|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on which Registered

|

|

|

|

|

|

|

|

|

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company

|

|

|

|

|

Emerging growth company

|

|

|

Class

|

Number of Shares Outstanding

|

|

Class A Common Stock, $0.0001 par value

|

|

|

Class B Common Stock, $0.0001 par value

|

|

|

PART I.

|

5

|

||

|

Item 1.

|

5 | ||

| 5 | |||

| 6 | |||

| 7 | |||

| 9 | |||

| 10 | |||

|

Item 2.

|

35

|

||

|

Item 3.

|

63 | ||

|

Item 4.

|

63 | ||

|

PART II.

|

63 | ||

|

Item 1.

|

63 | ||

|

Item 1A.

|

64 | ||

|

Item 2.

|

71 | ||

|

Item 5.

|

Other Information

|

71 | |

|

Item 6.

|

72 | ||

| 73 | |||

|

•

|

If any PRC central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the

authority’s permission or approval to continue the listing of ACM Research’s Class A common stock in the United States or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such

permission or approval, ACM Shanghai may be unable to obtain any such permission or approval or may only be able to obtain such permission or approval on terms and conditions that impose material new restrictions and limitations on

the operations of ACM Shanghai, either of which could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects and on the trading price of ACM Research Class A common stock.

|

|

•

|

PRC central government authorities may intervene in, or influence, ACM Shanghai’s PRC-based operations at any time, and those

authorities’ rules and regulations can change quickly with little or no advance notice.

|

|

•

|

The PRC central government may determine to exert additional control over offerings conducted overseas or foreign investment in

PRC-based issuers, which could result in a material change in our operations and the value of ACM Research Class A common stock.

|

| PART I. |

FINANCIAL INFORMATION

|

| Item 1. |

Financial Statements

|

|

June 30,

2022

|

December 31,

2021

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Restricted cash

|

||||||||

|

Short-term time deposits (note 2)

|

||||||||

|

Trading securities (note 15)

|

|

|

||||||

|

Accounts receivable (note 4)

|

|

|

||||||

|

Income tax receivable

|

||||||||

|

Other receivables

|

|

|

||||||

|

Inventories (note 5)

|

|

|

||||||

|

Advances to related party (note 16)

|

||||||||

|

Prepaid expenses

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Property, plant and equipment, net (note 6)

|

|

|

||||||

|

Land use right, net (note 7)

|

|

|

||||||

|

Operating lease right-of-use assets, net (note 11)

|

|

|

||||||

|

Intangible assets, net

|

|

|

||||||

| Long-term time deposits (note 2) | ||||||||

|

Deferred tax assets (note 19)

|

|

|

||||||

|

Long-term investments (note 14)

|

|

|

||||||

|

Other long-term assets (note 8)

|

|

|

||||||

|

Total assets

|

|

|

||||||

|

Liabilities and Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Short-term borrowings (note 9)

|

|

|

||||||

|

Current portion of long-term borrowings (note 12)

|

|

|

||||||

|

Related party accounts payable (note 16)

|

||||||||

|

Accounts payable

|

|

|

||||||

|

Advances from customers

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Income taxes payable (note 19)

|

|

|

||||||

|

FIN-48 payable (note 19)

|

|

|

||||||

|

Other payables and accrued expenses (note 10)

|

|

|

||||||

|

Current portion of operating lease liability (note 11)

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Long-term borrowings (note 12)

|

|

|

||||||

|

Long-term operating lease liability (note 11)

|

|

|

||||||

|

Deferred tax liability (note19)

|

|

|

||||||

|

Other long-term liabilities (note 13)

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and contingencies (note 20)

|

||||||||

|

Equity:

|

||||||||

| Stockholders’ equity: |

||||||||

|

Common stock (1) (note 17)

|

|

|

||||||

|

Common stock (1) (note 17)

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Statutory surplus reserve (note 22)

|

||||||||

|

Accumulated other comprehensive income (loss)

|

(

|

)

|

|

|||||

|

Total ACM Research, Inc. stockholders’ equity

|

|

|

||||||

|

Non-controlling interests

|

|

|

||||||

|

Total equity

|

|

|

||||||

|

Total liabilities and equity

|

$

|

|

$

|

|

||||

|

(1)

|

|

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Revenue (note 3)

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Cost of revenue

|

|

|

|

|

||||||||||||

|

Gross profit

|

|

|

|

|

||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Sales and marketing

|

|

|

|

|

||||||||||||

|

Research and development

|

|

|

|

|

||||||||||||

|

General and administrative

|

|

|

|

|

||||||||||||

|

Total operating expenses, net

|

|

|

|

|

||||||||||||

|

Income from operations

|

|

|

|

|

||||||||||||

|

Interest income

|

|

|

|

|

||||||||||||

|

Interest expense

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||

|

Unrealized gain (loss) on trading securities

|

(

|

)

|

|

(

|

)

|

|

||||||||||

|

Other income (expense), net

|

|

(

|

)

|

|

(

|

)

|

||||||||||

|

Equity income in net income of affiliates

|

|

|

|

|

||||||||||||

|

Income before income taxes

|

|

|

|

|

||||||||||||

|

Income tax benefit (expense) (note 19)

|

(

|

)

|

(

|

)

|

(

|

)

|

|

|||||||||

|

Net income

|

|

|

|

|

||||||||||||

|

Less: Net income attributable to non-controlling interests

|

|

|

|

|

||||||||||||

|

Net income attributable to ACM Research, Inc.

