As filed with the Securities and Exchange Commission

on

Registration No. 333-268025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in its Charter)

| 2833 | Not Applicable | |||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Telephone: +

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

Telephone: 800-221-0102

______________________________________________________________________________ (Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Henry F. Schlueter, Esq. Celia Velletri, Esq. Schlueter & Associates, P.C. 5290 DTC Parkway, Suite 150 Greenwood Village, CO 80111 Telephone: 303-292-3883 |

Mark E. Crone, Esq. Liang Shih, Esq. The Crone Law Group P.C. 420 Lexington Avenue, Suite 2446 New York, New York 10170 Telephone: 646-861-7891 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

If an emerging growth company that prepares its financial

statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED _____________, 2022

PRELIMINARY PROSPECTUS

ZHONG YUAN BIO-TECHNOLOGY HOLDINGS LIMITED

[●] Ordinary Shares

and

[●] Ordinary Shares offered by the Selling Shareholder

This is an offering of ordinary shares, US$0.001 par value per share (“Ordinary Shares”) of Zhong Yuan Bio-Technology Holdings Limited, an exempted company incorporated in the Cayman Islands with limited liability (the “Company” or “Zhong Yuan Cayman”). The Company is offering, on a firm commitment engagement basis, [●] Ordinary Shares. The Selling Shareholder (as defined herein) is offering an additional [●] Ordinary Shares to be sold in the offering pursuant to this prospectus. We will not receive any proceeds from the sale of the Ordinary Shares to be sold by the Selling Shareholder. We anticipate that the public offering price of the Ordinary Shares will be between US$[●]and US$[●] per Ordinary Share.

Prior to this offering, our Ordinary Shares were traded on the OTC Market under the symbol ZHYBF. However, there has been only a limited trading market for our Ordinary Shares and there can be no assurance that a viable public market will ever develop. We intend to list our Ordinary Shares on the Nasdaq Capital Market. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market. We will not close this offering unless we have obtained approval from the Nasdaq Stock Market to list our Ordinary Shares on the Nasdaq Capital Market in conjunction with this public offering.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 23 to read about factors you should consider before buying our Ordinary Shares.

We are an “emerging growth company” and a “foreign private issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Being an Emerging Growth Company and a Foreign Private Issuer” beginning on page 19 of this prospectus for more information.

Upon completion of this offering, our issued and outstanding shares will consist of [●] Ordinary Shares.

The total underwriting discounts payable by us will be US$[●], and the total proceeds to us, before expenses, will be US$[●].

Investing in the Ordinary Shares involves a high degree of risk. See “Risk Factors” beginning on page 23 of this prospectus.

We are not a Chinese operating company but a holding company organized under the laws of the Cayman Islands with operations conducted by our operating subsidiary based in the Peoples Republic of China (“China” and the “PRC”) and our principal executive office located in Hong Kong. Because our operations are conducted in China through our wholly-owned operating subsidiary, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to government review could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause our securities to significantly decline in value or to be worthless.

Pursuant to the Holding Foreign Companies Accountable Act (the “HFCAA”), which became law in December 2020, our Ordinary Shares may be prohibited from trading on a U.S. exchange if our auditor cannot be fully inspected by the Public Company Accounting Oversight Board (the “PCAOB”). The HFCAA prohibits foreign companies from listing their securities on U.S. exchanges if the company’s auditor has been unavailable for PCAOB inspection or investigation for three consecutive years beginning in 2021. In June 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”) which, if signed into law, would reduce the time period for the delisting of foreign companies under the HFCAA to two consecutive years instead of three years. On December 16, 2021, the PCAOB issued a Determination Report (the “Determination Report”), which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the Determination Report identified specific registered public accounting firms subject to these determinations.

Our previous public accounting firm, Centurion ZD CPA & Co (“Centurion ZD”), who audited our financial statements for the fiscal years ended March 31, 2020 and 2021, is headquartered in Hong Kong and thus subject to the determinations announced by the PCAOB in its Determination Report. As the PCAOB was not able to fully conduct inspections of our previous auditor’s work papers in Hong Kong, our shareholders were deprived of the benefits of such inspection.

Effective February 25, 2022, to protect our investors and to carry out the PCAOB’s mandate, we dismissed Centurion ZD as our independent registered public accounting firm and we engaged K.R. Margetson Ltd. (“Margetson”), whose principal office is located in Vancouver, British Columbia, Canada, as our new independent registered public accounting firm. As Margetson is not located in China or Hong Kong, Margetson is not subject to the determinations announced by the PCAOB on December 16, 2021. We believe that the PCAOB’s inspectors and investigators will have consistent access to the audit work performed by Margetson for us. Therefore, we do not expect to be affected by the HFCAA or the AHFCAA at this time.

Therefore, in addition to subjecting our securities to the possibility of being prohibited from trading or delisted from a U.S. exchange, the inability of the PCAOB to conduct inspections of our auditors’ work papers in China or Hong Kong would make it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures as compared to auditors outside of China that are subject to PCAOB inspections. As a result, our investors would be deprived of the benefits of the PCAOB’s oversight of our auditor through such inspections and they may lose confidence in our reported financial information and procedures and the quality of our financial statements. Also, we cannot assure you that U.S. regulatory authorities will not apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected. See “Risk Factors – Risks Related to Our Company – To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for the Company may, in the future, be located in China or in Hong Kong, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange” on page 28 of this prospectus.

On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC (the “SOP”), taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with U.S. law. Pursuant to the SOP, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. However, uncertainties still exist as to whether the applicable parties, including governmental agencies, will fully comply with the framework. The PCAOB has indicated that its December 2021 determinations under the HFCAA remain in effect; however, the PCAOB is required to reassess those determinations by the end of 2022. Under the PCAOB’s rules, a reassessment of a determination under the HFCAA may result in the PCAOB reaffirming, modifying or vacating the determination. Depending on the implementation of the SOP, if the PCAOB continues to be prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in China and/or Hong Kong, then companies audited by those firms will be delisted pursuant to the HFCAA despite the SOP. Therefore, there is no assurance that the SOP will provide relief from the delisting risk arising from the application of the HFCAA or the AHFCAA.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews and expanding efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements, as we do not have a variable interest entity structure and our business does not involve the collection of user data, implicate cybersecurity or involve any other type of restricted industry. Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or what the potential impact of any such modified or new laws and regulations will be on our daily business operations or our ability to accept foreign investments and list on a U.S. exchange.

