United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-23174

(Investment Company Act File Number)

Federated Hermes Project and Trade Finance Tender Fund

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

Peter J. Germain, Esquire

Federated Hermes, Inc.

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(412) 288-1900

(Registrant's Telephone Number)

Date of Fiscal Year End: 03/31/2024

Date of Reporting Period: 03/31/2024

| Item 1. | Reports to Stockholders |

Federated Hermes Project and Trade Finance Tender Fund

Dear Valued Shareholder,

|

|

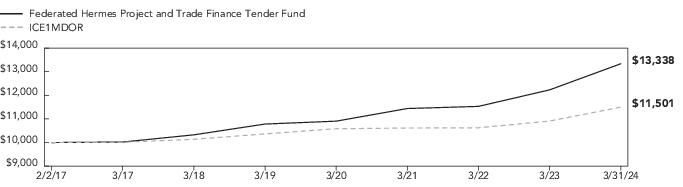

1 Year

|

5 Years

|

Since

Inception 2/2/2017

|

|

Fund

|

9.04%

|

4.34%

|

4.10%

|

|

ICE1MDOR

|

5.41%

|

2.10%

|

1.97%

|

|

Security Type

|

Percentage of

Total Net Assets

|

|

Trade Finance Agreements

|

96.6%

|

|

Derivative Contracts2

|

0.2%

|

|

Cash Equivalents3

|

0.9%

|

|

Other Assets and Liabilities—Net4

|

2.3%

|

|

TOTAL

|

100%

|

|

1

|

See the Fund’s Prospectus for a description of the principal types of securities in which the Fund invests.

|

|

2

|

Based upon net unrealized appreciation (depreciation) or value of the derivative contracts

as applicable. Derivative contracts may consist of futures, forwards,

options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may

indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More

complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values

or amounts of such contracts, can be found in the table at the end of the Portfolio

of Investments included in this report.

|

|

3

|

Cash Equivalents include any investments in money market mutual funds and/or overnight

repurchase agreements.

|

|

4

|

Assets, other than investments in securities and derivative contracts, less liabilities.

See Statement of Assets and Liabilities.

|

|

Foreign

Currency

Par Amount,

Principal

Amount

or Shares

|

|

|

Acquisition

Date1

|

Acquisition

Cost

in U.S. Dollars1

|

Value

in

U.S. Dollars

|

|

|

|

TRADE FINANCE AGREEMENTS—96.6%

|

|

|

|

|

|

|

Air Transportation—0.7%

|

|

|

|

|

$ 4,099,114

|

2

|

Aercap Holdings NV, 7.021% (3-month USLIBOR +1.450%), 12/31/2025

|

11/23/2021

|

$ 4,232,283

|

$ 4,099,114

|

|

|

|

Airlines—1.5%

|

|

|

|

|

9,000,000

|

2

|

Maher Terminal, LLC, 7.829% (SOFR CME +2.500%), 11/17/2025

|

3/7/2024

|

8,932,500

|

8,934,817

|

|

|

|

Automotive—0.7%

|

|

|

|

|

4,000,000

|

2

|

JSC UzAuto Motors (“UzAuto Motors”), 9.516% (SOFR CME +4.250%), 8/24/2026

|

9/18/2023

|

4,000,000

|

4,000,000

|

|

|

|

Banking—16.0%

|

|

|

|

|

EUR 7,000,000

|

2

|

Akbank Turk II, 7.596% (6-month EURIBOR +3.500%), 4/26/2024

|

10/5/2023

|

7,362,228

|

7,549,712

|

|

$ 5,000,000

|

2

|

Eastern and Southern African Trade and Development Bank, 6.779% (SOFR CME

+1.450%), 11/23/2026

|

2/9/2023-

11/30/2023

|

5,000,000

|

5,000,000

|

|

9,000,000

|

2

|

Far East Horizon Ltd., 6.977% (1-month USLIBOR +1.400%), 9/10/2024

|

9/15/2021

|

9,000,000

|

9,000,000

|

|

8,500,000

|

2

|

Joint Stock Commercial Bank Agrobank, 8.153% (SOFR CME +3.000%), 1/24/2025

|

10/17/2022-

3/7/2023

|

8,410,750

|

8,513,134

|

|

11,000,000

|

2

|

Joint-Stock Co. Asakabank, 8.725% (180-Day Average SOFR +3.500%), 3/28/2025

|

10/4/2023-

3/25/2024

|

10,985,000

|

11,063,288

|

|

EUR 1,500,000

|

2

|

National Bank for Foreign Economic Activity of the Republic of Uzbekistan (NBU),

7.338% (6-month EURIBOR +3.400%), 6/18/2024

|

6/25/2021

|

1,791,821

|

1,618,275

|

|

7,500,000

|

2

|

QNB Finansbank AS/Turkey, 7.413% (3-month EURIBOR +3.475%), 6/6/2024

|

5/24/2023-

10/5/2023

|

7,893,731

|

8,078,281

|

|

12,500,000

|

2

|

T.C. Ziraat Bankasi AS, 7.405% (3-month EURIBOR +3.480%), 4/26/2024

|

10/13/2023

|

13,107,194

|

13,485,624

|

|

9,500,000

|

2

|

The Republic of Cote d’Ivoire acting through The Ministry of Economy and Finance of

