As filed with

the Securities and Exchange Commission on August 9, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

AMENDMENT NUMBER 1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

UPAY, Inc.

(Exact name of Registrant

as specified in its charter)

| Nevada |

|

6199 |

|

37-1793622 |

| State or other jurisdiction |

|

Primary Standard Industrial |

|

(I.R.S. Employer |

| Incorporation or organization |

|

Classification Code Number) |

|

Identification Number) |

(972) 888-6052

Telephone Number of Registrant’s Principal

3010 LBJ Freeway, 12th Floor

Dallas, Texas 75234

Executive Offices and Principal Place of

Business)

Wouter Fouche

3010 LBJ Freeway, 12th Floor

Dallas, Texas 75234

Name, address, including zip code, and telephone

number, including area code, of agent for service)

Communication Copies to

Frederick M. Lehrer, P. A.

Frederick M. Lehrer. Esquire

Attorney and Counselor at Law

600 River Birch Court, 1015

Clermont, Florida 34711

flehrer@securitiesattorney1.com

(561) 706-7646

Approximate date of proposed sale to the

public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

If

this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

x |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

Title of Each

Class of

Securities to be

Registered | |

Amount to be

Registered (1) | | |

Proposed

Maximum

Offering Price

Per Share (2) | | |

Proposed

Maximum

Aggregate

Offering Price (2) | | |

Registration

Fee(3) | |

| Shares of Common Stock, par value $0.0001 | |

| 2,267,810 | | |

$ | 0.10 | | |

$ | 226,781 | | |

$ | 22.84 | |

| (1) | Represents an aggregate of 2,267,810 shares of common stock being registered for resale on behalf

of the selling stockholders of such securities and (ii) pursuant to Rule 416 under the Securities Act, an indeterminate number

of shares of common stock that are issuable upon stock splits, stock dividends, recapitalizations or other similar transactions

affecting the shares of the selling stockholder. |

| (2) | The offering price has been estimated solely for the purpose

of computing the amount of the registration fee in accordance with Rule 457(o). Further, the offering price has been arbitrarily

determined by the Company and bears no relationship to assets, market assets, earnings, or any other valuation criteria.

No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any

other price. |

Our Common Stock is not traded on any national exchange or trading

medium and in accordance with Rule 457 the offering price was determined by the price of the shares that were sold to our shareholders

in a private placement. The price of $0.10 is a fixed price at which the selling security holders may sell their shares until our

Common Stock is quoted on the OTC Markets at which time the shares may be sold at prevailing market prices or privately negotiated

prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory

Authority, which operates the OTC Markets, nor can there be any assurance that such an application for quotation will be approved.

| (3) | Estimated solely for purposes of calculating the registration

fee in accordance with Rule 457(o) of the Securities Act. |

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to

such Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed without notice. The selling stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither

the Registrant nor the selling stockholders are soliciting offers to buy these securities, in any state where the offer or sale

of these securities is not permitted.

SUBJECT TO

COMPLETION ON AUGUST 9, 2016

PRELIMINARY PROSPECTUS

UPAY, Inc.

(Nevada Corporation)

2,267,810 COMMON STOCK

SHARES

This prospectus relates to 2,267,810 shares

of our common stock, which may be offered by the selling security holders for their own account. We are paying the expenses

incurred in registering the shares, but all selling and other expenses incurred by the selling security holders will be borne by

them. We will not receive any proceeds from the sale of shares being sold by selling security holders.

The shares of common stock being

offered by the selling security holders pursuant to this prospectus are “restricted securities” under the

Securities Act of 1933, as amended (the “Securities Act”), before their sale under this prospectus. This

prospectus has been prepared for the purpose of registering these shares of common stock under the Securities Act to allow

for a sale by the selling stockholders to the public without restriction. Each of the selling stockholders and the prices at

which the selling security holders may sell their shares will be at a fixed price of $0.10 per share until such time as the

shares of our common stock are traded on the OTCQB operated by OTC Markets Group, Inc. The selling security holders have not

engaged any underwriter in connection with the sale of their common stock shares. Although we intend to apply for quotation

of our common stock on the OTCQB through a market maker, public trading of our common stock may never materialize. If our

common stock becomes traded on the OTCQB, then the sale price to the public will vary according to prevailing market prices

or privately negotiated prices by the selling shareholders.

We intend to apply to have our common stock

quoted on the OTCQB. There can be no assurance that a market maker will agree to file the necessary documents with the Financial

Industry Regulatory Authority (“FINRA”) to facilitate such quotation, nor can there be any assurance that such an application

for quotation will be approved. There is no assurance that we will be able to develop an active trading market for our shares will

develop or will be sustained if developed.

We are an “emerging growth company”

under the Jumpstart Our Business Startups Act (“JOBS Act”) and are eligible for reduced public company reporting requirements.

We do not consider ourselves a shell company

or a blank check company. We and our management have no plans or intentions to be acquired by or to merge with an operating

company, nor do we, our management or any of our shareholders, have plans to enter into a change of control or similar transaction

or to change our management.

We have made no written communications

as defined under Rule 405 of the Securities Act to prospective investors or investors.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective.

This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

You should rely only on the information

contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this

prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus.

Investing in our common

stock involves a high degree of risk. See “Risk Factors” beginning on page 8 to read about factors you should

consider before buying shares of our common stock.

Our common stock is

presently not quoted on any market or exchange.

NEITHER THE SECURITIES AND EXCHANGE

COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Prospectus is dated _________, 2016

TABLE OF CONTENTS

Please read this prospectus carefully.

It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will

have the information necessary to make an informed investment decision.

You should rely only on the information

that we have provided in this prospectus. We have not authorized anyone to provide you with different information and you must

not rely on any unauthorized information or representation. We are not making an offer to sell these securities in any jurisdiction

where an offer or sale is not permitted. This document may only be used where it is legal to sell these securities. You should

assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus, regardless

of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations

may have changed since the date on the front of this prospectus. We urge you to carefully read this prospectus before deciding

whether to invest in any of the common stock being offered.

