SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended |

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

F/K/A China Biotech Holdings Limited

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Telephone: +

Email:

(Name, Telephone, email and/or fax number and address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

ORDINARY SHARES, PAR VALUE $0.001

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary Shares, $0.001 par value, at March 31, 2022

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

Yes ☐

If the report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15D of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

Large Accelerated Filer ☐

Accelerated Filer ☐

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

Yes ☐

TABLE OF CONTENTS

| PART I | Page | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 11 |

| Item 2. | Offer Statistics and Expected Timetable | 11 |

| Item 3. | Key Information | 11 |

| Item 4. | Information on the Company | 31 |

| Item 4A. | Unresolved Staff Comments | 58 |

| Item 5. | Operating and Financial Review and Prospects | 58 |

| Item 6. | Directors, Senior Management and Employees | 72 |

| Item 7. | Major Shareholders and Related Party Transactions | 72 |

| Item 8. | Financial Information | 74 |

| Item 9. | The Offer and Listing | 74 |

| Item 10. | Additional Information | 74 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 8 |

| Item 12. | Description of Securities Other Than Equity Securities | 79 |

| PART II | ||

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 79 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 79 |

| Item 15. | Controls and Procedures | 79 |

| Item 16. | Reserved | 80 |

| Item 16A. | Audit Committee Financial Expert | 80 |

| Item 16B. | Code of Ethics | 80 |

| Item 16C. | Principal Accountant Fees and Services | 81 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 81 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliates Purchasers | 81 |

| Item 16F. | Changes in Registrant's Certifying Accountants | 81 |

| Item 16G. | Corporate Governance | 81 |

| 81Item 16H. | Mine Safety Disclosure. | 81 |

| PART III | ||

| Item 17. | Financial Statements | 82 |

| Item 18. | Financial Statements | 82 |

| Item 19. | Exhibits | 82 |

| SIGNATURES | 83 |

| 3 |

INTRODUCTION

Zhong Yuan Bio-Technology Holdings Limited (the “Company” or “we”) is a limited liability company incorporated under the laws of the Cayman Islands. Since inception and through our operating subsidiaries in the People’s Republic of China (the “PRC” or “China”), our goal is to provide a complete solution for neurological disorders, from screening to intervention. We are dedicated to the development of early detection kits for brain diseases, plant-derived nervonic acid health supplements and new drugs for neurological diseases. Over the past decade, we have focused on research related to neurological diseases and discovered that nervonic acid can be used as a core molecular marker laying the foundation for the development of the detection kits and drugs. More recently, we have made breakthroughs in the research and development of new drugs to treat cognitive impairment, brain atrophy and other encephalopathies caused by brain white matter damage.

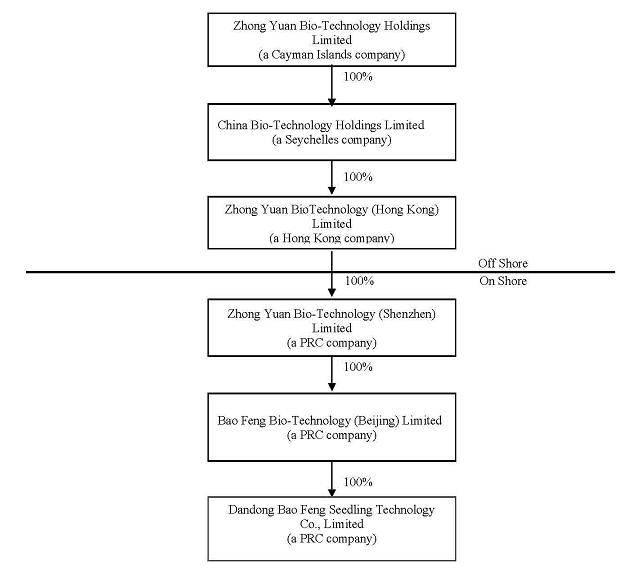

Our equity structure is a direct holding structure. The overseas entity that is trading on the OTCQB Market in the United States is Zhong Yuan Bio-Technology Holdings Limited, a Cayman Islands company. The Company has five wholly-owned subsidiaries as follows:

| (i) | The Company directly owns and controls China Bio-Technology Holdings Limited, a Seychelles company (“China Bio”), which is a holding company and not conducting any business operations; |

| (ii) | China Bio directly owns and controls Zhong Yuan Bio-Technology (Hong Kong) Limited, a Hong Kong company (“Zhong Yuan-HK”), which is a holding company and not conducting any business operations; |

| (iii) | Zhong Yuan-HK directly owns and controls Zhong Yuan Bio-Technology (Shenzhen) Limited, (“Zhong Yuan-SZ”), a China company and a wholly foreign owned entity (“WFOE”), which is a holding company and not conducting any business operations; |

| (iv) | Zhong Yuan-SZ directly owns and controls Bao Feng Bio-Technology (Beijing) Limited, a China company (“Bao Feng”), which is one of our operating subsidiaries; and |

| (v) | Bao Feng directly owns and controls Dandong Bao Feng Seedling Technology Co. Limited, a China company (“Dandong BF”), which is another operating subsidiary. |

All of the above-referenced companies are either direct or indirect wholly-owned subsidiaries of the Company. China Bio, Zhong-Yuan-HK and Zhong Yuan-SZ are holding companies and do not conduct any business operations. Bao Feng and Dandong BF are our operating subsidiaries, both of which conduct business operations in China (collectively, our “Operating Subsidiaries” or our “PRC Subsidiaries”).

