Filed Pursuant to Rule 424(b)(4)

Registration No. 333-281892

4,020,000 Shares of Common Stock

5,070,910 Pre-Funded Warrants to Purchase 5,070,910 Shares of Common Stock

18,181,820 Common Warrants to Purchase 18,181,820 Shares of Common Stock

23,252,730 Shares of Common Stock underlying the Pre-Funded Warrants and Common Warrants

This is a reasonable best efforts offering of up to 4,020,000 shares (the “shares”) of our common stock, par value $0.001 per share ("common stock") together with 18,181,820 common warrants to purchase 18,181,820 shares of common stock at a combined offering price of $0.33 per share and common warrants. Each share of common stock is being offered together with two common warrants, each to purchase one share of common stock. The common warrants will be exercisable beginning on the effective date of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Capital Market (or any successor entity) to permit the exercise of the common warrants (“Stockholder Approval”) at an exercise price of $0.33 per share and will expire five years from the date of Stockholder Approval. In the event that we are unable to obtain any required Stockholder Approval, the common warrants will not be exercisable and therefore have no value. In addition, the common warrants will include a provision that resets their exercise price in the event of a share split, share dividend, share combination or other such event (the "Share Combination Event"), of our common stock, to a price equal to the lower of (i) the then current exercise price and (ii) lowest volume weighted average price ("VWAP") during the period commencing five consecutive trading days immediately preceding and ending immediately after the five consecutive trading days beginning on the date we effect a Share Combination Event. The shares of common stock and common warrants will be separately issued. This prospectus also covers the shares of common stock issuable from time to time upon the exercise of the common warrants.

We are also offering 5,070,910 pre-funded warrants to those purchasers, whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering in lieu of the shares of our common stock that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%). Each pre-funded warrant will be exercisable for one share of common stock at an exercise price of $0.0001 per share. Each pre-funded warrant is being offered together with the same two common warrants, each to purchase one share of common stock described above being offered with each share of common stock. The purchase price of each pre-funded warrant will equal the combined offering price per share of common stock and common warrants being sold in this offering, less the $0.0001 per share exercise price of each such pre-funded warrant. Each pre-funded warrant will be exercisable upon issuance and will expire when exercised in full. The pre-funded warrants and common warrants will be separately issued. For each pre-funded warrant that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one basis. This prospectus also covers the shares of common stock issuable from time to time upon the exercise of the pre-funded warrants.

There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. We do not intend to apply for listing of the pre-funded warrants or common warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and common warrants will be limited.

Roth Capital Partners, LLC, or the placement agent, acted as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are

offering and the placement agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum number of shares of securities or minimum aggregate amount of proceeds that is a condition for this offering to close. Because there is no escrow account and no minimum number of securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus. We will bear all costs associated with the offering. See “Plan of Distribution” on page 24 of this prospectus for more information regarding these arrangements. This offering will terminate no later than October 15, 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date.

Our common stock is listed on the Nasdaq Capital Market under the symbol “APVO.” On September 16, 2024, the last reported sale price of our common stock on the Nasdaq Capital Market was $0.33 per share. All share, common warrant and pre-funded warrant numbers are based on a combined offering price of $0.33 per share or pre-funded warrant, as applicable, and common warrants.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information By Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 7 of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

|

|

Per Share and Common Warrant |

|

|

Per Pre-Funded Warrant and Common Warrant |

|

|

Total |

|

|||

Offering price |

|

$ |

0.3300 |

|

|

$ |

0.3299 |

|

|

$ |

2,999,493.21 |

|

Placement Agent fees(1) |

|

$ |

0.0231 |

|

|

$ |

0.0231 |

|

|

$ |

209,964.52 |

|

Proceeds to us, before expenses(2) |

|

$ |

0.3069 |

|

|

$ |

0.3068 |

|

|

$ |

2,789,528.68 |

|

________________________

(1)

We have agreed to pay the placement agent a cash placement commission equal to 7% of the aggregate proceeds from this offering subject to a partial adjustment in the event certain investors participate. We have also agreed to reimburse the Placement Agent for certain expenses incurred in connection with this offering. See “Plan of Distribution” for additional information about the compensation payable to the placement agent.

(2)

Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. We estimate the total expenses of this offering payable by us, excluding the placement agent fee, will be approximately $265,000.

The delivery of the shares of common stock and any pre-funded warrants and common warrants to purchasers is expected to be made no later than October 15, 2024.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus is September 16, 2024.

TABLE OF CONTENTS

|

Page |

i |

|

ii |

|

1 |

|

5 |

|

7 |

|

11 |

|

12 |

|

13 |

|

14 |

|

20 |

|

24 |

|

27 |

|

27 |

|

28 |

|

28 |

ABOUT THIS PROSPECTUS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to invest in our securities.

We have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

The information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source.

For investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

This prospectus and the information incorporated by reference into this prospectus contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus and the information incorporated by reference into this prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and any documents we incorporate by reference, contain certain forward-looking statements that involve substantial risks and uncertainties. All statements contained in this prospectus and any documents we incorporate by reference, other than statements of historical facts, are forward-looking statements including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “target”, “potential”, “will”, “would”, “could”, “should”, “continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

•

our ability to continue as a going concern;

•

our failure to maintain compliance with the Nasdaq Capital Market's ("Nasdaq") continued listing requirements could result in the delisting of our common stock;

•

our plans to develop and commercialize our drug candidates;

•

our ability to become profitable;

•

our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•

our ability to maintain and establish collaborations or obtain additional funding;

•

our ability to obtain regulatory approval of current and future drug candidates;

•

our expectations regarding our ability to fund operating expenses and capital expenditure requirements with our existing cash and cash equivalents, and future expenses and expenditures;

•

our ability to secure sufficient funding and alternative source of funding to support when needed and on terms favorable to us to support our business objective, product development, other operations or commercialization efforts;

•

the success of our clinical development activities, clinical trials and research and development programs;

•

our ability to retain key employees, consultants and advisors;

•

our ability to obtain, maintain, protect and enforce sufficient intellectual property rights for our candidates and technology;

•

our anticipated strategies and our ability to manage our business operations effectively;

•

the impact of legislative, regulatory or policy changes;

•

the possibility that we may be adversely impacted by other economic, business, and/or competitive factors; and

•

other risks and uncertainties, including those listed in the "Risk Factors" section of this prospectus and the documents incorporated by reference herein.

