knsl-2023123100016691622023FYfalse12/31——————00016691622023-01-012023-12-3100016691622023-06-30iso4217:USD00016691622024-02-16xbrli:shares00016691622023-12-3100016691622022-12-31iso4217:USDxbrli:shares00016691622022-01-012022-12-3100016691622021-01-012021-12-310001669162us-gaap:CommonStockMember2020-12-310001669162us-gaap:AdditionalPaidInCapitalMember2020-12-310001669162us-gaap:RetainedEarningsMember2020-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100016691622020-12-310001669162us-gaap:CommonStockMember2021-01-012021-12-310001669162us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001669162us-gaap:RetainedEarningsMember2021-01-012021-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001669162us-gaap:CommonStockMember2021-12-310001669162us-gaap:AdditionalPaidInCapitalMember2021-12-310001669162us-gaap:RetainedEarningsMember2021-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100016691622021-12-310001669162us-gaap:CommonStockMember2022-01-012022-12-310001669162us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001669162us-gaap:RetainedEarningsMember2022-01-012022-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001669162us-gaap:CommonStockMember2022-12-310001669162us-gaap:AdditionalPaidInCapitalMember2022-12-310001669162us-gaap:RetainedEarningsMember2022-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001669162us-gaap:CommonStockMember2023-01-012023-12-310001669162us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001669162us-gaap:RetainedEarningsMember2023-01-012023-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001669162us-gaap:CommonStockMember2023-12-310001669162us-gaap:AdditionalPaidInCapitalMember2023-12-310001669162us-gaap:RetainedEarningsMember2023-12-310001669162us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31xbrli:pure0001669162srt:MaximumMemberus-gaap:BuildingMember2023-12-310001669162us-gaap:LandImprovementsMembersrt:MinimumMember2023-12-310001669162srt:MaximumMemberus-gaap:LandImprovementsMember2023-12-310001669162us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310001669162us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310001669162us-gaap:TechnologyEquipmentMembersrt:MinimumMember2023-12-310001669162srt:MaximumMemberus-gaap:TechnologyEquipmentMember2023-12-310001669162us-gaap:BuildingMember2023-12-310001669162us-gaap:BuildingMember2022-12-310001669162us-gaap:ParkingMember2023-12-310001669162us-gaap:ParkingMember2022-12-310001669162us-gaap:LandMember2023-12-310001669162us-gaap:LandMember2022-12-310001669162us-gaap:EquipmentMember2023-12-310001669162us-gaap:EquipmentMember2022-12-310001669162us-gaap:SoftwareDevelopmentMember2023-12-310001669162us-gaap:SoftwareDevelopmentMember2022-12-310001669162us-gaap:FurnitureAndFixturesMember2023-12-310001669162us-gaap:FurnitureAndFixturesMember2022-12-310001669162us-gaap:LeaseholdImprovementsMember2023-12-310001669162us-gaap:LeaseholdImprovementsMember2022-12-310001669162us-gaap:LandImprovementsMember2023-12-310001669162us-gaap:LandImprovementsMember2022-12-310001669162us-gaap:ConstructionInProgressMember2023-12-310001669162us-gaap:ConstructionInProgressMember2022-12-310001669162knsl:ExcessandsurpluslinesinsuranceauthorizationMember2022-01-012022-12-310001669162knsl:ExcessandsurpluslinesinsuranceauthorizationMember2021-01-012021-12-310001669162knsl:ExcessandsurpluslinesinsuranceauthorizationMember2023-01-012023-12-310001669162us-gaap:USTreasuryAndGovernmentMember2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001669162us-gaap:CorporateDebtSecuritiesMember2023-12-310001669162us-gaap:AssetBackedSecuritiesMember2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:USTreasuryAndGovernmentMember2022-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001669162us-gaap:CorporateDebtSecuritiesMember2022-12-310001669162us-gaap:AssetBackedSecuritiesMember2022-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:DebtSecuritiesMember2023-12-31utr:Rate0001669162us-gaap:RealEstateInvestmentMember2023-01-012023-12-310001669162us-gaap:RealEstateInvestmentMember2022-01-012022-12-310001669162us-gaap:RealEstateInvestmentMember2021-01-012021-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2023-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:FairValueMeasurementsRecurringMember2023-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMember2022-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:FairValueMeasurementsRecurringMember2022-12-310001669162us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001669162us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-12-310001669162us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001669162us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001669162us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001669162us-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001669162us-gaap:StateAndLocalJurisdictionMember2023-12-310001669162us-gaap:StateAndLocalJurisdictionMember2022-12-310001669162knsl:ShortDurationInsuranceContractAccidentYear2021and2022MemberMember2023-01-012023-12-310001669162knsl:ShortDurationInsuranceContractAccidentYear2020and2021MemberMember2022-01-012022-12-310001669162us-gaap:CatastropheMember2022-01-012022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Member2021-01-012021-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Member2021-01-012021-12-310001669162us-gaap:CatastropheMember2021-01-012021-12-310001669162us-gaap:PropertyInsuranceProductLineMember2023-01-012023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberus-gaap:PropertyInsuranceProductLineMember2019-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberus-gaap:PropertyInsuranceProductLineMember2020-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberus-gaap:PropertyInsuranceProductLineMember2021-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberus-gaap:PropertyInsuranceProductLineMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberus-gaap:PropertyInsuranceProductLineMember2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberus-gaap:PropertyInsuranceProductLineMember2020-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberus-gaap:PropertyInsuranceProductLineMember2021-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberus-gaap:PropertyInsuranceProductLineMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberus-gaap:PropertyInsuranceProductLineMember2023-12-310001669162us-gaap:PropertyInsuranceProductLineMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2021-12-310001669162us-gaap:PropertyInsuranceProductLineMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2022-12-310001669162us-gaap:PropertyInsuranceProductLineMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberus-gaap:PropertyInsuranceProductLineMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberus-gaap:PropertyInsuranceProductLineMember2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2023Memberus-gaap:PropertyInsuranceProductLineMember2023-12-310001669162us-gaap:PropertyInsuranceProductLineMember2023-12-310001669162knsl:CasualtyclaimsmadeMember2023-01-012023-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2014-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2015-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2016-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2017-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2018-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2019-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2020-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2021-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2015-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2016-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2017-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2018-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2019-