UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2019

OR

☐ TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _________

For the transition period from _________ to __________

Commission file number 001-38170

NEWATER TECHNOLOGY, INC.

(Exact Name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

c/o Yantai Jinzheng Eco-Technology Co., Ltd.

1 Ruida Road, Laishan District, Yantai City

Shandong Province

People’s Republic of China 264003

(Address of principal executive offices)

Yuebiao Li

c/o Yantai Jinzheng Eco-Technology Co., Ltd.

1 Ruida Road, Laishan District, Yantai City

Shandong Province

People’s Republic of China 264003

(+86) 535-8012911

Email: market@newater.cc

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of Exchange on which registered | |

| Common Shares, $0.001 par value per share | The Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d): None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 10,809,000 outstanding common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued | Other ☐ |

| By the International Accounting Standards Board ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

EXPLANATORY NOTE

This Amendment No. 1 to Form 20-F (the “Form 20-F/A”) amends the annual report on Form 20-F of Newater Technology, Inc, (“Newater”) for the fiscal year ended December 31, 2019, originally filed with the U.S. Securities and Exchange Commission (“SEC”) on June 8, 2020 (the “Form 20-F”). This Form 20-F/A is being filed to confirm Newater is relying on the SEC’s March 4, 2020 Order (Release No. 34-88318), as modified on March 25, 2020 (Release No. 34-88465) (the “SEC Order”), and to state the reasons why Newater was unable to comply with the original filing deadline for the Form 20-F as required by the SEC Order.

No other changes have been made to the Form 20-F. The Form 20-F, as amended by this Form 20-F/A, speaks as of the original filing date of the Form 20-F, is not intended to reflect events that may have occurred subsequent to the original filing date of the Form 20-F, and is not intended to update in any way the disclosures made in the Form 20-F.

RELIANCE ON SEC ORDER

As we previously reported in our current report on Form 6-K as filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 27, 2020, the filing of this Annual Report for the period ended December 31, 2019 (“the 2019 Annual Report”) was delayed due to circumstances related to COVID-19 and we are relying on the SEC Order (as defined below).

On March 4, 2020, the SEC issued an order under Section 36 (Release No. 34-88318) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), granting exemptions from specified provisions of the Exchange Act and certain rules thereunder. On March 25, 2020, the order was modified and superseded by a new SEC order (Release No. 34-88465) which provides conditional relief to public companies that are unable to timely comply with their filing obligations as a result of the novel coronavirus (“COVID-19”) outbreak (the “SEC Order”).

We conduct our business operations throughout China, with our headquarters located in Yantai. In accordance with the epidemic control measures imposed by the local authorities related to COVID-19 since February 2020, our manufacturing facilities remained closed until after the Chinese New Year holiday (January 24-February 2, 2020) until February 10, 2020. Further, our corporate headquarters in Yantai, where our management is located, did not resume normal operations until February 29, 2020. In addition, COVID-19 caused severe disruptions in transportation and limited access to our facilities resulting in limited support from our staff and professional advisors, including our auditor, which prevented them from completing their audit procedures as scheduled. This, in turn, delayed our ability to complete our audit and prepare the 2019 Annual Report and file it by the original filing deadline of April 30, 2020. In accordance and in compliance with the SEC Order, we filed the 2019 Annual Report on June 8, 2020, prior to the extended June 14, 2020 filing deadline as set forth in the SEC Order.

We acted in accordance with local epidemic control measures, and issued stringent rules on employee health and virus protection to ensure the health of our employees, while trying to sustain productivity during the pandemic. Further, we believe we took all possible measures to overcome the adverse impact derived from the COVID-19 outbreak related to the annual audit and filing of the 2019 Annual Report.

Table of Contents

i

Defined Terms and Conventions

Except where the context otherwise requires and for purposes of this annual report on Form 20-F only:

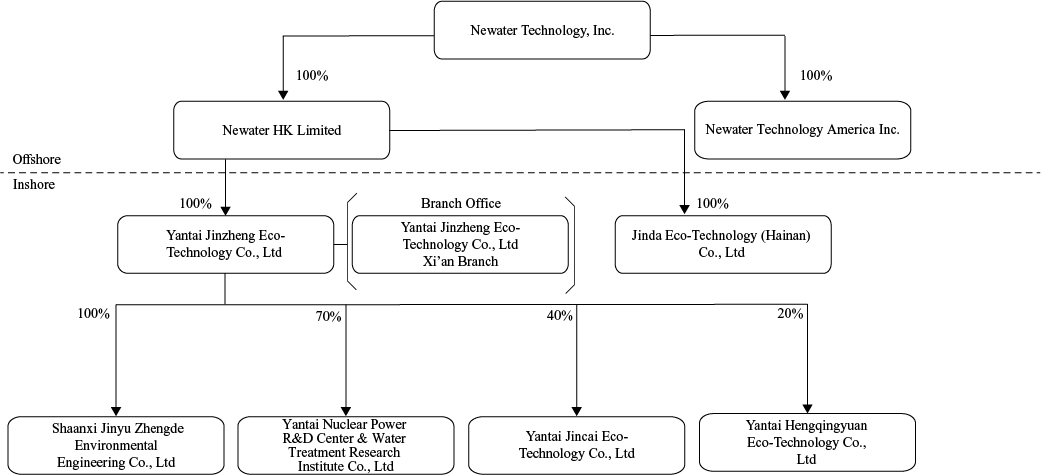

| ● | The terms “we,” “us,” “Company” “our company,” and “our” refer to Newater Technology, Inc. and its wholly-owned subsidiaries; |

| ● | Newater Technology, Inc., a British Virgin Islands company (“Newater Technology” when referring solely to our British Virgin Islands listing company); |

| ● | Newater HK Limited, a Hong Kong company wholly-owned by Newater Technology (“Newater HK”); |

| ● | Yantai Jinzheng Eco-Technology Co., Ltd, a wholly-owned subsidiary of Newater HK (“Jinzheng”); |

| ● | Newater Technology America, Inc. a wholly owned subsidiary of Newater Technology, Inc. (“Newater America”); |

| ● | Jinda Eco-Technology (Hainan) Co., Ltd (“Jinda”), a wholly-owned subsidiary of Newater HK; |

| ● | Shaanxi Jinyu Zhengde Evironmental Engineering Co., Ltd (“Jinyu”), a wholly-owned subsidiary of Jinzheng; |

| ● | Yantai Nuclear-Power R&D Center & Water Treatment Research Institute Co., Ltd (“Yantai Nuclear-Power”), a 70% owned subsidiary of Jinzheng; |

| ● | Yantai Jincai Eco-Technology Co., Ltd (“Jincai”), a 40% owned subsidiary of Jinzheng; |

| ● | Yantai Hengqingyuan Eco-Technology Co., Ltd (“Hengqingyuan”), a 20% owned subsidiary of Jinzheng; |

| ● | Yantai Jinzheng Eco-Technology Co., Ltd Xi’an Branch (Jinzheng-Xi’an”); |

| ● | “shares” and “common shares” refer to our common shares, $0.001 par value per share; |

| ● | “China” and “PRC” refer to the People’s Republic of China, excluding, for the purposes of this annual report only, Macau, Taiwan and Hong Kong; and |

| ● | all references to “RMB,” and “Renminbi” are to the legal currency of China, and all references to “USD,” and “U.S. Dollars” are to the legal currency of the United States. |

