UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to_____

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

(Address of principal executive offices) (Zip Code)

Telephone: (

(Registrant’s telephone number, including area code)

Title of each class | Name of each exchange on which registered |

Class A Common Stock, Par Value $0.01 Per Share | New York Stock Exchange |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

$0.01 par value per share |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | Non-accelerated filer ◻ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, as of June 30, 2021, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $

As of February 18, 2022, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to its 2022 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended December 31, 2021 are incorporated herein by reference in Part III.

Camping World Holdings, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2021

INDEX

2

Summary of Principal Risk Factors

We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control. In evaluating our company, you should consider carefully this summary of risks and uncertainties described below together with the other information included in this Annual Report on Form 10-K (“Form 10-K”), including our consolidated financial statements and related notes included in Part II, Item 8, “Financial Statements and Supplementary Data” in this Form 10-K. The occurrence of any of the following risks may materially and adversely affect our business, financial condition, results of operations and future prospects:

| ● | The COVID-19 pandemic has had, and could have in the future, certain negative impacts on our business, and such impacts may have a material adverse effect on our results of operations, financial condition and cash flows. |

| ● | We may not successfully execute or achieve the expected benefits of our 2019 Strategic Shift (as defined below) and this program may result in further asset impairment charges and adversely affect the Company’s business. |

| ● | Our business is affected by the availability of financing to us and our customers. |

| ● | Fuel shortages, or higher prices for fuel, could have a negative effect on our business. |

| ● | Our success depends to a significant extent on the well-being, as well as the continued popularity and reputation for quality, of our manufacturers, particularly Thor Industries, Inc. and Forest River, Inc. |

| ● | Our business model is impacted by general economic conditions in our markets, and ongoing economic and financial uncertainties could cause a decline in consumer spending that could adversely affect our business, financial condition and results of operations. |

| ● | Changes in consumer preferences for our products or our failure to gauge those preferences could lead to reduced sales and increased cost of sales and selling, general and administrative expenses. |

| ● | Competition in the market for services, protection plans, products and resources targeting the RV lifestyle or RV enthusiast could reduce our revenue and profitability |

| ● | Our expansion into new, unfamiliar markets, businesses, product lines or categories presents increased risks that may prevent us from being profitable in these new markets, businesses, product lines or categories. Delays in opening or acquiring new retail locations could have a material adverse effect on our business, financial condition and results of operations. |

| ● | Unforeseen expenses, difficulties, and delays encountered in connection with acquisitions and new store openings could inhibit our growth and negatively impact our profitability. |

| ● | Failure to maintain the strength and value of our brands could have a material adverse effect on our business, financial condition and results of operations. |

| ● | Our failure to successfully order and manage our inventory to reflect consumer demand in a volatile market and anticipate changing consumer preferences and buying trends has and may continue to have an adverse effect on our business, financial condition and results of operations. |

| ● | Our same store revenue may fluctuate and may not be a meaningful indicator of future performance. |

| ● | Our business is seasonal and this leads to fluctuations in sales and revenues. |

| ● | Disruptions or breaches involving our or our third-party providers’ information technology systems or network security, such as the cybersecurity incident disclosed in February 2022, could interrupt our operations, compromise our reputation, expose us to litigation, government enforcement actions and costly response measures and could have a material adverse effect on our business, financial condition and results of operations |

3

| ● | Our ability to operate and expand our business and to respond to changing business and economic conditions will depend on the availability of adequate capital. |

| ● | Our Senior Secured Credit Facilities and our Floor Plan Facility contain restrictive covenants that may impair our ability to access sufficient capital and operate our business. |

| ● | We primarily rely on six fulfillment and distribution centers for our retail, e-commerce and catalog businesses, and, if there is a natural disaster or other serious disruption at any such facility, we may be unable to deliver merchandise effectively to our stores or customers. |

| ● | Natural disasters, whether or not caused by climate change, unusual weather conditions, epidemic outbreaks, terrorist acts or political events could disrupt our business and result in lower sales and otherwise adversely affect our financial performance. |

| ● | We depend on our relationships with third-party providers of services, protection plans, products and resources and a disruption of these relationships or these providers’ operations could have an adverse effect on our business and results of operations. |

| ● | Because certain of the products that we sell are manufactured abroad, we may face delays, new or increased tariffs, increased cost or quality control deficiencies in the importation of these products, which could reduce our net sales and profitability. |

| ● | A portion of our net income is from financing, insurance and extended service contracts, which depend on third-party lenders and insurance companies. We cannot assure you third-party lending institutions will continue to provide financing for RV purchases. |

| ● | If we are unable to retain senior executives and attract and retain other qualified employees, our business might be adversely affected. |

| ● | We are subject to risks associated with leasing substantial amounts of space. |

| ● | Our private brand offerings expose us to various risks. |

| ● | We could incur impairment charges for goodwill, intangible assets or other long-lived assets. |

| ● | Our business is subject to numerous federal, state and local regulations and litigation risks. |

| ● | We are subject to risks associated with our organizational structure. |

| ● | There are risks associated with ownership of our Class A common stock. |

BASIS OF PRESENTATION

As used in this Form 10-K, unless the context otherwise requires, references to:

| ● | “we,” “us,” “our,” the “Company,” “Camping World,” “Good Sam” and similar references refer to Camping World Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including CWGS Enterprises, LLC, which we refer to as “CWGS, LLC” and, unless otherwise stated, all of its subsidiaries. |

| ● | "Active Customer" refers to a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. Unless otherwise indicated, the date of measurement is December 31, 2021, our most recently completed fiscal quarter. |

| ● | “Continuing Equity Owners” refers collectively to ML Acquisition, funds controlled by Crestview Partners II GP, L.P. and the Former Profits Unit Holders and each of their permitted transferees that own common units in CWGS, LLC and who may redeem at each of their options their |

4

| common units for, at our election (determined solely by our independent directors within the meaning of the rules of the New York Stock Exchange who are disinterested), cash or newly-issued shares of our Class A common stock. |

| ● | “Crestview” refers to Crestview Advisors, L.L.C., a registered investment adviser to private equity funds, including funds affiliated with Crestview Partners II GP, L.P. |

| ● | “CWGS LLC Agreement” refers to CWGS, LLC’s amended and restated limited liability company agreement, as amended. |

| ● | “Former Equity Owners” refers to those Original Equity Owners controlled by Crestview Partners II GP, L.P. that have exchanged their direct or indirect ownership interests in CWGS, LLC for shares of our Class A common stock in connection with the consummation of our initial public offering (“IPO”). |

| ● | “Former Profits Unit Holders” refers collectively to our named executive officers (excluding Marcus Lemonis and Matthew Wagner), Andris A. Baltins and K. Dillon Schickli, who are members of our Board of Directors, and certain other current and former non-executive employees and former directors, in each case, who held common units of CWGS, LLC pursuant to CWGS, LLC’s equity incentive plan that was in existence prior to our IPO and received common units of CWGS, LLC in exchange for their profits units in CWGS, LLC. |

| ● | “ML Acquisition” refers to ML Acquisition Company, LLC, a Delaware limited liability company, indirectly owned by each of Stephen Adams and our Chairman and Chief Executive Officer, Marcus Lemonis. |

