UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________to ________.

Commission file number: 333-210190

VERITAS FARMS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 90-1254190 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

1815 Griffin Road, Suite 401, Dania Beach, FL

33004

(Address of principal executive offices and zip

code)

Registrant’s telephone number, including

area code: (833) 691-4367

Securities registered pursuant to Section 12(b)

of the Act: None

Securities registered pursuant to Section 12(g)

of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (ss.232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting

common equity held by non-affiliates of the registrant computed by reference to the last reported sale price of the common stock quoted

on the OTCQB, operated by OTC Markets Group, Inc., as of June 30, 2021, the last business day of the registrant’s most recently

completed second fiscal quarter, was $7,599,487.

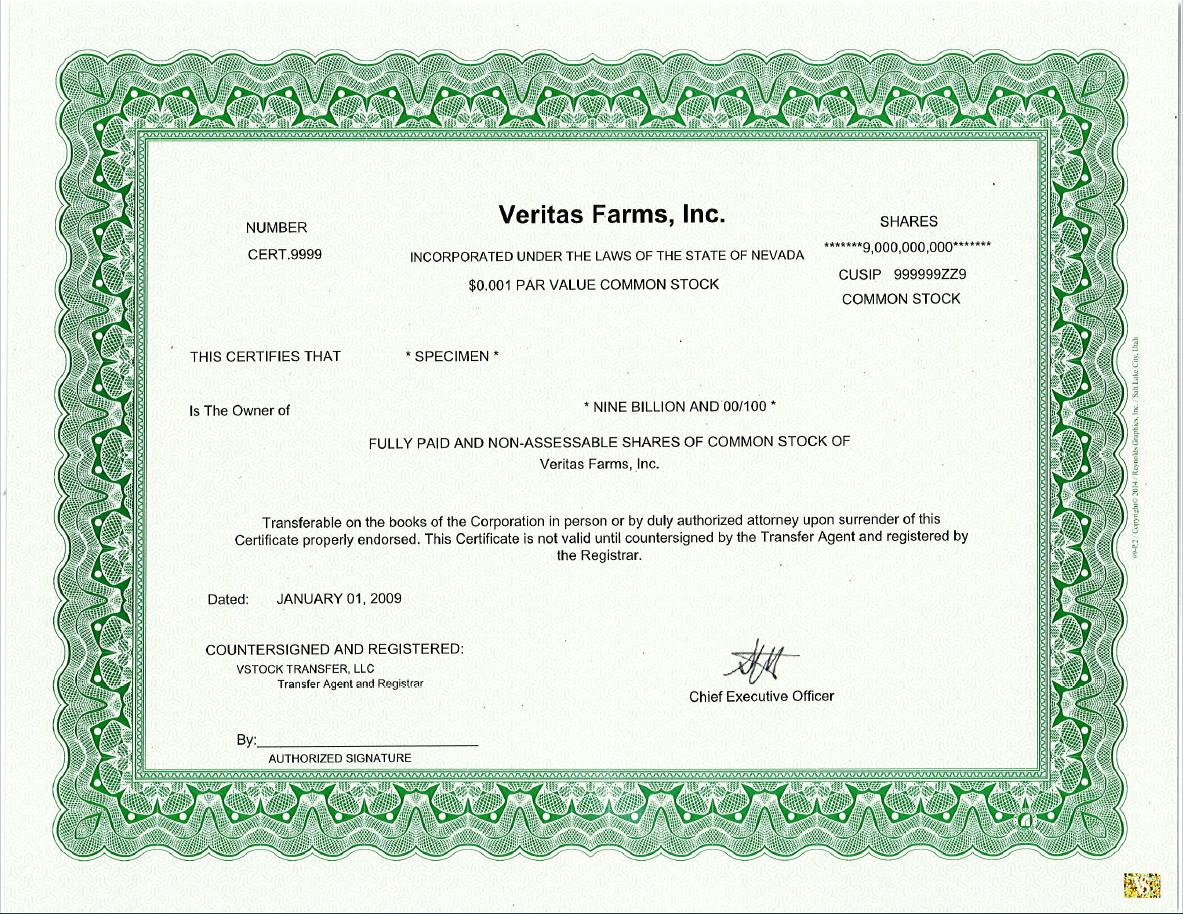

The number of shares outstanding of the registrant’s common stock,

$0.001 par value, as of April 11, 2022 was 41,625,331 shares.

VERITAS FARMS, INC

Annual Report on Form 10-K for the year ended

December 31, 2021

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements made in this report are “forward-looking

statements” regarding the plans and objectives of management for future operations. All statements other than statements of

historical facts contained or incorporated by reference in this report, including statements regarding our future financial position,

business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,”

“believe,” “estimate,” “will,” “may,” “future,” “plan,” “intend”

and “expect” and similar expressions generally identify forward-looking statements. Such statements involve known and unknown

risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements

included herein are based on current expectations that involve numerous risks and uncertainties. Our plans and objectives are based, in

part, on assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions and future

business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Particular

uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

our history of losses; our inability to receive regulatory approval for our products; later discovery of previously unknown problems;

reliance on third parties; competition between us and other companies in the industry; delays in the development of products; our ability

to raise additional capital; continued services of our executive management team; and statements of assumption underlying any of the foregoing,

as well as other factors set forth under the caption “Risk Factors” on page 10 of this report. Although we believe that our

assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there

can be no assurance that the forward-looking statements included in this report will prove to be accurate. In light of the significant

uncertainties inherent in the forward-looking statements included herein particularly in view of the current state of our operations,

the inclusion of such information should not be regarded as a statement by us or any other person that our objectives and plans will be

achieved. Except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements, whether as

a result of new information, future events or otherwise.

Unless the context otherwise requires, references

in this report to “the Company,” “Veritas Farms,” “Veritas,” “we,”

“us” and “our” refer to Veritas Farms, Inc. and its subsidiary. All share and per share information

in this report gives pro forma effect to the implementation of a one for four reverse stock split effective September 20, 2019.

PART I

Item 1. Business.

Business Overview

Veritas Farms, Inc. is a vertically-integrated

agribusiness focused on growing, producing, marketing, and distributing superior quality, whole plant, full spectrum hemp oils and extracts

containing naturally occurring phytocannabinoids (collectively, “CBD”). Veritas Farms™ owns and operates

a 140 acre farm in Pueblo, Colorado, capable of producing over 200,000 proprietary full spectrum hemp plants which can potentially yield

a minimum annual harvest of 250,000 to 300,000 pounds of outdoor-grown industrial hemp. While part of the cannabis family, hemp, which

contains less than 0.3% tetrahydrocannabinol (“THC”), the psychoactive compound that produces the “high” in marijuana,

is distinguished from marijuana by its use, physical appearance and lower THC concentration (marijuana generally has a THC level of 10%

or more). The Company also operates approximately 15,000 square feet of climate-controlled greenhouses to produce a consistent supply

of year-round indoor-cultivated hemp. In addition, there is a 10,000 square foot onsite facility used for processing raw hemp, oil extraction,

formulation laboratories and quality/purity testing. Veritas Farms is registered with the Colorado Department of Agriculture to grow industrial

hemp and with the Colorado Department of Public Health and Environment to process hemp and manufacture hemp products in accordance with

Colorado’s hemp program. The Company primarily conducts its business operations through its wholly-owned subsidiary, 271 Lake Davis

Holdings, LLC, a Delaware limited liability company (“271 Lake Davis”).

