| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a–12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

Vertiv Holdings Co 505 N. Cleveland Avenue Westerville, Ohio 43082 April 26, 2024 |

|

Annual Meeting of Stockholders – June 19, 2024

Dear Stockholder,

On behalf of the Board of Directors of Vertiv Holdings Co (“Vertiv”), I am pleased to invite you to participate in Vertiv’s 2024 Annual Meeting of Stockholders on June 19, 2024, at 11 a.m. Eastern time. The meeting will be virtual and can be accessed via live webcast at the following address www.virtualshareholdermeeting.com/VRT2024.

We encourage you to review the proxy statement, which contains important information about the stockholder meeting, our nominees for election to our Board of Directors, and executive compensation, among other important disclosures.

Whether or not you plan to participate in the meeting, it is important that your shares be represented. Please vote your shares via the internet, the toll-free telephone number provided or, if you received a paper copy of a proxy card or voter instruction form by mail, you may vote your shares by completing, signing, dating, and returning your proxy card or voter instruction form in the postage-paid envelope.

We value you as one of our stockholders, we appreciate your investment in Vertiv, and we welcome your participation in our upcoming stockholder meeting.

| Kind regards, | ||

| ||

| David M. Cote Executive Chairman of the Board | ||

|

Notice of Annual Meeting of Stockholders

To be held on June 19, 2024

11:00 a.m. (ET)

|

Notice is hereby given that the 2024 annual meeting of stockholders (the “Annual Meeting”) of Vertiv Holdings Co, a Delaware corporation (the “Company,” “Vertiv” or “we”), will be held on June 19, 2024 at 11:00 a.m. (Eastern Time), via live webcast at the following address www.virtualshareholdermeeting.com/VRT2024. We are holding the meeting for the following purposes:

| 1. | Election of Directors. Elect eleven directors to our Board of Directors, each for a term of one year expiring at the 2025 annual meeting of stockholders and until such director’s successor has been duly elected and qualified; |

| 2. | Say-On-Pay. Approve, on an advisory basis, the 2023 compensation of our named executive officers as disclosed in the accompanying proxy statement; and |

| 3. | Independent Auditor. Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

Only stockholders of record as of the close of business on April 22, 2024 (the “Record Date”) will be entitled to virtually attend or vote at the Annual Meeting or any adjournment or postponement thereof. A complete list of these stockholders will be available on the bottom panel of your screen during the meeting after entering the 16-digit control number included on the Notice of Internet Availability of Proxy Materials or any proxy card that you received, or on the materials provided by your bank or broker.

To facilitate voting, Internet and telephone voting are available. The instructions for voting are on the proxy card. If you hold your shares through a bank, broker, or other holder of record, please follow the voter instruction form you received from the holder of record.

The 2024 Annual Meeting will be virtual. You may attend the Annual Meeting and vote your shares electronically during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/VRT2024. You will need the 16-digit control number that is printed on your proxy card, voter instruction form or Notice of Internet Availability of Proxy Materials, to enter the Annual Meeting. Vertiv recommends that you log in 15 minutes before the Annual Meeting to ensure you are logged in when the Annual Meeting starts.

Your vote is important. Please act as soon as possible to vote your shares, whether or not you plan to virtually attend the Annual Meeting. Additionally, please mark, sign, date, and return the accompanying proxy card or voter instruction form in the postage-paid envelope or vote by telephone or via the Internet. Instructions are included on your proxy card, voter instruction form or Notice of Internet Availability of Proxy Materials.

April 26, 2024

| ||

| Stephanie L. Gill Chief Legal Counsel and Corporate Secretary | ||

These materials were first sent or made available to shareholders on April 26, 2024.

Table of Contents

| 1 | ||||

| 6 | ||||

| 10 | ||||

| 10 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| Attendance at Board of Directors and Committee Meetings and Annual Meeting |

18 | |||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 23 | ||||

| 26 | ||||

| 26 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| Understanding Our Summary Compensation Table and Grants of Plan-Based Awards in Fiscal 2023 Table |

38 | |||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 43 | ||||

| 44 | ||||

| 48 | ||||

| PROPOSAL 2: ADVISORY VOTE TO APPROVE COMPENSATION OF NAMED EXECUTIVE OFFICERS |

49 | |||

| PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

50 | |||

| INFORMATION REGARDING INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

51 | |||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| Submission of Stockholder Proposals at Next Year’s Annual Meeting |

57 | |||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

|

|

|

- 2024 Proxy Statement | i |

PROXY SUMMARY

This Proxy Summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. Please read the entire proxy statement carefully before voting.

Meeting Details

| • Time and Date: |

June 19, 2024 (11:00 a.m. Eastern Time) | |||

| • Place: |

Virtual Meeting (see www.virtualshareholdermeeting.com/VRT2024) | |||

| • Record Date: |

April 22, 2024 | |||

| • Voting: |

Stockholders of Vertiv as of the Record Date are entitled to vote. Each share of Vertiv Class A common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted upon at the Annual Meeting. | |||

Meeting Agenda

|

|

Item |

|

Proposal | Board’s Voting Recommendation |

Page Reference | |||||

| ➊ | Election of Directors

Elect eleven directors to our Board of Directors, each for a term of one year expiring at the 2025 annual meeting of stockholders and until such director’s successor has been duly elected and qualified; |

FOR (each nominee) |

10 | |||||||

| ➋ | Say-on-Pay

Approve, on an advisory basis, the 2023 compensation of our named executive officers as disclosed in the accompanying proxy statement; and |

FOR | 49 | |||||||

| ➌ | Independent Auditor

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

FOR | 50 | |||||||

2023 Performance

After developing a strategic framework in 2022 to strengthen and improve our operational and financial performance, 2023 was a year of transformative growth for our business driven by our relentless pursuit of operational excellence and execution. Throughout 2023, we aggressively focused and executed on our strategic priorities: institutionalizing operational excellence and execution; building a high-performance culture of collaboration, accountability, and innovation; and delivering profitable growth and improved cash flow. Laser focused on operational execution, we continued to implement our Vertiv Operating System, strengthened supply chain resiliency, and significantly expanded and enhanced our manufacturing capacity, footprint and capabilities. Moreover, we collaborated and deepened our relationships with our customers and technology partners to strengthen our market leadership position, doubling down on our efforts to develop and deliver innovative, highly efficient and reliable products and services for our customers today and the next generation of technologies for the future.

With the proliferation of data traffic growth and the credible, unprecedented acceleration and demand for artificial intelligence (“AI”), demand for our products, software, and services remained strong throughout 2023. We delivered profitable growth and improved cash flow, and repeatedly raised and exceeded financial guidance across key financial metrics over the course of the year. Based upon this strong performance, our Board of Directors authorized an increase in our annual cash dividend, as well as our first share repurchase program, as part of our overall capital deployment strategy to provide greater flexibility in returning capital to shareholders.

|

|

|

- 2024 Proxy Statement | 1 |

By the numbers, we ended 2023 with the strongest financial results in our history, with full year net sales rising 21% over prior year to ~$6.9 billion, record backlog of ~$5.5 billion (an increase of 16% over prior year), operating profit increasing 290% over prior year to ~$872 million, and adjusted free cash flow of ~$778M (up more than $1 billion over prior year). In short, 2023 was a year of operational and financial transformation, culminating in our strongest financial results in history and delivering on our commitments to our employees, customers and shareholders.

Because of the cumulative efforts of all of our employees, and the relentless pursuit of operational excellence, underpinned by having the right leadership in place and the enduring strength of our customer and technology partnerships, we are well positioned for sustained short- and long-term growth and value creation for our shareholders.

