UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23166

(Investment Company Act File Number)

(Exact Name of Registrant as Specified in Charter)

360 S. Rosemary Avenue, Suite 1420

West Palm Beach, FL 33401

(Address of Principal Executive Offices)

Marcus L. Collins, Esq.

RiverNorth Capital Management, LLC

360 South Rosemary Avenue, Suite 1420

West Palm Beach, FL 33401

(Name and Address of Agent for Service)

(312) 832-1440

(Registrant’s Telephone Number)

Date of Fiscal Year End: June 30

Date of Reporting Period: June 30, 2022

| Item 1. | Reports to Stockholders. |

| (a) |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

Table of Contents

| Shareholder Letter | 2 |

| Performance Overview | 4 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 34 |

| Statement of Operations | 35 |

| Statements of Changes in Net Assets Attributable to Common Shareholders | 36 |

| Statement of Cash Flows | 38 |

| Financial Highlights | 40 |

| Notes to Financial Statements | 43 |

| Report of Independent Registered Public Accounting Firm | 56 |

| Dividend Reinvestment Plan | 57 |

| Summary of Updated Information Regarding the Fund | 59 |

| Directors and Officers | 86 |

| Additional Information | 93 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Shareholder Letter | June 30, 2022 (Unaudited) |

Dear Fellow Shareholders,

Last year, we started off one of our shareholder letters with the following sentence: “The economic environment in the U.S. has changed meaningfully relative to a year ago.” Those words were written as the global economy was sharply rebounding from the depths of the COVID-19 pandemic. For different reasons, those words ring true again as we pen this year’s annual letter.

Inflation is running at levels we haven’t seen in decades. Interest rates are ratcheting up accordingly. The Federal Reserve (“Fed”) is aggressively hiking short term rates to slow the pace of rising prices while implementing its plan to reduce the size of its balance sheet which had grown by several trillion dollars while fighting the economic effects of the pandemic.

While financial pundits debate the probability of aggressive Fed monetary policy throwing the U.S. economy into a recession, higher long-term rates have thrown some cold water on the red-hot U.S. residential real estate market.

Add geopolitical uncertainty to the mix, mainly from the Russian invasion of Ukraine, and it’s no surprise that broad based equity and fixed income asset classes have experienced steep losses over the past several months. Many fixed income indices have experienced the worst start to a calendar year ever. A common theme surrounding recent market performance has been, “no place to hide,” as assets across the risk spectrum have experienced significant volatility.

RiverNorth’s investment strategies have historically benefitted from volatility. We believe the asset classes we specialize in including closed-end funds (“CEFs”), business development companies (“BDCs”) and special-purpose acquisition companies (“SPACs”) tend to be under-followed, less-liquid, and misunderstood by the general investing public. Our view is that those characteristics, combined with volatility, may create opportunities to add value through our trading strategies. After reaching fully valued levels last summer, we are seeing attractive discounts again in both CEFs and BDCs. After record issuance in 2020 and Q1 2021, the SPAC market has cooled considerably. While these developments sound negative on the surface, we believe that they may create opportunity for RiverNorth.

Combined with our efforts to grow the Fund's net asset value ("NAV") through prudent and opportunistic portfolio management, RiverNorth utilizes its 18+ years of experience in researching and trading CEFs to design the structure of our listed CEFs. To that end, our objective is to set a level distribution policy that may appeal to investors. We also utilize our CEF capital markets experience as we strive to optimize the Fund’s use of leverage, especially considering the interest rate volatility mentioned at the top of this letter. For example, towards the end of 2021, OPP locked in permanent, fixed-rate financing through the issuance of a preferred security at a very attractive coupon of 4.75%.

We’d be remiss if we didn’t highlight the strong relationship we share with the very distinguished DoubleLine Capital. We believe DoubleLine’s opportunistic fixed income strategy pairs nicely with RiverNorth’s tactical CEF trading strategy. Overall, we remain optimistic about the Fund’s portfolio and prospects looking forward, especially relative to other fixed income asset classes.

We are pleased to provide you with the following 2022 Annual Report.

| 2 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Shareholder Letter | June 30, 2022 (Unaudited) |

Please visit www.rivernorth.com for additional information.

We thank you for your investment and trust in managing your assets.

Respectfully,

RiverNorth Capital Management, LLC

Opinions and estimates offered constitute our judgement and are subject to change.

| Annual Report | June 30, 2022 | 3 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Performance Overview | June 30, 2022 (Unaudited) |

WHAT IS THE FUND’S INVESTMENT STRATEGY?

The RiverNorth/DoubleLine Strategic Opportunity Fund (“the Fund”) seeks to achieve its investment objective by allocating its Managed Assets among the three principal investment strategies described below:

Tactical Closed-End Fund Income Strategy: This strategy seeks to (i) generate returns through investments in closed-end funds, special purpose acquisition companies ("SPACs"), exchange-traded funds and business development companies (collectively, the “Underlying Funds”) that invest primarily in income- producing securities, and (ii) derive value from the discount and premium spreads associated with closed-end funds.

Opportunistic Income Strategy: This strategy seeks to generate attractive risk-adjusted returns through investments in fixed income instruments and other investments, including agency and non-agency residential mortgage-backed and other asset-backed securities, corporate bonds, municipal bonds, and real estate investment trusts. At least 50% of the Managed Assets allocated to this strategy is invested in mortgage-backed securities.

Alternative Credit Strategy: This strategy seeks to achieve a high level of income by investing in alternative credit instruments. The Fund's alternative credit investments may be made through a combination of: (i) investing in loans to small and mid-sized companies (“SMEs”); (ii) investing in notes or other pass-through obligations issued by an alternative credit platform (or an affiliate) representing the right to receive the principal and interest payments on an alternative credit investment (or fractional portions thereof) originated through the platform (“Pass-Through Notes”); or (iii) purchasing asset-backed securities representing ownership in a pool of alternative credit. The Fund may invest in income-producing securities of any maturity and credit quality, including unrated or below investment grade.

RiverNorth Capital Management, LLC (“RiverNorth”) allocates the Fund’s Managed Assets among three principal strategies: Tactical CEF Income Strategy, Alternative Credit Strategy, and Opportunistic Income Strategy. RiverNorth manages the Tactical CEF Income Strategy and the Alternative Credit Strategy, DoubleLine Capital, LP ("DoubleLine") manages the Opportunistic Income Strategy.

RiverNorth determines which portion of the Fund’s assets is allocated to each strategy based on market conditions.

The Tactical CEF Income Strategy typically invests in CEFs, BDCs, SPACs and ETFs. The Opportunistic Income Strategy primarily invests in agency and non-agency residential mortgage-backed securities and commercial mortgage-backed securities ("CMBS") seeking to derive value from inefficiencies within the subsectors of the fixed income market while maintaining active risk constraints. The Alternative Credit Strategy invests primarily in a portfolio of small and medium size business loans and related instruments originated from alternative credit platforms.

| 4 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Performance Overview | June 30, 2022 (Unaudited) |

HOW DID THE FUND PERFORM RELATIVE TO ITS BENCHMARK DURING THE PERIOD?

PERFORMANCE as of June 30, 2022

| Cumulative | Annualized | ||||

| TOTAL RETURN(1) | 6 Months | 1 Year | 3 Years(3) | 5 Years(3) | Since Inception(2)(3) |

| RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. – NAV(4) | -14.89% | -14.82% | -2.40% | 0.43% | 1.60% |

| RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. – Market(5) | -17.56% | -19.86% | -1.15% | 0.81% | 1.14% |

| Bloomberg U.S. Aggregate Bond Index(6) | -10.35% | -10.29% | -0.93% | 0.88% | 0.59% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on September 28, 2016. |

| (3) | Annualized. |

| (4) | Performance returns are net of management fees and other Fund expenses. |

| (5) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

| (6) | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of investment grade fixed-rate debt issues with maturities of at least one year. The index cannot be invested in directly and does not reflect fees and expenses. |

The total annual expense ratio as a percentage of net assets attributable to common shares as of June 30, 2022 is 1.88% (excluding interest on facility loan payable). Including interest on facility loan payable, the expense ratio is 1.93%.

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (844) 569-4750. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

WHAT CONTRIBUTING FACTORS WERE RESPONSIBLE FOR THE FUND’S RELATIVE PERFORMANCE DURING THE PERIOD?

RiverNorth Tactical Closed-End Fund Income Sleeve

The sleeve’s exposure to the underlying net asset values of CEFs was the largest detractor from returns for the period. The sleeve’s exposure to BDCs contributed positively over the period. While the first half of the fiscal year was a period of general strength in the CEF market, a dramatic shift in expectations for higher interest rates drove a significant sell-off in the back half of the fiscal year.

| Annual Report | June 30, 2022 | 5 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Performance Overview | June 30, 2022 (Unaudited) |

In addition to the contributing factors referenced above, RiverNorth believes that the Fund's level distribution policy did not have a material impact on the Fund's ability to execute on its investment strategy during the fiscal year ended June 30, 2022.

The Fund made monthly distributions to common shareholders set at a level monthly rate of $0.1586 per common share for the period from July 1, 2021 to December 31, 2021, and $0.1478 per common share for the period from January 1, 2022 to June 30, 2022. These distributions are made from net assets and are reflected in the Fund Performance numbers provided in the section above. For the fiscal year ended June 30, 2022, a majority of the distribution was characterized as a return of capital.

DoubleLine Opportunistic Income Sleeve

During the Period, the DoubleLine sleeve generated a negative total return but still outperformed the Bloomberg US Aggregate Bond Index (the "Index") return of -10.29%. The primary driver of the relative outperformance was duration positioning; the portfolio consistently maintained a lower duration than the Index which helped relative performance as interest rates rose sharply over this period. A secondary driver of outperformance was credit selection because the credit holdings in the portfolio predominantly outperformed the credit holdings in the Index. The top-performing sectors in the portfolio for the period were asset-backed securities and CMBS. These sectors were especially hard-hit by the COVID-19 pandemic and still had some room for price recovery during the second half of 2021 as the US economy fully reopened. During the first half of 2022, their relatively low durations and high levels of monthly interest income helped shield them from steeper losses as interest rates rose. The worst-performing sectors were emerging market debt and Agency mortgage-backed securities (“MBS”). The emerging market holdings experienced credit spread widening during the latter portion of this performance period as recessionary fears gripped global markets. Agency MBS experienced duration-related price declines as well as some negative sentiment in the market stemming from the Fed's tapering of monthly asset purchases.

HOW WAS THE RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND POSITIONED AT THE END OF THE PERIOD?

The Fund's Managed Assets were allocated 26% RiverNorth Tactical CEF Income and 74% DoubleLine Opportunistic Income. The biggest asset class allocations were to non-agency MBS, cash and SPACs. The Alternative Credit Sleeve was added to the Fund's strategy after the Fund's fiscal year end.

The Fund issued a Series B preferred in November 2021. Total leverage of the portfolio at period end was ~ 35%.

DEFINITIONS:

Alternative Credit refers to debt asset types that fall outside of traditional fixed income markets.

Asset-Backed Securities (ABS) are investment securities—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

| 6 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Performance Overview | June 30, 2022 (Unaudited) |

Business Development Companies (BDC) are organizations that invests in small-and medium-sized companies as well as distressed companies. A BDC helps the small-and medium-sized firms grow in the initial stages of their development.