Cote d’Ivoire (MOF IVORY COAST), 6.916% (6-month EURIBOR +3.000%), 6/28/2024

|

11/28/2023

|

10,438,127

|

10,249,074

|

|

$ 7,500,000

|

|

Turkiye Ihracat Kredi Bankasi AS, 8.728%, 9/17/2024

|

9/13/2023

|

7,500,000

|

7,500,000

|

|

7,500,000

|

|

Turkiye Vakiflar Bankasi T.A.O., 9.040%, 5/23/2024

|

10/25/2023

|

7,473,750

|

7,500,000

|

|

8,000,000

|

2

|

Zenith Bank PLC, 8.314% (SOFR CME +3.000%), 1/24/2025

|

2/7/2024

|

8,000,000

|

8,000,000

|

|

|

|

TOTAL

|

|

|

97,557,388

|

|

|

|

Basic Industry - Metals/Mining Excluding Steel—5.2%

|

|

|

|

|

12,000,000

|

2

|

CSN, 7.820% (SOFR CME +2.500%), 12/31/2027

|

3/26/2024

|

12,000,000

|

12,000,000

|

|

5,500,000

|

2

|

Harmony Gold Mining Co. Ltd., 8.170% (SOFR CME +2.850%), 5/31/2027

|

7/31/2018-

7/6/2021

|

5,507,949

|

5,555,000

|

|

10,000,000

|

2

|

Navoi Mining and Metallurgical Co., 10.076% (SOFR CME +4.760%), 4/20/2027

|

11/24/2022

|

10,000,000

|

10,000,000

|

|

4,400,000

|

2

|

PJSC MMC Norilsk Nickel, 6.844% (SOFR CME +1.400%), 2/20/2025

|

11/30/2020-

10/22/2021

|

4,365,981

|

4,186,345

|

|

|

|

TOTAL

|

|

|

31,741,345

|

|

|

|

Basic Industry - Steel Producers/Products—1.1%

|

|

|

|

|

6,500,000

|

2

|

JSC Uzbek Steel, 9.573% (SOFR CME +4.250%), 8/4/2024

|

8/22/2023

|

6,502,250

|

6,507,230

|

|

|

|

Beverages—0.6%

|

|

|

|

|

3,720,588

|

2

|

International Beverage Tashkent, 10.072% (SOFR CME +4.500%), 12/29/2026

|

12/28/2021-

3/8/2022

|

3,720,588

|

3,720,588

|

|

|

|

Chemicals—4.0%

|

|

|

|

|

5,000,000

|

|

ADNOC Global Trading Ltd., 6.330%, 4/16/2024

|

3/28/2024

|

4,983,295

|

4,983,295

|

|

5,000,000

|

2

|

BASF Intertrade AG, 6.430% (SOFR CME +1.100%), 4/15/2024

|

3/28/2024

|

4,983,925

|

4,983,925

|

|

4,570,000

|

2

|

Egyptian Ethylene & Derivatives Co. SAE, 9.315% (SOFR CME +4.000%), 9/13/2028

|

9/22/2023-

10/17/2023

|

4,570,000

|

4,570,000

|

|

10,000,000

|

2

|

PJSC Acron, 7.026% (1-month USLIBOR +1.700%), 5/18/2026

|

11/26/2021

|

10,000,000

|

9,818,923

|

|

|

|

TOTAL

|

|

|

24,356,143

|

|

|

|

Communications - Cable & Satellite—0.6%

|

|

|

|

|

3,600,000

|

2

|

IHS Zambia Ltd., 10.576% (3-month USLIBOR +5.000%), 12/15/2027

|

11/26/2021

|

3,595,400

|

3,593,020

|

|

Foreign

Currency

Par Amount,

Principal

Amount

or Shares

|

|

|

Acquisition

Date1

|

Acquisition

Cost

in U.S. Dollars1

|

Value

in

U.S. Dollars

|

|

|

|

TRADE FINANCE AGREEMENTS—continued

|

|

|

|

|

|

|

Communications - Telecom Wirelines—2.4%

|

|

|

|

|

$ 5,970,000

|

2

|

Gridiron Fiber Corp., 9.059% (SOFR CME +3.750%), 8/31/2030

|

11/22/2023

|

$ 5,970,000

|

$ 5,970,000

|

|

EUR 8,200,000

|

2

|

Telekom Srbija a.d. Beograd, 9.000% (6-month EURIBOR +4.950%), 6/1/2026

|

5/26/2023-

5/30/2023

|

8,693,710

|

8,846,569

|

|

|

|

TOTAL

|

|

|

14,816,569

|

|

|

|

Consumer Goods - Food - Wholesale—0.0%

|

|

|

|

|

$ 137,500

|

2

|

Ghana Cocoa Board, 10.227% (6-month USLIBOR +4.400%), 11/12/2024

|

5/13/2020-

8/11/2021

|

137,500

|

135,562

|

|

894,737

|

2,3,4,5

|

Vicentin SAIC II, 10.793% (3-month USLIBOR + 6.000%), 1/15/2024

|

1/8/2018-

2/21/2018

|

894,737

|

98,421

|

|

|

|

TOTAL

|

|

|

233,983

|

|

|

|

Electric Utilities—1.5%

|

|

|

|

|

4,000,000

|

2

|

Karpower Latam Solutions DMCC, 10.564% (SOFR CME +5.250%), 10/30/2026

|

8/29/2023

|

3,984,000

|

3,977,536

|

|

5,000,000

|

2

|

Qatar Electricity and Water Co., 6.484% (SOFR CME +5.320%), 6/30/2027

|

2/8/2024

|

4,916,817

|

4,918,915

|

|

|

|

TOTAL

|

|

|

8,896,451

|

|

|

|

Energy - Exploration & Production—9.0%

|

|

|

|

|

EUR 9,500,000

|

|

Axpo Solutions AG, 5.010%, 5/20/2024

|

12/11/2023

|

10,226,270

|

10,253,845

|

|

$11,000,000

|

2

|

Azule Energy Holding Ltd., 9.810% (SOFR CME +4.500%), 7/29/2029

|

10/27/2022-

12/19/2022

|

11,000,000

|

11,112,223

|

|

7,305,818

|

2

|

Carmo Energy SA, 7.987% (SOFR CME +5.280%), 12/23/2027

|

6/30/2023

|

7,305,818

|

7,377,668

|

|

11,000,000

|

2

|

CC Energy Development Ltd., 9.299% (SOFR CME +3.750%), 7/1/2028

|

8/31/2022

|

11,000,000

|

11,000,000

|

|

5,000,000

|

2

|

SOCAR Energy, 9.188% (6-month USLIBOR +3.450), 8/11/2026

|

8/11/2021

|

4,957,500

|

5,000,000

|

|

7,116,667

|

2

|

Sonangol Finance Ltd., 9.645% (1-month USLIBOR +5.364%), 1/31/2025

|

12/16/2022-

10/11/2023

|

7,065,405

|

7,116,667

|

|

2,900,000

|

2

|

Sonangol Finance Ltd., 10.695% (1-month USLIBOR +5.364%), 9/30/2026

|

9/15/2021

|

2,871,000

|

2,900,000

|

|

|

|

TOTAL

|

|

|

54,760,403

|

|

|

|

Energy - Gas Distribution—4.6%

|

|

|

|

|

3,620,838

|

2

|

Papua New Guinea Liquefied Natural Gas Global Co., 9.261% (6-month USLIBOR

+3.500%), 6/15/2026

|

4/14/2023

|

3,584,629

|

3,620,838

|

|

739,170

|

2

|

Papua New Guinea Liquefied Natural Gas Global Co., 10.011% (6-month USLIBOR

+4.250%), 6/15/2024

|

4/14/2023

|

739,170

|

739,170

|

|

5,000,000

|

2

|

Shell International Trading Middle East, 6.230% (SOFR CME +0.900%), 4/15/2024

|

3/28/2024

|

4,984,424

|

4,984,425

|

|

11,310,811

|

2

|

Venture Global Calcasieu Pass LLC, 8.052% (1-month USLIBOR +2.625%), 8/19/2026

|

1/28/2021-

2/10/2023

|

11,704,830

|

11,310,811

|

|

7,113,363

|

2

|

Venture Global Plaquemines LNG LLC, 7.302% (SOFR CME +1.975%), 5/25/2029

|

12/15/2022-

3/15/2024

|

7,113,363

|

7,113,363

|

|

|

|

TOTAL

|

|

|

27,768,607

|

|

|

|

Energy - Integrated Energy—4.4%

|

|

|

|

|

EUR 11,000,000

|

|

BP Gas Marketing, 4.951%, 4/22/2024

|

1/16/2024

|

11,959,745

|

11,867,815

|

|

$10,000,000

|

2

|

Ecopetrol SA, 6.744% (SOFR CME +1.250%), 8/16/2024

|

12/11/2023

|

9,988,750

|

10,000,000

|

|

4,788,417

|

2

|

Staatsolie Maatschappij Suriname NV, 11.086% (SOFR CME +5.500%), 1/25/2028

|

6/30/2021

|

4,788,417

|

4,788,417

|

|

|

|

TOTAL

|

|

|

26,656,232

|

|

|

|

Energy - Oil Field Equipment & Services—5.9%

|

|

|

|

|

8,116,719

|

2

|