The Chinese government may exercise significant oversight and discretion over the conduct of our business in China and may intervene in or influence our Operating Subsidiaries’ operations at any time, which could result in a material change in their operations and/or the value of our Ordinary Shares. In addition, we may be materially affected by recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based companies including, but not limited to, cybersecurity review and regulatory review of the overseas listing of our Ordinary Shares through an offshore holding company. We are also subject to the risks of uncertainty about any future actions the Chinese government may take in this regard.

If the Chinese government were to choose to exercise significant oversight and discretion over the conduct of our Operating Subsidiaries’ businesses, it may intervene in or influence our Operating Subsidiaries’ operations. Such governmental actions:

| ● | could result in a material change in our Operating Subsidiaries’ operations; | |

| ● | could hinder our ability to offer securities to investors; and | |

| ● | may cause the value of our Ordinary Shares to significantly decline or cause our Ordinary Shares to become worthless. |

| 4 |

Cybersecurity Review Measures

As we conduct a substantial portion of our operations in China, we are subject to legal and operational risks associated with such operations, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States and Chinese or United States regulations, which risks could result in a material change in our operations and/or cause our Ordinary Shares to significantly decline in value or to become worthless and could affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews and expanding efforts in anti-monopoly enforcement. New laws, such as the Measures for Cybersecurity Review, could significantly limit or completely hinder our ability to offer or continue to offer securities to overseas investors and cause such securities to significantly decline in value or to be worthless.

The PRC, through the Cyberspace Administration of China (the “CAC”), has recently proposed new rules and enacted new laws that would require companies collecting or holding large amounts of data to undergo a cybersecurity review prior to listing in foreign countries, a move that would significantly tighten oversight over China-based Internet giants. Pursuant to Article 6 of the Measures for Cybersecurity Review (Draft for Comments), companies holding data on more than 1 million users must apply for cybersecurity approval when seeking listings in other nations due to the risk that such data and personal information could be “affected, controlled, and maliciously exploited by foreign governments.” On January 4, 2022 and effective February 15, 2022, the CAC issued the Revised Measures on Cyberspace Security (the “Revised Measures”), which requires that operators of critical information infrastructure (“CII”) intending to procure network products and services that may affect national security undergo cybersecurity review. This has impacted and could potentially impact a broad range of data-rich tech companies. The Revised Measures expand the scope of reviewed business entities to now include network platform (“NP”) operators intending to engage in certain activities, such as applying to list abroad. The Revised Measures establish a Cybersecurity Review Office (the “CRO”), an administrative body within the CAC, to formulate the regulations for cybersecurity review and to lead the cybersecurity review process. Applicable CII operators and NP operators are required to submit an application to the CRO, and the CRO will assess whether a cybersecurity review is required.

If an entity is a CII operator or an NP operator, it is required to apply for cybersecurity review if any of the following three conditions is met: (i) the CII operator proposes to procure network products and services that affect or may affect national security; (ii) the NP operator proposes to carry out data processing activities that affect or may affect national security; (iii) or the NP operator controls personal information of more than 1,000,000 users and proposes to apply for overseas listing. The term “overseas listings” is often interpreted as listings outside of China, such as in the U.S.; “network products and services” include core network equipment, high capability computers and servers, high capacity data storage, large databases and applications, network security equipment and cloud computing services; and “data processing” means the collection, storage, use, processing, transmission, provision and disclosure of data.

Our operations in China involve the development of early detection kits for brain diseases, plant-derived nervonic acid health supplements and new drugs for neurological diseases. Over the past decade, we have focused on research related to neurological diseases and discovered that nervonic acid can be used as a core molecular marker laying the foundation for the development of the detection kits and drugs. Our businesses may involve the collection of user data, implicate cybersecurity or involve another type of restricted industry.

Our PRC counsel, Tahota (Beijing) Law Firm, has advised us that none of our Operating Subsidiaries is subject to cybersecurity review under the Revised Measures nor are the Ordinary Shares subject to the review or prior approval of the CAC or the China Securities Regulatory Commission (the “CSRC”). Uncertainties still exist, however, due to the possibility that laws, regulations or policies in the PRC could change rapidly in the future. Any future action by the PRC government expanding the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC could significantly limit or completely hinder our ability to offer or continue to offer securities to overseas investors and could cause such securities to significantly decline in value or to be worthless.

| 5 |

PCAOB

The PCAOB’s HFCAA Determination Report dated December 16, 2021, that the Board is unable to inspect or investigate completely registered public accounting firms headquartered in China or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in China or Hong Kong (“the Determination”) could result in the prohibition of trading in our securities by our not being allowed to list on a U.S. exchange and, as a result, an exchange may determine to delist our securities, which would materially affect the interest of our investors.

The Holding Foreign Companies Accountable Act (the “HFCAA”), which was enacted on December 18, 2020, states that if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over the counter trading market in the United States.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCAA, including the listing and trading prohibition requirements described above.

On June 22, 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA) which, if signed into law, would reduce the time period for the delisting of foreign companies under the HFCAA to two consecutive years instead of three years. In the event the HFCAA is amended to prohibit an issuer’s securities from trading on any U.S. stock exchange and our auditor is not subject to PCAOB inspections for two consecutive years instead of three, it will reduce the time before our Ordinary Shares may be prohibited from trading or delisted from an exchange if our auditor is not subject to inspection by the PCAOB.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCAA. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

On December 16, 2021, the PCAOB issued a Determination Report (the “Determination Report”), which found that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the Determination Report identified the specific registered public accounting firms subject to these determinations.

Our previous public accounting firm, Centurion ZD CPA & Co (“Centurion ZD”), who audited our financial statements for the fiscal years ended March 31, 2020 and 2021, is headquartered in Hong Kong and thus subject to the determinations announced by the PCAOB in its Determination Report. As the PCAOB was not able to fully conduct inspections of our previous auditor’s work papers in Hong Kong, our shareholders were deprived of the benefits of such inspection.