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Comprehensive income (loss):

|

||||||||||||||||

|

Net income

|

|

|

|

|

||||||||||||

|

Foreign currency translation adjustment, net of tax

|

(

|

)

|

|

(

|

)

|

|

||||||||||

|

Comprehensive income (loss)

|

(

|

)

|

|

(

|

)

|

|

||||||||||

|

Less: Comprehensive income (loss) attributable to non-controlling interests

|

(

|

)

|

|

(

|

)

|

|

||||||||||

|

Comprehensive income (loss) attributable to ACM Research, Inc.

|

$

|

(

|

)

|

$

|

|

$

|

(

|

)

|

$

|

|

||||||

|

Net income attributable to ACM Research, Inc. per common share (note 2):

|

||||||||||||||||

|

Basic

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Diluted

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Weighted average common shares outstanding used in computing per share amounts (note 2):

|

||||||||||||||||

|

Basic (1)

|

|

|

|

|

||||||||||||

|

Diluted (1)

|

|

|

|

|

||||||||||||

|

(1)

|

|

|

|

Common

Stock Class A

|

Common

Stock Class B

|

||||||||||||||||||||||||||||||||||||||

|

|

Shares (1)

|

Amount

|

Shares (1)

|

Amount

|

Additional Paid-

in Capital

|

Retained earnings

|

Statutory Surplus

Reserve

|

Accumulated

Other

Comprehensive

Income

|

Non-controlling

interests

|

Total

Equity

|

||||||||||||||||||||||||||||||

|

Balance at December 31, 2020

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Exercise of stock options

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Stock-based compensation

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Exercise of stock warrants

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Conversion of Class B common stock to Class A common stock

|

|

|

(

|

)

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Balance at June 30, 2021

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||||||||||||||||

|

|

Common

Stock Class A

|

Common

Stock Class B

|

||||||||||||||||||||||||||||||||||||||

|

|

Shares (1)

|

Amount

|

Shares (1)

|

Amount

|

Additional Paid-

in Capital

|

Retained earnings

|

Statutory Surplus

Reserve

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Non-controlling

interests

|

Total

Equity

|

||||||||||||||||||||||||||||||

|

Balance at December 31, 2021

|

|

$

|

|

|

$ |

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

-

|

|

-

|

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||

|

Exercise of stock options

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Stock-based compensation

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Conversion of Class B common stock to Class

A common stock

|

|

|

(

|

)

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Balance at June 30, 2022

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||||||||||||||

|

(1)

|

Prior period results have been adjusted to reflect the

|

|

Common

Stock Class A

|

Common

Stock Class B

|

|||||||||||||||||||||||||||||||||||||||

|

Shares (1)

|

Amount

|

Shares (1)

|

Amount

|

Additional Paid-

in Capital

|

Retained earnings |

Statutory Surplus

Reserve

|

Accumulated

Other

Comprehensive

Income

|

Non-controlling

interests

|

Total

Equity

|

|||||||||||||||||||||||||||||||

|

Balance at March 31, 2021

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

|

|

|

||||||||||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Exercise of stock options

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Stock-based compensation

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Exercise

of warrants |

||||||||||||||||||||||||||||||||||||||||

| Conversion of class B common shares to Class A common shares | ( |

) | ||||||||||||||||||||||||||||||||||||||

|

Balance at June 30, 2021

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||||||||||||||||

|

Common

Stock Class A

|

Common

Stock Class B

|

|||||||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Additional Paid-

in Capital

|

Retained earnings |

Statutory Surplus

Reserve

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Non-controlling

interests

|

Total

Equity

|

|||||||||||||||||||||||||||||||

|

Balance at March 31, 2022

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||||||||||||||||

|

Net Income

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

-

|

|

-

|

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||

|

Exercise of stock options

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Stock-based compensation

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Balance at June 30, 2022

|

|

$

|

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||||||||||||||

|

(1)

|

|

|

|

Three Months Ended June 30, |

Six

Months Ended June 30,

|

||||||||||||||

|

|

2022 |

2021 |

2022

|

2021

|

||||||||||||

|

Cash flows from operating activities:

|

||||||||||||||||

|

Net income

|

$ | $ |

$

|

|

$

|

|

||||||||||

|

Adjustments to reconcile net income from operations to net cash provided by (used in) operating activities

|

||||||||||||||||

|

Depreciation and amortization

|

|

|

||||||||||||||

|

Gain on disposals of property, plant and equipment

|

( |

) |

|

|

||||||||||||

|

Equity income in net income of affiliates

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Unrealized loss (gain) on trading securities

|

( |

) |

|

(

|

)

|

|||||||||||

|

Deferred income taxes

|

( |

) |

|

(

|

)

|

|||||||||||

|

Stock-based compensation

|

|

|

||||||||||||||

|

Net changes in operating assets and liabilities:

|

||||||||||||||||

|

Accounts receivable

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Other receivables

|

(

|

)

|

(

|

)

|

||||||||||||

|

Inventories

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

| Advances to related party (note 16) |

( |

) | ( |

) | ||||||||||||

|

Prepaid expenses

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Other long-term assets

|

( |

) |

|

(

|

)

|

|||||||||||

| Related party accounts payable (note 16) |

||||||||||||||||

|

Accounts payable

|

( |

) |

|

|

||||||||||||

|

Advances from customers

|

|

|

||||||||||||||

|

Deferred revenue

|

||||||||||||||||

|

Income tax payable

|

|

|

||||||||||||||

|

FIN-48 payable

|

( |

) | ( |

) | ||||||||||||

|

Other payables and accrued expenses

|

( |

) |

|

|

||||||||||||

|

Other long-term liabilities

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Net cash flow (used in) provided by operating activities

|

( |

) | ( |

) |

(

|

)

|

|

|||||||||

|

|

||||||||||||||||

|

Cash flows from investing activities:

|

||||||||||||||||

|

Purchase of property, plant and equipment

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Purchase of intangible assets

