Great Elm Capital Corp. NASDAQ: GECC Investor Presentation Quarter Ended March 31, 2022 May 11, 2022 Exhibit 99.2

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,” “continue,” “upside,” “potential,” “preliminary” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, the price of GECC common stock, the performance of GECC’s portfolio and investment manager and risks associated with the economic impact of the COVID-19 pandemic on GECC and its portfolio companies. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K and other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. You should consider the investment objective, risks, charges and expenses of GECC carefully before investing. GECC’s filings with the SEC contain this and other information about GECC and are available by contacting GECC at the phone number and address at the end of this presentation. The SEC also maintains a website that contains the aforementioned documents. The address of the SEC’s website is http://www.sec.gov. These documents should be read and considered carefully before investing. The performance, distributions and financial data contained herein represent past performance, distributions and results and neither guarantees nor is indicative of future performance, distributions or results. Investment return and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than the original cost. GECC’s market price and net asset value will fluctuate with market conditions. Current performance may be lower or higher than the performance data quoted. All information and data, including portfolio holdings and performance characteristics, is as of March 31, 2022, unless otherwise noted, and is subject to change. This presentation does not constitute an offer of any securities for sale. Forward Looking Statement

Great Elm Capital Corp. Externally managed, total-return-focused BDC Directors of GECC, employees of GECM and officers and directors of GECM’s parent, including investment funds managed by directors of GECM’s parent, own approximately 35% of GECC’s outstanding shares Investment Objective To generate current income and capital appreciation by investing in debt and income generating equity securities, including actively pursuing investments in specialty finance businesses Portfolio (as of 3/31/2022) $199.4 million of portfolio fair value; $69.3 million of net asset value (“NAV”) Debt investments carry a weighted average current yield of 10.4%1 57 investments (45 debt, 12 equity) in 41 companies across 22 industries, excluding investments in SPACs (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. About GECC

First Quarter 2022 (Quarter Ended 3/31/2022)

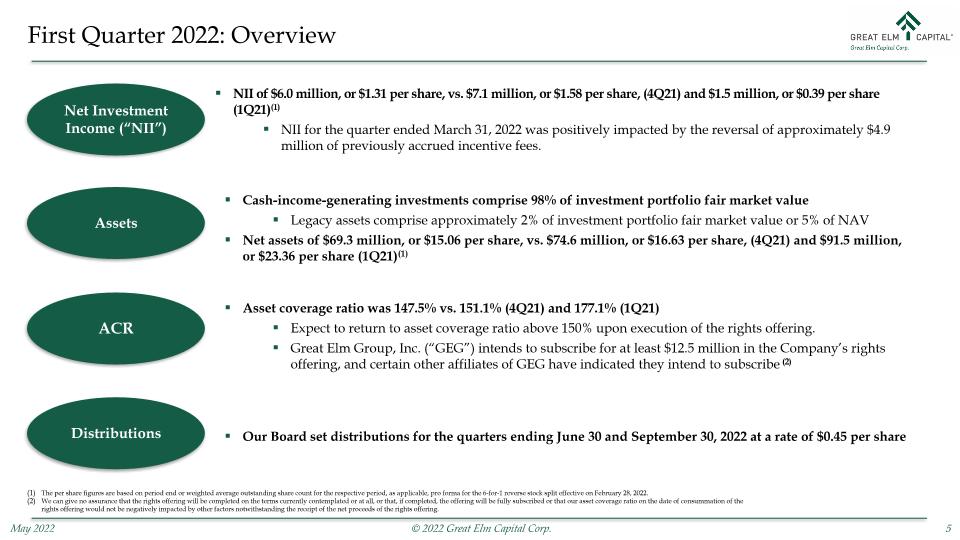

NII of $6.0 million, or $1.31 per share, vs. $7.1 million, or $1.58 per share, (4Q21) and $1.5 million, or $0.39 per share (1Q21)(1) NII for the quarter ended March 31, 2022 was positively impacted by the reversal of approximately $4.9 million of previously accrued incentive fees. Net Investment Income (“NII”) First Quarter 2022: Overview Assets Distributions Cash-income-generating investments comprise 98% of investment portfolio fair market value Legacy assets comprise approximately 2% of investment portfolio fair market value or 5% of NAV Net assets of $69.3 million, or $15.06 per share, vs. $74.6 million, or $16.63 per share, (4Q21) and $91.5 million, or $23.36 per share (1Q21)(1) Our Board set distributions for the quarters ending June 30 and September 30, 2022 at a rate of $0.45 per share ACR The per share figures are based on period end or weighted average outstanding share count for the respective period, as applicable, pro forma for the 6-for-1 reverse stock split effective on February 28, 2022. We can give no assurance that the rights offering will be completed on the terms currently contemplated or at all, or that, if completed, the offering will be fully subscribed or that our asset coverage ratio on the date of consummation of the rights offering would not be negatively impacted by other factors notwithstanding the receipt of the net proceeds of the rights offering. Asset coverage ratio was 147.5% vs. 151.1% (4Q21) and 177.1% (1Q21) Expect to return to asset coverage ratio above 150% upon execution of the rights offering. Great Elm Group, Inc. (“GEG”) intends to subscribe for at least $12.5 million in the Company’s rights offering, and certain other affiliates of GEG have indicated they intend to subscribe (2)