PROSPECTUS SUMMARY

This summary highlights material information

appearing elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements

included elsewhere in this prospectus. This summary may not contain all the information you should consider before investing in

our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including the

sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

Unless the

context otherwise requires, we use the terms “we”, “us” and “our” in this prospectus to refer

to UPAY, Inc., a Nevada incorporated entity. Because we are considered a continuation

of a South Africa entity, Rent Pay (Pty) Ltd (“Rent Pay”) and our audited financials are presented in which the prior

historical information consists solely of Rent Pay’s results of operations and cash flows, references to Rent Pay where the

context permits are also referred to herein as “we”, “us” or “our”.

None of our officers or directors agreed

to serve as our officer or director in connection with any plan, agreement or understanding that they, respectively, would solicit,

participate in, or facilitate the sale of us (or a business combination with) to a third party looking to obtain or become a public

reporting entity, and the officers and directors also confirm that they have no such present intentions or any intentions whatsoever

in the foreseeable future.

Our management has determined that it is

in our best interests to become a reporting company under the Securities and Exchange Act of 1934, and endeavor to establish a

public trading market for our common stock. Our management believes that establishing a public market: (i) will increase our profile

as an active company in the credit software business, giving us greater identity and recognition in the US: and (ii) will make

it easier for us to attract additional equity capital, which we need to expand our business in various US states. There is no assurance

that we will accomplish any of the foregoing goals and prospective investors are cautioned to carefully read the risk factors set

forth herein prior to making an investment decision.

Corporate

Background

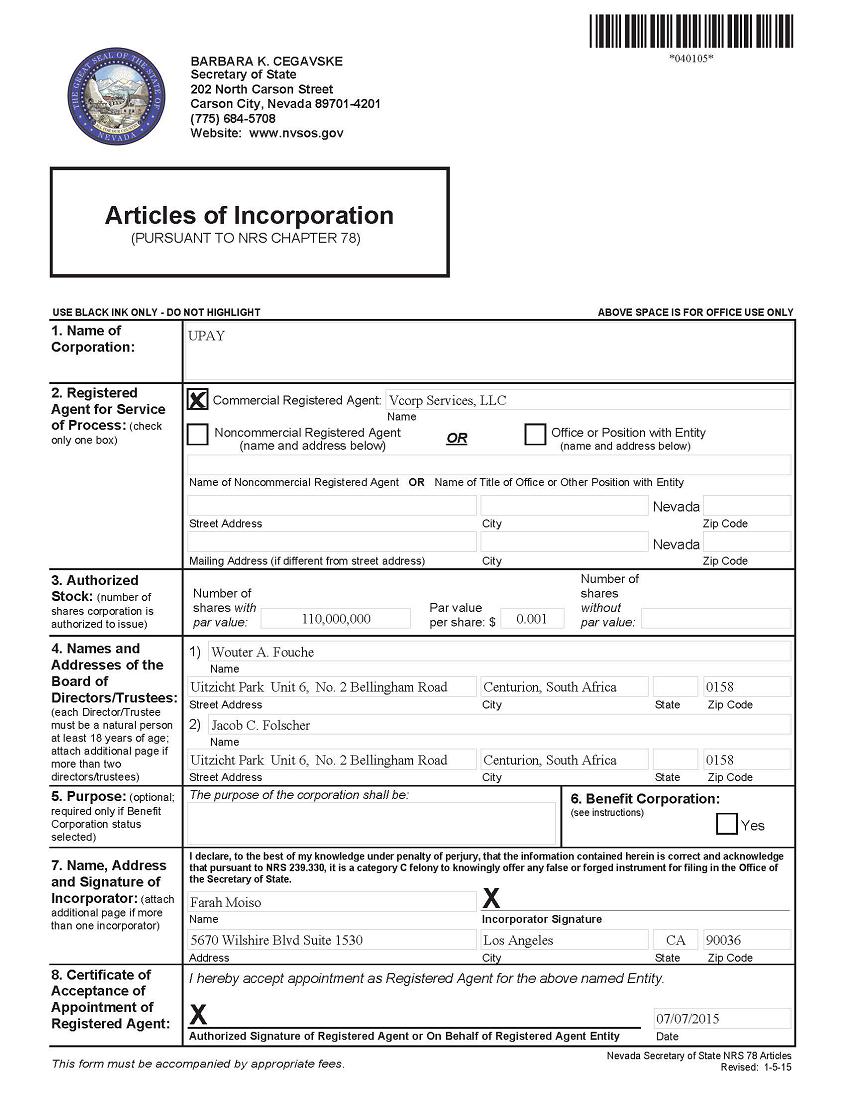

We were formed

on July 8, 2015 in the state of Nevada. On November 4, 2015, we conducted a share exchange (the “Share Exchange”)

with Rent Pay (Pty), Ltd (“Rent Pay”), a South African company, and Rent Pay’s shareholders. In the

Share Exchange, we exchanged 200,000 shares of our common stock for all of Rent Pay’s 1,000 outstanding shares, 500 of

which were in the name of Loantech Trust, a trust controlled by our officer, Wouter Fouche, and 500 shares in the name of Folscher

Family Trust, a trust controlled by our other officer, Jaco Folscher. As a result of the Share Exchange, Rent Pay become

our wholly owned subsidiary.

Apart

from the Share Exchange, we have never been the subject of a material reclassification, merger, consolidation, or purchase or

sale of a significant amount of assets not in the ordinary course of business. Further, we have never been the subject of a

bankruptcy, receivership or similar proceeding.

Rent Pay was registered as a South

Africa closed corporation on July 21, 2008. In South Africa, a closed corporation is a business entity usually associated

with smaller businesses. On February 1, 2012, Rent Pay was converted into a South Africa Limited Liability or private

company, which in South Africa is the equivalent of a limited liability company in the US and denotes a larger entity since the

shareholders are not limited as with a closed corporation.

Business

Overview

We

are a provider of cloud-based loan and client administration software solutions, fully integrated with payment gateways and credit

bureaus as well as other decision making and risk management tools. Our business has operated in South Africa since July

2008. We are expanding our operations to the US and opened our US head office

in Dallas, Texas, from where we will run our US operations. We have not earned any revenue in the US yet but plan to

be in operation in the US by October 2016.

