UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the Fiscal year ended

OR

For the transition period from _________ to __________

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b)

of the Act:

Securities registered pursuant to Section 12(g) of the Act: None.

Title of class

Not Applicable

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes ☒

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by checkmark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

There was

As of August 15, 2024,

there were

NYIAX, INC.

TABLE OF CONTENTS

i

PART I

Forward-Looking Information

This Annual Report of NYIAX, Inc. on Form 10-K contains forward-looking statements, particularly those identified with the words, “anticipates,” “believes,” “expects,” “plans,” “intends,” “objectives,” and similar expressions. These statements reflect management’s best judgment based on factors known at the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” generally, and specifically therein under the captions “Going Concern, Liquidity and Capital Resources” as well as elsewhere in this Annual Report on Form 10-K. Actual events or results may differ materially from those discussed herein. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

Except as otherwise indicated herein or as the context otherwise requires, references in this Annual Report on Form 10-K to “NYIAX,” the “Company,” “we,” “us” and “our” refer to NYIAX, Inc.

1

ITEM 1. BUSINESS

Our Company

NYIAX is a financial platform technology company founded in 2012 by Carolina Abenante, Mark Grinbaum and Graham Mosley, who formulated the genesis of NYIAX’s business model to bring forth a new era of financial platform technology and financial rigor to the advertising industry. NYIAX’s platform utilizes the Nasdaq financial framework (“NFF”). NYIAX utilizes Smart Contracts and blockchain technology as its core ledger, which enables contract formation, compliance and reconciliation. NYIAX’s utilization of financial technology brings automation of many manual and outdated processes to the advertising industry. Our mission is to connect buyers and sellers, enabling trusted, secure, and efficient transactions.

NYIAX’s business model is focused on the creation of a marketplace where advertising inventory, campaigns and audience can easily be listed and sold through utilization of highly efficient financial buying and selling technology. A media buyer (“Media Buyer”) is typically an advertiser, advertising agency or intermediary that buys on behalf of an advertiser. A media seller (“Media Seller”) is typically a publisher of content, such as websites, magazines, billboards, network TV, mobile or desktop applications or other content, or a Supply or Sell Side Platform1 (SSP, which refers to a technology platform enabling web publishers and digital out-of-home media owners to manage their advertising inventory, fill it with ads, and receive revenue). NYIAX has developed a technology platform which provides Media Buyers and Media Sellers a marketplace where advertising or audience campaigns are listed, bought and sold.

Our Strengths

We believe the strengths stated below provide us with an advantage in the industry we operate in.

End to End Platform. Our platform enables clients to save time and money on (i) outdated and manual processes; (ii) discovery and negotiation of deals; and (iii) reconciliation and billing, providing financially rigorous transparency and automation to the contracting process across the media eco systems.

Technology Innovation. Our use of Nasdaq technology, our patented adaptation of financial buying and selling systems, and our use of other innovative technologies, such as distributed ledgers and Smart Contracts enables us to interoperate with both the advertising marketplace and the new technologies as they evolve, thereby providing both NYIAX and its customers increased efficiency in automation as digital transformation accelerates.

2

Two-Sided Market. NYIAX’s unique approach of having a two-sided marketplace enables publishers and agencies to describe, negotiate, and form the contract for the inventory while enabling and maintaining contract, descriptors and attributes standards. Our approach directly improves upon the current advertising industry Private Marketplaces and Automated Guaranteed (AG) platforms. The current advertising industry models are auctions based on first or second price for the inventory, while NYIAX enables dynamic pricing which allows buyers and seller to combine both human intelligence and artificial auction models, thereby providing a market for both buyer and sellers to transact according to their business requirements.

Agnostic and Complimentary Nature. Our Platform is agnostic and complimentary to the current technology partners our clients prefer for delivery, tracking and media types, thereby enabling us to offer service and value to our customers across the ecosystem. For example, we originally developed our platform to work with Ad Contract delivery occurring through the primary publisher and agency ad serving technology, whereas today we also support delivery of media via both direct and indirect delivery platforms via our relationships with Supply or Sell Side Platforms (SSPs, which refer to technology platforms enabling web publishers and digital out-of-home media owners to manage their advertising inventory, fill it with ads, and receive revenue).

NYIAX plans to follow the new industry standards around third- party cookies and data and intends to support the emerging solutions for campaigns and transaction on the NYIAX platform.

Our Growth and Scale Strategy

NYIAX focuses on the below areas to enable growth and scale of the NYIAX platform for its clients and partners.

| ● | Publisher Supply listing and availability via direct and indirect channels, balanced with agency and advertiser demand needs. |

| ● | Continued expansion and maintenance of the Omni channel demand and supply as distribution evolves to new media types. |

| ● | As demand from the buy side of the market dictates, we will continue to expand internationally. We have initially focused on the United States, however, interest from global markets will enable both growth and scale over time. |

| ● | Automation with technology is core to the growth and scale of the business. Reducing costs for us and our clients, which enables increased productivity and efficiency. |

3

New Market Opportunities

We are of the belief that NYIAX’s platform may be extendable to other markets, and have received unsolicited interest based on business development efforts with corporations that have inquired about using our platform for other markets. This interest is based on the jointly owned patent with Nasdaq that allows for the technology’s use in other markets.

Management will continue to review opportunities to extend our platform to other markets. As of the date of this Registration Statement, we have no understandings or agreements to develop technology, or partner with any other persons or entities. We currently have no concrete plans to extend our technology to other markets.

NYIAX will continue to extend its products and services to support our growth. Advertising delivery/verification and integrations increase the efficiency and cost-effectiveness for both NYIAX and our customers. Improvements to this infrastructure, APIs20 enable us to interoperate automatically with partners.

Our Platform

NYIAX provides a solution to the advertising marketplace challenges through the creation of a trusted, transparent, efficient, and auditable marketplace and platform where Media Buyers and Media Sellers can discover, negotiate, contract formation, reconcile and bill all in one platform and with use of a dashboard, while ensuring compliance with advertising contracts. We are of the belief that NYIAX is the first to bring this level of automation, efficiency, financial rigor, and auditability to the advertising industry.

NYIAX platform captures the material terms of a buyer’s and seller’s contract/campaigns to the corresponding inventory, such as, counterparties to the contract, delivery dates of the campaigns, campaign metrics, pricing, media inventory (sites, channels or applications), inventory attributes (advertising specific attributes like content type, ad type, language, ad sizes, content categories, etc.), and standardize contract terms (count of record for delivery tracking and payment terms).

Further, the NYIAX platform capture campaign, planning, inventory discovery negotiations between buyer and seller contract creation, delivery of the campaign, reconciliations of campaign metrics, and payment distribution to seller by the buyer. NYIAX utilizes blockchain (Hyperledger) to record the contract creation and smart contracts to enable the reconciliation of the campaign and payment.

Moreover, the NYIAX platform facilitates the contract/campaign through both standardization within the NYIAX taxonomy and bespoke taxonomy which over time may become part of the NYIAX taxonomy. NYIAX taxonomy is based on industry standards and new customized attributes which are standard to our clients. However, volume, price and value of the contract are negotiated and accepted between and among buyers and sellers in order to create the contract.

