An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

Preliminary Offering Circular

Subject to Completion. Dated January 25, 2018

FINN POWER ENERGY CORPORATION

$19,999,998.60

2,971,768 SHARES OF COMMON STOCK

$6.73 PER SHARE

This is the initial public offering of securities of Finn Power Energy Corporation, a Delaware corporation. We are offering 2,932,168 shares of our common stock, par value $0.0001 (“Common Stock”) at an offering price of $6.73 per share (the “Shares” or “Offered Shares”). We expect to offer Offered Shares in this offering until it raises the maximum amount being offered. There is no minimum purchase requirement per investor.

These securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 9 of this Offering Circular.

We are offering up to 2,971,768 shares of our Common Stock at $6.73 per share. There is no minimum investment in the Offered Shares. We expect to offer Offered Shares in this offering until it raises the maximum amount being offered.

Prior to this offering, there has been no public market for the Company’s common stock. No assurances can be given that a public market will develop following completion of this offering or that, if a market does develop, it will be sustained. The offering price for the Offered Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. The Shares will become tradable on the qualification date of this Offering Circular.

We are offering our shares without the use of an exclusive placement agent, however, we may engage various securities brokers to place shares in this offering with investors for commissions of up to 10% of the gross proceeds.

See “Risk Factors” to read about factors you should consider before buying shares of common stock.

As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts in an attempt to offer and sell the Offered Shares. Our Officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 9 for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.

| Per Share |

Total Maximum (2) |

|||||||

| Public Offering Price (1) | $ | 6.73 | $ | 19,999,998.60 | ||||

| Underwriting Discounts and Commissions (3) | $ | 0 | $ | 0 | ||||

| Proceeds to Us from this Offering to the Public (Before Expenses (4)) | $ | 6.73 | $ | 19,999,998.60 | ||||

| (1) | We are offering shares on a continuous basis. See “Distribution – Continuous Offering. |

| (2) | This is a “best efforts” offering. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. See “How to Subscribe.” |

| (3) | We are offering these securities without an underwriter. |

| (4) | Excludes estimated total Offering expenses, including underwriting discount and commissions, will be approximately $0 assuming the maximum offering amount is sold. |

Our Board of Directors used its business judgment in setting a value of $6.73 per share to the Company as consideration for the stock to be issued under the Offering. The sales price per share bears no relationship to our book value or any other measure of our current value or worth.

No sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The date of this Offering Circular is January 25, 2018.

This offering is being made on a self-underwritten basis without the use of an exclusive placement agent, however, we may engage various securities brokers to place shares in this offering with investors on a commission basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Management will make its best effort to fill the subscription in NY, CT, MA, DC, IL, TX, CA, WA, NV, and VA. However, in the event that management is unsuccessful in raising the required funds in these states, the Company may file a post qualification amendment to include additional jurisdictions that Management has determined to be in the best interest of the Company for the purpose of raising the maximum offer. In the event that the Offering Circular is fully subscribed, any additional subscriptions shall be rejected and returned to the subscribing party along with any funds received.

In order to subscribe to purchase the shares, a prospective investor must complete a subscription agreement and send payment by check, wire transfer or ACH. Investors must answer certain questions to determine compliance with the investment limitation set forth in Regulation A Rule 251(d)(2)(i)(C) under the Securities Act of 1933, which states that in offerings such as this one, where the securities will not be listed on a registered national securities exchange upon qualification, the aggregate purchase price to be paid by the investor for the securities cannot exceed 10% of the greater of the investor’s annual income or net worth. In the case of an investor who is not a natural person, revenues or net assets for the investor’s most recently completed fiscal year are used instead. The Company has not currently engaged any party for the public relations or promotion of this offering. As of the date of this filing, there are no additional offers for shares, nor any options, warrants, or other rights for the issuance of additional shares except those described herein.

TABLE OF CONTENTS

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, references to “Finn Power,” “Finn Power Energy Corporation”, “we”, the “Company”, “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of Finn Power Energy Corporation.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | The speculative nature of the business we intend to develop; |

| ● | Our ability to successfully develop material revenue streams from our developmental activities, many of which are close to start up and not operating at the present time. |

| ● | Our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to continue as a “going concern;” |

| ● | Our ability to effectively execute our business plan; |

| ● | Our ability to manage our expansion, growth and operating expenses; |

| ● | Our ability to finance our businesses; |

| ● | Our ability to promote our businesses; |

| ● | Our ability to compete and succeed in highly competitive and evolving businesses; |

| ● | Our ability to respond and adapt to changes in technology and customer behavior; and |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance strong brands. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

1

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

History

Finn Power Energy Corporation, formerly known as Pearl Island Acquisition Corporation (“Finn Power” or the “Company”), was incorporated in Delaware on April 4, 2016 and filed a registration statement on Form 10 with the Securities and Exchange Commission on May 2, 2016 and became a public reporting company sixty days thereafter; provided, however, the Company filed a Form 15 on January 6, 2017 terminating its registration as a public reporting company.

In June 2016, Pearl Island Acquisition Corporation changed its name to Finn Power Energy Corporation pursuant to a change of control with the resignation of the then officers and directors, redemption of 19,500,000 shares of the 20,000,000 outstanding shares of its common stock, the appointment of new officers and directors and the issuance of 5,000,000 shares of common stock to the new shareholders of the Company.