The structure of cash flows within our organization, and a summary of the applicable regulations, is as follows:

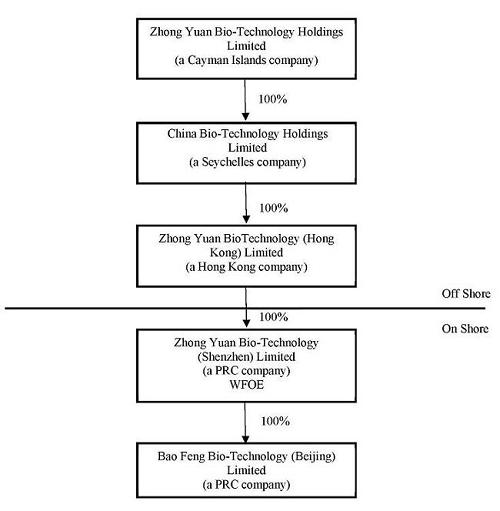

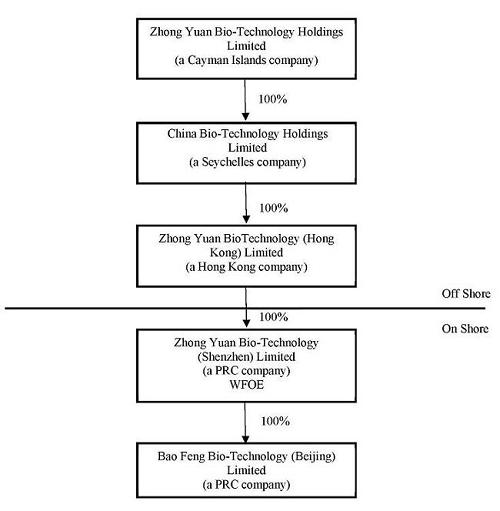

1. Our equity structure is a direct holding structure, that is, the overseas entity that is trading on the OTC Market in the United States is Zhong Yuan Cayman. Zhong Yuan Cayman directly controls China Bio-Technology Holdings Limited (“China Bio”), a Seychelles company. China Bio directly controls Zhong Yuan Bio-Technology (Hong Kong) Limited (“Zhong Yuan HK”), a Hong Kong company. Zhong Yuan HK directly controls Zhong Yuan Bio-Technology (Shenzhen) Limited (“Zhong Yuan SZ”), a China company and a wholly foreign owned entity (“WFOE”). Our WFOE conducts its operations through Bao-Feng Bio-Technology (Beijing) Limited (“Bao-Feng”), a China company and, currently, our sole operating subsidiary. See “Our Business -- History of the Company” and “Our Business -- Corporate Structure” for additional details.

2. Within our direct holding structure and based on our compliance with current foreign exchange regulations, the cross-border transfer of funds within our corporate group is legal and compliant with the laws and regulations of the PRC. After investors’ funds enter into Zhong Yuan Cayman, the funds can be directly transferred to Zhong Yuan HK. Zhong Yuan HK can then directly transfer funds to Zhong Yuan SZ, and those funds can then be transferred to Bao-Feng. However, as these foreign exchange regulations, including their interpretation and implementation, have been evolving, it is unclear how these regulations, and any future regulations concerning offshore or cross-border transactions, will be interpreted, amended and implemented by the relevant government authorities. For example, we may be subject to a more stringent review and approval process with respect to our foreign exchange activities, such as cross-border transfer of funds, remittance of dividends and foreign currency-denominated borrowings, which may adversely affect our financial condition and results of operations.

If the Company intends to distribute dividends, Bao-Feng will distribute dividends to Zhong Yuan SZ, our WFOE, which will then directly distribute dividends to Zhong Yuan HK in accordance with the laws and regulations of the PRC. Zhong Yuan HK will transfer dividends to China Bio, which will transfer them to the Company. The Company will then distribute dividends to all of its shareholders in proportion to the Ordinary Shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

3. As of the date of this prospectus, neither the Company nor any of its subsidiaries has ever paid dividends or made distributions to U.S. investors. Since consummation of the Share Exchange, the Company has not transferred any funds to its subsidiaries to fund their business operations, nor has it received any transfer of funds from its subsidiaries. In the future, any cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our subsidiaries via capital contribution or shareholder loans, as the case may be. For a detailed description of the transfers from the Company to its subsidiaries and from its subsidiaries to the Company, see “Transfers of Cash to and from Our Subsidiaries” in the “Prospectus Summary” section of this prospectus.

4. Our PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. These reserves are not distributable as cash dividends. See “Regulations in China Applicable to Our Business -- Regulations On Dividend Distribution” for more information.

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, implemented a series of capital control measures, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our PRC subsidiaries incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a 10% withholding tax will be applicable to dividends payable by Chinese companies to non-PRC resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect of the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from the standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiaries.

Please see “Risk Factors” beginning on page 23 of this prospectus for additional information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

If we complete this offering, net proceeds will be delivered to us on the closing date.

The underwriters expect to deliver the Ordinary Shares to the purchasers against payment on or about [●], 2022.

