An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Subject to Completion, Dated October 7, 2016

FORM 1-A

REGULATION A OFFERING STATEMENT

PART II- PRELIMINARY OFFERING CIRCULAR

SECURED REAL ESTATE INCOME FUND II, LLC

8315 E Broadway Blvd.

Tucson, Arizona 85710

Tel: (888) 444-2102

info@reincomefunds.com

All correspondence to:

J. Martin Tate, Esq.

CARMAN LEHNHOF ISRAELSEN, LP

299 S. Main Street, Suite 1300

Salt Lake City, UT 84111

(801)(534-4435)

EMAIL FOR CORRESPONDENCE: mtate@clilaw.com

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

6162

|

81-2952810

|

|

(Primary standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

Up to $50,000,000 in Class A Units of Membership Interests

$5,000.00 Minimum Investment

This is an initial public offering of SECURED REAL ESTATE INCOME FUND II, LLC and no public market currently exists for our Class A Units of Membership Interests ("Class A Units"). The initial public offering price of our Class A Units is expected to be $10.00 per Class A Units. We plan to apply to have our Class A Units quoted on the OTCQB.

This offering circular follows the disclosure format of Form S-11 pursuant to general instructions of Part II(a)(1)(ii) of Form 1-A.

1

Secured Real Estate Income Fund II, LLC is a newly organized Delaware limited liability company ("SREIF" or the "Company") formed for the purpose of investing in a diversified portfolio of real estate loans and other debt instruments collateralized by first and second position security interests in residential real estate in the U.S. and the underlying real estate collateral. We intend to acquire senior and subordinate real estate secured loans, and to invest in real estate and real estate-related debt instruments primarily originated by our affiliates. In addition, we may acquire any real properties or real estate equity investments that in the opinion of our Managing Member, meets our investment objectives. We plan to diversify our portfolio by investment type, investment size and investment risk with the goal of attaining a portfolio of real estate assets that provide attractive and stable returns to our investors. We may make our investments through the investment in or acquisition of individual loans or loan portfolios. We may also finance real estate projects using other funding methods, including (but not limited to) joint venture equity financing. As of the date of this offering circular, we have not commenced operations and do not own any real property or real estate loans.

We are managed by SREIF Manager II, LLC, a Nevada limited liability company (the "Managing Member"), who has overall responsibility for managing and administering the business and affairs of the Company. The Managing Member has delegated responsibility and authority for making investment decisions for the Company to Good Steward Capital Management, Inc., an Arizona Corporation and investment adviser registered with the Securities and Exchange Commission, or SEC ("Investment Manager").

We are offering a minimum of 50,000 and a maximum of 5,000,000 Class A Units at an initial offering price of $10.00 per share, for a minimum offering amount of $500,000 and a maximum offering amount of $50,000,000. The minimum purchase requirement is 500 Class A Units, or $5,000; however, we can waive the minimum purchase requirement in our sole discretion. Following achievement of our minimum offering amount, we intend to hold additional closings on at least a monthly basis. The final closing will occur whenever we have reached the maximum offering amount. Until we achieve the minimum offering and have our initial closing and thereafter prior to each additional closing, the proceeds for that closing will be kept in an escrow account or, for subscribers purchasing through the FOLIO Investments, Inc. platform, deposited in such subscriber's account with FOLIO Investments, Inc., or Folio. We expect to offer Class A Units in this offering until we raise the maximum amount being offered, unless terminated by our Managing Member at an earlier time. Until the earlier of (a) December 31, 2016 or (b) the listing of our shares on a public exchange, the per Class A Unit purchase price for our Class A Units will be $10.00 per Class A Unit, an amount that was arbitrarily determined by our Managing Member. Thereafter, the per Class A Unit purchase price will be adjusted monthly on the first day of each month and will equal the sum of our net asset value, or NAV, divided by the number of our Class A Units outstanding as of the end of the prior month (NAV per Class A Unit). We intend to contact an authorized OTCQB market maker for sponsorship of our securities on the OTCQB, upon qualification of this Form 1-A. However, there is no guarantee our Class A Units will be accepted for quotation on the OTCQB.

We have engaged Cambria Capital, LLC, a FINRA member firm, which we refer to as Cambria Capital, to act as our non-exclusive placement agent in connection with this offering. We may engage other FINRA member firms to act as placement agents for this offering. Our placement agents will offer our shares to prospective investors on a best efforts basis. Neither Cambria Capital nor any other placement agent that we engage will be required to purchase any of our securities or make any firm commitment. There can be no assurance that any securities will be sold in this offering.

Investing in our Class A Units is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See "Risk Factors" beginning on page 20 to read about the more significant risks you should consider before buying our Class A Units. These risks include the following:

2

|

|

·

|

We depend on our Investment Manager to select our investments and conduct our operations. We will pay fees and expenses to our Managing Member, the Investment Manager and their affiliates that were not determined on an arm's length basis, and therefore we do not have the benefit of arm's length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

|

|

|

|

|

|

|

·

|

We have no operating history. The prior performance of our sponsor and its affiliated entities may not predict our future results. Therefore, there is no assurance that we will achieve our investment objectives.

|

|

|

|

|

|

|

·

|

We have not identified any investments to acquire with the net proceeds of this offering. You will not be able to evaluate our investments prior to purchasing Class A Units.

|

|

|

·

|

This offering is being made pursuant to recently adopted rules and regulations under Regulation A of the Securities Act of 1933, as amended, or the Securities Act. The legal and compliance requirements of these rules and regulations, including ongoing reporting requirements related thereto, are relatively untested.

|

|

|

|

|

|

|

·

|

If we raise substantially less than the maximum offering amount, we may not be able to acquire a diverse portfolio of investments and the value of your Class A Units may vary more widely with the performance of specific assets. We may commence operations with as little as $500,000.

|

|

|

|

|

|

|

·

|

We may change our investment guidelines without member consent, which could result in investments that are different from those described in this offering circular.

|

|

|

|

|

|

|

·

|

Although our distribution policy is not to use the proceeds of this offering to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds, borrowings or sales of assets. We have not established a limit on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for investments and your overall return may be reduced.

|

|

|

|

|

|

|

·

|

Our internal accountants will calculate our NAV on a quarterly basis using valuation methodologies that involve subjective judgments and estimates. As a result, our NAV may not accurately reflect the actual prices at which our real estate assets and investments, including related liabilities, could be liquidated on any given day.

|

|

|

|

|

|

|

·

|

Our Operating Agreement does not require our Managing Member to seek member approval to liquidate our assets by a specified date, nor does our Operating Agreement require our Managing Member to list our Class A Units for trading or to have them quoted on the over the counter market by a specified date. No public market currently exists for our Class A Units. Until our Class A Units are listed on an exchange or quoted on the over the counter market, if ever, you may not sell your Class A Units in a public market and must sell those securities through private transactions. If you are able to sell your Class A Units, you may have to sell them at a loss.

|

|

|

|

|

|

|

·

|

Our intended investments in real estate loans, real estate and other select real estate-related assets will be subject to risks relating to the volatility in the value of the underlying real estate, default on underlying income streams, fluctuations in interest rates, and other risks associated with debt, and real estate investments generally. These investments are only suitable for sophisticated investors with a high-risk investment profile.

|

|

·

|

We believe we are a partnership for U.S. federal income tax purposes and are solely relying on an opinion rendered by Durham Jones & Pinegar P.C. in making this determination. Partnership status requires a facts and circumstances determination and if we are incorrect in our determination, we would be required to pay tax at corporate rates on any portion of our net income that does not constitute tax-exempt income, and distributions by us to our members would be taxable dividends to the extent of our current and accumulated earnings and profits.

