0001671933DEF 14AFALSE00016719332022-01-012022-12-31iso4217:USD00016719332021-01-012021-12-3100016719332020-01-012020-12-310001671933ecd:PeoMemberttd:AdjustmentEquityAwardsReportedValueMember2022-01-012022-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001671933ecd:PeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2022-01-012022-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001671933ecd:PeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2022-01-012022-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-01-012022-12-310001671933ttd:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2022-01-012022-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2022-01-012022-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310001671933ecd:PeoMemberttd:AdjustmentEquityAwardsReportedValueMember2021-01-012021-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001671933ecd:PeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2021-01-012021-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001671933ecd:PeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2021-01-012021-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-01-012021-12-310001671933ttd:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2021-01-012021-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2021-01-012021-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310001671933ecd:PeoMemberttd:AdjustmentEquityAwardsReportedValueMember2020-01-012020-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310001671933ecd:PeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2020-01-012020-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001671933ecd:PeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2020-01-012020-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-01-012020-12-310001671933ttd:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInYearEndValueOfPriorYearAwardsUnvestedMember2020-01-012020-12-310001671933ecd:NonPeoNeoMemberttd:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001671933ecd:NonPeoNeoMemberttd:ChangeInFairValueOfPriorYearAwardsVestedMember2020-01-012020-12-310001671933ttd:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310001671933ecd:PeoMemberttd:EquityAwardsGrantedDuringTheYearPerformanceOptionsUnvestedMember2021-01-012021-12-310001671933ttd:EquityAwardsGrantedDuringTheYearPerformanceOptionsVestedMemberecd:PeoMember2021-01-012021-12-31000167193312022-01-012022-12-31000167193322022-01-012022-12-31000167193332022-01-012022-12-31000167193342022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.___)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☒ | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☐ | Soliciting Material under §240.14a-12 |

THE TRADE DESK, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The Trade Desk, Inc.

42 N. Chestnut Street

Ventura, California 93001

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 25, 2023

To our stockholders:

You are cordially invited to attend the 2023 annual meeting of stockholders of The Trade Desk, Inc. (the “Annual Meeting”) to be held virtually on Thursday, May 25, 2023, at 1:00 p.m. Pacific Time. You can attend the Annual Meeting via the Internet, vote your shares electronically and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/TTD2023 (there is no physical location for the Annual Meeting). You will need to have your 16-Digit Control Number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting.

We are holding the Annual Meeting for the following purposes:

1.To elect two Class I directors;

2.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

3.To transact such other business as may properly come before the Annual Meeting or at any and all adjournments, continuations or postponements thereof.

If you owned our Class A common stock or Class B common stock at the close of business on March 31, 2023, you may attend and vote at the Annual Meeting. A list of stockholders eligible to vote at the Annual Meeting will be available for review during our regular business hours at our headquarters in Ventura, California for the ten days prior to the Annual Meeting for any purpose related to the Annual Meeting. The list of stockholders will also be available on the bottom panel of your screen during the Annual Meeting after entering your 16-Digit Control Number included on your Notice or your proxy card. On or about April 12, 2023, we expect to mail to our stockholders the Notice containing instructions on how to access our proxy statement for our Annual Meeting (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”). The Proxy Statement and the Annual Report can be accessed directly at the following Internet address: www.proxyvote.com. All you have to do is enter the control number located on your proxy card.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope that you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. You may also submit your proxy card or voting instruction card for the Annual Meeting by completing, signing, dating and returning your proxy card or voting instruction card in the envelope provided. Any stockholder of record attending the Annual Meeting may vote during the Annual Meeting, even if you have already returned a proxy card or voting instruction card.

Thank you for your ongoing support of The Trade Desk.

| | | | | |

| Sincerely, |

| |

| Jeff T. Green |

| Chief Executive Officer |

Ventura, California

April 12, 2023

| | |

YOUR VOTE IS IMPORTANT ALL STOCKHOLDERS ARE INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE VOTE AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. PLEASE NOTE THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. |

THE TRADE DESK, INC.

2023 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

TABLE OF CONTENTS

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

THE TRADE DESK, INC.

GENERAL INFORMATION

The board of directors of The Trade Desk, Inc. is soliciting proxies for our 2023 annual meeting of stockholders (the “Annual Meeting”) to be held on Thursday, May 25, 2023, at 1:00 p.m. Pacific Time. This year's Annual Meeting will be held entirely via the Internet. Stockholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/TTD2023. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our Annual Meeting (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) is first being mailed on or about April 12, 2023, to stockholders entitled to vote at the Annual Meeting. We also made these materials available on our website at www.thetradedesk.com under the headings “Investors” on or about April 12, 2023. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully. Unless the context requires otherwise, the words “The Trade Desk,” “we,” “the Company,” “us,” and “our” refer to The Trade Desk, Inc.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING,

THE PROXY MATERIALS AND VOTING YOUR SHARES

WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS?

We have elected to furnish our proxy materials, including this Proxy Statement and our Annual Report, primarily via the Internet. The Notice is being provided in accordance with the Securities and Exchange Commission (“SEC”) rules and contains instructions on how to access our proxy materials. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

WHAT ITEMS WILL BE VOTED ON AT THE ANNUAL MEETING?

There are two items that will be voted on at the Annual Meeting:

1.The election of two Class I directors; and

2.The ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

WHAT ARE OUR BOARD OF DIRECTORS’ VOTING RECOMMENDATIONS?

Our board of directors recommends that you vote your shares “FOR” each of the nominees to the board of directors and “FOR” the ratification of the appointment of PwC.

WHAT IS A PROXY?

Our board of directors is soliciting your vote at the Annual Meeting. A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy, that designation also is called a “proxy” or, if in a written document, a “proxy card.” Jeff Green, Blake Grayson and Jay Grant have been designated as proxies for the Annual Meeting.

WHO CAN VOTE AT THE ANNUAL MEETING?

Only holders of record of our Class A common stock and Class B common stock at the close of business on March 31, 2023 (the “Record Date”) will be entitled to vote at the Annual Meeting. The Record Date was established by our board of directors. Stockholders of record at the close of business on the Record Date are entitled to:

•Receive notice of the Annual Meeting; and

•Vote at the Annual Meeting and any adjournments, continuations or postponements of the Annual Meeting.

