UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| ALCOA CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2

Alcoa Corporation (“Alcoa”) expects to file a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies to approve the issuance of shares of common stock of Alcoa in connection with a proposed transaction to acquire all of the shares of Alumina Limited (“Alumina”) in an all-stock transaction (the “Proposed Transaction”) at a special meeting of its stockholders.

Item 1: On February 25, 2024, Alcoa issued a press release announcing that it has entered into an exclusivity and transaction process deed with Alumina on terms and process with respect to the Proposed Transaction. A copy of the press release is filed herewith as Exhibit 1.

Item 2: On February 25, 2024, Alcoa issued an investor presentation in connection with the Proposed Transaction, a copy of which is filed herewith as Exhibit 2.

Caution Concerning Forward-Looking Statements

This communication contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,” “believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,” “plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,” “targets,” “will,” “working,” “would,” or other words of similar meaning. All statements by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different from those described herein, (2) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4) the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses resulting from the proposed transaction; (6) uncertainty of the expected financial performance following completion of the proposed transaction; (7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (11) volatility and declines in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which are linked to LME or other commodities; (12) the disruption

3

of market-driven balancing of global aluminum supply and demand by non-market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability to execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18) our ability to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (19) economic, political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations in foreign currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21) changes in tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts; (25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26) climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions; (27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (28) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches, system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other employee relations issues; (36) a decline in the liability discount rate or lower-than-expected investment returns on pension assets; and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements and none of the information contained herein should be regarded as a representation that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its shareholders in connection with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain important information about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents, when they become available, because they will contain important information about Alcoa and the proposed transaction. Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

4

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm), and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers” included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm). Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

5

Exhibit 1

Alcoa Announces Agreement With Alumina Limited on Terms and Process to Acquire Alumina Limited in All-Stock Transaction

02/25/2024

| · | Transaction would further enhance Alcoa’s position as of one of the world’s largest bauxite and alumina producers with increased ownership of core, tier-1 assets |

| · | Transaction would provide Alumina Limited shareholders the opportunity to participate in the upside potential of a stronger, better-capitalized company with a larger, more diversified portfolio |

| · | Transaction would result in significant and long-term value creation for both companies’ shareholders from greater operational flexibility |

| · | Alumina Limited’s largest holder, Allan Gray Australia, has entered into an agreement with Alcoa which gives Alcoa the right to acquire up to 19.9% of Alumina Limited’s issued share capital |

| · | Investor conference call scheduled for today, February 25, 2024 at 6:00 p.m. ET / February 26, 2024 at 10:00 a.m. AEDT |

PITTSBURGH--(BUSINESS WIRE)-- Alcoa (NYSE: AA or “Alcoa”) today announced that it has entered into an agreement with Alumina Limited (ASX: AWC) on terms and process for the acquisition of Alumina Limited, subject to entry into a scheme implementation agreement.

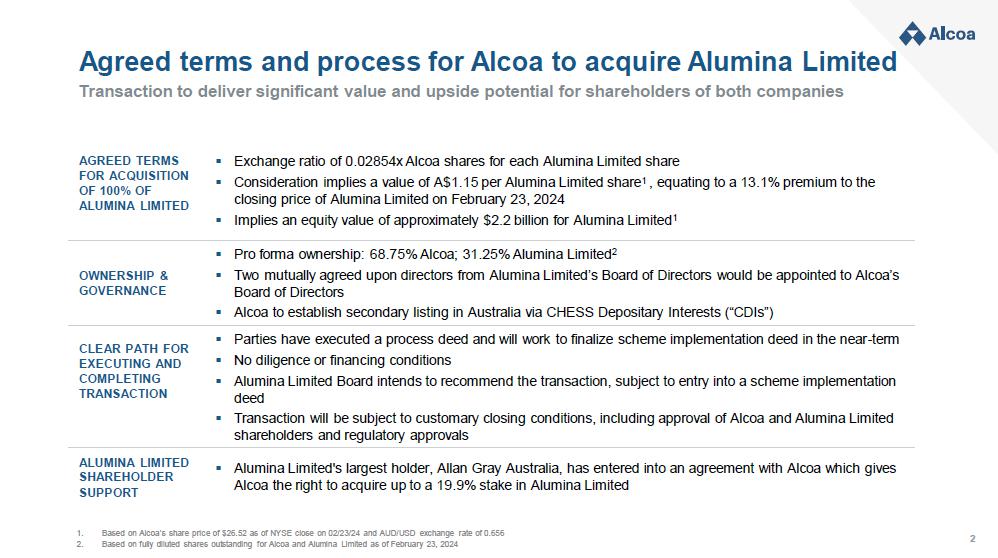

Alcoa and Alumina Limited have entered into an exclusivity and transaction process deed (“Process Deed”), and the Alumina Limited Board of Directors has confirmed that, subject to entry into a scheme implementation agreement, it intends to recommend the transaction to Alumina Limited shareholders. Under the all-scrip, or all-stock, transaction, Alumina Limited shareholders would receive consideration of 0.02854 Alcoa shares for each Alumina Limited share (the “Agreed Ratio”). Based on Alcoa’s closing share price as of February 23, 2024, the Agreed Ratio implies an equity value of approximately $2.2 billion for Alumina Limited.

The Alumina Limited Board of Directors intends to recommend the Agreed Ratio in the absence of a superior proposal and subject to an independent expert concluding (and continuing to conclude) that the transaction is in the best interests of Alumina Limited shareholders.

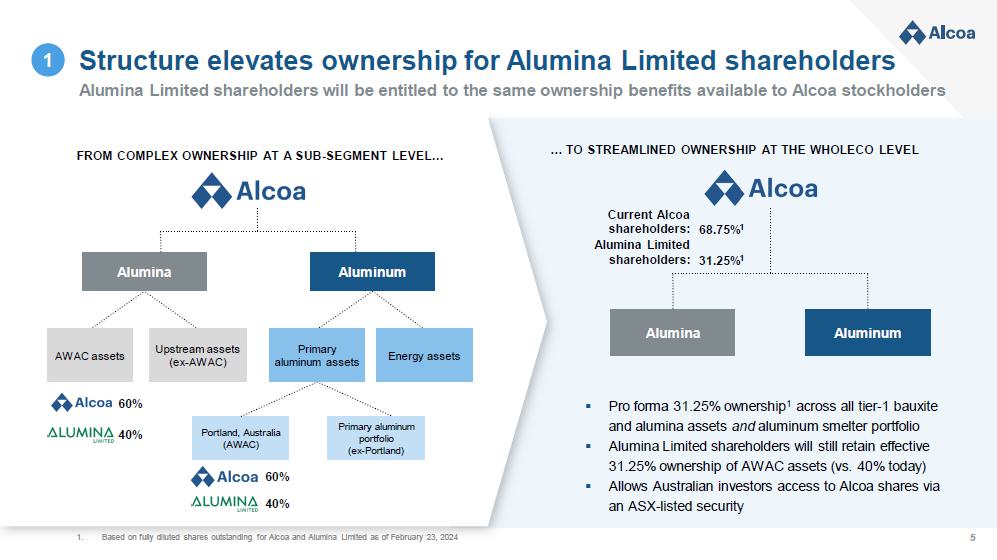

Under the Process Deed, Alcoa and Alumina Limited intend to finalize and enter into a scheme implementation agreement for the all-scrip transaction (the “Agreement”). Upon completion of the Agreement, Alumina Limited shareholders would own 31.25 percent, and Alcoa shareholders would own 68.75 percent of the combined company.1

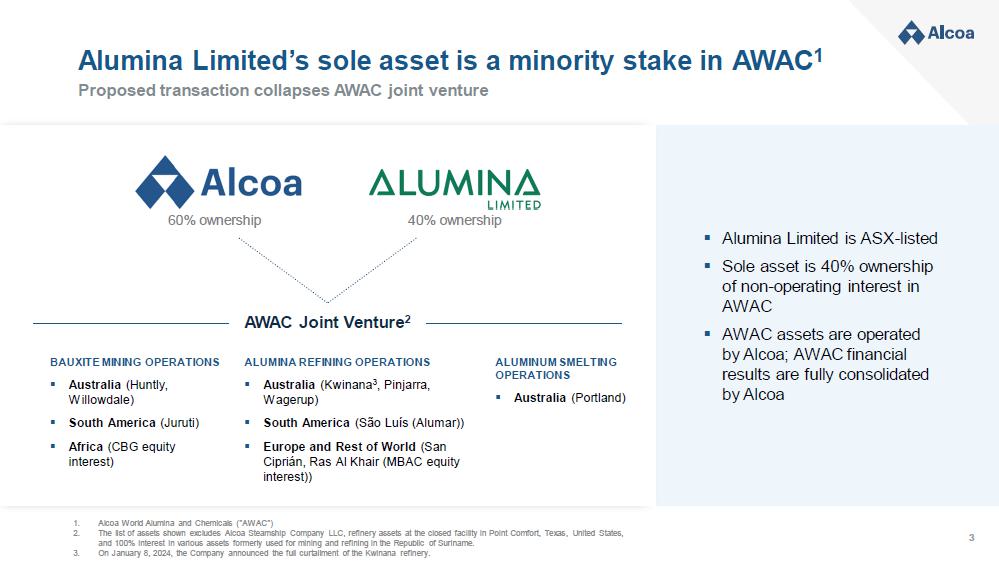

Alcoa is the sole operator of Alcoa World Alumina and Chemicals (AWAC), a joint venture (“JV”) with Alumina Limited. AWAC consists of a number of affiliated entities that own, operate or have an interest in bauxite mines and alumina refineries in Australia, Brazil, Spain, Saudi Arabia and

6

Guinea. AWAC also has a 55 percent interest in an aluminum smelter in Victoria, Australia. Alcoa owns 60 percent and Alumina Limited owns 40 percent of the AWAC entities, respectively, directly, or indirectly.