|

3

|

|

|

Per Class A Unit

|

|

|

Total Minimum

|

|

|

Total Maximum

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Public Offering Price(1)

|

|

$

|

10.00

|

|

|

$

|

500,000

|

(2)

|

|

$

|

50,000,000

|

|

|

Underwriting Discounts and Commissions(3)

|

|

$

|

.90

|

|

|

$

|

45,000

|

|

|

$

|

4,500,000

|

|

|

Total Proceeds to Us (Before Expenses)(4)

|

|

$

|

9.10

|

|

|

$

|

455,000

|

|

|

$

|

45,500,000

|

|

|

(1)

|

|

The price per Class A Unit shown was arbitrarily determined by our Managing Member and will apply until December 31, 2016. Thereafter, our price per Class A Unit will be adjusted every fiscal quarter and will be based on our NAV as of the end of the prior fiscal quarter.

|

|

|

|

|

|

(2)

|

|

This is a "best efforts" offering. We will not start operations or draw down on investors' funds and admit investors as members until we have raised at least $500,000 in this offering. Until the minimum threshold is met, investors' funds will be revocable and will remain at the investors' bank/financial institution. If we do not raise $500,000 within 12 months, we will cancel the offering and release all investors from their commitments. See "How to Subscribe".

|

|

(3)

|

We have engaged Cambria Capital, LLC, a FINRA member firm, as our non-exclusive placement agent. We may engage other placement agents. We have agreed to pay Cambria Capital a placement fee of 7.0% of the gross proceeds of this offering received by the Company that are derived from investors introduced to the Company by Cambria Capital ("Cambria Referrals") and we have advanced to Cambria Capital a retainer in the amount of $15,000 for the payment of actual, accountable and reasonable out-of-pocket expenses incurred by it. This retainer amount will be set off against and credited toward the non-accountable expense reimbursement described below. In addition, we have agreed to pay Cambria Capital a non-accountable expense reimbursement of 1.50% of the gross proceeds received by the Company in this offering that are derived from Cambria Referrals. We have also agreed to pay a platform fee of 0.5% to Folio on all investment funds that clear through the Folio platform. Accordingly, this table depicts underwriting discounts, commissions and expense reimbursements of up to 9% of the gross offering proceeds. We will pay Cambria Capital and any other placement agents that we may engage in the future selling commissions, underwriting discounts and expense reimbursements of up to 9% of the gross offering proceeds.

|

|

|

(4)

|

|

We will reimburse our Managing Member for organization and offering costs, which are expected to be approximately $100,000. See "Management Compensation" for a description of additional fees and expenses that we will pay our Managing Member.

|

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The date of this offering circular is October 7, 2016.

4

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the offering circular. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This offering circular is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as we make material investments, update our quarterly NAV per Class A Unit amount, make material changes or have other material developments, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled "Additional Information" below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov, or our website located at www.SecuredRealEstateFunds.com. The contents on our website (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in or otherwise a part of this offering circular.

Our Managing Member and those selling Class A Units on our behalf in this offering will be permitted to make a determination that the purchasers of Class A Units in this offering are "qualified purchasers" in reliance on the information and representations provided by the member regarding the member's financial situation. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