The Company’s offices are located at 48 Wall Street, Suite 1100, New York, New York 10005 United States. The Company’s main phone number is (212) 203-7229. The Company’s fiscal year end is December 31. We maintain a website at http://www.fpecorp.net/. We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

Business Summary

Finn Power Energy Corporation is a group of energy companies that operates and develops power plant projects located primarily in South-East Asia, with future plans to potentially expand its business to opportunities in other regions. Finn Power Energy Corporation’s business model is to generate a steady revenue stream from its power plants, strengthen relationships with strategic partners and to expand its portfolio to increase its revenue base. The proceeds of this offering will be used primarily to fund current operations, acquire and/or facilitate the development of new power generation plants and/or for general corporate purposes, including the cost of this offering.

Summary of Operations

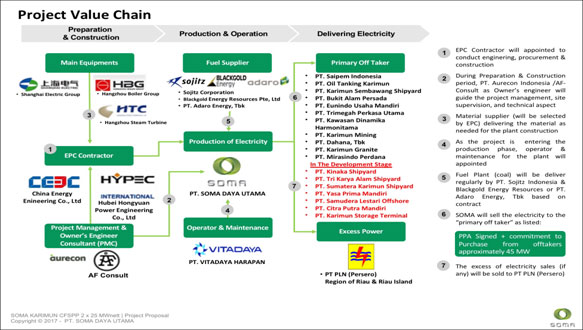

Finn Power Energy Corporation operates through its subsidiaries PT. Soma Power Indonesia (PT SPI) and PT Soma Daya Utama (PT SDU), two Indonesian entities that design, own and operate 100 MW hydroelectric and 2x31MW coal-fired power plants, respectively, in Indonesia. Both PT. Soma Power Indonesia and PT Soma Daya Utama primarily engage in the generation of electricity for the sales and distribution to the local industries, businesses and residents. Through the synergistic integration of these companies, we believe we can achieve higher operating profits than the industry average. The Company believes that this should lead to greater returns on invested capital.

Risks and Uncertainties facing the Company

As an early-stage company, the Company has limited operating history and has only recently begun to operations and has in the past experienced losses. The Company needs to continue to build upon its recent success in increasing its revenue or locate additional financing in order to continue its developmental plans. As a company in the early part of its life, management of the Company must develop and market its technologies in order to execute the business plan of the Company on a broad scale.

2

One of the biggest challenges facing the Company will be in securing adequate capital to maintain our operations and implement effective sales, marketing and distribution strategies to reach our intended end customers. The Company has considered and devised its initial sales, marketing and advertising strategy, however, the Company will need to skillfully implement this strategy in order to achieve success in its business.

Due to financial constraints and the early stage of the Company’s life, the Company has to date conducted limited advertising and marketing to reach customers. To date, the Company has relied upon a small number of customers. In addition, the Company has not yet located the sources of funding to develop the Company on a broader scale through acquisitions or other major partnerships. If the Company is unable to locate such financing and/or encounters difficulty with its current customer relationships, it will face headwinds in its attempts to develop strong and reliable sources of potential customers and a means to efficiently reach buyers and customers, which will make it much more difficult for the Company to develop its operations to return revenue sufficient to further develop its business plan. Moreover, the above assumes that the Company’s services are consistently met with client satisfaction in the marketplace and exhibit steady success amongst the potential customer base, neither of which is reasonably predictable or guaranteed.

Dividends

The Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable future. The Board of Directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company’s earnings, capital requirements and other factors.

Trading Market

Currently, there is no trading market for the securities of the Company. The Company intends to initially apply for admission to quotation of its securities on the OTC Pink Market as soon as possible which may be while this offering is still in process. There can be no assurance that the Company will qualify for quotation of its securities on the OTC Pink Market.

3

THE OFFERING

| Issuer: | Finn Power Energy Corporation | |

| Securities offered: | A maximum of 2,971,768 shares of our common stock, par value $0.0001 (“Common Stock”) at an offering price of $6.73 per share (the “Offered Shares”). | |

| Number of shares of Common Stock outstanding before the Offering: | 20,000,000 shares of Common Stock | |

| Number of shares of Common Stock to be outstanding after the Offering: | 22,971,768 shares of Common Stock, if the maximum amount of Offered Shares are sold | |

| Price per share: | $6.73 | |

| Maximum offering amount: | 2,971,768 shares at $6.73 per share, or $19,999,998.60. | |

| Trading Market: | Currently, there is no trading market for the securities of the Company. The Company intends to initially apply for admission to quotation of its securities on the OTC Pink Market as soon as possible which may be while this offering is still in process. There can be no assurance that the Company will qualify for quotation of its securities on the OTC Pink Market. | |

| Use of proceeds: | If we sell all of the shares being offered, our net proceeds (after our estimated offering expenses) will be $19,999,998.60. We will use these net proceeds for acquisitions and working capital and other general corporate purposes. | |

| Risk factors: | Investing in our Common Stock involves a high degree of risk, including, but not limited to:

Speculative nature of our business.

Competition.

Long sales lead time.

Our need for more capital.

Risks of government programs and regulations in our business.

Risk of new technology.

Immediate and substantial dilution.

Limited market for our stock.

Dilution.

Use of Forward-Looking Statements

Investors are advised to read and pay careful attention to the section on Risk Factors. |

4

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this Offering Circular, before purchasing our Common Stock. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements”.

Risks Relating to Our Businesses

Risks of Hydroelectric and Coal Assets

Speculative nature and hazards of hydroelectric and coal energy production activities.