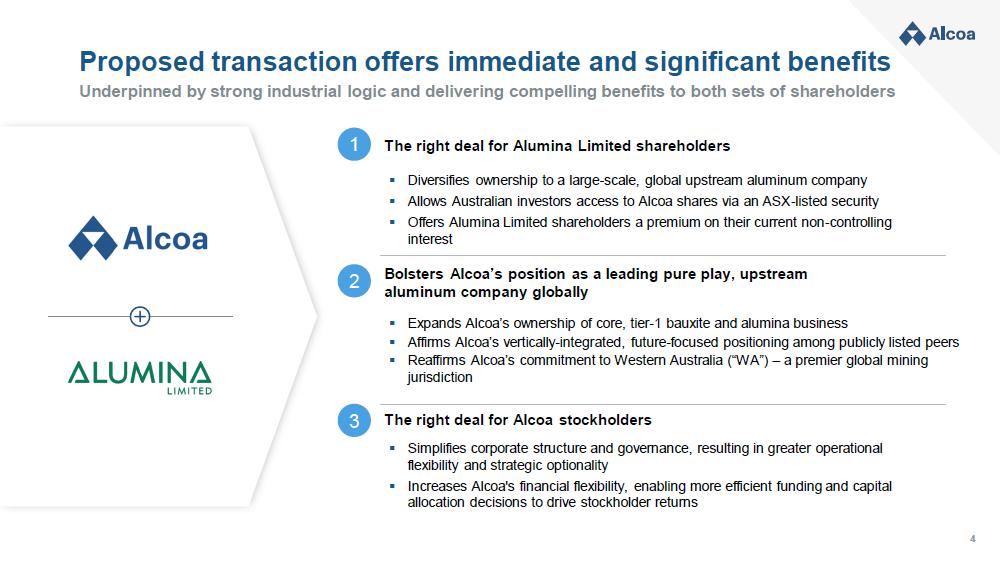

The Agreement would increase Alcoa’s economic interest in its core business and simplify governance by acquiring the minority partner in its AWAC JV, resulting in greater operational flexibility and strategic optionality. It would also allow Alumina Limited shareholders to participate in the upside potential of a stronger, better-capitalized company with a larger and more diversified portfolio while offering exposure to Alcoa’s upstream aluminum business.

Executive Commentary

“We are pleased to have entered into the transaction process and exclusivity deed to finalize the terms of the transaction, which will provide significant and long-term benefits to both Alcoa and Alumina Limited shareholders,” said William F. Oplinger, Alcoa’s President and CEO. “Alcoa has been a proven operator of AWAC, and we recognize the value creation opportunities possible under a simplified ownership structure, including the ability to implement AWAC’s operational and strategic decisions on an accelerated basis. We believe now is the right time to consolidate ownership in AWAC and look forward to working closely with the Alumina Limited team to consummate a transaction that will better position Alcoa to execute on our long-term growth strategy.”

Mr. Oplinger continued, “This acquisition would build on our commitment to Western Australia, and provides significant benefits to employees, customers, host communities, and others who rely on the continuing success of our global business.”

Compelling Strategic and Financial Benefits

| · | Increases Alcoa’s exposure to its core, tier-1 bauxite and alumina business, and provides Alumina Limited shareholders with exposure to Alcoa’s global aluminum business. The acquisition of Alumina Limited would consolidate Alcoa’s ownership of one of the world’s largest bauxite and alumina producers with tier 1 assets. With this acquisition, Alcoa would significantly increase its ownership in five of the 20 largest bauxite mines and five of the 20 largest alumina refineries globally (excluding China).2 This complements Alcoa’s low carbon, global smelting portfolio that has the fifth largest global production (excluding China).3 Importantly, Alumina Limited shareholders gain access to the benefits of Alcoa’s upstream aluminum business. |

| · | Enhances Alcoa’s global position as the leading pure-play upstream aluminum company. A combination of Alcoa and Alumina Limited would enhance Alcoa’s vertical integration across the value chain, with leading positions across bauxite, alumina and aluminum smelting and casting, excluding China. AWAC's mining operations are strategically located in proximity to AWAC refineries and major Atlantic and Pacific markets. Alcoa’s smelters are strategically located proximate to key markets in North America and Europe. The increased vertical integration in a combined company also provides more stability throughout the commodity cycle. |

| · | Offers Alumina Limited shareholders ownership in a stronger, well-capitalized business. With ownership of the combined entity, Alumina Limited shareholders will exchange their shares in a non-operating passive investment vehicle for an ownership |

7

| position in Alcoa. As part of this transition, Alumina Limited shareholders would participate in Alcoa’s capital returns program, including the current dividend, and would have access to a larger, strong balance sheet that will be better able to fund portfolio actions, maintenance capital, and growth capital. |

| · | Simplifies corporate structure and governance, resulting in greater operational flexibility and strategic optionality. Having 100 percent ownership of AWAC simplifies the corporate structure and allows for a more efficient operating model. With a centralized management team and strategy, Alcoa will be better positioned to execute operational and strategic decisions on an accelerated basis. In addition, a simplified corporate structure will result in efficiencies through a reduction in corporate costs. |

| · | Bolsters long-term financial profile and maximizes value creation for both companies’ shareholders. The proposed transaction would increase Alcoa's financial flexibility, enabling more efficient funding and capital allocation decisions, as well as liability management. Alcoa would be better positioned to achieve many of the Company’s long-term strategies to maximize value creation for shareholders. These being: returning cash to shareholders, increasing portfolio exposure to what has been Alcoa’s highest margin and highest return on capital business historically, and positioning for growth with the ability to make decisions on a streamlined basis. Additionally, an acquisition of Alumina Limited increases Alcoa’s financial flexibility for its Western Australia mining projects and near-term portfolio actions. |

| · | Reaffirms Alcoa’s commitment to Western Australia – a premier global mining jurisdiction. Alcoa has a long track record in the tier-1 Western Australia mining jurisdiction. The proposed acquisition of Alumina Limited builds on Alcoa’s commitment to continued productive relationships built on engagement with local communities, significant employment, and improved environmental performance. The proposed acquisition would better position Alcoa to continue its long-term plan of investing in Australian bauxite mining and alumina refining. |

Transaction Details

Under the proposed all-scrip, or all-stock, Agreement, Alumina Limited shareholders would receive consideration of 0.02854 Alcoa shares for each Alumina Limited share.4 This consideration would imply a value of A$1.15 per Alumina Limited share, based on Alcoa’s closing share price on the NYSE as of February 23, 2024 of $26.52.5 This represents a premium of 13.1% to the closing price of Alumina Limited’s shares on February 23, 2024.

As part of the proposed transaction, Alcoa would apply to establish a secondary listing on the Australian Securities Exchange ("ASX") to allow Alumina Limited shareholders to trade Alcoa common stock via CHESS Depositary Interests ("CDIs") on the ASX.

Under the terms of the Agreement, two new mutually agreed upon directors from Alumina Limited’s Board would be appointed to Alcoa’s Board of Directors upon closing.

Conditional Share Sale Agreement with Allan Gray Australia

Alumina Limited’s largest holder, Allan Gray Australia, has entered into an agreement with Alcoa that gives Alcoa the right to acquire up to 19.9 percent of Alumina Limited at the Agreed

8

Price 0.02854 Alcoa shares for each Alumina Limited share. The conditional share sale agreement will be disclosed in a substantial holder notice to be released to ASX.

Transaction Conditions

The transaction would be subject to the satisfaction of certain customary conditions and regulatory approval, including entry into a scheme implementation agreement, a recommendation from Alumina Limited’s Board of Directors that Alumina Limited shareholders vote in favor in the absence of a superior proposal, and an independent expert concluding (and continuing to conclude) that the proposed transaction is in the best interests of Alumina Limited's shareholders, approval by Australia's Foreign Investment Review Board, Alumina Limited's shareholders approving the transaction and Alcoa shareholders approving the issue of the new Alcoa shares under the NYSE rules. The transaction is not conditional on due diligence or financing.

The parties expect to be in a position to announce a scheme implementation agreement detailing the full details of the transaction in the near-term.

Transaction Website

Associated materials regarding the transaction will be available on the investor relations section of Alcoa's website as well as a transaction website at www.strongawacfuture.com.

Advisors

J.P. Morgan Securities LLC and UBS Investment Bank are acting as financial advisors to Alcoa, and Ashurst and Davis Polk & Wardwell LLP are acting as its legal counsel.

Conference Call

Alcoa will hold a conference call at 6:00 p.m. Eastern Time (ET) on Sunday, February 25, 2024 (10:00 a.m. AEDT on Monday, February 26, 2024), to discuss today’s announcement.

The call will be webcast via the Company’s homepage on www.alcoa.com. Presentation materials for the call will be available for viewing on the same website prior to the call. The conference may also be accessed by calling 1-844-763-8274 (international callers dial 1-412-717-9224). Participants may preregister for the conference call at https://dpregister.com/sreg/10186845/fbb5eeb996.