We refer to Jinzheng by name in discussing the entity that conducts our day-to-day water filtration business in China and refer to “our company” when discussing our strategies, business plans, organization and other decision-making focused matters. Because we own Jinzheng by virtue of our ownership of Newater HK, we believe it would be misleading in most cases to discuss the business decisions of Jinzheng as though Jinzheng were at arm’s-length from our company.

For the sake of clarity, this annual report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our chief executive officer will be presented as “Yuebiao Li”, even though, in Chinese, his name would be presented as “Li Yuebiao”.

ii

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. All statements contained in this annual report other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this annual report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of these forward-looking statements after the date of this annual report or to conform these statements to actual results or revised expectations.

iii

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

| A. | Selected Financial Data. |

In the table below, we provide the summary financial data of our company. The selected consolidated statements of income and comprehensive income data for the years ended December 31, 2019, 2018 and 2017, and the selected consolidated balance sheets data as of December 31, 2018 and 2017 are derived from our audited consolidated financial statements, which are included elsewhere in this annual report. The selected consolidated statement of income and comprehensive income data for the years ended December 31, 2015 and 2014 and the selected consolidated balance sheets data as of December 31, 2017, 2016 and 2015 are derived from our audited consolidated financial statements, which are not included in this annual report. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read it along with the historical statements and notes.

Selected Consolidated Statements of Income and Comprehensive Income Data

| For the years ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Net revenue | $ | 23,716,978 | $ | 25,973,963 | $ | 16,192,503 | $ | 6,425,338 | $ | 6,978,254 | ||||||||||

| Net revenue from related parties | 13,857,014 | 21,066,741 | 9,146,994 | 5,854,383 | - | |||||||||||||||

| Subtotal of revenues | 37,573,992 | 47,040,704 | 25,339,497 | 12,279,721 | 6,978,254 | |||||||||||||||

| Cost of revenues | 20,233,998 | 20,474,072 | 17,199,866 | 7,182,081 | 3,763,871 | |||||||||||||||

| Cost of revenue from related parties | 1,450,627 | 5,669,252 | - | 556,692 | - | |||||||||||||||

| Subtotal of cost of revenues | 21,684,625 | 26,143,324 | 17,199,866 | 7,738,773 | 3,763,871 | |||||||||||||||

| Gross profit | 15,889,367 | 20,897,380 | 8,139,631 | 4,540,948 | 3,214,383 | |||||||||||||||

| Total operating expenses | 10,148,039 | 12,025,924 | 5,452,349 | 3,146,521 | 1,643,313 | |||||||||||||||

| Income from operations | 5,741,328 | 8,871,456 | 2,687,282 | 1,394,427 | 1,571,070 | |||||||||||||||

| Other expenses (income) | ||||||||||||||||||||

| Government grants | (946,164 | ) | (627,748 | ) | (513,538 | ) | (1,750,726 | ) | - | |||||||||||

| Interest income | (38,328 | ) | (26,632 | ) | (112,592 | ) | (5,091 | ) | (2,612 | ) | ||||||||||

| Interest expenses | 1,087,051 | 658,290 | 242,707 | 155,553 | 164,613 | |||||||||||||||

| Investment loss | 17,023 | - | - | - | - | |||||||||||||||

| Other expenses (income) | (153,546 | ) | (1,162 | ) | 3,956 | 12,534 | 10,642 | |||||||||||||

| Total other expense (income) | (33,964 | ) | 2,748 | (379,467 | ) | (1,587,730 | ) | 172,643 | ||||||||||||

| Income before provision for income taxes | 5,775,292 | 8,868,708 | 3,066,749 | 2,982,157 | 1,398,427 | |||||||||||||||

| Income tax provisions | 1,463,745 | 1,657,279 | 475,818 | 548,437 | 452,850 | |||||||||||||||

| Net income | $ | 4,311,547 | $ | 7,211,429 | $ | 2,590,931 | $ | 2,433,720 | $ | 945,577 | ||||||||||

| Earnings (loss) per shares | ||||||||||||||||||||

| Basic | $ | 0.40 | $ | 0.67 | $ | 0.26 | 0.28 | 0.12 | ||||||||||||

| Diluted | $ | 0.40 | $ | 0.67 | $ | 0.26 | 0.28 | 0.10 | ||||||||||||

Selected Balance Sheets Data

| As of December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Cash and cash equivalents | $ | 9,944,765 | $ | 2,461,501 | $ | 3,118,080 | $ | 1,484,762 | $ | 135,152 | ||||||||||

| Total current assets | 46,649,020 | 39,535,357 | 31,634,747 | 14,063,217 | 9,200,052 | |||||||||||||||

| Total non-current assets | 31,411,176 | 22,216,775 | 13,710,900 | 3,528,207 | 1,461,572 | |||||||||||||||

| Total assets | 78,060,196 | 61,752,132 | 45,345,647 | 17,591,424 | 10,661,624 | |||||||||||||||

| Total current liabilities | 45,305,700 | 30,258,610 | 24,343,309 | 6,838,202 | 6,877,885 | |||||||||||||||

| Total non-current liabilities | 1,777,385 | 4,449,889 | 11,050 | - | 30,808 | |||||||||||||||

| Total liabilities | 47,083,085 | 34,708,499 | 24,354,359 | 6,838,202 | 6,908,693 | |||||||||||||||

| Total shareholders’ equity | 30,977,111 | 27,043,633 | 20,991,288 | 10,753,222 | 3,752,931 | |||||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,060,196 | $ | 61,752,132 | $ | 45,345,647 | $ | 17,591,424 | $ | 10,661,624 | ||||||||||

1

Exchange Rate Information

Our business is conducted in China, and the financial records of Jinzheng are maintained in RMB, its functional currency. However, we use the U.S. dollar as our reporting currency; therefore, periodic reports made to shareholders will include current period amounts translated into U.S. dollars using the then-current exchange rates. Our financial statements have been translated into U.S. dollars in accordance with Accounting Standards Codification (“ASC”) 830-10, “Foreign Currency Matters.” We have translated our asset and liability accounts using the exchange rate in effect at the balance sheet date. We translated our statements of operations using the average exchange rate for the period. We reported the resulting translation adjustments under other comprehensive income (loss). The consolidated balance sheet amounts, with the exception of equity at December 31, 2019 and 2018 were translated at RMB 6.9668 and RMB 6.8764 to $1.00, respectively. The equity accounts were stated at their historical rate. The average translation rates applied to consolidated statements of income and comprehensive income and cash flows for the years ended December 31, 2019, 2018 and 2017 were RMB 6.9072, RMB 6.6146 and RMB 6.7570 to $1.00, respectively.

