UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2317-1

NB Crossroads Private Markets Fund IV (TI) - Client LLC

(Exact name of registrant as specified in charter)

325 North Saint Paul Street

49th Floor

Dallas, TX 75201

(Address of principal executive offices) (Zip code)

James Bowden, Chief Executive Officer and President

Neuberger Berman Investment Advisers LLC

53 State Street

Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-476-8800

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Financial Statements

For the year ended March 31, 2022

NB Crossroads Private Markets Fund IV (TI) - Client LLC

(Unaudited)

MARKET OVERVIEW

The last two years have been defined by the broader healthcare and economic impacts of COVID-19 and the world’s adjustment to changes in work and lifestyle habits. As vaccines paved the way for an easing of restrictions and the reopening of economies, 2021 marked a turning point for many economies with a strong rebound in growth, albeit clouded by inflationary pressures, and the prospect of higher interest rates. Against this backdrop, NB Crossroads Private Markets Fund IV (TI) - Client LLC (the “Fund”) has continued to perform well.

Volatility increased across markets at the start of 2022, with many indices declining significantly in the early months of the year. The terrible events in Ukraine have led to heightened volatility in markets as governments grapple with the potential longer-term impacts to economies and international relations, not to mention the devastating humanitarian crisis.

We believe the private equity model, with active governance and potential to drive real value at underlying companies, is a significant advantage in this uncertain environment. Private equity managers can be quick to react to change, and importantly take advantage of opportunities. We believe the Fund’s underlying portfolio is comprised of market-leading private equity managers and companies that have secular growth trends and should be relatively resilient to inflationary pressures. Despite the uncertain environment so far in 2022, we believe the Fund has a portfolio that is well positioned to generate value for our investors.

FUND OVERVIEW

The Fund invests all or substantially all of its assets in NB Crossroads Private Markets Fund IV Holdings LP (the “Master Fund” and together with the Fund, “PMF IV”). The Master Fund has the same investment objective, investment policies and restrictions as its feeder funds. This form of investment structure is commonly known as a "master/feeder" structure. PMF IV seeks to achieve its objective by investing in a diversified global portfolio of high quality third- party private equity funds (“Portfolio Funds”), including secondary investments in underlying Portfolio Funds acquired from investors in such Portfolio Funds, pursuing investment strategies in small and mid-cap buyout, large-cap buyout, special situations (primarily distressed-oriented strategies), and venture and growth capital, and by co-investing directly in portfolio companies alongside Portfolio Funds and other private equity firms. PMF IV is now fully committed to a diversified set of Portfolio Funds and portfolio companies and allocated across by investment strategy, asset class, industry, sponsor and geography, and is maturing towards the latter portion of its investment period.

The Fund generated a 27.61% total return on a net asset value (NAV) basis for the 12 months ended March 31, 2022. PMF IV performed strongly across its three key transaction types: primary, secondary and co-investments. Among the key value drivers, PMF IV benefitted mostly from an increase in value from its position in a leading North American buyout fund that specializes in business services companies that primarily serve the public sector. PMF IV also benefitted from exposure to two leading European growth equity and buyout funds that experienced significant appreciation primarily within their technology and healthcare portfolios. On the other hand, PMF IV generated negative performance from a co-investment in a North American publicly traded technology business.

The portfolio composition, industries and holdings of the Fund are subject to change without notice. The opinions are as of the date of this report and are subject to change without notice.

NB Crossroads Private Markets Fund IV (TI) - Client LLC

(Unaudited)

Fund Performance – Average Annual Total Return Ended 3/31/2022

| 1 Year | 5 Year | Since Inception | ||||||||||

| NB Crossroads Private Markets Fund IV (TI) - Client LLC* | 27.61 | % | 16.53 | % | 6.60 | % | ||||||

MSCI World Index (Net)** | 10.12 | % | 12.42 | % | 13.54 | % | ||||||

The performance data quoted represent past performance and does not predict future performance. Current performance may be lower or higher than the performance data quoted.

The results shown in the table reflect the reinvestment of distributions, if any. The results do not reflect the effect of taxes a Fund investor (“Investor”) would pay on Fund distributions or on the sale of the Fund’s limited liability company interests (the ‘‘Interests’’).

Unlike open-end funds, the Fund’s Interests are not continually offered. The Fund offered its Interests only to persons or entities that are both ‘‘accredited investors’’ as defined in Section 501(a) of Regulation D under the Securities Act of 1933, as amended (the ‘‘Securities Act’’), and ‘‘qualified clients’’ as defined in Rule 205-3 under the Investment Advisers Act of 1940, as amended, in private placement transactions that do not involve any ‘‘public offering’’ within the meaning of Section 4(a)(2) of, and/or Regulation D under, the Securities Act.

* The Fund commenced operations on November 15, 2016.

** The MSCI World Index captures large and mid cap representation across 23 Developed Markets countries. With 1,539 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Developed Markets countries include Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. The index is unmanaged and does not include fees. Investors may not invest in the index directly.

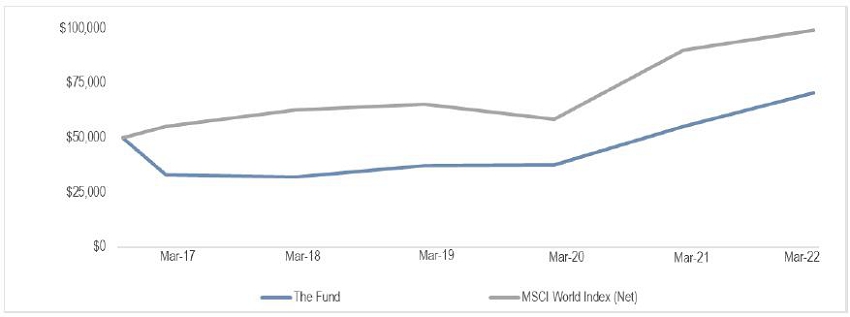

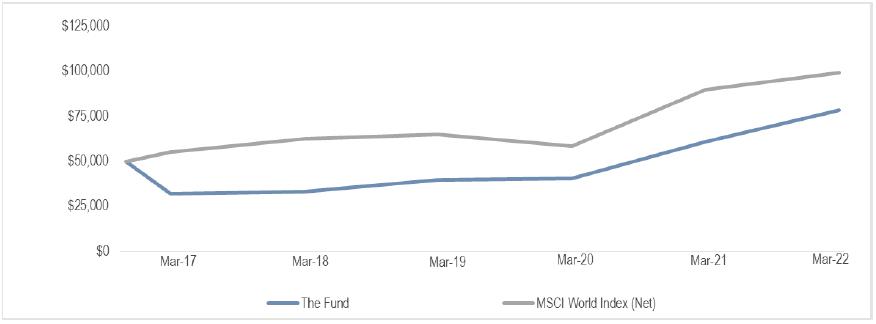

Growth of $50,000 Investment

This graph shows the change in value of a hypothetical $50,000 investment in the Fund for the life of the Fund since commencement of operations. The results shown in the graph reflect the reinvestment of Fund distributions, if any. The results do not reflect the effect of taxes an Investor would pay on Fund distributions. The result is compared with a broad-based market index. The market index has not been reduced to reflect any of the fees and costs of investing. The required minimum initial capital commitment by an Investor in the Fund was $50,000. Consistent with Securities and Exchange Commission reporting requirements, the line graph above assumes that an Investor's $50,000 capital commitment was fully called and invested at the commencement of the Fund's operations; however, as disclosed to potential investors, their initial capital commitments to the Fund would not be fully called and immediately invested. Rather, Investors’ capital commitments are called and drawn down by the Fund as investment opportunities are identified by the Fund’s Investment Adviser over the term of the Fund. As such, the investment growth shown in the line graph above may not reflect the actual performance experience of an Investor invested in the Fund over this time period.