Effective February 25, 2022, to protect our investors and to carry out the PCAOB’s mandate, we dismissed Centurion ZD as our independent registered public accounting firm and we engaged K.R. Margetson Ltd. (“Margetson”), whose principal office is located in Vancouver, British Columbia, Canada, as our new independent registered public accounting firm. As Margetson is not located in China or Hong Kong, Margetson is not subject to the determinations announced by the PCAOB on December 16, 2021. We believe that the PCAOB’s inspectors and investigators will have consistent access to the audit work performed by Margetson for us. Therefore, we do not expect to be affected by the HFCAA or the AHFCAA at this time.

| 6 |

However, to the extent that our auditor’s work papers may, in the future, become located in China or Hong Kong, such work papers will not be subject to inspection by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the Chinese or Hong Kong authorities. If such lack of inspection were to extend for the requisite period of time under the HFCAA or the AHFCAA, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange and, if the AHFCAA is enacted, it will decrease the number of “non-inspection years” from three years to two years, thereby reducing the time before our Ordinary Shares may be prohibited from trading or delisted. In addition, inspections of certain other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. Therefore, in addition to subjecting our securities to the possibility of being prohibited from trading or delisted from a U.S. exchange, the inability of the PCAOB to conduct inspections of our auditors’ work papers in China or Hong Kong would make it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures as compared to auditors outside of China that are subject to PCAOB inspections. As a result, our investors would be deprived of the benefits of the PCAOB’s oversight of our auditor through such inspections and they may lose confidence in our reported financial information and procedures and the quality of our financial statements. Also, we cannot assure you that U.S. regulatory authorities will not apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected. See “Risk Factors – Risks Relating to Our Operating Subsidiaries’ Business – To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for the Company may, in the future be located in China or in Hong Kong, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange” on page 16 of this Annual Report.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

| · | Being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| · | Not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| · | Reduced disclosure obligations regarding executive compensation; and |

| · | Not being required to hold a non-binding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; (ii) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; (iii) the issuance, in any three-year period, by our company of more than $1.0 billion in non-convertible debt securities; or (iv) the last day of the fiscal year ending after the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

We are also considered a “foreign private issuer” and will report under the Exchange Act as a non-U.S. company with foreign private issuer status. This means that, even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| · | The sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| 7 |

| · | The sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| · | The rules under the Exchange Act requiring the filing with the Securities and Exchange Commission of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

Cash Flows

The structure of cash flows within our organization, and a summary of the applicable regulations, is as follows:

| 1. | Our equity structure is a direct holding structure, that is, the overseas entity that is trading on the OTCQB Market in the United States is the Company. The Company directly owns and controls China Bio-Technology Holdings Limited (“China Bio”), a Seychelles company. China Bio directly owns and controls Zhong Yuan Bio-Technology (Hong Kong) Limited (“Zhong Yuan Hong Kong”), a Hong Kong company. Zhong Yuan Hong Kong directly owns and controls Zhong Yuan Bio-Technology (Shenzhen) Limited (“Zhong Yuan Shenzhen”), a China company and a wholly foreign owned entity (“WFOE”). Bao Feng Bio-Technology (Beijing) Limited (“Bao Feng”), a China company, directly owns and controls Dandong Bao Feng Seedling Technology Co. Limited (“Dandong BF”), a China company. |

| 2. | Within our direct holding structure, the cross-border transfer of funds within our corporate group is legal and compliant with the laws and regulations of the PRC. After investors’ funds enter the Company, the funds can be directly transferred to China Bio, which can transfer them to Zhong Yuan HK. Zhong Yuan HK can then directly transfer funds to Zhong Yuan SZ, and those funds can then be transferred to the subordinate operating entities. |

If we intend to distribute dividends, our Operating Subsidiaries will transfer dividends to Zhong Yuan SZ and then further transfer them to Zhong Yuan HK in accordance with the laws and regulations of the PRC. Zhong Yuan HK will transfer dividends to China Bio, which will transfer them to us. We will then transfer dividends to all of our shareholders respectively in proportion to the Ordinary Shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

| 3. | As of the date of this Annual Report, neither we nor our Operating Subsidiaries have ever paid dividends or made distributions to U.S. investors. As of the date of this Annual Report, we have not transferred any assets or funds to our Operating Subsidiaries to fund their business operations or. received any transfer of funds from our Operating Subsidiaries. In the future, any cash proceeds raised from overseas financing activities may be transferred by us to our Operating Subsidiaries via capital contribution or shareholder loans, as the case may be. |

| 4. | Our Operating Subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our Operating Subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our Operating Subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable as cash dividends. |

| 8 |

Foreign Exchange

The PRC government’s control over the conversion of foreign exchange and fluctuations in the value of RMB may result in foreign currency exchange losses and limit our ability to pay dividends. Since our PRC Subsidiaries conduct business in the PRC, we receive part of their revenue and pay part of our expenses in RMB. The value of the RMB against the U.S. dollar and other currencies fluctuates from time to time and is subject to domestic and international political and economic developments, including the global and monetary effects of the war in Ukraine, as well as the fiscal and foreign exchange policies prescribed by the PRC government. We cannot assure you that the value of the RMB will remain at the current level against the U.S. dollar or any other foreign currency. If the RMB appreciates or depreciates against the U.S. dollar or any other foreign currency, it will have mixed effects on our PRC Subsidiaries’ businesses, and there is no assurance that the overall effect will be positive.