|

|

|

5

TABLE OF CONTENTS

|

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

|

5

|

|

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

|

7

|

|

OFFERING SUMMARY

|

8

|

|

THE OFFERING

|

19

|

|

RISK FACTORS

|

20

|

|

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

|

42

|

|

DETERMINATION OF OFFERING PRICE

|

44

|

|

ESTIMATED USE OF PROCEEDS

|

44

|

|

PLAN OF OPERATION

|

46

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

48

|

|

GENERAL INFORMATION

|

53

|

|

INVESTMENT OBJECTIVES AND STRATEGY

|

54

|

|

LENDING STANDARDS AND POLICIES

|

65

|

|

MANAGEMENT

|

72

|

|

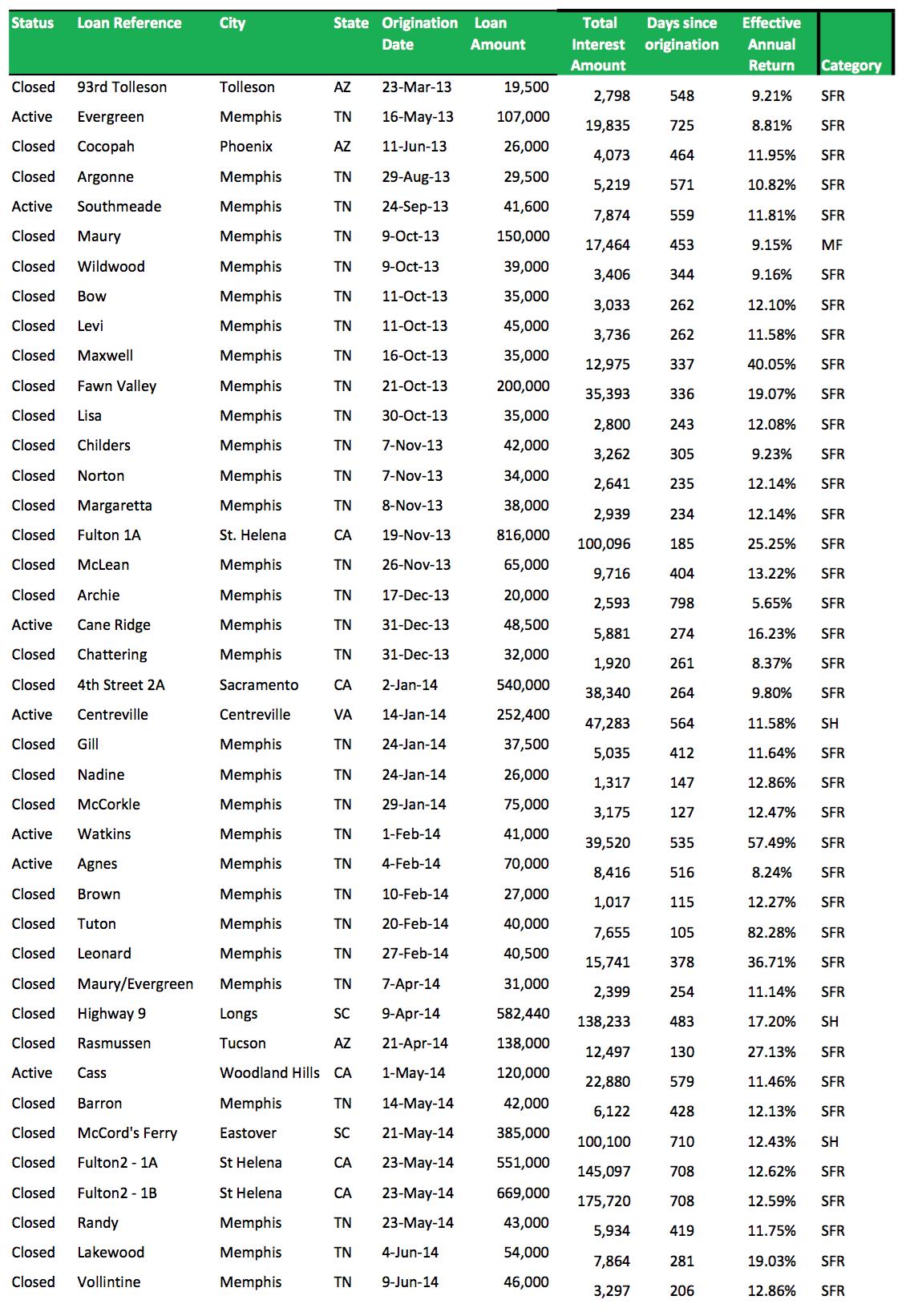

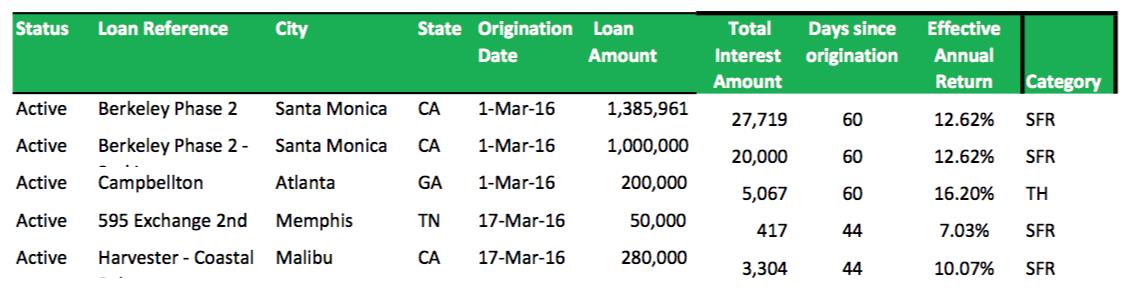

PRIOR PERFORMANCE SUMMARY

|

79

|

|

MANAGEMENT COMPENSATION

|

85

|

|

FIDUCIARY RESPONSIBILITY OF MANAGING MEMBER

|

86

|

|

OWNERSHIP OF PRINCIPAL MEMBERS

|

87

|

|

CONFLICTS OF INTEREST

|

88

|

|

DESCRIPTION OF OUR CLASS A UNITS

|

92

|

|

U.S. FEDERAL INCOME TAX CONSIDERATIONS

|

100

|

|

ERISA CONSIDERATIONS

|

109

|

|

PLAN OF DISTRIBUTION

|

112

|

|

HOW TO SUBSCRIBE

|

117

|

|

LEGAL MATTERS

|

119

|

|

EXPERTS

|

119

|

|

ADDITIONAL INFORMATION

|

119

|

|

INDEX TO FINANCIAL STATEMENTS OF SECURED REAL ESTATE INCOME FUND II, LLC

|

120

|

6

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Class A Units are being offered and sold only to "qualified purchasers" (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law "Blue Sky" review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Class A Units offered hereby are offered and sold only to "qualified purchasers" or at a time when our Class A Units are listed on a national securities exchange. "Qualified purchasers" include: (i) "accredited investors" under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our Class A Units does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). However, our Class A Units may, in the sole discretion of the issuer, be offered and sold only to those investors that are within the latter category (i.e., investors whose investment in our Class A Units does not represent more than 10% of the applicable amount), regardless of an investor's status as an "accredited investor." Accordingly, we reserve the right to reject any investor's subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a "qualified purchaser" for purposes of Regulation A.

To determine whether a potential investor is an "accredited investor" for purposes of satisfying one of the tests in the "qualified purchaser" definition, the investor must be a natural person who has:

|

|

1.

|

an individual net worth, or joint net worth with the person's spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person; or

|

|

|

2.

|

earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

|

If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a "qualified purchaser," annual income and net worth should be calculated as provided in the "accredited investor" definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor's home, home furnishings and automobiles.

7

OFFERING SUMMARY

This offering summary highlights material information regarding our business and this offering that is not otherwise addressed in the "Questions and Answers About this Offering" section of this offering circular. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire offering circular carefully, including the "Risk Factors" section before making a decision to invest in our Class A Units.

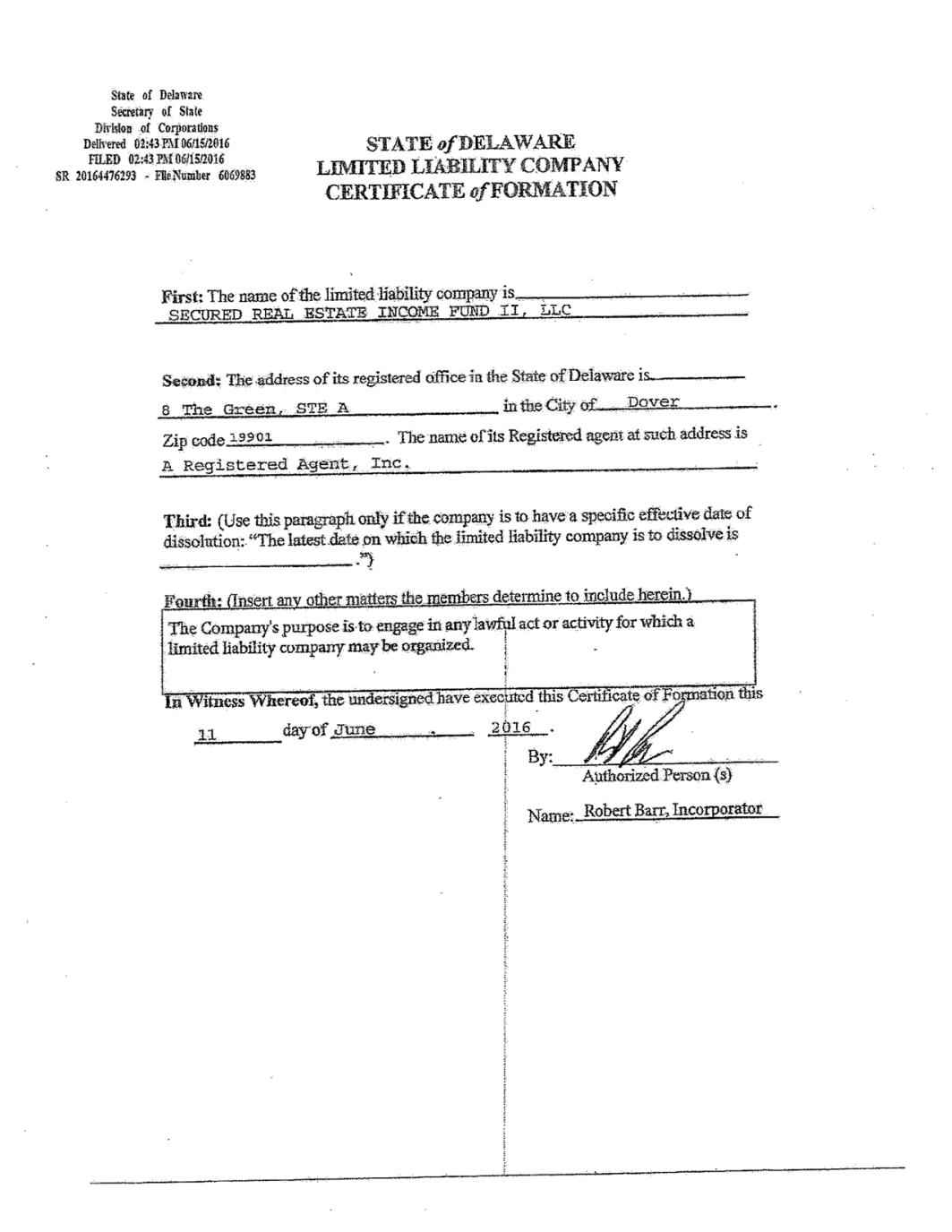

SECURED REAL ESTATE INCOME FUND II, LLC commenced operations in June 2016. Except as otherwise indicated, the terms "we," "us," "our" and the "Company" refer to SECURED REAL ESTATE INCOME FUND II, LLC.

Overview of Secured Real Estate Income Fund II, LLC

The Company has been organized primarily for the purpose of investing in a diversified portfolio of real estate loans ("Loans") and other debt instruments collateralized by first and second position security interests in residential and real estate in the U.S. and the underlying real estate collateral. We intend to acquire senior and subordinate mortgage bridge and other real estate loans, and to invest in real estate and real estate-related debt instruments primarily originated by one or more entities affiliated with the Company, the Managing Member, the Investment Manager or their respective officers, directors, managers and members ("Affiliates"). In addition, we may acquire any real properties or real estate equity investments suggested by the Investment Manager that, in the opinion of our Managing Member, meet our investment objectives. We plan to diversify our portfolio by investment type, investment size and investment risk with the goal of attaining a portfolio of real estate assets that provide attractive and stable returns to our investors. We may make our investments through direct loan origination, the acquisition of individual loans or loan portfolios. We may also finance real estate projects using other funding methods, including (but not limited to) joint venture equity financing.