NB Crossroads Private Markets Fund IV (TI) - Client LLC

(Unaudited)

Impact of the Fund’s Distribution Policy

The Fund does not have a policy or practice of maintaining a specified level of distributions to Investors. From time to time, the Fund pays distributions at the discretion of the Board of Managers as distributions are received from underlying fund investments due to liquidity events. In general, this practice does not affect the Fund’s investment strategy and may reduce the Fund’s net asset value. Over time, a portion of an Investor’s distribution will be a return of its capital given the Fund has a limited term and will seek to return its available assets to Investors. The tax characteristics of an Investor’s distributions will be reflected on its annual Schedule K-1 form.

NB Crossroads Private Markets Fund IV (TI) - Client LLC

For the year ended March 31, 2022

NB Crossroads Private Markets Fund IV (TI) – Client LLC

Statement of Assets, Liabilities and Members’ Equity – Net Assets

As of March 31, 2022

| Assets | ||||

| Investment in the Company, at fair value | $ | 273,605,827 | ||

| Investment in Money Market Fund | 5,392,365 | |||

| Interest receivable | 433 | |||

| Total Assets | $ | 278,998,625 | ||

| Liabilities | ||||

| Distribution and servicing fees payable | $ | 413,494 | ||

| Tax preparation fees payable | 114,555 | |||

| Due to Member | 70,143 | |||

| Audit fees payable | 23,050 | |||

| Administration service fees payable | 7,875 | |||

| Due to Affiliate | 4,480 | |||

| Other payables | 4,760 | |||

| Total Liabilities | $ | 638,357 | ||

| Commitments and contingencies (Note 4) | ||||

| Members’ Equity - Net Assets | $ | 278,360,268 | ||

| Units of Membership Interests outstanding (unlimited units authorized) | 244,272.29 | |||

| Net Asset Value Per Unit | $ | 1,139.55 | ||

The accompanying notes and attached financial statements of NB Crossroads Private Markets Fund IV Holdings LLC are an integral part of these financial statements.

| 1 |

NB Crossroads Private Markets Fund IV (TI) – Client LLC

For the year ended March 31, 2022

| Net Investment Loss Allocated from the Company: | ||||

| Dividend income | $ | 542,927 | ||

| Interest income | 2,489 | |||

| Expenses | (1,826,934 | ) | ||

| Total Net Investment Loss Allocated from the Company | (1,281,518 | ) | ||

| Fund Income: | ||||

| Interest income | 795 | |||

| Total Fund Income | 795 | |||

| Fund Expenses: | ||||

| Distribution and servicing fees | 1,653,977 | |||

| Tax preparation fees | 119,035 | |||

| Administration service fees | 31,500 | |||

| Audit fees | 23,050 | |||

| Other expenses | 55,294 | |||

| Total Fund Expenses | 1,882,856 | |||

| Net Investment Loss | (3,163,579 | ) | ||

| Net Realized and Change in Unrealized Gain on Investment in the Company (Note 2) | ||||

| Net realized gain on investment in the Company | 47,125,304 | |||

| Net change in unrealized appreciation on investment in the Company | 23,008,526 | |||

| Net Realized and Change in Unrealized Gain on Investment in the Company | 70,133,830 | |||

| Net Increase in Members’ Equity – Net Assets Resulting from Operations | $ | 66,970,251 |

The accompanying notes and attached financial statements of NB Crossroads Private Markets Fund IV Holdings LLC are an integral part of these financial statements.

| 2 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Statements of Changes in Members’ Equity – Net Assets

| For the year ended March 31, 2021 |

| Members' Equity | Special Member | Total | ||||||||||

| Members' committed capital | $ | 206,747,100 | $ | - | $ | 206,747,100 | ||||||

| Members' equity at April 1, 2020 | $ | 147,475,938 | $ | - | $ | 147,475,938 | ||||||

| Capital contributions | 20,654,710 | - | 20,654,710 | |||||||||

| Net investment loss | (3,185,041 | ) | - | (3,185,041 | ) | |||||||

| Net realized gain on investment in the Company | 3,482,353 | - | 3,482,353 | |||||||||

| Net change in unrealized appreciation on investment in the Company | 77,075,328 | - | 77,075,328 | |||||||||

| Net change in incentive carried interest | (3,530,294 | ) | 3,530,294 | - | ||||||||

| Members' equity at March 31, 2021 | $ | 241,972,994 | $ | 3,530,294 | $ | 245,503,288 | ||||||

| For the year ended March 31, 2022 |

| Members' Equity | Special Member | Total | ||||||||||

| Members' committed capital | $ | 206,747,100 | $ | - | $ | 206,747,100 | ||||||

| Members' equity at April 1, 2021 | $ | 241,972,994 | $ | 3,530,294 | $ | 245,503,288 | ||||||

| Capital distributions | (34,113,271 | ) | - | (34,113,271 | ) | |||||||

| Net investment loss | (3,163,579 | ) | - | (3,163,579 | ) | |||||||

| Net realized gain on investment in the Company | 47,125,304 | - | 47,125,304 | |||||||||

| Net change in unrealized appreciation on investment in the Company | 23,008,526 | - | 23,008,526 | |||||||||

| Net change in incentive carried interest | (4,353,066 | ) | 4,353,066 | - | ||||||||

| Members' equity at March 31, 2022 | $ | 270,476,908 | $ | 7,883,360 | $ | 278,360,268 | ||||||

The accompanying notes and attached financial statements of NB Crossroads Private Markets Fund IV Holdings LLC are an integral part of these financial statements.

| 3 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

For the year ended March 31, 2022

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net change in Members’ Equity – Net Assets resulting from operations | $ | 66,970,251 | ||

| Adjustments to reconcile net change in Members’ Equity – Net Assets resulting from operations to net cash provided by operating activities: | ||||

| Proceeds received from investment in the Company | 37,214,478 | |||

| Change in fair value of investment in the Company | (68,852,312 | ) | ||

| Reclassification to short term investment | (5,392,365 | ) | ||

| Changes in assets and liabilities related to operations | ||||

| (Increase) decrease in interest receivable | (398 | ) | ||

| Increase (decrease) in tax preparation fees payable | 69,758 | |||

| Increase (decrease) in audit fees payable | 1,300 | |||

| Increase (decrease) in due to Affiliate | (75,690 | ) | ||

| Increase (decrease) in other payables | (972 | ) | ||

| Net cash provided by (used in) operating activities | 29,934,050 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Distributions to Members | (34,043,128 | ) | ||

| Net cash provided by (used in) financing activities | (34,043,128 | ) | ||

| Net change in cash and cash equivalents | (4,109,078 | ) | ||

| Cash and cash equivalents at the beginning of the year | 4,109,078 | |||

| Cash and cash equivalents at the end of the year | $ | - |

The accompanying notes and attached financial statements of NB Crossroads Private Markets Fund IV Holdings LLC are an integral part of these financial statements.