About Alcoa Corporation

Alcoa (NYSE: AA) is a global industry leader in bauxite, alumina and aluminum products with a vision to reinvent the aluminum industry for a sustainable future. With a values-based approach that encompasses integrity, operating excellence, care for people and courageous leadership, our purpose is to Turn Raw Potential into Real Progress. Since developing the process that made aluminum an affordable and vital part of modern life, our talented Alcoans have developed breakthrough innovations and best practices that have led to greater efficiency, safety, sustainability and stronger communities wherever we operate.

9

Dissemination of Company Information

Alcoa intends to make future announcements regarding company developments and financial performance through its website, www.alcoa.com, as well as through press releases, filings with the Securities and Exchange Commission, conference calls and webcasts. The Company does not incorporate the information contained on, or accessible through, its corporate website into this press release.

__________________

| 1 Based on fully diluted shares outstanding for Alcoa and Alumina Limited as of February 23, 2024. |

| 2 Per Wood Mackenzie |

| 3 Per Wood Mackenzie |

| 4 Interests in Alcoa shares would be delivered in the form of “CDIs” - Clearing House Electronic Sub-register System Depositary Interests representing a unit of beneficial ownership in a share of Alcoa common stock. CDIs are tradeable on the Australian Stock Exchange (ASX). |

| 5 Based on the prevailing AUD / USD exchange rate of 0.656 as of February 23, 2024. |

Forward-Looking Statements

This communication contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,” “believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,” “plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,” “targets,” “will,” “working,” “would,” or other words of similar meaning. All statements by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different from those described herein, (2) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4) the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses resulting from the proposed transaction; (6) uncertainty of the expected financial performance following completion of the proposed transaction; (7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (11)

10

volatility and declines in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which are linked to LME or other commodities; (12) the disruption of market-driven balancing of global aluminum supply and demand by non-market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability to execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18) our ability to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (19) economic, political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations in foreign currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21) changes in tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts; (25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26) climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions; (27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (28) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches, system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other employee relations issues; (36) a decline in the liability discount rate or lower-than-expected investment returns on pension assets; and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements and none of the information contained herein should be regarded as a representation that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy

11

Statement or any other document that Alcoa may file with the SEC and send to its stockholders in connection with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain important information about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents, when they become available, because they will contain important information about Alcoa and the proposed transaction.

Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm), and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers” included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm). Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

12

Investor

Contact:

James Dwyer

James.Dwyer@alcoa.com

Media

Contact:

Jim Beck

James.Beck@alcoa.com

Additional Media Contacts

Australia

Citadel MAGNUS

Paul Ryan +61 409 296 511

pryan@citadelmagnus.com

United

States

Joele Frank, Wilkinson Brimmer Katcher

Sharon Stern / Kaitlin Kikalo / Lyle Weston

Alcoa-jf@joelefrank.com

Source: Alcoa

13

Exhibit 2

1 Alcoa announces agreement with Alumina Limited on terms and process to acquire Alumina Limited in an all - stock transaction A Consolidation of Alcoa’s Ownership of AWAC February 25, 2024

2 1. 2. Based on Alcoa’s share price of $26.52 as of NYSE close on 02/23/24 and AUD/USD exchange rate of 0.656 Based on fully diluted shares outstanding for Alcoa and Alumina Limited as of February 23, 2024 Agreed terms and process for Alcoa to acquire Alumina Limited Transaction to deliver significant value and upside potential for shareholders of both companies AGREED TERMS FOR ACQUISITION OF 100% OF ALUMINA LIMITED ▪ Exchange ratio of 0.02854x Alcoa shares for each Alumina Limited share ▪ Consideration implies a value of A$1.15 per Alumina Limited share 1 , equating to a 13.1% premium to the closing price of Alumina Limited on February 23, 2024 ▪ Implies an equity value of approximately $2.2 billion for Alumina Limited 1 OWNERSHIP & GOVERNANCE ▪ Pro forma ownership: 68.75% Alcoa; 31.25% Alumina Limited 2 ▪ Two mutually agreed upon directors from Alumina Limited’s Board of Directors would be appointed to Alcoa’s Board of Directors ▪ Alcoa to establish secondary listing in Australia via CHESS Depositary Interests (“CDIs”) CLEAR PATH FOR EXECUTING AND COMPLETING TRANSACTION ▪ Parties have executed a process deed and will work to finalize scheme implementation deed in the near - term ▪ No diligence or financing conditions ▪ Alumina Limited Board intends to recommend the transaction, subject to entry into a scheme implementation deed ▪ Transaction will be subject to customary closing conditions, including approval of Alcoa and Alumina Limited shareholders and regulatory approvals ALUMINA LIMITED SHAREHOLDER SUPPORT ▪ Alumina Limited's largest holder, Allan Gray Australia, has entered into an agreement with Alcoa which gives Alcoa the right to acquire up to a 19.9% stake in Alumina Limited

3 Alumina Limited’s sole asset is a minority stake in AWAC 1 Proposed transaction collapses AWAC joint venture ▪ Alumina Limited is ASX - listed ▪ Sole asset is 40% ownership of non - operating interest in AWAC ▪ AWAC assets are operated by Alcoa; AWAC financial results are fully consolidated by Alcoa AWAC Joint Venture 2 40% ownership 60% ownership ALUMINA REFINING OPERATIONS ▪ Australia (Kwinana 3 , Pinjarra, Wagerup) ▪ South America (São Luís (Alumar)) ▪ Europe and Rest of World (San Ciprián, Ras Al Khair (MBAC equity interest)) BAUXITE MINING OPERATIONS ▪ Australia (Huntly, Willowdale) ▪ South America (Juruti) ▪ Africa (CBG equity interest) ALUMINUM SMELTING OPERATIONS ▪ Australia (Portland) 1. 2. 3. Alcoa World Alumina and Chemicals ("AWAC") The list of assets shown excludes Alcoa Steamship Company LLC, refinery assets at the closed facility in Point Comfort, Texas, United States, and 100% interest in various assets formerly used for mining and refining in the Republic of Suriname. On January 8, 2024, the Company announced the full curtailment of the Kwinana refinery.

4 Proposed transaction offers immediate and significant benefits Underpinned by strong industrial logic and delivering compelling benefits to both sets of shareholders Bolsters Alcoa’s position as a leading pure play, upstream aluminum company globally 1 The right deal for Alumina Limited shareholders ▪ Diversifies ownership to a large - scale, global upstream aluminum company ▪ Allows Australian investors access to Alcoa shares via an ASX - listed security ▪ Offers Alumina Limited shareholders a premium on their current non - controlling interest The right deal for Alcoa stockholders ▪ Simplifies corporate structure and governance, resulting in greater operational flexibility and strategic optionality ▪ Increases Alcoa's financial flexibility, enabling more efficient funding and capital allocation decisions to drive stockholder returns ▪ Expands Alcoa’s ownership of core, tier - 1 bauxite and alumina business ▪ Affirms Alcoa’s vertically - integrated, future - focused positioning among publicly listed peers ▪ Reaffirms Alcoa’s commitment to Western Australia (“WA”) – a premier global mining jurisdiction 2 3

5 Structure elevates ownership for Alumina Limited shareholders Alumina Limited shareholders will be entitled to the same ownership benefits available to Alcoa stockholders Portland, Australia (AWAC) Primary aluminum portfolio (ex - Portland) 60% 40% 60% 40% AWAC assets Upstream assets (ex - AWAC) Primary aluminum assets Energy assets Alumina Aluminum FROM COMPLEX OWNERSHIP AT A SUB - SEGMENT LEVEL… ▪ Pro forma 31.25% ownership 1 across all tier - 1 bauxite and alumina assets and aluminum smelter portfolio ▪ Alumina Limited shareholders will still retain effective 31.25% ownership of AWAC assets (vs. 40% today) ▪ Allows Australian investors access to Alcoa shares via an ASX - listed security … TO STREAMLINED OWNERSHIP AT THE WHOLECO LEVEL urrent Alcoa shareholders: 68.75% 1 umina Limited shareholders: 31.25% 1 Alumina Aluminum 1 1. Based on fully diluted shares outstanding for Alcoa and Alumina Limited as of February 23, 2024 C Al