Mortgage-Backed Securities (MBS) are asset-backed securities that are secured by a mortgage or collection of mortgages.

Pass-Through securities are pools of fixed-income securities backed by a package of assets. A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holders of the pass-through security.

Residential Mortgage-Backed Securities (RMBS) are fixed-income investment products that are backed by mortgages on residential properties rather than commercial real estate.

Commercial Mortgage-Backed Securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Special Purpose Acquisition Companies (SPAC) are companies with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.

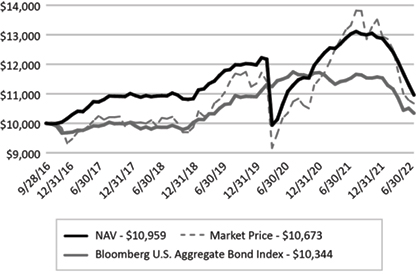

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the closing market price (NYSE: OPP) of $20.00 on September 28, 2016 (commencement of operations) and tracking its progress through June 30, 2022.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

| Annual Report | June 30, 2022 | 7 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Performance Overview | June 30, 2022 (Unaudited) |

TOP TEN HOLDINGS* as of June 30, 2022

| % of Net Assets | |

| U.S. Treasury Bond, 1.63%, 11/15/2050 | 7.43% |

| Oxford Square Capital Corp., 0.00%, 03/30/2024 | 2.69% |

| Legacy Mortgage Asset Trust, 4.50%, 11/25/2059 | 2.68% |

| Invesco Dynamic Credit Opportunities Fund, | 2.44% |

| Government National Mortgage Association, 3.50%, 02/20/2047 | 1.97% |

| Freddie Mac REMICS, 4.00%, 12/15/2040 | 1.91% |

| CHL GMSR Issuer Trust, 4.37%, 05/25/2023 | 1.78% |

| PennantPark Floating Rate Capital, Ltd., 4.25%, 04/01/2026 | 1.70% |

| COLT 2021-4 Mortgage Loan Trust, 4.14%, 10/25/2066 | 1.48% |

| Nuveen Credit Strategies Income Fund, | 1.28% |

| 25.36% |

| * | Holdings are subject to change and exclude short-term investments. |

ASSET ALLOCATION as of June 30, 2022^

| ^ | Holdings are subject to change. |

Percentages are based on net assets of the Fund and do not include derivatives.

| 8 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| CLOSED-END FUNDS (14.78%) | ||||||||

| 19,109 | Apollo Senior Floating Rate Fund, Inc. | $ | 245,168 | |||||

| 148,397 | Apollo Tactical Income Fund, Inc. | 1,786,700 | ||||||

| 153,742 | Barings Global Short Duration High Yield Fund | 2,000,183 | ||||||

| 356,322 | BlackRock 2022 Global Income Opportunity Trust | 15,037 | ||||||

| 86,404 | BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | 727,522 | ||||||

| 145,033 | Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund | 2,764,329 | ||||||

| 142,624 | First Trust High Yield Opportunities 2027 Term Fund | 2,072,327 | ||||||

| 96,061 | GDL Fund | 788,661 | ||||||

| 475,840 | Invesco Dynamic Credit Opportunities Fund | 5,343,681 | ||||||

| 378,236 | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | 1,698,280 | ||||||

| 114,786 | Nuveen Core Plus Impact Fund | 1,345,292 | ||||||

| 541,486 | Nuveen Credit Strategies Income Fund | 2,815,727 | ||||||

| 189,813 | PGIM Global High Yield Fund, Inc. | 2,177,155 | ||||||

| 113,940 | PGIM Short Duration High Yield Opportunities Fund | 1,698,845 | ||||||

| 152,496 | PIMCO Dynamic Income Opportunities Fund | 2,112,070 | ||||||

| 149,631 | Western Asset Diversified Income Fund | 2,073,886 | ||||||

| 683,035 | Western Asset High Income Opportunity Fund, Inc. | 2,704,819 | ||||||

| TOTAL CLOSED-END FUNDS | ||||||||

| (Cost $39,043,472) | 32,369,682 | |||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| BANK LOANS (5.70%) | |||||||||||||||

| $ | 104,210 | Aegion Corp., First Lien - Initial Term Loan(a) | 3M US L + 4.75% | 05/17/28 | $ | 95,613 | |||||||||

| 509,077 | Air Methods Corp., First Lien - Initial Term Loan(a) | 3M US L + 3.50% | 04/22/24 | 453,715 | |||||||||||

| 315,000 | American Tire Distributors, Inc., First Lien - Initial Term Loan | 3M US L + 6.25% | 10/08/28 | 298,620 | |||||||||||

| 645,000 | Applied Systems, Inc., Second Lien - 2021 Term Loan(a) | 3M US L + 5.50% | 09/19/25 | 626,053 | |||||||||||

| 680,000 | Astra Acquisition Corp., Second Lien - Initial Term Loan | 1M US L + 8.875% | 10/22/29 | 632,399 | |||||||||||

| 583,538 | Astra Acquisition Corp., First Lien - Initial Term Loan | 3M US L + 5.25% | 10/22/28 | 510,108 | |||||||||||

| 95,000 | Asurion LLC, Second Lien - New B-3 Term Loan(a) | 1M US L + 5.25% | 01/31/28 | 81,581 | |||||||||||

| 521,063 | Atlas Purchaser, Inc., First Lien - Initial Term Loan(a) | 3M US L + 3.00% | 05/18/28 | 432,482 | |||||||||||

| 600,000 | Aveanna Healthcare LLC, Second Lien - Initial Term Loan(a) | 3M US L + 7.50% | 12/10/29 | 537,000 | |||||||||||

| 65,000 | Blackhawk Network Holdings, Inc., Second Lien (a) | 1M US L + 7.00% | 06/15/26 | 63,754 | |||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 9 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| BANK LOANS (continued) | |||||||||||||||

| $ | 402,593 | Bright Bidco B.V., First Lien - 2018 Refinancing B Term Loan(a) | 3M US L + 3.50% | 06/30/24 | $ | 180,015 | |||||||||

| 248,117 | Cengage Learning, Inc., First Lien - B Term Loan | 3M US L + 5.00% | 06/29/26 | 224,546 | |||||||||||

| 765,000 | Constant Contact, Inc., Second Lien - Initial Term Loan(a) | 3M US L + 7.50% | 02/12/29 | 742,051 | |||||||||||

| 208,546 | Cyxtera DC Holdings, Inc., First Lien - Initial Term Loan(a) | 3M US L + 3.00% | 05/01/24 | 197,319 | |||||||||||

| 295,000 | DCert Buyer, Inc., Second Lien - First Amendment Refinancing Term Loan(a) | 1M US L + 7.00% | 02/19/29 | 275,825 | |||||||||||

| 250,000 | DG Investment Intermediate Holdings 2, Inc., Second Lien - Initial Term Loan(a) | 1M US L + 6.75% | 03/30/29 | 242,500 | |||||||||||

| 172,421 | Edgewater Generation LLC, First Lien (a) | 1M US L + 3.75% | 12/13/25 | 147,657 | |||||||||||

| 580,954 | Envision Healthcare Corp., First Lien - Initial Term Loan(a) | 1M US L + 3.75% | 10/10/25 | 197,669 | |||||||||||

| 517,073 | Envision Healthcare Corp., First Lien - Series 2020 New Term Loan(a) | 1M US L + 3.75% | 10/10/25 | 177,527 | |||||||||||

| 244,882 | Gainwell Acquisition Corp., First Lien - B Term Loan(a) | 3M US L + 4.00% | 10/01/27 | 232,256 | |||||||||||

| 330,805 | Grab Holdings, Inc., First Lien - Initial Term Loan(a) | 3M US L + 4.50% | 01/29/26 | 303,513 | |||||||||||

| 255,032 | Gulf Finance, LLC TL 1L | 1M US L + 6.75% | 08/25/26 | 190,478 | |||||||||||

| 266,785 | Intelsat Jackson Holdings S.A.TLB 1L | 3M US L + 4.00% | 01/26/29 | 245,394 | |||||||||||

| 123,002 | ION Trading Finance, Ltd., First Lien - Initial Dollar (2021) Term Loan(a) | 3M US L + 4.75% | 04/01/28 | 113,815 | |||||||||||

| 135,000 | Kenan Advantage Group, Inc, Second Lien - Initial Term Loan | 1M US L + 7.25% | 08/18/27 | 123,525 | |||||||||||

| 32,443 | Lealand Finance Company B.V., First Lien - Take-Back Term Loan(a) | 3M US L + 1.00% | 06/30/25 | 16,640 | |||||||||||

| 2,433 | Lealand Finance Company B.V., First Lien - Make-Whole Term Loan(a) | 3M US L + 3.00% | 06/28/24 | 1,582 | |||||||||||

| 165,000 | LSF9 ATLANTIS HOLDINGS, LLC, First Lien - B Term Loan | 8.00% | 03/29/29 | 152,130 | |||||||||||

| 319,860 | Minotaur Acquisition, Inc., First Lien - B Term Loan(a) | 1M US L + 4.75% | 03/27/26 | 303,601 | |||||||||||

| 204,516 | Misys, Ltd., First Lien - Dollar Term Loan(a) | 3M US L + 3.50% | 06/13/24 | 184,927 | |||||||||||

| 230,000 | Misys, Ltd., Second Lien - Dollar Term Loan(a) | 3M US L + 7.25% | 06/13/25 | 199,443 | |||||||||||

See Notes to Financial Statements.