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2020-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2021-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2016-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2017-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2018-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2019-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2020-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2021-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2022-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2023-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2017-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2018-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2019-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2020-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2021-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2022-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2023-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2018-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2019-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2020-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2021-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberknsl:CasualtyclaimsmadeMember2019-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberknsl:CasualtyclaimsmadeMember2020-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberknsl:CasualtyclaimsmadeMember2021-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2019Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberknsl:CasualtyclaimsmadeMember2020-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberknsl:CasualtyclaimsmadeMember2021-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2021-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2022-12-310001669162knsl:CasualtyclaimsmadeMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberknsl:CasualtyclaimsmadeMember2022-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162us-gaap:ShortDurationInsuranceContractAccidentYear2023Memberknsl:CasualtyclaimsmadeMember2023-12-310001669162knsl:CasualtyclaimsmadeMember2023-12-310001669162knsl:CasualtyoccurrenceMember2023-01-012023-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2014-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2015-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2016-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2017-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2018-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2019-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2020-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2021-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2022-12-310001669162us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberknsl:CasualtyoccurrenceMember2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2015-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2016-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2017-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2018-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2019-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2016-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2017-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2018-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2019-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2017-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2018-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2019-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2018-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2019-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2019-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2020Member2020-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2020Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2020Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2020Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2021-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2022Member2022-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2022Member2023-12-310001669162knsl:CasualtyoccurrenceMemberus-gaap:ShortDurationInsuranceContractAccidentYear2023Member2023-12-310001669162knsl:CasualtyoccurrenceMember2023-12-310001669162knsl:CasualtyMember2023-01-012023-12-310001669162knsl:CreditRiskReinsurerOneMember2023-12-310001669162knsl:CreditRiskReinsurerTwoMember2023-12-310001669162knsl:CreditRiskReinsurerThreeMember2023-12-310001669162knsl:CreditRiskReinsurerFourMember2023-12-310001669162knsl:CreditRiskReinsurerFiveMember2023-12-310001669162knsl:MajorReinsurersMemberus-gaap:ReinsurerConcentrationRiskMemberknsl:ReinsuranceRecoverablesOnPaidAndUnpaidLossesFromTheCompanysFiveLargestReinsurersAsPercentOfTotalReinsuranceRecoverablesMember2023-01-012023-12-310001669162knsl:MajorReinsurersMemberknsl:PrepaidReinsurancePremiumsCededToFiveReinsurersAsAPercentageOfTotalCededUnearnedPremiumBalanceMemberus-gaap:ReinsurerConcentrationRiskMember2023-01-012023-12-3100016691622022-11-152022-11-1500016691622022-11-150001669162knsl:A2016OmnibusIncentivePlanMembersrt:MaximumMember2016-07-270001669162knsl:A2016OmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMember2016-07-272016-07-270001669162us-gaap:EmployeeStockOptionMember2016-07-272016-07-270001669162us-gaap:EmployeeStockOptionMember2022-12-310001669162us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001669162us-gaap:EmployeeStockOptionMember2023-12-310001669162us-gaap:RestrictedStockMembersrt:MinimumMember2023-01-012023-12-310001669162srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001669162us-gaap:RestrictedStockMember2022-12-310001669162us-gaap:RestrictedStockMember2023-01-012023-12-310001669162us-gaap:RestrictedStockMember2023-12-310001669162us-gaap:RestrictedStockMember2022-01-012022-12-310001669162us-gaap:RestrictedStockMember2021-01-012021-12-310001669162us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMember2024-01-012024-01-010001669162us-gaap:DividendDeclaredMemberus-gaap:SubsequentEventMember2024-02-122024-02-120001669162us-gaap:DividendDeclaredMemberus-gaap:SubsequentEventMember2024-02-120001669162us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001669162us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001669162us-gaap:SeniorNotesMemberknsl:A2034SeriesANotesMember2023-01-012023-12-310001669162us-gaap:SeniorNotesMemberknsl:A2034SeriesANotesMember2023-12-310001669162us-gaap:SeniorNotesMember2023-12-310001669162knsl:A2034SeriesBNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001669162knsl:A2034SeriesBNotesMemberus-gaap:SeniorNotesMember2023-12-310001669162us-gaap:LineOfCreditMember2023-12-310001669162us-gaap:LineOfCreditMember2023-01-012023-12-310001669162us-gaap:LineOfCreditMember2022-12-310001669162us-gaap:SeniorNotesMemberknsl:A2034SeriesANotesMember2022-12-310001669162knsl:A2034SeriesBNotesMemberus-gaap:SeniorNotesMember2022-12-310001669162knsl:CommercialPropertyMember2023-01-012023-12-310001669162knsl:CommercialPropertyMember2022-01-012022-12-310001669162knsl:CommercialPropertyMember2021-01-012021-12-310001669162knsl:ExcessCasualtyInsuranceProductLineMember2023-01-012023-12-310001669162knsl:ExcessCasualtyInsuranceProductLineMember2022-01-012022-12-310001669162knsl:ExcessCasualtyInsuranceProductLineMember2021-01-012021-12-310001669162knsl:SmallBusinessCasualtyMember2023-01-012023-12-310001669162knsl:SmallBusinessCasualtyMember2022-01-012022-12-310001669162knsl:SmallBusinessCasualtyMember2021-01-012021-12-310001669162us-gaap:ConstructionMember2023-01-012023-12-310001669162us-gaap:ConstructionMember2022-01-012022-12-310001669162us-gaap:ConstructionMember2021-01-012021-12-310001669162knsl:GeneralCasualtyInsuranceProductLineMember2023-01-012023-12-310001669162knsl:GeneralCasualtyInsuranceProductLineMember2022-01-012022-12-310001669162knsl:GeneralCasualtyInsuranceProductLineMember2021-01-012021-12-310001669162knsl:AlliedHealthInsuranceProductLineMember2023-01-012023-12-310001669162knsl:AlliedHealthInsuranceProductLineMember2022-01-012022-12-310001669162knsl:AlliedHealthInsuranceProductLineMember2021-01-012021-12-310001669162knsl:ProductsLiabilityMember2023-01-012023-12-310001669162knsl:ProductsLiabilityMember2022-01-012022-12-310001669162knsl:ProductsLiabilityMember2021-01-012021-12-310001669162knsl:SmallBusinessPropertyMember2023-01-012023-12-310001669162knsl:SmallBusinessPropertyMember2022-01-012022-12-310001669162knsl:SmallBusinessPropertyMember2021-01-012021-12-310001669162knsl:LifeSciencesMember2023-01-012023-12-310001669162knsl:LifeSciencesMember2022-01-012022-12-310001669162knsl:LifeSciencesMember2021-01-012021-12-310001669162us-gaap:EntertainmentMember2023-01-012023-12-310001669162us-gaap:EntertainmentMember2022-01-012022-12-310001669162us-gaap:EntertainmentMember2021-01-012021-12-310001669162knsl:EnergyInsuranceProductLineMember2023-01-012023-12-310001669162knsl:EnergyInsuranceProductLineMember2022-01-012022-12-310001669162knsl:EnergyInsuranceProductLineMember2021-01-012021-12-310001669162us-gaap:ProfessionalLiabilityInsuranceMember2023-01-012023-12-310001669162us-gaap:ProfessionalLiabilityInsuranceMember2022-01-012022-12-310001669162us-gaap:ProfessionalLiabilityInsuranceMember2021-01-012021-12-310001669162knsl:ManagementLiabilityInsuranceProductLineMember2023-01-012023-12-310001669162knsl:ManagementLiabilityInsuranceProductLineMember2022-01-012022-12-310001669162knsl:ManagementLiabilityInsuranceProductLineMember2021-01-012021-12-310001669162knsl:EnvironmentalMember2023-01-012023-12-310001669162knsl:EnvironmentalMember2022-01-012022-12-310001669162knsl:EnvironmentalMember2021-01-012021-12-310001669162knsl:ExcessProfessionalMember2023-01-012023-12-310001669162knsl:ExcessProfessionalMember2022-01-012022-12-310001669162knsl:ExcessProfessionalMember2021-01-012021-12-310001669162us-gaap:HealthCareMember2023-01-012023-12-310001669162us-gaap:HealthCareMember2022-01-012022-12-310001669162us-gaap:HealthCareMember2021-01-012021-12-310001669162knsl:PublicEntityMember2023-01-012023-12-310001669162knsl:PublicEntityMember2022-01-012022-12-310001669162knsl:PublicEntityMember2021-01-012021-12-310001669162knsl:CommercialAutoMember2023-01-012023-12-310001669162knsl:CommercialAutoMember2022-01-012022-12-310001669162knsl:CommercialAutoMember2021-01-012021-12-310001669162knsl:InlandMarineInsuranceProductLineMember2023-01-012023-12-310001669162knsl:InlandMarineInsuranceProductLineMember2022-01-012022-12-310001669162knsl:InlandMarineInsuranceProductLineMember2021-01-012021-12-310001669162knsl:AviationMember2023-01-012023-12-310001669162knsl:AviationMember2022-01-012022-12-310001669162knsl:AviationMember2021-01-012021-12-310001669162knsl:OceanMarineMember2023-01-012023-12-310001669162knsl:OceanMarineMember2022-01-012022-12-310001669162knsl:OceanMarineMember2021-01-012021-12-310001669162knsl:ProductRecallMember2023-01-012023-12-310001669162knsl:ProductRecallMember2022-01-012022-12-310001669162knsl:ProductRecallMember2021-01-012021-12-310001669162knsl:RailroadMember2023-01-012023-12-310001669162knsl:RailroadMember2022-01-012022-12-310001669162knsl:RailroadMember2021-01-012021-12-310001669162us-gaap:PropertyAndCasualtyCommercialInsuranceProductLineMember2023-01-012023-12-310001669162us-gaap:PropertyAndCasualtyCommercialInsuranceProductLineMember2022-01-012022-12-310001669162us-gaap:PropertyAndCasualtyCommercialInsuranceProductLineMember2021-01-012021-12-310001669162knsl:PersonalInsuranceMember2023-01-012023-12-310001669162knsl:PersonalInsuranceMember2022-01-012022-12-310001669162knsl:PersonalInsuranceMember2021-01-012021-12-310001669162knsl:HighValueHomeownersMember2023-01-012023-12-310001669162knsl:HighValueHomeownersMember2022-01-012022-12-310001669162knsl:HighValueHomeownersMember2021-01-012021-12-310001669162us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2023-01-012023-12-310001669162us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2022-01-012022-12-310001669162us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2021-01-012021-12-310001669162us-gaap:SalesRevenueNetMember2023-01-012023-12-310001669162knsl:MajorInsuranceBrokersGroupOneMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001669162us-gaap:SalesRevenueNetMemberknsl:MajorInsuranceBrokersGroupTwoMember2023-01-012023-12-310001669162knsl:MajorInsuranceBrokersGroupThreeMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001669162knsl:MajorInsuranceBrokersGroupOneMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001669162us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberknsl:MajorInsuranceBrokersGroupTwoMember2023-01-012023-12-310001669162knsl:MajorInsuranceBrokersGroupThreeMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001669162srt:RestatementAdjustmentMember2022-01-012022-12-310001669162srt:RestatementAdjustmentMember2021-01-012021-12-310001669162us-gaap:USTreasuryAndGovernmentMember2023-12-310001669162us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001669162us-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001669162us-gaap:AssetBackedSecuritiesMember2023-12-310001669162us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001669162us-gaap:FixedMaturitiesMember2023-12-310001669162us-gaap:ExchangeTradedFundsMember2023-12-310001669162us-gaap:BanksTrustAndInsuranceEquitiesMember2023-12-310001669162us-gaap:IndustrialMiscellaneousAndAllOthersMember2023-12-310001669162us-gaap:NonredeemablePreferredStockMember2023-12-310001669162us-gaap:EquitySecuritiesInvestmentSummaryMember2023-12-310001669162us-gaap:ShortTermInvestmentsMember2023-12-310001669162srt:ParentCompanyMember2023-12-310001669162srt:ParentCompanyMember2022-12-310001669162srt:ParentCompanyMemberus-gaap:RelatedPartyMember2023-12-310001669162srt:ParentCompanyMemberus-gaap:RelatedPartyMember2022-12-310001669162srt:ParentCompanyMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001669162srt:ParentCompanyMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001669162srt:ParentCompanyMember2021-01-012021-12-310001669162srt:ParentCompanyMember2023-01-012023-12-310001669162srt:ParentCompanyMember2022-01-012022-12-310001669162srt:ParentCompanyMember2021-12-310001669162srt:ParentCompanyMember2020-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2022-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2023-01-012023-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2023-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2022-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2023-01-012023-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2023-12-310001669162knsl:SECSchedule1209AllowanceFixedMaturitySecuritiesMember2022-12-310001669162knsl:SECSchedule1209AllowanceFixedMaturitySecuritiesMember2023-01-012023-12-310001669162knsl:SECSchedule1209AllowanceFixedMaturitySecuritiesMember2023-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2021-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2022-01-012022-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2021-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2022-01-012022-12-310001669162knsl:SECSchedule1209AllowanceFixedMaturitySecuritiesMember2021-12-310001669162knsl:SECSchedule1209AllowanceFixedMaturitySecuritiesMember2022-01-012022-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2020-12-310001669162us-gaap:AllowanceForUncollectiblePremiumsReceivableMember2021-01-012021-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001669162us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2020-12-310001669162us-gaap:AllowanceForReinsuranceRecoverableMember2021-01-012021-12-3100016691622023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-37848