Alfa Lula Alto S.a.r.l., 7.672% (SOFR CME +2.100%), 1/15/2028

|

6/16/2023

|

8,036,001

|

8,160,197

|

|

745,522

|

2

|

Alfa Lula Alto S.a.r.l., 7.872% (SOFR CME +2.300%), 12/15/2029

|

6/16/2023

|

730,612

|

743,826

|

|

7,175,241

|

2

|

Beta Lula Central S.a.r.l. (Lux, Inc.), 7.872% (SOFR CME +2.300%), 6/15/2030

|

12/6/2023

|

7,140,831

|

7,212,300

|

|

9,361,702

|

2

|

Heritage Petrol Co. Ltd., 10.896% (SOFR CME +5.250%), 5/5/2029

|

11/9/2023

|

9,625,522

|

9,587,856

|

|

10,275,428

|

2

|

Sonasing Xikomba Ltd. (“Xikomba”), Bermuda, Inc., 7.869% (3-month USLIBOR

+2.300%), 5/29/2026

|

5/17/2022-

11/4/2022

|

10,278,419

|

10,275,428

|

|

|

|

TOTAL

|

|

|

35,979,607

|

|

Foreign

Currency

Par Amount,

Principal

Amount

or Shares

|

|

|

Acquisition

Date1

|

Acquisition

Cost

in U.S. Dollars1

|

Value

in

U.S. Dollars

|

|

|

|

TRADE FINANCE AGREEMENTS—continued

|

|

|

|

|

|

|

Energy - Oil Refining and Marketing—6.0%

|

|

|

|

|

$ 1,195,171

|

2

|

Trafigura Environmental Solutions S.a.r.l., 7.220% (SOFR CME +1.900%), 9/5/2024

|

9/6/2023

|

$ 1,195,171

|

$ 1,196,224

|

|

4,882,500

|

2

|

Trafigura Pte Ltd. AUS, 7.445% (1-month USLIBOR +2.000%), 6/30/2024

|

12/20/2022

|

4,882,500

|

4,882,500

|

|

10,000,000

|

2

|

Turkiye Petrol Rafinerileri AS, 8.071% (SOFR CME +2.750%), 4/16/2024

|

2/19/2024

|

9,881,171

|

9,957,287

|

|

8,854,153

|

2

|

Yinson Bergenia Production, 9.213% (SOFR CME +3.900%), 6/10/2028

|

3/6/2023-

2/22/2024

|

8,854,153

|

8,854,153

|

|

11,492,400

|

2

|

Yinson Boronia Production, 9.072% (3-month USLIBOR +3.500%), 8/11/2026

|

12/17/2021-

8/19/2022

|

11,492,400

|

11,492,400

|

|

|

|

TOTAL

|

|

|

36,382,564

|

|

|

|

Foreign Sovereign—12.3%

|

|

|

|

|

5,000,000

|

2

|

African Export-Import Bank (Afreximbank), 6.187% (SOFR CME +1.000%), 4/29/2024

|

9/6/2022-

5/1/2023

|

5,000,000

|

5,000,000

|

|

EUR 235,600

|

2

|

Bank of Industry Ltd. Central Bank of Nigeria, 8.432% (3-month EURIBOR

+4.500%), 2/14/2025

|

3/17/2020

|

258,500

|

254,177

|

|

6,000,000

|

2

|

Bank of Industry Ltd. Central Bank of Nigeria, 5.548% (3-month EURIBOR

+1.650%), 7/20/2024

|

9/1/2023

|

6,402,561

|

6,465,906

|

|

4,114,286

|

|

Benin, Government of, 8.222%, 12/21/2026

|

12/21/2021

|

4,642,149

|

4,259,209

|

|

4,457,143

|

2

|

Benin, Government of, 8.222% (6-month USLIBOR +4.300%), 12/21/2026

|

12/23/2021

|

5,051,949

|

4,808,588

|

|

2,625,000

|

2

|

Benin, Government of, 8.052% (6-month EURIBOR +3.950%), 4/30/2027

|

6/29/2023

|

2,848,832

|

2,831,981

|

|

10,000,000

|

2

|

Cote d’Ivoire, Government of, 6.926% (3-month EURIBOR +2.900%), 12/7/2024

|

5/17/2022-

6/21/2022

|

10,544,469

|

10,788,499

|

|

$ 1,246,217

|

|

Egypt, Government of, 7.887%, 8/27/2024

|

5/24/2023-

8/24/2023

|

1,242,296

|

1,246,218

|

|

8,483,207

|

2

|

Energy Development Oman, 7.380% (1-month USLIBOR +2.050%), 8/11/2028

|

11/2/2021-

12/5/2023

|

8,453,601

|

8,483,207

|

|

4,000,000

|

2

|

Kenya, Government of, 12.152% (6-month USLIBOR +6.450%), 3/4/2026

|

2/16/2024

|

3,973,000

|

4,000,000

|

|

EUR 3,500,000

|

2

|

Minister of Finance of Ukraine, 8.028% (3-month EURIBOR +4.100%), 9/1/2026

|

8/26/2021

|

4,114,075

|

2,980,497

|

|

8,000,000

|

2

|

Senegal, Government of, 8.285% (3-month EURIBOR +4.350%), 3/1/2026

|

6/9/2023

|

8,596,799

|

8,630,799

|

|

$10,000,000

|

2

|

The Federal Republic of Nigeria acting by and through the Federal Ministry of Finance,

Budget and National Planning of Nigeria (MOF), 11.555% (SOFR CME

+5.950%), 12/30/2024

|

9/1/2022-

1/19/2023

|

10,000,000

|

10,000,000

|

|

EUR 5,000,000

|

2

|

Turkiye Ihracat Kredi Bankasi AS, 7.720% (6-month EURIBOR +3.650%), 5/23/2024

|

10/17/2023

|

5,277,657

|

5,394,249

|

|

|

|

TOTAL

|

|

|

75,143,330

|

|

|

|

Government Agency—3.9%

|

|

|

|

|

7,500,000

|

2

|

Republic of Senegal Via Ministry of Finance and Budget, 9.724% (6-month EURIBOR

+5.800%), 12/22/2028

|

12/19/2023

|

8,233,877

|

7,966,956

|

|

9,532,292

|

|

Republic of Senegal, represented by the Ministry of Economy, Planning & Corporation,

7.053%–8.196%, 12/12/2024

|

1/11/2023-

1/4/2024

|

10,348,066

|

10,239,178

|

|

5,000,000

|

2

|

The Republic De Cote D’Ivoire via The Ministre Des Finances Et Du Budget, 6.902%

(3-month EURIBOR +3.000%), 12/19/2024

|

12/21/2023

|

5,458,589

|

5,394,250

|

|

|

|

TOTAL

|

|

|

23,600,384

|

|

|

|

Other—0.8%

|

|

|

|

|

$ 5,377,496

|

2

|

Ten FPSO, 8.745% (SOFR CME +3.125%), 3/15/2026

|

2/19/2024

|

5,092,496

|

5,134,738

|

|

|

|

Pharmaceuticals—1.2%

|

|

|

|

|

EUR 6,669,465

|

2

|

Medina, 6.912% (3-month EURIBOR +3.000%), 4/30/2029

|

8/31/2023

|

7,162,301

|

7,104,654

|

|

|

|

Supranational—3.1%

|

|

|

|

|

$ 9,000,000

|

2

|

Africa Finance Corp., 6.059% (3-month USLIBOR +0.900%), 1/17/2025

|

3/11/2022

|

9,002,250

|

9,000,000

|

|

5,000,000

|

2

|

Eastern and Southern African Trade and Development Bank, 6.693% (SOFR CME

+1.350%), 8/23/2024

|

2/9/2023

|

4,936,750

|

4,981,032

|

|

5,000,000

|

2

|

Eastern and Southern African Trade and Development Bank, 6.793% (SOFR CME

+1.450%), 8/23/2025

|

7/18/2023

|

4,876,750

|

4,987,508

|

|

|

|

TOTAL

|

|

|

18,968,540

|

|

Foreign

Currency

Par Amount,

Principal

Amount

or Shares

|

|

|

Acquisition

Date1

|

Acquisition

Cost

in U.S. Dollars1

|

Value

in

U.S. Dollars

|

|

|

|

TRADE FINANCE AGREEMENTS—continued

|

|

|

|

|

|

|

Technology & Electronics - Tech Hardware & Equipment—0.5%

|

|

|

|

|

$ 3,405,705

|

2

|

Datatec PLC, 11.329% (1-month USLIBOR +3.000%), 4/26/2024

|

3/25/2024

|

$ 3,373,553

|

$ 3,373,553

|

|

|

|

Telecommunications - Wireless—5.7%

|

|

|

|

|

12,220,000

|

2

|

IHS Holding Ltd., 9.251% (SOFR CME +3.750%), 10/28/2025

|

12/13/2022-

10/31/2023

|

11,820,750

|

12,220,000

|

|

EUR 4,800,000

|

2

|

Phoenix Tower International (PTI) Iberica V, NewCo created and, Inc. in Spain, 7.108%