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

| Per Share | Total | |||||||||||

| Offering price(1) | US$ | [●] | US$ | [●] | (4) | |||||||

| Underwriting discounts and commissions to be paid by us (2) | US$ | [●] | US$ | [●] | ||||||||

Underwriting discounts and commissions to be paid by the Selling Shareholder(2) |

US$ | [●] | US$ | [●] | ||||||||

| Proceeds to the Company before expenses(3) | US$ | [●] | US$ | [●] | ||||||||

| Proceeds to the Selling Shareholder | US$ | [●] | US$ | [●] | ||||||||

| (1) | Offering price per share is assumed to be US$[●], being the mid-point of the offering price range. |

| (2) | We and the Selling Shareholder have agreed to pay the underwriters a discount equal to 7.0% of the gross proceeds of the offering. This table does not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering payable to the underwriters. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 109. |

| (3) | Excludes fees and expenses payable to the underwriters. The total amount of underwriters expenses related to this offering is set forth in the section entitled “Underwriting – Discounts, Commission and Expenses” on page 109. |

| (4) | Includes US$[●] gross proceeds from the sale of [●] Ordinary Shares offered by the Company and US$[●] gross proceeds from the sale of [●] Ordinary Shares offered by the Selling Shareholder. |

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

REVERE SECURITIES LLC

The date of this prospectus is [●], 2022

TABLE OF CONTENTS

| Page | |

| ABOUT THIS PROSPECTUS | 2 |

| PRESENTATION OF FINANCIAL INFORMATION | 2 |

| MARKET AND INDUSTRY DATA | 2 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 2 |

| NOTES ON PROSPECTUS PRESENTATION | 4 |

| DEFINITIONS | 4 |

| PROSPECTUS SUMMARY | 6 |

| RISK FACTORS | 23 |

| ENFORCEABILITY OF CIVIL LIABILITIES | 47 |

| USE OF PROCEEDS | 49 |

| MARKET FOR ORDINARY SHARES AND RELATED SHAREHOLDER MATTERS | 49 |

| DIVIDEND POLICY | 50 |

| CAPITALIZATION AND INDEBTEDNESS | 50 |

| DILUTION | 51 |

| SELECTED FINANCIAL DATA | 52 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 55 |

| OUR BUSINESS | 62 |

| REGULATIONS IN CHINA APPLICABLE TO OUR BUSINESS | 78 |

| MANAGEMENT | 86 |

| COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 92 |

| PRINCIPAL AND SELLING SHAREHOLDERS | 96 |

| RELATED PARTY TRANSACTIONS | 98 |

| DESCRIPTION OF SHARE CAPITAL | 100 |

| CERTAIN CAYMAN ISLANDS COMPANY CONSIDERATIONS | 105 |

| SHARES ELIGIBLE FOR FUTURE SALE | 110 |

| UNDERWRITING | 111 |

| EXPENSES RELATED TO THIS OFFERING | 114 |

| LEGAL MATTERS | 114 |

| EXPERTS | 114 |

| WHERE YOU CAN FIND MORE INFORMATION | 115 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 |

Until ______, 2022 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

| 1 |

ABOUT THIS PROSPECTUS

Neither the Company, the Selling Shareholder nor any of the underwriters has authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither the Company, the Selling Shareholder nor the underwriters take responsibility for, or provide any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. The Company’s business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither the Company, the Selling Shareholder nor the underwriters has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated, may not be the arithmetic aggregation of the percentages that precede them.

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate,” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we file with the SEC, other information sent to our shareholders and other written materials.

| 2 |

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| · | our business and operating strategies and our various measures to implement such strategies; |

| · | our operations and business prospects, including development and capital expenditure plans for our existing business; |

| · | changes in policies, legislation, regulations or practices in the industry and those countries or territories in which we operate that may affect our business operations; |

| · | our financial condition, results of operations and dividend policy; |

| · | changes in political and economic conditions and competition in the area in which we operate, including a downturn in the general economy; |

| · | the regulatory environment and industry outlook in general; |

| · | future developments in the market for our products and actions of our competitors; |

| · | catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences; |

| · | the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us; |

| · | the overall economic environment and general market and economic conditions in the jurisdictions in which we operate; |

| · | our ability to execute our strategies; |

| · | our ability to anticipate and respond to changes in the markets in which we operate, and in client demands, trends and preferences; |

| · | changes in the need for capital and the availability of financing and capital to fund those needs; |

| · | exchange rate fluctuations, including fluctuations in the exchange rates of currencies that are used in our business; |

| · | changes in interest rates or rates of inflation; and |

| · | legal, regulatory and other proceedings arising out of our operations. |

| 3 |

NOTES ON PROSPECTUS PRESENTATION

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus is based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources referenced above, our internal research and our knowledge of the health supplement industry and, specifically, Acer truncatum. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Accordingly, actual events or circumstances may differ materially from events and circumstances that are assumed in this information and you are cautioned not to give undue weight to such data.

DEFINITIONS

“Amended and Restated Memorandum and Articles of Association” means the amended and restated memorandum of association and the amended and restated articles of association of our Company as filed with the Cayman Islands Registrar of Companies on March 16, 2018, as amended from time to time, a copy of which is filed as Exhibit A to our Definitive Schedule 14(C) filed with the SEC on January 16, 2018.

“Bao Feng” means Bao Feng Bio-Technology (Beijing) Limited, a limited liability company incorporated on August 30, 2012 under the laws of the PRC, which is the Company’s primary operating subsidiary.

“Business Day” means any day other Saturday, Sunday or a day that is a public holiday in the United States.

“Company” or “our Company” or “Zhong Yuan Cayman” means Zhong Yuan Bio-Technology Holdings Limited, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act, and its subsidiaries or any of them.

“China Bio” means China Bio Technology Holdings Limited, a limited liability company incorporated on June 27, 2016 under the laws of Seychelles, which is a holding company and not conducting any operations.

“Companies Act” means the Companies Act (Revised) of the Cayman Islands.

“COVID-19” means the Coronavirus Disease 2019.

“Dandong BF” means Dandong Bao Feng Seedling Technology Co., Limited, a limited liability company incorporated on March 11, 2019 under the laws of the PRC, which was one of the Company’s operating subsidiaries prior to its sale in September 2022.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“FINRA” means Financial Industry Regulatory Authority, Inc.

“Group,” “our Group,” “we,” “us,” or “our” means the Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before the Company became the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of the Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“Hong Kong” or “H.K.” means the Hong Kong Special Administrative Region of the People’s Republic of China.

“Operating Subsidiary” means Bao Feng Technology (Beijing) Limited, a China company and an indirect subsidiary of the Company.

“Ordinary Resolution” means a resolution passed by a simple majority of votes cast or approved in writing by all of the votes entitled to be cast by the shareholders entitled to vote at a general meeting of the Company.