Strategic Compensation-Related and Other Actions to Position Us for Long-Term Growth

During 2023, we were laser focused on operational excellence and execution, and building a high-performance culture throughout our company, including operations, manufacturing, supply chain, and other disciplines within our business. In response to the unprecedented growth in data and the increasing demands and acceleration that AI is presenting in our industry, we took focused actions against the strategic framework we laid out in 2022 to improve operational and financial performance, to enhance and expand our capacity and capabilities to meet customer demand, to retain and attract top talent, and to position our business for short- and long-term growth in the face of geopolitical and macroeconomic uncertainty. For example:

| ✓ | Continued Focus on Pay for Performance. As described in more detail in the “Compensation Discussion and Analysis” below, our executive compensation program focused on performance. For example, cash bonus payouts for named executive officers were generally above target due to our strong financial performance in 2023 and achievement of results above our financial targets. We continued to focus on annual equity grants in the form of stock options, which only have value if our stockholders receive value through stock price increases. |

| ✓ | Strategic Restricted Stock Equity Awards for Non-Executives. The Compensation Committee authorized our CEO to grant special, strategic Restricted Stock equity awards to certain eligible non-executive employees to incentivize them for the achievement of results above the financial metrics for our annual incentive plan and in recognition of strong 2023 financial performance for the business. These awards were in addition to the cash bonus payouts to |

| 2 | |

|

- 2024 Proxy Statement |

| eligible employees and were issued in an effort to align with our pay for performance focus and to promote the long-term retention of the business leaders that the Company needs to attain such goals. |

| ✓ | Successful Leadership Transition. In January 2023, we successfully transitioned leadership of our business to Giordano Albertazzi, our CEO. As such, our compensation program decisions supported this successful transition, and encouraged Mr. Albertazzi to focus his efforts on key priorities, such as operational excellence and execution, building a high-performance culture, and delivering profitable growth and improved cash flow. See the “Compensation Discussion and Analysis” for more information. |

| ✓ | Cost Mitigation. We continued to take decisive actions to enhance supply chain resiliency, mitigate inflationary pressures from material and labor costs through the qualification and on-boarding of alternate suppliers, analyze and reduce discretionary spending, and other actions targeted to keep fixed costs constant. |

| ✓ | Supply Chain Improvements. We continued our global cadence of reviewing both internal and external supply chain challenges to address inflationary costs and labor and parts shortages. We continued our focused efforts on supplier diversity and resiliency, as well as engineering redesign initiatives, to enable us to qualify alternate part and component suppliers for our products and improve supplier delivery times and reductions in cost. Further, we maintained our “in region, for region” supply base emphasis to focus suppliers in region on delivering parts and components for our operations in the region. |

| ✓ | Attracting and Retaining of Our Workforce Talent. As we continue to position our business for short- and long-term growth, we maintained our focused approach regarding retention of our employee talent pool, and efforts to attract, hire and retain talent, particularly in our engineering, research and development and operations teams. We have continued to grow in a reasonable manner despite a competitive labor environment and rising labor costs in 2023. |

| ✓ | Management Focus. Our entire management team, together with our Executive Chairman as further described in the “Board of Directors Leadership Structure” below, is actively involved in setting and implementing our strategic priorities and responding to the opportunities and challenges we faced as a company in 2023. |

| ✓ | Price Actions. We continued our relentless focus on pricing actions to mitigate inflationary pressures on materials and labor, and we realized $470 million in price in 2023. Also see other financial highlights in the “Compensation Discussion and Analysis” below. |

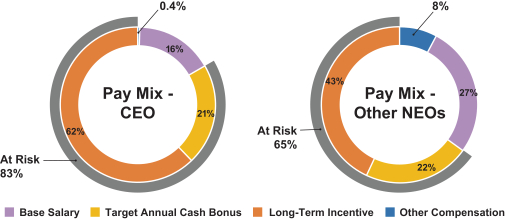

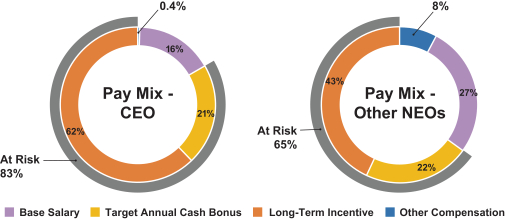

Compensation Packages Are Strongly Aligned with Stockholder Interests

The following charts show the mix of the primary compensation elements for 2023 for our CEO and our other NEOs, including salary, target annual cash incentive, annual long-term incentive awards granted during the year (in the form of stock options, excluding the one-time performance equity awards)(1) and other benefits. As reflected in the charts below, we have structured executive compensation, particularly for the CEO, to be performance-based and aligned with stockholder value.

| (1) | See the “Compensation Discussion and Analysis—2023 Summary” below for an explanation of amounts excluded from these charts. |

|

|

|

- 2024 Proxy Statement | 3 |

CEO Compensation Is Focused on Variable Pay

Mr. Albertazzi’s primary compensation opportunities for 2023, are summarized below:

| 2023 Compensation of Our CEO (Mr. Albertazzi) | 2023 | |||

| Base Salary |

$900,000 | |||

| Target Cash Bonus (as % of Base Salary) |

125% | |||

| Approximate Grant Date Fair Value of Annual Equity Awards Granted |

$3.3 M | |||

Corporate Governance Highlights

| ✓ | Annual Full Board Elections. We provide for director elections on an annual basis to provide our stockholders with regular input on the composition of our Board of Directors. |

| ✓ | Separate Chairman and CEO Roles. We believe that, at this time, our continuing separation of the roles of CEO and Chairman enables the Board of Directors to effectively exercise its role in oversight of Vertiv while allowing our CEO to focus on the management of the day-to-day conduct of our business. See “Board of Directors Leadership Structure” below for further information. |

| ✓ | Code of Conduct. We have a code of conduct that applies to all our directors, officers and other employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The code of conduct, along with other corporate governance documents, is available on our website, https://investors.vertiv.com/corporate-governance/documents/default.aspx. |

| ✓ | No Poison Pill. Vertiv does not maintain a poison pill or stockholder rights plan. |

| ✓ | Robust Stock Ownership Guidelines. We require executive officers and directors to hold meaningful amounts and values of stock and to meet certain other guidelines, as further set forth below under “Stock Ownership Guidelines for Company Officers and Directors.” Further, the Company adopted a “no sale” restriction that restricts an executive officer from selling stock until such officer has met or exceeds ownership guidelines. All of our executive officers and directors have met or are on their way to meeting these guidelines within the applicable time period. |

| ✓ | Prohibition of Hedging and Pledging. Our insider trading policy prohibits our officers, directors and employees from hedging or pledging our shares. |