NYIAX provides a contract marketplace that is expected to allow Media Sellers and Media Buyers to transact purchases and sales of digital advertising inventory with an elevated level of transparency for pricing and inventory details. NYIAX will provide a comprehensive platform for clients, and support integrations with existing client vendors for seamless onboarding. All buying and selling activity is intended to be recorded in the ledger on the Blockchain.

Our platform is a key component connecting the Media sellers, Media buyers and intermediaries within the advertising supply chain.

4

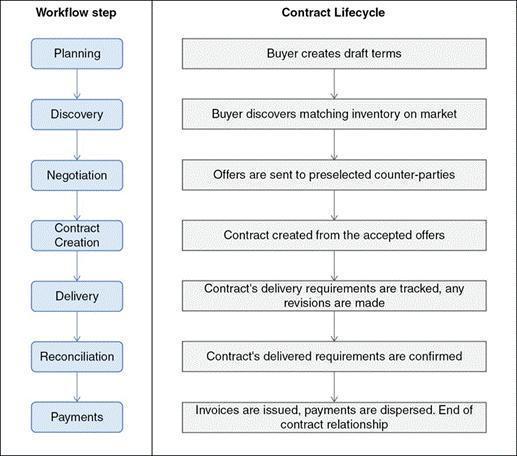

The below diagram illustrates the lifecycle of an advertising contract through the NYIAX platform.

Customer Setup: supports the onboarding of clients into the platform.

| ● | Discovery: enables both buy and sell sides to view/sort the market. |

| ● | Negotiation: negotiates contract terms, price, volume, inventory, and campaign attributes. |

| ● | Contract Formation: contract is formed from the match of a buy and a sell order. |

| ● | Delivery: consists of a few steps: Pre-delivery, is a lock-down period prior to delivery where an instrument can no longer be bought, sold or amended as to material terms and the campaign is properly configured with both parties. Delivery is when the ad is delivered and both parties can view the impression reporting and pacing. |

| ● | Reconciliation: after the close of the delivery period, any delivery issues are reconciled, and final billing is processed, happening near simultaneously with delivery. |

| ● | Billing: enables multiple billing workflows based on contract terms and counterparties. |

| ● | Compliance: end to end audits of key elements of the process to ensure compliance. |

How Participants Use the NYIAX Platform

Buy-Side

Media Buyers can view the current market via filters. Initially, the most common method will be for a Media Buyer to use different filters to see what instruments are available at various prices. However, a Media Seller could give the buyer a particular symbol, which is visible in the standard public market, or only available in a limited private market with a discounted price, mirroring the Private Marketplace Deal ID1 mechanism currently used in the current Real Time Bidding environment. In addition to the general instrument attributes, advertisers can specify their potential Media Buyers, which will then be matched against any existing restrictions, referred to as blocklists (which allow ads to be prevented from running on specific websites and apps), set by the Media Seller.

| 1 | marketingland.com/navigating-modern-ad-serving-stack-part-3-private-marketplaces-deal-id-128234, “Deal ID” is a component of the Real Time Bidding technology standard (Open Real Time Bidding). It allows publishers to take their inventory off the open auction and place it in an invitation-only area. |

5

Sell-Side

NYIAX helps Media Sellers create Ad Instruments (listings) on the exchange, based on current forecasting and sales packages. If Media Sellers are already offering Automated or Programmatic Guaranteed packages, we can utilize those either directly in NYIAX’s platform or through integration with their existing vendor. For the initial launch period with any new seller, we will provide these services to Media Sellers on a fully managed basis through our upload tools. In the longterm, we expect the Media Sellers to be able to create their own instruments or push from an existing Automated Guaranteed system as self-service.

The NYIAX Platform enables the Media Buyers and Sellers the ability to transact similar to other types of markets, which can require payment on the sale or on any aspect of payment settled between Media Buyer and Seller within the order book and is a significant change compared to the advertising industry’s current payment terms.

Further, our contract (direct2, RFP3 and RFQ4) market is focused on the underserved and highly manual direct transactions that continue to exist in the high value portion of the advertising market. These are conducted via known counterparties and consist of upfront buys typically conducted in advance and in bulk toward the beginning of the year and ongoing individual buys purchasing inventory for a specific quarter or month.

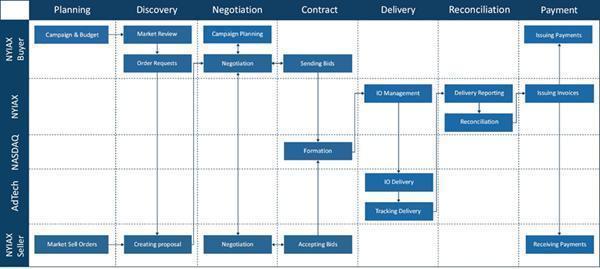

Below is a snapshot of the Platform Workflow:

| 2 | Direct marketing consists of any marketing that relies on direct communication or distribution to individual consumers, rather than through a third party such as mass media. Mail, email, social media, and texting campaigns are among the delivery systems used. It is called direct marketing because it generally eliminates the middleman, such as advertising media. |

| 3 | A request for proposal (RFP) is a business document that announces a project, describes it, and solicits bids from qualified contractors to complete it. Most organizations prefer to launch their projects using RFPs, and many governments always use them. |

| 4 | A request for quote (RFQ), also known as an invitation for bid (IFB), is a process in which a company solicits select suppliers and contractors to submit price quotes and bids for the chance to fulfill certain tasks or projects. The RFQ process is especially important to businesses that need a consistent supply of a specific number of standard products. Companies may send RFQs alone or before a request for proposal (RFP). |

6

Our Technology

The key differentiators of the NYIAX technology include the following.

| ● | Promotes transparency in the supply chain with interoperability between multiple blockchain implementations. |

| ● | Standardizes contract types including key variable contract terms, creating increased liquidity and compliance for market participants. |

| ● | Enables rapid development and deployment of capital markets rigor through cloud and container-based architecture.25 |

| ● | Reduces reconciliation and manual task costs for buyers and sellers, with automation of contract workflow. |

| ● | Enables contract and data compliance capabilities for the full contracting lifecycle with standard financial exchange grade technology via Nasdaq licensed technology. |

NYIAX Blockchain Implementation

By using Blockchain as its ledger, NYIAX can provide permitted transparency to its clients, with accurate historical data set utilized for auditing, compliance, and financial transparency.

We use Hyperledger Fabric, an open-source project from the Linux Foundation. Hyperledger Fabric is considered an enterprise blockchain platform, which means a governance layer allows for advanced privacy controls so that only the data we designate is permitted for participants to view, share, and transact.

All transactions are private between the designated participants, defined in the protocol within the governance layer of the Blockchain.

Further, Hyperledger Fabric supports on chain and business logic based smart contracts. We designate and determine automated NYIAX business processes enabling self-executing terms between the participants written into lines of code. Our implementation is not distributed or decentralized. However, the contracts written into the ledger are trackable and irreversible, enabling trust, transparency, and audibility between participants.

An enterprise blockchain saves time, reduces costs, and reduces risk through transparency and accountability. We do not see the need to integrate with a public blockchain at this time since we believe that a governance layer is required in business-to-business transactions.

The image below depicts the structure of how the NYIAX/Nasdaq platform connects clients and partners in the advertising ecosystem.

