UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the Fiscal Year Ended

For the transition period from _______________ to _______________

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| (Address of principal executive offices) | (Zip Code) | (Registrant’s telephone number, including area code) |

Securities registered under Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding year (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

The aggregate market value of the common stock

held by non-affiliates of the registrant, based on the closing price of the shares of common stock on October 31, 2023 (the last business

day of the registrant’s most recently completed second fiscal quarter), as reported by The Nasdaq Stock Market LLC on such date

was approximately $

There were shares of common stock outstanding as of July 29, 2024.

Documents incorporated by reference:

ALZAMEND NEURO, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2024

INDEX

| Page | |||

| PART I | |||

| Item 1. | Business | 2 | |

| Item 1A. | Risk Factors | 23 | |

| Item 1B. | Unresolved Staff Comments | 47 | |

| Item 1C. | Cybersecurity | 47 | |

| Item 2. | Properties | 48 | |

| Item 3. | Legal Proceedings | 48 | |

| Item 4. | Mine Safety Disclosures | 48 | |

| PART II | |||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 49 | |

| Item 6. | [Reserved] | 49 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 50 | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 60 | |

| Item 8. | Financial Statements and Supplementary Data | 60 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 60 | |

| Item 9A. | Controls and Procedures | 61 | |

| Item 9B. | Other Information | 62 | |

| Item 9C. | Disclosures Regarding Foreign Jurisdictions that Prevent Inspections | 62 | |

| PART III | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 63 | |

| Item 11. | Executive Compensation | 67 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Stockholder Matters | 72 | |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 74 | |

| Item 14. | Principal Accountant Fees and Services | 76 | |

| PART IV | |||

| Item 15. | Exhibit and Financial Statement Schedules | 77 | |

| Item 16. | Form 10-K Summary | 78 | |

| Signatures | 79 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “expects,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predict,” “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions; uncertainties and other factors may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Annual Report is filed, and we do not intend to update any of the forward-looking statements after the date this Annual Report is filed to confirm these statements to actual results, unless required by law.

This Annual Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties and contained in this Annual Report and, accordingly, we cannot guarantee their accuracy or completeness, though we do generally believe the data to be reliable. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this Annual Report. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

RISK FACTOR SUMMARY

Below is a summary of the principal factors that make an investment in our common stock speculative. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this Annual Report and our other filings with the Securities and Exchange Commission (the “SEC”), before making investment decisions regarding our common stock.

| · | We need to obtain substantial additional funding to complete the development and any commercialization of AL001 and ALZN002. If we are unable to raise this capital when needed, we may be forced to delay, reduce or eliminate our research and development programs or other operations. |

| · | We are at an early stage of clinical development and currently have no source of near-term revenue and may never become profitable. |

| · | We have a limited operating history on which to judge our business prospects and management. |

| · | We have both operational and financial milestones that must be met to maintain the licensing rights to our current technology and intellectual property from the University of South Florida Research Foundation. |

| · | If we fail to comply with our obligations in the agreements under which we license intellectual property and other rights from third parties or otherwise experience disruptions to our business relationships with the Licensor, we could lose license rights that are important to our business. |

| · | We are substantially dependent on the success of our product candidates, which may not receive regulatory approval or be successfully commercialized. |

| · | Serious adverse events or other safety risks could require us to abandon development and preclude, delay or limit approval of AL001 or ALZN002, or limit the scope of any approved label or market acceptance. |

| · | Development and regulatory approval of our drug candidates present a number of risks, which are delineated in the Risk factors section. |

| · | If we fail to attract and keep senior management and key scientific personnel, we may be unable to successfully develop AL001, ALZN002 or any future product candidates, conduct our in-licensing and development efforts or commercialize AL001, ALZN002 or any of our future product candidates. |

| · | Our intellectual property rights present a number of risks. |

| · | Our affiliates and related party transactions present a number of risks. |

| · | If we do not regain compliance with or continue to satisfy the Nasdaq Capital Market continued listing requirements, our common stock could be delisted from the Nasdaq Capital Market. |

| · | The market price of our common stock is volatile, which could result in substantial losses for investors. |

| · | The concentration of our stock ownership will limit your ability to influence corporate matters, including the ability to influence the outcome of director elections and other matters requiring stockholder approval. |

| · | We have identified a material weakness in our internal control over financial reporting. If our remediation of this material weakness is not effective, or if we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our common stock. |

PART I

| ITEM 1. | BUSINESS |

In this Annual Report, unless the context requires otherwise, references to the “Company,” “Alzamend,” “we,” “our company” and “us” refer to Alzamend Neuro, Inc., a Delaware corporation and its subsidiary.

Company Overview

We are a clinical-stage biopharmaceutical company focused on developing novel products for the treatment of Alzheimer’s disease (“Alzheimer’s”), bipolar disorder (“BD”), major depressive disorder (“MDD”) and post-traumatic stress disorder (“PTSD”). With our two product candidates, we aim to bring treatments or potential cures to market as quickly as possible. Far too many individuals, patients and caregivers suffer from the burden created by these devastating, and often fatal, diseases. Our primary target, Alzheimer’s, is among the most-feared diseases (second only to cancer) among Americans, according to a 2023 Center for Disease Control survey. Alzheimer’s is also the seventh leading cause of death (in 2020 and 2021) in the United States (“U.S.”) according to a 2024 report from the Alzheimer’s Association, a nonprofit that funds research. Existing Alzheimer’s treatments only temporarily relieve symptoms and while one treatment has been shown to slow the progression of the disease, none had been shown to halt the progression of the disease, which currently affects roughly 6.9 million Americans, and that number is expected to grow to 13 million individuals by 2050. Alzheimer’s also impacts more than 11 million Americans who provide an estimated 18 billion hours of unpaid care per year, according to data provided by the Alzheimer’s Association. In 2024, the estimated healthcare costs for treating individuals with Alzheimer’s in the U.S. will be $360 billion, including $231 billion in Medicare and Medicaid payments. These costs could rise to as high as $1 trillion per year by 2050 if no permanent treatment or cure for Alzheimer’s is found, according to the Alzheimer’s Association.

Our pipeline consists of two novel therapeutic drug candidates:

| · | AL001 - A patented ionic cocrystal technology delivering a therapeutic combination of lithium, salicylate and proline through three royalty-bearing exclusive worldwide licenses from the University of South Florida Research Foundation, Inc., as licensor (the “Licensor”); and |

| · | ALZN002 - A patented method using a mutant peptide sensitized cell as a cell-based therapeutic vaccine that seeks to restore the ability of a patient’s immunological system to combat Alzheimer’s through a royalty-bearing exclusive worldwide license from the Licensor. |

Our most advanced product candidate (lead product) is licensed and in clinical development in humans is AL001, an ionic cocrystal of lithium for the treatment of Alzheimer’s, BD, MDD and PTSD. Based on our preclinical data involving mice models, AL001 treatment prevented cognitive deficits, depression and irritability and is superior in improving associative learning and memory and irritability compared with lithium carbonate treatments, supporting the potential of AL001 for the treatment of Alzheimer’s, BD, MDD and PTSD in humans. Lithium was the first mood stabilizer approved by the U.S. Food and Drug Administration (“FDA”) and is still a first-line treatment option (considered the “gold standard”) for BD and is prescribed off-label for MDD and PTSD. Moreover, lithium has been marketed for more than 35 years and human toxicology regarding its use has been well characterized, potentially mitigating the regulatory burden for safety data.