On the Record Date, there were 444,040,336 shares of our Class A common stock outstanding and 44,035,900 shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to 10 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this Proxy Statement as our “common stock.”

IS MY VOTE CONFIDENTIAL?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either among our employees or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy card, which are then forwarded to our management.

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A “STOCKHOLDER OF RECORD” AND HOLDING SHARES AS “BENEFICIAL OWNER” (OR IN “STREET NAME”)?

Most stockholders are considered “beneficial owners” of their shares, that is, they hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name.”

Stockholder of Record: If your shares are registered directly in your name with our transfer agent, you are considered the “stockholder of record” with respect to those shares and we are sending the Notice directly to you to access proxy materials. As a stockholder of record, you have the right to grant your voting proxy directly to us or to vote at the Annual Meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name, and proxy materials are being forwarded to you by your broker, bank or other nominee (who is considered the stockholder of record with respect to those shares). As a beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares if you follow the instructions you receive from your broker, bank or other nominee. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares at the Annual Meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or other nominee.

WHAT ARE THE DIFFERENT METHODS THAT I CAN USE TO VOTE MY SHARES OF COMMON STOCK?

By Internet: Until 11:59 p.m. Eastern Time on May 24, 2023, you can vote via the Internet by visiting the website noted on your proxy card. Internet voting is available 24 hours a day. We encourage you to vote via the Internet, as it is the most cost-effective way to vote. Beneficial owners may vote by telephone or the Internet if their banks, brokers or nominees make those methods available, by following the instructions provided to them with the proxy materials.

By Telephone: Until 11:59 p.m. Eastern Time on May 24, 2023, you can also vote your shares by telephone by calling the toll-free telephone number indicated on your proxy card and following the voice prompt instructions. Telephone voting is available 24 hours a day.

By Mail: You can vote your shares by marking, signing and timely returning the proxy card enclosed with the proxy materials that are provided in printed form. Beneficial owners must follow the directions provided by their broker, bank or other nominee in order to direct such broker, bank or other nominee as to how to vote their shares.

During the Annual Meeting: You can vote and submit questions during the Annual Meeting by attending the virtual meeting at www.virtualshareholdermeeting.com/TTD2023. Please have your Notice or proxy card in hand when you visit the website.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

The holders of a majority of the voting power of all of our issued and outstanding shares of our common stock as of the Record Date must be present at the Annual Meeting or represented by proxy for the transaction of business at the Annual Meeting. This is called a quorum.

Your shares will be counted for purposes of determining if there is a quorum, if you:

•Are entitled to vote and you are present at the Annual Meeting; or

•Have voted on the Internet, by telephone or by properly submitting a proxy card or voting instruction form by mail.

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. If there are not enough shares present both at the Annual Meeting and by timely and properly submitted proxy cards to constitute a quorum, the Annual Meeting may be adjourned until such time as a sufficient number of shares are present.

HOW ARE ABSTENTIONS COUNTED?

You may choose to abstain or refrain from voting your shares on one or more issues presented for a vote at the Annual Meeting. However, for purposes of determining the presence of a quorum, abstentions are counted as present. For the purpose of determining whether the stockholders have approved a matter, abstentions will not affect the outcome of the vote of any matter being voted on at the Annual Meeting.

WHAT IF A STOCKHOLDER DOES NOT PROVIDE A PROXY OR, IF A PROXY IS RETURNED, IT DOES NOT SPECIFY A CHOICE FOR ONE OR MORE ISSUES?

You should specify your choice for each issue to be voted upon at the Annual Meeting. If no proxy is returned or if a proxy is signed and returned but no specific instructions are given on one or more of the issues to be voted upon at that Annual Meeting, proxies will be voted in accordance with applicable rules, laws and regulations as follows:

Stockholders of Record. If you are a stockholder of record and you do not return a proxy and you do not vote at the Annual Meeting, your shares will not be voted at our Annual Meeting, and if you are not present at the Annual Meeting, your shares will not be counted for purposes of determining whether a quorum exists for the Annual Meeting. If you do return a proxy via the Internet, telephone or mail, but you fail to specify how your shares should be voted on one or more issues to be voted upon at the Annual Meeting, then to the extent you did not specify a choice, your shares will be voted: (i) FOR Proposal One for the election of all of the director nominees and (ii) FOR Proposal Two ratifying the selection of PwC as our independent auditors.

Beneficial Owners. If you are a beneficial owner and (i) you do not provide your broker or other nominee who holds your shares with voting instructions, or (ii) you do provide a proxy card but you fail to specify your voting instructions on one or more of the issues to be voted upon at our Annual Meeting, under applicable rules, your broker or other nominee may exercise discretionary authority to vote your shares on routine proposals but may not vote your shares on non-routine proposals.

The shares that cannot be voted by brokers and other nominees on non-routine matters but are represented at the Annual Meeting will be deemed present at our Annual Meeting for purposes of determining whether the necessary quorum exists to proceed with the Annual Meeting but will not be considered entitled to vote on the non-routine proposals.

We believe that under applicable rules Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm is considered a routine matter for which brokerage firms may vote shares that are held in the name of brokerage firms and which are not voted by the applicable beneficial owners.

However, we believe that Proposal One: Election of Directors is considered a non-routine matter under applicable rules. Accordingly, brokers or other nominees cannot vote on this proposal without instruction from beneficial owners.

WHAT IS THE VOTING REQUIREMENT TO APPROVE EACH OF THE PROPOSALS?