The operation and development of properties related to the production of energy from hydroelectric and coal power sources is not an exact science and involves a high degree of risk. There is no assurance that our activities in the hydroelectric and coal power industry will yield sufficient production or other operating revenues that will allow us to remain profitable. We may be subject to liability for pollution and other damages and will be subject to statutes and regulations relating to environmental matters. Although we may obtain and maintain the insurance coverage and amounts we deem appropriate, we may suffer losses due to hazards against which we cannot insure or against which we may elect not to insure.

Importance of Future Prices, Supply and Demand for Energy.

Revenues generated from our energy production activities in the hydroelectric and coal industries will be highly dependent upon the future prices and demand for energy. Factors which may affect prices and demand for energy include, but are not limited to, the worldwide supply of energy; the price of energy globally; consumer demand for energy; the price and availability of alternative fuels; government regulation; and general, national and worldwide economic political conditions.

Markets for Sale of Production.

Our ability to market the energy that we produce will depend on numerous factors beyond our control, the effect of which cannot be accurately predicted or anticipated. Some of these factors include, without limitation, the availability of a ready market, the effect of government regulation of production, operations, transportation and sales, and general national and worldwide economic conditions. There is no assurance that we will be able to market any energy we produced, or, if such energy production is marketed, that we can obtain favorable prices.

Price Control and Possible Energy Legislation.

There are currently no applicable government price controls on our production so that sales of our energy can be made at uncontrolled market prices. However, there can be no assurance that applicable governmental authorities will not enact controls at any time. No prediction can be made as to what additional energy legislation may be proposed, if any, nor which bills may be enacted nor when any such bills, if enacted, would become effective.

Environmental Regulations.

The operation of hydroelectric and coal-fired power plants are subject to various laws and regulations designed to protect the environment. Various governmental agencies are considering, and some have adopted, laws and regulations regarding environmental control which could adversely affect our business. Compliance with such legislation and regulations, together with any penalties resulting from noncompliance therewith, will increase the cost of energy production at our plants.

5

Government Regulation.

The energy business is subject to extensive governmental regulation under which, among other things, rates of production may be fixed. Governmental regulation also may limit or otherwise affect the market for our energy production and the price which may be paid for that production. Governmental regulations relating to environmental matters could also affect our operations. The nature and extent of various regulations, the nature of other political developments and their overall effect upon us are not predictable.

Industry and geographical concentration.

Unfavorable conditions in our markets, unfavorable events that affect our assets, or unfavorable events affecting energy production from hydroelectric and coal sources could materially affect us.

Price declines may result in reduced profits.

Commodity prices have a significant impact on the present value of our operations. To the extent the price of energy declines indicate a reduction of the estimated useful life or estimated future cash flows of our assets, our assets may be impaired.

Prices and markets for energy are unpredictable and tend to fluctuate significantly, which could reduce the value of our assets.

Energy is a commodities whose prices are determined based on world demand, supply, and other factors, all of which are beyond our control. World prices for energy have fluctuated widely in recent years. We expect that prices will continue to fluctuate in the future. Price fluctuations will have a significant impact on our revenue, the return from our reserves and on our financial condition generally. Price fluctuations for energy may also impact the investment market for companies engaged in our industry. Decreases in the prices of energy may have a material adverse effect on our assets and our cash flows.

Our assets may not be insured against all of the operating hazards to which they are exposed.

Our operations are subject to the usual hazards incident to the production of energy from hydroelectric and coal sources. These hazards can cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage, clean-up responsibilities, regulatory investigation and penalties, and suspension of operations, all of which could result in a substantial loss. We may maintain insurance against some, but not all, of the risks described above. Such insurance may not be adequate to cover losses or liabilities. Also, we cannot give assurance of the continued availability of insurance at premium levels that justify its purchase.

Technology

Risks

______

Ability to develop commercial products.

The Company cannot predict that it will be successful in developing commercially ready products for any of the technology in the near future or at any time.

Rapid technological changes.

The industries in which the Company intends to compete with are subject to rapid technological changes. No assurances can be given that the technological advantages which may be enjoyed by the Company in respect of their technologies cannot or will not be overcome by technological advances in the respective industries rendering the Company’s technologies obsolete or non-competitive.

6

Lack of indications of commercial acceptability.

The success of the Company will be dependent upon its ability to develop commercially acceptable products and to sell such products in quantities sufficient to yield profitable results. To date, the Company has received no indications of the commercial acceptability of any of its proposed products. Accordingly, the Company cannot predict whether its products can be marketed and sold in a commercial manner.

Competition

Although management believes its business will have significant competitive advantages to it competitors in its respective industry, with respect to such products, the Company will be competing in industries, such as the energy production industry, where enormous competition exists. Competitors in these industries have greater financial, engineering and other resources than the Company. No assurances can be given that any advances or developments made by such companies will not supersede the competitive advantages of the Company’s products.

Protection of intellectual property.

The success of the Company will be dependent, in part, upon the protection of its various proprietary technologies from competitive use. Certain of its technologies are the subject of various patents in varying jurisdictions. In addition to the patent applications, the Company relies on a combination of trade secrets, nondisclosure agreements and other contractual provisions to protect its intellectual property rights. Nevertheless, these measures may be inadequate to safeguard the Company’s underlying technologies. If these measures do not protect the intellectual property rights, third parties could use the Company’s technologies, and its ability to compete in the market would be reduced significantly.