The results of randomized, placebo-controlled, clinical trials of lithium in the treatment of patients with Alzheimer’s dementia and subjects with mild cognitive impairment have been widely published. Clinical studies have indicated that lithium administered at doses lower than those used for affective disorders can favorably impact Alzheimer’s outcomes. A study by O.V. Forlenza, et al., entitled “Disease-Modifying Properties of Long-Term Lithium Treatment for Amnestic Mild Cognitive Impairment: Randomized Controlled Trial,” which appeared in the British Journal of Psychiatry (2011), reported that lithium was superior to a placebo, evidencing a slower decline of cognitive function as measured by the Alzheimer’s Disease Assessment Scale cognitive subscale. Given the absence of adequate, widely adopted treatments that can slow, halt or even reverse the decline of this highly prevalent disease, the potential efficacy of lithium in the long-term management of Alzheimer’s may positively impact public health. There is an unmet medical need for safe and effective Alzheimer’s treatments, particularly for treatments with neuroprotective properties.

There is increasing evidence to suggest that depressive illness, particularly in the elderly, is associated with neuronal cell loss. These findings suggest that lithium may exert some long-term beneficial effects in the treatment of affective disorders via underappreciated neuroprotective effects. Molecular biology and animal studies have also indicated that lithium may offer protection against Alzheimer’s. Given the absence of other adequate treatments, we believe that research and commercialization of the potential efficacy of lithium in the long-term treatment of neurodegenerative disorders is well worth pursuing.

| - 2 - |

Our Business Strategy

We intend to develop and commercialize therapeutics that are better than existing treatments and have the potential to significantly improve the lives of individuals afflicted by Alzheimer’s, BD, MDD and PTSD. To achieve these goals, we are pursuing the following key business strategies:

| • | Advance clinical development of AL001 for Alzheimer’s, BD, MDD and PTSD treatment. We completed our Phase I clinical trial in March 2022 and initiated a Phase IIA Multiple Ascending Dose (“MAD”) clinical trial in May 2022. We completed the clinical portion of the Phase IIA MAD clinical trial in March 2023 and reported topline data in June 2023. We announced that we successfully identified a maximum tolerated dose (“MTD”) for development of AL001, as assessed by an independent safety review committee. This MTD, providing lithium at a lithium carbonate equivalent dose of 240 mg 3-times daily, is designed to be unlikely to require lithium therapeutic drug monitoring (“TDM”). Also, this MTD mitigates risk in treatments for fragile populations, such as Alzheimer’s patients. Additionally, we are investigating the potential of AL001 for patients suffering from BD, MDD and PTSD, and submitted several Investigational New Drug (“IND”) applications to the FDA for these indications: (i) the IND for BD was submitted in August 2023 and we received a “study may proceed” letter from the FDA in September 2023; (ii) the IND for MDD was submitted in October 2023 and we received a “study may proceed” letter from the FDA in November 2023; and (iii) the IND for PTSD was submitted in November 2023 and we received a “study may proceed” from the FDA in December 2023. If we achieve successful Phase III clinical trials in humans, we intend to seek approval to commercialize AL001 via a New Drug Application (“NDA”); |

| • | Advance clinical development of ALZN002 for Alzheimer’s treatment. We submitted an IND application to the FDA in September 2022, and received a “study may proceed” letter in October 2022. In April 2023, we initiated a Phase I/IIA clinical trial for ALZN002 to treat mild to moderate dementia of the Alzheimer’s type. If we achieve successful Phase III clinical trials in humans, we intend to seek approval to commercialize ALZN002 through a Biologics License Application (“BLA”); |

| • | Expand our pipeline of pharmaceuticals to include additional delivery methods. Another element of our business strategy is to explore, resources permitting, different formulations (liquid, immediate release and sprinkle capsules) to deliver AL001 to accommodate the needs of patients afflicted with Alzheimer’s, BD, MDD and PTSD; |

| • | Focus on translational and functional endpoints to efficiently develop product candidates. We believe that AL001 is positioned for a Section 505(b)(2) regulatory pathway for new drug approvals. We also believe that AL001 and ALZN002 are positioned for breakthrough therapy designations because of their positive effects on a pharmacodynamic biomarker (beta-amyloids) and potential for a clinically meaningful effect on Alzheimer’s, making them eligible to receive assistance from the FDA throughout the approval process that may shorten the development timelines. However, we have neither received breakthrough therapy designation nor have we qualified for expedited development, and no assurance can be given that we will. Even if we qualify for breakthrough therapy designation or expedited development, it may not actually lead to faster development or expedited regulatory review and approval or necessarily increase the likelihood that we will ultimately receive FDA approval; and |

| • | Optimize the value of AL001 and ALZN002 in major markets. We intend to commercialize AL001 and ALZN002 by seeking FDA marketing approval for both product candidates and partnering with biopharmaceutical companies seeking to strategically fortify pipelines and, in turn, receiving funding for the costly later-stage clinical development. We do not anticipate selling products directly into the marketplace, though we may do so depending on market conditions. Our focus is expected to concentrate on entering into strategic transactions with established distributors and producers, which will provide distribution and marketing capabilities for the sale of our products in the marketplace. |

| - 3 - |

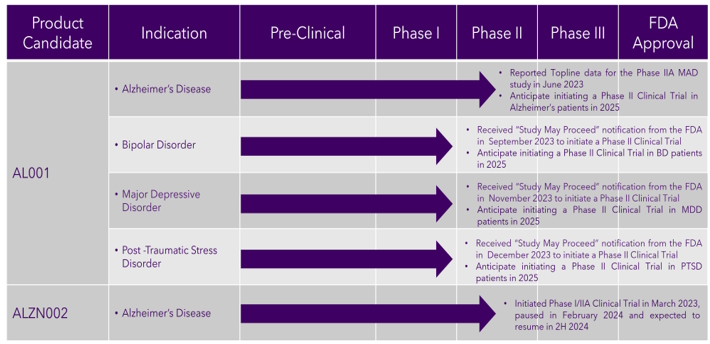

Our Development Pipeline

The following chart provides an overview of the current development stages of our product candidates.

Our product candidates will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before either of them or any successors are likely to provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval for and commercialize our product candidates, our long-term business plans will not materialize, and we will be unable to generate the revenue we have forecast for the foreseeable future, if any. We do not anticipate that we will generate our maximum revenue for several years, or that we will achieve profitability for any of our therapeutic drug candidates until at least a few years after generating material revenue, if at all. If we are unable to generate revenue or raise substantial additional capital, we will not be able to pursue any expansion of our business or acquire additional intellectual property, we will never become profitable, and we will be unable to continue our operations at the currently planned pace, if at all.