“Ordinary Shares” or “Shares” means the Company’s Ordinary Shares, par value $0.001 per share.

| 4 |

“PRC” or “China” means the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, the Macau Special Administrative Region of the People’s Republic of China and Taiwan.

“Resale Registration Statement” means the registration statement on Form F-1 filed by the Company on June 11, 2020 and declared effective by the SEC on June 29, 2020 (SEC File No. 333-235983), plus any Post-Effective Amendments thereto, pursuant to which 2,236,192 Ordinary Shares were registered for resale on behalf of certain existing shareholders of the Company.

“Sarbanes-Oxley Act” means the U.S. Sarbanes-Oxley Act of 2002.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Securities and Exchange Commission,” “SEC,” “Commission” or similar term means the United States Securities and Exchange Commission.

“Selling Shareholder” means Mr. Yu Chang, a pre-existing shareholder, who is selling [●] Ordinary Shares pursuant to the registration statement on Form F-1 of which this prospectus is a part.

“Special Resolution” means a resolution passed by a majority of not less than two-thirds of the shareholders entitled to vote on the matter, in person or, where proxies are allowed, by proxy, at a general meeting of the Company or in writing by all of the shareholders entitled to vote on the matter.

“WFOE” means a wholly foreign-owned entity, a common investment vehicle for a China-based business wherein foreign parties can incorporate a foreign-owned limited liability company without the involvement of a Chinese investor; starting January 2020, per the new Foreign Investment Law, WFOE has been abolished and superseded by a new type of business referred to as "foreign-funded enterprise" and existing businesses are expected to transition to the new designation within five years.

“Zhong Yuan HK” means Zhong Yuan Bio-Technology (Hong Kong) Limited, a limited liability company incorporated on February 27, 2017 under the laws of Hong Kong, which is a holding company and not conducting any business operations.

“Zhong Yuan SZ” means Zhong Yuan Bio-Technology (Shenzhen) Limited, a limited liability company incorporated on June 10, 2014 under the laws of the PRC, and a wholly foreign owned entity, which is a holding company and not conducting any business operations.

“United States,” “U.S.” and “US” refer to the United States of America.

“$,” “U.S. $,” “U.S. dollars,” “dollars,” “US$” and “USD” refer to United States dollars.

| 5 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our Ordinary Shares, you should carefully read the entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus. You should also consider, among other things, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case appearing elsewhere in this prospectus. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company” or “Zhong Yuan Cayman” and similar designations refer to Zhong Yuan Bio-Technology Holdings Limited, a Cayman Islands exempted company with limited liability. All references to “Operating Subsidiary” refer to Bao Feng Bio-Technology (Beijing) Limited, a China company.

Overview

The Company was originally incorporated in the State of Delaware on April 4, 2016 under the name “Agate Island Acquisition Corporation.” Its business purpose was to seek the acquisition of, or merger with, an existing company. Accordingly, the Company was considered to be a “blank check” company. On March 13, 2017, the Company’s name was changed to China Biotech Holdings Limited in anticipation of entering into a transaction with a company in China engaged in the biopharma or biotech industry. Effective August 21, 2018, the Company was redomiciled from Delaware to the Cayman Islands by merging into its wholly-owned Cayman Islands subsidiary, Zhong Yuan Bio-Technology Holdings Limited (the “Redomicile Merger”). As a result of the Redomicile Merger, the Company’s name was changed to Zhong Yuan Bio-Technology Holdings Limited.

In 2019, the Company closed on a share exchange (the “Share Exchange”) with Zhong Yuan Investment Limited, (“Zhong Yuan Investment”), a Seychelles company limited by shares, that owned 100% of the shares of China Bio-Technology Holdings Limited (“China Bio”), a company organized under the laws of the Republic of Seychelles. As a result of the Share Exchange, China Bio is now a wholly-owned subsidiary of the Company and the Company, through its indirect subsidiary, Bao Feng, is engaged in the business of nervonic acid research, the development and sale of nervonic acid-based health supplements and the development of nervonic acid-based herbal and chemical drugs. See “Our Business – History of the Company” on page 60 of this prospectus.

The following chart sets forth our corporate structure as of the date of this prospectus.

| 6 |

China Bio-Technology Holdings Limited (“China Bio”) was incorporated under the laws of the Republic of Seychelles on June 27, 2016 under the name Hua Hong Powerloop Technology Limited. On February 13, 2017, its name was changed to China Bio-Technology Limited, and on March 6, 2017 it was changed to China Bio-Technology Holdings Limited. It became a wholly-owned subsidiary of the Company in August 2019 as a result of the Share Exchange described above.

Zhong Yuan Bio-Technology (Hong Kong) Limited (“Zhong Yuan HK”) was incorporated in Hong Kong on June 13, 2016. The original shareholders transferred all of the shares to China Bio on February 27, 2017.

Zhong Yuan Bio-Technology (Shenzhen) Limited (“Zhong Yuan SZ”) was established under the laws of the PRC on June 10, 2014 and is our WFOE. The original shareholders transferred all of the shares to Zhong Yuan HK on May 12, 2017.

Bao Feng Bio-Technology (Beijing) Limited (“Bao Feng)” was incorporated in the PRC on August 30, 2012 under the name Beijing Acer Truncatum Century Agricultural Science and Technology Co., Ltd. On August 10, 2017, the company’s name was changed to Bao Feng Bio-Technology (Beijing) Limited. It became a wholly-owned subsidiary of Zhong Yuan-SZ on February 13, 2019. Bao Feng is currently the Company’s sole operating subsidiary.

All of the above-referenced companies are either direct or indirect wholly-owned subsidiaries of the Company. China Bio, Zhong Yuan HK and Zhong Yuan SZ are holding companies and do not conduct any business operations. Bao Feng, which conducts business operations in China, is our sole operating subsidiary (our “Operating Subsidiary”).

The Company files annual and periodic reports with the United States Securities and Exchange Commission (the "SEC") under Rule 13(a) of the Exchange Act.

When we refer in this prospectus to business and financial information for periods prior to the consummation of the Share Exchange, we are referring to the business and financial information of China Bio and its subsidiaries unless the context suggests otherwise; when we use terms such as “we,” “our,” “Company” and “us,” we are referring to the Company and all of its subsidiaries, as a combined entity. When we use the term “Operating Subsidiary,” we are referring to Bao Feng.

