As filed with the Securities and Exchange Commission on April 30, 2019

Registration No. 333-214881

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

USCF Funds Trust

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 6770 | 38-7159729 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

|

United States Commodity Funds LLC 1850 Mt. Diablo Boulevard, Suite

640 |

Daphne G. Frydman 1850 Mt. Diablo Boulevard, Suite

640 |

|

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

(Name, Address, Including Zip Code,

and Telephone |

Copies to:

James M. Cain, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW, Suite 700

Washington, DC 20001-3980

202.383.0100

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | o |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. x

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

United States 3x Short Oil Fund*

30,000,000 Shares

*Principal U.S. Listing Exchange: NYSE Arca, Inc.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

The United States 3x Short Oil Fund (the “Fund”), a series of the USCF Funds Trust, is a fund that issues shares that trade on NYSE Arca Equities, Inc. (“NYSE”). The investment objective of the Fund is for the daily changes in percentage terms of its shares’ per share net asset value (“NAV”) to reflect three times the inverse (-3x) of the daily change in percentage terms of the price of a specified short-term futures contract on light, sweet crude oil called the “Benchmark Oil Futures Contract.” The Benchmark Oil Futures Contract is the futures contract on light, sweet crude oil as traded on the New York Mercantile Exchange (the “NYMEX”), traded under the trading symbol “CL” (for WTI Crude Oil futures), that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be the futures contract that is the next month contract to expire. The Fund seeks a return that is -300% of the return of the Benchmark Oil Futures Contract for a single day. The Fund should not be expected to provide -300% of the cumulative return for the Benchmark Oil Futures Contract for periods greater than a day. The amount for this breakeven analysis takes into account a brokerage fee waiver, which USCF may terminate at any time in its discretion. Please see page 60 for more information.

The Fund seeks to achieve its investment objective by primarily investing in short positions in futures contracts for light, sweet crude oil that are traded on the NYMEX, ICE Futures Europe or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”).

The Fund will, to a lesser extent and in view of regulatory requirements and/or market conditions:

| (i) | next invest in (a) cleared swap transactions based on short positions in the Benchmark Oil Futures Contract, (b) non-exchange traded (“over-the-counter” or “OTC”) negotiated swap contracts that are based on short positions in the Benchmark Oil Futures Contract, and (c) forward contracts for oil; |

| (ii) | followed by investments in short positions in futures contracts for other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels, each of which are traded on the NYMEX, ICE Futures Europe or other U.S. and foreign exchanges as well as cleared swap transactions and OTC swap contracts valued based on the foregoing; and |

| (iii) | finally, invest in exchange-traded cash settled options on Oil Futures Contracts. |

All such other investments are referred to as “Other Oil-Related Investments” and, together with Oil Futures Contracts, are “Oil Interests.” The Fund supports its investments by holding the amounts of its margin, collateral and other requirements relating to these obligations in short-term obligations of the United States of two years or less (“Treasuries”), cash and cash equivalents. The majority of the Fund’s assets are held in Treasuries, cash and/or cash equivalents.

The Fund pays its sponsor, United States Commodity Funds LLC (“USCF”), a limited liability company, a management fee and incurs certain other costs. The address of both USCF and the Fund is 1850 Mt. Diablo Boulevard, Suite 640 Walnut Creek, California 94596. The telephone number for both USCF and the Fund is 510.522.9600. In order for a hypothetical investment in shares to breakeven over the next 12 months, assuming a selling price of $6.11 per share (the net asset value as of February 28, 2019), the investment would have to generate a 0.360% or $0.022 return.

The Fund is an exchange traded fund. This means that most investors who decide to buy or sell shares of the Fund place their trade orders through their brokers and may incur customary brokerage commissions and charges. Shares of the Fund trade on the NYSE under the ticker symbol “USOD” and are bought and sold throughout the trading day at bid and ask prices like other publicly traded securities.

Shares trade on the NYSE after they are initially purchased by “Authorized Participants,” institutional firms that purchase and redeem shares in blocks of 50,000 shares called “baskets” through the Fund’s marketing agent, ALPS Distributors, Inc. (the “Marketing Agent”). The price of a basket is equal to the NAV of 50,000 shares on the day that the order to purchase the basket is accepted by the Marketing Agent. The NAV per share is calculated by taking the current market value of the Fund’s total assets (after close of the NYSE) subtracting any liabilities and dividing that total by the total number of outstanding shares. Authorized Participants that do offer to the public shares from the baskets they create do so at per-share offering prices that reflect, among other factors, the trading price of the shares on NYSE, the NAV of the shares at the time the Authorized Participant purchased the Creation Baskets, the NAV of the shares at the time of the offer of the shares to the public, the supply of and demand for shares at the time of sale, and the liquidity of the Oil Futures Contract market and the market for Other Oil-Related Investments. Please see below for additional information. The offering of the Fund’s shares will be a “best efforts” offering, which means that no Authorized Participant is required to purchase a specific number or dollar amount of shares nor is the Marketing Agent required to facilitate any specific number or dollar amount of creation or redemption orders for baskets.

USCF pays the Marketing Agent a service fee. Aggregate compensation paid to the Marketing Agent and any affiliate of USCF for marketing and/or distribution-related services in connection with this offering of shares may not exceed ten percent (10%) of the gross proceeds of the offering.

The Fund is not appropriate for all investors and presents many different risks than other types of funds, including risks associated with the use of leverage. The Fund is intended to be a daily trading tool for sophisticated investors to manage daily trading risks. The Fund uses leverage and should produce returns for a single day that are more volatile than that of the Benchmark Oil Futures Contract. Additionally, the Fund is designed to achieve its stated investment objective on a daily basis, but its performance over different periods of time can differ significantly from its stated daily objective. The Fund is riskier than securities that have intermediate or long-term investment objectives, and may not be suitable for investors who plan to hold shares of the Fund for a period other than one day. The return of the Fund for a period longer than a single day is the result of its return for each day compounded over the period and usually will differ from the -300% of the performance of the Benchmark Oil Futures Contract for the same period. Daily compounding of the Fund’s investment returns can dramatically and adversely affect its longer-term performance during periods of high volatility. Volatility may be at least as important to the Fund’s return for a period as the return of the Benchmark Oil Futures Contract. Accordingly, the Fund should be purchased only by knowledgeable investors who understand the potential consequences of seeking daily compounding leveraged short investment results. Investors should actively and frequently monitor their investments in the Fund, even intra-day. It is possible that you will suffer significant losses in the Fund even if the long-term performance of the Benchmark Oil Futures Contract is negative.

Investors who buy or sell shares during the day from their broker may do so at a premium or discount relative to the market value of the underlying Benchmark Oil Futures Contracts in which the Fund invests due to supply and demand forces at work in the secondary trading market for shares. Investing in the Fund involves risks similar to those involved with inverse leveraged exposure to the Benchmark Oil Futures Contracts, and other significant risks. See “Risk Factors Involved with an Investment in the Fund” beginning on page 6.

The offering of the Fund’s shares is registered with the Securities and Exchange Commission (“SEC”) in accordance with the Securities Act of 1933 (the “1933 Act”). The offering is intended to be a continuous offering and is not expected to terminate until all of the registered shares have been sold or three years from the date of the original offering, whichever is earlier, unless extended as permitted under the rules under the 1933 Act, although the offering may be temporarily suspended if and when no suitable investments for the Fund are available or practicable. The Fund is not an investment company registered under the Investment Company Act of 1940 (“1940 Act”) and is not subject to regulation under such Act.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OFFERED IN THIS PROSPECTUS, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Fund is a commodity pool and USCF is a commodity pool operator subject to regulation by the Commodity Futures Trading Commission (“CFTC”) and the National Futures Association (“NFA”) under the Commodity Exchange Act (“CEA”).