AL001 Drug Candidate

Our lead product candidate that we have licensed and begun clinical development of in humans is an ionic cocrystal of lithium for the treatment of Alzheimer’s, BD, MDD and PTSD. Lithium salts have a long history of human consumption beginning in the 1800s. In psychiatry, they have been used to treat mania and as a prophylactic for depression since the mid-20th century. Today, lithium salts are used as a mood stabilizer for the treatment of BD. Although the FDA has approved no medications as safe and effective treatments for suicidality, lithium has proven to be the only drug that consistently reduces suicidality in patients with neuropsychiatric disorders. Despite these effective medicinal uses, current FDA-approved lithium pharmaceutics (lithium carbonate and lithium citrate) are limited by a narrow therapeutic window that requires regular blood monitoring of plasma lithium levels and blood chemistry by a clinician to mitigate adverse events. Because conventional lithium salts (carbonate and citrate) are eliminated relatively quickly, multiple administrations throughout the day are required to safely reach therapeutic plasma concentrations. Existing lithium drugs, such as lithium chloride and lithium carbonate, suffer from chronic toxicity, poor physicochemical properties, and poor brain bioavailability. Because lithium is so effective at reducing manic episodes in patients with BD, it is still used clinically despite its narrow therapeutic index. This has led researchers to begin to look for other treatment methods than lithium but that may evince similar bioactivities.

Scientists from the University of South Florida have developed a new lithium cocrystal composition and method of preparation that, under certain clinical and/or testing conditions, have been shown to allow for lower dosages to achieve therapeutic brain levels of lithium for psychiatric disorders, which could lead to a broadening of lithium’s therapeutic index. Our studies and tests have indicated that the compound offers improved physiochemical properties compared to existing forms of lithium, giving it the potential to be developed as an anti-suicidal drug and for use against mood disorders.

Recent evidence suggests that lithium may be efficacious for both the treatment and prevention of Alzheimer’s. Unlike traditional medications, which only address a single therapeutic target, lithium appears to be neuroprotective through several modes of action. For example, recent studies have indicated that it exerts neuroprotective effects, in part, by increasing a brain-derived neurotrophic factor leading to restoration of learning and memory. Another neuroprotective mechanism of lithium indicated by recent studies is the attenuation of the production of inflammatory cytokines like IL-6 and nitric oxide in activated microglia. Results from recent clinical studies suggest that lithium treatment may reduce the progression of dementia while preserving cognitive function and reducing biomarkers associated with Alzheimer’s.

| - 4 - |

AL001, the novel ionic cocrystal of lithium, which was designed, synthesized and characterized by a team of inventors from the University of South Florida, has been shown to exhibit improved nonclinical pharmacokinetics compared to currently available FDA-approved lithium products and is also bioactive in many in vitro models of Alzheimer’s. AL001 may constitute a means of treating Alzheimer’s, BD, MDD and PTSD.

We believe that our ability to re-engineer lithium in solid dosage forms in order to optimize performance has the potential to address a wide range of clinical applications ranging from neurodegenerative disorders, not merely Alzheimer’s, but also amyotrophic lateral sclerosis (known as ALS and popularly referred to as Lou Gehrig’s disease), Huntington’s disease, multiple sclerosis, Parkinson’s disease and traumatic brain injury, to more psychiatric conditions such as BD, MDD, mania, PTSD and suicidality. This novel approach is intended to achieve the desired therapeutic outcome of enhanced penetration through the blood-brain barrier and sustained brain lithium concentrations while systemic exposures (and toxicities) are mitigated for other organ systems. The optimal modified-release lithium dosing approach for AL001 should avoid acutely toxic peak concentrations in blood, as well as in the brain, and should maintain such relatively minor blood concentrations for a predictable, clinically relevant time, with overall low systemic exposures that mitigate the potential for adverse events. We anticipate that the lithium delivery system will be adaptable to a dosing regimen that maintains therapeutic brain lithium concentrations consistently for the longest possible time while allowing only modest exposures and providing adequate recovery periods between doses for other organ systems.

Clinical Trials

Phase I Study

On September 13, 2021, we initiated a randomized, balanced, Phase I, single-dose, open-label, two-treatment, two-period, two- sequence, crossover, relative bioavailability clinical trial to investigate lithium pharmacokinetics and safety of AL001 formulation compared to a marketed immediate release lithium carbonate formulation in healthy subjects. The primary objective of this clinical trial was to assess the relative bioavailability of the AL001 lithium formulation relative to a marketed lithium carbonate formulation in healthy subjects for the purpose of determining potential clinically safe and effective AL001 dosing in future studies. Additionally, we wanted to characterize safety and tolerability of the tested formulations under the conditions of this clinical trial. This was a first-in-human clinical trial of the AL001 formulation and this trial was designed to assess the relative bioavailability of the AL001 lithium formulation compared to a marketed lithium carbonate formulation in at least 24 completed healthy subjects (30 subjects were to be enrolled) for the purpose of determining potential clinically safe and effective AL001 dosing in future clinical trials. The AL001 lithium content was nearly half of the reference lithium carbonate capsule dosage as it was expected that treatment of frail Alzheimer’s patients will require half the lithium dose used for treatment of BD. Lithium carbonate 300 mg (Reference product) was given as a single dose in this clinical trial; this is often used as a starting dose for treatment of BD when given three times daily. The shape of the AL001 lithium plasma concentration versus time curve was unknown prior to this study. Also unknown were the AL001 rate and extent of lithium absorption. The Phase I study was completed in March 2022 with the following results:

| · | AL001 was shown to be safe and well-tolerated in healthy adult subjects; |

| · | No death or serious adverse events were reported during the trial; |

| · | The safety profiles of both AL001 and the marketed lithium carbonate capsule were benign; |

| · | No clinically significant abnormal findings in electrocardiograms were noted during the trial; |

| · | AL001 salicylate plasma concentrations were observed to be well tolerated and consistently within safe limits; and |

| · | Dose-adjusted relative bioavailability analyses of the rate and extent of lithium absorption in plasma indicated that AL001, at a lithium carbonate equivalent dose of 150 mg, is bioequivalent to a marketed 300 mg lithium carbonate capsule and the shapes of the lithium plasma concentration versus time curves are similar. |

Phase IIA Study

On May 5, 2022, we initiated a multiple-dose, steady-state, double-blind, ascending dose safety, tolerability, pharmacokinetic clinical trial (www.clinicaltrials.gov, identifier: NCT05363293) of AL001 in patients with mild to moderate Alzheimer’s and healthy subjects with the following objectives:

| · | Primary: To evaluate the safety and tolerability of AL001 under multiple-dose, steady-state conditions in Alzheimer’s patients and healthy subjects; |

| - 5 - |

| · | Secondary: To characterize the MTD of AL001 in patients with mild to moderate Alzheimer’s and healthy subjects; and |

| · | Exploratory: Determination of qualitative and quantitative evaluations of patients with Alzheimer’s and healthy subjects desirable characteristics for future Phase II and III clinical studies in order to: |

| o | Facilitate recruitment into subsequent AL001 clinical trials; and |

| o | Facilitate trial-adherence to completion of study requirements including treatment adherence. |

We completed the Phase IIA clinical trial in March 2023 and announced positive topline data in June 2023. We announced that we successfully identified an MTD for development of AL001 from a multiple-ascending dose study as assessed by an independent safety review committee. This dose, providing lithium at a lithium carbonate equivalent dose of 240 mg 3-times daily (“TID”), is designed to be unlikely to require lithium TDM. Also, this MTD is risk mitigated for the purpose of treating fragile populations, such as Alzheimer’s patients.