| 10 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| BANK LOANS (continued) | |||||||||||||||

| $ | 164,588 | Ola Singapore/OLA Netherlands 12/21 TL, First Lien - Initial Term Loan | 1M US L + 6.25% | 12/03/26 | $ | 140,997 | |||||||||

| 336,822 | Riverbed Technology, Inc., First Lien - Initial Term Loan | 4M US L + 8.00% | 12/06/26 | 201,989 | |||||||||||

| 112,141 | Sweetwater Borrower, LLC, First Lien - Initial Term Loan | 1M US L + 4.25% | 08/03/28 | 96,722 | |||||||||||

| 379,000 | Team Health Holdings, Inc., First Lien - Initial Term Loan(a) | 1M US L + 2.75% | 02/06/24 | 338,684 | |||||||||||

| 218,900 | Think & Learn Private, Ltd., First Lien - B Term Loan | 3M US L + 5.50% | 11/05/26 | 187,160 | |||||||||||

| 220,000 | TIBCO Software, Inc., Second Lien (a) | 1M US L + 7.25% | 03/04/28 | 217,085 | |||||||||||

| 597,834 | Travel Leaders Group LLC, First Lien - 2018 Refinancing Term Loan(a) | 1M US L + 4.00% | 01/25/24 | 536,183 | |||||||||||

| 757,898 | Travelport Finance Luxembourg SARL 1L, 2021, First Lien - Initial (Priority) Term Loan(a) | 3M US L + 8.75% | 02/28/25 | 751,740 | |||||||||||

| 89,842 | Travelport Finance S.a r.l., First Lien - 2021 Consented Term Loan(a) | 3M US L + 6.75% | 05/29/26 | 70,162 | |||||||||||

| 550,000 | UKG, Inc. TL 2L | 3M US L + 5.25% | 05/03/27 | 511,775 | |||||||||||

| 554,765 | Vantage Specialty Chemicals, Inc., First Lien - Closing Date Term Loan(a) | 3M US L + 3.50% | 10/28/24 | 527,373 | |||||||||||

| 233,825 | Viad Corp, First Lien - Initial Term Loan(a) | 3M US L + 5.00% | 07/30/28 | 220,965 | |||||||||||

| 533,793 | WaterBridge Midstream Operating LLC, First Lien - Initial Term Loan(a) | 3M US L + 5.75% | 06/22/26 | 506,169 | |||||||||||

| TOTAL BANK LOANS | |||||||||||||||

| (Cost $14,023,730) | 12,490,742 | ||||||||||||||

| Shares/Description | Value | |||||||

| SPECIAL PURPOSE ACQUISITION COMPANIES (16.24%) | ||||||||

| 51,583 | 8i ACQUISITION 2 Corp.(b) | 509,124 | ||||||

| 42,066 | Accretion Acquisition Corp.(b) | 414,342 | ||||||

| 36,143 | Achari Ventures Holdings Corp. I(b) | 361,069 | ||||||

| 81,790 | ALSP Orchid Acquisition Corp. I(b) | 816,264 | ||||||

| 29,842 | AltEnergy Acquisition Corp.(b) | 296,331 | ||||||

| 7,413 | Apeiron Capital Investment Corp.(b) | 73,833 | ||||||

| 36,781 | Arisz Acquisition Corp.(b) | 362,661 | ||||||

| 138,896 | Avalon Acquisition, Inc.(b) | 1,387,572 | ||||||

| 114,259 | Barings BDC, Inc. | 1,063,751 | ||||||

| 29,282 | BioPlus Acquisition Corp.(b) | 289,599 | ||||||

| 49,448 | Black Mountain Acquisition Corp.(b) | 492,008 | ||||||

| 14,842 | Blockchain Coinvestors Acquisition Corp. I(b) | 147,233 | ||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 11 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| SPECIAL PURPOSE ACQUISITION COMPANIES (continued) | ||||||||

| 36,149 | Blockchain Moon Acquisition Corp.(b) | $ | 357,514 | |||||

| 109,883 | Blue Ocean Acquisition Corp.(b) | 1,090,039 | ||||||

| 73,502 | Bullpen Parlay Acquisition Co.(b) | 728,405 | ||||||

| 59,686 | Cactus Acquisition Corp. 1, Ltd.(b) | 594,473 | ||||||

| 22,012 | Crescera Capital Acquisition Corp.(b) | 219,460 | ||||||

| 2,146 | CW TRAVEL(b) | 42,920 | ||||||

| 35,646 | Deep Medicine Acquisition Corp.(b) | 355,391 | ||||||

| 24,051 | Digital Health Acquisition Corp.(b) | 241,232 | ||||||

| 38,368 | Direct Selling Acquisition Corp.(b) | 384,447 | ||||||

| 12,048 | Enterprise 4.0 Technology Acquisition Corp.(b) | 119,998 | ||||||

| 32,156 | Everest Consolidator Acquisition Corp.(b) | 320,917 | ||||||

| 12,019 | ExcelFin Acquisition Corp.(b) | 119,589 | ||||||

| 40,085 | Finnovate Acquisition Corp.(b) | 398,445 | ||||||

| 215,585 | First Eagle Alternative Capital BDC, Inc. | 763,171 | ||||||

| 15,126 | Founder SPAC(b) | 153,529 | ||||||

| 58,432 | Games & Esports Experience Acquisition Corp.(b) | 584,320 | ||||||

| 46,043 | GigCapital5, Inc.(b) | 463,653 | ||||||

| 62,828 | Globalink Investment, Inc.(b) | 622,625 | ||||||

| 29,652 | Green Visor Financial Technology Acquisition Corp. I(b) | 296,520 | ||||||

| 18,354 | Hunt Cos. Acquisition Corp. I(b) | 184,458 | ||||||

| 24,074 | Industrial Human Capital, Inc.(b) | 241,462 | ||||||

| 17,822 | Innovative International Acquisition Corp.(b) | 178,576 | ||||||

| 73,254 | Integrated Rail and Resources Acquisition Corp.(b) | 728,877 | ||||||

| 8,038 | Intelligent Medicine Acquisition Corp.(b) | 80,782 | ||||||

| 880 | Intelsat Jackson Holdings SA(b) | 3,410 | ||||||

| 4,203 | Intelsat New Common(b) | 113,481 | ||||||

| 44,245 | Jupiter Wellness Acquisition Corp.(b) | 439,795 | ||||||

| 51,780 | LAMF Global Ventures Corp. I(b) | 515,729 | ||||||

| 12,126 | Learn CW Investment Corp.(b) | 120,532 | ||||||

| 88,428 | Legato Merger Corp. II(b) | 877,206 | ||||||

| 36,722 | LF Capital Acquisition Corp. II, Class A(b) | 366,118 | ||||||

| 128,274 | Lionheart III Corp.(b) | 1,280,176 | ||||||

| 62,178 | LIV Capital Acquisition Corp. II(b) | 621,780 | ||||||

| 24,030 | M3-Brigade Acquisition III Corp.(b) | 239,579 | ||||||

| 29,228 | Mana Capital Acquisition Corp.(b) | 290,526 | ||||||

| 13,637 | McDermott International, Ltd.(b) | 7,500 | ||||||

| 16,082 | McLaren Technology Acquisition Corp.(b) | 160,981 | ||||||

| 80,170 | Mercato Partners Acquisition Corp.(b) | 798,493 | ||||||

| 53,922 | Mount Rainier Acquisition Corp.(b) | 542,455 | ||||||

| 63,000 | Mountain Crest Acquisition Corp. V(b) | 623,070 | ||||||

| 58,756 | Nabors Energy Transition Corp.(b) | 587,560 | ||||||

| 24,074 | Newcourt Acquisition Corp.(b) | 241,462 | ||||||

| 86,683 | OmniLit Acquisition Corp.(b) | 869,430 | ||||||

| 20,906 | Onyx Acquisition Co. I(b) | 209,060 | ||||||

| 71,293 | OPY Acquisition Corp. I(b) | 701,523 | ||||||

See Notes to Financial Statements.

| 12 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| SPECIAL PURPOSE ACQUISITION COMPANIES (continued) | ||||||||

| 38,618 | Pershing Square Tontine Holdings, Ltd.(b) | $ | 771,201 | |||||

| 13,488 | Phoenix Biotech Acquisition Corp.(b) | 135,150 | ||||||

| 47,750 | Project Energy Reimagined Acquisition Corp.(b) | 465,085 | ||||||

| 64,779 | PROOF Acquisition Corp. I(b) | 639,369 | ||||||

| 5,941 | Pyrophyte Acquisition Corp.(b) | 59,766 | ||||||

| 87,648 | ROC Energy Acquisition Corp.(b) | 880,862 | ||||||

| 58,888 | Roth CH Acquisition V Co.(b) | 578,869 | ||||||

| 12,046 | Sanaby Health Acquisition Corp. I(b) | 120,942 | ||||||

| 27,067 | Screaming Eagle Acquisition Corp.(b) | 262,821 | ||||||

| 8,017 | Semper Paratus Acquisition Corp.(b) | 80,330 | ||||||

| 104,224 | Sizzle Acquisition Corp.(b) | 1,043,282 | ||||||

| 75,000 | Social Capital Hedosophia Holdings Corp. VI(b) | 744,750 | ||||||

| 16,034 | Spindletop Health Acquisition Corp.(b) | 159,859 | ||||||

| 18,072 | SportsMap Tech Acquisition Corp.(b) | 179,816 | ||||||

| 58,567 | ST Energy Transition I, Ltd.(b) | 583,913 | ||||||

| 32,164 | TG Venture Acquisition Corp.(b) | 319,163 | ||||||

| 12,018 | Thrive Acquisition Corp.(b) | 120,541 | ||||||

| 2,376 | TKB Critical Technologies 1(b) | 23,855 | ||||||

| 11,778 | TLGY Acquisition Corp.(b) | 118,016 | ||||||

| 96,492 | Trine II Acquisition Corp.(b) | 959,130 | ||||||

| 49,450 | Tristar Acquisition I Corp.(b) | 487,083 | ||||||

| 87,648 | UTA Acquisition Corp.(b) | 879,986 | ||||||

| 29,228 | Vahanna Tech Edge Acquisition I Corp.(b) | 291,695 | ||||||

| 61,760 | Worldwide Webb Acquisition Corp.(b) | 608,954 | ||||||

| TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES | ||||||||

| (Cost $35,659,052) | 35,608,894 | |||||||

| Shares/Description | Value | |||||||

| PREFERRED STOCKS (4.27%) | ||||||||

| 106,658 | First Eagle Alternative Capital BDC, Inc., 5.00%, 05/25/2026 | $ | 2,458,467 | |||||

| 235,511 | Oxford Square Capital Corp., 6.50%, 03/30/2024 | 5,887,775 | ||||||

| 2,946 | Riverbed Tech Pref A, 1.50%, 11/17/28(b) | 17,676 | ||||||

| 39,726 | XAI Octagon Floating Rate Alternative Income Term Trust, Series 2026, 6.50%, 03/31/2026 | 1,001,095 | ||||||

| TOTAL PREFERRED STOCKS | ||||||||

| (Cost $9,615,146) | 9,365,013 | |||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| COLLATERALIZED LOAN OBLIGATIONS (6.81%) | |||||||||||||||

| $ | 500,000 | Apidos CLO XXIV(a)(c) | 3M US L + 5.80% | 10/20/30 | $ | 428,890 | |||||||||

| 500,000 | Apidos CLO XXXII(a)(c) | 3M US L + 6.75% | 01/20/33 | 454,969 | |||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 13 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| COLLATERALIZED LOAN OBLIGATIONS (continued) | |||||||||||||||

| $ | 500,000 | Bain Capital Credit Clo 2019-3, Ltd.(a)(c) | 3M US L + 7.10% | 10/21/34 | $ | 453,207 | |||||||||

| 500,000 | Bain Capital Credit CLO 2021-2, Ltd.(a)(c) | 3M US L + 3.15% | 07/16/34 | 467,363 | |||||||||||

| 500,000 | Bain Capital Credit CLO 2022-3, Ltd.(a)(c) | 3M US SOFR + 7.35% | 07/17/35 | 465,755 | |||||||||||

| 500,000 | Barings CLO, Ltd.(a)(c) | 3M US L + 5.82% | 10/15/30 | 413,417 | |||||||||||

| 500,000 | Canyon Capital CLO, Ltd.(a)(c) | 3M US L + 5.75% | 07/15/31 | 414,165 | |||||||||||

| 500,000 | Carlyle Global Market Strategies CLO, Ltd.(a)(c) | 3M US L + 5.35% | 05/15/31 | 404,107 | |||||||||||

| 500,000 | Carlyle Global Market Strategies CLO, Ltd.(a)(c) | 3M US L + 5.50% | 10/15/30 | 404,586 | |||||||||||