We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The Chinese government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade.

| B. | Capitalization and indebtedness. |

Not applicable for annual reports on Form 20-F.

| C. | Reasons for Offer and use of Proceeds. |

Not applicable for annual reports on Form 20-F.

| D. | Risk Factors. |

Risks Related to Our Business

We are susceptible to general economic conditions, natural catastrophic events and public health crises, and a potential downturn in the membrane filtration market could adversely affect our operating results in the near future.

Our business is subject to the impact of natural catastrophic events, such as earthquakes, or floods, public health crisis, such as disease outbreaks, epidemics, or pandemics in China, and all these could result in a decrease or sharp downturn of economies, including our markets and business locations in the current and future periods. The outbreak of the coronavirus (COVID-19) pandemic (“COVID-19”) in China resulted in increased travel restrictions, and shutdown of businesses, which may cause slower recovery of the China economy. We may experience impact from quarantines, market downturns and changes in customer behavior related to pandemic fears and impact on our workforce if the virus continues to spread. COVID-19 could cause delays or the inability to deliver our products and services on a timely basis. In addition, one or more of our customers, partners, service providers or suppliers may experience financial distress, delayed or defaults on payment, file for bankruptcy protection, sharp diminishing of business, or suffer disruptions in their business due to the outbreak. The extent to which the coronavirus impacts our results will depend on future developments and reactions in China, which are highly uncertain and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus. It is likely to result in a potential material adverse impact on our business, results of operations and financial condition in the short run if the situation gets worse in China. Wider-spread COVID-19 in China and globally could prolong the deterioration in economic conditions and could cause decreases in or delays in spending and reduce and/or negatively impact our short-term ability to grow our revenues. Any decreased collectability of accounts receivable, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

Our limited operating history makes it difficult to evaluate our future prospects and results of operations, and we face certain risks and uncertainties as an early stage company, which, if we are unsuccessful in addressing such risks, could have a material adverse effect on our business.

Jinzheng was established in 2012. Newater Technology and Newater HK were established in 2015. As our operating history is not lengthy and the environment protection industry in China is still developing, it is difficult to evaluate our business and future prospects. We cannot assure that we will maintain our profitability or that we will not incur net losses in the future. Any failure to achieve targeted sales could result in our revenue growth to slow or even operating losses. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by developing companies in the evolving Chinese markets for water treatment. In addition, we face numerous risks, uncertainties, expenses and difficulties frequently encountered by companies at an early stage of development. We will continue to encounter risks and difficulties in implementing our business model, including potential failure to:

| ● | increase our revenue and market share by targeting specific markets; | |

| ● | expand our operations and business to other regions in China and internationally; | |

| ● | attract additional customers and increase spending per customer; | |

| ● | attract a wider client base; | |

| ● | increase visibility of our brand and maintain customer loyalty; | |

| ● | respond to competitive market conditions; |

2

| ● | anticipate and adapt to changing conditions in the markets in which we operate as well as changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics; | |

| ● | manage risks associated with intellectual property rights; | |

| ● | maintain effective control of our costs and expenses; | |

| ● | raise sufficient capital to sustain and expand our business; | |

| ● | attract, train, retain and motivate qualified personnel, continue to train, motivate and retain our existing employees, attract and integrate new employees, including into our senior management; and | |

| ● | upgrade our technology to support additional research and development of new water treatment filtration products. |

We cannot predict whether we will be successful in addressing any or all of these risks. If we were unsuccessful in addressing these risks and uncertainties, our business, financial condition and results of operation may be materially and adversely affected.

Wage increases in China may prevent us from sustaining our competitive advantage and could reduce our profit margins.

Labor costs in China have increased with China’s economic development, including Yantai where our offices are based. Rising inflation in China is also putting pressure on wages. Wage costs for our employees form a significant part of our costs. For instance, in 2019, 2018 and 2017, our compensation and benefit costs for our employees were 4.2 million $6.8 million and $2.5 million, respectively. These amounts accounted for 11%, 14% and 10% of our total revenues for the years ended December 31, 2019, 2018 and 2017, respectively. In addition, we are required by Chinese laws and regulations to pay various statutory employee benefits, including pensions, housing funds, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance to designated governmental agencies for the benefit of our employees. We expect that our labor costs, including wages and employee benefits, will continue to increase, particularly as we seek to remain competitive in retaining the quality and number of employees that our business requires. In addition, the future issuance of equity-based compensation to our professional staff and other employees would also result in additional stock dilution for our shareholders. Unless we are able to pass on these increased labor costs to our customers by increasing prices for our products, projects and services, our profitability and results of operations may be materially and adversely affected. Furthermore, the Chinese government has promulgated new laws and regulations to enhance labor protections in recent years, such as the Labor Contract Law and the Social Insurance Law. As the interpretation and implementation of these new laws and regulations are still evolving, our employment practice may not at all times be deemed in compliance with the new laws and regulations. If we are subject to penalties or incur significant liabilities in connection with labor disputes or investigation, our business and profitability may be adversely affected.

Our revenue will decrease if the industries in which our customers operate experience a protracted slowdown.

Our customers generally operate in the waste (garbage), chemical and energy industries. Therefore, we are subject to general changes in economic conditions impacting these industry segments of the economy. If these industries do not grow or if there is a contraction in these industries, demand for our business will decrease. Our revenue will also be affected by factors such as interest rates, environmental laws and regulations, private and public investment in infrastructure projects and health of the overall Chinese economy.

Any decline in the availability or increase in the cost of raw materials could materially impact our earnings.

