable, which could lead those customers to fabricate fewer semiconductors and to invest less in capital equipment such as our tools. In addition, if the PRC were to impose additional tariffs on raw

materials, subsystems or other supplies that we source from the United States, our cost for those supplies would increase. As a result of any of the foregoing events, the imposition of new or additional tariffs may limit our ability to

manufacture tools, increase our selling and/or manufacturing costs, decrease margins, or inhibit our ability to sell tools or to purchase necessary equipment and supplies, which could have a material adverse effect on our business,

results of operations, or financial condition.

|

| • |

On March 24, 2021, the SEC adopted interim final amendments to implement congressionally mandated submission and disclosure required of the HFCA Act, and on December 2, 2021, the SEC adopted final amendments

to finalize rules implementing the submission and disclosures in the HFCA Act. These final amendments apply to registrants that the SEC identifies as having filed an Annual Report on Form 10-K (or certain other forms) with an audit

report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by any non-U.S. authority.

Any such identified registrant will be required to submit documentation to the SEC establishing that it is not owned or controlled by a governmental entity in that foreign jurisdiction and will also require disclosure in the

registrant’s annual report regarding the audit arrangements of, and governmental influence on, such a registrant.

|

| • |

Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was enacted under the Consolidated Appropriations Act, 2023, on December 29, 2022, as

further described below, and which amended the HFCA Act to require the SEC to prohibit an issuer’s securities from trading on any national securities exchange or over-the-counter market in the United States if the PCAOB has been unable

to inspect an issuer’s auditor for two, rather than three, consecutive years. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCA Act, which provides a framework for the PCAOB to use when determining, as

contemplated under the HFCA Act, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in any

non-U.S. jurisdiction.

|

| • |

On December 16, 2021, the PCAOB designated China and Hong Kong as jurisdictions where the PCAOB was not allowed to conduct full and complete audit inspections and identified firms registered in such

jurisdictions, including BDO China. Pursuant to each annual determination by the PCAOB, the SEC will, on an annual basis, identify issuers that have used non-inspected audit firms.

|

| • |

On March 8, 2022, the SEC published its first “Provisional list of issuers identified under the HFCAA.” Our company was identified on the SEC’s provisional list after we filed our Annual Report on Form 10-K

for the year ended December 31, 2021, which included an audit report issued by BDO China.

|

| • |

On March 30, 2022, our company was transferred to the SEC’s “Conclusive list of issuers identified under the HFCAA.”

|

| • |

On August 26, 2022, the PCAOB signed a Statement of Protocol, or SOP, Agreement with the CSRC and China’s Ministry of Finance. The SOP, together with two protocol agreements governing inspections and

investigation, establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in China and Hong Kong, as required under U.S. law. Pursuant to the fact sheet with

respect to the SOP disclosed by the SEC, the PCAOB has sole discretion to select the audit firms, engagements and potential violations that it inspects or investigates and has the ability to transfer information to the SEC in the normal

course. PCAOB inspectors and investigators can view all audit documentation without redaction, and the PCAOB can retain any audit information it reviews as needed to support the findings of its inspections and investigations. In

addition, the SOP allows the PCAOB to interview and take testimony of personnel associated with the audits that the PCAOB inspects or investigates.

|

| • |

On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in the PRC and Hong Kong in 2022 and

vacated its previous December 16, 2021 determination to the contrary. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in the PRC and

Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. PRC authorities will need to ensure that the PCAOB continues to have full access for inspections and investigations in 2023

and beyond. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in the PRC and Hong Kong, among other jurisdictions. If the PRC authorities do not allow the PCAOB complete access for

inspections and investigations for two consecutive years, the SEC would prohibit trading in the securities of issuers engaging those audit firms, as required under the HFCA Act.

|

| • |

On December 29, 2022, the Consolidated Appropriations Act, 2023, was signed into law by U.S. President Biden, which, among other things, amended the HFCA Act to reduce the number of consecutive non-inspection

years that would trigger the trading prohibition under the HFCA Act from three years to two years (originally such threshold under the HFCA Act was three consecutive years), and so that any foreign jurisdiction could be the reason why

the PCAOB does not have complete access to inspect or investigate a company’s public accounting firm (originally the HFCA Act only applied if the PCAOB’s ability to inspect or investigate was due to a position taken by an authority in

the jurisdiction where the relevant public accounting firm was located).