| 4 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Financial Highlights

| For the year ended March 31, 2022 | For the year ended March 31, 2021 | For the year ended March 31, 2020 | For the year ended March 31, 2019 | For the year ended March 31, 2018 | ||||||||||||||||

| Per Unit Operating Performance (1) | ||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF YEAR | $ | 1,005.04 | $ | 685.42 | $ | 677.75 | $ | 582.50 | $ | 596.94 | ||||||||||

| INCOME FROM INVESTMENT OPERATIONS: | ||||||||||||||||||||

| Net investment loss | (12.95 | ) | (13.23 | ) | (14.60 | ) | (22.00 | ) | (46.27 | ) | ||||||||||

| Net realized and change in unrealized gain on investments | 287.11 | 332.85 | 22.27 | 117.25 | 31.83 | |||||||||||||||

| Net increase (decrease) in net assets resulting from operations after incentive carried interest | 274.16 | 319.62 | 7.67 | 95.25 | (14.44 | ) | ||||||||||||||

| DISTRIBUTIONS TO MEMBERS: | ||||||||||||||||||||

| Net change in Members’ Equity - Net Assets due to distributions to Members | (139.65 | ) | - | - | - | - | ||||||||||||||

| NET ASSET VALUE, END OF YEAR | $ | 1,139.55 | $ | 1,005.04 | $ | 685.42 | $ | 677.75 | $ | 582.50 | ||||||||||

| TOTAL NET ASSET VALUE RETURN (1), (2), (3) | 27.61 | % | 46.63 | % | 1.13 | % | 16.35 | % | (2.42 | )% | ||||||||||

| RATIOS AND SUPPLEMENTAL DATA: | ||||||||||||||||||||

| Members' Equity - Net Assets, end of year in thousands (000's) | $ | 278,360 | $ | 245,503 | $ | 147,476 | $ | 125,737 | $ | 52,152 | ||||||||||

| Ratios to Average Members' Equity - Net Assets: (4) | ||||||||||||||||||||

| Expenses excluding incentive carried interest | 1.39 | % | 2.00 | % | 2.49 | % | 4.13 | % | 9.73 | % | ||||||||||

| Net change in incentive carried interest | 1.63 | % | 1.93 | % | - | - | - | |||||||||||||

| Expenses including incentive carried interest | 3.02 | % | 3.93 | % | 2.49 | % | 4.13 | % | 9.73 | % | ||||||||||

| Net investment loss excluding incentive carried interest | (1.18 | )% | (1.74 | )% | (2.12 | )% | (3.67 | )% | (9.34 | )% | ||||||||||

| INTERNAL RATES OF RETURN: | ||||||||||||||||||||

| Internal Rate of Return before incentive carried interest (5) | 21.85 | % | 19.65 | % | 6.06 | % | 11.63 | % | 3.73 | % | ||||||||||

| Internal Rate of Return after incentive carried interest (5) | 21.02 | % | 19.02 | % | 6.06 | % | 11.63 | % | 3.73 | % | ||||||||||

| (1) | Selected data for a unit of membership interest outstanding throughout each year. |

| (2) | Total investment return, based on per unit net asset value, reflects the changes in net asset value based on the effects of organizational costs, the performance of the TI Fund during the year and assumes distributions, if any, were reinvested. The TI Fund's units are not traded in any market; therefore, the market value total investment return is not calculated. |

| (3) | Total return and the ratios to average members' equity - net assets is calculated for the TI Fund taken as a whole. The total return does not reflect the impact of incentive carried interest; refer to the Internal Rates of Return for the impact of incent ive carried interest. |

| (4) | Ratios include expenses allocated from the Company. |

| (5) | The Internal Rate of Return is computed based on the actual dates of the cash inflows and outflows since inception and the ending net assets before and after incentive carried interest at the end of the year as of each measurement date. |

The accompanying notes and attached financial statements of NB Crossroads Private Markets Fund IV Holdings LLC are an integral part of these financial statements.

| 5 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

1. Organization

NB Crossroads Private Markets Fund IV (TI) – Client LLC (the “TI Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The TI Fund was organized as a Delaware limited liability company on February 29, 2016. The TI Fund commenced operations on November 15, 2016. The duration of the TI Fund is ten years from the final subscription closing date (the “Final Closing”), which occurred on June 30, 2017, subject to two two-year extensions which may be approved by the Board of Managers of the TI Fund (the “Board” or the “Board of Managers”). Thereafter, the term of the TI Fund may be extended by consent of a majority-in-interest of its Members as defined in the TI Fund’s limited liability company agreement (the “LLC Agreement”).

The TI Fund’s investment objective is to provide attractive risk-adjusted returns. The TI Fund pursues its investment objective by investing substantially all of its assets in NB Crossroads Private Markets Fund IV Holdings LLC (the “Company”). The Company seeks to achieve its objective primarily by investing in a diversified global portfolio of high quality third-party private equity funds (“Portfolio Funds”) and by co-investing directly in portfolio companies. Neither the Company, the TI Fund, nor the Registered Investment Adviser (as defined below) guarantees any level of return or risk on investments and there can be no assurance that the Company or the TI Fund will achieve its investment objective. The Portfolio Funds are not registered as investment companies under the Investment Company Act.

The financial statements of the Company, including the Company's Schedule of Investments, are attached to this report and should be read in conjunction with the TI Fund's financial statements. The percentage of the Company's members' contributed capital owned by the TI Fund at March 31, 2022 was approximately 61.84%.

The Board has overall responsibility to manage and supervise the operation of the TI Fund, including the exclusive authority to oversee and to establish policies regarding the management, conduct, and operation of the TI Fund. The Board exercises the same powers, authority and responsibilities on behalf of the TI Fund as are customarily exercised by directors of a typical investment company registered under the Investment Company Act. The Board has engaged Neuberger Berman Investment Advisers LLC (“NBIA” or “Registered Investment Adviser”) and NB Alternatives Advisers LLC (“NBAA” or “Sub-Adviser”) to provide investment advice regarding the selection of the Portfolio Funds and Co-Investments and to manage the day-to-day operations of the Company.

2. Significant Accounting Policies

The TI Fund meets the definition of an investment company and follows the accounting and reporting guidance as issued through Accounting Standards Codification (“ASC”) 946, Financial Services – Investment Companies. The following is a summary of significant accounting policies followed by the TI Fund in the preparation of its financial statements.

| 6 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

A. Basis of Accounting

The TI Fund’s policy is to prepare its financial statements on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Consequently, income and the related assets are recognized when earned, and expenses and the related liabilities are recognized when incurred. The books and records of the TI Fund are maintained in U.S. dollars.

B. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and the differences could be material.

C. Valuation of Investments

The value of the TI Fund's investment in the Company reflects the TI Fund's proportionate interest in the total members' contributed capital of the Company at March 31, 2022. Valuation of the investments held by the Company is discussed in Note 2 of the Company's financial statements, attached to these financial statements.

D. Cash and Cash Equivalents

Cash and cash equivalents consist primarily of cash and short-term investments which are readily convertible into cash and have an original maturity of three months or less. UMB Bank N.A. serves as the TI Fund’s custodian.