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Decrease (increase) of short-term time deposits

|

( |

) | ||||||||||||||

| Decrease (increase) of long-term time deposits |

( |

) | ||||||||||||||

|

Net cash (used in) provided by investing activities

|

( |

) |

(

|

)

|

(

|

)

|

||||||||||

|

|

||||||||||||||||

|

Cash flows from financing activities:

|

||||||||||||||||

|

Proceeds from short-term borrowings

|

|

|

||||||||||||||

|

Repayments of short-term borrowings

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

| Proceeds

from long-term borrowings |

||||||||||||||||

|

Repayments of long-term borrowings

|

( |

) | ( |

) |

(

|

)

|

(

|

)

|

||||||||

|

Proceeds from exercise of stock options

|

|

|

||||||||||||||

| Proceeds from warrant exercise to common stock |

||||||||||||||||

|

Net cash (used in) provided by financing activities

|

( |

) |

(

|

)

|

|

|||||||||||

|

|

||||||||||||||||

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash

|

$ | ( |

) | $ |

$

|

(

|

)

|

$

|

|

|||||||

|

Net decrease in cash, cash equivalents and restricted cash

|

$ | ( |

) | $ | ( |

) |

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

|

||||||||||||||||

|

Cash, cash equivalents and restricted cash at beginning of period

|

|

|

||||||||||||||

|

Cash, cash equivalents and restricted cash at end of period

|

$ | $ |

$

|

|

$

|

|

||||||||||

|

|

||||||||||||||||

|

Supplemental disclosure of cash flow information:

|

||||||||||||||||

|

Interest paid, net of capitalized interest

|

$ | $ |

$

|

|

$

|

|

||||||||||

|

Cash paid for income taxes

|

$ | $ |

$

|

|

$

|

|

||||||||||

|

|

||||||||||||||||

|

Non-cash financing activities:

|

||||||||||||||||

| Conversion of Class B common stock to Class A common stock |

$ |

$ |

$ |

$ |

||||||||||||

|

Cashless exercise of stock options

|

$ | $ |

$

|

|

$

|

|

||||||||||

| Non-cash investing activities: |

||||||||||||||||

| Transfer of prepayment for property to property, plant and equipment |

$ |

$ |

$ |

$ |

||||||||||||

|

|

|

Effective interest held as at

|

|||||||

|

Name of subsidiaries

|

Place and date of incorporation

|

June 30,

2022

|

December 31,

2021

|

||||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

|

|

|

|

%

|

|

%

|

||||

| % | % | ||||||||

| % | |||||||||

| % | |||||||||

|

•

|

In March 2022, several regions in China began to experience elevated levels of COVID-19 infections, and the PRC government instituted policies to restrict the spread of the virus. The

policies began with an increase of “spot quarantines,” under which a positive polymerase chain reaction (PCR) or other test would result in the quarantining of individual buildings, groups of buildings, or even full neighborhoods. The

policies were later expanded to full-city quarantines, including in the City of Shanghai, where substantially all of ACM Shanghai’s operations are located. COVID-19 related restrictions in Shanghai began to limit employee access to, and

logistics activities of, ACM Shanghai’s offices and production facilities in the Pudong district of Shanghai in March 2022, and therefore limited ACM Shanghai’s ability to ship finished products to customers and to produce new products.

Spot quarantines in mid-March 2022 began to impact a number of ACM Shanghai’s employees and led to a closure of ACM Shanghai’s administrative and R&D offices in Zhangjiang in the Pudong district. A subsequent quarantine of the

entire Pudong region of Shanghai was imposed in late March 2022 and impacted the operation of ACM Shanghai’s Chuansha production facility. Although the facility remained partially operational with a number of personnel staying on-site

for a prolonged period, the level of production declined significantly versus more normal levels. Furthermore, a number of the Company’s customers have substantial operations based in operations areas of the PRC, including in the City

of Shanghai, subject to a full-city restrictions, which began limiting the operations of those customers since the first quarter of 2022, including inhibiting their ability to receive, implement and operate new tools for their

manufacturing facilities. As a result, in some cases, ACM Shanghai was required to defer shipments of finished products to these customers because of operational and logistical limitations affecting customers other than, or in addition

to, ACM Shanghai.

|

|

•

|

In late April 2022, ACM Shanghai began to increase the level of its operations at the Chuansha manufacturing site using the “closed loop method,” in which a limited collection of

workers remain together as a group between a single hotel, the ACM Shanghai facility, and a dedicated bus transportation route, also referred to as “two spots and one line,” and had resumed substantially all of its Chuansha

manufacturing site operations by the end of the second quarter of 2022. On July 1, 2022, the Company transitioned operations at the Chuansha facility to a more normal production process, in which workers we able to return home

following their factory shifts.

|

|

•

|

In mid-June 2022, substantially all of ACM Shanghai’s R&D and administrative employees were allowed to return to work at the ZhangJiang facility following a 6-8 week period of

restricted access during which many employees had continued to work from home. ACM Shanghai has established several policies to help avoid or limit future outbreaks among employees and aimed at protecting employee safety and limiting

the possibility of a facility reclosing.

|

|

June 30,

2022

|

December 31,

2021

|

|||||||

|

United States

|

$

|

|

$

|

|

||||

|

Mainland China

|

|

|

||||||

|

China Hong Kong

|

||||||||

|

South Korea

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Deposit in China Merchant Bank which will mature on

|

$

|

|

$

|

|

||||

|

Deposit in China Everbright Bank which will mature on

|

|

|

||||||

|

Deposit in China Industrial Bank which will mature on

|

|

|

||||||

|

Deposit in China Merchant Bank which will mature on

|

|

|

||||||

|

Deposit in Bank of Ningbo which will mature on

|

|

|

||||||

|

|

$

|

|

$

|

|

||||

|

1.

|

Identify the contract(s) with a customer;

|

|

2.

|

Identify the performance obligations in the contract;

|

|

3.