Commitment to Responsible Business Initiatives

Vertiv continues to advance our efforts with certain responsible business initiatives. In particular:

| ✓ | Reporting — We issued our second annual ESG report in 2023, which was aligned to certain elements of the Sustainability Accounting Standards Board (“SASB”), Task Force on Climate-Related Financial Disclosures (“TCFD”), and Global Reporting Initiative (“GRI”) frameworks and select United Nations Sustainable Development Goals (“UNSDGs”) that we viewed as most relevant to our business. |

| ✓ | Governance — We intend to continue to hold ourselves to high governance standards. In 2023, our Responsible Business Steering Committee continued to develop our responsible business strategies, evaluate related disclosure frameworks for public reporting, and apprised our Board of Directors on various responsible business topics. |

| ✓ | Efficient Products and Systems — We continued to innovate and develop products, services and solutions that help enable our customers to meet their energy efficiency and environmental-related goals, such as the New Vertiv™ TimberMod™ variant, which can significantly reduce a customer’s carbon footprint as compared to steel modular structures, and the Vertiv™ Liebert® HPC-S Aircooled Freecooling Chiller Range with Scroll Compressor and low-Global Warming Potential (“GWP”) refrigerant, which is designed to reduce CO2e emissions, increase seasonal efficiency, and lower annual energy consumption. Our approach to meeting our customers’ demands of growing critical digital infrastructure, while enabling them to reduce their impact on the environment, rests on five key principles that we strive to achieve when developing and delivering high-performing, energy and water efficient products, services and solutions: |

| • | High efficiency: Continuously designing products and solutions that improve upon energy and water efficiency. |

| • | High reliability: Building resilient and highly serviceable equipment that’s durable and long lasting. |

| • | Low impact: Striving to reduce the life cycle carbon emissions of products by using lower carbon construction materials, such as low GWP refrigerants and mass timber, and building them in manufacturing facilities with lower carbon footprints. |

| 4 | |

|

- 2024 Proxy Statement |

| • | Low touch: Enabling remote troubleshooting, optimization services, and more connected systems to improve and reduce the environmental impact of maintenance practices. |

| • | Circular economy: Seeking to increase our use of recycled materials in our products and product packaging and to reuse, refurbish, or recycle end-of-life equipment and materials. |

| ✓ | Responsible Operations — We continued to benchmark our operations by collecting and evaluating our greenhouse gas emissions inventory in an effort to refine internal plans to reduce our carbon emissions and the waste footprint of our own operations, in addition to helping reduce our customers’ impacts on the environment through our energy and water efficient operations and products. |

| ✓ | Our Neighbors — We believe our success is intrinsically linked to our responsibility towards the planet, our employees, customers, communities, and other stakeholders we serve, and the ethical values that underpin our corporate culture. In 2023, together with our employees and their families, Vertiv supported various organizations and activities within our local communities all around the world, whether by providing volunteer services or monetary donations. Examples include, Columbus Crew STEM Day, PCsForPeople, iMasons JASON Learning Initiative, Pelotonia, SOS Satele Copiilor Romania Youth Can program, Treedom, and other environmental and social impact projects. |

| ✓ | Our People — As further described in the “Compensation Discussion and Analysis” below, our Compensation Committee demonstrated strong leadership by recognizing and rewarding our management team’s strong performance in delivering transformative results by paying above target bonuses, generally, to our NEOs for 2023 and to eligible non-executive employees. These bonuses were paid in recognition of company and individual performance results, and are in furtherance of our pay for performance culture and in an effort to maximize the retention of our employees who helped us implement and deliver strong results against our strategic framework in 2023. We recognize that our employees are critical to achieving our strategic priorities and business objectives, and investing in them is a key component to our success. |

We provide development and training programs for our employees, including new product training for our sales and services organizations, “Managing@Vertiv” for our management level employees, and “MyFirst90Days” for newly hired employees as key human capital measures and objectives. Additionally, our salaried and services employees participate in our comprehensive annual performance review process meant to encourage a direct conversation where candid feedback can be shared to help our employees develop, achieve their career goals, and drive our high-performance culture.

Further, we offer leadership development programs for employees at the early career levels in finance, sales, services and engineering and customized programs for target populations to further develop their skills, and specialized partnership programs with local universities that lead to obtaining bachelors and/or masters degrees in technology.

Our offerings include:

| • | Finance, Sales, Engineering, and Field Services Leadership Development Rotational Programs for early-career employees based in the Americas, India, or Europe, Middle-East, and Africa reporting units. |

| • | Specialized partnership programs with local universities in India for high-potential engineers to earn a post-secondary baccalaureate and/or a graduate degree. |

| • | Programs for identified high-potential leaders in early-, mid-, senior-, and leadership-ready positions across multiple functions globally that focus on training in the areas of operational and strategic thinking, offers the opportunity to participate and lead global projects, and obtain global networking & visibility to executive leadership. |

| • | Specialized training for employees based in our support hubs, located in the Philippines and Romania, around key business skills including customer service, finance fundamentals and customer service mindset. |

| • | VOS training is delivered globally. This training, known as VOS Academy, is offered virtually for salaried employees and all hourly employees receive training at our global manufacturing sites.” |

| ✓ | Safety. We employ a sophisticated global occupational health and safety management system designed to monitor, track, and improve processes and procedures to enhance employee safety. Utilizing this system to enable continual improvement in our safety programs, we have achieved some of the lowest injury rates in our industry. Additionally, we have a dedicated team of environmental, health and safety professionals throughout our facilities and service regions, as well as on-site medical services at many of our manufacturing facilities. We believe a safe and healthy workplace is essential to flourish as a business. We prioritize the health and safety of our global workforce and anyone who enters our facilities or interacts with our products. We believe we have an effective employee, health and safety strategy, as evidenced by our strong safety record, including our total recordable injury rate of 0.27 and our lost time incident rate of 0.16 relative to certain peers. Safety is of fundamental importance to us. We aim to provide the tools, training, and other resources needed to achieve our goal of reducing and controlling workplace risks and creating an injury-free workplace. We believe that employee engagement is essential to our continuous improvement efforts. One way we measure proactive engagement is through our “good catch” initiative that encourages reporting of safety observations, hazards, and suggestions for improvement. We encourage, value and recognize employees who provide input, and through documented procedures, our local management teams respond promptly to address any observed matters. |

|

|

|

- 2024 Proxy Statement | 5 |

GENERAL INFORMATION

We are making this proxy statement available to our stockholders on or about April 26, 2024 in connection with the solicitation of proxies by our Board of Directors for the Annual Meeting, which will be held on June 19, 2024 at 11:00 a.m. (Eastern Time), via live webcast at the following address www.virtualshareholdermeeting.com/VRT2024. The Annual Meeting will be completely virtual. You may attend the Annual Meeting and vote your shares electronically during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/VRT2024. You will need the 16-digit control number that is printed on your proxy card, voter instruction form or Notice of Internet Availability of Proxy Materials, to enter the Annual Meeting. Vertiv recommends that you log in 15 minutes before the meeting to ensure you are logged in when the Annual Meeting starts. Please note that you will not be able to attend the Annual Meeting in person. Below are answers to common questions stockholders may have about the Annual Meeting. Our fiscal year ends on December 31.

We have one class of outstanding common stock, our Class A common stock, which has one vote per share. Shares of our common stock generally vote together as a single class on all matters submitted to a vote of our stockholders.

What information is included in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, our Board of Directors, Board Committees and corporate governance matters, the compensation of current directors and certain executive officers for the year ended December 31, 2023, and other information.

What are the Proxy Materials?

The “Proxy Materials” are this proxy statement and our annual report to stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (referred to herein as the “Form 10-K”).

Why did I receive a one-page notice in the mail regarding the Internet Availability of the Proxy Materials instead of a full set of the Proxy Materials?

Pursuant to rules adopted by the Securities and Exchange Committee (“SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, we have elected to furnish our Proxy Materials via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders. All stockholders will have the ability to access the Proxy Materials on the website referred to in the Notice of Internet Availability of Proxy Materials or request to receive an electronic copy or printed set of the Proxy Materials. Instructions on how to access the Proxy Materials over the Internet or to request an electronic copy or printed copy may be found in the Notice of Internet Availability of Proxy Materials. In addition, stockholders may request to receive the Proxy Materials in printed form by mail or electronically by email on an ongoing basis.

What items will be voted on at the Annual Meeting and how does the Board of Directors recommend that I vote?