| ● | “ML Related Parties” refers to ML Acquisition and its permitted transferees of common units. |

| ● | “ML RV Group” refers to ML RV Group, LLC, a Delaware limited liability company, wholly-owned by our Chairman and Chief Executive Officer, Marcus Lemonis. |

| ● | “Original Equity Owners” refers to the direct and certain indirect owners of interests in CWGS, LLC, collectively, prior to the Reorganization Transactions and Recapitalization (as defined in Note 1 – Summary of Significant Accounting Policies and Note 18 – Stockholders’ Equity to our consolidated financial statements included in Part II, Item 8 of this Form 10-K, respectively) conducted in conjunction with our IPO, including ML Acquisition, funds controlled by Crestview Partners II GP, L.P. and the Former Profits Unit Holders. |

| ● | “Tax Receivable Agreement” refers to the tax receivable agreement that the Company entered into with CWGS, LLC, each of the Continuing Equity Owners and Crestview Partners II GP, L.P. in connection with the Company’s IPO. |

5

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts contained in this Form 10-K may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding the timeline for and benefits of our 2019 Strategic Shift; expected new retail location openings and closures, including greenfield locations and acquired locations; the impact of the COVID-19 pandemic on our business; the expected impact of the February 2022 cybersecurity incident; sufficiency of our sources of liquidity and capital and potential need for additional financing; our stock repurchase program; future capital expenditures and debt service obligations; refinancing, retirement or exchange of outstanding debt; expectations regarding industry trends and consumer behavior and growth; our ability to capture positive industry trends and pursue growth; our plans to increase new products offered to our customers and grow our businesses to enhance our visibility with respect to revenue and cash flow, and to increase our overall profitability; volatility in sales and potential impact of miscalculating the demand for our products or our product mix; expectations regarding increase of certain expenses in connection with our growth; expectations regarding our pending litigation, and our plans related to dividend payments, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘anticipates,’’ ‘‘could,’’ ‘‘intends,’’ ‘‘targets,’’ ‘‘projects,’’ ‘‘contemplates,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘potential’’ or ‘‘continue’’ or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including the important factors described in this Form 10-K under Item 1A. Risk Factors and in our other filings with the Securities and Exchange Commission (“SEC”), that may cause our actual results, performance or achievements to differ materially and adversely from those expressed or implied by the forward-looking statements.

Any forward-looking statements made herein speak only as of the date of this Form 10-K, and you should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, performance, or achievements reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Form 10-K or to conform these statements to actual results or revised expectations.

6

PART I

ITEM 1. BUSINESS

Overview

Camping World Holdings, Inc. (together with its subsidiaries) is America’s largest retailer of recreational vehicles (“RVs”) and related products and services. Our vision is to build a long-term legacy business that makes RVing fun and easy, and our Camping World and Good Sam brands have been serving RV consumers since 1966. We strive to build long-term value for our customers, employees, and shareholders by combining a unique and comprehensive assortment of RV products and services with a national network of RV dealerships, service centers and customer support centers along with the industry’s most extensive online presence and a highly-trained and knowledgeable team of associates serving our customers, the RV lifestyle, and the communities in which we operate. We also believe that our Good Sam organization and family of programs and services uniquely enables us to connect with our customers as stewards of the RV lifestyle. On December 31, 2021, we operated a total of 187 retail locations, with 185 of these selling and/or servicing RVs.

Business Strategy

Key elements of our business strategy are:

Offer a Unique and Comprehensive Assortment of RV Products and Services. We believe our product and service offerings represent the best and most comprehensive assortment of services, protection plans, products and resources in the RV industry. Many of our offerings, including our Good Sam services and plans, our private label RVs, and our private label accessories, are unique to us and have been developed in collaboration with leading industry suppliers and RV enthusiasts. With more than 50 years of RV industry experience, 185 retail locations selling and/or servicing RVs, and 5.5 million Active Customers, we believe our size and scale allows us to deliver exceptional value to our customers.

Operate a National Network of RV Dealerships and Service Centers. As of December 31, 2021, we operated a national network of 185 RV dealerships and/or service centers. The majority of these RV dealerships and service centers are conveniently located off major highways and interstates in key RV markets, staffed with knowledgeable local team members offering expert advice and a comprehensive assortment of RV-related products and services. Our RV dealerships and service centers are a one-stop-shop for everything RV and give RV consumers peace of mind that they can find what they need when they need it in their local market or while traveling throughout the country.

Focus on Customer Service. We believe customer service is a critical component of our business. Our dealerships and service centers are staffed with knowledgeable local team members offering expert advice and a wide assortment of products and services. We currently operate call centers in Denver, CO, Bowling Green, KY, Greenville, NC, and Island Lake, IL. All associates at our call centers have been cross trained, and the call centers have redundant services and systems in place in the event of a power or connectivity disruption at one of our call center locations. Our goal is that every call – whether to one of our call centers or to a store – will be answered promptly by a live person. Our call center specialists are extensively trained to assist customers with complex orders and provide a level of service that leads to exceptional customer service and long-term customer relationships. In 2021, our call centers handled more than 2.4 million calls and responded to over 360,000 emails and social media communications.

Leverage Our Resources and Synergies. Our unique and comprehensive assortment of RV products and services, our national network of RV dealerships and service centers, our network of customer service and contact centers, and our online and e-commerce platforms all work together to service our customers and make RVing fun and easy. When a new customer transacts with us across any of our business areas, the new customer enters our database and we leverage customized customer relationship management (“CRM”) tools

7

and analytics to actively and intelligently engage, service and promote other offerings and the RV lifestyle. We believe our size and scale allows us to deliver exceptional value to our customers.

Stewards of the RV Lifestyle. We believe that our Good Sam organization and family of programs and services uniquely enables us to connect with our customers as stewards of the RV lifestyle. Good Sam programs such as extended vehicle warranty programs, roadside assistance plans, vehicle and home insurance programs, and Good Sam TravelAssist travel protection plans help to ensure our customers’ health and safety while traveling, and our Good Sam Club, co-branded credit card and vehicle protection plans provide great value to keep our customers’ RVs in top shape while providing a host of discounts and services all designed to enhance the overall customer RV experience. By providing unique programs that promote the health, safety and protection of the RV community, the Company drives an unparalleled opportunity to build a large, loyal, and growing community of RV enthusiasts to whom we can provide our basket of products and services for years to come.

Background, Restructuring and Recent Developments

Founded in 1966, our Good Sam and Camping World brands have been serving RV owners and outdoor enthusiasts for more than 50 years. Good Sam combined with Camping World in 1997, when the Good Sam Club had approximately 911,000 members and Camping World had 26 retail locations. In 2011, Camping World Good Sam combined with FreedomRoads, a successful RV dealership business founded in 2003, to form the largest provider of products and services for RVs in North America. From 2011 to date, we have continued to expand our footprint of RV dealerships through new store openings and acquisitions.