The date of this prospectus is May [1], 2019

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGE 59 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 60.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 6.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

SWAPS TRANSACTIONS, LIKE OTHER FINANCIAL TRANSACTIONS, INVOLVE A VARIETY OF SIGNIFICANT RISKS. THE SPECIFIC RISKS PRESENTED BY A PARTICULAR SWAP TRANSACTION NECESSARILY DEPEND UPON THE TERMS OF THE TRANSACTION AND YOUR CIRCUMSTANCES. IN GENERAL, HOWEVER, ALL SWAPS TRANSACTIONS INVOLVE SOME COMBINATION OF MARKET RISK, CREDIT RISK, COUNTERPARTY CREDIT RISK, FUNDING RISK, LIQUIDITY RISK, AND OPERATIONAL RISK.

HIGHLY CUSTOMIZED SWAPS TRANSACTIONS IN PARTICULAR MAY INCREASE LIQUIDITY RISK, WHICH MAY RESULT IN A SUSPENSION OF REDEMPTIONS. HIGHLY LEVERAGED TRANSACTIONS MAY EXPERIENCE SUBSTANTIAL GAINS OR LOSSES IN VALUE AS A RESULT OF RELATIVELY SMALL CHANGES IN THE VALUE OR LEVEL OF AN UNDERLYING OR RELATED MARKET FACTOR.

IN EVALUATING THE RISKS AND CONTRACTUAL OBLIGATIONS ASSOCIATED WITH A PARTICULAR SWAP TRANSACTION, IT IS IMPORTANT TO CONSIDER THAT A SWAP TRANSACTION MAY BE MODIFIED OR TERMINATED ONLY BY MUTUAL CONSENT OF THE ORIGINAL PARTIES AND SUBJECT TO AGREEMENT ON INDIVIDUALLY NEGOTIATED TERMS. THEREFORE, IT MAY NOT BE POSSIBLE FOR THE COMMODITY POOL OPERATOR TO MODIFY, TERMINATE, OR OFFSET THE POOL’S OBLIGATIONS OR THE POOL’S EXPOSURE TO THE RISKS ASSOCIATED WITH A TRANSACTION PRIOR TO ITS SCHEDULED TERMINATION DATE.

TABLE OF CONTENTS

This is only a summary of the prospectus and, while it contains material information about the Fund and its shares, it does not contain or summarize all of the information about the Fund and its shares contained in this prospectus that is material and/or which may be important to you. You should read this entire prospectus, including “Risk Factors Involved with an Investment in the Fund” beginning on page 6, before making an investment decision about the shares. For a glossary of defined terms, see Appendix A.

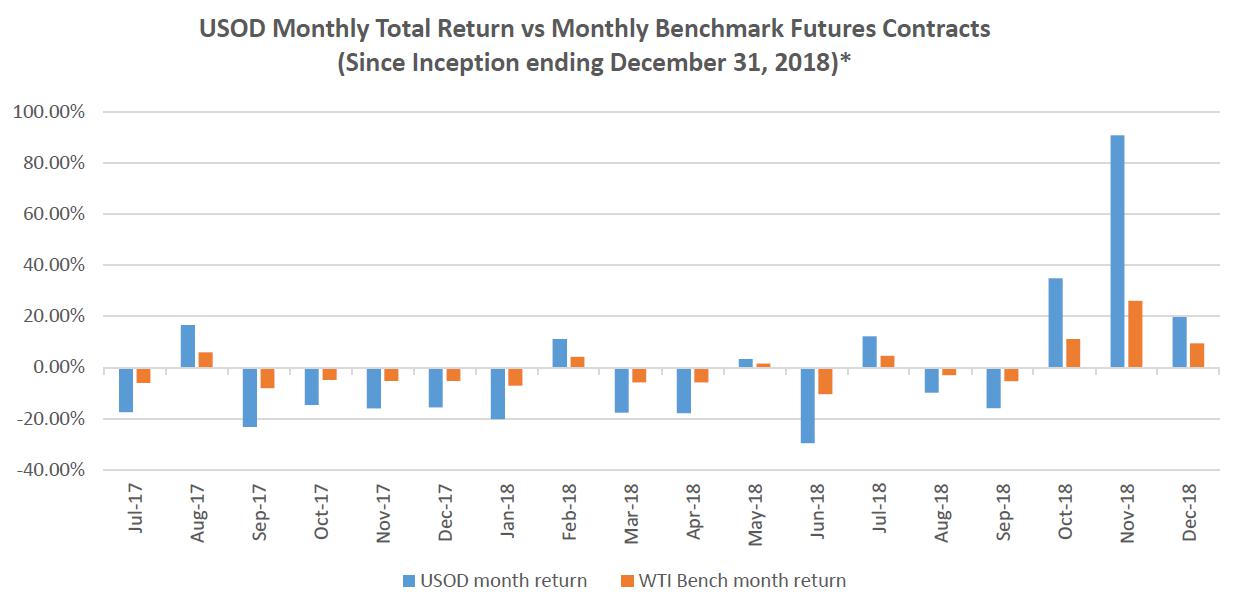

The Fund is not appropriate for all investors and present different risks than other types of funds, including risks associated with the effects of leveraged investing. An investor should only consider an investment in the Fund if he or she understands the consequences of seeking daily inverse leveraged investment results. The Fund seeks to return (before fees and expenses) an inverse multiple (-3x) of the performance of the Benchmark Oil Futures Contract for a single day, not for any other period. The return of the Fund for a period longer than a single day is the result of its return for each day compounded over the period and usually will differ from the Fund’s inverse multiple times the return of the Benchmark Oil Futures Contract for the same period. Daily compounding of the Fund’s investment returns can dramatically and adversely affect its longer-term performance during periods of high volatility. Volatility may be at least as important to the Fund’s return for a period as the return of the Benchmark Oil Futures Contract. The Fund uses leverage and should produce returns for a single day that are more volatile than that of the Benchmark Oil Futures Contract. For example, the return of the Fund for a single day should be approximately three times as volatile as the return of a fund for a single day with an objective of inversely tracking the same Benchmark Oil Futures Contract. Shareholders who invest in the Fund should actively manage and monitor their investments, as frequently as daily.

The USCF Funds Trust (the “Trust”) is a Delaware statutory trust formed on March 2, 2016. The Trust is a series trust formed pursuant to the Delaware Statutory Trust Act. The Trust contains four series: United States 3x Short Oil Fund (“USOD” or the “Fund”), United States 3x Oil Fund (“USOU” together with USOD, the “Funds” or the “Trust Series”), REX S&P MLP Fund (“RMLP”), and REX S&P MLP Inverse Fund (“MLPD”). USOU and USOD commenced operations on July 19, 2017. RMLP and MLPD (together, the “REX Funds”) were in registration and had not commenced operations. Both REX Funds filed to withdraw from registration on March 30, 2018. USOU and USOD are commodity pools that continuously issue common shares of beneficial interest that may be purchased and sold on NYSE Arca Equities, Inc. stock exchange (“NYSE Arca”). The Trust and the Funds operate pursuant to the Trust’s Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”), dated as of June 23, 2017. The sole trustee of the Trust is Wilmington Trust Company, National Association, a national banking association, with its principal place of business in the State of Delaware (the “Trustee”). The Trust and the Funds are managed and operated by the United States Commodity Funds, LLC (“USCF” or the “Sponsor”). USCF is a limited liability company formed in Delaware on May 10, 2005, that is registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”).

On September 4, 2018, the Trust, and USOD, a series of the Trust, received a notice from the NYSE Arca, notifying the Trust that USOD is not in compliance with the requirement under Rule 8.200E(d)(2)(c) that USOD meet the NYSE Arca’s continued listing standard to maintain a market value of not less than $1,000,000. USOD received an initial six-month period (the “Cure Period”) to regain compliance with Rule 8.200E(d)(2)(c), after the Trust submitted, and NYSE Arca accepted, a written response describing USOD’s plan to cure the deficiency during the Cure Period. To regain compliance during the Cure Period, USOD was required to demonstrate that it had a market value of $1,000,000 or more for thirty or more trading days. On November 21, 2018, USOD received a notice from NYSE Arca that it had regained compliance with NYSE Arca’s continued listing standard by maintaining a market value of not less than $1,000,000 for thirty or more trading days.