These forward-looking statements are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. We have included important factors in the cautionary statements included in this prospectus that could cause actual future results or events to differ materially from the forward-looking statements

ii

that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

iii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section in this prospectus and under similar captions in the documents incorporated by reference into this prospectus. In this prospectus, unless otherwise stated or the context otherwise requires, references to the terms “APVO,” “the Company,” “we,” “us” and “our” refer to Aptevo Therapeutics Inc., together with its subsidiaries, unless the context otherwise requires. This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus and the information incorporated herein by reference are the property of their respective owners.

Business Overview

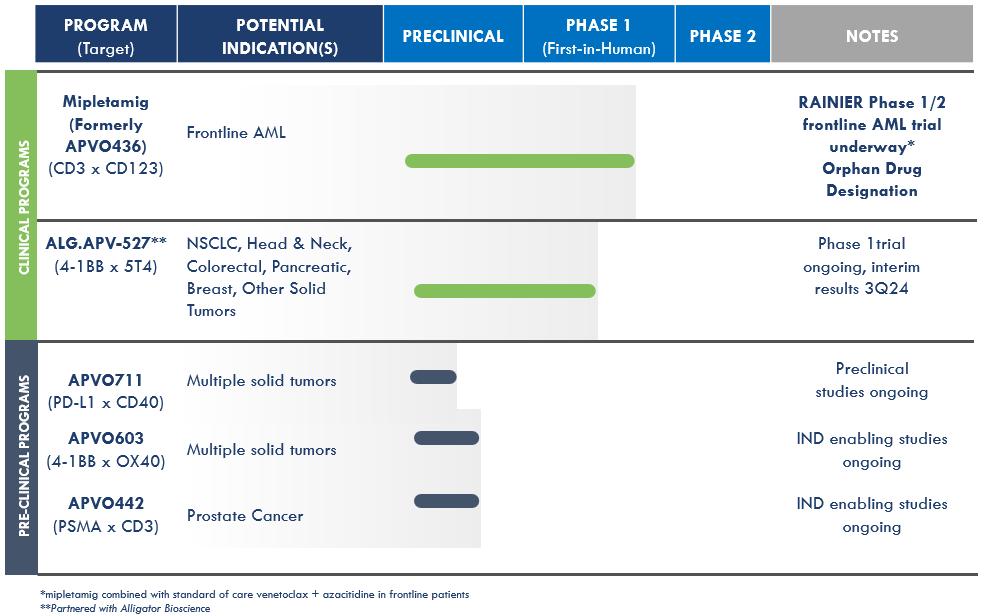

We are a clinical-stage, research and development biotechnology company focused on developing novel immunotherapy candidates for the treatment of different forms of cancer. We have developed two versatile and enabling platform technologies for rational design of precision immune modulatory drugs and have two clinical candidates and three preclinical candidates currently in development. Clinical candidate mipletamig (formerly APVO436) is a CD3xCD123 T-cell engager currently being clinically evaluated in the RAINIER trail, part one of a Phase 1b/2 program initiated in August 2024 for the treatment of acute myelogenous leukemia (AML). Clinical candidate ALG.APV-527 targets 4-1BB (co-stimulatory receptor) and 5T4 (tumor antigen). The compound is designed to reactivate antigen-primed T-cells to specifically kill tumor cells and is currently being evaluated for the treatment of multiple solid tumor types.

Preclinical candidates, APVO603 and APVO711, were also developed using our ADAPTIR™ modular protein technology platform. Our preclinical candidate APVO442 was developed using our ADAPTIR-FLEX™ modular protein technology platform.