There are three proposals to be voted on at the Annual Meeting:

| 1. | Election of Directors: elect eleven directors to our Board of Directors for a term of one year expiring at the annual meeting of stockholders to be held in 2025 and until such director’s successor has been duly elected and qualified; |

| 2. | Say-on-Pay: approve, on an advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement; and |

| 3. | Independent Auditor: ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

The Board of Directors recommends that you vote FOR each nominee in proposal 1, and FOR each of proposals 2 and 3.

Our bylaws provide advance notice procedures for stockholders seeking to bring business before our Annual Meeting, or to nominate candidates for election as directors at any meeting of stockholders. We have not received any such proposals. We do not anticipate any other matters will come before the Annual Meeting. If any other matter comes before the Annual Meeting, the proxy holders appointed by our Board of Directors will have discretion to vote on those matters.

Who may vote at the meeting?

Holders of Class A common stock, together as a single class, as of the close of business on April 22, 2024, the Record Date, may vote at the Annual Meeting.

| 6 | |

|

- 2024 Proxy Statement |

How many votes do I have?

As of the Record Date, there were 374,344,987 shares of Class A common stock outstanding. Holders of Class A common stock are entitled to one vote per share of Class A common stock held as of the Record Date.

What vote is required for each proposal?

For proposal 1, the election of directors, each director must be elected by a plurality of the votes cast by the stockholders present in person or represented by proxy at the meeting and entitled to vote thereon. This means that the eleven nominees receiving the largest number of “FOR” votes will be elected as directors.

Proposal 2, the approval, on an advisory basis, of the compensation of our named executive officers, proposal 3, the ratification of the appointment of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and any other proposals that may properly come before the Annual Meeting must be approved by the affirmative vote of a majority of the votes cast by stockholders present in person or represented by proxy and entitled to vote thereon.

How are abstentions and broker non-votes counted?

Abstentions (shares present at the meeting in person or by proxy that are voted “abstain”) and broker non-votes (explained below) are counted for the purpose of establishing the presence of a quorum but are not counted as votes cast in respect of proposals 1, 2 and 3 to be voted on at the Annual Meeting, and as a result, have no impact on those proposals.

What constitutes a “quorum”?

The holders of a majority of the voting power of the shares of Class A common stock issued, outstanding and entitled to vote at the Annual Meeting, either in person or represented by proxy, constitute a quorum.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

| • | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are a stockholder of record. |

| • | Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are a beneficial owner of shares held in street name. The organization holding your account is considered the stockholder of record. As a beneficial owner, you have the right to direct the organization holding your account on how to vote the shares you hold in your account. |

How do I vote?

| • | Vote by Internet. Visit www.proxyvote.com to vote via the Internet. Stockholders of record may submit proxies over the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials or, if printed copies of the Proxy Materials were requested, the instructions on the printed proxy card. Most beneficial stockholders may vote by accessing the website specified on the voter instruction forms provided by their brokers, trustees, banks, or other nominees. Please check your voter instruction form for Internet voting availability. |

| • | Vote by Telephone. Call toll-free 1-800-690-6903 in the United States or from foreign countries from any touch-tone telephone and follow the instructions. Stockholders of record may submit proxies using any touch-tone telephone from within the United States by following the instructions on the Notice of Internet Availability of Proxy Materials or, if printed copies of the Proxy Materials were requested, the instructions on the printed proxy card. Most beneficial owners may vote using any touch-tone telephone from within the United States by calling the number specified on the voter instruction forms provided by their brokers, trustees, banks or other nominees. |

| • | Vote by Mail. Stockholders of record may submit proxies by mail by requesting printed proxy cards and completing, signing and dating the printed proxy cards and mailing them in the pre-addressed envelopes that will accompany the printed Proxy Materials. Beneficial owners may vote by completing, signing and dating the voter instruction forms provided and mailing them in the pre-addressed envelopes accompanying the voter instruction forms. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by that proxy as recommended by the Board of Directors. If you are a beneficial owner and you return your signed voter instruction form but do not indicate your voting preferences, please see “How are abstentions and broker non-votes counted?” regarding whether your broker, bank, or other holder of record may vote your uninstructed shares on each proposal. |

|

|

|

- 2024 Proxy Statement | 7 |

| • | Vote at the Annual Meeting. All stockholders as of the close of business on the Record Date can vote at the Annual Meeting via the Annual Meeting website. There will not be a physical meeting location. Any stockholder as of the Record Date can attend the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/VRT2024 where such stockholders may vote during the Annual Meeting. The Annual Meeting starts at 11 a.m., Eastern Time. We encourage you to allow ample time for online check-in, which will open at 10:45 a.m., Eastern Time. You will need the 16-digit control number that is printed on your proxy card, voter instruction form or Notice of Internet Availability of Proxy Materials, to enter the Annual Meeting. Instructions on who can attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/VRT2024. |

Can I change my vote after submitting a proxy?

Stockholders of record may revoke their proxy at any time before it is exercised at the Annual Meeting by (i) delivering written notice, bearing a date later than the proxy, stating that the proxy is revoked to Vertiv Holdings Co, 505 N. Cleveland Avenue, Westerville, Ohio 43082, Attn: Secretary, (ii) submitting a later-dated proxy relating to the same shares by mail, telephone or the Internet prior to the vote at the Annual Meeting, or (iii) attending the Annual Meeting virtually and voting at the Annual Meeting via the Annual Meeting website. If you are a beneficial stockholder, you may revoke your proxy or change your vote only by following the separate instructions provided by your broker, trust, bank, or other nominee.

If I hold shares in street name through a broker, can the broker vote my shares for me?

If you hold your shares in street name and you do not instruct your broker on how to vote your shares, the broker or other organization holding your shares can vote on certain routine proposals but cannot vote on other proposals. Proposals 1 and 2 are not considered routine proposals. If you hold shares in street name and do not instruct your broker on how to vote on proposal 1 or 2, your shares will not be voted in respect of those proposals and will be counted as “broker non-votes.” Proposal 3 is a “routine” proposal, and your broker has discretion to vote those shares.

Who is paying for this proxy solicitation?

We have retained Georgeson LLC to solicit proxies, for which we will pay a fee of approximately $12,500.00 plus reasonable out-of- pocket expenses. Members of our Board of Directors and officers and employees may solicit proxies by mail, telephone, fax, email or in person. We will not pay directors, officers, or employees any extra amounts for soliciting proxies. We may, upon request, reimburse brokerage firms, banks or similar entities representing street name holders for their expenses in forwarding Proxy Materials to their customers who are street name holders and obtaining their voter instructions.

How can I attend the Annual Meeting?

You may attend the Annual Meeting virtually and vote your shares online during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/VRT2024. You will need the 16-digit control number that is printed on your proxy card, voter instruction form or Notice of Internet Availability of Proxy Materials, to enter the Annual Meeting. If you are a beneficial owner and do not have your 16-digit control number, contact your banker, broker, or other nominee. Please note that you will not be able to physically attend the Annual Meeting in person, but may attend the Annual Meeting in person online.

How can I ask questions at the Annual Meeting?

We have designed the virtual Annual Meeting to provide substantially the same opportunities to participate as stockholders would have at an in-person meeting. Our virtual Annual Meeting will be conducted on the internet via live webcast. Stockholders will be able to attend and participate online and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/VRT2024, as further described above.

The virtual Annual Meeting format allows stockholders to communicate with Vertiv during the Annual Meeting so they can ask questions of Vertiv’s management and Board of Directors, as appropriate. If you wish to submit a question during the Annual Meeting, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/VRT2024, clicking the Q&A button on your screen and typing your question into the provided text field.

We reserve the right to exclude questions regarding topics that are not pertinent to meeting matters or company business or are inappropriate. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition. Any questions that are appropriate and pertinent to the Annual Meeting will be answered in the live Question and Answer session during the Annual Meeting, subject to time constraints. Any such questions that cannot be answered during the Annual Meeting due to time constraints will be posted and answered on our Investor Relations website, www.investors.vertiv.com, as soon as practicable after the Annual Meeting.

| 8 | |

|

- 2024 Proxy Statement |

Additional information regarding the ability of stockholders to ask questions during the Annual Meeting, related rules of conduct, and other materials for the Annual Meeting will be available during the Annual Meeting at www.virtualshareholdermeeting.com/VRT2024.

Who can I contact if I have technical difficulties accessing or participating in the Annual Meeting?

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting login page for assistance. Technical support will be available beginning approximately 15 minutes prior to the start of the Annual Meeting through its conclusion. Additional information regarding matters addressing technical and logistical issues, including technical support during the Annual Meeting, will be available at www.virtualshareholdermeeting.com/VRT2024. The virtual Annual Meeting platform is fully supported across browsers (Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. You should ensure that you have a strong internet connection if you intend to attend and/or participate in the Annual Meeting.

Where can I find voting results?

Final voting results from the Annual Meeting will be filed with the SEC on a Current Report on Form 8-K on or before the fourth business day after the Annual Meeting concludes.

I share an address with another stockholder. Why did we receive only one set of Proxy Materials?

We may satisfy SEC rules regarding delivery of our Proxy Materials, including our proxy statement, or delivery of the Notice of Internet Availability of Proxy Materials, by delivering a single copy of these documents to an address shared by two or more stockholders. This process is known as householding. We have delivered only one set of the Proxy Materials or one Notice of Internet Availability of Proxy Materials, as applicable, to stockholders who share an address with another stockholder, unless contrary instructions were received prior to the mailing date. We undertake to promptly deliver, upon written or oral request, a separate copy of our proxy statement, our annual report including our Form 10-K for the fiscal year ended December 31, 2023 and/or our Notice of Internet Availability of Proxy Materials, as requested, to a stockholder at a shared address to which a single copy of these documents was delivered. To make such a request, please send the request to Vertiv Holdings Co, Attn: Investor Relations, 505 N. Cleveland Avenue, Westerville, Ohio 43082 or calling us at 614.841.6776.

If your shares are held by a brokerage firm or bank and you prefer to receive separate copies of our proxy statement, our annual report including our Form 10-K for the fiscal year ended December 31, 2023 and/or our Notice of Internet Availability of Proxy Materials, either now or in the future, please contact your brokerage firm or bank. If your brokerage firm or bank is unable or unwilling to assist you, please contact our Investor Relations department at our executive office by calling 614.841.6776. Stockholders sharing an address who are receiving multiple copies of the Proxy Materials and/or our Notice of Internet Availability of Proxy Materials may request to receive a single copy of the Proxy Materials and/or our Notice of Internet Availability of Proxy Materials, either now or in the future, by contacting our Investor Relations department at our executive office by calling 614.841.6776.

Whom should I contact if I have additional questions?

You can contact our Investor Relations department at our executive office at 614.841.6776. Stockholders who hold their shares in street name should contact the organization that holds their shares for additional information on how to vote.

We make available, free of charge on our website, all of our filings that are made electronically with the SEC, including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. These filings are available on the Investor Relations page of our corporate website at www.investors.vertiv.com. Copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including financial statements and schedules and amendments thereto filed with the SEC, are also available without charge to stockholders upon written request addressed to:

Vertiv Holdings Co

Attn: Investor Relations

505 N. Cleveland Avenue

Westerville, Ohio 43082

|

|

|

- 2024 Proxy Statement | 9 |

Proposal 1: Election of Directors

At the Annual Meeting, stockholders will vote to elect the eleven nominees named in this proxy statement as directors. Each of the directors elected at the Annual Meeting will hold office until the 2025 annual meeting of stockholders and until his/her successor has been duly elected and qualified. Our Board of Directors has nominated each of David M. Cote, Giordano Albertazzi, Jacob Kotzubei, Matthew Louie, Roger Fradin, Steven S. Reinemund, Joseph van Dokkum, Robin L. Washington, Edward L. Monser, Joseph J. DeAngelo, and Jakki L. Haussler to serve as directors for terms expiring at the 2025 annual meeting of stockholders and until each of their successors has been duly elected and qualified. The persons named as proxies will vote to elect each of David M. Cote, Giordano Albertazzi, Jacob Kotzubei, Matthew Louie, Roger Fradin, Steven S. Reinemund, Joseph van Dokkum, Robin L. Washington, Edward L. Monser, Joseph J. DeAngelo, and Jakki L. Haussler unless a stockholder indicates that his or her shares should be withheld with respect to one or more of such nominees.

In the event that any nominee for director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the persons named as proxies will vote the proxies in their discretion for any nominee who is designated by the current Board of Directors to fill the vacancy. All the nominees are currently serving as directors and we do not expect that the nominees will be unavailable or will decline to serve. Information about each of the director nominees is set forth below.

|

Our Board of Directors recommends that you vote FOR each of the nominees for our Board of Directors in this proposal 1. |

Nominees for Election

The following sets forth certain information about our directors as of the date of this proxy statement.

Directors

|

|

DAVID M. COTE

Age: 71 Director Since: 2020 Director and Executive Chairman of the Board |

|||

|

Background:

Mr. Cote has served as our Executive Chairman of our Board of Directors since February 7, 2020. From April 2018 until the Business Combination (defined below), Mr. Cote served as Chief Executive Officer, President and Secretary, and Chairman of the Board of Directors of GSAH (defined below). Mr. Cote served as Chairman and Chief Executive Officer of Honeywell from July 2002 to March 2017. Most recently, Mr. Cote was Executive Chairman of the Board at Honeywell until April 23, 2018. He joined Honeywell as President and Chief Executive Officer in February 2002. Prior to joining Honeywell, he served as Chairman, President and Chief Executive Officer of TRW Inc., a provider of products and services for the aerospace, information systems and automotive markets, from August 2001 to February 2002. From February 2001 to July 2001, he served as TRW’s President and Chief Executive Officer and from November 1999 to January 2001 he served as its President and Chief Operating Officer. Mr. Cote was Senior Vice President of General Electric Company and President and Chief Executive Officer of GE Appliances from June 1996 to November 1999. Mr. Cote was a director of the Federal Reserve Bank of New York from March 2014 to March 2018, as well as a director of Juniper Industrial Holdings, Inc. from March 2020 until its merger with Janus International Group Inc. in June 2021.

Qualifications:

Mr. Cote was selected to serve on our Board due to his significant leadership experience and his extensive management and investment experience, including in the industrial sector.

| ||||

| 10 | |

|

- 2024 Proxy Statement |

|

|

GIORDANO ALBERTAZZI

Age: 58 Director Since: 2023 Director and Chief Executive Officer |

|||

|

Background:

Mr. Albertazzi has served as our Chief Executive Officer and as one of our directors since January 1, 2023. Previously, he served as our Chief Operating Officer from October 2022 until January 2023, President, Americas from March 2022 until July 2023 and as President of Europe, Middle East and Africa from February 2020 until March 2022. From 2016 until the Business Combination in February 2020, Mr. Albertazzi served as the President of Vertiv in Europe, Middle East and Africa and was responsible for Vertiv’s operations and business development within the region. Mr. Albertazzi began his career at Kone Elevators, where he progressed through operations and product development leadership. Mr. Albertazzi joined Emerson Network Power, a group of Emerson Electric (NYSE: EMR) in 1998 and held positions with increasing responsibility, including Plant Manager from 1999 to 2001, EMEA Marketing and Product Management Director from 2002 to 2004, and Managing Director for the Italian market unit from 2004 to 2006. In 2006, Mr. Albertazzi was promoted to Vice President Services for the Liebert Europe business. In 2011, Mr. Albertazzi was appointed Vice President Services for the broader Europe, Middle East and Africa region until he was promoted in 2014 to Vice President Sales. Mr. Albertazzi holds a bachelor’s degree in mechanical engineering from the Polytechnic University of Milan and master’s degree in management from Stanford Graduate School of Business.