Cash and cash equivalents can include deposits in money market accounts, which are classified as Level 1 assets. As of March 31, 2022, the TI Fund held $5,392,365 in an overnight sweep that is deposited into a money market account.

E. Investment Gains and Losses

The TI Fund records its share of the Company's investment income, expenses, and realized and change in unrealized gains and losses in proportion to the TI Fund's aggregate commitment to the Company. The Company's income and expense recognition policies are discussed in Note 2 of the Company's financial statements, attached to these financial statements.

F. Income Taxes

The TI Fund is a limited liability company that is treated as a partnership for tax reporting. Tax basis income and losses are passed through to Members and, accordingly, there is no provision for income taxes reflected in these financial statements. The TI Fund has a tax year end of December 31.

Differences arise in the computation of Members' equity for financial reporting in accordance with GAAP and Members' equity for federal and state income tax reporting. These differences are primarily due to the fact that change in unrealized gains and losses are allocated for financial reporting purposes and are not allocated for federal and state income tax reporting purposes.

| 7 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

The cost of the TI Fund's investment in the Company for federal income tax purposes is based on amounts reported to the TI Fund on Schedule K-1 from the Company. As of March 31, 2022, the TI Fund had not received information to determine the tax cost of the Company. Based on the amounts reported to the TI Fund on Schedule K-1 (where available) as of December 31, 2020, and after adjustment for purchases and sales between December 31, 2020 and March 31, 2022, the estimated cost of the TI Fund’s investment in the Company at March 31, 2022, for federal income tax purposes aggregated $106,455,953. The net and gross unrealized appreciation for federal income tax purposes on the TI Fund's investment in the Company was estimated to be $167,149,874.

The TI Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the TI Fund is subject to examination by federal, state, local and foreign jurisdictions, where applicable. As of December 31, 2021, the tax years that remain subject to examination by the major tax jurisdictions under the statute of limitations is from the year 2018 forward (with limited exceptions). FASB ASC 740-10, Income Taxes requires the Registered Investment Adviser to determine whether a tax position of the Company is more likely than not to be sustained upon examination by taxing authorities, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority. The Registered Investment Adviser has reviewed the TI Fund’s tax positions for the current tax year and has concluded that no provision for taxes is required in the TI Fund’s financial statements for the year ended March 31, 2022. The TI Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended March 31, 2022, the TI Fund did not incur any interest or penalties.

G. Restrictions on Transfers

Interests of the TI Fund (“Interests”) are generally not transferable. No Member may assign, sell, transfer, pledge, hypothecate or otherwise dispose of any of its Interests without the prior written consent of the Board which may be granted or withheld in the Board’s sole discretion, and in compliance with applicable securities and tax laws.

H. Fund Expenses

The TI Fund bears its own expenses and, indirectly bears a pro rata portion of the Company’s expenses incurred in the course of business on an accrual basis, including, but not limited to, the following: Distribution and Servicing Fees (as defined herein); Independent Managers’ fees (as defined herein); Advisory fees (as defined herein); legal fees; administration; auditing; tax preparation fees; custodial fees; costs of insurance; and registration expenses.

| 8 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

| 3. | Advisory Fee, Distribution and Servicing Fee, Administration Service Fee and Related Party Transactions |

The Registered Investment Adviser provides investment advisory services to the Company and incurs research, travel and other expenses related to the selection and monitoring of Portfolio Funds. Further, the Registered Investment Adviser provides certain management and administrative services to the TI Fund, including providing office space and other support services, maintaining files and records, and preparing and filing various regulatory materials. In consideration for such services, the Company pays the Registered Investment Adviser an investment advisory fee (the "Advisory Fee") quarterly in arrears based on an annual rate of 0.10% during the first 12-months following the Company's commencement of operations; 0.55% beginning in year two through the end of year eight from the commencement of operations and then 0.30% for the remaining life of the Company, in each case based on the Members' total capital commitments. For the year ended March 31, 2022, the Company incurred Advisory Fees totaling $1,838,674, of which $1,137,109 was allocated to the TI Fund.

In consideration for the services provided under the Placement Agreement, the TI Fund pays Neuberger Berman BD LLC (“NBBD” or the “Placement Agent”) a distribution and servicing fee (the "Distribution and Servicing Fee") quarterly in arrears at the annual rate of 0.80% during the period from the commencement of investment operations through the end of year eight, and at the annual rate of 0.15% thereafter, based on the Members’ total capital commitments, determined and accrued as of the last day of each calendar quarter. For the year ended March 31, 2022, the TI Fund incurred Distribution and Servicing Fees totaling $1,653,977.

Pursuant to an Administrative and Accounting Services Agreement, the TI Fund retains UMB Fund Services, Inc. (the “Administrator”), a subsidiary of UMB Financial Corporation, to provide administration, custodial, accounting, tax preparation, and investor services to the TI Fund. In consideration for these services, the TI Fund pays the Administrator a fixed fee of $7,875 per calendar quarter. In accordance with the service level agreement additional fees may be charged for out of scope services and quarterly filings made on behalf of the TI Fund. For the year ended March 31, 2022, the TI Fund incurred administration service fees totaling $31,500.

The Board consists of six managers, each of whom is not an “interested person” of the TI Fund as defined by Section 2(a)(19) of the Investment Company Act (the “Independent Managers”). Currently, the Independent Managers are each paid an annual retainer of $175,000 for serving on the boards of the funds in the fund complex. Compensation to the Board is paid and expensed by the Company on a quarterly basis. The Independent Managers are also reimbursed for out of pocket expenses in connection with providing their services to the Company. For the year ended March 31, 2022, the Company incurred $171,875 in Independent Managers’ fees, of which $106,294 was allocated to the TI Fund.

As of March 31, 2022, four persons had ownership of approximately 12.10%, 9.68%, 8.94%, and 6.85% of the TI Fund’s total capital commitments and are treated as “affiliated persons”, as defined

| 9 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

in the Investment Company Act (the “Affiliated Persons”). The affiliation between the Affiliated Persons and the TI Fund is based solely on the capital commitments made and percentage ownership.

4. Capital Commitments from Members

At March 31, 2022 and 2021 capital commitments from Members totaled $206,747,100. Capital contributions received by the TI Fund with regard to satisfying Member capital commitments totaled $152,952,854, which represents approximately 74% of committed capital at March 31, 2022 and 2021.

Capital contributions will be credited to Members’ capital accounts and units will be issued when paid. Capital contributions will be determined based on a percentage of capital commitments. During the years ended March 31, 2022 and 2021 the TI Fund issued 0.00 and 29,110.73 units, respectively.

The net profits or net losses of the TI Fund are allocated to Members in a manner that takes into account the amount of cash that would be distributed based upon a hypothetical liquidation, such that it would follow the distributions outlined below.

Distributions shall be made of available cash (net of reserves that the Board deems reasonable) or other net investment proceeds to Members at such times and in such amounts as determined by the Board of Managers in its sole discretion and in accordance with Members’ respective percentage interests, as defined in the LLC Agreement. As of March 31, 2022, the TI Fund had distributed $34,113,272 to Members. Distributions from the TI Fund are made in the following priority:

(a) First, to Members of the TI Fund until they have received a 125% return of all drawn capital commitments; and

(b) Then, a 93.5% - 6.5% split between the Members and the Special Member (as defined in Note 1 of the Company’s notes), respectively. The Special Member will not collect any of the incentive carried interest that it may have earned until after the fourth anniversary of the Final Closing.