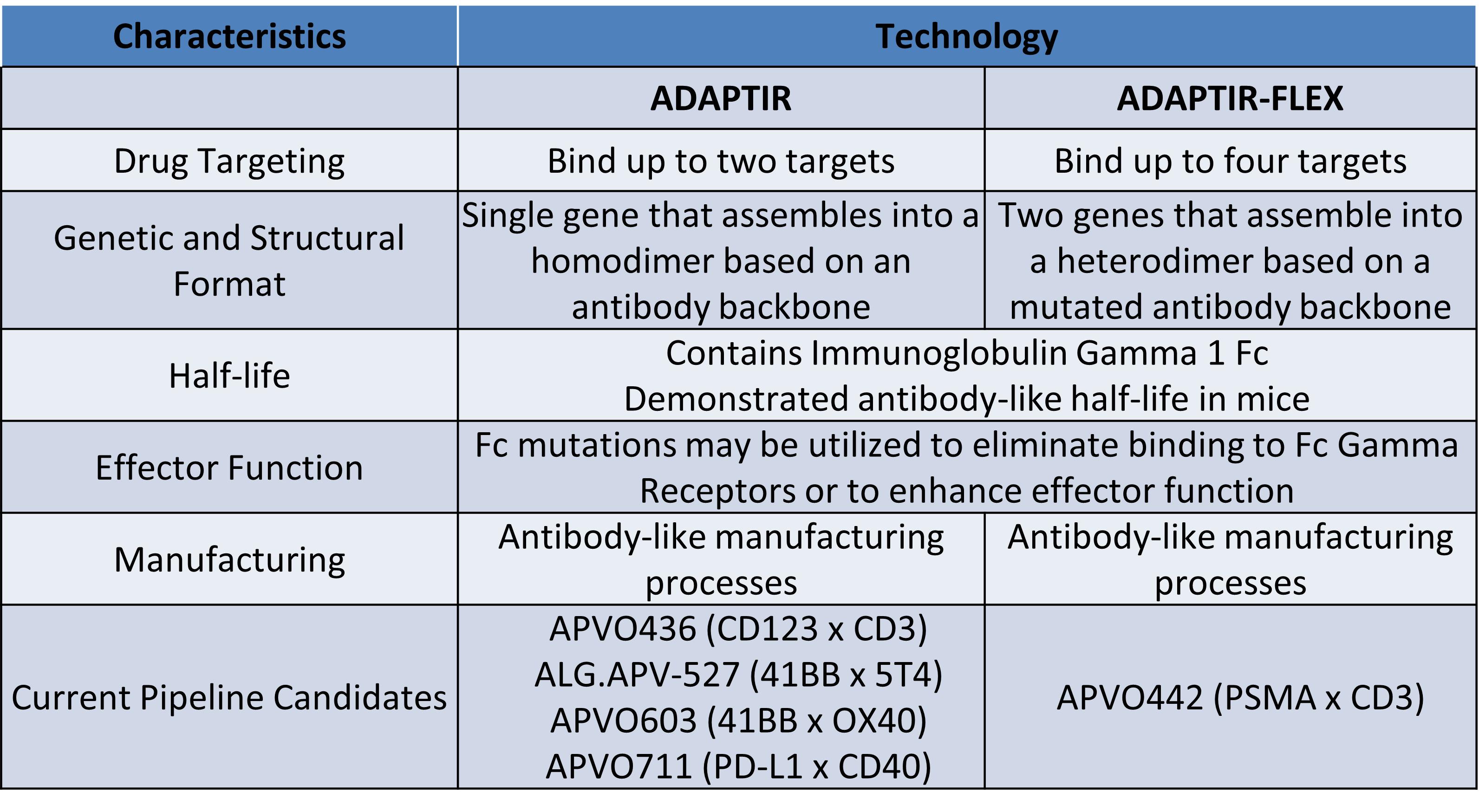

Our ADAPTIR and ADAPTIR-FLEX platforms are designed to generate monospecific, bispecific, and multi-specific antibody candidates capable of enhancing the human immune system against cancer cells. ADAPTIR and ADAPTIR-FLEX are both modular platforms, which gives us the flexibility to potentially generate immunotherapeutic candidates with a variety of mechanisms of action. This flexibility in design allows us to generate novel therapeutic candidates that may provide effective strategies against difficult to treat, as well as advanced forms of cancer. We have successfully designed and constructed numerous investigational-stage product candidates based on our ADAPTIR platform. The ADAPTIR platform technology is designed to generate monospecific and bispecific immunotherapeutic proteins that specifically bind to one or more targets, for example, bispecific therapeutic molecules, which may have structural and functional advantages over monoclonal antibodies. The structural differences of ADAPTIR molecules over monoclonal antibodies allow for the development of ADAPTIR immunotherapies that are designed to engage immune effector cells and disease targets to produce signaling responses that modulate the immune system to kill tumor cells.

We believe we are skilled at candidate generation, validation, and subsequent preclinical and clinical development using the ADAPTIR platform and the ADAPTIR-FLEX platform to generate bispecific and multi-specific candidates or other candidates to our platform capabilities. We have developed a preclinical candidate based on the ADAPTIR-FLEX platform which is advancing in our pipeline. We are developing our ADAPTIR and ADAPTIR-FLEX molecules using our protein engineering, preclinical development, process development, and clinical development capabilities.

Our Strategy

We seek to grow our business by, among other things:

Advancing our lead clinical blood cancer candidate, mipletamig, through clinical development to evaluate its therapeutic potential alone and in combination with other therapies. Based on the positive results from our Phase 1 dose escalation and Phase 1b dose expansion studies, we initiated RANIER in August 2024 as part of our ongoing program to evaluate mipletamig in combination with venetoclax + azacitidine for frontline patients with acute myeloid leukemia (AML). RAINIER will be conducted in two parts, first with a Phase 1b frontline AML study followed by a Phase 2 study.

1

Advancing our lead solid tumor candidate, ALG.APV-527, developed in partnership with Alligator Bioscience AB (Alligator), further in the clinic. Aptevo and Alligator continue to investigate ALG.APV-527 for the treatment of multiple solid tumor types with 5T4-tumor expressing antigens. This drug candidate is in an ongoing first-in-human Phase I clinical trial that started in the first quarter of 2023. ALG.APV-527 targets the 4-1BB co-stimulatory receptor (on T lymphocytes and NK cells) and 5T4 (solid tumor antigen) and is designed to promote anti-tumor immunity. Aptevo believes this compound has the potential to be clinically important because 4-1BB can stimulate the immune cells (tumor-specific T-cells and NK cells) involved in tumor control, making 4-1BB a particularly compelling target for cancer immunotherapy.

Continued development and advancement of our preclinical candidates, APVO603 (targeting 4-1BB (CD137) and OX40 (CD134), both members of the TNF-receptor family), APVO442 (targeting Prostate Specific Membrane Antigen (PSMA), a tumor antigen that is highly expressed on prostate cancer cells and CD3), and APVO711 (an anti-PD-L1 x anti-CD40 compound). We continue to advance APVO711, APVO603 and APVO442 through preclinical and IND-enabling studies. In January 2023, we filed a provisional patent with the U.S. Patent and Trademark Office (USPTO) pertaining to APVO711. In January 2024, the provisional patent was amended to include new preclinical data and a patent application under the Patent Cooperation Treaty ("PCT") was filed pertaining to APVO711, which has the potential to treat a range of solid malignancies such as head and neck cancer. APVO711 is a dual mechanism bispecific antibody candidate that is designed to provide synergistic stimulation of CD40 on antigen presenting cells while simultaneously blocking the PD-1/PD-L1 inhibitory pathway to potentially promote a robust anti-tumor response. Preclinical studies are planned to further evaluate the mechanism of action and efficacy of APVO711.

Development of novel bispecific and multi-specific proteins for the treatment of cancer using our ADAPTIR and ADAPTIR-FLEX platforms. We have expertise in molecular and cellular biology, immunology, oncology, pharmacology, translational sciences, antibody engineering and the development of protein therapeutics. This includes target validation, preclinical proof of concept, cell line development, protein purification, bioassay and process development and analytical characterization. We focus on product development using our ADAPTIR and ADAPTIR-FLEX platforms. We plan to generate additional monospecific, bispecific, and multi-specific protein immunotherapies for development, potentially with other collaborative partners, to exploit the potential of the ADAPTIR and ADAPTIR-FLEX platforms. We will select novel candidates that have the potential to demonstrate proof of concept early in development. We expect to continue to expand the ADAPTIR and ADAPTIR-FLEX product pipelines to address areas of unmet medical need. Bispecific therapeutics are increasingly recognized as potent anti-cancer agents. Eleven new bispecific agents have been approved for use by the FDA in the last three years and there is a total of 125 bispecific drug candidates currently in development. We believe our candidates in development and our future molecules derived from our ADAPTIR and ADAPTIR-FLEX platforms will be highly competitive in the market as they are rationally designed for safety and tolerability as well as efficacy.