In the future, the Company may be required to protect or enforce its patents and patent rights through patent litigation against third parties, such as infringement suits or interference proceedings. These lawsuits could be expensive, take significant time, and could divert management’s attention from other business concerns. These actions could put the Company’s patents at risk of being invalidated or interpreted narrowly, and any patent applications at risk of not issuing. In defense of any such action, these third parties may assert claims against the Company. The Company cannot provide any assurance that it will have sufficient funds to vigorously prosecute any patent litigation, that it will prevail in any of these suits, or that the damages or other remedies awarded, if any, will be commercially valuable. During the course of these suits, there may be public announcements of the results of hearings, motions and other interim proceedings or developments in the litigation, which could result in the negative perception by investors, which could cause the price of the Company’s common stock to decline dramatically.

General Business Risks

Our business and operations may experience rapid growth. If we fail to manage our growth, our business and operating results could be harmed and we may have to incur significant expenditures to address the additional operational and control requirements of this growth.

We may experience rapid growth in our sales and operations, which may place significant demands on our management, operational and financial infrastructure. If we do not manage our growth, the quality of our products and services could suffer, which could negatively affect our brand and operating results. To manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements will require significant capital expenditures and allocation of valuable management resources. If the improvements are not implemented successfully, our ability to manage our growth will be impaired and we may have to make significant additional expenditures to address these issues, which could harm our financial position. The required improvements may include: Enhancing our information and communication systems to attempt to optimize proper service to our customers, and Enhancing systems of internal controls to ensure timely and accurate reporting of all of our operations

7

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our brand and operating results could be harmed. We may in the future discover areas of our internal controls that need improvement. We cannot be certain that any measures we implement will ensure that we achieve and maintain adequate controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

We have limited operating history and a relatively new business model in an emerging and rapidly evolving market. This makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have limited operating history. You must consider our business and prospects in light of the risks and difficulties we will encounter as an early-stage company in a new and rapidly evolving market. We may not be able to successfully address these risks and difficulties, which could materially harm our business and operating results.

We cannot be certain that additional financing will be available on reasonable terms when required, or at all.

From time to time, we may need additional financing. Our ability to obtain additional financing, if and when required, will depend on investor demand, our operating performance, the condition of the capital markets, and other factors. We cannot assure you that additional financing will be available to us on favorable terms when required, or at all. We may need to raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences, or privileges senior to the rights of our Common Stock, and our existing stockholders may experience dilution.

Risks Related to this Offering

There has been a limited public market for our Common Stock prior to this Offering, and an active market in which investors can resell their shares may not develop.

Prior to this Offering, there has been a limited public market for our Common Stock. We cannot predict the extent to which an active market for our Common Stock will develop or be sustained after this Offering, or how the development of such a market might affect the market price of our Common Stock. The initial offering price of our Common Stock in this Offering will be agreed between us and the underwriters based on a number of factors, including market conditions in effect at the time of the Offering, and it may not be in any way indicative of the price at which our shares will trade following the completion of this Offering. Investors may not be able to resell their shares at or above the initial offering price.

Investors in this Offering will experience immediate and substantial dilution.

If all of the shares offered hereby are sold, investors in this Offering will own 13% of the then outstanding shares of all classes of common stock, but will have paid over 104% of the total consideration for our outstanding shares, resulting in a dilution of $0.74 per share. See “Dilution.”

The market price of our Common Stock may fluctuate, and you could lose all or part of your investment.

The offering price for our Common Stock will be set by us based on a number of factors, and may not be indicative of prices that will prevail on public capital markets following this Offering. The price of our Common Stock may decline following this Offering. The stock market in general, and the market price of our Common Stock will likely be subject to fluctuation, whether due to, or irrespective of, our operating results, financial condition and prospects.

8

Our financial performance, our industry’s overall performance, changing consumer preferences, technologies and advertiser requirements, government regulatory action, tax laws and market conditions in general could have a significant impact on the future market price of our Common Stock. Some of the other factors that could negatively affect our share price or result in fluctuations in our share price include:

| ● | actual or anticipated variations in our periodic operating results; |

| ● | changes in earnings estimates; |

| ● | changes in market valuations of similar companies; |

| ● | actions or announcements by our competitors; |

| ● | adverse market reaction to any increased indebtedness we may incur in the future; |

|

|

● | additions or departures of key personnel; |

| ● | actions by stockholders; |

| ● | speculation in the press or investment community; and |

| ● | our intentions and ability to list our Common Stock on a national securities exchange and our subsequent ability to maintain such listing. |

We do not expect to declare or pay dividends in the foreseeable future.

We do not expect to declare or pay dividends in the foreseeable future, as we anticipate that we will invest future earnings in the development and growth of our business. Therefore, holders of our Common Stock will not receive any return on their investment unless they sell their securities, and holders may be unable to sell their securities on favorable terms or at all.

Our financial statements are unaudited and have not been reviewed by an independent accountant.

Management has prepared the Company’s financial statements. These statements have not been audited. No independent accountant has reviewed these financial statements.

Because we do not have an audit or compensation committee, shareholders will have to rely on our directors, none of whom is not independent, to perform these functions.

We do not have an audit or compensation committee comprised of an independent director. Indeed, we do not have any audit or compensation committee. The Board of Directors performs these functions as a whole. No members of the Board of Directors are an independent director. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

Because we lack certain internal controls over financial reporting in that we do not have an audit committee and our Board of Directors has no technical knowledge of U.S. GAAP and internal control of financial reporting and relies upon the Company’s financial personnel to advise the Board on such matters, we are subject to increased risk related to financial statement disclosures.