Veritas Farms meticulously processes its hemp

crop to produce superior quality whole-plant hemp oil, extracts and derivatives which contain the entire full spectrum of cannabinoids

extracted from the flowers and leaves of hemp plants. Veritas Farms employs the use of the cold ethanol extraction method to extract the

whole plant hemp oil from its hemp crop. Whole-plant hemp oil is known to provide the essential phytocannabinoid “entourage effect”

resulting from the synergistic absorption of the entire full spectrum of unique hemp cannabinoids by the receptors of the human endocannabinoid

system. As a result, Veritas Farms believes that its products are premier quality cannabinoids and are highly sought after by consumers

and manufacturers of premium hemp products.

Veritas Farms has developed a wide variety of

formulated phytocannabinoid-rich hemp products containing naturally occurring phytocannabinoids which are marketed and distributed by

the Company under its Veritas Farms brand name. Our products are also available in bulk, white label and private label custom formulations

for distributors and retailers. These types of products are in high demand by health food markets, wellness centers, pet suppliers, physicians

and other healthcare practitioners.

Veritas Farms products (50+ SKUs) include capsules,

gummies, tinctures, lotions, salves, creams, balm sticks, lip balms and pet chews. All product applications come in various flavors and

strength formulations, in addition to bulk volume sales. Many of the Company’s whole-plant hemp oil products and formulations are

available for purchase online directly from the Company through its Veritas Farms website, www.theVeritasFarms.com, as well as through

numerous other online retailers and “brick and mortar” retail outlets.

The branding of the Company’s line of hemp oil and extract products

has enabled market penetration during 2020 and 2021 into large retail chains vastly increasing brand exposure and awareness. The initial

rollouts have been successful in creating distribution opportunities into thousands of new retail outlets across the country (over 8,000

retail outlets as of the date of this report). The shift from smaller order fulfilment to larger “Big Box” orders creates

an economy of scale that offers the opportunity for the Company to achieve profitability.

Effects of the Current Coronavirus (COVID-19) Pandemic on the Company

The adverse public health developments and economic

effects of the current COVID-19 pandemic in the United States, could adversely affect the Company’s customers and suppliers as a

result of quarantines, facility closures, closing of “brick and mortar” retail outlets and logistics restrictions imposed

or which otherwise occur in connection with the pandemic. More broadly, the high degree unemployment resulting from the pandemic could

potentially lead to an extended economic downturn, which would likely decrease spending, adversely affect demand for our products and

services and harm our business, results of operations and financial condition. The rapidly changing global market and economic conditions

as a result of the COVID-19 pandemic have negatively impacted, and are expected to continue to negatively impact, our operations and business.

The broader implications of the COVID-19 pandemic and related global economic unpredictability on our business, financial condition, and

results of operations remain uncertain. At this time, we cannot accurately predict the effect the COVID-19 pandemic will have on the Company.

Our Mission

Veritas Farms is a pioneer in quality CBD products

and organic farming methods. It is committed to serving the global community by uncompromising on our quality and continuing the pursuit

of cutting-edge, ethical innovation.

Veritas Farms is different from the majority of

our competitors. We produce pure natural hemp derivatives, pesticide residual and solvent free, with whole plant phytocannabinoids. We

achieve the highest potency and purity in the derivative products from our oils.

Veritas Farms is committed to the research and

development of improved proprietary hemp genetics cultivation and innovation in order to provide the global community with uncompromised

quality hemp products, containing the highest quality, quantity and consistency in the industry.

Our commitment to enhancing the symbiotic relationship between healthy

plants and healthy people ensures that we provide whole-plant, broad spectrum cannabinoid-rich hemp products while using only natural

protocols and sustainable farming methods.

Our philosophy is to practice strict natural protocols

for hemp cultivation and utilize the latest technology to assist our sustainable, environmentally sound farming practices to ensure pure,

pesticide free, and high-quality consistent products.

Why Cannabinoids?

Cannabinoid-rich hemp oil is made from the stalks

and leaves of the cannabis sativa plant. Like THC, cannabinoid-rich hemp is an active cannabinoid found in cannabis plants. Unlike THC,

however, cannabinoid-rich hemp has no psychoactive properties and its health benefits may be even more profound than those of THC.

What are cannabinoids? They are chemical

compounds secreted by the flowers of the cannabis plant. Our brains have receptors that respond pharmacologically to them. THC is the

psychoactive cannabinoid, which binds to receptors in the brain, while cannabinoid-rich hemp binds to receptors throughout the body. Whole-plant

hemp extracts are known to provide the essential phytocannabinoid “entourage effect” resulting from the synergistic absorption

of the entire broad spectrum of unique hemp cannabinoids by the receptors of the human endocannabinoid system.

Through our body’s endocannabinoid receptors, cannabinoid-rich

hemp oil can mitigate both pain, swelling and inflammation associated with it. Science has long known about cannabinoid’s analgesic

properties, which is why we now have a number of cannabinoid-rich hemp-infused topical creams and salves designed for direct application

to skin.

There seems to be no end to the painful conditions

for which cannabinoid-rich hemp oil could mean a measure of localized relief. Enthusiasts commonly cite arthritis, menstrual cramps, headaches,

and even plain old muscle soreness or the itchiness from psoriasis and dermatitis as potential targets for the cannabis compound.

Current Industry Factors and Market Opportunity

Typical Cannabinoid Company

Profile. The majority of cannabinoid companies are either farmers/extractors, manufacturers, or retail brands. Farmers often grow

and extract their oil, sometimes selling their oil wholesale to product manufacturers and sometimes manufacturing their own products and

then selling them in bulk to brands that use them for private label products. Retail brands are forced into a state of constant supply

search and often have to order from multiple farmers/extractors in order to ensure their demand is met. This can cause inconsistency in

product potency and quality, often leading to products that do not have an accurate Certificate of Analysis or additional contaminate

tests.

Poor Quality Products,

Morally Questionable Companies. As with any burgeoning new market, opportunistic entrepreneurs and entities have surfaced selling

inferior products that are often misrepresented and mislabeled. These products may contain little to no active cannabinoid compounds,

or contaminated cannabinoid compounds. These entities often seek a quick payday for the company’s founders and take advantage of

the lack of consumer education about the industry.

Lack of Consumer Knowledge/Confusion

in Market Place. New markets and products are often rife with miseducation and misunderstanding. Cannabinoid products are just beginning

to be absorbed by the mainstream public, who may be unaware of the implications of the lack of quality control, proper application, dosing

and uses.

The industrial hemp market is projected to grow at a compound annual

growth rate of 34% from $4.6 billion in 2019 to $26.6 billion by 2025. The growth of this market is attributed to the increased consumption

of hemp-based products. Our goal is to secure as large a share of the growing market for CBD products as possible, by taking advantage

of the fractured nature of the industry, the poor quality products offered by some competitors and the lack of knowledge of the potential

benefits of CBD by means of:

| ● | Offering only the highest quality products by

maintaining control of the growing, extracting and manufacturing processes; |

| | | |

| ● | Providing a one-stop vertically integrated source

for CBD products; |

| | | |

| ● | Increasing demand by educating consumers on the

potential benefits of use of CBD products; and |

| | | |

| ● | Employing an integrated marketing plan across

both traditional and digital channels. |

Our Products

Veritas Farms has developed a wide variety of

formulated phytocannabinoid-rich hemp products containing naturally occurring phytocannabinoids which are marketed and distributed by

the Company under its Veritas Farms brand name. Our products are also available in bulk, white label and private label custom formulations

for distributors and retailers. These types of products are in high demand by health food markets, wellness centers, pet suppliers, physicians

and other healthcare practitioners.