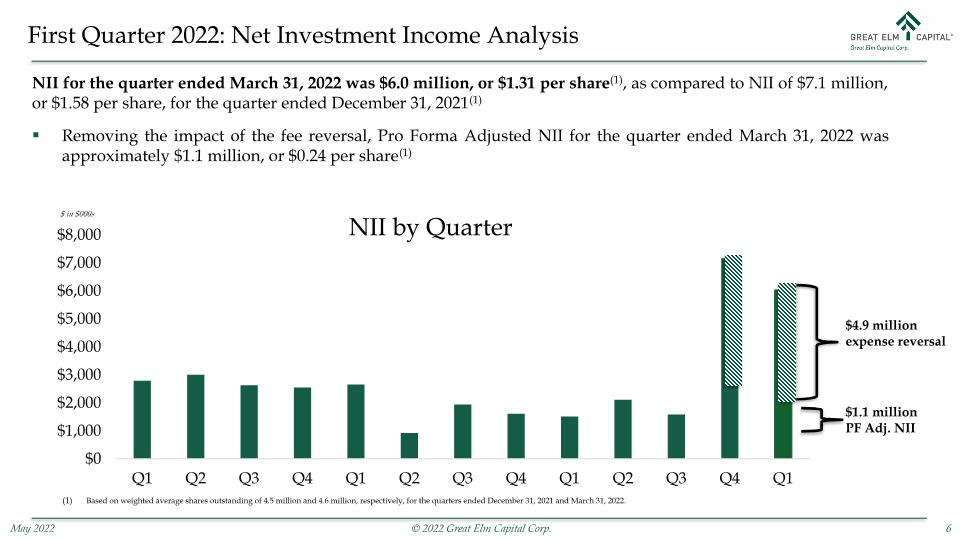

First Quarter 2022: Net Investment Income Analysis NII for the quarter ended March 31, 2022 was $6.0 million, or $1.31 per share(1), as compared to NII of $7.1 million, or $1.58 per share, for the quarter ended December 31, 2021(1) Removing the impact of the fee reversal, Pro Forma Adjusted NII for the quarter ended March 31, 2022 was approximately $1.1 million, or $0.24 per share(1) $ in $000s Based on weighted average shares outstanding of 4.5 million and 4.6 million, respectively, for the quarters ended December 31, 2021 and March 31, 2022. $4.9 million expense reversal $1.1 million PF Adj. NII

First Quarter 2022: NAV Walk Net assets were approximately $69.3 million ($15.06 per share(1)) on March 31, 2022, as compared to $74.6 million ($16.63 per share(2)) on December 31, 2021 Based on weighted average shares outstanding of 4.5 million and 4.6 million, respectively, for the quarters ended December 31, 2021 and March 31, 2022.

Portfolio Review (Quarter Ended 3/31/2022)