Establishing collaborative partnerships to broaden our pipeline and provide funding for research and development. We intend to pursue collaborations with other biotechnology and pharmaceutical companies, academia, and non-governmental organizations to advance our product portfolio.

2

Product Candidates and Platform Technology

Product Portfolio

Our current product candidate pipeline is summarized in the table below:

Platform Technologies

3

Recent Developments

Warrant Re-Price

In connection with this offering, we also agreed to amend certain existing warrants that were previously issued on (i) November 9, 2023 to purchase up to 362,900 shares of our common stock and have an exercise price of $0.515 per share, (ii) April 15, 2024 to purchase up to 4,444,446 shares of our common stock and have an exercise price of $0.515 per share and (iii) July 1, 2024 to purchase up to 7,015,428 shares of our common stock and have an exercise price of $0.515 per share (collectively, the “Existing Warrants”), such that effective upon the closing of this offering, the Existing Warrants will be amended to have a reduced exercise price equal to $0.33 per share and include the same exercise price adjustments as the common warrants issued in connection with this offering, as described more fully under the heading “Description of Securities we are Offering” beginning on page 20 of this prospectus. The exercise of the repriced Existing Warrants will be subject to the Stockholder Approval along with the common warrants issued in this offering.

Phase 1 ALG.APV-527 Monotherapy Trial Data

On September 16, 2024, we and Alligator Bioscience AB announced positive interim data from the dose escalation phase of the Phase 1 trial evaluating ALG.APV-527 for the treatment of solid tumors likely to express the tumor antigen 5T4. The results, which include clinical activity, safety, tolerability outcomes, pharmacokinetics and pharmacodynamics were presented in a poster session on Saturday, September 14, 2024, at the European Society for Medical Oncology Annual Congress in Barcelona, Spain.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. To the extent we qualify as a smaller reporting company, we may continue to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not smaller reporting companies, including, among other things, providing only two years of audited financial statements and we are also permitted to elect to incorporate by reference information filed after the effective date of the S-1 registration statement of which this prospectus forms a part. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our shares of Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our shares of Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

On August 6, 2015, Emergent BioSolutions Inc. (“Emergent”), announced a plan to separate into two independent publicly traded companies. To accomplish this separation, Emergent created Aptevo Therapeutics Inc. (“Aptevo”), to be the parent company for the development-based biotechnology business focused on novel oncology and hematology therapeutics. Aptevo was incorporated in Delaware in February 2016 as a wholly owned subsidiary of Emergent. To effect the separation, Emergent made a pro rata distribution of Aptevo’s Common Stock to Emergent’s stockholders on August 1, 2016.

Our Common Stock currently trades on the Nasdaq under the symbol “APVO.” Our primary executive offices are located at 2401 4th Avenue, Suite 1050, Seattle, Washington and our telephone number is (206) 838-0500. Our website address is www.aptevotherapeutics.com. The information contained in, or that can be accessed through, our website is not a part of or incorporated by reference in this prospectus, and you should not consider it part of this prospectus or of any prospectus supplement. We have included our website address in this prospectus solely as an inactive textual reference.

4

THE OFFERING

Common Stock to be Offered |

|

4,020,000 shares.

|

Pre-funded Warrants to be Offered |

|

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, up to 5,070,910 pre-funded warrants to purchase shares of common stock, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant and accompanying common warrants will equal the price at which the share of common stock and accompanying common warrants are being sold in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue two common warrants, each to purchase one share of common stock for each share of our common stock and for each pre-funded warrant to purchase one share of our common stock sold in this offering, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold.

|

Common Warrants to be Offered |

|

Common warrants to purchase up to 18,181,820 shares of our common stock. Each common warrant has an exercise price of $0.33 per share of common stock. Common warrants will become exercisable beginning on the date of the Stockholder Approval and will expire five years from the date of Stockholder Approval.

The shares of common stock and pre-funded warrants, and the accompanying common warrant, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the common warrants.

|

Common Stock Outstanding Before this Offering

|

|

9,421,174 shares. |

Common Stock to be Outstanding Immediately After this Offering

|

|

18,512,084 shares, (assuming full exercise of the pre-funded warrants and assuming no exercise of the common warrants). |

Use of Proceeds |

|

We estimate that the net proceeds from this offering will be approximately $2.5 million, excluding the proceeds, if any, from the cash exercise of the common warrants in this offering. We currently intend to use the net proceeds from this offering for working capital and general corporate purposes, including the further development of our product candidates. See “Use of Proceeds” for additional information.

|

Risk Factors |

|

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus and the other information included and incorporated by reference in |

5

|

|

this prospectus for a discussion of the risk factors you should carefully consider before deciding to invest in our securities.

|

Nasdaq Symbol |

|

Our common stock is listed on the Nasdaq Capital Market under the symbol “APVO.” There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants or common warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and common warrants will be limited. |

The above discussion is based on 9,421,174 shares of our common stock outstanding as of September 16, 2024, assumes no sale of pre-funded warrants and excludes, as of that date, the following:

•

9,624 shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $557.31 per share;

•

69,458 shares of Common Stock issuable upon the vesting of outstanding restricted stock units at a weighted average fair value per unit of $6.68 per share;

•

101,766 shares of Common Stock reserved for future grants of equity-based awards under our equity incentive plans;

•

1,316 and 1,316 shares of Common Stock issuable upon the exercise of Series A and Series B common warrants, respectively, at an exercise price of $27.28 per share;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series A-1 and Series A-2 common warrants, respectively, at an exercise price of $10.25;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series B-1 and Series B-2 common warrants, respectively, at an exercise price of $10.25;

•

133,332 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $1.35; and

•

17,997,853 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $0.515.

6

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, including the shares of common stock offered by this prospectus, you should carefully consider the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, any subsequent Quarterly Report on Form 10-Q and our other filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business, results of operations or financial condition and prospects could be harmed. In that event, the market price of our common stock and the value of the warrants could decline, and you could lose all or part of your investment.

Risks Related to This Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.” You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our securities to decline and delay the development of our product candidates. Pending the application of these funds, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase. You may also experience future dilution as a result of future equity offerings.