Business of Bao Feng

Bao Feng is in the business of nervonic acid research, the development of nervonic acid based herbal and chemical drugs and the sale of health supplements containing nervonic acid. Nervonic acid is a long chain unsaturated omega 9 fatty acid that is an important component in myelin biosynthesis in the central and peripheral nervous system. Myelin insulates nerve cell axons to increase the speed at which information (encoded as an electrical signal) travels from one nerve cell body to another or from a nerve cell to another type of cell in the body. It is thought that nervonic acid may enhance brain function and prevent demyelination of nerve cells, and that, therefore, it may be effective in retaining or improving the health of the brain, for example in preventing or ameliorating attention-deficit hyperactive disorder (“ADHD”) in children, Alzheimer's disease and mental degradation in the elderly and cerebrovascular disease, as well as promoting normal brain development in premature infants. The role of nervonic acid is also being studied with respect to psychotic illnesses, such as schizophrenia.

Bao Feng’s goal is to provide a complete solution for neurological disorders, from screening to intervention. Bao Feng is dedicated to the development of early detection kits for brain diseases, plant-derived nervonic acid health supplements and new drugs for neurological diseases. Over the past decade, it has focused on research related to neurological diseases and discovered that nervonic acid can be used as a core molecular marker, laying the foundation for the development of the detection kits and drugs. More recently, Bao Feng has made breakthroughs in the research and development of new drugs to treat cognitive impairment, brain atrophy and other encephalopathies caused by brain white matter damage.

| 7 |

Nervonic acid is considered to be an important biomarker for many neurological diseases, such as ADHD in children and neurodegenerative diseases in the elderly and, thus, in high demand among those populations. Bao Feng’s marketing efforts are primarily aimed at the elderly population. The problem of the aging of the world population is becoming more and more serious. According to the United Nations’ “World Population Ageing 2019: Highlights” report, in 2019, there were 703 million persons aged 65 years or over in the world population, or approximately 10% of the global population. It is estimated that by 2050 the world’s 65 and over population will double to 1.5 billion so that one in six people in the world will be aged 65 years or over. According to census statistics released by the National Bureau of Statistics, in 2022, China has 267 million persons aged 60 or over, representing 18.9% of the total population, and 14% of the country’s population are aged 65 or over.

The price of nervonic acid in the world market ranges from approximately $2,000 to approximately $6,000 per kilogram, depending on the purity. Since it is considered to be an important biomarker for many neurological diseases, such as ADHD in children and neuro-degenerative diseases in the elderly, management believes that there exists a significant market for nervonic acid health supplements among those populations. Bao Feng’s marketing efforts are primarily aimed at the elderly population.

Nervonic acid is not present in many foods. In the past, nervonic acid was derived from the brains of sharks. However, the extraction process from that source is difficult, and the cost is too high for commercialization. In addition, sharks are protected by the United Nations and many countries. Another good source of nervonic acid is the malania oleifera plant, which is native to southern China. The malania oliefera plant is said to have up to 40.9% to 50% nervonic acid; however, it is a threatened species in the world and is on the list of key wild plants for state protection. The dried seeds of the Acer truncatum tree, which is a type of maple native to northern China, Mongolia and Korea, were found to contain 5.8% nervonic acid. Therefore, the seed oil of the Acer truncatum tree is considered to be a good source of natural nervonic acid, as well as other compounds such as Vitamin E. Bao Feng extracts the nervonic acid that it utilizes in its products from Acer truncatum seeds.

The raw material sources of nervonic acid are insufficient to meet Chinese demand. Therefore, Bao Feng has a contract with the Wengniuteqi government pursuant to which it obtains Acer truncatum seeds for use in making its products. In 2011, the Chinese government No. 9 announcement “Food Safety Law of the People’s Republic of China” and “Regulations of Novel Foods” approved Acer truncatum seed oil as a new resource for food ingredients, thereby recognizing the safety status of Acer truncatum.

Bao Feng intends to expand its product line by building factories for purification of nervonic acid for medical level product usage. There can be no assurance, however, that either Bao Feng or the Company will be able to effect this plan.

Bao Feng’s current products consist of:

| · | NEURO ENHANCER nervonic acid oil; |

| · | Muzhiyuan Acer truncatum formula oil; and |

| · | Life’s NA Candy. |

Early detection kits

Bao Feng is in the process of developing early screening kits for brain white matter signal abnormalities, Parkinson’s disease and ischemic strokes. It is in the clinical trial stage. After completion of clinical trials, Bao Feng will apply to the Ministry of Health of the PRC for an innovation class III product registration certificate and related business operation license in China for the production and sale of domestic disposable medical devices. It intends to distribute its innovation class III products to major clinics and hospitals through domestic distributors, as well as through direct sales to its partner hospitals and other medical institutions.

Plant-based and synthetic drugs

Bao Feng has improved its purification process so as to produce high (medical) grade nervonic acid in a laboratory setting and is currently working on building factories in order to achieve mass production. The next step is expected to be the development of pharmaceutical products or the sale of raw materials for nervonic acid products throughout China and abroad.

| 8 |

Application of Acer truncatum seed oil for regulation of intestinal flora

Bao Feng has found that supplementation of Acer truncatum seed oil can regulate intestinal flora. Its research in this area found that after taking nervonic acid oil, the abundance of Firmicobacterium, which increases with Alzheimer's disease, showed a downward trend, while the abundance of Bacteroidetes, which decreases with Alzheimer's disease, showed an upward trend. Therefore, we believe that taking nervonic acid oil may help to improve Alzheimer's disease. This research may also be used in the future to intervene in other diseases believed to be caused by disorders of intestinal flora, such as autism.

Competitive Advantages

Experienced team of scientists

Our team of scientists has over 30 years of combined experience in the field of Acer truncatum tree research, and more than 10 years in nervonic acid applications. In addition, Bao Feng achieved the National High-Tech Enterprise Award in 2017. This award recognizes the continuous research and development and the transformation of technological achievements in the high-tech fields supported by the state, forming the core independent intellectual property rights of the enterprise, and the carrying on of business activities on this basis in China (not including resident enterprises registered in Hong Kong, Macao and Taiwan) for more than one year.