Lithium is a commonly prescribed drug for manic episodes in BD type 1 as well as maintenance therapy of BP in patients with a history of manic episodes. Lithium is also prescribed off-label for MDD, BD and treatment of PTSD, among other disorders. Lithium was the first mood stabilizer approved by the FDA and is still a first-line treatment option (considered the “gold standard”) but is underutilized, perhaps because of the need for TDM. Lithium was the first drug that required TDM by regulatory authorities in product labelling because the effective and safe range of therapeutic drug blood concentrations is narrow and well defined for treatment of BP when using lithium salts. Excursions above this range can be toxic, and dosages below it can impair effectiveness.

Planned Future Studies

We intend to initiate clinical trials at the MTD to determine relative increased lithium levels in the brain compared to a marketed lithium salt for BD, MDD and PTSD, based on published mouse studies that predict that lithium can be given at lower doses for equivalent therapeutic benefit when treating with AL001. For example, the goal is to replace a 300 mg TID lithium carbonate dose for treatment of BD with a 240 mg TID AL001 lithium equivalent, which represents a daily decrease of 20% of lithium given to a patient. We will also include cohorts of healthy subjects and Alzheimer’s patients. We anticipate partnering with a reputable research institution for the study in the second half of 2024.

Based on the results from our Phase IIA MAD study for AL001, we also plan to initiate two safety and efficacy clinical trials in subjects with mild to moderate dementia of the Alzheimer’s type. These studies would most likely commence after the “lithium in brain” study.

ALZN002 Drug Candidate

The other product candidate that we have licensed to clinically develop in humans is ALZN002, a patented method using a mutant peptide sensitized cell as a cell-based therapeutic vaccine which seeks to restore the ability of the patient’s immunological system to combat Alzheimer’s. The proposed mechanism of action is through the pulsed-Dendritic Cell (“DC”) activation of T-cells that stimulates the immune system, resulting in the clearance of brain amyloid. Preclinical studies conducted from April 2005 to July 2010 demonstrated that the infusion of transgenic (or genetically modified) mice with ALZN002-pulsed DCs is associated with lower amyloid burden and improved neuro-behavioral performance. This is likely to be mediated by an anti-inflammatory effect in addition to the immunogenicity of this therapy.

The development of ALZN002 is predicated on the theory that Alzheimer’s symptoms may be caused in large part by plaque deposits that can cluster in the brain composed of protein fragments called beta-amyloids that build up between nerve cells. One hypothesis is that a special type of immune cell, natural beta-amyloid antibodies, may play a role in preventing plaque build-up in people without Alzheimer’s. As people age, their immune systems may degrade, and some people may be unable to produce natural beta-amyloid antibodies, the absence of which leads to the plaque build-up causing Alzheimer’s.

ALZN002 is intended to elicit an immune response to produce anti-amyloid antibodies, which can then neutralize circulated beta-amyloids and prevent additional plaque build-up. The mutant antigen within ALZN002 was selected specifically for its high human leukocyte antigens binding affinity, thereby avoiding the need for an adjuvant, which may cause an adverse (Th1) immune response.

ALZN002 is an autologous modified DC treatment. More precisely, it is a patient-specific therapy where the patient undergoes leukapheresis, a nonsurgical treatment used to reduce the quantity of white blood cells in the bloodstream, to isolate peripheral blood monocytes that are subsequently matured into DCs using cytokine therapy (IL4+ GM-CSF) cocktail. The DCs are incubated with a modified amyloid beta (Aβ) peptide to sensitize them, and then administered to the same patient.

| - 6 - |

Significant evidence has accumulated recently suggesting that immunotherapy is a highly promising modality of treatment in Alzheimer’s. Most current immune-based active investigations are focused on passive immunization by pre-prepared Aβ antibody administration. Active immunization may offer additional or more lasting effects on the clearance of amyloid and a safer approach due to its reliance on autologous immune mechanisms. Further, preliminary evidence suggests a recurrence of the amyloid accumulation after clearance with the immunoglobulins. A prior attempt at engaging the immune system to treat Alzheimer’s was conducted using the immunization with pre-aggregated synthetic Aβ (AN-1792) combined with the immunogenic adjuvant QS-21. The Phase IIA study with AN-1792 was terminated by the FDA due to severe meningoencephalitis in approximately 6% of vaccinated subjects. We believe that this may have been caused by using a QS-21 adjuvant in the vaccine formulation.

Clinical Trials

Pre-Clinical

On July 23, 2021, we announced that Alzamend received positive toxicology results for ALZN002 in a good laboratory practices (“GLP”) toxicology study using a transgenic mouse model of Alzheimer’s. The study was conducted by Charles River Laboratories. ALZN002 is a patented method using a mutant-peptide sensitized cell as a cell-based therapeutic vaccine that seeks to restore the ability of a patient’s immunological system to combat Alzheimer’s.

A five-dose GLP study with ALZN002-sensitized cells was completed using a transgenic mouse model of Alzheimer’s to investigate the tolerability of ALZN002. Single injections were administered on days 1, 30, 50, 70, and 90. The mice were evaluated for potential toxicity and reversibility of any findings at 75 and 90 days after the final dosing.

Histopathology results demonstrate that there was no indication of T-cell infiltration or meningoencephalitis, which suggests that ALZN002 therapy is safe and tolerable as there were no adverse findings over a 90-day period or 90 days after the last dose. There were no treatment-related mortalities or reports of adverse effects on clinical observations, body weight parameters, organ weight parameters, clinical pathology parameters, gross pathology observations, or histopathologic observations during the main study or the recovery phase.

Modified cell therapies, especially DCs, may provide a safer and more patient-specific active immunization. Ex-vivo modification of DCs as a modality of treatment has been previously used in oncological therapeutics. It has been shown to be relatively safe and capable of engaging the immune system to attack the target tissues with success. Its use in Alzheimer’s therapeutics is relatively recent.

Phase I/II Study

We submitted a pre-IND meeting request for ALZN002 and supporting briefing documents to the Center for Biological Evaluation and Research of the FDA on July 30, 2021. We received a written response relating to the pre-IND from the FDA providing a path for Alzamend’s planned clinical development of ALZN002 on September 30, 2021. The FDA agreed to allow Alzamend to submit an IND to conduct a combined Phase I/II study.

On September 28, 2022, we submitted an IND to the FDA for ALZN002 and received a “study may proceed” letter on October 31, 2022. The product candidate is an immunotherapy vaccine designed to treat mild to moderate dementia of the Alzheimer’s type. ALZN002 is a proprietary “active” immunotherapy product, which means it is produced by each patient’s immune system. It consists of autologous DCs consisting of activated white blood cells taken from each individual patient so that they can be engineered outside of the body to attack Alzheimer’s-related amyloid-beta proteins. These DCs are pulsed with a novel amyloid-beta peptide (E22W) designed to bolster the ability of the patient’s immune system to combat Alzheimer’s; the goal is to foster tolerance to treatment for safety purposes while stimulating the immune system to reduce the brain’s beta-amyloid protein burden, resulting in reduced Alzheimer’s signs and symptoms. Compared to passive immunization treatment approaches that use foreign blood products (such as monoclonal antibodies), active immunization with ALZN002 is anticipated to offer a more robust and long-lasting effect on the clearance of amyloid. This approach could prove safer due to its reliance on autologous immune components, using each individual patient’s own white blood cells rather than foreign cells and/or blood products.