Incentive carried interest is accrued based on the net asset value (“NAV”) of the TI Fund at each quarter-end as an allocation of profits, to the extent there is an amount to be accrued. The Statement of Changes in Members’ Equity – Net Assets discloses the amount payable and paid to the Special Member in the period in which it occurs. At March 31, 2022 and 2021, the accrued and unpaid incentive carried interest was $7,883,360 and $3,530,294, respectively.

| 10 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

5. Indemnifications

In the normal course of business, the TI Fund enters into contracts that provide general indemnifications. The TI Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the TI Fund, and therefore cannot be established; however, based on the Registered Investment Adviser’s experience, the risk of loss from such claims is considered remote.

6. Concentrations of Market, Credit, Liquidity, Industry, Currency and Capital Call Risk

Due to the inherent uncertainty of valuations, estimated values may differ significantly from the values that would have been used had a ready market for the securities existed, and the difference could be material. The Company’s investments are subject, directly or indirectly, to various risk factors including market, credit, industry, currency and capital call risk. Certain investments are made internationally, which may subject the investments to additional risks resulting from political or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions affecting such countries or regions. Market risk represents the potential loss in value of financial instruments caused by movements in market variables, such as interest and foreign exchange rates and equity prices. The Company may have a concentration of investments, as permitted by its registration statement, in a particular industry or sector. Investment performance of the sector may have a significant impact on the performance of the Company. The Company's investments are also subject to the risk associated with investing in private equity securities. The investments in private equity securities are illiquid, can be subject to various restrictions on resale, and there can be no assurance that the Company will be able to realize the value of such investments in a timely manner if at all.

This portfolio strategy presents a high degree of business and financial risk due to the nature of underlying companies in which the Portfolio Funds invest, which may include entities with little operating history, minimal capitalization, operations in new or developing industries, and concentration of investments in one industry or geographical area.

The Company believes that its liquidity and capital resources are adequate to satisfy its operational needs as well as the continuation of its investment program.

If the Company defaults on its commitment or fails to satisfy capital calls, it will be subject to significant penalties, including the complete forfeiture of the Company’s investment in the Portfolio Fund. This may impair the ability of the Company to pursue its investment program, force the Company to borrow or otherwise impair the value of the Company’s investments (including the complete devaluation of the Company). In addition, defaults by Members on their capital commitments to the TI Fund, may cause the Company to, in turn, default on its commitment to a Portfolio Fund. In this case, the Company, and especially the non-defaulting Members, will bear the penalties of such default as outlined above. While the Registered Investment Adviser has taken steps to mitigate this risk, there is no guarantee that such measures will be sufficient or successful.

| 11 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Notes to the Financial Statements

March 31, 2022

7. Other Matters

The outbreak of COVID-19 in many countries has, among other things, disrupted global travel and supply chains, and adversely impacted global commercial activity, the transportation industry and commodity prices in the energy sector. The impact of this virus has negatively affected and may continue to affect the economies of many nations, individual companies and the global securities and commodities markets, including liquidity and volatility. The development and fluidity of this situation precludes any prediction as to its ultimate impact, which may have a continued adverse effect on global economic and market conditions. Such conditions (which may be across industries, sectors or geographies) have impacted and may continue to impact certain issuers of the securities held by the Company and in turn, may impact the financial performance of the Company. In addition, the impact of the COVID-19 pandemic may lead to adverse impacts on valuations and other financial analyses for current and future periods.

8. Subsequent Events

The TI Fund has evaluated all events subsequent to March 31, 2022, through the date these financial statements were available to be issued and has determined that there were no subsequent events that require disclosure.

| 12 |

Report of Independent Registered Public Accounting Firm

To the Members and Board of Managers

NB Crossroads Private Markets Fund IV (TI) - Client LLC:

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and members’ equity - net assets of NB Crossroads Private Markets Fund IV (TI) - Client LLC (the Company) as of March 31, 2022, the related statements of operations and cash flows for the year then ended, the statements of changes in members’ equity - net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of March 31, 2022, the results of its operations and its cash flows for the year then ended, the changes in its members’ equity for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more NB Private Markets/NB Crossroads Private Markets investment companies since 2016.

Boston, Massachusetts

May 27, 2022

| 13 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

INVESTMENT PROGRAM (UNAUDITED)

Investment Objective and Process

In pursuing its investment objective, NB Crossroads Private Markets Fund IV (TI) - Client LLC (the "Fund") invests all or substantially all of its assets in NB Crossroads Private Markets Fund IV Holdings LLC (the "Master Fund"). The Master Fund has the same investment objective, investment policies and restrictions as those of the Fund. This form of investment structure is commonly known as a "master/feeder" structure. For convenience of reference, references herein to "the Fund" include the Fund and the Master Fund, unless the context requires otherwise.

The investment objective of the Fund is to provide attractive risk-adjusted returns to investors ("Investors"). Through its investment in the Master Fund, the Fund seeks to achieve its investment objective principally by making primary investments (each, a "Primary Investment") in a portfolio of newly formed, third party private equity funds ("Portfolio Funds") managed by various experienced unaffiliated asset managers ("Portfolio Fund Managers") that generally have an established track record. The Fund may also invest, on an opportunistic basis, in "secondary investments" in Portfolio Funds acquired in privately negotiated transactions from investors in these Portfolio Funds typically after the end of the Portfolio Fund's fundraising period (each, a "Secondary Investment") in more mature Portfolio Funds and make opportunistic direct investments in equity or debt securities of portfolio companies alongside Portfolio Funds and other private equity firms (each, a "Co-Investment"). Neuberger Berman Investment Advisers LLC (the "Investment Adviser") believes the coupling of Secondary Investments and Co-Investment activities with Primary Investments should enhance and accelerate investment returns and offers Investors an opportunity to gain exposure to a broad range of private equity investment opportunities in the United States, Europe and emerging markets.

Each of the Fund and the Master Fund is a non-diversified fund under the Investment Company Act of 1940, as amended (the "1940 Act"). However, the Master Fund generally will not commit more than 25% of the value of total capital commitments ("Commitment") by Investors (measured at the time of the Commitment) in a single Portfolio Fund.

The Investment Adviser serves as investment adviser of the Master Fund. The Investment Adviser has engaged NB Alternatives Advisers LLC (the "Sub-Adviser" and, together with the Investment Adviser, the "Adviser") to make investment decisions on behalf of the Master Fund. The Investment Adviser and the Sub-Adviser are indirect wholly-owned subsidiaries of Neuberger Berman Group LLC ("Neuberger Berman" or the "Firm"). None of the Master Fund, the Fund or the Adviser guarantees any level of return or risk on investments and there can be no assurance that the Fund's investment objective will be achieved.