USOD remained in compliance from such date through March 31, 2019. However, there can be no assurance that USOD will be able to regain compliance with the market value requirement or otherwise maintain compliance with the other NYSE Arca listing requirements. See “Risk Factors - Other Risks” - “NYSE Arca may halt trading in the Fund’s shares, which would adversely impact an investor’s ability to sell shares” and “A Fund could terminate at any time and cause the liquidation and potential loss of an investor’s investment and could upset the overall maturity and timing of an investor’s investment portfolio” in this prospectus.

| 1 |

The Sponsor is also the general partner of the United States Oil Fund, LP (“USO”), the United States Natural Gas Fund, LP (“UNG”), the United States 12 Month Oil Fund, LP (“USL”) and the United States Gasoline Fund, LP (“UGA”), which listed their limited partnership shares on the American Stock Exchange (the “AMEX”) under the ticker symbols “USO” on April 10, 2006, “UNG” on April 18, 2007, “USL” on December 6, 2007 and “UGA” on February 26, 2008, respectively. As a result of the acquisition of the AMEX by NYSE Euronext, each of USO’s, UNG’s, USL’s and UGA’s shares commenced trading on the NYSE Arca on November 25, 2008. USCF is also the general partner of the United States 12 Month Natural Gas Fund, LP (“UNL”) and the United States Brent Oil Fund, LP (“BNO”), which listed their limited partnership shares on the NYSE Arca under the ticker symbols “UNL” on November 18, 2009 and “BNO” on June 2, 2010, respectively. USCF previously served as the general partner for the United States Short Oil Fund, LP (“DNO”) and the United States Diesel-Heating Oil Fund, LP (“UHN”), both of which were liquidated in 2018.

USCF is also the sponsor of the United States Commodity Index Funds Trust, a Delaware statutory trust, and each of its series, the United States Commodity Index Fund (“USCI”), the United States Copper Index Fund (“CPER”) and the United States Agriculture Index Fund (“USAG”), which liquidated in 2018. USCI and CPER listed their shares on the NYSE Arca under the ticker symbols “USCI” on August 10, 2010 and “CPER” on November 15, 2011, respectively.

All funds listed previously, other than USAG, DNO and UHN, are referred to collectively herein as the “Related Public Funds.”

The Fund’s Investment Objective and Strategy

The investment objective of the Fund is for the daily changes in percentage terms of its shares’ per share net asset value (“NAV”) to reflect three times the inverse (-3x) of the daily change in percentage terms of the price of a specified short-term futures contract on light, sweet crude oil (the “Benchmark Oil Futures Contract”) less the Fund’s expenses. To achieve this objective, USCF will endeavor to have the notional value of the Fund’s aggregate short exposure to the Benchmark Oil Futures Contract at the close of each trading day approximately equal to 300% of the Fund’s NAV. The Fund seeks a return that is -300% of the return of the Benchmark Oil Futures Contract for a single day and does not seek to achieve its stated investment objective over a period of time greater than one day. The pursuit of daily inverse leveraged investment goals means that the return of the Fund for a period longer than a full trading day may have no resemblance to -300% of the return of the Benchmark Oil Futures Contract for a period of longer than a full trading day because the aggregate return of the Fund is the product of the series of each trading day’s daily returns.

What Is the “Benchmark Oil Futures Contract”?

The Benchmark Oil Futures Contract is the futures contract on light, sweet crude oil as traded on the New York Mercantile Exchange (the “NYMEX”), traded under the trading symbol “CL” (for WTI Crude Oil futures), that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be the futures contract that is the next month contract to expire.

How Does the Fund Intend to Meet Its Investment Objectives?

The Fund seeks to achieve its investment objective by primarily investing in short positions in futures contracts for light, sweet crude oil that are traded on the NYMEX, ICE Futures Europe or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”).

The Fund will, to a lesser extent and in view of regulatory requirements and/or market conditions:

| (i) | next invest in (a) cleared swap transactions based on short positions in the Benchmark Oil Futures Contract, (b) non-exchange traded (“over-the-counter” or “OTC”), negotiated swap contracts that are based on short positions in the Benchmark Oil Futures Contract, and (c) forward contracts for oil; |

| (ii) | followed by investments in short positions in futures contracts for other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels, each of which are traded on the NYMEX, ICE Futures Europe or other U.S. and foreign exchanges as well as cleared swap transactions and OTC swap contracts valued based on the foregoing; and |

| (iii) | finally, invest in exchange-traded cash settled options on Oil Futures Contracts. |

All such other investments are referred to as “Other Oil-Related Investments” and, together with Oil Futures Contracts, are “Oil Interests.”

| 2 |

For the Fund to maintain a consistent 300% return versus short positions in the Benchmark Oil Futures Contract, the Fund’s holdings must be rebalanced on a daily basis by selling additional Oil Interests or buying Oil Interests for which it holds short positions. Such rebalancing occurs generally before or at the close of trading of the shares on the exchange, at or as near as possible to that day’s settlement price, and is disclosed on the Fund’s website as pending trades before the opening of trading on the exchange the next business day and is taken into account in the Fund’s intra-day Indicative Fund Value and reflected in the Fund’s end of day NAV on that business day.

To the extent the Fund invests in Oil Futures Contracts other than the Benchmark Oil Futures Contract or Other Oil-Related Investments, it will invest in futures, cleared and non-cleared swaps, and call and put options to hedge the short-term price movements of such Oil Futures Contracts and Other Oil-Related Investments against the price movements of the current Benchmark Oil Futures Contract. For example, if the Fund invested in diesel-heating oil futures contracts, it may also enter into a swap or forward contract that is valued based on the difference between the short positions in the diesel-heating oil futures contract and short positions in the Benchmark Oil Futures Contract so that the investment in the diesel-heating oil futures contracts together with such swap would provide a return that more closely matches the movements in the price of the Benchmark Oil Futures Contract.

USCF currently anticipates that regulatory requirements such as accountability levels set by exchanges or position limits set by exchanges or by other regulators, such as the CFTC, and market conditions including those allowing the Fund to obtain greater liquidity or to execute transactions with more favorable pricing, could cause the Fund to invest in Other Oil-Related Investments.

The Fund supports its investments by holding the amounts of its margin, collateral and other requirements relating to these obligations in short-term obligations of the United States of two years or less (“Treasuries”), cash and cash equivalents. Cash equivalents are short-term instruments with maturities of less than three months and shall include the following: (i) certificates of deposit issued against funds deposited in a bank or savings and loan association; (ii) bankers’ acceptances, which are short-term credit instruments used to finance commercial transactions; (iii) repurchase agreements and reverse repurchase agreements; (iv) bank time deposits, which are monies kept on deposit with banks or savings and loan associations for a stated period of time at a fixed rate of interest; (v) commercial paper, which are short-term unsecured promissory notes; and (vi) money market funds.

The Fund may invest in money market funds, as well as Treasuries, as an investment for assets not used for margin or collateral in the Oil Interests. The majority of the Fund’s assets are held in Treasuries, cash and/or cash equivalents with the Custodian.