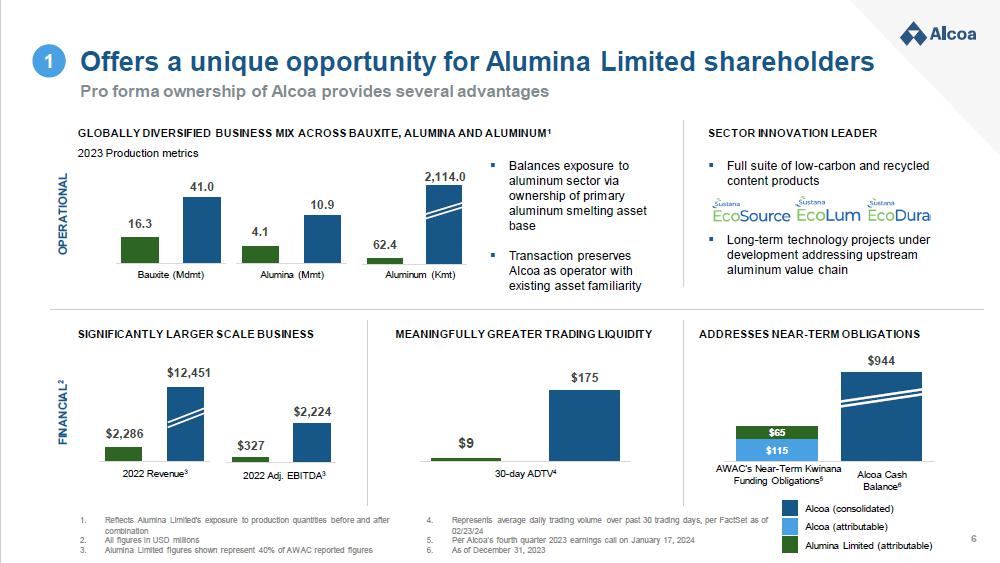

6 $2 ,2 86 $1 2, 451 4. 1 10 . 9 1. 2. 3. Reflects Alumina Limited's exposure to production quantities before and after combination All figures in USD millions Alumina Limited figures shown represent 40% of AWAC reported figures 4. 5. 6. Represents average daily trading volume over past 30 trading days, per FactSet as of 02/23/24 Per Alcoa’s fourth quarter 2023 earnings call on January 17, 2024 As of December 31, 2023 Offers a unique opportunity for Alumina Limited shareholders Pro forma ownership of Alcoa provides several advantages OPERATIONAL F I NANC I A L 2 ▪ Balances exposure to aluminum sector via ownership of primary aluminum smelting asset base ▪ Transaction preserves Alcoa as operator with existing asset familiarity 16 .3 41 . 0 Bauxite (Mdmt) Alumina (Mmt) Aluminum (Kmt) 2022 Revenue 3 $9 $175 30 - day ADTV 4 $115 $65 AWAC’s Near - Term Kwinana Funding Obligations 5 Alcoa Cash Balance 6 62 .4 2 ,1 14 .0 SIGNIFICANTLY LARGER SCALE BUSINESS MEANINGFULLY GREATER TRADING LIQUIDITY ADDRESSES NEAR - TERM OBLIGATIONS SECTOR INNOVATION LEADER ▪ Full suite of low - carbon and recycled content products ▪ Long - term technology projects under development addressing upstream aluminum value chain $327 $2 ,2 24 2022 Adj. EBITDA 3 $944 1 GLOBALLY DIVERSIFIED BUSINESS MIX ACROSS BAUXITE, ALUMINA AND ALUMINUM 1 2023 Production metrics Alcoa (consolidated) Alcoa (attributable) Alumina Limited (attributable)

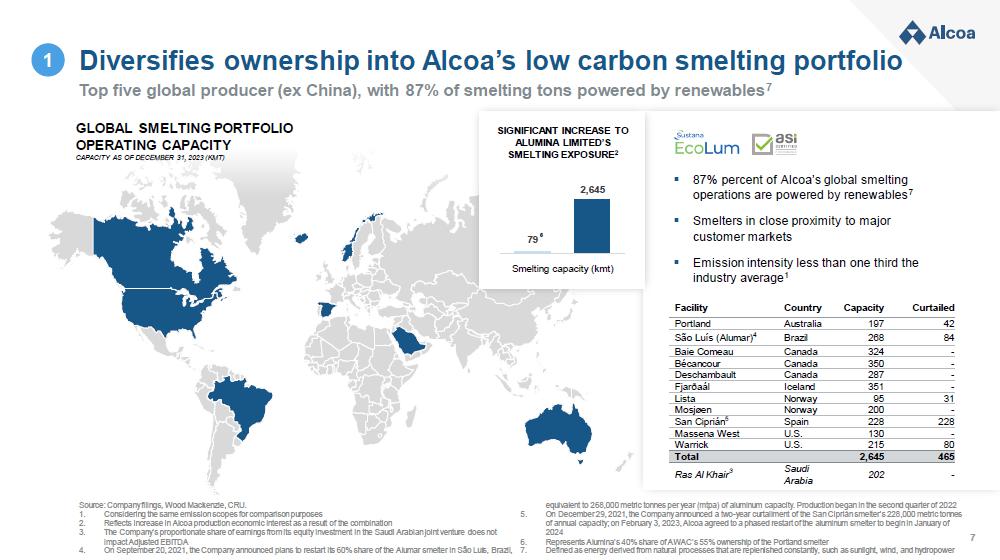

7 Diversifies ownership into Alcoa’s low carbon smelting portfolio Top five global producer (ex China), with 87% of smelting tons powered by renewables 7 Source: Company filings, Wood Mackenzie, CRU. 1. 2. 3. Considering the same emission scopes for comparison purposes Reflects increase in Alcoa production economic interest as a result of the combination The Company’s proportionate share of earnings from its equity investment in the Saudi Arabian joint venture does not impact Adjusted EBITDA 4. equivalent to 268,000 metric tonnes per year (mtpa) of aluminum capacity. Production began in the second quarter of 2022 5. On December 29, 2021, the Company announced a two - year curtailment of the San Ciprián smelter’s 228,000 metric tonnes of annual capacity; on February 3, 2023, Alcoa agreed to a phased restart of the aluminum smelter to begin in January of 2024 6. Represents Alumina’s 40% share of AWAC’s 55% ownership of the Portland smelter On September 20, 2021, the Company announced plans to restart its 60% share of the Alumar smelter in São Luís, Brazil, 7. Defined as energy derived from natural processes that are replenished constantly, such as sunlight, wind, and hydropower GLOBAL SMELTING PORTFOLIO SIGNIFICANT INCREASE TO OPERATING CAPACITY ALUMINA LIMITED’S CAPACITY AS OF DECEMBER 31, 2023 (KMT) SMELTING EXPOSURE 2 ▪ 87% percent o 2,645 operations are ▪ Smelters in cl 79 6 customer mar Smelting capacity (kmt) ▪ Emission inten industry avera F ac ili t y f Alcoa’s gl powered b ose proximi kets sity less th ge 1 Country obal smelting y renewabl ty to major an one third Capacity Portland Australia 197 São Luís (Alumar) 4 Brazil 268 Baie Comeau Canada 324 Bécancour Canada 350 Deschambault Canada 287 Fjarðaál Iceland 351 Lista Norway 95 Mosjøen Norway 200 San Ciprián 5 Spain 228 Massena West U.S. 130 W a rr i ck U.S. 215 T o t a l 2,645 Ras Al Khair 3 Saudi Arabia 202 1

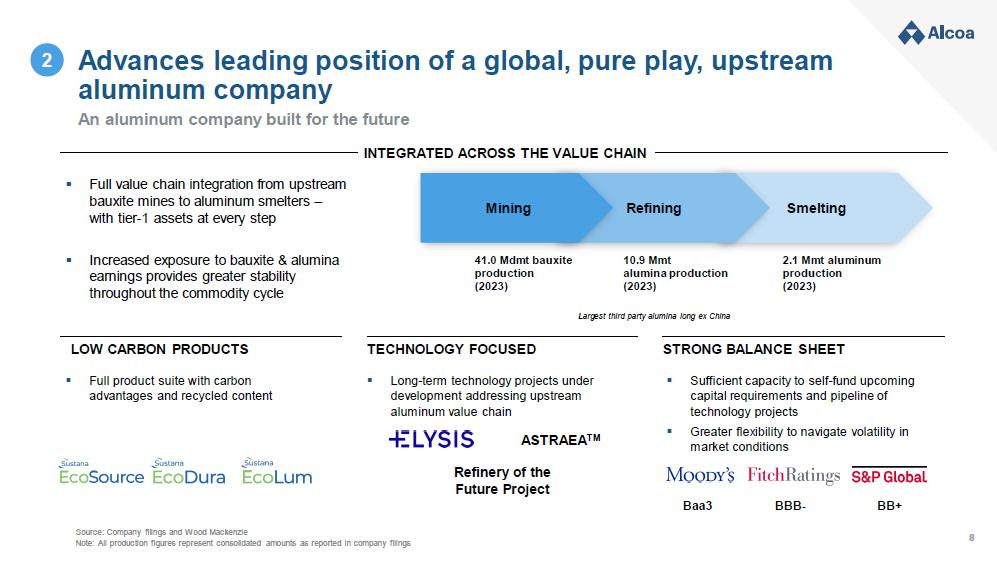

8 S m e l t i n g Source: Company filings and Wood Mackenzie Note: All production figures represent consolidated amounts as reported in company filings Advances leading position of a global, pure play, upstream aluminum company STRONG BALANCE SHEET LOW CARBON PRODUCTS TECHNOLOGY FOCUSED R e f i n i n g Baa3 BB B - BB+ 41.0 Mdmt bauxite production (2023) 10.9 Mmt alumina production (2023) 2.1 Mmt aluminum production (2023) Largest third party alumina long ex China ▪ Full product suite with carbon advantages and recycled content ▪ Long - term technology projects under development addressing upstream aluminum value chain ASTRAEA TM ▪ Sufficient capacity to self - fund upcoming capital requirements and pipeline of technology projects ▪ Greater flexibility to navigate volatility in market conditions ▪ Increased exposure to bauxite & alumina earnings provides greater stability throughout the commodity cycle ▪ Full value chain integration from upstream bauxite mines to aluminum smelters – with tier - 1 assets at every step 2 An aluminum company built for the future INTEGRATED ACROSS THE VALUE CHAIN M i ning Refinery of the Future Project