|

Determine the transaction price;

|

|

4.

|

Allocate the transaction price to the performance obligations in the contract; and

|

|

5.

|

Recognize revenue when (or as) the entity satisfies a performance obligation.

|

|

●

|

When the customer has previously accepted the same tool with the same specifications and the Company can objectively demonstrate that the tool meets all of the required acceptance criteria;

|

|

●

|

When the sales contract or purchase order contains no acceptance agreement or lapsing acceptance provision and the Company can objectively demonstrate that the tool meets all of the required acceptance criteria;

|

|

●

|

When the customer withholds acceptance due to issues unrelated to product performance, in which case revenue is recognized when the system is performing as intended and meets predetermined specifications; or

|

|

●

|

When the Company’s sales arrangements do not include a general right of return.

|

|

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Numerator:

|

||||||||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Less: Net income attributable to non-controlling interests

|

|

|

|

|

||||||||||||

|

Net income available to common stockholders, basic

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Less: Dilutive effect arising from stock-based awards by ACM Shanghai

|

||||||||||||||||

| Net income available to common stockholders, diluted | $ | $ | $ | $ | ||||||||||||

|

Weighted average shares outstanding, basic (1)

|

|

|

|

|

||||||||||||

|

Effect of dilutive securities

|

|

|

|

|

||||||||||||

|

Weighted average shares outstanding, diluted

|

|

|

|

|

||||||||||||

|

Net income per common share:

|

||||||||||||||||

|

Basic

|

|

|

|

|

||||||||||||

|

Diluted

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

(1)

|

|

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Single wafer cleaning, Tahoe and semi-critical cleaning equipment

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

ECP (front-end and packaging), furnace and other technologies

|

|

|

|

|

||||||||||||

|

Advanced packaging (excluding ECP), services & spares

|

|

|

|

|

||||||||||||

|

Total Revenue By Product Category

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Wet cleaning and other front-end processing tools

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Advanced packaging, other processing tools, services and spares

|

|

|

|

|

||||||||||||

|

Total Revenue Front-end

and Back-End

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Mainland China

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Other Regions

|

|

|

|

|

||||||||||||

|

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

|

||||||||

|

Accounts receivable

|

$

|

|

$

|

|

||||

|

Advances from customers

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Accounts receivable

|

$

|

|

$

|

|

||||

|

Less: Allowance for doubtful accounts

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Raw materials

|

$

|

|

$

|

|

||||

|

Work in process

|

|

|

||||||

|

Finished goods

|

|

|

||||||

|

Total inventory

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Buildings and plants

|

$ | $ | ||||||

|

Manufacturing equipment

|

|

|

||||||

|

Office equipment

|

|

|

||||||

|

Transportation equipment

|

|

|

||||||

|

Leasehold improvement

|

|

|

||||||

|

Total cost

|

|

|

||||||

|

Less: Total accumulated depreciation and amortization

|

(

|

)

|

(

|

)

|

||||

|

Construction in progress

|

|

|

||||||

|

Total property, plant and equipment, net

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Land use right purchase amount

|

$

|

|

$

|

|

||||

|

Less: accumulated amortization

|

(

|

)

|

(

|

)

|

||||

|

Land use right, net

|

$

|

|

$

|

|

||||

|

Year ending December 31,

|

||||

|

Remainder of 2022

|

$ |

|

||

|

2023

|

|

|||

|

2024

|

|

|||

|

2025

|

|

|||

|

2026

|

|

|||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Prepayment for property - Lingang

|

$

|

|

$

|

|

||||

|

Prepayment for property, plant and equipment and other non-current assets

|

|

|

||||||

|

Prepayment for property - lease deposit

|

|

|

||||||

|

Security deposit for land use right

|

|

|

||||||

|

Others

|

|

|

||||||

|

Total other long-term assets

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Line of credit up to RMB

|

||||||||

|

due on June 7,2022 with an annual interest rate of

|

$

|

|

$

|

|

||||

|

Line of credit up to RMB

|

||||||||

|

due on October 21,2022 with annual interest rate of

|

|

|

||||||

|

Line of credit up to RMB

|

||||||||

|

due on October 25,2022 with an annual interest rate of

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Accrued commissions

|

$ |

|

$ |

|

||||

|

Accrued warranty

|

|

|

||||||

|

Accrued payroll

|

|

|

||||||

|

Accrued professional fees

|

|

|

||||||

|

Accrued machine testing fees

|

|

|

||||||

|

Others

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Operating lease cost

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Short-term lease cost

|

|

|

|

|

||||||||||||

|

Lease cost

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Cash paid for amounts included in the measurement of lease liabilities:

|

||||||||||||||||

|

Operating cash outflow from operating leases

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

|

December 31,

|

|||

|

Remainder of 2022

|

$ |

|

||

|

2023

|

|

|||

|

2024

|

|

|||

|

2025

|

|

|||

|

2026

|

|

|||

| 2027 | ||||

|

Total lease payments

|

$ |

|

||

|

Less: Interest

|

(

|

)

|

||

|

Present value of lease liabilities

|

$

|

|

||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Remaining lease term and discount rate:

|

||||||||

|

Weighted average remaining lease term (years)

|

|

|

||||||

|

Weighted average discount rate

|

|

%

|

|

%

|

||||

|

June 30,

2022

|

December 31,

2021

|

|||||||

|

Loan from China Merchants Bank

|

$

|

|

$

|

|

||||

|

Loans from Bank of China

|

|

|

|

|

||||

|

Less: Current portion

|

(

|

)

|

(

|

)

|

||||

|

$

|

|

$

|

|

|||||

|

Year ending December 31

|

||||

|

2022

|

$

|

|

||

|

2023

|

|

|||

|

2024

|

|

|||

|

2025

|

|

|||

| 2026 | ||||

|

Thereafter

|

|

|||

|

$

|

|

|||

For the six months ended June 30, 2022 and 2021, respectively, interest related to long-term borrowings of $