ITCH supports market data and is a direct data-feed protocol such as TCP (Transmission Control Protocol) or UDP (User Datagram Protocol). ITCH26 makes it possible for subscribers to track the status of each order from the time it is first entered until the time it is either executed or canceled.

Financial Information eXchange (FIX) protocol is an electronic communications protocol initiated in 1992 for international real-time exchange of information related to securities transactions and markets.

7

Our Clients

NYIAX has signed participants on the NYIAX platform through a master service agreement which describes the terms and the conditions of both Media Buyers (advertisers, advertising agencies and others buying advertising placement and audience on the NYIAX platform) and Media Sellers (publishers who own advertising inventory). Material terms of the NYIAX agreements are as follows:

| ● | Statement and Scope of work which is a description of NYIAX as a contract management platform. Buyer (agency, advertiser or proxy for the advertiser) shall communicate all proposed Campaign details and Terms and Conditions to NYIAX. These details will be provided to Seller (publisher, proxy for the publisher (SSP Advertising Network or other proxy)). Upon acceptance from Seller and confirmation of acceptance from Buyer, NYIAX shall supply an Advertising Contract (“Advertising Contract” means the agreement setting forth the actual purchase or sale of publisher inventory, the serving of advertising inventory, the processing of data related to advertising inventory for analysis, or an insertion order for the Campaign, to which the Services apply), which will, contain all governing Campaign terms and details. NYIAX represents that it has an agreement in place with the Buyer whereunder NYIAX provides Services to the Seller as contemplated thereunder. NYIAX is a contract management platform. NYIAX provides a full contract management suite of services for Advertising Contract compliance, reconciliation, oversight, invoicing and distribution for Buyer, Seller and if required 3rd party technology providers involved in advertising. Utilization of NYIAX services also known as the NYIAX platform is the Seller’s operational frontend and backend for the Campaign (Advertising Contract). |

| ● | NYIAX shall provide the specific Services set forth in the Advertising Contract solely for the Campaign on behalf of the Buyer for the particular Campaign. NYIAX shall provide contract management, reconciliation, reporting accounting services, invoicing and distribution of funds throughout the lifecycle of the Campaign (Advertising Contract). For this service NYIAX shall be entitled to a (fee percentage is negotiated) fee (“NYIAX Fee”), which will be deducted by NYIAX from the fees due to Seller pursuant to the Advertising Contract, after such fees have been reconciled, accepted, invoiced, and paid by the Buyer to NYIAX (“Company Fees”), where reconciled or reconciliation means the final impression volume and number used to generate invoicing and billing to the Buyer in accordance with the set Advertising Contract. The Seller shall be paid by NYIAX net (time period negotiated) calendar days (“Remittance Time Period”) after receipt of invoice and payment of the Campaign from the Buyer, less the NYIAX Fee. NYIAX is the facilitator for the Advertising Contract and adheres to sequential liability, which means only upon receipt of payment of the Campaign by the Buyer post reconciliation and agreement by the Advertiser or Agency shall NYIAX remit payment to the Company. |

| ● | NYIAX provides reconciliation and reporting statements to both the Buyer and the Seller. NYIAX shall supply the Seller with daily reporting from the Advertising Contract term Count (s) of Record where, “Count(s) of Record” is defined as the agreed upon sources, selected at the time Advertising Contract formation, which represents the baseline count of delivered ads by terms and conditions of the Campaign or Advertising Contract. This is a non-exhaustive list and can be amended by mutual agreement of the Agency and Company from time to time. Count(s) of Record may include the following: (various reporting certification providers which are negotiated) and any other Count (s) of Record the Buyer so chooses. In the event the Count of Record is from the Seller, then Seller shall supply daily reporting to NYIAX. NYIAX shall provide a monthly reconciliation report, with details reduced by day, in alignment with the delivery reporting associated with the Advertising Contract. At a minimum, NYIAX shall provide Seller with all necessary metrics in its reporting so that Seller is able to properly determine if any disputes in reporting are present. If Company disputes details of the monthly reconciliation report, notice must be provided in writing within (negotiated timeframe) business days of receipt of the monthly reconciliation report. NYIAX will work with the Seller in good faith for a period of not less than (negotiated timeframe) calendar days to reconcile any disputes Seller has with the reconciliation reports on a timely basis. NYIAX acknowledges and agrees that Seller may use and disclose Services, inclusive of reports and information provided therein, in the ordinary course of its business and may disclose such reports and information to its client. |

| ● | Term of the agreement is based on campaign specific timeframe, multiple campaigns timeframe or ongoing relations where termination by either party can be effectuated with written notice (negotiated timeframe). Immediate termination on material breach by either party. |

8

NYIAX has signed agreements with various public and private companies and has commenced full commercial use of the NYIAX platform as of 2021. On September 29, 2021, NYIAX and PubMatic entered into a Managed Services Term Sheet (“PubMatic Agreement”). Under the PubMatic Agreement, the initial term commenced from September 1, 2021 and continues indefinitely until either party terminates the agreement with thirty (30) days written notice.

On August 16, 2021, NYIAX and OpenX entered into an Ad Exchange Access Partner Agreement (“OpenX Agreement”). The term of the OpenX Agreement commenced on August 16, 2021 and continues for twenty-four (24) months thereafter. Pursuant to the OpenX Agreement, either party may terminate the agreement (i) for convenience upon sixty (60) business days’ prior written notice to the other party, (ii) for material breach of the agreement and the failure to cure such breach by the breaching party within thirty (30) days after receiving written notice of the material breach from the non-breaching party, and (iii) upon insolvency (as defined under the OpenX Agreement).

On October 14, 2021, NYIAX and Univision entered into a Managed Services Agreement (“Univision Agreement”). The term of the Univision Agreement commenced on November 1, 2021 and continues until completion of the services (as defined under the Univision Agreement). Pursuant to the Univision Agreement, either party may terminate the agreement for material breach of the agreement and the failure of the breaching party to cure such breach within thirty (30) calendar days after receiving written notice of the material breach from the non-breaching party.

During the year ended December 31, 2021, NYIAX has performed services for 25 Media Buyers and 23 Media Sellers. At December 31, 2021, the Company was performing services for 16 Media Buyers and 18 Media Sellers. As of December 31, 2021, three Media Sellers, namely PubMatic, OpenX and Univision represented approximately 30% 26%, and 11% of net revenue.

As of December 31, 2022, three Media Sellers represented approximately 51%, 12% and 10% respectively of revenue, net. As of December 31, 2022, two Media Buyers represented 67% and 20% of accounts receivable. As of December 31, 2022, two Media Sellers represented 61% and 8% of accounts payable.

NYIAX has continued to strengthen the sell side of its marketplace by adding premium publishers and supply partners, extending NYIAX’s supply footprint into digital out-of-home (DOOH) and in-game advertising, marking significant progress towards NYIAX becoming an omnichannel marketplace.