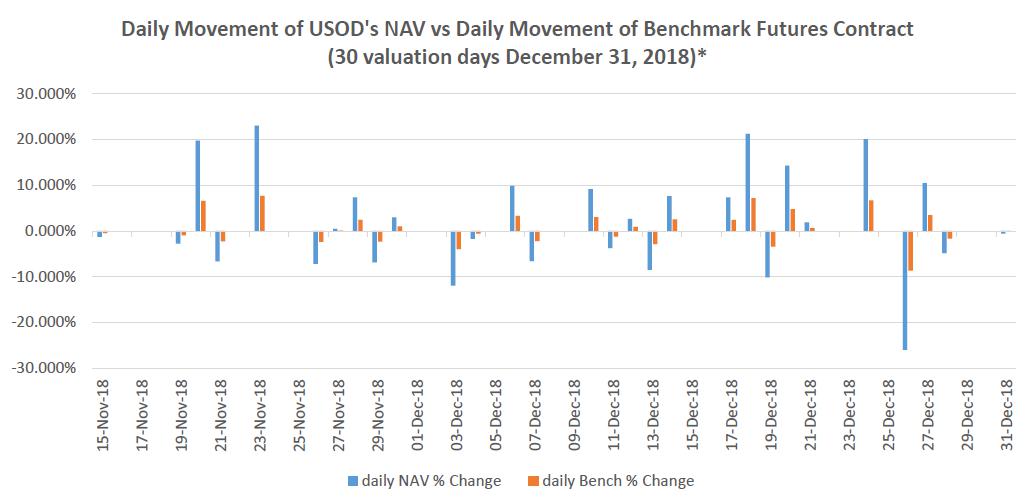

The Fund seeks to invest in a combination of Oil Interests such that the daily changes in its NAV, measured in percentage terms, less the Fund’s expenses, track three times the inverse (-3x) of the daily changes in the price of the Benchmark Oil Futures Contract, also measured in percentage terms. As a specific benchmark, USCF endeavors to place the Fund’s trades in Oil Interests and otherwise manage the Fund’s investments so that the difference between “A” and “B” will be plus/minus 0.30 percent (0.30%) of “B”, where:

| • | A is the average daily percentage change in the Fund’s per share NAV for any period of thirty (30) successive valuation days, i.e., any NYSE trading day as of which the Fund calculates its per share NAV, less the Fund’s expenses; and |

| • | B is three times the inverse of the average daily percentage change in the price of the Benchmark Oil Futures Contract over the same period. |

The design of the Fund’s Benchmark Oil Futures Contract is such that every month it begins by using the near month contract to expire until the near month contract is within two weeks of expiration, when, over a four day period, it transitions to the next month contract to expire as its benchmark contract and keeps that contract as its benchmark until it becomes the near month contract and close to expiration. In the event of a crude oil futures market where near month contracts trade at a higher price than next month to expire contracts (“backwardation”), then, absent the impact of the overall movement in crude oil prices, the value of the benchmark contract would tend to rise as it approaches expiration. Conversely, in the event of a crude oil futures market where near month contracts trade at a lower price than next month contracts (“contango”), then, absent the impact of the overall movement in crude oil prices, the value of the benchmark contract would tend to decline as it approaches expiration.

USCF believes that market arbitrage opportunities will cause daily changes in the Fund’s share price on the NYSE on a percentage basis, to closely track the daily changes in the Fund’s per share NAV on a percentage basis. The Fund does not seek to achieve its stated investment objective over a period of time greater than one day. The pursuit of daily inverse leveraged investment goals means that the return of the Fund for a period longer than a full trading day may have no resemblance to -300% of the return of the Benchmark Oil Futures Contract for a period of longer than a full trading day because the aggregate return of the Fund is the product of the series of each trading day’s daily returns. During periods of market volatility, the volatility of the Benchmark Oil Futures Contract may affect the Fund’s return as much as or more than the return of the Benchmark Oil Futures Contract. Further, the return for investors that invest for periods less than a full trading day or for a period different than a trading day will not be the product of the return of the Fund’s stated investment objective and the performance of the Benchmark Oil Futures Contract for the full trading day. Additionally, investors should be aware that the Fund’s investment objective is not for its NAV or market price of shares to equal, in dollar terms, the spot price of light, sweet crude oil or to track the inverse performance thereof. Natural market forces called contango and backwardation can impact the total return on an investment in the Fund’s shares relative to a hypothetical direct investment in crude oil and, in the future, it is likely that the relationship between the market price of the Fund’s shares and changes in the spot prices of light, sweet crude oil will continue to be so impacted by contango and backwardation. (It is important to note that the disclosure above ignores the potential costs associated with physically owning and storing crude oil, which could be substantial.)

| 3 |

Principal Investment Risks of an Investment in the Fund

An investment in the Fund involves a degree of risk. Some of the risks you may face are summarized below. A more extensive discussion of these risks appears beginning on page 6.

Investment Risk

Investors may choose to use the Fund as a means of indirectly taking a short position in crude oil. There are significant risks and hazards inherent in the crude oil industry that may cause the price of crude oil to widely fluctuate.

Correlation Risk

To the extent that investors use the Fund as a means of indirectly taking a short position in crude oil, there is the risk that the daily changes in the price of the Fund’s shares on the NYSE on a percentage basis, will not closely track the inverse of the daily changes in the spot price of light, sweet crude oil on a percentage basis. This could happen if the price of shares traded on the NYSE does not correlate closely with the value of the Fund’s NAV; the changes in the Fund’s NAV do not inversely correlate closely with the changes in the price of the Benchmark Oil Futures Contract; or the changes in the price of the Benchmark Oil Futures Contract do not closely correlate with the changes in the cash or spot price of crude oil. This is a risk because if these correlations do not exist, then investors may not be able to use the Fund as a cost-effective way to indirectly take a short interest in crude oil or as a hedge against the risk of loss in crude oil-related transactions.

The price relationship between the near month contract to expire and the next month contract to expire that compose the Benchmark Oil Futures Contract will vary and may impact both the total return over time of the Fund’s NAV, as well as the degree to which its total return tracks other crude oil price indices’ total returns. In cases of contango, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to decline as it approaches expiration. In cases of backwardation, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to rise as it approaches expiration.

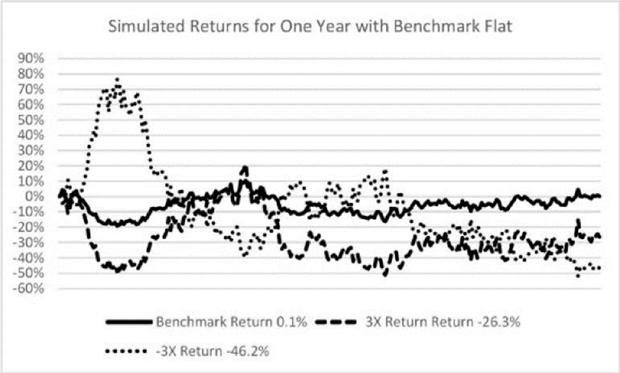

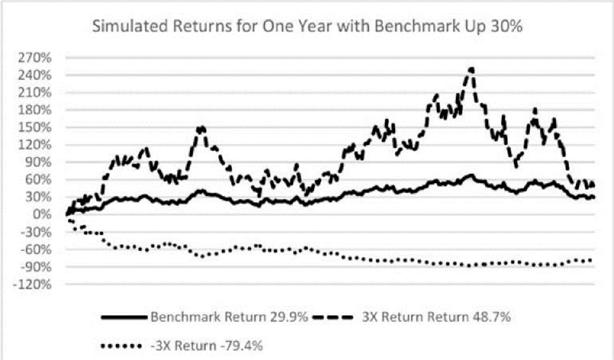

Compounding Risk

The Fund has a single-day investment objective. Because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from -300% of the return of the Benchmark Oil Futures Contract over the same period. The Fund may lose money if the Benchmark Oil Futures Contract performance is flat over time, and as a result of daily rebalancing, the volatility of the Benchmark Oil Futures Contract and the effects of compounding, it is even possible that the Fund will lose money over time while the level of the Benchmark Oil Futures Contract decreases.

The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse leveraged investment results and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios.

Tax Risk

The Fund is organized and operated as a series of a Delaware statutory trust, in accordance with the provisions of its Trust Agreement and applicable state law, but is taxed in a manner similar to a limited partnership and therefore, has a more complex tax treatment than conventional mutual funds.

| 4 |

Over-the-Counter (“OTC”) Contract Risk

The Fund may also invest in negotiated “OTC” contracts, which are not as liquid as exchange-traded futures contracts. OTC contracts expose the Fund to the risk that the Fund’s counterparty may not be able to satisfy its obligations to the Fund.