(6-month EURIBOR +3.250%), 10/25/2030

|

10/19/2023

|

5,082,242

|

5,323,516

|

|

482,625

|

2

|

Phoenix Tower International (PTI) Iberica V, NewCo created and, Inc. in Spain,

7.108%–7.300% (6-month EURIBOR +3.250%), 10/25/2030

|

10/19/2023-

12/21/2023

|

520,174

|

535,263

|

|

$ 7,000,000

|

2

|

Phoenix Tower International Spain ETVE, S.L.U., 9.348% (SOFR CME

+4.000%), 8/10/2027

|

11/21/2022

|

6,951,000

|

7,113,904

|

|

EUR 8,750,000

|

2

|

TDC Net A/S, 6.346% (3-month EURIBOR +2.300%), 2/2/2027

|

3/28/2023

|

9,492,118

|

9,439,937

|

|

|

|

TOTAL

|

|

|

34,632,620

|

|

|

|

Transportation - Transport Infrastructure/Services—2.4%

|

|

|

|

|

7,500,000

|

2

|

Fraport TAV Antalya Yatirim Yapim ve Isletme, 9.425% (6-month EURIBOR

+5.500%), 9/25/2025

|

9/1/2022

|

7,461,001

|

8,172,288

|

|

$ 6,674,107

|

|

Impala Terminals Switzerland SAR, 8.510%, 8/13/2025

|

3/28/2023-

12/1/2023

|

6,576,570

|

6,632,111

|

|

|

|

TOTAL

|

|

|

14,804,399

|

|

|

|

Utility - Electric-Generation—2.5%

|

|

|

|

|

EUR 7,000,000

|

2

|

Eesti Energia AS, 8.398% (6-month EURIBOR +4.500%), 5/11/2028

|

5/5/2023

|

7,712,249

|

7,551,949

|

|

$ 4,020,000

|

2

|

Karadeniz Powership Osman Khan Co., Ltd., 10.987% (6-month USLIBOR

+5.500%), 9/15/2026

|

10/14/2021

|

3,979,800

|

4,019,211

|

|

1,736,500

|

2

|

Karpower International DMCC (opco, Dubai) (“Karpower Reef”), 11.809% (SOFR CME

+6.500%), 6/30/2026

|

3/20/2023

|

1,714,794

|

1,725,291

|

|

984,017

|

2

|

Karpowership, 10.207% (6-month USLIBOR +4.928%), 2/28/2025

|

7/30/2020-

7/9/2021

|

970,850

|

988,938

|

|

219,943

|

2

|

SMN Barka Power Co. S.A.O.C., 6.512% (6-month USLIBOR +1.250%), 3/31/2026

|

12/2/2020

|

230,809

|

219,833

|

|

538,462

|

2

|

The Sharjah Electricity and Water Authority, 7.541% (3-month USLIBOR

+1.950%), 12/23/2025

|

12/21/2020

|

537,519

|

538,461

|

|

|

|

TOTAL

|

|

|

15,043,683

|

|

|

|

TOTAL TRADE FINANCE AGREEMENTS

(IDENTIFIED COST $588,102,250)

|

|

|

587,809,962

|

|

|

|

INVESTMENT COMPANY—0.9%

|

|

|

|

|

5,477,751

|

|

Federated Hermes Institutional Prime Value Obligations Fund, Institutional Shares,

5.37%6

(IDENTIFIED COST $5,474,291)

|

|

|

5,478,299

|

|

|

|

TOTAL INVESTMENT IN SECURITIES—97.5%

(IDENTIFIED COST $593,576,541)7

|

|

|

593,288,261

|

|

|

|

OTHER ASSETS AND LIABILITIES - NET—2.5%8

|

|

|

15,034,478

|

|

|

|

TOTAL NET ASSETS—100%

|

|

|

$608,322,739

|

|

Settlement

Date

|

Counterparty

|

Foreign

Currency

Units to

Deliver/Receive

|

In

Exchange

For

|

Net Unrealized

Appreciation

|

|

|

Contracts Sold:

|

|

|

|

|

|

|

6/27/2024

|

Credit Agricole

|

93,400,000

|

EUR

|

$101,630,156

|

$516,884

|

|

6/27/2024

|

Barclays Bank

|

92,500,000

|

EUR

|

$100,583,862

|

$444,915

|

|

NET UNREALIZED APPRECIATION ON FOREIGN EXCHANGE CONTRACTS

|

$961,799

|

||||

|

|

Federated Hermes Institutional

Prime Value

Obligations Fund,

Institutional Shares

|

|

Value as of 3/31/2023

|

$90,363,791

|

|

Purchases at Cost

|

$413,204,197

|

|

Proceeds from Sales

|

$(498,111,856)

|

|

Change in Unrealized Appreciation/Depreciation

|

$(11,437)

|

|

Net Realized Gain/(Loss)

|

$33,604

|

|

Value as of 3/31/2024

|

$5,478,299

|

|

Shares Held as of 3/31/2024

|

5,477,751

|

|

Dividend Income

|

$2,946,816

|

|

1

|

Denotes a restricted security that either: (a) cannot be offered for public sale without

first being registered, or availing of an exemption from registration, under

the Securities Act of 1933; or (b) is subject to a contractual restriction on public

sales. At March 31, 2024, these restricted securities amounted to $587,809,962,

which represented 96.6% of total net assets.

|

|

2

|

Floating/variable note with current rate and current maturity or next reset date shown.

|

|

3

|

Issuer in default.

|

|

4

|

Market quotations and price evaluations are not available. Fair value determined using

significant unobservable inputs in accordance with procedures established

by and under the general supervision of the Fund’s Adviser acting through its Valuation Committee (“Valuation Committee”).

|

|

5

|

Non-income-producing security.

|

|

6

|

7-day net yield.

|

|

7

|

The cost of investments for federal tax purposes amounts to $593,596,003.

|

|

8

|

Assets, other than investments in securities, less liabilities. See Statement of Assets

and Liabilities.

|

The following is a summary of the inputs used, as of March 31, 2024, in valuing the Fund’s assets carried at fair value:

|

Valuation Inputs

|

||||

|

|

Level 1—

Quoted

Prices

|

Level 2—

Other

Significant

Observable

Inputs

|

Level 3—

Significant

Unobservable

Inputs

|

Total

|

|

Debt Securities:

|

|

|

|

|

|

Trade Finance Agreements

|

$—

|

$—

|

$587,809,962

|

$587,809,962

|

|

Investment Company

|

5,478,299

|

—

|

—

|

5,478,299

|

|

TOTAL SECURITIES

|

$5,478,299

|

$—

|

$587,809,962

|

$593,288,261

|

|

Other Financial Instruments1

|

|

|

|

|

|

Assets

|

$—

|

$961,799

|

$—

|

$961,799

|

|

|

|

|

|

|

|

1

|

Other financial instruments are foreign exchange contracts.