Market Dynamics

The advertising industry has grown significantly in the past twenty years. According to Statista(a frequently quoted research company which claims to source information of over 1,000,000 statistics on over 80,000 topics from more than 22,500 sources in over 150 countries), the total global advertising spend for 2023 was over 918.18 billion US dollars and for 2024 it is estimated to reach 989.8 billion US dollars a 7.8% growth over the prior year. Additionally, eMarketer (a frequently quoted research company which claims to source information from 3,000 sources), published in October of 2023 that digital advertising spend worldwide was estimated to increase by 10.7% for 2023 as a percentage of total advertising spend and in March of 2024 revised their estimate to a 12% increase as a total of advertising spend and has estimated a continued increase in global digital spend to 12.2% for 2024 as a total of advertising spend. US Internet advertising revenues reached a record-high of $225 billion, increasing by 7.3% year-over-year overall between 2022 and 2023, according “IAB Internet Advertising Revenue Report: Full Year 2023”, which was released on April 16, 2024 by IAB/PwC. The report found that Q4 of 2024 growth rate of 12.3% from the year prior (4.4%), with revenues rising to $64.5 billion where the US continues to be largest market for digital advertising lead by Retail Media revenues 16% y/y growth in advertising revenues, reaching $43.7 billion in 2023, Video advertising revenue (10.6%) y/y growth, $52.1 billion in 2023, and Audio advertising growth of 18.9% to reach $7 billion.

Our Competition

As a new modality in advertising, we compete against existing forms of buying and selling media. It is essential to note that we also complement current industry technologies and partner with them, many of which have existed in the marketplace for years and have more readily access to technology, more relationships, and significantly greater financial and human resources than us.

Competition in our market involves rapidly changing technologies, in order to promote compliance and transparency as evolving automation tools to streamline media supply and demand monetization. If we are unable to keep pace with the evolving needs of the industry, demand for our products and services may be reduced and our business and results of operations would be harmed.

9

Intellectual Property

The protection of our technology and intellectual property is an important component of our success. We protect our intellectual property rights by relying on federal and state statutory and common law rights, foreign laws where applicable, and contractual restrictions. We seek to control access to our proprietary technology by entering into non-disclosure agreements with third parties and disclosure and invention assignment agreements with our employees and contractors.

We consider our patents, copyrights, trade secrets, and other intellectual property rights to be, in the aggregate, material to our business. We currently co-owned one issued U.S. patent, expiring in 2037, relating to electronic continuous buying and selling systems, and matching data records representing inventories with variant characteristics such as, variant length, variant data types, etc. Example implementations provide for generating instrument descriptors that include unitary-valued attributes and set-valued attributes, and the use of both types of attributes in buying and selling decision making. We also own trademark registrations and applications for the “NYIAX” name and other product-related marks in the United States. We are in the process of registering other NYIAX name variants and product-related marks in the United States. We have also registered numerous Internet domain names related to our business.

In addition to our intellectual property rights, we also consider the skills and ingenuity of our employees and the functionality and frequent enhancements to our solutions to be contributors to our success in the marketplace. We believe our platform would be difficult, time consuming, and costly to replicate. We protect our competitive technology position through our ability to execute and deliver new functionality quickly, as well as our continuous development of new intellectual property as we innovate.

We intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost effective. Despite our efforts to protect our intellectual property rights, it may not be respected in the future or may be invalidated, circumvented, or challenged. In addition, the laws of various foreign countries may not protect our intellectual property rights to the same extent as laws in the United States.

On June 25, 2017, Nasdaq, Inc. and NYIAX signed a Joint Intellectual Property Ownership Agreement setting forth property rights related to a filed co-owned patent which is titled: “SYSTEMS AND METHODS FOR ELECTRONIC CONTINUOUS TRADING OF VARIANT INVENTORIES.” The first patent and second patent were granted by the USPTO on March 31, 2020 and August 9, 2022, respectively, to Nasdaq Technology AB and NYIAX, Inc. as co-applicants, Patent No. US 10,607,291 B2 and Patent No. US 11,410,236 B2. These patents disclose an invention that enables and extends discovery and automated matching of contracts with complex attributes, requirements and order types.

Recently about fifty percent (50%) of all equity trading took place off exchange. (The Value of Off-Exchange Data Thomas Ernst, Jonathan Sokobin and Chester Spatt, April 26, 2021). The joint patent between Nasdaq and NYIAX could extend to new market sectors where the technology may enable efficient buy and sell matching through price discovery of complex contracts, thereby enabling efficient and effective regulatory compliance, audit and clearing. Price discovery, transparent and orderly buying and selling within markets enable liquidity, market making, capital investment, compliance and auditability6. We currently have no concrete plans to extend our platform to other industries other than advertising. If we were to utilize our technology for other industries and with complex contract typologies, then we would require a legal and regulatory review.

The illustration below describes how NYIAX creates a durable instrument with media as an example.

| 6 | Randall Dodd, Markets: Exchange or Over-the-Counter, February 24, 2020. |

10

Privacy and Data

We are subject to laws and regulations governing privacy and the transmission, collection, and use of consumer data. Interest-based advertising, or the use of data to draw inferences about a consumer’s interests and deliver relevant advertising to that consumer, has come under increasing scrutiny by legislative, regulatory, and self-regulatory bodies, privacy advocates, academics, and commercial interests in the United States and abroad that focus on data protection and consumer privacy. In particular, much of this scrutiny has focused on the use of cookies and other tracking technologies that collect or aggregate information about consumers’ online browsing and mobile app usage activity. Because both our company and our publishers rely upon large volumes of such data collected primarily through cookies and other tracking technologies, it is essential that we monitor legal requirements and other developments in this area, domestically and globally, maintain a robust privacy and security compliance program, and engage in responsible privacy practices, including providing consumers with notice of the types of data we collect, how we collect it, with whom we share it, how we use that data to provide our solutions, and the applicable choices we offer consumers.

We provide notice through our privacy policies and notices, which can be found on the new website at www.NYIAX.com. As stated in our privacy policy, we do not collect information, such as names, addresses or telephone phone numbers, for providing our advertising services that can be used directly to reveal the identity of the underlying individual. We take steps not to collect and store such information (although on occasion, our publishers voluntarily share information of their consumers with us and in such circumstances, we require the publishers to have obtained all necessary consents for such sharing). Our advertising and reporting rely on information that does not (and we do not attempt to associate this information with other information that can identify such individuals). We currently do not collect and we do not store IP addresses, geo-location information, and device identifiers that are considered personal data or personal information under the privacy laws of some jurisdictions or otherwise may be the subject of current or future data privacy legislation or regulation. The definition of personally identifiable information, personal information, or personal data, varies by jurisdiction and continues to evolve in ways that may require us to adapt our practices to avoid violating laws or regulations related to the collection, storage, and use of consumer data. As a result, our technology platform and business practices must be assessed regularly against a continuously evolving legal and regulatory landscape, and we have adopted strong data minimization practices that mitigate our compliance risks.

Additionally, our compliance with our privacy policy and our general consumer data privacy and security practices are subject to review by the Federal Trade Commission, which may bring enforcement actions to challenge allegedly unfair and deceptive trade practices, including the violation of privacy policies and representations or material omissions therein.

We currently do not work with publishers outside of the United States. In the future is we work with publishers outside of the United States and take in consumer data then our privacy and data practices are subject to regulation by data protection authorities and other regulators in the countries in which we do business. The use and transfer of personal data in member states of the European Union is currently governed under the General Data Protection Regulation (“GDPR”), which grants additional rights to consumers about their data, such as deletion and portability, and generally prohibits the transfer of personal data of EU subjects outside of the EU, unless the party exporting the data from the EU implements a compliance mechanism designed to ensure that the receiving party will adequately protect such data.