In May 2017, we acquired certain assets of Gander Mountain Company (“Gander Mountain”) and its Overton’s, Inc. (“Overton’s”) marine and watersports business through a bankruptcy auction. Prior to the bankruptcy, Gander Mountain operated 160 retail locations and an e-commerce business that serviced the hunting, camping, fishing, shooting sports, and outdoor markets. Following the acquisition, we rebranded the Gander Mountain business as Gander Outdoors and began opening the rebranded Gander Outdoors stores in December 2017. In 2017 and 2018, we also acquired several other specialty retail businesses.

In 2019, we made a strategic decision to refocus our business around our core RV competencies. In August of 2019, we divested 13 specialty store locations under the Uncle Dan’s and Rock Creek nameplates. On September 3, 2019, our Board of Directors approved a plan to strategically shift our business away from locations where we did not have the ability or where it was not feasible to sell and/or service RVs (the “2019 Strategic Shift”). As of December 31, 2020, the Company had completed the store closures and divestitures relating to the 2019 Strategic Shift. Additionally, under the 2019 Strategic Shift we rebranded Gander Outdoors to Gander RV and, through September 30, 2021, have recorded all of the inventory reserve charges for the exit of certain non-RV outdoor product categories. For more information on the impact to our 2021, 2020 and 2019 financial results, please see Note 5 – Restructuring and Long-lived Asset Impairment to our consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Segments and Offerings

We operate two reportable segments: (i) Good Sam Services and Plans and (ii) RV and Outdoor Retail. See Note 22 — Segment Information to our consolidated financial statements included in Part II, Item 8 of this Form 10-K for further information regarding our reportable segments.

8

The following table presents revenue and gross profit details for our product and service offerings for the year ended December 31, 2021:

Year Ended December 31, 2021 | ||||||||||||

Percent of | Percent of | |||||||||||

($ in thousands) |

| Revenue(1) |

| Revenue | Gross Profit(2) | Gross Profit | Gross Margin | |||||

Good Sam Services and Plans | $ | 180,722 | 2.6% | $ | 107,845 | 4.4% | 59.7% | |||||

New vehicles | 3,299,454 | 47.7% | 875,976 | 35.7% | 26.5% | |||||||

Used vehicles | 1,686,217 | 24.4% | 438,423 | 17.8% | 26.0% | |||||||

Products, service and other | 1,100,942 | 15.9% | 394,868 | 16.1% | 35.9% | |||||||

Finance and insurance, net | 598,475 | 8.7% | 598,475 | 24.4% | 100.0% | |||||||

Good Sam Club | 47,944 | 0.7% | 40,741 | 1.7% | 85.0% | |||||||

Total | $ | 6,913,754 | 100.0% | $ | 2,456,328 | 100.0% | 35.5% | |||||

| (1) | Components of revenue are presented after intersegment eliminations. |

| (2) | Gross profit is presented exclusive of depreciation and amortization, which is presented separately in operating expenses. |

Our broad product offerings allow us to target our customers’ needs with products and services focused towards recurring revenue, our installed base, and first-time buyers. Our recurring revenues are also marketed to customers outside of purchasers of our new and used RVs and are often annual or multi-year plans, so these recurring revenues do not necessarily correlate to sales of new and used RVs.

Good Sam Services and Plans

Our Good Sam Services and Plans segment consists of programs, plans and services that are geared towards protecting, insuring and promoting the RV lifestyle, and include services such as extended vehicle service contracts, vehicle roadside assistance, property and casualty insurance, travel protection, travel

9

planning and directories, and consumer shows and publications. Because our Good Sam protection plans and programs are often purchased to cover a multiple-year period and are renewable in nature, this area of our business tends to generate high-margin, recurring revenue that is driven both by vehicle purchases and the installed base of RV owners in the United States. Founded in 1966 to help fellow RV travelers on the road, the Good Sam brand has been supporting and assisting RVers for more than 50 years.

Our Good Sam Services and Plans segment offerings include:

| ● | Good Sam extended vehicle service contracts. We offer mechanical breakdown insurance underwritten and insured by a third party to members of the Good Sam Club. The contracts cover the cost of parts, labor and repairs to motorized and towable RVs as well as autos, pick-up trucks and sport utility vehicles. The contracts ensure the members will have continuous protection during the life of the contracts. The third party assumes full underwriting risk associated with the contracts and we are compensated on a commission basis. As of December 31, 2021, we had approximately 59,000 contracts in force underwritten by the third party. |

| ● | Good Sam roadside assistance plans. We offer roadside assistance plans for services such as towing, jump starting, tire changing, mobile mechanics and others. We contract with a third party to handle dispatch calls through its network of tow providers and we pay a fee per incident or call. As of December 31, 2021, we had approximately 782,000 contracts in force under our emergency roadside assistance plan. |

| ● | Good Sam property and casualty insurance programs. We offer property and casualty insurance for RVs and other types of vehicles as well as home insurance underwritten by various insurance providers. We do not share the underwriting risk of the insurance programs and we receive a marketing fee based on the amount of premium paid to the insurance providers. For the year ended December 31, 2021, we sold, through third-party insurance providers, insurance policies with an aggregate net written premium of $302 million for which we earn a marketing fee. |

| ● | Good Sam TravelAssist travel protection. We offer travel protection plans designed to assist travelers with medical emergency situations. The plans provide 24/7 coverage for emergency medical evacuation, return-home services, emergency medical monitoring, as well as other travel assistance services. We contract with a third party to offer travel protection plans through Good Sam TravelAssist, where the third party primarily assumes the underwriting risk through third-party underwriters. As of December 31, 2021, we had approximately 269,000 contracts in force primarily underwritten by a third party. |

| ● | Good Sam consumer shows. We offer RV and outdoor related consumer shows designed to promote and sell RV and outdoor lifestyle and related products and services. During 2020, as a consequence of COVID-19, we reduced the number of in-person consumer shows that we promoted and operated to 24 consumer shows in 20 cities across 15 states that attracted more than 210,000 visitors. During 2021, also due to COVID-19, the Company held one in-person consumer show. By comparison, during 2019, we promoted and operated 37 consumer shows in 29 cities across 18 states that attracted more than 285,000 visitors. Further, due to ongoing COVID-19 concerns, we currently expect to hold fewer than 10 in-person consumer shows in 2022. These shows provide a strategic opportunity to expose first-time buyers and existing RV and outdoor sports enthusiasts to our products and services. |

| ● | Other activities. We produce certain monthly and annual RV focused consumer magazines, and travel and planning directories, and operate the Coast to Coast Club which provides access to and savings at private membership campgrounds. |

RV and Outdoor Retail

Our RV and Outdoor Retail segment consists of all aspects of our RV dealership operations, which includes selling new and used RVs, assisting with the financing of new and used RVs, selling protection and insurance related services and plans for RVs, servicing and repairing new and used RVs, installing RV parts