All of the Loans are expected to be evidenced by a promissory note secured by instruments granting a security interest in real property which may be mortgages, deeds of trust, security deeds or deeds to secure debt, depending upon the prevailing practice and law in the state in which the mortgaged property is located. Mortgages, deeds of trust and deeds to secure debt are referred to in this offering circular collectively as "Mortgages." Any of the foregoing types of mortgages will create a lien upon, or grant a title interest in, the subject property, the priority of which will depend on the terms of the particular security instrument, as well as separate, recorded, contractual arrangements with others holding interests in the mortgaged property, the knowledge of the parties to such instrument as well as the order of recordation of the instrument in the appropriate public recording office. However, recording does not generally establish priority over governmental claims for real estate taxes and assessments and other charges imposed under governmental police powers.

Our office is located at 8315 Broadway Blvd., Tucson, Arizona 85710. Our telephone number is (888) 444-2102. Information regarding our company is available at www.SecuredRealEstateFunds.com. Information available on our website is not incorporated by reference in and is not deemed a part of this offering circular.

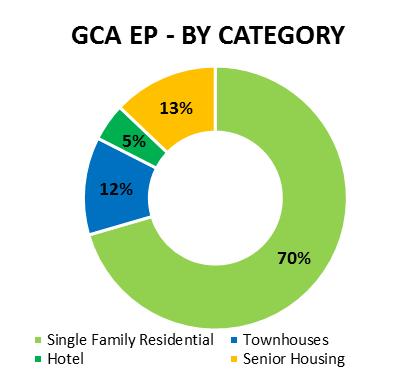

Investment Strategy

We intend to use substantially all of the proceeds of this offering to originate, invest in and manage a diversified portfolio of real estate investments. We expect to use substantially all of the net proceeds from this offering to originate, acquire and structure Loans collateralized by single family and multifamily non-owner occupied residences and commercial properties and land. For its loan portfolio, the Company will secure Loans with first and/or second position security interests. The Company may also finance real estate projects using other funding methods, including (but not limited to) joint venture equity financing.

8

The Company's primary Loan product will be short-term, or "bridge", Loans, which will be characterized with the following targeted parameters:

|

1.

|

Twelve (12) to twenty-four (24) month note secured by first or second position deeds of trust, mortgage, security deed or similar instruments;

|

|

2.

|

Borrowers will typically be required to pay interest-only payments at annualized rates of 10% or greater and shall also pay loan origination fees or loan arrangement fees in the amount of two (2) or more points;

|

|

3.

|

Loan amount can include acquisition, development, improvement, or new construction loans with the associated costs;

|

|

4.

|

Subject to possible tax restrictions, some of the Loans may utilize Shared Appreciation Mortgages ("SAMs," also known as Contingent Interest Notes) in order to secure an equity position in the underlying collateral. For such financing the Company's targeted share of the return is 10% or greater of the appreciation in equity;

|

|

5.

|

Loans will be extended to borrowers in relation to non-owner occupied single family or multi-family residences (including condos, townhomes and Planned Unit Developments), as well as for land development, property renovation, new construction, and commercial properties;

|

|

6.

|

Loan amounts will usually be based on 70% or less of the As-Completed Value of the property excluding interest reserves. This figure may increase if sufficient additional collateral is provided by the borrower;

|

|

7.

|

Short term loans allow borrowers to purchase properties that may not qualify for financing through conventional mortgage lenders. Once the property is rehabilitated or developed, the borrower may sell the property wholesale or retail;

|

|

8.

|

Exit fees may be payable to the Company by the borrower upon sale or resale of property and/or loans. All exit fees on loans in which the Company is the lender, co-lender, or fractional lender, shall be payable to the Company. In the event the Company is the co-lender or a participating or fractionalized lender, the Company shall receive its pro-rata share of the exit fee based on its time and ownership percentage of the loan.

|

The Company may also make, purchase, and otherwise acquire Loans which have a duration of more than 24 months or may directly acquire property for longer term investment. The Managing Member intends to have one or more Affiliates directly structure, underwrite and originate many of the debt products in which we invest as this provides for the best opportunity to control our borrower and partner relationships and optimize the terms of our investments. The management team of our Managing Member has extensive real estate experience and the ability to perform comprehensive financial, structural, operational and legal due diligence of our borrowers and partners in order to optimize pricing and structuring and mitigate risk. We feel the current and future market environment (including any existing or future government-sponsored programs) provides a wide range of opportunities to generate compelling investments with strong risk-return profiles for our members.

We will seek to create and maintain a portfolio of Loans and other real estate investments that generate a low volatility income stream of attractive and consistent cash distributions. Our focus on investing in debt instruments with qualified borrowers (which may include entities which are owned or controlled by the Company, the Managing Members or their Affiliates) that will emphasize the payment of current returns to investors and preservation of invested capital as our primary investment objectives, with a lesser emphasis on seeking capital appreciation from our investments, as is typically the case with more opportunistic or equity-oriented strategies.

In addition, the Company may, from time to time, acquire in its own name, or through one or more wholly owned subsidiaries, commercial properties or interests in real estate properties.

Investment Objectives

Our primary investment objectives are to identify, originate and fund Loans and other investments designed to create capital preservation and pay consistent and appealing cash distributions.

We will also seek to realize growth in the value of our investments by timing the sale or disposition to maximize value.

9

Market Opportunities

FCI Lender Services, Inc, one of the largest non-bank originated loan servicers, recently estimated the US real estate private-lending industry generates approximately $65 billion in mortgages per annum1. Based on our research, we believe the private commercial real estate lending market will continue to have a promising outlook over the short and medium term, with lending to the residential and small commercial real estate sectors all projected to grow in the coming years.

According to the Urban Land Institute, the value of commercial real estate in the US is expected to grow 3.6% every year through 2018. The same report indicates that single-family housing starts are projected to increase from 714,600 units in 2015 to 900,000 units in 2018.2. In addition, the residential apartment market is expected to experience solid growth in the coming years, as housing construction increases and home values rise. According to Freddie Mac, the multifamily housing market will also "remain strong into the foreseeable future"3.According to the ULI, apartment rental rate growth is expected to grow in 2016 and '17 by 3.6% and 3.0%, respectively, and remain above the 20-year average growth rate of 2.8%.4 A recent report by CBRE indicates the senior housing market has a very strong long-term outlook5, with demand increasingly steadily and reliably as the US population ages. Student housing is expected to grow in the near term6, with the student population increasing to 23 million by 2020. Student housing sales have increased significantly in the last 10 years, and the student population has steadily increased over the last 20 years.

Given the prospect of continued growth for the economy, we favor a strategy weighted toward targeting senior position collateralized Loans secured by residential and real estate assets which emphasize capital preservation and maximize current income. In contrast, returns typically associated with pure equity strategies are mostly "back-ended" and are dependent on asset appreciation, capitalization rate compression, cash flow growth, aggressive refinancing and/or sale of the underlying property.

We believe that our investment strategy, combined with the experience and expertise of our Managing Member's management team, will provide opportunities to originate investments with attractive current and accrued returns and strong structural features directly with real estate companies, thereby taking advantage of changing market conditions in order to seek the best risk-return dynamic for our members

Management

The Managing Member is responsible for the overall management of the Company's affairs and has control over the day-to-day operations and activities of the Company. The Managing Member has delegated investment management responsibilities to the Investment Manager. Subject only to the provisions of the Operating Agreement, its delegation of authority to the Investment Manager and the requirements of applicable law, the Managing Member shall possess full and exclusive right, power and authority to manage and conduct the business and affairs of the Company. In managing and conducting the business and affairs of the Company, the Managing Member may, among other things, cause the Company to take such actions as the Managing Member reasonably determines in good faith to be necessary, appropriate, advisable, incidental or convenient to effect the formation of the Company, promote or conduct the Company's business or achieve the Company's objectives. See the Operating Agreement for a complete description of the powers of the Managing Member and the limitations on those powers.