9 41 .0 12 .1 10 .4 2 . 1 1 . 0 Source: Company filings for Alcoa + Alumina Limited production; Wood Mackenzie as of December 2023 for peers’ production 1. 2. Denotes rank among publicly - listed pure play aluminum peers First quartile by CRU analysis as of October 2023; full impacts of lower bauxite grade in Australia, San Ciprián curtailment and operational issues in Brazil being assessed could place Alumina in second quartile in 2024 Fully integrated across the value chain, with leading positions across bauxite, alumina and aluminum production Advances leading position of a global, pure play, upstream aluminum company (cont.) 10 .9 5 . 7 5 .6 1 .0 0 . 4 Category 1 4 .0 2 .1 1. 8 0 .7 0 . 3 Category 1 #1 bauxite producer (Mdmt) 1 ▪ Strategic global presence with locations in proximity to Alcoa’s refineries ▪ 1st quartile cost curve position (2023) B a u x it e #1 alumina producer (Mmt) 1 A l u m i n a #2 aluminum producer (Mmt) 1 Aluminum ▪ Refinery portfolio with 1st quartile emissions intensity ▪ 1st quartile cost curve position (2023) 2 ▪ Global smelting portfolio with 87% of production from renewable energy ▪ 2nd quartile cost curve position (2023) 2

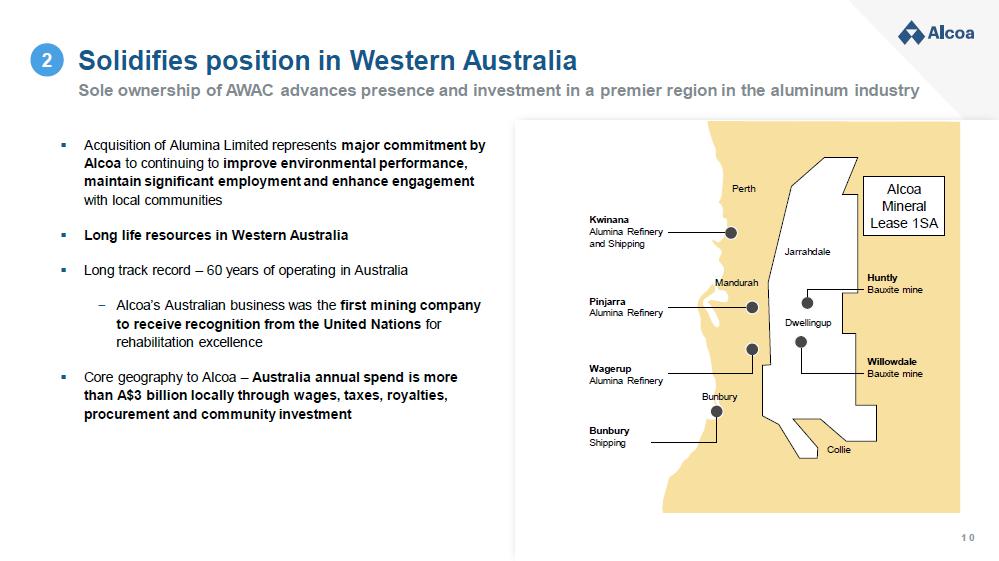

10 Solidifies position in Western Australia Sole ownership of AWAC advances presence and investment in a premier region in the aluminum industry ▪ Acquisition of Alumina Limited represents major commitment by Alcoa to continuing to improve environmental performance, maintain significant employment and enhance engagement with local communities ▪ Long life resources in Western Australia ▪ Long track record – 60 years of operating in Australia − Alcoa’s Australian business was the first mining company to receive recognition from the United Nations for rehabilitation excellence ▪ Core geography to Alcoa – Australia annual spend is more than A$3 billion locally through wages, taxes, royalties, procurement and community investment Jarrahdale Dwellingup Huntly Bauxite mine Willowdale Bauxite mine Pinjarra Alumina Refinery Wagerup Alumina Refinery Kwinana Alumina Refinery and Shipping Bunbury Shipping B un b u r y Collie P e r t h Mandurah 2 10 Alcoa Mineral Lease 1SA

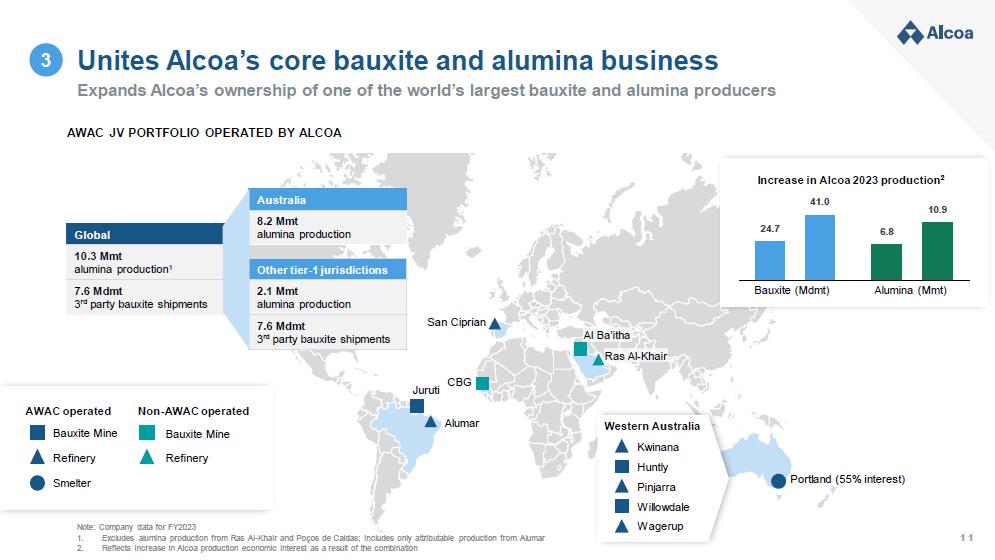

11 Note: Company data for FY2023 1. 2. Excludes alumina production from Ras Al - Khair and Poços de Caldas; includes only attributable production from Alumar Reflects increase in Alcoa production economic interest as a result of the combination Unites Alcoa’s core bauxite and alumina business Expands Alcoa’s ownership of one of the world’s largest bauxite and alumina producers AWAC JV PORTFOLIO OPERATED BY ALCOA Portland (55% interest) Al Ba’itha Ras Al - Khair San Ciprian Juruti CBG A l u m a r Australia 8.2 Mmt alumina production Other tier - 1 jurisdictions 2.1 Mmt alumina production 7.6 Mdmt 3 rd party bauxite shipments Global 10.3 Mmt alumina production 1 7.6 Mdmt 3 rd party bauxite shipments AWAC operated Bauxite Mine S m e l t e r Refinery Non - AWAC operated Bauxite Mine Refinery 24 . 7 6 . 8 Increase in Alcoa 2023 production 2 41.0 10.9 Bauxite (Mdmt) Alumina (Mmt) Western Australia Kwinana Huntly Pinjarra Willowdale Wagerup 3

12 41.0 33.2 21.0 18.4 18.3 13.7 13.2 11.0 10.9 9 . 8 8 . 3 6.7 6.0 6.0 5.6 4.8 4.6 3.2 3.1 3 . 0 S m b - W a p Weipa / Amrun H un t l y C B G Boddington B o f f a Sangarédi T r o m be t a s G o ve Paragominas Willowdale Panchpatmali Baphlimali Juruti I ndone s i a K e t apan g Al Ba'Itha T i m a n Bauxite Hills (Project) Discovery Bay Kodingamali Expands economic interest in tier - 1 bauxite and alumina assets Some of the world’s largest bauxite mines and alumina refineries – already operated by Alcoa today TOP 20 GLOBAL BAUXITE MINES (EX CHINA) Wood Mackenzie estimated annual production (Mdmt), 2023 TOP 20 GLOBAL ALUMINA REFINERIES (EX CHINA) Wood Mackenzie estimated annual production (Mmt), 2023 6 . 2 4 . 5 4 . 2 3.4 3.4 3 . 0 2 . 6 2.4 2.3 2 . 2 2 . 0 1 . 7 1 . 7 1.6 1.5 1.4 1.4 1.4 1.0 1.0 A l un o rt e W o r s l e y Pinjarra A l u m a r G l ad s t on e (Qal) Y a r w u n Wagerup Al Taweelah U t k a l D a m a n j o d i K e t apan g Ras Al - Khair Lanjigarh Bintan Alumina Vaudreuil A u g h i n i sh K w i nan a P av l o d ar J a m a l co Bogoslovsk Ba u x i t e ▪ One of the world’s largest bauxite producers with core, tier - 1 assets across four continents ▪ ~15% of global annual production (ex China) ▪ 1st quartile cash costs bauxite assets A lu m in a ▪ World’s third largest alumina producer and largest (ex China) ▪ Alumina products from a refinery portfolio with average emissions intensity below 0.6 tonne CO e per tonne of alumina 4 2 ▪ ~18% of global annual production (ex China) ▪ 1st quartile cash costs alumina assets 5 Interest 1 Source: Wood Mackenzie and CRU 1. AWAC has a 45% interest in the bauxite mining company, Halco (Mining) Inc. Halco owns 51% of Compagnie des Bauxites de Guinéa, the manager of several bauxite mines at Boké in north - west Guinea, West Africa. 2. JV between Alcoa and the Saudi Arabian Mining Company (Ma'aden) which is comprised of two entities: the Ma’aden Bauxite and Alumina Company (MBAC) and the Ma’aden Aluminium Company (MAC). 3. Planned curtailment announced January 8, 2024. 4. Scope 1 and 2, mining and refining. 5. First quartile by CRU analysis. Full impacts of lower bauxite grade in Australia, San Ciprián curtailment and operational issues in Brazil being assessed could place Alumina in second quartile in 2024 Interest 2 3 Interest 2 COMBINED COMPANY METRICS 3