The following table sets forth the voting requirement with respect to each of the proposals:

| | | | | | | | |

| Proposal One—Election of directors | | As set forth in our bylaws, each director must be elected by a plurality of the votes cast, meaning that the two nominees receiving the most “FOR” votes (among votes properly cast at the Annual Meeting or by proxy) will be elected. Only votes “FOR” will affect the outcome. Brokers will not have discretionary voting authority with respect to shares held in street name for their clients. Abstentions and broker non-votes will not affect the outcome of the vote. |

| | | |

| Proposal Two—Ratification of appointment of independent registered public accounting firm | | As set forth in our bylaws, to be approved by our stockholders, a majority of the votes cast at the Annual Meeting or by proxy must vote “FOR” this proposal. Brokers will have discretionary voting authority with respect to shares held in street name for their clients, even if the broker does not receive voting instructions from their client. Accordingly, we do not anticipate that there will be any broker non-votes on this proposal; however, broker non-votes will not be counted as votes cast and will therefore have no effect on the proposal. Abstentions will also have no effect on the proposal. |

HOW DO I CHANGE OR REVOKE MY PROXY?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), or by signing and returning a new proxy card with a later date, or by attending the Annual Meeting and voting during the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD?

It means that your shares are registered differently or you have multiple accounts. Please vote all of these shares separately to ensure all of the shares you hold are voted.

HOW CAN STOCKHOLDERS SUBMIT A PROPOSAL FOR INCLUSION IN OUR PROXY STATEMENT FOR THE 2024 ANNUAL MEETING?

To be included in our proxy statement for the 2024 annual meeting, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and be received by our Secretary at our principal executive offices no later than December 14, 2023, which is one hundred twenty (120) calendar days before the one-year anniversary of the date on which we first released this Proxy Statement to stockholders in connection with this year’s Annual Meeting. In connection with the 2024 annual meeting, we intend to file a proxy statement and a WHITE proxy card with the SEC in connection with our solicitation of proxies for that meeting.

HOW CAN STOCKHOLDERS SUBMIT PROPOSALS TO BE RAISED AT THE 2024 ANNUAL MEETING THAT WILL NOT BE INCLUDED IN OUR PROXY STATEMENT FOR THE 2024 ANNUAL MEETING?

To be raised at the 2024 annual meeting, stockholder proposals must comply with our bylaws. Under our bylaws, a stockholder must give advance notice to our Secretary of any business, including nominations of candidates for election as directors to our board, that the stockholder wishes to raise at our annual meeting. To be timely, a stockholder’s notice must be delivered to, or mailed and received at, our principal executive offices not less than ninety (90) days nor more than one hundred twenty (120) days prior to the one-year anniversary of the preceding year’s annual meeting. Since our Annual Meeting is on May 25, 2023, stockholder proposals must be received by our Secretary at our principal executive offices no earlier than January 26, 2024 and no later than February 25, 2024, in order to be raised at our 2024 annual meeting.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

WHAT IF THE DATE OF THE 2024 ANNUAL MEETING CHANGES BY MORE THAN 30 DAYS FROM THE ANNIVERSARY OF THIS YEAR’S ANNUAL MEETING?

Under Rule 14a-8 of the Exchange Act, if the date of the 2024 annual meeting changes by more than 30 days from the anniversary of this year’s annual meeting, to be included in our proxy statement, stockholder proposals must be received by us within a reasonable time before our solicitation is made.

Under our bylaws, if the date of the 2024 annual meeting is advanced by more than thirty (30) days or delayed by more than sixty (60) days from the anniversary of this year’s annual meeting, stockholder proposals to be brought before the 2024 annual meeting must be delivered, or mailed and received, not later than the ninetieth (90th) day prior to such annual meeting or, if later, the tenth (10th) day following the day on which public disclosure of the date of such annual meeting was first made.

DOES A STOCKHOLDER PROPOSAL REQUIRE SPECIFIC INFORMATION?

With respect to a stockholder’s nomination of a candidate for our board of directors, the stockholder notice to the Secretary must contain certain information as set forth in our bylaws about both the nominee and the stockholder making the nomination. With respect to any other business that the stockholder proposes, the stockholder notice must contain a brief description of such business and the reasons for conducting such business at the Annual Meeting, as well as certain other information as set forth in our bylaws. If you wish to bring a stockholder proposal or nominate a candidate for director, you are advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. A copy of our bylaws is available via the website of the Securities and Exchange Commission at http://www.sec.gov. You may also contact our Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

WHAT HAPPENS IF WE RECEIVE A STOCKHOLDER PROPOSAL THAT IS NOT IN COMPLIANCE WITH THE TIME FRAMES DESCRIBED ABOVE?

If we receive notice of a matter to come before the 2024 annual meeting that is not in accordance with the deadlines described above, we will use our discretion in determining whether or not to bring such matter before such meeting. If such matter is brought before such meeting, then our proxy card for such meeting will confer upon our proxy holders’ discretionary authority to vote on such matter.

WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE ANNUAL MEETING?

Other than the two items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Jeff Green, Blake Grayson and Jay Grant, or any of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our board of directors.

WHO BEARS THE COST OF THIS SOLICITATION?

We pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition, we may reimburse banks, brokers and other custodians, nominees and fiduciaries representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of our directors, officers and employees, personally or by mail, telephone, facsimile, email or other means of communication (electronic or otherwise). No additional compensation will be paid for such services.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports, or Notices of Internet Availability of Proxy Materials, with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. In accordance with these rules, only one proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, will be delivered to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. Stockholders who currently receive multiple copies of the proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, at their address and would like to request “householding” of their communications should contact their broker if they are beneficial owners or direct their request to Broadridge at the contact information below if they are record holders.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, please notify your broker, if you are a beneficial owner or, if you are a record holder, direct your written request to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717 or call Broadridge at 1-866-540-7095.

If requested, we will also promptly deliver, upon oral or written request, a separate copy of the proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, to any stockholder residing at an address to which only one copy was mailed.

WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting, which will be available on our website.

PROPOSAL ONE:

ELECTION OF DIRECTORS

In voting on the election of our director nominees, stockholders may:

•Vote in favor of all nominees;

•Vote in favor of specific nominees; or

•Withhold votes as to specific nominees.

Assuming a quorum is present; directors will be elected by a plurality of the votes cast.