Our

main client base and target market is the payday and installment loan industry. Our software offers a comprehensive solution to

small medium and large organizations to limit risk, improve collections on installment loans and comply fully with new US federal

and state and South Africa regulations.

Our wholly owned subsidiary, Rent Pay, is a software company

that offers services to “small dollar loan” South Africa credit facilities, including store fronts that provide such

loans (“Store Fronts”). Rent Pay owns its own financial software and provides a loan management service to its

South Africa storefronts and online lenders and assists them in all loan cycle segments.

We intend to operate the same business as Rent Pay, but we intend

to serve “small dollar loan” providers in the US, currently permitted by 33 states. We will use the same software

used by Rent Pay, but designed for our future US clients. Our US business will initially concentrate on Texas and California

and then to Illinois, Florida, Louisiana and Tennessee.

Where You Can Find

Us

Our US offices

are located at 3010 LBJ Freeway, 12th Floor, Dallas, Texas 75234. Our telephone number is (972) 888-6052.

Rent

Pay’s is located at No 6 Uitzicht Office Park, 2 Bellingham Street, Centurion 0157, South Africa. Rent Pay’s

telephone number is +27 12 665 0319.

Our Website

Our website is located at www.upaytechnology.com.

No information included in our website is included in this prospectus.

Risk Factors

| · | Because our Chief Executive Officer and

Chief Financial Officer have no experience managing an SEC Reporting Company that is publicly traded this could adversely impact

our ability to comply with the reporting requirements of US securities laws. |

| · | Approximately three quarters of our current business in South Africa

is composed of only 4 customers; a loss of one or more of such customers will negatively impact our financial condition. |

| · | Economic uncertainties or downturns could materially adversely affect

our business. |

| · | Our customers’ inability to effectively, efficiently, and profitably

introduce or manage new products could have a material adverse effect on our business, prospects, results of operations, and financial

condition. |

| · | We currently lack product and business diversification; as a result,

our revenues and earnings may be disproportionately negatively impacted by external factors and may be more susceptible to fluctuations

than more diversified companies. |

| · | Adverse economic conditions may significantly and adversely affect

our business, prospects, and financial condition, and access to liquidity. |

| · | Competition in our industry could cause us to lose market share or

reduce our fees, possibly resulting in a decline in our revenues and earnings. |

| · | We depend on product development in order to remain competitive in

our industry. |

| · | Our products may not achieve market acceptance, which may make it

difficult for us to compete. |

| · | Technology and customer needs change rapidly in our market, which

could render our products obsolete and negatively affect our business, financial condition and results of operations. |

| · | We depend upon proprietary technology and we are subject to the risk

of third party claims of infringement. |

| · | A decline in computer software spending

may result in a decrease in our revenues or lower our growth rate. |

| · | Our software products may contain defects

or errors, which could decrease sales, injure our reputation or delay shipments of our products. |

| · | Our products may contain undetected software

defects, which could negatively affect our revenues. |

| · | Our independent registered

accounting firm has issued a going concern opinion stating that there is substantial doubt that we will continue our

operations. |

| · | Ever expanding credit regulations in the

US, both federal and state, and South Africa may negatively affect our customers’ business and financial condition and in

turn negatively affect our revenues and financial condition. |

| · | We have potential liabilities involving our customers and third parties. |

| · | Our financial results may be adversely

affected if we are unable to execute on our marketing strategy. |

| · | We have incurred, and will continue to

incur, increased costs, and are subject to additional regulations and requirements as a result of being a public company, which

could lower our profits or make it more difficult to run our business. |

| · | The shares of our common stock are highly speculative in nature and

involve a high degree of risk. |

Emerging Growth Company Status

We are an "emerging growth company",

as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions

from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required

to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding

executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding

advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We

cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some

investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and

our stock price may be more volatile.

Section 107 of the JOBS Act provides that

an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of

the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company”

can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We

have elected not to opt out of the transition period pursuant to Section 107(b).

We could remain an “emerging growth company” for

up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed

$1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act,

which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business

day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible

debt during the preceding three-year period.

Notwithstanding the above, we are also currently a “smaller

reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary

of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues

of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller

reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required

to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging

growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”,

“smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are

exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting

firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased

disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited

financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging

growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations

and financial prospects.

THE OFFERING

| Common Stock offered by selling security holders |

|

2,267,810 Common Stock Shares |

| |

|

|

| Common Stock outstanding before the offering |

|

23,815,310

Common Stock Shares |

| |

|

|

| Terms of the Offering |

|

The prices at which the selling security holders may sell their shares will be at a fixed price of $0.10 per share until such time as the shares of our common stock are traded on the OTCQB operated by OTC Markets Group, Inc. (“OTC Markets”). The selling security holders have not engaged any underwriter in connection with the sale of their shares of Common Stock. Although we intend to apply for quotation of our common stock on the OTCQB through a market maker, public trading of our common stock may never materialize. If our common stock becomes traded on the OTCQB, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders. |

| |

|

|

|

Termination of the Offering

|

|

The offering will conclude upon the earliest of (i) such time as all the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act (iii) or we decide at any time to terminate the registration of the shares at our sole discretion. |

| |

|

|

| Trading Market |

|

Currently, there is no trading market for our securities. We intend to apply for quotation on the OTC Markets OTCQB. We will require the assistance of a market maker to apply for quotation and there is no guarantee that a market maker will agree to assist us or be successful in obtaining approval for a quotation. |

| |

|

|

| Use of proceeds |

|

We are not selling any shares of the Common

Stock covered by this prospectus. As such, we will not receive any of the offering proceeds from the registration of the shares

of Common Stock covered by this prospectus.

Expenses – We will pay all expenses

associated with this registration statement |

| |

|

|

| Risk Factors |

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 8. |

RISK FACTORS

The shares of our

common stock being issued in the offering are highly speculative and should be purchased only by persons who can afford to lose

the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider

the following factors relating to our business and prospects. If any of the following risks occur, our business, financial condition

or operating results could be materially adversely affected. In such case, you may lose all or part of our investment. You should

carefully consider the risks described below and the other information in this prospectus before in investing in our common stock.