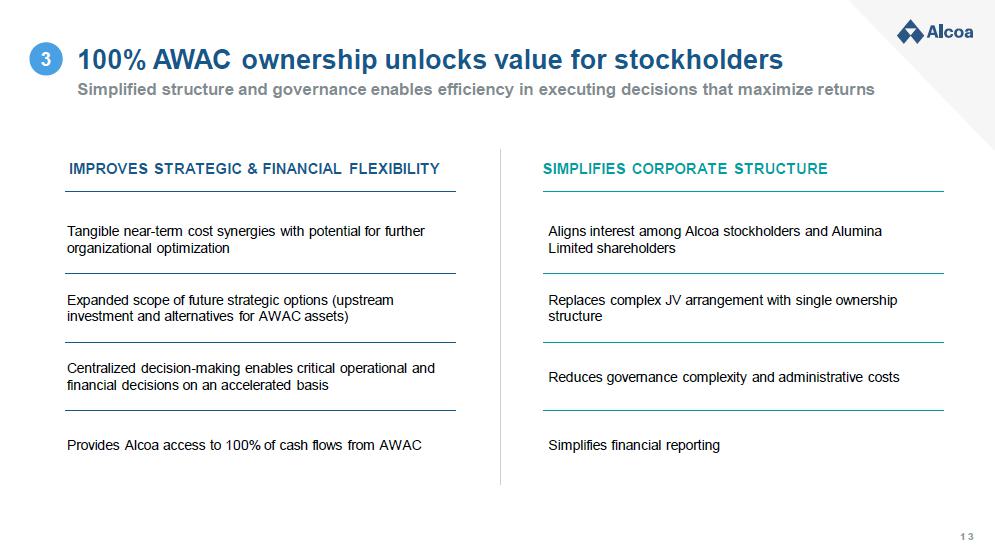

13 100% AWAC ownership unlocks value for stockholders Simplified structure and governance enables efficiency in executing decisions that maximize returns IMPROVES STRATEGIC & FINANCIAL FLEXIBILITY Tangible near - term cost synergies with potential for further organizational optimization SIMPLIFIES CORPORATE STRUCTURE Aligns interest among Alcoa stockholders and Alumina Limited shareholders Expanded scope of future strategic options (upstream investment and alternatives for AWAC assets) Centralized decision - making enables critical operational and financial decisions on an accelerated basis Replaces complex JV arrangement with single ownership structure Reduces governance complexity and administrative costs Simplifies financial reporting Provides Alcoa access to 100% of cash flows from AWAC 3

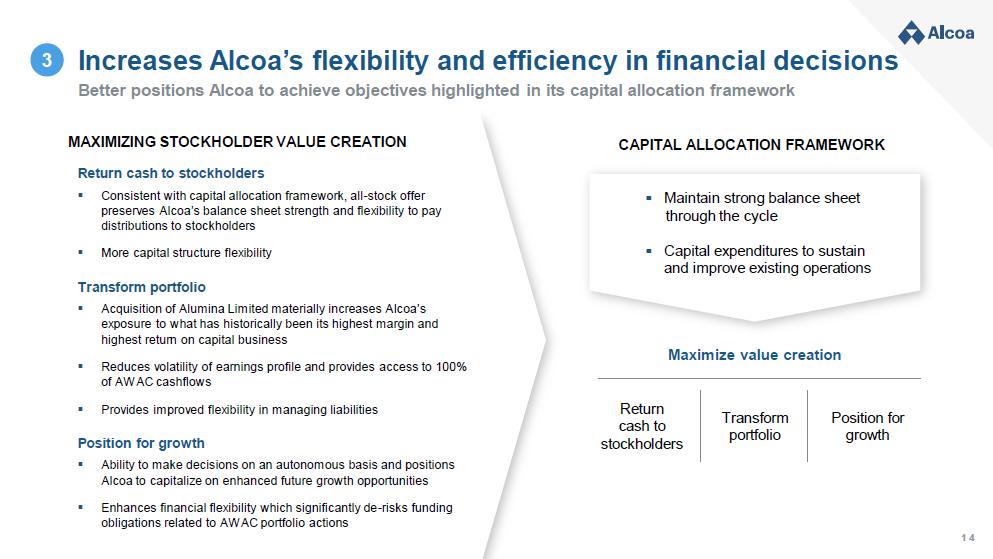

14 Increases Alcoa’s flexibility and efficiency in financial decisions Better positions Alcoa to achieve objectives highlighted in its capital allocation framework MAXIMIZING STOCKHOLDER VALUE CREATION Return cash to stockholders ▪ Consistent with capital allocation framework, all - stock offer preserves Alcoa’s balance sheet strength and flexibility to pay distributions to stockholders ▪ More capital structure flexibility Transform portfolio ▪ Acquisition of Alumina Limited materially increases Alcoa’s exposure to what has historically been its highest margin and highest return on capital business ▪ Reduces volatility of earnings profile and provides access to 100% of AWAC cashflows ▪ Provides improved flexibility in managing liabilities Position for growth ▪ Ability to make decisions on an autonomous basis and positions Alcoa to capitalize on enhanced future growth opportunities ▪ Enhances financial flexibility which significantly de - risks funding obligations related to AWAC portfolio actions CAPITAL ALLOCATION FRAMEWORK ▪ Maintain strong balance sheet through the cycle ▪ Capital expenditures to sustain and improve existing operations Maximize value creation Return cash to s t o ck h o l d e rs Transform portfolio Position for growth 3

15 A compelling opportunity for Alcoa and Alumina Limited The right deal for Alumina Limited shareholders 1 Bolsters Alcoa’s position as a leading pure play, upstream aluminum company globally 2 The right deal for Alcoa stockholders 3

16 Appendix

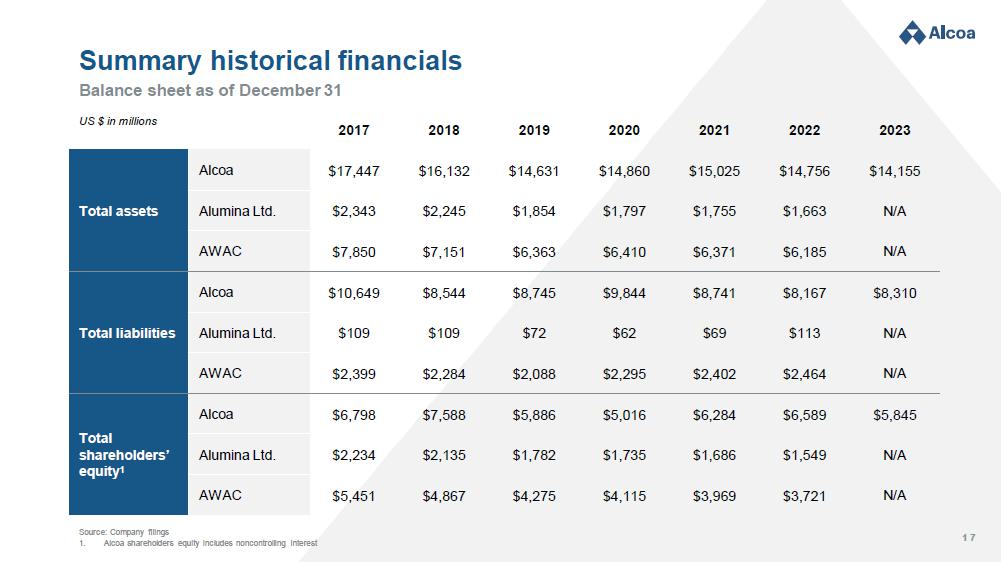

17 Summary historical financials Balance sheet as of December 31 US $ in millions 2017 2018 2019 2020 2021 2022 2023 Total assets Alcoa $17,447 $16,132 $14,631 $14,860 $15,025 $14,756 $14,155 Alumina Ltd. $2,343 $2,245 $1,854 $1,797 $1,755 $1,663 N/A AWAC $7,850 $7,151 $6,363 $6,410 $6,371 $6,185 N/A Total liabilities Alcoa $10,649 $8,544 $8,745 $9,844 $8,741 $8,167 $8,310 Alumina Ltd. $109 $109 $72 $62 $69 $113 N/A AWAC $2,399 $2,284 $2,088 $2,295 $2,402 $2,464 N/A T o t a l s h a r e ho l d e r s ’ e qu i t y 1 Alcoa $6,798 $7,588 $5,886 $5,016 $6,284 $6,589 $5,845 Alumina Ltd. $2,234 $2,135 $1,782 $1,735 $1,686 $1,549 N/A AWAC $5,451 $4,867 $4,275 $4,115 $3,969 $3,721 N/A Source: Company filings 1. Alcoa shareholders equity includes noncontrolling interest