|

| • |

imposition of, or adverse changes in, foreign laws or regulatory requirements, such as work stoppages and travel restrictions imposed in connection with the COVID-19 pandemic;

|

| • |

the need to comply with the import laws and regulations of various foreign jurisdictions, including a range of U.S. import laws;

|

| • |

potentially adverse tax consequences, including withholding tax rules that may limit the repatriation of our earnings, and higher effective income tax rates in foreign countries where we conduct business;

|

| • |

competition from local suppliers with which potential customers may prefer to do business;

|

| • |

seasonal reduction in business activity, such as during the Lunar New Year in parts of Asia and in other periods in various individual countries;

|

| • |

increased exposure to foreign currency exchange rates;

|

| • |

reduced protection for intellectual property;

|

| • |

longer sales cycles and reliance on indirect sales in certain regions;

|

| • |

increased length of time for shipping and acceptance of our products;

|

| • |

greater difficulty in responding to customer requests for maintenance and spare parts on a timely basis;

|

| • |

greater difficulty in enforcing contracts and accounts receivable collection and longer collection periods;

|

| • |

difficulties in staffing and managing foreign operations and the increased travel, infrastructure and legal and compliance costs associated with multiple international locations;

|

| • |

heightened risk of unfair or corrupt business practices in certain geographies and of improper or fraudulent sales arrangements that may impact financial results and result in restatements of, or

irregularities in, our consolidated financial statements; and

|

| • |

general economic conditions, geopolitical events or natural disasters in countries where we conduct our operations or where our customers are located, including political unrest, war, acts of terrorism or

responses to such events.

|

| • |

our sales growth;

|

| • |

the costs of applying our existing technologies to new or enhanced products;

|

| • |

the costs of developing new technologies and introducing new products;

|

| • |

the costs associated with protecting our intellectual property;

|

| • |

the costs associated with our expansion, including capital expenditures and Lingang-related land purchases and deposits, and with increasing our sales and marketing and service and support efforts, and with

expanding our geographic operations;

|

| • |

our ability to continue to obtain governmental subsidies for developmental projects in the future;

|

| • |

future debt repayment obligations; and

|

| • |

the number and timing of any future acquisitions.

|

| • |

the cyclicality of the semiconductor industry and the related impact on the purchase of equipment used in the manufacture of chips;

|

| • |

the timing of purchases of our tools by chip fabricators, which order types of tools based on multi-year capital plans under which the number and dollar amount of tool purchases can vary significantly from

year to year;

|

| • |

the relatively high average selling price of our tools and our dependence on a limited number of customers for a substantial portion of our revenue in any period, whereby the timing and volume of purchase

orders or cancellations from our customers could significantly reduce our revenue for that period;

|

| • |

the significant expenditures required to customize our products often exceed the deposits received from our customers;

|

| • |

the lead time required to manufacture our tools;

|

| • |

the timing of recognizing revenue due to the timing of shipment and acceptance of our tools;

|

| • |

our ability to sell additional tools to existing customers;

|

| • |

the changes in customer specifications or requirements;

|

| • |

the length of our product sales cycle;

|

| • |

changes in our product mix, including the mix of systems, upgrades, spare parts and service;

|

| • |

the timing of our product releases or upgrades or announcements of product releases or upgrades by us or our competitors, including changes in customer orders in anticipation of new products or product

enhancements;

|

| • |

our ability to enhance our tools with new and better functionality that meet customer requirements and changing industry trends;

|

| • |

constraints on our suppliers’ capacity;

|

| • |

our ability to sell our tools to Chinese customers due to regulatory restrictions, including the addition of our customers to the Entity List;

|

| • |

the ability of other suppliers to provide sufficient quantities of their tools to our Chinese customers which may indirectly impact the production plans of our customers and result in a reduction of demand for

our tools;

|

| • |

the timing of investments in research and development related to releasing new applications of our technologies and new products;

|

| • |

delays in the development and manufacture of our new products and upgraded versions of our products and the market acceptance of these products when introduced;

|

| • |

our ability to control costs, including operating expenses and the costs of the components and subassemblies used in our products;

|

| • |

the costs related to the acquisition and integration of product lines, technologies or businesses; and

|

| • |

the costs associated with protecting our intellectual property, including defending our intellectual property against third-party claims or litigation.