We lack certain internal controls over financial reporting in that we do not have an audit committee and our Board of Directors has no technical knowledge of U.S. GAAP and internal control of financial reporting and relies upon the Company’s financial personnel to advise the Board on such matters. Accordingly, we are subject to increased risk related to financial statement disclosures.

9

Our control shareholder holds a significant percentage of our outstanding voting securities, which could reduce the ability of minority shareholders to effect certain corporate actions.

Our control shareholder controls 97% of the voting securities prior to the Offering and 84% of our outstanding voting securities after the Offering, assuming all 2,971,768 shares of common stock in this Offering are sold. As a result of this ownership, he possesses and can continue to possess significant influence and can elect and can continue to elect a majority of our Board of Directors and authorize or prevent proposed significant corporate transactions. His ownership and control may also have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination or discourage a potential acquirer from making a tender offer.

Upon the completion of this Offering, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 1 issuers. We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

Upon the completion of this Offering, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 1 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year.

We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

The preparation of our consolidated financial statements involves the use of estimates, judgments and assumptions, and our consolidated financial statements may be materially affected if such estimates, judgments or assumptions prove to be inaccurate.

Financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) typically require the use of estimates, judgments and assumptions that affect the reported amounts. Often, different estimates, judgments and assumptions could reasonably be used that would have a material effect on such financial statements, and changes in these estimates, judgments and assumptions may occur from period to period over time. Significant areas of accounting requiring the application of management’s judgment include, but are not limited to, determining the fair value of assets and the timing and amount of cash flows from assets. These estimates, judgments and assumptions are inherently uncertain and, if our estimates were to prove to be wrong, we would face the risk that charges to income or other financial statement changes or adjustments would be required. Any such charges or changes could harm our business, including our financial condition and results of operations and the price of our securities. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of the accounting estimates, judgments and assumptions that we believe are the most critical to an understanding of our consolidated financial statements and our business.

If securities industry analysts do not publish research reports on us, or publish unfavorable reports on us, then the market price and market trading volume of our Common Stock could be negatively affected.

Any trading market for our Common Stock will be influenced in part by any research reports that securities industry analysts publish about us. We do not currently have and may never obtain research coverage by securities industry analysts. If no securities industry analysts commence coverage of us, the market price and market trading volume of our Common Stock could be negatively affected. In the event we are covered by analysts, and one or more of such analysts downgrade our securities, or otherwise reports on us unfavorably, or discontinues coverage or us, the market price and market trading volume of our Common Stock could be negatively affected.

10

Future issuances of our Common Stock or securities convertible into our Common Stock, or the expiration of lock-up agreements that restrict the issuance of new Common Stock, if any, or the trading of outstanding stock, could cause the market price of our Common Stock to decline and would result in the dilution of your shareholding.

Future issuances of our Common Stock or securities convertible into our Common Stock, and/or conversion of the Notes convertible into Common Stock, or the expiration of lock-up agreements that restrict the sale of Common Stock by selling shareholders, or the trading of outstanding stock, could cause the market price of our Common Stock to decline. We cannot predict the effect, if any, of the exercise of conversion of the Notes into Common Stock or other future issuances of our Common Stock or securities convertible into our Common Stock, or the future expirations of lock-up agreements, on the price of our Common Stock. In all events, future issuances of our Common Stock would result in the dilution of your shareholding. In addition, the perception that locked-up parties will sell their securities when the lock-ups expire, could adversely affect the market price of our Common Stock.

Our shares are subject to the penny stock rules, making it more difficult to trade our shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. If the price of our Common Stock is less than $5.00, our Common Stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information. In addition, the penny stock rules require that before effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our Common Stock, and therefore stockholders may have difficulty selling their shares.

Our management has broad discretion as to the use of certain of the net proceeds from this Offering.

We intend to use a portion of the net proceeds from this Offering (if we sell all of the shares being offered) for working capital and other general corporate purposes. However, we cannot specify with certainty the particular uses of such proceeds. Our management will have broad discretion in the application of the net proceeds designated for use as working capital or for other general corporate purposes. Accordingly, you will have to rely upon the judgment of our management with respect to the use of these proceeds. Our management may spend a portion or all of the net proceeds from this Offering in ways that holders of our Common Stock may not desire or that may not yield a significant return or any return at all. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from this Offering in a manner that does not produce income or that loses value. Please see “Use of Proceeds” below for more information.

Cautionary Statement Regarding Forward-Looking Statements

This Offering Circular contains various “forward-looking statements.” You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements may be impacted by a number of risks and uncertainties.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our Securities. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled “Risk Factors.”

11

If we sell all of the shares being offered, our net proceeds will be approximately $19,733,490. We will use these net proceeds for:

If 25% of the Shares offered are sold:

| Percentage of Offering Sold |

Offering Proceeds |

Approximate Offering Expenses |

Total

Net Offering Proceeds |

Principal Uses of Net Proceeds | |||||||||||

| $ | 3,500,000 | Acquisition of energy assets | |||||||||||||

| $ | 500,000 | Salaries | |||||||||||||

| $ | 125,000 | Business Development | |||||||||||||

| $ | 62,500 | Marketing | |||||||||||||

| $ | 62,500 | Consulting | |||||||||||||

| $ | 6,250 | Operational costs | |||||||||||||

| $ | 6,250 | Selling, general and administrative | |||||||||||||

| $ | 670,872 | Working capital | |||||||||||||

| 25.00 | % | $ | 4,933,372 | $ | 0 | $ | 4,933,372 | ||||||||

If 50% of the Shares offered are sold:

| Percentage of Offering Sold |

Offering Proceeds |

Approximate Offering Expenses |

Total

Net Offering Proceeds |

Principal Uses of Net Proceeds | |||||||||||

| $ | 8,000,000 | Acquisition of energy assets | |||||||||||||

| $ | 500,000 | Salaries | |||||||||||||

| $ | 125,000 | Business Development | |||||||||||||

| $ | 62,500 | Marketing | |||||||||||||

| $ | 62,500 | Consulting | |||||||||||||

| $ | 6,250 | Operational costs | |||||||||||||

| $ | 6,250 | Selling, general and administrative | |||||||||||||

| $ | 1,104,245 | Working capital | |||||||||||||

| 50.00 | % | $ | 9,866,745 | $ | 0 | $ | 9,866,745 | ||||||||

If 100% of the Shares offers are sold:

| Percentage of Offering Sold |

Offering Proceeds |

Approximate Offering Expenses |

Total

Net Offering Proceeds |

Principal Uses of Net Proceeds | |||||||||||

| $ | 17,500,000 | Acquisition of energy assets | |||||||||||||

| $ | 500,000 | Salaries | |||||||||||||

| $ | 125,000 | Business Development | |||||||||||||

| $ | 62,500 | Marketing | |||||||||||||

| $ | 62,500 | Consulting | |||||||||||||

| $ | 6,250 | Operational costs | |||||||||||||

| $ | 6,250 | Selling, general and administrative | |||||||||||||

| $ | 1,470,990 | Working capital | |||||||||||||

| 100.00 | % | $ | 19,733,490 | $ | 0 | $ | 19,733,490 | ||||||||

12

The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors.

As indicated in the table above, if we sell only 75%, or 50%, or 25% of the shares offered for sale in this Offering, we would expect to use the resulting net proceeds for the same purposes as we would use the net proceeds from a sale of 100% of the shares, and in approximately the same proportions, until such time as such use of proceeds would leave us without working capital reserve. At that point we would expect to modify our use of proceeds by limiting our expansion, leaving us with the working capital reserve indicated.

The expected use of net proceeds from this Offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve and change. The amounts and timing of our actual expenditures, specifically with respect to working capital, may vary significantly depending on numerous factors. The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this Offering.

In the event we do not sell all of the shares being offered, we may seek additional financing from other sources in order to support the intended use of proceeds indicated above. If we secure additional equity funding, investors in this Offering would be diluted. In all events, there can be no assurance that additional financing would be available to us when wanted or needed and, if available, on terms acceptable to us.

If you purchase shares in this Offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged for each share in this Offering and the net tangible book value per share of our Common Stock after this Offering.

Our historical net tangible book value as of September 30, 2017 was $[739,000] or $[0.04] per then-outstanding share of our Common Stock. Historical net tangible book value per share equals the amount of our total tangible assets less total liabilities, divided by the total number of shares of our Common Stock outstanding, all as of the date specified.

The following table illustrates the per share dilution to new investors discussed above, assuming the sale of, respectively, 100%, 50% and 25% of the shares offered for sale in this Offering:

| Percentage of shares offered that are sold | 100% | 50% | 25% | |||||||||

| Price to the public charged for each share in this Offering | 6.73 | 6.73 | 6.73 | |||||||||

| Historical net tangible book value per share as of September 30, 2017 (1) | 0.04 | 0.04 | 0.04 | |||||||||

| Increase in net tangible book value per share attributable to new investors in this Offering (2) | 0.78 | 0.42 | 0.22 | |||||||||

| Net tangible book value per share, after this Offering | 0.74 | 0.38 | 0.18 | |||||||||

| Dilution per share to new investors | 5.99 | 6.35 | 6.55 | |||||||||

| (1) | Based on net tangible book value as of September 30, 2017 of $[739,000] and 20,000,000 outstanding shares of Common stock. |

13

This Offering Circular is part of an Offering Statement that we filed with the SEC, using a continuous offering process. Periodically, as we have material developments, we will provide an Offering Circular supplement that may add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

Pricing of the Offering

Prior to the Offering, there has been a limited public market for the Offered Shares. The initial public offering price was determined by us. The principal factors considered in determining the initial public offering price include:

| ● | the information set forth in this Offering Circular and otherwise available; | |

| ● | our history and prospects and the history of and prospects for the industry in which we compete; | |

| ● | our past and present financial performance; | |

| ● | our prospects for future earnings and the present state of our development; | |

| ● | the general condition of the securities markets at the time of this Offering; | |

| ● | the recent market prices of, and demand for, publicly traded common stock of generally comparable companies; and | |

| ● | other factors deemed relevant by us. |

Investment Limitations

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth (please see below on how to calculate your net worth). Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Because this is a Tier 1, Regulation A Offering, most investors must comply with the 10% limitation on investment in the Offering. The only investor in this Offering exempt from this limitation is an “accredited investor” as defined under Rule 501 of Regulation D under the Securities Act (an “Accredited Investor”). If you meet one of the following tests you should qualify as an Accredited Investor:

| (i) | You are a natural person who has had individual income in excess of $200,000 in each of the two most recent years, or joint income with your spouse in excess of $300,000 in each of these years, and have a reasonable expectation of reaching the same income level in the current year; | |

| (ii) | You are a natural person and your individual net worth, or joint net worth with your spouse, exceeds $1,000,000 at the time you purchase Offered Shares (please see below on how to calculate your net worth); | |

| (iii) | You are an executive officer or general partner of the issuer or a manager or executive officer of the general partner of the issuer; | |

| (iv) | You are an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the Code, a corporation, a Massachusetts or similar business trust or a partnership, not formed for the specific purpose of acquiring the Offered Shares, with total assets in excess of $5,000,000; |