Revenues from our products, projects and service depend heavily on the availability of various raw materials. Raw materials may become unavailable from time to time, and their prices may fluctuate significantly. If our suppliers are unable or unwilling to provide us with raw materials, we may be unable to produce certain products, which could adversely impact our projects and services. This could result in a decrease in revenue, damage to our corporate reputation and even financial loss. In the event our raw material costs increase, we may not be able to pass these higher costs on to our customers in full or at all.

We rely on a limited number of suppliers, and the loss of any supplier could harm our business, and the loss of any significant supplier could have a material adverse effect on our business.

We have not entered into a long-term contract with our suppliers and instead rely on individual contracts. Although we believe that we can locate a replacement supplier readily on the market for prevailing prices, any difficulty in securing the replacement supplier could negatively affect our company’s performance to the extent it results in higher prices or a slower supply chain.

Decline in sales to related parties may adversely impact our revenue, which could have a material adverse impact on our business.

In 2019, 37% of our sales revenues or $13,857,014 was generated from related parties. In the event the related parties do not purchase our products to the same extent as in 2019 our revenues will likely decrease, and our business, financial condition and results of operation may be materially and adversely affected.

3

Collectability of our accounts receivable has adversely impacted our operating cash flow, and may continue to do so.

We reported cash flow provided by operations in the amounts of 13,291,596 for the year ended December 31, 2019 and cash flow used in operations in the amount of $2,456,777 and $3,189,701 for the years ended December 31, 2018 and 2017, respectively. Improvement in cash flow from operations in 2019, 2018 and 2017 was partly due to the increase in net income. As of December 31, 2019 and 2018, the balance of net accounts receivable from third parties were $11,293,625 and $10,064,847, respectively; and the net accounts receivable from related parties as of December 31, 2019 and 2018 were $2,392,087 and $1,948,009, respectively. If the accounts receivable cannot be collected on time, or at all, a significant amount of bad debt expense will occur, and our business, financial condition and results of operation may be materially and adversely affected.

We face substantial inventory risk, which if such risk is not addressed could have a material adverse effect on our business.

We typically acquire materials through a combination of purchase orders, supplier contracts and open orders, based on projected demand. As part of our business strategy, we order materials for our products, projects and services and build inventory in advance. This strategy has enabled us to complete customer orders in a short amount of time as compared to months of lead time for our competitors. This strategy has proven to be effective and given us the competitive advantage since certain customers require expedited order production and shipment.

Our inventory includes raw materials, work-in progress products and finished goods. As of December 31, 2019, our inventory was $13,715,369. Inventory turnover for the year ended December 31, 2019 was 231 days. As our markets are competitive and subject to rapid technology and price changes, there is a risk that we will project demands incorrectly and order or produce incorrect amounts of inventories or not fully utilize our purchase commitments. If we fail to accurately project demands and build inventories, our business, financial condition and results of operation may be materially and adversely affected.

Any disruption in the supply chain of raw materials and our products could adversely impact our ability to produce and deliver products, which could have a material adverse effect on our business.

In order to optimize our production process, we must manage our supply chain for raw materials and delivery of our products. Supply chain fragmentation and local protectionism within China further complicates supply chain management. Local administrative bodies and physical infrastructure built to protect local interests may pose transportation challenges for raw material transportation as well as product delivery. In addition, government actions, legal enforcements, natural disasters, and other events could impact our supply chain. Any of these events could cause significant disruptions to our supply chain, production capacity and distribution. If we were unsuccessful in managing our supply chain, our business, financial condition and results of operation may be materially and adversely affected.

Based on our current operation results, we rely on our manufacturing inspection, quality testing and customer support teams, to keep repair and maintenance claims at a level that does not require a financial reserve. However, if we experience any significant increases in claims or customers refusing to pay the final 5-20% of the price due to product quality, our financial results could be adversely affected.

Our operations are subject to geographic market risks, which could adversely affect our revenues and profitability.

In 2019, approximately 59% of our revenues were realized from three geographic markets, with approximately 30%, 22%, and 7% of our revenues from clients located in the Beijing City, Shandong Province and Hainan Province, respectively. Accordingly, we are subject to risks related to the economies of these geographic markets. In addition, the geographic concentration of our primary clients suggests that region-specific legislations, taxation and natural disasters such as earthquakes could adversely affect us and our financial performance. A slowdown in wastewater treatment demand or economic growth in these regions could result in a material decline in our business, financial condition and results of operation.

We face certain risks in collecting our accounts receivable and we have a small number of customers who account for a significant amount of our revenues, the failure to collect could have a material adverse effect on our business.

With the recent expansion of our business, our accounts receivable has increased. At the end of 2019 and 2018, our net accounts receivable from both third parties and related parties were 13,685,712 and $12,012,856, respectively. These amounts represented 36% of our total revenues in 2019 and 26% of our total revenues in 2018. In 2019, accounts receivable turnover was 125 days, and in 2018, it was 70 days.

4

Although we believe that we have developed a robust receivables management system and have not incurred a situation where an accounts receivable has become uncollectable, as our business continues to scale, we believe that our accounts receivable balance will continue to grow. This, in turn, increases our risks for bad debts and uncollectible receivables. To the extent we incur additional bad debts and/or uncollectible receivables, our business, financial condition and results of operation may be materially and adversely affected.

We have experienced rapid growth in recent periods. If we fail to manage our growth effectively, we may be unable to execute our business plan and address competitive challenges, which could have a material adverse effect on our business.

We increased our number of full-time employees from 75 at December 31, 2015, to 170 at December 31, 2019, and our total revenues from $7 million in 2015, to $38 million in 2019. This expansion has resulted, and will continue to result, in substantial demands on our managerial, administrative, operational, financial and other resources. Furthermore, we intend to grow by expanding our business reach, penetrating markets with our existing products, developing new products and expand our targeted markets such as industrial park wastewater treatment, municipality wastewater recycling, and seawater desalination. To cope with this growth, we must improve our existing administration, adopt new systems, enhance our financial oversight and management controls and further grow, train and manage our work force.

As we continue these efforts, we may incur substantial costs and expend substantial resources due to, among other things, different technology standards, legal considerations and cultural differences. We will be required to dedicate additional financial resources and personnel to optimize our operational infrastructure and to recruit more personnel to train and manage our growing employee base. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, projects and services, which will impair our revenue growth and hurt our overall financial performance.

We cannot assure you that our growth strategy will be successful, which may result in a negative impact on our growth, financial condition, results of operations and cash flow.