Our bylaws provide that the authorized number of directors shall be determined from time to time by resolution of the board of directors, provided the board of directors shall consist of at least one (1) member. Our board of directors is currently comprised of eight (8) directors. Our certificate of incorporation provides that our board of directors shall be divided into three classes, each consisting of as nearly one-third of the total number of directors as possible. Each class of directors serves a three-year term expiring at the annual meeting of stockholders in the year listed in the table below:

| | | | | | | | | | | | | | |

| Class I (2023) | | Class II (2024) | | Class III (2025) |

| Jeff T. Green | | David R. Pickles | | Lise J. Buyer |

| Andrea L. Cunningham | | Gokul Rajaram | | Kathryn E. Falberg |

| Eric B. Paley | | | | David B. Wells |

Based on the recommendation of the nominating and corporate governance committee, our board of directors has nominated Jeff T. Green and Andrea L. Cunningham for election as Class I directors, each to serve a three-year term that expires at the annual meeting of stockholders in 2026 and until their successors are duly elected and qualified. Ms. Cunningham and Messrs. Green and Paley are currently serving as Class I directors. Each of Ms. Cunningham and Mr. Green has consented to serve for a new term. Mr. Paley’s current term as a Class I director will expire immediately prior to our Annual Meeting and he will not stand for re-election at the Annual Meeting. Effective upon the end of Mr. Paley’s term as a director immediately prior to the Annual Meeting, the authorized number of directors will be reduced to seven (7).

Directors listed in Class II and Class III above are not being elected this year and will continue in office for the remainder of their terms, as described above, unless such directors resign or their service as directors otherwise ceases in accordance with our certificate of incorporation or bylaws.

Vote Required

The Class I directors being voted on this year are elected by a plurality of the votes cast. This means that the director nominee with the most affirmative votes for a particular seat is elected for that seat. Abstentions have no effect on the outcome of the vote.

It is the intention of the persons named as proxies herein to vote in favor of the candidates nominated by our board of directors unless such authority is withheld, either by affirmative vote of the stockholders or deemed withheld by the failure of stockholders to submit their votes. If any nominee should not be available for election, the proxies will be voted in the best judgment of the persons authorized as proxies.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES.

Information Concerning Director Nominees

The name and age of each nominee for director, his or her position with us, the year in which he or she first became a director, and certain biographical information as of April 12, 2023 is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with the Company | | Director Since |

| Jeff T. Green | | 46 | | President and Chief Executive Officer, Director | | November 2009 |

| Andrea L. Cunningham | | 66 | | Class A Director | | January 2022 |

| | | | | | |

Jeff T. Green co-founded The Trade Desk and has served as our president and chief executive officer and as a member of our board of directors since November 2009. Prior to joining The Trade Desk, from May 2004 to October 2009, Mr. Green founded AdECN, the world’s first online advertising exchange, and served as its chief operating officer, where he led strategy, product and business development until it was acquired by Microsoft in 2007. At Microsoft Corporation, Mr. Green oversaw the AdECN exchange business, as well as all reseller and channel partner business. Mr. Green has also played a leadership role in the ad tech industry, having served on the Networks and Exchanges Quality Assurance Guidelines Committee for the Internet Advertising Bureau (“IAB”) from 2011 to 2012. At IAB, Mr. Green led working groups that established rules and best practices for acquiring inventory and set data transaction standards.

We believe that Mr. Green is qualified to serve on our board of directors due to his extensive management experience and sophisticated industry background.

Andrea L. Cunningham has served as a member of our board of directors since January 2022. Since 2012, Ms. Cunningham has served as the president of Cunningham Collective, a consulting firm she founded that advises companies on marketing, brand and communication strategies. She previously held various senior marketing positions at various companies, including serving as Chief Marketing Officer for Avaya Inc., a cloud communications company, from 2014 to 2015. Ms. Cunningham currently serves on the boards of directors of numerous private companies, and previously served on the boards of directors of RhythmOne plc (formerly Blinkx), a digital advertising technology company then-traded on the London Stock Exchange, from February 2016 to February 2018. Ms. Cunningham received a B.A. in English from Northwestern University and completed the Harvard Business School Executive Education program.

On February 22, 2022, in accordance with Article VI, Section E of our certificate of incorporation, our board of directors appointed Ms. Cunningham to serve as a representative of our Class A common stock. For more information, see “Information About the Board of Directors and Corporate Governance-Class A Director.”

We believe that Ms. Cunningham is qualified to serve on our board of directors due to her extensive management experience, track record at other technology companies and industry background.

Information Concerning Current Directors and Directors Continuing in Office

The name and age of each director currently or continuing in office, his or her position with us, the year in which he or she first became a director, and certain biographical information as of April 12, 2023 is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with the Company | | Director Since |

| Lise J. Buyer | | 63 | | Lead Independent Director | | March 2019 |

| Kathryn E. Falberg | | 62 | | Director | | August 2016 |

| Eric B. Paley | | 47 | | Director | | March 2010 |

| David R. Pickles | | 45 | | Chief Technology Officer, Director | | February 2021 |

| Gokul Rajaram | | 48 | | Director | | May 2018 |

| David B. Wells | | 51 | | Director | | December 2015 |

Lise J. Buyer has served as a member of our board of directors since March 2019, and she was appointed as lead independent director in February 2021. Since 2006, Ms. Buyer has served as a partner of Class V Group LLC, a consulting firm she co-founded that advises companies on initial public offerings and other market strategies. From August 2005 to August 2006, she served as vice president of Tellme Networks, Inc., a private Internet telephone business. Between April 2003 and August 2005, Ms. Buyer served as the director of business optimization at Google. From September 2002 to March 2003, she served as a consultant and the director of research for Vista Research LLC, an independent equity research firm in New York, New York. From May 2000 to July 2002 she was a general partner at Technology Partners, a Palo Alto, California venture capital firm. Ms. Buyer was the director of internet/new media research at Credit Suisse First Boston from July 1998 to May 2000. Prior to that, she spent six years as vice president at T. Rowe Price Group, Inc. working predominantly on its Science and Technology Fund, and the preceding nine years as an institutional equity investor and analyst of both the technology and media industries. Ms. Buyer served on the board of directors of publicly traded Greenfield Online Inc., an online survey company, from April 2004 until it was acquired by Microsoft Corporation. Ms. Buyer received a B.A. in Economics and Geology from Wellesley College and an M.B.A. from the Owen Graduate School of Management at Vanderbilt University.