Other jurisdictions have enacted legislation that closely tracks the concepts, obligations, and consumer rights described in the GDPR, including Brazil’s General Data Protection law and Thailand’s Personal Data Protection Act. Some jurisdictions, including Russia and China, have in recent years enacted data localization laws, which require any personal information of citizens of those jurisdictions to be stored and processed on servers located in those jurisdictions. Such laws are gaining momentum and are being enforced by local authorities.

11

Potential Futures Industry Governmental Regulation

Interest-based advertising, or the use of data to draw inferences about a user’s interests and deliver relevant advertising to that user, has come under increasing scrutiny by legislative, regulatory, and self-regulatory bodies in the United States and abroad that focus on consumer protection or data privacy. There may be some self-regulatory activities with regard to rules enforcement and market surveillance required by us in order to maintain an orderly market and forestall any external regulation needs. In terms of competition, if regulation were to occur, NYIAX is of the opinion that the Nasdaq X-stream29 platform’s built-in regulatory and basic surveillance requirements could be adapted to provide support that exceed potential NYIAX needs in a foreseeable future. There are a patchwork or state legislation which have come to fruition, but also there is proposed pre-emptive legislation namely H.R. 1816 which introduced a hybrid of the GDPR and the California Consumer Privacy Act of 2018 (CCPA). H.R. 1816 is less restrictive to the advertising industry and pre-emptive to state legislation which would allow for use of “non-sensitive” data which is data which does not directly identify the individual. H.R. 1816 specifically states that “non-sensitive” data is anything not “sensitive personal information” which is defined in the bill as financial account numbers and authentication credentials, such as usernames and passwords; health information; genetic data; any information pertaining to children under 13; social Security numbers and any “unique government-issued identifiers”; precise geolocation information; the content of oral or electronic communications, such as email or direct messaging; personal call detail records; biometric data; sexual orientation, gender identity or intersex status; citizenship or immigration status; mental or physical health diagnoses, religious beliefs; and web browsing history and application usage history30.

We do not expect that our current business model involving the sale and purchase of advertising audience and inventory by Media Buyers and Media Sellers of such advertising triggers regulation and supervision by the United States Commodity Futures Trading Commission (“CFTC”) under the Commodity Exchange Act.

Furthermore, we do not expect that our facilitating the sale of advertising on the Nasdaq X-stream marketplace platform will be subject to SEC regulation and compliance requirements with respect to such activity.

If in the future the services and products offered by NYIAX are expanded to include products and or services that could trigger regulatory oversight by a market regulator (e.g. CFTC and/or SEC), NYIAX will engage with the appropriate regulator in a timely manner to ensure full compliance with the applicable statutes and regulations.

Human Capital

As of August 15, 2024 we have 6 full-time employees and 8 contractors.

Through TriNet, our PEO, or professional employer organization, NYIAX offers a full range of benefits to our employees and employees are required to adhere to our ethics policies and are continually evaluated against goals and objectives by our chief executive officer.

Available Information

We maintain an internet website at www.nyiax.com. We do not intend the address of our website to be an active link or to otherwise incorporate the contents of our website into this Annual Report. You may also find all of the reports that we have filed electronically with the SEC at their internet site www.sec.gov.

12

NYIAX Platform and Nasdaq Technology

The NYIAX platform was developed in collaboration with Nasdaq in order to bring financial rigor and oversight to the advertising and media ecosystem. NYIAX and Nasdaq have entered into a co-patent agreement for the adaptation of novel financial technology to industries with complex attributes and requirements; such as, advertising and media in order to enhance speed and scale through standardized instruments, which enable discovery, contract creation, and reconciliation with compliance and auditability.

In July 2017, Nasdaq and NYIAX signed a Joint Intellectual Property Ownership Agreement (the “Joint IP Agreement”) setting forth property rights related to a filed co-owned patent which is titled: “SYSTEMS AND METHODS FOR ELECTRONIC CONTINUOUS TRADING OF VARIANT INVENTORIES.” The methodology set forth in the proposed patent allows for the buying and selling of a variety of highly heterogeneous inventories; such as, but not limited to, advertising, insurance, container shipment, SWAPs101, “Designer” Bespoke Tranche, petroleum and industrial Chemicals, agricultural seeds, FLEX Options103, unstructured (presently) debt, real estate, wine and spirits by creation of encoded unique and durable inventory descriptors (defined as “tokens”) from a superset of marketplace defined inventory characteristics (defined as “attributes”). Buyers and sellers can then state their firm buying and selling intentions for such variant inventory instances, setting stage for their continuous electronic matching and contract formation. Pursuant to the Joint IP Agreement, all right, title, and interest to the US Patent Family Members (as defined in the Joint IP Agreement) shall belong jointly to both NYIAX and Nasdaq Inc., including all rights appurtenant such as the right to sue for damages and other remedies available for past infringement. NYIAX does not own foreign rights to the patent. Furthermore, NYIAX may not assign the patent even under a change of control or merger without written consent of Nasdaq, Inc.. In addition, NYIAX shall be permitted to grant non-exclusive licenses under the US Patent Family Members, only to (a) to bona fide clients of NYIAX, and only to the extent necessary to permit such clients to use the services provided by NYIAX in NYIAX’s ordinary course of business, and (b) to bona fide vendors (e.g., cloud providers, consultants, and other vendors) of NYIAX, and only to the extent such licenses are necessary to permit such vendors to assist NYIAX in providing services in NYIAX’s ordinary course of business.

NYIAX’s current business model has utilized this technology to provide a marketplace for Media Buyers and Media Sellers to enter into contracts for the purchase and sale of advertising inventory and audience. Thereby, applying NYIAX’s technology in order to create a transparent and efficient marketplace where participants can discover, execute contract terms and reconcile all aspects of the contract during its lifespan.

NYIAX and Nasdaq have entered into several agreements to build the NYIAX platform. On December 21, 2015, NYIAX and Nasdaq entered into a Design Study Agreement, pursuant to which the design study for adapting and creating of the functional specification to build the NYIAX marketplace and platform was completed. Further, on May 2016, NYIAX entered into a services agreement (the “IT Services Agreement”) with Nasdaq for building and completion of the specification of the design study from December 20, 2015, which included exclusivity and bound Nasdaq to work only with NYIAX until October 2021 in the scope of advertising platforms. On December 30, 2020, NYIAX and Nasdaq entered into an amendment to the IT Services Agreement to extend the term of the agreement for an additional 10 years until April 5, 2032. Nasdaq provides cloud-based marketplace technology to NYIAX, and NYIAX’s adapted utilization of Nasdaq’s technology is a backend infrastructure component of that processes.

Pursuant to the IT Services Agreement, as amended, commencing April 2022, NYIAX is obligated to compensate NASDAQ an annual license fee of $350,000 and revenue sharing of 0.5% to 10% of revenue depending upon various criteria. No expenses were incurred related to the annual license fee and revenue sharing agreements for the years ended December 31 2021 and 2020. No payments were made in 2019, 2020 and 2021 related to the annual license fee and revenue sharing agreements. The Company recognizes expenses related to the NASDAQ annual licensing fee in the period for the which the services related to the annual license are utilized and recognizes expenses related to the NASDAQ revenue sharing in the period that the Company recognizes revenue related to the NASDAQ agreements.