The Investment Manager has discretionary investment authority over the Company's assets. The Managing Member and the Investment Manager may each employ additional personnel. The Investment Manager is responsible for investing the capital and resources of the Company and monitoring such investments, as necessary, in order to achieve the Company's investment objective.

1 Source: http://www.wsj.com/articles/private-lenders-remodel-the-mortgage-market-1462984898

2Source: Urban Land Institute http://uli.org/research/centers-initiatives/center-for-capital-markets/barometers-forecast-and-data/uli-real-estate-consensus-forecast/

3 Source: FreddieMac MultiFamily Outlook 2016 http://www.freddiemac.com/multifamily/pdf/freddieMac_mf_outlook_2016.pdf

4 Source: Urban Land Institute http://uli.org/wp-content/uploads/ULI-Documents/ULIREConsensusForecast_Spring2016.pdf

5 Source: CBRE Investor Survey and Market Outlook February 2016 http://www.cbre.us/services/valuationadvisory/AssetLibrary/CBRE_SeniorsHousing_InvestorSurvey_H2_2015.pdf

6 Source: CCIM http://www.ccim.com/cire-magazine/articles/323626/2014/09/student-housing-stats/?gmSsoPc=1

10

The Managing Member may replace the Investment Manager from time-to-time in its discretion, or appoint itself as the Investment Manager.

Management Compensation

Our Managing Member and the Investment Manager and their Affiliates will receive fees and expense reimbursements for services relating to this offering and the investment and management of our assets. The items of compensation are summarized in the following table. Neither our Managing Member, our Investment Manager nor any of their respective Affiliates will receive any selling commissions or placement agent fees in connection with the offer and sale of our Class A Units. See "Management Compensation" for a more detailed explanation of the fees and expenses payable to our Managing Member, Investment Manager and its Affiliates.

The following discussion summarizes some important areas of compensation to be received by the Managing Member

|

Form of Compensation

|

Estimated Amount or Method of Compensation

|

Recipient

|

||

|

ORGANIZATIONAL AND OFFERING EXPENSES

|

To date, our Managing Member has paid organization and offering expenses on our behalf. We will reimburse our Managing Member for these costs and future organization and offering costs it may incur on our behalf. We expect organization and offering expenses to be approximately $100,000

|

Managing Member.

|

||

|

LOAN ORIGINATION/ LOAN ARRANGEMENT FEES

|

Loan origination fees are generally collected from borrowers. Such fees average between two and five percent (2-5%) depending on market conditions.

|

All loan origination fees will be shared between the Managing Member and holders of the Class A Units. The Managing Member's portion will constitute compensation to the Managing Member.

|

||

|

LOAN EXTENSION AND MODIFICATION FEES

|

Loan extension and modification fees are collected from borrowers and payable to the Company. Such fees are typically between one and three percent (1-3%) of the original loan amount, but could be higher or lower depending on market rates and conditions.

|

Such fees collected by the Managing Member are collected on the Company's behalf and are not considered a part of the Managing Member's direct compensation, as such fees are payable only to the Company.

|

||

|

LOAN PROCESSING, LOAN DOCUMENTATION AND OTHER SIMILAR FEES

|

Loan processing, documentation and other similar fees are collected from the borrower and payable to the Company or its broker or loan servicing company at prevailing industry rates.

|

Such fees collected by the Managing Member are collected on the Company's behalf and are not considered a part of the Managing Member's direct compensation, as such fees are payable only to the Company.

|

11

|

OTHER LOAN FEES

|

The Company will earn other loan fees as follows:

One Hundred Percent (100%) of its pro-rata share of the following fees paid by borrowers on account of Loans: (i) all late fees incurred by borrowers on defaulted loans; (ii) all default interest incurred by borrowers on defaulted loans (default interest means the amount of interest charged upon a default being declared that is above the contract interest rate); (iii) all forbearance, extension and other fees incurred by borrowers; (iv) all prepayment penalties incurred by borrowers; (v) all pro-rata contingent interest and/or exit fees.

|

Such fees collected by the Managing Member are collected on the Company's behalf and are not considered a part of the Managing Member's direct compensation, as such fees are payable only to the Company

|

||

|

PURCHASE OF EXISTING LOANS

|

When the Company purchases an existing loan (or pool of loans) from a third party, the Managing Member or Affiliate will not be paid any fee comparable to a loan origination fee.

|

Neither the Company, the Managing Member nor any Affiliate will receive any fees or commissions in connection with such transactions.

|

||

|

MANAGEMENT FEE AND PROFIT SHARE

|

The Investment Manager shall be entitled to a management fee in an annual amount of two-percent (2%) of the capital contributions. In addition, the Managing Member shall be entitled to receive twenty percent (20%) of the net profits after the payment of the Preferred Return. The Managing Member may direct all, or a portion of its profit share to the Investment Manager.

|

Investment Manager and Managing Member.

|

||

|

REAL ESTATE COMMISSIONS

|

The Company or Affiliates of the Managing Member may earn real estate commissions to list and sell real estate that the Company has acquired through foreclosure. Such fees shall be at market rates and shall not exceed 10% of the total proceeds received upon asset disposition.

|

The company or Affiliates of the Managing Member.

|

||

|

PROJECT MANAGEMENT FEES

|

The Company or Affiliates of the Managing Member may earn project management fees. Such fees shall be at market rates and shall not exceed 10% of the total proceeds received upon asset disposition.

|

The Company or Affiliates of the Managing Member

|

12

Summary of Risk Factors

Investing in our Class A Units involves a high degree of risk. You should carefully review the "Risk Factors" section of this offering circular, beginning on page 21, which contains a detailed discussion of the material risks that you should consider before you invest in our Class A Units.

Conflicts of Interest

Our Managing Member, Investment Manager and their respective Affiliates will experience conflicts of interest in connection with the management of our business. Some of the material conflicts that our Managing Member and its Affiliates will face include the following:

|

|

·

|

The management team of our Managing Member and our Investment Manager must determine which investment opportunities to recommend to us and other managed entities.

|

|

·

|

The Managing Member may also participate in real estate transactions in their own capacity and some of these transactions may be alongside the Company

|

|

|

|

|

|

|

|

·

|

The management team of our Managing Member and our Investment Manager will have to allocate their time among us, other businesses, programs and activities in which they are involved.

|

|

|

|

|

|

|

·

|

The terms of our Operating Agreement (including the Managing Member's rights and obligations and the compensation payable to our Managing Members and its Affiliates) were not negotiated at arm's length.

|

|

|

|

|

|

|

·

|

Our members may only remove our Managing Member for "cause" following the affirmative vote of members holding two-thirds of the outstanding Class A Units. Unsatisfactory financial performance does not constitute "cause" under the Operating Agreement.

|

|

|

·

|

The Managing Member may, without member consent unless otherwise required by law, determine that we should merge or consolidate through a roll-up or other similar transaction involving other entities, including entities Affiliated with our Managing Member, into or with such other entities.

|

|

|

|

|

|

·

|

The Managing Member or its Affiliates may receive project management fees or other compensation related to the administration and management of certain Company investments.

|

|

|

|

·

|

The Managing Member and its principals, directors, officers and/or affiliates may sell, buy or hypothecate loans (use loans as collateral for another loan) to or from the Company.

|

Distributions

The Managing Member will make distributions to the members of an amount equal to an annual preferred return (the "Preferred Return") on their investment, payable each calendar month (and prorated as applicable for the amount of time that a member was a member of the Company during such month). This Preferred Return will be payable prior to any other distributions or profit participation by the Managing Member (however, all expenses and fees (including loan origination fees and Lender Fees) will be paid to the Managing Member prior to the payment of the Preferred Return). The Preferred Return for any member shall be equal to an annualized rate of eight percent (8.00%). The Preferred Return will be calculated and distributed on a monthly basis.