10

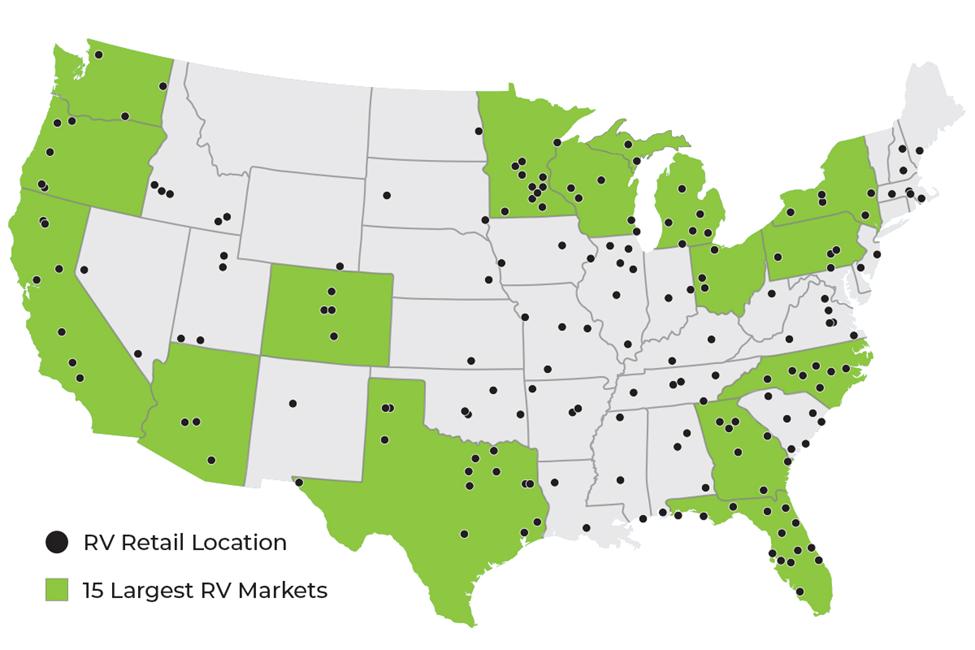

and accessories, and selling RV and outdoor related products, parts and accessories. Within our RV and Outdoor Retail business, we also operate the Good Sam Club, which we believe is the largest membership-based RV organization in the world, with approximately 2.1 million members as of December 31, 2021. Membership benefits include a variety of discounts, exclusive benefits, specialty publications and other membership benefits, all of which we believe enhance the RV experience, drive customer engagement and loyalty, and provide cross-selling opportunities for our other products and services. A map depicting our national network of 185 RV dealerships and service centers as of December 31, 2021 is provided below:

Source: Statistical Surveys, Inc. (15 largest RV markets)

RV and Outdoor Retail segment offerings include:

| ● | New and Used Vehicles. A wide selection of new and used RVs across a range of price points, classes and floor plans. The table below contains a breakdown of our new RV unit sales and average selling price by RV class for 2021. Sales of new vehicles represented 47.4%, 51.8% and |

11

| 48.5% of total revenue for 2021, 2020 and 2019, respectively. Sales of used vehicles represented 24.4%, 18.1% and 17.5% of total revenue for 2021, 2020, and 2019, respectively. |

| • | Vehicle financing. Through arrangements with third-party lenders we are able to provide financing for most of the new and used RVs we sell through our retail locations. Generally, our financing transactions are structured through long-term retail installment sales contracts with terms of up to 20 years, which we enter into with our customers on behalf of our third-party lenders. The retail installment sales contracts are then assigned on a non-recourse basis, with the third-party lender assuming underwriting and credit risk. In 2021, we arranged financing transactions for approximately 75.2% of our total number of new and used units sold for which we earn a commission from the third-party lender. |

| • | Protection Plans. We offer and sell a variety of protection plans and services to the purchasers of our RVs as part of the delivery process, as well as gap, wheel, tire and fabric protection plans. These products are primarily underwritten and administered by independent third parties, and we are primarily compensated on a commission basis. |

| • | Repair and Maintenance. We offer RV repair and maintenance services at the majority of our retail locations. With approximately 2,575 RV service bays across our national footprint, we are equipped to offer comprehensive repair and maintenance services for most RV components. |

| • | RV parts, accessories and installation services. We offer a wide range of RV parts, equipment, supplies and accessories, including towing and hitching products, satellite and GPS systems, electrical and lighting products, appliances and furniture, and other products for inside the RV, at the campsite, and around the campground. Our full-service repair facilities enable us to install all parts and accessories that we sell in our retail locations. We believe our ability to both sell and install parts and accessories affords us a competitive advantage over online and big box retailers, that do not have service centers designed to accommodate RVs, and over RV dealerships that do not offer a comprehensive selection of parts and accessories. While we do continue to offer some non-RV outdoor products and accessories, our focus is on providing products and services that are targeted toward RV enthusiasts and owners. |

| • | Collision repair and restoration. We offer collision repair services, including fiberglass front and rear cap replacement, windshield replacement, interior remodel solutions, and paint and body work, at many of our retail locations, and 59 of our retail locations are equipped with full body paint booths. We perform collision repair services for a number of insurance carriers. |

12

| • | Good Sam Club. The Good Sam Club is a membership organization that offers savings on a variety of products and services, including products purchased at any of our retail and online stores, discounts on nightly rates at affiliated Good Sam RV parks and other benefits related to the RV lifestyle. We believe the Good Sam Club is the largest membership-based RV enthusiast organization in the world. As of December 31, 2021, there were approximately 2.1 million members in our Good Sam Club. |

| • | Co-branded credit cards. We contract with Visa and Comenity Capital Bank to offer a Good Sam Rewards Visa® branded credit card, as well as Good Sam private label credit card. Cardholders receive enhanced rewards points, which are referred to as Good Sam Rewards, for money spent at our retail locations, on our e-commerce platforms, at gas stations and at private campgrounds across the U.S. and Canada. As of December 31, 2021, we had approximately 228,000 issued and open Good Sam co-branded credit card accounts. |

Vehicle Sourcing and Dealer Agreements

We acquire new RVs for retail sale directly from the original equipment manufacturer. Our strategy is to partner with financially sound manufacturers that make high quality products, have adequate manufacturing capacity and distribution, and maintain an appropriate product mix. We have strategic relationships with leading RV manufacturers, including Thor Industries, Inc. and Forest River, Inc. As of December 31, 2021, Thor Industries and Forest River accounted for approximately 72.4% and 24.1%, respectively, of our new RV inventory. In certain instances, our manufacturing partners produce private label products exclusively available at our RV dealerships and through our e-commerce platforms.

Our supply arrangements with manufacturers are typically governed by dealer agreements, which are customary in the RV industry, made on a location-by-location basis, and each retail location typically enters into multiple dealer agreements with multiple manufacturers. Dealer agreements generally give us the right to sell certain RV makes and models within an exclusive designated area. The terms of these dealer agreements typically require us to, among other things, meet all the requirements and conditions of the manufacturer’s applicable programs, maintain certain minimum inventory requirements and meet certain retail sales objectives, perform services and repairs for all owners of the manufacturer’s RVs (regardless from whom the RV was purchased) that are still under warranty, and stock certain of the manufacturer’s parts and accessories needed to service and repair the manufacturer’s RVs, actively advertise and promote the manufacturer’s RVs, and indemnify the manufacturer under certain circumstances.