Veritas Farms products (50+ SKUs) include capsules,

gummies, tinctures, lotions, salves, creams, balm sticks, lip balms and pet chews. All product applications come in various flavors and

strength formulations, in addition to bulk volume sales. Many of the Company’s whole-plant hemp oil products and formulations are

available for purchase online directly from the Company through its Veritas Farms website, www.theVeritasFarms.com, as well as through

numerous other online retailers and “brick and mortar” retail outlets.

Our primary products are made as:

| ● | Cannabinoid-rich hemp oil: a pure, concentrated

extract made from the flowers, leaves and stalks of the cannabis species, which is sold at wholesale in bulk wholesale and also used for

Veritas Farms product formulation. |

| | | |

| ● | Cannabinoid-rich hemp capsules and gummies in

easy-to-swallow or chew form. |

| | | |

| ● | Tinctures that are used sublingually as an efficient

way to absorb cannabinoids. |

| | | |

| ● | Topically applied products such as lotions and

oils that are applied directly to the skin, usually to treat a specific spot of pain or inflammation. |

All Veritas Farms products are of the highest-quality

and are third-party laboratory tested for strength/purity, bio-contaminants, heavy metals, pesticides, and solvents. Our core product

lines pipeline include:

| ● | The General Health & Wellness line of products

including hemp oils, capsules, gummies, salves, balm sticks and lip balms. |

| | | |

| ● | The

Functional product line consisting of hemp oils, soft gels, gummies, and sports creams. |

| | | |

| ● | A

CBD-infused line of pet products - Veritas Pets™. |

| | | |

| ● | The Veritas Beauty™ and skin care product

line, encompassing massage oils, salves, lotions and creams. |

Adoption

of a Functional Product Line

Since inception, Veritas Farms has offered a variety

of full-spectrum hemp oil products designed to improve the general health and wellness of our consumers. However, due to the COVID-19

pandemic and evolving needs of our consumers, Veritas will be launching a new purpose-built product line in the second quarter of 2022

designed to target a wider variety of common health conditions, supported with additional dietary supplements.

According to data insights from New Frontier

Data, 82% of consumers that purchase CBD products do so for a specific need. Only 18% of consumers purchase CBD for general health and

wellness. By modifying the cannabinoid potency levels (CBD, CBG, CBN, etc.) and adding in additional natural botanicals and adaptogens

that have a proven benefit for certain health conditions, Veritas has been able to scientifically design a functional line of products

that is specific to the needs of consumers. The new line consists of six products including Sleep Support, Stress Relief, Muscle &

Joint Relief, Immunity Boost, Heart Health, and Energy Boost.

Production

Hemp growth, extraction, processing, formulation

and product manufacturing takes place at our facilities located on our 140-acre farm in Pueblo Colorado. Our farm is capable of producing

over 200,000 plants potentially yielding a minimum annual harvest of 250,000 to 300,000 pounds of outdoor grown hemp.

In addition, the Company’s 15,000 square

feet of climate-controlled greenhouses are capable of producing a consistent supply of approximately 25,000 pounds per year of indoor

cultivated hemp over 4-6 individual harvests.

There is an additional 10,000 square foot on-site

facility used for plant processing and oil extraction, in addition to housing Veritas Farms’ testing and formulation laboratories,

wherein GMP (good manufacturing practices) are strictly maintained.

The production process starts in the ground, with

our cultivation team. Veritas Farms is fortunate to have a team of dedicated, experienced, and passionate farming experts that nurture

our plants with individual care, much like the care and attention paid to vines in a vineyard.

After harvest, our in-house laboratory chemists

and extraction technicians produce varieties of high quality, pure hemp derivative oils while constantly finding methods to improve processes

and improve our products.

Veritas Farms uses advanced, strict natural protocols

to cultivate its cannabinoid-rich hemp oil yield from its plants. After naturally air drying, only the leaves and flowers richly coated

with trichomes are processed with our advanced ethanol spray evaporation extractors according to the planned uses for the cannabinoid-rich

hemp extracts. Whole-plant full spectrum cannabinoid-rich hemp extracts are then further processed using chromatography and other techniques

yielding pure distillates and other derivatives exceeding 80% cannabinoid-rich hemp with 0.3% or less THC.

Marketing and Sales

Overview

The primary target customers and markets for Veritas

Farms products are:

| ● | Ages 25 – 55 (Millennials and Gen Xers) |

| | | |

| o | Health conscious/open minded consumers looking for an “alternative” all-natural approach to

health and wellness |

| | | |

| o | Middle to upper class income levels |

| | | |

| o | Looking to treat chronic disease, illness, pain, stress, sleep, and other specific conditions |

| | | |

| o | Seeking alternatives to pharmaceuticals for chronic conditions |

| | | |

| o | Helps relieve pain and reduce inflammation |

| | | |

| o | Aids in muscle relaxation |

| | | |

| o | Disposable income to spend on pets |

| | | |

The Veritas Farms product line is expected to

continually expand to offer additional products and applications.

Currently, Veritas Farms has implemented a marketing

plan to compete in the cannabinoid industry. To become a market leader in the industry, the Company plans to use three primary channels

to market its products, web-based marketing, traditional marketing and medical marketing.

Web-Based Marketing

General. Veritas Farms’

expanded e-commerce retail platform is designed to offer for sale the Company’s premium phytocannabinoid-rich extract products directly

to consumers under the Veritas Farms brand. The site gives us the ability to quickly adapt to a rapidly evolving market and to position

our branded product lines as a leader in the industry. In addition to our e-commerce platform, Veritas Farms is pursuing distribution

with leading third-party online retailers.

Content Marketing via Blogs

and Social Media. We believe that content marketing offers a cost-effective marketing strategy. The core components to Veritas Farms’

content marketing strategy are blogs and social media posts. Veritas Farms launched an engaging social media campaign to promote an overall

vision of quality and transparent phytocannabinoid products.

Influencer Campaigns.

Influencer marketing is a type of marketing that focuses on using online leaders to drive the brand’s message to the larger market.

Rather than market directly to a large group of consumers, Veritas Farms will partner with influencers to utilize their personal social

channels to spread the word about the brand. Influencers are celebrities, high-quality content creators, buzz builders and promoters and

natural health advocates. Extensive tracking methods will be implemented to determine the effectiveness of the influencer campaigns.

Affiliate Marketing, Affiliate

marketing leverages partners or affiliates that earn a commission for marketing our products. The affiliates are allowed to pick which

products they enjoy selling the most, preferably products they use and find effective, then promote that product to their followers and

earn a piece of the profit. The sales are tracked via affiliate links from their website to ours.

Search Engine Optimization,

(“SEO”). SEO is important for establishing and creating an online presence. Most online interaction starts with key words

manually entered into a search engine, in relevant website options for the user. The Veritas Farms SEO marketing plan contemplates a monthly

campaign to ensure the website ranks in top relevance for industry-related searches on major search engines such as Google, Bing and Yahoo.