We believe that Ms. Buyer is qualified to serve on our board of directors due to her extensive management experience, high-growth company background and strategic leadership track record.

Kathryn E. Falberg has served as a member of our board of directors since August 2016. Ms. Falberg served as executive vice president and chief financial officer of Jazz Pharmaceuticals, PLC, a biopharmaceutical company, from March 2012 to March 2014 after serving as senior vice president and chief financial officer since December 2009. From 2001 through 2009, Ms. Falberg worked with a number of smaller companies, including AdECN, Inc. (“AdECN”), while serving as a corporate director and audit committee chair for several companies. Ms. Falberg was with Amgen from 1995 through 2001, where she served as senior vice president, finance and strategy and chief financial officer and before that as vice president, controller and chief accounting officer, and vice president, treasurer. Ms. Falberg currently serves on the board of directors of publicly traded Arcus Biosciences, Inc., Nuvation Bio and Tricida, Inc., and previously served on a number of boards including publicly traded Urogen Pharma Ltd., Aimmune Therapeutics, Inc., Axovant Sciences Ltd., BioMarin Pharmaceutical Inc, Medivation, Inc., Halozyme Therapeutics, Inc., and aTyr Pharma, Inc. Ms. Falberg received a B.A. in Economics and an M.B.A. from the University of California, Los Angeles and is a Certified Public Accountant (inactive).

We believe that Ms. Falberg is qualified to serve on our board of directors due to her extensive management experience, strategic leadership track record and service on other boards of directors.

Eric B. Paley has served as a member of our board of directors since March 2010. Since January 2009, he has served as a co-founder and managing partner at Founder Collective, a seed stage venture capital fund. Mr. Paley serves on the board of directors of numerous private companies. From October 2002 to December 2008, Mr. Paley served as the chief executive officer and a co-founder of Brontes Technologies, Inc., a company offering advanced dental imaging technology solutions, which was acquired by The 3M Company in October 2006. Mr. Paley received a B.A. in Government from Dartmouth College and an M.B.A. from Harvard Business School.

Mr. Paley’s term as a director and as a member of our nominating and corporate governance committee will expire immediately prior to the Annual Meeting.

David R. Pickles has served as our chief technology officer since March 2010 and as a member of our board of directors since February 2021. Prior to The Trade Desk, he was with Microsoft Corporation where he served as development lead from September 2008 to March 2010 and senior software development engineer from March 2008 to September 2008. From May 2004 to February 2008, he served as senior database engineer at CallWave, Inc., where he was involved in

building back-end components of the system: client session management services, telephone call handling services, client registration services, B2B integrations with all major telephone carriers, and complex high performance database systems (including a custom billing and CRM system). Mr. Pickles received a B.S. in Computer Science from the University of California, Santa Barbara.

We believe that Mr. Pickles is qualified to serve on our board of directors due to his extensive management experience, track record at other technology companies and industry background.

Gokul Rajaram has served as a member of our board of directors since May 2018. Mr. Rajaram has served on the executive team at DoorDash Inc. (“DoorDash”) since November 2019, after DoorDash acquired a food delivery business owned by Square, Inc. (“Square”) called Caviar, Inc. (“Caviar”), where he served as the Lead for Caviar. Prior to DoorDash, Mr. Rajaram worked as the Product Engineering Lead from July 2013 to October 2019 at Square, where he led several product development teams and served on Square’s executive team. Before joining Square in July 2013, Mr. Rajaram served as Product Director, Ads at Facebook, Inc. from August 2010 to July 2013, where he helped Facebook transition its advertising business to become mobile-first. Mr. Rajaram served as Product Management Director for Google AdSense from January 2003 to November 2007, where he helped launch the product and grow it into a substantial portion of Google's business. Mr. Rajaram has served on the boards of directors of Coinbase Inc. since August 2020 and publicly traded Pinterest, Inc. since February 2020. He also served on the board of directors of publicly traded RetailMeNot, Inc. from September 2013 until it was taken private in May 2017. Mr. Rajaram received a B. Tech in Computer Science from the Indian Institute of Technology Kanpur, an M.S. in Computer Science from the University of Texas and an M.B.A. from the Massachusetts Institute of Technology Sloan School of Management.

We believe that Mr. Rajaram is qualified to serve on our board of directors due to his extensive entrepreneurial background, strategic leadership track record and service on other boards of directors of technology companies.

David B. Wells has served as a member of our board of directors since December 2015. Mr. Wells served as the chief financial officer of Netflix, Inc., a media-services provider, for eight years, retiring in early 2019 after nearly 15 years with the company and having served as vice president of financial planning and analysis prior to chief financial officer. Mr. Wells is also a director for public direct to consumer healthcare company HIMS, where he is audit chair, and is the chairman of the board and a member of the remuneration committee (formerly the senior independent director) for UK based fintech company WISE PLC. Mr. Wells received a B.S. in Commerce and English from the University of Virginia and an M.B.A./M.P.P. Magna Cum Laude from the University of Chicago.

We believe that Mr. Wells is qualified to serve on our board of directors due to his extensive management experience, financial expertise, high-growth company background and strategic leadership track record.

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

On the recommendation of our audit committee, our board of directors has appointed PwC, an independent registered public accounting firm, to audit our consolidated financial statements for the fiscal year ending December 31, 2023 and attest to our internal control over financial reporting as of December 31, 2023. We are submitting this selection to our stockholders for ratification. Although we are not required to seek stockholder approval for this appointment, we believe it is sound corporate practice to do so. Representatives from PwC will be in attendance at the Annual Meeting to respond to any appropriate questions and will have the opportunity to make a statement, if they so desire.

In the vote on the ratification of the selection of PwC as our independent auditors, stockholders may:

•Vote in favor of ratification;

•Vote against ratification; or

•Abstain from voting on ratification.