| | | | | | | | |

| KINSALE CAPITAL GROUP, INC. |

(Exact name of registrant as specified in its charter)

|

| Delaware | | 98-0664337 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

2035 Maywill Street, Suite 100

Richmond, Virginia 23230

(Address of principal executive offices, including zip code)

(804) 289-1300

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | KNSL | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the shares of the registrant's common stock held by non-affiliates as of June 30, 2023 was approximately $8,197,188,903.

The number of the registrant’s common shares outstanding was 23,189,095 as of February 16, 2024.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement relating to its 2024 annual meeting of stockholders (the "2024 Proxy Statement") are incorporated by reference into Part III of this Annual Report on Form 10-K. The 2024 Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

Table of Contents

| | | | | | | | |

| | Page |

| PART I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | | |

| Item 15. | | |

| Item 16. | | |

Unless the context requires otherwise, the words "Kinsale," the "Company," "we," "us" and "our" in this Annual Report on Form 10-K refer to Kinsale Capital Group, Inc. and its subsidiaries.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to historical or current fact. These statements may discuss, among others, our future financial performance, our business prospects and strategy, our anticipated financial position, liquidity and capital, dividends and general market and industry conditions. You can identify forward-looking statements by words such as "anticipates," "estimates," "expects," "intends," "plans," "predicts," "projects," "believes," "seeks," "outlook," "future," "will," "would," "should," "could," "may," "can have" and similar terms. Forward-looking statements are based on management’s current expectations and assumptions about future events, which are subject to uncertainties, risks and changes in circumstances that are difficult to predict. These statements are only predictions and are not guarantees of future performance. Actual results may differ materially from those contemplated by a forward-looking statement. Factors that may cause such differences include, without limitation:

•the possibility that our loss reserves may be inadequate to cover our actual losses, which could have a material adverse effect on our financial condition, results of operations and cash flows;

•the inherent uncertainty of models resulting in actual losses that are materially different than our estimates;

•the failure of any of the loss limitations or exclusions we employ, or change in other claims or coverage issues, having a material adverse effect on our financial condition or results of operations;

•the inability to obtain reinsurance coverage at reasonable prices and on terms that adequately protect us;

•the possibility that severe weather conditions and catastrophes, including due to climate change, pandemics and similar events adversely affecting our business, results of operations and financial condition;

•adverse economic factors, including recession, inflation, periods of high unemployment or lower economic activity resulting in the sale of fewer policies than expected or an increase in frequency or severity of claims and premium defaults or both, affecting our growth and profitability;

•a decline in our financial strength rating adversely affecting the amount of business we write;

•the potential loss of one or more key executives or an inability to attract and retain qualified personnel adversely affecting our results of operations;

•our reliance on a select group of brokers;

•the changing market conditions of our excess and surplus lines ("E&S") insurance operations, as well as the cyclical nature of our business, affecting our financial performance;

•our employees taking excessive risks;

•the intense competition for business in our industry;

•the effects of litigation having an adverse effect on our business;

•the performance of our investment portfolio adversely affecting our financial results;

•the ability to pay dividends being dependent on our ability to obtain cash dividends or other permitted payments from our insurance subsidiary;

•being forced to sell investments to meet our liquidity requirements;

•our credit agreements contain a number of financial and other covenants, the breach of which could result in acceleration of payment of amounts due under our borrowings;

•extensive regulation adversely affecting our ability to achieve our business objectives or the failure to comply with these regulations adversely affecting our financial condition and results of operations;

•the other risks and uncertainties discussed in Part I, Item 1A of this Annual Report on Form 10-K.