We plan to grow by expanding our business reach, penetrating markets with our existing products, developing new products and grow our targeted markets such as industrial park wastewater treatment, municipality wastewater recycling, and seawater desalination. However, many risks to this plan exist, including results of marketing campaigns, competition from similar businesses, and results outcome of our research and development investments. We cannot, therefore, assure you that we will be able to successfully overcome such risks and grow our business as planned. Failure in our growth strategy may have a negative impact on our growth, future financial condition, and results of operations or cash flows.

If we fail to compete successfully against new and existing competitors, we may not be able to increase our market share, and our profitability may be adversely affected.

We do and will continue to face significant competition in China in the wastewater treatment business. Currently, our competitive advantages include our brand reputation, price, quick production and shipment time, and the range of our products and services. Our existing and potential competitors may have competitive advantages, such as financial resources, marketing campaigns or other resources. We cannot assure that we will be able to successfully compete with those competitors. If we fail to maintain our competitive advantages and respond to our competitors’ actions, customers demand for our products, projects and services could decline.

5

If we fail to protect our intellectual property rights, it could harm our business and competitive position.

We own 58 patents in China covering our wastewater treatment technology, and we rely on a combination of patent, computer software copyrights, trademark, domain names and trade secret laws and non-disclosure agreements and other methods to protect our intellectual property rights.

The process of seeking patent protection on future patents can be lengthy and expensive, our patent applications may be rejected, and our existing and future patents may be insufficient to provide us with sufficient protection or commercial advantage. Our patents and patent applications may also be challenged, invalidated or circumvented.

Implementation of Chinese intellectual property-related laws has historically been ineffective, primarily due to ambiguities in Chinese laws and enforcement difficulties. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as those in the United States or other developed countries. Furthermore, indemnifying unauthorized use of proprietary technology is difficult and expensive, and we may need to resort to litigation to enforce or defend our patents. Such litigations and its results could cause substantial costs and diversion of resources and management attention, which could harm our business and growth.

We may be exposed to intellectual property infringement and other claims by third parties which, if successful, could disrupt our business and have a material adverse effect on our financial condition and results of operations.

Our success depends, in a large part, on our ability to use and develop our technology and know-how without infringing third party intellectual property rights. With global expansion of our products, and increased amount of business activities we are exposed to a higher litigation risk for intellectual property infringement, invalidity and indemnification relating to other parties’ proprietary rights. Our current or potential competitors, many of which have substantial resources and have made substantial investments in competing technologies, may have obtained or going to obtain patents that will prevent, limit or interfere with our products in either China or other countries. The defense of the potential suits, including patent infringement suits, and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. Furthermore, an adverse determination in any such litigation or proceedings to which we may become a party could cause us to:

| ● | pay damages; | |

| ● | seek licenses from third parties; | |

| ● | pay ongoing royalties; | |

| ● | redesign our existing products; or | |

| ● | be restricted by injunctions. |

Any of these events could prevent us from expanding to new markets, maintaining our current customer base and obtaining new customers, which could have a material adverse effect on our financial condition and results of operations.

Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of proprietary information and trade secrets.

In addition to patents, we rely on confidentiality agreements to protect our technical know-how and other proprietary information. Confidentiality agreements are used, for example, when we talk to potential clients, consultants, contractors and vendors. In addition, our scientists and each of our research and development and manufacturing employees have signed a confidentiality agreement. Nevertheless, there can be no guarantee that an employee or a third party will not make an unauthorized disclosure of our proprietary confidential information. This might happen intentionally or inadvertently. It is possible that a competitor will make use of such information, and that our competitive position will be compromised, in spite of any legal action we might take against persons making such unauthorized disclosures.

6

If we experience a significant disruption in, or a breach in security of, our information technology systems or if we fail to implement, manage or integrate new systems, software and technologies successfully, it could harm our business.

Our information technology (“IT”) systems are an integral part of our business. We depend on our IT systems to process transactions, manage logistics, keep financial records, prepare our financial reporting and operate other critical functions. Security breaches, cyber-attacks or other serious disruptions of our IT systems can create systemic disruptions, shutdowns or unauthorized disclosure of confidential information. If we are unable to prevent or adequately respond to such breaches, attacks or other disruptions, our operations could be adversely affected or we may suffer financial or reputational damage.

In addition, our ability to effectively implement our business plan in a rapidly evolving market requires effective planning, reporting and analytical processes and systems. We are improving and expect that we will need to continue to improve and further integrate our IT systems, reporting systems and operating procedures on an ongoing basis. If we fail to do so effectively, it could adversely affect our ability to achieve our objectives.

Product defects and unanticipated use or inadequate disclosure with respect to our products could adversely affect our business, reputation and financial performance.

Manufacturing or design defects (including in products or components that we source from third parties), unanticipated use of, or inadequate disclosure of risks relating to, the use of products that we make and sell may lead to personal injury, death or property damage. These events could lead to recalls or alerts relating to our products, result in the removal of a product from the market or result in product liability claims being brought against us. Product recalls, removals and liability claims can lead to significant costs, as well as negative publicity and damage to our reputation that could reduce demand for our products.

Our future growth depends on new products and new technology innovation, and failure to invent and innovate could adversely impact our business prospects.

Our future growth depends in part on maintaining our competitive advantage with current products in new and existing markets, as well as our ability to develop new products and technologies to serve such markets. To the extent that competitors develop competitive products and technologies, or new products or technologies that achieve higher customer satisfaction, our business prospects could be adversely impacted. In addition, regulatory approvals for new products or technologies may be required and these approvals may not be obtained in a timely or cost effective manner, adversely impacting our business prospects.

Changes in demand for our products and business relationships with key customers and suppliers may negatively affect operating results.

To achieve our objectives, we must develop and sell products that are subject to the demands of our customers. This is dependent on many factors, including managing and maintaining relationships with key customers, responding to the rapid pace of technological change and obsolescence, which may require increased investment by us or result in greater pressure to commercialize developments rapidly or at prices that may not fully recover the associated investment, and the effect on demand resulting from customers’ research and development, capital expenditure plans and capacity utilization. If we are unable to keep up with our customers’ demands, our sales, earnings and operating results may be negatively affected.

7

We may be unable to deliver our backlog on time, which could affect future sales and profitability and our relationships with customers.

Our ability to meet customer delivery schedules for backlog is dependent on a number of factors including sufficient manufacturing plant capacity, adequate supply channel access to raw materials and other inventory required for production, an adequately trained and capable workforce, project engineering expertise for certain large projects and appropriate planning and scheduling of manufacturing resources. Many of the contracts we enter into with our customers require long manufacturing lead times. Failure to deliver in accordance with customer expectations could subject us to contract cancellations and financial penalties, and may result in damage to existing customer relationships and could have a material adverse effect on our business, financial condition and results of operations.