Research in cooperation with hospitals

Bao Feng has participated in numerous academic and scientific research projects in cooperation with China Medical University, the first top-tier medical institution established in China, and Xuanwu Hospital of Capital Medical University, a pre-eminent general hospital in both Geriatrics and neuroscience. This research supplements Bao Feng’s in-house research and, together, they provide the scientific basis for Bao Feng’s current and proposed products.

Stable source of high quality Acer truncatum

Bao Feng obtains its Acer truncatum seeds from the Wengniuteqi District government farm in Inner Mongolia, which contains approximately 70,000 mu of wild 100-year old Acer truncatum trees. Under a cooperation agreement entered into in 2017 between Bao Feng and the Wengniuteqi District, Bao Feng provides the seedlings for an additional 10,000 mu of Acer truncatum trees being grown on the government farm and Bao Feng has the exclusive right to purchase the seeds from both the old and the new trees.

Extensive intellectual property

Bao Feng currently holds 17 invention patents and 18 computer software copyrights related to its research. It is also the holder of 20 trademarks related to its products.

Limited current competition

The nervonic acid health product industry is in its early stages; therefore, Bao Feng does not face as much competition as it would in a more established industry. However, as more companies enter the market the competition may be expected to become more intense. Management of Bao Feng plans to preempt the effect of such competition by: (i) increasing its Acer truncatum production; (ii) increasing its investment in research and development; (iii) obtaining certification for innovation class III products and drugs; and (iii) enhancing its purification of nervonic acid technology to enter the medical usage market. We will also continue to emphasize marketing in an effort to maintain and strengthen the company’s position in the nervonic acid health product market and will attempt to build the leading nervonic acid health product brand in China.

| 9 |

Bao Feng has its own national laboratories.

Genetic Metabolism Key Laboratory is a joint project of Bao Feng and Health Commission Occupational Disease Research Center. Complete analytical and testing instruments are available, including LC-MS, GC-MS and LC-QTOF-MS, for targeted and untargeted metabolomics, etc. Excellent laboratories are necessary to develop and prove our theories on the applications of nervonic acid, and research on the mechanism through which nervonic acid works provides the direction for future applications of nervonic acid, giving Bao Feng a competitive edge in the future

Clinical application of nervonic acid

Bao Feng has formed strategic partnerships with the First Affiliated Hospital of Tsinghua University, Tiantan Hospital, Xuanwu Hospital and the First Hospital of Sanming City. The doctors of the hospitals are our consultants. In the future, we plan to carry out clinical application trials of nervonic acid in different areas of medicine. Only through clinical trials can the application and effective concentration of nervonic acid be found, and effective combinations of nervonic acid and other drugs to improve the efficacy of a single target drug be determined.

Excellent Acer truncatum germplasm resources.

Although many manufacturers sell crude Acer truncatum oil, the content cannot reach our concentration of nervonic acid because we have an excellent seed plasm resource. We extract the nervonic acid utilized in our products from the seeds of Acer truncatum trees. Our seeds are supplied by the Wengniuteqi District government farm in Inner Mongolia, which contains approximately 70,000 mu (11,532 acres) of wild 100-year old Acer truncatum trees. In March 2017, Bao Feng entered into a cooperation agreement with the Wengniuteqi District (the “Cooperation Agreement”). In accordance with the terms and provisions of the Cooperation Agreement, Bao Feng provides the seedlings for an additional 10,000 mu (1647 acres) of Acer truncatum trees and the government farm provides the land and plants and maintains the seedlings. The government farm harvests the seeds, which are currently estimated to be approximately 400,000 tons per year, and Bao Feng has the exclusive right to purchase the seeds from both the old and the new trees. We believe that this germplasm resource is unmatched by other companies using newly sown Acer truncatum. Therefore, by using this high content, Acer truncatum crude oil, we can obtain a higher content of nervonic acid with the same process and cost as our competitors.

Bao Feng’s breeding base of seedlings results from agricultural technology developed by scientists under contract with Bao Feng. The concentration of nervonic acid from young trees is significantly lower than that from older trees. Our breeding base serves as a strategic reserve for the supply of raw materials for non-high-content nervonic acid products. Low levels of nervonic acid are used for daily supplements, medium levels for health care and high levels for future use in medicine and therapy. As the young trees mature, the concentration of nervonic acid in the seeds of those trees will increase. Therefore, our breeding base is an important part of Bao Feng’s strategy for corporate sustainability.

Price

Through product innovation and exclusive formulae, Bao Feng improves its products’ effectiveness and taste, while maintaining a low product cost and sales price. In this way it produces unique products at prices suitable for mass consumption

Market-driven research and development allow for continual improvement and long-term client loyalty

Bao Feng adheres to a market-oriented research and development approach and actively cooperates with universities, hospitals, medical institutions, distributors and independent sales agents in sorting out our R&D orientation based on real market demand. We continuously upgrade and improve our products and technologies to better suit our customers.

| 10 |

Risks and Challenges

Investing in our Ordinary Shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 23 of this prospectus, which you should carefully consider before making a decision to purchase our Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

These risks include but are not limited to the following:

Risks Related to Our Company

| · | The Company is in the process of developing its business and has a limited operating history. See “Risk Factors – Risks Related to Our Company - Our limited operating history makes it difficult to evaluate our future prospects and results of operations” on page 23 of this prospectus. |

| · | The Company has experienced negative cash flow and losses from operations. See “Risk Factors – Risks Related to Our Company - The Company has incurred net losses in the past and may incur losses again in the future” on page 23 of this prospectus. |

| · | We may not be able to raise additional capital. See “Risk Factors – Risks Related to Our Company - We may not be able to raise the additional capital necessary to execute our business strategy, which could result in the curtailment of our operations” on page 24 of this prospectus. |

| · | We are a holding company with a total of four subsidiaries; however, at the current time only one subsidiary, Bao Feng, is conducting operations and we are and will remain dependent on Bao Feng for our revenue. See “Risk Factors – Risks Related to Our Company - We currently have only one operating subsidiary and one line of products” on page 24 of this prospectus. |