Forward-looking statements speak only as of the date on which they are made. Except as expressly required under federal securities laws or the rules and regulations of the Securities and Exchange Commission ("SEC"), we do not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

PART I

Item 1. Business

Kinsale is a property and casualty insurance company that focuses exclusively on the excess and surplus lines ("E&S") market in the U.S., where we can use our underwriting expertise to write coverages for hard-to-place, small business risks and personal lines risks. We market and sell these insurance products in all 50 states, the District of Columbia, the Commonwealth of Puerto Rico and the U.S. Virgin Islands primarily through a network of independent insurance brokers. Our experienced and cohesive management team has an average of over 30 years of relevant experience. Many of our employees and members of our management team have also worked together for decades at other E&S insurance companies.

Our goal is to deliver long-term value for our stockholders by growing our business and generating attractive returns. We seek to accomplish this by generating consistent and attractive underwriting profits while managing our capital prudently. Using our proprietary technology platform and leveraging the expertise of our highly-experienced employees in our daily operations, we have built a company that is entrepreneurial and highly efficient. We believe our systems and technology are at the digital forefront of the insurance industry and allow us to quickly collect and analyze data, thereby improving our ability to manage our business and reduce our response times to our customers. We believe that we have differentiated ourselves from our competitors by effectively leveraging technology, vigilantly controlling expenses and maintaining control over our underwriting and claims operations.

We have significantly grown our business and have generated strong returns. During 2023, our gross written premiums increased by 42.3%, to $1.6 billion for the year ended December 31, 2023. Our return on equity and combined ratios were 33.6% and 75.4%, respectively, for the year ended December 31, 2023. Our operating return on equity, a non-GAAP financial measure, was 31.8% for the year ended December 31, 2023. We believe that we are well positioned to continue to capitalize on attractive opportunities in our target market and to prudently grow our business. See "Management’s Discussion and Analysis of Financial Condition and Results of Operations — Reconciliation of Non-GAAP Financial Measures" for a reconciliation of net income to net operating earnings and calculations using net operating earnings (e.g., operating return on equity).

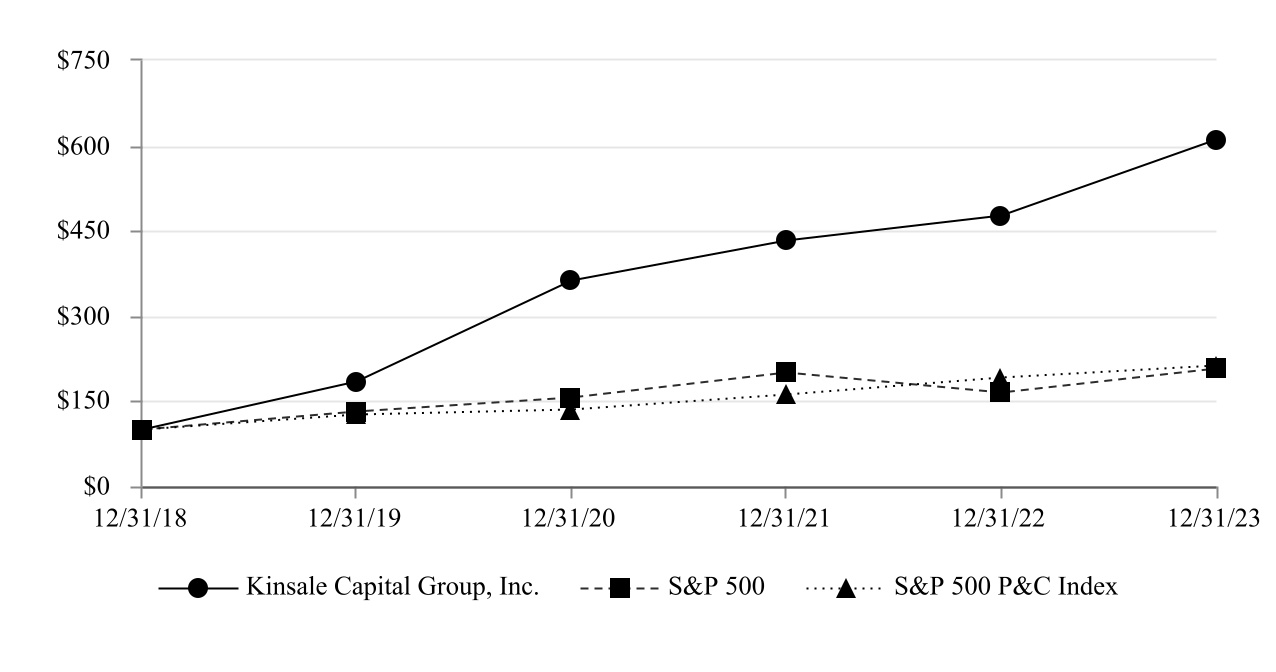

The following table compares stockholder returns of Kinsale to those of the S&P 500.

| | | | | | | | | | | | | | |

| Kinsale's Performance vs. the S&P 500 |

| | | | |

| | Annual Percentage Change (1) |

| Year | | Kinsale (2) | | S&P 500 |

| 2016 | | 113.5 | | | 4.2 | |

| 2017 | | 33.2 | | | 21.8 | |

| 2018 | | 24.1 | | | (4.4) | |

| 2019 | | 83.7 | | | 31.5 | |

| 2020 | | 97.3 | | | 18.4 | |

| 2021 | | 19.2 | | | 28.7 | |

| 2022 | | 10.2 | | | (18.1) | |

| 2023 | | 28.3 | | | 26.3 | |

| Compounded Annual Gain ─ 2016-2023 | | 51.2 | % | | 13.2 | % |

| Overall Gain ─ 2016-2023 | | 2,052.6 | % | | 151.4 | % |

(1) Data for 2016 begins with Kinsale's initial public offering date of July 28, 2016 and assumes reinvestment of dividends.