Members will also be eligible for regular quarterly income distributions of the Company's Net Income, as follows: Members will be eligible for quarterly income distributions of their pro-rata share of 80% of the Net Income of the Company according to the member's capital account to the extent cash is available and provided that the quarterly income distribution will not impact the continuing operations of the Company. "Net Income" means the Company's quarterly gross income less the Company's quarterly operating expenses, management fees, payment of the Preferred Return and an allocation of income for a loan loss reserve. All Net Income distributions, if any, will be made on a quarterly basis, in arrears.

13

Each member has the option of having his, her or its share of the earnings of the Company (including any Preferred Return) that is payable to the member credited to his, her or its capital accounts and reinvested in the Company. However, the Managing Member reserves the right to commence making cash distributions at any time to any member(s) in order for the Company to remain exempt from the ERISA plan asset regulations. (See "ERISA Considerations" and "Summary of Operating Agreement" below). In addition, the Managing Member may elect to redeem all or a part of a member's Class A Units for any reason upon thirty (30) days written notice to the member at a price equal to the member's capital contribution plus any accrued but unpaid Preferred Return and other fees which are owed to the member on the date of redemption. The Managing Member may also, by notice to a member, force the sale of all or a portion of such member's interest on such terms as the Managing Member determines to be fair and reasonable, or take such other action as it determines to be fair and reasonable in the event that the Managing Member determines or has reason to believe that: (i) such member has attempted to effect a transfer of, or a transfer has occurred with respect to, any portion of such member's interest in violation of the Operating Agreement; (ii) continued ownership of such Class A Units by such Member is reasonably likely to cause the Company to be in violation of securities laws of the United States or any other relevant jurisdiction or the rules of any self-regulatory organization applicable to the Managing Member or its Affiliates; (iii) continued ownership of such interest by such member may be harmful or injurious to the business or reputation of the Company or the Managing Member, or may subject the Company or any members to a risk of adverse tax or other fiscal consequence, including without limitation, adverse consequence under ERISA; (iv) any of the representations or warranties made by such member in connection with the acquisition of such Member's interest was not true when made or has ceased to be true; or (v) such member's interest has vested in any other person by reason of the bankruptcy, dissolution, incompetency or death of such member.

Members shall receive cash in the form of quarterly income distributions and monthly distributions of Preferred Returns unless a member elects to have all such amounts reinvested into the Company. An election to reinvest quarterly income distribution or monthly Preferred Return is revocable at any time upon a written request to revoke such election. Members may change their election at any time upon thirty (30) days written notice to the Company. Upon receipt and after the thirty (30) day notice has occurred, the member's election shall be changed and reflected on the following first day of the successive period in which the member is entitled to receive a distribution. Notwithstanding the preceding sentences, the Managing Member may at any time immediately commence with income distributions in cash only (hence, suspending the reinvestment option for such member(s) to any member(s) in order for the Company to remain exempt from the ERISA plan asset regulations. (See "ERISA Considerations" and "Summary of Operating Agreement" below).

Prospective investors should understand that earnings, cash flow and distributions of the Company may necessarily fluctuate in accordance with the business and operations of the Company. At the end of each calendar quarter, the Managing Member will (as soon as reasonably practicable) review distributions paid during the prior quarter (i.e. the quarter prior to the quarter just ended) and make ratable adjustments to the income distributions and Preferred Return distributions paid or payable to members in order to ensure that Members receive accurate income and Preferred Return distributions.

Any distributions that we make will directly impact our NAV, by reducing the amount of our assets. Our goal is to provide a reasonably predictable and stable level of current income, through monthly or other periodic distributions, while at the same time maintaining a fair level of consistency in our NAV. Over the course of your investment, your distributions plus the change in NAV per Class A Unit (either positive or negative) will produce your total return.

Our distributions will constitute a return of capital to the extent that they exceed our current and accumulated earnings and profits as determined for U.S. federal income tax purposes. To the extent that a distribution is treated as a return of capital for U.S. federal income tax purposes, it will reduce a holder's adjusted tax basis in the holder's Class A Units, and to the extent that it exceeds the holder's adjusted tax basis will be treated as gain resulting from a sale or exchange of such Class A Units.

14

Borrowing Policy

We may employ conservative levels of borrowing in order to provide additional funds to support our investment activities. Our target portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is approximately 40% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. During the period when we are beginning our operations and growing our portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the initial portfolio) in order to quickly build a diversified portfolio of assets. Our Managing Member may from time to time modify our leverage policy in its discretion in light of then-current economic conditions, relative costs of debt and equity capital, market values of our properties, general conditions in the market for debt and equity securities, growth and acquisition opportunities or other factors. However, other than during our initial period of operations, it is our policy to not borrow more than 60% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Managing Member's investment committee. See "Investment Objectives and Strategy" for more details regarding our leverage policies.

Valuation Policies

The value of our Class A Units shall initially be $10.00 per unit. Beginning December 31, 2016, our Managing Member will calculate our NAV per Class A Unit on a monthly basis using a process that reflects (1) estimated values of each of our real estate assets and investments, including related liabilities, provided in individual appraisal reports or internal valuation assessments of the underlying real estate, as they may be updated upon certain material events described below, (2) accruals of our quarterly or other periodic distributions, and (3) estimates of quarterly accruals, on a net basis, of our operating revenues, expenses and fees. Our goal is to provide a reasonable estimate of the market value of our Class A Units on a monthly basis. However, the majority of our assets will consist of real estate loans and, as with any real estate valuation protocol, the conclusions reached by our Managing Member will be based on a number of judgments, assumptions and opinions about future events that may or may not prove to be correct. The use of different judgments, assumptions or opinions would likely result in different estimates of the value of our real estate assets and investments. In addition, for any given month, our published NAV per Class A Unit may not fully reflect certain material events, to the extent that the financial impact of such events on our portfolio is not immediately quantifiable. As a result, the monthly calculation of our NAV per Class A Unit may not reflect the precise amount that might be paid for a Class A Units in a market transaction, and any potential disparity in our NAV per Class A Unit may be in favor of either members who redeem their Class A Units, or members who buy new Class A Units, or existing members. However, to the extent quantifiable, if a material event occurs in between monthly updates of NAV that would cause our NAV per Class A Unit to change by 5% or more from the last disclosed NAV, we will disclose the updated price and the reason for the change in an offering circular supplement as promptly as reasonably practicable, and will update the NAV information provided on our website.

NAV Share Price Adjustments

Our Managing Member set our initial offering price at $10.00 per Class A Unit, which will be the purchase price of our Class A Units until December 31, 2016. Thereafter, the per Class A Unit purchase price will be adjusted monthly on the first day of the month and will be equal to our NAV divided by the number of Class A Units outstanding as of the close of business on the last business day of the prior month, in each case prior to giving effect to any share purchases or redemptions to be effected on such day

Beginning after December 31, 2016, we will file with the SEC on a monthly basis an offering circular supplement disclosing the monthly determination of our NAV per Class A Unit that will be applicable for such month, which we refer to as the pricing supplement. We will disclose, on a monthly basis in an offering circular supplement filed with the SEC, the principal valuation components of our NAV. In addition, if a material event occurs in between monthly updates of NAV that would cause our NAV per Class A Unit to change by 5% or more from the last disclosed NAV, we will disclose the updated price and the reason for the change in an offering circular supplement as promptly as reasonably practicable, and will update the NAV information provided on our website.