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Subsidies to Stress Free Polishing project, commenced in 2008 and 2017

|

$

|

|

$

|

|

||||

|

Subsidies to Electro Copper Plating project, commenced in 2014

|

|

|

||||||

|

Subsidies to other cleaning tools,commenced in 2020

|

|

|

||||||

|

Subsidies to SW Lingang R&D development in 2021

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

| Equity investee: |

June 30,

2022

|

December 31,

2021

|

||||||

|

Ninebell

|

$

|

|

$

|

|

||||

|

Shengyi

|

|

|

||||||

|

Hefei Shixi

|

|

|

||||||

| Subtotal |

||||||||

| Other investee: |

||||||||

| Waferworks |

||||||||

|

Total

|

$

|

|

$

|

|

||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Trading securities listed in Shanghai Stock Exchange

|

||||||||

|

Cost

|

$

|

|

$

|

|

||||

|

Market value

|

|

|

||||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

(in thousands)

|

(in thousands)

|

|||||||||||||||

|

Unrealized gain (loss) on trading securities

|

$

|

(

|

)

|

$

|

|

$ | ( |

) |

$

|

|

||||||

|

|

June 30,

|

December 31,

|

||||||

| Prepaid expenses |

2022 | 2021 | ||||||

|

Ninebell

|

$

|

|

$

|

|

||||

|

|

June 30,

|

December 31,

|

||||||

| Accounts payable | 2022 | 2021 | ||||||

|

Ninebell

|

$

|

|

$

|

|

||||

|

Shengyi

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

Purchase of materials

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Ninebell

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Shengyi

|

|

|

|

|

||||||||||||

|

Total

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Three Months Ended June 30,

|

Six

Months Ended June 30,

|

|||||||||||||||

|

Service fee charged by

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Shengyi

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Total

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Stock-Based Compensation Expense:

|

||||||||||||||||

|

Cost of revenue

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Sales and marketing expense

|

|

|

|

|

||||||||||||

|

Research and development expense

|

|

|

|

|

||||||||||||

|

General and administrative expense

|

|

|

|

|

||||||||||||

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Stock-based compensation expense by type:

|

||||||||||||||||

|

Employee stock option plan

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Non-employee stock option plan

|

|

|

|

|

||||||||||||

|

Subsidiary stock option plan

|

|

|

|

|

||||||||||||

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

|

Number of

Option Shares (1)

|

Weighted

Average Grant

Date Fair Value

|

Weighted

Average

Exercise Price

|

Weighted Average

Remaining

Contractual Term

|

|||||||||

|

Outstanding at December 31, 2021

|

|

|

|

|

|||||||||

|

Granted

|

|

|

|||||||||||

|

Exercised

|

(

|

)

|

|

|

|||||||||

|

Forfeited/cancelled

|

(

|

)

|

|

|

|||||||||

|

Outstanding at June 30, 2022

|

|

$

|

|

$ |

|

||||||||

|

Vested and exercisable at June 30, 2022

|

|

|

|||||||||||

|

(1)

|

|

|

Six-months ended

|

Year-ended |

|||||||

|

June 30,

2022 (6)

|

December 31,

2021 (6)

|

|||||||

|

Fair value of common share(1)

|

$

|

|

$ | |||||

|

Expected term in years(2)

|

|

|

||||||

|

Volatility(3)

|

|

%

|

% | |||||

|

Risk-free interest rate(4)

|

|

%

|

% | |||||

|

Expected dividend(5)

|

% | % | ||||||

|

(1)

|

|

|

(2)

|

|

|

(3)

|

|

|

(4)

|

|

|

(5)

|

|

|

(6)

|

|

|

|

Number of

Option Shares (1)

|

Weighted

Average Grant

Date Fair Value

|

Weighted

Average

Exercise Price

|

Weighted

Average

Remaining

Contractual Term

|

|||||||||

|

Outstanding at December 31, 2021

|

|

|

|

|

|

|

|||||||

|

Granted

|

|

|

|

||||||||||

|

Exercised

|

(

|

)

|

|

|

|

||||||||

|

Expired

|

|

|

|

|

|||||||||

|

Forfeited/cancelled

|

(

|

)

|

|

|

|

||||||||

|

Outstanding at June 30, 2022

|

|

$

|

|

$

|

|

|

|||||||

|

Vested and exercisable at June 30, 2022

|

|

|

|||||||||||

|

(1)

|

|

|

|

Number of

Option Shares in

ACM Shanghai

|

Weighted

Average Grant

Date Fair Value

|

Weighted

Average

Exercise Price

|

Weighted

Average

Remaining

Contractual Term

|

|||||||||

|

Outstanding at December 31, 2021

|

|

$

|

|

$ |

_

|

||||||||

|

Outstanding at June 30, 2022

|

|

$

|

|

$ |

|

||||||||

|

Vested and exercisable at June 30, 2022

|

|

|

|||||||||||

|

Three Months Ended June 30,

|

Six Months Ended June 30, | |||||||||||||||

|

2022

|

2021

|

2022 | 2021 | |||||||||||||

|

Total income tax benefit (expense)

|

$

|

(

|

)

|

$

|

(

|

)

|

$ | ( |

) | $ | ||||||

|

|

June 30,

2022

|

December 31,

2021

|

||||||

|

Long-lived assets by geography:

|

||||||||

|

Mainland China

|

$

|

|

$

|

|

||||

|

South Korea

|

|

|

||||||

|

United States

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

| ● |

Space Alternated Phase Shift, or SAPS, technology for flat and patterned (deep via or deep trench with stronger structure) wafer surfaces. SAPS technology employs

alternating phases of megasonic waves to deliver megasonic energy in a highly uniform manner on a microscopic level. We have shown SAPS technology to be more effective than conventional megasonic and jet spray technologies in removing

random defects across an entire wafer, with increasing relative effectiveness at more advanced production nodes.