We primarily acquire used RVs through customer trade-ins, as well as private party purchases and consignments, and we generally recondition used RVs acquired for retail sale in our parts and service departments. Historically, used RVs that we have not sold at our RV-centric retail locations generally have been sold through other channels at wholesale prices.

We finance the purchase of substantially all of our new RV inventory from manufacturers through our Floor Plan Facility. Used vehicles may also be financed from time to time through our Floor Plan Facility. For more information on our Floor Plan Facility, see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Senior Secured Credit Facilities and Floor Plan Facility” included in Part II, Item 7 of this Form 10-K and Note 4 — Inventories and Floor Plan Payables to our consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Marketing and Advertising

The lifestyle element of the RV industry and the multi-year nature of many of our products and services provides the opportunity to build long-term relationships with our customers. Our marketing strategies are focused on developing awareness around our brands, products and services, and driving traffic to our stores and websites, and we utilize a combination of direct mail, email, print materials, digital, social and traditional media, as well as online inventory listings to accomplish this. As part of our marketing efforts, we maintain a proprietary database of individuals and customer purchasing data that we utilize for direct mail, email, text messaging and telemarketing campaigns. As of December 31, 2021, this database contained over 30 million unique contacts. In addition, we are involved in various sponsored sporting event activities. We are the sponsor

13

of the NASCAR Camping World Truck Series, Major League Baseball, and National Hot Rod Association (“NHRA”) Camping World Drag Racing Series plus the naming rights sponsor of Camping World Stadium in Orlando, Florida. We also have official partner status for our brands for both Major League Baseball and NASCAR. In 2020 we introduced our first ever virtual consumer show with a five-day online event. In 2021, we hosted 10 multi-day virtual events which we plan to continue in the coming years as part of our national lead generation strategy for both our physical and digital channels across our growing ecosystem.

Trademarks and Other Intellectual Property

We own a variety of registered trademarks and service marks related to our brands and our services, protection plans, products and resources, including Good Sam, Camping World, Gander Outdoors, Gander RV, and Overton’s. We also own the copyrights to certain articles in our publications and numerous domain names, including www.goodsamclub.com, www.campingworld.com, www.ganderoutdoors.com, www.ganderrv.com, www.rv.com, www.rvs.com, www.rvrentals.com, www.highways.com, www.overtons.com, www.skis.com, www.snowboards.com, and www.the-house.com, among others. We believe that our trademarks and other intellectual property have significant value and are important to our marketing efforts. We do not know of any material pending claims of infringement or other challenges to our right to use our intellectual property in the United States or elsewhere. For additional information regarding our intellectual property, see Note 7 – Goodwill and Intangible Assets to our consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Human Capital Resources

Our Talent

As of December 31, 2021, we had 12,584 full-time and 500 part-time or seasonal employees. None of our employees are represented by a labor union or are party to a collective bargaining agreement, and we have had no labor-related work stoppages. We believe that our employee relations are generally good.

Development

In November 2020, we launched an entity-wide online training platform with a curriculum that is tailored to each associate’s job function. This program includes interactive courses such as COVID-19 safety, communication, management, critical thinking, software skills, and workplace harassment and discrimination. Our learning and development team continues to create proprietary content for this training library. We are also making an approximately $1.5 million investment in establishing learning labs at each of our locations that will allow for a dedicated space with the appropriate technology for employees to engage in their training programs. These learning labs are expected to be completed during the first half of 2022.

Our service technicians are critical to providing the high-quality installation and repair services that our customers expect. Our Camping World Technical Institute (“CWTI”) includes full-time instructors at two dedicated campuses and one part-time campus as of December 31, 2021. An additional dedicated campus is expected to open in 2022. The CWTI offers monthly 10-day training sessions to our service technicians. In 2019, we provided training to 159 technicians through the CWTI and, despite the challenges faced with social distancing limitations as a result of COVID-19 safety precautions, we were able to train 357 and 101 new technicians on our level 1 course in 2021 and 2020, respectively.

Diversity, Equity, and Inclusion

We strive to make diversity, equity, and inclusion (“DE&I”) a top priority in all areas of our Company. These areas include but are not limited to our board of directors, senior management, field operations, and the creation of campaigns, products and services. We believe that our Company and our brand should reflect the

14

increasingly diverse audience of outdoor enthusiasts and our culture should promote respect and dignity of all humans.

Community Engagement

Since 2013, we have operated the Project Good Samaritan initiative, which encourages our associates to perform eight hours of volunteer work per quarter for a cause that is meaningful to that associate, such as local soup kitchens, food pantries, home building, meal distribution, recycling programs, homeless shelters, veteran programs, and nursing homes. Associates receive paid time off for these volunteer hours. In 2019, 3,364 associates volunteered 51,680 hours in their communities under the program. In 2020, 840 associates volunteered 6,268 hours during January and February before the program was suspended as a safety precaution as a result of the COVID-19 pandemic. We plan to reactivate the program when it is safe to do so.

Health and Safety

We maintain a safety program to provide a safe and healthful workplace for our associates. We strive to comply with all health and safety standards that pertain to our operations. We have created and implemented processes to identify, reduce or eliminate physical hazards from the work environment, improve safety communication and train employees on safe work practices.

In response to the COVID-19 pandemic, we have implemented new health and safety measures at all of our locations. We also issued COVID-19 awareness training to our associates to educate associates on how the virus is transmitted, how to monitor for symptoms of the virus, and how to protect themselves and others from increased spread of the virus. For further discussion, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — COVID-19” in Item 7 of Part II of this Form 10-K.

Competition

We face competition in all areas of our business. We believe that the principal competitive factors in the RV industry are breadth and depth of products and services, quality, pricing, availability, convenience, and customer service. Our competitors vary in size and breadth of their product offerings.

We compete directly or indirectly with the following types of companies:

| ● | other RV dealers selling new and used RVs; |

| ● | major national insurance and warranty companies, providers of roadside assistance and providers of extended vehicle service contracts; |

| ● | multi-channel retailers and mass merchandisers, warehouse clubs, discount stores, department stores and other retailers, such as Wal-Mart, Target and Amazon; |

| ● | distributors of RV furniture and accessories; |

| ● | online retailers; and |

| ● | independent, local specialty stores. |

Additional competitors may enter the businesses in which we currently operate. Moreover, some of our mass merchandising competitors do not currently compete in many of the product categories we offer but may choose to offer a broader array of competing products in the future.

COVID-19

The COVID-19 pandemic adversely impacted our business from mid-March through much of April 2020, but shifted to a favorable impact beginning primarily in May 2020. For further discussion, see

15

“Management’s Discussion and Analysis of Financial Condition and Results of Operations — COVID-19” in Item 7 of Part II of this Form 10-K.

Seasonality

Historically, our business has been seasonal. Since recreational vehicles are primarily used by vacationers and campers during times of warmer weather, demand for our products and services tends to be highest in the spring and summer months and lowest in the winter months. As a result, our revenue and profitability has historically been higher in the second and third quarters than in the first and fourth quarters. On average over the last three years ended December 31, 2021, we generated 29.8% and 28.9% of our annual revenue in the second and third quarters, respectively, and 21.2% and 20.1% in the first and fourth quarters, respectively. For further discussion, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Seasonality” in Item 7 of Part II of this Form 10-K.