| 1,000,000 | Carlyle US CLO 2020-2, Ltd.(a)(c) | 3M US L + 6.70% | 01/25/35 | 910,556 | |||||||||||

| 500,000 | Carlyle US CLO 2021-1, Ltd.(a)(c) | 3M US L + 6.00% | 04/15/34 | 425,426 | |||||||||||

| 500,000 | Chenango Park CLO, Ltd.(a)(c) | 3M US L + 5.80% | 04/15/30 | 444,603 | |||||||||||

| 500,000 | Fillmore Park CLO, Ltd.(a)(c) | 3M US L + 5.40% | 07/15/30 | 442,604 | |||||||||||

| 1,000,000 | Galaxy XIX CLO, Ltd.(a)(c) | 3M US L + 6.53% | 07/24/30 | 865,096 | |||||||||||

| 500,000 | Goldentree Loan Management US Clo 10, Ltd.(a)(c) | 3M US L + 6.20% | 07/20/34 | 427,363 | |||||||||||

| 500,000 | Goldentree Loan Management US CLO 3, Ltd.(a)(c) | 3M US L + 2.85% | 04/20/30 | 470,820 | |||||||||||

| 500,000 | Milos CLO, Ltd.(a)(c) | 3M US L + 6.15% | 10/20/30 | 434,231 | |||||||||||

| 500,000 | Myers Park CLO, Ltd.(a)(c) | 3M US L + 5.50% | 10/20/30 | 445,061 | |||||||||||

| 500,000 | Neuberger Berman Loan Advisers CLO 37, Ltd.(a)(c) | 3M US L + 5.75% | 07/20/31 | 453,837 | |||||||||||

| 500,000 | Neuberger Berman Loan Advisers CLO 42, Ltd.(a)(c) | 3M US L + 5.95% | 07/16/35 | 437,014 | |||||||||||

| 500,000 | Neuberger Berman Loan Advisers Clo 44, Ltd.(a)(c) | 3M US L + 6.00% | 10/16/34 | 435,863 | |||||||||||

| 500,000 | Ocean Trails CLO V(a)(c) | 3M US L + 3.45% | 10/13/31 | 457,021 | |||||||||||

| 500,000 | REESE PARK CLO, Ltd.(a)(c) | 3M US L + 6.50% | 10/15/34 | 447,559 | |||||||||||

See Notes to Financial Statements.

| 14 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| COLLATERALIZED LOAN OBLIGATIONS (continued) | |||||||||||||||

| $ | 500,000 | Sound Point CLO XXVI, Ltd.(a)(c) | 3M US L + 6.86% | 07/20/34 | $ | 438,094 | |||||||||

| 500,000 | Sound Point CLO XXXII, Ltd.(a)(c) | 3M US L + 6.70% | 10/25/34 | 430,193 | |||||||||||

| 500,000 | THL Credit Wind River 2017-3 CLO, Ltd.(a)(c) | 3M US L + 7.08% | 04/15/35 | 456,875 | |||||||||||

| 500,000 | THL Credit Wind River CLO, Ltd.(a)(c) | 3M US L + 5.75% | 07/15/30 | 434,620 | |||||||||||

| 500,000 | Unity-Peace Park CLO, Ltd.(a)(c) | 3M US SOFR + 7.175% | 04/20/35 | 464,142 | |||||||||||

| 500,000 | Voya CLO 2019-1, Ltd.(a)(c) | 3M US L + 6.12% | 04/15/31 | 451,521 | |||||||||||

| 500,000 | Voya CLO, Ltd.(a)(c) | 3M US L + 5.25% | 07/15/31 | 401,367 | |||||||||||

| 500,000 | Voya CLO, Ltd.(a)(c) | 3M US L + 5.95% | 07/14/31 | 416,541 | |||||||||||

| 500,000 | Webster Park CLO, Ltd.(a)(c) | 3M US L + 5.50% | 07/20/30 | 439,771 | |||||||||||

| TOTAL COLLATERALIZED LOAN OBLIGATIONS | |||||||||||||||

| (Cost $16,765,406) | 14,936,637 | ||||||||||||||

| Shares/Description | Value | |||||||

| RIGHTS (0.02%)(d) | ||||||||

| 51,583 | 8i ACQUISITION 2 Corp., Strike Price $11.50, Expires 11/24/2022 | 11,864 | ||||||

| 42,066 | Accretion Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | 5,069 | ||||||

| 36,781 | Arisz Acquisition Corp., Strike Price $11.50, Expires 05/01/2023 | 3,678 | ||||||

| 36,149 | Blockchain Moon Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | 1,959 | ||||||

| 35,646 | Deep Medicine Acquisition Corp., Strike Price $11.50, Expires 12/09/2022 | 3,925 | ||||||

| 62,828 | Globalink Investment, Inc., Strike Price $11.50, Expires 08/19/2023 | 4,712 | ||||||

| 44,245 | Jupiter Wellness Acquisition Corp., Strike Price $11.50, Expires 12/31/2049 | 5,314 | ||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 15 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| RIGHTS (continued) | ||||||||

| 29,228 | Mana Capital Acquisition Corp., Strike Price $11.50, Expires 12/01/2026 | $ | 4,706 | |||||

| TOTAL RIGHTS | ||||||||

| (Cost $83,776) | 41,227 | |||||||

| Shares/Description | Value | |||||||

| WARRANTS (0.08%)(d) | ||||||||

| 51,583 | 8i ACQUISITION 2 Corp., Strike Price $11.50, Expires 11/24/2022 | 10,316 | ||||||

| 21,033 | Accretion Acquisition Corp., Strike Price $11.50, Expires 02/19/2023 | 1,891 | ||||||

| 36,143 | Achari Ventures Holdings Corp. I, Strike Price $11.50, Expires 02/05/2023 | 4,699 | ||||||

| 40,895 | ALSP Orchid Acquisition Corp. I, Strike Price $11.50, Expires 05/03/2023 | 4,192 | ||||||

| 14,921 | AltEnergy Acquisition Corp., Strike Price $11.50, Expires 02/06/2023 | 2,504 | ||||||

| 36,781 | Arisz Acquisition Corp., Strike Price $11.50, Expires 05/01/2023 | 3,310 | ||||||

| 104,172 | Avalon Acquisition, Inc., Strike Price $11.50, Expires 02/26/2023 | 9,428 | ||||||

| 37,086 | Black Mountain Acquisition Corp., Strike Price $11.50, Expires 10/15/2027 | 6,675 | ||||||

| 7,421 | Blockchain Coinvestors Acquisition Corp. I, Strike Price $11.50, Expires 01/03/2024 | 594 | ||||||

| 36,149 | Blockchain Moon Acquisition Corp., Strike Price $11.50, Expires 03/24/2023 | 2,711 | ||||||

| 29,843 | Cactus Acquisition Corp. 1, Ltd., Strike Price $11.50, Expires 07/20/2023 | 3,283 | ||||||

| 11,006 | Crescera Capital Acquisition Corp., Strike Price $11.50, Expires 04/20/2023 | 1,761 | ||||||

| 24,051 | Digital Health Acquisition Corp., Strike Price $11.50, Expires 10/14/2023 | 2,646 | ||||||

| 19,184 | Direct Selling Acquisition Corp., Strike Price $11.50, Expires 11/23/2023 | 1,938 | ||||||

| 6,024 | Enterprise 4.0 Technology Acquisition Corp., Strike Price $11.50, Expires 09/24/2023 | 1,024 | ||||||

| 16,078 | Everest Consolidator Acquisition Corp., Strike Price $11.50, Expires 07/19/2023 | 1,608 | ||||||

| 6,010 | ExcelFin Acquisition Corp., Strike Price $11.50, Expires 07/05/2023 | 1,142 | ||||||

| 30,063 | Finnovate Acquisition Corp., Strike Price $11.50, Expires 04/15/2023 | 3,112 | ||||||

| 46,043 | GigCapital5, Inc., Strike Price $11.50, Expires 12/31/2028 | 2,956 | ||||||

See Notes to Financial Statements.

| 16 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| WARRANTS (continued) | ||||||||

| 62,828 | Globalink Investment, Inc., Strike Price $11.50, Expires 08/19/2023 | $ | 2,727 | |||||

| 14,826 | Green Visor Financial Technology Acquisition Corp. I, Strike Price $11.50, Expires 05/08/2023 | 2,002 | ||||||

| 9,177 | Hunt Cos. Acquisition Corp. I, Strike Price $11.50, Expires 12/31/2028 | 1,377 | ||||||

| 24,074 | Industrial Human Capital, Inc., Strike Price $11.50, Expires 12/31/2028 | 964 | ||||||

| 8,911 | Innovative International Acquisition Corp., Strike Price $11.50, Expires 04/03/2023 | 669 | ||||||

| 36,627 | Integrated Rail and Resources Acquisition Corp., Strike Price $11.50, Expires 05/21/2023 | 10,622 | ||||||

| 25,890 | LAMF Global Ventures Corp. I, Strike Price $11.50, Expires 04/04/2023 | 2,071 | ||||||

| 6,063 | Learn CW Investment Corp., Strike Price $11.50, Expires 12/31/2028 | 485 | ||||||

| 44,214 | Legato Merger Corp. II, Strike Price $11.50, Expires 02/05/2023 | 11,614 | ||||||

| 18,361 | LF Capital Acquisition Corp. II, Strike Price $11.50, Expires 01/07/2026 | 1,838 | ||||||

| 64,137 | Lionheart III Corp., Strike Price $11.50, Expires 03/19/2023 | 10,902 | ||||||

| 8,010 | M3-Brigade Acquisition III Corp., Strike Price $11.50, Expires 05/11/2023 | 801 | ||||||

| 14,614 | Mana Capital Acquisition Corp., Strike Price $11.50, Expires 12/01/2026 | 2,338 | ||||||

| 8,041 | McLaren Technology Acquisition Corp., Strike Price $11.50, Expires 03/03/2023 | 874 | ||||||

| 40,085 | Mercato Partners Acquisition Corp., Strike Price $11.50, Expires 12/28/2026 | 5,211 | ||||||

| 53,922 | Mount Rainier Acquisition Corp., Strike Price $11.50, Expires 12/04/2022 | 7,549 | ||||||

| 29,378 | Nabors Energy Transition Corp., Strike Price $11.50, Expires 06/08/2023 | 7,638 | ||||||

| 12,037 | Newcourt Acquisition Corp., Strike Price $11.50, Expires 04/12/2028 | 811 | ||||||

| 10,453 | Onyx Acquisition Co. I, Strike Price $11.50, Expires 01/07/2023 | 1,045 | ||||||

| 35,646 | OPY Acquisition Corp. I, Strike Price $11.50, Expires 04/08/2023 | 8,908 | ||||||

| 6,744 | Phoenix Biotech Acquisition Corp., Strike Price $11.50, Expires 09/01/2026 | 674 | ||||||

| 23,875 | Project Energy Reimagined Acquisition Corp., Strike Price $11.50, Expires 12/31/2028 | 3,374 | ||||||

| 29,444 | Roth CH Acquisition V Co., Strike Price $11.50, Expires 05/24/2023 | 4,858 | ||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 17 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Shares/Description | Value | |||||||