|

| ● |

Timely Energized Bubble Oscillation, or TEBO, technology for patterned wafer surfaces at advanced process nodes. TEBO technology has been developed to provide

effective, damage-free cleaning for 2D and 3D patterned wafers with fine feature sizes. We have demonstrated the damage-free cleaning capabilities of TEBO technology on patterned wafers for feature nodes as small as 1xnm (16 to 19

nanometers, or nm), and we have shown TEBO technology can be applied in manufacturing processes for patterned chips with 3D architectures having aspect ratios as high as 60‑to‑1.

|

| ● |

Tahoe technology for cost and environmental savings. Tahoe technology delivers high cleaning performance using significantly less sulfuric acid and hydrogen peroxide

than is typically consumed by conventional high-temperature single-wafer cleaning tools.

|

| ● |

ECP technology for advanced metal plating. Our Ultra ECP ap, or Advanced Packaging, technology was developed for back-end assembly processes to deliver a more uniform

metal layer at the notch area of wafers prior to packaging. Our Ultra ECP map, or Multi-Anode Partial Plating, technology was developed for front-end wafer fabrication processes to deliver advanced electrochemical copper plating for copper

interconnect applications. Ultra ECP map offers improved gap-filling performance for ultra-thin seed layer applications, which is critical for advanced nodes at 28nm, 14nm and beyond.

|

| • |

In 2009 we introduced SAPS megasonic technology, which can be applied in wet wafer cleaning at numerous steps during the chip fabrication process.

|

| • |

In 2016 we introduced TEBO technology, which can be applied at numerous steps during the fabrication of small node conventional two-dimensional and three-dimensional

patterned wafers.

|

| • |

In August 2018 we introduced the Ultra-C Tahoe wafer cleaning tool, which delivers high cleaning performance with significantly less sulfuric acid than typically

consumed by conventional high temperature single-wafer cleaning tools.

|

| • |

In March 2019 we introduced (a) the Ultra ECP AP or Advanced Wafer Level Packaging tool, a back-end assembly tool used for bumping, or applying copper, tin and nickel

to wafers at the die-level prior to packaging, and (b) the Ultra ECP MAP or Multi Anode Plating tool, a front-end process tool that utilizes our proprietary technology to deliver world-class

electrochemical copper planting for copper interconnect applications.

|

| • |

In April 2020 we introduced the Ultra Furnace, our first system developed for multiple dry processing applications.

|

| • |

In May 2020 we introduced the Ultra C Family of semi-critical cleaning systems, including the Ultra C b for backside clean,

the Ultra C wb automated wet bench, and the Ultra C s scrubber.

|

| • |

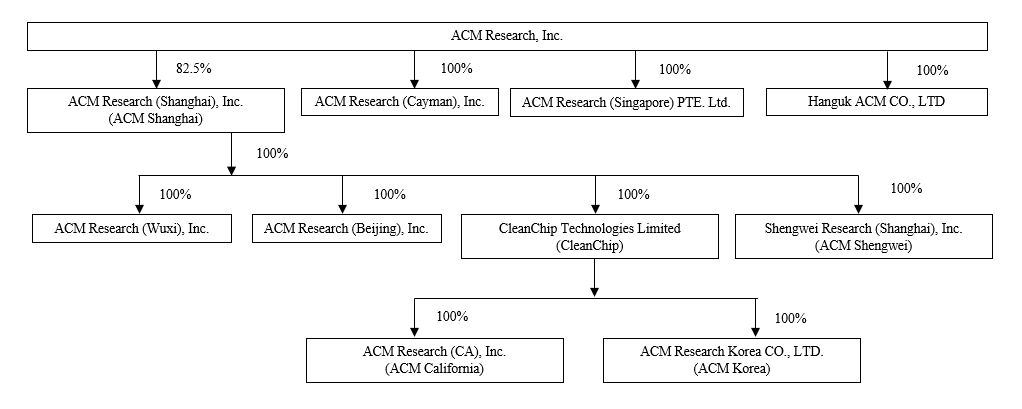

In 2011 we formed a wholly-owned subsidiary in the PRC, ACM Research (Wuxi), Inc., which now is a wholly-owned subsidiary of ACM Shanghai, to manage sales and service

operations.

|

| • |

In June 2017 we formed a subsidiary in Hong Kong, CleanChip Technologies Limited, which now is a wholly-owned subsidiary of ACM Shanghai, to act on our behalf in

Asian markets outside the PRC by, for example, serving as a trading partner between ACM Shanghai and its customers, procuring raw materials and components, performing sales and marketing activities, and making strategic investments.

|

| • |

In December 2017 we formed a subsidiary in the Republic of Korea, ACM Research Korea CO., LTD., which now is an indirect wholly-owned subsidiary of ACM Shanghai, to serve our customers based in the Republic of Korea and perform sales and marketing and R&D activities.

|

| • |

In March 2019 ACM Shanghai formed a wholly-owned subsidiary in the PRC, Shengwei Research (Shanghai), Inc., or ACM Shengwei, to manage

activities related to addition of future long-term production capacity.

|

|

•

|

In June 2019 CleanChip Technologies Limited formed a wholly-owned subsidiary in California, ACM Research (CA), Inc., to provide procurement services on

behalf of ACM Shanghai.

|

| • |

In August 2021 we formed a wholly-owned subsidiary in Singapore, ACM Research (Singapore) PTE, Ltd., to perform sales, marketing, and other business development

activities.