Laws and Regulations

See “Risk Factors — Risks Related to Our Business — Our business is subject to numerous federal, state and local regulations,” “— Our failure to comply with certain environmental regulations could adversely affect our business, financial condition and results of operations,” and “— Climate change legislation or regulations restricting emission of “greenhouse gases” could result in increased operating costs and reduced demand for RVs we sell” in Item 1A of Part I of this Form 10-K. Although we incur costs to comply with applicable laws and regulations in the ordinary course of our business, we do not presently anticipate that such costs will have a material effect on our capital expenditures, earnings and competitive position.

Environmental, Health and Safety Regulations

Our operations involve the use, handling, storage and contracting for recycling and/or disposal of materials such as motor oil and filters, transmission fluids, antifreeze, refrigerants, paints, thinners, batteries, cleaning products, lubricants, degreasing agents, tires and propane. Consequently, our business is subject to a complex variety of federal, state and local requirements that regulate the environment and public health and safety. For a discussion of the impact of COVID-19 on our business, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — COVID-19” in Item 7 of Part II of this Form 10-K. We do not have any material known environmental commitments or contingencies.

Additional Information

We were incorporated in the State of Delaware in 2016. Our principal executive offices are located at 250 Parkway Drive, Suite 270, Lincolnshire, IL 60069 and our telephone number is (847) 808-3000. We make available our public filings, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports with the SEC free of charge through our website at www.campingworld.com in the “Investor Relations” section under “Financial Info” as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. The information contained in, or accessible through, our website does not constitute a part of this Form 10-K.

We intend to use our official Facebook, Twitter, and Instagram accounts, each at the handle @CampingWorld, as a distribution channel of material information about the Company and for complying with our disclosure obligations under Regulation FD. The information we post through these social media channels may be deemed material. Accordingly, investors should subscribe to these accounts, in addition to following our press releases, SEC filings and public conference calls and webcasts. These social media channels may be updated from time to time. The information we post through these channels is not a part of this Annual Report on Form 10-K.

16

ITEM 1A. RISK FACTORS

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with the other information included in this Form 10-K. The occurrence of any of the following risks may materially and adversely affect our business, financial condition, results of operations and future prospects. In these circumstances, the market price of our Class A common stock could decline. Other events that we do not currently anticipate or that we currently deem immaterial may also affect our business, prospects, financial condition and results of operations.

Risks Related to the COVID-19 Pandemic

The COVID-19 pandemic has had, and could have in the future, certain negative impacts on our business, and such impacts may have a material adverse effect on our results of operations, financial condition and cash flows.

The public health crisis caused by the COVID-19 pandemic and the measures being taken by governments, businesses, including us and our vendors, and the public at large to limit COVID-19's spread have had, and could again have in the future, certain negative impacts on our business including, without limitation, the following:

| ● | We have faced, and may continue to face, delays in the delivery of certain products from our vendors as a result of shipping delays due to, among other things, additional safety requirements imposed by governmental authorities and capacity constraints experienced by our transportation contractors. |

| ● | Some of our vendors have experienced, and may experience in the future, temporary facility closures, production slowdowns and disruption to operations as a result of the impact of the COVID-19 pandemic on their respective businesses, such as Thor Industries, Inc.’s temporary closure of its North American production facilities from late March to early May 2020. |

| ● | Disruptions in supply chains may place constraints on our ability to source products, which may increase our product costs or lead to shortages. For instance, disruptions in the supply of adhesives may negatively impact our procurement of fiberglass travel trailers. |

| ● | When governmentally mandated or voluntary stay-at-home guidelines have been put in place, we have experienced a decrease in traffic at our retail locations, which resulted in a decrease in the sales of certain of our products and services at our retail locations. If stay-at-home or shelter-in-place orders are reinstated, we may again experience negative impacts on our sales that could be more prolonged and more severe than what we have experienced to date. |

| ● | National parks and RV parks temporarily closed and may in the future close again in response to the COVID-19 pandemic, which could cause consumers to use their RVs less frequently and be less inclined to need or renew certain of our services or purchase products through our e-commerce websites. |

| ● | As of December 31, 2021 and 2020, we had temporarily closed one and two locations, respectively, as a result of COVID-19 and branding changes. To the extent the COVID-19 pandemic intensifies or governmental orders change, we may be forced to temporarily close more locations in the future. |

| ● | Deteriorating economic conditions as a result of the COVID-19 pandemic, such as increased unemployment, financial market uncertainty, increased inflation or decreases in disposable income, declines in consumer confidence, or economic slowdowns or recessions, could cause a decrease in demand for our products and services or impact our borrowing costs. |

17

| ● | We have made temporary changes to our operating procedures at our retail locations and offices. We have taken measures to protect our customers, employees and facilities, which include, but are not limited to, social distancing, providing employees with face coverings and/or other protective clothing as required, and implementing additional cleaning and sanitization routines. These measures may not be sufficient to prevent the spread of COVID-19 among our employees and, therefore, we may face labor shortages including key positions. Additionally, our employees may not be as efficient while operating under such procedures, which could result in additional labor costs. |

| ● | The financial impact of the COVID-19 pandemic may cause one or more of our counterparty financial institutions to fail or default on their obligations to us, which could cause us to incur significant losses. |

| ● | Deteriorations in our financial results and financial condition as a result of the COVID-19 pandemic could cause us to default on one or multiple of our credit agreements, including any of the subjective acceleration clauses in such agreements. If this occurs, our obligations under the relevant agreement may be accelerated which would have a material adverse impact on our business, liquidity position and financial position. |

| ● | We may be required to record significant impairment charges with respect to noncurrent assets, including goodwill, other intangible assets, and other long-lived assets whose fair values may be negatively affected by the effects of the COVID-19 pandemic on our operations. Also, we may be required to write off excess or obsolete inventory as a result of the COVID-19 pandemic’s damaging impacts on our business. |

| ● | As a result of the COVID-19 pandemic, including related governmental guidance or directives, we have required, at times, most office-based employees to work remotely. We may experience reductions in productivity and disruptions to our business routines and heightened cybersecurity risks while our remote work policy remains in place. |

The resumption of normal business operations after the disruptions caused by the COVID-19 pandemic may be delayed or constrained by its lingering effects on our consumers, vendors or third-party service providers.

Risks Related to Our Business

We may not successfully execute or achieve the expected benefits of our 2019 Strategic Shift and this program may result in further asset impairment charges and adversely affect the Company's business.

In the third fiscal quarter of 2019, we announced the 2019 Strategic Shift. Implementation of the program may be costly and disruptive to our business. We may not be able to realize the benefits initially anticipated and the expected costs may be greater than expected. A variety of factors could cause the Company not to realize some or all of the expected benefits or incur greater costs, including, among others, delays in the anticipated timing of activities related to the 2019 Strategic Shift, unexpected costs associated with executing the 2019 Strategic Shift, or the Company's ability to achieve the benefits contemplated by the program. Further, any cost savings that the Company realizes may be offset, in whole or in part, by a reduction in revenues or through increases in other expenses. In addition, the Company may need to incur further impairment charges to its long-lived assets, including its operating lease assets, as a result of the 2019 Strategic Shift.