Principal Risk Factors

AN INVESTMENT IN THE FUND INVOLVES A HIGH DEGREE OF RISK AND THEREFORE SHOULD ONLY BE UNDERTAKEN BY QUALIFIED INVESTORS WHOSE FINANCIAL RESOURCES ARE SUFFICIENT TO ENABLE THEM TO

| 14 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

ASSUME THESE RISKS AND TO BEAR THE LOSS OF ALL OR PART OF THEIR INVESTMENT. THE FOLLOWING RISK FACTORS SHOULD BE CONSIDERED CAREFULLY, BUT ARE NOT MEANT TO BE AN EXHAUSTIVE LISTING OF ALL OF THE POTENTIAL RISKS ASSOCIATED WITH AN INVESTMENT IN THE FUND. INVESTORS SHOULD CONSULT WITH THEIR OWN FINANCIAL, LEGAL, INVESTMENT AND TAX ADVISORS PRIOR TO INVESTING IN THE FUND.

The Fund's investment program is speculative and entails substantial risks. Because the Fund invests all or substantially all of its assets in the Master Fund, in pursuit of its investment objective, the risks associated with an investment in the Fund are in effect the risks of investing in the Master Fund. The Master Fund and the Fund have the same investment objectives, policies and strategies. Accordingly, except for specific references to the contrary, all references to the Fund, its investments or its investment portfolio in this summary of risk factors refer to the combined risks relating to the investments by the Fund and the Master Fund, and all references to the Adviser refer to the Adviser as, collectively, the Investment Adviser and Sub-Adviser of the Master Fund, unless the context suggests otherwise. Investors should be aware of certain risk factors, which include the following:

General Risks

There is no assurance that the investment held by the Fund will be profitable, that there will be proceeds from such investments available for distribution to Investors, or that the Fund will achieve its investment objective. An investment in the Fund is speculative and involves a high degree of risk. Fund performance may be volatile and an Investor could incur a total or substantial loss of its investment. In general, neither the Fund nor the Investors will have the ability to direct or influence the management of Co-Investments, the Portfolio Funds or the investment of their assets. There can be no assurance that projected or targeted returns for the Fund will be achieved.

Illiquidity; Lack of Current Distributions

An investment in the Fund is suitable only for certain qualified investors who have no need for liquidity in the investment. The investments made by the Fund via its investment in the Master Fund and indirectly in the Portfolio Funds and Co-Investments are illiquid and typically cannot be transferred or redeemed for a substantial period of time. The Fund does not have any obligation to repurchase limited liability company interests in the Fund ("Interests") from Investors. In addition there may be little or no near-term cash flow available to the Investors from the Fund. The return of capital and the realization of gains on the Fund's investments, if any, will generally occur only upon the partial or complete disposition of a Co-Investment or an underlying investment by a Portfolio Fund, which is not generally within the control of the Adviser.

Due to the pattern of cash flows in private equity funds and the illiquid nature of their investments, Investors typically will see negative returns in the Fund's early stages; in particular it can take several years for Portfolio Fund investments to be realized during which time

| 15 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

management fees will be continued to be drawn from committed capital and certain underperforming investments may be written down or written off. Then as investments are able to realize liquidity events, such as a sale or initial public offering, positive returns will be realized if the Portfolio Fund is successful in achieving its investment strategy.

Restrictions on Transfer and Withdrawals

The Interests, and the interests in the Portfolio Funds and Co-Investments indirectly held by the Fund, have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act") or applicable state securities laws and may not be resold unless an exemption from such registration is available. The Fund is not under, and the Portfolio Funds and Co-Investments are not expected to be under, any obligation to cause such an exemption (whether pursuant to Rule 144 under the Securities Act or otherwise) to be available. Accordingly, there is no secondary market for the Interests or a Fund's indirect interests in the Portfolio Funds, and such market is not expected to develop. Furthermore, transfers of Interests may be made only with the prior written consent of the Board of Managers of the Fund (the "Board"), which may be withheld in the Board's sole discretion. The Fund generally will not have the right to withdraw from any Portfolio Fund.

Risks of Private Equity Investments Generally

The investments made by the Portfolio Funds will entail a high degree of risk and in most cases be highly illiquid and difficult to value. Unless and until those investments are sold or mature into marketable securities they will remain illiquid. In addition to the extent a Portfolio Fund focuses on venture capital investments the companies in which the Portfolio Fund will invest may be in a conceptual or early stage of development, may not have a proven operating history, may offer services or products that are not yet developed or ready to be marketed or that have no established market, may be operating at a loss or have significant fluctuations in operating results, may be engaged in a rapidly changing business, may require substantial additional capital to support their operations to finance expansion or to maintain their competitive position, or otherwise may have a weak financial condition. As a general matter, companies in which the Portfolio Fund invests may face intense competition, including competition from companies with far greater financial resources; more extensive research, development, technological, marketing and other capabilities; and a larger number of qualified managerial and technical personnel.

Neither the Master Fund nor the Fund will obtain or seek to obtain any control over the management of any portfolio company in which any Portfolio Fund may invest. The success of each investment made by a Portfolio Fund will largely depend on the ability and success of the management of the portfolio companies in addition to economic and market factors.

Capital Contributions

An Investor's full Commitment will not be immediately invested. The Fund will invest in the Master Fund and the Master Fund will invest in Portfolio Funds and Co-Investment opportunities as Commitments are drawn (generally within 6 months of any drawdown). It may take a

| 16 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

significant amount of time to fully draw down the Commitments. The Fund's performance will only include the Commitments that have been drawn-down, thus an Investor's individual performance may be lower than the performance of the Fund.

Portfolio Funds Business and Market Risks

The Fund's investment portfolio will consist, in part, of Portfolio Funds which will hold securities issued primarily by privately held companies, and operating results for the portfolio companies in a specified period will be difficult to predict. Such investments involve a high degree of business and financial risk that can result in substantial losses.

Buyout Funds. Buyout transactions may result in new enterprises that are subject to extreme volatility, require time for maturity and may require additional capital. In addition, they frequently rely on borrowing significant amounts of capital, which can increase profit potential but at the same time increase the risk of loss. Leveraged companies may be subject to restrictive financial and operating covenants. The leverage may impair the ability of these companies to finance their future operations and capital needs. Also, their flexibility to respond to changing business and economic conditions and to business opportunities may be limited. A leveraged company's income and net assets will tend to increase or decrease at a greater rate than if borrowed money was not used. Although these investments may offer the opportunity for significant gains, such buyout investments involve a high degree of business and financial risk that can result in substantial losses, which risks generally are greater than the risks of investing in public companies that may not be as leveraged.

Venture Funds. Venture capital funds primarily invest in private companies that have limited operating history, are attempting to develop or commercialize unproven technologies or to implement novel business plans or are not otherwise developed sufficiently to be self-sustaining financially or to become public. Although these investments may offer the opportunity for significant gains, such investments involve a high degree of business and financial risk that can result in substantial losses, which risks generally are greater than the risks of investing in public companies that may be at a later stage of development.