| WARRANTS (continued) | ||||||||

| 6,023 | Sanaby Health Acquisition Corp. I, Strike Price $11.50, Expires 07/30/2028 | $ | 693 | |||||

| 8,017 | Spindletop Health Acquisition Corp., Strike Price $11.50, Expires 12/31/2028 | 641 | ||||||

| 13,554 | SportsMap Tech Acquisition Corp., Strike Price $11.50, Expires 09/01/2027 | 2,169 | ||||||

| 32,164 | TG Venture Acquisition Corp., Strike Price $11.50, Expires 08/13/2023 | 3,860 | ||||||

| 6,009 | Thrive Acquisition Corp., Strike Price $11.50, Expires 03/09/2023 | 667 | ||||||

| 48,246 | Trine II Acquisition Corp., Strike Price $11.50, Expires 12/31/2027 | 7,237 | ||||||

| 24,725 | Tristar Acquisition I Corp., Strike Price $11.50, Expires 12/31/2028 | 3,023 | ||||||

| 14,614 | Vahanna Tech Edge Acquisition I Corp., Strike Price $11.50, Expires 07/13/2024 | 2,338 | ||||||

| 30,880 | Worldwide Webb Acquisition Corp., Strike Price $11.50, Expires 03/27/2023 | 2,683 | ||||||

| TOTAL WARRANTS | ||||||||

| (Cost $329,683) | 178,453 | |||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. CORPORATE BONDS (6.28%) | |||||||||||||||

| Basic Materials (0.21%) | |||||||||||||||

| $ | 175,000 | ASP Unifrax Holdings, Inc.(c) | 7.50 | % | 09/30/29 | $ | 121,795 | ||||||||

| 260,000 | Illuminate Buyer LLC / Illuminate Holdings IV, Inc.(c) | 9.00 | % | 07/01/28 | 205,739 | ||||||||||

| 195,000 | Vibrantz Technologies, Inc.(c) | 9.00 | % | 02/15/30 | 137,737 | ||||||||||

| 465,271 | |||||||||||||||

| Communications (0.57%) | |||||||||||||||

| 275,000 | Cengage Learning, Inc.(c) | 9.50 | % | 06/15/24 | 254,768 | ||||||||||

| 545,000 | Embarq Corp Eq | 8.00 | % | 06/01/36 | 410,486 | ||||||||||

| 510,000 | Endurance International Group Holdings, Inc.(c) | 6.00 | % | 02/15/29 | 368,817 | ||||||||||

| 225,000 | McGraw-Hill Education, Inc.(c) | 5.75 | % | 08/01/28 | 193,094 | ||||||||||

| 1,227,165 | |||||||||||||||

| Consumer, Cyclical (0.66%) | |||||||||||||||

| 45,000 | Carnival Corp.(c) | 7.63 | % | 03/01/26 | 34,959 | ||||||||||

| 330,000 | Dealer Tire LLC / DT Issuer LLC(c) | 8.00 | % | 02/01/28 | 285,519 | ||||||||||

| 60,000 | Park River Holdings, Inc.(c) | 5.63 | % | 02/01/29 | 37,478 | ||||||||||

| 300,000 | PetSmart, Inc. / PetSmart Finance Corp.(c) | 7.75 | % | 02/15/29 | 270,826 | ||||||||||

| 155,000 | Premier Entertainment Sub LLC(c) | 5.63 | % | 09/01/29 | 110,589 | ||||||||||

See Notes to Financial Statements.

| 18 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| Consumer, Cyclical (continued) | |||||||||||||||

| $ | 125,000 | Premier Entertainment Sub LLC(c) | 5.88 | % | 09/01/31 | $ | 86,925 | ||||||||

| 280,000 | SWF Escrow Issuer Corp.(c) | 6.50 | % | 10/01/29 | 188,699 | ||||||||||

| 190,000 | TKC Holdings, Inc.(c) | 10.50 | % | 05/15/29 | 155,743 | ||||||||||

| 405,000 | Wheel Pros, Inc.(c) | 6.50 | % | 05/15/29 | 286,759 | ||||||||||

| 1,457,497 | |||||||||||||||

| Consumer, Non-cyclical (0.46%) | |||||||||||||||

| 270,000 | Air Methods Corp.(c) | 8.00 | % | 05/15/25 | 177,233 | ||||||||||

| 160,000 | CHS/Community Health Systems, Inc.(c) | 6.88 | % | 04/15/29 | 103,666 | ||||||||||

| 40,000 | Coty, Inc.(c) | 6.50 | % | 04/15/26 | 36,937 | ||||||||||

| 150,000 | PECF USS Intermediate Holding III Corp.(c) | 8.00 | % | 11/15/29 | 119,085 | ||||||||||

| 127,656 | Pyxus Holdings, Inc. | 10.00 | % | 08/24/24 | 106,459 | ||||||||||

| 305,000 | Radiology Partners, Inc.(c) | 9.25 | % | 02/01/28 | 229,506 | ||||||||||

| 110,000 | Sabre GLBL, Inc.(c) | 7.38 | % | 09/01/25 | 102,240 | ||||||||||

| 190,000 | Triton Water Holdings, Inc.(c) | 6.25 | % | 04/01/29 | 135,215 | ||||||||||

| 1,010,341 | |||||||||||||||

| Energy (0.40%) | |||||||||||||||

| 200,000 | Kosmos Energy, Ltd.(e) | 7.50 | % | 03/01/28 | 166,106 | ||||||||||

| 580,000 | NGL Energy Operating LLC / NGL Energy Finance Corp.(c) | 7.50 | % | 02/01/26 | 524,045 | ||||||||||

| 250,000 | SierraCol Energy Andina LLC(c) | 6.00 | % | 06/15/28 | 182,876 | ||||||||||

| 873,027 | |||||||||||||||

| Financial (3.37%) | |||||||||||||||

| 2,000,000 | Bain Capital Specialty Finance, Inc. | 8.50 | % | 06/10/23 | 2,000,000 | ||||||||||

| 1,648,448 | New Mountain Finance Corp. | 5.75 | % | 08/15/23 | 1,650,096 | ||||||||||

| 4,150,000 | PennantPark Floating Rate Capital, Ltd. | 4.25 | % | 04/01/26 | 3,728,438 | ||||||||||

| 7,378,534 | |||||||||||||||

| Industrial (0.22%) | |||||||||||||||

| 105,000 | Artera Services LLC(c) | 9.03 | % | 12/04/25 | 84,887 | ||||||||||

| 365,000 | Triumph Group, Inc.(c) | 6.25 | % | 09/15/24 | 326,043 | ||||||||||

| 90,000 | Triumph Group, Inc. | 7.75 | % | 08/15/25 | 69,426 | ||||||||||

| 480,356 | |||||||||||||||

| Technology (0.31%) | |||||||||||||||

| 510,000 | Castle US Holding Corp.(c) | 9.50 | % | 02/15/28 | 436,195 | ||||||||||

| 72,390 | CWT Travel Group, Inc.(c) | 8.50 | % | 11/19/26 | 65,422 | ||||||||||

| 225,000 | Virtusa Corp.(c) | 7.13 | % | 12/15/28 | 181,198 | ||||||||||

| 682,815 | |||||||||||||||

| Utilities (0.08%) | |||||||||||||||

| 200,000 | Mercury Chile Holdco LLC(c) | 6.50 | % | 01/24/27 | 173,684 | ||||||||||

| TOTAL U.S. CORPORATE BONDS | |||||||||||||||

| (Cost $15,793,888) | 13,748,690 | ||||||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 19 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. GOVERNMENT / AGENCY MORTGAGE BACKED SECURITIES (36.51%) | |||||||||||||||

| $ | 204,466 | Alternative Loan Trust(a) | 3.37 | % | 12/25/35 | $ | 192,914 | ||||||||

| 548,038 | Alternative Loan Trust | 5.50 | % | 11/25/35 | 383,138 | ||||||||||

| 1,917,736 | Alternative Loan Trust | 5.50 | % | 12/25/35 | 1,579,354 | ||||||||||

| 1,898,590 | Alternative Loan Trust | 5.75 | % | 03/25/37 | 1,215,257 | ||||||||||

| 2,195,772 | Alternative Loan Trust | 6.00 | % | 07/25/37 | 1,297,483 | ||||||||||

| 1,864,104 | Alternative Loan Trust | 6.25 | % | 08/25/37 | 1,170,429 | ||||||||||

| 1,053,340 | Alternative Loan Trust | 6.50 | % | 09/25/36 | 648,159 | ||||||||||

| 1,631,773 | Banc of America Funding Trust(a) | 2.70 | % | 05/20/36 | 1,351,565 | ||||||||||

| 894,394 | Banc of America Mortgage Trust | 6.00 | % | 09/25/37 | 815,980 | ||||||||||

| 1,214,959 | Bear Stearns ALT-A Trust(a) | 3.25 | % | 01/25/36 | 1,142,944 | ||||||||||

| 781,079 | Bear Stearns ARM Trust(a) | 3.25 | % | 07/25/36 | 699,943 | ||||||||||

| 2,519,873 | Chase Mortgage Finance Trust Series(a) | 1M US L + 0.60 | % | 06/25/37 | 844,978 | ||||||||||

| 2,320,330 | ChaseFlex Trust Series 2007-1 | 6.50 | % | 02/25/37 | 996,635 | ||||||||||

| 3,930,000 | CHL GMSR Issuer Trust(a)(c) | 1M US L + 2.75 | % | 05/25/23 | 3,892,615 | ||||||||||

| 1,427,049 | CHL Mortgage Pass-Through Trust(a) | 3.05 | % | 03/25/37 | 1,265,200 | ||||||||||

| 1,425,385 | CHL Mortgage Pass-Through Trust | 5.75 | % | 07/25/37 | 843,321 | ||||||||||

| 1,458,865 | CHL Mortgage Pass-Through Trust(a) | 1M US L + 0.60 | % | 03/25/35 | 1,343,086 | ||||||||||

| 331,756 | Citigroup Mortgage Loan Trust(a) | 2.97 | % | 04/25/37 | 323,408 | ||||||||||

| 1,168,239 | Citigroup Mortgage Loan Trust, Inc.(a) | 2.98 | % | 10/25/35 | 759,418 | ||||||||||

| 4,500,000 | COLT 2021-4 Mortgage Loan Trust(a)(c) | 4.14 | % | 10/25/66 | 3,253,623 | ||||||||||

| 2,000,000 | Connecticut Avenue Securities Trust 2022-R02(a)(c) | 30D US SOFR + 7.65 | % | 01/25/27 | 1,753,414 | ||||||||||

| 1,000,000 | Connecticut Avenue Securities Trust 2022-R03(a)(c) | 30D US SOFR + 9.85 | % | 03/25/42 | 960,743 | ||||||||||

| 705,865 | CSFB Mortgage-Backed Pass-Through Certificates | 5.50 | % | 10/25/35 | 425,347 | ||||||||||

| 1,371,002 | CSMC Mortgage-Backed Trust | 6.00 | % | 02/25/37 | 920,030 | ||||||||||

| 1,626,872 | CSMC Mortgage-Backed Trust | 6.75 | % | 08/25/36 | 1,065,589 | ||||||||||

| 1,585,407 | Fannie Mae REMICS(a)(f) | 0.00 | % | 07/25/43 | 1,039,429 | ||||||||||

| 1,587,368 | Fannie Mae REMICS(a)(g) | 5.90% - 1M US L | 10/25/41 | 213,879 | |||||||||||

| 4,398,876 | Fannie Mae REMICS(a)(g) | 6.05% - 1M US L | 07/25/49 | 573,460 | |||||||||||

| 1,681,384 | Fannie Mae REMICS(a)(g) | 6.45% - 1M US L | 03/25/42 | 231,978 | |||||||||||

| 1,395,926 | Fannie Mae REMICS(a)(g) | 6.50% - 1M US L | 12/25/41 | 186,728 | |||||||||||