|

|

|

Investments in Trade

Finance Agreements

|

|

Balance as of 3/31/2023

|

$472,021,560

|

|

Accreted/amortized discount/premiums

|

2,452,627

|

|

Realized gain (loss)

|

(1,598,190)

|

|

Change in unrealized appreciation/depreciation

|

3,546,745

|

|

Purchases

|

652,039,259

|

|

(Sales)

|

(540,652,039)

|

|

Balance as of 3/31/2024

|

$587,809,962

|

|

Total change in unrealized appreciation/depreciation attributable to

investments still held at 3/31/2024

|

$2,454,447

|

|

The following acronym(s) are used throughout this portfolio:

|

|

|

|

EUR

|

—Euro

|

|

|

EURIBOR

|

—Euro Interbank Offered Rate

|

|

|

JSC

|

—Joint Stock Company

|

|

|

LIBOR

|

—London Interbank Offered Rate

|

|

|

SOFR

|

—Secured Overnight Financing Rate

|

|

|

|

Year Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Net Asset Value, Beginning of Period

|

$9.87

|

$9.80

|

$9.92

|

$9.71

|

$9.98

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.78

|

0.46

|

0.19

|

0.25

|

0.39

|

|

Net realized and unrealized gain (loss)

|

0.08

|

0.12

|

(0.11)

|

0.22

|

(0.27)

|

|

TOTAL FROM INVESTMENT OPERATIONS

|

0.86

|

0.58

|

0.08

|

0.47

|

0.12

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.75)

|

(0.51)

|

(0.20)

|

(0.26)

|

(0.38)

|

|

Distributions from net realized gain

|

(0.07)

|

(0.00)2

|

(0.00)2

|

(0.00)2

|

(0.01)

|

|

TOTAL DISTRIBUTIONS

|

(0.82)

|

(0.51)

|

(0.20)

|

(0.26)

|

(0.39)

|

|

Net Asset Value, End of Period

|

$9.91

|

$9.87

|

$9.80

|

$9.92

|

$9.71

|

|

Total Return3

|

9.04%

|

6.07%

|

0.80%

|

4.91%

|

1.13%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses4

|

0.41%

|

0.41%

|

0.41%

|

0.71%

|

0.71%

|

|

Net investment income

|

7.77%

|

4.70%

|

1.94%

|

2.57%

|

3.94%

|

|

Expense waiver/reimbursement5

|

0.22%

|

0.24%

|

0.22%

|

0.44%

|

0.32%

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$608,323

|

$577,272

|

$560,685

|

$39,835

|

$63,873

|

|

Portfolio turnover6

|

47%

|

52%

|

36%

|

47%

|

73%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Represents less than $0.01.

|

|

3

|

Based on net asset value.

|

|

4

|

Amount does not reflect net expenses incurred by investment companies in which the

Fund may invest.

|

|

5

|

This expense decrease is reflected in both the net expense and the net investment

income ratios shown above. Amount does not reflect expense waiver/

reimbursement recorded by investment companies in which the Fund may invest.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

|

Assets:

|

|

|

Investment in securities, at value including $5,478,299 of investments in affiliated

holdings* (identified cost $593,576,541, including

$5,474,291 of identified cost in affiliated holdings)

|

$593,288,261

|

|

Cash denominated in foreign currencies (identified cost $18,667,497)

|

18,800,753

|

|

Income receivable

|

8,604,068

|

|

Income receivable from affiliated holdings

|

139,083

|

|

Receivable for investments sold

|

1,551,712

|

|

Unrealized appreciation on foreign exchange contracts

|

961,799

|

|

Total Assets

|

623,345,676

|

|

Liabilities:

|

|

|

Payable to bank

|

14,794,705

|

|

Payable for investment adviser fee (Note 5)

|

16,214

|

|

Accrued expenses (Note 5)

|

212,018

|

|

Total Liabilities

|

15,022,937

|

|

Net assets for 61,366,020 shares outstanding

|

$608,322,739

|

|

Net Assets Consist of:

|

|

|

Paid-in capital

|

$609,987,999

|

|

Total distributable earnings (loss)

|

(1,665,260)

|

|

Total Net Assets

|

$608,322,739

|

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share:

|

|

|

$608,322,739 ÷ 61,366,020 shares outstanding, no par value, unlimited shares authorized

|

$9.91

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

|

Investment Income:

|

|

|

Interest

|

$45,646,669

|

|

Dividends received from affiliated holdings*

|

2,946,816

|

|

TOTAL INCOME

|

48,593,485

|

|

Expenses:

|

|

|

Investment adviser fee (Note 5)

|

2,972,034

|

|

Administrative fee (Note 5)

|

1,395

|

|

Custodian fees

|

24,055

|

|

Transfer agent fees

|

144,119

|

|

Directors’/Trustees’ fees (Note 5)

|

9,837

|

|

Auditing fees

|

78,104

|

|

Legal fees

|

16,201

|

|

Portfolio accounting fees

|

370,230

|

|

Share registration costs

|

92,963

|

|

Printing and postage

|

22,564

|

|

Offering Costs

|

27,423

|

|

Miscellaneous (Note 5)

|

14,978

|

|

TOTAL EXPENSES

|

3,773,903

|

|

Waiver/reimbursement of investment adviser fee (Note 5)

|

(1,336,402)

|

|

Net expenses

|

2,437,501

|

|

Net investment income

|

46,155,984

|

|

Realized and Unrealized Gain (Loss) on Investments, Foreign Currency Transactions

and Foreign Exchange Contracts:

|

|

|

Net realized loss on investments (including net realized gain of $33,604 on sales

of investments in affiliated holdings*)

|

(1,564,587)

|

|

Net realized gain on foreign currency transactions

|

255,136

|

|

Net realized gain on foreign exchange contracts

|

2,301,868

|

|

Net change in unrealized depreciation of investments (including net change in unrealized

appreciation of $(11,437) on investments in affiliated

holdings*)

|

3,535,308

|

|

Net change in unrealized appreciation/ depreciation of translation of assets and liabilities

in foreign currency

|

133,136

|

|

Net change in unrealized appreciation of foreign exchange contracts

|

942,662

|

|

Net realized and unrealized gain (loss) on investments, foreign currency transactions

and foreign exchange contracts

|

5,603,523

|

|

Change in net assets resulting from operations

|

$51,759,507

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

|

Year Ended March 31

|

2024

|

2023

|

|

Increase (Decrease) in Net Assets

|

|

|

|

Operations:

|

|

|

|

Net investment income

|

$46,155,984

|

$26,831,968

|

|

Net realized gain (loss)

|

992,417

|

1,109,941

|

|

Net change in unrealized appreciation/depreciation

|

4,611,106

|

5,437,987

|

|

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS

|

51,759,507

|

33,379,896

|

|

Distributions to Shareholders

|

(49,091,995)

|

(29,259,498)

|

|

Share Transactions:

|

|

|

|

Proceeds from sale of shares

|

—

|

20,000,000

|

|

Net asset value of shares issued to shareholders in payment of distributions declared

|

28,382,884

|

16,367,790

|

|

Cost of shares redeemed

|

—

|

(23,900,996)

|

|

CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS

|

28,382,884

|

12,466,794

|

|

Change in net assets

|

31,050,396

|

16,587,192

|

|

Net Assets:

|

|

|

|

Beginning of period

|

577,272,343

|

560,685,151

|

|

End of period

|

$608,322,739

|

$577,272,343

|

|

Operating Activities:

|

|

|

Change in net assets resulting from operations

|

$51,759,507

|

|

Adjustments to Reconcile Change in Net Assets Resulting From Operations to Net Cash