14

| (v) | You are a bank or a savings and loan association or other institution as defined in the Securities Act, a broker or dealer registered pursuant to Section 15 of the Exchange Act, an insurance company as defined by the Securities Act, an investment company registered under the Investment Company Act of 1940 (the “Investment Company Act”), or a business development company as defined in that act, any Small Business Investment Company licensed by the Small Business Investment Act of 1958 or a private business development company as defined in the Investment Advisers Act of 1940; | |

| (vi) | You are an entity (including an Individual Retirement Account trust) in which each equity owner is an accredited investor; | |

| (vii) | You are a trust with total assets in excess of $5,000,000, your purchase of Offered Shares is directed by a person who either alone or with his purchaser representative(s) (as defined in Regulation D promulgated under the Securities Act) has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective investment, and you were not formed for the specific purpose of investing in the Offered Shares; or | |

| (viii) | You are a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has assets in excess of $5,000,000. |

Offering Period and Expiration Date

This Offering will start on or after the Qualification Date and will terminate once the Maximum Offering is reached or, if it is not reached, upon the discretion of the Board of Directors.

Procedures for Subscribing

When you decide to subscribe for Offered Shares in this Offering, you should:

| 1. | Electronically receive, review, execute and deliver to us a subscription agreement; and | |

| 2. | Deliver funds directly by wire or electronic funds transfer via ACH to the specified account maintained by us. |

Any potential investor will have ample time to review the subscription agreement, along with their counsel, prior to making any final investment decision. We shall only deliver such subscription agreement upon request after a potential investor has had ample opportunity to review this Offering Circular.

Right to Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred to the escrow account, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the shares subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

Under Rule 251 of Regulation A, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A non-accredited, natural person may only invest funds which do not exceed 10% of the greater of the purchaser’s annual income or net worth (please see below on how to calculate your net worth).

15

NOTE: For the purposes of calculating your net worth, it is defined as the difference between total assets and total liabilities. This calculation must exclude the value of your primary residence and may exclude any indebtedness secured by your primary residence (up to an amount equal to the value of your primary residence). In the case of fiduciary accounts, net worth and/or income suitability requirements may be satisfied by the beneficiary of the account or by the fiduciary, if the fiduciary directly or indirectly provides funds for the purchase of the Offered Shares.

In order to purchase offered Shares and prior to the acceptance of any funds from an investor, an investor will be required to represent, to the Company’s satisfaction, that he is either an accredited investor or is in compliance with the 10% of net worth or annual income limitation on investment in this Offering.

16

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of our operations together with our consolidated financial statements and the notes thereto appearing elsewhere in this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations, whose actual outcomes involve risks and uncertainties. Actual results and the timing of events may differ materially from those stated in or implied by these forward-looking statements due to a number of factors, including those discussed in the sections entitled “Risk Factors”, “Cautionary Statement Regarding Forward-Looking Statements” and elsewhere in this Offering Circular. Please see the notes to our Financial Statements for information about our Critical Accounting Policies and Recently Issued Accounting Pronouncements.

Management’s Discussion and Analysis

The Company has not had material revenues from operations in each of the last two fiscal years, or in the first three quarters of the current fiscal year.

Finn Power Energy Corporation is a group of energy companies that operates and develops power plant projects located primarily in South-East Asia, with future plans to potentially expand its business to opportunities in other regions. Finn Power Energy Corporation’s business model is to generate a steady revenue stream from its power plants, strengthen relationships with strategic partners and to expand its portfolio to increase its revenue base. The proceeds of this offering will be used primarily to fund current operations, acquire and/or facilitate the development of new power generation plants and/or for general corporate purposes, including the cost of this offering.

Finn Power Energy Corporation operates through its subsidiaries PT. Soma Power Indonesia (PT SPI) and and PT Soma Daya Utama (PT SDU), two Indonesian entities that design, own and operate 100 MW hydroelectric and 2x31MW coal-fired power plants, respectively, in Indonesia. Both PT. Soma Power Indonesia and PT Soma Daya Utama primarily engage in the generation of electricity for the sales and distribution to the local industries, businesses and residents. Through the synergistic integration of these companies, we believe we can achieve higher operating profits than the industry average. This should lead to greater returns on invested capital.

Plan of Operation for the Next Twelve Months

The Company believes that the proceeds of this Offering will satisfy its cash requirements for the next twelve months. To complete the Company’s entire development plan, it may have to raise additional funds in the next twelve months. The Company may make significant changes in the number of employees at the corporate level.

Investments. The Company intends to make substantial investment in energy producing assets that can make use of its energy production technologies.

Marketing and sales. The Company will cause its companies to make substantial marketing and sales expenses which will consist primarily of salaries, and benefits for our employees engaged in sales, sales support, marketing, business development, and customer service functions. Our marketing and sales expenses also include marketing and promotional expenditures.

Cost of revenue. The Company expects that the cost of revenue for its operations will consist primarily of expenses associated with the delivery and distribution of our products. These include expenses related to providing products and services and salaries and benefits for employees on our operations teams.

Research and development. The Company will continue to engage in research and development expenses. These will consist primarily of salaries, and benefits for employees who are responsible for building new products as well as improving existing products. We will expense all of our research and development costs as they are incurred.