Our business is affected by the availability of financing to us and our customers.

Our business is affected by the availability of financing to us and our customers. Generally, RV dealers, including us, finance their purchases of inventory with financing provided by lending institutions. As of December 31, 2021, we had up to $1.7 billion in maximum borrowing capacity under our Eighth Amended and Restated Credit Agreement for floor plan financing (see Note 4 ─ Inventories and Floor Plan Payables to our consolidated financial statements included in Part II, Item 8 of this Form 10-K). A decrease in the availability of

18

this type of wholesale financing or an increase in the cost of such wholesale financing could prevent us from carrying adequate levels of inventory, which may limit product offerings and could lead to reduced sales and revenues.

Furthermore, many of our customers finance their RV purchases. Consumer credit market conditions continue to influence demand, especially for RVs, and may continue to do so. There continue to be fewer lenders, more stringent underwriting and loan approval criteria, and greater down payment requirements than in the past. If credit conditions or the credit worthiness of our customers worsen, and adversely affect the ability of consumers to finance potential purchases at acceptable terms and interest rates, it could result in a decrease in the sales of our products and have a material adverse effect on our business, financial condition and results of operations.

Fuel shortages, or high prices for fuel, could have a negative effect on our business.

Gasoline or diesel fuel is required for the operation of RVs. There can be no assurance that the supply of these petroleum products will continue uninterrupted, that rationing will not be imposed or that the price of or tax on these petroleum products will not significantly increase in the future. Shortages of gasoline and diesel fuel have had a material adverse effect on the RV industry as a whole in the past and any such shortages or substantial increases in the price of fuel could have a material adverse effect on our business, financial condition or results of operations.

Our success depends to a significant extent on the well-being, as well as the continued popularity and reputation for quality, of our manufacturers, particularly Thor Industries, Inc. and Forest River, Inc.

Thor Industries, Inc. and Forest River, Inc. supplied approximately 72.4% and 24.1%, respectively, of our new RV inventory as of December 31, 2021. We depend on our manufacturers to provide us with products that compare favorably with competing products in terms of quality, performance, safety and advanced features. Any adverse change in the production efficiency, product development efforts, technological advancement, marketplace acceptance, reputation, marketing capabilities or financial condition of our manufacturers, particularly Thor Industries, Inc. and Forest River, Inc., could have a substantial adverse impact on our business. Any difficulties encountered by any of these manufacturers, resulting from economic, financial, or other factors, could adversely affect the quality and amount of products that they are able to supply to us, and the services and support they provide to us.

The interruption or discontinuance of the operations of Thor Industries, Inc. and Forest River, Inc. or other manufacturers could cause us to experience shortfalls, disruptions, or delays with respect to needed inventory. Although we believe that adequate alternate sources would be available that could replace any manufacturer as a product source, those alternate sources may not be available at the time of any interruption, and alternative products may not be available at comparable quality and prices.

Our supply arrangements with manufacturers are typically governed by dealer agreements, which are customary in the RV industry. Our dealer agreements with manufacturers are generally made on a location-by-location basis, and each retail location typically enters into multiple dealer agreements with multiple manufacturers. These dealer agreements may contain affirmative obligations that we must comply with. Our dealer agreements also generally provide for a one-year term, which is typically renewed annually. For more information on our dealer arrangements, see “Item 1. Business ─ Vehicle Sourcing and Dealer Arrangements” under Part I of this Form 10-K.

In addition, certain of our dealer agreements contain stocking level requirements and certain of our dealer agreements contain contractual provisions concerning minimum advertised product pricing for current model year units. Wholesale pricing is generally established on a model year basis and is subject to change at the manufacturer’s sole discretion. In certain cases, manufacturers have, and may continue to establish a suggested retail price, below which we cannot advertise that manufacturer’s RVs. Any change, non-renewal, unfavorable renegotiation or termination of these arrangements for any reason could adversely affect product availability and cost and our financial performance.

19

Our business model is impacted by general economic conditions in our markets, and ongoing economic and financial uncertainties could cause a decline in consumer spending that could adversely affect our business, financial condition and results of operations.

As a business that relies on consumer discretionary spending, we have in the past and may in the future be adversely affected if our customers reduce, delay or forego their purchases of our services, protection plans, products and resources as a result of:

| ● | job losses, lower income levels or other population and employment trends; |

| ● | bankruptcies; |

| ● | higher consumer debt and interest rates; |

| ● | reduced access to credit; |

| ● | higher energy and fuel costs; |

| ● | relative or perceived cost, availability and comfort of RV use versus other modes of travel, such as air travel and rail; |

| ● | falling home prices; |

| ● | lower consumer confidence or discretional consumer spending; |

| ● | higher inflation rates; |

| ● | uncertainty or changes in tax policies and tax rates; |

| ● | uncertainty due to national or international security concerns; or |

| ● | other general economic conditions, including deflation and recessions. |

We also rely on our retail locations to attract and retain customers and to build our customer database. If we close retail locations, are unable to open or acquire new retail locations due to general economic conditions or otherwise, or experience declines in customer transactions in our existing retail locations due to general economic conditions or otherwise, our ability to maintain and grow our customer database and our Active Customers will be limited, which could have a material adverse effect on our business, financial condition and results of operation.

Decreases in Active Customers, average spend per customer, or retention and renewal rates for our Good Sam services and plans would negatively affect our financial performance, and a prolonged period of depressed consumer spending could have a material adverse effect on our business. In prior years, promotional activities and decreased demand for consumer products affected our profitability and margins, and this negative impact could return or worsen in future periods. In addition, adverse economic conditions may result in an increase in our operating expenses due to, among other things, higher costs of labor, energy, equipment and facilities, as well as higher tariffs. Due to fluctuations in the U.S. economy, our sales, operating and financial results for a particular period are difficult to predict, making it difficult to forecast results for future periods. Additionally, we are subject to economic fluctuations in local markets that may not reflect the economic conditions of the U.S. economy. Any of the foregoing factors could have a material adverse effect on our business, financial condition and results of operations.

In addition, the success of our recurring Good Sam services and plans depends, in part, on our customers’ use of certain RV websites and/or the purchase of services, protection plans, products and resources through participating merchants, as well as the health of the RV industry generally.

20

In addition, we have faced, and may continue to face, increased competition from other businesses with similar product and service offerings during recent periods. For example, our competitors have listed RVs at or below cost and we have had little visibility into our competitors or manufacturers’ inventories. As a result, we have responded and may need to further respond by establishing pricing, marketing and other programs or by seeking out additional strategic alliances or acquisitions that may be less favorable to us than we could otherwise establish or obtain in more favorable economic environments. Such programs have adversely impacted our gross margin, operating margin and selling, general and administrative expenses. In addition, declines in the national economy could cause merchants who participate in our programs to go out of business. It is likely that, should the number of merchants entering bankruptcy rise, the number of uncollectible accounts would also rise. These factors could have a material adverse effect on our business, financial condition and results of operations.