| · | Our Operating Subsidiary may not be able to obtain or maintain all necessary licenses, permits and approvals and to make all necessary registrations and filings for its business activities in multiple jurisdictions and related to residents therein, especially in the PRC, or otherwise relating to PRC residents. See “Risk Factors – Risks Related to Our Company - Our Operating Subsidiary may not be able to obtain or maintain all necessary licenses, permits and approvals and to make all necessary registrations and filings for its business activities in multiple jurisdictions and related to residents therein, especially in the PRC, or otherwise relating to PRC residents” on page 24 of this prospectus. |

| · | It may be difficult or impossible for a shareholder to effect service of process or to bring an action against us or against our directors and officers in the Cayman Islands, in Hong Kong or in China in the event that a shareholder believes that his rights have been infringed under the securities laws or otherwise. Even if a shareholder is successful in bringing an action of this kind, the laws of the Cayman Islands, Hong Kong and China may render the shareholder unable to enforce a judgment against our assets or the assets of our directors and officers. See “Risk Factors – Risks Related to Our Company - Our shareholders may face difficulties in protecting their interests, and their ability to protect their rights through the U.S. federal courts may be limited because we are incorporated under Cayman Islands law, we conduct all of our operations in China and with the exception of Ms. Huang, one of our independent directors who resides in the United States, all of our other directors and officers reside outside the United States” as disclosed on page 25 of this prospectus. |

| 11 |

| · | No overseas securities regulator is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. The inability of an overseas securities regulator to directly conduct investigation or evidence collection activities within China may result in difficulties faced by our shareholders in protecting their interests. See “Risk Factors – Risks Related to Our Company - It may be difficult for overseas regulators to conduct investigations or collect evidence within China” on page 26 of this prospectus. |

| · | If we fail to implement and maintain an effective system of internal controls over financial reporting, we may be unable to accurately report our results of operations, meet reporting obligations or prevent fraud. As a result, holders of our securities could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our securities. See “Risk Factors – Risks Related to Our Company - We have identified material weaknesses in our internal control over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the future trading price of our Ordinary Shares” on page 26 of this prospectus. |

| · | U.S. public companies that have substantially all of their operations in China (including in Hong Kong) have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered on financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. See “Risk Factors – Risks Related to Our Company - The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq and an act passed by the U.S. Senate and the U.S. House of Representatives all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, Ordinary Share price and reputation” on page 27 of this prospectus. |

| · | The HFCAA prohibits foreign companies from listing their securities on U.S. exchanges if the company’s auditor has been unavailable for PCAOB inspection or investigation for three consecutive years beginning in 2021 and, if the AHFCAA becomes law, that time period would be reduced to two years. If our auditor’s work papers were to become located in China or Hong Kong, and thereby not be available for PCAOB inspection, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange. See “Risk Factors – Risks Related to Our Company - To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for the Company may, in the future, be located in China or in Hong Kong, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange” on page 28 of this prospectus. |

Risks Related to the Business of Bao Feng

| · | We believe that market recognition of our brand is a key factor to ensuring our future success, and the quality and acceptance of our products will determine whether our brand becomes recognized as a leading brand in the industry. As we continue to grow in size and broaden the scope of our product offerings, however, it may become increasingly difficult to maintain the quality and consistency of the products we offer, which may negatively impact our brand and the popularity of our products offered thereunder. See “Risk Factors – Risks Related to the Business of Bao Feng - Bao Feng’s business depends on the market recognition of its brand. If we are not able to maintain our reputation and enhance our brand recognition, our business and operating results may be materially and adversely affected” on page 30 of this prospectus |

| · | Our business is in an industry that we expect to become increasingly competitive, and many of our competitors, both local and international, may have substantially greater technical, financial and marketing resources than we have.. See “Risk Factors – Risks Related to the Business of Bao Feng - We may face increasing competition in our industry and may not be able to successfully compete with our competitors” on page 30 of this prospectus. |

| 12 |

| · | We currently offer three health supplement products. We intend to continue developing new products, as well as further enhancing our existing products. However, this process is subject to risks and uncertainties. See “Risk Factors – Risks Related to the Business of Bao Feng - We may not be successful in introducing new products or enhancing our existing products” on page 30 of this prospectus. |

| · | We depend upon factors relating to discretionary consumer spending in China. See “Risk Factors – Risks Related to the Business of Bao Feng - Our business is affected by global, national and local economic conditions, as the products it sells are discretionary” on page 31 of this prospectus. |

| · | As substantially all of our assets and operations are located in the PRC, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in the PRC generally. The Chinese government continues to play a significant role in regulating industry development and in controlling the PRC’s economic growth. See “Risk Factors – Risks Related to the Business of Bao Feng - Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations” on page 31 of this prospectus. |

| · | If we fail to anticipate, identify or react appropriately to changes in consumer demand, we could experience excess inventories, higher than normal markdowns or be unable to sell the products, which would reduce our revenue, financial position and results of operations. See “Risk Factors – Risks Related to the Business of Bao Feng - Consumer preferences in the health care industry change rapidly and are difficult to predict” on page 31 of this prospectus. |

| · | We depend on our largest customers for a significant portion of our sales revenue, and we cannot be certain that sales to these customers will continue. If sales to these customers do not continue, then our sales revenue will decline and our business will be negatively impacted. See “Risk Factors – Risks Related to the Business of Bao Feng - We depend on our largest customers for a significant portion of our sales revenue, and we cannot be certain that sales to these customers will continue” on page 32 of this prospectus. |

| · | We collect and retain large volumes of data relating to our business and from our employees and customers for business purposes. A penetrated or compromised data system or the intentional, inadvertent or negligent release or disclosure of data could result in theft, loss or fraudulent or unlawful use of data relating to our Company or our employees, independent distributors or customers, which could harm our reputation, disrupt our operations or result in remedial and other costs, fines or lawsuits. See “Risk Factors – Risks Related to the Business of Bao Feng - Cyber security risks and the failure to maintain the integrity of data belonging to our Company, employees and customers could expose us to data loss, litigation and liability, and our reputation could be significantly harmed” on page 33 of this prospectus. |