Special Situations. The special situations asset class will likely invest a significant portion of its assets in Portfolio Funds that invest in portfolio companies that may be in transition, out of favor, financially leveraged or troubled, or potentially troubled and may be or have recently been involved in major strategic actions, restructurings, bankruptcy, reorganization, or liquidation. These companies may be experiencing, or are expected to experience, financial difficulties that may never be overcome. The securities of such companies are likely to be particularly risky investments although they also may offer the potential for correspondingly high returns. Such companies' securities may be considered speculative, and the ability of such companies to pay their debts on schedule could be affected by adverse interest rate movements, changes in the general economic climate, economic factors affecting a particular industry or specific developments within such companies. Such investments could, in certain circumstances, subject a Portfolio Fund to certain additional potential liabilities. For example, under certain circumstances, a lender who has inappropriately exercised control of the management and

| 17 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

policies of a debtor may have its claims subordinated, or disallowed, or may be found liable for damages suffered by parties as a result of such actions. In addition, under certain circumstances, payments by such companies to us could be required to be returned if any such payment is later determined to have been a fraudulent conveyance or a preferential payment. Numerous other risks also arise in the workout and bankruptcy contexts. In addition, there is no minimum credit standard that is a prerequisite to a Portfolio Fund's investment in any instrument and a significant portion of the obligations and preferred stock in which a Portfolio Fund may invest may be less than investment grade.

Risks Associated with Private Company Investments

Private companies are generally not subject to Securities and Exchange Commission reporting requirements, are not required to maintain their accounting records in accordance with generally accepted accounting principles, and are not required to maintain effective internal controls over financial reporting. As a result, the Adviser may not have timely or accurate information about the business, financial condition and results of operations of the private companies in which the Master Fund invests. There is risk that the Master Fund may invest on the basis of incomplete or inaccurate information, which may adversely affect the Master Fund's, and in turn, the Fund's investment performance. Private companies in which the Master Fund may invest may have limited financial resources, shorter operating histories, more asset concentration risk, narrower product lines and smaller market shares than larger businesses, which tend to render such private companies more vulnerable to competitors' actions and market conditions, as well as general economic downturns. These companies generally have less predictable operating results, may from time to time be parties to litigation, may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence, and may require substantial additional capital to support their operations, finance expansion or maintain their competitive position. These companies may have difficulty accessing the capital markets to meet future capital needs, which may limit their ability to grow or to repay their outstanding indebtedness upon maturity.

Typically, investments in private companies are in restricted securities that are not traded in public markets and subject to substantial holding periods, so that the Master Fund may not be able to resell some of its holdings for extended periods, which may be several years. There can be no assurance that the Master Fund will be able to realize the value of private company investments in a timely manner.

Dependence on the Adviser and Key Personnel

To the extent that the Fund invests its assets in the Master Fund, the Fund's performance depends upon the performance of the Master Fund, which, in turn, will depend on the performance of the Co-Investments and the Portfolio Fund Managers with which the Master Fund invests, and the Adviser's ability to select, allocate and reallocate effectively the Master Fund's assets among Portfolio Funds and Co-Investments. The success of the Fund is thus substantially dependent on the Adviser and its continued employment of certain key personnel. Similarly, the success of each Portfolio Fund in which the Fund invests is also likely to be substantially dependent on certain key personnel of that Portfolio Fund. Should one or more of the key personnel of the

| 18 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

Adviser or of the management of the Portfolio Funds become incapacitated or in some other way cease to participate in management activities, the Fund performance could be adversely affected. There can be no assurance that these key personnel will continue to be associated with or available to the Adviser or the general partner of the Portfolio Funds throughout the life of the Fund.

Investment in Junior Securities

Although the Portfolio Funds may invest in securities that are relatively senior within a portfolio company's capital structure, it is expected that the Portfolio Funds will invest primarily in securities that are among the more junior securities in a portfolio company's capital structure and, thus, subject to the greatest risk of loss. Generally, there will be no collateral to protect an investment once made.

Leveraged Investments

The Portfolio Funds may employ leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Although the use of leverage may enhance returns and increase the number of investments that can be made, leverage also involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy, or deterioration in the condition of the assets underlying such investments. In addition, the borrowings of a Portfolio Fund may in certain cases be secured by the Commitments and the other assets of a Portfolio Fund, which may increase the risk of loss of such assets.

Limited Number of Portfolio Fund Investments

The number of investments made by the Portfolio Funds is and will be limited and, as a consequence, the Master Fund's and the Fund's returns as a whole may be substantially affected by the unfavorable performance of a single investment made by a Portfolio Fund. In addition, a Portfolio Fund may invest exclusively or primarily in a particular asset type or category, which may reduce the overall diversity of the Fund's assets and increase risk.

Risks Associated with Secondary Investments

Competition for Secondary Investment Opportunities. Many institutional investors, including other fund-of-funds entities, as well as existing investors of private equity funds may seek to purchase secondary interests of the same private equity fund which the Master Fund may also seek to purchase. In addition, many top-tier private equity managers have become more selective by adopting policies or practices that exclude certain types of investors, such as fund-of-funds. These managers may also be partial to secondary interests being purchased by existing investors of their funds with whom they have existing relationships. In addition, some secondary opportunities may be conducted pursuant to a specified methodology (such as a right of first refusal granted to existing investors or a so-called "Dutch auction," where the price of the investment is lowered until a bidder bids and that first bidder purchases the investment, thereby

| 19 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

limiting a bidder's ability to compete for price) which can restrict the availability of such opportunity for the Master Fund. No assurance can be given that the Master Fund will be able to identify investment opportunities that satisfy the Master Fund's investment objective and desired diversification goals or, if the Master Fund is successful in identifying such investment opportunities, that the Master Fund will be permitted to invest, or invest in the amounts desired, in such opportunities.

Nature of Secondary Investments. The Master Fund may acquire secondary interests in existing private equity funds primarily from existing investors in such funds (and not from the issuers of such investments). Because the Master Fund will not be acquiring such interests directly from the issuers, it is generally not expected that the Master Fund will have the opportunity to negotiate the terms of the interests being acquired or other special rights or privileges. There can be no assurance as to the number of investment opportunities that will be presented to the Master Fund. In addition, valuation of such private equity funds interests may be difficult, as there generally will be no established market for such investments or for the privately-held portfolio companies in which such funds may own securities. Moreover, the purchase price of interests in such funds will be subject to negotiation with the sellers of the interests and there is no assurance that the Master Fund will be able to purchase interests at attractive discounts to net asset value, or at all. The overall performance of the Fund will depend in large part on the acquisition price paid by the Master Fund for its secondary interests, the structure of such acquisitions and the overall success of the underlying private equity fund.

Pooled Secondary Investments. The Master Fund may have the opportunity to acquire a portfolio of private equity fund interests from a seller, on an "all or nothing" basis. In some such cases, certain of the private equity fund interests may be less attractive than others, and certain of the investment managers managing such funds may be more familiar to the Adviser than others or may be more experienced or highly regarded than others. In such cases, it may not be possible for the Master Fund to carve out from such purchases those investments which the Adviser considers (for commercial, tax legal or other reasons) less attractive.

Contingent Liabilities Associated With Secondary Investments. In the cases where the Master Fund acquires an interest in a private equity fund through a secondary transaction, the Master Fund may acquire contingent liabilities of the seller of the interest. More specifically, where the seller has received distributions from the relevant private equity fund and, subsequently, that private equity fund recalls one or more of these distributions, the Master Fund (as the purchaser of the interest to which such distributions are attributable and not the seller) may be obligated to return the monies equivalent to such distribution to the private equity fund. While the Master Fund may, in turn, make a claim against the seller for any such monies so paid to the private equity fund, there can be no assurances that the Master Fund would prevail on such claim.