Vote Required for Approval

Assuming a quorum is present, the selection of PwC as our independent auditors will be ratified if the affirmative vote of a majority of the votes cast on the matter at the Annual Meeting is obtained (meaning the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal). In the event that the stockholders do not ratify the selection of PwC, the appointment of the independent auditors will be reconsidered by the audit committee of the board of directors. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF PWC AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

Auditor Information

Set forth below are the fees for services rendered by PwC for the fiscal years ended December 31, 2022 and 2021:

| | | | | | | | | | | | | | |

| Fee Category | | 2022 | | 2021 |

Audit Fees(1) | | $ | 4,111,960 | | | $ | 3,418,749 | |

Audit-Related Fees(2) | | 480,000 | | | — | |

Tax Fees(3) | | 676,173 | | | 786,382 | |

All Other Fees(4) | | 108,818 | | | 5,470 | |

| Total | | $ | 5,376,951 | | | $ | 4,210,601 | |

(1)Audit Fees for 2022 and 2021 cover professional services rendered for the audit of our annual financial statements and review of financial statements included in our Quarterly Reports on Form 10-Q, audit of our internal control over financial reporting, and services normally provided by PwC in connection with statutory and regulatory filings or engagements.

(2)Audit-Related Fees were for assurance and other services related to service provider compliance reports, including Service Organization Controls (SOC) reports on the effectiveness of our controls for our demand side platform.

(3)Tax Fees cover tax compliance, advice, and planning services and consisted primarily of review of consolidated federal income tax returns and foreign tax planning and advice.

(4)All Other Fees include professional services rendered by PwC not reported in any other category such as pre-approved permissible advisory and other services, including SOC-1 and SOC-2 readiness advisory services and the license fees for accounting research software.

Pre-Approval Policies and Procedures

The audit committee has adopted policies and procedures regarding pre-approval of permitted audit and non-audit services. Each year, and as needed at other times during the year, (1) the independent registered public accounting firm will submit to the audit committee for approval the terms, fees and conditions of our engagement of the independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and to review our interim financial statements; and (2) management and the independent registered public accounting firm will submit to the audit committee for approval a written pre-approval request of additional audit and non-audit services to be performed for us during the year, including a budgeted range of fees for each category of service outlined in such request. The audit committee has designated the audit committee chair to have the authority to pre-approve interim requests for permissible services that were not contemplated in the engagement letter or in pre-approval requests. The audit committee chair may approve or reject any interim service requests and shall report any interim service pre-approvals at the next regular audit committee meeting. All services provided by PwC during the fiscal years ended December 31, 2022 and 2021 were pre-approved by the audit committee.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this audit committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, through any general statement incorporating by reference in its entirety the Proxy Statement in which this report appears, except to the extent that The Trade Desk, Inc. specifically incorporates this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

The audit committee of our board of directors is comprised of three members and acts under a written charter that has been approved by our board of directors. The members of the audit committee are independent directors, based upon standards set forth in applicable laws, rules, and regulations. The audit committee has reviewed and discussed the audited financial statements with management and has discussed with PwC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and the SEC.

The audit committee has also received the written disclosures and the letter from PwC required by the applicable requirements of the PCAOB regarding PwC’s communications with the audit committee concerning independence and has discussed with PwC its independence.

Management is responsible for our financial reporting process and the system of internal controls, including internal control over financial reporting, and procedures designed to promote compliance with accounting standards and applicable laws and regulations. PwC is responsible for the audit of the consolidated financial statements and our internal control over financial reporting in accordance with the standards of the PCAOB. The audit committee's responsibility is to monitor and oversee these processes and procedures. The members of the audit committee are not professionally engaged in the practice of accounting or auditing and are not professionals in these fields. The audit committee relies, without independent verification, on the information provided by and on the representations made by management regarding the effectiveness of internal control over financial reporting, that the financial statements have been prepared with integrity and objectivity, and that such financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. The audit committee also relies on the opinion of PwC on the consolidated financial statements and internal controls over financial reporting.

The audit committee’s meetings facilitate communication among the members of the audit committee, management and PwC. The audit committee separately met with PwC, with and without management, to discuss the results of their examinations and their observations and recommendations regarding our internal controls. The audit committee also met separately with management.

Based on its discussions with management and PwC, and its review of the representations and information provided by management and PwC, the audit committee recommended to our board of directors that our audited financial statements for the fiscal year ended December 31, 2022 be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

By order of the audit committee of the board of directors of The Trade Desk,

AUDIT COMMITTEE

David B. Wells (Chairperson)

Lise J. Buyer

Gokul Rajaram

INFORMATION ABOUT THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Leadership Structure of the Board of Directors

Our board of directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide effective oversight of management. Our bylaws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of chairman of the board of directors and chief executive officer.

Our board of directors currently believes that our existing leadership structure, under which our chief executive officer, Mr. Green, serves as chairman of our board of directors is effective. Mr. Green’s knowledge of the issues, opportunities and risks facing us, our business and our industry renders him best positioned among our directors to fulfill the chairman’s responsibility to develop agendas that focus the time and attention of our board of directors on the most critical matters.

Our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate. Our chief executive officer works with the nominating and corporate governance committee and the board of directors on a regular basis to ensure there is a current and effective plan of succession and development for the CEO and the executive management team. Our board of directors believes that the directors and the CEO should collaborate on management succession planning, and that the entire board of directors should be involved in the critical aspects of the succession planning process, including establishing selection criteria that reflect our business strategies, reviewing the company’s leadership pipeline and talent strategies, and identifying and evaluating potential internal candidates. Directors also become familiar with potential successors for key positions at regular meetings and in less formal settings, and management succession is discussed at least annually in the meetings and executive sessions of the board of directors.

In accordance with our bylaws, the independent directors elected Lise J. Buyer to serve as lead independent director. As lead independent director, Ms. Buyer will preside at all meetings of the board of directors at which the chairman of the board of directors is not present, including executive sessions, and performs such additional responsibilities as set forth in our corporate governance guidelines.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with our board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements, considers and approves or disapproves any related-persons transactions, and receives periodic updates and reports from our information security team on cybersecurity matters, including actions taken to mitigate cybersecurity risk. Our nominating and governance committee monitors the effectiveness of our corporate governance guidelines. Our compensation committee assesses and monitors whether any of our compensation programs, policies and practices have the potential to encourage excessive or inappropriate risk-taking.

Board Meetings

Our board of directors held a total of four meetings during 2022. Each director attended at least 75% of the total number of board of directors and committee meetings that were held during the time he or she was a director in 2022.