On April 3, 2023, we announced the initiation of a Phase I/IIA clinical trial for ALZN002 to treat mild to moderate dementia of the Alzheimer’s type. The purpose of this trial is to assess the safety, tolerability, and efficacy of multiple ascending doses of ALZN002 compared with that of a placebo in 20-30 subjects with mild to moderate morbidity. The primary goal of this clinical trial is to determine an appropriate dose of ALZN002 for treatment of patients with Alzheimer’s in a larger Phase IIB efficacy and safety clinical trial. On February 13, 2024, we received notice from the company we engaged as our contract research organization (“CRO”), Biorasi, LLC (“Biorasi”) that Biorasi was terminating our contract with them. We are currently pursuing the engagement of a replacement CRO.

| - 7 - |

Intellectual Property and Licensing Agreements

On July 2, 2018, we entered into two Standard Exclusive License Agreements with Sublicensing Terms for AL001 with the Licensor and its affiliate, the University of South Florida (the “AL001 Licenses”), pursuant to which the Licensor granted us a royalty bearing exclusive worldwide licenses limited to the field of Alzheimer’s, under U.S. Patent Nos. (i) 9,840,521, entitled “Organic Anion Lithium Ionic Cocrystal Compounds and Compositions,” filed September 24, 2015 and granted December 12, 2017, and (ii) 9,603,869, entitled “Lithium Co-Crystals for Treatment of Neuropsychiatric Disorders”, filed May 21, 2016 and granted March 28, 2017. On February 1, 2019, we entered into the First Amendments to the AL001 Licenses, on March 30, 2021, we entered into the Second Amendments to the AL001 Licenses and on June 8, 2023, we entered into the Third Amendments to the AL001 Licenses (collectively, the “AL001 License Agreements”). The Third Amendments to the AL001 Licenses modified the timing of the payments for the license fees.

The AL001 License Agreements require that we pay combined royalty payments of 4.5% on net sales of products developed from the licensed technology for AL001. We have already paid an initial license fee of $200,000 for AL001. As an additional licensing fee for the license of the AL001 technologies, the Licensor received 14,853 shares of our common stock. Minimum royalties for AL001 License Agreements are $40,000 on the first anniversary of the first commercial sale, $80,000 on the second anniversary of the first commercial sale and $100,000 on the third anniversary of the first commercial sale and every year thereafter, for the life of the AL001 License Agreements.

On May 1, 2016, we entered into a Standard Exclusive License Agreement with Sublicensing Terms for ALZN002 with the Licensor (the “ALZN002 License”), pursuant to which the Licensor granted us a royalty bearing exclusive worldwide license limited to the field of Alzheimer’s Immunotherapy and Diagnostics, under U.S. Patent No. 8,188,046, entitled “Amyloid Beta Peptides and Methods of Use”, filed April 7, 2009 and granted May 29, 2012. On August 18, 2017, we entered into the First Amendment to the ALZN002 License, on May 7, 2018, we entered into the Second Amendment to the ALZN002 License, on January 31, 2019, we entered into the Third Amendment to the ALZN002 License, on January 24, 2020, we entered into the Fourth Amendment to the ALZN002 License, on March 30, 2021, we entered into the Fifth Amendment to the ALZN002 License, on April 17, 2023, we entered into the Sixth Amendment to the ALZN002 License and on December 11, 2023, we entered into the Seventh Amendment to the ALZN002 License (collectively, the “ALZN002 License Agreement”). The Seventh Amendment to the ALZN002 License modified the timing of the payments for the license fees.

The ALZN002 License Agreement requires us to pay royalty payments of 4% on net sales of products developed from the licensed technology for ALZN002. We have already paid an initial license fee of $200,000 for ALZN002. As an additional licensing fee for the license of ALZN002, the Licensor received 24,012 shares of our common stock. Minimum royalties for ALZN002 are $20,000 on the first anniversary of the first commercial sale, $40,000 on the second anniversary of the first commercial sale and $50,000 on the third anniversary of the first commercial sale and every year thereafter, for the life of the ALZN002 License Agreement.

On November 19, 2019, we entered into two Standard Exclusive License Agreements with Sublicensing Terms for two additional indications of AL001 with the Licensor (the “November AL001 License”), pursuant to which the Licensor granted us a royalty bearing exclusive worldwide licenses limited to the fields of (i) neurodegenerative diseases excluding Alzheimer’s and (ii) psychiatric diseases and disorders. On March 30, 2021, we entered into the First Amendments to the November AL001 License and on April 17, 2023, we entered into the Second Amendments to the November AL001 License (collectively, the “November AL001 License Agreements”). The Second Amendments to the November AL001 License modified the timing of the payments for the license fees.

The November AL001 License Agreements require us to pay royalty payments of 3% on net sales of products developed from the licensed technology for AL001 in those fields. We paid an initial license fee of $20,000 for the additional indications. Minimum royalties for November AL001 License Agreements are $40,000 on the first anniversary of the first commercial sale, $80,000 on the second anniversary of the first commercial sale and $100,000 on the third anniversary of the first commercial sale and every year thereafter, for the life of the November AL001 License Agreements.

These license agreements have an indefinite term that continue until the later of the date that no licensed patent under the applicable agreement remains a pending application or enforceable patent, the end date of any period of market exclusivity granted by a governmental regulatory body, or the date on which the licensee’s obligations to pay royalties expire under the applicable license agreement. Under our various license agreements, if we fail to meet a milestone by its specified date, Licensor may terminate the license agreement. The Licensor was also granted a preemptive right to acquire such shares or other equity securities that may be issued from time to time by us while the Licensor remains the owner of any equity securities of our company.

| - 8 - |

Additionally, we are required to pay milestone payments on the due dates to the Licensor for the license of the AL001 technologies and for the ALZN002 technology, as follows:

Original AL001 Licenses:

| Payment | Due Date | Event | |||

| $ | 50,000 | * | Completed September 2019 | Pre-IND meeting | |

| $ | 65,000 | * | Completed June 2021 | IND application filing | |

| $ | 190,000 | * | Completed December 2021 | Upon first dosing of patient in a clinical trial | |

| $ | 500,000 | * | Completed March 2022 | Upon completion of first clinical trial | |

| $ | 1,250,000 | March 2025 | Upon first patient treated in a Phase III clinical trial | ||

| $ | 10,000,000 | 8 years from the effective date of the agreement | Upon FDA NDA approval | ||

| * | Milestone met and completed |

ALZN002 License:

| Payment | Due Date | |||

| $ | 50,000 | * | Upon IND application - completed January 2022 | |

| $ | 50,000 | Upon first dosing of patient in first Phase I clinical trial | ||

| $ | 500,000 | Upon completion of first Phase IIB clinical trial | ||

| $ | 1,000,000 | Upon first patient treated in a Phase III clinical trial | ||

| $ | 10,000,000 | Upon first commercial sale | ||

| * | Milestone met and completed |

Additional AL001 Licenses:

| Payment | Due Date | Event | |||

| $ | 2,000,000 | March 2026 | Upon first patient treated in a Phase III clinical trial | ||

| $ | 16,000,000 | August 1, 2029 | First commercial sale | ||

| - 9 - |

Market Opportunity

According to the National Institute of Health (“NIH”), there are more than 43.7 million Americans afflicted with Alzheimer’s, BD, MDD and PTSD. The rise in the prevalence of these diseases/disorders and the various risks, such as high stress, substance abuse, and advancements in a combination of drugs are primarily propelling market growth. Advancements in technology allowing more accurate diagnosis/detection of Alzheimer’s, BD, MDD, and PTSD are also positively influencing market growth. Other factors, such as increasing research and development activities (via clinical trials) and investments by the government to improve the healthcare industry, are expected to further drive market growth. Additionally, increased awareness about Alzheimer’s, BD, MDD and PTSD via the various disease/disorder-specific non-profit organizations is accelerating market growth. The potential marketplace for a commercialized therapy or treatment would be tremendously significant with large financial support available from numerous national and international pharmaceutical companies and various governments and worldwide agencies. We were founded with a mission to further develop AL001 and ALZN002, by funding them through human clinical trials administered by the FDA and ultimately, if successful, making them available to the public.