|

| • |

our ability to demonstrate the differentiated, innovative nature of our SAPS, TEBO, Tahoe, ECP, furnace and other technologies and the advantages of our tools over those of our competitors;

|

| • |

compatibility of our tools with existing or potential customers’ manufacturing processes and products;

|

| • |

the level of customer service available to support our products; and

|

| • |

the experiences our customers have with our products.

|

| • |

accurate anticipation of market requirements, changes in technology and evolving standards;

|

| • |

the availability of qualified product designers and technologies needed to solve difficult design challenges in a cost-effective, reliable manner;

|

| • |

our ability to design products that meet chip manufacturers’ cost, size, acceptance and specification criteria, and performance requirements;

|

| • |

the ability and availability of suppliers and third-party manufacturers to manufacture and deliver the critical components and subassemblies of our tools in a timely manner;

|

| • |

market acceptance of our customers’ products, and the lifecycle of those products; and

|

| • |

our ability to deliver products in a timely manner within our customers’ product planning and deployment cycle.

|

| • |

greater financial, technical, sales and marketing, manufacturing, distribution and other resources;

|

| • |

established credibility and market reputations;

|

| • |

longer operating histories;

|

| • |

broader product offerings;

|

| • |

more extensive service offerings, including the ability to have large inventories of spare parts available near, or even at, customer locations;

|

| • |

local sales forces; and

|

| • |

more extensive geographic coverage.

|

| • |

efforts by our sales force;

|

| • |

the complexity of our customers’ manufacturing processes and the compatibility of our tools with those processes;

|

| • |

our customers’ internal technical capabilities and sophistication; and

|

| • |

our customers’ capital spending plans and processes, including budgetary constraints, internal approvals, extended negotiations or administrative delays.

|

|

•

|

our customers may delay or reject acceptance of our tools that contain defects or fail to meet their specifications;

|

| • |

we may suffer customer dissatisfaction, negative publicity and reputational damage, resulting in reduced orders or otherwise damaging our ability to retain existing customers and attract new customers;

|

| • |

we may incur substantial costs as a result of warranty claims or service obligations or in order to enhance the reliability of our tools;

|

| • |

the attention of our technical and management resources may be diverted;

|

| • |

we may be required to replace defective systems or invest significant capital to resolve these problems; and

|

| • |

we may be required to write off inventory and other assets related to our tools.

|

| • |

potential price increases;

|

| • |

capacity shortages or other inability to meet any increase in demand for our products;

|

| • |

reduced control over manufacturing process for components and subassemblies and delivery schedules;

|

| • |

limited ability of some suppliers to manufacture and sell subassemblies or parts in the volumes we require and at acceptable quality levels and prices, due to the suppliers’ relatively small operations and

limited manufacturing resources;

|

| • |

increased exposure to potential misappropriation of our intellectual property; and

|

| • |

limited warranties on subassemblies and components supplied to us.

|

| • |

hire, train, integrate and manage additional qualified engineers for research and development activities, sales and marketing personnel, service and support personnel and financial and information technology

personnel;

|

| • |

manage multiple relationships with our customers, suppliers and other third parties; and

|

| • |

continue to enhance our information technology infrastructure, systems and controls.

|

| • |

the acquired product lines, technologies or businesses may not improve our financial and strategic position as planned;

|

| • |

we may determine we have overpaid for the product lines, technologies or businesses, or that the economic conditions underlying our acquisition have changed;

|

| • |

we may have difficulty integrating the operations and personnel of the acquired company;

|

| • |

we may have difficulty retaining the employees with the technical skills needed to enhance and provide services with respect to the acquired product lines or technologies;

|

| • |

the acquisition may be viewed negatively by customers, employees, suppliers, financial markets or investors;

|

| • |

we may have difficulty incorporating the acquired product lines or technologies with our existing technologies;

|

| • |

we may encounter a competitive response, including price competition or intellectual property litigation;

|

| • |

we may encounter difficulties related to required CFIUS approval (see also “-Regulatory Risks-Certain of our investments may be subject to review by and approval from CFIUS, which may prevent us from taking

advantage of investment opportunities that would otherwise be advantageous to our stockholders”);

|

| • |

we may become a party to product liability or intellectual property infringement claims as a result of our sale of the acquired company’s products;

|

| • |

we may incur one-time write-offs, such as acquired in-process research and development costs, and restructuring charges;

|

| • |

we may acquire goodwill and other intangible assets that are subject to impairment tests, which could result in future impairment charges;

|

| • |

our ongoing business and management’s attention may be disrupted or diverted by transition or integration issues and the complexity of managing geographically or culturally diverse enterprises; and

|

| • |

our due diligence process may fail to identify significant existing issues with the target business.