The price per share, together with the number of shares of our common stock we propose to issue and ultimately will issue if this offering is completed, may result in an immediate decrease in the market price of our common stock. Our historical net tangible book value as of July 31, 2024 was $2.5 million, or approximately $0.26 per share of our common stock. After giving effect to the 9,090,910 shares of our common stock or the exercise of the pre-funded warrants to be sold in this offering at a combined offering price of $0.33 per share and common warrants, our as adjusted net tangible book value as of July 31, 2024 would have been $5.0 million, or approximately $0.27 per share of our common stock. This represents an immediate increase in the net tangible book value of $0.01 per share of our common stock to our existing stockholders and an immediate dilution in net tangible book value of approximately $0.06 per share of our common stock to new investors, representing the difference between the combined offering price and our as adjusted net tangible book value as of July 31, 2024, after giving effect to this offering, and the combined offering price per share and common warrants.

In addition, in order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. In the event that the outstanding options or warrants are exercised or settled, or that we make additional issuances of common stock or other convertible or exchangeable securities, you could experience additional dilution. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders, including investors who purchase shares of common stock in this offering. The price per share at which we sell additional shares of our common stock or securities convertible into common stock in future transactions, may be higher or lower than the price per share in this offering. As a result, purchasers of the shares we sell, as well as our existing stockholders, will experience significant dilution if we sell at prices significantly below the price at which they invested.

7

There is no public market for the common warrants or pre-funded warrants being offered by us in this offering.

There is no established public trading market for the common warrants or the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the common warrants or pre-funded warrants on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the common warrants and pre-funded warrants will be limited.

The common warrants are not exercisable until Stockholder Approval and may not have any value.

Under Nasdaq listing rules, the common warrants are not exercisable without Stockholder Approval for the issuance of shares issuable upon exercise of the common warrants. While we intend to use reasonable best efforts to seek Stockholder Approval for issuances of shares of common stock issuable upon exercise of the common warrants, there is no guarantee that the Stockholder Approval will ever be obtained. The common warrants will be exercisable commencing on the date Stockholder Approval is obtained, if at all, at an initial exercise price per share of $0.33. In the event that the price of a share of our common stock does not exceed the exercise price of the common warrants during the period when the common warrants are exercisable, the common warrants may not have any value. If we are unable to obtain the Stockholder Approval, the common warrants will not be exercisable and therefore would have no value.

In addition, we may incur substantial cost, and management may devote substantial time and attention, in attempting to obtain Stockholder Approval of the issuance of shares of common stock upon exercise of the common warrants issued in this offering.

The common warrants and pre-funded warrants are speculative in nature.

The common warrants and pre-funded warrants offered hereby do not confer any rights of share of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price. Specifically, only following receipt of the Stockholder Approval, holders of the common warrants may acquire the shares of common stock issuable upon exercise of such warrants at an exercise price of $0.33 per share of common stock, and holders of the pre-funded warrants may acquire the shares of common stock issuable upon exercise of such warrants at an exercise price of $0.0001 per share of common stock. Moreover, following this offering, the market value of the common warrants and pre-funded warrants is uncertain and there can be no assurance that the market value of the common warrants or pre-funded warrants will equal or exceed their respective offering prices. There can be no assurance that the market price of the shares of common stock will ever equal or exceed the exercise price of the common warrants or pre-funded warrants, and consequently, whether it will ever be profitable for holders of common warrants to exercise the common warrants or for holders of the pre-funded warrants to exercise the pre-funded warrants.

Holders of the warrants offered hereby will have no rights as common stockholders with respect to the shares of our common stock underlying the warrants until such holders exercise their warrants and acquire our common stock, except as otherwise provided in the warrants.

Until holders of the common warrants and the pre-funded warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our common stock underlying such warrants, except to the extent that holders of such warrants will have certain rights to participate in distributions or dividends paid on our common stock as set forth in the warrants. Upon exercise of the common warrants and the pre-funded warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

This is a reasonable best efforts offering, no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans.

The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us,

8

and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable to us.

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including, but not limited to: (i) timely delivery of securities; (ii) agreement to not enter into any financings for 60 days from closing; and (iii) indemnification for breach of contract.

Resales of our common stock in the public market during this offering by our stockholders may cause the market price of our common stock to fall.

Sales of a substantial number of shares of our common stock could occur at any time. The issuance of new shares of our common stock could result in resales of our common stock by our current stockholders concerned about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our common stock.

Our common stock may be at risk for delisting from the Nasdaq Capital Market in the future if we do not maintain compliance with Nasdaq’s continued listing requirements. Delisting could adversely affect the liquidity of our common stock and the market price of our common stock could decrease.

Our common stock is currently listed on Nasdaq. Nasdaq has minimum requirements that a company must meet in order to remain listed on Nasdaq, including corporate governance standards and a requirement that we maintain a minimum closing bid price of $1.00 per share.

On June 25, 2024, the Company received a letter from Nasdaq notifying the Company that, for the last 30 consecutive business days, the bid price of the Company’s common stock had closed below $1.00 per share, the minimum closing bid price required by the continued listing requirements of Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

Nasdaq’s letter has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on Nasdaq, subject to the Company’s compliance with the other continued listing requirements. Nasdaq’s letter provides the Company 180 calendar days, or until December 23, 2024 (the "Compliance Date"), to regain compliance with the Bid Price Requirement. To regain compliance with the Bid Price Requirement, the closing bid price of the Company’s common stock must be at least $1.00 per share for a minimum of ten consecutive business days before the Compliance Date. The Company may be eligible for an additional 180-day period to regain compliance if the Company meets all other listing standards of Nasdaq, with the exception of the bid price requirement, and provides written notice to Nasdaq of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, Nasdaq Listing Rule 5810(c)(3)(A)(iv) states that any listed company that fails to meet the Bid-Price Requirement after effecting one or more reverse stock splits over the prior two-year period with a cumulative ratio of 250 shares or more to one, then the company is not eligible for a compliance period to regain compliance and would be subject to delisting by Nasdaq. If during any compliance period, a company's security has a closing bid price of $0.10 or less for ten consecutive trading days, the Company's security would be subject to delisting immediately. In addition, under proposed Nasdaq rules, if the price of the Company's common stock fails to satisfy the Bid Price Requirement within one year of the Company's previous 1-for-44 reverse stock split effectuated on March 5, 2024, then the Company's common stock would be subject to delisting by Nasdaq without any opportunity for a cure period. In the event the Company fails to regain compliance, the Company would have the right to a hearing before the Nasdaq Listing Qualifications Panel (the "Panel"). There can be no assurance that, if the Company receives a delisting notice and appeals the delisting determination by the Panel, such appeal would be successful.