Industry Overview

Alzheimer’s

Currently, Alzheimer’s is the seventh leading cause of death in the U.S. and, when extrapolated globally, the market for preventions, treatments and cures of this crippling disease is massive. Since 1990, life expectancy has increased by six years and the worldwide average continues to increase. With the increase in the mean age of the population in developed countries, the prevalence of deteriorating neurological diseases has also increased. According to the Alzheimer’s Association, in the U.S. alone, one of nine persons older than 65 has Alzheimer’s, with roughly 6.9 million Americans currently living with it. It is estimated that this number will grow to 13 million by 2050 barring the development of medical breakthroughs to prevent, slow or cure the disease. Many Alzheimer’s related associations believe the actual number of adults with Alzheimer’s may be much higher since current statistics do not account for deaths from complications or from related diseases like pneumonia or heart attack. These death certificates only list the most immediate cause. The fastest growing age group in the U.S. is the “over 85” group within which one in three individuals has Alzheimer’s.

| - 10 - |

It is estimated that the cost of caring for people with Alzheimer’s and other dementias will increase from an estimated $360 billion in 2024 to a projected $1 trillion per year by 2050 with Medicare and Medicaid covering approximately 70% of such costs. Over 11 million Americans provide unpaid care for people with Alzheimer’s or other dementias. The Alzheimer’s Association estimated that, in 2023, caregivers to individuals with Alzheimer’s provided 18.4 billion hours of care valued at $346.6 billion.

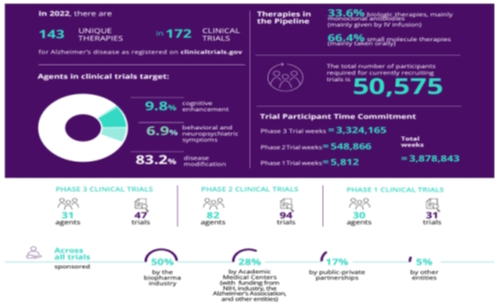

Alzheimer’s Therapeutic Landscape

According to the Alzheimer’s Association, the following is a pictorial representation of the more recent published data encompassing the Alzheimer’s therapeutics landscape.

There are currently several experimental therapeutic agents for Alzheimer’s in various stages of development with clinical testing directed towards amyloid-beta, or Aβ, clearance, and inhibition of Tau protein aggregation or phosphorylated-Tau, or pTau, clearance. In June 2021, the FDA approved Biogen’s Alzheimer’s drug aducanumab, also known as Aduhelm, making it the first medication cleared by U.S. regulators to reduce amyloid plaques in people living with Alzheimer’s and the first new medication for the disease in nearly two decades. There were previously no drugs cleared by the FDA that can slow the mental decline caused by Alzheimer’s, which is the seventh-leading cause of death in the U.S. In July 2023, an anti-beta amyloid antibody known as Lecanemab-irmb (“Leqembi”), received full approval by FDA for treatment of Alzheimer’s. In July 2024, the FDA approved Eli Lilly’s Alzheimer’s drug donanemab, also known as Kisunla, which targets amyloid in the brain. Given the current weight of evidence, amyloid is now established as a cause of Alzheimer’s.

Both Leqembi and Kisunla are humanized monoclonal antibodies that bind with high affinity to soluble amyloid-beta oligomers, which reportedly are toxic to neurons. Both Leqembi and Kisunla reduced biomarkers of amyloid in early Alzheimer’s and resulted in moderately less decline on measures of cognition and function compared to placebo at 18 months. Since Leqembi and Kisunla only provide passive immunity, antibody infusions are needed every 2 or 4 weeks, respectively. Both Leqembi and Kisunla support and validate the amyloid theory, but in routine medical practice there will be a large burden on the health care system due to the need for bi-weekly or monthly infusions.

| - 11 - |

Bipolar Disorder

BD, previously known as manic depression, is a mood disorder characterized by periods of depression and periods of abnormally elevated happiness that each lasts from days to weeks. If the elevated mood is severe or associated with psychosis, it is called mania; if it is less severe, it is called hypomania. During mania, an individual behaves or feels abnormally energetic, happy, or irritable, and they often make impulsive decisions with little regard for the consequences. There is usually also a reduced need for sleep during manic phases. During periods of depression, the individual may experience crying and have a negative outlook on life and poor eye contact with others. The risk of suicide is high; over a period of 20 years, 6% of those with BD died by suicide, while 30–40% engaged in self-harm. Other mental health issues, such as anxiety disorders and substance use disorders, are commonly associated with BD.

While the causes of BD are not clearly understood, both genetic and environmental factors are thought to play a role. Many genes, each with small effects, may contribute to the development of the disorder. Genetic factors account for about 70–90% of the risk of developing BD. Environmental risk factors include a history of childhood abuse and long-term stress. The condition is classified as bipolar I disorder if there has been at least one manic episode, with or without depressive episodes, and as bipolar II disorder if there has been at least one hypomanic episode (but no full manic episodes) and one major depressive episode. If these symptoms are due to drugs or medical problems, they are not diagnosed as BD. Other conditions that have overlapping symptoms with BD include attention deficit hyperactivity disorder, personality disorders, schizophrenia, and substance use disorder as well as many other medical conditions. Medical testing is not required for a diagnosis, though blood tests or medical imaging can rule out other problems.

BD occurs in approximately 1% of the global population. According to the NIH, roughly seven million are estimated to be affected at some point in their lives; rates appear to be similar in females and males. Symptoms most commonly begin between the ages of 20 and 25 years old; an earlier onset in life is associated with a worse prognosis. Interest in functioning in the assessment of patients with BD is growing, with an emphasis on specific domains such as work, education, social life, family, and cognition. Around one-quarter to one-third of people with BD have financial, social or work-related problems due to the illness. BD is among the top 20 causes of disability worldwide and leads to substantial costs for society. Due to lifestyle choices and the side effects of medications, the risk of death from natural causes such as coronary heart disease in people with BD is twice that of the general population.

Bipolar Disorder Therapeutic Landscape

Mood stabilizers, including lithium and certain anticonvulsants, such as valproate and carbamazepine, as well as atypical antipsychotics, such as aripiprazole, are the mainstay of long-term pharmacologic relapse prevention. Antipsychotics are additionally given during acute manic episodes as well as in cases where mood stabilizers are poorly tolerated or ineffective. In patients where compliance is of concern, long-acting injectable formulations are available. There is some evidence that psychotherapy improves the course of BD. The use of antidepressants in depressive episodes is controversial; they can be effective but have been implicated in triggering manic episodes. The treatment of depressive episodes, therefore, is often difficult. Electroconvulsive therapy (“ECT”) is effective in acute manic and depressive episodes, especially with psychosis or catatonia. Admission to a psychiatric hospital may be required if a person is a risk to themselves or others; involuntary treatment is sometimes necessary if the affected person refuses treatment.