|

| • |

a decline in demand for our products;

|

| • |

an increase in reserves on accounts receivable due to our customers’ inability to pay us;

|

| • |

an increase in reserves on inventory balances due to excess or obsolete inventory as a result of our inability to sell such inventory;

|

| • |

valuation allowances on deferred tax assets;

|

| • |

restructuring charges;

|

| • |

asset impairments including the potential impairment of goodwill and other intangible assets;

|

| • |

a decline in the value of our investments;

|

| • |

exposure to claims from our suppliers for payment on inventory that is ordered in anticipation of customer purchases that do not come to fruition;

|

| • |

a decline in the value of certain facilities we lease to less than our residual value guarantee with the lessor; and

|

| • |

challenges maintaining reliable and uninterrupted sources of supply.

|

| • |

The U.S. Patent and Trademark Office and various foreign governmental patent agencies require compliance with a number of procedural, documentary, fee payment and other provisions during the patent process.

There are situations in which noncompliance can result in abandonment or lapse of a patent or patent application, resulting in partial or complete loss of patent rights in the relevant jurisdiction. In such an event, competitors might

be able to enter the market earlier than would otherwise have been the case.

|

| • |

Patent applications may not result in any patents being issued.

|

| • |

Patents that may be issued may be challenged, invalidated, modified, revoked, circumvented, found to be unenforceable or otherwise may not provide any competitive advantage.

|

| • |

Our competitors may seek or may have already obtained patents that will limit, interfere with, or eliminate our ability to make, use and sell our potential product candidates.

|

| • |

The PRC and other countries other than the United States may have patent laws less favorable to patentees than those upheld by U.S. courts, allowing foreign competitors a better opportunity to create, develop

and market competing product candidates.

|

| • |

be time consuming and expensive to defend, whether or not meritorious;

|

| • |

force us to stop selling products or using technology that allegedly infringes the third party’s intellectual property rights;

|

| • |

delay shipments of our products;

|

| • |

require us to pay damages or settlement fees to the party claiming infringement;

|

| • |

require us to attempt to obtain a license to the relevant intellectual property, which may not be available on reasonable terms or at all;

|

| • |

force us to attempt to redesign products that contain the allegedly infringing technology, which could be expensive or which we may be unable to do;

|

| • |

require us to indemnify our customers, suppliers or other third parties for any loss caused by their use of our technology that allegedly infringes the third party’s intellectual property rights; or

|

| • |

divert the attention of our technical and managerial resources.

|

| • |

actual or anticipated fluctuations in our revenue and other operating results;

|

| • |

the financial projections we may provide to the public, any changes in these projections or our failure to meet these projections;

|

| • |

actions of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our company, or our failure to meet these estimates or the

expectations of investors;

|

| • |

changes in projections for the chips or chip equipment industries or in the operating performance or expectations and stock market valuations of chip companies, chip equipment companies or technology companies

in general;

|

| • |

changes in operating results;

|

| • |

any changes in the financial projections we may provide to the public, our failure to meet these projections, or changes in recommendations by any securities analysts that elect to follow Class A common stock;

|

| • |

additional shares of Class A common stock being sold into the market by us or our existing stockholders or the anticipation of such sales;

|

| • |

price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole;

|

| • |

lawsuits threatened or filed against us;

|

| • |

litigation and other developments relating to our patents or other proprietary rights or those of our competitors;

|

| • |

developments in new legislation and pending lawsuits or regulatory actions, including interim or final rulings by judicial or regulatory bodies; and

|

| • |

general economic trends, including changes in the demand for electronics or information technology or geopolitical events such as war or acts of terrorism, or any responses to such events.