RISKS RELATED TO OUR BUSINESS

Our independent registered public

accounting firm has issued a going concern opinion; there is substantial doubt that we will continue operations in which

case you could lose your investment.

Our consolidated financial statements

have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the

liquidation of liabilities in the normal course of business. As of July 8, 2016, we do not have revenues sufficient to

execute our business plan. We intend to fund our operations through equity financing arrangements; however, there is no

assurance that this will be successful in raising sufficient funds for our operations. These factors, among others, raise

substantial doubt about our ability to continue as a going concern.

Our operating results may fluctuate

and/or be negatively affected due to various factors

Our operating results are likely to fluctuate

and/or be negatively affected due to:

| · | Expanded or decreased credit regulations

affecting our potential clients and clients; |

| · | Whether we are able to successfully establish

our US operations; and |

| · | Whether

our products and services receive favorable market reaction in the US. |

Any one or a combination of the above factors

could negatively affect our operations, revenues and operating results.

Because our Chief Executive Office

and Chief Financial Officer have no experience managing an SEC Reporting Company that is publicly traded this could adversely impact

our ability to comply with the reporting requirements of US securities laws.

Our Chief Executive Officer and Chief Financial

Officer have no experience managing an SEC Reporting Company that is publicly traded, which could impair our ability to comply

with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Such responsibilities include complying

with federal securities laws and making required disclosures on a timely basis. Any such reporting deficiencies, weaknesses or

lack of compliance could have a materially adverse effect on our ability to comply with the Securities & Exchange Act of 1934,

as amended (“Exchange Act”) reporting requirements. If we were to fail to fulfill those obligations, our ability to

continue as a public company would be in jeopardy and you could lose your entire investment.

Our market is highly competitive.

The lending software systems industry is

highly competitive. There are a number of larger companies, including computer manufacturers, computer service and software companies

and lending companies that have greater operational, personnel and financial resources than we have. These companies currently

offer and have the technological ability to develop software products similar to those offered by us. These companies present a

significant competitive challenge to our business. Because we do not have the same financial resources as these competitors, we

may have a difficult time in the future in competing with these companies. We compete on the basis of our lending knowledge, products,

service, price, system functionality and performance and technological advances. All of our US competitors have longer operating

histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources

than we do since we have not even started our US operations. Our US competitors will be able to:

| · | Undertake more extensive marketing campaigns

for their brands and services; |

| · | Devote more resources to product development |

| · | Adopt more aggressive pricing policies; and |

| · | Make more attractive offers to potential employees and third-party

service providers. |

The industry in which we operate has low barriers to entry and

is highly fragmented and very competitive. We believe that the market may become even more competitive as the credit and credit

software industry matures and/or consolidates. We compete primarily with product/service credit software providers that serve cash

advance providers, small loan providers, credit unions, short-term consumer lenders, other financial service entities, and other

retail businesses that offer consumer loans or other products and services that are similar to ours

Should we fail to effectively compete against

our competitors, our revenues and results of operations will be negatively impacted.

Our ability

to raise capital in the future may be limited, which could make us unable to fund our capital requirements.

Our business and

operations may consume resources faster than we anticipate and we will require additional funds to pursue our expansion opportunities.

In the future, we may need to raise additional funds through the issuance of new equity securities, debt or a combination of both.

Additional financing may be unavailable on favorable terms or at all. If adequate funds are unavailable on acceptable terms, we

may be unable to fund our capital requirements. If we issue new debt securities, the debt holders would have rights senior to common

stockholders to make claims on our assets, and the terms of any debt could restrict our operations, including our ability to pay

dividends on our common stock. If we issue additional equity securities, existing stockholders may experience dilution. Our board

is authorized to issue preferred stock, which could have rights and preferences senior to those of our common stock. Because our

decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot

predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk of our future securities

offerings reducing the market price of our common stock, diluting their interest or being subject to rights and preferences senior

to their own.

In addition, we may file with the SEC

a shelf registration statement to sell from time to time additional shares of our common stock in one or more offerings in amounts,

at prices and on the terms that we will determine at the time of offering. If we raise additional funds by issuing additional equity

or convertible debt securities (whether in a public offering or private placement), the ownership percentages of existing stockholders

would be reduced. In addition, the equity or debt securities that we issue may have rights, preferences, or privileges senior to

those of the holders of our common stock. We currently have no established line of credit or other business borrowing facility

in place.

It is possible that our future capital

requirements may vary materially from those now planned. The amount of capital that we will need in the future will depend on many

factors, including:

| · | Market acceptance of our products; |

| · | Levels of promotion and advertising that will be required to launch

and introduce our products and services in the US; |

| · | Our business, product, capital expenditure and research and development

plans and product and technology roadmaps; |

| · | Levels of working capital that we maintain; |

| · | Technological advances to our products or the failure thereof to make

such advances; and |

| · | Our competitors’ response to our products. |

We may incur substantial additional

debt, which could adversely affect our business, results of operations, and financial condition by limiting our ability to obtain

financing in the future and react to changes in our business.

We may incur substantial additional

debt in the future. If we incur substantial additional debt, it could have important consequences to our business. For example,

it could:

| · | require us to dedicate a substantial portion

of our cash flow from operations to payments on our debt obligations, which will reduce our funds available for dividends, working

capital, capital expenditures, the development of new or replacement products and services, or further geographic expansion; |

| · | limit our operational flexibility through

restrictive covenants that will likely limit our ability to explore certain business opportunities, dispose of assets, and take

other actions; |

| · | limit our flexibility in planning for, or reacting to, changes in

our business; |

| · | limit our ability to borrow additional

funds in the future, if we need them, due to applicable financial and restrictive covenants in our debt instruments; |

| · | make

us vulnerable to interest rate increases, because a majority of our borrowings are, and will continue to be, at variable rates

of interest; and |

| · | place

us at a disadvantage compared to our competitors that have proportionately less debt. |

In the event that key management

personnel leave us, our operations and results of operations could be negatively impacted.