See Notes to Financial Statements.

| 20 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. GOVERNMENT / AGENCY MORTGAGE BACKED SECURITIES (continued) | |||||||||||||||

| $ | 497,268 | Fannie Mae REMICS(a) | 7.62% - 1M US L | 11/25/42 | $ | 355,689 | |||||||||

| 699,311 | Federal Home Loan Mortgage Corp. REMICS(a) | 4.05% - 1M US L | 01/15/33 | 635,808 | |||||||||||

| 297,875 | First Horizon Alternative Mortgage Securities Trust(a) | 3.20 | % | 10/25/35 | 264,997 | ||||||||||

| 11,987,627 | Freddie Mac REMICS(g) | 2.00 | % | 11/25/50 | 1,503,297 | ||||||||||

| 4,137,237 | Freddie Mac REMICS | 4.00 | % | 12/15/40 | 4,176,960 | ||||||||||

| 2,864,245 | Freddie Mac REMICS(a)(g) | 5.90% - 1M US L | 12/15/41 | 315,515 | |||||||||||

| 3,618,367 | Freddie Mac REMICS(a)(g) | 6.10% - 1M US L | 08/25/50 | 568,087 | |||||||||||

| 2,000,000 | Freddie Mac STACR REMIC Trust 2020-DNA6(a)(c) | 30D US SOFR + 5.65 | % | 12/25/50 | 1,711,509 | ||||||||||

| 1,700,000 | Freddie Mac STACR REMIC Trust 2021-DNA1(a)(c) | 30D US SOFR + 4.75 | % | 01/25/51 | 1,332,910 | ||||||||||

| 1,250,000 | Freddie Mac STACR REMIC Trust 2022-DNA1(a)(c) | 30D US SOFR + 7.10 | % | 01/25/42 | 1,016,667 | ||||||||||

| 5,133,882 | Government National Mortgage Association(a)(g) | 0.73 | % | 09/16/58 | 188,389 | ||||||||||

| 8,404,847 | Government National Mortgage Association(a)(g) | 0.81 | % | 11/20/69 | 422,556 | ||||||||||

| 6,050,069 | Government National Mortgage Association(a)(g) | 0.98 | % | 12/16/62 | 446,001 | ||||||||||

| 5,990,904 | Government National Mortgage Association(a)(g) | 1.35 | % | 11/20/70 | 396,564 | ||||||||||

| 7,478,339 | Government National Mortgage Association(a)(g) | 1.36 | % | 09/20/70 | 419,177 | ||||||||||

| 7,441,851 | Government National Mortgage Association(a)(g) | 1.74 | % | 09/20/66 | 436,375 | ||||||||||

| 7,353,607 | Government National Mortgage Association(a)(g) | 1.98 | % | 06/20/70 | 366,107 | ||||||||||

| 9,826,858 | Government National Mortgage Association(a)(g) | 2.20 | % | 11/20/71 | 540,860 | ||||||||||

| 4,443,768 | Government National Mortgage Association | 3.50 | % | 02/20/47 | 4,326,892 | ||||||||||

| 16,651,398 | Government National Mortgage Association(a)(g) | 2.65% - 30D US SOFR | 01/20/52 | 347,493 | |||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 21 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. GOVERNMENT / AGENCY MORTGAGE BACKED SECURITIES (continued) | |||||||||||||||

| $ | 6,891,005 | Government National Mortgage Association(a)(g) | 3.20% - 30D US SOFR | 12/20/51 | $ | 217,577 | |||||||||

| 7,752,523 | Government National Mortgage Association(a)(g) | 3.70% - 30D US SOFR | 09/20/51 | 436,408 | |||||||||||

| 6,275,408 | Government National Mortgage Association(a)(g) | 3.75% - 1M US L | 10/20/50 | 403,728 | |||||||||||

| 7,139,515 | Government National Mortgage Association(a)(g) | 3.75% - 1M US L | 11/20/50 | 314,640 | |||||||||||

| 14,877,453 | Government National Mortgage Association(a)(g) | 3M US L + 2.44 | % | 06/20/51 | 260,263 | ||||||||||

| 8,415,177 | Government National Mortgage Association(a)(g) | 5.37% - 1M US L | 07/20/44 | 784,155 | |||||||||||

| 3,983,453 | Government National Mortgage Association(a)(g) | 6.30% - 1M US L | 09/20/50 | 646,793 | |||||||||||

| 3,574,302 | Government National Mortgage Association(a)(g) | 6.30% - 1M US L | 10/20/50 | 525,365 | |||||||||||

| 3,970,088 | Government National Mortgage Association(a)(g) | 6.30% - 1M US L | 01/20/51 | 590,377 | |||||||||||

| 834,225 | Homeward Opportunities Fund Trust 2020-BPL1(c)(h) | 5.44 | % | 08/25/25 | 831,539 | ||||||||||

| 1,700,000 | Imperial Fund Mortgage Trust 2021-NQM3(a)(c) | 4.18 | % | 11/25/56 | 1,207,906 | ||||||||||

| 5,900,000 | Legacy Mortgage Asset Trust(c)(h) | 4.50 | % | 11/25/59 | 5,872,209 | ||||||||||

| 1,543,638 | Luminent Mortgage Trust(a) | 1M US L + 0.40 | % | 05/25/36 | 1,334,667 | ||||||||||

| 949,894 | Luminent Mortgage Trust(a) | 1M US L + 0.42 | % | 05/25/36 | 892,774 | ||||||||||

| 1,803,262 | Nomura Asset Acceptance Corp. Alternative Loan Trust(h) | 5.69 | % | 08/25/35 | 1,038,071 | ||||||||||

| 7,363,971 | Nomura Asset Acceptance Corp. Alternative Loan Trust(a) | 1M US L + 0.54 | % | 02/25/36 | 1,171,478 | ||||||||||

| 1,447,043 | RALI Series Trust(a) | 5.36 | % | 09/25/37 | 1,256,127 | ||||||||||

| 1,994,334 | Residential Asset Securitization Trust | 5.75 | % | 02/25/36 | 933,975 | ||||||||||

| 1,873,685 | Residential Asset Securitization Trust | 6.00 | % | 05/25/37 | 1,242,313 | ||||||||||

| 683,859 | RFMSI Trust(a) | 2.75 | % | 06/25/35 | 479,535 | ||||||||||

| 1,470,022 | RFMSI Trust | 6.00 | % | 09/25/36 | 1,243,146 | ||||||||||

| 1,936,000 | Spruce Hill Mortgage Loan Trust 2020-SH1(a)(c) | 4.68 | % | 01/28/50 | 1,767,601 | ||||||||||

| 473,074 | Structured Adjustable Rate Mortgage Loan Trust(a) | 3.04 | % | 12/25/35 | 428,168 | ||||||||||

See Notes to Financial Statements.

| 22 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. GOVERNMENT / AGENCY MORTGAGE BACKED SECURITIES (continued) | |||||||||||||||

| $ | 1,377,147 | Structured Adjustable Rate Mortgage Loan Trust(a) | 3.48 | % | 09/25/37 | $ | 1,265,126 | ||||||||

| 282,151 | Structured Asset Mortgage Investments II Trust(a) | 1.16 | % | 03/25/46 | 282,163 | ||||||||||

| 1,000,000 | Verus Securitization Trust 2021-7(a)(c) | 4.19 | % | 10/25/66 | 698,482 | ||||||||||

| 1,031,445 | WaMu Mortgage Pass-Through Certificates Trust(a) | 2.92 | % | 08/25/46 | 956,601 | ||||||||||

| 912,968 | WaMu Mortgage Pass-Through Certificates Trust(a) | 3.10 | % | 08/25/36 | 795,094 | ||||||||||

| 1,040,497 | WaMu Mortgage Pass-Through Certificates Trust(a) | 3.29 | % | 03/25/37 | 989,696 | ||||||||||

| TOTAL U.S. GOVERNMENT / AGENCY MORTGAGE BACKED SECURITIES | |||||||||||||||

| (Cost $102,883,291) | 80,027,877 | ||||||||||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| U.S. GOVERNMENT BONDS AND NOTES (7.44%) | |||||||||||||||

| 23,150,000 | U.S. Treasury Bond | 1.63 | % | 11/15/50 | 16,292,265 | ||||||||||

| TOTAL U.S. GOVERNMENT BONDS AND NOTES | |||||||||||||||

| (Cost $22,030,703) | 16,292,265 | ||||||||||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| FOREIGN CORPORATE BONDS (5.49%) | |||||||||||||||

| Basic Materials (0.55%) | |||||||||||||||

| 300,000 | Braskem Idesa SAPI(c) | 6.99 | % | 02/20/32 | 232,454 | ||||||||||

| 200,000 | CAP SA(e) | 3.90 | % | 04/27/31 | 157,143 | ||||||||||

| 350,000 | Metinvest BV(e) | 7.75 | % | 10/17/29 | 191,853 | ||||||||||

| 400,000 | OCP SA(e) | 5.13 | % | 06/23/51 | 266,654 | ||||||||||

| 200,000 | Unigel Luxembourg SA(e) | 8.75 | % | 10/01/26 | 198,280 | ||||||||||

| 250,000 | Vedanta Resources Finance II PLC(c) | 9.25 | % | 04/23/26 | 149,631 | ||||||||||

| 1,196,015 | |||||||||||||||

| Communications (0.39%) | |||||||||||||||

| 435,000 | Intelsat Escrow Shares | 0.00 | % | 12/31/49 | – | ||||||||||

| $ | 350,000 | Oi SA(i) | 10.00 | % | 07/27/25 | $ | 171,829 | ||||||||

| 300,000 | Telecommunications Services of Trinidad & Tobago, Ltd.(e) | 8.88 | % | 10/18/29 | 288,965 | ||||||||||

| 205,000 | Telesat Canada / Telesat LLC(c) | 5.63 | % | 12/06/26 | 129,814 | ||||||||||

| 400,000 | VTR Finance NV(e) | 6.38 | % | 07/15/28 | 286,047 | ||||||||||

| 876,655 | |||||||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 23 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| Consumer, Cyclical (0.07%) | |||||||||||||||

| $ | 200,000 | Gajah Tunggal Tbk PT | 8.95 | % | 06/23/26 | $ | 152,000 | ||||||||

| Consumer, Non-cyclical (0.79%) | |||||||||||||||

| 150,000 | Atento Luxco 1 SA(c) | 8.00 | % | 02/10/26 | 107,271 | ||||||||||

| 150,000 | Camposol SA(c) | 6.00 | % | 02/03/27 | 126,355 | ||||||||||

| 150,000 | Camposol SA(e) | 6.00 | % | 02/03/27 | 126,355 | ||||||||||

| 200,000 | Coruripe Netherlands BV(e) | 10.00 | % | 02/10/27 | 172,510 | ||||||||||