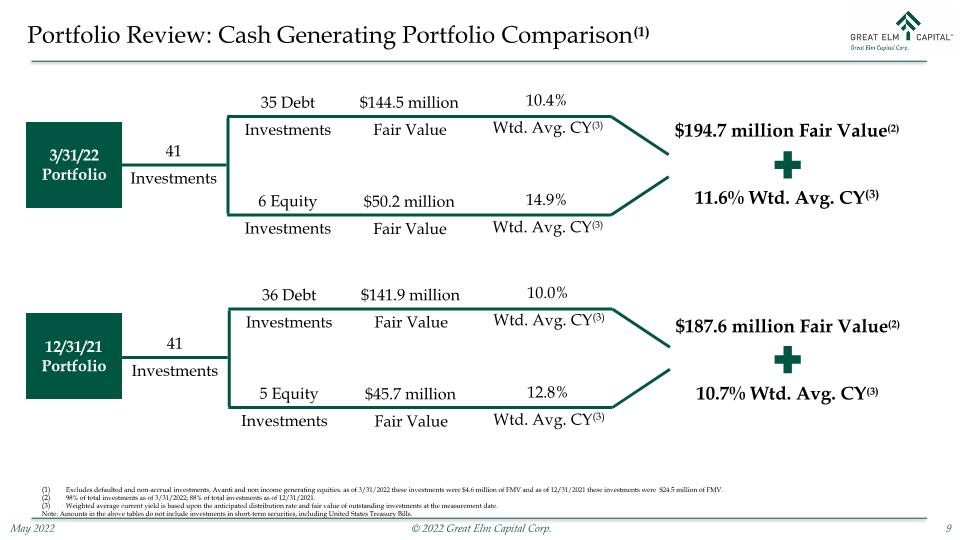

Portfolio Review: Cash Generating Portfolio Comparison(1) Excludes defaulted and non-accrual investments, Avanti and non income generating equities. as of 3/31/2022 these investments were $4.6 million of FMV and as of 12/31/2021 these investments were $24.5 million of FMV. 98% of total investments as of 3/31/2022; 88% of total investments as of 12/31/2021. Weighted average current yield is based upon the anticipated distribution rate and fair value of outstanding investments at the measurement date. Note: Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. 6 Equity Investments $50.2 million Fair Value 14.9% Wtd. Avg. CY(3) 35 Debt Investments $144.5 million Fair Value 10.4% Wtd. Avg. CY(3) 41 Investments $194.7 million Fair Value(2) 11.6% Wtd. Avg. CY(3) 5 Equity Investments $45.7 million Fair Value 12.8% Wtd. Avg. CY(3) 36 Debt Investments $141.9 million Fair Value 10.0% Wtd. Avg. CY(3) 41 Investments $187.6 million Fair Value(2) 10.7% Wtd. Avg. CY(3) 3/31/22 Portfolio 12/31/21 Portfolio

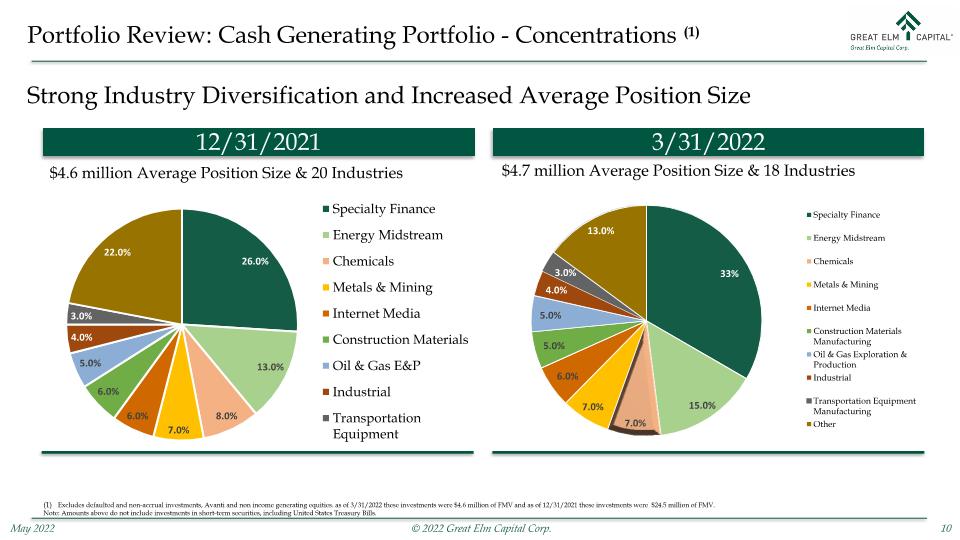

Portfolio Review: Cash Generating Portfolio - Concentrations (1) 12/31/2021 3/31/2022 Strong Industry Diversification and Increased Average Position Size $4.6 million Average Position Size & 20 Industries $4.7 million Average Position Size & 18 Industries Excludes defaulted and non-accrual investments, Avanti and non income generating equities. as of 3/31/2022 these investments were $4.6 million of FMV and as of 12/31/2021 these investments were $24.5 million of FMV. Note: Amounts above do not include investments in short-term securities, including United States Treasury Bills.

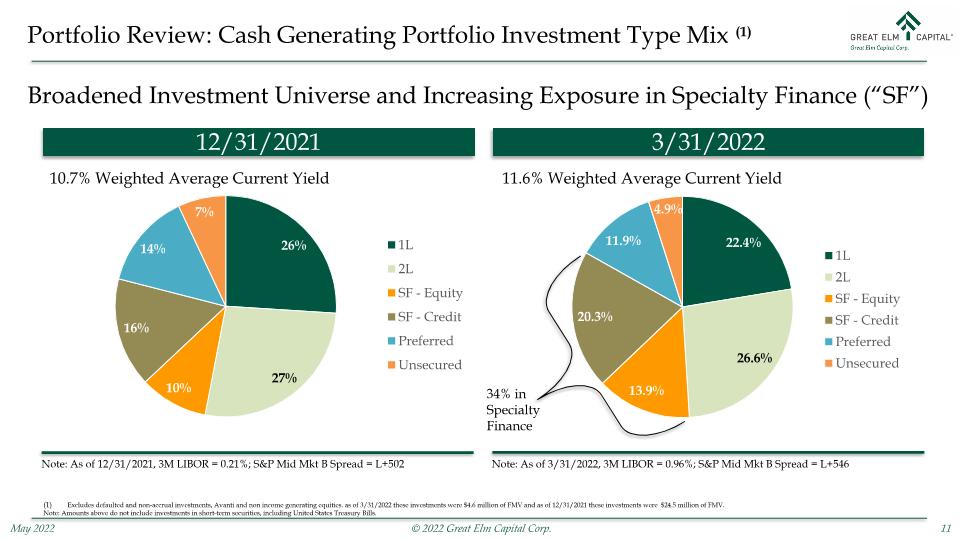

Portfolio Review: Cash Generating Portfolio Investment Type Mix (1) Excludes defaulted and non-accrual investments, Avanti and non income generating equities. as of 3/31/2022 these investments were $4.6 million of FMV and as of 12/31/2021 these investments were $24.5 million of FMV. Note: Amounts above do not include investments in short-term securities, including United States Treasury Bills. 12/31/2021 3/31/2022 Broadened Investment Universe and Increasing Exposure in Specialty Finance (“SF”) 10.7% Weighted Average Current Yield 11.6% Weighted Average Current Yield Note: As of 12/31/2021, 3M LIBOR = 0.21%; S&P Mid Mkt B Spread = L+502 Note: As of 3/31/2022, 3M LIBOR = 0.96%; S&P Mid Mkt B Spread = L+546 34% in Specialty Finance