Provided By Operating Activities:

|

|

|

Purchase of investment securities

|

(652,039,259)

|

|

Proceeds from disposition of investment securities

|

540,652,039

|

|

Proceeds of short-term investments, net

|

84,907,658

|

|

Amortization/accretion of premium/discount, net

|

(2,452,627)

|

|

Increase in income receivable

|

(3,675,200)

|

|

Decrease in receivable for investments sold

|

8,171,404

|

|

Increase in accrued expenses

|

9,596

|

|

Net realized loss on investments

|

1,564,587

|

|

Net change in unrealized appreciation/depreciation of investments

|

(3,535,308)

|

|

Net change in unrealized appreciation/depreciation of foreign exchange contracts

|

(942,662)

|

|

Net Cash Provided By Operating Activities

|

24,419,735

|

|

Financing Activities:

|

|

|

Increase in cash overdraft

|

14,794,705

|

|

Income distributions to participants

|

(20,709,111)

|

|

Net Cash Used by Financing Activities

|

(5,914,406)

|

|

Increase in cash

|

18,505,329

|

|

Cash at beginning of year

|

295,424

|

|

Cash at end of year

|

$18,800,753

|

|

Fair Value of Derivative Instruments

|

||

|

|

Assets

|

|

|

|

Statement of

Assets and

Liabilities

Location

|

Fair

Value

|

|

Derivatives not accounted for as hedging

instruments under ASC Topic 815

|

|

|

|

Foreign exchange contracts

|

Unrealized appreciation on

foreign exchange contracts

|

$961,799

|

|

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income

|

|

|

|

Foreign

Exchange

Contracts

|

|

Foreign exchange contracts

|

$2,301,868

|

|

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income

|

|

|

|

Foreign

Exchange

Contracts

|

|

Foreign exchange contracts

|

$942,662

|

|

|

Year Ended

3/31/2024

|

Year Ended

3/31/2023

|

|

Shares sold

|

—

|

2,027,374

|

|

Shares issued to shareholders in payment of distributions declared

|

2,871,266

|

1,683,385

|

|

Shares redeemed

|

—

|

(2,400,406)

|

|

NET CHANGE RESULTING FROM FUND SHARE TRANSACTIONS

|

2,871,266

|

1,310,353

|

|

|

2024

|

2023

|

|

Ordinary income1

|

$46,307,150

|

$29,227,526

|

|

Long-term capital gains

|

$2,784,845

|

$31,972

|

|

1

|

For tax purposes, short-term capital gain distributions are considered ordinary income

distributions.

|

|

Undistributed ordinary income

|

$1,124,798

|

|

Net unrealized depreciation

|

$(307,742)

|

|

Capital loss carryforwards and deferrals

|

$(2,615,572)

|

|

Other temporary differences

|

$133,256

|

|

TOTAL

|

$(1,665,260)

|

|

Purchases

|

$239,990,140

|

|

Sales

|

$174,500,228

|

|

Country

|

Percentage of

Total Net Assets

|

|

Turkey

|

11.1%

|

|

Brazil

|

9.2%

|

|

Nigeria

|

7.5%

|

|

Uzbekistan

|

7.5%

|

|

United States

|

5.5%

|

|

Angola

|

5.2%

|

|

Senegal

|

4.6%

|

|

Ivory Coast

|

4.3%

|

|

Switzerland

|

3.6%

|

|

Oman

|

3.2%

|

|

United Kingdom

|

2.5%

|

|

Mauritius

|

2.5%

|

|

Russia

|

2.3%

|

|

Benin

|

2.0%

|

|

Egypt

|

1.8%

|

|

United Arab Emirates

|

1.7%

|

|

Colombia

|

1.6%

|

|

Trinidad And Tobago

|

1.6%

|

|

Denmark

|

1.5%

|

|

Ghana

|

1.5%

|

|

China

|

1.5%

|

|

Serbia

|

1.4%

|

|

Estonia

|

1.2%

|

|

Chile

|

1.2%

|

|

Spain

|

1.2%

|

|

Singapore

|

1.0%

|

|

Italy

|

1.0%

|

|

South Africa

|

0.9%

|

|

Azerbaijan

|

0.8%

|

|

Qatar

|

0.8%

|

|

Suriname

|

0.8%

|

|

Papua New Guinea

|

0.7%

|

|

Ireland

|

0.7%

|

|

Kenya

|

0.7%

|

|

Dominican Republic

|

0.6%

|

|

Zambia

|

0.6%

|

|

Ukraine

|

0.5%

|

|

New Caledonia

|

0.3%

|

|

Argentina

|

0.0%1

|

|

1

|

Represents less than 0.01%.

|

May 23, 2024

|

|

Beginning

Account Value

10/1/2023

|

Ending

Account Value

3/31/2024

|

Expenses Paid

During Period1

|

|

Actual

|

$1,000

|

$1,045.90

|

$2.10

|

|

Hypothetical (assuming a 5% return before expenses)

|

$1,000

|

$1,022.95

|

$2.07

|

|

1

|

Expenses are equal to the Fund’s annualized net expense ratio of 0.41%, multiplied by the average account value over the period, multiplied by 183/366 (to

reflect the one-half-year period).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated

Hermes Fund

Family; Director or Trustee of the Funds in the Federated Hermes Fund Family; President,

Chief Executive Officer and

Director, Federated Hermes, Inc.; Chairman and Trustee, Federated Investment Management

Company; Trustee, Federated

Investment Counseling; Chairman and Director, Federated Global Investment Management

Corp.; Chairman and Trustee,

Federated Equity Management Company of Pennsylvania; Trustee, Federated Shareholder

Services Company; Director,

Federated Services Company.

Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer,

Federated

Investment Management Company, Federated Global Investment Management Corp. and Passport

Research, Ltd; Chairman,

Passport Research, Ltd.

|

|

Thomas R. Donahue*

Birth Date: October 20, 1958

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee of certain of the funds in the Federated Hermes Fund Family;

Chief Financial

Officer, Treasurer, Vice President and Assistant Secretary, Federated Hermes, Inc.;

Chairman and Trustee, Federated

Administrative Services; Chairman and Director, Federated Administrative Services,

Inc.; Trustee and Treasurer, Federated

Advisory Services Company; Director or Trustee and Treasurer, Federated Equity Management

Company of Pennsylvania,

Federated Global Investment Management Corp., Federated Investment Counseling, and

Federated Investment

Management Company; Director, MDTA LLC; Director, Executive Vice President and Assistant

Secretary, Federated Securities

Corp.; Director or Trustee and Chairman, Federated Services Company and Federated

Shareholder Services Company; and

Director and President, FII Holdings, Inc.

Previous Positions: Director, Federated Hermes, Inc.; Assistant Secretary, Federated Investment Management

Company,

Federated Global Investment Management Company and Passport Research, LTD; Treasurer,

Passport Research, LTD;

Executive Vice President, Federated Securities Corp.; and Treasurer, FII Holdings,

Inc.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John G. Carson

Birth Date: May 15, 1965

Trustee

Indefinite Term

Began serving: January 2024

|

Principal Occupations: Director or Trustee of certain Funds in the Federated Hermes Fund Family; Chief Executive

Officer,

Chief Investment Officer, Northstar Asset Management (Financial Services); formerly,

Chief Compliance Officer, Northstar

Asset Management (Financial Services).

Other Directorships Held: None.

Qualifications: Mr. Carson has served in various business management roles throughout his career.

Mr. Carson was a Vice

President at the Glenmede Trust Company and a Managing Director at Oppenheimer & Company.

Prior to that he spent

more than a decade with the Bank of America/Merrill Lynch as a Director of Institutional

Sales. Earlier on, Mr. Carson held

similar positions for Wertheim Schroder/Schroders PLC and Drexel Burnham Lambert.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

G. Thomas Hough

Birth Date: February 28, 1955

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee and Chair of the Board of Directors or Trustees of the Federated

Hermes Fund

Family; formerly, Vice Chair, Ernst & Young LLP (public accounting firm) (Retired).

Other Directorships Held: Director, Chair of the Audit Committee, Member of the Compensation Committee, Equifax,

Inc.;

Lead Director, Member of the Audit and Nominating and Corporate Governance Committees,

Haverty Furniture Companies,

Inc.; formerly, Director, Member of Governance and Compensation Committees, Publix

Super Markets, Inc.

Qualifications: Mr. Hough has served in accounting, business management and directorship positions

throughout his career.