|

| • |

our dual class common stock structure provides holders of Class B common stock with the ability to control the outcome of matters requiring stockholder approval, even if they own significantly less than a

majority of the total number of outstanding shares of Class A and Class B common stock;

|

| • |

when the outstanding shares of Class B common stock represent less than a majority of the combined voting power of common stock;

|

| • |

amendments to our charter or bylaws will require the approval of two-thirds of the combined vote of our then-outstanding shares of Class A and Class B common stock;

|

| • |

vacancies on the board of directors will be able to be filled only by the board and not by stockholders;

|

| • |

the board, which currently is not staggered, will be automatically separated into three classes with staggered three-year terms;

|

| • |

directors will only be able to be removed from office for cause; and

|

| • |

our stockholders will only be able to take action at a meeting and not by written consent;

|

| • |

only our chair, our chief executive officer or a majority of our directors is authorized to call a special meeting of stockholders;

|

| • |

advance notice procedures apply for stockholders to nominate candidates for election as directors or to bring matters before an annual meeting of stockholders;

|

| • |

our charter authorizes undesignated preferred stock, the terms of which may be established, and shares of which may be issued, without stockholder approval; and

|

| • |

cumulative voting in the election of directors is prohibited.

|

| • |

any derivative action or proceeding brought on our behalf;

|

| • |

any action asserting a claim of breach of a fiduciary duty owed to us, our stockholders, creditors or other constituents by any of our directors, officers, other employees, agents or stockholders;

|

| • |

any action asserting a claim arising under the Delaware General Corporation Law, our charter or bylaws, or as to which the Delaware General Corporation Law confers jurisdiction on the Court of Chancery of the

State of Delaware; or

|

| • |

any action asserting a claim that is governed by the internal affairs doctrine.

|

| Item 2. |

Properties

|

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

Sale Date

|

Exercised

Shares (Net)

|

|

October 25, 2022

|

50,387

|

|

November 3, 2022

|

25,481

|

|

November 14, 2022

|

35,530

|

|

November 22, 2022

|

35,327

|

|

December 2, 2022

|

26,189

|

|

December 12, 2022

|

6,600

|

|

Total

|

179,514

|

|

|

Base

|

|||||||||||||||||||||||||||

|

|

Period

|

Years Ending

|

||||||||||||||||||||||||||

|

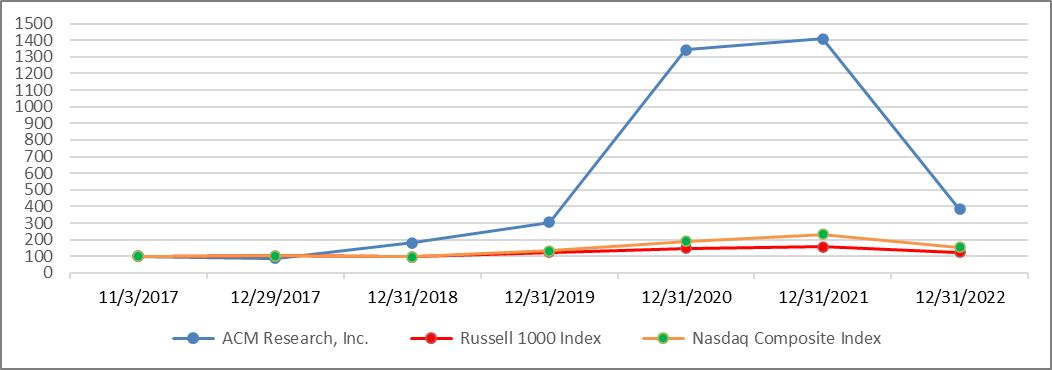

Company Name/Index

|

11/3/17

|

12/29/17

|

12/31/18

|

12/31/19

|

12/31/20

|

12/31/21

|

12/31/22

|

|||||||||||||||||||||

|

ACM Research, Inc.

|

$

|

100

|

$

|

87

|

$

|

180

|

$

|

305

|

$

|

1,343

|

$

|

1,409

|

$

|

382

|

||||||||||||||

|

Russell 1000 Index

|

$

|

100

|

$

|

103

|

$

|

97

|

$

|

124

|

$

|

148

|

$

|

157

|

$

|

123

|

||||||||||||||

|

Nasdaq Composite Index

|

$

|

100

|

$

|

102

|

$

|

98

|

$

|

133

|

$

|

191

|

$

|

231

|

$

|

155

|

||||||||||||||

| Item 6. |

[Reserved]