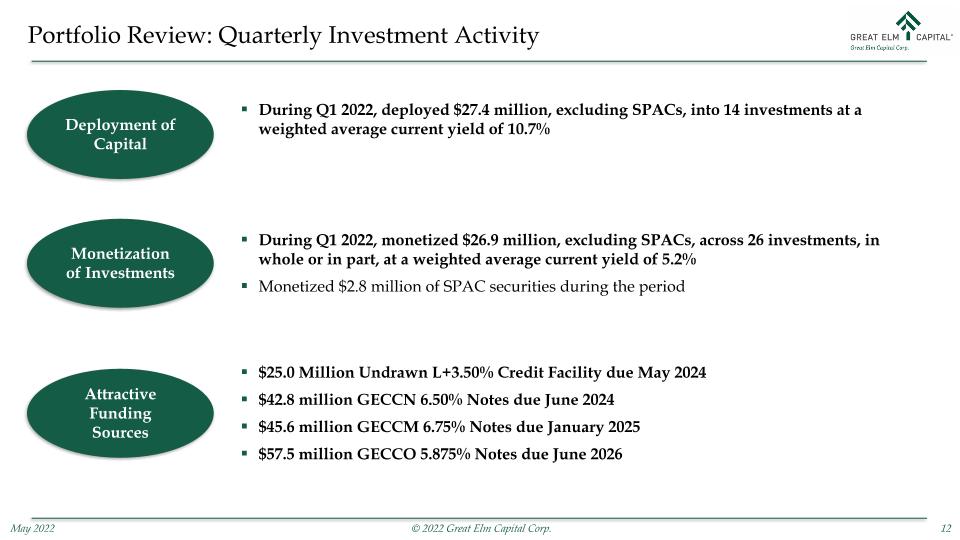

$25.0 Million Undrawn L+3.50% Credit Facility due May 2024 $42.8 million GECCN 6.50% Notes due June 2024 $45.6 million GECCM 6.75% Notes due January 2025 $57.5 million GECCO 5.875% Notes due June 2026 Attractive Funding Sources During Q1 2022, deployed $27.4 million, excluding SPACs, into 14 investments at a weighted average current yield of 10.7% Deployment of Capital During Q1 2022, monetized $26.9 million, excluding SPACs, across 26 investments, in whole or in part, at a weighted average current yield of 5.2% Monetized $2.8 million of SPAC securities during the period Monetization of Investments Portfolio Review: Quarterly Investment Activity

Income Generating Equity Investments Portfolio Review: Total Quarter End Portfolio Detail 45 Debt Investments $145.2 million 98.46%(1) Weighted Average Dollar Price of Debt Investments 10.4%(1) Weighted Average Current Yield of Debt Investments 72.9% Of Portfolio in Debt Investments 12 Equity Investments, excl. SPACs Debt Investments: Equity Investments: 25.2% (1) Weighted average dollar price and current yield are based upon fair value of outstanding investments and the anticipated distribution rate, as applicable, at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. Weighted Average Current Yield of Income-Generating Equity Investments 6 $50.3 million $3.7 million 1.8% 14.9%(1) 6 Other Equity Investments Of Portfolio in Equity Investments Fair value of Equity Investments Fair value of Debt Investments