Moreover, on December 8, 2017, NYIAX and Nasdaq jointly filed a patent application for a US patent (Applicants: Nasdaq Technology AB and NYIAX, Inc.), which represents NYIAX and Nasdaq’s combined effort and innovation to extend financial buying and selling platforms in order to bring any type of asset class on exchange. The application was subsequently published on June 13, 2019 and a patent was issued on March 31, 2020 (Patent No. 10,607,291). This joint ownership of innovation and enhancements to the buying and selling platforms extends NYIAX and Nasdaq’s technology cooperation not just for advertising and media, but also for future consideration of other complex contract types which can be bought and sold on a buying and selling platforms. The inventors of the patent are Richard Payne, Valery Gridnev from Nasdaq Technology AB and Mark Grinbaum, Carolina Abenante and Sergey Tsoy from NYIAX. We currently have no concrete plans to extend our platform to other industries other than advertising.

On July 8, 2023, the Company completed the purchase of a portfolio of patents and trade secrets (the “Portfolio”) from Network Foundation Technologies, LLC (“NIFTY”). The Company issued 2,000,000 shares of its common stock to NIFTY as consideration for the Portfolio. The 2,000,000 shares of common stock of NYIAX have various registration restrictions and provisions for the clawback of shares by the Company in certain events as set forth in the Asset Purchase Agreement. In 2007, a NYIAX director, Thomas F. O’Neill., and a NYIAX officer, Mark Grinbaum, Co-Founder and Executive Vice President of Financial Products, purchased approximately 0.17% (acquired for $50,000) and 0.35% (acquired for $100,00) of NIFTY, respectively and owned these amounts as of July 8, 2023. Neither Mr. O’Neill nor Mr. Grinbaum were a director or officer of NIFTY.

The Portfolio consists of a portfolio of eighteen (18) patents and trade secrets, of which six of the patents are active. The Company will amortize the active patents over their useful lives.

The Company will use the Portfolio to enhance its offerings for the buying and selling of media, advertising audience, and advertising inventory. Additionally, the Company will use the Portfolio acquired from NIFTY to create new revenue streams in markets such as: (i) market data, (ii) streaming media (advertising, livestreaming and video-on-demand), and (iii) the webinar market. NYIAX engaged an intellectual property valuation company to assess the potential opportunities of the patents and trade secrets prior to our acquisition of the patents and trade secrets.

13

ITEM 1A. RISK FACTORS

The risks and uncertainties described below could materially and adversely affect our business, financial condition and results of operations and could cause actual results to differ materially from our expectations and projections. You should read these Risk Factors in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and our Financial Statements and related notes in Item 8. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial.

Risks Related to Our Business

There can be no guarantee that the Company will be successful in securing capital.

The Company requires additional capital. The Company believes it does not have sufficient cash to meet working capital and capital requirements for at least twelve months from the issuance of these financial statements.

Historically, the Company’s liquidity needs have been met by the sale of common shares, the issuance of common shares through the exercise of warrants, and issuance of convertible note payable. Without a new loan or other equity support, the Company would not be able to support the current operating plans through twelve months from the issuance of these financial statements. No assurance can be given at this time, however, as to whether we will be able to raise new equity or loan support.

For the years ended December 31, 2023 and 2022, the Company’s operations lost approximately $8.7 million and $11.1 million, respectively, of which approximately $2.7 million and $4.1 million, respectively, were non-cash expenses, net.

The Company generated negative cash used in operating activities of approximately $3.3 million for the twelve months ended December 31, 2023 and generated negative cash used in operating activities of approximately $5.3 million for the twelve months ended December 31, 2022. Historically, the Company’s liquidity needs have been met by the sale of convertible notes payable, common shares, and the issuance of common shares through the exercise of warrants.

As of December 31, 2023, NYIAX had total current assets of approximately $323,000, of which approximately $55,000 was cash and total current liabilities of approximately $7.9 million, of which approximately $2.4 million was convertible notes payable, accrued interest, and payables to shareholder-founders, all payable-in-kind of the Company’s shares.

To enable the Company to meet immediate capital requirements until longer term requirements can be met, during the second quarter of 2024, the Company sold convertible notes for the 2024A Convertible Notes Payable offering and during the third quarter the Company sold convertible notes for the 2024B Convertible Note Offering. The Company sold approximately $1.3 million of the 2024A Convertible Note Payable and as of August 15, 2024, the Company sold approximately $0.2 million of the 2024B Convertible Note Payable offerings.

We have incurred net losses and experienced net cash outflows from operating activities. If we do not effectively manage our cash and other liquid financial assets, execute our plan to increase profitability and obtain additional financing, we may not be able to satisfy repayment requirements on our obligations.

We have historically incurred operating losses, experienced cash outflows from operations and we have accumulated deficit. Our net loss was approximately $8.7 million for the twelve months ended December 31, 2023, $11.1 million for the year ended December 31, 2022, $13.5 million for the year ended December 31, 2021, and $6.2 million for the year ended December 31, 2020.

As of December 31, 2023, the Company had negative working capital of approximately $7.6 million of which approximately $2.4 million were convertible notes payable, accrued interest, and note payable, stockholder, all payable-in-kind of the Company’s shares.

The Company has also been historically reliant on sales of debt or equity securities to fund its working capital obligations. As a result, the Company is of the opinion that it will not have sufficient cash to meet working capital and capital requirements for at least twelve months from the date of this prospectus unless it is able to raise additional capital. Management has implemented various efforts to improve liquidity and conserve cash, including the sale of convertible notes and reducing staffing levels. Because we are not yet producing sufficient revenue to sustain our operating costs, we are dependent upon raising capital to continue our business.

If we are unable to raise additional capital, increase revenue and reduce operating expenses we may not be able to continue as a going concern. See page 40 for the Going Concern, Liquidity and Capital Resources section of the Management Discussion and Analysis of Financial Condition and Results of the of Operations for further discussion of the Company’s liquidity and capital resources.

14

We will not be able to execute our business plan or stay in business without additional or adequate funding.

Our ability to successfully develop our business, generate operating revenues and achieve profitability will depend upon our ability to obtain the necessary or adequate financing to implement our business plan. We will require financing through the issuance of additional debt and/or equity to implement our business plan, including identifying, acquiring and distributing consumer products, building inventory, hiring additional personnel as needed and eventually establishing profitable operations. Such financing may not be forthcoming. As has been widely reported, global and domestic financial markets and economic conditions have been, and continue to be, distressed and volatile due to a variety of factors, including, but not limited to, economic conditions triggered by the COVID-19 pandemic, supply-chain disruptions, high inflation, and rising interests. As a result, the cost of raising money in the debt and equity capital markets may increase while the availability of funds from those markets could diminish significantly, even more so for smaller companies like ours. If such conditions and constraints exist, we may not be able to acquire funds either through credit markets or through equity markets and, even if financing is available, it may not be available on terms which we find favorable. Failure to secure funding when needed will have an adverse effect on our ability to meet our obligations and remain in business.

We may be subject to litigation from time to time during the normal course of business, which may adversely affect our business, financial condition and results of operations.

Currently, WestPark, the Company, and one of our directors are named defendants in a pending U.S. District Court case, which could have a negative effect on us or on our business.