Qualifications:

Mr. Albertazzi was selected to serve on our Board due to his extensive knowledge of the data center industry and his more than 25 years of employment in a wide range of leadership, sales and operations roles and responsibilities with Vertiv. | ||||

|

|

JOSEPH J. DEANGELO

Age: 62 Director Since: 2022 Director |

|||

|

Background:

Mr. DeAngelo has served as one of our directors since October 3, 2022. Mr. DeAngelo served as Chairman of the Board, President and Chief Executive Officer of HD Supply Holdings, Inc., one of the largest industrial distributors in North America, beginning March 2015, President and Chief Executive Officer beginning January 2005, and was a member of HDS’s board beginning August 2007, serving in each position until the closing of the acquisition of HDS by The Home Depot (NYSE: HD) during 2020. Mr. DeAngelo served as Executive Vice President and Chief Operating Officer of The Home Depot during 2007. From 2005 to 2006, he served as Executive Vice President of HD Supply. In 2005, Mr. DeAngelo served as Senior Vice President, Home Depot Supply, Pro Business and Tool Rental, and from 2004 through 2005, he served as Senior Vice President, Pro Business and Tool Rental. Mr. DeAngelo previously served as Executive Vice President of The Stanley Works, a tool manufacturing company, from 2003 through 2004. From 1986 until 2003, Mr. DeAngelo held various positions with General Electric (“GE”). His final position with GE was President and Chief Executive Officer of General Electric TIP/Modular Space, a division of General Electric Capital. Mr. DeAngelo holds a bachelor’s degree in accounting and economics from the State University of New York at Albany. Mr. DeAngelo serves on the Board of the Combat Marine Outdoors (CMO). Mr. DeAngelo served on the board of directors of Owens-Illinois, Inc. from May 2016-July 2017, on the board of trustees of the Shepherd Center Foundation 2016–2020, and CEO Advisory Council of the Cristo Rey Atlanta Jesuit High School 2016–2020.

Qualifications:

Mr. DeAngelo was selected to serve on our Board due to his extensive leadership and management experience and industry knowledge.

| ||||

|

|

|

- 2024 Proxy Statement | 11 |

|

|

JOSEPH VAN DOKKUM

Age: 70 Director Since: 2020 Director |

|||

|

Background:

Mr. van Dokkum has served as one of our directors since February 7, 2020. Mr. van Dokkum is senior advisor and co-founder of Imperative Science Ventures, a venture capital firm focused on science breakthroughs since 2019. From 2009 to 2019, he was an Operating Partner with Kleiner Perkins in Menlo Park, CA, where he worked closely with his investment partners and the leadership of their start-up and growth portfolio companies to accelerate commercialization and scale the businesses. Prior to 2009, Mr. van Dokkum served for seven years as President of UTC Power, a division of Raytheon Technologies Corporation (NYSE: RTX) (formerly, United Technologies Corporation), where he was instrumental in organically growing UTC Power’s power generation products and service offerings, including fuel cells, renewable power solutions and combined cooling, heating and power applications for the commercial building markets. Prior to his tenure with UTC Power, Mr. van Dokkum was with Siemens (OTC: SIEGY) for 17 years. For the last six of those years, he served as President and Chief Executive Officer of Siemens Power Transmission & Distribution, Inc. during which time he augmented the company’s traditional power equipment, such as switchgear, power breakers, transformers and regulators, with intelligent systems and controls. This effort returned profitability to the business and enabled the expansion of the product portfolio through numerous acquisitions. Mr. van Dokkum has served on the boards of Ionic Materials, Inc. since 2013 and Ndustrial since 2017, and served as a director on the board of Solidia Technologies from 2011 until his retirement in December 2021. He earned his bachelor’s and master’s degrees in electrical engineering from the Institute of Technology, Albertus Magnus.

Qualifications:

Mr. van Dokkum was selected to serve on our Board due to his extensive leadership experience and industry knowledge.

| ||||

|

|

ROGER FRADIN

Age: 70 Director Since: 2020 Director |

|||

|

Background:

Mr. Fradin has served as one of our directors since February 7, 2020. From June 2018 until the Business Combination, Mr. Fradin served as one of GSAH’s directors. Mr. Fradin joined Honeywell in 2000 when Honeywell acquired Pittway Corporation. Mr. Fradin served as President and Chief Executive Officer of Honeywell’s Automation and Control Solutions business from January 2004 to April 2014. Mr. Fradin served as Vice Chairman of Honeywell from April 2014 until his retirement in February 2017. Mr. Fradin is also a consultant for The Carlyle Group and an advisor to Seal Rock Partners. Mr. Fradin received his M.B.A. and B.S. degrees from The Wharton School at the University of Pennsylvania, where he has also served as a member of the faculty. Mr. Fradin has served as the chairman of Victory Innovation, a Carlyle Group company, and a director of L3Harris Technologies Inc. (NYSE: LHX) since 2016, Resideo Technologies Inc (NYSE: REZI) since 2018, and Janus International Group Inc (NYSE: JBI) since 2021, where he has served as Vice Chairman from July 2023 until his appointment to Chairman of the Board of Directors in January 2024, and was formerly a director of MSC Industrial Direct Co., Inc. (Nasdaq: MSM) from 1998 to 2019, Pitney Bowes Inc. (NYSE: PBI) from 2019–2021, and Juniper II Corporation (NYSE: JUN) from 2021–2022.

Qualifications:

Mr. Fradin was selected to serve on our Board due to his deep industrial expertise, specifically in the automation and control solutions sectors, as well as for his experience overseeing acquisitions.

| ||||

| 12 | |

|

- 2024 Proxy Statement |

|

|

JACOB KOTZUBEI

Age: 55 Director Since: 2020 Director |

|||

|

Background:

Mr. Kotzubei has served as one of our directors since February 7, 2020. Mr. Kotzubei joined Platinum Equity, a private equity firm, in 2002 and is Co-President of the firm. Mr. Kotzubei serves as a director or manager of a number of Platinum Equity’s portfolio companies. Prior to joining Platinum Equity in 2002, Mr. Kotzubei worked for 4.5 years for Goldman Sachs’ Investment Banking Division in New York City. Previously, he was an attorney at Sullivan & Cromwell LLP in New York City, specializing in mergers and acquisitions. Mr. Kotzubei serves on the board of directors of Ryerson Holding Corporation (NYSE: RYI) since 2010, and is a former director of Key Energy Services, Inc. (2016 to February 2022) and Verra Mobility Corporation (NASDAQ: VRRM) (2018 to 2021). Mr. Kotzubei received a bachelor’s degree from Wesleyan University and holds a juris doctor from Columbia University School of Law, where he was elected a member of the Columbia Law Review.