Because we are almost entirely dependent

on the efforts of our Chief Executive Officer/Director, Wouter Fouche, and our Chief Operating Officer/Director, Jaco Folscher,

either one of their departures could have a material adverse effect on our business. We do not maintain key man life insurance

on our sole officer/director. Should we lose the services of either one of our officers (or both) there is no assurance that we

will be able to hire a Chief Executive Officer or a Chief Financial Officer with equal background and competence.

We have not commenced our operations

in the US and we have significant challenges to establish a US market; should we fail to do so, our results of operations will

be significantly impaired.

Apart from establishing a US office in

Dallas, Texas and planning activities, we have not commenced our US operations. We have significant challenges going forward, including:

| · | Establishing

and activating our marketing campaign; |

| · | Developing

and adapting our credit software program to US needs and regulatory standards; and |

| · | Establishing

our operations in 6 states. |

Our success is contingent upon our ability

to efficiently execute the above steps in our business plan; should we fail to do so in any one or a combination of the above,

our results of operations will be negatively impacted and you may lose your entire investment.

Approximately three quarters of our

business in South Africa is composed of only 4 customers.

During our Fiscal Year 2016, 4

customers accounted for 75% of our revenues business in South Africa, as follows: (a) 33% - Finance 27, an online lender; (b)

21% - Discount Finance, a store front lender; (c) 14% - Babereki, a payroll lender; and (d) 7% - Mpowa Finance, an online

lender. Should we lose any one of these South Africa customers, our revenues will be materially and adversely affected.

If we are unable to hire and

retain key current and future personnel, the loss of their services could materially and adversely affect our business, financial

condition and results of operations.

Our future performance depends in significant

part upon the continued service of our senior management and current and future programmers, system engineers, sales manager, sales

representatives, and training consultants. We do not have employment agreements with our key employees that govern the length of

their service. The loss of the services of our key employees would materially and adversely affect our business, financial condition

and results of operations. Our future success also depends on our ability to continue to attract, retain, and motivate qualified

personnel, particularly highly skilled engineers involved in the ongoing research and development required to develop and enhance

our products. Competition for these employees remains high and employee retention is a common problem in our industry. Our inability

to attract and retain the highly trained technical personnel that are essential to our product development, marketing, service

and support teams may limit the rate at which we can generate revenue, develop new products or product enhancements and generally

would have an adverse effect on our business, financial condition and results of operations.

Economic uncertainties or downturns

could materially adversely affect our business.

Current or future

economic uncertainties or downturns could adversely affect our business and results of operations. Negative conditions in the general

economy including conditions resulting from changes in gross domestic product growth, the continued sovereign debt crisis, financial

and credit market fluctuations, political deadlock, natural catastrophes, warfare and terrorist attacks could cause a decrease

in business investments.

General worldwide

economic conditions have experienced a significant downturn and continue to remain unstable. These conditions make it extremely

difficult for us to forecast and plan future business activities accurately, and they could cause our potential customers to reevaluate

their decisions to purchase our services. Also, customers may choose to develop in-house services as an alternative to using our

services.

We cannot predict

the timing, strength or duration of any economic slowdown, instability or recovery, generally or within any particular industry.

If the economic conditions of the general economy or industries in which we operate do not improve, or worsen from present levels,

our business, results of operations, financial condition and cash flows could be adversely affected.

The concentration of our revenues

in certain states could adversely affect us.

While we will

attempt to have a diverse geographic presence, our first 24 months of operations will target only 6 states, California, Texas,

Florida, Illinois, Louisiana and Tennessee. Our revenues derived from those states will be positively or negatively impacted from

prevailing regulatory, economic, demographic, competitive, and other conditions in those states. Changes to any of these conditions

in the markets in which we operate could lead to a reduction in demand for our products and services, a decline in our revenues,

or an increase in our provision for doubtful accounts that could result in a deterioration of our financial condition.

Our customers’

inability to effectively, efficiently, and profitably introduce or manage new products or alternative methods for conducting business

could have a material adverse effect on our business, prospects, results of operations, and financial condition.

Our customers

might need to offer new or modified products and services. In order for our customers to offer these products, such products need

to be developed on our software system and need to comply with additional credit related regulatory and licensing requirements.

Each modification, new product or service, and alternative method of conducting business is subject to risk and uncertainty for

our customers and requires significant investment in time and capital, including additional marketing expenses, legal costs, and

other incremental start-up costs. Additionally, we will be required to update our customers’ regulatory requirements, which

may lead to additional operating costs and additional charges to our customers. Should we fail to adequately modify or test adequately

our system, collection procedures, customer contracts, monitoring, and other operations for our customer’ benefit prior to

offering a new product, our brand name reputation and results of operations may be negatively affected. Additionally, any failure

of our customers to offer new products or services resulting from regulatory changes could result in fines, suspensions, or legal

actions against them and could have a material adverse effect on our customers’ business, prospects, results of operations,

and financial condition and in turn negatively affect us.

We currently

lack product and business diversification; as a result, our revenues and earnings may be disproportionately negatively impacted

by external factors and may be more susceptible to fluctuations than more diversified companies.

Our primary business

activity is offering software for cash advance and loan installment services. If we are unable to maintain our credit software

and/or diversify our operations, our revenues and earnings could decline. Our current lack of product and business diversification

could inhibit our opportunities for growth, reduce our revenues and profits, and make us more susceptible to earnings fluctuations

than many of our competitors who are more diversified. External factors, such as changes in laws and regulations, new entrants,

and enhanced competition, could also make it more difficult for us to operate as profitably as a more diversified company could

operate. Any internal or external change in our industry could result in a decline in our revenues and earnings, which could have

a material adverse effect on our business, prospects, results of operations, and financial condition.

The credit

industry is highly regulated under federal law, state and local laws; our customers’ failure to comply with these regulations

and statutes could have a material adverse effect on our customers’ business, prospects, results of operations, and financial

condition, which in turn may negatively affect our results of operations.