(2) Returns are calculated from the initial public offering price of $16.00 per share.

Our Products

We write a broad array of insurance coverages for risks that are unusual or hard to place in the standard insurance market. Typical E&S risks include newly established companies or industries, high-risk operations, insureds in litigious venues or companies with poor loss histories. We target classes of business where our underwriters have extensive experience allowing us to compete effectively and earn attractive returns. Our underwriters specialize in individual lines of business which allows them to develop in-depth knowledge and experience of the risks they underwrite. Our core client focus is small- to medium-sized accounts, which we believe are subject to less competition and have better pricing. The average premium per policy written by us in 2023 was $15,200. Excluding our personal insurance division, which has a relatively low premium per policy written, the average premium per policy written was $16,400 in 2023. We believe that our strategy, experience and expertise allow us to compete effectively in the E&S market and will enable us to generate attractive long-term stockholder value.

In 2023, the percentage breakdown of our gross written premiums was 67.3% casualty and 32.7% property. Our commercial lines offerings include commercial property, excess casualty, small business casualty, construction, general casualty, allied health, products liability, small business property, life sciences, entertainment, energy, professional liability, management liability, environmental, excess professional, health care, public entity, commercial auto, inland marine, aviation, ocean marine, product recall, and railroad. We also write homeowners' coverage in the personal lines market, which in aggregate represented 2.5% of our gross written premiums in 2023.

The following table provides a summary of gross premiums written by division for the years ended December 31, 2023, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 | | 2021 |

| | ($ in thousands) |

| Commercial: | | | | | | | | | | | | |

| Commercial Property | | $ | 411,956 | | | 26.3 | % | | $ | 181,505 | | | 16.5 | % | | $ | 72,392 | | | 9.5 | % |

| Excess Casualty | | 194,049 | | | 12.4 | % | | 147,485 | | | 13.4 | % | | 108,487 | | | 14.2 | % |

| Small Business Casualty | | 174,080 | | | 11.1 | % | | 149,366 | | | 13.6 | % | | 112,553 | | | 14.7 | % |

| Construction | | 137,887 | | | 8.8 | % | | 122,524 | | | 11.1 | % | | 101,441 | | | 13.3 | % |

| General Casualty | | 118,745 | | | 7.5 | % | | 69,784 | | | 6.3 | % | | 36,037 | | | 4.7 | % |

| Allied Health | | 67,808 | | | 4.3 | % | | 58,839 | | | 5.4 | % | | 51,945 | | | 6.8 | % |

| Products Liability | | 61,786 | | | 3.9 | % | | 60,374 | | | 5.5 | % | | 55,070 | | | 7.2 | % |

| Small Business Property | | 43,893 | | | 2.8 | % | | 21,002 | | | 1.9 | % | | 6,160 | | | 0.8 | % |

| Life Sciences | | 41,379 | | | 2.6 | % | | 41,346 | | | 3.7 | % | | 40,487 | | | 5.3 | % |

| Entertainment | | 39,218 | | | 2.5 | % | | 22,268 | | | 2.0 | % | | 12,401 | | | 1.6 | % |

| All other commercial lines | | 239,537 | | | 15.3 | % | | 193,049 | | | 17.5 | % | | 140,277 | | | 18.4 | % |

| Total commercial | | 1,530,338 | | | 97.5 | % | | 1,067,542 | | | 96.9 | % | | 737,250 | | | 96.5 | % |

| Personal: | | | | | | | | | | | | |

| Personal Insurance | | 24,182 | | | 1.5 | % | | 31,289 | | | 2.8 | % | | 27,002 | | | 3.5 | % |

| High Value Homeowners | | 14,295 | | | 1.0 | % | | 3,261 | | | 0.3 | % | | 121 | | | — | % |

| Total personal | | $ | 38,477 | | | 2.5 | % | | $ | 34,550 | | | 3.1 | % | | $ | 27,123 | | | 3.5 | % |

| Total gross written premiums | | $ | 1,568,815 | | | 100.0 | % | | $ | 1,102,092 | | | 100.0 | % | | $ | 764,373 | | | 100.0 | % |

Our Competitive Strengths

We believe that our competitive strengths include:

Exclusive focus on the E&S market. The E&S, or non-admitted, market has historically operated at lower loss ratios and higher margins, and has grown direct premiums written more quickly than the standard, or admitted, market. From 2001

to 2022, A.M. Best Company's ("A.M. Best") domestic professional surplus lines composite produced an average net loss and loss adjustment expense ratio of 69.3% and grew direct premiums written by 9.6% annually, versus 73.6% and 4.2%, respectively for the property and casualty ("P&C") industry.

Underwriting expertise across a broad spectrum of hard-to-place risks. We have a broad appetite to underwrite a diverse set of risks across the E&S market. Our underwriting team is highly experienced, and individually underwrites each risk to appropriately price and structure solutions. We balance our broad risk appetite by maintaining a diversified book of smaller accounts with strong pricing and well-defined coverages. Unlike many of our competitors, we do not extend underwriting authority to brokers, agents or other third parties. For the year ended December 31, 2023, our loss and loss adjustment expense ratio was 54.6%.

Technology is a core competency. As an insurance company that was founded in 2009, we have the benefit of having built a proprietary technology platform that reflects the best practices our management team has learned from its extensive experience. We operate on an integrated digital platform with a data warehouse that collects an array of statistical data. Our platform provides a high degree of efficiency, accuracy and speed across all of our processes. We are able to use the data that we collect to quickly analyze trends across all functions in our business. Our customized proprietary systems help us to reduce the risk of administrative errors in our policy forms and include all of the necessary exclusions for the specified risk, and provides for the efficient and accurate handling of claims. Additionally, our systems enable us to rapidly respond to brokers, allowing our underwriters to reply to many of our submissions within 24 hours, a significant benefit to our brokers. While our technology offers a competitive advantage, we also recognize that more modern technologies provide solutions for increased automation and efficiency; as such, we continue to dedicate resources to maintain and improve our technology. We believe that our approach to technological advancement will provide us with an enduring competitive advantage as it allows us to quickly respond to market opportunities, and will continue to scale as our business grows.