18 Summary historical financials Income statement for twelve months ended December 31 Source: Company filings US $ in millions 2017 2018 2019 2020 2021 2022 2023 Revenue Alcoa $11,652 $13,403 $10,433 $9,286 $12,152 $12 , 45 1 $10,551 Alumina Ltd. $1 $2 $3 $0 $0 $1 N/A AWAC 2 $5,274 $6,749 $5,216 $4,330 $5,224 $5 , 71 5 N/A Net income attributable to respective shareholders Alcoa $279 $250 ($1,125) ($170) $429 ($123) ($651) Alumina Ltd. $340 $635 $214 $147 $188 $104 N/A AWAC $901 $1,640 $565 $402 $444 $301 N/A A d j u s t e d E B I T D A excluding special items Alcoa $2,478 $3,129 $1,656 $1,151 $2,763 $2 , 22 4 $536 Alumina Ltd. N/A N/A N/A N/A N/A N/A N/A AWAC $1,685 $2,797 $1,586 $895 $1,206 $815 N/A

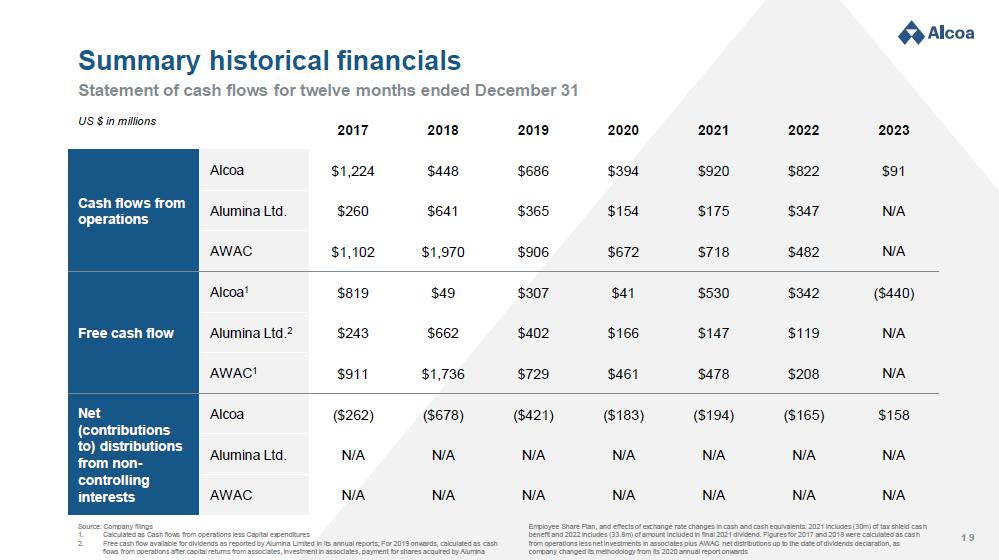

19 Summary historical financials Statement of cash flows for twelve months ended December 31 Source: Company filings 1. 2. Calculated as Cash flows from operations less Capital expenditures Free cash flow available for dividends as reported by Alumina Limited in its annual reports; For 2019 onwards, calculated as cash flows from operations after capital returns from associates, investment in associates, payment for shares acquired by Alumina Employee Share Plan, and effects of exchange rate changes in cash and cash equivalents. 2021 includes (30m) of tax shield cas h benefit and 2022 includes (33.8m) of amount included in final 2021 dividend. Figures for 2017 and 2018 were calculated as cas h from operations less net investments in associates plus AWAC net distributions up to the date of dividends declaration, as company changed its methodology from its 2020 annual report onwards US $ in millions 2017 2018 2019 2020 2021 2022 2023 Cash flows from operations Alcoa $1,224 $448 $686 $394 $920 $822 $91 Alumina Ltd. $260 $641 $365 $154 $175 $347 N/A AWAC $1,102 $1,970 $906 $672 $718 $482 N/A Free cash flow Alcoa 1 $819 $49 $307 $41 $530 $342 ($440) Alumina Ltd. 2 $243 $662 $402 $166 $147 $119 N/A AWAC 1 $911 $1,736 $729 $461 $478 $208 N/A Net (contributions to) distributions from non - controlling interests Alcoa ($262) ($678) ($421) ($183) ($194) ($165) $158 Alumina Ltd. N/A N/A N/A N/A N/A N/A N/A AWAC N/A N/A N/A N/A N/A N/A N/A

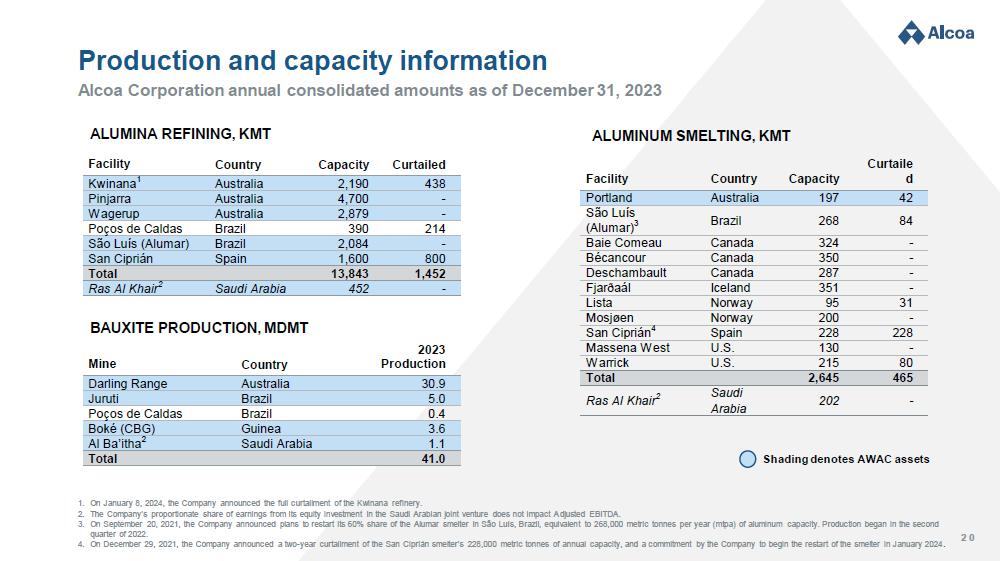

20 Production and capacity information Alcoa Corporation annual consolidated amounts as of December 31, 2023 BAUXITE PRODUCTION, MDMT Mine Country 2023 Pr odu c t i o n Darling Range Australia 30.9 Juruti Brazil 5.0 Poços de Caldas Brazil 0.4 Boké (CBG) Guinea 3.6 Al Ba’itha 2 Saudi Arabia 1.1 Total 41.0 ALUMINA REFINING, KMT Facility Country Capacity Curtailed Kwinana 1 Australia 2,190 438 Pinjarra Australia 4,700 - Wagerup Australia 2,879 - Poços de Caldas Brazil 390 214 São Luís (Alumar) Brazil 2,084 - San Ciprián Spain 1,600 800 Total 13,843 1,452 Ras Al Khair 2 Saudi Arabia 452 - ALUMINUM SMELTING, KMT Facility Country Capacity Portland Australia 197 São Luís (Alumar) 3 Brazil 268 Baie Comeau Canada 324 Bécancour Canada 350 Deschambault Canada 287 Fjarðaál Iceland 351 Lista Norway 95 Mosjøen Norway 200 San Ciprián 4 Spain 228 Massena W est U.S. 130 Warrick U.S. 215 Total 2,645 Ras Al Khair 2 Saudi Arabia 202 1. On January 8, 2024, the Company announced the full curtailment of the Kwinana refinery. 2. The Company’s proportionate share of earnings from its equity investment in the Saudi Arabian joint venture does not impact Adjusted EBITDA. 3. On September 20, 2021, the Company announced plans to restart its 60% share of the Alumar smelter in São Luís, Brazil, equivalent to 268,000 metric tonnes per year (mtpa) of aluminum capacity. Production began in the second quarter of 2022. 4. On December 29, 2021, the Company announced a two - year curtailment of the San Ciprián smelter’s 228,000 metric tonnes of annual capacity, and a commitment by the Company to begin the restart of the smelter in January 2024 . Shading denotes AWAC assets