Our customers’

businesses are subject to stringent US federal and US state regulation and the National Credit Act in South Africa. Our customers

must comply with the Federal Truth-in-Lending Act and Regulation Z adopted under that Act, the Equal Credit Opportunity Act,

the Fair Debt Collection Practices Act, the Fair and Accurate Credit Transaction Act, the Fair Credit Reporting Act and the Gramm-Leach-Bliley

Act, the Dodd-Frank Act, which subjects them to supervision by the Consumer Finance Protection Bureau (“CFPB”), the

Bank Secrecy Act, the Money Laundering Control Act of 1986, the Money Laundering Suppression Act of 1994, and the PATRIOT Act.

In addition, our customers’ marketing efforts and statements that our customers make about their products and services are

subject to federal and state unfair and deceptive practices statutes, most significantly, the Federal Trade Commission, which

enforces the Federal Trade Commission Act (See Government Regulations Section at page 32).

Our customers’

businesses are regulated under a variety of enabling state statutes, including cash advance, deferred presentment, check cashing,

money transmission and small loan laws, all of which are subject to change and which may impose significant costs, limitations

or prohibitions on the way our customers conduct or expand their business. In some states, referenda initiatives have been proposed

that allow voters to limit or prohibit our customers’ ability to conduct our business in a profitable manner. Legislation

has been introduced or adopted in some states that prohibits or severely restricts certain credit products and services. Laws prohibiting

cash advances and similar products and services could be passed in any other state at any time or existing enabling laws could

expire or be amended. Statutes authorizing cash advance and similar products and services typically provide the state agencies

that regulate banks and financial institutions with significant regulatory powers to administer and enforce the law. In most states,

our customers are required to apply for a license, file periodic written reports regarding business operations, and undergo comprehensive

state examinations to ensure that we comply with applicable laws.

To conduct our

business, we are required to manage, use, and store large amounts of personally identifiable information, consisting primarily

of confidential personal and financial data regarding clients our customers. As a result, we are subject to numerous U.S. laws

and regulations designed to protect this information, including various U.S. federal and state laws governing the protection of

financial or other individually identifiable information. Security breaches involving our files and infrastructure could lead to

unauthorized disclosure of confidential information, as well as shutdowns or disruptions of our systems.

Our customers’

business may be subject to various local rules and regulations such as local zoning regulations. Any actions taken in the future

by local zoning boards or other local governing bodies to require special use permits for, or impose other restrictions on providers

of cash advance and/or other credit services could have a material adverse effect on our business, results of operations, and financial

condition and in turn negatively affect our results of operations and revenues.

Current

and future litigation, regulatory proceedings, and other legal proceedings against our customers’ officers and directors

could have a material adverse effect on our business, prospects, results of operations, and financial condition.

Our

customers’ businesses are subject to lawsuits, regulatory proceedings, and other legal proceedings, including

government investigations, that generate adverse publicity, cause our customers to incur substantial expenditures, and could

significantly impair our customers’ business and/or force them to cease doing business in one or more states.

Accordingly, our customers may incur significant expenditures in connection with matters involving our customers’

current or former officers and directors. Any of these lawsuits, regulatory proceedings, or other legal matters could have a

material adverse effect on our customers’ business, prospects, results of operations, and financial condition and as a

result negatively affect our business

Media reports and public perception of cash advances and

similar loans as being predatory or abusive could materially adversely affect our business, prospects, results of operations, and

financial condition.

Consumer advocacy groups, certain media reports, and many regulators

and elected officials advocate for governmental and regulatory action to prohibit or severely restrict our customers’ products

and services. The consumer groups and media reports typically focus on the cost to a consumer and characterize our customers’

products and services as predatory or abusive toward consumers. If this negative characterization of advances becomes widely accepted

by consumers, demand for our customers’ products and services could significantly decrease, which could materially adversely

affect our business, results of operations, and financial condition. Negative perception of our customers’ products and services

could also result in increased regulatory scrutiny and litigation, encourage restrictive local zoning rules, make it more difficult

to obtain government approvals necessary to open new centers and cause industry trade group to promote policies that cause our

customers’ businesses to be less profitable. In addition, media coverage and public statements that assert some form of corporate

wrongdoing can lower morale, make it more difficult for our customers to attract and retain qualified personnel and directors,

divert management attention, and increase expenses. These trends could materially adversely affect our customers’ business,

prospects, results of operations, and financial condition and in turn similarly affect our business.

We depend on product development in order to remain competitive

in our industry.

Our future success will depend on our ability to continue to

enhance our current product line and to continue to develop and introduce new products that keep pace with competitive product

introductions and technological developments, satisfy diverse and evolving lending industry requirements and otherwise achieve

market acceptance. We may not be successful in continuing to develop and market, on a timely and cost-effective basis, product

enhancements or new products that respond to technological advances by others Any failure by us to anticipate or respond adequately

to changes in technology and lending industry preferences, or any significant delays in product development or introduction, would

significantly and adversely affect our business, operating results and financial condition.

Our products may not achieve market acceptance, which

may make it difficult for us to compete.

Our future success will depend upon our

ability to increase the number of lending companies that use our software products. As a result of the intense competition in our

industry and the rapid technological changes, which characterize it, our products may not achieve significant market acceptance.

Further, lending companies are typically characterized by slow decision-making and numerous bureaucratic and institutional obstacles,

which will make our efforts to significantly expand our customer base difficult.

We depend upon proprietary technology and we are subject

to the risk of third party claims of infringement.

Our success and ability to compete depends

in part upon our proprietary software technology. We currently have no patents or patent applications pending. Despite our efforts

to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain and use information

that we regard as proprietary. The steps we take to protect our proprietary technology may not prevent misappropriation of our

technology, and this protection may not stop competitors from developing products which function or have features similar to our

products.

While we believe that our products

and trademarks do not infringe upon the proprietary rights of third parties, third parties may claim that our products infringe,

or may infringe, upon their proprietary rights. Any infringement claims, with or without merit, could be time-consuming, result

in costly litigation and diversion of technical and management personnel, cause product shipment delays or require us to develop

non-infringing technology or enter into royalty or licensing agreements. Royalty or licensing agreements, if required, may not

be available on terms acceptable to us or at all. If a claim of product infringement against us is successful and we fail or are

unable to develop non-infringing technology or license the infringed or similar technology, our business, operating results and

financial condition could be significantly and adversely affected.