Mr. Hough most recently held the position of Americas Vice Chair of Assurance with

Ernst & Young LLP (public accounting

firm). Mr. Hough serves on the President’s Cabinet and Business School Board of Visitors for the University of Alabama.

Mr. Hough previously served on the Business School Board of Visitors for Wake Forest

University, and he previously served as

an Executive Committee member of the United States Golf Association.

|

|

Maureen Lally-Green

Birth Date: July 5, 1949

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Adjunct Professor of Law,

Emerita,

Duquesne University School of Law; formerly, Dean of the Duquesne University School

of Law and Professor of Law and

Interim Dean of the Duquesne University School of Law; formerly, Associate General

Secretary and Director, Office of Church

Relations, Diocese of Pittsburgh.

Other Directorships Held: Director, CNX Resources Corporation (natural gas).

Qualifications: Judge Lally-Green has served in various legal and business roles and directorship

positions throughout her

career. Judge Lally-Green previously held the position of Dean of the School of Law

of Duquesne University (as well as

Interim Dean). Judge Lally-Green previously served as Director of the Office of Church

Relations and later as Associate

General Secretary for the Diocese of Pittsburgh, a member of the Superior Court of

Pennsylvania and as a Professor of Law,

Duquesne University School of Law. Judge Lally-Green was appointed by the Supreme

Court of Pennsylvania and previously

served on the Supreme Court’s Board of Continuing Judicial Education and the Supreme Court’s Appellate Court Procedural

Rules Committee. Judge Lally-Green was then appointed by the Supreme Court of Pennsylvania

and currently serves on the

Judicial Ethics Advisory Board. Judge Lally-Green also currently holds the positions

on not for profit or for profit boards of

directors as follows: Director and Chair, UPMC Mercy Hospital; Regent, Saint Vincent

Seminary; Member, Pennsylvania State

Board of Education (public); Director, Catholic Charities, Pittsburgh; and Director,

CNX Resources Corporation (natural gas).

Judge Lally-Green has held the positions of: Director, Auberle; Director, Epilepsy

Foundation of Western and Central

Pennsylvania; Director, Ireland Institute of Pittsburgh; Director, Saint Thomas More

Society; Director and Chair, Catholic High

Schools of the Diocese of Pittsburgh, Inc.; Director, Pennsylvania Bar Institute;

Director, Saint Vincent College; Director and

Chair, North Catholic High School, Inc.; Director and Vice Chair, Our Campaign for

the Church Alive!, Inc.; and Director and

Vice Chair, Saint Francis University.

|

|

Thomas M. O’Neill

Birth Date: June 14, 1951

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee and Chair of the Audit Committee of the Federated Hermes Fund

Family; Sole

Proprietor, Navigator Management Company (investment and strategic consulting).

Other Directorships Held: None.

Qualifications: Mr. O’Neill has served in several business, mutual fund and financial management roles and directorship

positions throughout his career. Mr. O’Neill serves as Director, Medicines for Humanity. Mr. O’Neill previously served as Chief

Executive Officer and President, Managing Director and Chief Investment Officer, Fleet

Investment Advisors; President and

Chief Executive Officer, Aeltus Investment Management, Inc.; General Partner, Hellman,

Jordan Management Co., Boston,

MA; Chief Investment Officer, The Putnam Companies, Boston, MA; Credit Analyst and

Lending Officer, Fleet Bank; Director

and Consultant, EZE Castle Software (investment order management software); Director,

Midway Pacific (lumber); and

Director, The Golisano Children’s Museum of Naples, Florida.

|

|

Madelyn A. Reilly

Birth Date: February 2, 1956

Trustee

Indefinite Term

Began serving:

November 2020

|

Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; formerly, Senior Vice President

for Legal

Affairs, General Counsel and Secretary of Board of Directors, Duquesne University

(Retired).

Other Directorships Held: None.

Qualifications: Ms. Reilly has served in various business and legal management roles throughout her

career. Ms. Reilly

previously served as Senior Vice President for Legal Affairs, General Counsel and

Secretary of Board of Directors and Director

of Risk Management and Associate General Counsel, Duquesne University. Prior to her

work at Duquesne University,

Ms. Reilly served as Assistant General Counsel of Compliance and Enterprise Risk as

well as Senior Counsel of Environment,

Health and Safety, PPG Industries. Ms. Reilly currently serves as a member of the

Board of Directors of UPMC Mercy

Hospital, and as a member of the Board of Directors of Catholic Charities, Pittsburgh.

|

|

P. Jerome Richey

Birth Date: February 23, 1949

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Retired; formerly, Senior

Vice Chancellor

and Chief Legal Officer, University of Pittsburgh and Executive Vice President and

Chief Legal Officer, CONSOL Energy Inc.

(now split into two separate publicly traded companies known as CONSOL Energy Inc.

and CNX Resources Corp.).

Other Directorships Held: None.

Qualifications: Mr. Richey has served in several business and legal management roles and directorship

positions throughout

his career. Mr. Richey most recently held the positions of Senior Vice Chancellor

and Chief Legal Officer, University of

Pittsburgh. Mr. Richey previously served as Chairman of the Board, Epilepsy Foundation

of Western Pennsylvania and

Chairman of the Board, World Affairs Council of Pittsburgh. Mr. Richey previously

served as Chief Legal Officer and Executive

Vice President, CONSOL Energy Inc. and CNX Gas Company; and Board Member, Ethics Counsel

and Shareholder, Buchanan

Ingersoll & Rooney PC (a law firm).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John S. Walsh

Birth Date:

November 28, 1957

Trustee

Indefinite Term

Began serving: August 2016

|

Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; President and Director,

Heat Wagon, Inc.

(manufacturer of construction temporary heaters); President and Director, Manufacturers

Products, Inc. (distributor of

portable construction heaters); President, Portable Heater Parts, a division of Manufacturers

Products, Inc.

Other Directorships Held: None.

Qualifications: Mr. Walsh has served in several business management roles and directorship positions

throughout his career.

Mr. Walsh previously served as Vice President, Walsh & Kelly, Inc. (paving contractors).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Jeremy D. Boughton

Birth Date:

September 29, 1976

TREASURER

Officer since: March 2024

|

Principal Occupations: Principal Financial Officer and Treasurer of the Federated Hermes Fund Family; Senior

Vice President,

Federated Administrative Services, Federated Administrative Services, Inc., Federated

Advisory Services Company,

Federated Equity Management Company of Pennsylvania, Federated Global Investment Management

Corp., Federated

Investment Counseling, Federated Investment Management Company and Federated MDTA,

LLC. Formerly, Controller,

Federated Hermes, Inc. and Financial and Operations Principal for Federated Securities

Corp. Mr. Boughton has received the

Certified Public Accountant designation.

Previous Positions: Senior Vice President and Assistant Treasurer, Federated Investors Management Company;

Treasurer,

Federated Investors Trust Company; Assistant Treasurer, Federated Administrative Services,

Federated Administrative

Services, Inc., Federated Securities Corp., Federated Advisory Services Company, Federated

Equity Management Company

of Pennsylvania, Federated Global Investment Management Corp., Federated Investment

Counseling, Federated Investment

Management Company, Federated MDTA, LLC and Federated Hermes (UK) LLP, as well as

other subsidiaries of Federated

Hermes, Inc.

|

|

Peter J. Germain

Birth Date:

September 3, 1959

CHIEF LEGAL OFFICER,

SECRETARY and EXECUTIVE

VICE PRESIDENT

Officer since: November 2016

|

Principal Occupations: Mr. Germain is Chief Legal Officer, Secretary and Executive Vice President of the

Federated Hermes

Fund Family. He is General Counsel, Chief Legal Officer, Secretary and Executive Vice

President, Federated Hermes, Inc.;

Trustee and Senior Vice President, Federated Investors Management Company; Trustee

and President, Federated

Administrative Services; Director and President, Federated Administrative Services,

Inc.; Director and Vice President,

Federated Securities Corp.; Director and Secretary, Federated Private Asset Management,

Inc.; Secretary, Federated

Shareholder Services Company; and Secretary, Retirement Plan Service Company of America.