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

| ● |

SAPS technology for flat and patterned wafer surfaces, which employs alternating phases of megasonic waves to deliver megasonic energy in a highly uniform manner on a

microscopic level;

|

| ● |

TEBO technology for patterned wafer surfaces at advanced process nodes, which provides effective, damage-free cleaning for 2D and 3D patterned wafers with fine feature

sizes;

|

| ● |

Tahoe technology for cost and environmental savings, which delivers high cleaning performance using significantly less sulfuric acid and hydrogen peroxide than is

typically consumed by conventional high-temperature single-wafer cleaning tools; and

|

| ● |

ECP technology for advanced metal plating, which includes Ultra ECP ap, or Advanced Packaging, technology for back-end assembly processes, Ultra ECP 3d for

through-silicon-via, or tsv, and Ultra ECP map, or Multi-Anode Partial Plating, technology for front-end wafer fabrication processes.

|

| • |

a listing, which we refer to as the STAR Listing, of shares of ACM Shanghai on the Shanghai Stock Exchange’s Sci-Tech innovAtion boaRd, known as the STAR Market; and

|

| • |

a concurrent initial public offering, which we refer to as the STAR IPO, of ACM Shanghai shares in the PRC, at a pre-offering valuation of not less than RMB 5.15 billion ($747.1 million).

|

| • |

the land lease for, and construction of, ACM Shanghai’s proposed development and production center in the Lingang region of Shanghai;

|

| • |

product development to upgrade and expand our process equipment targeted at more advanced process nodes, including technical improvement and development of TEBO megasonic cleaning equipment, Tahoe single wafer

wet bench combined cleaning equipment, front-end brush scrubbing equipment, auto bench and backside cleaning equipment, electroplating equipment, stress free polish equipment, vertical furnace equipment, and additional new products to

expand our product portfolio; and

|

| • |

working capital.

|

| • |

Operations: We conduct substantially all of our product development, manufacturing, support and services in the PRC through ACM Shanghai, and those activities have been

directly impacted by COVID–19 and related restrictions on transportation and public appearances.

|

| • |

Customers: Our customers’, including the customers of ACM Shanghai, business operations have been, and are continuing to be, subject to business interruptions arising

from the COVID–19 pandemic. Historically substantially all of our revenue has been derived from customers located in the PRC and surrounding areas that have been impacted by COVID–19. Three customers that accounted for 43.8% of our

revenue in 2022 are based in the PRC, two customers that accounted for 48.9% of our revenue in 2021 are based in the PRC, and three customers that accounted for 75.8% of our revenue in 2020 are based in the PRC. One of those customers,

YMTC — which, together with one of its subsidiaries, accounted for 10.0% of our 2022 revenue, 20.8% of our 2021 revenue, and 26.8% of our 2020 revenue, — is based in Wuhan. While YMTC and other key customers continued to operate their

fabrication facilities without interruption during and after the first quarter of 2020, some customers have been forced to restrict access of service personnel and deliveries to and from their facilities. We have experienced longer and,

in some cases, more costly shipping expenses in the delivery of tools to certain customers.

|

| • |

Suppliers: Our global supply chain includes components sourced from the PRC, Japan, Taiwan, the United States and Europe. While, to date, we have not experienced

material issues with our supply chain beyond the logistics related to the Shanghai facilities of ACM Shanghai, supply chain constraints have intensified due to COVID-19, contributing to global shortages in the supply of semiconductors

and other materials, and in some cases the pricing of materials used in the production of our own tools. As with our customers, we continue to be in close contact with our key suppliers to help ensure we are able to identify any

potential supply issues that may arise.

|

| • |

Projects: Our strategy includes a number of plans to support the growth of our core business, including ACM Shanghai’s acquisition of a land use right in the Lingang

area of Shanghai where ACM Shanghai began construction of a new R&D center and factory in July 2020. The extent to which COVID–19 impacts these projects will depend on future developments that are highly uncertain, but to date, the

timing of these ongoing projects has not been delayed or significantly disrupted by COVID–19 or related government measures.

|

| ● |

Sales and Development. During the sale process we may, depending on a prospective customer’s specifications and requirements, need to perform additional research,

development and testing to establish that a tool can meet the prospective customer’s requirements. We then host an in-house demonstration of the customized tool prototype. Sales cycles for orders that require limited customization and

do not require that we develop new technology usually take from 6 to 12 months, while the product life cycle, including the initial design, demonstration and final assembly phases, for orders requiring development and testing of new

technologies can take as long as 2 to 4 years. As we expand our customer base, we expect to gain more repeat purchase orders for tools that we have already developed and tested, which will reduce the need for a demonstration phase and

shorten the development cycle.