Qualifications:

Mr. Kotzubei was selected to serve on our Board due to his experience in executive management oversight, private equity, capital markets, mergers and acquisitions and other transactional matters. | ||||

|

|

JAKKI L. HAUSSLER

Age: 66 Director Since: 2022 Director |

|||

|

Background:

Ms. Haussler has served as one of our directors since August 8, 2022. Since June 2019, Ms. Haussler has served as the Non- Executive Chairman of Opus Capital Management LLC, an investment advisory firm that she co-founded in 1996. Prior to serving as the Non-Executive Chairman, Ms. Haussler was the Chief Executive Officer of Opus Capital Management LLC from 1996 until 2019. Ms. Haussler serves on the Board of Directors of Barnes Group Inc. (NYSE: B) since July 2021, where she serves on the compensation and management development committee and Service Corporation International (NYSE: SCI) since May 2018, where she serves on the audit and investment committees. Further, Ms. Haussler serves as a director and a trustee of the Morgan Stanley Funds, where she chairs the audit committee and serves on the equity committees. Ms. Haussler is a former director of Cincinnati Bell Inc., serving from 2008 until its acquisition by Macquarie Infrastructure Partners Inc. in 2021, where she served as chair of the audit and governance committees. She has an extensive financial background, having served in a variety of leadership positions in the investment community, including as managing director of Capvest Venture Fund LP from 2000 to 2011, and partner at both Adena Ventures LP from 2001 to 2010 and Blue Chip Venture Company from 1993 to 1995. Ms. Haussler, a former certified public accountant, holds a bachelor’s degree in accounting from the University of Cincinnati and a juris doctor from Salmon P. Chase College of Law at Northern Kentucky University.

Qualifications:

Ms. Haussler was selected to serve on the board due to her extensive experience in management and accounting along with her financial expertise.

| ||||

|

|

|

- 2024 Proxy Statement | 13 |

|

|

MATTHEW LOUIE

Age: 46 Director Since: 2020 Director |

|||

|

Background:

Mr. Louie has served as one of our directors since February 7, 2020. Mr. Louie joined Platinum Equity in 2008 and is a Managing Director at the firm. Mr. Louie serves as a director or manager of a number of Platinum Equity’s portfolio companies. Prior to joining Platinum Equity in 2008, Mr. Louie was an investment professional at American Capital Strategies, a middle market-focused private equity firm. Prior to American Capital, Mr. Louie worked in venture capital and growth equity at both Canaan Partners and Agilent Technologies, and in investment banking at Donaldson, Lufkin & Jenrette. Mr. Louie holds undergraduate degrees in both economics as well as political science from Stanford University and a MBA from Harvard Business School.

Qualifications:

Mr. Louie was selected to serve on our Board due to his experience related to private equity, capital markets, transactional matters and post-acquisition oversight of operational performance at portfolio companies. | ||||

|

|

EDWARD L. MONSER

Age: 73 Director Since: 2020 Director |

|||

|

Background:

Mr. Monser has served as one of our directors since February 7, 2020. Mr. Monser serves on the board of directors for Air Products & Chemicals, Inc. (NYSE: APD) since 2013, where he is the Lead Director and a member of the Governance and the Management Development and Compensation Committees, and formerly served as a director and member of the Audit and Compensation Committees for Canadian Pacific Railway Limited (TSX: CP) (NYSE: CP), serving on the Board from 2018 until his retirement in April 2022. From 2010 to 2018, Mr. Monser served as President of Emerson (NYSE: EMR), where he had more than 30 years of experience in senior operational positions and played a key role in its globalization. From 2001 to 2015, he was a member of Emerson’s Office of the Chief Executive and served as its Chief Operating Officer. Mr. Monser is active in promoting international understanding and trade and is Vice Chairman of the U.S.-India Strategic Partnership Forum. He has served on the advisory Economic Development Board for China’s Guangdong Province, the board of advisors for South Ural State University in Chelyabinsk, Russia and the board of the U.S.-China Business Council, where he was also Vice Chairman. Mr. Monser received a bachelor’s degree in electrical engineering from Illinois Institute of Technology in 1980 and has a bachelor’s degree in education from Eastern Michigan University. He is an alumnus of the executive education program at the Stanford University Graduate School of Business.

Qualifications:

Mr. Monser was selected to serve on our Board due to his extensive experience in key management positions, including at Emerson when Vertiv was part of that company.

| ||||

| 14 | |

|

- 2024 Proxy Statement |

|

|

STEVEN S. REINEMUND

Age: 76 Director Since: 2020 Director |

|||

|

Background:

Mr. Reinemund has served as one of our directors since February 7, 2020. From June 2018 until the Business Combination, Mr. Reinemund served as one of GSAH’s directors. Mr. Reinemund served as Dean of Business at Wake Forest University from July 2008 to June 2014, an organization he joined after a 23-year career with PepsiCo, Inc. (NASDAQ: PEP) (“PepsiCo”). At PepsiCo, Mr. Reinemund served as Executive Chairman from October 2006 to May 2007, and as Chairman and Chief Executive Officer from May 2001 to October 2006. Prior to being Chief Executive Officer, he was PepsiCo, Inc.’s President and Chief Operating Officer from September 1999 to May 2001. Mr. Reinemund began his career with PepsiCo, Inc. in 1984 at Pizza Hut, Inc. and held other positions until he became President and Chief Executive Officer of Frito-Lay’s North American snack division in 1992. He became Chairman and Chief Executive Officer of Frito-Lay’s worldwide operations in 1996. Mr. Reinemund was a director of Johnson & Johnson (NYSE: JNJ) from 2003 to 2008, American Express Company (NYSE: AXP) from 2007 to 2015, Exxon Mobil Corporation (NYSE: XOM) from 2007 to 2020, Marriott International, Inc. (Nasdaq: MAR) from 2007 to 2020, Chick-fil-A from 2015 to 2021, GS Acquisition Holdings Corp. II from 2020 until its merger with Mirion Technologies in October 2021, and Kohana Coffee Holdings, where he served as chairman, from 2021 to 2022. Further, Mr. Reinemund previously served as a director and chair of the compensation committee of Walmart Inc. (NYSE: WMT) from 2010 to 2022, and a director and chair of the audit committee of Catalyst Partners Acquisition Corp (NASDAQ: CPARU) from 2021 to 2023. Mr. Reinemund currently serves on the Board of Directors at USNA Foundation. A graduate of the United States Naval Academy in 1970, Mr. Reinemund served five years as an officer in the United States Marine Corps, achieving the rank of Captain. He received a MBA from the University of Virginia and has been awarded honorary doctorate degrees by Johnson and Wales University and Bryant University.

Qualifications:

Mr. Reinemund was selected to serve on our Board due to his considerable business leadership roles, mergers and acquisitions experience and his relevant board expertise. | ||||

|

|

ROBIN L. WASHINGTON

Age: 61 Director Since: 2020 Director |

|||

|

Background:

Robin L. Washington has served as one of our directors since February 7, 2020. Ms. Washington also serves on the Board of Directors of Alphabet, Inc. (NASDAQ: GOOG) since April 2019, where she is chair of the leadership development and compensation committee, Honeywell International, Inc. (NYSE: HON) since April 2013, Salesforce.com (NYSE: CRM) since September 2013, where she is the lead independent director and chairs the nominating and governance committee, and privately held companies, Beacon Biosignals and StockX. Ms. Washington served as Executive Vice President and Chief Financial Officer of Gilead Sciences, Inc., from May 2008–November 2019 where she oversaw Global Finance, Facilities and Operations, Investor Relations and the Information Technology organizations. Prior to Gilead, Ms. Washington was the Chief Financial Officer of Hyperion Solutions Inc. from January 2006 until it was acquired by Oracle Corporation in March 2007. Prior to that, she spent nearly 10 years at Peoplesoft, Inc. where she served in a number of executive financial positions. Ms. Washington is also a member of the Presidents Council & Ross Business School Advisory Board, University of Michigan, and a trustee of both the Financial Accounting Foundation and Mastercard Foundation. She is a certified public accountant and holds a bachelor’s degree in business administration from the University of Michigan and a MBA from Pepperdine University.