We depend on our key personnel, and our business and growth prospects may be severely disrupted if we lose their services.

Our future success depends heavily upon the continued service of our key executives. In particular, we rely on the expertise and experience of Yuebiao Li, our founder, Chairman and Chief Executive Officer. We rely on his industry expertise and experience in our business operations, and in particular, his business vision, management skills, and working relationship with our employees, our other major shareholders, the regulatory authorities, and many of our clients. If he became unable or unwilling to continue in his present position, or if he joined a competitor or formed a competing company in violation of his employment agreement, we may not be able to replace him easily, our business may be significantly disrupted and our financial condition and results of operations may be materially adversely affected.

We do not maintain key man life insurance on all of our senior management or key personnel. The loss of any one of them would have a material adverse effect on our business and operations. Competition for senior management and our other key personnel is intense and the pool of suitable candidates is limited. We may be unable to locate a suitable replacement for any senior management or key personnel that we lose. In addition, if any member of our senior management or key personnel joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our Company. Although each of our senior management and key personnel has signed a confidentiality and non-competition agreement in connection with his or her employment with us, we cannot assure that we will be able to successfully enforce these provisions in the event of a dispute between us and any member of our senior management or key personnel.

In addition, we compete for qualified personnel with other water treatment companies, and we face competition in attracting skilled personnel and retaining the members of our senior management team. These personnel possess technical and business capabilities, including expertise relevant to the water treatment market, which are difficult to replace. There is intense competition for experienced senior management with technical and industry expertise in the water treatment industry, and we may not be able to retain our key personnel. Intense competition for these personnel could cause our compensation costs to increase, which could have a material adverse effect on our results of operations. Our future success and ability to grow our business will depend in part on the continued service of these individuals and our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals.

Our senior management lacks experience in managing a public company and complying with laws applicable to operating as a U.S. public company domiciled in the British Virgin Islands and failure to comply with such obligations could have a material adverse effect on our business.

Prior to the completion of our initial public offering, Jinzheng operated as a private company located in China. In connection with our initial public offering, we formed Newater Technology in the British Virgin Islands, Newater HK Limited in Hong Kong and restructured Jinzheng a Newater subsidiary in China. In the process of taking these steps to prepare our company for the initial public offering, Jinzheng’s senior management became the senior management of Newater Technology. None of Newater Technology’s senior management has experience managing a public company or managing a British Virgin Islands company.

8

As a result of our initial public offering, our company became subject to laws, regulations and obligations that did not previously apply to it, and our senior management had no experience in complying with such laws, regulations and obligations. For example, Newater Technology needs to comply with the British Virgin Islands laws applicable to companies that are domiciled in that country. The senior management was only experienced in operating the business of Jinzheng in compliance with Chinese laws. Similarly, by virtue of our initial public offering, Newater Technology is required to file annual and current reports in compliance with U.S. securities and other laws. These obligations can be burdensome and complicated, and failure to comply with such obligations could have a material adverse effect on Newater. In addition, we expect that the process of learning about such new obligations as a public company in the United States will require our senior management to devote time and resources to such efforts that might otherwise be spent on the operation of our water treatment business.

We have limited business insurance coverage. Any future business liability, disruption or litigation we experience might divert management focus from our business and could significantly impact our financial results.

Availability of business insurance products and coverage in China is limited, and most such products are expensive in relation to the coverage offered. We have determined that the risks of disruption, cost of such insurance and the difficulties associated with acquiring such insurances on commercially reasonable terms make it impractical for us to maintain such insurances. As a result, we do not have any business liability, disruption or litigation insurance coverage for our operations in China. Accordingly, a business disruption, litigation or natural disaster may result in substantial costs and divert management’s attention from our business, which would have an adverse effect on our results of operations and financial condition.

We may require additional financing in the future and our operations could be curtailed if we are unable to obtain required additional financing when needed.

We may need to obtain additional debt or equity financing to fund future capital expenditures. Any additional equity financing may result in dilution to the holders of our outstanding shares of capital stock. Additional debt financing may impose affirmative and negative covenants that restrict our freedom to operate our business, including covenants that:

| ● | limit our ability to pay dividends or require us to seek consent for the payment of dividends; |

| ● | increase our vulnerability to general adverse economic and industry conditions; |

| ● | require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and |

| ● | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

We cannot guaranty that we will be able to obtain additional financing on terms that are acceptable to us, or any financing at all, and the failure to obtain sufficient financing could adversely affect our business operations.

Potential disruptions in the capital and credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements, which could adversely affect our results of operations, cash flows and financial condition.

Potential changes in the global economy may affect the availability of business and consumer credit. We may need to rely on the credit markets, particularly for short-term borrowings from banks in China, as well as the capital markets, to meet our financial commitments and short-term liquidity needs if internal funds from our operations are not available to be allocated to such purposes. Disruptions in the credit and capital markets could adversely affect our ability to draw on such short-term bank facilities. Our access to funds under such credit facilities is dependent on the ability of the banks that are parties to those facilities to meet their funding commitments, which may be dependent on governmental economic policies in China. Those banks may not be able to meet their funding commitments to us if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests from us and other borrowers within a short period of time.

9

Long-term disruptions in the credit and capital markets could result from uncertainty, changing or increased regulations, reduced alternatives or failures of financial institutions could adversely affect our access to the liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Such measures may include deferring capital expenditures, and reducing or eliminating discretionary uses of cash. These events would adversely impact our results of operations, cash flows and financial position.

We rely on short-term borrowings for our liquidity and we may not be able to continue to obtain financing on favorable terms, if at all.

Our liquidity relies significantly on short-term borrowings. For the years ended December 31, 2019, 2018 and 2017, cash provided by borrowings from third-parties was $7,454,711, $11,493,557 and $8,805,683, respectively. Financing may not be available to us on favorable terms, if at all. If we are unable to obtain short-term financing in an amount sufficient to support our operations, it may be necessary, to suspend or curtail our operations, which would have a material adverse effect on our business and financial condition. In that event, current stockholders would likely experience a loss of most of or all of their investment.

Our bank accounts are not insured or protected against loss.

Jinzheng maintains cash accounts with various banks located in China. Such cash accounts are not insured or otherwise protected. Should any bank holding such cash deposits become insolvent, or if Jinzheng is otherwise unable to withdraw funds, Jinzheng would lose the cash on deposit with that particular bank.