| 225,000 | Endo Luxembourg Finance Co. I SARL / Endo US, Inc.(c) | 6.13 | % | 04/01/29 | 170,530 | ||||||||||

| 450,000 | Frigorifico Concepcion SA(c) | 7.70 | % | 07/21/28 | 354,285 | ||||||||||

| 450,000 | Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.(c) | 7.00 | % | 12/31/27 | 338,074 | ||||||||||

| 200,000 | Movida Europe SA(e) | 5.25 | % | 02/08/31 | 155,281 | ||||||||||

| 200,000 | SSMS Plantation Holdings Pte, Ltd. | 7.75 | % | 01/23/23 | 177,000 | ||||||||||

| 1,727,661 | |||||||||||||||

| Diversified (0.08%) | |||||||||||||||

| 200,000 | ABM Investama Tbk PT(c) | 9.50 | % | 08/05/26 | 177,070 | ||||||||||

| Energy (1.32%) | |||||||||||||||

| 250,000 | AI Candelaria Spain SA(c) | 5.75 | % | 06/15/33 | 183,396 | ||||||||||

| 350,000 | Ecopetrol SA | 5.88 | % | 05/28/45 | 238,875 | ||||||||||

| 200,000 | Ecopetrol SA | 5.88 | % | 11/02/51 | 131,175 | ||||||||||

| 250,000 | Gran Tierra Energy, Inc.(c) | 7.75 | % | 05/23/27 | 214,030 | ||||||||||

| 183,200 | Hunt Oil Co. of Peru LLC Sucursal Del Peru(e) | 6.38 | % | 06/01/28 | 168,086 | ||||||||||

| 400,000 | MC Brazil Downstream Trading SARL(e) | 7.25 | % | 06/30/31 | 318,938 | ||||||||||

| 100,000 | NGD Holdings BV | 6.75 | % | 12/31/26 | 44,600 | ||||||||||

| 200,000 | Pertamina Persero PT(e) | 4.15 | % | 02/25/60 | 149,307 | ||||||||||

| 150,000 | Petrobras Global Finance BV | 5.50 | % | 06/10/51 | 114,067 | ||||||||||

| 240,000 | Petrobras Global Finance BV | 6.90 | % | 03/19/49 | 214,962 | ||||||||||

| 400,000 | Petroleos del Peru SA(e) | 5.63 | % | 06/19/47 | 272,662 | ||||||||||

| 250,000 | Petroleos Mexicanos | 6.38 | % | 01/23/45 | 151,966 | ||||||||||

| 150,000 | Petroleos Mexicanos | 6.75 | % | 09/21/47 | 93,143 | ||||||||||

| 200,000 | Tullow Oil PLC(c) | 10.25 | % | 05/15/26 | 191,531 | ||||||||||

| 189,725 | UEP Penonome II SA(c) | 6.50 | % | 10/01/38 | 177,585 | ||||||||||

| 350,000 | YPF SA | 7.00 | % | 12/15/47 | 172,429 | ||||||||||

| 100,000 | YPF SA | 8.50 | % | 06/27/29 | 61,935 | ||||||||||

| 2,898,687 | |||||||||||||||

| Financial (1.23%) | |||||||||||||||

| 200,000 | Agile Group Holdings, Ltd.(a)(j) | 6.88 | % | Perpetual Maturity | 43,900 | ||||||||||

| 300,000 | Alpha Holding SA de CV(c) | 9.00 | % | 02/10/25 | 19,500 | ||||||||||

See Notes to Financial Statements.

| 24 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| Financial (continued) | |||||||||||||||

| $ | 200,000 | Banco Davivienda SA(a)(c)(j) | 10Y US TI + 5.10 | % | Perpetual Maturity | $ | 160,127 | ||||||||

| 300,000 | Banco do Brasil SA(a)(j) | 6.25 | % | Perpetual Maturity | 264,000 | ||||||||||

| 100,000 | Banco GNB Sudameris SA(a)(e) | 5Y US TI + 4.56 | % | 04/03/27 | 89,963 | ||||||||||

| 200,000 | Banco GNB Sudameris SA(a)(c) | 5Y US TI + 6.66 | % | 04/16/31 | 171,199 | ||||||||||

| 250,000 | Banco Mercantil del Norte SA/Grand Cayman(a)(c)(j) | 10Y US TI + 5.034 | % | Perpetual Maturity | 204,625 | ||||||||||

| 200,000 | Banco Mercantil del Norte SA/Grand Cayman(a)(e)(j) | 10Y US TI + 5.034 | % | Perpetual Maturity | 163,700 | ||||||||||

| 300,000 | Bangkok Bank PCL(a)(c)(j) | 5Y US TI + 4.73 | % | Perpetual Maturity | 276,198 | ||||||||||

| 200,000 | Central China Real Estate, Ltd. | 7.25 | % | 07/16/24 | 64,500 | ||||||||||

| 200,000 | Credivalores-Crediservicios SAS(c) | 8.88 | % | 02/07/25 | 110,632 | ||||||||||

| 250,000 | Gilex Holding SARL | 8.50 | % | 05/02/23 | 244,425 | ||||||||||

| 350,000 | Itau Unibanco Holding SA Island(a)(e)(j) | 5Y US TI + 4.63 | % | Perpetual Maturity | 280,482 | ||||||||||

| 200,000 | Jababeka International BV(e) | 6.50 | % | 10/05/23 | 131,200 | ||||||||||

| 250,000 | Mexarrend SAPI de CV(c) | 10.25 | % | 07/24/24 | 119,447 | ||||||||||

| 200,000 | Operadora de Servicios Mega SA de CV Sofom ER(c) | 8.25 | % | 02/11/25 | 130,273 | ||||||||||

| 200,000 | RKP Overseas Finance, Ltd.(j) | 7.95 | % | Perpetual Maturity | 90,802 | ||||||||||

| 200,000 | Ronshine China Holdings, Ltd. | 6.75 | % | 08/05/24 | 18,000 | ||||||||||

| 250,000 | Unifin Financiera SAB de CV(a)(e)(j) | 8.88 | % | Perpetual Maturity | 81,767 | ||||||||||

| 200,000 | Yuzhou Group Holdings Co., Ltd. | 8.30 | % | 05/27/25 | 15,000 | ||||||||||

| 2,679,740 | |||||||||||||||

| Industrial (0.27%) | |||||||||||||||

| 400,000 | Mexico City Airport Trust(e) | 5.50 | % | 07/31/47 | 275,468 | ||||||||||

| 400,000 | Simpar Europe SA(e) | 5.20 | % | 01/26/31 | 309,614 | ||||||||||

| 585,082 | |||||||||||||||

| Utilities (0.79%) | |||||||||||||||

| 200,000 | AES Andres BV(c) | 5.70 | % | 05/04/28 | 170,732 | ||||||||||

| 292,600 | Empresa Electrica Cochrane SpA(e) | 5.50 | % | 05/14/27 | 246,513 | ||||||||||

| 300,000 | Empresas Publicas de Medellin ESP(e) | 4.38 | % | 02/15/31 | 230,051 | ||||||||||

| 400,000 | EnfraGen Energia Sur SA / EnfraGen Spain SA / Prime Energia SpA(e) | 5.38 | % | 12/30/30 | 270,682 | ||||||||||

| 200,000 | Guacolda Energia SA(e) | 4.56 | % | 04/30/25 | 70,763 | ||||||||||

| 200,000 | Inkia Energy, Ltd.(e) | 5.88 | % | 11/09/27 | 183,400 | ||||||||||

| 450,000 | Minejesa Capital BV | 5.63 | % | 08/10/37 | 364,956 | ||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 25 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| Utilities (continued) | |||||||||||||||

| $ | 250,000 | Mong Duong Finance Holdings BV(e) | 5.13 | % | 05/07/29 | $ | 202,188 | ||||||||

| 1,739,285 | |||||||||||||||

| TOTAL FOREIGN CORPORATE BONDS | |||||||||||||||

| (Cost $15,911,854) | 12,032,195 | ||||||||||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| FOREIGN GOVERNMENT BONDS (0.62%) | |||||||||||||||

| Government (0.62%) | |||||||||||||||

| 450,000 | Brazilian Government International Bond | 4.75 | % | 01/14/50 | 306,238 | ||||||||||

| 200,000 | Colombia Government International Bond | 4.13 | % | 02/22/42 | 124,765 | ||||||||||

| 200,000 | Colombia Government International Bond | 5.00 | % | 06/15/45 | 134,410 | ||||||||||

| 200,000 | Colombia Government International Bond | 5.20 | % | 05/15/49 | 136,160 | ||||||||||

| 250,000 | Dominican Republic International Bond(e) | 5.30 | % | 01/21/41 | 174,136 | ||||||||||

| 200,000 | Dominican Republic International Bond(c) | 6.00 | % | 02/22/33 | 167,112 | ||||||||||

| 350,000 | Republic of South Africa Government International Bond | 5.65 | % | 09/27/47 | 239,872 | ||||||||||

| 300,000 | Ukraine Government International Bond(e) | 7.25 | % | 03/15/33 | 75,376 | ||||||||||

| 1,358,069 | |||||||||||||||

| TOTAL FOREIGN GOVERNMENT BONDS | |||||||||||||||

| (Cost $2,033,450) | 1,358,069 | ||||||||||||||

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (31.80%) | |||||||||||||||

| 28,899 | Affirm Asset Securitization Trust 2021-Z1(c) | 0.00 | % | 08/15/24 | 210,239 | ||||||||||

| 372,000 | Alen 2021-ACEN Mortgage Trust(a)(c) | 1M US L + 4.00 | % | 04/15/26 | 353,531 | ||||||||||

| 700,000 | AMSR 2021-SFR3 Trust(c) | 4.90 | % | 10/17/26 | 622,649 | ||||||||||

| 1,550,000 | AMSR 2021-SFR3 Trust(c) | 5.88 | % | 10/17/26 | 1,385,628 | ||||||||||

| 538,000 | AREIT Trust(a)(c) | 30D SOFR + 2.76 | % | 09/16/36 | 528,376 | ||||||||||

| 433,000 | Atrium Hotel Portfolio Trust(a)(c) | 1M US L + 3.40 | % | 06/15/35 | 395,949 | ||||||||||

| 500,000 | Atrium XIII(a)(c) | 3M US L + 6.05 | % | 11/21/30 | 437,779 | ||||||||||

See Notes to Financial Statements.