Significantly lower expense ratio than our competitors. Expense management is ingrained in our business culture. We believe that the combination of our proprietary technology platform and our expense management allows us to process quotes, underwrite policies and operate with a substantial cost advantage over our direct competitors. In particular, our efficient platform allows us to provide a higher level of service to our brokers and to target smaller accounts which we believe are generally subject to less competition. For the year ended December 31, 2023, our expense ratio was 20.8%.

Fully integrated claims management. We believe that actively managing our claims results in more favorable outcomes and a higher degree of reserve accuracy. We manage all of our claims in-house and do not delegate claims management authority to third parties. We promptly and thoroughly investigate all claims, generally through direct contact with the insured, and leverage both our systems and our underwriters to gather the relevant facts. As necessary, we employ local counsel in defense of our policy holders and independent adjusters for task assignments. When we believe claims are without merit, we vigorously contest payment. We currently average 93 open claims per claims adjuster (92 open claims per claims adjuster excluding catastrophe claims), which we believe is lower than industry average. As of December 31, 2023, our reserves for claims incurred but not reported were approximately 90.5% of our total net loss reserves. Of the total open claims as of December 31, 2023, 16.1% were open for accident years 2019 and prior.

Entrepreneurial management team with a track record of success. Our management team is highly experienced with an average of over 30 years of relevant experience, bringing together a full suite of underwriting, claims, technology and operating skills that we believe will drive our long-term success. The majority of our management team has a proven track record of successfully building high-performing specialty insurance companies. We are led by Michael Kehoe who, prior to founding Kinsale, was the president and chief executive officer of James River Insurance Company from 2002 until 2008. Prior to James River Insurance Company, Mr. Kehoe held several senior positions at Colony Insurance Company. Many of our other employees and members of our management team worked with Mr. Kehoe at James River Insurance Company and have decades of experience at other E&S insurance companies. As meaningful owners of Kinsale, we believe our management team has closely-aligned interests with our stockholders.

Our Board of Directors has deep insurance and financial services industry experience. Our Board of Directors is comprised of accomplished industry veterans. Collectively, our board members bring decades of experience from their prior roles operating and working in insurance and other financial services companies.

Our Strategy

We believe that our approach to our business will allow us to achieve our goals of both growing our business and generating attractive returns. Our approach involves:

Expand our presence in the E&S market. According to A.M. Best, the total E&S market was approximately $98.5 billion of direct written premiums in 2022. Based on our 2023 gross written premiums of $1.6 billion, our current market share is approximately 1.6%. We believe that our exclusive focus on the E&S market and our high levels of service, including our ability to quote, underwrite and bind insurance policies in a timely manner through our efficient systems, allow us to better serve our brokers and position us to profitably increase our market share.

Generate underwriting profits. We focus on underwriting profitability regardless of market cycles. Our strategy is to concentrate on hard-to-place risks and to maintain adequate rate levels for the risks that we underwrite. We maintain control over our underwriting process to ensure consistent quality of work. We underwrite each account individually and never delegate authority to any outside agents or brokers.

Maintain a contrarian risk appetite. Our flexibility as an E&S insurer enables us to write business at attractive returns while offering competitive policies to our brokers and insureds. We believe we distinguish ourselves in the market with our contrarian risk appetite and our willingness to offer terms on risks requiring more extensive underwriting that some of our competitors may decline to consider. Such accounts frequently offer us a better return than those preferred by our competitors due to reduced competition.

Leverage investment in technology to drive efficiencies. We use a proprietary technology platform to drive a high level of efficiency, accuracy and speed in our underwriting and quoting process. We have organized our workflows, designed our systems and aligned our staff to provide superior service levels to brokers while achieving a level of efficiency that we believe provides us with a competitive advantage and helps contribute to our low expense ratio. We believe that automation also reduces human error in our underwriting, policy processing, accounting, collections, and claims adjusting processes. Additionally, we are able to track quotes, monitor historical loss experience and reserve development, and measure other relevant metrics at a granular level of detail. We believe that our technology approach is scalable and will allow us to maintain a low expense ratio as we continue to organically grow our business.

Maintain a strong balance sheet. In order to maintain the confidence of policyholders, brokers, reinsurers, investors, regulators and rating agencies, we seek to establish and maintain a conservative balance sheet. We have a robust process for setting our loss reserves and regularly reviewing our estimates. In addition, we maintain a conservative investment portfolio. Our strong balance sheet allows us to maintain the confidence of our investors and other constituencies, and thereby position ourselves to better achieve our goals.

Our Structure

The chart below displays our corporate structure:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Kinsale Capital Group, Inc. (Delaware corporation) | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Kinsale Management, Inc. (Delaware corporation; management services company) | | Kinsale Insurance Company (Arkansas corporation; stock insurance company) | | | Aspera Insurance Services, Inc. (Virginia corporation; insurance broker) | | | Kinsale Real Estate, Inc. (Delaware corporation; real estate holding company) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | 2001 Maywill, LLC (Delaware limited liability company; real estate entity) | | | 2000 Maywill, LLC (Delaware limited liability company; real estate entity) |

Kinsale Capital Group, Inc., a Delaware domiciled insurance holding company, was formed on June 3, 2009 for the purpose of acquiring and managing insurance entities. Prior to September 5, 2014, the Company was a Bermuda registered holding company, formerly known as Kinsale Capital Group, Ltd. ("KCGL"). Effective September 5, 2014, KCGL was re-domesticated from Bermuda to Delaware. A wholly-owned subsidiary of KCGL, Kinsale Capital Group, Inc., which was formed on June 4, 2009 as a U.S. holding company, was immediately merged into the re-domesticated entity and Kinsale Capital Group, Ltd. changed its name to Kinsale Capital Group, Inc.