Any subscriptions that we receive prior to the end of a month will be executed at a price equal to our NAV per Class A Unit applicable to such month. See "Description of Our Class A Units—NAV Share Price Adjustments" for more details.

15

Redemptions

Until such time as the Class A Units are listed on the OTCQB, the holders of Class A Units may request redemptions of the Class A Units in accordance with the Company's redemption plan, including following procedures and restrictions. At any time after 15 (fifteen) months following the purchase of Class A Units, a member may request that the Company redeem those Class A Units by giving the Managing Member 90 days' notice.

Based on an assessment of the Company's liquid resources and redemption requests, the Company's Managing Member has the authority, in its sole discretion, to limit redemptions by each member during any quarter, including if the Managing Member deems such action to be in the best interest of the members.

The redemption price will be based upon the most current NAV on the date of the distribution. The redemption price will be reduced by the aggregate sum of distributions, if any, declared on the Class A Units subject to the redemption request with record dates during the period between the quarter-end redemption request date and the redemption date.

Because the Company is not required to make a distribution for up to 90 days following the request and NAV per Class A Unit will be calculated at the beginning of each month, the redemption price may change between the date we receive the redemption request and the date on which redemption proceeds are paid. As a result, the redemption price that a member will receive may be different from the redemption price on the day the redemption request is made.

We cannot guarantee that the funds set aside for the redemption plan will be sufficient to accommodate all requests made in any quarter. In the event that we do not have sufficient funds available to redeem all of the Class A Units for which redemption requests have been submitted in any quarter, we plan to redeem our Class A Units on a pro rata basis on the redemption date.

We are not obligated to redeem Class A Units. We presently intend to limit the number of Class A Units to be redeemed during any calendar year to 10.0% of the weighted average number of Class A Units outstanding during the prior calendar year (or 2.5% per quarter, with excess capacity carried over to later quarters in the calendar year).

There is no fee in connection with a redemption of our Class A Units unless a redemption request is made prior to 15 months following the purchase of such Class A Units, in which case the Managing Member may, on behalf of the Company, require the redeeming member to pay a redemption fee of ten percent (10%) of the amount of the redemption request. A member requesting redemption will be responsible for reimbursing us for any third-party costs incurred as a result of the redemption request, including but not limited to, bank transaction charges, custody fees, and/or transfer agent charges.

In addition, the Managing Member may, in its sole discretion, amend, suspend, or terminate the redemption plan at any time without notice, including to protect our operations and our non-redeemed members, to prevent an undue burden on our liquidity, to preserve or facilitate our tax status, following any material decrease in our NAV, or for any other reason. The Managing Member may also, in its sole discretion, decline any particular redemption request if it believes such action is necessary to preserve or facilitate our tax status. Therefore, you may not have the opportunity to make a redemption request prior to any potential termination of our redemption plan.

Please refer to the section entitled "Description of Our Class A Units—Redemptions" for more information.

16

OTC Listing

We intend to contact an authorized OTCQB market maker for sponsorship of our securities on the OTCQB, upon qualification of this Form 1-A. However, there is no guarantee our Class A Units will be accepted for quotation on the OTCQB.

Voting Rights

Our Class A Unitholders will have voting rights only with respect to certain matters, primarily relating to amendments to our Operating Agreement that would adversely change the rights of the Class A Units, and removal of our Managing Member for "cause". Each outstanding Class A Unit entitles the holder to one vote on all matters submitted to a vote of Class A Unitholders. Our members do not elect or vote on our Managing Member, and, unlike the holders of common stock in a corporation, have only limited voting rights on matters affecting our business, and therefore limited ability to influence decisions regarding our business. For additional information, see "Description of Our Class A Units—Voting Rights."

Other Governance Matters

Other than the limited member voting rights described above, our Operating Agreement vests most other decisions relating to our assets and to the business of our company, including decisions relating to acquisitions, originations and dispositions, the engagement of asset managers, the issuance of securities in our company including additional Class A Units, mergers, dispositions, roll-up transactions, and other decisions relating to our business, in our Managing Member. See "Management" for more information about the rights and responsibilities of our Managing Member.

Investment Company Act Considerations

We intend to conduct our operations so that neither we, nor any of our subsidiaries, are required to register as investment companies under the Investment Company Act of 1940, as amended, or the Investment Company Act. Section 3(a)(1)(A) of the Investment Company Act defines an investment company as any issuer that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the Investment Company Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer's total assets (exclusive of U.S. Government securities and cash items) on an unconsolidated basis, which we refer to as the 40% test. Excluded from the term "investment securities," among other things, are U.S. Government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company set forth in Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act.

We anticipate that we will hold real estate and real estate-related assets described below (i) directly, (ii) through wholly-owned subsidiaries, (iii) through majority-owned joint venture subsidiaries, and, (iv) to a lesser extent, through minority-owned joint venture subsidiaries.

We intend, directly or through our subsidiaries, to originate, invest in and manage a diversified portfolio of real estate investments. We expect to use substantially all of the net proceeds from this offering to originate, acquire and structure real estate loans (including senior mortgage loans, subordinated mortgage loans, mezzanine loans, and participations in such loans) and to make other investments in real estate.

We will monitor our compliance with the 40% test and the holdings of our subsidiaries to ensure that each of our subsidiaries is in compliance with an applicable exemption or exclusion from registration as an investment company under the Investment Company Act.

The securities issued by any wholly-owned or majority-owned subsidiary that we may form and that are excluded from the definition of "investment company" based on Section 3(c)(1) or 3(c)(7) of the Investment Company Act, together with any other investment securities we may own, may not have a value in excess of 40% of the value of our total assets on an unconsolidated basis.

17

The Investment Company Act defines a majority-owned subsidiary of a person as a company 50% or more of the outstanding voting securities of which are owned by such person, or by another company which is a majority-owned subsidiary of such person. We treat companies in which we own at least a majority of the outstanding voting securities as majority-owned subsidiaries. The determination of whether an entity is a majority-owned subsidiary of our company is made by us. We also treat subsidiaries of which we or our wholly-owned or majority-owned subsidiary is the manager (in a manager-managed entity) or managing member (in a member-managed entity) or in which our agreement or the agreement of our wholly-owned or majority-owned subsidiary is required for all major decisions affecting the subsidiaries (referred to herein as "Controlled Subsidiaries"), as majority-owned subsidiaries even though none of the interests issued by such Controlled Subsidiaries meets the definition of voting securities under the Investment Company Act. We reached our conclusion on the basis that the interests issued by the Controlled Subsidiaries are the functional equivalent of voting securities. We have not asked the SEC staff for concurrence of our analysis and it is possible that the SEC staff could disagree with any of our determinations. If the SEC staff were to disagree with our treatment of one or more companies as majority-owned subsidiaries, we would need to adjust our strategy and our assets. Any such adjustment in our strategy could have a material adverse effect on us.

We believe that neither we nor certain of our subsidiaries will be considered investment companies for purposes of Section 3(a)(1)(A) of the Investment Company Act because we and they will not engage primarily or hold themselves out as being primarily in the business of investing, reinvesting or trading in securities. Rather, we and such subsidiaries will be primarily engaged in non-investment company businesses related to real estate. Consequently, we and our subsidiaries expect to be able to conduct our operations such that none will be required to register as an investment company under the Investment Company Act.

Certain of our subsidiaries may also rely upon the exclusion from the definition of investment company under Section 3(c)(5)(C) of the Investment Company Act. Section 3(c)(5)(C), as interpreted by the staff of the SEC, requires an entity to invest at least 55% of its assets in "mortgages and other liens on and interests in real estate", which we refer to as "qualifying real estate interests", and at least 80% of its assets in qualifying real estate interests plus "real estate-related assets".