|

| • |

In February 2022, ACM Shanghai formed a wholly-owned subsidiary in China, ACM Research (Beijing), Inc., to perform sales, marketing and other business development

activities.

|

| • |

In March 2022, ACM formed a wholly-owned subsidiary in South Korea, Hanguk ACM CO., LTD, to perform business development and other related activities.

|

| • |

ACM Shanghai’s initial factory is located in the Pudong Region of Shanghai and has a total of 36,000 square feet of available floor space.

|

| • |

ACM Shanghai’s second production facility is located in the Chuansha district of Pudong, approximately 11 miles from our initial factory. In September 2018 we announced the opening of the first building of the second production

facility. The first building initially had a total of 50,000 square feet of available floor space for production capacity, which was increased by 50,000 square feet in the second quarter of 2020. In February 2021 ACM Shanghai leased a

second building immediately adjacent to the second factory, which increased the available floor space for production by another 100,000 square feet, bringing to total available floor space for production capacity of second production

facility to 200,000 square feet.

|

| • |

In July 2020 ACM Shanghai began a multi-year construction project to build a development and production center in the Lingang region of Shanghai. The new facility is expected to have a total of 1,000,000

square feet of available floor space for production. capacity.

|

| • |

In January 2022 ACM Shanghai completed the purchase of a housing facility in the Lingang region of Shanghai to assist in employee retention and recruitment in connection with its new R&D center and

factory currently under construction.

|

| • |

If any PRC central government authority were to determine that existing PRC laws or regulations require that ACM Shanghai obtain the authority’s permission or approval to continue the listing of ACM Research’s Class A common stock in

the United States or if those existing PRC laws and regulations, or interpretations thereof, were to change to require such permission or approval, ACM Shanghai may be unable to obtain any such permission or approval or may only be able

to obtain such permission or approval on terms and conditions that impose material new restrictions and limitations on the operations of ACM Shanghai, either of which could have a material adverse effect on our business, financial

condition, results of operations, reputation and prospects and on the trading price of ACM Research Class A common stock.

|

| • |

PRC central government authorities may intervene in, or influence, ACM Shanghai’s PRC-based operations at any time, and those authorities’ rules and regulations can change quickly with little or no advance notice.

|

| • |

The PRC central government may determine to exert additional control over offerings conducted overseas or foreign investment in PRC-based issuers, which could result in a material change in our operations and the value of ACM Research

Class A common stock.

|

| • |

Operations: We conduct substantially all of our product development, manufacturing, support and services in the PRC through ACM Shanghai, and

those activities have been directly impacted by COVID–19 and related restrictions on transportation and public appearances.

|

| • |

Customers: Our customers’, including the customers of ACM Shanghai, business operations have been, and are continuing to be, subject to business interruptions arising

from the COVID–19 pandemic. Historically substantially all of our revenue has been derived from customers located in the PRC and surrounding areas that have been impacted by COVID–19. Two customers that accounted for 48.9% of our revenue in

2021 are based in the PRC, and three customers that accounted for 75.8% of our revenue in 2020, and 73.8% of our revenue in 2019 are based in the PRC and South Korea. One of those customers, Yangtze Memory Technologies Co., Ltd. — which

accounted for 20.2% of our 2021 revenue, 26.8% of our 2020 revenue, and 27.5% of our 2019 revenue — is based in Wuhan. While Yangtze Memory Technologies Co., Ltd. and other key customers continued to operate their fabrication facilities

without interruption during and after the first quarter of 2020, some customers have been forced to restrict access of service personnel and deliveries to and from their facilities. We have experienced longer and in some cases more costly

shipping expenses in the delivery of tools to certain customers.

|

| • |

Suppliers: Our global supply chain includes components sourced from the PRC, Japan, Taiwan, the United States and Europe. While, to date, we have not experienced

material issues with our supply chain beyond the logistics related to the Shanghai facilities of ACM Shanghai, supply chain constraints have intensified due to COVID-19, contributing to global shortages in the supply of semiconductors and

other materials, and in some cases the pricing of materials used in the production of our own tools. As with our customers, we continue to be in close contact with our key suppliers to help ensure we are able to identify any potential

supply issues that may arise.

|

| • |

Projects: Our strategy includes a number of plans to support the growth of our core business, including ACM Shanghai’s acquisition of a land use right in the Lingang

area of Shanghai where ACM Shanghai began construction of a new R&D center and factory in July 2020. The extent to which COVID–19 impacts these projects will depend on future developments that are highly uncertain, but to date, the

timing of these ongoing projects has not been delayed or significantly disrupted by COVID–19 or related government measures.

|

| ● |

Government subsidies relating to current expenses are recorded as reductions of those expenses in the periods in which the current expenses are recorded. For the six months ended June 30, 2022 and 2021,

related government subsidies recognized as reductions of relevant expenses in the consolidated statements of operations and comprehensive income were $0.1 million and $4.2 million, respectively.

|

| ● |

Government subsidies related to depreciable assets are credited to income over the useful lives of the related assets for which the grant was received. For the six months ended June 30, 2022 and 2021, related

government subsidies recognized as other income in the consolidated statements of operations and comprehensive income were $155,000 and $80,000, respectively.