|

| ● |

Evaluation Periods. When a chip manufacturer proposes to purchase a particular type of tool from us for the first time, we offer the manufacturer an opportunity to

evaluate the tool for a period that can extend for 24 months or longer. In some cases, we do not receive any payment on first-time purchases until the tool is accepted. As a result, we may spend more than $2.0 million to produce a tool

without receiving payment for more than 24 months or, if the tool is not accepted, without receiving any payment. Please see “Item 1A. Risk Factors—Risks Related to Our Business and Our Industry—We may incur significant expenses long

before we can recognize revenue from new products, if at all, due to the costs and length of research, development, manufacturing and customer evaluation process cycles.”

|

| ● |

Purchase Orders. In accordance with industry practice, sales of our tools are made pursuant to purchase orders. Each purchase order from a customer for one of our

tools contains specific technical requirements intended to ensure, among other things, that the tool will be compatible with the customer’s manufacturing process line. Until a purchase order is received, we do not have a binding

purchase commitment. Some of our customers to date have provided us with non-binding one- to two-year forecasts of their anticipated demands, and we expect future customers to furnish similar non-binding forecasts for planning purposes.

Any of those forecasts would be subject to change, however, by the customer at any time, without notice to us.

|

| ● |

Fulfillment. We seek to obtain a purchase order for a tool from three to four months in advance of the expected delivery date. Depending upon the nature of a

customer’s specifications, the lead time for production of a tool generally will extend from two to four months. The lead-time can be more than six months, however, and in some cases, we may need to begin producing a tool based on a

customer’s non-binding forecast, rather than waiting to receive a binding purchase order.

|

| ● |

direct costs, which consist principally of costs of tool components and subassemblies purchased from third-party vendors;

|

| ● |

compensation of personnel associated with our manufacturing operations, including stock-based compensation;

|

| ● |

depreciation of manufacturing equipment;

|

| ● |

amortization of costs of software used for manufacturing purposes;

|

| ● |

other expenses attributable to our manufacturing department; and

|

| ● |

allocated overhead for rent and utilities.

|

| ● |

compensation of personnel associated with pre- and after-sales support and other sales and marketing activities, including stock-based compensation;

|

| ● |

sales commissions paid to independent sales representatives;

|

| ● |

fees paid to sales consultants;

|

| ● |

cost of trade shows;

|

| ● |

costs of tools built for promotional purposes for current or potential new customers;

|

| ● |

travel and entertainment; and

|

| ● |

allocated overhead for rent and utilities.

|

| ● |

compensation of personnel associated with our research and development activities, including stock-based compensation;

|

| ● |

costs of components and other research and development supplies;

|

| ● |

costs of tools built for product development purposes;

|

| ● |

travel expense associated with the research of technical requirements for product development purposes and testing of concepts under consideration;

|

| ● |

amortization of costs of software used for research and development purposes; and

|

| ● |

allocated overhead for rent and utilities.

|

| ● |

compensation of executive, accounting and finance, human resources, information technology, and other administrative personnel, including stock-based compensation;

|

| ● |

professional fees, including accounting and legal fees;

|

| ● |

other corporate expenses; and

|

| ● |

allocated overhead for rent and utilities.

|

| ● |

Stock-based awards granted to employees and non-employees are measured at the fair value of the awards on the grant date and are recognized as expenses either (a) immediately on grant, if no vesting conditions

are required, or (b) using the graded vesting method, net of estimated forfeitures, over the requisite service period. The fair value of stock options is determined using the Black-Scholes valuation model. Stock-based compensation

expense, when recognized, is charged to cost of revenue or to the category of operating expense corresponding to the service function of the employee or non-employee.

|

| ● |

We also grant discounts to employees when they subscribe for the new shares of ACM Shanghai, and we account for those stock-based awards in accordance with Accounting Standards Codification, or ASC, Topic 718,

Compensation—Stock Compensation

|

| ● |

Government subsidies relating to current expenses are recorded as reductions of those expenses in the periods in which the current expenses are recorded. For the years ended December 31, 2022, 2021 and 2020,

related government subsidies recognized as reductions of relevant expenses in the consolidated statements of operations and comprehensive income (loss) were $1.2 million, $11.3 million, and $2.7 million, respectively.