Qualifications:

Ms. Washington was selected to serve on the board due to her extensive experience in management, operations and accounting in the life sciences and technology sectors along with her financial expertise.

| ||||

|

|

|

- 2024 Proxy Statement | 15 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Composition

Our Board of Directors consists of eleven directors. In accordance with our certificate of incorporation and bylaws, the number of directors on our Board of Directors will be determined from time to time by the Board of Directors.

Each director is to be elected annually and to hold office until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Vacancies and newly created directorships on the Board of Directors may be filled at any time by the remaining directors.

Director Independence

The rules of the New York Stock Exchange (“NYSE”) require that a majority of our Board of Directors be independent. An independent director is defined generally as a person that, in the opinion of the company’s Board of Directors has no material relationship with the listed company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the company) that would be inconsistent with a determination that the director is independent in accordance with independence requirements under our Corporate Governance Guidelines and as implemented by NYSE. Our Board has determined that nine of our Directors, being each of Joseph J. DeAngelo, Joseph van Dokkum, Roger Fradin, Jakki L. Haussler, Jacob Kotzubei, Matthew Louie, Edward L. Monser, Steven S. Reinemund, and Robin L. Washington, are independent under applicable SEC and NYSE rules.

Board of Directors Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to ensure oversight of management and a high-functioning, engaged Board. When evaluating the structure, the Board may take into consideration a variety of criteria, such as, but not limited to, strategic priorities, skillsets of the independent directors, current market environment, the strengths and talents of Vertiv’s management team, and stockholder feedback. Thus, instead of taking a “one-size-fits all” approach to Board leadership, the Board selects the structure that it believes will provide the most effective leadership and oversight for the Company, taking into consideration the Company’s needs and circumstances at any given time.

We do not have a policy on whether or not the role of chairman and CEO should be separate or combined and, if it is to be separate, whether the chairman should be selected from the non-employee directors or be an executive officer. This approach provides the Board with flexibility to determine whether the two roles should be separate or combined based upon the Company’s needs in light of the dynamic environment in which we operate and the Board’s assessment of the Company’s leadership needs at such time.

Currently, we separate the roles of chairman of the Board of Directors and CEO. Mr. Cote serves as the Executive Chairman of our Board of Directors. This structure enables the Board of Directors to effectively exercise its role in oversight of our management team while allowing our CEO to focus on the management of the day-to-day operational execution of our business.

Mr. Cote’s role as Executive Chairman includes acting as the primary liaison between senior management and the independent directors, and providing strategic leadership, advice and counsel based on his experience and expertise to our executive officers. In his support of the management team in their decision-making processes and implementation of strategy, management and the Executive Chairman may communicate daily, and Mr. Cote attends regular meetings with management.

With input from the other board members, committee chairs, and senior management, Mr. Cote develops the agenda for board meetings, sets board meeting schedules, and presides over meetings of the Board of Directors. As Vertiv’s Executive Chairman and board member since the Business Combination, Mr. Cote combines a detailed and in-depth knowledge of Vertiv’s day-to-day operations with an ability to identify strategic priorities essential to Vertiv’s future success and effectively advise our management team on execution and implementation processes to achieve Vertiv’s strategic plans. Mr. Cote leads the executive sessions of the independent directors focused on an agenda developed by Committee Chairs to address the most critical issues of Vertiv. In this role, he helps assure that such sessions remain effective forums for promoting open and candid discussion among the independent directors regarding issues of importance to Vertiv, including evaluating the performance and effectiveness of members of our management team.

| 16 | |

|

- 2024 Proxy Statement |

Board of Directors Role in Risk Oversight

It is the duty of our Board of Directors to serve as a prudent fiduciary for stockholders and to oversee the management of our Company. The specific risk areas of focus for the Board of Directors and each of its Committees are summarized below.

| Board/Committee | Primary Areas of Risk Oversight | |

| Board of Directors |

• Our Board of Directors engages in the oversight of risk in various ways.

• Oversees the Company’s strategic risks, including those associated with operations, supply chain and economic conditions such as inflation.

• Sets goals and standards for our employees, officers, and directors.

• Reviews the structure and operation of our various departments and functions. In these reviews, our Board of Directors discusses with management material risks affecting those departments and functions and management’s approach to mitigating those risks.

• Reviews and approves management’s operating plans and any risks that could affect the results of those operating plans.

• In collaboration with the Audit Committee, oversees the Company’s cybersecurity initiatives, product security, enterprise resource planning and SOX compliance, and internal controls.

• In its review of Annual Reports on Form 10-K (including any amendments thereto), our Board of Directors reviews our business and related risks, including as described in the “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the reports.

• When our Board of Directors reviews particular transactions and initiatives that require its approval, or that otherwise merit its involvement, it generally includes related analysis and risk mitigation plans among the matters addressed with senior management. The day-to-day identification and management of risk is the responsibility of our management.

• As the market environment, industry practices, regulatory requirements and our business evolve, we expect that senior management and our Board of Directors will respond with appropriate risk mitigation strategies and oversight. | |

| Audit Committee |

• Our Audit Committee engages in the oversight of risk in various ways.

• Discusses with management the major financial, legal, compliance and other significant risks faced by the Company

• Discusses guidelines and policies governing the process by which our senior management assesses and manages the Company’s exposure to risk.

• Works directly with members of senior management, our independent auditors and, if appropriate, and our internal audit team to review and assess (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) our independent auditor’s qualifications and independence, and (4) the performance of our internal audit function and independent auditors.

• Assists the Board’s oversight of, among other things, data and cybersecurity policies, procedures and activities, product security initiatives, compliance with laws and regulatory requirements including SOX, internal controls, and enterprise resource planning.

• Reviews our business and related risks quarterly in connection with the preparation of Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K.

| |

| Compensation Committee |

• Our Compensation Committee engages in the oversight of risk in various ways.

• Oversees the management of risks relating to our executive compensation programs and employee benefit plans.

• Reviews at least annually our executive compensation programs, meets regularly with management to understand the financial, human resources and stockholder implications of compensation decisions and reports as appropriate to our Board of Directors.

| |

| Nominating and Corporate Governance Committee |

• Our Nominating and Corporate Governance Committee engages in the oversight of risk in various ways.

• Oversees the management of risks relating to our director selection process and board and committee composition.

• Oversees the management of risks relating to our corporate governance principles and governance structure.

| |

|

|

|

- 2024 Proxy Statement | 17 |

Attendance at Board of Directors and Committee Meetings and Annual Meeting

During the year ended December 31, 2023:

| • | the Board of Directors held four meetings; |

| • | the Audit Committee held eight meetings; |

| • | the Nominating and Corporate Governance Committee held three meetings; and |

| • | the Compensation Committee held three meetings. |

In the year ended December 31, 2023, no member of our Board of Directors attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director) and (ii) the number of meetings held by all Committees of the Board of Directors (during the periods that he or she served on such Committees).

According to our Corporate Governance Guidelines, our directors are expected to make reasonable best efforts to attend the Annual Meeting, meetings of the Board of Directors and meetings of Committees on which they serve. Eight of our directors in office at the time of our 2023 annual meeting of stockholders attended the meeting. Directors are expected to review meeting materials prior to Board of Directors and Committee meetings and management will make appropriate personnel available to answer any questions a director may have about any aspect of the Company’s business.

Board Committees

Our Board has three standing Committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which is composed solely of independent directors. Each Committee operates under a charter that was approved by our Board and has the composition and responsibilities described below. The charter of each Committee is available on the investors page of our website at https://investors.vertiv.com/corporate-governance/documents/default.aspx.

Audit Committee