9

The Company intends to take all reasonable measures available to regain compliance under the Nasdaq Listing Rules and remain listed on Nasdaq, including by effecting a reverse stock split.

In the future, if we fail to maintain such minimum requirements and a final determination is made by Nasdaq that our common stock must be delisted, the liquidity of our common stock would be adversely affected and the market price of our common stock could decrease. In addition, if delisted, we would no longer be subject to Nasdaq rules, including rules requiring us to have a certain number of independent directors and to meet other corporate governance standards. Our failure to be listed on Nasdaq or another established securities market would have a material adverse effect on the value of your investment in us.

If our common stock is not listed on Nasdaq or another national exchange, the trading price of our common stock is below $5.00 per share and we have net tangible assets of $6,000,000 or less, the open-market trading of our common stock will be subject to the “penny stock” rules promulgated under the Securities Exchange Act of 1934, as amended. If our shares become subject to the “penny stock” rules, broker-dealers may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected.

This offering may cause the trading price of our common stock to decrease.

The price per share, together with the number of shares of common stock we propose to issue and ultimately will issue if this offering is completed, may result in an immediate decrease in the market price of our common stock. This decrease may continue after the completion of this offering.

10

USE OF PROCEEDS

We estimate that the net proceeds from the offering will be approximately $2.5 million, after deducting the placement agent fees and estimated offering expenses payable by us, assuming no sale of any fixed combinations of pre-funded warrants and warrants offered hereunder. We may only receive additional proceeds from the exercise of the common warrants issuable in connection with this offering if the Stockholder Approval is obtained and, if such common warrants are exercised in full for cash, the estimated net proceeds will increase to $5.5 million.

We currently intend to use the net proceeds from this offering for working capital to fund our clinical programs and general corporate purposes, including the further development of our product candidates. This expected use of proceeds from this offering represents our intentions based upon our current plans and prevailing business conditions, which could change in the future as our plans and prevailing business conditions evolve. The amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used by our operations. As a result, we will retain broad discretion in the allocation of the net proceeds of this offering.

11

CAPITALIZATION

The following table presents a summary of our cash and cash equivalents and capitalization as of July 31, 2024:

•

on an actual basis; and

•

on an as adjusted basis to reflect the issuance and sale of common stock and accompanying common warrants in this offering, after deducting placement agent fees and estimated offering expenses payable by us. The as adjusted basis assumes no Pre-Funded warrants are sold in this offering and excludes the proceeds, if any, from the exercise of any Common Warrants issued in this offering.

The unaudited as adjusted information below is prepared for illustrative purposes only and our capitalization following the completion of this offering will be adjusted based on the actual offering price and other terms of this offering determined at pricing. You should read the following table in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the historical financial statements and related notes in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the period ended June 30, 2024, incorporated herein by reference.

|

|

As of July 31, 2024 |

|

|||||

(in thousands) |

|

Actual |

|

|

As adjusted |

|

||

Cash and cash equivalents |

|

$ |

7,554 |

|

|

$ |

10,079 |

|

Common stock: $0.001 par value; 500,000,000 shares authorized; 9,420,489 shares issued and outstanding, actual; 18,511,399 shares issued and outstanding, pro forma as adjusted |

|

|

74 |

|

|

|

83 |

|

Additional paid-in capital |

|

|

242,905 |

|

|

|

245,421 |

|

Accumulated deficit |

|

|

(237,971 |

) |

|

|

(237,971 |

) |

Total stockholders' equity |

|

$ |

5,008 |

|

|

$ |

7,533 |

|

The number of shares of our Common Stock outstanding before and after this offering is based on 9,420,489 shares of our common stock outstanding as of July 31, 2024, assumes no sale of pre-funded warrants and excludes, as of that date, the following:

•

9,656 shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $559.05 per share;

•

70,205 shares of Common Stock issuable upon the vesting of outstanding restricted stock units at a weighted average fair value per unit of $8.51 per share;

•

101,686 shares of Common Stock reserved for future grants of equity-based awards under our equity incentive plans;

•

1,316 and 1,316 shares of Common Stock issuable upon the exercise of Series A and Series B common warrants, respectively, at an exercise price of $27.28 per share;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series A-1 and Series A-2 common warrants, respectively, at an exercise price of $10.25;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series B-1 and Series B-2 common warrants, respectively, at an exercise price of $10.25;

•

133,332 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $1.35; and

•

17,997,853 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $0.515.

12

DILUTION

If you purchase shares of our common stock, your interest will be diluted immediately to the extent of the difference between the offering price per share you will pay in this offering and the as adjusted net tangible book value per share of our common stock after this offering. Net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding.

As of July 31, 2024, our net tangible book value was $2.5 million, or $0.26 per share of Common Stock.

After giving effect to the foregoing pro forma adjustments and the sale by us of 9,090,910 shares of common stock (or pre-funded warrants in lieu of) and accompanying common warrants at a combined offering price of $0.33 per share and $0.0001 per pre-funded warrant and accompanying common warrants, and after deducting the placement agent fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of July 31, 2024, would have been $5.0 million, or $0.27 per share. This represents an immediate increase in as adjusted net tangible book value of approximately $0.01 per share to our existing stockholders, and an immediate dilution of $0.06 per share to purchasers of shares in this offering, as illustrated in the following table:

Combined offering price per share and common warrants |

|

$ |

0.33 |

|

Net tangible book value per share as of July 31, 2024 |

|

$ |

0.26 |

|

Net increase in net tangible book value per share attributable to existing shareholders |

|

$ |

0.01 |

|

As adjusted net tangible book value per share after this offering |

|

$ |

0.27 |

|

Dilution in net tangible book value per share to new investors in the offering |

|

$ |

(0.06 |

) |

The above discussion is based on 9,420,489 shares of our common stock outstanding as of July 31, 2024, assumes no sale of pre-funded warrants and excludes, as of that date, the following:

•

9,656 shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $559.05 per share;

•

70,205 shares of Common Stock issuable upon the vesting of outstanding restricted stock units at a weighted average fair value per unit of $8.51 per share;

•

101,686 shares of Common Stock reserved for future grants of equity-based awards under our equity incentive plans;

•

1,316 and 1,316 shares of Common Stock issuable upon the exercise of Series A and Series B common warrants, respectively, at an exercise price of $27.28 per share;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series A-1 and Series A-2 common warrants, respectively, at an exercise price of $10.25;

•

8,762 and 8,762 shares of Common Stock issuable upon the exercise of Series B-1 and Series B-2 common warrants, respectively, at an exercise price of $10.25;

•

133,332 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $1.35; and

•

17,997,853 shares of Common Stock issuable upon the exercise of common warrants at an exercise price of $0.515.