Qualification for exemption from registration under the Investment Company Act will limit our ability to make certain investments. To the extent that the SEC staff provides more specific guidance regarding any of the matters bearing upon such exclusions, we may be required to adjust our strategy accordingly. Any additional guidance from the SEC staff could provide additional flexibility to us, or it could further inhibit our ability to pursue the strategies we have chosen.

The loss of our exclusion from regulation pursuant to the Investment Company Act could require us to restructure our operations, sell certain of our assets or abstain from the purchase of certain assets, which could have an adverse effect on our financial condition and results of operations. See "Risk Factors—Risks related to Our Organizational Structure—Maintenance of our Investment Company Act exemption imposes limits on our operations, which may adversely affect our operations."

18

The Offering

We are offering to investors the opportunity to purchase up to a maximum of $50,000,000 of Class A Units, subject to a minimum offering amount of $500,000.00. The offering will continue through the earlier of December 31, 2017 or the date upon which all $50,000,000 in offering proceeds have been received. Following qualification of the Offering Statement, the Company will conduct closings in this offering at its discretion, or the Closing Dates and each, a Closing Date, until the Offering Termination. The Company reserves the right to extend the offering if the maximum target amount has not been reached by December 31, 2017.

|

Issuer

|

Secured Real Estate Income Fund II, LLC, a Delaware limited liability company

|

|

Securities Offered

|

Class A Membership Interest Units ("Class A Units").

|

|

Use of Proceeds

|

We estimate that the net proceeds of this offering will be approximately $45,400,000, after deducting sales commissions of 7.0% of the offering proceeds payable to the placement agents that we engage for this offering, a non-accountable expense allowance of 1.50% of the offering proceeds payable to the placement agents, a platform fee of 0.50% of the gross proceeds from this offering payable to Folio for its clearing and facilitation services and $100,000 in expenses incurred by us in connection with this offering. Specified sales may be made net of selling commissions, accountable expense allowance and non-accountable expense allowance. See "Plan of Distribution." We intend to use the net proceeds from this offering to originate and acquire real estate loans in our target asset class and repay bridge loans used to acquire assets, which may include loans from Affiliates.

|

|

No Listing

|

Currently, there is no public market for our Class A Units. We do, however, plan to identify a market maker who will file an application on Form 211 with FINRA following the qualification of the Offering Statement of which this offering circular forms a part and take such other action as is required with OTC Markets, Inc. to have our securities quoted on the OTCQB as soon as practicable following the qualification of our Offering Statement.

|

|

Governing Law

|

The Company and the Class A Units will be governed by the laws of the State of Delaware.

|

|

Risk Factors

|

An investment in the Units involves certain risks. You should carefully consider the risks described under "Risk Factors" beginning on page 20 of this Offering Circular before making an investment decision.

|

|

Distribution Policy

|

We expect to make monthly distributions of income received from investments in an annual amount of eight percent (8%) as a preferred return to the holders of the Class A Units and quarterly distributions of eighty percent (80%) of the net income.

|

19

RISK FACTORS

An investment in our Class A Units involves substantial risks. You should carefully consider the following risk factors in addition to the other information contained in this offering circular before purchasing Class A Units. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled "Statements Regarding Forward-Looking Information."

Risks Related to an Investment in Secured Real Estate Investment Fund

We have no prior operating history, and the prior performance of other real estate investment opportunities sponsored by our Managing Member may not predict our future results.

We are a recently formed company. As of the date of this offering circular, we have not made any investments. Upon closing, we will make investments into Loans and other real estate assets ("Real Assets"). You should not assume that our performance will be similar to the past performance of our Managing Member or other real estate investment opportunities managed or sponsored by members of Managing Member. Our lack of an operating history significantly increases the risk and uncertainty you face in making an investment in our Class A Units.

Because no public trading market for the Class A Units currently exists, it will be difficult for you to sell your Class A Units and, if you are able to sell your Class A Units such sale may be at a loss

Our Operating Agreement does not require our Managing Member to seek member approval to liquidate our assets by a specified date, nor does our Operating Agreement require our Managing Member to list our Class A Units for trading on a national securities exchange by a specified date. There is no public market for our Class A Units, however, we do plan to list our Class A Units on the OTCQB or other trading market in the near future. Until our Class A Units are listed, if ever, you may not sell your Class A Units unless the buyer meets the applicable suitability and minimum purchase standards. In its sole discretion, including to protect our operations and our non-redeemed members or to prevent an undue burden on our liquidity, our Managing Member could amend, suspend or terminate our redemption plan without notice. Further, our Operating Agreement includes numerous restrictions that would limit your ability to sell your Class A Units. We describe these restrictions in more detail under "Description of Our Class A Units — Redemptions." Therefore, it will be difficult for you to sell your Class A Units promptly or at all. If you are able to sell your Class A Units, you would likely have to sell them at a substantial discount to their public offering price. It is also likely that your Class A Units would not be accepted as the primary collateral for a loan. Because of the illiquid nature of our Class A Units, you should purchase our Class A Units only as a long-term investment and be prepared to hold them for an indefinite period of time.

If we are unable to find suitable investments, we may not be able to achieve our investment objectives or pay distributions.

Our ability to achieve our investment objectives and to pay distributions depends upon the performance of our Managing Member and Investment Manager in the origination, acquisition and servicing of Loans, Real Assets and other similar investments. In some cases, we may also depend upon the performance of third-party loan servicers to service our Loans and other similar investments. Except for investments that may be described in supplements to this offering circular prior to the date you subscribe for our Class A Units, you will have no opportunity to evaluate the economic merits or the terms of our investments before making a decision to invest in our company. You must rely entirely on the management abilities of our Managing Member, Investment Manager and the loan servicers our Managing Member may select. We cannot assure you that our Investment Manager will be successful in originating or obtaining suitable Loans and Real Assets on financially attractive terms or that, if our Managing Member makes investments on our behalf, our objectives will be achieved. If we, through our Managing Member, are unable to find suitable investments promptly, we will hold the proceeds from this offering in an interest-bearing account or invest the proceeds in short-term assets in a manner described herein. In the event we are unable to timely locate suitable investments, we may be unable or limited in our ability to pay distributions and we may not be able to meet our investment objectives.

20

Future disruptions in the financial markets or deteriorating economic conditions could adversely impact the real estate market as well as the market for debt-related investments generally, which could hinder our ability to implement our business strategy and generate returns to you.

We intend to originate and acquire a diversified portfolio of real estate loans and other investments in real estate. We may also invest in real estate-related debt securities, and other real estate-related assets. Economic conditions greatly increase the risks of these investments (see "Risks Related to Our Investments"). The value of collateral securing any loan investment we may make could decrease below the outstanding principal amount of such loan. In addition, revenues on the properties and other assets underlying any loan investments we may make could decrease, making it more difficult for borrowers to meet their payment obligations to us. Each of these factors would increase the likelihood of default and foreclosure, which would likely have a negative impact on the value of our loan investment. More generally, the risks arising from the financial market and economic conditions are applicable to all of the investments we may make. The risks apply to commercial mortgage, priority and subordinate debt and bridge loans.

Future disruptions in the financial markets or deteriorating economic conditions may also impact the market for our investments and the volatility of our investments. The returns available to investors in our targeted investments are determined, in part, by: (i) the supply and demand for such investments and (ii) the existence of a market for such investments, which includes the ability to sell or finance such investments. During periods of volatility, the number of investors participating in the market may change at an accelerated pace. If either demand or liquidity increases, the cost of our targeted investments may increase. As a result, we may have fewer funds available to make distributions to investors.

All of the factors described above could adversely impact our ability to implement our business strategy and make distributions to our investors and could decrease the value of an investment in us.

We may suffer from delays in locating suitable investments, which could limit our ability to make distributions and lower the overall return on your investment.