The RMB is not currently a freely convertible currency. Conversion and remittance of foreign currencies are subject to PRC foreign exchange regulations. Pursuant to the existing foreign exchange regulations in the PRC, we are allowed to carry out foreign exchange transactions for current account items (including dividend payment) without submitting the relevant documentary evidence of such transactions to the State Administration of Foreign Exchange of the PRC (“SAFE”) for approval in advance as long as they are processed by banks designated for foreign exchange trading. However, we may need to obtain the SAFE’s prior approval for foreign exchange transactions for capital account items. If we fail to obtain the SAFE’s approval to convert RMB into foreign currencies for foreign exchange transactions, our Operating Subsidiaries’ business operations, financial condition, results of operations and prospects, as well as our ability to pay dividends, could be materially and adversely affected.

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the SAFE implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends, and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our PRC Subsidiaries incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to transfer cash or the assets of our PRC Subsidiaries and pay dividends in foreign currencies to our shareholders. There can be no assurance that the PRC government will not intervene or impose restrictions on our ability to transfer or distribute cash or assets within our organization or to foreign investors, which could result in our being unable to make, or being prohibited from making, transfers or distributions outside of China and may adversely affect our business and financial condition.

In addition, the Enterprise Income Tax Law (the “EIT Law”) and its implementation rules (the “EIT Rules”) provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC-resident enterprises are tax resident. Pursuant to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiaries.

| 9 |

Payment of Dividends

Dividends payable by us to our foreign investors and gain on the sale of our Ordinary Shares may be subject to PRC income taxes. Pursuant to the EIT Law and the EIT Rules, subject to any applicable tax treaty or arrangement between the PRC and the jurisdiction of residence of our investors that provides a different income tax arrangement, the payment of dividends by a PRC resident enterprise to investors that are non-PRC resident enterprises (including enterprises that do not have an establishment or place of business in the PRC and enterprises that have an establishment or place of business in the PRC but the income of which is not effectively connected with the establishment or place of business) or any gain realized on the transfer of shares by such investors is generally subject to PRC income tax at a rate of 10% to the extent that such dividend has its source in the PRC or such gain is regarded as income derived from sources within the PRC. Under the Individual Income Tax Law of the PRC and its implementation rules, dividends sourced within the PRC paid to foreign individual investors who are not PRC residents and gains from PRC sources realized on the transfer of our Ordinary Shares by such investors would be subject to PRC income tax at a rate of 20%, subject to any reduction or exemption set out in applicable tax treaties and PRC laws.

It is uncertain whether we will be considered a PRC ‘‘resident enterprise.’’ If we are considered a PRC ‘‘resident enterprise,’’ dividends payable by us with respect to our Ordinary Shares or any gain realized from the transfer of our Ordinary Shares may be treated as income derived from sources within the PRC and may be subject to PRC income tax, subject to the interpretation, application and enforcement of the EIT Law and the EIT Rules by the relevant tax authorities. If we are required under the EIT Law or other related regulations to withhold PRC income tax on our dividends payable to foreign holders of our Ordinary Shares which are ‘‘non-resident enterprises,’’ or if our Shareholders are required to pay PRC income tax on the transfer of our Ordinary Shares under PRC tax laws, the value of an investment in our Ordinary Shares may be materially and adversely affected.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements. A forward-looking statement is a projection about a future event or result, and whether the statement comes true is subject to many risks and uncertainties. These statements often can be identified by the use of terms such as "may," "will," "expect," "believe," "anticipate," "estimate," "approximate" or "continue," or the negative thereof. The actual results or activities of the Company will likely differ from projected results or activities of the Company as described in this Annual Report, and such differences could be material.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results and performance of the Company to be different from any future results, performance and achievements expressed or implied by these statements. In other words, our performance might be quite different from what the forward-looking statements imply. You should review carefully all information included in this Annual Report.

You should rely only on the forward-looking statements that reflect management's view as of the date of this Annual Report. We undertake no obligation to publicly revise or update these forward-looking statements to reflect subsequent events or circumstances. You should also carefully review the risk factors described in other documents we file from time to time with the Securities and Exchange Commission (the "SEC"). The Private Securities Reform Act of 1995 contains a safe harbor for forward-looking statements on which the Company relies in making such disclosures. In connection with the "safe harbor," we hereby identify important factors that could cause actual results to differ materially from those contained in any forward-looking statements made by us or on our behalf. Factors that might cause such a difference include, but are not limited to, those discussed in the section entitled "Risk Factors" under Item 3. – "Key Information."

FINANCIAL STATEMENTS AND CURRENCY PRESENTATION

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America and publish our financial statements in United States Dollars.

| 10 |

REFERENCES

In this Annual Report, “China” or “PRC” refers to all parts of the People's Republic of China other than the Special Administrative Region of Hong Kong. The terms “we,” “our,” “us,” and “the “Company” refer to Zhong Yuan Bio-Technology Holdings Limited and its subsidiaries. The terms “Operating Subsidiaries” and “PRC Subsidiaries” refer to Bao Feng and Dandong BF. References to “dollars,” “U.S. Dollars,” “$” or “US$” are to United States Dollars, “HK$” are to Hong Kong Dollars, “Euros” or “euro” are to the European Monetary Union's Currency and “RMB” are to Chinese Renminbi.

PART I

Item 1. Identity of Directors, Senior Management and Advisors

Not Applicable.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

| A. | Reserved |

| B. | Capitalization and Indebtedness |

Not Applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

| D. | Risk Factors |

You should carefully consider the following risks, together with all other information included in this Annual Report. The realization of any of the risks described below could have a material adverse effect on our business, results of operations and future prospects.