On November 17, 2023, certain individual investors in NYIAX filed a complaint in the United States District Court for the Southern District of New York (the “Complaint”) against Westpark Capital, Inc., the Company, Robert Ainbinder, Jr., a director of the Company since April 2016, and Robert Ainbinder, Jr.’s brother, alleging claims of violation of securities law, common law fraud and negligence. The case underlying the Complaint was earlier the subject of a FINRA arbitration case, without NYIAX as a party to the FINRA arbitration case, subsequently withdrawn and filed in the United States District Court for the Southern District of New York.

The Company has concluded that it is not possible to assess the likelihood of a loss at this time. The case underlying the Complaint could impede our ability to raise funds and may have a material adverse effect on the Company’s business, financial condition, operating results, or cash flows. The Company intends to vigorously defend its positions. However, there can be no assurances that the Company’s contentions and affirmative defenses in response to claims will be successful in the Court or in arbitration. A copy of the Complaint will be sent to any investor free of charge upon e-mail request to the Company at info@nyiax.com.

A Former Underwriter may initiate a lawsuit to recover amounts it claims are owed pursuant to its engagement by the Company and the Company may initiate litigation against the Former Underwriter.

A Former Underwriter claims that the Company owes or will owe the Former Underwriter approximately $1 million for commissions on funds privately raised by the Company during its engagement with the Former Underwriter and approximately $1.2 million if the Company completes an IPO with another underwriter.

The Former Underwriter may continue to claim that the Company owes or will owe the Former Underwriter approximately $1 million for commissions on funds privately raised by the Company during its engagement with the Former Underwriter and approximately $1.2 million if the Company completes an IPO with another underwriter.

There can be no assurance that the Former Underwriter will not initiate a lawsuit to recover the amounts it claims are owed and any such litigation could impede our ability to complete an IPO and could negatively affect our financial condition. There can be no assurance that the Company will prevail in any lawsuit it commences against the Former Underwriter. The Company disputes the amounts owed that have been claimed by the Former Underwriter and further is of the belief that if any commissions are due to the Former Underwriter, they would be significantly less than the amounts claimed by the Former Underwriter. It is reasonably possible that the Company and the Former Underwriter will end up in litigation over claims by the Former Underwriter against the Company and claims by the Company against the Former Underwriter. Litigation is expensive and time consuming with uncertain outcomes.

15

The Former Underwriter may not release us from its ROFR under our engagement letter agreement.

The Company executed an engagement letter with the Former Underwriter that terminates on the later of (i) eighteen (18) months from the date executed (March 23, 2021) or (ii) twelve months from the completion date of the IPO and the term may be extended pursuant to the engagement letter. The Company agreed that the advisor shall have the right of first refusal (ROFR) for two (2) years from the consummation of a transaction or termination or expiration of the Engagement Letter to act as advisor or as joint financial advisor under at least equal economic terms to the Engagement Letter. The Former Underwriter has a right of first refusal (“ROFR”) pursuant to the initial engagement letter agreement entered into by and between the Company and the Former Underwriter.

There can be no assurance that the Former Underwriter will release us from the ROFR or that our ability to complete an IPO will not be impeded as a result.

Our business is subject to the risk of catastrophic events such as pandemics, earthquakes, flooding, fire, and power outages, and to interruption by man-made problems such as terrorism and wars.

Our business is vulnerable to damage or interruption from pandemics, earthquakes, flooding, fire, power outages, telecommunications failures, terrorist attacks, acts of war, human errors, break-ins, and similar events. A significant natural disaster could have a material adverse effect on our business, results of operations, and financial condition, and our insurance coverage may be insufficient to compensate us for losses that may occur.

Our business, financial condition and results of operations may be negatively affected by economic and other consequences from Russia’s military action against Ukraine and the international sanctions imposed in response to that action.

We employ a U.S. based development company, BWSoft Management LLC, (“BWSoft”) with employees around the world, including Russia. In late February 2022, Russia launched a large-scale military attack on Ukraine. In response to the military action by Russia, various countries, including the United States, issued broad-ranging economic sanctions against Russia. Such sanctions included, among other things, a prohibition on doing business with certain Russian companies. The war in Ukraine and related sanctions imposed on Russia could limit our ability to transact with our developer that has employees located in Russia. Currently, BWSoft is not under sanctions. The Company, along with BWSoft carefully monitors regulation initiatives. In the event of future sanctions, BWSoft and NYIAX will react accordingly to provide consistent and safe development services to NYIAX. We are currently reviewing other options for our external development. If our developer were to terminate the employment of these development team members located in Russia, such termination could disrupt or delay the development of incremental features to our platform, increase our costs, or force us to shift development efforts to resources in other geographies that may not possess the same level of cost efficiencies. Additionally, as of the date of this prospectus, there are no import or export control restrictions applicable to our business or our relationship with BWSoft.

Since our formation, we have never been profitable. Our lack of operating history makes it difficult to evaluate our business and prospects and may increase the risks associated with an investment in our Common Stock.

Since our formation, we have never been profitable. Our lack of operating history makes it difficult to evaluate our business and prospects and there can be no guarantee that we will ever be profitable. Furthermore, we do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements for our business will not exceed our estimates. In particular, additional capital may be required if our operating costs increase beyond our expectations or we encounter greater costs associated with general and administrative expenses or other costs.

We will have a Board with new members and an even number of directors.

Following the resignation of a Board member on April 30, 2024, and the appointment of three (3) new independent members, the Company’s Board consists of two long-term members that are also included as management, the new chief executive officer, and three (3) new independent members. The new directors have not worked together or with management. The new directors will have different backgrounds, experiences and perspectives from those individuals who have historically served on our Board and may have different views on the direction of our business. The effect of implementation of those views may be difficult to predict and may result in conflict amongst the Board members or with management, at least in the short term, and could result in disruption of the strategic direction of our business.

Additionally, the ability of the new directors to quickly expand their knowledge of our business operations will be critical to their ability to make informed decisions about our business and strategies, particularly given the competitive environment in which we operate. There can be no assurance that our new directors will have the ability to gain the requisite knowledge in a timely matter.

16

Legislation and regulation of online businesses, including privacy and data protection regulations/restrictions, could create unexpected costs, subject us to enforcement actions for compliance failures, or cause us to change our technology platform or business model, which could have a material adverse effect on our business.

Government regulation could increase the costs of doing business online. U.S. and foreign governments have enacted or are considering legislation related to online advertising and we expect to see an increase in legislation and regulation related to advertising online, the use of geo-location data to inform advertising, the collection and use of anonymous Internet user data and unique device identifiers, such as IP address or unique mobile device identifiers, and other data protection and privacy regulation. Recent revelations about bulk online data collection by the National Security Agency, and news articles suggesting that the National Security Agency may gather data from cookies placed by Internet advertisers to deliver interest-based advertising, may further interest governments in legislation regulating data collection by commercial entities, such as advertisers and publishers and technology companies that serve the advertising industry. Such legislation could affect the costs of doing business online and could reduce the demand for our solution or otherwise harm our business, financial condition and results of operations. For example, a wide variety of provincial, state, national and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal data. Our failure to comply with applicable laws and regulations, or to protect personal data, could result in enforcement action against us, including fines, imprisonment of our officers and public censure, claims for damages by consumers and other affected individuals, damage to our reputation and loss of goodwill, any of which could have a material adverse impact on our business, financial condition and results of operations. Even the perception of privacy concerns, whether or not valid, could harm our reputation and inhibit adoption of our solution by current and future advertisers and advertising agencies.