13

DESCRIPTION OF CAPITAL STOCK

The following summary of the rights of our capital stock is not complete and is subject to and qualified in its entirety by reference to our Charter and Bylaws, copies of which are filed as exhibits to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 5, 2024, and the Certificate of Designations and forms of securities, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part , which are incorporated by reference herein.

As of the date of this prospectus, our certificate of incorporation, authorizes us to issue up to 500,000,000 shares of Common Stock, $0.001 par value per share, and 15,000,000 shares of preferred stock, $0.001 par value per share. Our Common Stock is registered under Section 12(b) of the Exchange Act and is listed on the Nasdaq under the trading symbol “APVO.” As of September 16, 2024, 9,421,174 shares of Common Stock were outstanding and no shares of preferred stock were outstanding.

The following summary describes the material terms of our capital stock. The summary is qualified in its entirety by reference to our certificate of incorporation and our bylaws.

Authorized Shares

Our authorized Shares consists of 500,000,000 shares of Common Stock and 15,000,000 shares of preferred stock, $0.001 par value per share (the “Preferred Stock”). Our Common Stock is registered under Section 12(b) of the Exchange Act and is listed on the Nasdaq under the trading symbol “APVO.”

Common Stock

Voting Rights

Each holder of our Common Stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. Under our amended and restated certificate of incorporation and amended and restated bylaws, our stockholders do not have cumulative voting rights. Because of this, the holders of a majority of the shares of Common Stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends

Subject to preferences that may be applicable to any then-outstanding shares of preferred stock, holders of Common Stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation

In the event of our liquidation, dissolution or winding up, holders of Common Stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock.

Rights and Preferences

Each share of Common Stock includes an associated right pursuant to and as set forth in the Rights Agreement that we entered into with Broadridge Corporate Issuer Solutions, Inc. on November 8, 2020 (the “rights agreement”). Each right initially represents the right to purchase from us one one-thousandth of a share of our Series A Junior Participating Preferred Stock, par value $0.001 per share. This right is not exercisable until the occurrence of certain events specified in such rights agreement. The value attributable to these rights, if any, is reflected in the value of our Common Stock. The rights agreement and the rights granted thereunder will expire upon the earliest to occur of (i) the date on which all of such rights are redeemed, (ii) the date on which such rights are exchanged, and (iii) the close of business on November 4, 2024.

Fully Paid and Nonassessable.

All of our outstanding shares of Common Stock are fully paid and nonassessable.

14

Preferred Stock

Pursuant to our amended and restated certificate of incorporation, our board of directors has the authority, without further action by our stockholders, to designate up to 15,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the designation of, such series, any or all of which may be greater than the rights of common stock.

The Delaware General Corporation Law (“DGCL”) provides that the holders of preferred stock will have the right to vote separately as a class on any proposal involving fundamental changes in the rights of holders of that preferred stock. This right is in addition to any voting rights that may be provided for in the applicable certificate of designation.

Warrants

Series A and Series B Common Warrants 2023 - As of September 16, 2024, we have issued and outstanding 1,316 Series A and 1,316 Series B common warrants to purchase shares of our Common Stock at an exercise price of $27.28 per share and 41,239 Series A common warrants outstanding with an amended exercise price or $0.515 per share. The Series A common warrants and Series B common warrants are immediately exercisable and expire in August 2028 and February 2025, respectively. The exercise price and the number of shares of Common Stock purchasable upon the exercise of the warrants are subject to adjustment upon the occurrence of specific events, including sales of additional shares of Common Stock, stock dividends, stock splits, reclassifications and combinations of our Common Stock. If, at any time warrants are outstanding, any fundamental transaction occurs, as described in the warrants, the successor entity must assume the obligations to the warrant holders. Additionally, in the event of a fundamental transaction, the holders of the warrants will be entitled to receive upon exercise of the warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the warrants immediately prior to such fundamental transaction. Holders of the warrants do not have the rights or privileges of holders of our common shares, including any voting rights, until they exercise their warrants, with exceptions for participation in rights offerings or extraordinary distributions.

New Series A and Series B Common Warrants - November 2023 - On November 9, 2023, we entered into a warrant Inducement Agreement (“Inducement Agreement”) with certain holders of our existing Series A common warrants and Series B common warrants (together, the "Existing Warrants") to purchase shares of common stock. Pursuant to the terms of the Inducement Agreement, the holders agreed to exercise for cash their Existing Warrants to purchase up to an aggregate of 363,930 shares of common stock at an exercise price of $10.25 during the period from the date of the Inducement Agreement until December 8, 2023. In consideration of the holder’s agreement to exercise the Existing Warrants, we agreed to issue new Series A and new Series B common warrants (together, the "New Warrants"), to purchase a number of shares of common stock equal to 200% of the number of shares of common stock issued upon exercise of the Existing Warrants. Holders exercised 140,726 Existing Series A and 181,965 Existing Series B Warrants and the Company received $3.3 million in gross proceeds. As of September 16, 2024, we have 17,524 New Series A and 17,524 New Series B Common Warrants outstanding from our November 2023 warrant inducement with an exercise price of $10.25 per share and 263,928 New Series A and 346,406 New Series B common warrants with an amended exercise price of $0.515 per share. If the New Warrants are exercised, we may receive up to an additional $0.7 million in gross proceeds.