Risks Related to Our Operating Subsidiaries’ Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We, through our Operating Subsidiaries, are in the process of developing our business and have a limited operating history. You should consider our Operating Subsidiaries’ future prospects in light of the risks and uncertainties experienced by early-stage companies. Some of these risks and uncertainties relate to our Operating Subsidiaries’ ability to:

| · | Offer products of sufficient quality to attract and retain a larger customer base; |

| · | Attract additional customers and increase spending per customer; |

| · | Increase awareness of our products and continue to develop customer loyalty; |

| · | Respond to competitive market conditions; |

| · | Respond to changes in our regulatory environment; |

| · | Maintain effective control of our costs and expenses; |

| · | Raise sufficient capital to sustain and expand our business; and |

| · | Attract, retain and motivate qualified personnel. |

| 11 |

We envision a period of rapid growth that may impose a significant burden on our administrative and operational resources that, if not effectively managed, could impair our growth.

Our strategy for our Operating Subsidiaries envisions a period of rapid growth that may impose a significant burden on our administrative and operational resources. The growth of our business will require significant investments of capital and management’s close attention. Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management, research and development, sales and marketing and other personnel; we may be unable to do so. In addition, our failure to successfully manage our growth could result in our sales not increasing commensurately with capital investments. If we are unable to successfully manage our growth, we may be unable to achieve our goals.

We may not be able to raise the additional capital necessary to execute our business strategy, which could result in the curtailment of our operations.

We will need to raise additional funds to fully fund our existing operations and for development and expansion of our Operating Subsidiaries’ business. We have no current arrangements with respect to sources of additional financing, and the needed additional financing may not be available on commercially reasonable terms, on a timely basis or at all. The inability to obtain additional financing when needed would have a negative effect on us, including possibly requiring us to curtail our operations. If any future financing involves the sale of equity securities, the Ordinary Shares held by our shareholders could be diluted substantially. If we borrow money or issue debt securities, the Company will be subject to the risks associated with indebtedness, including the risk that interest rates may fluctuate and the possibility that it may not be able to pay principal and interest on the indebtedness when due. Insufficient funds would prevent us from implementing our business plan and would require us to delay, scale back or eliminate certain of our operations.

We will be required to hire and retain skilled managerial, research and development and sales and marketing personnel.

Our continued success depends in large part on our ability to attract, train, motivate and retain qualified management, research and development and sales and marketing personnel. Any failure to attract and retain the required personnel who are integral to our business may have a negative impact on our operations, which would have a negative impact on revenues. There can be no assurance that we will be able to attract and retain skilled persons, and the loss of skilled personnel would adversely affect us.

We are dependent upon our officers and management for direction, and the loss of any of these persons could adversely affect our operations and results.

We are dependent on our and Bao Feng’s officers for implementation of our proposed strategy and execution of our business plan. The loss of any of our or Bao Feng’s officers could have a material adverse effect on our results of operations and financial position. We do not maintain “key person” life insurance for any of our or Bao Feng’s officers. The loss of any of our or Bao Feng’s officers could delay or prevent the achievement of our business objectives.

We currently have only two Operating Subsidiaries and one line of products.

We are a holding company with a total of five subsidiaries. However, at present, only two of those subsidiaries are our Operating Subsidiaries, Bao Feng and Dandong BF, which are conducting operations. Although we plan to expand the marketing and sale of Bao Feng’s products into the international arena and have a different subsidiary, Zhong Yuan Bio-Technology (Hong Kong) Limited, to handle the international business, it is expected that China will remain our primary market. In addition, the products sold in the international market will be the same products developed by Bao Feng. Therefore, we will remain primarily dependent on Bao Feng for our revenue. If Bao Feng is not profitable, our business, results of operations and cash flows could be significantly and adversely affected.

| 12 |

Our Operating Subsidiaries may not be able to obtain or maintain all necessary licenses, permits and approvals and to make all necessary registrations and filings for our business activities in multiple jurisdictions and related to residents therein, especially in the PRC, or otherwise relating to PRC residents.

As of the date of this Annual Report, our Operating Subsidiaries have received all necessary governmental approvals and licenses for operations in the PRC, including the business approvals and licenses issued by the PRC State Administration for Market Regulation, and they have not been denied any such approvals. However, in the event that our Operating Subsidiaries have erroneously concluded that certain licenses, permits or approvals are not required or if applicable laws, regulations or interpretations change and they are required to obtain additional permissions or approvals in the future, our Operating Subsidiaries may incur significant costs and expenses and may need to budget additional resources to comply with any such requirements. Moreover, if our Operating Subsidiaries fail to renew their relevant licenses or filings or fail to obtain future required licenses, permits or approvals, they may become subject to fines and other penalties, which may have a material adverse effect on our business, operations and financial condition.

We may be sued or become a party to litigation, which could require significant management time and attention and result in significant legal expenses and may result in an unfavorable outcome, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may be subject to lawsuits from time to time arising in the ordinary course of our business. The expense of defending ourselves against such litigation may be significant. The amount of time to resolve these lawsuits is unpredictable, and defending ourselves may divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in such litigation could have a material adverse effect on our business, results of operations and cash flows.

Risks Related to the Company

Future sales of our securities, or the perception in the markets that these sales may occur, could depress our stock price.

We currently have issued and outstanding 17,679,618 Ordinary Shares. Although only 2,236,192 of those Ordinary Shares have been registered under a registration statement filed with the Securities and Exchange Commission, the remaining 15,443,426 Ordinary Shares may also be sold in the future if registered under the Securities Act or if the shareholder qualifies for an exemption from registration under Rule 144 or Rule 701 under the Securities Act, or another applicable exemption. The market price of our capital stock could drop significantly if the holders of these restricted Ordinary Shares sell them or are perceived by the market as intending to sell them. These factors also could make it more difficult for us to raise capital or make acquisitions through the issuance of additional Ordinary Shares or other equity securities.