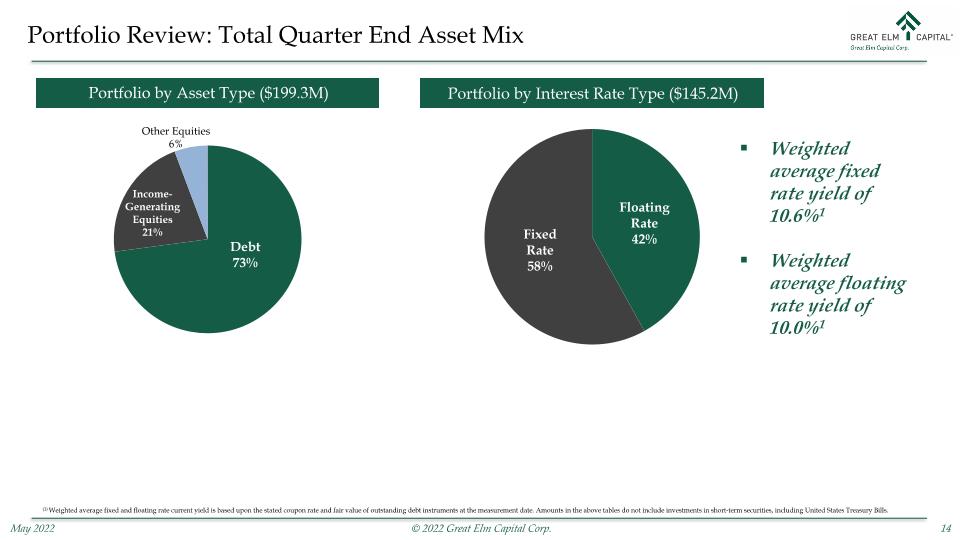

Portfolio by Asset Type ($199.3M) Portfolio by Interest Rate Type ($145.2M) Weighted average fixed rate yield of 10.6%1 Weighted average floating rate yield of 10.0%1 (1) Weighted average fixed and floating rate current yield is based upon the stated coupon rate and fair value of outstanding debt instruments at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. Portfolio Review: Total Quarter End Asset Mix

Total Quarter End Industry Breakdown Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills.

Strategy Update

Background In February 2020, Great Elm Group, Inc. the parent of GECC’s external investment manager, added three new board members with significant investment management experience Began process of reshaping the investment management business In 2H 2020, the Investment Committee and Investment Process were revamped Added Jason Reese and Matt Kaplan to the Investment Committee In 1Q 2021, Erik Falk replaced the last legacy Full Circle director at GECC Mr. Falk, Head of Strategy at Magnetar, brings credit market insights as well as asset management and BDC experience to GECC In 4Q 2021, Great Elm Specialty Finance was formed with Michael P. Keller as President Mr. Keller brings significant experience in direct lending with a focus on asset-based lending, having managed over $20 billion in assets across various lending strategies In 1Q 2022, GECC transitioned its executive leadership and reshuffled its board Peter Reed resigned as CEO and Chairman of the Board and Matt Kaplan was named CEO Matthew Drapkin, a large shareholder of GECC through Northern Right Capital Management, appointed Chairman of the Board Two new independent director joined with significant financial and operational experience.

Investment Approach Changes Leadership Changes Led to New Investment Approach Objectives: Increase Allocation to Specialty Finance through: Equity Investments in Specialty Finance Companies (“SFCs”) Direct Credit Investments and Participations Creation of Great Elm Specialty Finance (“GESF”) with experienced leadership Increase Quality of Portfolio with Focus on Performing Credit Reduce Portfolio Concentration / Increase Diversification of non-Specialty Finance Portfolio Increase Scale by Raising Equity and Debt Capital

Increasing Focus and Allocation in Specialty Finance GECC’s Specialty Finance Platform is led by Michael Keller as it continues to expand across the “Continuum of Lending” Equity ownership in SFCs generates two levels of unique and proprietary investment exposure for investors: We believe direct investments in SFCs are largely uncorrelated to the broader syndicated credit market and have the potential to offer attractive risk-adjusted returns Ability for GECC to participate directly in underlying transactions originated by SFCs Multiple SFCs owned by one BDC will leverage institutional permanent capital and generate natural referral sources, creating a competitive advantage for the businesses GECC’s growth strategy incorporates building equity stakes in each of the key specialty finance categories across the “Continuum of Lending” as SFCs are challenged from the lack of client “stickiness.” SMBs by their nature are either growing or shrinking (and potentially going out of business) SFCs must continually find new clients as existing clients outgrow the platform, get acquired, or shut down We intend to combat this issue by investing in a number of different SFCs along the “Continuum of Lending” Inventory / P.O. / Other Factoring ABL Leveraged Loan Real Estate Lending Bridge Lending Equipment Lending

Continuum of Lending Benefits A “Continuum of Lending” platform provides significant benefits The Continuum allows lenders to improve “stickiness” of clientele and hold onto key borrowers longer The Continuum provides an ideal platform to cross-sell products and services to a borrower By adding one-stop shop/complimentary loan products, we enhance our ability to hold onto profitable relationships longer, across the lending continuum By having a Continuum of Lending platform, we will be able to offer borrowers economic incentives to stay within the Great Elm family The Continuum allows for customer acquisition costs to be spread across platforms The Continuum provides an incentive within all Specialty Finance verticals to refer business and work in a collaborative manner

Focus and Execution Great Elm is utilizing a 3-pronged approach to build out its specialty finance platform: Strategic Acquisitions: Opportunities which allow Great Elm to further build out its specialty finance platform, expand its continuum of lending strategy and add complementary lines of business. 2019 – Prestige Factoring 2021 – Lenders Funding Provider of Participant Capital to SFCs 2022 – Sterling Commercial Credit Asset Based/Backed Lending Platform Joint Venture/Strategic Relationships: Situations where Great Elm can help a third party platform by providing capital that will allow for larger deal execution. Additionally, Great Elm can partner with banks by providing last out financing on their ABLs or with groups that have specific expertise (i.e. liquidation firms). This strategy should increase overall deal flow to the GESF family and allow Great Elm to piggyback off of partners skill sets to generate attractive risk-adjusted returns. 2022 – Great Elm Utica Equipment Financing JV Direct Originations: Proprietary originations send a clear message to the market that GESF is an active player in the asset backed and specialty finance market. Furthermore, direct originations provide currency that will encourage strategic partners to work with us. If GESF can deliver deal flow, groups with capital will place a premium on working with Great Elm to create a Joint Venture or partnership. Finally, these transactions offer GECC tremendous risk-adjusted investment opportunities.