Common Warrants April 2024 - As of September 16, 2024, we have issued and outstanding common warrants to purchase 133,332 shares of our Common Stock at an exercise price of $1.35 per share issued as part of our April 2024 public offering (the "April 2024 Warrants") and 6,666,668 common warrants outstanding with an amended exercise price of $0.515 per share. The April 2024 Warrants are immediately exercisable and expire on April 10, 2029. The exercise price and the number of shares of Common Stock purchasable upon the exercise of the April 2024 Warrants are subject to adjustment upon the occurrence of specific events, including stock dividends, stock splits, reclassifications and combinations of our Common Stock. If, at any time the April 2024 Warrants are outstanding and a fundamental transaction, as described in the April 2024 Warrant, and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting

15

power represented by our outstanding common stock, occurs the holders of the April 2024 Warrants will be entitled to receive upon exercise of the April 2024 Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the April 2024 Warrants immediately prior to such fundamental transaction, other than one in which a successor entity that is a publicly traded corporation (whose stock is quoted or listed for trading on a national securities exchange, including, but not limited to, the New York Stock Exchange, the NYSE American, the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market) assumes the common warrant such that the warrant shall be exercisable for the publicly traded common stock of such successor entity. Additionally, as more fully described in the common warrants, at the option of the holders of the common warrants the holder can receive consideration in the same type and form of an amount equal to the Black Scholes value (as defined in the common warrant) of such unexercised common warrants on the date of consummation of such transaction. Except as otherwise provided in the April 2024 Warrants or by virtue of the holder’s ownership of shares of our common stock, such holder of April 2024 Warrants does not have the rights or privileges of a holder of our common stock, including any voting rights, until such holder exercises such holder’s April 2024 Warrants. The April 2024 Warrants provide that the holders of the April 2024 Warrants have the right to participate in distributions or dividends paid on our shares of common stock.

Common Warrants - July 2024 - As of September 16, 2024, we have issued and outstanding common warrants to purchase up to 10,679,612 shares of our Common Stock at an exercise price of $0.515 per share issued as part of our July 2024 registered direct offering (the "July 2024 Warrants"). The July 2024 Warrants became exercisable upon approval by stockholders on August 6, 2024, and expire on August 6, 2029. The exercise price of the July 2024 Warrants is subject to adjustment for stock splits and similar capital transactions and is subject to repricing in the event of a share split, share dividend, share combination or other such event as described in the July 2024 Warrants. If, at any time the July 2024 Warrants are outstanding and a fundamental transaction, as described in the July 2024 Warrant, and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock occurs, the holders of the July 2024 Warrants will be entitled to receive upon exercise of the July 2024 Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the July 2024 Warrants immediately prior to such fundamental transaction, other than one in which a successor entity that is a publicly traded corporation (whose stock is quoted or listed for trading on a national securities exchange, including, but not limited to, the New York Stock Exchange, the NYSE American, the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market) assumes the common warrant such that the warrant shall be exercisable for the publicly traded common stock of such successor entity. Additionally, as more fully described in the common warrants, at the option of the holders of the common warrants, the holder can receive consideration in the same type and form of an amount equal to the Black Scholes value (as defined in the common warrant) of such unexercised common warrants on the date of consummation of such transaction. Except as otherwise provided in the July 2024 Warrants or by virtue of the holder’s ownership of shares of our common stock, such holder of July 2024 Warrants does not have the rights or privileges of a holder of our common stock, including any voting rights, until such holder exercises such holder’s July 2024 Warrants. The July 2024 Warrants provide that the holders of the July 2024 Warrants have the right to participate in distributions or dividends paid on our shares of common stock.

Stockholder Registration Rights

Certain holders of shares of our Common Stock are entitled to certain rights with respect to registration of such shares under the Securities Act. These shares are referred to as registrable securities. The holders of these registrable securities possess registration rights described in additional detail below pursuant to the terms of a registration rights agreement.

The registration of shares of our Common Stock pursuant to the exercise of registration rights described below would enable the holders to trade these shares without restriction under the Securities Act when the applicable registration statement is declared effective. We will pay the registration expenses, other than underwriting discounts, selling commissions and stock transfer taxes, of the shares registered pursuant to the demand and piggyback registration rights described below.

Generally, in an underwritten offering, the managing underwriter, if any, has the right, subject to specified conditions, to limit the number of shares the holders may include.

16

Demand Registration Rights

The holders of the registrable securities are entitled to certain demand registration rights. At any time, the holders of at least 20% of the registrable securities, on not more than two occasions, may request that we register all or a portion of their shares, subject to certain specified exceptions. Such request for registration must cover securities the aggregate offering price of which, before payment of underwriting discounts and commissions, exceeds $10,000,000.

Piggyback Registration Rights

In connection with the filing of the registration statement of which this prospectus forms a part, the holders of the registrable securities were entitled to, and the necessary percentage of holders waived, their rights to notice of such filing and to include their shares of registrable securities in the registration statement of which this prospectus forms a part. If we propose to register for offer and sale any of our securities under the Securities Act in a future offering, either for our own account or for the account of other security holders, the holders of these shares will be entitled to certain “piggyback” registration rights allowing them to include their shares in such registration, subject to certain marketing and other limitations. As a result, whenever we propose to file a registration statement under the Securities Act, including a registration statement on Form S-3 as discussed below, other than with respect to a demand registration or a registration statement on Forms S-4 or S-8 or related to stock issued upon conversion of debt securities, the holders of these shares are entitled to notice of the registration and have the right, subject to limitations that the underwriters may impose on the number of shares included in the registration, to include their shares in the registration.

Lincoln Park Registration Rights

On February 16, 2022, we entered into a Purchase Agreement ("2022 Purchase Agreement") and a Registration Rights Agreement with Lincoln Park (the "Registration Rights Agreement"). The 2022 Purchase Agreement and Registration Rights Agreement replaced the Purchase Agreement and Registration Rights Agreement with Lincoln Park that we entered into on December 20, 2018. Under the 2022 Purchase Agreement, Lincoln Park committed to purchase up to $35.0 million of our common stock over a 36-month period commencing after the satisfaction of certain conditions, which are within our control, as set forth in the 2022 Purchase Agreement. The purchase price per share will be based on prevailing market prices; provided, however, that the prevailing market price is not below $1.00. We agreed to and issued 2,256 shares of our common stock to Lincoln Park for no cash consideration as an initial fee for its commitment to purchase shares of our common stock under the 2022 Purchase Agreement.

Certain Anti-Takeover Provisions of Our Certificate of Incorporation, Our Bylaws, the DGCL and our Rights Plan

Delaware Law

We are subject to Section 203 of the DGCL, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

•

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

•

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

In general, Section 203 defines a “business combination” to include the following:

17

•

any merger or consolidation involving the corporation and the interested stockholder;

•