Major Depressive Disorder

MDD, also known simply as depression, is a mental disorder characterized by at least two weeks of pervasive low mood, low self-esteem, and loss of interest or pleasure in normally enjoyable activities. Those affected may also occasionally have delusions or hallucinations. Introduced by a group of U.S. clinicians in the mid-1970s, the term was adopted by the American Psychiatric Association for this symptom cluster under mood disorders in the 1980 version of the Diagnostic and Statistical Manual of Mental Disorders (DSM-III) and has become widely used since.

The diagnosis of MDD is based on the person's reported experiences and a mental status examination. There is no laboratory test for the disorder, but testing may be done to rule out physical conditions that can cause similar symptoms. The most common time of onset is in a person’s 20s, with females affected about twice as often as males. The course of the disorder varies widely, from one-episode lasting months to a lifelong disorder with recurrent major depressive episodes.

MDD is believed to be caused by a combination of genetic, environmental, and psychological factors, with about 40% of the risk being genetic. Risk factors include a family history of the condition, major life changes, certain medications, chronic health problems, and substance use disorders. It can negatively affect a person's personal life, work life, or education as well as sleeping, eating habits, and general health. According to the NIH, MDD affected approximately 21 million adults (8.4% of all U.S. adults) in 2020. The prevalence of adults with a major depressive episode was higher among adult females (10.5%) than males (6.2%). The prevalence of adults with a major depressive episode was highest among individuals aged 18-25 (17.0%). MDD causes the second-most years lived with disability, after lower back pain.

| - 12 - |

Major Depressive Therapeutic Landscape

Those with MDD are typically treated with psychotherapy and antidepressant medication. Medication appears to be effective, but the effect may predominantly be significant in the most severely depressed. Hospitalization (which may be involuntary) may be necessary in cases with associated self-neglect or a significant risk of harm to self or others. ECT may be considered if other measures are not effective.

Although lithium does not have an FDA approved indication for augmentation of an antidepressant in MDD, it has been prescribed off-label for this purpose for decades. While a wide variety of medications have been used historically in this capacity, lithium is one of the few agents that has demonstrated efficacy in multiple randomized controlled trials. Although the ideal role for lithium augmentation has yet to be established, there is evidence to support the clinical practice of adding lithium to conventional antidepressants in pursuit of MDD remission. Lithium augmentation has been cited as a main strategy for depressed patients not responding to an antidepressant, lithium prophylaxis for recurrent unipolar depression as an alternative to prophylaxis with an antidepressant, and for lithium's anti-suicidal properties, where appropriate.

Post-Traumatic Stress Disorder

PTSD is a mental and behavioral disorder that can develop because of exposure to a traumatic event, such as sexual assault, warfare, traffic collisions, child abuse, domestic violence, or other threats to a person’s life. Symptoms may include disturbing thoughts, feelings, or dreams related to the events, mental or physical distress to trauma-related cues, attempts to avoid trauma-related cues, alterations in the way a person thinks and feels, and an increase in the fight-or-flight response. These symptoms may remain for more than a month after the event. A person with PTSD is at a higher risk of suicide and intentional self-harm.

Most people who experience traumatic events do not develop PTSD. People who experience interpersonal violence such as rape, other sexual assaults, being kidnapped, stalking, physical abuse by an intimate partner, and incest or other forms of childhood sexual abuse are more likely to develop PTSD than those who experience non-assault-based trauma, such as accidents and natural disasters. Those who experience prolonged trauma, such as slavery, concentration camps, or chronic domestic abuse, may develop complex post-traumatic stress disorder (“C-PTSD”). C-PTSD is similar to PTSD but has a distinct effect on a person's emotional regulation and core identity.

According to the NIH, about 3.5%, or roughly nine million, adults in the U.S. have PTSD in a given year, and 9% of people develop it at some point in their life. In much of the rest of the world, rates for a given year are between 0.5% and 1% of the population. Higher rates may occur in regions of armed conflict. It is more common in women than men. PTSD was first mentioned in the American Psychiatric Association Diagnostic and Statistical Manual of Mental Disorders (DSM-I) in the 1950s under the term “gross stress reaction.” Although this diagnosis included psychological problems related to traumatic events such as wartime combat, it limited symptoms to six months. This diagnosis was removed from the American Psychiatric Association Diagnostic and Statistical Manual of Mental Disorders (DSM-II) in 1968, representing a regression in accurate PTSD characterization. The long-term psychological disabilities experienced by trauma survivors, including Vietnam veterans, sexual assault victims and Holocaust survivors led to the introduction of PTSD in the American Psychiatric Association Diagnostic and Statistical Manual of Mental Disorders (DSM-III) in 1980, where, for the first time, the definition of PTSD highlighted the critical connection between traumatic events and long-term psychological symptoms.

Post-Traumatic Stress Disorder Therapeutic Landscape

Prevention may be possible when counselling is targeted at those with early symptoms but is not effective when provided to all trauma-exposed individuals, whether or not symptoms are present. The main treatments for people with PTSD are counselling (psychotherapy) and medication. Antidepressants of the selective serotonin reuptake inhibitors (“SSRI”) or serotonin-norepinephrine reuptake inhibitors (“SNRI”) type are the first-line medications used for PTSD and are moderately beneficial for about half of people. Benefits from medication are less than those seen with counselling. It is not known whether using medications and counselling together has greater benefit than either method separately.

Sertraline (Zoloft) and Paroxetine (Paxil) are FDA-approved medications for PTSD. Reviews by a group of doctors of pharmacological monotherapy in 2015 and 2021 found that paroxetine, fluoxetine, sertraline and venlafaxine could be effective for PTSD, but the magnitude of the effect was low and the clinical relevance was unclear. These reviews excluded lithium treatments. Medications, other than some SSRIs or SNRIs, do not have enough evidence to support their use and, in the case of benzodiazepines, may worsen outcomes.

Case reports suggest that lithium treatment may be useful for irritability/anger outbursts in PTSD patients. For example, one study by Kitchner and Greenstein provided case histories of four males (aged approximately 31–42 years) who suffered from PTSD resulting from their experiences in the Vietnam War. Results from treatment with low doses (300–600 mg/day) of lithium carbonate were reported to indicate that treatment was effective in reducing inappropriate anger, irritability, anxiety, and insomnia.

| - 13 - |

The clinical observation of mood swings beyond the normal range but milder than those associated with BD reportedly suggested the presence of a subthreshold mood disorder in these PTSD patients. It has also been proposed that treatment of trauma with lithium to forestall the development of PTSD may be provided by pharmacological induction of a mild transient amnesia.

Manufacturing

Currently, we do not have in-house manufacturing capabilities. We have outsourced and expect to continue to outsource the manufacturing of our products to third party contractors with special capabilities to manufacture chemical drugs and biologic drug candidates for submission and clinical testing under FDA guidelines and, for AL001 and ALZN002, have received Good Manufacturing Practices, or GMP, material manufactured for clinical trial. There are several sources of manufacturing available once a therapy or treatment can achieve Phase II study as identified in a publication by Pharma.org released in 2013 (http://www.phrma.org/sites/default/files/Alzheimer’s%202013.pdf).