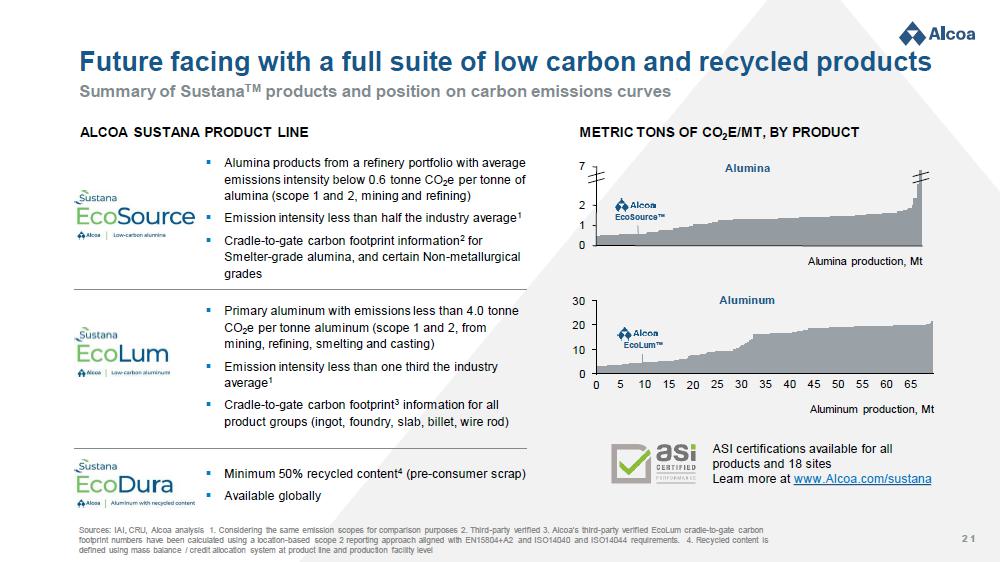

21 Sources: IAI, CRU, Alcoa analysis 1. Considering the same emission scopes for comparison purposes 2. Third - party verified 3. Alcoa’s third - party verified EcoLum cradle - to - gate carbon footprint numbers have been calculated using a location - based scope 2 reporting approach aligned with EN15804+A2 and ISO14040 and ISO14044 requirements. 4. Recycled content is defined using mass balance / credit allocation system at product line and production facility level Future facing with a full suite of low carbon and recycled products Summary of Sustana TM products and position on carbon emissions curves ALCOA SUSTANA PRODUCT LINE METRIC TONS OF CO 2 E/MT, BY PRODUCT ▪ Primary aluminum with emissions less than 4.0 tonne CO 2 e per tonne aluminum (scope 1 and 2, from mining, refining, smelting and casting) ▪ Emission intensity less than one third the industry average 1 ▪ Cradle - to - gate carbon footprint 3 information for all product groups (ingot, foundry, slab, billet, wire rod) ▪ Alumina products from a refinery portfolio with average emissions intensity below 0 . 6 tonne CO 2 e per tonne of alumina (scope 1 and 2 , mining and refining) ▪ Emission intensity less than half the industry average 1 ▪ Cradle - to - gate carbon footprint information 2 for Smelter - grade alumina, and certain Non - metallurgical grades ▪ Minimum 50% recycled content 4 (pre - consumer scrap) ▪ Available globally 20 30 10 0 0 5 10 15 20 25 30 35 40 45 50 55 60 65 Aluminum production, Mt 2 1 0 7 Alumina production, Mt Al u m i n a EcoSource Œ Al u m i n u m E c oLu m Œ ASI certifications available for all products and 18 sites Learn more at www.Alcoa.com/sustana

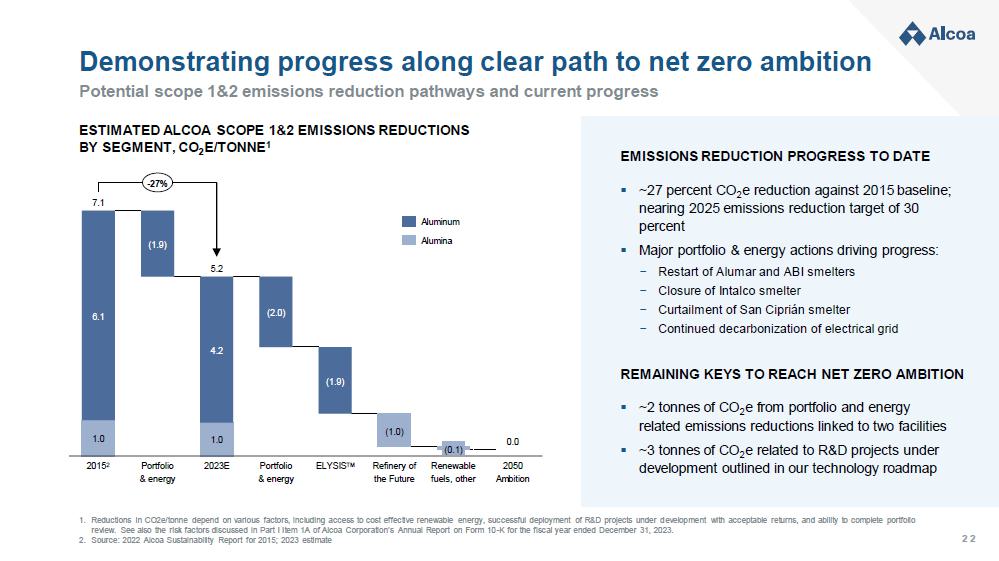

22 Demonstrating progress along clear path to net zero ambition Potential scope 1&2 emissions reduction pathways and current progress ESTIMATED ALCOA SCOPE 1&2 EMISSIONS REDUCTIONS BY SEGMENT, CO 2 E/TONNE 1 1.0 1.0 6.1 4.2 2015 2 (1.9) Portfolio & energy 2023E (2.0) Portfolio & energy (1.9) ELYSIS TM (1.0) (0.1) Refinery of Renewa b le the Future fuels, other 2050 Ambition 7.1 5.2 0.0 - 27% 1. Reductions in CO2e/tonne depend on various factors, including access to cost effective renewable energy, successful deployment of R&D projects under development with acceptable returns, and ability to complete portfolio review. See also the risk factors discussed in Part I Item 1A of Alcoa Corporation’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2023. 2. Source: 2022 Alcoa Sustainability Report for 2015; 2023 estimate A lu m inum Alumina ▪ ~27 percent CO e reduction against 2015 baseline; 2 nearing 2025 emissions reduction target of 30 percent ▪ Major portfolio & energy actions driving progress: − Restart of Alumar and ABI smelters − Closure of Intalco smelter − Curtailment of San Ciprián smelter − Continued decarbonization of electrical grid EMISSIONS REDUCTION PROGRESS TO DATE ▪ ~2 tonnes of CO 2 e from portfolio and energy related emissions reductions linked to two facilities ▪ ~3 tonnes of CO 2 e related to R&D projects under development outlined in our technology roadmap REMAINING KEYS TO REACH NET ZERO AMBITION

23 Source: 2022 Sustainability Report Alcoa sustainability goals Alcoa strategic long - term sustainability goals, baseline and progress Goal Description 2015 Baseline 2022 Progress Safety Zero fatalities and serious injuries (life - threatening, life - altering injury or illness) 5 fatal or serious i n j u r i e s / i ll n e ss e s 0 fatalities and 1 serious i n j u r y / i ll n e s s Diversity and inclusion Attain an inclusive ‘everyone culture’ that reflects the diversity of the communities in which we operate N / A 18.4% global women Mine rehabilitation Maintain a corporate - wide running 5 - year average ratio of 1:1 or better for active mining disturbance (excluding long - term infrastructure) to mine rehabilitation N / A 0 . 82 : 1 Bauxite residue From a 2015 baseline, reduce bauxite residue land requirements per metric tonne of alumina produced by 15% by 2030 53.2 m2/kmt Ala 15.6% reduction Waste From a 2015 baseline, reduce landfilled waste 15% by 2025 and 25% by 2030. Baseline restated to reflect divestiture of Warrick Rolling. 131.7 mt 37.6% reduction Water From a 2015 baseline, reduce the intensity of our total water use from Alcoa - defined water - scarce locations by 5% by 2025 and 10% by 2030 3.79 m3/mt 5.3% reduction Greenhouse gas emissions Align our greenhouse gas (direct + indirect) emissions reduction targets with the 2ºC decarbonization path by reducing greenhouse gas intensity by 30% by 2025, and 50% by 2030 from a 2015 baseline 7.10 mt CO 2 e/mt 25.1% reduction Sustainable value chain By 2022, implement a social management system at all locations, including the definition of performance metrics and long - term goals to be accomplished by 2025 and 2030 N / A Launched SP360 – Alcoa Social Management System in 2021

24 Forward - Looking Statements This communication contains statements that relate to future events and expectations and as such constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include those containing such words as “aims,” “ambition,” “anticipates,” “believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,” “plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “stri ve,” “targets,” “will,” “working,” “would,” or other words of similar meaning. All statements by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements of historical fact, are forward - looking statements, including, without limitation, statements regarding the proposed transaction; the ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as well as other factors that management believes are appropriate in the circumstances. Forward - looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward - looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward - looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different from those described herein, (2) the non - satisfaction or non - waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4) the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses resulting from the proposed transaction; (6) uncertainty of the expected financial performance following completion of the proposed transaction; (7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end - use markets; (11) volatility and declines in aluminum and alumina demand and pricing, including global, regional, and product - specific prices, or significant changes in production costs which are linked to LME or other commodities; (12) the disruption of market - driven balancing of global aluminum supply and demand by non - market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability to execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18) our ability to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (19) economic, political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations in foreign currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21) changes in tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts; (25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26) climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions; (27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (28) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches, system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other employee relations issues; (36) a decline in the liability discount rate or lower - than - expected investment returns on pension assets; and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated wi th the proposed transaction, will be more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward - looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks described above and other risks in the market. Neither Alcoa, nor any other person assumes responsibility for the accuracy and completeness of any of these forward - looking statements and none of the information contained herein should be regarded as a representation that the forward - looking statements contained herein will be achieved. Additional Information and Where to Find It This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its stockholders in connection with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain important information about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents, when they become available, because they will contain important information about Alcoa and the proposed transaction. Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/. Participants in the Solicitation Alcoa, its directors, executive officers and other persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form 10 - K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa - 20231231.htm), and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers” included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which is available at https:// www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm). Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.