Other Risks

Shareholders will lose money when the Benchmark Oil Futures Contract rises – a result that is the opposite from traditional funds.

The Fund pays fees and expenses that are incurred regardless of whether it is profitable.

Unlike mutual funds, commodity pools or other investment pools that manage their investments in an attempt to realize income and gains and distribute such income and gains to their investors, the Fund generally does not distribute cash to limited partners or other shareholders. You should not invest in the Fund if you will need cash distributions from the Fund to pay taxes on your share of income and gains of the Fund, if any, or for any other reason.

The Fund has a limited operating history, so there is limited performance history to serve as a basis for you to evaluate an investment in the Fund.

You will have no rights to participate in the management of the Fund and will have to rely on the duties and judgment of USCF to manage the Fund.

The Fund is subject to actual and potential inherent conflicts involving USCF, the Marketing Agent, various commodity futures brokers and “Authorized Participants,” the institutional firms that directly purchase and redeem shares in basket. USCF’s officers, directors and employees do not devote their time exclusively to the Fund. USCF’s personnel are directors, officers or employees of other entities that may compete with the Fund for their services, including other commodity pools (funds) that USCF manages. USCF could have a conflict between its responsibilities to the Fund and to those other entities. As a result of these and other relationships, parties involved with the Fund have a financial incentive to act in a manner other than in the best interest of the Fund and the shareholders.

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You should note that you may pay brokerage fees on purchases and sales of the Fund’s shares, which are not reflected in the table. Authorized Participants will pay applicable creation and redemption fees. See “Creation and Redemption of Shares—Creation and Redemption Transaction Fee,” page 85.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Fees and Expenses | ||||

| Management Fee(1) | 0.95 | % | ||

| Brokerage Fees | 0.70 | % | ||

| Total Annual Fund Operating Expenses | 1.65 | % | ||

| (1) | Based on amounts for the year ended December 31, 2018. The individual expense amounts in dollar terms are shown in the table below. |

| Management Fees | $ | 12,206 | ||

| Brokerage commissions | $ | 8,980 |

|

These amounts are based on the Fund’s average total net assets, which are the sum of daily total net assets of the Fund divided by the number of calendar days in the year. For the year ended December 31, 2018, the Fund’s average total net assets were $1,284,877. |

| 5 |

RISK FACTORS INVOLVED WITH AN INVESTMENT IN THE FUND

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this prospectus as well as information found in our periodic reports, which includes the Trust’s and the Fund’s financial statements and related notes.

Risks Related to Leveraged Investments

Due to the compounding of daily returns, the Fund’s returns over periods longer than a single day will likely differ in amount and possibly even direction from the Fund multiple times the benchmark return for the period.

The investment objective of the Fund is for the daily changes in percentage terms of its per share NAV to reflect three times the inverse (-3x) of the daily change in percentage terms of the Benchmark Oil Futures Contract. The Fund seeks investment results for a single day only, as measured from NAV calculation time to NAV calculation time, and not for any other period. The return of the Fund for a period longer than a single day is the result of its return for each day compounded over the period, and usually will differ from three times the inverse (-3x) of the return of the Benchmark Oil Futures Contract for the same period. The Fund could lose money over time regardless of the performance of the Benchmark Oil Futures Contract, including as a result of daily rebalancing, the Benchmark Oil Futures Contract’s volatility, and compounding. Longer holding periods, higher volatility of the Benchmark Oil Futures Contract, inverse exposure and greater leverage each affect the impact of compounding on the Fund’s returns. Daily compounding of the Fund’s investment returns can dramatically and adversely affect its longer-term performance during periods of high volatility. Volatility may be at least as important to the Fund’s return for a period as the return of the Benchmark Oil Futures Contract.

The Fund uses leverage and should produce returns for a single day that are more volatile than that of the Benchmark Oil Futures Contract. For example, the return for a single day should be approximately three times as volatile for a single day as the return of a fund with an objective of inversely tracking the performance of the Benchmark Oil Futures Contract. The Fund is not appropriate for all investors and present different risks than other funds. The Fund uses leverage and is riskier than similarly benchmarked exchange-traded funds that do not use leverage. An investor should only consider an investment in the Fund if he or she understands the consequences of seeking daily inverse leveraged investment results for a single day. Daily objective inverse leveraged funds, if used properly and in conjunction with the investor’s view on the future direction and volatility of the markets, can be useful tools for investors who want to manage their exposure to various markets and market segments and who are willing to monitor and/or periodically rebalance their portfolios. Shareholders who invest in the Fund should actively manage and monitor their investments, as frequently as daily.

In general, during periods of higher volatility for the Benchmark Oil Futures Contract, compounding will cause the Fund’s results for periods longer than a single day to be less than three times the inverse (-3x) of the return of the Benchmark Oil Futures Contract. This effect becomes more pronounced as volatility increases. Conversely, in periods of lower volatility for the Benchmark Oil Futures Contract (particularly when combined with higher returns for the Benchmark Oil Futures Contract), the Fund’s returns over longer periods can be higher than three times the inverse (-3x) of the return of the Benchmark Oil Futures Contract. Actual results for a particular period, before fees and expenses, are also dependent on the magnitude of the return of the Benchmark Oil Futures Contract in addition to the volatility of the Benchmark Oil Futures Contract. The significance of these effects may be even greater with inverse leveraged funds, such as the Fund.

Intraday Price/Performance Risk.

The Fund is typically rebalanced at or about the time of its NAV calculation. As such, the intraday position of the Fund will generally be different from the Fund’s stated daily investment objective (i.e., -3x). When shares are bought intraday, the performance of the Fund’s shares until the Fund’s next NAV calculation will generally be greater than or less than the Fund’s stated daily inverse multiple.

The use of inverse leveraged positions could result in the total loss of an investor’s investment.

The Fund utilizes leverage in seeking to achieve its investment objective and will lose more money in market environments adverse to its respective daily investment objectives than funds that do not employ leverage. The use of leveraged positions could result in the total loss of an investor’s investment.

For example, because the investment objective of the Fund is for the daily changes in percentage terms of its per share NAV to reflect three times the inverse (-3x) of the daily change in percentage terms of the Benchmark Oil Futures Contract, a single-day movement in the Benchmark Oil Futures Contract approaching 33% at any point in the day could result in the total loss or almost total loss of an investor’s investment if that movement is contrary to the investment objective of the Fund, even if the Benchmark Oil Futures Contract subsequently moves in an opposite direction, eliminating all or a portion of the movement. This would be the case with upward single-day or intraday movements in the Benchmark Oil Futures Contract, even if the Benchmark Oil Futures Contract maintains a level greater than zero at all times.

| 6 |

The NAV of the Fund’s shares relates inversely to the value of the Benchmark Oil Futures Contracts and other assets held by the Fund and fluctuations in the prices of these assets could materially adversely affect an investment in the Fund’s shares. Past performance is not necessarily indicative of futures results; all or substantially all of an investment in the Fund could be lost.

The net assets of the Fund consist primarily of short positions in Oil Futures Contracts and, to a lesser extent, in Other Oil-Related Investments. The NAV of the Fund’s shares relates directly to the value of these assets (less liabilities, including accrued but unpaid expenses), which in turn relates to the price of light, sweet crude oil in the marketplace. Crude oil prices depend on local, regional and global events or conditions that affect supply and demand for oil.

Economic conditions impacting crude oil. The demand for crude oil correlates closely with general economic growth rates. The occurrence of recessions or other periods of low or negative economic growth will typically have a direct adverse impact on crude oil prices. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates, periods of civil unrest, government austerity programs, or currency exchange rate fluctuations, can also impact the demand for crude oil. Sovereign debt downgrades, defaults, inability to access debt markets due to credit or legal constraints, liquidity crises, the breakup or restructuring of fiscal, monetary, or political systems such as the European Union, and other events or conditions that impair the functioning of financial markets and institutions also may adversely impact the demand for crude oil.