The ability of the Board of Directors of the Company to issue preferred shares and any anti-takeover provisions we adopt may depress the value of our Ordinary Shares.

Our Articles of Association authorize our Board of Directors to provide, out of unissued shares, for preferred shares in one or more classes or series within a class upon the authority of the Board without further shareholder approval. While no preferred shares are currently issued or outstanding, we may issue preferred shares in the future. Any preferred shares issued in the future may rank senior to the Ordinary Shares with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up of the Company, or both, and any such preferred shares may have class or series voting rights. The future issuance of preferred shares could materially and adversely affect the rights of the holders of our Ordinary Shares and dilute the ordinary shareholders’ holdings.

In addition, the Board of Directors may, in the future, adopt anti-takeover measures (albeit the Board of Directors may not introduce any anti-takeover measures in our Articles of Association within a Special Resolution of Shareholders). The authority of the Board of Directors to issue preferred shares and any future anti-takeover measures it may adopt may, in certain circumstances, delay, deter or prevent takeover attempts and other changes in our control not approved by the Board of Directors. As a result, our shareholders may lose opportunities to dispose of their Ordinary Shares at favorable prices generally available in takeover attempts or that may be available under a merger proposal, and the market price of the Ordinary Shares and the voting and other rights of our shareholders may also be affected.

| 13 |

Our shareholders may face difficulties in protecting their interests, and their ability to protect their rights through the U.S. federal courts may be limited because we are incorporated under Cayman Islands law, we conduct substantially all of our operations in China and all of our directors and officers reside outside the United States.

We are incorporated in the Cayman Islands and conduct substantially all of our operations in China. All of our directors and officers reside outside the United States, and their assets are located outside of the United States. As a result, it may be difficult or impossible for a shareholder to effect service of process or to bring an action against us or against these individuals in the Cayman Islands or in Hong Kong or China in the event that a shareholder believes that his rights have been infringed under the securities laws or otherwise. Even if a shareholder is successful in bringing an action of this kind, the laws of the Cayman Islands, Hong Kong and China may render the shareholder unable to enforce a judgment against our assets or the assets of our directors and officers. There is no statutory recognition in the Cayman Islands or Hong Kong of judgments obtained in the United States, although the courts of the Cayman Islands and Hong Kong will generally recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits.

Our corporate affairs are governed by our Memorandum and Articles of Association, as amended and restated from time to time, and by the Companies Law (Revised) and common law of the Cayman Islands. The rights of shareholders to take legal action against us and our directors, actions by minority shareholders and the fiduciary responsibilities of our directors are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from English common law, which provides persuasive, but not binding, authority on a court in the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedents in the United States. In particular, the Cayman Islands has a less developed body of securities laws than the United States and provides significantly less protection to investors. In addition, Cayman Islands companies may not have the standing to initiate a shareholder derivative action in U.S. federal courts.

PRC courts may recognize and enforce foreign judgments in accordance with the requirements of PRC Civil Procedure Law based either on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other form of reciprocity with the United States or the Cayman Islands that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedure Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates the basic principles of PRC law or national sovereignty, security or public interest.

As a result, our shareholders may have more difficulty in protecting their interests through actions against us, our management, our directors or our major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

It may be difficult for overseas regulators to conduct investigations or collect evidence within China.

Shareholder claims or regulatory investigations that are common in the United States generally are difficult to pursue as a matter of law or practicality in China. For example, in China, there are significant legal and other obstacles to providing information needed for regulatory investigations or litigation initiated outside China. While the authorities in China may establish a regulatory cooperation mechanism with the securities regulatory authorities of another country or region to implement cross-border supervision and administration, such cooperation with the securities regulatory authorities in the Unities States may not be efficient in the absence of a mutual and practical cooperation mechanism. Furthermore, according to Article 177 of the PRC Securities Law, or Article 177, which became effective in March 2020, no overseas securities regulator is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. While detailed interpretation or implementation of the rules under Article 177 have yet to be promulgated, the inability of an overseas securities regulator to directly conduct investigation or evidence collection activities within China may further increase difficulties faced by our shareholders in protecting their interests.

There may be conflicts of interest between our management and our non-management shareholders.

Conflicts of interest create the risk that our officers and directors may have an incentive to act adversely to the interests of the Company. A conflict of interest may arise between our officers’ and directors’ personal pecuniary interests and their fiduciary duty to our shareholders.

| 14 |

We have identified material weaknesses in our internal control over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the future trading price of our Ordinary Shares.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, is designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations. Ineffective internal control could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the future trading price of our Ordinary Shares.

We have identified material weaknesses in our internal control over financial reporting in the Company and in China Bio and its subsidiaries. As defined in Regulation 12b-2 under the Exchange Act, a “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. Specifically, we determined that we had the following material weaknesses in our internal control over financial reporting: (i) we had limited controls over information processing; (ii) we had inadequate segregation of duties; (iii) we did not have a formal audit committee with a financial expert; and (iv) we did not have sufficient formal written policies and procedures for accounting and financial reporting with respect to the requirements and application of both generally accepted accounting principles in the United States of America, or GAAP, and SEC guidelines.

As a result, on August 1, 2022, our Board of Directors appointed three independent directors, two of whom the Board has determined qualify as financial experts under the applicable SEC rules, and formed an audit committee comprised of three independent directors. However, although the financial statements and footnotes are now reviewed by our management and our audit committee, we still do not have a formal policy to review significant accounting transactions and the accounting treatment of such transactions.