Changes in consumer preferences for our products or our failure to gauge those preferences could lead to reduced sales and increased cost of sales and selling, general and administrative expenses.

We cannot be certain that historical consumer preferences for RVs in general, and any related products, will remain unchanged. RVs are generally used for recreational purposes, and demand for our products may be adversely affected by competition from other activities that occupy consumers’ leisure time and by changes in consumer lifestyle, usage pattern, or taste. Similarly, an overall decrease in consumer leisure time may reduce consumers’ willingness to purchase our products. As described above, during the COVID-19 pandemic, we experienced significant acceleration in our in-store traffic and revenue trends in May 2020 continuing into the quarter ended June 30, 2021 and demand in new and used vehicles remained elevated through the remainder of 2021 and into the beginning of 2022. The industry has seen an influx of new first-time participants because RVs allow people to travel in a safe and socially distant manner during the COVID-19 crisis. These trends may not continue in the future. Over the past several years, we have seen a shift in our overall sales mix towards new travel trailer vehicles, which has led to declines in our average selling price of a new vehicle unit. From 2015 to 2021, new vehicle travel trailer units as a percent of total new vehicles increased from 62% to 72% of total new vehicle unit sales and from 2015 to 2020 our average selling price of a new vehicle unit had decreased from $39,853 to $36,277. However, over the past twelve months due to lower industry supply of travel trailers and motorhomes, both average cost and average sales price have increased. Should the supply chain correct itself over the next twelve months, average sales price may again decline and impact our same store revenue.

Competition in the market for services, protection plans, products and resources targeting the RV lifestyle or RV enthusiast could reduce our revenues and profitability.

The markets for services, protection plans, products and resources targeting RV owners and enthusiasts are highly fragmented and competitive. Major competitive factors that drive the RV, outdoor and active sports markets are price, product and service features, technology, performance, reliability, quality, availability, variety, delivery and customer service. We compete directly or indirectly with the following types of companies:

| ● | other RV dealers selling new and used RVs; |

| ● | major national insurance and warranty companies, providers of roadside assistance and providers of extended vehicle service contracts; |

| ● | multi-channel retailers and mass merchandisers, warehouse clubs, discount stores, department stores and other retailers, such as Wal-Mart, Target and Amazon; |

| ● | distributors of RV furniture and accessories; |

| ● | online retailers; and |

| ● | independent, local specialty stores. |

21

Additional competitors may enter the businesses in which we currently operate. Moreover, some of our mass merchandising competitors do not currently compete in many of the product categories we offer, but may choose to offer a broader array of competing products in the future. Some of our competitors may build new stores in or near our existing locations and certain RV and accessory manufacturers may choose to expand their direct to consumer offerings. In addition, an increase in the number of aggregator and price comparison sites for insurance products may negatively impact our sales of these products. If any of our competitors successfully provides a broader, more efficient or attractive combination of services, protection plans, products and resources to our target customers, our business results could be materially adversely affected. Our inability to compete effectively with existing or potential competitors could have a material adverse effect on our business, financial condition and results of operations.

Our expansion into new, unfamiliar markets, businesses, product lines or categories presents increased risks that may prevent us from being profitable in these new markets, businesses, product lines or categories. Delays in opening or acquiring new retail locations could have a material adverse effect on our business, financial condition and results of operations.

In the past, we have acquired new retail locations in new markets and new businesses, product lines or product categories. As a result of this and any future expansion, we may have less familiarity with local consumer preferences and less business, product or category knowledge with respect to new businesses, product lines or categories, and could encounter difficulties in attracting customers due to a reduced level of consumer familiarity with our brands or reduced product or category knowledge. Other factors that may impact our ability to open or acquire new retail locations in new markets and to operate them profitably or acquire new businesses, product lines or categories, many of which are beyond our control, include:

| ● | our ability to identify suitable acquisition opportunities or new locations, including our ability to gather and assess demographic and marketing data to determine consumer demand for our products in the locations we select or accurately assess profitability; |

| ● | our ability to negotiate favorable lease agreements; |

| ● | our ability to secure product lines; |

| ● | delays in the entitlement process, the availability of construction materials and labor for new retail locations and significant construction delays or cost overruns; |

| ● | our ability to secure required third-party or governmental permits and approvals; |

| ● | our ability to hire and train skilled store operating personnel, especially management personnel; |

| ● | our ability to provide a satisfactory mix of merchandise that is responsive to the needs of our customers living in the geographic areas where new retail locations are built or acquired; |

| ● | our ability to supply new retail locations with inventory in a timely manner; |

| ● | our competitors building or leasing retail locations near our retail locations or in locations we have identified as targets; and |

| ● | regional economic and other factors in the geographic areas where we expand. |

Our expansion into new markets, businesses, products or categories such as a purchase of an RV furniture distributor, may not be supported adequately by our current resources, personnel and systems, and may also create new distribution and merchandising challenges, including additional strain on our distribution centers, an increase in information to be processed by our management information systems and diversion of management attention from existing operations. To the extent that we are not able to meet these additional challenges, our sales could decrease, and our operating expenses could increase, which could have a material adverse effect on our business, financial condition and results of operations.

22

Finally, the size, timing, and integration of any future new retail location openings or acquisitions or the acquisition of new businesses, product lines or categories may cause substantial fluctuations in our results of operations from quarter to quarter. Consequently, our results of operations for any quarter may not be indicative of the results that may be achieved for any subsequent quarter or for a full fiscal year. These fluctuations could adversely affect the market price of our common stock.

As a result of the above factors, we cannot assure you that we will be successful in operating our retail locations in new markets or acquiring new businesses, product lines or categories on a profitable basis, and our failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Unforeseen expenses, difficulties, and delays encountered in connection with acquisitions could inhibit our growth and negatively impact our profitability

Our ability to continue to grow through the acquisition of additional retail locations will depend upon various factors, including the following:

| ● | the availability of suitable acquisition candidates at attractive purchase prices; |

| ● | the ability to compete effectively for available acquisition opportunities; |

| ● | the availability of cash on hand, borrowed funds or Class A common stock with a sufficient market price to finance the acquisitions; |

| ● | the ability to obtain any requisite third-party or governmental approvals; and |

| ● | the absence of one or more third parties attempting to impose unsatisfactory restrictions on us in connection with their approval of acquisitions. |

As a part of our strategy, we occasionally engage in discussions with various dealerships and other outdoor lifestyle businesses regarding their potential acquisition by us. In connection with these discussions, we and each potential acquisition candidate exchange confidential operational and financial information, conduct due diligence inquiries, and consider the structure, terms, and conditions of the potential acquisition. Potential acquisition discussions frequently take place over a long period of time and involve difficult business integration and other issues, including in some cases, management succession and related matters. As a result of these and other factors, a number of potential acquisitions that from time to time appear likely to occur do not result in binding legal agreements and are not consummated. In addition, we may have disagreements with potential acquisition targets, which could lead to litigation. Any of these factors or outcomes could result in a material adverse effect on our business, financial condition and results of operations.

Failure to maintain the strength and value of our brands could have a material adverse effect on our business, financial condition and results of operations.