Intellectual Property

We do not currently have any patents or copyrights.

We currently own trademark registrations for the marks “VERITAS FARMS”, and “Veritas | Farms”, and a pending trademark

application for the mark “VERITAS FARMS V BE TRULY HEALTHY”.

We rely on a combination of trade secret, including

federal, state and common law rights in the United States, nondisclosure agreements, and other measures to protect our intellectual property.

We require our employees, consultants, and advisors to execute confidentiality agreements and to agree to disclose and assign to us all

inventions conceived under their respective employment, consultant, or advisor agreement, using our property, or which relate to our business.

Despite any measures taken to protect our intellectual property, unauthorized parties may attempt to copy aspects of our products or to

obtain and use information that we regard as proprietary. Our business is affected by our ability to protect against misappropriation

and infringement of our intellectual property, including our trademarks, service marks, domain names, and other proprietary rights.

Government Regulation

We operate our business in markets that are both

highly regulated and rapidly evolving. We are subject to numerous federal, state, local, and foreign laws and regulations affecting our

operations in a number of areas. These laws and regulations affect the Company’s activities in areas including, but not limited

to, the hemp business in the United States, the consumer products and nutritional supplement markets in the United States, consumer protection,

labor, intellectual property ownership and infringement, interstate commerce and taxation, federal and state healthcare, environmental

and safety. The successful execution of our business objectives will be contingent upon our compliance with all applicable laws and regulations

and obtaining all necessary regulatory approvals, permits and registrations, which may be onerous and expensive.

The federal Agricultural Improvement Act of 2018

(“Farm Bill”), signed into law on December 20, 2019, along with the Agricultural Act of 2014, the corresponding Consolidated

Appropriations Act of 2016 provisions (as extended by resolution into 2019) and Colorado’s Industrial Hemp Regulatory Program and

related state law, permit the cultivation of hemp, and the processing and manufacturing of hemp products, as part of agricultural pilot

programs and/or state plans adopted by individual states, including Colorado (pursuant to which we operate). However, there can be no

assurance that new legislation or regulations may be introduced at either the federal and/or state level which, if passed, would impose

new regulatory requirements on the manufacture, packaging, labeling, advertising and distribution and sale of hemp-derived products. New

legislation or regulations may require the reformulation, elimination or relabeling of certain products to meet new standards and revisions

to certain sales and marketing materials and it is possible that the costs of complying with these new regulatory requirements could be

material.

The U.S. Food and Drug Administration (“FDA”),

Federal Trade Commission (“FTC”) and their state-level equivalents, possess broad authority to enforce the provisions of federal

and state law, respectively, applicable to consumer products. These regulations provide consumer safeguards for foods, dietary supplements

and cosmetics, and give the power to these agencies to issue a public warning or notice of violation letter to a company, publicize information

about illegal products, detain illegal products intended for import or export (in conjunction with U.S. Customs and Boarder Protection),

require a recall of illegal products from the market, and request the Department of Justice, or the state-level equivalent, to initiate

a seizure action, an injunction action, or a criminal prosecution in federal. or state courts. The initiation of any regulatory action

towards industrial hemp or hemp derivatives by the FDA, FTC or any other related federal or state agency, could result in greater legal

cost to Veritas Farms, may result in substantial financial penalties and enjoinment from certain business-related activities, and if such

actions were publicly reported, they may have a materially adverse effect on the Company, its business and its results of operations.

Competition

The industrial hemp cultivation and derivative

products industry is relatively new and evolving. Brand recognition, quality, performance, availability, and price are some of the factors

that impact consumers’ choices among competing products and brands. Advertising, promotion, merchandising and the pace and timing

of new product introductions also have a significant impact on consumers’ buying decisions. While we believe that the industry is

fragmented at the present time, there is vigorous competition within each market where our products are sold, and there are numerous competitors,

including Green Roads, Charlotte’s Web, cbdMD, Medterra and CV Sciences, some of whom are larger and have a longer operating history

and greater financial resources than does the Company. Moreover, we may also face competition with larger firms in the consumer products

manufacturing and distribution industry, who elect to enter the market given the relatively low barriers to entry. Veritas Farms believes

that it competes effectively with these companies because of its vertical integration through the cultivation, extraction, formulation,

manufacturing and distribution processes, the quality of its products and customer service. However, no assurance can be given that Veritas

Farms will effectively compete with its existing or future competitors.

Human Capital Resources

We strive to create a high-performance culture

that embraces diversity, inclusion, diverse perspectives and experiences, to ensure that employees have opportunities to develop the skills

they need to grow and excel in their fields. Human capital management is a priority for our executives and board of directors. We are

committed to identifying and developing the talent necessary for our long-term success. We have a robust talent and succession planning

process and have established programs to support the development of our talent pipeline for critical roles in our organization. Annually,

we conduct a robust review with the leadership team focusing on high performing and high potential talent, diverse talent and succession

for our critical roles.

We also recognize that it is important to develop

our future leaders. We provide a variety of resources to help our employees build and develop their skills, including online development

resources as well as individual development opportunities and projects for key talent. Additionally, we have leadership development resources

for our future leaders as they continue to develop their skills.

We also foster a strong corporate culture that

promotes high standards of ethics and compliance for our business, including policies that set forth principles to guide employee, officer,

director, and vendor conduct, such as our Code of Business Conduct and Ethics. We also maintain a whistleblower policy and anonymous hotline

for the confidential reporting of any suspected policy violations or unethical business conduct on the part of our employees, officers,

directors, or vendors.

As of December 31, 2021 we employed 44 full time

employees and consultants Company-wide including 20 of whom are based in Florida, Maryland and California and 24 of whom are based in

Colorado. We believe that relations with our employees are good. None of our employees are represented by a collective bargaining

agreement.

In response to the COVID-19 pandemic, we implemented

significant changes that we determined were in the best interest of our employees as well as the communities in which we operate. These

measures include allowing many employees to work from home and implementing additional safety measures for employees continuing critical

on-site work. We believe in supporting our employees’ health and well-being. Our goal is to help employees make informed decisions

about their health by providing the tools and resources necessary to achieve a healthier lifestyle. We offer our employees a wide array

of benefits such as life and health (medical, dental, and vision) insurance, and paid time off, as well as emotional well-being services

through our health insurance program.

We offer competitive compensation to attract and

retain the best people, and we help care for our people so they can focus on our mission. Our employees’ total compensation package includes

market-competitive salary, bonuses or sales commissions, and equity. We generally offer equity grants to certain full-time employees,

primarily management, after their one-year anniversary of hire and through annual equity grants because we want them to be owners of the

Company and committed to our long-term success. We have conducted an annual pay equity analysis, and continue to be committed to pay equity.

Our Background

Veritas Farms was incorporated as Armeau Brands

Inc. in the State of Nevada on March 15, 2011. On October 13, 2017, the Company filed Amended and Restated Articles of Incorporation with

the Nevada Secretary of State changing the name from “Armeau Brands Inc.” to “SanSal Wellness Holdings, Inc.,”

and on January 31, 2019, the Company filed a Certificate of Amendment to the Articles of Incorporation with the Nevada Secretary of State

changing the name from “SanSal Wellness Holdings, Inc.” to “Veritas Farms, Inc.”