Board Committees

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee:

•appoints our independent registered public accounting firm;

•evaluates the independent registered public accounting firm’s qualifications, independence and performance;

•determines the engagement of the independent registered public accounting firm;

•reviews and approves the scope of the annual audit and the audit fee;

•discusses with management and the independent registered public accounting firm the results of the annual integrated audit and the review of our quarterly financial statements;

•approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services;

•monitors the rotation of partners of the independent registered public accounting firm on our engagement team in accordance with requirements established by the SEC;

•is responsible for reviewing our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC;

•reviews the adequacy of internal financial controls with management and our independent registered public accounting firm;

•reviews our critical accounting policies and estimates; and

•reviews the audit committee charter and the committee’s performance at least annually.

The members of our audit committee are Messrs. Wells (chairperson) and Rajaram, and Ms. Buyer. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and The Nasdaq Stock Market LLC (“Nasdaq”). Our board of directors has determined that Mr. Wells is an audit committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of Nasdaq. Under the rules of the SEC, members of the audit committee must also meet heightened independence standards. Our board of directors has determined that each of Messrs. Wells and Rajaram and Ms. Buyer are independent under the heightened audit committee independence standards of the SEC and Nasdaq. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. A copy of the charter of our audit committee is available on our website at http://investors.thetradedesk.com/.

During 2022, our audit committee met four times in person or by telephone.

Compensation Committee

Our compensation committee reviews and recommends policies relating to the compensation and benefits of our executive officers and employees. Among other matters, our compensation committee:

•reviews and recommends to our board of directors corporate goals and objectives relevant to the compensation of our chief executive officer and other executive officers;

•evaluates the performance of our executive officers in light of those goals and objectives, and approves the compensation of these executive officers based on such evaluations;

•reviews and approves or recommends to our board of directors the grant of stock options and other awards under our stock plans;

•reviews and recommends to our board of directors the compensation of our non-employee directors; and

•reviews and evaluates, at least annually, the performance of the compensation committee and its members, including compliance by our compensation committee with its charter.

In fulfilling its responsibilities, our compensation committee has the authority to delegate any or all of its responsibilities to a subcommittee of the compensation committee. Our compensation committee also has the authority to authorize one of our officers to grant rights or options to officers (other than executive officers) and employees, in a manner that is in accordance with applicable law, which it has previously authorized our chief executive officer and chief financial officer to do for certain employee equity awards.

The members of our compensation committee are Ms. Falberg (chairperson), and Messrs. Rajaram and Wells. Each of the members of our compensation committee is independent under the applicable rules and regulations of Nasdaq and meets all other eligibility requirements of applicable laws. Our compensation committee operates under a written charter that

satisfies the applicable standards of the SEC and Nasdaq. A copy of the charter of our compensation committee is available on our website at http://investors.thetradedesk.com.

During 2022, our compensation committee met five times in person or by telephone.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies and reporting and making recommendations to our board of directors concerning governance matters.

The members of our nominating and corporate governance committee are Mses. Buyer (chairperson), Falberg and Cunningham, and Mr. Paley. Ms. Cunningham joined our nominating and corporate governance committee on February 22, 2022. Ms. Falberg intends to step down as a member of the nominating and corporate governance committee, and Mr. Paley will no longer serve as a member of the nominating and corporate governance committee, each effective as of or immediately prior to the Annual Meeting. Each of the members of our nominating and corporate governance committee is an independent director under the applicable rules and regulations of NASDAQ. The nominating and corporate governance committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the charter of our nominating and corporate governance committee is available on our website at http://investors.thetradedesk.com.

During 2022, our nominating and corporate governance committee met four times in person or by telephone.

Compensation Committee Interlocks and Insider Participation

During 2022, Ms. Falberg and Messrs. Rajaram and Wells all served as members of our compensation committee. None of the members of our compensation committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers on our board of directors or compensation committee.

Identifying and Evaluating Director Nominees

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, will take into account many factors, including the following:

•personal and professional integrity;

•ethics and values;

•experience in corporate management, such as serving as an officer or former officer of a publicly held company;

•experience in the industries in which we compete;

•experience as a board member or executive officer of another publicly held company;

•diversity of expertise and experience in substantive matters pertaining to our business relative to other board members;

•conflicts of interest; and

•practical and mature business judgment.

Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders' best interests. Our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. Although the nominating and corporate governance committee may consider whether nominees assist in achieving a mix of board members that represents a diversity of background and experience, which is not only limited to race, gender or national origin, we have no formal policy regarding board diversity.

The following table sets forth certain diversity statistics as self-reported by the current members of our board of directors.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 12, 2023) |

| Total Number of Directors | 8 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | |

| Directors | 3 | 4 | — | 1 |

| Part II: Demographic Background | |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 3 | 3 | — | — |

| Two or More Races or Ethnicities | — | — | — | — |

| LGBTQ+ | 1 |

| Did Not Disclose Demographic Background | 2 |

Class A Director

Article VI, Section E of our certificate of incorporation provides that beginning on the date we publicly announce the class of the first director to serve in a Class A Director Seat (as defined below) and ending on the final conversion of our Class B common stock, the holders of our Class A common stock, voting as a single class, will have the right to elect one director if the total number of directors is eight or fewer or two directors if the total number of directors is nine or greater, with our board of directors determining the initial class into which each such director will be elected. Any seat filled by any director contemplated by this provision of the certificate of incorporation is referred to as a “Class A Director Seat.” On February 22, 2022, our board of directors appointed Ms. Cunningham to the Class A Director Seat.

Stockholder Recommendations and Nominations to the Board of Directors

Stockholders may submit recommendations for director candidates to the nominating and corporate governance committee by sending the individual's name and qualifications to our Chief Legal Officer c/o The Trade Desk, Inc., 42 N. Chestnut St., Ventura, CA 93001, who will forward all recommendations to the nominating and corporate governance committee. The nominating and corporate governance committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our website at http://investors.thetradedesk.com. Any amendments to the code of business conduct and ethics, or any waivers of its requirements, will be disclosed on our website. The reference to our web address does not constitute incorporation by reference of the information contained at, or available through, our website.