Other crude oil demand-related factors. Other factors that may affect the demand for crude oil and therefore its price, include technological improvements in energy efficiency; seasonal weather patterns, which affect the demand for crude oil associated with heating and cooling; increased competitiveness of alternative energy sources that have so far generally not been competitive with oil without the benefit of government subsidies or mandates; and changes in technology or consumer preferences that alter fuel choices, such as toward alternative fueled vehicles.

Other crude oil supply-related factors. Crude oil prices also vary depending on a number of factors affecting supply. For example, increased supply from the development of new oil supply sources and technologies to enhance recovery from existing sources tends to reduce crude oil prices to the extent such supply increases are not offset by commensurate growth in demand. Similarly, increases in industry refining or petrochemical manufacturing capacity may impact the supply of crude oil. World oil supply levels can also be affected by factors that reduce available supplies, such as adherence by member countries to the Organization of the Petroleum Exporting Countries (“OPEC”) production quotas and the occurrence of wars, hostile actions, natural disasters, disruptions in competitors’ operations, or unexpected unavailability of distribution channels that may disrupt supplies. Technological change can also alter the relative costs for companies in the petroleum industry to find, produce, and refine oil and to manufacture petrochemicals, which in turn may affect the supply of and demand for oil.

Other factors impacting the crude oil market. The supply of and demand for crude oil may also be impacted by changes in interest rates, inflation, and other local or regional market conditions, as well as by the development of alternative energy sources.

Price Volatility May Possibly Cause the Total Loss of Your Investment. Futures contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Consequently, you could lose all or substantially all of your investment in the Fund.

Because USCF will “roll” the Fund’s positions in Oil Interests, it may be subject to the potential negative impact from rolling futures positions.

USCF will “roll” the Fund’s positions in Oil Interests and, as a result, is subject to risks related to rolling. The contractual obligations of a buyer or seller holding a futures contract to expiration may generally be satisfied by settling in cash as designated in the contract specifications. Alternatively, futures contracts may be closed out prior to expiration by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of settlement. Once this date is reached, the futures contract “expires.” As the futures contracts held by the Fund near expiration, they are generally closed out and replaced by contracts with a later expiration. This process is referred to as “rolling.” The Fund does not intend to hold futures contracts through expiration, but instead to “roll” its positions.

| 7 |

When the market for these contracts is such that the prices are higher in the more distant delivery months than in the nearer delivery months, the sale during the course of the “rolling process” of the more nearby contract would take place at a price that is lower than the price of the more distant contract. This pattern of higher futures prices for longer expiration futures contracts is often referred to as “contango.” Alternatively, when the market for these contracts is such that the prices are higher in the nearer months than in the more distant months, the sale during the course of the “rolling process” of the more nearby contract would take place at a price that is higher than the price of the more distant contract. This pattern of higher futures prices for shorter expiration futures contracts is referred to as “backwardation.”

The presence of contango in the Benchmark Oil Futures Contract at the time of rolling would be expected to positively affect the Fund’s position, and the presence of backwardation in the Benchmark Oil Futures Contract at the time of rolling such contracts would be expected to adversely affect the Fund’s position.

There have been extended periods in which contango or backwardation has existed in the futures contract markets for various types of futures contracts, and such periods can be expected to occur in the future. These extended periods have in the past and can in the future cause significant losses for the Fund, and the periods can have as much or more impact over time than movements in the level of the Fund’s Benchmark Oil Futures Contract Benchmark Component Futures Contracts.

An investment in the Fund may provide little or no diversification benefits. Thus, in a declining market, the Fund may have no gains to offset losses from other investments, and an investor may suffer losses on an investment in the Fund while incurring losses with respect to other asset classes.

Historically, Oil Futures Contracts and Other Oil-Related Investments have generally been non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is a low statistically valid relationship between the performance of futures and other commodity interest transactions, on the one hand, and stocks or bonds, on the other hand.

However, there can be no assurance that such non-correlation will continue during future periods. If, contrary to historic patterns, the Fund’s performance were to move in the same general direction as the financial markets, investors will obtain little or no diversification benefits from an investment in the Fund’s shares. In such a case, the Fund may have no gains to offset losses from other investments, and investors may suffer losses on their investment in the Fund at the same time they incur losses with respect to other investments.

Variables such as drought, floods, weather, embargoes, tariffs and other political events may have a larger impact on crude oil prices and crude oil-linked instruments, including Oil Futures Contracts and Other Oil-Related Investments, than on traditional securities. These additional variables may create additional investment risks that subject the Fund’s investments to greater volatility than investments in traditional securities.

Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be opposite of each other. There is no historical evidence that the spot price of crude oil and prices of other financial assets, such as stocks and bonds, are negatively correlated. In the absence of negative correlation, the Fund cannot be expected to be automatically profitable during favorable periods for the stock market, or vice versa.

Historical performance of the Fund and the Benchmark Oil Futures Contract Benchmark Component Futures Contracts is not indicative of future performance.

Past performance of the Fund or the Benchmark Oil Futures Contract Benchmark Component Futures Contracts is not necessarily indicative of future results. Therefore, past performance of the Fund or the Benchmark Oil Futures Contract should not be relied upon in deciding whether to buy shares of the Fund.

Investors purchasing shares to hedge against movements in the price of crude oil will have an efficient hedge only if the price investors pay for their shares closely correlates, on an inverse basis, with the price of crude oil. Investing in the Fund’s shares for hedging purposes involves the following risks:

| • | The market price at which the investor buys or sells shares may be significantly less or more than NAV. |

| • | Daily percentage changes in NAV may not closely correlate with daily percentage changes, on an inverse leveraged basis, in the price of the Benchmark Oil Futures Contract. |

| • | Daily percentage changes in the price of the Benchmark Oil Futures Contract may not closely correlate with daily percentage changes in the price of light, sweet crude oil. |

| 8 |

Further, in order to achieve a high degree of inverse correlation with the Benchmark Oil Futures Contract, the Fund seeks to rebalance its portfolios daily to keep exposure consistent with its investment objectives. Being materially under- or overexposed to the Benchmark Oil Futures Contract may prevent the Fund from achieving a high degree of inverse correlation with the Benchmark Oil Futures Contract. Market disruptions or closures, large amounts of assets into or out of the Fund, regulatory restrictions or extreme market volatility will adversely affect the Fund’s ability to adjust exposure to requisite levels. The target amount of portfolio exposure is impacted dynamically by the Benchmark Oil Futures Contract’s movements during each day. Because of this, it is unlikely that the Fund will be perfectly exposed (i.e., -3x) at the end of each day, and the likelihood of being materially under- or overexposed is higher on days when the benchmark levels are volatile near the close of the trading day.

In addition, unlike other funds that do not rebalance their portfolios as frequently, the Fund may be subject to increased trading costs associated with daily portfolio rebalancing in order to maintain appropriate exposure to the underlying benchmarks. Such costs include commissions paid to the FCMs, and may vary by FCM.

The market price at which investors buy or sell shares may be significantly less or more than NAV.

The Fund’s NAV per share will change throughout the day as fluctuations occur in the market value of the Fund’s portfolio investments. The public trading price at which an investor buys or sells shares during the day from their broker may be different from the NAV of the shares. Price differences may relate primarily to supply and demand forces at work in the secondary trading market for shares that are closely related to, but not identical to, the same forces influencing the prices of the light, sweet crude oil and the Benchmark Oil Futures Contract at any point in time. USCF expects that exploitation of certain arbitrage opportunities by “Authorized Participants,” the institutional firms that directly purchase and redeem shares in blocks of 50,000 shares (“Creation Baskets” and “Redemption Baskets” respectively, together, “baskets”), and their clients and customers will tend to cause the public trading price to track NAV per share closely over time, but there can be no assurance of that.