On September 27, 2017, the Company entered into

a Securities Exchange Agreement with all the members of 271 Lake Davis, pursuant to which 271 Lake Davis became a wholly-owned subsidiary

of the Company (the “271 Lake Davis Holdings, LLC Acquisition”). 271 Lake Davis was founded in February 2015 to produce natural

rich-hemp products.

On May 11, 2021, the Company entered into a Securities

Purchase Agreement (“SPA”) with the Cornelis F. Wit Revocable Living Trust, of which Cornelis F. Wit is the trustee (“Wit

Trust”), an existing shareholder, pursuant to which the Company contemporaneously sold to the Wit Trust an aggregate of (a) 2,000,000

shares of its Series A Convertible Preferred Stock (“Series A Preferred Shares”); and (b) 1,000,000 shares of its Series B

Convertible Preferred Stock (“Series B Preferred Shares,” and together with the Series A Preferred Shares, collectively, “Preferred

Shares”) in exchange for (i) the payment of $2,000,000 (including $302,500 principal plus accrued but unpaid interest in bridge

financing provided by the Wit Trust to the Company during April 2021); and (ii) the surrender of 2,000,000 units (“Units”),

each Unit consisting of two shares of common stock and one warrant to purchase an additional share of common stock in accordance with

the terms of the subscription agreements for the purchase of the Units entered into by the Wit Trust and the Company in September and

October 2020. As a result of the transaction and the voting rights accorded the Preferred Shares, the Wit Trust then held approximately

88% of the voting power of the Company and accordingly, a “Change in Control” occurred.

Pursuant to the SPA, the Wit Trust and the Company

agreed to fix the number of members of the board of directors of the Company at five (5), three of whom shall be designated by the Wit

Trust and two of whom shall be “independent” and acceptable to the Wit Trust. In addition, the Wit Trust has been accorded

certain registration rights under the Securities Act of 1933 (“Securities Act”), as amended, with respect to the shares of

common stock issuable upon conversion of the Preferred Shares and ongoing financial and other information rights with respect to the Company.

In connection with the consummation of the issuance

and sale of the Preferred Shares to the Wit Trust pursuant to the SPA, Alexander M. Salgado stepped down as the Company’s Chief

Executive Officer and director, and Dr. Bao T. Doan and Marc J. Horowitz resigned as directors of the Company. In addition, Michael Pelletier

stepped down as an employee of the Company and entered into a three-month consulting agreement with the Company to continue as the Company’s

Chief Financial Officer until his successor is appointed.

Contemporaneously therewith, Stephen E. Johnson

(“Mr. Johnson”), Kuno D. van der Post (“Dr. van der Post”) and Craig J. Fabel (“Mr. Fabel”) were elected

and appointed as the Wit Trust’s designees on the board of directors. In addition, Mr. Johnson was appointed as Chief Executive

Officer and President of the Company, and Ramon A. Pino (“Mr. Pino”), was appointed as Executive Vice President of Finance,

Treasurer and Secretary of the Company.

Available Information

Our website address is www.theVeritasFarms.com.

The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into this report or any other

filings we make with the Securities and Exchange Commission (“SEC”). We file annual, quarterly, and current reports with

the SEC. Our SEC filings, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and

any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (“Exchange Act”)

are available free of charge over the Internet at the SEC’s web site at www.sec.gov. Our SEC filings are not posted on our website.

Item 1A. Risk Factors.

An investment in our securities is speculative

in nature and involves a high degree of risk. In addition to the other information contained in this report, our stockholders and

prospective investors should carefully consider the following risk factors in evaluating us and our business, any of which could materially

adversely affect our business, financial condition, or operating results and could result in a loss of your investment.

We have a history of losses, a large accumulated deficit and may

incur future losses. We may be unable to achieve or maintain profitability in the future.

The Company commenced operations in 2016 and began

generating commercial revenues in 2017. The Company incurred net losses of $7,263,567, $7,592,539 and $11,147,608 for the years ended

December 31, 2021, 2020, and 2019, respectively. At December 31, 2021, we had an accumulated deficit of $33,930,714. We are subject to

all the problems, expenses, difficulties, complications and delays encountered in establishing a new business. The Company does not

know if it will become commercially viable and ever generate significant revenues or operate at a profit.

We have incurred a material amount of indebtedness

to fund our operations, the terms of which have required us to pledge substantially all of our assets as security. Our ability to conduct

our business could be materially affected if we were unable to repay or extend the maturity dates of our outstanding indebtedness.

As of the filing date of this report, we had outstanding

borrowings of $2,002,422 of principal amount, of which:

| ● | approximately $200,000 at 10% interest is due

in October 2022; |

| ● | approximately $37,304 at 9.5% interest is due

in December 2022; |

| ● | approximately $10,614 at 9.5% interest is due

in May 2023; |

| ● | approximately $50,510 at 7.2% interest is due

in September 2024; |

| ● | approximately $750,000 at 10% interest is due

in October 2024 (“Credit Line”); |

| ● | approximately $803,994 at 1% interest is due

in February 2026; and |

| ● | approximately $150,000 at 3.75% interest is due

in June 2050; |

Further, in connection with the Credit Line which

is for an amount up to $1,500,000 by the Wit Trust, we have granted the trust a security interest in our assets, such that all of our

tangible and intangible assets are subject to a lien held by the trust. See Note 13: Subsequent Events

The debt instruments include events of default,

including, among other things, payment defaults, any breach by us of representations, warranties or covenants, certain bankruptcy events

and, and in connection with the Credit Line, if any lawsuit, money judgment, writ or similar process is entered or filed against us or

our subsidiary or any of our assets for more than $100,000. If an event of default were to occur under any of the debt instruments and

we were unable to obtain a waiver for the default or extend the maturity dates of the debt instruments, the counterparties could, among

other remedies, accelerate our obligations under the debt instrument, and in connection with the Credit Line exercise the creditor’s

right to foreclose on their security interests, which would cause substantial harm to our business and prospects.

The Company needs additional financing to continue

operations and become profitable; if we do not raise additional capital, we will need to curtail or cease operations; and our financial

statements contain a going concern qualification.

We require additional capital for the development

of our business operations. We may also encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that

may increase our capital needs and/or cause us to spend our cash resources faster than we expect. Accordingly, we will need to obtain

additional funding in order to continue our operations. The uncertainties surrounding our ability to fund our operations raise substantial

doubt about our ability to continue as a going concern.

To date, the Company has funded its development activities primarily

through private placements of equity, capital contributions from its principals and stockholder loans. As of December 31, 2021, we had

approximately $481,763 in cash. The report of our independent registered public accounting firm on our financial statements for the year

ended December 31, 2021, includes an explanatory paragraph stating that our lack of revenues and working capital raise substantial doubt

about our ability to continue as a going concern. To become profitable, the Company will require additional financing. There can

be no assurance that additional financing will be available to the Company when needed, on favorable terms or otherwise. The exact

amount of additional financing raised, if any, will determine how quickly we can reach profitability on our operations. If additional

funding is not obtained, we may need to reduce, defer or cancel product development efforts, our production and marketing operations,

or overhead expenditures to the extent necessary. Moreover, any such additional financing may dilute the interests of existing stockholders. The

absence of additional financing, if and when needed, could cause the Company to delay full implementation of its business plan in whole

or in part, curtail its business activities, seriously harm the Company and its prospects and have an adverse effect on the Company’s

financial condition and results of operations.

We cannot accurately predict the long-term

adverse effects of the current COVID-19 pandemic on the Company.