A decline in computer software

spending may result in a decrease in our revenues or lower our growth rate.

A decline in the demand for computer

software among our current and prospective customers may result in decreased revenues or a lower growth rate for us because our

sales depend, in part, on our customers’ level of funding for new or additional computer software systems and services. Moreover,

demand for our solutions may be reduced by a decline in overall demand for computer software and services. The current decline

in overall technology spending may cause our customers to reduce or eliminate software and services spending and cause price erosion

for our solutions, which would substantially affect our sales of new software licenses and the average sales price for these licenses.

Because of these market and economic conditions, we believe there will continue to be uncertainty in the level of demand for our

products and services. Accordingly, we cannot assure you that we will be able to increase or maintain our revenues.

Our technology may become obsolete

which could materially adversely affect our ability to sell our products and services.

If our technology, products and services

become obsolete, our business operations would be materially adversely affected. The market in which we compete is characterized

by rapid technological change, evolving industry standards, introductions of new products, and changes in customer demands that

can render existing products obsolete and unmarketable. Our current products will require continuous upgrading or our technology

will become obsolete. Our future success will depend upon our ability to address the increasingly sophisticated needs of our customers

by supporting existing and emerging hardware, software, database, and networking platforms and by developing and introducing enhancements

to our existing products and new products on a timely basis that keep pace with technological developments, evolving industry standards,

and changing customer requirements.

Our quarterly revenues and operating

results are difficult to predict and could fall below analyst or investor expectations, which could cause the price of our common

stock to fall.

If our operating results do not meet

the expectations of securities analysts or investors, our stock price may decline. Fluctuations in our operating results may be

due to a number of factors, including the following:

| · | The gain or loss of customers; |

| · | The size and timing of orders; |

| · | The size and timing of product returns; |

| · | Our ability to maintain or increase gross margins; |

| · | Our ability to anticipate market needs and to identify, develop,

complete, introduce, market and produce new products and technologies in a timely manner to address those needs |

| · | availability and pricing of competing products and technologies and

the resulting effect on sales and pricing of our products; |

| · | Effect of new and emerging technologies |

| · | General economic conditions. |

Our products may contain undetected

software defects, which could negatively affect our revenues.

Our software products are complex and

may contain undetected defects. In the past, we have discovered software defects in certain of our products and have experienced

delayed or lost revenues during the period it took to correct these problems. Although we test our products, it is possible that

errors may be found or occur in our new or existing products after we have commenced commercial shipment of those products. Defects,

whether actual or perceived, could result in adverse publicity, loss of revenues, product returns, a delay in market acceptance

of our products, loss of competitive position, or claims against us by customers. Any such problems could be costly to remedy and

could cause interruptions, delays, or cessation of our product sales, which could cause us to lose existing or prospective customers

and could negatively affect our results of operations.

Security and privacy breaches

may harm our business.

The uninterrupted operation of our

hosted solutions and the confidentiality and security of third-party information is critical to our business. Any failures in our

security and privacy measures, such as “hacking” of our systems by outsiders, could have a material adverse effect

on our financial position and results of operations. If we are unable to protect, or our customers perceive that we are unable

to protect, the security and privacy of our electronic information, our growth could be materially adversely affected. A security

or privacy breach may cause our customers to lose confidence in our solutions, adversely harm our brand name reputation, expose

us to liability and increase our expenses from potential remediation costs. Additionally, any damage to, or failure of, our systems

generally could result in interruptions in our service. Interruptions in our service may reduce our revenue, cause us to issue

credits or pay penalties, cause customers to terminate their on-demand services, and adversely affect our renewal rates and our

ability to attract new customers.

While we believe we use proven applications

designed for data security and integrity to process electronic transactions, there can be no assurance that our use of these applications

will be sufficient to address changing market conditions or the security and privacy concerns of existing and potential customers.

In addition, our customers and end users may use our products and services in a manner, which violates security or data privacy

laws in one or more jurisdictions. Any significant or high profile data privacy breaches or violations of data privacy laws, whether

directly through our hosted solutions or by third parties using our products and services, could result in the loss of business

and reputation, litigation against us and regulatory investigations and penalties that could adversely affect our operating results

and financial condition.

Our

entire Plan of Operations is contingent upon obtaining financing

Our entire Plan

of Operations (see page 41-42) is contingent upon obtaining financing, of which there is no assurance. Should we be unable to

obtain financing for the steps in our Plan of Operations, our US operations will be severely and negatively impacted as well as

our results of operations and you may lose your entire investment.

RISKS RELATED TO OUR STATUS AS AN EMERGING

GROWTH COMPANY AND IF THIS REGISTRATION STATEMENT IS DECLARED EFFECTIVE, AN SEC REPORTING ISSUER

Reporting requirements under the

Exchange Act and compliance with the Sarbanes-Oxley act of 2002, including establishing and maintaining acceptable internal controls

over financial reporting, are costly and may increase substantially.

The rules and regulations of the SEC require

a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal,

accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley

Act of 2002 (the “Sarbanes-Oxley Act”) requires, among other things, that we design, implement and maintain adequate

internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically

qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial

reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our

internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial

condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject

to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities

rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless

increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand

on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires,

among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

We are working with our legal, accounting

and financial advisors to identify those areas in which changes should be made to our financial and management control systems

to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure

controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these

and other areas. However, we anticipate that the expenses that will be required in order to adequately prepare for being a public

company could be material. We estimate that the aggregate cost of increased legal services; accounting and audit functions; personnel,

such as a chief financial officer familiar with the obligations of public company reporting; consultants to design and implement

internal controls; and financial printing alone could be several hundred thousand dollars per year. In addition, if and when we

retain independent directors and/or add senior management, we may incur additional expenses related to director compensation and/or

premiums for directors’ and officers’ liability insurance, the costs of which we cannot estimate at this time. We may

also incur additional expenses associated with investor relations and similar functions, the cost of which we also cannot estimate

at this time. However, these additional expenses individually, or in the aggregate, may also be material.

In addition, being a public company could

make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’

liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain

the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified

persons to serve on our Board, our Board committees or as executive officers.