| · | We currently market dietary supplements. However, if government officials should determine that our products should be categorized as health foods, this could end or limit our ability to market such products in China and have a material adverse effect on our results of operations and financial condition. In addition, if we expand into the medical market, we will need to apply for medical qualifications. See “Risk Factors – Risks Related to the Business of Bao Feng - Difficulties in registering our products for sale in Mainland China could have a material adverse effect on our results of operations and financial condition” on page 33 of this prospectus. |

| · | Our business has been and may continue to be adversely impacted by the COVID-19 epidemic. We may also experience negative effects from future public health crises beyond our control. These events are impossible to forecast, their negative effects may be difficult to mitigate and they could adversely affect our business, financial condition and results of operations. See “Risk Factors – Risks Related to the Business of Bao Feng - Our business is subject to risks arising from epidemic diseases, such as the recent outbreak of COVID-19” on page 34 of this prospectus. |

| 13 |

Risks Related to the People’s Republic of China

| · | As a business operating in China, we are subject to the laws and regulations of the PRC, which can be complex and evolve rapidly. The PRC government has the power to exercise significant oversight and discretion over the conduct of our Operating Subsidiary’s business, and the regulations to which it is subject may change rapidly and with little notice to us or our shareholders. As a result, the application, interpretation and enforcement of new and existing laws and regulations in the PRC are often uncertain. To the extent that any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected, which could materially decrease the value of our Ordinary Shares. See “Risk Factors – Risks Related to the People’s Republic of China - Because a substantial portion of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares” on page 34 of this prospectus. For further discussion, including the possible consequences for non-compliance, see “Regulations in China Applicable to Our Business” on page 76 of this prospectus. |

| · | We may become subject to a variety of PRC laws and other regulations regarding data security or securities offerings that are conducted overseas and/or other foreign investment in China-based issuers. See “Risk Factors – Risks Related to the People’s Republic of China - If the Chinese government were to impose new requirements for approval from the PRC authorities to issue the Company’s Ordinary Shares to foreign investors or list on a foreign exchange, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause such securities to significantly decline in value or become worthless” and “If the Chinese government chooses to exert greater oversight and control over offerings that are conducted overseas and/or foreign investment in China based issuers, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to overseas investors and cause such securities to significantly decline in value or to be worthless” on pages 35 and 37, respectively, of this prospectus. |

| · | In recent years, international market conditions and the international regulatory environment have been increasingly affected by competition among countries and geopolitical frictions. Changes to national trade or investment policies, treaties and tariffs, fluctuations in exchange rates or the perception that these changes could occur, could adversely affect the financial and economic conditions in China, as well as our future international and cross-border operations, our financial condition and results of operations. See “Risk Factors – Risks Related to the People’s Republic of China - Changes in international trade or investment policies and barriers to trade or investment, and the ongoing geopolitical conflict, may have an adverse effect on our business and expansion plans and could lead to the delisting of our securities from U.S. exchanges and/or other restrictions or prohibitions on investing in our securities” on page 36 of this prospectus. |

| · | Recently, there have been heightened tensions in the economic and political relations between the United States and China. Legislative or administrative actions in respect of Sino-U.S. relations could cause investor uncertainty for affected issuers, including us, and the market price of our Ordinary Shares could be adversely affected. See “Risk Factors – Risks Related to the People’s Republic of China - The market price for our Ordinary Shares could be adversely affected by increased tensions between the United States and China” on page 38 of this prospectus. |

| · | While many of the economies in Asia, including China, have experienced rapid growth over the last two decades, they currently are experiencing inflationary pressures. Inflationary pressures may result in government intervention in the economy, including policies that may adversely affect the overall performance of the respective countries’ economy, which could, in turn, adversely affect our operations and the price of our Ordinary Shares. See “Risk Factors – Risks Related to the People’s Republic of China - Many of the economies in Asia, including China, are experiencing substantial inflationary pressures, which may prompt governments to take action to control the growth of the economy and inflation that could lead to a significant decrease in our profitability” on page 39 of this prospectus. |

| · | Our PRC Operating Subsidiary is subject to PRC laws and regulations. However, these laws and regulations change frequently, and their interpretation and enforcement involve uncertainties. Such uncertainties, including the inability to enforce our contracts, could affect our business and operations. See “Risk Factors – Risks Related to the People’s Republic of China - The PRC legal system embodies uncertainties, which could limit law enforcement availability” on page 40 of this prospectus. |

| · | We are a Cayman Islands holding company, and we rely principally on dividends and other distributions on equity from our PRC subsidiaries for our cash requirements. Any limitation on the ability of our PRC subsidiaries to distribute dividends or other payments to their shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business. See “Risk Factors – Risks Related to the People’s Republic of China - We rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” on page 40 of this prospectus. |

| 14 |

Risks Related to the Company’s Ordinary Shares

| · | There can be no assurance that a regular public market for our Ordinary Shares will ever develop. If a regular trading market for our securities does not develop, you will likely not be able to sell your Ordinary Shares. We cannot predict the extent, if any, to which investor interest will lead to the development of a viable trading market in our Ordinary Shares. See “Risk Factors – Risks Related to the Company’s Ordinary Shares - There is currently only a limited trading market for our Ordinary Shares” on page 41 of this prospectus. |

| · | The trading price of our Shares may be volatile. See “Risk Factors – Risks Related to the Company’s Ordinary Shares - It is likely that there will be significant volatility in the trading price of our Ordinary Shares” on page 41 of this prospectus. |

| · | We intend to list our Ordinary Shares on the Nasdaq Capital Market concurrently with this offering, and we will not close this offering unless we have obtained approval from the Nasdaq Stock Market to list our Ordinary Shares on the Nasdaq Capital Market. In order to continue listing our Shares on Nasdaq subsequent to closing this offering, we must maintain certain financial and share price levels, and we may be unable to meet these requirements in the future. We cannot assure you that our Ordinary Shares will continue to be listed on Nasdaq in the future. See “Risk Factors – Risks Related to the Company’s Ordinary Shares - We may not maintain the listing of our Ordinary Shares on the Nasdaq Capital Market which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions” on page 41 of this prospectus. |