The adverse public health developments and economic

effects of the current COVID-19 pandemic in the United States, could adversely affect the Company’s customers and suppliers as a

result of quarantines, facility closures, closing of “brick and mortar” retail outlets and logistics restrictions imposed

or which otherwise occur in connection with the pandemic. More broadly, negative global and national economic trends, such as decreased

consumer and business spending, high unemployment levels and declining consumer and business confidence resulting from the pandemic could

potentially lead to an extended economic downturn, which would likely decrease spending, adversely affect demand for our products and

services and harm our business, results of operations and financial condition. At this time, we cannot accurately predict the long-term

effects the COVID-19 pandemic will have on the Company.

Our limited operating history makes it difficult

for potential investors to evaluate our business prospects.

The Company commenced operations in 2016 and began

generating commercial revenues in 2017. Accordingly, we have a limited operating history upon which to base an evaluation of our business

and prospects. Operating results for future periods are subject to numerous uncertainties, and we cannot assure you that the Company will

achieve or sustain profitability in the future.

The Company’s prospects must be considered

in light of the risks encountered by companies in the early stage of development, particularly companies in new and rapidly evolving markets.

Future operating results will depend upon many factors, including our success in attracting and retaining motivated and qualified personnel,

our ability to establish credit lines or obtain financing, our ability to develop and market new products, our ability to control costs,

and general economic conditions. We cannot assure you that the Company will successfully address any of these risks. There can be no assurance

that our efforts will be successful or that we will ultimately be able to attain profitability.

The Company’s ultimate success will be

dependent in part on our ability to successfully develop, produce and market a portfolio of natural phytocannabinoid-rich industrial hemp

products, and market acceptance of our planned products.

Our ultimate success will be dependent in part

on our ability to successfully develop, produce and market a portfolio of natural phytocannabinoid-rich industrial hemp products. We are

an agribusiness and grow our product indoors and outdoors, and there are risks associated with the production of our product relating

to such things as weather, soil deterioration, and infestation that could affect our supplies and inventory. In addition, market acceptance

by and demand for our products from consumers will also be key factors in our ability to succeed. If we are unable to develop and market

our portfolio of existing and planned products or if they are not accepted by consumers, our business, results of operations and financial

condition could be seriously harmed.

We face substantial risk of product liability

claims and potential adverse product publicity.

Like any other retailer, distributor or manufacturer

of products that are designed to be ingested, we face an inherent risk of exposure to product liability claims, regulatory action and

litigation if our products are alleged to have caused loss or injury. Although we carry products liability insurance, a successful products

liability claim brought against us that is in excess of our insurance coverage limits or assertion or settlement of any uninsured claim,

or a significant number of insured claims could have a material adverse effect on our business and results of operations.

A significant product defect or product recall

could materially and adversely affect our brand image, causing a decline in our sales and profitability, and could reduce or deplete our

financial resources.

A significant product defect could materially

harm our brand image and could force us to conduct a product recall. This could damage our relationships with our customers and reduce

end-user loyalty. A product recall would be particularly harmful to us because we have limited financial and administrative resources

to effectively manage a product recall and it would detract management’s attention from implementing our core business strategies.

As a result, a significant product defect or product recall could cause a decline in our sales and profitability and could reduce or deplete

our financial resources.

We need to undertake additional significant

marketing efforts for our present and planned products.

Until 2019, our marketing efforts were limited

in large part to sales in the business-to-business channel. In order to achieve profitability, we need to undertake significant marketing

efforts for our existing and planned products in the business-to-consumer and medical channels, including building awareness of our Veritas

Farms™ brand and promoting both online and “brick and mortar” sales. While we have significantly expanded our efforts

since 2019, these marketing efforts must continue on an ongoing basis. There is no assurance that any marketing strategy we develop can

be successfully implemented or if implemented, that it will result in significant sales of our existing and planned products.

Our agreements with customers do not require

the purchase of any specified amount of products.

Our agreements with customers do not require them

to purchase any specified amounts of our products or dollar amounts of sales or to make any purchases whatsoever. Therefore, we cannot

assure you that, in any future period, our sales generated from our customers, individually or in the aggregate, will equal or exceed

historical levels. We also cannot assure you that, if sales to any of our customers cease or decline, we will be able to replace these

sales with sales to either existing or new customers in a timely manner, or at all. A cessation or reduction of sales, or a decrease in

the prices of products sold to one or more of these customers could cause a significant decline in our net sales and profitability.

If the Company fails to properly manage its

anticipated growth, the Company’s business could suffer.

A significant part of the Company’s strategy

will be to expand sales and marketing of its existing products into new channels and geographic markets and develop, sell and market additional

products, such as those in its Veritas Farms™ product line. As we continue to grow our business and develop products, we expect

to need additional research, development, managerial, operational, sales, marketing, financial, accounting, legal and other resources.

The Company expects its growth to place a significant strain on management, as well as on operational and financial resources and systems.

To manage growth effectively, the Company will need to maintain a system of management controls, and attract and retain qualified personnel,

as well as develop, train and manage management-level and other employees. Failure to manage our anticipated growth effectively could

cause us to over-invest or under-invest in infrastructure, and result in losses or weaknesses in our infrastructure, which could have

a material adverse effect on the ability to successfully implement our planned growth strategies, as well as on the Company’s business,

results of operations and financial condition.

Our management may not be able to control costs

in an effective or timely manner.

The Company’s management has used reasonable

efforts to assess, predict and control costs and expenses. However, the Company only has a limited operating history upon which to base

those efforts. Implementing our business plan may require more employees, capital equipment, supplies or other expenditure items than

management has predicted. Likewise, the cost of compensating employees and consultants or other operating costs may be higher than management’s

estimates, which could lead to sustained losses.

We expect our quarterly financial results to

fluctuate.

We expect our net sales and operating results

to vary significantly from quarter to quarter due to a number of factors, including changes in:

| ● | Demand for our products; |

| ● | Our ability to obtain and retain existing customers

or encourage repeat purchases; |

| ● | Our ability to manage our product inventory; |

| ● | General economic conditions, both domestically

and in foreign markets; |

| ● | Advertising and other marketing costs; and |

| ● | Costs of creating and expanding product lines. |

As a result of the variability of these and other

factors, our operating results in future quarters may be below the expectations of our stockholders.

Cybersecurity breaches of our IT systems could degrade our ability

to conduct our business operations and deliver products and services to our customers, delay our ability to recognize revenue, compromise

the integrity of our software programs, result in significant data losses and the theft of our intellectual property, damage our reputation,

expose us to liability to third parties and require us to incur significant additional costs to maintain the security of our networks

and data.

We increasingly depend upon our IT systems to

conduct virtually all of our business operations, ranging from our internal operations and product development activities to our marketing

and sales efforts and communications with our customers and business partners. Computer programmers may attempt to penetrate our network

security, or that of our website, and misappropriate our proprietary information or cause interruptions of our service. Because the techniques

used by such computer programmers to access or sabotage networks change frequently and may not be recognized until launched against a

target, we may be unable to anticipate these techniques. In addition, sophisticated hardware and operating system software and applications

that we produce or procure from third parties may contain defects in design or manufacture, including “bugs” and other problems

that could unexpectedly interfere with the operation of the system. We have also outsourced a number of our business functions to third-party

contractors, and our business operations also depend, in part, on the success of our contractors’ own cybersecurity measures. Similarly,

we rely upon distributors, resellers and system integrators to sell our products and our sales operations depend, in part, on the reliability

of their cybersecurity measures. Additionally, we depend upon our employees to appropriately handle confidential data and deploy our IT

resources in a safe and secure fashion that does not expose our network systems to security breaches and the loss of data. Accordingly,

if our cybersecurity systems and those of our contractors fail to protect against unauthorized access, sophisticated cyberattacks and

the mishandling of data by our employees and contractors, our ability to conduct our business effectively could be damaged.