Mr. Germain joined Federated

Hermes, Inc. in 1984 and is a member of the Pennsylvania Bar Association.

Previous Positions: Deputy General Counsel, Special Counsel, Managing Director of Mutual Fund Services,

Federated

Hermes, Inc.; Senior Vice President, Federated Services Company; and Senior Corporate

Counsel, Federated Hermes, Inc.

|

|

Stephen Van Meter

Birth Date: June 5, 1975

CHIEF COMPLIANCE OFFICER

AND SENIOR VICE PRESIDENT

Officer since: June 2016

|

Principal Occupations: Senior Vice President and Chief Compliance Officer of the Federated Hermes Fund Family;

Vice

President and Chief Compliance Officer of Federated Hermes, Inc. and Chief Compliance

Officer of certain of its subsidiaries.

Mr. Van Meter joined Federated Hermes, Inc. in October 2011. He holds FINRA licenses

under Series 3, 7, 24 and 66.

Previous Positions: Mr. Van Meter previously held the position of Compliance Operating Officer, Federated

Hermes, Inc.

Prior to joining Federated Hermes, Inc., Mr. Van Meter served at the United States

Securities and Exchange Commission in

the positions of Senior Counsel, Office of Chief Counsel, Division of Investment Management

and Senior Counsel, Division

of Enforcement.

|

|

Robert J. Ostrowski

Birth Date: April 26, 1963

Chief Investment Officer

Officer since: November 2016

|

Principal Occupations: Robert J. Ostrowski joined Federated Hermes, Inc. in 1987 as an Investment Analyst

and became a

Portfolio Manager in 1990. He was named Chief Investment Officer of Federated Hermes’ taxable fixed-income products in

2004 and also serves as a Senior Portfolio Manager. Mr. Ostrowski became an Executive Vice President of the Fund’s Adviser

in 2009 and served as a Senior Vice President of the Fund’s Adviser from 1997 to 2009. Mr. Ostrowski has received the

Chartered Financial Analyst designation. He received his M.S. in Industrial Administration

from Carnegie Mellon University.

|

|

Ihab Salib

Birth Date: December 14, 1964

VICE PRESIDENT

Officer since: November 2016

Portfolio Manager since:

December 2016

|

Principal Occupations: Ihab Salib has been the Portfolio Manager of the Fund since December 2016. He is

Vice President of

the Fund. Mr. Salib joined Federated Hermes in April 1999 as a Senior Fixed-Income

Trader/Assistant Vice President of the

Fund’s Adviser. In July 2000, he was named a Vice President of the Fund’s Adviser and in January 2007 he was named a

Senior Vice President of the Fund’s Adviser. He has served as a Portfolio Manager since January 2002. From January 1994

through March 1999, Mr. Salib was employed as a Senior Global Fixed-Income Analyst

with UBS Brinson, Inc. Mr. Salib

received his B.A. with a major in Economics from Stony Brook University.

|

|

Chris McGinley

Birth Date: July 28, 1978

Vice President

Officer since: November 2016

Portfolio Manager since:

December 2016

|

Principal Occupations: Chris McGinleyhas been the Fund’s Portfolio Manager since December 2016. He is Vice President of

the Fund. Mr. McGinley joined Federated Hermes in 2004 as an associate research analyst

in the international fixed-income

department. He became an Assistant Vice President of the Fund’s Adviser in 2005 and Vice President in 2013. Mr. McGinley

joined the Sub-Adviser in 2013. Mr. McGinley worked in Senator Rick Santorum’s office in 2001 and from 2002 to 2004 he

served as Legislative Correspondent for Senator Santorum. Mr. McGinley earned his

B.S. and received his M.P.I.A. from the

University of Pittsburgh.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Maarten Offeringa

Birth Date: February 1, 1976

Vice President

Officer since: August 2019

Portfolio Manager since:

July 2019

|

Principal Occupations: Maarten Offeringa has been the Fund’s Portfolio Manager since July 2019. He is Vice President of the

Fund. Mr. Offeringa joined Federated Hermes in 2018. Mr. Offeringa is responsible

for providing research and advice on

sector allocation and security selection. He has worked in financial services since

2002; has worked in investment

management since 2018; has managed investment portfolios since 2019. Previous associations:

Director, Bank of America

Merrill Lynch; Vice President, J.P. Morgan. Education: MA, Vrije Universiteit Amsterdam.

|

|

Kazaur Rahman

Birth Date: November 30, 1982

Vice President

Officer since: August 2023

Portfolio Manager since:

July 2023

|

Principal Occupations: Kazaur Rahman has been the Fund’s Portfolio Manager since July 2023. He is Vice President of the

Fund. Mr. Rahman joined Federated Hermes in 2019. Mr. Rahman is responsible for providing

research and advice on sector

allocation and security selection. He has worked in financial services since 2005;

has worked in investment management since

2019; has managed investment portfolios since 2023. Previous associations include

roles with: Deutsche Bank; VTB Capital;

Bank of America; PricewaterhouseCoopers (PwC). Education: BSc, University of London.

|

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

| Item 2. | Code of Ethics |

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics (the "Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers") that applies to the registrant's Principal Executive Officer and Principal Financial Officer; the registrant's Principal Financial Officer also serves as the Principal Accounting Officer.

(c),(d) There were no amendments to or waivers from the Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers during the period covered by this report.

(f)(3) The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant at 1-800-341-7400, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3. Audit Committee Financial Expert

The registrant's Board has determined that each of the following members of the Board's audit committee (the “Audit Committee”) is an “audit committee financial expert,” and is "independent," for purposes of this Item: Thomas M. O’Neill and John S. Walsh.

| Item 4. | Principal Accountant Fees and Services |

(a) Audit Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2024 – $79,413

Fiscal year ended 2023 - $75,632

(b) Audit-Related Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2024 - $5,170

Fiscal year ended 2023 - $0

Fiscal year ended 2024- Audit consent fee for N-2 filing.

Amount requiring approval of the registrant’s Audit Committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(c) Tax Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2024 - $0

Fiscal year ended 2023 - $0

Amount requiring approval of the registrant’s Audit Committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(d) All Other Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2024 - $0

Fiscal year ended 2023 - $0

Amount requiring approval of the registrant’s Audit Committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(e)(1) Audit Committee Policies regarding Pre-approval of Services.

The Audit Committee is required to pre-approve audit and non-audit services performed by the independent auditor in order to assure that the provision of such services do not impair the auditor’s independence. Unless a type of service to be provided by the independent auditor has received general pre-approval, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels will require specific pre-approval by the Audit Committee.

Certain services have the general pre-approval of the Audit Committee. The term of the general pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. The Audit Committee will annually review the services that may be provided by the independent auditor without obtaining specific pre-approval from the Audit Committee and may grant general pre-approval for such services. The Audit Committee will revise the list of general pre-approved services from time to time, based on subsequent determinations. The Audit Committee will not delegate to management its responsibilities to pre-approve services performed by the independent auditor.

The Audit Committee has delegated pre-approval authority to its chairman (the “Chairman”) for services that do not exceed a specified dollar threshold. The Chairman or Chief Audit Executive will report any such pre-approval decisions to the Audit Committee at its next scheduled meeting. The Committee will designate another member with such pre-approval authority when the Chairman is unavailable.

AUDIT SERVICES

The annual audit services engagement terms and fees will be subject to the specific pre-approval of the Audit Committee. The Audit Committee will approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope, registered investment company (RIC) structure or other matters.