|

|

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

|

2022

|

2021

|

2022

|

2021

|

||||||||||||

|

Revenue

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||||

|

Cost of revenue

|

57.7

|

59.8

|

56.4

|

59.3

|

||||||||||||

|

Gross margin

|

42.3

|

40.2

|

43.6

|

40.7

|

||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Sales and marketing

|

7.3

|

10.7

|

9.8

|

11.4

|

||||||||||||

|

Research and development

|

10.9

|

14.7

|

19.6

|

13.8

|

||||||||||||

|

General and administrative

|

4.9

|

6.7

|

6.8

|

7.6

|

||||||||||||

|

Total operating expenses, net

|

23.1

|

32.2

|

36.2

|

32.7

|

||||||||||||

|

Income from operations

|

19.2

|

8.0

|

7.3

|

8.0

|

||||||||||||

|

Interest income (expense), net

|

1.8

|

(0.3

|

)

|

2.3

|

(0.3

|

)

|

||||||||||

|

Unrealized gain (loss) on trading securities

|

(0.4

|

)

|

7.0

|

(2.9

|

)

|

2.8

|

||||||||||

|

Other income (expense), net

|

2.4

|

(1.7

|

)

|

1.9

|

(0.4

|

)

|

||||||||||

|

Equity income in net income of affiliates

|

0.5

|

0.5

|

0.3

|

0.6

|

||||||||||||

|

Income before income taxes

|

23.5

|

13.6

|

8.9

|

10.7

|

||||||||||||

|

Income tax benefit (expense)

|

(7.4

|

)

|

(0.0

|

)

|

(2.5

|

)

|

2.8

|

|||||||||

|

Net income

|

16.1

|

13.6

|

6.4

|

13.5

|

||||||||||||

|

Less: Net income attributable to non-controlling interests

|

4.3

|

1.4

|

1.9

|

1.1

|

||||||||||||

|

Net income attributable to ACM Research, Inc.

|

11.8

|

%

|

12.2

|

%

|

4.3

|

%

|

12.3

|

%

|

||||||||

|

|

Three Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

% Change

2022 v 2021 |

Absolute Change

2022 v 2021 |

||||||||||||

| |

(in thousands)

|

|||||||||||||||

|

Revenue

|

$

|

104,395

|

$

|

53,864

|

93.8

|

%

|

$

|

50,531

|

||||||||

|

|

||||||||||||||||

|

Single wafer cleaning, Tahoe and semi-critical cleaning equipment

|

$

|

72,583

|

$

|

45,461

|

59.7

|

%

|

$

|

27,122

|

||||||||

|

ECP (front-end and packaging), furnace and other technologies

|

20,500

|

-

|

NM

|

20,500

|

||||||||||||

|

Advanced packaging (excluding ECP), services & spares

|

11,312

|

8,403

|

34.6

|

%

|

2,909

|

|||||||||||

|

Total Revenue by Product Category

|

$

|

104,395

|

$

|

53,864

|

93.8

|

%

|

$

|

50,531

|

||||||||

|

|

||||||||||||||||

|

Wet cleaning and other front-end processing tools

|

$

|

79,553

|

$

|

45,974

|

73.0

|

%

|

$

|

33,579

|

||||||||

|

Advanced packaging, other processing tools, services and spares

|

24,842

|

7,890

|

214.9

|

%

|

16,952

|

|||||||||||

|

Total Revenue Front and Back-End

|

$

|

104,395

|

$

|

53,864

|

93.8

|

%

|

$

|

50,531

|

||||||||

|

|

Three Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

% Change

2022 v 2021 |

Absolute Change

2022 v 2021

|

||||||||||||

|

|

(in thousands)

|

|||||||||||||||

|

Cost of revenue

|

$

|

60,238

|

$

|

32,184

|

87.2

|

%

|

$

|

28,054

|

||||||||

|

Gross profit

|

44,157

|

21,680

|

103.7

|

%

|

22,477

|

|||||||||||

|

Gross margin

|

42.3

|

%

|

40.2

|

%

|

1.95

|

(9.4

|

)%

|

|||||||||

|

|

Three Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

% Change

2022 v 2021 |

Absolute Change

2022 v 2021

|

||||||||||||

|

|

(in thousands)

|

|||||||||||||||

|

Sales and marketing expense

|

$

|

7,664

|

$

|

5,789

|

32.4

|

%

|

$

|

1,875

|

||||||||

|

Research and development expense

|

11,367

|

7,933

|

43.3

|

%

|

3,434

|

|||||||||||

|

General and administrative expense

|

5,091

|

3,627

|

40.4

|

%

|

1,464

|

|||||||||||

|

Total operating expenses

|

$

|

24,122

|

$

|

17,349

|

39.0

|

%

|

$

|

6,773

|

||||||||

| • |

compensation of personnel associated with pre- and after-sale services and support and other sales and marketing activities, including stock-based compensation;

|

| • |

sales commissions paid to independent sales representatives;

|

| • |

fees paid to sales consultants;

|

| • |

cost of trade shows;

|

| • |

costs of tools built for promotional purposes for current or potential new customers;

|

| • |

travel and entertainment; and

|

| • |

allocated overhead for rent and utilities.

|

| • |

compensation of personnel associated with our research and development activities, including stock based compensation;

|

| • |

costs of components and other research and development supplies;

|

| • |

costs of tools built for product development purposes;

|

| • |

travel expense associated with the research of technical requirements for product development purposes and testing of concepts under consideration;

|

| • |

amortization of costs of software used for research and development purposes; and

|

| • |

allocated overhead for rent and utilities.

|

| • |

compensation of executive, accounting and finance, human resources, information technology, and other administrative personnel, including stock-based compensation;

|

| • |

professional fees, including accounting and corporate legal and defense fees;

|

| • |

other corporate expenses including insurance; and

|

| • |

allocated overhead for rent and utilities.

|

|

|

Three Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

% Change

2022 v 2021 |

Absolute Change

2022 v 2021

|

||||||||||||

|

|

(in thousands)

|

|||||||||||||||

|

Income from operations

|

$

|

20,035

|

$

|

4,331

|

362.6

|

%

|

$

|

15,704

|

||||||||

|

|

Three Months Ended June 30,

|

|||||||||||||||

|

|

2022

|

2021

|

% Change

2022 v 2021 |

Absolute Change

2022 v 2021

|

||||||||||||

|

|

(in thousands)

|

|||||||||||||||

|

Interest Income