The market for CBD products is highly competitive

and the Company faces substantial competition. If we are unable to compete effectively in the market, our business and operating results

could be materially and adversely affected.

The industrial hemp cultivation and derivative

products industry is relatively new and rapidly evolving. While we believe that the industry is fragmented at the present time, there

are numerous competitors, including Green Roads, Charlotte’s Webb, Folium Biosciences, Mary’s Nutritional and CV Sciences,

some of whom are larger and more well-established with a longer operating history and greater financial resources than does the Company.

Moreover, we may also face competition with larger firms in consumer products manufacturing and distribution industry, who elect to enter

the market given the relatively low barriers to entry. The Company believes that it competes effectively with its competitors because

of its vertical integration through the cultivation, extraction, formulation, manufacturing and distribution processes, the quality of

its products and customer service. However, no assurance can be given that the Company will effectively compete with its existing or future

competitors. In addition, competition may drive the prices of our products down, which may have a materially adverse effect on our business.

Given the rapid changes affecting the global,

national and regional economies generally, and the CBD industry specifically, the Company may experience difficulties in further establishing

and maintaining a competitive advantage in the marketplace. The Company’s success will depend on our ability to keep pace with any

changes in such markets, especially legal and regulatory changes. Our success will depend on our ability to respond to, among other things,

changes in the economy, market conditions and competitive pressures. Any failure to anticipate or respond adequately to such changes could

have a material adverse effect on the Company’s business, financial condition and results of operations.

Our failure to appropriately and timely respond to changing consumer

preferences and demand for new products and services could significantly harm our customer relationships and have a material adverse effect

on our business, financial condition and results of operations.

Our business is subject to changing consumer trends

and preferences. Our failure to accurately predict or react to these trends could negatively impact consumer opinion of us as a source

for the latest products, which in turn could harm our customer relationships and cause us to lose market share. The success of our product

offerings depends upon a number of factors, including our ability to:

| ● | Anticipate customer needs; |

| ● | Innovate and develop new products; |

| ● | Successfully introduce new products in a timely

manner; |

| ● | Price our products competitively with retail

and online competitors; |

| ● | Deliver our products in sufficient volumes and

in a timely manner; and |

| ● | Differentiate our product offerings from those

of our competitors. |

If we do not introduce new products or make enhancements

to meet the changing needs of our customers in a timely manner, some of our products could be rendered obsolete, which could have a material

adverse effect on our financial condition and results of operations.

Recent turnover with our executive officers

and board of directors may disrupt our operations, our strategic focus or our ability to drive stockholder value.

There have been significant changes to our executive

officers and board of directors in May 2021 as previously reported in our Current Report on Form 8-K filed May 12, 2021. On May 12, 2021,

in accordance with the terms of a Securities Purchase Agreement dated May 12, 2021 with the Wit Trust, an existing stockholder, and the

sale to the Wit Trust of the Series B Convertible Preferred Stock and Series A Convertible Preferred Stock, (i) Dr. Bao T. Doan and Marc

J. Horowitz stepped down from the board of directors, (ii) Alexander M. Salgado stepped down as Chief Executive Officer and a director

of the Company, (iii) Michael Pelletier stepped down as an employee of the Company, except pursuant to a consulting agreement entered

into with Mr. Pelletier on the same date, he continued to serve as Chief Financial Officer until August 11, 2021, (iv) Mr. Johnson, Dr.

van der Post and Mr. Fabel were elected and appointed as directors on the board of directors, (v) Thomas E. Vickers, an incumbent director,

was appointed as Chairman of the Board, (vi) Mr. Johnson was appointed as Chief Executive Officer and President of the Company, and (vii)

Mr. Pino was appointed as Executive Vice President of Finance, Treasurer and Secretary of the Company, and who was subsequently appointed

as Chief Financial Officer on August 11, 2021. Turnover among our executive officers and board of directors may disrupt our operations,

our strategic focus or our ability to drive stockholder value, and could have a material adverse effect on our operations, business and

financial condition.

We are dependent upon our executive officers

and the loss of any of such individuals could have an adverse effect on the Company.

Our success depends in large part upon the efforts

of Mr. Johnson, our Chief Executive Officer and our other executive officers, including Dave Smith (“Mr. Smith”), our Chief

Operating Officer and Mr. Pino, our Chief Financial Officer. While we are party to employment agreements with Mr. Johnson and Mr. Pino,

we do not currently maintain “key man” life insurance on any of our executive officers. Accordingly, the loss of the services

of any of our executive officers, could potentially have a material adverse effect on the Company.

The Company’s success will be dependent

in part upon its ability to attract qualified personnel and consultants.

The Company’s success will be dependent

in part upon its ability to attract qualified management, operational, administrative, product development and marketing and sales personnel

and consultants. The inability to do so on favorable terms may harm the Company’s proposed business.

Increases in costs, disruption of supply or shortage of materials,

including raw materials could harm our business.

The Company may experience increases in the cost

or a sustained interruption in the supply or shortage of materials needed for the growing and production of its products. Any such an

increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results.

We use various materials, including raw materials, in our business. The prices for these materials fluctuate depending on market conditions

and global demand for these materials and could adversely affect our business and operating results. Substantial increases in the prices

for our materials increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased

prices for our products and services.

Natural elements and adverse weather events

can disrupt our business.

Our business involves the growing of hemp, an

agricultural product. Such business will be subject to the risks inherent in the agricultural business, such as insects, plant diseases

and similar agricultural risks. Further, to the extent that our products are grown outside, we are subject to weather and climate conditions.

Extended cold streaks, rain or snow, or generally cold weather or adverse climate conditions, could materially adversely affect our hemp

plants. Accordingly, there can be no assurance that natural elements will not have a material adverse effect on any future production

of our products.

There is limited availability of clinical studies

regarding industrial hemp-based products.

Although hemp plants have a long history of human

consumption, there is little long-term experience with human consumption of certain of these innovative product ingredients or combinations

thereof in concentrated form. Although the Company performs research and/or tests the formulation and production of its products, there

is limited clinical data regarding the safety and benefits of ingesting industrial hemp-based products. Any instance of illness or negative

side effects of ingesting industrial hemp-based products would have a material adverse effect on our business and operations.

We do not have any business interruption insurance, and this may

cause us to be unable to continue as a going concern if there is an interruption to our business.

There are a variety of things that may cause an

interruption in our business, such as weather events. We do not carry business interruption insurance, which means that if our business

is interrupted, we could be unable to produce, develop and market our products, and could lose substantial revenue and cash flow, materially

harming our business, operations, and financial results.

We depend upon our trademarks and proprietary rights, and any failure

to protect our intellectual property rights or any claims that we are infringing upon the rights of others may adversely affect our competitive

position.