The NAV of the Fund’s shares may also be influenced by non-concurrent trading hours between the NYSE and the various futures exchanges on which crude oil is traded. While the shares trade on the NYSE from 9:30 a.m. to 4:00 p.m. Eastern Time, the trading hours for the futures exchanges on which light, sweet crude oil trade may not necessarily coincide during all of this time. For example, while the shares trade on the NYSE until 4:00 p.m. Eastern Time, liquidity in the global light sweet crude market will be reduced after the close of the NYMEX at 2:30 p.m. Eastern Time. As a result, during periods when the NYSE is open and the futures exchanges on which light, sweet crude oil is traded are closed, trading spreads and the resulting premium or discount on the shares may widen and, therefore, increase the difference between the price of the shares and the NAV of the shares.

Daily percentage changes in the Fund’s NAV may not correlate with daily percentage changes, on an inverse leveraged basis, in the price of the Benchmark Oil Futures Contract.

It is possible that the daily percentage changes in the Fund’s NAV per share may not closely correlate, on an inverse leveraged basis, to daily percentage changes in the price of the Benchmark Oil Futures Contract. Non-correlation may be attributable to disruptions in the market for light, sweet crude oil, the imposition of position or accountability limits by regulators or exchanges, or other extraordinary circumstances. As the Fund approaches or reaches position limits with respect to the Benchmark Oil Futures Contract and other Oil Futures Contracts or in view of market conditions, the Fund may begin investing in Other Oil-Related Investments. In addition, the Fund is not able to replicate exactly the changes in the price of the Benchmark Oil Futures Contract because the total return generated by the Fund is reduced by expenses and transaction costs, including those incurred in connection with the Fund’s trading activities, and increased by interest income from the Fund’s holdings of Treasuries (defined below). Tracking the inverse of the Benchmark Oil Futures Contract requires trading of the Fund’s portfolio with a view to tracking the inverse of the Benchmark Oil Futures Contract over time and is dependent upon the skills of USCF and its trading principals, among other factors.

Daily percentage changes in the price of the Benchmark Oil Futures Contract may not correlate with daily percentage changes in the spot price of light, sweet crude oil.

The correlation between changes in prices of the Benchmark Oil Futures Contract and the spot price of crude oil may at times be only approximate. The degree of imperfection of correlation depends upon circumstances such as variations in the speculative oil market, supply of and demand for Oil Futures Contracts (including the Benchmark Oil Futures Contract) and Other Oil-Related Investments, and technical influences in oil futures trading.

| 9 |

Natural forces in the oil futures market known as “backwardation” and “contango” may increase the Fund’s tracking error and/or negatively impact total return.

The design of the Fund’s Benchmark Oil Futures Contract is such that every month it begins by using the near month contract to expire until the near month contract is within two weeks of expiration, when, over a four day period, it transitions to the next month contract to expire as its benchmark contract and keeps that contract as its benchmark until it becomes the near month contract and close to expiration. In the event of a crude oil futures market where near month contracts trade at a higher price than next month to expire contracts, a situation described as “backwardation” in the futures market, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to rise as it approaches expiration. Conversely, in the event of a crude oil futures market where near month contracts trade at a lower price than next month contracts, a situation described as “contango” in the futures market, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to decline as it approaches expiration. When compared to total return of other price indices, such as the spot price of crude oil, the impact of backwardation and contango may cause the total return of the Fund’s per share NAV to vary significantly. Moreover, absent the impact of rising or falling oil prices, a prolonged period of backwardation could have a significant negative impact on the Fund’s per share NAV and total return and investors could lose part or all of their investment. See “Additional Information About the Fund, its Investment Objective and Investments” for a discussion of the potential effects of contango and backwardation.

Accountability levels, position limits, and daily price fluctuation limits set by the exchanges have the potential to cause tracking error, which could cause the price of shares to substantially vary from the price of the Benchmark Oil Futures Contract.

Designated contract markets, such as the NYMEX and ICE Futures Europe have established accountability levels and position limits on the maximum net long or net short futures contracts in commodity interests that any person or group of persons under common trading control (other than as a hedge, which an investment by the Fund is not) may hold, own or control. These levels and position limits apply to the futures contracts that the Fund invests in to meet its investment objective. In addition to accountability levels and position limits, the NYMEX and ICE Futures Europe also set daily price limits on futures contracts. The daily price fluctuation limit establishes the maximum amount that the price of a futures contract may vary either up or down from the previous day’s settlement price. Once the daily price fluctuation limit has been reached in a particular futures contract, no trades may be made at a price beyond that limit.

The accountability levels for the Benchmark Oil Futures Contract and other Oil Futures Contracts traded on U.S.-based futures exchanges, such as the NYMEX, are not a fixed ceiling, but rather a threshold above which the NYMEX may exercise greater scrutiny and control over an investor’s positions. The current accountability level for investments for any one-month in the Benchmark Oil Futures Contract is 10,000 contracts and the all month accountability level is 20,000 contracts. The current ICE Futures Europe accountability level for any one month in the ICE WTI Crude Futures Contract (the most comparable future to the Benchmark Oil Futures contract) is 10,000 contracts and the all month accountability level is 20,000 contracts. If the Fund and the Related Public Funds exceed these accountability levels for investments in the Benchmark Oil Futures Contracts, the NYMEX and ICE Futures Europe will monitor such exposure and may ask for further information on their activities, including the total size of all positions, investment and trading strategy, and the extent of liquidity resources of the Fund and the Related Public Funds. If deemed necessary by the NYMEX and/or ICE Futures Europe, The Fund could be ordered to reduce its aggregate net futures contracts back to the accountability level. At this time, given the size of the oil futures market, it is unlikely that a fund or its Related Public Fund will exceed the above accountability levels.

Position limits differ from accountability levels in that they represent fixed limits on the maximum number of futures contracts that any person may hold and cannot allow such limits to be exceeded without express CFTC authority to do so. In addition to accountability levels and position limits that may apply at any time, the NYMEX and ICE Futures Europe impose position limits on contracts held in the last few days of trading in the near month contract to expire. The relevant exchange current spot limit for the Benchmark Oil futures Contract and the ICE WTI Crude Oil futures contract is 3,000 contracts. It is unlikely that the Fund will run up against such position limits because the Fund’s investment strategy is to close out its positions and “roll” from the near month contract to expire to the next month contract during a four-day period beginning two weeks from expiration of the contract.

| 10 |

The CFTC has proposed to adopt limits on speculative positions in certain physical commodity futures and option contracts related to such futures as well as swaps that are economically equivalent to such contract futures (including energy contracts, such as the Benchmark Oil Futures Contracts (the “Position Limit Rules”). The Position Limit Rules would, among other things: identify which contracts are subject to speculative position limits; set thresholds that restrict the size of speculative positions that a person may hold in the spot month, other individual months, and all months combined; create an exemption for positions that constitute bona fide hedging transactions; impose responsibilities on designated contract markets (“DCMs”) and swap execution facilities (“SEFs”) to establish position limits or, in some cases, position accountability rules; and apply to both futures and swaps across four relevant venues: OTC, DCMs, SEFs as well as certain non-U.S. located platforms. The CFTC’s first attempt at finalizing the Position Limit Rules, in 2011, was successfully challenged by market participants in 2012 and, since then, the CFTC has reproposed them and solicited comments from market participants multiple times. At this time, it is unclear how the Position Limit Rules may affect the Fund, but the effect may be substantial and adverse. By way of example, the Position Limit Rules may negatively impact the ability of the Fund to meet its investment objectives through limits that may inhibit USCF’s ability to sell additional Creation Baskets of the Fund.