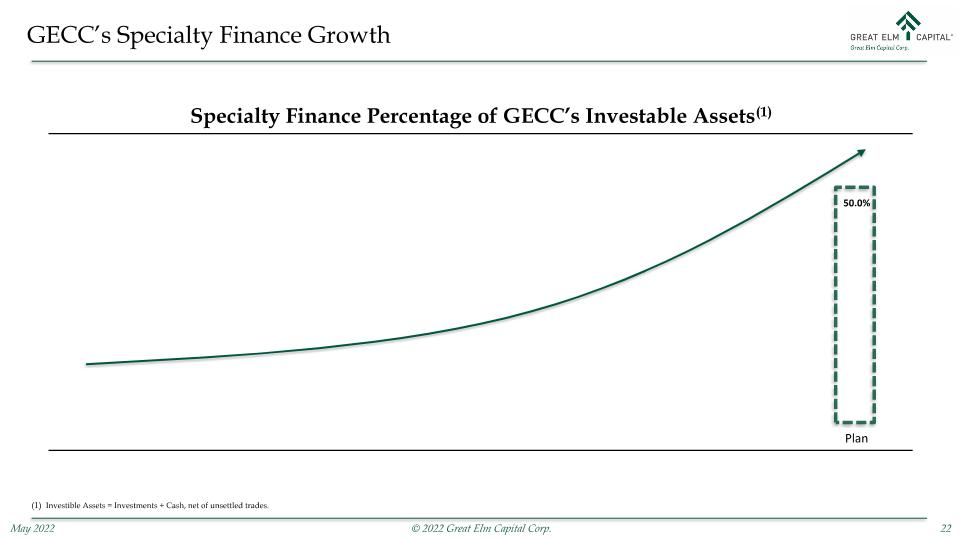

GECC’s Specialty Finance Growth Specialty Finance Percentage of GECC’s Investable Assets(1) Investible Assets = Investments + Cash, net of unsettled trades. Plan 50.0%

Great Elm Specialty Finance

Great Elm Specialty Finance Great Elm Specialty Finance (“GESF”) is a holding company that was created for GECC’s existing Specialty Finance investments and all future specialty finance acquisitions, strategic partnerships, and direct origination opportunities The following chart highlights the GESF’s Organizational Structure including existing platforms (shaded below) and other areas into which GESF may look to expand Direct Origination is critical as these efforts will provide deal flow for all of our specialty finance verticals Great Elm Specialty Finance Prestige Capital Lenders Funding Sterling Commercial Credit Great Elm Utica Real Estate Industry Specific Junior Capital Direct Origination

Provider of “spot factoring” services, providing clients with opportunities to sell individual accounts receivable for upfront payments GESF: Prestige Capital Finance Functional Prestige purchases the individual accounts receivable of creditworthy companies from its clients. It typically advances 75%-85% of the receivable to the client upfront and remits the rest to the client (less Prestige’s fee) upon payment of the receivable Diversified Customer Base Prestige’s clients are generally unable to access traditional bank financing to meet their capital needs but have accounts receivable from creditworthy companies Limited Risk The combination of clients’ capital needs and receivables from creditworthy counterparties allows Prestige to consistently underwrite profitable business while taking limited corporate credit risk Experienced Over 30 years in business and through $6+ billion of transactions factored, Prestige has a track record of strong credit underwriting with minimal losses

GESF: Lenders Funding Private funding and risk sharing source for factors and asset-based lenders Purchases participations in factoring and asset-based lending transactions as well as provides working capital solutions to customers under a variety of lending programs Founder and CEO Robert Zadek continues to lead the business and maintains an equity interest Long-term track record of profitable growth In September 2021, GECC purchased a majority interest in Lenders Funding for $7.25 million, consisting of: $4 million in cash and $3.25 million in GECC shares issued at GECC’s NAV In connection with the transaction, GECC issued to Lenders Funding $10 million of additional GECC shares at NAV in exchange for a subordinated note in an equal principal amount The proceeds from the transaction were retained by Lenders Funding to help support the growth of the business Transaction Details

GESF: Sterling Commercial Credit Provider of asset-based loans to small and middle market companies throughout the United States Provides short term, asset-based loans and working capital solutions to small businesses with annual sales typically between $3 Million and $10 Million Management continues to lead the business and maintains an equity interest Long-term track record of profitable growth In February 2022, GECC purchased a majority interest in Sterling for $7.5 million, consisting of: $4.9 million in cash and $2.6 million in GECC shares issued at GECC’s NAV In connection with the acquisition, GECC provided subordinated debt to Sterling to fund growth initiatives The proceeds from the transaction were retained by Sterling to help support the growth of the business Transaction Details