Fee pressure may result in a reduction in the fees we are able to charge on our platform, which could have a material adverse effect on our business.

Fee pressure would be any pressure from publishers or advertisers to reduce the percentage that NYIAX would receive due to the downturn of the value of instruments or specific instruments including mismatched pricing. Fee pressures also have to do with the cyclicality of the advertising market, which is dependent upon the spending based on the particular time of the year. Any fee pressure could have a material adverse impact on the Company’s business and results of operations.

Projecting the market’s acceptance of a new price or structure is imperfect and we may price too high or too low, both of which may carry adverse consequences.

If our estimates related to expenditures are inaccurate, our business may fail.

Our success is dependent in part upon the accuracy of our management’s estimates of expenditures for the next twelve months and beyond. If such estimates are inaccurate, or we encounter unforeseen expenses and delays, we may not be able to carry out our business plan, which could result in the failure of our business.

Because we rely on third-party blockchain technologies, users of our platform could be subject to blockchain protocol risks.

Reliance upon other third-party blockchain technologies to create our platform subjects us and our customers to the risk of ecosystem malfunction, unintended function, unexpected functioning of, or attack on, the providers’ blockchain protocol, which may cause our platform to malfunction or function in an unexpected manner, including, but not limited to, slowdown or complete cessation in functionality of the platform.

Artificial Intelligence May Have Risks to the Company’s Operations and Profitability

As Artificial Intelligence (AI) evolves, AI laws, regulations, and standards all may impact the Company’s productivity and profitability as well as have an impact on increased cybersecurity risks and social and ethical challenges from reliance on third-party AI systems. The Company is studying AI and its potential impacts.

17

We depend on a limited number of customers and the loss of one or more of these customers could have a material adverse effect on our business, financial condition and results of operations.

As of December 31, 2023, three Media Sellers represented approximately 46%, 14% and 7% respectively of our revenue, net. As of December 31, 2023, three Media Buyer represented 34%, 25% and 18% of our accounts receivable. As of December 31, 2023, two Media Sellers represented 80% and 10% of our accounts payable.

As of December 31, 2022, three Media Sellers represented approximately 51%, 12% and 10% respectively of our revenue, net. As of December 31, 2022, two Media Buyer represented for 67% and 20% of accounts receivable. As of December 31, 2022, two Media Sellers represented 61% and 8% of accounts payable.

Due to the concentration of revenues from a limited number of customers, if we do not receive the payments from or if our relationships become impaired with any of these major customers, our revenue, results of operation and financial condition will be negatively impacted.

In addition, we cannot assure that any of our customers in the future will not cease using our products and services, significantly reduce orders or seek price reductions in the future, and any such event could have a material adverse effect on our revenue, profitability, and results of operations.

Our revenue and operating results will be highly dependent on the overall demand for advertising and could fluctuate significantly depending upon various factors, such as seasonal fluctuations and market changes. Factors that affect the amount of advertising spending, such as economic downturns, particularly in the fourth quarter of our fiscal year, will make it difficult to predict our revenue, and could cause our operating results to fall below investors’ expectations and adversely affect our business and financial condition.

Our business depends on the overall demand for advertising and on the economic health of our current and prospective sellers and buyers. If advertisers reduce their overall advertising spending, our revenue and results of operations are directly affected. Many advertisers devote a disproportionate amount of their advertising budgets to the fourth quarter of the calendar year to coincide with increased holiday purchasing, and buyers may spend more in the fourth quarter for budget reasons. As a result, any events that reduce the amount of advertising spending during the fourth quarter or reduce the amount of inventory available to buyers during that period, could have a disproportionate adverse effect on our revenue and operating results for that fiscal year. Economic downturns or instability in political or market conditions generally may cause current or new advertisers to reduce their advertising budgets. Reductions in inventory due to loss of sellers would make our solution less robust and attractive to buyers. Adverse economic conditions and general uncertainty about economic recovery are likely to affect our business prospects. Uncertainty regarding economic conditions in the United States and other countries may cause general business conditions in the United States and elsewhere to deteriorate or become volatile, which could cause buyers to delay, decrease or cancel purchases, exposing us to reduced demand for our solution, and increased credit risk on buyer orders. Moreover, any changes in the favorable tax treatment of advertising expenses and the deductibility thereof would likely cause a reduction in advertising demand. In addition, concerns over the sovereign debt situation in certain countries in the European Union as well as continued geopolitical turmoil in many parts of the world have and may continue to put pressure on global economic conditions, which could lead to reduced spending on advertising.

Our revenue, cash flow from operations, operating results and other key operating and financial measures may vary from quarter to quarter due to the seasonal nature of advertiser spending. For example, many advertisers devote a disproportionate amount of their advertising budgets to the fourth quarter of the calendar year to coincide with increased holiday purchasing. Moreover, advertising inventory in the fourth quarter may be more expensive due to increased demand for advertising inventory.

Our revenue can vary greatly from period to period and it is dependent on several factors, including on our business development team and the Media Contracts. Our net revenue decreased sequentially quarter on quarter in 2022 and 2023.

Our business is in the early stage and depends on the overall demand for digital advertising, the economic health of our current and prospective sellers and buyers and the on-boarding of new Media Contracts, which can vary greatly from period to period. The value of each Media Contracts varies dependent upon several factors, including size of the media buy and commission rates. We currently have only a limited number of buyers and sellers on our platform and need to increase the number of Media Contracts in order to increase our revenues.

Revenue is also dependent upon the cumulative effort of business development employees driving revenue relationships to the Company. The Company does not currently have a book of repeatable business and as such revenue is substantially dependent upon business development headcount driving relationships and new transactions.

18

Obtaining new Media Contracts is dependent on several factors, including on our new business development (sales and representatives) team, which headcount has decreased from eleven at December 31, 2021 to three at March 31, 2023. (At March 31, 2021, the business development headcount was one and revenue for the three-month period ended March 31, 2021 was nil.)

In addition, our revenue from quarter to quarter has decreased for quarters ended March 31, 2022, June 30, 2022, September 30, 2022, March 31, 2023, and June 30, 2023, and increased for the quarters ended December 31, 2022, September 30, 2023, and December 31, 2023 as follows:

| 31-Mar-22 | $ | 485,065 | ||

| 30-Jun-22 | 339,423 | |||

| 30-Sep-22 | 124,987 | |||

| 31-Dec-22 | 374,830 | |||

| For The Year Ended December 31, 2022 | $ | 1,324,305 | ||

| 31-Mar-23 | $ | 138,037 | ||

| 30-Jun-23 | 88,977 | |||

| 30-Sep-23 | 97,820 | |||

| 31-Dec-23 | 331,266 | |||

| For The Year Ended December 31, 2023 | $ | 656,100 |

There can be no assurance that we will be able to increase the number of Media Contracts the value per Media Contract, or our overall revenue. In the event that we are unable to increase the number of Media Contracts and/or the value per Media Contract, on our platform, we will not be able to increase revenues and may be unable to continue in business.

Our business depends substantially on the continuing efforts of our executive officers and key employees, and our business may be severely disrupted if we lose their services.