Stockholder Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the board of directors may do so by writing to: Board of Directors, c/o The Trade Desk, Inc., 42 N. Chestnut St., Ventura, CA 93001. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of our audit committee and handled in accordance with applicable procedures established by the audit committee.

Independence of the Board of Directors

Our board of directors currently consists of eight members, and will consist of seven directors at the time of our Annual Meeting. Our board of directors has determined that all of our directors, other than Mr. Green, our chief executive officer, and Mr. Pickles, our chief technology officer, qualify as “independent” directors in accordance with the NASDAQ listing requirements. In addition, as required by NASDAQ rules, our board of directors has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

Director Stock Ownership

The Board believes that all directors should maintain a meaningful personal financial stake in the company to align their long-term interests with those of our stockholders. We maintain stock ownership guidelines that apply to our executive officers and non-employee directors. Under the guidelines, non-employee directors are to attain and maintain a minimum share ownership level equal to at least three times the value of their annual cash retainer, i.e., $150,000, within the later of five years of becoming a director or December 31, 2023. All of the covered individuals are either in compliance with our stock ownership guidelines or have a period of time remaining to meet the required ownership level.

Director Attendance at Annual Meetings of Stockholders

Directors are encouraged, but not required, to attend our annual meetings of stockholders. Six out of eight of our directors then serving on the board of directors attended the 2022 annual meeting of stockholders.

Whistleblower Procedures

In accordance with the Sarbanes-Oxley Act of 2002, we have established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission of concerns regarding accounting or auditing matters. If an individual has a concern regarding questionable accounting, internal accounting controls or auditing matters, or the reporting of fraudulent financial information, such individual may report his or her concern by sending a letter (which may be anonymous at the discretion of the reporting person), to us at our principal executive offices to the attention of the chief legal officer and to the chair of the audit committee. Individual employees may also report their concerns by telephone or online (which may be anonymous at the discretion of the reporting person) by using our ethics reporting system accessible through our website. Such complaints received by telephone or via online reporting system, are promptly sent to the chief legal officer and to the chair of the audit committee.

Limitation on Liability and Indemnification Matters

Our certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

•any breach of the director’s duty of loyalty to us or our stockholders;

•any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

•unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or

•any transaction from which the director derived an improper personal benefit.

Our certificate of incorporation and bylaws provide that we are required to indemnify our directors and officers, in each case to the fullest extent permitted by Delaware law. Our bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under Delaware law. We have entered and expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We believe that these bylaw provisions and indemnification agreements

are necessary to attract and retain qualified persons as directors and officers. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage.

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers and management as of April 12, 2023:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Jeff T. Green | | 46 | | President and Chief Executive Officer, Director |

| Blake J. Grayson | | 49 | | Chief Financial Officer |

| David R. Pickles | | 45 | | Chief Technology Officer, Director |

| Jay R. Grant | | 56 | | Chief Legal Officer |

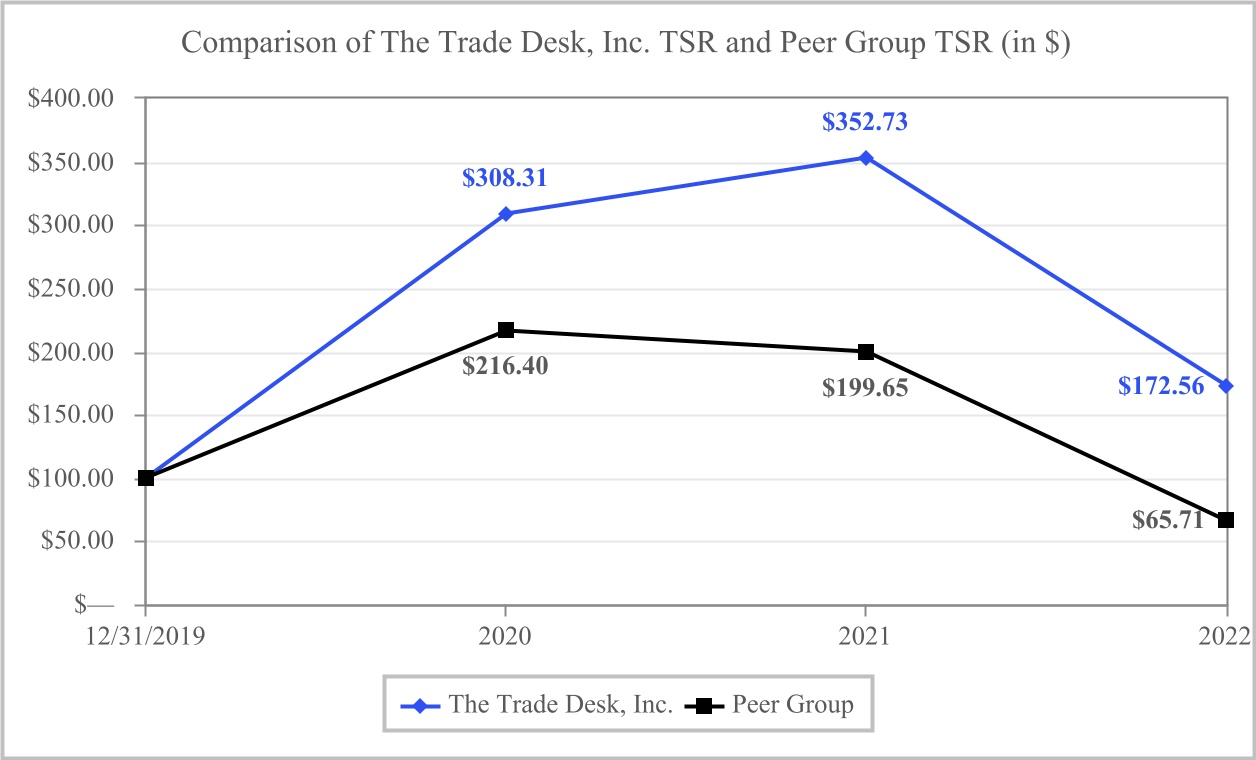

Jeff T. Green. See Proposal One: Information Concerning Director Nominees for Mr. Green’s biographical information.