GESF: Great Elm Utica Great Elm Utica (“GEU”) is a JV formed to leverage the equipment financing track record and expertise of Utica LeaseCo (“Utica”) with the permanent capital of GECC Utica’s expertise in appraising and liquidating equipment will allow the JV to finance deals with hard asset coverage In addition to Utica’s current business, GEU will allow Utica to go up-market and originate larger deals with higher credit quality clients Efficient JV structure leverages Utica’s infrastructure to support monitoring and servicing functions In February 2022, GECC entered into a joint venture with Utica for the purpose of co-investing in proprietary equipment financings originated by Utica. GECC plans to provide subordinated debt, subject to approval of Utica’s senior lender, and equity alongside Utica’s co-founders to jump start the entity and begin funding its growth GEU plans to raise senior financing to support asset growth Transaction Details

Financial Review (Quarter Ended 3/31/2022)

Financial Review: Per Share Data Q1/20211 Q2/20211 Q3/20211 Q4/20211,2 Q1/20221,3 Earnings Per Share (“EPS”) $3.22 $0.63 ($0.79) ($4.95) ($1.12) Net Investment Income (“NII”) Per Share $0.39 $0.54 $0.39 $1.58 $1.31 Net Realized Gains / (Losses) Per Share ($0.84) ($0.60) $0.42 ($1.26) ($4.37) Net Unrealized Gains / (Losses) Per Share $3.67 $0.69 ($1.60) ($5.27) $1.94 Net Asset Value Per Share at Period End $23.36 $23.40 $22.17 $16.63 $15.06 Distributions Paid / Declared Per Share $0.60 $0.60 $0.60 $0.60 $0.60 The per share figures are based on a weighted average outstanding share count for the respective period after considering the effect of the 6-for-1 reverse split effective on February 28, 2022. In the quarter ended December 31, 2021, GECC reversed approximately $5.2 million of previously accrued incentive fees which benefited NII by $1.16 per share in the period. In the quarter ended March 31, 2022, GECC reversed approximately $4.9 million of previously accrued incentive fees which benefited NII by $1.06 per share in the period. Financial Highlights – Per Share Data

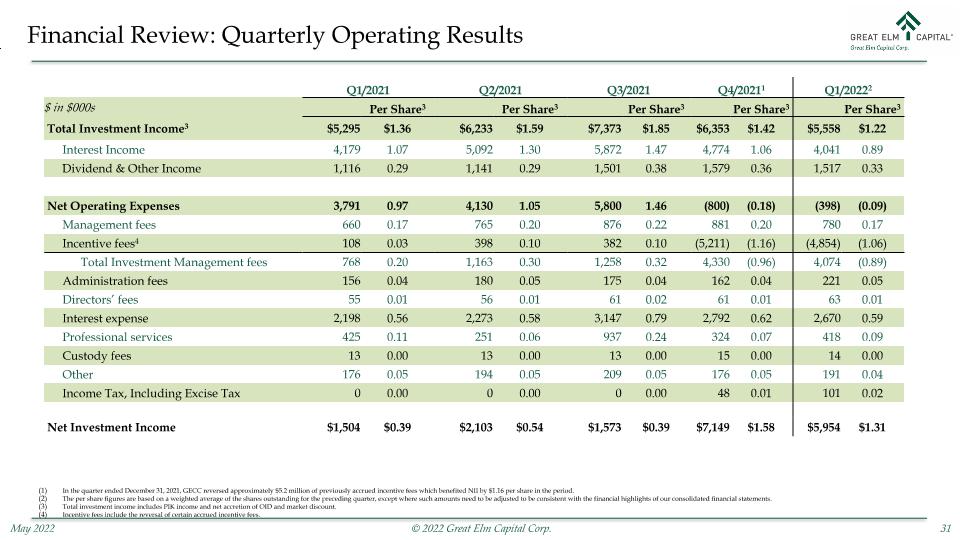

Financial Review: Quarterly Operating Results In the quarter ended December 31, 2021, GECC reversed approximately $5.2 million of previously accrued incentive fees which benefited NII by $1.16 per share in the period. The per share figures are based on a weighted average of the shares outstanding for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. Total investment income includes PIK income and net accretion of OID and market discount. Incentive fees include the reversal of certain accrued incentive fees. Q1/2021 Q2/2021 Q3/2021 Q4/20211 Q1/20222 $ in $000s Per Share3 Per Share3 Per Share3 Per Share3 Per Share3 Total Investment Income3 $5,295 $1.36 $6,233 $1.59 $7,373 $1.85 $6,353 $1.42 $5,558 $1.22 Interest Income 4,179 1.07 5,092 1.30 5,872 1.47 4,774 1.06 4,041 0.89 Dividend & Other Income 1,116 0.29 1,141 0.29 1,501 0.38 1,579 0.36 1,517 0.33 Net Operating Expenses 3,791 0.97 4,130 1.05 5,800 1.46 (800) (0.18) (398) (0.09) Management fees 660 0.17 765 0.20 876 0.22 881 0.20 780 0.17 Incentive fees4 108 0.03 398 0.10 382 0.10 (5,211) (1.16) (4,854) (1.06) Total Investment Management fees 768 0.20 1,163 0.30 1,258 0.32 4,330 (0.96) 4,074 (0.89) Administration fees 156 0.04 180 0.05 175 0.04 162 0.04 221 0.05 Directors’ fees 55 0.01 56 0.01 61 0.02 61 0.01 63 0.01 Interest expense 2,198 0.56 2,273 0.58 3,147 0.79 2,792 0.62 2,670 0.59 Professional services 425 0.11 251 0.06 937 0.24 324 0.07 418 0.09 Custody fees 13 0.00 13 0.00 13 0.00 15 0.00 14 0.00 Other 176 0.05 194 0.05 209 0.05 176 0.05 191 0.04 Income Tax, Including Excise Tax 0 0.00 0 0.00 0 0.00 48 0.01 101 0.02 Net Investment Income $1,504 $0.39 $2,103 $0.54 $1,573 $0.39 $7,149 $1.58 $5,954 $1.31