| 26 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (continued) | |||||||||||||||

| $ | 500,000 | Atrium XIV LLC(a)(c) | 3M US L + 5.65 | % | 08/23/30 | $ | 448,218 | ||||||||

| 730,000 | BAMLL Commercial Mortgage Securities Trust(a)(c) | 2.57 | % | 03/15/34 | 701,980 | ||||||||||

| 682,000 | BBCMS Trust(a)(c) | 1M US L + 3.55 | % | 07/15/37 | 647,536 | ||||||||||

| 463,247 | BB-UBS Trust(a)(c) | 3.68 | % | 06/05/30 | 348,594 | ||||||||||

| 498,000 | Benchmark 2018-B4 Mortgage Trust(a)(c) | 2.95 | % | 07/17/51 | 383,086 | ||||||||||

| 546,000 | Benchmark 2021-B31 Mortgage Trust(c) | 2.25 | % | 11/15/31 | 323,980 | ||||||||||

| 315,000 | BF Mortgage Trust(a)(c) | 1M US L + 3.00 | % | 12/15/35 | 285,059 | ||||||||||

| 2,133,074 | Blackbird Capital Aircraft Lease Securitization, Ltd.(c)(h) | 5.68 | % | 12/16/41 | 1,804,524 | ||||||||||

| 321,000 | BX Commercial Mortgage Trust(a)(c) | 1M US L + 1.90 | % | 04/15/34 | 305,428 | ||||||||||

| 325,000 | BX Trust(a)(c) | 4.08 | % | 12/06/41 | 262,823 | ||||||||||

| 167,283 | Carbon Capital VI Commercial Mortgage Trust(a)(c) | 1M US L + 2.85 | % | 11/15/21 | 163,443 | ||||||||||

| 5,000 | Carvana Auto Receivables Trust(c) | 0.00 | % | 05/10/28 | 2,200,644 | ||||||||||

| 416,111 | Castlelake Aircraft Securitization Trust(c) | 6.63 | % | 06/15/43 | 279,748 | ||||||||||

| 1,250,000 | Castlelake Aircraft Structured Trust(c) | 0.00 | % | 04/15/39 | 218,750 | ||||||||||

| 500,000 | CIFC Funding 2019-III, Ltd.(a)(c) | 3M US L + 6.80 | % | 10/16/34 | 458,880 | ||||||||||

| 500,000 | CIFC Funding, Ltd.(a)(c) | 3M US L + 6.50 | % | 07/15/34 | 448,341 | ||||||||||

| 138,000 | Citigroup Commercial Mortgage Trust(c) | 2.85 | % | 02/12/49 | 90,985 | ||||||||||

| 475,000 | Citigroup Commercial Mortgage Trust(a)(c) | 3.62 | % | 12/12/41 | 323,294 | ||||||||||

| 196,000 | Citigroup Commercial Mortgage Trust(a)(c) | 4.42 | % | 02/12/48 | 175,829 | ||||||||||

| 319,000 | Citigroup Commercial Mortgage Trust(a)(c) | 1M US L + 3.65 | % | 12/15/36 | 299,345 | ||||||||||

| 320,000 | Citigroup Commercial Mortgage Trust 2019-SMRT(a)(c) | 4.75 | % | 01/10/36 | 310,363 | ||||||||||

| 1,500,000 | Cologix Data Centers US Issuer LLC(c) | 5.99 | % | 12/28/26 | 1,359,336 | ||||||||||

| 878,000 | COMM Mortgage Trust(a)(c) | 1M US L + 2.18 | % | 09/15/33 | 817,805 | ||||||||||

| 428,000 | CSAIL 2016-C6 Commercial Mortgage Trust(a)(c) | 5.09 | % | 01/15/49 | 360,499 | ||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 27 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (continued) | |||||||||||||||

| $ | 264,991 | DBGS 2018-BIOD Mortgage Trust(a)(c) | 1M US L + 2.00 | % | 05/15/35 | $ | 250,655 | ||||||||

| 416,000 | DBJPM 16-C1 Mortgage Trust(a) | 3.33 | % | 05/12/49 | 363,052 | ||||||||||

| 500,000 | Dryden 37 Senior Loan Fund(a)(c) | 3M US L + 5.15 | % | 01/15/31 | 402,442 | ||||||||||

| 500,000 | Dryden 38 Senior Loan Fund(a)(c) | 3M US L + 5.60 | % | 07/15/30 | 409,553 | ||||||||||

| 500,000 | Dryden 40 Senior Loan Fund(a)(c) | 3M US L + 5.75 | % | 08/15/31 | 412,566 | ||||||||||

| 496,942 | Extended Stay America Trust 2021-ESH(a)(c) | 1M US L + 3.70 | % | 07/15/26 | 468,614 | ||||||||||

| 35,207,599 | Fannie Mae-Aces(a)(g) | 0.22 | % | 10/25/29 | 455,713 | ||||||||||

| 46,440,000 | Fannie Mae-Aces(a)(g) | 0.27 | % | 05/25/30 | 629,216 | ||||||||||

| 16,832,098 | Fannie Mae-Aces(a)(g) | 0.35 | % | 04/25/29 | 329,004 | ||||||||||

| 9,024,808 | Fannie Mae-Aces(a)(g) | 0.58 | % | 12/25/30 | 240,427 | ||||||||||

| 18,030,032 | Fannie Mae-Aces(a)(g) | 0.63 | % | 02/25/29 | 508,328 | ||||||||||

| 16,640,154 | Fannie Mae-Aces(a)(g) | 0.67 | % | 11/01/31 | 587,144 | ||||||||||

| 15,959,338 | Fannie Mae-Aces(a)(g) | 0.87 | % | 07/25/32 | 1,045,111 | ||||||||||

| 5,416,338 | Fannie Mae-Aces(a)(g) | 1.15 | % | 03/25/31 | 391,610 | ||||||||||

| 4,786,345 | Fannie Mae-Aces(a)(g) | 1.30 | % | 09/25/30 | 332,356 | ||||||||||

| 700,000 | FirstKey Homes 2020-SFR1 Trust(c) | 4.28 | % | 08/19/37 | 659,547 | ||||||||||

| 1,700,000 | FMC GMSR Issuer Trust(a)(c) | 4.36 | % | 07/25/26 | 1,532,978 | ||||||||||

| 1,750,000 | FMC GMSR Issuer Trust(a)(c) | 4.44 | % | 10/25/26 | 1,570,073 | ||||||||||

| 546,000 | Fontainebleau Miami Beach Trust(a)(c) | 3.96 | % | 12/12/36 | 479,442 | ||||||||||

| 750,000 | Freddie Mac Multifamily Structured Credit Risk(a)(c) | 30D US SOFR + 3.75 | % | 01/25/51 | 653,324 | ||||||||||

| 267,035 | FREMF 2015-KF07 Mortgage Trust(a)(c) | 1M US L + 4.95 | % | 02/25/25 | 266,865 | ||||||||||

| 299,980 | FREMF 2016-KF19 Mortgage Trust(a)(c) | 1M US L + 5.50 | % | 06/25/23 | 299,962 | ||||||||||

| 266,080 | FREMF 2016-KF25 Mortgage Trust(a)(c) | 1M US L + 5.00 | % | 10/25/23 | 265,995 | ||||||||||

| 795,901 | FREMF 2018-KF56 Mortgage Trust(a)(c) | 1M US L + 5.80 | % | 11/25/28 | 783,787 | ||||||||||

| 994,040 | FREMF 2019-KF71 Mortgage Trust(a)(c) | 1M US L + 6.00 | % | 10/25/29 | 995,369 | ||||||||||

| 1,200,000 | FRTKL 2021-SFR1(c) | 4.11 | % | 09/17/26 | 1,039,719 | ||||||||||

| 500,000 | FS Rialto 2022-FL5 Issuer LLC(a)(c) | 1M US SOFR + 4.818 | % | 06/19/37 | 493,839 | ||||||||||

| 5,994,895 | Ginnie Mae Strip(g) | 1.40 | % | 09/16/45 | 505,238 | ||||||||||

See Notes to Financial Statements.

| 28 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (continued) | |||||||||||||||

| $ | 4,224,104 | Government National Mortgage Association(a)(g) | 0.16 | % | 09/16/53 | $ | 28,140 | ||||||||

| 5,561,821 | Government National Mortgage Association(a)(g) | 0.99 | % | 05/16/63 | 439,173 | ||||||||||

| 1,100,000 | Great Wolf Trust(a)(c) | 1M US L + 3.13 | % | 12/15/36 | 1,010,685 | ||||||||||

| 500,000 | GS Mortgage Securities Corp. II(a)(c) | 1M US L + 5.00 | % | 11/15/23 | 473,668 | ||||||||||

| 500,000 | GS Mortgage Securities Corp. II(a)(c) | 1M US L + 5.9332 | % | 11/15/23 | 473,716 | ||||||||||

| 300,000 | GS Mortgage Securities Corp. Trust 2018-RIVR(a)(c) | 1M US L + 1.55 | % | 07/15/35 | 267,927 | ||||||||||

| 1,078,000 | GS Mortgage Securities Trust(a)(c) | 4.51 | % | 11/10/47 | 774,815 | ||||||||||

| 655,000 | GS Mortgage Securities Trust(a)(c) | 1M US L + 3.92 | % | 07/15/31 | 586,352 | ||||||||||

| 373,000 | GS Mortgage Securities Trust 2015-GC28(a)(c) | 4.46 | % | 02/10/48 | 335,971 | ||||||||||

| 3,680,000 | GS Mortgage Securities Trust 2021-GSA3(a)(c)(g) | 1.53 | % | 12/15/31 | 373,870 | ||||||||||

| 230,000 | Hawaii Hotel Trust(a)(c) | 1M US L + 2.75 | % | 05/15/38 | 213,012 | ||||||||||

| 500,000 | Highbridge Loan Management 4-2014, Ltd.(a)(c) | 3M US L + 5.55 | % | 01/28/30 | 420,391 | ||||||||||

| 500,000 | Highbridge Loan Management, Ltd.(a)(c) | 3M US L + 5.10 | % | 02/05/31 | 420,076 | ||||||||||

| 178,457 | HPLY Trust(a)(c) | 1M US L + 3.90 | % | 11/17/36 | 168,361 | ||||||||||

| 1,062,000 | JP Morgan BB Commercial Mortgage Securities Trust(a)(c) | 3.36 | % | 11/18/48 | 831,333 | ||||||||||

| 632,000 | JP Morgan BB Commercial Mortgage Securities Trust(a)(c) | 3.94 | % | 02/18/48 | 525,753 | ||||||||||

| 109,000 | JP Morgan Chase Commercial Mortgage Securities Trust(c) | 4.34 | % | 05/05/32 | 104,905 | ||||||||||

| 111,000 | JP Morgan Chase Commercial Mortgage Securities Trust(a)(c) | 4.45 | % | 05/05/32 | 105,179 | ||||||||||

| 130,000 | JP Morgan Chase Commercial Mortgage Securities Trust(a)(c) | 4.45 | % | 05/05/32 | 121,947 | ||||||||||

| 136,000 | JP Morgan Chase Commercial Mortgage Securities Trust(a)(c) | 4.45 | % | 05/05/32 | 120,098 | ||||||||||

| 148,000 | JP Morgan Chase Commercial Mortgage Securities Trust(a)(c) | 4.45 | % | 05/05/32 | 130,526 | ||||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2022 | 29 |

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

| Schedule of Investments | June 30, 2022 |

| Principal Amount/Description | Rate | Maturity | Value | ||||||||||||

| NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (continued) | |||||||||||||||

| $ | 411,000 | JP Morgan Chase Commercial Mortgage Securities Trust(a)(c) | 5.71 | % | 02/15/46 | $ | 148,414 | ||||||||