Even if we develop effective internal controls over financial reporting, such controls may become inadequate due to changes in conditions, or the degree of compliance with such policies or procedures may deteriorate, which could result in the discovery of additional material weaknesses and deficiencies. In any event, the process of determining whether our existing internal control over financial reporting is compliant with Section 404 of the Sarbanes-Oxley Act (“Section 404”) and is sufficiently effective requires the investment of substantial time and resources by our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete. In addition, we cannot predict the outcome of this process and whether we will need to implement remedial actions in order to establish effective controls over financial reporting. The determination of whether our internal controls are sufficient and any remedial actions required could result in our incurring additional costs that we did not anticipate, including the hiring of additional outside consultants. We may also fail to timely complete our evaluation, testing and any remediation required to comply with Section 404.

We are required, pursuant to Section 404, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. However, for as long as we are a “smaller reporting company,” our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. While we could be a smaller reporting company for an indefinite amount of time and thus relieved of the above-mentioned attestation requirement, an independent assessment of the effectiveness of our internal control over financial reporting could detect problems that our audit committee’s assessment might not. Such undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation.

| 15 |

The recent joint statement by the SEC, proposed rule changes submitted by NASDAQ, and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, Ordinary Share price and reputation.

U.S. public companies that have substantially all of their operations in China (including in Hong Kong) have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered on financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud.

On December 7, 2018, the SEC and the PCAOB issued a joint statement highlighting continued challenges faced by U.S. regulators in their oversight of financial statement audits of U.S.-listed companies with significant operations in China. On April 21, 2020, SEC Chairman Jay Clayton and PCAOB Chairman William D. Duhnke III, along with other senior SEC staff, released a joint statement highlighting the risks associated with investing in companies based in or that have substantial operations in emerging markets including China, reiterating past SEC and PCAOB statements on matters including the difficulty associated with inspecting accounting firms and audit work papers in China, higher risks of fraud in emerging markets and the difficulty of bringing and enforcing SEC, Department of Justice and other U.S. regulatory actions, including in instances of fraud, in emerging markets generally.

On May 20, 2020, the U.S. Senate passed the HFCAA requiring foreign companies to certify that they are not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities are prohibited from trading on a national exchange. On December 2, 2020, the U.S. House of Representatives approved the HFCAA.

On May 21, 2021, NASDAQ filed three proposals with the SEC to (i) apply a minimum offering size requirement for companies primarily operating in a “Restrictive Market,” (ii) prohibit Restrictive Market companies from directly listing on the Nasdaq Capital Market and only permit them to list on the Nasdaq Global Select or Nasdaq Global Market in connection with a direct listing, and (iii) apply additional and more stringent criteria to an applicant or listed company based on the qualifications of the company’s auditors.

As a result of this scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits and SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on us, our offering, our business and our Ordinary Share price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend ourselves. This situation would be costly and time consuming and would distract our management from developing our growth. If such allegations are not proven to be groundless, we and our business operations will be severely affected and you could sustain a significant decline in the value of our Ordinary Shares.

To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for the Company may, in the future, be located in China or in Hong Kong, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange.

The HFCAA prohibits foreign companies from listing their securities on U.S. exchanges if the company’s auditor has been unavailable for PCAOB inspection or investigation for three consecutive years beginning in 2021. In June 2021, the Senate passed the AHFCAA which, if signed into law, would reduce the time period for the delisting of foreign companies under the HFCAA to two consecutive years instead of three years. On December 16, 2021, the PCAOB issued the Determination Report, which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the Determination Report identified specific registered public accounting firms subject to these determinations.

| 16 |

Our previous public accounting firm, Centurion ZD CPA & Co (“Centurion ZD”), who audited our financial statements for the fiscal years ended March 31, 2020 and 2021, is headquartered in Hong Kong and thus subject to the determinations announced by the PCAOB in its Determination Report. Therefore, to protect our investors and to carry out the PCAOB’s mandate, we dismissed Centurion ZD as our independent registered public accounting firm effective February 25, 2022 and we engaged K.R. Margetson Ltd., whose principal office is located in Vancouver, British Columbia, Canada, as our new independent registered public accounting firm. Since Margetson is not located in China or Hong Kong, Margetson is not subject to the determinations announced by the PCAOB on December 16, 2021. We believe that the PCAOB’s inspectors and investigators will have consistent access to the audit work performed by Margetson for us. Therefore, we do not expect to be affected by the HFCAA or the AHFCAA at this time.

However, to the extent that our auditor’s work papers may, in the future, become located in mainland China or in Hong Kong, such work papers will not be available for inspection by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the Chinese or Hong Kong authorities. If such lack of inspection were to extend for the requisite period of time under the HFCAA or the AHFCAA, our Ordinary Shares could be delisted and prohibited from trading on a U.S. exchange and, if the AHFCAA is enacted, it will decrease the number of “non-inspection years” from three years to two years, thereby reducing the time before our Ordinary Shares may be prohibited from trading or delisted. In addition, if our auditor’s work papers were to become located in China or Hong Kong, and thereby not be available for PCAOB inspection, our investors would be deprived of the benefits of the PCAOB’s oversight of our auditor through such inspections, and they may lose confidence in our reported financial information and procedures and the quality of our financial statements. Also, we cannot assure you that U.S. regulatory authorities will not apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected.

We have never paid dividends on our Ordinary Shares.

We have never paid dividends on our Ordinary Shares and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for payment of dividends will be re-invested into the Company to further its business strategy.

Risks Related to the Business of our Operating Subsidiaries

Bao Feng’s business depends on the market recognition of its brand. If we are not able to maintain our reputation and enhance our brand recognition, our business and operating results may be materially and adversely affected.

The quality and acceptance of our products will determine whether our brand becomes recognized as a leading brand in the industry. We believe that market recognition of our brand is a key factor to ensuring our future success. As we continue to grow in size and broaden the scope of our product offerings, however, it may become increasingly difficult to maintain the quality and consistency of the products we offer, which may negatively impact our brand and the popularity of our products offered thereunder.