Risk of Early Termination. The governing documents of the underlying private equity funds are expected to include provisions that would enable the general partner, the manager, or a majority in interest (or higher percentage) of their limited partners or members, under certain circumstances, to terminate such funds prior to the end of their respective stated terms. Early

| 20 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

termination of a private equity fund in which the Master Fund is invested may result in (i) the Master Fund having distributed to it a portfolio of immature and illiquid securities, or (ii) the Master Fund's inability to invest all of its capital commitments as anticipated, either of which could have a material adverse effect on the performance of the Fund.

Co-Investments Risks

The Master Fund may make Co-Investments on an opportunistic basis. There can be no assurance that the Master Fund will be given Co-Investment opportunities, or that any Co-Investment offered to the Master Fund would be appropriate or attractive to the Master Fund. The market for Co-Investment opportunities is competitive and may be limited, and the Co-Investment opportunities to which the Master Fund wishes to allocate assets may not be available at any given time. Due diligence will be conducted on Co-Investment opportunities; however, the Adviser may not have the ability to conduct the same level of due diligence applied to Portfolio Fund investments. In addition, the Adviser may have little opportunities to negotiate the terms of such Co-Investments. The Master Fund generally will rely on the Portfolio Fund manager or sponsor offering such Co-Investment opportunity to perform most of the due diligence on the relevant portfolio company and to negotiate terms of the Co-Investment.

The Master Fund's ability to dispose of Co-Investments may be severely limited, both by the fact that the securities are expected to be unregistered and illiquid and by contractual restrictions that may limit, preclude or require certain approvals for the Master Fund to sell such investment. Co-Investments may be heavily negotiated and, therefore, the Master Fund may incur additional legal and transaction costs in connection therewith. Co-Investments are generally subject to many of the same risks as investments in the Portfolio Funds. See "—Risks of Private Equity Investments Generally."

Co-Investing Alongside Other Parties Risks

Co-investing alongside one or more other parties in an investment involves risks that may not be present in investments made by lead or sponsoring private equity investors. As a co-investor, the Fund may have interests or objectives that are inconsistent with those of the lead private equity investors that generally have a greater degree of control over such investments.

In addition, in order to take advantage of co-investment opportunities, the Master Fund generally will be required to hold a non-controlling interest, for example, by becoming a limited partner in a co-investment partnership that is controlled by the general partner or manager of the private equity fund offering the co-investment to the Master Fund. In this event, the Master Fund would have less control over the investment and may be adversely affected by actions taken by such general partner or manager with respect to the portfolio company and the Master Fund's investment in it. The Master Fund may not have the opportunity to participate in structuring investments or to determine the terms under which such investments will be made.

| 21 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

Absence of Regulatory Oversight

The Portfolio Funds will not be registered as investment companies under the 1940 Act, and the Fund, as an indirect investor in these Portfolio Funds, will not have the benefit of the protection afforded by the 1940 Act to investors in registered investment companies (which, among other protections, require investment companies to have a majority of disinterested directors, require securities held in custody at all times to be individually segregated from the securities of any other person and marked to clearly identify such securities as the property of such investment company, and regulate the relationship between the adviser and the investment company).

In-Kind Distributions

The Adviser expects in most instances to cause the Master Fund to make distributions to the Fund in cash, but retains the discretion to make distributions of securities in kind to the Fund to the extent permitted under applicable law. There can be no assurance that securities distributed in kind will be readily marketable or salable, and Investors may be required to hold such securities for an indefinite period and/or may incur additional expense in connection with any disposition of such securities. If the Fund ultimately receives distributions in kind indirectly from any of the Portfolio Funds, it may incur additional costs and risks in connection with the disposition of such assets or may distribute such assets in kind to the Investors who may incur such costs and risks.

Projections

Projected operating results of a Co-Investment or a portfolio company in which a Portfolio Fund invests normally will be based primarily on financial projections prepared by each company's management. In all cases, projections are only estimates of future results that are based upon information received from the company and assumptions made at the time the projections are developed. There can be no assurance that the results are set forth in the projections will be attained, and actual results may be significantly different from the projections. Also, general economic factors, which are not predictable, can have a material effect on the reliability of projections.

Carried Interests

Generally, each of the Portfolio Funds provides its respective general partners or managers certain specified carried interests or other special allocations based on the returns to its investors. Such carried interests may create incentives for the general partners or managers of the Portfolio Funds to make more risky or speculative investments than they would otherwise make. Each Investor in the Fund will pay, in effect, two sets of carried interests, one at the Fund level and one indirectly through the Master Fund at the Portfolio Fund level. Consequently, the returns to Investors will be lower than returns to a direct investor in the Portfolio Funds.

Solely in respect of carried interest, the holding period required to claim the lower U.S. federal income tax rate generally applicable to long-term capital gains is greater than three years rather

| 22 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

than greater than one year. Gain recognized by the Fund on investments held by the Portfolio Funds for more than one year but not more than three years would continue to be treated as long-term capital gains if allocated to the Investors in respect of their capital contributions but would be treated as short-term capital gain (generally subject to U.S. federal income tax at ordinary income rates) if allocated in respect of the special member of the Master Fund's carried interest. Thus, the Adviser has an incentive, not shared by the Investors, to ensure that the Master Fund holds investments for more than three years.

Investments Longer Than Term

The Fund may make investments which may not be realized prior to the date the Fund is to be dissolved. The Fund may attempt to sell, distribute, or otherwise dispose of investments at a time which may be disadvantageous, and as a result, the price obtained for such investments may be less than that which could have been obtained if the investments were held for a longer period of time. Moreover, the Fund may be unsuccessful in realizing investments at the time of the Fund's dissolution. There can be no assurance that the winding up of the Fund and the final distribution of its assets will be able to be executed expeditiously.

Illiquid and Long-Term Investments

An investment in the Fund requires a long-term commitment. Although the Co-Investments and portfolio companies of the Portfolio Funds invested in by the Fund may occasionally generate some current income, return of capital and the realization of gains, if any, from such portfolio company generally will occur only upon partial or complete sale or other disposition of such portfolio company. While one or more of these transactions may occur at any time with respect to a given portfolio company, sale or other disposition of a portfolio company of a Portfolio Fund is generally not expected to occur for a number of years (in most instances two to four years, or longer) after the initial investment is made.

Financial Markets Fluctuations and Changes

General fluctuations in the market prices of securities may affect the value of the Fund's investments. Instability in the securities markets also may increase the risks inherent in the Fund's investments. The ability of portfolio companies to refinance debt securities may depend on their ability to sell new securities in the public high-yield debt market or otherwise.

Need for Follow-On Investments

Following its initial investment in a given portfolio company, a Portfolio Fund may decide to provide additional funds to such portfolio company or may have the opportunity to increase its investment in a successful portfolio company. There is no assurance that a Portfolio Fund will make follow-on investments or that a Portfolio Fund will have sufficient funds to make all or any of such investments. Any decision by a Portfolio Fund not to make follow-on investments or its inability to make such investments (i) may have a subsequent negative effect on a portfolio company in need of such an investment, (ii) result in a lost opportunity for a Portfolio Fund to

| 23 |

NB Crossroads Private Markets Fund IV (TI) - Client LLC

Investment Program (Unaudited)

March 31, 2022

increase its participation in a successful operation, or (iii) result in a loss of certain anti-dilution protection.

Non-U.S. Investments