Our commercial success depends, in large part,

on our ability to obtain, maintain and protect our current and future brands (including Veritas Farms™), our proprietary formulations

and products and to defend our intellectual property rights. Our ability to successfully implement our business plan depends on our ability

to build and maintain brand recognition using trademarks, service marks, trade dress and other intellectual property. We cannot be sure

that trademarks will be issued with respect to any future trademark applications or that our competitors will not challenge, invalidate

or circumvent any existing or future trademarks issued to us. We may rely on trade secret, trademark, patent and copyright laws, and confidentiality

and other agreements with employees and third parties, all of which offer only limited protection. The steps we have taken and the steps

we will take to protect our proprietary rights may not be adequate to preclude misappropriation of our proprietary information or infringement

of our intellectual property rights. If our efforts to protect our intellectual property are unsuccessful or inadequate, or if any third

party misappropriates or infringes on our intellectual property, the value of our brands may be harmed, which could have a material adverse

effect on the Company’s business and prevent our brands from achieving or maintaining market acceptance. Protecting against unauthorized

use of our trademarks and other intellectual property rights may be expensive, difficult and in some cases not possible. In some cases,

it may be difficult or impossible to detect third-party infringement or misappropriation of our intellectual property rights, and proving

any such infringement may be even more difficult.

The Company may experience difficulty opening or maintaining bank

accounts.

Because the use, sale and distribution of cannabis

remains illegal under federal law, many banks will not accept deposits from or provide other bank services to businesses involved with

cannabis. Consequently, those businesses involved in the cannabis industry continue to encounter difficulty establishing banking relationships,

which may increase over time. Our inability to maintain our current bank accounts would make it difficult for us to operate our business,

increase our operating costs, and pose additional operational, logistical and security challenges and could result in our inability to

implement our business plan. Furthermore, the inability to open bank accounts may make it difficult for our existing and potential customers

to operate and may make it difficult for them to contract with us.

Laws and regulations affecting the CBD industry

are evolving under the Farm Bill, and changes to applicable regulations may materially affect our future operations in the CBD market.

The CBD used by the Company is derived from hemp

as defined in the Farm Bill and codified at 7 USC 1639o means “the plant Cannabis sativa L. and any part of that plant, including

the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with

a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis.” The cannabis sativa plant and

its derivatives may also be deemed marijuana, depending on certain factors. “Marijuana” is a Schedule I controlled substance

and is defined in the Federal Controlled Substances Act (“CSA”) at 21 USC Section 802(16) as “all parts of the plant

Cannabis sativa L., whether growing or not; the seeds thereof; the resin extracted from any part of such plant; and every compound, manufacture,

salt, derivative, mixture, or preparation of such plant, its seeds or resin.” Exemptions to that definition provided in 21 USC Section

802(16) include “the mature stalks of such plant, fiber produced from such stalks, oil or cake made from the seeds of such plant,

any other compound, manufacture, salt, derivative, mixture, or preparation of such mature stalks (except the resin extracted therefrom),

fiber, oil, or cake, or the sterilized seed of such plant which is incapable of germination” or hemp as defined in 7 USC 1639o.

Substances meeting the definition of hemp in the

Farm Bill and 7 USC 1639o may be used in clinical studies and research through an Investigational New Drug (“IND”) application

with the FDA. Substances scheduled as controlled substances, like marijuana, require more rigorous regulation, including interaction with

several agencies including the FDA, the U.S. Drug Enforcement Administration (“DEA”), and the National Institute on Drug Abuse

within the National Institutes of Health (“NIH”).

Accordingly, if the CBD used by the Company is

deemed marijuana and, therefore, a Schedule I controlled substance, the Company could be subject to significant additional regulation,

as well as enforcement actions and penalties pertaining to the CSA, and any resulting liability could require the Company to modify or

cease its operations.

Furthermore, in conjunction with the Farm Bill,

the FDA released a statement about the status of CBD as a nutritional supplement, noting that the Farm Bill explicitly preserved the FDA’s

authority to regulate products containing cannabis or cannabis-derived compounds under the Federal Food, Drug, and Cosmetic Act ( “FDCA”)

and Section 351 of the Public Health Service Act. Any difficulties we experience in complying with existing and/or new government regulation

could increase our operating costs and adversely impact our results of operations in future periods. The FDA has issued guidance titled

“FDA Regulation of Cannabis and Cannabis-Derived Products, Including Cannabidiol (CBD)” pursuant to which the FDA has taken

the position that CBD is prohibited from use as an ingredient in a food or beverage or as a dietary ingredient in or as a dietary supplement

based on several provisions of the FDCA. In the definition of “dietary supplement” found in the FDCA at 21 USC 321(ff), an

article authorized for investigation as a new drug, antibiotic, or biological for which substantial clinical investigations have been

instituted and for which the existence of such investigations has been made public, is excluded from the definition of dietary supplement.

A similar provision in the FDCA at 21 USC 331(ll) makes it a prohibited act to introduce or deliver into commerce any food with a substance

that was investigated as a new drug prior to being included in a food. There are no similar exclusions for the use of CBD in non-drug

topical products, as long as such products otherwise comply with applicable laws. The FDA created a task force to address the further

regulation of CBD and other cannabis-derived products and is currently evaluating the applicable science and pathways for regulating CBD

and other cannabis-derived ingredients.

As a result of the Farm Bill’s recent passage,

we expect that there will be a constant evolution of laws and regulations affecting the CBD industry which could affect the Company’s

plan of operations. Local, state and federal hemp laws and regulations may be broad in scope and subject to changing interpretations.

These changes may require us to incur substantial costs associated with legal compliance and may ultimately require us to alter our business

plan. Furthermore, violations of these laws, or alleged violations, could disrupt our business and result in a material adverse effect

on our operations. We cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible that

regulations may be enacted in the future that will be directly applicable to our business.

Changes to state laws pertaining to industrial

hemp could slow the use of industrial hemp, which could impact our revenues in future periods. Approximately 40 states have authorized

industrial hemp programs pursuant to the Farm Bill. Additionally, various states have enacted state-specific laws pertaining to the handling,

manufacturing, labeling, and sale of CBD and other hemp products. Compliance with state-specific laws and regulations could impact our

operations in those specific states. Continued development of the industrial hemp industry will be dependent upon new legislative authorization

of industrial hemp at the state level, and further amendment or supplementation of legislation at the federal level. Any number of events

or occurrences could slow or halt progress all together in this space. While progress within the industrial hemp industry is currently

encouraging, growth is not assured, and while there appears to be ample public support for favorable legislative action, numerous factors

may impact or negatively affect the legislative process(es) within the various states where we have business interests.

Our business is subject to compliance with

government regulation, and the failure and costs associated therewith to comply with present and future government regulation could harm

our business, results of operations, financial condition and prospects, could put us out of business and could cause you to lose your

entire investment.

We are subject to numerous federal, state, local,

and foreign laws and regulations, including those relating to:

| ● | the production of our products; |

| | | |

| ● | environmental protection; |

| | | |

| ● | interstate commerce and taxation; and |

| | | |

| ● | workplace and safety conditions, minimum wage

and other labor requirements. |

The Farm Bill, along with the Agricultural Act

of 2014, the corresponding Consolidated Appropriations Act of 2016 provisions (as extended by resolution into 2018) and Colorado’s

Industrial Hemp Regulatory Program and related state law, provide for the cultivation of hemp, and processing and manufacturing of hemp