Our brand value will also be affected by customer perceptions. Those perceptions are affected by a number of factors, some of which are based on first-hand observation of our product quality and effectiveness, while others may be based on indirect information from media or other sources. Incidents and any negative publicity related thereto, even if factually incorrect, may lead to significant deterioration of our brand image and reputation and consequently negatively affect customers’ interest in our products, as well as top-notch sales and marketing personnel’s interest in being associated with our brand. Particularly in the age of digital media and social network, impacts of negative publicity associated with any single incident could be easily amplified and potentially cause impacts that go beyond our estimation or control.

In addition, scientific studies on health products are constantly evolving and new or innovative conclusions on effectiveness may affect customers’ perception of our products. If we are unable to maintain our reputation, enhance our brand recognition or increase positive awareness of our products, it may be difficult to maintain and grow our customer base and distribution channels, and our business and growth prospects may be materially and adversely affected.

| 17 |

We may face increasing competition in our industry and may not be able to successfully compete with our competitors.

Our business is in an industry that we expect to become increasingly competitive, and many of our competitors, both local and international, may have substantially greater technical, financial and marketing resources than we have. As a result, we may be unable to compete successfully with these competitors. As competition increases, we may also face pressures on pricing, which could result in lower margins. Lower margins may affect our ability to cover our costs, which could have a material negative impact on our operations and our business.

We may not be successful in introducing new products or enhancing our existing products.

We currently offer four health supplement products, plus our Acer truncatum seedlings. We intend to continue developing new products, as well as further enhancing our existing products. This process is subject to risks and uncertainties, such as unexpected technical, regulatory, operational, logistical or other problems that could delay the process temporarily or permanently. Moreover, we cannot assure you that any of these new products or enhancements of existing products will fulfill customer needs, match the quality or popularity of those developed by our competitors, achieve widespread market acceptance or generate incremental revenues.

In addition, introducing new products or enhancing existing products requires us to make various investments in research and development, incur personnel expenses and potentially reallocate other resources. If we are unable to develop new products or cannot do so in a cost-effective manner or are otherwise unable to effectively manage the quality of those products, our financial condition and results of operations could be adversely affected.

Our business is affected by global, national and local economic conditions, as the products we sell are discretionary.

We depend upon factors relating to discretionary consumer spending in China. These factors include economic conditions, consumers, employment rates, the amounts of consumers' disposable income, business conditions, interest rates, consumer debt, availability of credit and applicable taxation in regional and local markets where we sell our products. There can be no assurance that consumer spending for our products will not be adversely affected by changes in economic conditions.

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

Substantially all of our assets and operations are located in the PRC. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in the PRC generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over the PRC’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in the PRC, in the policies of the Chinese government or in the laws and regulations in the PRC could have a material adverse effect on the overall economic growth of the PRC. Such developments could adversely affect our business and operating results, lead to a reduction in demand for our products and adversely affect our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past, the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in the PRC, which may adversely affect our business and operating results.

| 18 |

Our ability to establish effective marketing and advertising campaigns is the key to our success.

Our advertisements promote our products and the pricing of such products. If we are unable to increase awareness of our brands and our products, we may not be able to attract new customers. Our marketing activities may not be successful in promoting or pricing our products or retaining and enlarging our customer base. We cannot assure you that our marketing programs will be adequate to support our future growth, which may lead to material adverse effects on our results of operations.

Consumer preferences in the health care industry change rapidly and are difficult to predict.

The success of our business depends on our ability to accurately anticipate and respond to future changes in consumer demand, maintain the correct inventory, deliver the appropriate products at the right prices and produce our products at minimum costs. We must optimize our product selection and inventory based on consumer preferences and sales trends. If we fail to anticipate, identify or react appropriately to changes in consumer demand, we could experience excess inventories, higher than normal markdowns or be unable to sell the products, which would reduce our revenue, financial position and results of operations.

While we must maintain sufficient inventory to operate our business successfully and meet our customers' demands, we must be careful to not overstock.

Changing consumer demands and uncertainty surrounding new product launches expose us to increasing inventory risks. Demand for products can change rapidly and unexpectedly, affecting product availability and back-order time. We carry five different products for which we must maintain sufficient inventory amounts. In the event that consumer demand for one or more of our products decreases, we may be unable to sell our inventory of those products. Our inventory holding costs will increase if we maintain excess inventory. Conversely, if we do not have sufficient inventory to fulfill customer orders, we may lose orders or customers, which may adversely affect our business, financial condition and results of operations. We cannot assure you that we can accurately predict consumer demand and events and avoid over-stocking or under-stocking products.

We primarily depend on a few products for our revenue.

We currently rely on four products, including our Acer truncatum seedlings, for our revenue. We do not currently have any other products on which we could rely to support our operations if we were to experience any difficulty with the manufacture, marketing, sale or distribution of these product lines. If we were to become unable to sustain or increase the price or sales levels for these product lines, our business could be harmed.

If we expand our product offerings, or if we experience increased capital requirements for any reason, we may need to raise additional capital.

We primarily depend on our Neuro Enhancer product line for more than 65% of our revenue. We may decide to expand our product portfolio, which would entail increased research and development expenses. If cash generated from operations is insufficient to satisfy our requirements in this regard, we may need to raise additional capital. If we are unable to raise the additional required capital in a timely manner or on acceptable terms, we could be forced to reduce our growth plans. There can be no assurance that additional capital will be available to us or that it will be available on acceptable terms.

We depend on our largest customers for a significant portion of our sales revenue, and we cannot be certain that sales to these customers will continue. If sales to these customers do not continue, then our sales revenue will decline, and our business will be negatively impacted.