Distribution and Marketing

We intend to develop AL001 and ALZN002 through successive de-risking milestones towards regulatory approval and seek marketing approval of AL001 and ALZN002 or enter into partnering transactions with biopharmaceutical companies seeking to strategically fortify pipelines and, in turn, receiving funding for the costly later-stage clinical development required to achieve successful commercialization. We do not anticipate selling products directly into the marketplace, though we may do so depending on market conditions. Our focus is to strategically effect partnering transactions that will provide distribution and marketing capabilities to sell products into the marketplace.

Government Regulation

Clinical trials, the pharmaceutical approval process, and the marketing of pharmaceutical products, are intensively regulated in the United States and in all major foreign countries.

Human Health Product Regulation in the United States

In the United States, the FDA regulates pharmaceuticals under the Federal Food, Drug, and Cosmetic Act and related regulations promulgated thereunder. Pharmaceuticals are also subject to other federal, state, and local statutes and regulations. Failure to comply with applicable U.S. regulatory requirements at any time during the product development process, approval process or after approval may subject an applicant to administrative or judicial sanctions. These sanctions could include the imposition by the FDA of an Institutional Review Board, or IRB, a clinical hold on trials, a refusal to approve pending applications, withdrawal of an approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties or referrals to the Department of Justice for criminal prosecution. Any agency or judicial enforcement action could have a material adverse effect on us.

The FDA and comparable regulatory agencies in state and local jurisdictions impose substantial requirements upon the clinical development, manufacturing and marketing of pharmaceutical products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising and promotion of our products.

The FDA’s policies may change, and additional government regulations may be promulgated that could prevent or delay regulatory approval of new disease indications or label changes. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the United States or elsewhere.

Marketing Approval

The process required by the FDA before human health care pharmaceuticals may be marketed in the U.S. generally involves the following:

| • | nonclinical laboratory and, at times, animal tests; |

| • | adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use or uses; |

| • | pre-approval inspection of manufacturing facilities and clinical trial sites; and |

| • | FDA approval of an NDA or BLA, which must occur before a drug or biologic product can be marketed or sold. |

| - 14 - |

We will need to successfully complete sufficient clinical trials in order to be in a position to submit a BLA or NDA to the FDA. We must reach agreement with the FDA on the proposed protocols for our future clinical trials in the U.S. A separate submission to the FDA must be made for each successive clinical trial to be conducted during product development. Further, an independent IRB for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that site, and an informed consent must also be obtained from each study subject. Regulatory authorities, a data safety monitoring board or the sponsor may all suspend or terminate a clinical trial at any time on numerous grounds.

For purposes of BLA or NDA approval for human health products, human clinical trials are typically conducted in phases that may overlap.

| • | Phase I. The drug is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients. |

| • | Phase II. This phase involves trials in a limited subject population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. Phase II studies may be sub-categorized into Phase IIA studies which are smaller, pilot studies to evaluate limited drug exposure and efficacy signals, and Phase IIB studies, which are larger studies testing both safety and efficacy more rigorously. |

| • | Phase III. This phase involves trials undertaken to further evaluate dosage, clinical efficacy and safety in an expanded subject population, often at geographically dispersed clinical trial sites. These trials are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. |

All of these trials must be conducted in accordance with Good Clinical Practice (“GCP”), requirements in order for the data to be considered reliable for regulatory purposes.

New Drug and Biologics License Applications

In order to obtain approval to market a pharmaceutical in the United States, a marketing application must be submitted to the FDA that provides data establishing to the FDA’s satisfaction the safety and effectiveness of the investigational drug for the proposed indication. Each NDA or BLA submission requires a substantial user fee payment unless a waiver or exemption applies (such as with the Orphan Drug Designation discussed below). For fiscal year 2023, the FDA set the application fee at $3,242,026 for new drug applications that require clinical data. The manufacturer and/or sponsor of certain drugs approved under an NDA or BLA is also subject to annual prescription drug program fees, currently set at $393,933 per product for fiscal year 2023. These fees are typically increased annually. The NDA or BLA includes all relevant data available from pertinent non-clinical studies and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company-sponsored clinical trials intended to test the safety and effectiveness of the use of a product, or from a number of alternative sources, including studies initiated by investigators.

The FDA will initially review the NDA or BLA for completeness before it accepts it for filing. The FDA has 60 days from its receipt of an NDA or BLA to determine whether the application will be accepted for filing based on the agency’s threshold determination that the application is sufficiently complete to permit substantive review. After the NDA or BLA submission is accepted for filing, the FDA reviews the NDA or BLA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with current GMP, or cGMP, to assure and preserve the product’s identity, strength, quality and purity. The FDA may refer applications for novel drug products or drug products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and, if so, under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it typically considers such recommendations carefully when making decisions.

Based on pivotal Phase III trial results submitted in an NDA or BLA, upon the request of an applicant, the FDA may grant a “Priority Review” designation to a product, which sets the target date for FDA action on the application at six to eight months, rather than the standard ten to 12 months. The FDA can extend these reviews by three months. Priority Review is given where preliminary estimates indicate that a product, if approved, has the potential to provide a significant improvement compared to marketed products or offers a therapy where no satisfactory alternative therapy exists. Priority Review designation does not change the scientific/medical standard for approval or the quality of evidence necessary to support approval.

After the FDA completes its initial review of an NDA or BLA, it will communicate to the sponsor that the application for the drug will either be approved, or it will issue a complete response letter to communicate that the NDA or BLA will not be approved in its current form and inform the sponsor of changes that must be made or additional clinical, nonclinical or manufacturing data that must be received before the application can be approved, with no implication regarding the ultimate approvability of the application.

| - 15 - |

Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is manufactured, even if such facilities are located overseas. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and are adequate to assure consistent production of the product within required specifications.

Additionally, before approving an NDA or BLA, the FDA may inspect one or more clinical sites and manufacturing sites to assure compliance with GCP and GMP. If the FDA determines that any of the application, manufacturing process or manufacturing facilities is not acceptable, it typically will outline the deficiencies and often will request additional testing or information. This may significantly delay further review of the application. If the FDA finds that a clinical site did not conduct the clinical trial in accordance with GCP, the FDA may determine that the data generated by the clinical site should be excluded from the primary efficacy analyses provided in the NDA or BLA. Additionally, the FDA may identify deficiencies in the manufacturing process and require changes prior to approval. Notwithstanding the submission of any requested additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

The testing and approval process for a drug requires substantial time, effort and financial resources, and this process may take several years to complete. Data obtained from clinical activities are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA may not grant approval on a timely basis, or at all. We may encounter difficulties or unanticipated costs in our efforts to secure necessary governmental approvals, which could delay or preclude us from marketing our products.

The FDA may require, or companies may at their own discretion pursue, additional clinical trials after a product is approved. These so-called Phase IV studies may be made a condition that must be satisfied for continuing drug approval. The results of Phase IV studies can confirm the effectiveness of a product candidate and can provide important safety information. In addition, the FDA has express statutory authority to require sponsors to conduct post-market studies to specifically address safety issues identified by the agency. Any approvals that we may ultimately receive could be withdrawn if required post-marketing trials or analyses do not meet the FDA requirements, which would materially harm the commercial prospects for AL001 or ALZN002.