Changes in China’s environmental laws and policies may affect our financial condition.

Our products, projects and services are mainly used in the fields of municipal and industrial wastewater treatment and reuse, water purification and desalination. Our business is in line with China’s current focus on environmental protection policies, specifically the Water Ten Plan and the 13th Five Year Plan (2016-2020). However, should China alter its environmental policies towards less regulation, we believe demand for our products will decrease, adversely impacting our results of operations, cash flows and financial position.

Risks Relating to Our Corporate Structure

We will likely not pay dividends in the foreseeable future.

We have not previously paid any cash dividends, and we do not anticipate paying any dividends on our common shares in the foreseeable future. Although we have achieved net profitability in 2019, we cannot assure that our operations will continue to result in sufficient revenues to enable us to operate at profitable levels or to generate positive cash flows from operating activities. Furthermore, there is no assurance that our Board of Directors will declare dividends even if we are profitable. Dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors. If we determine to pay dividends on any of our common shares in the future, we will be dependent, in large part, on receipt of funds from Jinzheng for our cash needs, including the funds necessary to pay dividends and other cash distributions, if any, to our shareholders, to service any debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in China is subject to limitations as described herein. Under British Virgin Islands law, we may only pay dividends from surplus (the excess, if any, at the time of the determination of the total assets of our Company over the sum of our liabilities, as shown in our books of account, plus our capital), and we must be solvent before and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the ordinary course of business; and the realizable value of assets of our Company will not be less than the sum of our total liabilities, other than deferred taxes as shown on our books of account, and our capital. If we determine to pay dividends on any of our common shares in the future, as a holding company, we will be dependent on receipt of funds from Jinzheng and Jinda. See “Dividend Policy.”

10

Pursuant to the Chinese enterprise income tax law, dividends payable by a foreign investment entity to its foreign investors are subject to a withholding tax of 10%. Similarly, dividends payable by a foreign investment entity to its Hong Kong investor who owns 25% or more of the equity of the foreign investment entity is subject to a withholding tax of 5%.

The payment of dividends by entities organized in China is subject to limitations, procedures and formalities. Regulations in China currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. Our Chinese subsidiaries are also required to set aside at least 10% of its after-tax profit based on Chinese accounting standards each year to its compulsory reserves fund until the accumulative amount of such reserves reaches 50% of its registered capital.

The transfer to this reserve must be made before distribution of any dividend to shareholders. The surplus reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or converted into registered capital, provided that the remaining reserve balance after such issue is not less than 25% of the registered capital. As of December 31, 2019 and 2018, the accumulated appropriations to statutory reserves amounted to $2,267,219 and $1,765,711, respectively.

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

We have never declared or paid cash dividends. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. As a result, capital appreciation, if any, of our ordinary shares will be your sole source of gain for the foreseeable future.

Our business may be materially and adversely affected if any of our Chinese subsidiaries declare bankruptcy or become subject to a dissolution or liquidation proceeding.

The Enterprise Bankruptcy Law of China provides that an enterprise may be liquidated if the enterprise fails to settle its debts as and when they fall due and if the enterprise’s assets are, or are demonstrably, insufficient to clear such debts.

Our Chinese subsidiaries hold certain assets that are important to our business operations. If any of our Chinese subsidiaries undergoes a voluntary or involuntary liquidation proceeding, unrelated third-party creditors may claim rights to some or all of these assets, thereby hindering our ability to operate our business, which could materially and adversely affect our business, financial condition and results of operations.

Our Chinese subsidiaries are required to allocate a portion of its after-tax profits, to the statutory reserve fund, and as determined by its board of directors, to the staff welfare and bonus funds, which may not be distributed to equity owners.

Pursuant to Company Law of P.R. China (2018 Revision),the Foreign Investment Law of the PRC and the Regulations for Implementation the Foreign Investment Law of the PRC, our Chinese subsidiaries are required to allocate a portion of its after-tax profits, to the statutory reserve fund, and in its discretion, to the staff welfare and bonus funds. No lower than 10% of an enterprise’s after tax-profits should be allocated to the statutory reserve fund. When the statutory reserve fund account balance is equal to or greater than 50% of the registered capital, no further allocation to the statutory reserve fund account is required. Our Chinese subsidiaries can determine, in their own discretion, the amount contributed to the staff welfare and bonus funds. The staff welfare and bonus fund is used for the collective welfare of the staff of our Chinese subsidiaries. These reserves represent appropriations of retained earnings determined according to Chinese law.

As of the date of this annual report, the amounts of staff welfare and bonus funds have not yet been determined, and we have not committed to establishing such amounts at this time. Under current Chinese laws, our Chinese subsidiaries are required to set aside staff welfare and bonus funds amounts, but has not yet done so. Our Chinese subsidiaries have not done so because Chinese authorities grant companies flexibility in making a determination. Chinese law requires such a determination to be made in accordance with the company’s organizational documents and our Chinese subsidiaries’ organizational documents do not require the determination to be made within a particular timeframe. Although we have not yet been required by Chinese authorities to make such determinations or set aside such amounts, Chinese authorities may require us to rectify its noncompliance and we may be fined if we fail to do so after receiving a warning within its set time period.

Additionally, Chinese law provides that a Chinese company must allocate a portion of after-tax profits to the statutory reserve fund and the staff welfare and bonus funds reserve prior to the retention of profits or the distribution of profits to foreign invested companies. Therefore, if for any reason, the dividends from Jinzheng and Jinda cannot be repatriated to us or not in time, our cash flow may be adversely impacted or we may become insolvent.

11

Our failure to obtain prior approval of the China Securities Regulatory Commission (“CSRC”) for the listing and trading of our common shares on a foreign stock exchange could have a material adverse effect upon our business, operating results, reputation and trading price of our common shares.

On August 8, 2006, six Chinese regulatory agencies, including the Ministry of Commerce of the People’s Republic of China (“MOFCOM”), jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which was subsequently revised on June 22, 2009 (the New “M&A Rule”). The New M&A Rule contains provisions that require that an offshore special purpose vehicle (“SPV”) formed for overseas listing purposes and controlled directly or indirectly by Chinese companies or individuals shall obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange.