Financial Review: Portfolio Q1/2021 Q2/2021 Q3/2021 Q4/2021 Q1/2022 Capital Deployed $58.4 million $49.9 million $72.3 million $34.2 million $27.4 million Investments Monetized $28.3 million $35.5 million $30.0 million $40.3 million $26.9 million Total Fair Value of Investments at Period End1 $193.6 million $209.4 million $246.7 million $212.1 million $199.3 million Net Asset Value at Period End $91.5 million $91.7 million $99.4 million $74.6 million $69.3 million Total Assets at Period End $371.4 million $397.8 million $415.2 million $426.3 million $315.8 million Total Debt Outstanding at Period End (Par Value) $118.7 million $138.4 million2 $151.7 million $145.9 million $145.9 million Debt to Equity Ratio at Period End 1.30x 1.51x 1.53x 1.96x 2.11x Cash at Period End3 $26.6 million $29.1 million4 $20.6 million $9.1 million $8.5 million Total Fair Value of Investments does not include investments in short-term securities, including United States Treasury Bills. Total debt outstanding excludes the Company’s 6.50% senior notes due 2022 (NASDAQ: GECCL), which were called prior to quarter end and subsequently redeemed at 100% of their principal amount, plus accrued and unpaid interest through the redemption date on July 23, 2021. Cash does not include our holdings in United States Treasury Bills or Restricted Cash. Comprised of $59.8 million of gross cash less $30.7 million reserved for the July 23rd redemption of our unsecured notes due 2022 Financial Highlights - Portfolio

Distributions

Distributions: Quarterly Cash Dividends In addition, our Board of Directors has approved a $0.45 per share cash distribution for the quarter ending September 30, 2022. The distribution is contingent on an asset coverage ratio of 150% or greater at the time such distribution is paid Annualized, the distribution equates to a 12.8% dividend yield on our closing market price on May 10, 2022 of $14.06 and a 12.0% dividend yield on our pro forma NAV of $15.06 per share The record and payment dates for the distribution are expected to be set in the third quarter, pursuant to authority granted by our Board of Directors On March 4, 2022, we announced that our Board of Directors approved a quarterly dividend of $0.45 per share for the quarter ending June 30, 2022 The second quarter distribution will be payable on June 30, 2022 to stockholders of record as of June 23, 2022 Quarterly Distributions Quarter Ending September 30, 2022 Quarter Ending June 30, 2022

General Risks Debt instruments are subject to credit and interest rate risks. Credit risk refers to the likelihood that an obligor will default in the payment of principal or interest on an instrument. Financial strength and solvency of an obligor are the primary factors influencing credit risk. In addition, lack or inadequacy of collateral or credit enhancement for a debt instrument may affect its credit risk. Credit risk may change over the life of an instrument, and debt instruments that are rated by rating agencies are often reviewed and may be subject to downgrade. Our debt investments either are, or if rated would be, rated below investment grade by independent rating agencies. These “junk bonds” and “leveraged loans” are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may be illiquid and difficult to value and typically do not require repayment of principal before maturity, which potentially heightens the risk that we may lose all or part of our investment. Interest rate risk refers to the risks associated with market changes in interest rates. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate obligations) or directly (especially in the case of an instrument whose rates are adjustable). In general, rising interest rates will negatively impact the price of a fixed rate debt instrument and falling interest rates will have a positive effect on price. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). GECC utilizes leverage to seek to enhance the yield and net asset value of its common stock. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk, including the potential for higher volatility and greater declines of GECC’s net asset value, fluctuations of dividends and other distributions paid by GECC and the market price of GECC’s common stock, among others. The amount of leverage that GECC may employ at any particular time will depend on, among other things, our Board’s and our adviser’s assessment of market and other factors at the time of any proposed borrowing. As part of our lending activities, we may purchase notes or make loans to companies that are experiencing significant financial or business difficulties, including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financings may result in significant financial returns to us, they involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties is unusually high. We cannot assure you that we will correctly evaluate the value of the assets collateralizing our investments or the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a portfolio company, we may lose all or part of the amounts advanced to the borrower or may be required to accept collateral with a value less than the amount of the investment advanced by us to the borrower.

Investor Relations Contact: Garrett Edson investorrelations@greatelmcap.com Contact Information