Until such time as the Position Limit Rules are adopted, the regulatory architecture in effect prior to the adoption of the Position Limit Rules will govern transactions in commodities and related derivatives. Under that system, the CFTC enforces federal limits on speculation in nine agricultural products (e.g., corn, wheat and soy), while futures exchanges establish and enforce position limits and accountability levels for other agricultural products and certain energy products (e.g., oil and natural gas). As a result, the Fund may be limited with respect to the size of its investments in any commodities subject to these limits.

Under existing and recently adopted CFTC regulations, for the purposes of position limits, a market participant is generally required, subject to certain narrow exceptions, to aggregate all positions for which that participant controls the trading decisions with all positions for which that participant has a 10 percent or greater ownership interest in an account or position, as well as the positions of two or more persons acting pursuant to an express or implied agreement or understanding with that market participant (the “Aggregation Rules”). The Aggregation Rules will also apply to the Position Limit Rules if and when such Position Limit Rules are adopted.

All of these limits may potentially cause a tracking error between the price of the Fund’s shares and the price of the Benchmark Oil Futures Contract. This may in turn prevent investors from being able to effectively use the Fund as a way to hedge against crude oil-related losses or as a way to indirectly take a short position in crude oil.

The Fund has not limited the size of its offering and is committed to utilizing substantially all of its proceeds to take short positions in Oil Futures Contracts and Other Oil-Related Investments. If the Fund encounters accountability levels, position limits, or price fluctuation limits for Oil Futures Contracts on the NYMEX or ICE Futures Europe, it may then, if permitted under applicable regulatory requirements, take short positions in Oil Futures Contracts on other exchanges that trade listed crude oil futures or enter into swaps or other transactions to meet its investment objective. In addition, if the Fund exceeds accountability levels on either the NYMEX or ICE Futures Europe and is required by such exchanges to reduce its holdings, such reduction could potentially cause a tracking error between the price of the Fund’s shares and the price of the Benchmark Oil Futures Contract.

An investor’s tax liability may exceed the amount of distributions, if any, on its shares.

Cash or property will be distributed at the sole discretion of USCF. USCF does not currently intend to make cash or other distributions with respect to shares. Investors will be required to pay U.S. federal income tax and, in some cases, state, local, or foreign income tax, on their allocable share of the Fund’s taxable income, without regard to whether they receive distributions or the amount of any distributions. Therefore, the tax liability of an investor with respect to its shares may exceed the amount of cash or value of property (if any) distributed.

An investor’s allocable share of taxable income or loss may differ from its economic income or loss on its shares.

Due to the application of the assumptions and conventions applied by the Fund in making allocations for U.S. federal income tax purposes and other factors, an investor’s allocable share of the Fund’s income, gain, deduction or loss may be different than its economic profit or loss from its shares for a taxable year. This difference could be temporary or permanent and, if permanent, could result in it being taxed on amounts in excess of its economic income.

Items of income, gain, deduction, loss and credit with respect to shares could be reallocated, and the Fund could be liable for U.S. federal income tax, if the U.S. Internal Revenue Service (“IRS”) does not accept the assumptions and conventions applied by the Fund in allocating those items, with potential adverse consequences for an investor.

The U.S. tax rules pertaining to entities taxed as partnerships are complex and their application to large, publicly traded entities such as the Fund is in many respects uncertain. The Fund applies certain assumptions and conventions in an attempt to comply with the intent of the applicable rules and to report taxable income, gains, deductions, losses and credits in a manner that properly reflects shareholders’ economic gains and losses. These assumptions and conventions may not fully comply with all aspects of the Internal Revenue Code (the “Code”) and applicable Treasury Regulations, however, and it is possible that the IRS will successfully challenge the Fund’s allocation methods and require the Fund to reallocate items of income, gain, deduction, loss or credit in a manner that adversely affects investors.

| 11 |

The Fund may be liable for U.S. federal income tax on any “imputed understatement” of tax resulting from an adjustment as a result of an IRS audit. The amount of the imputed understatement generally includes increases in allocations of items of income or gains to any investor and decreases in allocations of items of deduction, loss, or credit to any investor without any offset for any corresponding reductions in allocations of items of income or gain to any investor or increases in allocations of items of deduction, loss, or credit to any investor. If the Fund is required to pay any U.S. federal income taxes on any imputed understatement, the resulting tax liability would reduce the net assets of the Fund and would likely have an adverse impact on the value of the shares. Under certain circumstances, the Fund may be eligible to make an election to cause the investors to take into account the amount of any imputed understatement, including any interest and penalties. The ability of a publicly traded partnership such as the Fund to make this election is uncertain. If the election is made, the Fund would be required to provide investors who owned beneficial interests in the shares in the year to which the adjusted allocations relate with a statement setting forth their proportionate shares of the adjustment (“Adjusted K-1s”). The investors would be required to take the adjustment into account in the taxable year in which the Adjusted K-1s are issued. For an additional discussion please see “U.S. Federal Income Tax Considerations – Other Tax Matters.”

The Fund could be treated as a corporation for U.S. federal income tax purposes, which may substantially reduce the value of the shares.

The Trust, on behalf of the Fund, has received an opinion of counsel that, under current U.S. federal income tax laws, the Fund will be treated as a partnership that is not taxable as a corporation for U.S. federal income tax purposes, provided that (i) at least 90 percent of the Fund’s annual gross income consists of “qualifying income” as defined in the Code, (ii) the Trust and the Fund is organized and operated in accordance with its governing agreements and applicable law and (iii) the Trust and the Fund does not elect to be taxed as a corporation for U.S. federal income tax purposes. Although USCF anticipates that the Fund will satisfy the “qualifying income” requirement for all of its taxable years, that result cannot be assured. The Fund has not requested and nor will the Fund request any ruling from the IRS with respect to its classification as a partnership not taxable as a corporation for U.S. federal income tax purposes. If the IRS were to successfully assert that the Fund is taxable as a corporation for U.S. federal income tax purposes in any taxable year, rather than passing through its income, gains, losses and deductions proportionately to shareholders, the Fund would be subject to tax on its net income for the year at corporate tax rates. In addition, although the Fund currently does not intend to make any distributions with respect to the shares any distributions would be taxable to shareholders as dividend income to the extent of the Fund’s current or accumulated earnings and profits. Subject to holding period and other requirements, any such dividend would be a qualifying dividend subject to U.S. federal income tax at the lower maximum tax rates applicable to long-term capital gains. Taxation of the Trust and the Fund as a corporation could materially reduce the after-tax return on an investment in shares and could substantially reduce the value of the shares.

The Fund is organized and operated as a Delaware statutory trust in accordance with the provisions of its Trust Agreement and applicable state law, but is taxed in a manner similar to a limited partnership, and therefore, has a more complex tax treatment than conventional mutual funds.

The Fund is organized and operated as a Delaware statutory trust in accordance with the provisions of its Trust Agreement and applicable state law, but is taxed in a manner similar to a limited partnership, and therefore, has a more complex tax treatment than conventional mutual funds. No U.S. federal income tax is paid by the Fund on its income. Instead, the Fund will furnish shareholders each year with tax information on IRS Schedule K-1 (Form 1065) and each U.S. shareholder is required to report on its U.S. federal income tax return its allocable share of the income, gain, loss and deduction of the Fund. This must be reported without regard to the amount (if any) of cash or property the shareholder receives as a distribution from the Fund during the taxable year. A shareholder, therefore, may be allocated income or gain by the Fund but receive no cash distribution with which to pay the tax liability resulting from the allocation, or may receive a distribution that is insufficient to pay such liability.

In addition to U.S. federal income taxes, shareholders may be subject to other taxes, such as state and local income taxes, unincorporated business taxes, business franchise taxes and estate, inheritance or intangible taxes that may be imposed by the various jurisdictions in which the Fund does business or owns property or where the shareholders reside. Although an analysis of those various taxes is not presented here, each prospective shareholder should consider their potential impact on its investment in the Fund. It is each shareholder’s responsibility to file the appropriate U.S. federal, state, local and foreign tax returns.

| 12 |