|

| ● |

Government subsidies related to depreciable assets are credited to income over the useful lives of the related assets for which the grant was received. For the years ended December 31, 2022, 2021 and 2020,

related government subsidies recognized as other income in the consolidated statements of operations and comprehensive income (loss) were $0.3 million, $0.2 million, and $0.1 million, respectively.

|

| 1. |

Identify the contract(s) with a customer;

|

| 2. |

Identify the performance obligations in the contract;

|

| 3. |

Determine the transaction price;

|

| 4. |

Allocate the transaction price to the performance obligations in the contract; and

|

| 5. |

Recognize revenue when (or as) the entity satisfies a performance obligation.

|

| ● |

When the customer has previously accepted the same tool with the same specifications and we can objectively demonstrate that the tool meets all of the required acceptance criteria;

|

| ● |

When the sales contract or purchase order contains no acceptance agreement and we can objectively demonstrate that the tool meets all of the required acceptance criteria;

|

| ● |

When our sales arrangements do not include a general right of return.

|

| ● |

We use the market closing price for the Class A common stock as reported on the Nasdaq Global Market to determine the fair value of the Class A common stock.

|

| ● |

The risk-free interest rates for periods within the expected life of the option are based on the yields of zero-coupon U.S. Treasury securities.

|

| ● |

Due to a lack of company-specific historical and implied volatility data, we have based our estimate of expected volatility on the historical volatility of a group of similar companies that are publicly

traded. For these analyses, we have selected companies with comparable characteristics to ours including enterprise value, risk profile, position within the industry, and with historical share price information sufficient to meet the

expected life of the stock-based awards. We compute the historical volatility data using the daily closing prices for the selected companies’ shares during the equivalent period of the calculated expected term of our stock-based awards.

We will continue to apply this process until a sufficient amount of historical information regarding the volatility of our own stock price becomes available.

|

| ● |

The expected term represents the period of time that options are expected to be outstanding. The expected term of stock options is based on the average between the vesting period and the contractual term for

each grant according to Staff Accounting Bulletin No. 110.

|

| ● |

The expected dividend yield is assumed to be 0%, based on the fact that we have never paid cash dividends and have no present intention to pay cash dividends.

|

The following table sets forth our results of operations for the periods presented, as percentages of revenue.

|

Year Ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Revenue

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||

|

Cost of revenue

|

52.8

|

55.8

|

55.6

|

|||||||||

|

Gross margin

|

47.2

|

44.2

|

44.4

|

|||||||||

|

Operating expenses:

|

||||||||||||

|

Sales and marketing

|

10.3

|

10.3

|

10.7

|

|||||||||

|

Research and development

|

16.0

|

13.2

|

12.2

|

|||||||||

|

General and administrative

|

5.8

|

5.9

|

7.8

|

|||||||||

|

Total operating expenses, net

|

32.0

|

29.3

|

30.7

|

|||||||||

|

Income from operations

|

15.2

|

14.9

|

13.7

|

|||||||||

|

Interest income (expense), net

|

1.8

|

(0.1

|

)

|

(0.1

|

)

|

|||||||

|

Change in fair value of financial liability

|

-

|

-

|

(7.6

|

)

|

||||||||

|

Realized gain from sale of trading securities

|

0.3

|

-

|

-

|

|||||||||

|

Unrealized gain (loss) on trading securities

|

(2.0

|

)

|

0.2

|

8.0 |

||||||||

|

Other income (expense), net

|

0.9

|

(0.2

|

)

|

(2.2

|

)

|

|||||||

|

Equity income in net income of affiliates

|

1.2

|

1.8

|

0.4

|

|||||||||

|

Income before income taxes

|

17.4

|

16.5

|

12.3

|

|||||||||

|

Income tax benefit (expense)

|

(4.3

|

)

|

(0.1

|

)

|

1.5

|

|||||||

|

Net income

|

13.0

|

16.4

|

13.8

|

|||||||||

|

Less: Net income attributable to non-controlling interests

|

2.9

|

2.0

|

1.8

|

|||||||||

|

Net income attributable to ACM Research, Inc.

|

10.1

|

%

|

14.4

|

%

|

12.0

|

%

|

||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2022

|

2021

|

2020

|

% Change

2022 v 2021 |

% Change

2021 v 2020 |

||||||||||||||||

|