On June 4, 2009, we incorporated Kinsale Management, Inc. ("Kinsale Management") as a wholly-owned subsidiary domiciled in Delaware, in order to provide management services to all of our U.S.-based subsidiaries.

On February 5, 2010, we acquired American Healthcare Specialty Insurance Company and changed its name to Kinsale Insurance Company ("Kinsale Insurance"). Kinsale Insurance is an Arkansas-domiciled insurance company and is eligible to operate on an excess and surplus lines basis in 50 states, the District of Columbia, the Commonwealth of Puerto Rico and the U.S. Virgin Islands.

On August 21, 2013, we established Aspera Insurance Services, Inc. ("Aspera"), an insurance broker. Aspera is domiciled in Virginia and is authorized to conduct business in Virginia, Alabama, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, South Carolina, Texas, Vermont and Washington.

On December 3, 2018, we incorporated Kinsale Real Estate, Inc. ("Kinsale Real Estate"), as a wholly-owned subsidiary domiciled in Delaware, in order to acquire and hold real estate.

On December 3, 2018, we incorporated 2001 Maywill, LLC, as a wholly-owned subsidiary of Kinsale Real Estate, domiciled in Delaware, in order to hold our corporate headquarters.

On September 8, 2022, we incorporated 2000 Maywill, LLC, as a wholly-owned subsidiary of Kinsale Real Estate, domiciled in Delaware, in order to acquire and hold real estate investment property.

Marketing and Distribution

We market our products through a broad group of independent insurance brokers that we believe can produce reasonable volumes of business for us. We also sell policies through our wholly-owned broker, Aspera. In 2023, Aspera distributed

1.9% of Kinsale’s premiums, primarily manufactured housing risks within our personal insurance division. Kinsale does not grant its independent brokers any underwriting or claims authority.

We select our brokers based on management's review of the experience, knowledge and business plan of each broker. While many of our brokers have more than one office, we evaluate each office as if it were a separate brokerage and may appoint some but not all offices owned by a broker for specialized lines of business. We seek brokers with business plans that are consistent with our strategy and underwriting objectives. Our underwriters regularly visit with brokers in their offices in order to market and discuss the products we offer.

For the year ended December 31, 2023, our largest brokers were RSG Specialty, LLC, which produced $316.5 million, or 20.2%, of our gross written premiums, AmWINS Brokerage, which produced $286.8 million, or 18.3% of our gross written premiums and CRC Commercial Solutions, which produced $178.7 million, or 11.4%, of our gross written premiums. No other broker accounted for more than 10% of our gross written premiums in the year ended December 31, 2023.

It is important to us that we maintain excellent relationships with our brokers. Commissions are an important part of that relationship, but brokers will also typically consider the ultimate price to the insured, and the service and expertise offered by the carrier when determining where to place their business. In 2023, we paid an average commission to our brokers of 14.5% of gross written premiums. We believe this is slightly lower than the average commission paid by our competitors. We believe that our specialization in hard-to-place risks, combined with our high degree of service, including our rapid response times, permits us to manage our commission expense as part of our overall management of the underwriting process. Additionally, we do not contract out our underwriting to program managers or general agents which typically requires a higher commission level to compensate the third party for its work on behalf of the carrier.

We sell policies in all 50 states, the District of Columbia, the Commonwealth of Puerto Rico and the U.S. Virgin Islands. The following tables show our gross written premiums by state for the years ended December 31, 2023, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | % of Total | | 2022 | | % of Total | | 2021 | | % of Total |

| | ($ in thousands) |

| Gross written premiums by state: | | | | | | | | | | |

| California | | $ | 295,242 | | | 18.8 | % | | $ | 221,994 | | | 20.1 | % | | $ | 168,694 | | | 22.1 | % |

| Florida | | 266,153 | | | 17.0 | % | | 186,891 | | | 17.0 | % | | 118,736 | | | 15.5 | % |

| Texas | | 198,758 | | | 12.7 | % | | 136,309 | | | 12.4 | % | | 88,679 | | | 11.6 | % |

| New York | | 66,489 | | | 4.2 | % | | 42,427 | | | 3.9 | % | | 31,495 | | | 4.1 | % |

| Louisiana | | 49,970 | | | 3.2 | % | | 30,981 | | | 2.8 | % | | 14,507 | | | 1.9 | % |

| Washington | | 46,507 | | | 3.0 | % | | 40,546 | | | 3.7 | % | | 31,167 | | | 4.1 | % |

| Colorado | | 43,852 | | | 2.8 | % | | 32,406 | | | 2.9 | % | | 26,250 | | | 3.4 | % |

| New Jersey | | 42,061 | | | 2.7 | % | | 30,425 | | | 2.8 | % | | 22,125 | | | 2.9 | % |

| Georgia | | 36,585 | | | 2.3 | % | | 23,539 | | | 2.1 | % | | 14,920 | | | 1.9 | % |

| Pennsylvania | | 33,333 | | | 2.1 | % | | 23,396 | | | 2.1 | % | | 16,518 | | | 2.2 | % |

| All other states | | 489,865 | | | 31.2 | % | | 333,178 | | | 30.2 | % | | 231,282 | | | 30.3 | % |

| | $ | 1,568,815 | | | 100.0 | % | | $ | 1,102,092 | | | 100.0 | % | | $ | 764,373 | | | 100.0 | % |

Underwriting

Our underwriting department consisted of approximately 280 employees as of December 31, 2023. We use our proprietary technology platform to drive a high level of efficiency, accuracy and speed in our underwriting and quoting process. We believe our internal business processing systems allow us to maintain a high ratio of underwriters to total employees, as we do not require a significant number of administrative personnel to facilitate our underwriting process. We also believe that our digital environment allows us to engage fewer employees in policy administration.