General and administrative. The majority of our general and administrative expenses will consist of salaries, benefits, and share-based compensation for certain of our executives as well as our legal, finance, human resources, corporate communications and policy employees, and other administrative employees. In addition, general and administrative expenses include professional and legal services. The Company expects to incur substantial expenses in marketing the current Offering, in closing sales, and in promoting and managing its operations.

17

Revenues and Losses

During the nine months ended September 30, 2017, the Company posted net revenues of $0, total operating expenses of $242,124, consisting of license, registration and acquisition expenses of $127,801, operating expenses of $82,239 and administrative expenses of $32,084, and a net loss of $240,543. In contrast, during the nine months ended September 30, 2016, the Company posted net revenues of $0, total operating expenses of $299,982, consisting of license, registration and acquisition expenses of $118,856, operating expenses of $165,692 and administrative expenses of $15,434, and a net loss of $352,092.

Liquidity and Capital Resources

As of September 30, 2017, the Company had an increased cash position of $42,003 from approximately $41,960 as of December 31, 2016.

Results of Operations

Discussion of the Year Ended December 31, 2016 as compared to the Year Ended December 31, 2015

Our total revenue was $0 and $0 for the years ended December 31, 2016 and 2015, respectively.

During the year ended December 31, 2016, the Company incurred total operating expenses of $377,261, consisting of operating and maintenance expenses of $315,113 and administrative expenses of $62,148. In contrast, during the year ended December 31, 2015, the Company incurred total operating expenses of $12,114, consisting of operating and maintenance expenses of $10,599 and administrative expenses of $1,515. The increase in total operating expenses resulted is attributable to the expansion of the Company’s business from the start-up phase.

In the year ended December 31, 2016, the Company posted net loss of $398,786 as compared to net loss of $12,114 for the year ended December 31, 2015. The increase in net loss resulted from increases in total operating expenses attributable to the expansion of the Company’s business from the start-up phase.

In the year ended December 31, 2016, the Company generated cash from operating activities of $1,285,787. During such period, the Company also used cash in investing activities in the amount of $1,417,044 and generated cash from financing activities of $170,603. In comparison, for the year ended December 31, 2015, the Company generated no cash from operating activities, generated no cash from investing activities and generated cash from financing activities of $14,281.

Discussion of the nine months ended September 30, 2017 as compared to the nine months ended September 30, 2016

For the nine months ended September 30, 2017, the Company posted net income of $0. At September 30, 2017, it had an accumulated deficit of approximately $646,598. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations, which it has not been able to accomplish to date, and/or obtain additional financing from its stockholders and/or other third parties.

During the nine months ended September 30, 2017 and September 30, 2016, respectively, the Company posted net revenues of $0.

During the nine months ended September 30, 2017, the Company incurred total operating expenses of $242,124, consisting of license, registration and acquisition expenses of $127,801, operating expenses of $82,239 and administrative expenses of $32,084. In contrast, during the nine months ended September 30, 2016, the Company incurred total operating expenses of $299,982, consisting of license, registration and acquisition expenses of $118,856, operating expenses of $165,692 and administrative expenses of $15,434. The decrease in total operating expenses resulted is attributable decreases in the operating costs of the Company.

18

During the nine months ended September 30, 2017, the Company posted net loss of $240,543 as compared to net loss of $352,092 for the nine months ended September 30, 2016. The decrease in net loss resulted from decreases in total operating costs related to the Company’s business.

For the nine months ended September 30, 2017, the Company used cash from operating activities of $80,377. During such period, the Company also generated cash from investing activities in the amount of $77,211 and generated cash from financing activities of $3,798. In comparison, for the nine months ended September 30, 2016, the Company generated cash from operating activities of $1,284,537, used cash in investing activities in the amount of $1,417,044 and generated cash from financing activities of $170,603.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

Quantitative and Qualitative Disclosures about Market Risk

In the ordinary course of our business, we are not exposed to market risk of the sort that may arise from changes in interest rates or foreign currency exchange rates, or that may otherwise arise from transactions in derivatives.

The preparation of financial statements in conformity with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s significant estimates and assumptions include the fair value of the Company’s common stock, stock-based compensation, the recoverability and useful lives of long-lived assets, and the valuation allowance relating to the Company’s deferred tax assets.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. The Company’s management, in consultation with its legal counsel as appropriate, assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company, in consultation with legal counsel, evaluates the perceived merits of any legal proceedings or unasserted claims, as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates a potentially material loss contingency is not probable, but is reasonably possible, or is probable, but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss, if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Relaxed Ongoing Reporting Requirements

Upon the completion of this Offering, we expect to elect to become a public reporting company under the Exchange Act. If we elect to do so, we will be required to publicly report on an ongoing basis as an “emerging growth company” (as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act) under the reporting rules set forth under the Exchange Act. For so long as we remain an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other Exchange Act reporting companies that are not “emerging growth companies”, including but not limited to:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

19

| ● | taking advantage of extensions of time to comply with certain new or revised financial accounting standards; | |

| ● | being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and | |

| ● | being exempt from the requirement to hold a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We expect to take advantage of these reporting exemptions until we are no longer an emerging growth company. We would remain an “emerging growth company” for up to five years, although if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of any July 30 before that time, we would cease to be an “emerging growth company” as of the following December 31.

If we elect not to become a public reporting company under the Exchange Act, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 1 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year.

In either case, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

20

Corporate History and General Information