The increased costs associated with operating

as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our

business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these

requirements divert our management’s attention from other business concerns, they could have a material adverse effect on

our business, financial condition and results of operations.

We are an “emerging growth

company,” and any decision on our part to comply only with certain reduced disclosure requirements applicable to “emerging

growth companies” could make our common stock less attractive to investors.

We are an “emerging growth company,”

as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we expect and fully

intend to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging

growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements

of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic

reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation

and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company”

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues

exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under

the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million

as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued

more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act

also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section

7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth

company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have elected to opt in to the extended transition period for complying with the revised accounting standards. We have elected

to rely on these exemptions and reduced disclosure requirements applicable to “emerging growth companies” and expect

to continue to do so.

Our internal control over financial

reporting does not currently meet the standards required by Section 404 of the Sarbanes-Oxley Act, and failure to achieve

and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act

could have a material adverse effect on our business and stock price.

We previously have not been required to

maintain internal control over financial reporting in a manner that meets the standards of publicly traded companies required by

Section 404(a) of the Sarbanes-Oxley Act (“Section 404(a)”). Internal control over financial reporting is

a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements in accordance with GAAP. We are not currently in compliance with, and we cannot be certain when we will be able to implement

the requirements of Section 404(a). We may encounter problems or delays in implementing any changes necessary to make a favorable

assessment of our internal control over financial reporting. If we cannot favorably assess the effectiveness of our internal control

over financial reporting, or if our independent registered public accounting firm is unable to provide an unqualified attestation

report on our internal controls, investors could lose confidence in our financial information and the price of our common stock

could decline.

Additionally, the existence of any material

weakness or significant deficiency would require management to devote significant time and incur significant expense to remediate

any such material weaknesses or significant deficiencies and management may not be able to remediate any such material weaknesses

or significant deficiencies in a timely manner. The existence of any material weakness in our internal control over financial reporting

could also result in errors in our financial statements that could require us to restate our financial statements causing us to

fail to meet our reporting obligations and cause stockholders to lose confidence in our reported financial information, all of

which could materially and adversely affect us.

We will not be required to evaluate the

effectiveness of our internal controls over procedures for financial reporting nor will we be required to disclose the results

of such evaluation, until the filing of our second annual report. The lack of such evaluations may lead to an extended period of

inadequate internal controls which could jeopardize the accuracy of our financial reporting, the result of which would be that

investors would not be aware of any inaccurate reporting of our financial affairs.

If we are not required to continue

filing reports under Section 15(d) of the Securities Exchange Act of 1934 in the future, for example because we have less than

three hundred shareholders of record at the end of the first fiscal year in which this registration statement is declared effective,

and we do not file a Registration Statement on Form 8-A, our common shares (if listed or quoted) would no longer be eligible for

quotation, which could reduce the value of your investment.

As a result of

this offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities

and Exchange Commission as required under Section 15(d). However, if in the future we are not required to continue filing

reports under Section 15(d), for example because we have less than three hundred shareholders of record at the end of the first

fiscal year in which this registration statement is declared effective, and we do not file a Registration Statement on Form 8-A

upon the occurrence of such an event, our common stock can no longer be quoted on the OTC Markets OTC Link, which could reduce

the value of your investment. There is no guarantee that we will be able to meet the requirements to be able to cease filing

reports under Section 15(d), in which case we will continue filing those reports in the years after the fiscal year in which this

registration statement is declared effective. Filing a registration statement on Form 8-A will require us to continue to

file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers,

directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity.

You may have limited access to information

regarding our business because our obligations to file periodic reports with the SEC could be automatically suspended under certain

circumstances.

As of effectiveness of our registration

statement of which this prospectus is a part, we will be required to file periodic reports with the SEC, which will be immediately

available to the public for inspection and copying (see “Where You Can Find More Information” elsewhere in this prospectus).

Except during the year that our registration statement becomes effective, these reporting obligations may (in our discretion) be

automatically suspended under Section 15(d) of the Exchange Act if we have less than 300 shareholders and do not file a registration

statement on Form 8A (which we have no current plans to file).

If this occurs after the year in which

our registration statement becomes effective, we will no longer be obligated to file periodic reports with the SEC and your access

to our business information would then be even more restricted. After this registration statement on Form S-1 becomes effective,

we will be required to deliver periodic reports to security holders. However, we will not be required to furnish proxy statements

to security holders and our directors, officers and principal beneficial owners will not be required to report their beneficial

ownership of securities to the SEC pursuant to Section 16 of the Exchange Act. Previously, a company with more than 500 shareholders

of record and $10 million in assets had to register under the Exchange Act. However, the JOBS Act raises the minimum shareholder

threshold from 500 to either 2,000 persons or 500 persons who are not “accredited investors” (or 2,000 persons in the

case of banks and bank holding companies). The JOBS Act excludes securities received by employees pursuant to employee stock incentive

plans for purposes of calculating the shareholder threshold. This means that access to information regarding our business and operations

will be limited.

Our election not to opt out of JOBS

Act extended accounting transition period may not make our financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as

an emerging growth company we can elect to opt out of the extended transition period for any new or revised accounting standards

that may be issued by the PCAOB or the SEC. We have elected not to opt out of such extended transition period, which means that

when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging

growth company, can adopt the application date for private companies. Our financial statements may therefore not be comparable

to those of companies that comply with such new or revised accounting standards. As of present, there are no new or revised accounting

standards that have been issued by the PCAOB or the SEC applicable to us for which we have adopted the application date for private

companies.

The JOBS Act will also allow us to

postpone the date by which we must comply with certain laws and regulations intended to protect investors and to reduce the amount

of information provided in reports filed with the SEC. The recently enacted JOBS Act is intended to reduce the regulatory burden

on emerging growth companies. The Registrant meets the definition of an emerging growth company and so long as it qualifies as

an “emerging growth company,” it will, among other things:

| |

· |

be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley

Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of

its internal control over financial reporting; |

| |

· |

be exempt from the “say on pay”

provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say

on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for

certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain

disclosure requirements of the Dodd-Frank Act relating to compensation of its chief executive officer; |

| |

· |

be permitted to omit the detailed compensation