However, the application of the New M&A Rule remains unclear with no consensus currently existing among leading Chinese law firms regarding the scope and applicability of the CSRC approval requirement. Our Chinese counsel, GFE Law Firm, has given us the following advice, based on their understanding of current Chinese laws and regulations:

| ● | At the time of our equity interest acquisition, as the acquiree, Jinzheng was not related to or connected with the acquirer, Newater HK. Accordingly, we did not need the approval from MOFCOM. In addition, we have received all relevant approvals and certificates required for the acquisition; and |

| ● | the CSRC approval under the New M&A Rule only applies to overseas listings of SPVs that have used their existing or newly issued equity interest to acquire existing or newly issued equity interest in Chinese domestic companies, or the SPV-domestic company share swap, due to the fact there has not been any SPV-domestic company share swap in our corporate history, Newater Technology does not constitute a SPV that is required to obtain approval from the CSRC for overseas listing under the New M&A Rule. | |

| ● | In spite of the lack of clarity on this issue, the CSRC has not issued any definitive rule or interpretation regarding whether offerings like our initial public offering are subject to the New M&A Rule. |

The CSRC has not issued any such definitive rule or interpretation, and we have not chosen to voluntarily request approval under the New M&A Rule. We did not obtain CSRC approval prior to our initial public offering. If prior CSRC approval was required, we may face regulatory actions or other sanctions from the CSRC or other Chinese regulatory authorities. These authorities may impose fines and penalties upon our operations in China, limit our operating privileges in China, or take other actions that could have a material adverse effect upon our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common shares.

12

Risks Related to Doing Business in China

Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed an Enterprise Income Tax Law (the “EIT Law”) and implementing rules, both of which became effective on January 1, 2008, and amended from time to time. Under the EIT Law, resident enterprises pay income tax at the rate of 25% for their worldwide income while non-resident enterprises pay 20% for their income generated from China. As far as the definition of resident enterprises, according to the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise.” The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation of China (the “SAT”) issued the Circular 82 Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of De Facto Management Bodies (“Circular 82”) further interpreting the application of the EIT Law and its implementation to offshore entities controlled by a Chinese enterprise or group. Pursuant to the Circular 82, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “non-domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate stamps, board and stockholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management are often resident in China. The SAT issued a Bulletin Concerning on the Administration Measures on Resident Enterprise Income Tax for Oversea Incorporated Enterprises Controlled by Chinese Enterprise or Enterprise Group on July 27, 2011 or Bulletin 45, which provides more guidance on the implementation of Circular 82. Bulletin 45 clarifies certain matters relating to resident status determination, post-determination administration, competent tax authorities, tax registration administration and tax reporting obligations. In addition, the SAT issued a Bulletin Concerning the Accreditation of Resident Enterprises Based on the Criteria of De Factor Management Bodies on January 29, 2014, or Bulletin 9, which further provides that, among other things, an entity that is classified as a “resident enterprise” in accordance with Circular 82 shall file the application for classifying its status of residential enterprise with the local tax authorities where its main domestic investors are registered. From the year in which the entity is determined to be a “resident enterprise,” any dividend, profit and other equity investment gain derives from other resident enterprises in China after January 1, 2008 shall be taxed in accordance with the EIT law and its implementing rules. A resident enterprise would have to pay a withholding tax at a rate of 10% when paying dividends to its non-PRC stockholders, however, as stipulated in the Arrangement between Mainland China and Hong Kong Special Administration Region for the Avoidance of Double Taxation and the Prevention of Tax Evasion on Income, if a PRC resident enterprise pays dividends to its Hong Kong shareholder which directly owns more than 25% of its equity interest, the withholding tax rate may be reduced to 5%, subject to certain requirements.

We believe that neither Newater Technology nor Newater HK meet all the conditions outlined in the preceding paragraph to be classified as a PRC “resident enterprise.” Newater Technology does not have a PRC enterprise or enterprise group as its primary controlling shareholder, and we are not aware of any offshore company with a corporate structure similar to the company that has been deemed a PRC “resident enterprise” by the PRC tax authorities. However, as the tax resident status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body,” we cannot guarantee that the relevant authorities will not make a contrary conclusion to ours. If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income. In our case, this would mean that income such as non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, tax reporting obligations would follow if we are deemed a resident enterprise. Finally, it is possible that future guidance issued with respect to the “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. In addition to the uncertainty in how the resident enterprise classification could apply, it is also possible that the rules may change in the future, possibly with retroactive effect. If we are required under the Enterprise Income Tax law to withhold PRC income tax on our dividends payable to our foreign shareholders, or if we are required to pay PRC income tax on the transfer of our shares under the circumstances mentioned above, the value of your investment in our shares or ADSs may be materially and adversely affected. It is unclear whether, if we are considered as a PRC resident enterprise, holders of our shares would be able to claim the benefit of income tax treaties or agreements entered into between China and other countries or areas.

13

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law.

In connection with our initial public offering, we became subject to the U.S. Foreign Corrupt Practices Act (“FCPA”), and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are also subject to the Anti-Unfair Competition Law of the PRC and the relevant anti-bribery provisions in the Criminal Law of the PRC, or together, the “PRC Anti-Bribery Laws.” The current PRC Anti-Bribery Laws prohibit the payment of bribes to government officials, private companies or individuals in a commercial transaction or their agents. We have operations, agreements with third parties, and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants or distributors of our company, because these parties are not always subject to our control. We are in process of implementing an anticorruption program, which prohibits the offering or giving of anything of value to foreign officials, directly or indirectly, for the purpose of obtaining or retaining business. The anticorruption program also requires that clauses mandating compliance with our policy be included in all contracts with foreign sales agents, sales consultants and distributors and that they certify their compliance with our policy annually. It further requires all hospitality involving promotion of sales to foreign governments and government-owned or controlled entities to be in accordance with specified guidelines. In the meantime, we believe to date we have complied in all material respects with the provisions of the FCPA and the PRC Anti-Bribery Laws.

However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or PRC Anti-Bribery Laws may result in severe criminal or administrative sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Our subsidiaries’ financial statements are prepared under different accounting standards than our consolidated financial statements.

We prepare the financial statements for each of our subsidiaries that are PRC legal entities in accordance with the requirements of generally accepted accounting principles in China, or PRC GAAP. These financial statements drive how we calculate the taxes payable for operations of these subsidiaries. By contrast, we prepare the consolidated financial statements for Newater Technology in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. The process of consolidating the financial statements and changing from PRC GAAP to U.S. GAAP requires us to make certain adjustments on consolidation. This can result in some discrepancies between the financial statements used to prepare our tax filings in China and the financial statements audited by our independent registered accounting firm and subsequently filed with the SEC. To the extent the discrepancies between PRC GAAP and U.S. GAAP are material, we could find, for example, that a PRC subsidiary shows taxable income for which payment of taxes is due, while our U.S. GAAP-audited financial statements show taxable loss.